INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 1 of 12 Confidential - Not to be Distributed 1. PURPOSE OptiNose, Inc. (together with its subsidiaries, the “Company”) has adopted this Insider Trading Policy (this “Policy”) to prevent “insider trading”. Simply stated, insider trading occurs when a person uses “material non-public information” (as defined in Article IV below) to make decisions to trade a company’s securities or to communicate that information to others who then trade the company’s securities. Penalties for violating insider trading laws can be severe, both for individuals involved in such unlawful conduct and their employers and supervisors, and may include fines and imprisonment. It is your obligation to understand and comply with this Policy and avoid improper trading or disclosure of material non-public information. Should you have any questions regarding this Policy, please contact the Company’s Chief Financial Officer1. 2. SCOPE This Policy applies to all officers, directors and employees of the Company (collectively, “Covered Persons”). Please note that the blackout periods, pre-clearance procedures and other trading and transfer restrictions identified in this Policy not only apply to you as a Covered Person but also apply to transactions in Company Securities (as defined in Article III below) by your family members that reside in your household as well as other persons that reside in your household, and to transactions by any person or entity whose transactions in Company Securities are subject to your control or influence (such as family members that do not reside with you who consult with you before they trade or transfer Company Securities). It is your responsibility to ensure that any transaction in Company Securities by these persons and entities comply with this Policy. 3. POLICY 3.1 General Policy 3.1.1 No Covered Person who is in possession of material non-public information concerning the Company may, either directly or indirectly, (i) purchase or sell securities of the Company, including common stock, options to purchase common stock, preferred stock, convertible debt and warrants, or any other type of securities that the Company has or may issue, as well as derivative securities that are not issued by the Company, such as exchange-traded put or call options or swaps relating to the Company Securities (collectively, “Company Securities”), or (ii) engage in any other action to take advantage of such material non-public information. 3.1.2 Covered Persons may not, either directly or indirectly, purchase or sell any securities of any other public company when in possession of material non-public information concerning such other company that is obtained in connection with his or her employment or service to the Company. 1 In relation to this Policy, the Chief Accounting Officer shall serve as the point of contact in the absence of a Company Chief Financial Officer.

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 2 of 12 Confidential - Not to be Distributed 3.1.3 Covered Persons may not disclose, convey or “tip” any material non-public information concerning the Company or any other public company to any person by providing them with such information. Unlawful tipping includes (but is not limited to) passing on material non- public information to friends, family members or acquaintances to help the recipients of such information to make a profit or avoid a loss by trading in Company Securities or the securities of other public companies based on such information. Because even a casual remark recommending a purchase or sale of Company Securities could be misconstrued as being based upon material non-public information, you should exercise caution in making any such recommendation. However, Covered Persons may disclose material non-public information on a “need to know” basis to other officers, directors and employees of the Company and to persons involved in the business or affairs of the Company that have a need to know such information and who have entered in an agreement (or are otherwise bound) to maintain the confidentiality of such information. When sharing material non-public information with permitted individuals, such information should be confined to as small a group as possible. 3.2 Definition of Material Non-Public Information 3.2.1 Material Information. Information is considered “material” if a reasonable investor would consider that information important in making a decision to buy, hold or sell Company Securities or the securities of another public company. Material information is not limited to historical facts but may also include projections and forecasts. Any information that could be expected to affect a company’s stock price, whether it is positive or negative, should be considered material. Determining whether information is material is not always straightforward; rather, materiality is based on an assessment of all of the facts and circumstances, and is often evaluated by enforcement authorities with the benefit of hindsight. When doubt exists as to whether information would be considered “material,” the information should be presumed to be material. While it is not possible to identify in advance all information that will be deemed to be material, some examples of such information would include the following: • annual or quarterly financial statements; • earnings and other financial results and estimates; • changes to financial or operational guidance; • the status of the Company’s progress toward achieving significant Company goals; • proposals, plans or agreements, even if preliminary in nature, involving mergers, acquisitions, joint ventures, partnerships, strategic alliances, collaborations or investment proposals; • information concerning preclinical studies and clinical trials and their results; • significant actions by regulatory agencies or significant communications to or from regulatory agencies; • new product launches or the introduction of new business strategies; • new major contracts, customers, distributors or suppliers, or the loss of any of the foregoing;

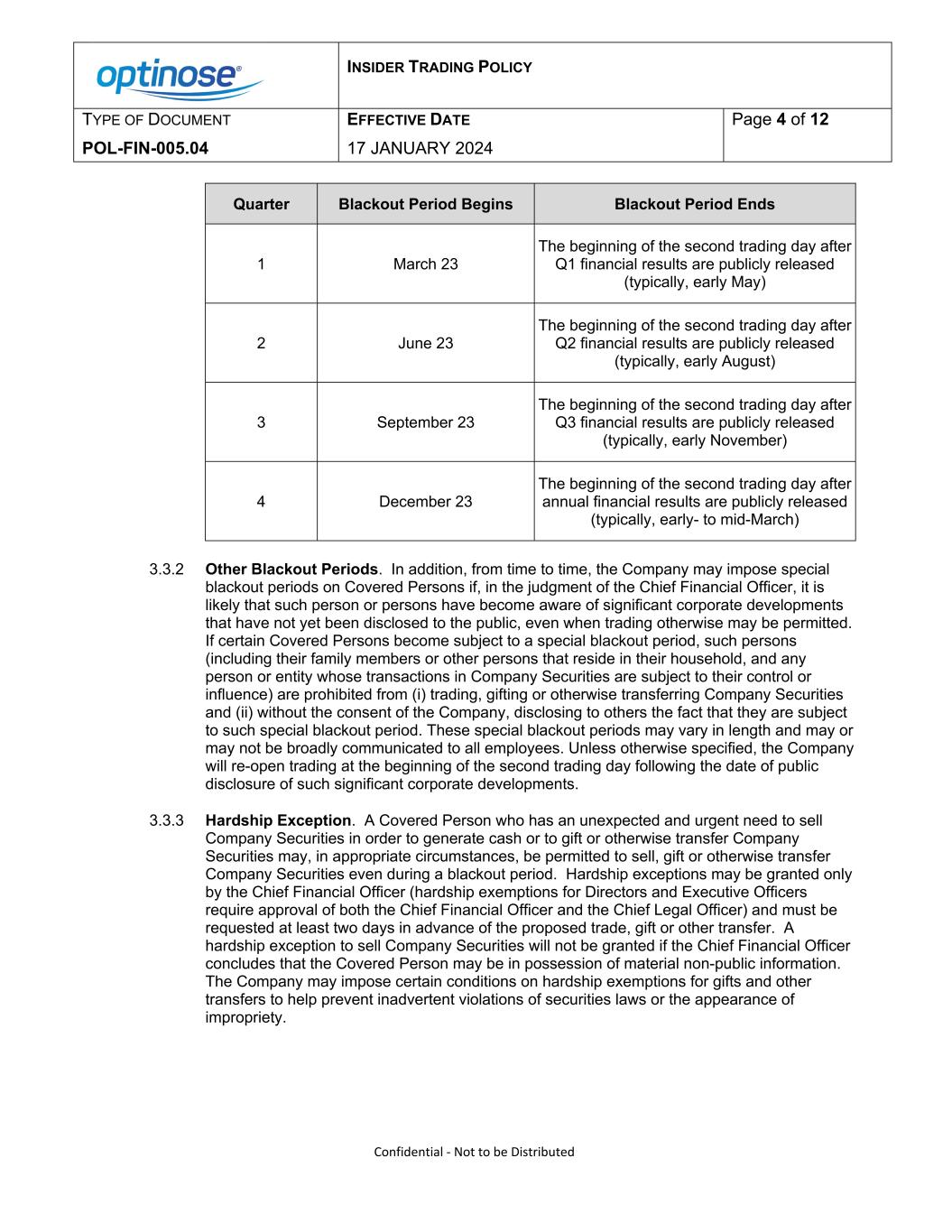

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 3 of 12 Confidential - Not to be Distributed • information concerning patents and other intellectual property rights; • litigation (pending or threatened); • significant expansion or curtailment of operations; • unusual borrowings; • public or private securities offerings; • changes in senior management or members of the Board of Directors; • listing on or delisting from a stock exchange; • stock splits or reverse stock splits; or • similar information concerning a significant subsidiary, business unit or investment. 3.2.2 Non-Public Information. Information that has not been widely disseminated to the public is generally considered to be “non-public information”. Information generally becomes available to the public when it has been disseminated in a manner designed to reach investors generally (such as by a press release or a filing with the Securities and Exchange Commission (“SEC”)) and investors have been given the opportunity to absorb the information fully. In general, information is considered to have been made available to the public at the beginning of the second trading day after the formal release of the information. 3.2.2.1 If you are unsure whether you are in possession of material non-public information, you should consult with the Chief Financial Officer prior to engaging in any transactions involving Company Securities or securities of a public company with whom the Company has a direct or indirect business relationship. 3.3 Blackout Periods 3.3.1 Quarterly Blackout Periods. In order to avoid the appearance of trading on material non- public information concerning the Company’s financial results, Covered Persons (including their family members or other persons that reside in their household, and any person or entity whose transactions in Company Securities are subject to their control or influence) are prohibited from trading, gifting or otherwise transferring Company Securities during the period beginning on the 23rd day of the last month of each fiscal quarter and ending on the beginning of the second trading day following public disclosure of the financial results for that quarter or the full year.

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 4 of 12 Confidential - Not to be Distributed Quarter Blackout Period Begins Blackout Period Ends 1 March 23 The beginning of the second trading day after Q1 financial results are publicly released (typically, early May) 2 June 23 The beginning of the second trading day after Q2 financial results are publicly released (typically, early August) 3 September 23 The beginning of the second trading day after Q3 financial results are publicly released (typically, early November) 4 December 23 The beginning of the second trading day after annual financial results are publicly released (typically, early- to mid-March) 3.3.2 Other Blackout Periods. In addition, from time to time, the Company may impose special blackout periods on Covered Persons if, in the judgment of the Chief Financial Officer, it is likely that such person or persons have become aware of significant corporate developments that have not yet been disclosed to the public, even when trading otherwise may be permitted. If certain Covered Persons become subject to a special blackout period, such persons (including their family members or other persons that reside in their household, and any person or entity whose transactions in Company Securities are subject to their control or influence) are prohibited from (i) trading, gifting or otherwise transferring Company Securities and (ii) without the consent of the Company, disclosing to others the fact that they are subject to such special blackout period. These special blackout periods may vary in length and may or may not be broadly communicated to all employees. Unless otherwise specified, the Company will re-open trading at the beginning of the second trading day following the date of public disclosure of such significant corporate developments. 3.3.3 Hardship Exception. A Covered Person who has an unexpected and urgent need to sell Company Securities in order to generate cash or to gift or otherwise transfer Company Securities may, in appropriate circumstances, be permitted to sell, gift or otherwise transfer Company Securities even during a blackout period. Hardship exceptions may be granted only by the Chief Financial Officer (hardship exemptions for Directors and Executive Officers require approval of both the Chief Financial Officer and the Chief Legal Officer) and must be requested at least two days in advance of the proposed trade, gift or other transfer. A hardship exception to sell Company Securities will not be granted if the Chief Financial Officer concludes that the Covered Person may be in possession of material non-public information. The Company may impose certain conditions on hardship exemptions for gifts and other transfers to help prevent inadvertent violations of securities laws or the appearance of impropriety.

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 5 of 12 Confidential - Not to be Distributed 3.4 Pre-Clearance Procedures/10b5-1 Trading Plans 3.4.1 Pre-Clearance Procedures. To help prevent inadvertent violations of securities laws and this Policy, all Covered Persons must obtain prior clearance from the Chief Financial Officer (or such person’s designee), before such Covered Person (including their family members or other persons that reside in their household, and any person or entity whose transactions in Company Securities are subject to their control or influence) makes any purchase, sale, gift or other transfer of Company Securities regardless of whether a blackout period is then in effect. Pre-clearance requests from Directors and Executive Officers require approval of both the Chief Financial Officer and the Chief Legal Officer. To obtain clearance for a transaction, submit via email the information contained in the Request for Clearance to Trade as set forth on Form A attached hereto. In evaluating each proposed transaction, the Chief Financial Officer (and in conjunction with the Chief Legal Officer for transactions requested by Directors and Executive Officers) will consult as necessary with counsel and senior management before clearing any proposed trade. Clearance of a transaction will generally be valid until the beginning of the next blackout period. Even if a Covered Person has obtained pre-clearance for a trade or transfer, it is the Covered Person’s responsibility to ensure he/she is not aware of material non-public information at the time of effecting the trade or transfer. 3.4.2 10b5-1 Trading Plans. Covered Persons do not need to receive pre-clearance for trades pursuant to an 10b5-1 trading plans, but are required to obtain pre-clearance for entering into or modifying a 10b5-1 trading plan. The requirements and pre-clearance procedures for 10b5- 1 trading plans are set forth in Schedule A. 3.5 Prohibited Transactions 3.5.1 The Company considers it inappropriate for officers, directors and employees to engage short- term or speculative transactions in Company Securities. In addition to the other restrictions set forth in this Policy, Covered Persons (including their family members or other persons that reside in their household, and any person or entity whose transactions in Company Securities are subject to their control or influence) are strictly prohibited from engaging in the following transactions at any time: • trading in call or put options involving Company Securities and other derivative securities; • engaging in short sales of Company Securities; • holding Company Securities in a margin account or pledging Company Securities to secure margin or other loans; and • all forms of hedging or monetization transactions, such as zero-cost collars and forward sale contracts. 3.5.2 If you are unsure whether a transaction is prohibited under this Policy, you should consult with the Chief Financial Officer prior to engaging in the transaction.

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 6 of 12 Confidential - Not to be Distributed 3.6 Transactions Not Subject to the Policy 3.6.1 The trading restrictions and pre-clearance procedures contained in this Policy do not apply to: • purchases or sales of Company Securities made pursuant to any binding contract, specific instruction or written plan entered into outside of a blackout period and while the purchaser or seller, as applicable, was unaware of any material non-public information and which contract, instruction or plan (i) meets all of the requirements of the affirmative defense provided by Rule 10b5-1 promulgated under the Securities Exchange Act of 1934 (the “Exchange Act”), (ii) was pre-cleared in advance pursuant to Article VI of this Policy and (iii) has not been amended or modified in any respect after such initial pre-clearance without such amendment or modification being pre- cleared in advance pursuant to this Policy; • the purchase or sale of Company Securities from or to the Company, as applicable (such as stock purchases pursuant to the Company’s employee stock purchase plan); or • transactions between Covered Persons and the Company with respect to grants under its equity incentive plan (or, to the extent applicable, granted outside such plan), including the exercise of stock options for cash; the vesting of restricted stock or restricted stock units (“RSUs”); or the exercise of a tax withholding right pursuant to which a person has elected to have the Company withhold shares subject to an option to satisfy tax withholding upon the exercise of stock options or the vesting of any restricted stock or RSUs. 3.6.2 For purposes of clarity, restrictions contained in this Policy would apply to the “cashless exercise” of an option effected through a broker or “same day sale” of an option, which generally entail the sale of a portion of the underlying stock in the market to cover the costs of exercise or the resulting taxes. 3.7 Compliance with Section 16 and Rule 144 Covered Persons who are also directors or executive officers are responsible for compliance with Section 16 of the Exchange Act and Rule 144 of the Securities Act of 1933 in connection with their transactions in Company Securities. The requirements of this Policy do not supersede the required compliance with your obligations under Section 16 or Rule 144. 3.7.1 Section 16 Reporting Obligations. Directors and executive officers should be aware that most transactions in Company Securities are subject to two business day reporting requirements under Section 16(a) of the Exchange Act. The Company’s policy is to assist directors and officers in completing and filing their individual Section 16 reports. It is important that the Chief Financial Officer receive prompt notice of reportable transactions, so that the Company can assist in filing the required reports on a timely basis.

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 7 of 12 Confidential - Not to be Distributed 3.7.2 Section 16 Trading Restrictions. Under Section 16(b) of the Exchange Act, any profit realized by an officer, director or any stockholder owning more than 10% of a public company’s securities (“10% Holder”) on a “short-swing” transaction (i.e., a non-exempt purchase and sale, or non-exempt sale and purchase, of the Company’s equity securities within a period of less than six months) must be disgorged to the Company upon demand by the Company or a stockholder acting on the Company’s behalf. Under Section 16(c) of the Exchange Act, officers, directors and 10% Holders are prohibited from effecting “short sales” of the Company’s equity securities. A “short sale” is one involving securities which the seller does not own at the time of sale, or, if owned, are not delivered within 20 days after the sale or deposited in the mail or other usual channels of transportation within five days after the sale. 3.7.3 Rule 144. Directors and executive officers are required to file a Form 144 before making open market sales of Company Securities. This form is generally prepared and filed by your broker. 3.8 Post-Employment Transactions 3.8.1 The trading restrictions of this Policy apply to all Covered Persons who are aware of material non-public information when they terminate employment or services. Such Covered Persons may not trade in Company Securities until that information has become public or is no longer material. In all other respects, the pre-clearance procedures and blackout periods set forth in this Policy will cease to apply to such Covered Person’s transactions in Company Securities at the time of such person’s termination of employment or services. 3.9 Consequences of Violations 3.9.1 Insider trading violations are pursued vigorously by the SEC, U.S. Attorneys and state enforcement authorities as well as the laws of foreign jurisdictions. Punishment for insider trading violations is severe and could include significant fines and imprisonment. While the regulatory authorities concentrate their efforts on the individuals who trade, or who tip inside information to others who trade, the federal securities laws also impose potential liability on companies and other “controlling persons” within the organization if they fail to take reasonable steps to prevent insider trading by company personnel. 3.9.2 In addition, an individual’s failure to comply with this Policy may subject the individual to Company-imposed sanctions, including dismissal for cause, whether or not the employee’s failure to comply results in a violation of law. 3.10 Administration of the Policy 3.10.1 The Company’s Chief Financial Officer (and in such person’s absence, an employee designated by the Chief Financial Officer), shall be responsible for administration of this Policy. All determinations and interpretations by the Chief Financial Officer (or such person’s designee) shall be final and not subject to further review. 3.10.2 Any person who has a question about this Policy or its application to any proposed transaction may obtain additional guidance from the Chief Financial Officer.

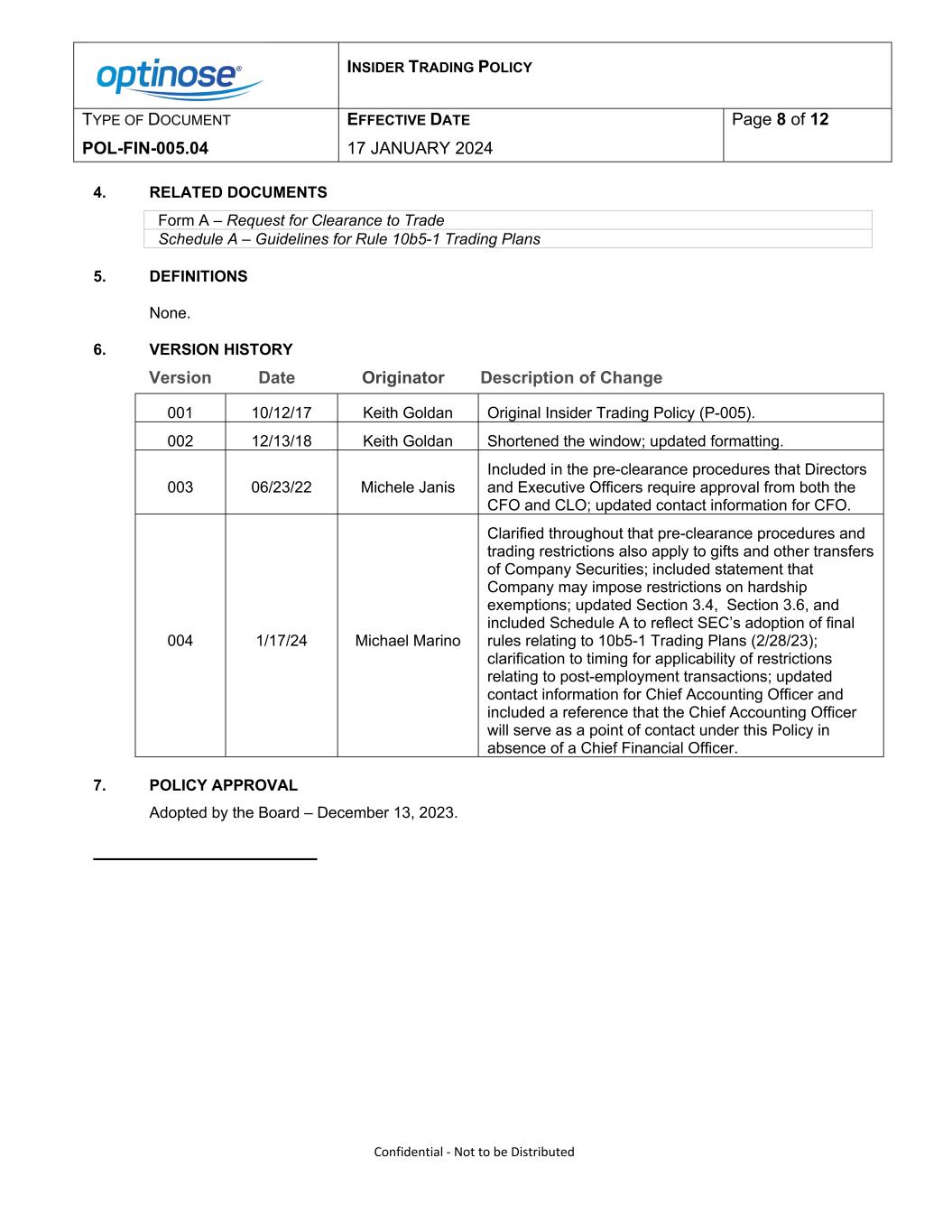

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 8 of 12 Confidential - Not to be Distributed 4. RELATED DOCUMENTS Form A – Request for Clearance to Trade Schedule A – Guidelines for Rule 10b5-1 Trading Plans 5. DEFINITIONS None. 6. VERSION HISTORY Version Date Originator Description of Change 001 10/12/17 Keith Goldan Original Insider Trading Policy (P-005). 002 12/13/18 Keith Goldan Shortened the window; updated formatting. 003 06/23/22 Michele Janis Included in the pre-clearance procedures that Directors and Executive Officers require approval from both the CFO and CLO; updated contact information for CFO. 004 1/17/24 Michael Marino Clarified throughout that pre-clearance procedures and trading restrictions also apply to gifts and other transfers of Company Securities; included statement that Company may impose restrictions on hardship exemptions; updated Section 3.4, Section 3.6, and included Schedule A to reflect SEC’s adoption of final rules relating to 10b5-1 Trading Plans (2/28/23); clarification to timing for applicability of restrictions relating to post-employment transactions; updated contact information for Chief Accounting Officer and included a reference that the Chief Accounting Officer will serve as a point of contact under this Policy in absence of a Chief Financial Officer. 7. POLICY APPROVAL Adopted by the Board – December 13, 2023.

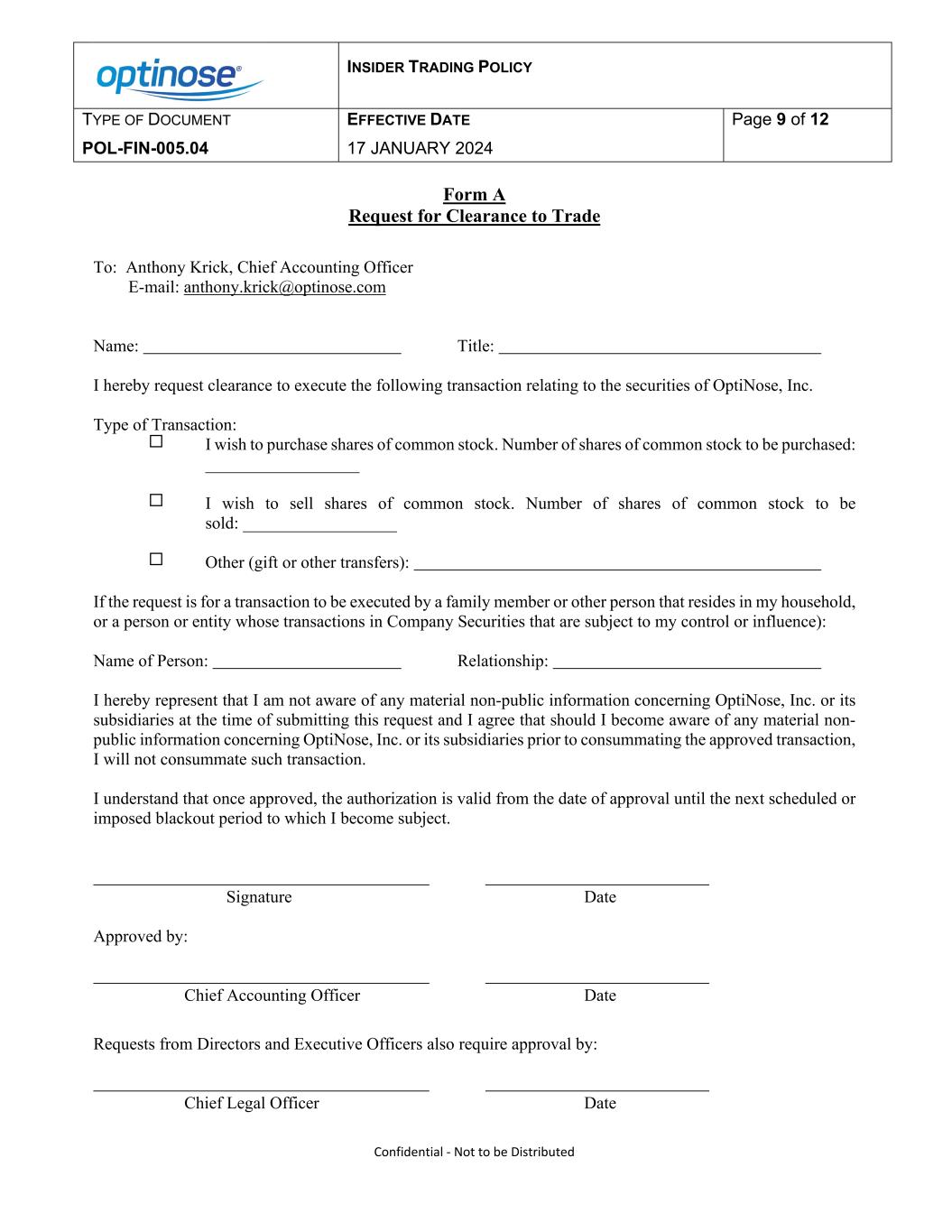

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 9 of 12 Confidential - Not to be Distributed Form A Request for Clearance to Trade To: Anthony Krick, Chief Accounting Officer E-mail: anthony.krick@optinose.com Name: Title: I hereby request clearance to execute the following transaction relating to the securities of OptiNose, Inc. Type of Transaction: I wish to purchase shares of common stock. Number of shares of common stock to be purchased: __________________ I wish to sell shares of common stock. Number of shares of common stock to be sold: __________________ Other (gift or other transfers): If the request is for a transaction to be executed by a family member or other person that resides in my household, or a person or entity whose transactions in Company Securities that are subject to my control or influence): Name of Person: Relationship: I hereby represent that I am not aware of any material non-public information concerning OptiNose, Inc. or its subsidiaries at the time of submitting this request and I agree that should I become aware of any material non- public information concerning OptiNose, Inc. or its subsidiaries prior to consummating the approved transaction, I will not consummate such transaction. I understand that once approved, the authorization is valid from the date of approval until the next scheduled or imposed blackout period to which I become subject. Signature Date Approved by: Chief Accounting Officer Date Requests from Directors and Executive Officers also require approval by: Chief Legal Officer Date

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 10 of 12 Confidential - Not to be Distributed SCHEDULE A OPTINOSE, INC. GUIDELINES FOR RULE 10B5-1 TRADING PLANS Rule 10b5-1 promulgated under the Securities Exchange Act of 1934, as amended, provides an affirmative defense against insider trading liability if purchases or sales of securities occur pursuant to a pre-arranged “trading plan” that meets specified conditions (a “10b5-1 Plan”). In order to be eligible to rely on this affirmative defense, an individual subject to the Company’s Insider Trading Policy (the “Insider Trading Policy”) must properly document the 10b5-1 Plan as set forth in the Insider Trading Plan and these guidelines, and comply with all procedural conditions of Rule 10b5-1 and other applicable laws. For transactions under a 10b5-1 Plan to be exempt from (i) the Insider Trading Policy with respect to transactions made while aware of material nonpublic information and (ii) the pre-clearance procedures and blackout periods established under the Insider Trading Policy, the 10b5-1 Plan and the person adopting such plan must comply with the conditions to the availability of the affirmative defense set forth in Rule 10b5-1 and meet other requirements as set forth below: 1. The 10b5-1 Plan must be submitted to the Chief Financial Officer and Chief Legal Officer for review and approval at least five business days prior to its adoption or amendment. 2. The 10b5-1 Plan must be in writing and signed by the person adopting the 10b5-1 Plan. 3. The 10b5-1 Plan must be adopted at a time when: ● the person adopting the 10b5-1 Plan is not aware of any material nonpublic information; and ● there is no quarterly, special or other trading blackout in effect with respect to the person adopting the 10b5-1 Plan. 4. The person adopting the 10b5-1 Plan must certify in the 10b5-1 Plan on the adoption date of the 10b5- 1 Plan that the person (1) is not aware of any material nonpublic information about the Company securities or the Company and (2) is adopting the 10b5-1 Plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b-5. 5. The person who adopted the 10b5-1 Plan must act in good faith with respect to the 10b5-1 Plan during the term of such plan. 6. The person adopting the 10b5-1 Plan may not have entered into or altered a corresponding or hedging transaction or position with respect to the securities subject to the 10b5-1 Plan and must agree not to enter into any such transaction while the 10b5-1 Plan is in effect. 7. Except as specifically permitted by Rule 10b5-1(c)(1), the person adopting the 10b5-1 Plan must not have another 10b5-1 Plan, or subsequently enter into another 10b5-1 Plan, for open-market purchases or sales of the same Company securities during any part of the period in which the new 10b5-1 Plan is to be effective.

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 11 of 12 Confidential - Not to be Distributed 8. Except as specifically permitted by Rule 10b5-1(c)(1), if the 10b5-1 Plan is a single-trade plan, the person adopting the 10b5-1 Plan may not have adopted another 10b5-1 Plan during the prior 12-month period that was designed to effect in a single transaction the open-market purchase or sale of all of the Company securities covered by the prior plan. 9. The first trade under the 10b5-1 Plan may not occur at the earliest until the expiration of the minimum waiting period required by Rule 10b5-1(c)(1) applicable to the person who adopted the 10b5-1 Plan. ● With respect to the Company’s board of directors and Section 16 officers, the applicable waiting period is the later of (i) 90 days after the adoption or modification of the 10b5-1 Plan, or (ii) two business days following the filing of the Form 10-Q or Form 10-K for the fiscal quarter in which the plan was adopted or modified. In any event, the required waiting period is not to exceed 120 days following adoption or modification of the 10b5-1 Plan. ● With respect to all other persons, the applicable cooling-off period is 30 days after the adoption or modification of the 10b5-1 Plan. 10. Regarding modifications of a 10b5-1 Plan: ● A modification of an existing 10b5-1 Plan involving a modification or change in the amount, price or timing of the purchase or sale of the securities underlying the 10b5-1 Plan (or a modification or change to a written formula or algorithm, or computer program that affects the amount, price or timing of the purchase or sale of the securities) (a “material modification”) will constitute the termination of the existing 10b5-1 Plan and the adoption of a new 10b5-1 Plan subject to all of the requirements of these guidelines applicable to the adoption of a 10b5-1 Plan. ● The 10b5-1 Plan may only be subject to a material modification or be otherwise modified when the person modifying the 10b5-1 Plan is not aware of material nonpublic information about the Company or its securities. ● The 10b5-1 Plan may only be subject to a material modification or be otherwise modified when there is no quarterly, special or other blackout in effect with respect to the person modifying the 10b5-1 Plan. 11. Within the one-year period preceding the adoption of a 10b5-1 Plan or material modification of a 10b5- 1 Plan, a person may not have otherwise adopted a 10b5-1 Plan or made a material modification of a 10b5-1 Plan more than once. 12. If the person that adopted the 10b5-1 Plan terminates the 10b5-1 Plan prior to its stated duration, he or she may not trade in the Company’s securities until 30 calendar days after termination. 13. The Company must be notified in advance of any modification or termination of the 10b5-1 Plan and of any suspension of trading under the 10b5-1 Plan. 14. The Company must have authority to require the suspension or cancellation of the 10b5-1 Plan at any time.

INSIDER TRADING POLICY TYPE OF DOCUMENT POL-FIN-005.04 EFFECTIVE DATE 17 JANUARY 2024 Page 12 of 12 Confidential - Not to be Distributed 15. The 10b5-1 Plan should grant discretion to a broker that has been preapproved by the Chief Financial Officer or Chief Legal Officer with respect to the execution of trades under the 10b5-1 Plan: ● trades made under the 10b5-1 Plan must be executed by someone other than the stockbroker or other person that executes trades in other securities for the person adopting the 10b5-1 Plan; ● the person adopting the 10b5-1 Plan may not confer with the person administering the 10b5- 1 Plan regarding the Company or its securities; and ● the person administering the 10b5-1 Plan must provide prompt notice to the Company of the execution of a transaction pursuant to the 10b5-1 Plan. 16. All transactions under the 10b5-1 Plan must be effected in accordance with applicable law. 17. The 10b5-1 Plan (including any modified 10b5-1 Plan) must meet such other requirements as the Chief Financial Officer or Chief Legal Officer may determine, including such other requirements as the Chief Financial Officer or Chief Legal Officer may determine to be necessary or appropriate for any 10b5-1 Plan to comply with Rule 10b5-1 and other rules of the Securities and Exchange Commission as in effect from time to time. 18. The 10b5-1 Plan (including any modified 10b5-1 Plan) must be filed with the Company’s Chief Legal Officer with a certificate executed by the person adopting the 10b5-1 Plan stating that the 10b5-1 Plan complies with Rule 10b5-1 and meets the other requirements set forth above. * * *