.3

Wright Medical Group N.V. Announces Definitive Agreement to be Acquired by Stryker Investor Presentation November 4, 2019

.3

Wright Medical Group N.V. Announces Definitive Agreement to be Acquired by Stryker Investor Presentation November 4, 2019

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation includes forward-looking statements that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from those implied by the forward-looking statements. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including all statements regarding the intent, belief or current expectation of Wright Medical Group N.V. (the “Company”) and members of its senior management team and can typically be identified by words such as “believe,” “expect,” “estimate,” “predict,” “target,” “potential,” “likely,” “continue,” “ongoing,” “could,” “should,” “intend,” “may,” “might,” “plan,” “seek,” “anticipate,” “project” and similar expressions, as well as variations or negatives of these words. Forward-looking statements include, without limitation, statements regarding the proposed transaction, prospective performance, future plans, events, expectations, performance, objectives and opportunities and the outlook for the Company’s business; the commercial success of the Company’s products, including the ability to achieve wide market acceptance of the Company’s products due to clinical, regulatory, cost reimbursement and other issues; filings and approvals relating to the proposed transaction; the expected timing of the completion of the proposed transaction; the ability to complete the proposed transaction considering the various closing conditions; and the accuracy of any assumptions underlying any of the foregoing. Investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and are cautioned not to place undue reliance on these forward-looking statements. Actual results may differ materially from those currently anticipated due to a number of risks and uncertainties. Risks and uncertainties that could cause the actual results to differ from expectations contemplated by forward-looking statements include: uncertainties as to the timing of the tender offer and other proposed transactions; uncertainties as to how many of the Company’s shareholders will tender their shares in the offer or approve the resolutions to be solicited at the extraordinary general meeting (the “EGM”); the possibility that various closing conditions for the proposed transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the proposed transaction; the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreement; the effects of the proposed transaction (or the announcement thereof) on relationships with associates, customers, other business partners or governmental entities; transaction costs; the risk that the proposed transaction will divert management’s attention from the Company’s ongoing business operations; changes in the Company’s businesses during the period between now and the closing; risks associated with litigation; and other risks and uncertainties detailed from time to time in documents filed with the Securities and Exchange Commission (the “SEC”) by the Company, including current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K, as well as the Schedule 14D-9, proxy statement and other documents to be filed by the Company. All forward-looking statements are based on information currently available to the Company, and the Company assumes no obligation to update any forward-looking statements. 2

IMPORTANT INFORMATION FOR INVESTORS AND SECURITY HOLDERS The tender offer for Wright’s outstanding ordinary shares referenced herein has not yet commenced. This announcement is not a recommendation, an offer to purchase or a solicitation of an offer to sell ordinary shares of Wright or any other securities. This presentation may be deemed to be solicitation material in respect of the EGM Proposals (defined below). At the time the tender offer is commenced, Stryker will file with the SEC a Tender Offer Statement on Schedule TO, and Wright will file with the SEC a Solicitation/Recommendation Statement on Schedule 14D-9. Wright also intends to file with the SEC a proxy statement in connection with the EGM, at which the Wright shareholders will vote on certain proposed resolutions (the “EGM Proposals”) in connection with the transactions referenced herein, and will mail the definitive proxy statement and a proxy card to each shareholder entitled to vote at the EGM. SHAREHOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT (INCLUDING THE OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND OTHER OFFER DOCUMENTS), THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AND THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO ANY OF THE FOREGOING) WHEN SUCH DOCUMENTS BECOME AVAILABLE, AS THEY WILL CONTAIN IMPORTANT INFORMATION THAT PERSONS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR ORDINARY SHARES OR MAKING ANY VOTING DECISION. Shareholders can obtain these documents when they are filed and become available free of charge from the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by Stryker will be available free of charge on Stryker’s website, www.stryker.com, or by contacting Stryker’s investor relations department at katherine.owen@stryker.com. Copies of the documents filed with the SEC by Wright will be available free of charge on Wright’s website, www.wright.com, or by contacting Wright’s investor relations department at julie.dewey@wright.com. In addition, Wright shareholders may obtain free copies of the tender offer materials by contacting the information agent for the tender offer that will be named in the Tender Offer Statement on Schedule TO. 3

PARTICIPANTS IN THE SOLICITATION Wright, its directors and executive officers and other members of its management and employees, as well as Stryker and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from Wright’s shareholders in connection with the EGM Proposals. Information about Wright’s directors and executive officers and their ownership of Wright’s ordinary shares is set forth in the proxy statement for Wright’s 2019 annual general meeting of shareholders, which was filed with the SEC on May 17, 2019. Information about Stryker’s directors and executive officers is set forth in the proxy statement for Stryker’s 2019 annual meeting of shareholders, which was filed with the SEC on March 20, 2019. Shareholders may obtain additional information regarding the direct and indirect interests of the participants in the solicitation of proxies in connection with the EGM Proposals, including the interests of Wright’s directors and executive officers in the transaction, which may be different than those of Wright’s shareholders generally, by reading the proxy statement and other relevant documents regarding the transaction which will be filed with the SEC. 4

Today’s Announcement Wright Medical Group N.V. Announces Definitive Agreement to be Acquired by Stryker Purchase Price of $30.75 Per Share in Cash; Total Equity Value of Approximately $4.7 Billion, Including Value of Outstanding Convertible Notes, and Total Enterprise Value of Approximately $5.4 Billion Proposed Acquisition Brings Together Highly Complementary Product Portfolios and Customer Base 5

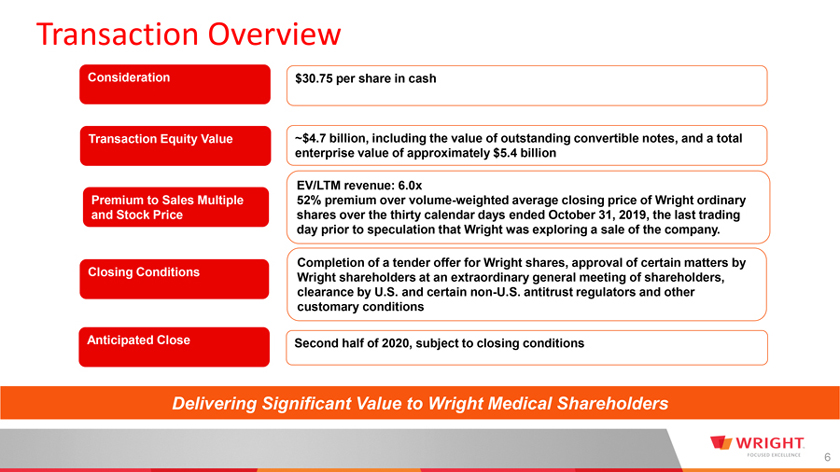

Transaction Overview Consideration $30.75 per share in cash Transaction Equity Value ~$4.7 billion, including the value of outstanding convertible notes, and a total enterprise value of approximately $5.4 billion EV/LTM revenue: 6.0x Premium to Sales Multiple 52% premium over volume-weighted average closing price of Wright ordinary and Stock Price shares over the thirty calendar days ended October 31, 2019, the last trading day prior to speculation that Wright was exploring a sale of the company. Completion of a tender offer for Wright shares, approval of certain matters by Closing Conditions Wright shareholders at an extraordinary general meeting of shareholders, clearance by U.S. and certain non-U.S. antitrust regulators and other customary conditions Anticipated Close Second half of 2020, subject to closing conditions Delivering Significant Value to Wright Medical Shareholders 6

Wright at a Glance Recognized Leader in Extremities & Biologics Global Footprint with the largest specialized direct sales force in the U.S. Broad extremities portfolio Strong R&D pipeline Emphasis on medical education and mobile surgical training 7

Stryker at a Glance One of the world’s leading medical technology companies offering innovative products and services in Orthopaedics, Medical and Surgical, and Neurotechnology and Spine. $13.6 billion in annual global sales in 2018 –39 straight years of sales growth One of the world’s best workplaces – 36,000 employees worldwide $862 million spent on R&D in 2018 –7,784 patents owned globally in 2018 8

Expected Benefits of the Proposed Acquisition Wright will be a significant addition to Stryker’s orthopaedics business Expands Stryker’s existing platform in upper extremities and lower extremities Adds new growth platforms in biologics and digital technologies Leverages combined organization’s world-class sales forces and expertise in developing and marketing innovative products Provides opportunity for further innovation to support extremities market growth and procedure penetration worldwide Combination meaningfully increases ability to ensure we meet needs of clinician customers around the world and patients they serve 9

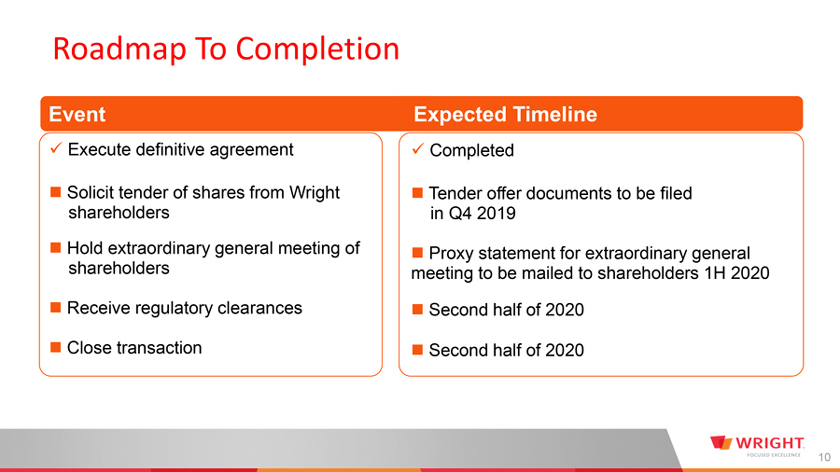

Roadmap To Completion Event Execute definitive agreement Solicit tender of shares from Wright shareholders Hold extraordinary general meeting of shareholders Receive regulatory clearances Close transaction Expected Timeline Completed Tender offer documents to be filed in Q4 2019 Proxy statement for extraordinary general meeting to be mailed to shareholders 1H 2020 Second half of 2020 Second half of 2020 10

A Bright and Exciting Future as Part of Stryker! Offers significant value for the company’s stakeholders, including shareholders, customers and employees Advances our broad platform of upper and lower extremities, biologics and digital technologies with one of the world’s leading medical technology companies Leverages combined organization’s world-class sales forces and expertise in developing and marketing innovative products Provides opportunity for further innovation to support extremities market growth and procedure penetration worldwide 11

For additional information, please contact: Julie Dewey Chief Communications Officer julie.dewey@wright.com (901) 290-5817 www.wright.com NASDAQ: WMGI 12