VP/#74147529.1 EMPLOYMENT AGREEMENT THIS AGREEMENT, effective as of January 1, 2026 (“Effective Date”), is by and between CUSTOMERS BANCORP, INC., a Pennsylvania corporation, with its main office located at 701 Reading Avenue, West Reading, PA 19611 (collectively with any of its subsidiaries and affiliates, the “Company”) and Samvir Sidhu (“Executive”). 1. Background. A. The Company currently employs Executive as its Vice Chair and President pursuant to an Employment Agreement dated January 22, 2020 (the “Current Employment Agreement”). B. The Company wishes to secure the services of Executive as the President and Chief Executive Officer of the Company. Effective on January 1, 2026, Executive’s title will change to President and Chief Executive Officer of Company. Executive will retain his positions as President and Chief Executive Officer of Customers Bank. C. Subject to the terms and conditions hereinafter, Executive is willing to enter into this Employment Agreement (this “Agreement”) upon the terms and conditions set forth. D. The Company’s Leadership Development and Compensation Committee of the Board of Directors (“LD&CC”) has approved this Agreement. NOW, THEREFORE, in consideration of the mutual promises and agreements set forth herein, the parties agree as follows: 2. Employment. Company agrees to employ Executive as President and Chief Executive Officer the Company, and President and Chief Executive Officer of Customers Bank, during the “Term” defined in Section 3 of this Agreement. Executive shall report to and be subject to the direction of the Board of Directors of the Company. In addition, on the Effective Date the Executive shall be appointed as a member of the Board of Directors. Executive shall have the powers and authority ordinarily given to the position described above as provided under the Bylaws of the Company. Executive will have such duties as normally apply to such position(s). Executive shall devote all of his working time, abilities and attention to the business of the Company, and will fulfill all of the duties required of him. The services of Executive shall be rendered principally in New York City, NY. Executive may work remotely as mutually agreed upon with Company, and shall undertake travel on behalf of Company as may be reasonably required. 3. Term of Employment. Subject to the terms and conditions of this Agreement, the initial term of employment hereunder shall be for the three (3)-year period commencing on the Effective Date and ending on the day preceding the three (3)-year anniversary of the Effective Date. As of each one (1)-year anniversary of the Effective Date, the term of employment hereunder shall be extended for another one (1) year, automatically, and shall continue unless and until either party delivers at least sixty (60) days’ notice of cancellation to the other party prior to such anniversary, in which case the term of employment hereunder shall expire as of the date to which it was last

2 VP/#74147529.1 extended pursuant to this sentence. Such notice shall be delivered in a manner consistent with the requirements of Section 14. References in this Agreement to the “Term” shall refer both to such initial term and any extension thereof. 4. Compensation. In consideration of the services to be rendered by Executive, Company shall pay to Executive during the initial Term: A. An annualized base salary rate of not less than nine hundred seventy five thousand dollars ($975,000) per annum for each year of the Term, payable in equal installments over such payroll cycles as the Company pays its executive officers generally, with any salary for initial or final partial months or other payroll periods being prorated based on the number of calendar days in question. B. Short-Term Incentive (“STI”): For performance year 2026 and each performance year during the Term thereafter, Executive will have a target STI equal to 100% of Executive’s annualized base salary rate. STI awards may be awarded as a mix of cash, and time-vested Restricted Stock Units (“RSUs”) typically scheduled to vest in three equal, annual installments. The actual vesting schedule and mix may vary year-over-year (e.g., awarded entirely in the form of RSUs) and is subject to final determination by the LD&CC. The actual payout of the STI for each performance year is expected to be payable in March of the calendar year immediately following the performance year and may be higher or lower than target for your role, based on the weighted level of Company performance achieved versus pre-defined metrics approved by the LD&CC. STI awards are not earned until they are paid, are subject to applicable deductions and withholdings, and remain subject to all policies and/or plan provisions under which they were awarded. C. Long-Term Incentive (“LTI”): (i) For performance year 2026 and each performance year during the Term, Executive will have a target LTI equal to 150% of Executive’s annualized base salary rate. LTI awards are typically awarded entirely in the form of RSUs, with 40% of the award scheduled to vest in three equal, annual installments, and 60% of the award scheduled to cliff vest 100% after three years resulting in a final payout that may be higher or lower than the target number of performance units, based on performance-based criteria approved by the LD&CC. LTI awards are typically granted in April of the calendar year following the end of the respective performance year (i.e., April 2027 for performance year 2026). LTI awards are not earned until they vest and remain subject to all policies and/or plan provisions under which they were awarded. (ii) On July 25, 2025, Executive was granted a Performance Share Unit award subject to the terms and conditions of a Performance Share Unit Award Agreement (the “PSU Agreement”). D. Benefits: (i) Executive will continue to be eligible for health and welfare benefits as well as paid time off and holidays in accordance with applicable Company plans and policies, which may be amended from time to time. Executive will also be eligible to participate in benefits and/or

3 VP/#74147529.1 perquisites commensurate with other similarly situated executives of the Company, including reimbursement of a country club membership. (ii) Executive will be eligible to participate in a non-qualified SERP benefit on terms and conditions of a separate SERP agreement with the Company. The annual amount of the non- qualified SERP benefit is expected to be $600,000 per year for life, generally payable at the later of age 65 or separation from service, with the dollar amount of the annual benefit either 100% guaranteed or 50%/guaranteed/50% investment-based at the choice of the Executive at inception. The Executive will at all times be a general unsecured creditor of the Company. 5. Reimbursement of Expenses. During the Term, Company shall reimburse Executive for reasonable expenses incurred by him in the performance of his duties, as well as those incurred in furtherance of or in connection with the business of Company, including but not limited to traveling, entertainment, dining and other expenses. 6. Termination of Employment. 6.1 Termination by Company; “Cause.” Company shall have the right to terminate Executive’s employment hereunder at any time, with or without “Cause” (as defined below). In the event of any termination by Company, Company shall give Executive forty-five (45) days prior notice of any termination without Cause, but shall not be obligated to give Executive prior notice of a termination with Cause. Company shall nevertheless be obligated to pay Executive such compensation and severance, if any, as may be provided for in this Agreement under the applicable circumstances. Company will give Executive notice of termination of his employment pursuant to a “Notice of Termination” (as defined below). 6.2 No Right to Compensation or Benefits Except as Stated. If the Company terminates Executive’s employment for Cause, Executive shall have no right to severance compensation of any kind, or any right to salary or other benefits for any period after such date of termination. If Executive is terminated by Company other than for Cause, Executive’s rights to compensation and benefits under this Agreement shall be as set forth in Section 6.6. 6.3 Termination by Executive for Good Reason. Executive shall have the right to terminate his employment for “Good Reason” (as defined below), subject to satisfying the procedural requirements within the definition of Good Reason. If Executive terminates his employment for Good Reason, Executive’s rights to compensation and benefits under this Agreement shall be as set forth in Section 6.6. 6.4 Termination by Executive without Good Reason. Executive shall have the right to terminate his employment without Good Reason, but, in all events, Executive shall give Company notice pursuant to a written “Notice of Termination” (as defined below) not less than forty-five (45) days prior to the date his termination of employment will be effective. Executive shall have no right to severance compensation of any kind, or any right to salary or other cash or equity-based compensation or benefits for any period after such date of termination. 6.5 Certain Definitions.

4 VP/#74147529.1 A. Cause: For the purpose of this Agreement, “Cause” means Executive’s (1) willful material failure by Executive to perform the duties to the Company required of Executive (other than any such failure resulting from incapacity due to physical or mental illness of Executive or material changes in the direction and policies of the Board of Directors of the Company), if such failure continues for thirty (30) days after a written demand for substantial performance is delivered to Executive by the Company which specifically identifies the manner in which it is believed that Executive has failed to attempt to perform Executive’s duties hereunder; (2) willful misconduct by Executive that is materially injurious to the Company; (3) receipt by the Company of a notice (which shall not have been appealed by Executive or shall have become final and non- appealable) of any governmental body or entity having jurisdiction over the Company requiring termination or removal of Executive from Executive’s then present position, or receipt of a written directive or order of any governmental body or entity having jurisdiction over the Company (which shall not have been appealed by Executive or shall have become final and non-appealable) requiring termination or removal of Executive from Executive’s then present position; (4) personal dishonesty, incompetence, willful misconduct, willful breach of fiduciary duty involving personal profit or conviction of a felony; or (5) material breach of any provision of Exhibit A, to the extent applicable. For purposes of this Section, no act, or failure to act, on Executive’s part shall be considered “willful” unless done or omitted to be done by Executive in bad faith and without reasonable belief that Executive’s action or omission was in the best interest of the Company. Any act or omission to act by Executive in reliance upon a written opinion of counsel to the Company shall not be deemed to be willful. B. Good Reason: For purposes of this Agreement, “Good Reason” shall mean the occurrence of any of the following without Executive’s written consent: (i) any reduction in title or a material adverse change in Executive’s responsibilities or authority which are inconsistent with, or the assignment to Executive of duties inconsistent with, Executive’s position with the Company immediately prior to such action; or (ii) any reduction in Executive’s annual base salary as in effect on the date hereof or as the same may be increased from time to time; (iii) a change in Executive’s primary work location to a location more than fifty (50) miles away from New York City, NY; (iv) any purported termination of Executive’s employment which is not effected in compliance with the requirements if this Agreement; or (v) a material breach by the Company of the provisions of this Agreement. Executive must provide written notice of termination for Good Reason to the Company within ninety (90) days after the event constituting Good Reason occurs. The Company shall have a period of thirty (30) days in which it may correct the act or failure to act that constitutes the grounds for Good Reason as set forth in Executive’s notice of termination. If the Company does not correct the act or failure to act, Executive’s employment will terminate for Good Reason on the first business day following the Company’s thirty (30)-day cure period. If the Company corrects the

5 VP/#74147529.1 act or failure to act within thirty (30) days following notice from Executive, no Good Reason shall exist. C. Notice of Termination. Any termination of Executive’s employment by Company or by Executive shall be communicated by written Notice of Termination to the other party hereto. For purposes of this Agreement, a “Notice of Termination” shall mean a dated notice which shall (1) indicate the specific termination provision in this Agreement relied upon; (2) set forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of Executive’s employment under the provision so indicated; and (3) be given in a manner consistent with the requirements of Section 14. 6.6 Compensation Upon Certain Types of Termination. If Executive’s Employment is terminated by the Company other than for Cause or by the Executive for Good Reason, in each case during the Term, then in lieu of any salary or damages payments to Executive for periods subsequent to the date of termination, Company shall pay as “Severance Compensation” to Executive, in lieu of all other damages, compensation and benefits other than any benefits the right to which shall have previously vested, an amount (the “Severance Compensation”) equal to the following, depending upon whether a “Change in Control” (as defined below) shall have occurred at the time of termination of employment: A. If a Change in Control shall not have occurred within twelve (12) months prior to the date of termination of Executive’s employment with the Company, the Company shall pay Executive the following Severance Compensation, payable at the respective times and on the respective conditions set forth in this subsection for each type of Severance Compensation: (i) Cash Severance Compensation. Notwithstanding anything to the contrary elsewhere in this Agreement, Executive shall be entitled to receive a dollar amount equal to three (3) times the sum of (x) Executive’s then current annualized base salary plus (y) the average of the annual performance bonus (consisting of both cash and other incentive compensation, but excluding the Company match and any deferred compensation) provided to him with respect to the three (3) fiscal years of the Company immediately preceding the fiscal year of termination. This element of Severance Compensation shall be payable over 36 months in equal installments on the normal pay dates following Executive’s separation from service with the Company within the meaning of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and the Treasury Regulations promulgated thereunder (such Section and regulations are sometimes referred to in this Agreement as “Section 409A”). If, as of the date of the Executive’s separation from service, stock of the Company or a holding company or other parent entity with respect to the Company is publicly traded on an established securities market or otherwise, and if necessary to comply with Section 409A, payments otherwise due during the six (6)- month period following his separation from service shall be suspended and paid in a lump sum upon completion of such six (6)-month period, at which time the balance of the payments shall commence in installments as described in the preceding sentence. Payments shall be subject to deductions for such tax withholdings as Company may be obligated to make;

6 VP/#74147529.1 (ii) Equity Awards. All equity-based awards granted to Executive during the Term that are unvested at the time of termination of employment shall vest in full; provided that the terms and conditions of the PSU Agreement shall control the vesting of the Performance Share Units covered by such PSU Agreement; (iii) Cash Bonus Including STI (but not LTI). Executive shall be entitled to a fraction of any Cash Bonus for the fiscal year of the Company within which Executive’s termination of employment occurs which, based upon the criteria established for such Cash Bonus, would have been payable to Executive had he remained employed through the scheduled date of payment, the numerator of which is the number of days of such fiscal year prior to his termination of employment and the denominator of which is three hundred and sixty-five (365); and (iv) Insurance. Provided Executive makes proper elections, the Executive shall continue to participate in health insurance (including dental if applicable) and any life insurance benefits, at the same cost as then current employees, for the shorter of (i) the length of the severance measurement period set forth in Section 6.6(A)(i) above, or (ii) the maximum period the Company is then permitted to extend each individual benefit under the applicable plan or policy or applicable law. B. If a Change in Control has occurred within twelve (12) months prior to the date of termination of Executive’s employment with the Company, the Company shall pay Executive the following Severance Compensation, payable at the respective times and on the respective conditions set forth in this subsection: (i) Termination by Company for Cause or Not for Cause. (a) If Executive’s employment is terminated by the Company for “Cause” (as defined in subsection 6.5(A) at any time, or with or without Cause before or after the Change in Control Period (as defined in subsection 6.6(B)(ii)(f) of this Section), Executive shall have no right to any severance under this Agreement due to such termination. (b) If Executive is terminated by the Company other than for Cause or by Executive for Good Reason within the Change in Control Period, Executive’s right to a severance payment under this Agreement shall be as set forth in subsection (ii)(g) of this Section. (ii) Termination by Executive for Good Reason or Not for Good Reason. (c) If Executive terminates Executive’s employment with the Company prior to a Change in Control for any reason, or without “Good Reason” (as defined in Section 6.5(B)) at any time, Executive shall have no right to any severance under this Agreement due to such termination. (d) If Executive terminates Executive’s employment with the Company for Good Reason within twelve (12) months after the date of a Change in Control, Executive’s right to a severance payment under this Agreement shall be as set forth in subsection (g) of this Section. (e) Definition of “Change in Control”. For purposes of this Agreement, a “Change in Control” of the Company shall mean:

7 VP/#74147529.1 (i) There occurs a merger, consolidation or other business combination or reorganization to which the Company is a party, whether or not approved in advance by the Board of Directors of the Company, in which (A) the members of the Board of Directors of the Company immediately preceding the consummation of such transaction do not constitute a majority of the members of the Board of Directors of the resulting corporation and of any parent corporation thereof immediately after the consummation of such transaction, and (B) the shareholders of the Company immediately before such transaction do not hold more than fifty percent (50%) of the voting power of securities of the resulting corporation; or (ii) There occurs a sale, exchange, transfer, or other disposition of at least fifty percent (50%) of the assets of the Company to another entity, whether or not approved in advance by the Board of Directors of the Company (for purpose of this Agreement, a sale of more than one-half of the branches of the Company would constitute a Change in Control, but for purposes of this paragraph, no branches or assets will be deemed to have been sold if they are leased back contemporaneously with or promptly after their sale); or (iii) A plan of liquidation or dissolution is adopted for the Company; or (iv) Any “person” or any group of “persons” (as such term is defined in Sections 13(d) and 14(d) of the Securities Exchange Act of 1934, as amended (‘Exchange Act”)), as if such provisions were applicable to the Company, other than the holders of shares of the Company’s common stock in existence on the date of the Opening for Business, is or shall become the “beneficial owner” (as defined in Rule l3d-3 under the Exchange Act), as if such rule were applicable to the Company, directly or indirectly, of securities of the Company representing fifty percent (50%) or more of the combined voting power of the Company’s then outstanding securities. (v) For purposes of this Agreement, the date of the Change in Control shall be the calendar date upon which a Change in Control event occurs. (f) Definition of “Change in Control Period”. For purposes of this Agreement, a “Change in Control Period” of the Company shall mean: the period commencing on the date that a written undertaking outlining the principal conditions of a contemplated Change in Control transaction (including, but not limited to, a letter of interest or intent) is executed by the parties and the two (2) year anniversary of the resulting Change in Control. For the avoidance of doubt, the written undertaking outlining the principal conditions of a contemplated Change in Control must actually occur in order for any termination by the Company other than for Cause prior to a Change in Control to constitute a termination giving rise to severance under this Agreement. (g) Cash Severance Compensation. If Executive’s employment is terminated by the Company other than for Cause or by Executive for Good reasons during the Change in Control Period, and Executive timely executes, does not revoke and delivers an effective release of claims in a form approved by the Company (“Release”), the Company shall pay as severance to Executive the sum of the following amounts in a single lump sum within thirty (30) days following the date of Executive’s termination of employment if such termination occurs during the Change in Control Period and after the Change in Control or (y) the date of the Change in Control if such termination

8 VP/#74147529.1 occurs during the Change in Control Period and prior to the Change in Control, subject to all tax withholding obligations of the Company: (i) three hundred percent (300%) of the highest rate of base annual salary that was payable to or for the benefit of Executive at any time during the twelve (12)-month period ending on the date of Executive’s termination of employment; and (ii) three hundred percent (300%) of the average of the annual performance bonus (consisting of both cash and other incentive compensation, but excluding the Company match and any deferred compensation) provided to him with respect to the three (3) fiscal years of the Company immediately preceding the fiscal year of termination. (h) Cash Bonus Including STI (but not LTI). Executive shall be entitled to a fraction of any Cash Bonus for the fiscal year of the Company within which Executive’s termination of employment occurs which, based upon the criteria established for such Cash Bonus, would have been payable to Executive had he remained employed through the scheduled date of payment, the numerator of which is the number of days of such fiscal year prior to his termination of employment and the denominator of which is three hundred and sixty-five (365); and (i) Equity Awards. All equity-based awards granted to Executive during the Term that are unvested at the time of termination of employment shall be vested in full; provided that the terms and conditions of the PSU Agreement shall control the vesting of the Performance Share Units covered by such PSU Agreement; and (j) Insurance. Provided Executive makes proper elections, the Executive shall continue to participate in health insurance (including dental if applicable) and any life insurance benefits, at the same cost as then current employees, for the shorter of (i) the length of the severance measurement period set forth in Section 6.6(A)(i) above, or (ii) the maximum period the Company is then permitted to extend each individual benefit under the applicable plan or policy or applicable law. (k) Communication of Termination. Any termination of Executive’s employment by the Company or by Executive shall be communicated by a dated, written notice, signed by the party giving the notice, which shall (1) indicate the specific termination provision in this Agreement relied upon; (2) set forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of Executive’s employment under the provision so indicated; and (3) specify the effective date of termination. (l) Golden Parachute Limitation. In the event it shall be determined that any payment, benefit or distribution to or for Executive’s benefit, or the acceleration thereof, under this Agreement or from any other source (collectively “Total Payments”), would be subject to the excise tax imposed by Section 4999 of the Internal Revenue Code of 1986, as amended, such Total Payments shall be reduced to the extent necessary to avoid such result; provided, however, that no such reduction shall occur if (i) the net amount of such Total Payments as so reduced (and after subtracting the net amount of federal, state and local income and employment taxes on such reduced Total Payments) is less than (ii) the net amount of such Total Payments without such reduction (but after subtracting the net

9 VP/#74147529.1 amount of federal, state and local income and employment taxes on such unreduced Total Payments and the amount of excise taxes to which Executive would be subject in respect of such unreduced Total Payments). (m) No Mitigation or Offset. Executive shall not be required to mitigate the amount of any payment provided for in this Agreement by seeking other employment or otherwise. The severance payment provided for in this Agreement shall not be reduced by any compensation or other payments received by Executive after the date of termination of Executive’s employment from any source. 7. Executive’s Restrictive Covenants. As a condition of this Agreement and condition precedent to Executive receiving any severance under this Agreement, Executive agrees to the Restrictive Covenants set forth in Exhibit A. 8. Section 409A. This Agreement is intended to comply with Section 409A of the Code, and its corresponding regulations, or an exemption thereto, and payments may only be made under this Agreement upon an event and in a manner permitted by Section 409A of the Code, to the extent applicable. Severance benefits under this Agreement are intended to be exempt from Section 409A of the Code under the “short-term deferral” exception. Notwithstanding anything in this Agreement to the contrary, if required by Section 409A of the Code, if Executive is considered a “specified employee” for purposes of Section 409A of the Code and if payment of any amounts under this Agreement is required to be delayed for a period of six (6) months after separation from service pursuant to Section 409A of the Code, payment of such amounts shall be delayed as required by Section 409A of the Code, and the accumulated amount shall be paid in a lump-sum payment within ten (10) days after the end of the six-month period. If Executive dies during the postponement period prior to the payment of benefits, the amounts withheld on account of Section 409A of the Code shall be paid to the personal representative of Executive’s estate within sixty (60) days after the date of Executive’s death. All payments to be made upon a termination of employment under this Agreement may only be made upon a “separation from service” under Section 409A of the Code. In no event may Executive, directly or indirectly, designate the calendar year of a payment. If the Company determines that a payment hereunder constitutes nonqualified deferred compensation subject to Section 409A of the Code, in no event shall the timing of Executive’s execution of a Release result in Executive designating, directly or indirectly, the calendar year of payment, and if the payment that is subject to execution of the Release could be made in more than one taxable year, payment shall be made in the later taxable year. 9. Prior Agreements. As of the Effective Date, this Agreement shall supersede the Current Employment Agreement. This Agreement is the entire agreement of the parties with respect to its subject matter and supersedes any and all prior or contemporaneous discussions, representations, understandings or agreements regarding its subject matter. 10. Assigns and Successors. The rights and obligations of the Company under this Agreement shall inure to the benefit of and shall be binding upon the successors and assigns of the Company and Executive, provided, however, that Executive shall not assign or anticipate any of Executive’s rights hereunder, whether by operation of the law or otherwise. The Company will require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise)

10 VP/#74147529.1 to all or substantially all of the business and/or assets of the Company (whether such assets are held directly or indirectly) to assume expressly and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place. For purposes of this Agreement, “Company” shall also refer to any successor to the Company, whether such succession occurs by merger, consolidation, purchase and assumption, sale of assets or otherwise. 11. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Pennsylvania without regard to its conflict of laws rules. 12. Executive’s Acknowledgement of Terms. Executive acknowledges that Executive has read the Agreement fully and carefully, understands its terms and it has been entered into by Executive voluntarily. Executive acknowledges that any payments be made hereunder will constitute additional compensation to Executive. 13. Amendments. No amendments to this Agreement shall be binding unless in writing and signed by both parties. 14. Notices. All notices under this Agreement shall be in writing and shall be deemed effective (i) when delivered in person or email, or (ii) forty-eight (48) hours after deposit thereof in the U.S. mails by certified or registered mail, return receipt requested, postage prepaid, addressed, in the case of Executive, to his last known address as carried on the personnel records of Company and, in the case of Company, to the corporate headquarters, attention of the Chairman of the Board of Directors, or to such other address as the party to be notified may specify by notice to the other party. 15. Binding Effect and Benefits. The rights and obligations of Company and Executive under this Agreement shall inure to the benefit of and shall be binding upon the respective heirs, personal representatives, successors and assigns of Company and Executive. 16. Construction. This Agreement shall be construed under the laws of the Commonwealth of Pennsylvania, as they may be preempted by federal laws and regulations. Section headings are for convenience only and shall not be considered a part of the terms and provisions of the Agreement. 17. Governing Law; Jurisdiction; Venue. The validity, interpretation, construction, performance and enforcement of this Agreement shall be governed by the internal laws of the Commonwealth of Pennsylvania, without regard to its conflicts of law rules, and by federal law to the extent it pre-empts state law. For purposes of any action or proceeding, the Executive irrevocably submits to the exclusive jurisdiction of the courts of the Commonwealth Pennsylvania and the courts of the United States of America located in Pennsylvania for the purpose of any judicial proceeding arising out of or relating to this Agreement or otherwise. The Executive irrevocably agrees to service of process by certified mail, return receipt requested, to the Executive at the address listed in the records of the Company. The proper venue for all such disputes, actions or proceedings shall be Chester County, Pennsylvania. 18. Executive’s Acknowledgment of Terms and Right to Separate Counsel. Executive acknowledges that he has read this Agreement fully and carefully, understands its terms and that

11 VP/#74147529.1 it has been entered into by Executive voluntarily. Executive further acknowledges that Executive has had sufficient opportunity to consider this Agreement and discuss it with Executive’s own advisors, including Executive’s attorney and accountants and that Executive has made Executive’s own free decision whether and to what extent to do so. 19. Legal Expenses. Company shall pay to Executive all reasonable legal fees and expenses incurred by him in seeking to obtain or enforce any rights or benefits provided by this Agreement to the extent he prevails in such efforts. 20. Indemnification of Executive. Company shall indemnify Executive against any liability incurred in connection with any proceeding in which the Executive may be involved as a party or otherwise by reason of the fact that Executive is or was serving as President and Chief Executive Officer of the Company to the extent permitted by the Company’s articles of incorporation, bylaws and applicable law. To further effect, satisfy or secure the indemnification obligations provided herein or otherwise, the Company shall cause its director and officer liability insurance to cover Executive during the Term and for such period thereafter as the Company’s liability insurance policy permits coverage for actions or omissions of former directors or officers. IN WITNESS WHEREOF, the parties hereto have caused the due execution of this Agreement as of the date first set forth above. Company: Executive: /s/ Jay Sidhu Jay Sidhu Executive Chairman of Customers Bancorp, Inc. /s/ Samvir Sidhu Samvir Sidhu

12 VP/#74147529.1 EXHIBIT A Restrictive Covenants 1. Limitations on Competition, Solicitation and Interference. (a) Except as otherwise provided in this Agreement, during the period in which the Executive is employed with and/or providing services to the Company and/or its subsidiaries and for the twelve (12) months following Executive’s termination of employment or service, irrespective of who ends the employment or service relationship or why, Executive will not, without the prior written consent of the Company: (i) Either individually or on behalf of or through any third party, directly or indirectly, compete with the Company or hold a job with the same or similar job duties as Executive’s job with the Company in any business in the Company’s Field of Interest in the geographic area(s) in which Executive provided services at any time within the twenty-four (24) months preceding Executive’s separation from employment or service. “Field of Interest” is defined as the services and products that (1) the Company provides or had plans to provide to customers as of the end of Executive’s employment or service with the Company, and (2) Executive worked in or was involved with at any time within the twenty-four (24) months preceding Executive’s separation from employment or service. Field of Interest also includes, but is not limited to, the business of commercial banking, consumer banking, digital banking, specialty finance, and asset management. (ii) Either individually or on behalf of or through any third party, directly or indirectly, solicit, divert, or appropriate or attempt to solicit, divert, or appropriate, for the purpose of competing in the Field of Interest with the Company, any customers or clients of the Company that Executive worked with or had business contact with at any time within the 24 months preceding Executive’s separation from employment or service. (iii) Either individually or on behalf of or through any third party, directly or indirectly, solicit, entice, or persuade or attempt to solicit, entice, or persuade any other executives, board members, employees of, or consultants to the Company to leave their employment or engagement with the Company. (iv) Either individually or on behalf of or through any third party, directly or indirectly, engage in any attempt to end or reduce the Company’s relationship with any person or entity with which the Company conducts business or make any statement or engage in any conduct that ends or reduces the Company’s business relationship with any person or entity with which the Company conducts business. (b) Executive acknowledges and agrees that the restrictions contained in this Section 1 are reasonable and necessary to protect and preserve the legitimate interests, properties, goodwill

13 VP/#74147529.1 and business of the Company, including its Proprietary Information (defined below), and that the Company would not have granted the applicable restricted stock units, stock options or other equity-based award under the Plan to Executive in the absence of such restrictions. (c) If any provision or part of Section 1 is held to be unenforceable because of scope, duration, or geographic area, the parties agree to modify such provision, or that the court making such determination shall have the power to modify such provision, to reduce the duration or area of such provision or both, or to delete specific words (“blue-penciling”) so that, in its reduced or blue-penciled form, such provision will then be enforceable, and it is the parties’ intent that it be enforced. (d) Executive acknowledges that due to the applicable law of the state in which Executive resides or works at the time of employment or service period, the terms or conditions of this Section 1 may be modified. These amendments are included in the Restrictive Covenants Addendum below, which forms a part of this Exhibit A, and it replaces and supersedes, where applicable, the corresponding provisions of this Section 1. The Company may modify the Restrictive Covenants Addendum at any time to the extent the Company deems such modification necessary to comply with applicable law. If applicable state law prohibits any of the post termination restrictions set forth in Section 1 above, then any such prohibited provisions shall not apply to Executive unless and until Executive works for the Company in a state that does not prohibit such provision(s). 2. Confidentiality Obligations. (a) Recognition of the Company’s Rights; Nondisclosure and Prohibition Against Misappropriation. Executive recognizes that during Executive’s employment or service with the Company, the Company will provide Executive with access to information of substantial value to the Company, including, but not limited to, Proprietary Information (defined below). At all times during Executive’s employment or service with the Company and thereafter, Executive will hold in strictest confidence any of the Company’s Proprietary Information unless the Company expressly authorizes the disclosure in writing. Executive further agrees that at all times during Executive’s employment or service with the Company and thereafter, Executive will not take, use, or otherwise misappropriate or use any of the Company’s Proprietary Information for any improper or unlawful purpose. (b) Proprietary Information. The term “Proprietary Information” shall mean any and all confidential and/or proprietary knowledge, data or information of the Company. By way of illustration but not limitation, “Proprietary Information” includes (i) trade secrets, inventions, mask works, ideas, processes, formulas, source and object codes, data, programs, other works of authorship, know-how, improvements, discoveries, developments, designs and techniques (hereinafter collectively referred to as “Inventions”); and (ii) information regarding plans for research, development, new products or services, marketing and selling, business plans, budgets and unpublished financial statements, licenses, prices and costs, vendors, and customers; and (iii) information regarding the skills and compensation of the Company’s team members, employees, consultants and/or contractors. The Company’s failure to mark any of the Proprietary Information as confidential or proprietary will not affect its status as Proprietary Information. “Proprietary Information” does not include information that has ceased to be confidential or proprietary by

14 VP/#74147529.1 reason of any of the following: (i) is generally available to the public and became generally available to the public other than as a result of improper disclosure by Executive or otherwise; (ii) became available to Executive on a non-confidential basis from a third party, provided that such third party is not known by Executive to be bound by a confidentiality agreement with, or other obligation of secrecy to, the Company, or another party or is otherwise prohibited from providing such information to Executive by a contractual, legal or fiduciary obligation; or (iii) Executive is required to disclose pursuant to applicable law or regulation (as to which information, Executive will provide the Company with prior notice of such requirement and, if practicable, an opportunity to obtain an appropriate protective order). (c) Third Party Information. Executive understands and agrees to maintain the confidentiality of confidential or proprietary information received from third parties. (d) No Improper Use of Information of Prior Employers and Others. During Executive’s or service employment with the Company, Executive will not improperly use or disclose any confidential information or trade secrets, if any, of any former employer or any other person to whom Executive has an obligation of confidentiality, and Executive will not bring onto the premises of the Company any unpublished documents or any property belonging to any former employer or any other person to whom Executive has an obligation of confidentiality unless consented to in writing by that former employer or person. Executive will use in the performance of Executive’s duties only information that is generally known and used by persons with training and experience comparable to Executive’s own, which is common knowledge in the industry or otherwise legally in the public domain, or which is otherwise provided or developed by the Company. (e) Notice. Executive is hereby advised that federal law provides criminal and civil immunity to federal and state claims for trade secret misappropriation to individuals who disclose a trade secret to their attorney, a court, or a government official in certain, confidential circumstances that are set forth at 18 U.S.C. §§ l 833(b)(1) and 1833(b)(2), related to the reporting or investigation of a suspected violation of the law, or in connection with a lawsuit for retaliation for reporting a suspected violation of the law. (f) Nothing in this Exhibit A shall preclude Executive from communicating or testifying truthfully (i) if disclosure is required by law, statute, rule, regulation (including any subpoena or other similar form of process, including, without limitation, according to any rule, regulation or policy statement of a regulatory agency or body) or by professional standards; or (ii) in response to a request from any banking or other regulatory authority with supervisory authority over the Company (including the U.S. Federal Reserve Bank, U.S. Securities and Exchange Commission, New York Stock Exchange, or Commonwealth of Pennsylvania). Further, nothing in this Exhibit A prohibits or limits Executive from (iii) initiating communications directly with, responding to any inquiry from, volunteering information to, or providing testimony before, the U.S. Securities & Exchange Commission (“SEC”), the U.S. Department of Justice (“DOJ”), the U.S. Financial Industry Regulatory Authority (“FINRA”), any other self-regulatory organization (“SRO”), or any other governmental, law enforcement, or regulatory authority, regarding this Exhibit A and its underlying facts and circumstances, or any reporting of, investigation into, or proceeding regarding suspected violations of law, and Executive is not required to advise or seek permission from the Company before engaging in any such activity. Executive’s ability to disclose

15 VP/#74147529.1 information may be limited or prohibited by applicable law and the Company does not consent to disclosures that would violate applicable law. Such applicable laws include, without limitation, laws and regulations restricting disclosure of confidential supervisory information or disclosures subject to the Bank Secrecy Act (31 U.S.C. §§ 5311-5330), including information that would reveal the existence or contemplated filing of a suspicious activity report. 3. Assignment of Inventions. Executive understands and agrees that Executive is performing work for hire for the Company and that Inventions developed or conceived by Executive during Executive’s employment or service with the Company are to be considered works made for hire and are the sole property of the Company. Executive agrees to assign, and does hereby assign, to the Company or its nominee, all right, title, and interest in and to Inventions made by Executive. Executive hereby waives any and all claims that Executive may now or hereafter have in any jurisdiction to so-called “moral rights” in connection with any such Inventions or any elements thereof. Executive will, with reasonable reimbursement for expenses, but at no other expense to the Company, at any time during or after Executive’s employment or service with the Company, sign and deliver all lawful papers and cooperate in such other lawful acts that may be reasonably necessary or desirable to protect or vest title in Inventions in the Company or its nominee, including applying for, obtaining, maintaining, and enforcing copyrights and/or patents on Inventions in all countries of the world. The Company, however, is not required to accept or perfect any such assignment or other conveyance of any interest in any patent or Inventions or require the Company to prosecute such patent or other application. This provision does not apply to Inventions for which Executive affirmatively proves that no equipment, supplies, facility, or trade secret information of the Company was used and which was developed entirely on Executive’s own time unless (i) the Inventions relate (A) directly to the business of the Company, or (B) to the Company’s actual or demonstrably anticipated research or development; or (ii) the Inventions result, either directly or indirectly, from any work performed by Executive for the Company. 4. Additional Provisions. (a) If Executive breaches or there is a threatened breach of any of the obligations in this Exhibit A, Executive agrees that such breach or threatened breach would cause irreparable harm to the Company, for which remedies at law will not be adequate. Executive therefore consents and agrees that the Company shall be entitled to seek, in addition to other available remedies, a temporary, preliminary, or permanent injunction or other equitable relief against such breach or threatened breach from any court of competent jurisdiction, without the necessity of showing any actual damages or that monetary damages would not afford an adequate remedy, and without the necessity of posting any bond or other security. This equitable relief will be in addition to, not in lieu of, legal remedies, monetary damages, or other available forms of relief. (b) Executive agrees further that if it is determined by a court that Executive has breached the terms of this Exhibit A, the Company will be entitled to recover from Executive all costs and attorneys’ fees incurred as a result of its attempts to redress such a breach or to enforce its rights and protect its legitimate interests.

16 VP/#74147529.1 Restrictive Covenants Addendum The Agreement and Exhibit A are governed by Pennsylvania law, but if Executive primarily resides or work in another state and it is found that that state’s law applies to the restrictive covenants in Section 1 of Exhibit A, then the relevant state portion of this Restrictive Covenants Addendum replaces and supersedes, where applicable, the corresponding provisions of Section 1 of Exhibit A. California If Executive primarily resides or works in California and it is found that California law applies to this Agreement or any dispute arising from this Agreement, then the restrictive covenants in Section 1 shall not apply to Executive after their termination of employment or service with the Company. Any conduct relating to solicitation that involves the misappropriation of the Company’s trade secret information, such as the use, retention or distribution of the Company’s protected customer information, will remain prohibited conduct at all times, and nothing in this Agreement shall be construed to limit or eliminate any rights or remedies the Company may have under this Agreement, trade secret law, unfair competition law, or other laws applicable in California absent this Agreement. The Company will not attempt to enforce any agreement or provision of any agreement to the extent deemed unenforceable under California Business and Professions Code Section 16600. Colorado The restrictive covenant in Section l(a)(i) does not apply to Executive unless Executive’s annualized cash compensation from the Company exceeds $76,254 for 2025 (or the earnings threshold in effect as adjusted annually by the Colorado Division of Labor Standards and Statistics in the Department of Labor and Employment). This Agreement contains restrictive covenants. Executive must review the restrictive covenants carefully. Executive acknowledges that they have been provided with a separate written notice and a copy of this Agreement at least 14 days before the earlier of the effective date of the Agreement or the effective date of any additional compensation or change in the terms or conditions of employment that provides consideration for the covenant not to compete. Executive acknowledges that they were provided the separate written notice in the language in which they communicate with the Company about their performance, and their signature above acknowledges receipt of this notice.

17 VP/#74147529.1 Illinois If Executive primarily resides or works in Illinois and it is found that Illinois law applies to this Agreement or any dispute arising from this Agreement, then the restrictive covenants in Section l(a)(i) and (ii) shall not apply unless Executive’s annual compensation meets or exceeds $45,000 (with the earnings threshold increasing by $2,500 every five years from January 1, 2027, through January 1, 2037). Executive further agrees that if, at the time Executive signs the Agreement, their earnings do not meet the earnings threshold, then the restrictive covenants in Section l(a)(i) and (ii) will automatically become enforceable against them if and when they begin earning an amount equal to or greater than the earnings threshold. If the Company terminates, furloughs, or lays Executive off as the result of business circumstances or governmental orders related to the COVID-19 pandemic or under circumstances that are similar to the COVID-19 pandemic, then the restrictive covenants in Section l(a)(i) and(ii) will not apply to Executive unless enforcement of the covenant includes compensation equivalent to Executive’s base salary at the time of termination for the period of enforcement minus compensation earned through subsequent employment during the period of enforcement. Executive agrees that the restrictive covenants in Section 1 apply are supported by sufficient and adequate consideration. Executive acknowledges that that they have been provided with this Agreement at least 14 days before executing this Agreement. Executive further acknowledges that they have been advised to consult with an attorney before signing this Agreement.

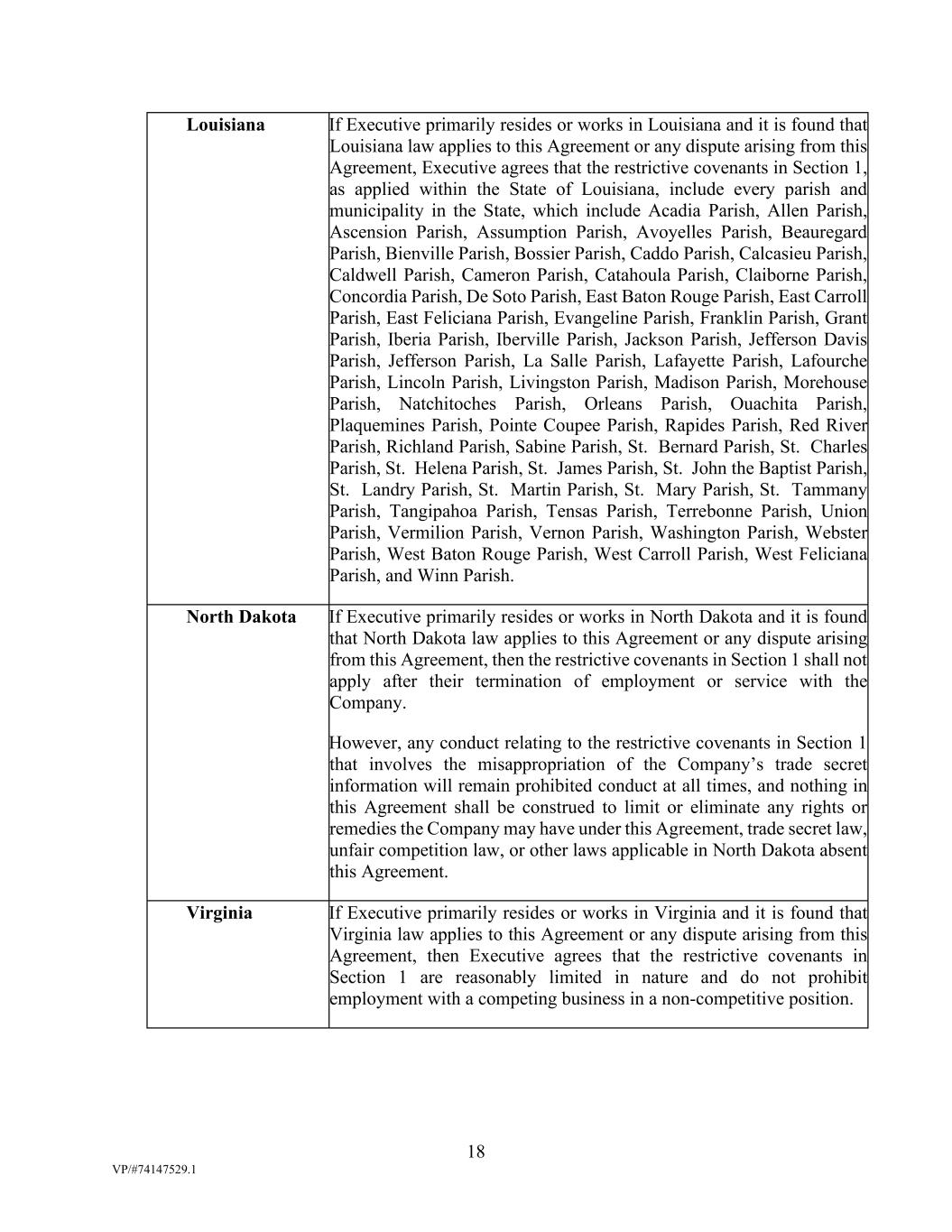

18 VP/#74147529.1 Louisiana If Executive primarily resides or works in Louisiana and it is found that Louisiana law applies to this Agreement or any dispute arising from this Agreement, Executive agrees that the restrictive covenants in Section 1, as applied within the State of Louisiana, include every parish and municipality in the State, which include Acadia Parish, Allen Parish, Ascension Parish, Assumption Parish, Avoyelles Parish, Beauregard Parish, Bienville Parish, Bossier Parish, Caddo Parish, Calcasieu Parish, Caldwell Parish, Cameron Parish, Catahoula Parish, Claiborne Parish, Concordia Parish, De Soto Parish, East Baton Rouge Parish, East Carroll Parish, East Feliciana Parish, Evangeline Parish, Franklin Parish, Grant Parish, Iberia Parish, Iberville Parish, Jackson Parish, Jefferson Davis Parish, Jefferson Parish, La Salle Parish, Lafayette Parish, Lafourche Parish, Lincoln Parish, Livingston Parish, Madison Parish, Morehouse Parish, Natchitoches Parish, Orleans Parish, Ouachita Parish, Plaquemines Parish, Pointe Coupee Parish, Rapides Parish, Red River Parish, Richland Parish, Sabine Parish, St. Bernard Parish, St. Charles Parish, St. Helena Parish, St. James Parish, St. John the Baptist Parish, St. Landry Parish, St. Martin Parish, St. Mary Parish, St. Tammany Parish, Tangipahoa Parish, Tensas Parish, Terrebonne Parish, Union Parish, Vermilion Parish, Vernon Parish, Washington Parish, Webster Parish, West Baton Rouge Parish, West Carroll Parish, West Feliciana Parish, and Winn Parish. North Dakota If Executive primarily resides or works in North Dakota and it is found that North Dakota law applies to this Agreement or any dispute arising from this Agreement, then the restrictive covenants in Section 1 shall not apply after their termination of employment or service with the Company. However, any conduct relating to the restrictive covenants in Section 1 that involves the misappropriation of the Company’s trade secret information will remain prohibited conduct at all times, and nothing in this Agreement shall be construed to limit or eliminate any rights or remedies the Company may have under this Agreement, trade secret law, unfair competition law, or other laws applicable in North Dakota absent this Agreement. Virginia If Executive primarily resides or works in Virginia and it is found that Virginia law applies to this Agreement or any dispute arising from this Agreement, then Executive agrees that the restrictive covenants in Section 1 are reasonably limited in nature and do not prohibit employment with a competing business in a non-competitive position.

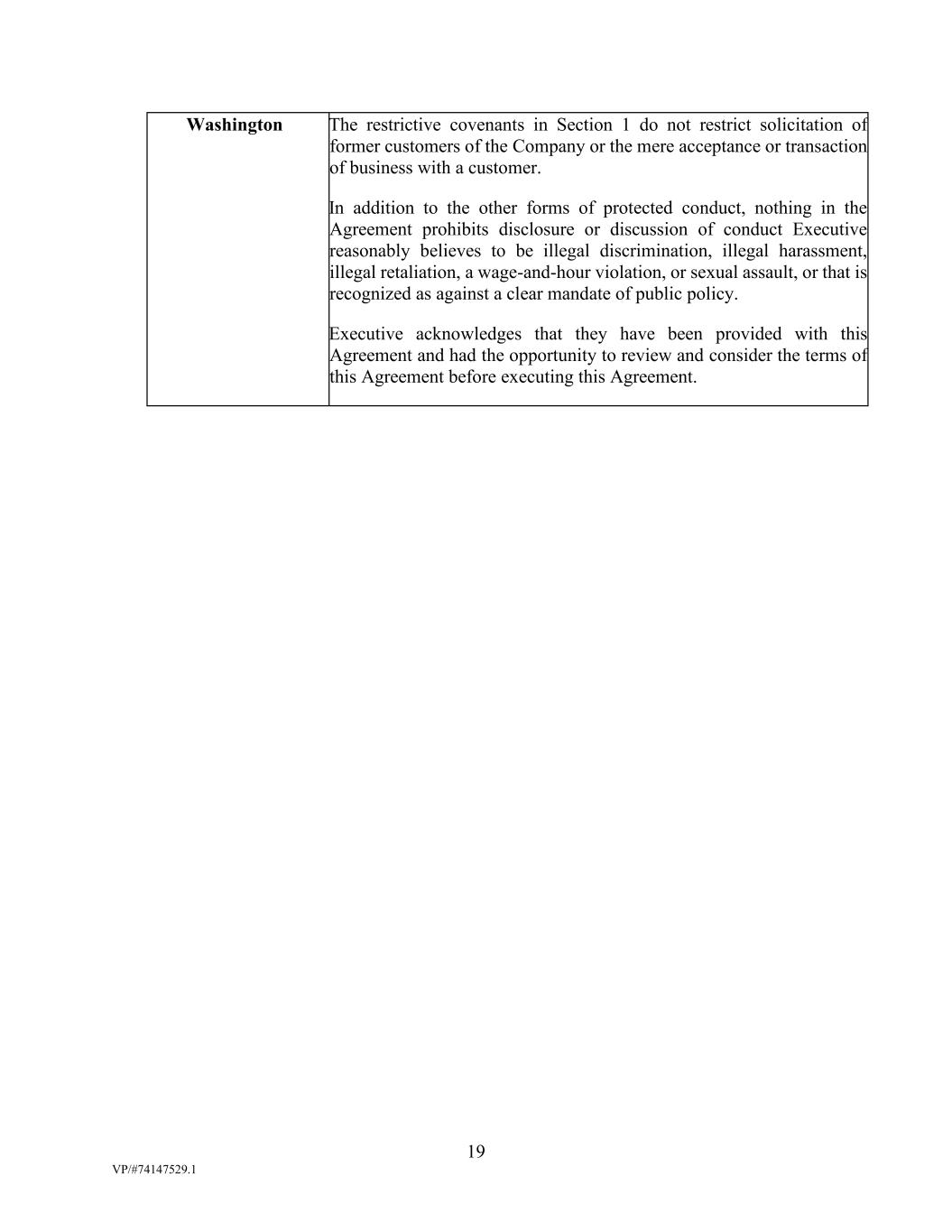

19 VP/#74147529.1 Washington The restrictive covenants in Section 1 do not restrict solicitation of former customers of the Company or the mere acceptance or transaction of business with a customer. In addition to the other forms of protected conduct, nothing in the Agreement prohibits disclosure or discussion of conduct Executive reasonably believes to be illegal discrimination, illegal harassment, illegal retaliation, a wage-and-hour violation, or sexual assault, or that is recognized as against a clear mandate of public policy. Executive acknowledges that they have been provided with this Agreement and had the opportunity to review and consider the terms of this Agreement before executing this Agreement.