UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

|

Filed by the Registrant ☑ |

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

|

☑ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a‑12 |

REVA Medical, Inc.

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☑ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14(a)‑6(i)(1) and 0‑11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (sets forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

April 5, 2018

Dear Stockholders:

We cordially invite you to attend our Annual General Meeting of Stockholders, also referred to as the “AGM” or the “Annual Meeting.” The meeting will be held Wednesday, May 16, 2018 at 4:00 p.m., US Pacific Daylight Time (which is 9:00 a.m. Thursday, 17 May 2018 Australian Eastern Standard Time), at the offices of DLA Piper LLP (US), 4365 Executive Drive, Suite 1100, San Diego, California 92121, U.S.A.

The matters to be acted upon are described in the accompanying Notice of 2018 Annual Meeting of Stockholders and Proxy Statement and consist of the following:

|

|

1) |

Election of two Class II board members |

|

|

2) |

Election of one Class I board member |

|

|

3) |

Ratification of auditors |

|

|

4) |

Approve issuance of equity securities up to 10% of the issued capital of the company |

|

|

5) |

Advisory vote on the frequency of a stockholder vote on executive compensation |

|

|

6) |

Advisory vote on executive compensation |

|

|

7) |

Approval of the issuance and transfer of securities under the Amended and Restated 2010 Equity Incentive Plan |

|

|

8) |

Approval of stock options and RSUs to directors |

|

|

9) |

Approval to transact any other business to come before the meeting |

Following the formal business of the meeting, management will provide an update on REVA’s operations; a copy of the management presentation will be posted on our website the day of the meeting.

All stockholders are invited to attend the Annual Meeting in person. Whether or not you expect to attend the Annual Meeting, you are urged to vote or submit your Proxy Card or CHESS Depositary Interest (or “CDI”) Voting Instruction Form as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. Telephone and Internet voting are available. For specific instructions on voting, please refer to the instructions in the Notice of Annual Meeting of Stockholders or the Proxy Card or CDI Voting Instruction Form. If you hold your shares through an account with a brokerage firm, bank, or other nominee, please follow the instructions you receive from them to vote your shares.

We look forward to seeing you at our Annual Meeting.

Very Truly Yours,

/s/ C. Raymond Larkin

C. Raymond Larkin

Chairman of the Board

|

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held 17 May 2018 (Australian Eastern Standard Time) May 16, 2018 (U.S. Pacific Daylight Time)

|

The 2018 Annual General Meeting (the “AGM” or “Annual Meeting”) of Stockholders of REVA Medical, Inc. will be held on 17 May 2018, at 9:00 a.m., Australian Eastern Standard Time (which is 4:00 p.m. on May 16, 2018 U.S. Pacific Daylight Time) at the offices of DLA Piper LLP (US), 4365 Executive Drive, Suite 1100, San Diego, California 92121, U.S.A., for the following purposes:

|

|

1. |

To elect the two Class II directors named in the Proxy Statement to hold office for a term of three years, and until their successors are duly elected and qualified, or until their earlier resignation or removal; |

|

|

2. |

To elect one Class I director named in the Proxy Statement to hold office for a term of two years, and until his successor is duly elected and qualified, or until his earlier resignation or removal; |

|

|

3. |

To ratify the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; |

|

|

4. |

For the purposes of Australian Securities Exchange (“ASX”) Listing Rule 7.1A and for all other purposes, to approve the issuance of equity securities up to 10% of the issued capital of the Company (calculated in accordance with the formula prescribed in ASX Listing Rule 7.1A) on the terms and conditions set forth in the Proxy Statement; |

|

|

5. |

To vote, on an advisory basis, on the frequency of a stockholder vote on executive compensation; |

|

|

6. |

To approve, on an advisory basis, the compensation of the named executive officers for the fiscal year ended December 31, 2017, as set forth in the Proxy Statement; |

|

|

7. |

For the purposes of ASX Listing Rule 7.2 (Exception 9) and for all other purposes, to approve the issuance and transfer of securities under the Amended and Restated 2010 Equity Incentive Plan on the terms and conditions set forth in the Proxy Statement, as an exception to ASX Listing Rule 7.1; |

|

|

8. |

For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 25,000 options to purchase 25,000 shares of common stock to Dr. Ross A. Breckenridge on the terms and conditions set forth in the Proxy Statement; |

|

|

9. |

For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 25,000 options to purchase 25,000 shares of common stock to Brian H. Dovey on the terms and conditions set forth in the Proxy Statement; |

|

|

11. |

For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 61,095 options to purchase 61,095 shares of common stock to C. Raymond Larkin on the terms and conditions set forth in the Proxy Statement; |

|

|

12. |

For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 86,917 options to purchase 86,917 shares of common stock to Dr. Stephen N. Oesterle on the terms and conditions set forth in the Proxy Statement; |

|

|

13. |

For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 25,000 options to purchase 25,000 shares of common stock to Robert B. Stockman on the terms and conditions set forth in the Proxy Statement; |

|

|

14. |

For the purposes of ASX Listing Rule 10.14 and for all other purposes, to approve the grant of 25,000 options to purchase 25,000 shares of common stock to Robert B. Thomas on the terms and conditions set forth in the Proxy Statement; |

|

|

15. |

To transact such other business as may properly come before the meeting or any adjournment or postponement of the meeting. |

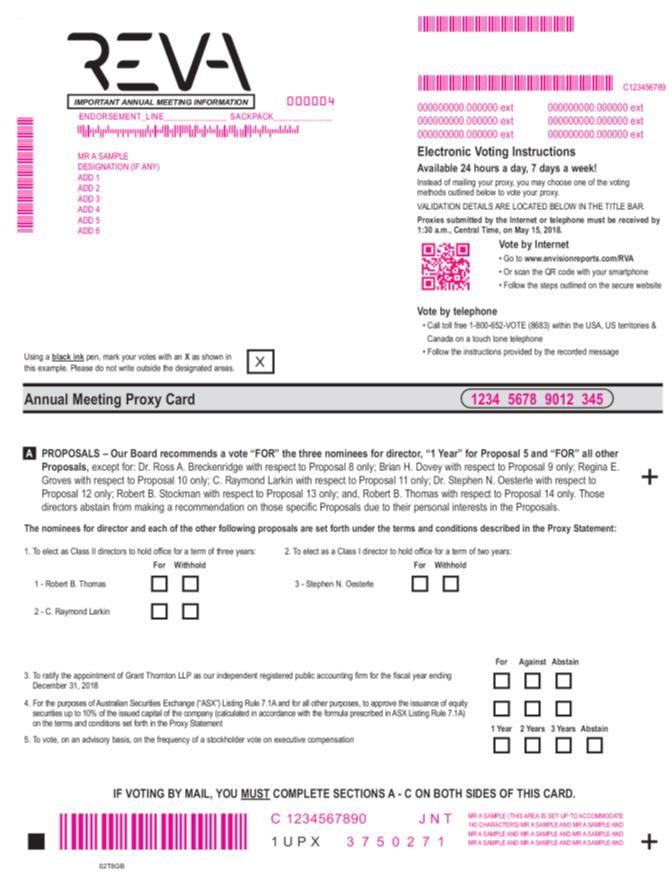

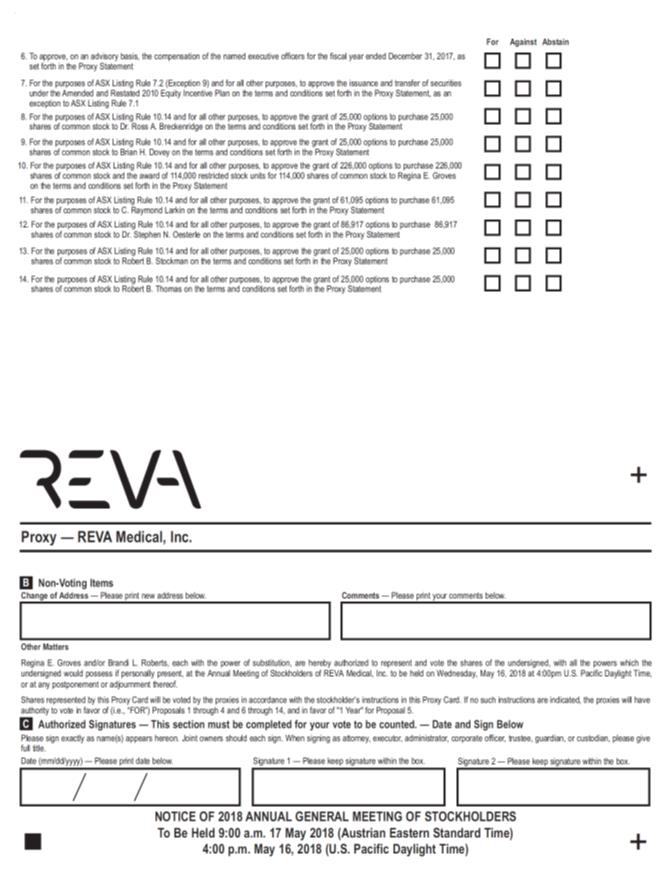

Our Board of Directors recommends that our stockholders vote “FOR” the three nominees for director, “1 YEAR” for Proposal 5, and “FOR” all other Proposals, except for Dr. Ross A. Breckenridge with respect to Proposal 8 only; Brian H. Dovey with respect to Proposal 9 only; Regina E. Groves with respect to Proposal 10 only; C. Raymond Larkin with respect to Proposal 11 only; Dr. Stephen N. Oesterle with respect to Proposal 12 only; Robert B. Stockman with respect to Proposal 13 only; and, Robert B. Thomas with respect to Proposal 14 only, all of who abstain from making a recommendation on those Proposals due to their personal interests in the Proposals.

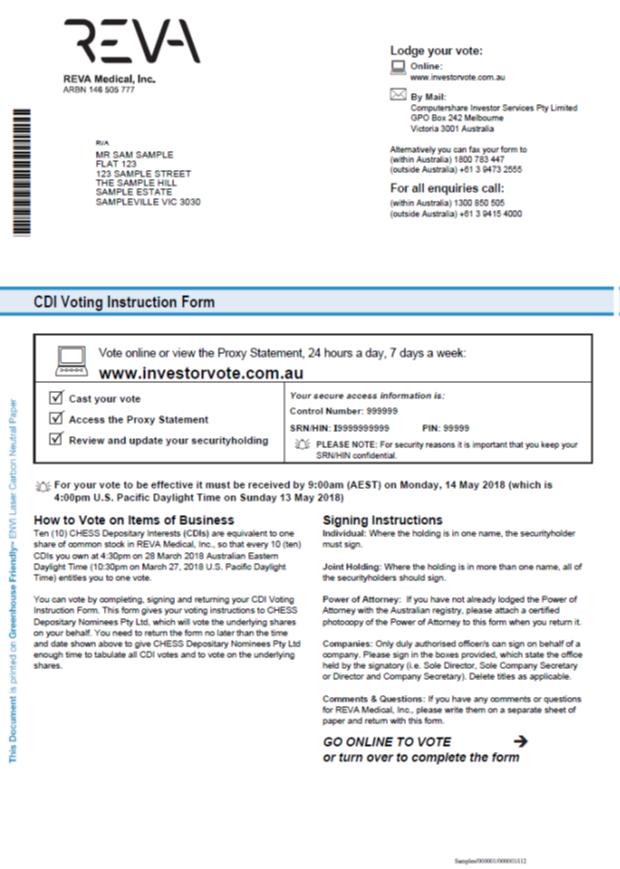

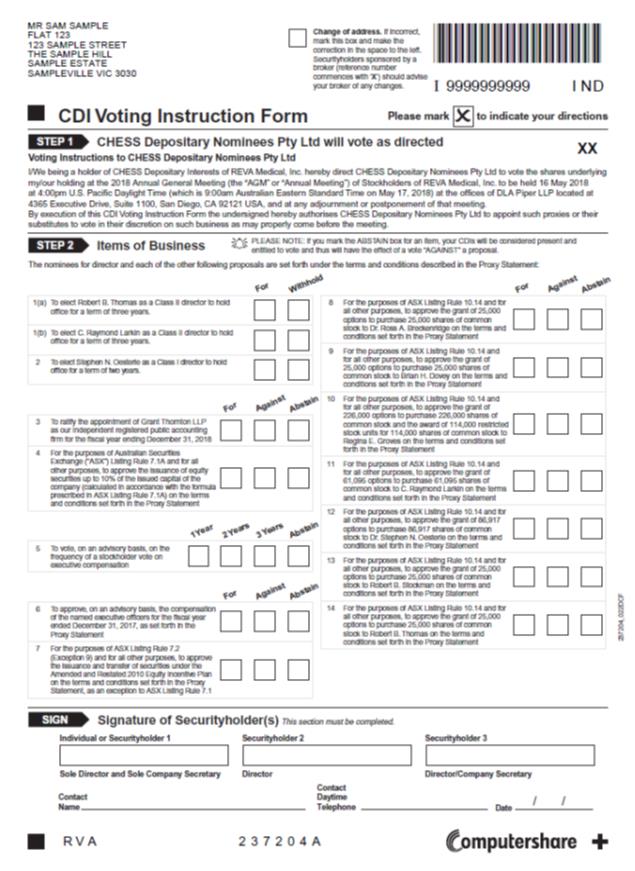

You are entitled to vote only if you were a REVA Medical, Inc. stockholder as of 4:30 p.m. on 28 March 2018 Australian Eastern Daylight Time (which was 10:30 p.m. on March 27, 2018 U.S. Pacific Daylight Time), the Record Date for the Annual Meeting. The owners of common stock as of that date are entitled to vote at the Annual Meeting and any adjournment or postponement of the meeting. Record holders of CHESS Depositary Interests (or “CDIs”) as of the close of business on the Record Date, are entitled to receive notice of and to attend the meeting or any adjournment or postponement of the meeting and may instruct our CDI Depositary, CHESS Depositary Nominees Pty Ltd (or “CDN”) to vote the shares underlying their CDIs by following the instructions on the CDI Voting Instruction Form or by voting online at www.investorvote.com.au. Doing so permits CDI holders to instruct CDN to vote on behalf of the CDI holders at the meeting in accordance with the instructions received via the CDI Voting Instruction Form or online.

For ten days prior to the meeting, a complete list of stockholders entitled to vote at the meeting will be available for examination by any stockholder, for any purpose relating to the meeting, during ordinary business hours at our principal offices located at 5751 Copley Drive, San Diego, California 92111, U.S.A.

The Proxy Statement that accompanies and forms part of this Notice of Annual Meeting provides information in relation to each of the matters to be considered. This Notice of Annual Meeting and the Proxy Statement should be read in their entirety. If stockholders are in doubt as to how they should vote, they should seek advice from their legal counsel, accountant, solicitor, or other professional advisor prior to voting.

By order of the Board of Directors:

/s/ Brandi L. Roberts

Brandi L. Roberts

Chief Financial Officer and Secretary

IMPORTANT: To ensure that your shares are represented at the meeting, please vote your shares (or, for CDI holders, direct CDN to vote your CDIs) via the Internet, by telephone, or by marking, signing, dating, and returning a Proxy Card or CDI Voting Instruction Form to the address specified. If you attend the meeting, you may choose to vote in person even if you have previously voted your shares, except that CDI holders may only instruct CDN to vote on their behalf by completing and signing the CDI Voting Instruction Form or voting online at www.investorvote.com.au and may not vote in person.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS:

Our Proxy Statement and 2017 Annual Report on Form 10-K

are available at

www.envisionreports.com/RVA (for holders of shares)

and at

www.investorvote.com.au (for holders of CDIs)

REVA MEDICAL, INC.

5751 Copley Drive, San Diego, California 92111, U.S.A.

PROXY STATEMENT FOR THE ANNUAL GENERAL MEETING OF STOCKHOLDERS

17 MAY 2018 (AUSTRALIAN EASTERN STANDARD TIME)

MAY 16, 2018 (U.S. PACIFIC DAYLIGHT TIME)

This Proxy Statement, along with a Proxy Card and/or CDI Voting Instruction Form,

is being made available to our stockholders and CDI holders on or about April 5, 2018

Why am I receiving these materials?

We have made these proxy materials available to you in connection with the solicitation by the Board of Directors (the “Board”) of REVA Medical, Inc. (the “Company” or “REVA”) of proxies to be voted at our 2018 Annual General Meeting of Stockholders (the “AGM” or “Annual Meeting”) to be held on 17 May 2018, at 9:00 a.m., Australian Eastern Standard Time (which is 4:00 p.m. on May 16, 2018 U.S. Pacific Daylight Time), at the DLA Piper LLP (US) offices in San Diego, CA, and at any postponements or adjournments of the Annual Meeting. If you held shares of our common stock as of 4:30 p.m. on 28 March 2018 Australian Eastern Daylight Time (which was 10:30 p.m. on March 27, 2018 U.S. Pacific Daylight Time), the Record Date for the Annual Meeting, you are invited to attend the Annual Meeting and vote on the proposals described below under the heading “On what proposals am I voting?” Those persons holding CHESS Depositary Interests (“CDIs”) are entitled to receive notice of and to attend the AGM and may instruct CHESS Depositary Nominees Pty Ltd. (“CDN”) to vote at the Annual Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.investorvote.com.au.

On what proposals am I voting?

There are 14 proposals scheduled to be voted on at the Annual Meeting:

|

|

1) |

Election of the two Class II directors named in this Proxy Statement to hold office for a term of three years, and until their successors are duly elected and qualified, or until their earlier resignation or removal; |

|

|

2) |

Election of the Class I director named in this Proxy Statement to hold office for a term of two years, and until his successor is duly elected and qualified, or until his earlier resignation or removal; |

|

|

3) |

Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018; |

|

|

4) |

For the purposes of Australian Securities Exchange (“ASX”) Listing Rule 7.1A and for all other purposes, to approve the issuance of equity securities up to 10% of the issued capital of the company (calculated in accordance with the formula prescribed in ASX Listing Rule 7.1A) on the terms and conditions set forth in the Proxy Statement; |

|

|

5) |

To vote, on an advisory basis, on the frequency of a stockholder vote on executive compensation; |

|

|

6) |

Approval, on an advisory basis, of the compensation of the named executive officers for the fiscal year ended December 31, 2017, as set forth in this Proxy Statement; |

|

|

7) |

Approval of the issuance and transfer of securities under the Amended and Restated 2010 Equity Incentive Plan on the terms and conditions set forth in this Proxy Statement; |

|

|

8) |

Approval of the grant of 25,000 options to purchase 25,000 shares of common stock to Dr. Ross A. Breckenridge on the terms and conditions set forth in this Proxy Statement; |

|

|

9) |

Approval of the grant of 25,000 options to purchase 25,000 shares of common stock to Brian H. Dovey on the terms and conditions set forth in this Proxy Statement; |

|

|

10) |

Approval of the grant of 226,000 options to purchase 226,000 shares of common stock and the award of 114,000 restricted stock units for 114,000 shares of common stock to Regina E. Groves on the terms and conditions set forth in this Proxy Statement; |

- 1 -

|

|

11) |

Approval of the grant of 61,095 options to purchase 61,095 shares of common stock to C. Raymond Larkin on the terms and conditions set forth in this Proxy Statement; |

|

|

12) |

Approval of the grant of 86,917 options to purchase 86,917 shares of common stock to Dr. Stephen N. Oesterle on the terms and conditions set forth in this Proxy Statement; |

|

|

13) |

Approval of the grant of 25,000 options to purchase 25,000 shares of common stock to Robert B. Stockman on the terms and conditions set forth in this Proxy Statement; |

|

|

14) |

Approval of the grant of 25,000 options to purchase 25,000 shares of common stock to Robert B. Thomas on the terms and conditions set forth in this Proxy Statement; |

How does the Board recommend that I vote?

Our Board recommends that you vote your shares “FOR” all Proposals, except for: Dr. Ross A. Breckenridge with respect to Proposal 8 only; Brian H. Dovey with respect to Proposal 9 only; Regina E. Groves with respect to Proposal 10 only; C. Raymond Larkin with respect to Proposal 11 only; Dr. Stephen N. Oesterle with respect to Proposal 12 only; Robert B. Stockman with respect to Proposal 13 only; and, Robert B. Thomas with respect to Proposal 14 only. Those directors abstain from making a recommendation on those specific Proposals due to their personal interests in the Proposals.

Who is entitled to vote at the Annual Meeting?

If you were a holder of REVA common stock, either as a stockholder of record or as the beneficial owner of shares held in street name as of 4:30 p.m. on 28 March 2018 Australian Eastern Daylight Time (which was 10:30 p.m. on March 27, 2018 U.S. Pacific Daylight Time), the Record Date for the Annual Meeting, subject to the voting exclusions below, you may vote your shares at the Annual Meeting. As of the Record Date, there were 41,245,820 shares of our common stock outstanding (equivalent to 412,458,200 CDIs assuming all shares of common stock were converted into CDIs on the Record Date). Each stockholder has one vote for each share of common stock held as of the Record Date. Each CDI holder is entitled to direct CDN to vote one vote for every ten (10) CDIs held by such holder. As summarized below, there are some distinctions between shares held of record and those owned beneficially and held in street name.

What does it mean to be a “stockholder of record?”

You are a “stockholder of record” if your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A. As a stockholder of record, you have the right to grant your voting proxy directly to REVA or to vote in person at the Annual Meeting. You may vote by Internet, telephone, or mail, as described below under the heading “How do I vote my shares of REVA common stock?” Holders of CDIs are entitled to receive notice of and to attend the Annual Meeting and may direct CDN to vote at the Annual Meeting by following the instructions on the CDI Voting Instruction Form or by voting online at www.investorvote.com.au.

What does it mean to beneficially own shares in “street name?”

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage firm, bank, broker‑dealer, trust, custodian, or other similar organization. If this is the case, proxy materials were forwarded to you by that organization. As the beneficial owner, you have the right to direct your broker, bank, trustee, or nominee how to vote your shares, and you are also invited to attend the Annual Meeting.

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposals for which your broker does not have discretionary authority to vote (a “broker non‑vote”). Since a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from the broker, bank, trustee, or nominee that holds your shares giving you the right to vote at the meeting. If you do not wish to vote in person or will not be attending the Annual Meeting, you may vote by proxy. Proxies can be lodged by Internet or telephone, as described below under “How do I vote my shares of REVA common stock?”

How many shares must be present or represented to conduct business at the Annual Meeting?

The quorum requirement for holding the Annual Meeting and transacting business is that holders of one-third of the voting power of the issued and outstanding shares of our common stock entitled to vote generally in the election of directors must be present in person or represented by proxy. Abstentions and shares represented by “broker non‑votes” are counted for the purpose of determining the presence of a quorum. As of the Record Date, there were 41,245,820 shares of our common stock outstanding, and each share is entitled to one vote at the Annual Meeting.

- 2 -

What is the voting requirement to approve each of the proposals?

Subject to voting exclusion statements for a Proposal, the vote required to approve each Proposal is set forth below. Information on voting exclusion statements are set forth in the additional information provided for each Proposal.

Proposals 1 and 2 — Election of Directors

Directors are elected by a plurality of the votes cast by the stockholders entitled to vote at the election, which means that the director nominees receiving the highest number of “FOR” votes will be elected. Neither abstentions nor broker non‑votes will count in determining which nominees received the largest number of votes cast and they will have no direct effect on the outcome of the election of directors.

Proposal 3 — Ratification of the Appointment of our Independent Registered Public Accounting Firm

The proposal to ratify the appointment of Grant Thornton LLP requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on such proposal. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” this proposal. Broker non-votes will have no direct effect on the outcome of this proposal.

Proposal 4 — Approval of Issuance of up to 10% of the Issued Capital of the Company

The proposal to approve the issuance of equity securities of up to 10 percent of the issued capital of the Company requires the affirmative vote of the holders of 75 percent of the shares present in person or represented by proxy at the Annual Meeting and voting on such proposals. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” this proposal. Broker non-votes will have no direct effect on the outcome of this proposal.

Proposal 5 — Advisory Vote on the Frequency of a Stockholder Vote on Executive Compensation

The proposal on whether advisory votes on executive compensation should be conducted annually, biennially or triennially will be determined by a plurality of votes, which means that the choice of frequency that receives the highest number of votes will be considered the advisory vote of the Company’s stockholders. Abstentions and broker non-votes will not count in determining which frequency choice received the largest number of votes, and will have no direct effect on the outcome of this proposal.

Proposal 6 — Approval, on an Advisory Basis, of Executive Compensation

The proposal to approve, on an advisory basis, the compensation awarded to the named executive officers for the fiscal year ended December 31, 2017 requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on such proposal. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” this proposal. Broker non-votes will have no direct effect on the outcome of this proposal.

Proposal 7 – Approval of the Issuance and Transfer of Securities under the Company’s Amended and Restated 2010 Equity Incentive Plan

The proposal to approve the issuance and transfer of securities under the Amended and Restated 2010 Equity Incentive Plan requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on such proposal. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” this proposal. Broker non-votes will have no direct effect on the outcome of this proposal.

Proposals 8 through 14 — Approval of the Grant of Stock Options and Restricted Stock Units to Directors

Each of the proposals to approve the grants of options to purchase shares of common stock or restricted stock units under the 2010 Equity Incentive Plan, as amended, to each of the non-executive directors of the Company requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on such proposal. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” these proposals. Broker non-votes will have no direct effect on the outcome of these proposals.

Voting exclusion statement:

The Company will disregard any votes cast on Proposals 7 through 14 by any director of REVA and by any associate of any director of REVA.

- 3 -

However, the Company need not disregard a vote cast on Proposals 7 through 14 if:

|

|

• |

it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card; or |

|

|

• |

it is cast by the person chairing the meeting as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card to vote as the proxy decides. |

How do I vote my shares of REVA common stock?

If you are a stockholder of record, you can vote in the following ways:

|

|

• |

By Internet: |

CDI holders: by following the Internet voting instructions included in the Notice of Annual Meeting of Stockholders at any time up until 9:00 a.m. on 14 May 2018 Australian Eastern Standard Time (which is 4:00 p.m. on May 13, 2018 U.S. Pacific Daylight Time);

U.S. stockholders: by following the Internet voting instructions included in the Notice of Annual Meeting of Stockholders at any time up until 1:30 a.m. U.S. Central Time on May 15, 2018

|

|

• |

By Telephone: |

U.S. stockholders: by following the telephone voting instructions included in the Notice of Annual Meeting of Stockholders at any time up until 1:30 a.m. U.S. Central Time on May 15, 2018

|

|

• |

By Mail: by marking, dating, and signing your proxy card in accordance with the instructions on it and returning it by mail in the pre‑addressed reply envelope. The proxy card must be received prior to the Annual Meeting. |

If your shares are held through a benefit or compensation plan or in street name, your plan trustee or your bank, broker, or other nominee should give you instructions for voting your shares. In these cases, you may vote by Internet, telephone, or mail by submitting a Voting Instruction Form.

If you satisfy the admission requirements to the Annual Meeting, as described below under the heading “How do I attend the Annual Meeting?” you may vote your shares in person at the meeting. Even if you plan to attend the Annual Meeting, we encourage you to vote in advance by Internet, telephone, or mail so that your vote will be counted in the event you later decide not to attend the Annual Meeting. Shares held through a benefit or compensation plan cannot be voted in person at the Annual Meeting.

How do I vote if I hold CDIs?

Each CDI holder is entitled to direct CDN to vote one vote for every ten (10) CDIs held by such holder. Those persons holding CDIs are entitled to receive notice of and to attend the Annual Meeting and any adjournment or postponement thereof, and may direct CDN to vote their underlying shares of common stock at the Annual Meeting by voting online at www.investorvote.com.au, or by returning the CDI Voting Instruction Form to Computershare, the agent we designated for the collection and processing of voting instructions from our CDI holders, no later than 9:00 a.m. on 14 May 2018 Australian Eastern Standard Time (which is 4:00 p.m. on May 13, 2018 U.S. Pacific Daylight Time) in accordance with the instructions on such form. Doing so permits CDI holders to instruct CDN to vote on their behalf in accordance with their written directions.

Alternatively, CDI holders have the following options in order to vote at the Annual Meeting:

|

|

• |

informing REVA that they wish to nominate themselves or another person to be appointed as CDN’s proxy for the purposes of attending and voting at the meeting; or |

|

|

• |

converting their CDIs into a holding of shares of REVA’s common stock and voting these at the meeting (however, if thereafter the former CDI holder wishes to sell their investment on ASX, it would be necessary to convert shares of common stock back into CDIs). This must be done prior to the record date for the meeting. |

As holders of CDIs will not appear on REVA’s share register as the legal holders of the shares of common stock, they will not be entitled to vote at our stockholder meetings unless one of the above steps is undertaken.

- 4 -

How do I attend the Annual Meeting?

Admission to the Annual Meeting is limited to REVA stockholders and CDI holders, one member of their immediate families, or their named representatives. We reserve the right to limit the number of immediate family members or representatives who may attend the meeting. Stockholders of record, holders of CDIs of record, immediate family member guests, and representatives will be required to present government‑issued photo identification (e.g., driver’s license or passport) to gain admission to the meeting. Please be advised that no cameras, recording equipment, electronic devices, large bags, briefcases, or packages will be permitted in the meeting.

To register to attend the Annual Meeting, please contact REVA’s investor relations as follows:

|

|

• |

by e‑mail at IR@revamedical.com; |

|

|

• |

by phone at (858) 966-3045 in the U.S. or at +61 3 9866 4722 in Australia; or |

|

|

• |

by mail to Investor Relations at 5751 Copley Drive, San Diego, California 92111, U.S.A. |

Please include the following information in your request:

|

|

• |

your name and complete mailing address; |

|

|

• |

whether you require special assistance at the meeting; |

|

|

• |

if you will be naming a representative to attend the meeting on your behalf, the name, complete mailing address, and telephone number of that individual; |

|

|

• |

proof that you own shares of REVA’s common stock or hold CDIs as of the Record Date (such as a letter from your bank, broker, or other financial institution; a photocopy of a current brokerage, Computershare, or other account statement; or, a photocopy of a holding statement); and, |

|

|

• |

the name of your immediate family member guest, if one will accompany you. |

What does it mean if I receive more than one Notice of Annual Meeting of Stockholders?

It generally means you hold shares registered in multiple accounts. To ensure that all your shares are voted, please submit proxies or voting instructions for all of your shares.

May I change my vote or revoke my proxy?

Yes.

If you are a stockholder of record, you may change your vote or revoke your proxy by:

|

|

• |

filing a written statement to that effect with our Corporate Secretary at or before the taking of the vote at the Annual Meeting; |

|

|

• |

voting again via the Internet or telephone at a later time before the closing of those voting facilities for: |

CDI holders: at any time up until 9:00 a.m. on 14 May 2018 Australian Eastern Standard Time (which is 4:00 p.m. on May 13, 2018 U.S. Pacific Daylight Time) or

U.S. stockholders: at any time up until 1:30 a.m. U.S. Central Time on May 15, 2018;

|

|

• |

submitting a properly signed proxy card with a later date that is received at or prior to the Annual Meeting; or, |

|

|

• |

attending the Annual Meeting, revoking your proxy, and voting in person. |

The written statement or subsequent proxy should be delivered to REVA Medical, Inc., 5751 Copley Drive, San Diego, California 92111, U.S.A., Attention: Corporate Secretary, or hand delivered to the Corporate Secretary, before the taking of the vote at the Annual Meeting. If you are a beneficial owner and hold shares through a broker, bank, or other nominee, you may submit new voting instructions by contacting your broker, bank, or other nominee. You may also change your vote or revoke your voting instructions in person at the Annual Meeting if you obtain a signed proxy from the record holder (broker, bank, or other nominee) giving you the right to vote the shares.

If you are a holder of CDIs and you direct CDN to vote by completing the CDI Voting Instruction Form, you may revoke those directions by delivering to Computershare, no later than 9:00 a.m. on 14 May 2018 Australian Eastern Standard Time

- 5 -

(which is 4:00 p.m. on May 13, 2018 U.S. Pacific Daylight Time), a written notice of revocation bearing a later date than the CDI Voting Instruction Form previously sent.

Could other matters be decided at the Annual Meeting?

We are currently unaware of any matters to be raised at the Annual Meeting other than those presented in this Proxy Statement. If other matters are properly presented for consideration at the Annual Meeting and you are a stockholder of record and have submitted your proxy, the persons named in your proxy will have the discretion to vote on those matters for you.

Who will pay for the cost of soliciting proxies?

We will pay the cost of soliciting proxies, including the cost of preparing and mailing proxy materials. Proxies may be solicited on our behalf by directors, officers, or employees (for no additional compensation) in person or by telephone, electronic transmission, and facsimile transmission.

If we hire soliciting agents, we will pay them a reasonable fee for their services. We will not pay directors, officers, or other regular employees any additional compensation for their efforts to supplement our proxy solicitation. We anticipate that banks, brokerage houses, and other custodians, nominees, and fiduciaries may forward soliciting material to the beneficial owners of shares of common stock entitled to vote at the Annual Meeting and that we will reimburse those persons for their out‑of‑pocket expenses incurred in this connection.

PROPOSAL 1 — ELECTION OF class ii DIRECTORS

At the Annual Meeting, our stockholders will be asked to elect the two directors nominated for election as Class II directors. Our Board of Directors currently consists of eight members and is divided into three classes; Class I and II comprise three directors each and Class III comprises two directors. The directors in Class II, if elected, will serve three‑year terms and in each case until their respective successors are duly elected and qualified. On March 22, 2018, the Board unanimously nominated Robert B. Thomas and C. Raymond Larkin for election at the 2018 Annual Meeting. R. Scott Huennekens, our other Class II director, has informed us that he does not intend to stand for re-election due to other time commitments.

Robert B. Thomas is a current Class II director whose term expires at the Annual Meeting. Our Board appointed C. Raymond Larkin on July 13, 2017 to serve as a Class II director until the next annual general meeting after his appointment (being this Annual Meeting), when he must be duly elected by a vote of our stockholders. If elected, the two directors nominated as Class II directors will serve until the Company’s annual meeting of stockholders in 2021, and in each case until their successors are elected and qualified, or until their earlier resignation or removal. Both nominees have indicated their willingness to serve if elected, but if any should be unable to serve or for good cause will not serve, the shares represented by proxies may be voted for a substitute as REVA may designate, unless a contrary instruction is indicated in the proxy.

If another Board member is not appointed as a Class II director by the date of the Annual General Meeting to replace R. Scott Huennekens, we may have a vacancy on the Board.

Vote Required for Approval

Directors are elected by a plurality of the votes cast at the Annual Meeting, which means that the two director nominees receiving the highest number of “FOR” votes will be elected as Class II directors. Abstentions and broker non‑votes are not counted as votes cast with respect to that director, and will have no direct effect on the outcome of the election of directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE

“FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

PROPOSAL 2 — ELECTION OF class i DIRECTOR

At the Annual Meeting, our stockholders will be asked to elect one director nominated for election as a Class I director. Our Board of Directors currently consists of eight members and is divided into three classes; Class I and II comprise three

- 6 -

directors each and Class III comprises two directors. The Class I director, if elected, will serve a two‑year term and until his respective successor is duly elected and qualified. On March 22, 2018, our Board unanimously nominated Dr. Stephen N. Oesterle for election at the 2018 Annual Meeting as a Class I director. Our Board appointed Dr. Stephen N. Oesterle on February 5, 2018 to serve as a Class I director until the next annual general meeting after his appointment (being this Annual Meeting), when he must be duly elected by a vote of our stockholders.

If elected, the Class I director will serve until the Company’s annual meeting of stockholders in 2020, and until his successor is elected and qualified, or until his earlier resignation or removal. The nominee has indicated his willingness to serve if elected, but if he should be unable to serve or for good cause will not serve, the shares represented by proxies may be voted for a substitute as REVA may designate, unless a contrary instruction is indicated in the proxy.

Vote Required for Approval

Directors are elected by a plurality of the votes cast at the Annual Meeting, which means that the director nominee receiving the highest number of “FOR” votes will be elected as a Class I director. Abstentions and broker non‑votes are not counted as votes cast with respect to that director, and will have no direct effect on the outcome of the election of directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE

“FOR” THE ELECTION OF THE DIRECTOR NOMINEE NAMED ABOVE.

PROPOSAL 3 — RATIFICATION OF INDEPENDENT AUDITOR

The audit committee has selected Grant Thornton LLP as the Company’s independent registered public accounting firm (the “independent auditor”) to audit our financial statements for the fiscal year ending December 31, 2018. We are asking our stockholders to ratify the appointment of Grant Thornton LLP as our independent auditor because we value our stockholders’ views on the Company’s independent auditor even though the ratification is not required by our bylaws or otherwise. If our stockholders fail to ratify the appointment, the audit committee will reconsider whether or not to retain Grant Thornton LLP as our independent auditor or whether to consider the appointment of a different firm. Even if the appointment is ratified, the audit committee in its discretion may direct the appointment of a different independent auditor at any time for the fiscal year ending December 31, 2018.

A representative of Grant Thornton LLP is expected to be present at the Annual Meeting, will have an opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

Vote Required for Approval

Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2018 requires the affirmative vote of a majority of the shares of common stock of the Company present in person or represented by proxy at the Annual Meeting and entitled to vote. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” this proposal. Broker non-votes will have no direct effect on the outcome of this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS vote

“FOR” THE RATIFICATION OF OUR INDEPENDENT auditor.

PROPOSAL 4 — APPROVAL OF ISSUANCE OF UP TO 10% OF THE ISSUED CAPITAL OF THE COMPANY

Introduction

We are a U.S. public reporting company listed on ASX and, therefore, are required to comply with the U.S. federal securities laws and the ASX Listing Rules. We are seeking stockholder approval for the potential issuance of securities in the future solely for purpose of ASX Listing Rules, as further described below.

- 7 -

ASX Listing Rule 7.1 allows a company to issue a maximum of 15 percent of its issued capital in any 12-month period without obtaining stockholder approval. In accordance with ASX Listing Rule 7.1A, eligible companies can issue a further 10 percent of their issued capital over a 12-month period (the “Placement Securities”) without obtaining stockholder approval for the individual issues, provided that stockholder approval is obtained at the company’s annual meeting (and the company is an “eligible entity” at the time of the annual meeting). The Company is an “eligible entity” as of the date of this Proxy Statement.

Under ASX Listing Rule 7.1A, the Placement Securities must be in the same class as an existing quoted class of equity securities of the Company. As of the date of this Proxy Statement, the Company has only one quoted class of equity securities on issue, namely CDIs (and the shares of common stock underlying those CDIs).

The purpose of this Proposal 4 is to provide us with flexibility to meet future business and financial needs. We believe that it is advantageous for us to have the ability to act promptly with respect to potential opportunities and that approval of the issuance of the Placement Securities is desirable in order to have the securities available, as needed, for possible future financing transactions, strategic transactions, or other general corporate purposes that are determined by our board to be in the Company’s best interests.

Approval of this Proposal 4 would enable us to issue shares of common stock or CDIs without the expense and delay of holding a stockholders’ meeting, except as may be required by applicable law or regulations. The cost, prior notice requirements, and delay involved in obtaining stockholder approval at the time a corporate action may become necessary could eliminate the opportunity to effect the action or could reduce the expected benefits.

If approved, subject to the limitations described below with respect to the additional 10 percent placement capacity, we will generally be permitted to issue up to 25 percent of our issued and outstanding capital without any further stockholder approval, unless such stockholder approval is required by applicable law, the rules of ASX, or the rules or another stock exchange on which our securities may be listed. Currently, we have no definitive plans, understandings, agreements, or arrangements to issue securities for any purpose, other than equity awards under our 2010 Equity Incentive Plan. We believe that the adoption of this Proposal 4 will enable us to promptly and appropriately respond to business opportunities or to raise additional equity capital. Our board of directors will determine the terms of any issuance of securities in the future.

The Company is seeking stockholder approval to have the ability to issue Placement Securities under ASX Listing Rule 7.1A. The exact number of Placement Securities that may be issued by the Company under ASX Listing Rule 7.1A will be determined in accordance with the formula prescribed in ASX Listing Rule 7.1A.2, as follows:

(A x D) - E

A = Number of fully paid ordinary securities on issue 12 months before the date of issue or agreement:

• plus the number of fully paid ordinary securities issued during the 12 months under an exception in ASX Listing Rule 7.2;

• plus the number of partly paid ordinary securities that became fully paid during the 12 months;

• plus the number of fully paid ordinary securities issued during the 12 months with stockholder approval under ASX Listing Rules 7.1 and 7.4; and,

• less the number of fully paid ordinary securities cancelled during the 12 months.

D = 10%

E = Number of equity securities issued or agreed to be issued under Listing Rule 7.1A.2 in the 12 months before the date of issue or agreement to issue that are not issued with stockholder approval under ASX Listing Rules 7.1 or 7.4.

If passed, Proposal 4 will allow our board of directors to issue up to an additional 10 percent of the Company’s issued capital during the 12-month period following the date of the annual meeting without requiring further stockholder approval. This is in addition to the 15 percent annual placement capacity provided in ASX Listing Rule 7.1.

- 8 -

As of the date of this Proxy Statement, the Company has no specific plans to issue Placement Securities under ASX Listing Rule 7.1A.

As required by ASX Listing Rule 7.3A, the following information is provided in relation to this Proposal 4:

(a) ASX Listing Rule 7.3A.1 — The minimum price at which Placement Securities may be issued pursuant to the ASX Listing Rule 7.1A approval will be no less than 75% of the volume weighted average price of the Company’s CDIs calculated over the 15 trading days on which trades in that class were recorded immediately before:

• the date on which the issue price of the Placement Securities is agreed; or

• if Placement Securities are not issued within 5 trading days of the date on which the issue price is agreed, the date on which Placement Securities are issued.

In accordance with ASX listing rules, if the Placement Securities are issued for non-cash consideration, the Company will provide a valuation to the market that demonstrates the non-cash consideration issue price of the Placement Securities complies with ASX Listing Rule 7.3A.

(b) ASX Listing Rule 7.3A.2 — If the Company issues Placement Securities under ASX Listing Rule 7.1A, the existing stockholders of the Company face the risk of economic and voting dilution as a result of the issue of Placement Securities, to the extent that such Placement Securities are issued, including the risk that:

• the market price for Placement Securities may be significantly lower on the issue date than on the date of the approval under ASX Listing Rule 7.1A; and

• Placement Securities may be issued at a price that is at a discount to the market price for those securities on the issue date.

The following table describes the potential dilution to existing stockholders on the basis of three different issue prices and values for variable ‘A’ in the formula in ASX Listing Rule 7.1A.2. The prices and values set out in the table are examples only and include scenarios prescribed by the ASX Listing Rules. Accordingly, they provide no indication of the actual market price of the Company’s CDIs or the price at which issues of Placement Securities under ASX Listing Rule 7.1A will be made (assuming Proposal 4 is approved by stockholders).

|

Variable 'A' in Listing Rule 7.1.A.2 |

|

|

|

CDI issue price of A$0.20 (50% of the current market price of the Company's CDIs) |

|

CDI issue price of A$0.40 (100% of the current market price of the Company's CDIs) |

|

CDI issue price of A$0.80 (200% of the current market price of the Company's CDIs) |

|

412,458,200 CDIs |

|

10% Voting Dilution |

|

41,245,820 CDIs |

|

41,245,820 CDIs |

|

41,245,820 CDIs |

|

(current variable 'A') |

|

Funds raised |

|

A$8,249,164 |

|

A$16,498,328 |

|

A$32,996,656 |

|

|

|

|

|

|

|

|

|

|

|

618,687,300 CDIs |

|

10% Voting Dilution |

|

61,868,730 CDIs |

|

61,868,730 CDIs |

|

61,868,730 CDIs |

|

(50% increase in variable 'A') |

|

Funds raised |

|

A$12,373,746 |

|

A$24,747,492 |

|

A$49,494,984 |

|

|

|

|

|

|

|

|

|

|

|

824,916,400 CDIs |

|

10% Voting Dilution |

|

82,491,640 CDIs |

|

82,491,640 CDIs |

|

82,491,640 CDIs |

|

(100% increase in variable 'A') |

|

Funds raised |

|

A$16,498,328 |

|

A$32,996,656 |

|

A$65,993,312 |

|

|

|

|

|

|

|

|

|

|

- 9 -

The above table has been prepared based on the following assumptions:

|

|

• |

The Company issues (as CDIs) the maximum number of Placement Securities available under the 10% placement capacity prescribed by ASX Listing Rule 7.1A. |

|

|

• |

No options are exercised before the date of issue of Placement Securities under ASX Listing Rule 7.1A. |

|

|

• |

The 10% voting dilution reflects the aggregate percentage dilution against the issued share capital at the time of issue. This is why the voting dilution is shown in each example as 10%. |

|

|

• |

The table shows only the effect of issues of Placement Securities under ASX Listing Rule 7.1A, not under the Company’s 15% placement capacity under ASX Listing Rule 7.1. |

|

|

• |

The issue price of A$0.40 is the last closing price of the Company’s CDIs on ASX as of March 22, 2018. |

|

|

• |

Assuming all shares of common stock are held as CDIs. |

(c) ASX Listing Rule 7.3A.3 — The date the Placement Securities must be issued by (assuming this Proposal 4 is approved by stockholders) is the date that is 12 months after the date of the Company’s 2018 annual general meeting (i.e., 17 May 2019 (Australian Time)) unless the Company approves a transaction under ASX Listing Rule 11.1.2 (a significant change to the nature or scale of the Company’s activities) or ASX Listing Rule 11.2 (disposal of the Company’s main undertaking), in which case the ASX Listing Rule 7.1A approval under this Proposal 4 will fall away on the date of stockholder approval for the relevant transaction.

(d) ASX Listing Rule 7.3A.4 — The Placement Securities will be issued for the purpose of funding the Company’s operations, including research and development, preclinical and clinical studies and commercialization.

(e) ASX Listing Rule 7.3A.5 — the Company’s allocation policy for issues of Placement Securities pursuant to approval under this Proposal 4 will depend on prevailing market conditions and the Company’s circumstances at the time of any proposed issue. The form and timing of any issue of Placement Securities under ASX Listing Rule 7.1A and the identity of the allottees of Placement Securities will be determined on a case by case basis having regard to any one or more of the following:

• the methods of raising funds available to the Company including, but not limited to, rights issues or other issues in which existing stockholders of the Company can participate;

• the effect of the issue of placement securities on the control of the Company;

• the financial situation of the Company; and

• advice from any one or more of the Company’s professional advisers.

Allottees for the purposes of the issue of Placement Securities under ASX Listing Rule 7.1A have not been determined as at the date of this Proxy Statement but may include existing substantial stockholders and/or new stockholders who are not related parties or associates of as related party of the Company. In addition, if the Company is successful in acquiring new assets or investments, it is possible that allottees for the purpose of the issue of Placement Securities under ASX Listing Rule 7.1A will be or include vendors or include vendors of the new assets or investments.

As of the date of this Proxy Statement, the Company has not formed an intention as to the parties which it may approach to participate in an issue of Placement Securities under ASX Listing Rule 7.1A including which such an issue would be made to existing stockholders or to new investors.

(f) ASX Listing Rule 7.3A.6— the Company previously obtained stockholder approval under ASX Listing Rule 7.1A at its 2016 Annual Meeting on 26 May 2016. The Company has not issued any securities pursuant to that ASX Listing Rule 7.1A approval which expired on 26 May 2017.

- 10 -

The Company will disregard any votes cast in respect of Proposal 4 by a person who may participate in the proposed issue of any Placement Securities and a person who might obtain a benefit, except a benefit solely in the capacity of a holder of shares, if Proposal 4 is passed, and any associates of those persons. However, the Company need not disregard a vote if:

• it is cast by a person as a proxy for a person who is entitled to vote, in accordance with the direction on the proxy card; or

• it is cast by the person chairing the meeting as a proxy for a person who is entitled to vote, in accordance with direction on the proxy card to vote as the proxy decides.

As at the date of this Proxy Statement, the Company has no specific plans to issue Placement Securities under ASX Listing Rule 7.1A and therefore it is not known who, if any, may participate in a potential issue of Placement Securities, if any, under ASX Listing Rule 7.1A. Accordingly, as at the date of this Proxy Statement, the Company is not aware of any person who would be excluded from voting on this Proposal 4.

Vote required and Board of Directors Recommendation

Under ASX Listing Rule 7.1A, Proposal 4 is required to be passed as a special resolution for the purposes of the ASX Listing Rules, which means that it must be approved by at least 75 percent of the votes cast by stockholders entitled to vote on Proposal 4.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ISSUANCE OF SECURITIES OF UP TO 10% OF THE ISSUED CAPITAL OF THE COMPANY.

PROPOSAL 5 — ADVISORY VOTE ON THE FREQUENCY OF A STOCKHOLDER VOTE ON EXECUTIVE COMPENSATION

This proposal gives our stockholders the opportunity, through the following resolution, to advise our Board how often we should conduct an advisory “Say on Pay” vote on the compensation of our named executive officers:

“RESOLVED, that an advisory vote of the stockholders of REVA Medical, Inc. to approve the compensation of named executive officers as disclosed pursuant to the United States Securities and Exchange Commission (“SEC”) compensation disclosure rules, shall be held at an annual meeting of stockholders, beginning with the 2018 Annual Meeting of Stockholders, (i) every 3 years, (ii) every 2 years, or (iii) every year.”

The enclosed proxy card gives you four choices for voting on this item. You can choose whether the Say on Pay vote should be conducted every 3 years, every 2 years, or 1 year. You may also abstain.

Recommendation

While we will continue to monitor developments in this area, our Board currently plans to seek an advisory vote on compensation of our named executive officers every year. Our Board believes that holding such a vote every year is advisable for a number of reasons, including the following:

|

|

• |

an annual advisory vote would enable our stockholders to provide the Company with input regarding the compensation of our named executive officers on a timely basis; |

|

|

• |

an annual advisory vote may provide a higher level of accountability and direct communication between the Company and its stockholders by enabling the vote to correspond to the information presented in the accompanying proxy statement for the applicable stockholders’ meeting; |

|

|

• |

an annual vote is consistent with the requirement for ASX listed Australian companies to conduct an advisory vote at each annual general meeting with respect to the approval of the Company’s remuneration report; and, |

- 11 -

We ask that you indicate your support for the advisory vote on compensation of our named executive officers to be held annually.

Because your vote is advisory, it will not be binding upon the Board. However, our Board values the opinions that our stockholders express in their votes and will take into account the outcome of the vote when considering how frequently we should conduct an advisory Say on Pay vote on the compensation of our named executive officers.

The choice of frequency that receives the highest number of votes will be considered the advisory vote of the stockholders. Abstentions and broker non-votes will not count in determining which frequency choice received the largest number of votes, and will have no direct effect on the outcome of this proposal.

THE BOARD RECOMMENDS A VOTE FOR A FREQUENCY OF EVERY “1 YEAR” FOR FUTURE NON-BINDING STOCKHOLDER VOTES ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL 6 — ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Board of Directors is providing stockholders with the opportunity to cast an advisory vote on the compensation of our named executive officers in accordance with the rules of the SEC. This proposal, commonly known as a “Say on Pay” proposal, gives you, as a stockholder, the opportunity to endorse or not endorse our executive compensation programs and policies and the compensation paid to our named executive officers.

The Say on Pay vote is advisory, and therefore not binding on the compensation committee or the Board. Although the vote is non‑binding, the compensation committee and the Board will review the voting results, seek to determine the cause or causes of any significant negative voting, and take them into consideration when making future decisions regarding executive compensation programs.

We design our executive compensation programs to implement our core objectives of providing competitive pay, pay for performance, and alignment of management’s interests with the interests of long‑term stockholders. We utilize an independent compensation consultant to assist us in designing our compensation programs. Stockholders are encouraged to read the “Compensation Discussion and Analysis” section of this Proxy Statement for a more detailed discussion of how our compensation programs reflect our core objectives.

We believe stockholders should consider the following key aspects of executive compensation with respect to our named executive officers when voting on this proposal:

|

|

• |

base salaries increased by three to five percent in fiscal year 2017, in line with industry standards, as compared to the 2016 base salaries; |

|

|

• |

in addition to base salaries, the executives have a potential for cash bonuses and equity awards that would comprise a significant percentage of total compensation. Bonuses were awarded for 2017 based upon achievements of milestones under a pre-defined program, as more fully described in the Compensation and Discussion Analysis presented in this Proxy Statement; |

|

|

• |

the Company grants long-term equity awards that link the interests of our executives with those of our stockholders; and, |

|

|

• |

our compensation programs were reviewed by the compensation committee and determined not to create inappropriate or excessive risk that is likely to have a material adverse effect on the Company. |

Recommendation

The Board believes the Company’s executive compensation program uses appropriate structures and sound pay practices that are effective in achieving our core objectives. Accordingly, the Board recommends that you vote in favor of the following resolution:

- 12 -

“RESOLVED, that the stockholders of REVA Medical, Inc. approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules, including the “Compensation Discussion and Analysis” and “Executive Compensation” sections of this Proxy Statement.”

Approval of the Say on Pay proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on such proposal. Abstentions are considered shares present and entitled to vote and thus will have the effect of a vote “AGAINST” this proposal. Broker non‑votes will have no direct effect on the outcome of this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS vote

“FOR” APPROVAL, ON AN ADVISORY BASIS, OF EXECUTIVE COMPENSATION.

PROPOSAL 7 — APPROVAL OF THE ISSUANCE AND TRANSFER OF SECURITIES UNDER THE AMENDED AND RESTATED 2010 EQUITY INCENTIVE PLAN

Introduction

ASX Listing Rule 7.1 provides that the prior approval of our stockholders is required for an issue of equity securities if the securities will, when aggregated with the securities issued by the Company during the previous 12 months, exceed 15% of the number of securities on issue at the commencement of that 12 months.

ASX Listing Rule 7.2 (Exception 9) sets out an exception to ASX Listing Rule 7.1. This rule provides that issues under an employee incentive scheme are exempt for a period of three years if stockholders approve the issue of securities under the scheme for the purposes of this exception.

Accordingly, Proposal 7 seeks approval from our stockholders to approve the issuance and transfer of securities under the Amended and Restated 2010 Equity Incentive Plan (or “2010 Plan” or “Restated Plan”).

Approval of this Proposal 7 will mean that for the period of three years following the date of this Annual Meeting, any issues or transfers of securities made under the Amended and Restated 2010 Equity Incentive Plan will be excluded from the calculation of the Company’s 15% issue capacity under ASX Listing Rule 7.1 and, to the extent applicable, from the Company’s additional 10% placement capacity under ASX Listing Rule 7.1A (assuming Proposal 4 is approved by stockholders).

The Board of Directors last sought and obtained approval of its stockholders to approve the issuance and transfer of securities under the Amended and Restated 2010 Equity Incentive Plan in May 2014. The Company is now requesting that its stockholders approve the issuance and transfer of securities under the Amended and Restated 2010 Equity Incentive Plan at this Annual Meeting for the purposes of ASX Listing Rule 7.2 (Exception 9) so that we may continue to offer a compensation program that will attract, retain, motivate, and reward the experienced, highly qualified, and performance-based directors, employees, and consultants who will contribute to our success and align their and the Company’s interests with those of our stockholders through our ability to grant a variety of equity-based awards.

The number of securities issued under the 2010 Plan since its last approval for ASX purposes in May 2014 is 3,394,550 options (exercisable over 3,394,550 shares of common stock) and 1,151,300 shares of restricted stock units (for 1,151,300 shares of common stock).

A summary of the principal provisions of the 2010 Plan is set out below. This summary is qualified in its entirety by the complete text of the Amended and Restated 2010 Equity Incentive Plan set forth in Appendix A to this Proxy Statement.

Shares Authorized. As approved by our stockholders in November 2010, the 2010 Plan (and the Restated Plan) also provides that the number of authorized shares automatically increases on January 1 of each subsequent year through 2020, by an “Annual Increase” equal to the smallest of (a) 3% of the number of shares of common stock issued and outstanding on the

- 13 -

immediately preceding December 31, and (b) a lesser amount determined by the Board of Directors. On January 1, 2018, the share reserve was increased by 1,237,374 shares.

As of March 22, 2018, options were outstanding under the 2010 Plan for a total of 6,547,948 shares of our common stock and a total of 691,500 shares were subject to unvested awards of “full value awards” (e.g., awards other than stock options and stock appreciation rights) were outstanding under the 2010 Plan. As of that date, a total of 3,142,438 shares remained available for the future grant of awards under the 2010 Plan.

Our average annual burn rate (gross number of shares granted during the year divided by weighted common shares outstanding) for the three years ending December 31, 2017 was 4.5%. On an annual basis, the burn rate for the prior three (3) years was approximately 3.1%, 1.5%, and 9.0% for the annual periods ending December 31, 2017, December 31, 2016, and December 31, 2015, respectively.

If any award granted under the 2010 Plan expires or otherwise terminates for any reason without having been exercised or settled in full, or if shares subject to forfeiture or repurchase are forfeited or repurchased by the Company for not more than the participant’s purchase price, any such shares reacquired or subject to a terminated award will again become available for issuance under the Restated Plan. Shares will not be treated as having been issued under the Restated Plan and will therefore not reduce the number of shares available for issuance to the extent an award is settled in cash. Shares that are withheld or reacquired by the Company in satisfaction of a tax withholding obligation or that are tendered in payment of the exercise price of an option will not be made available for new awards under the 2010 Plan. Upon the exercise of a stock appreciation right or net-exercise of an option, the number of shares available under the 2010 Plan will be reduced by the gross number of shares for which the award is exercised.

Adjustments for Capital Structure Changes. Appropriate and proportionate adjustments will be made to the number of shares authorized under the Restated Plan, to the numerical limits on certain types of awards described below, and to outstanding awards in the event of any change in our common stock through merger, consolidation, reorganization, reincorporation, recapitalization, reclassification, stock dividend, stock split, reverse stock split, split-up, split-off, spin-off, combination of shares, exchange of shares or similar change in our capital structure, or if we make a distribution to our stockholders in a form other than common stock.

Section 162(m) Award Limits. As described above, the 2010 Plan established a limit on the maximum aggregate number of shares or dollar value for which such awards may be granted to an employee in any fiscal year which are intended to qualify as performance-based awards under Section 162(m) of the Code, as follows:

• No more than five hundred thousand (500,000) shares under stock-based awards within any fiscal year.

• No more than $2,000,000 for each full fiscal year contained in the performance period under cash-based awards.

These amounts are doubled with respect to the first fiscal year in which an employee is hired.

Administration. The 2010 Plan generally is administered by the Compensation Committee, although the Board of Directors retains the right to appoint another of its committees to administer the Restated Plan or to administer the Restated Plan directly. In the case of awards intended to qualify for the performance-based compensation exemption under Section 162(m) of the Code, administration of the Restated Plan must be by a compensation committee comprised solely of two or more “outside directors” within the meaning of Section 162(m) of the Code. (For purposes of this summary, the term “Compensation Committee” will refer to either such duly appointed committee or the Board of Directors.) Subject to the provisions of the Restated Plan, the Compensation Committee determines in its discretion the persons to whom and the times at which awards are granted, the types and sizes of awards, and all of their terms and conditions. The Compensation Committee may, subject to certain limitations on the exercise of its discretion required by Section 162(m) of the Code or otherwise provided by the Restated Plan, amend, cancel or renew any award, waive any restrictions or conditions applicable to any award, and accelerate, continue, extend or defer the vesting of any award. The 2010 Plan provides, subject to certain limitations, for indemnification by the Company of any director, officer or employee against all reasonable expenses, including attorneys’ fees, incurred in connection with any legal action arising from such person’s action or failure to act in administering the 2010 Plan. All awards granted under the Restated Plan will be evidenced by a written or digitally signed agreement between the Company and the participant specifying the terms and conditions of the award, consistent with the requirements of the Restated Plan. The Compensation Committee will interpret the 2010 Plan and awards granted thereunder,

- 14 -

and all determinations of the Compensation Committee generally will be final and binding on all persons having an interest in the Restated Plan or any award.

Prohibition of Option and SAR Repricing. The 2010 Plan expressly provides that, without the approval of a majority of the votes cast in person or by proxy at a meeting of our stockholders, the Compensation Committee may not provide for any of the following with respect to underwater options or stock appreciation rights: (1) either the cancellation of such outstanding options or stock appreciation rights in exchange for the grant of new options or stock appreciation rights at a lower exercise price or the amendment of outstanding options or stock appreciation rights to reduce the exercise price, (2) the issuance of new full value awards in exchange for the cancellation of such outstanding options or stock appreciation rights, or (3) the cancellation of such outstanding options or stock appreciation rights in exchange for payments in cash.

Eligibility. Awards may be granted to employees, directors and consultants of the Company or any present or future parent or subsidiary corporation or other affiliated entity of the Company. Incentive stock options may be granted only to employees who, as of the time of grant, are employees of the Company or any parent or subsidiary corporation of the Company. As of March 22, 2018, we had approximately 56 employees, including four executive officers, and seven non-employee directors who are eligible under the 2010 Plan.

Stock Options. The Compensation Committee may grant nonstatutory stock options, incentive stock options within the meaning of Section 422 of the Code, or any combination of these. The exercise price of each option may not be less than the fair market value of a share of our common stock on the date of grant. However, any incentive stock option granted to a person who at the time of grant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any parent or subsidiary corporation of the Company (a “10% Stockholder”) must have an exercise price equal to at least 110% of the fair market value of a share of common stock on the date of grant. As of March 22, 2018, the last closing price of our common stock as reported on the ASX was $3.10 per share as adjusted to account for conversion of CDIs (A$0.40) into shares of common stock and converted into U.S. dollars based on the prevailing exchange rate of 0.7744 on March 22, 2018.

The 2010 Plan provides that the option exercise price may be paid in cash, by check, or cash equivalent; by means of a broker-assisted cashless exercise; by means of a net-exercise procedure; to the extent legally permitted, by tender to the Company of shares of common stock owned by the participant having a fair market value not less than the exercise price; by such other lawful consideration as approved by the Compensation Committee; or by any combination of these. Nevertheless, the Compensation Committee may restrict the forms of payment permitted in connection with any option grant. No option may be exercised unless the participant has made adequate provision for federal, state, local and foreign taxes, if any, relating to the exercise of the option, including, if permitted or required by the Company, through the participant’s surrender of a portion of the option shares to the Company.

Options will become vested and exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Compensation Committee. The maximum term of any option granted under the 2010 Plan is ten (10) years, provided that an incentive stock option granted to a 10% Stockholder must have a term not exceeding five (5) years. Unless otherwise permitted by the Compensation Committee, an option generally will remain exercisable for three months following the participant’s termination of service, provided that if service terminates as a result of the participant’s death or disability, the option generally will remain exercisable for 12 months, but in any event the option must be exercised no later than its expiration date, and provided further that an option will terminate immediately upon a participant’s termination for cause (as defined by the 2010 Plan).

Options are nontransferable by the participant other than by will or by the laws of descent and distribution, and are exercisable during the participant’s lifetime only by the participant. However, a nonstatutory stock option may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Compensation Committee.

Stock Appreciation Rights. The Compensation Committee may grant stock appreciation rights either in tandem with a related option (a “Tandem SAR”) or independently of any option (a “Freestanding SAR”). A Tandem SAR requires the option holder to elect between the exercise of the underlying option for shares of common stock or the surrender of the option and the exercise of the related stock appreciation right. A Tandem SAR is exercisable only at the time and only to the extent that the related stock option is exercisable, while a Freestanding SAR is exercisable at such times or upon such events and subject to such terms, conditions, performance criteria or restrictions as specified by the Compensation Committee. The exercise price of each stock appreciation right may not be less than the fair market value of a share of our common stock on the date of grant.

- 15 -

Upon the exercise of any stock appreciation right, the participant is entitled to receive an amount equal to the excess of the fair market value of the underlying shares of common stock as to which the right is exercised over the aggregate exercise price for such shares. Payment of this amount upon the exercise of a Tandem SAR may be made only in shares of common stock whose fair market value on the exercise date equals the payment amount. At the Compensation Committee’s discretion, payment of this amount upon the exercise of a Freestanding SAR may be made in cash or shares of common stock. The maximum term of any stock appreciation right granted under the 2010 Plan is ten (10) years.

Stock appreciation rights are generally nontransferable by the participant other than by will or by the laws of descent and distribution, and are generally exercisable during the participant’s lifetime only by the participant. If permitted by the Compensation Committee, a Tandem SAR related to a nonstatutory stock option and a Freestanding SAR may be assigned or transferred to certain family members or trusts for their benefit to the extent permitted by the Compensation Committee. Other terms of stock appreciation rights are generally similar to the terms of comparable stock options.

Restricted Stock Awards. The Compensation Committee may grant restricted stock awards under the 2010 Plan either in the form of a restricted stock purchase right, giving a participant an immediate right to purchase common stock, or in the form of a restricted stock bonus, in which stock is issued in consideration for services to the Company rendered by the participant. The Compensation Committee determines the purchase price payable under restricted stock purchase awards, which may be less than the then current fair market value of our common stock. Restricted stock awards may be subject to vesting conditions based on such service or performance criteria as the Compensation Committee specifies, including the attainment of one or more performance goals similar to those described below in connection with performance awards. Shares acquired pursuant to a restricted stock award may not be transferred by the participant until vested. Unless otherwise provided by the Compensation Committee, a participant will forfeit any shares of restricted stock as to which the vesting restrictions have not lapsed prior to the participant’s termination of service. Unless otherwise determined by the Compensation Committee, participants holding restricted stock will have the right to vote the shares and to receive any dividends paid, except that dividends or other distributions paid in shares will be subject to the same restrictions as the original award and dividends paid in cash may be subject to such restrictions.