John Hancock Code of Ethics

January 1, 2008

(revised January 1, 2011)

This is the Code of Ethics for the following:

John Hancock Advisers, LLC and

John Hancock Investment Management Services, LLC

(each, a “John Hancock Adviser”)

John Hancock Funds, LLC

John Hancock Distributors, LLC, and

each open-end and closed-end fund advised by a John Hancock Adviser

(the “John Hancock Affiliated Funds”)

(together, called “John Hancock”)

John Hancock is required by law to adopt a Code of Ethics. The purposes of a Code of Ethics are to ensure that companies and their “covered employees”1 comply with all applicable laws and to prevent abuses in the investment advisory business that can arise when conflicts of interest exist between the employees of an investment advisor and its clients. By adopting and enforcing a Code of Ethics, we strengthen the trust and confidence entrusted in us by demonstrating that at John Hancock, client interests come first.

The Code of Ethics (the “Code”) that follows represents a balancing of important interests. On the one hand, as registered investment advisers, the John Hancock Advisers owe a duty of undivided loyalty to their clients, and must avoid even the appearance of a conflict that might be perceived as abusing the trust they have placed in John Hancock. On the other hand, the John Hancock Advisers do not want to prevent conscientious professionals from investing for their own accounts where conflicts do not exist or that are immaterial to investment decisions affecting the John Hancock Advisers’ clients.

When conflicting interests cannot be reconciled, the Code makes clear that, first and foremost, covered employees owe a fiduciary duty to John Hancock clients. In most cases, this means that the affected employee will be required to forego conflicting personal securities transactions. In some cases, personal investments will be permitted, but only in a manner, which, because of the circumstances and applicable controls, cannot reasonably be perceived as adversely affecting John Hancock client portfolios or taking unfair advantage of the relationship John Hancock employees have to John Hancock clients.

The Code contains specific rules prohibiting defined types of conflicts. Since every potential conflict cannot be anticipated by the Code, it also contains general provisions prohibiting conflict situations. In view of these general provisions, it is critical that any covered employee who is in doubt about the applicability of the Code in a given situation seek a determination from Code of Ethics Administration or the Chief Compliance Officer about the propriety of the conduct in advance.

It is critical that the Code be strictly observed. Not only will adherence to the Code ensure that John Hancock renders the best possible service to its clients, it will help to ensure that no individual is liable for violations of law.

It should be emphasized that adherence to this policy is a fundamental condition of employment at John Hancock. Every covered employee is expected to adhere to the requirements of the Code despite any inconvenience that may be involved. Any covered employee failing to do so may be subject to disciplinary action, including financial penalties and termination of employment in conjunction with the John Hancock Schedule of Fines and Sanctions or as determined by Ethics Oversight Committee..

| 1 | “Covered employees” includes all “access persons” as defined under Securities and Exchange Commission (“SEC”) Rule 17j-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), and “supervised persons” as defined under SEC Rule 204A-1 under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). |

1

Table of Contents

| Section 1: General Principals | 1 | |||

| Section 2: To Whom Does This Code Apply? | 2 | |||

| Access Person Designations |

3 | |||

| Section 3: Which Accounts and Securities are Subject to the Code’s Personal Trading Requirements | 4 | |||

| Preferred Brokerage Account Requirement |

5 | |||

| Section 4: Overview of Policies | 7 | |||

| Section 5: Policies in the Code of Ethics | 8 | |||

| John Hancock Affiliated Funds Reporting Requirement and Holding Period |

8 | |||

| Pre-clearance Requirement of Securities Transactions |

9 | |||

| Pre-clearance of IPOs, Private Placements and Limited Offerings |

10 | |||

| Pre-clearance of MFC securities |

10 | |||

| Pre-clearance Process |

10 | |||

| Ban on Short-Term Profits |

11 | |||

| Ban on IPOs for Access Level I Persons |

11 | |||

| Ban on Speculative Transactions in MFC |

12 | |||

| Ban on ownership of publicly traded securities of subadvisers and their controlling parent |

12 | |||

| Ban on Restricted Securities |

13 | |||

| Excessive Trading |

13 | |||

| Disclosure of Private Placement Conflicts |

13 | |||

| Seven Day Blackout Period for Access Level I Persons |

14 | |||

| Three Day Blackout Period for Access Level II Persons |

14 | |||

| Restriction on Securities under Active Consideration |

15 | |||

| Exceptions |

15 | |||

| De Minimus Trading Rule |

15 | |||

| Market Cap Securities Exception |

15 | |||

| Trading in Exchange Traded Funds/Notes and Options on Covered Securities |

15 | |||

| Section 6: Policies outside of the Code of Ethics | 16 | |||

| MFC Code of Business Conduct & Ethics |

16 | |||

| John Hancock Gift & Entertainment Policy for the Advisers |

16 | |||

| John Hancock Insider Trading Policy |

17 | |||

| John Hancock Whistleblower Policy for the Advisers |

17 | |||

| Policy and Procedures Regarding Disclosure of Portfolio Holdings |

18 | |||

| Section 7: Reporting and Other Disclosures outside the Code of Ethics | 19 | |||

| Broker Letter/Duplicate Confirm Statements |

19 | |||

| Investment Professional Disclosure of Personal Securities Conflicts |

19 | |||

| Section 8: Reporting Requirements and Other Disclosures inside the Code of Ethics | 20 | |||

| Initial Holdings Report and Annual Holdings Report |

20 | |||

| Quarterly Transaction Certification |

21 | |||

| Quarterly Brokerage Account Certification |

22 | |||

| Annual Certification of Code of Ethics |

23 | |||

| Reporting of Gifts, Donations, and Inheritances |

24 |

i

| Section 9: Subadviser Compliance | 24 | |||

| Adoption and Approval |

24 | |||

| Reporting and Recordkeeping Requirements |

25 | |||

| Section 10: Reporting to the Board | 25 | |||

| Section 11: Reporting Violations | 25 | |||

| Section 12: Interpretation and Enforcement | 26 | |||

| Section 13: Exemptions & Appeals | 27 | |||

| Section 14: Education of Employees | 28 | |||

| Section 15: Recordkeeping | 28 | |||

| Appendix A: Access Person Categories | 29 | |||

| Appendix B: Affiliated Funds | 30 | |||

| Appendix C: Pre-clearance Procedures | 37 | |||

| Appendix D: Subadviser Publicly Traded Securities Restriction List | 41 | |||

| Appendix E: Other Important Policies Outside the Code | 45 | |||

| Appendix F: Investment Professional Disclosure of Personal Securities Conflicts | 46 | |||

| Appendix G: John Hancock Advisers Schedule of Fines and Sanctions | 47 | |||

| Appendix H: Chief Compliance Officers and Compliance Contacts | 48 | |||

ii

1) General Principles

Each covered person within the John Hancock organization is responsible for maintaining the very highest ethical standards when conducting our business.

This means that:

| • | You have a fiduciary duty at all times to place the interests of our clients and fund investors first. |

| • | All of your personal securities transactions must be conducted consistent with the provisions of the Code that apply to you and in such a manner as to avoid any actual or potential conflict of interest or other abuse of your position of trust and responsibility. |

| • | You should not take inappropriate advantage of your position or engage in any fraudulent or manipulative practice (such as front-running or manipulative market timing) with respect to our clients’ accounts or fund investors. |

| • | You must treat as confidential any information concerning the identity of security holdings and financial circumstances of clients or fund investors. |

| • | You must comply with all applicable federal securities laws, which, for purposes of the Code, means the Securities Act of 1933, as amended (the “Securities Act”), the Securities Exchange Act of 1934, the Sarbanes-Oxley Act of 2002, the 1940 Act, the Advisers Act, Title V of the Gramm-Leach-Bliley Act, any rules adopted by the SEC under any of these statutes, the Bank Secrecy Act as it applies to funds and investment advisers, and any rules adopted there under by the SEC or the Department of the Treasury. |

| • | You must promptly report any violation of the Code that comes to your attention to the Chief Compliance Officer of your company – see Appendix H. |

It is essential that you understand and comply with the general principles, noted above, in letter and in spirit as no set of rules can anticipate every possible problem or conflict situation.

As described in section 12 “Interpretation and Enforcement” on page 24 of the Code, failure to comply with the general principles and the provisions of the Code may result in disciplinary action, including termination of employment.

1

2) To Whom Does This Code Apply?

This Code applies to you if you are:

| • | a director, officer or other “Supervised Employee”2 of a John Hancock Adviser; |

| • | an interested director, officer or access person3 of John Hancock Funds, LLC, John Hancock Distributors, LLC, or a John Hancock open-end or closed-end fund registered under the 1940 Act and are advised by a John Hancock Adviser; |

| • | an independent member of the Board of John Hancock Trust or John Hancock Funds II; |

| • | an employee of Manulife Financial Corporation (“MFC”) or its subsidiaries who participates in making recommendations for, or receives information about, portfolio trades or holdings of the John Hancock Affiliated Funds. The preceding excludes MFC Global Investment Management (U.S.A.) Limited, MFC Global Investment Management (U. S) LLC, and Declaration Management and Research, LLC each of whom have adopted their own code of ethics in accordance with Rule 204A-1 under the Advisers Act. |

However, notwithstanding anything herein to the contrary, the Code does not apply to any Board member of John Hancock Funds who is not an “interested person” (as defined in Section 2(a)(19) of the 1940 Act) of the Funds (an “Independent Board Member”), so long as he or she is subject to a separate Code of Ethics.

Please note that if a policy described below applies to you, it also applies to all accounts over which you have a beneficial interest. Normally, you will be deemed to have a beneficial interest in your personal accounts, those of a spouse, “significant other,” minor children or family members sharing the same household, as well as all accounts over which you have discretion or give advice or information. “Significant others” are defined for these purposes as two people who (1) share the same primary residence; (2) share living expenses; and (3) are in a committed relationship and intend to remain in the relationship indefinitely.

There are four categories for persons covered by the Code, taking into account their positions, duties and access to information regarding fund portfolio trades. You have been notified about which of these categories applies to you, based on Code of Ethics Administration’s understanding of your current role. If you have a level of investment access beyond your assigned category, or if you

| 2 | A “Supervised Employee” is defined by the Advisers Act to mean a partner, officer, director (or other person occupying a similar status or performing similar functions) or employee, as well as any other person who provides advice on behalf of the adviser and is subject to the adviser’s supervision and control. However, in reliance on the Prudential no-action letter, John Hancock does not treat as a “Supervised Employee” any of its “non-advisory personnel”, as defined below. |

In reliance on the Prudential no-action letter, John Hancock treats as an “Advisory Person” any “Supervised Employee” who is involved, directly, or indirectly, in John Hancock Financial Services investment advisory activities, as well as any “Supervised Employee” who is an “Access Person”. John Hancock treats as “non-advisory personnel”, and does not treat as a “Supervised Person”, those individuals who have no involvement, directly or indirectly, in John Hancock investment advisory activities, and who are not “Access Persons”.

| 3 | You are an “Access Person” if you are a “Supervised Person” who has access to non-public information regarding any client’s purchase or sale of securities, or non-public information regarding the portfolio holdings of any John Hancock Affiliated Fund, or who is involved in making securities recommendations to clients, or who has access to such recommendations that are non-public. |

2

are promoted or change duties and as a result should more appropriately be included in a different category, it is your responsibility to notify Code of Ethics Administration.

Access Person Designations:

The basic definitions of four categories, with examples, are provided below. The more detailed definitions of each category are attached as Appendix A.

| “Access Level I” Investment Access |

“Access Level II” Regular Access |

“Access Level III” Periodic Access |

“Access Level IV” Board Members | |||

| A person who, in connection with his/her regular functions or duties, makes or participates in making recommendations regarding the purchase or sale of securities by the Fund or account.

Examples:

• Portfolio Managers

• Analysts

• Traders |

A person who, in connection with his/her regular functions or duties, has regular access to nonpublic information regarding any clients’ purchase or sale of securities, or nonpublic information regarding the portfolio holdings of any John Hancock Affiliated Fund or who is involved in making securities recommendations to clients, or who has regular access to such recommendations that are nonpublic.

Examples:

• Office of the Chief Compliance Officer

• Fund Administration

• Investment Management Services,

• Administrative Personnel for Access Level I Persons

• Technology Resources Personnel

• Private Client Group Personnel |

A person who, in connection with his/her regular functions or duties, has periodic access to nonpublic information regarding any clients’ purchase or sale of securities, or nonpublic information regarding the portfolio holdings of any John Hancock Affiliated Fund.

Examples:

• Legal Staff

• Marketing

• Product Development

• E-Commerce

• Corporate Publishing

• Administrative Personnel for Access Level II Persons |

An Independent Board Member of John Hancock Trust or John Hancock Funds II |

3

3) Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions?

If the Code describes “Personal Trading Requirements” (i.e., John Hancock Mutual Fund reporting requirement and holding period, the pre-clearance requirement, the ban on short-term profits, the ban on IPOs, the disclosure of private placement conflicts and the reporting requirements) that apply to your access category as described above, then the requirements apply to trades for any account in which you have a beneficial interest. Normally, this includes your personal accounts, those of a spouse, “significant other,” minor children or family members sharing your household, as well as all accounts over which you have discretion or give advice or information. This includes all brokerage accounts that contain securities (including brokerage accounts that only contain securities exempt from reporting, e.g., brokerage accounts holding shares of non- affiliated mutual funds).

This also includes all accounts holding John Hancock Affiliated Funds as well as accounts in the MFC Global Share Ownership Plan.

Accounts over which you have no direct or indirect influence or control are exempt. To prevent potential violations of the Code, you are strongly encouraged to request clarification for any accounts that are in question.

These personal trading requirements do not apply to the following securities:

| • | Direct obligations of the U.S. government (e.g., treasury securities) and indirect obligations of the U. S government having less than one year to maturity; |

| • | Bankers’ acceptances, bank certificates of deposit, commercial paper, and high quality short-term debt obligations, including repurchase agreements; |

| • | Shares issued by money market funds and all other open-end mutual funds registered under the 1940 Act that are not advised or subadvised by a John Hancock Adviser or another Manulife entity4; |

| • | Commodities and options and futures on commodities; and |

| • | Securities in accounts over which you have no direct or indirect influence or control. |

Except as noted above, the Personal Trading Requirements apply to all securities, including:

| • | Stocks; |

| • | Bonds; |

| • | Government securities that are not direct obligations of the U.S. government, such as Fannie Mae, or municipal securities, in each case that mature in more than one year; |

| • | John Hancock Affiliated Funds;4 |

| • | Closed-end funds; |

| 4 | Different requirements apply to shares of John Hancock Affiliated Funds. See the section titled “Reporting Requirement and Holding Period for positions in John Hancock Affiliated Funds” on page 8 of this Code. A list of Affiliated Funds can be found in Appendix B. |

4

| • | Options on securities, on indexes, and on currencies; |

| • | Limited partnerships; |

| • | Exchange traded funds and notes; |

| • | Domestic unit investment trusts; |

| • | Non-US unit investment trusts and Non-US mutual funds; |

| • | Private investment funds and hedge funds; and |

| • | Futures, investment contracts or any other instrument that is considered a “security” under the Securities Act of 1933. |

Preferred Brokerage Account Requirements:

This rule applies to new access persons commencing employment after January 1, 2008, plus any new brokerage accounts established by existing access persons.

While employed by John Hancock, you must maintain your accounts at one of the preferred brokers approved by John Hancock. The following are the preferred brokers for you to maintain your covered accounts:

| Charles Schwab | E*trade | Fidelity | Citigroup Smith Barney | |||

| Merrill Lynch | Morgan Stanley | TDAmeritrade | UBS Financial | |||

| Scottrade | ||||||

Exceptions: With approval from Code of Ethics Administration, you can maintain a brokerage account at a broker-dealer other than the ones listed above if any of the following applies:

| • | it contains only securities that can’t be transferred; |

| • | it exists solely for products or services that one of the above broker/dealers can not provide; |

| • | it exists solely because your spouse’s or significant other’s employer also prohibits external covered accounts; |

| • | it is managed by a third-party registered investment adviser; |

| • | it is restricted to trading interests in non-Hancock 529 College Savings Plans; |

| • | it is associated with an ESOP (employee stock option plan) or an ESPP (employee stock purchase plan) in which a related covered person is the participant; |

| • | it is required by a direct purchase plan, a dividend reinvestment plan, or an automatic investment plan with a public company in which regularly scheduled investments are made or planned; |

| • | it is required by a trust agreement; |

5

| • | it is associated with an estate of which you are the executor, but not a beneficiary, and your involvement with the account is temporary; or |

| • | transferring the account would be inconsistent with other applicable rules. |

What do I need to do to comply?

You will need to transfer assets of current brokerage accounts to one of the preferred brokers/dealers listed above within 45 days of commencement of employment and close your current accounts

Or

You will need to contact Code of Ethics Administration to obtain an exemption request form to submit a request for permission to maintain a brokerage account with a broker/dealer not on John Hancock’s preferred broker list.

6

4) Overview of Policies

| Access Level I Person |

Access Level II Person |

Access Level III Person |

Access Level IV Person | |||||

| General principles | Yes | Yes | Yes | Yes | ||||

| Policies Inside the Code | ||||||||

| Reporting requirement and holding period for positions in John Hancock Affiliated Funds | Yes | Yes | Yes | Yes | ||||

| Pre-clearance requirement | Yes | Yes | Limited | No | ||||

| Pre-clearance requirement for initial public offerings (“IPOs”) | Prohibited | Yes | Yes | No | ||||

| Pre-clearance requirement on private placements/ limited offerings | Yes | Yes | Yes | No | ||||

| Ban on IPOs | Yes | No | No | No | ||||

| Ban on short-term profits | Yes | Yes | No | No | ||||

| Fund trade blackout period rule | Yes | Yes | No | No | ||||

| Ban on speculative trading in MFC stock | Yes | Yes | Yes | Yes | ||||

| Ban on ownership of publicly traded subadvisers and controlling parent | Yes | Yes | No | Yes | ||||

| Reporting Requirements & Disclosures | ||||||||

| Reporting of gifts, donations, and inheritances | Yes | Yes | Yes | No | ||||

| Duplicate confirms & statements | Yes | Yes | Yes | No | ||||

| Initial & annual certification of the Code | Yes | Yes | Yes | Yes | ||||

| Initial & annual holdings reporting | Yes | Yes | Yes | Yes | ||||

| Quarterly personal transaction reporting | Yes | Yes | Yes | Limited | ||||

7

| Disclosure of private placement conflicts | Yes | No | No | No | ||||

| Policies Outside the Code | ||||||||

| MFC Code of Business Conduct & Ethics | Yes | Yes | Yes | No | ||||

| John Hancock Gift & Entertainment Policy for the Advisers | Yes | Yes | Yes | No | ||||

| John Hancock Insider Trading Policy | Yes | Yes | Yes | No | ||||

| John Hancock Whistleblower Policy for the Advisers | Yes | Yes | Yes | No | ||||

| Policy and Procedures Regarding Disclosure of Portfolio Holdings | Yes | Yes | Yes | No | ||||

| Investment Professional Personal Security Ownership Disclosure | Yes | No | No | No | ||||

5) Policies in the Code of Ethics

John Hancock Affiliated Funds Reporting Requirement and Holding Period

Applies to: All Access Levels

You must follow the reporting requirement and the holding period requirement specified below if you purchase either:

| • | a “John Hancock Mutual Fund” (i.e., a 1940 Act mutual fund that is advised or sub-advised by a John Hancock Adviser or by another Manulife entity); or |

| • | a “John Hancock Variable Product” (i.e., contracts funded by insurance company separate accounts that use one or more portfolios of John Hancock Trust). |

The reporting requirement and the holding period requirement for positions in John Hancock Affiliated Funds do not include John Hancock money market funds and any dividend reinvestment, payroll deduction, systematic investment/withdrawal and/or other program trades.

Reporting Requirement: You must report your holdings and your trades in a John Hancock Affiliated Fund held in an outside brokerage account. This is not a pre-clearance requirement—you can report your holdings after you trade by submitting duplicate confirmation statements to Code of Ethics Administration. If you are an Access Level I Person, Access Level II Person, or Access Level III Person, you must also make sure that your holdings in a John Hancock Affiliated Fund are included in your Initial Holdings Report (upon hire or commencement of access designation).

8

If you purchase a John Hancock Variable Product, you must notify Code of Ethics Administration of your contract or policy number.

Code of Ethics Administration will rely on the operating groups of the John Hancock Affiliated Funds for administration of trading activity, holdings and monitoring of market timing policies. Accordingly employees will not be required to file duplicate transaction and holdings reports for these products as long as the accounts holding these products are held with the respective John Hancock operating group, i.e. John Hancock Signature Services, Inc. and the contract administrators supporting the John Hancock variable products.

Code of Ethics Administration will have access to this information upon request.

Holding Requirement: You cannot profit from the purchase and sale of a John Hancock Mutual Fund within 30 calendar days. The purpose of this policy is to address the risk, real or perceived, of manipulative market timing or other abusive practices involving short-term personal trading in the John Hancock Affiliated Funds. Any profits realized on short-term trades must be surrendered by check payable to John Hancock Advisers, LLC, which will be contributed to a charity of its choice. You may request an exemption from this policy for involuntary sales due to unforeseen corporate activity (such as a merger), or for sales due to hardship reasons (such as unexpected medical expenses) by sending an e-mail to the Chief Compliance Officer of your company.

Pre-clearance Requirement of Securities Transactions

Applies to: Access Level I Persons, Access Level II Persons

Also, for a limited category of trades:

Access Level III Persons

Access Level I Persons and Access Level II Persons: If you are an Access Level I Person or Access Level II Person, you must “pre-clear” (i.e., receive advance approval of) any personal securities transactions in the categories described in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code.

Due to this pre-clearance requirement, participation in investment clubs and special orders, such as “good until canceled orders” and “limit orders,” are prohibited.

Place day orders only, i.e., orders that automatically expire at the end of the trading session. Be sure to check the status of all orders at the end of the trading day and cancel any orders that have not been executed. If any Access Person leaves an order open and it is executed the next day (or later), the transaction will constitute a violation of the Code by the Access Person.

Limited Category of Trades for Access Level III Persons: If you are an Access Level III Person, you must pre-clear transactions in securities of any closed-end funds advised by a John Hancock Adviser, as well as transactions in IPOs, private placements and limited offerings. An Access Level III Person is not required to pre-clear other trades. However, please keep in mind that an Access Level III Person is required to report securities transactions after every trade (even those

9

that are not required to be pre-cleared) by requiring your broker to submit duplicate confirmation statements, as described in section 7 of the Code.

Pre-clearance of IPOs, Private Placements and Limited Offerings Pre-clearance requests for these securities require some special considerations—the decision will take into account whether, for example: (1) the investment opportunity should be reserved for John Hancock clients; and (2) is it being offered to you because of your position with John Hancock. A separate procedure should be followed for requesting pre-clearance on these securities. See Appendix C.

Pre-clearance of MFC securities:

Applies to: Access Level I Persons, Access Level II Persons

All personal transactions in MFC securities including stock, company issued options, and any other securities such as debt must be pre-cleared excluding trades in the MFC Global Share Ownership Plan.

Pre-clearance Process:

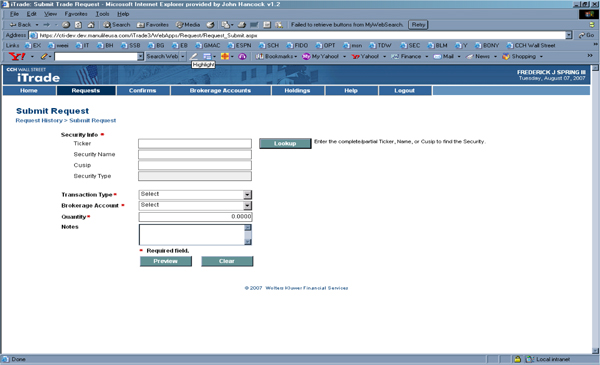

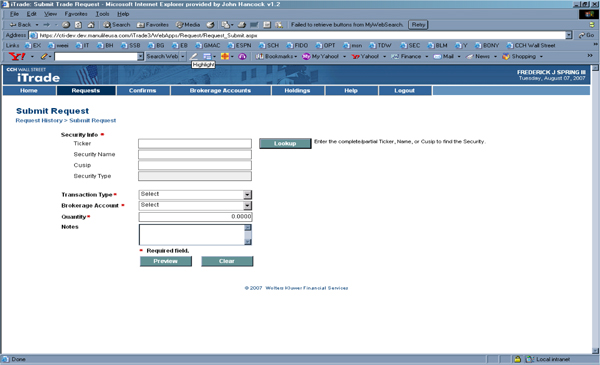

You may pre-clear a trade through the Personal Trading & Reporting System by following the steps outlined in the pre-clearance procedures, which are attached in Appendix C.

Please note that:

| • | You may not trade until clearance approval is received. |

| • | Clearance approval is valid only for the date granted (i.e. the pre-clearance requested date and the trade date should be the same). |

| • | A separate procedure should be followed for requesting pre-clearance of an IPO, a private placement, a limited offering as detailed in Appendix C. |

Code of Ethics Administration must maintain a five-year record of all pre-clearances of private placement purchases by Access Level I Persons, and the reasons supporting the clearances.

The pre-clearance policy is designed to proactively identify potential “problem trades” that raise front-running, manipulative market timing or other conflict of interest concerns (example: when an Access Level II Person trades a security on the same day as a John Hancock Affiliated Fund).

Certain transactions in securities that would normally require pre-clearance are exempt from the pre-clearance requirement in the following situations: (1) shares are being purchased as part of an automatic investment plan; (2) shares are being purchased as part of a dividend reinvestment plan; or (3) transactions are being made in an account over which you have designated a third party as having discretion to trade (you must have approval from the Chief Compliance Officer to establish a discretionary account).

10

Ban on Short-Term Profits

Applies to: Access Level I Persons, Access Level II Persons

If you are an Access Level I Person or Access Level II Person, you cannot profit from the purchase and sale (or sale and purchase) of the same (or equivalent) securities within 60 calendar days. This applies to any personal securities trades in the categories described in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code, except for personal security trades of John Hancock Affiliated Funds which you can not profit from within 30 days.

You may invest in derivatives, excluding certain equity options on MFC securities5 or sell short provided the transaction period exceeds the 60-day holding period

Remember, if you donate or gift a security, it is considered a sale and is subject to this rule.

This restriction does not apply to trading within a sixty calendar day period if you do not realize a profit.

The purpose of this policy is to address the risk, real or perceived, of front-running, manipulative market timing or other abusive practices involving short-term personal trading. Any profits in excess of $100.00 realized on short-term trades must be surrendered by check payable to John Hancock Advisers, LLC, which will be contributed to a charity of its choice

You may request an exemption from this policy for involuntary sales due to unforeseen corporate activity (such as a merger), or for sales due to hardship reasons (such as unexpected medical expenses) from Code of Ethics Administration. In addition, transactions in securities with the following characteristics will typically be granted an exemption from this provision.

Ban on IPOs

Applies to: Access Level I Persons

If you are an Access Level I Person, you may not acquire securities in an IPO. You may not purchase any newly-issued securities until the next business (trading) day after the offering date. This applies to any personal securities trades in the categories described above in the section “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions”.

There are two main reasons for this prohibition: (1) these purchases may suggest that persons have taken inappropriate advantage of their positions for personal profit; and (2) these purchases may create at least the appearance that an investment opportunity that should have been available to the John Hancock Affiliated Funds was diverted to the personal benefit of an individual employee.

You may request an exemption for certain investments that do not create a potential conflict of interest, such as: (1) securities of a mutual bank or mutual insurance company received as compensation in a demutualization and other similar non-voluntary stock acquisitions; (2) fixed

11

rights offerings; or (3) a family member’s participation as a form of employment compensation in their employer’s IPO.

Ban on Speculative Transactions in MFC

Applies to: All Access Levels

All covered employees under this code are prohibited from engaging in speculative transactions involving securities of MFC, since these transactions might be seen as evidencing a lack of confidence in, and commitment to, the future of MFC or as reducing the incentive to maximize the performance of MFC and its stock price. Accordingly, all covered employees, as well as their family members, are prohibited from entering into any transaction involving MFC securities for their personal account which falls into the following categories:

| 1. | Short sales of MFC securities |

| 2. | Buying put options or selling call options on MFC securities |

Ban on ownership of publicly traded securities of subadvisers and their controlling parent

Applies to: All Access Levels excluding Access Level III

As an Access Level I or Access Level II Person you are prohibited from purchasing publicly traded securities of any subadviser of a John Hancock Affiliated Fund.

As an Access Level IV you are prohibited from purchasing publicly traded securities of any subadviser of a John Hancock Affiliated Fund, as well as the publicly traded securities of the controlling parent of a subadviser.

MFC securities are excluded from this prohibition for Access Level I & Access Level II Persons.

A complete list of these securities can be found in Appendix D.

12

Ban on Restricted Securities

Applies to: All Access Levels excluding Access Level IV

No pre-clearance will be approved for securities appearing on the John Hancock Restricted List. Securities are placed on the Restricted List if:

| • | John Hancock or a member of John Hancock has received material non-public inside information on a security or company; or |

| • | In the judgment of the Legal Department, circumstances warrant addition of a security to this list |

The Restricted List is a confidential list of companies that is maintained in the possession of the Legal Department.

Excessive Trading

Applies to: All Access Levels excluding Access Level IV

While active personal trading may not in and of itself raise issues under applicable laws and regulations, we believe that a very high volume of personal trading can be time consuming and can increase the possibility of actual or apparent conflicts with portfolio transactions. Accordingly, an unusually high level of personal trading activity is strongly discouraged and may be monitored by Code of Ethics Administration to the extent appropriate for the category of person, and a pattern of excessive trading may lead to the taking of appropriate action under the Code.

An Access Person effecting more than 45 trades in a quarter, or redeeming shares of a John Hancock Affiliated Fund within 30 days of purchase, should expect additional scrutiny of his or her trades and he or she may be subject to limitations on the number of trades allowed during a given period.

Disclosure of Private Placement Conflicts

Applies to: Access Level I Persons

If you are an Access Level I Person and you own securities purchased in a private placement, you must disclose that holding when you participate in a decision to purchase or sell that same issuer’s securities for a John Hancock Affiliated Fund. This applies to any private placement holdings in the categories described above in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code. Private placements are securities exempt from SEC registration under section 4(2), section 4(6) and/or rules 504 –506 under the Securities Act.

The investment decision must be subject to an independent review by investment personnel with no personal interest in the issuer.

13

The purpose of this policy is to provide appropriate scrutiny in situations in which there is a potential conflict of interest.

Seven Day Blackout Period

Applies to: Access Level I Persons

An Access Level I Person is prohibited from buying or selling a security within seven calendar days before and after that security is traded for a fund that the Person manages unless no conflict of interest exists in relation to that security as determined by Code of Ethics Administration. If a conflict exists, Code of Ethics will report conflict to Ethics Oversight Committee for review.

In addition, Access Level I Persons are prohibited from knowingly buying or selling a security within seven calendar days before and after that security is traded for a John Hancock Affiliated Fund unless no conflict of interest exists in relation to that security. This applies to any personal securities trades in the categories described above in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code. If a John Hancock Affiliated Fund trades in a security within seven calendar days before or after an Access Level I Person trades in that security, the Person may be required to demonstrate that he or she did not know that the trade was being considered for that John Hancock Affiliated Fund.

You will be required to sell any security purchased in violation of this policy unless it is determined that no conflict of interest exists in relation to that security (as determined by Code of Ethics Administration Any profits realized on trades determined by Code of Ethics Administration to be in violation of this policy must be surrendered by check payable to John Hancock Advisers, LLC, which will be contributed to a charity of its choice.

Three Day Blackout Period

Applies to: Access Level II Persons

An Access Level II Person is prohibited from knowingly buying or selling a security within three calendar days before and after that security is traded for a John Hancock Affiliated Fund unless no conflict of interest exists in relation to that security as determined by Code of Ethics Administration. If a conflict exists, Code of Ethics will report conflict to Ethics Oversight Committee6 for review.

This applies to any personal securities trades in the categories described above in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code. If a John Hancock Affiliated Fund trades in a security within three calendar days before or after the Person trade in that security, you may be required to demonstrate that the Person did not know that the trade was being considered for that John Hancock Affiliated Fund.

| 6 | The Ethics Oversight Committee shall consist of the Chief Executive Officer, Chief Compliance Officer, Chief Investment Officer, Chief Legal Officer, Chief Financial Officer of the Trusts, Chief Counsel of Global Compliance, Chief Compliance Officer of US Compliance, President of MFC GIM (US) and a Senior Representative from Human Resources |

14

You will be required to sell any security purchased in violation of this policy unless it is determined that no conflict of interest exists in relation to that security as determined Code of Ethics Administration. Any profits realized on trades determined by Code of Ethics Administration to be in violation of this policy must be surrendered by check payable to John Hancock Advisers, LLC, which will be contributed to a charity of its choice.

Restriction on Securities under Active Consideration

Applies to: Access Level I & Access Level II Persons

Access Level I Persons and Access Level II Persons are prohibited from buying or selling a security if the security is being actively traded by a John Hancock Affiliated Fund.

Exceptions:

The Personal Trading and Reporting System will utilize the following exception criteria when determining approval or denial of pre-clearances requests:

De Minimis Trading Rule: Pre-clearance requests for 500 shares or less of a particular security with a market value of $25,000.00 or less, aggregated daily, would, in most cases, not be subject to the blackout period restrictions and the restriction on actively traded securities because management has determined that transactions of this size do not present any conflict of interest as long as the requestor is not associated with the conflicting fund or account.

Market Cap Securities Exception: Pre-clearance requests in a security with a market capitalization of $5 billion or more would in most cases except where another conflict occurs such as frontrunning violation, not be subject to the blackout period restrictions and the restriction on actively traded securities because management determined that transactions in these types of companies do not present any conflict of interest as long as the requestor is not associated with the conflicting fund or account.

Trading in Exchange Traded Funds/Notes and Options on covered securities

Exchange Traded Funds, Exchange Traded Notes and Options on covered securities are required to receive pre-clearance approval prior to trading. However if the Exchange Traded Fund/Note or Option has an average market capitalization of $5 billion or more; or is based on a non covered security; or is based on one of the following broad based indices it will be treated as a market cap exception security.

| • | the S&P 100, S&P Midcap 400, S&P 500, FTSE 100, and Nikkei 225; |

| • | Direct obligations of the U.S. Government (e.g., treasury securities) |

| • | Indirect obligations of the U.S. Government with a maturity of less than 1 year (GNMA) |

| • | Commodities; |

| • | Foreign currency |

15

6) Policies Outside of the Code of Ethics

The John Hancock Affiliated Funds have certain policies that are not part of the Code, but are equally important:

MFC Code of Business Conduct & Ethics

Applies to: All Covered Employees excluding Access Level IV Persons

The MFC Code of Business Conduct and Ethics (the “MFC Code”) provides standards for ethical behavior when representing the Company and when dealing with employees, field representatives, customers, investors, external suppliers, competitors, government authorities and the public.

The MFC Code applies to directors, officers and employees of MFC, its subsidiaries and controlled affiliates. Sales representatives and third party business associates are also expected to abide by all applicable provisions of the MFC Code and adhere to the principles and values set out in the MFC Code when representing Manulife to the public or performing services for, or on behalf of, Manulife.

Other important issues in the MFC Code include:

| • | MFC values – P.R.I.D.E.; |

| • | Ethics in workplace; |

| • | Ethics in business relationships; |

| • | Misuse of inside information; |

| • | Receiving or giving of gifts, entertainment or favors; |

| • | Misuse or misrepresentation of your corporate position; |

| • | Disclosure of confidential or proprietary information; |

| • | Disclosure of outside business activities; |

| • | Antitrust activities; and |

| • | Political campaign contributions and expenditures relating to public officials. |

Gift & Entertainment Policy for the John Hancock Advisers

Applies to: All Covered Employees excluding Access Level IV Persons

You are subject to the Gift and Entertainment Policy for the John Hancock Advisers which is designed to prevent the appearance of an impropriety, potential conflict of interest or improper payment.

16

The Gift & Entertainment Policy covers many issues relating to giving and accepting of gifts and entertainment when dealing with business partners, such as:

| • | Gift & Business Entertainment Limits |

| • | Restrictions on Gifts & Entertainment |

| • | Reporting of Gifts & Entertainment |

John Hancock Insider Trading Policy

Applies to: All Covered Employees excluding Access Level IV Persons

The antifraud provisions of the federal securities laws generally prohibit persons with material non-public information from trading on or communicating the information to others. Sanctions for violations can include civil injunctions, permanent bars from the securities industry, civil penalties up to three times the profits made or losses avoided, criminal fines and jail sentences. While Access Level I Persons are most likely to come in contact with material non-public information, the rules (and sanctions) in this area apply to all persons covered under this code and extend to activities both related and unrelated to your job duties.

The John Hancock Insider Trading Policy (the “Insider Trading Policy”) covers a number of important issues, such as:

| • | Possession of material non-public information |

| • | The misuse of material non-public information |

| • | Restricting access to material nonpublic information |

John Hancock Whistleblower Policy:

Applies to: All Covered Employees excluding Access Level IV Persons

The Audit Committee of the mutual funds’ Board of Trustees investigates improprieties or suspected improprieties in the operations of a fund and has established procedures for the confidential, anonymous submission by employees of John Hancock Advisers, LLC and John Hancock Investment Management Services, LLC. (collectively the “Advisers”) or any other provider of accounting related services, of complaints regarding accounting, internal accounting controls, or auditing matters.

The objective of this policy is to provide a mechanism by which complaints and concerns regarding accounting, internal accounting controls or auditing matters may be raised and addressed without the fear or threat of retaliation. The funds desire and expect that the employees and officers of the Advisers, or any other service provider to the funds will report any complaints or concerns they may have regarding accounting, internal accounting controls or auditing matters.

Persons may submit complaints or concerns to the attention of funds’ Chief Compliance Officer by sending a letter or other writing to the funds’ principal executive offices, by telephone call to or an email to the Ethics Hotline, Ethics Hotline can be reached at 1-866-294-9534, or through the Ethicspoint website at www.manulifeethics.com. The Ethics Hotline and Ethicspoint website

17

are operated by an independent third party, which maintains the anonymity of all complaints. Complaints and concerns may be made anonymously to the funds’ Chief Compliance Officer. In addition any complaints or concerns may also be communicated anonymously, directly to any member of the Audit Committee.

Policy and Procedures Regarding Disclosure of Portfolio Holdings

Applies to: All Covered Employees excluding Access Level IV Persons

It is our policy not to disclose nonpublic information regarding Fund portfolio holdings except in the limited circumstances noted in this Policy. You can only provide nonpublic information regarding portfolio holdings to any person, including affiliated persons, on a “need to know” basis (i.e., the person receiving the information must have a legitimate business purpose for obtaining the information prior to it being publicly available and you must have a legitimate business purpose for disclosing the information in this manner). We consider nonpublic information regarding Fund portfolio holdings to be confidential and the intent of the policy and procedures is to guard against selective disclosure of such information in a manner that would not be in the best interest of Fund shareholders.

A listing of other corporate and divisional policies with which you should be familiar is listed in Appendix E.

18

7) Reports and Other Disclosures Outside the Code of Ethics

Broker Letter/Duplicate Confirm Statements

Applies to: All Access Levels excluding Access Level IV

In accordance with Rule 17j-1(d)(2) under the 1940 Act and Rule 204A-1(b) under the Advisers Act, you are required to report to Code of Ethics Administration each transaction in any reportable security. This applies to any personal securities trades in the categories described above in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code, as well as trades in John Hancock Affiliated Funds.

To comply with these rules noted above you are required by this Code and by the Insider Trading Policy to inform your broker-dealer that you are employed by a financial institution. Your broker-dealer is subject to certain rules designed to prevent favoritism toward your accounts. You may not accept negotiated commission rates that you believe may be more favorable than the broker grants to accounts with similar characteristics.

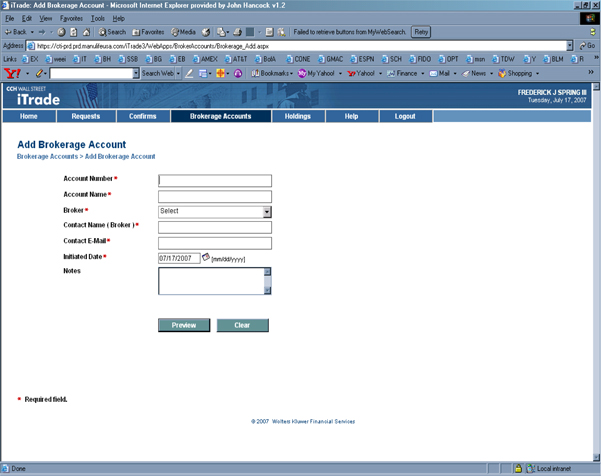

When a brokerage account in which you have a beneficial interest is opened you must do the following before any trades are made:

| • | Notify the broker-dealer with which you are opening an account that you are an employee of John Hancock; |

| • | Notify the broker-dealer if you are registered with the Financial Industry Regulatory Authority (the successor to the National Association of Securities Dealers) or are employed by John Hancock Funds, LLC or John Hancock Distributors, LLC |

| • | Notify Code of Ethics Administration, in writing, to disclose the new brokerage account before you place any trades, |

Code of Ethics Administration will notify the broker-dealer to have duplicate written confirmations of any trade, as well as statements or other information concerning the account, sent to John Hancock, Code of Ethics Administration, 601 Congress Street, 11th Floor, Boston, MA 02210-2805.

Code of Ethics Administration may rely on information submitted by your broker as part of your reporting requirements under the Code.

Investment Professional Disclosure of Personal Securities Conflicts

Applies to: Access Level I

As an investment professional, you must promptly disclose your direct or indirect beneficial interest in a security that is under consideration for purchase or sale in a John Hancock Affiliated Fund or account. See Appendix F.

19

8) Reporting Requirements and Other Disclosures Inside the Code of Ethics

Initial Holdings Report and Annual Holdings Report

Applies to: All Access Levels

In accordance with Rule 17j-1(d) under the 1940 Act and Rule 204A-1(b) under the Advisers Act; you must file an initial holdings report within 10 calendar days after becoming an Access Person. The information must be current as of a date no more than 45 days prior to your becoming an Access Person.

In addition, on an annual basis you must also certify to an annual holdings report within 45 calendar days after the required certification date determined by Code of Ethics Administration. The information in the report must be current as of a date no more than 45 days prior to the date the report is submitted. This applies to any personal securities holdings in the categories described in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” found on page 4 of the Code. It also includes holdings in John Hancock Affiliated Funds, including holdings in the John Hancock 401(k) plan.

Limited Category for Access Level IV Persons: Access Level IV Persons shall only be required to report the following information in their initial and annual holdings reports:

An Independent Board Member of John Hancock Trust must report any Insurance Contracts.

An Independent Board Member of John Hancock Funds II must report shares of any John Hancock Funds II Affiliated Funds.

You will receive an annual holdings certification packet from Code of Ethics Administration. Your annual holdings certification requirement will include a listing of your brokerage accounts on record with Code of Ethics Administration as of the required certification date and will be accompanied by copies of brokerage account statements for the certification date.

You will be required to review your annual holdings certification packet and return a signed certification form to Code of Ethics Administration by the required due date, attesting that the annual holdings certification information packet is accurate and complete.

This method will ensure that the holdings reporting requirements of Rule 17j-1(d) under the 1940 Act and Rule 204A-1(b) under the Advisers Act are satisfied:

| • | the title and type of security, and as applicable the exchange ticker symbol or CUSIP number, number of shares, and principal amount of each reportable security; |

| • | the name of any broker, dealer or bank with which you maintain an account; and |

| • | the date that you submit your certification. |

Holdings in John Hancock Affiliated Funds & Variable Products must be reported if these holdings are held in an outside brokerage account.

20

Group Savings and Retirement Services is charged with the administration of the Global Share Ownership Plan. Accordingly employees will not be required to file a duplicate holding report for the shares held in this plan. Code of Ethics Administration will have access to this information upon request.

Even if you have no holdings to report you will be asked to complete this requirement.

Quarterly Transaction Certification

Applies to: Access Level I Persons, Access Level II Person & Access Level III Person

Also, for a limited category of trades:

Access Level IV Persons

In accordance with Rule 17j-1(d) under the 1940 Act and Rule 204A-1(b) under the Advisers Act, on a quarterly basis, all access persons, excluding Access Level IV Persons, are required to certify that all transactions in their brokerage accounts, as well as transactions in John Hancock Affiliated Funds, have been effected in accordance with the Code. Within 30 calendar days after the end of each calendar quarter, you will be asked to log into the John Hancock Personal Trading and Reporting System to certify that the system has accurately captured all transactions for the preceding calendar quarter for accounts and trades which are required to be reported pursuant to section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code.

Transactions in John Hancock Affiliated Funds and Variable Products must be reported if these transactions are executed in an outside brokerage account.

Group Savings and Retirement Services is charged with the administration of the Global Share Ownership Plan. Accordingly employees will not be required to file a duplicate transaction report for this plan. Code of Ethics Administration will have access to this information upon request

Even if you have no transactions to report you will be asked to complete the certification.

Limited Category for Access Level IV Persons:

An Independent Board Member of John Hancock Trust must report transactions in any contracts that are funded by a John Hancock Trust Affiliated Fund under the trust as well as transactions in any other Covered Security if the trustee, at the time of that transaction, knew or, in the ordinary course of fulfilling his or her official duties as a trustee of the Trust, should have known that, during the 15-day period immediately preceding or after the date of the transaction by the trustee, the covered security is or was under active consideration for purchase or sale by the Trust or its investment adviser or subadviser or is or was purchased or sold by the Trust.

21

An Independent Board Member of John Hancock Funds II must report a transaction in any shares of a John Hancock Funds II Affiliated Fund as well as transactions in any other Covered Security if the trustee, at the time of that transaction, knew or, in the ordinary course of fulfilling his or her official duties as a trustee of a Trust, should have known that during the 15-day period immediately preceding or after the date of the transaction in a Covered Security by the trustee, a Fund purchased or sold the Covered Security or the Covered Security was under Active Consideration for purchase or sale by a Fund, its investment adviser or its subadviser(s).

Even if you have no transactions to report you will be asked to complete the certification.

Code of Ethics Administration will provide quarterly reporting to each Board member with specific details related to your board assignments and with a summary of your transactions.

For each transaction required to be reported you must certify the following information was captured accurately:

| • | the date of the transaction, the title, and as applicable the exchange ticker symbol or CUSIP number, interest rate and maturity date, number of shares, and principal amount of each reportable security involved; |

| • | the nature of the transaction (i.e. purchase, sale or any other type of acquisition or disposition); |

| • | the price at which the transaction was effected; |

| • | the name of the broker, dealer or bank with or through which the transaction was effected; and |

Quarterly Brokerage Account Certification

Applies to: Access Level I Persons, Access Level II Person & Access Level III Person

Also, for a limited category of trades:

Access Level IV Persons

In accordance with Rule 17j-1(d) under the 1940 Act, on a quarterly basis, all Access Persons, excluding Access Level IV Persons, will be required to certify to a listing of brokerage accounts as described in section 3: “Which Accounts and Securities are Subject to the Code’s Personal Trading Restrictions” on page 4 of the Code. This includes all brokerage accounts, including brokerage accounts that only contain securities exempt from reporting.

This also includes all accounts holding John Hancock Affiliated Funds and Variable Products as well as accounts in the MFC Global Share Ownership Plan.

Within 30 calendar days after the end of each calendar quarter you will be asked to log into the John Hancock Personal Trading and Reporting System and certify that all brokerage accounts are listed and the following information is accurate:

22

| • | Account number; |

| • | Account registration; and |

| • | Brokerage firm. |

Even if you have no existing or new accounts to report you will be asked to complete this certification.

Limited Category for Access Level IV Persons:

An Independent Board Member of John Hancock Trust must report contracts that are funded by a John Hancock Trust Affiliated Fund under the Trust.

An Independent Board Member of John Hancock Funds II must report accounts that hold positions in a John Hancock Funds II Affiliated Fund.

Even if you have no existing or new accounts to report, you will be asked to complete this certification.

Code of Ethics Administration will provide quarterly reporting to each trustee with specific details related to your board assignments.

Annual Certification to the Code of Ethics

Applies to: All Access Levels

At least annually (or additionally when the Code has been materially changed), you must provide a certification at a date designated by Code of Ethics Administration that you:

| (1) | have read and understood the Code; |

| (2) | recognize that you are subject to its policies; and |

| (3) | have complied with its requirements. |

You are required to make this certification to demonstrate that you understand the importance of these policies and your responsibilities under the Code.

23

Reporting of Gifts, Donations, and Inheritances

Applies to: All Access Levels excluding Access Level IV

| • | If you gift or donate shares of a reportable security it is considered a sale and you must notify Code of Ethics Administration of the gift or donation on the date given. You must also make sure the transaction is properly reported on your next quarterly transaction certification. |

| • | If you receive a gift or inherit a reportable security you must report the new holding to Code of Ethics Administration in a timely manner and you must make sure the holding is properly reported on your next annual holdings certification. |

9) Subadviser Compliance

A subadviser to a John Hancock Affiliated Fund has a number of code of ethics responsibilities:

| • | The sub-adviser must have adopted their own code of ethics in accordance with Rule 204A-1(b) under the Advisers Act which has been approved by the respective board |

| • | On a quarterly basis, each sub-adviser certifies compliance with their code of ethics or reports material violations if such have occurred; and |

| • | Each sub-advisor must report quarterly to the Chief Compliance Officer, any material changes to its code of ethics |

Adoption and Approval

The Board of a John Hancock Affiliated Fund, including a majority of the Fund’s Independent Board Members, must approve the code of ethics of the Fund’s adviser, subadviser or principal underwriter (if an affiliate of the underwriter serves as a Board member or officer of the Fund or the adviser) before initially retaining its services.

Any material change to a code of ethics of a subadviser to a fund must be approved by the applicable Board of the John Hancock Affiliated Fund, including a majority of the Fund’s Independent Board Members, no later than six months after adoption of the material change.

The Board may only approve the code if they determine that the code:

| • | contains provisions reasonably necessary to prevent the subadviser’s Access Persons (as defined in Rule 17j-1 under the 1940 Act and Rule 204A-1 under the Advisers Act) from engaging in any conduct prohibited by Rule 17j-1 and 204A-1; |

| • | requires the subadviser’s Access Persons to make reports to at least the extent required in Rule 17j-1(d) and Rule 204A-1(b); |

24

| • | requires the subadviser to institute appropriate procedures for review of these reports by management or compliance personnel (as contemplated by Rule 17j-1(d)(3) and Rule 204 A-1(a)(3); |

| • | provides for notification of the subadviser’s Access Persons in accordance with Rule 17j-1(d)(4) and Rule 204A-1(a)(5); |

| • | requires the subadviser’s Access Persons who are Investment Personnel to obtain the pre-clearances required by Rule 17j-1(e); and |

| • | requires the subadviser’s Access Persons to obtain the pre-clearances required by Rule 204A-1(c) |

The Chief Compliance Officer of the John Hancock Affiliated Funds oversees each of the fund’s sub-adviser’s to ensure compliance with each of the provisions included in this section

Subadviser Reporting & Recordkeeping Requirements

Each subadviser must provide an annual report and certification to the relevant John Hancock Adviser and the relevant Board in accordance with Rule 17j-1(c)(2)(ii). The subadviser must also provide other reports or information that the relevant John Hancock Adviser may reasonably request.

The subadviser must maintain all records for its Access Persons, as required by Rule 17j-1(f).

10) Reporting to the Board

No less frequently than annually, John Hancock and each subadviser will furnish to the Board of each John Hancock Affiliated Fund a written report that:

| • | describes issues that arose during the previous year under the code of ethics or the related procedures, including, but not limited to, information about material code or procedure violations, as well as any sanctions imposed in response to the material violations, and |

| • | certifies that each entity has adopted procedures reasonably necessary to prevent its Access Persons from violating its code of ethics. |

11) Reporting Violations

If you know of any violation of the Code, you have a responsibility to promptly report it to the Chief Compliance Officer of your company. You should also report any deviations from the controls and procedures that safeguard John Hancock and the assets of our clients.

Since we cannot anticipate every situation that will arise, it is important that we have a way to approach questions and concerns. Always ask first, act later. If you are unsure of what to do in any situation, seek guidance before you act.

Speak to your manager, a member of the Human Resources Department or Law Department or your divisional compliance officer if you have:

25

| • | a doubt about a particular situation; |

| • | a question or concern about a business practice; or |

| • | a question about potential conflicts of interest |

You may report suspected or potential illegal or unethical behavior without fear of retaliation. John Hancock does not permit retaliation of any kind for good faith reports of illegal or unethical behavior.

Concerns about potential or suspected illegal or unethical behavior should be referred to a member of the Human Resources or Law Department.

Unethical, unprofessional, illegal, fraudulent or other questionable behavior may also be reported by calling a confidential toll free Ethics Hotline or at www.ManulifeEthics.com.

Ethics Hotline can be reached at 1-866-294-9534.

12) Interpretation and Enforcement

The Code cannot anticipate every situation in which personal interests may be in conflict with the interests of our clients and fund investors. You should be responsive to the spirit and intent of the Code as well as its specific provisions.

When any doubt exists regarding any Code provision or whether a conflict of interest with clients or fund investors might exist, you should discuss the situation in advance with the Chief Compliance Officer of your company. The Code is designed to detect and prevent fraud against clients and fund investors, and to avoid the appearance of impropriety.

The Chief Compliance Officer has general administrative responsibility for the Code as it applies to the covered employees; an appropriate member of Code of Ethics Administration will administer procedures to review personal trading activity. Code of Ethics Administration also regularly reviews the forms and reports it receives. If these reviews uncover information that is incomplete, questionable, or potentially in violation of the rules in this document, Code of Ethics Administration will investigate the matter and may contact you.

Ethics Oversight Committee approves amendments to the code of ethics and dispenses sanctions for violations of the code of ethics. The Boards of the John Hancock Affiliated Funds also approve amendments to the Code and authorize sanctions imposed on Access Persons of the Funds. Accordingly, Code of Ethics Administration will refer violations to Ethics Oversight Committee and/or the Fund Boards for review and recommended action based on the John Hancock Advisers Schedule of Fines and Sanctions. See Appendix G.

The following factors will be considered when determining a fine or other disciplinary action:

| • | the person’s position and function (senior personnel may be held to a higher standard); |

| • | the amount of the trade; |

| • | whether the John Hancock Affiliated Funds hold the security and were trading the same day; |

| • | whether the violation was by a family member; |

26

| • | whether the person has had a prior violation and which policy was involved; and |

| • | whether the employee self-reported the violation. |

John Hancock takes all rule violations seriously and, at least once a year, provides the Boards of the John Hancock Affiliated Funds with a summary of all material violations and sanctions, significant conflicts of interest and other related issues for their review. Sanctions for violations could include (but are not limited to) fines, limitations on personal trading activity, suspension or termination of the violator’s position with John Hancock and/or a report to the appropriate regulatory authority.

You should be aware that other securities laws and regulations not addressed by the Code may also apply to you, depending on your role at John Hancock.

John Hancock and the Ethics Oversight Committee retain the discretion to interpret the Code’s provisions and to decide how they apply to any given situation.

13) Exemptions & Appeals

Exemptions to the Code may be granted by the Chief Compliance Officer where supported by applicable facts and circumstances. If you believe that you have a situation that warrants an exemption to the any of the rules and restrictions of this Code you need to complete a “Code of Ethics Exemption Request Form” to request approval from the Chief Compliance Officer.

Exemption requests which pose a conflict of interest for the Chief Compliance Officer will be escalated to the Ethics Oversight Committee for review and consideration.

Sole discretion Exemption: A transaction does not need to be pre-cleared if it takes place in an account that Code of Ethics Administration has approved in writing as exempt from the pre-clearance requirement. In the sole discretion of Code of Ethics Administration and the Chief Compliance Officer, accounts that will be considered for exclusion from the pre-clearance requirement are only those for which an employee’s securities broker or investment advisor has complete discretion. Employees wishing to seek such an exemption must complete a “Pre-Clearance Waiver Form for Sole Discretion Accounts” and satisfy all requirements.

These forms can be obtained by contacting Code of Ethics Administration.

You will be notified of the outcome of your request by the Code of Ethics Administrator and/or the Chief Compliance Officer.

Appeals: If you believe that your request has been incorrectly denied or that an action is not warranted, you may appeal the decision. To make an appeal, you need to give Code of Ethics Administration a written explanation of your reasons for appeal within 30 days of the date that you were informed of the decision. Be sure to include any extenuating circumstances or other factors not previously considered. During the review process, you may, at your own expense, engage an attorney to represent you. Code of Ethics Administration may arrange for Ethics Oversight Committee or other parties to be part of the review process.

27

14) Education of Employees

This Code constitutes the code of ethics required by Rule 17j-1 under the 1940 Act and by Rule 204A-1 under the Advisers Act for John Hancock. Code of Ethics Administration will provide a paper copy or electronic version of the Code (and any amendments) to each person subject to the Code. Code of Ethics Administration will also administer training to employees on the principles and procedures of the Code.

15) Recordkeeping

Code of Ethics Administration will maintain:

| • | a copy of the current Code for John Hancock and a copy of each code of ethics in effect at any time within the past five years. |

| • | a record of any violation of the Code, and of any action taken as a result of the violation, for six years. |

| • | a copy of each report made by an Access Person under the Code, for six years (the first two years in a readily accessible place). |

| • | a record of all persons, currently or within the past five years, who are or were required to make reports under the Code. This record will also indicate who was responsible for reviewing these reports. |

| • | a copy of each Code report to the Fund Boards, for six years (the first two years in a readily accessible place). |

| • | a record of any decision, and the reasons supporting the decision, to approve the acquisition by an Access Level I Persons of IPOs or private placement securities, for six years. |

| • | a record of any decision, and the reasons supporting the decision, to approve the acquisition by an Access Person of the John Hancock Advisers IPOs or private placement securities, for six years. |

28

Appendix A: Access Person Categories

You have been notified about which of these categories applies to you, based on Code of Ethics Administration’s understanding of your current role. If you have a level of investment access beyond that category, or if you are promoted or change duties and as a result should more appropriately be included in a different category, it is your responsibility to immediately notify the Chief Compliance Officer of your company.

| 1) | Access Level I - Investment Access Person: An associate, officer or non-independent board member of a John Hancock Adviser who, in connection with his/her regular functions or duties, makes or participates in making recommendations regarding the purchase or sale of securities by the John Hancock Affiliated Funds. |

(Examples: Portfolio managers; analysts; and traders)

| 2) | Access Level II - Regular Access Person: An associate, senior officer (vice president and higher) or non- independent board member of John Hancock Funds; a John Hancock Adviser; John Hancock Funds, LLC; John Hancock Trust; John Hancock Distributors, LLC, or other John Hancock entity who, in connection with his/her regular functions or duties, has regular access to nonpublic information regarding any clients’ purchase or sale of securities, or nonpublic information regarding the portfolio holdings of any John Hancock Affiliated Fund; or who is involved in making securities recommendations to clients, or who has regular access to such recommendations that are nonpublic. |

(Examples: Office of the Chief Compliance Officer, Fund Administration, Investment Management Services, Administrative Personnel supporting Access Level I Persons, Technology Resources Personnel with access to investment systems, Private Client Group Personnel, and anyone else that Code of Ethics Administration deems to have regular access.)

| 3) | Access Level III – Periodic Access Person: An associate, officer (assistant vice president and higher) or non-independent board member of John Hancock Funds; a John Hancock Adviser; John Hancock Funds, LLC; John Hancock Trust; John Hancock Distributors, LLC or other John Hancock entity who, in connection with his/her regular functions or duties, has periodic access to nonpublic information regarding any clients’ purchase or sale of securities, or nonpublic information regarding the portfolio holdings of any John Hancock Affiliated Fund. |

Examples: (Legal staff, Marketing, Product Development, E-Commerce, Corporate Publishing, Administrative Personnel supporting Access Level II Persons, and anyone else that Code of Ethics Administration deems to have periodic access.)

| 4) | Access Level IV – Trustees: An independent trustee or independent director of John Hancock Trust or John Hancock Funds II |

29

Appendix B – Affiliated Funds – Effective as of December 31, 2010

JOHN HANCOCK FUNDS

| Adviser: John Hancock Advisers, LLC. | ||

| Name of Trust and Funds: |

Subadviser for these Funds: | |

| Open-End Funds: | ||

| John Hancock Bond Trust: | ||

| Government Income Fund | Manulife Asset Management (U.S.), LLC | |

| High Yield Fund | Manulife Asset Management (U.S.), LLC | |

| Investment Grade Bond Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock California Tax-Free Income Fund: | ||

| California Tax-Free Income Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock Capital Series: | ||

| Classic Value Fund | Pzena Investment Management, LLC | |

| U. S. Global Leaders Growth Fund | Sustainable Growth Advisers, LP | |

| John Hancock Current Interest: | ||

| Money Market Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock Investment Trust: | ||

| Balanced Fund | Manulife Asset Management (U.S.), LLC | |

| Global Opportunities Fund | Manulife Asset Management (U.S.), LLC | |

| Large Cap Equity Fund | Manulife Asset Management (U.S.), LLC | |

| Small Cap Intrinsic Value Fund | Manulife Asset Management (U.S.), LLC | |

| Sovereign Investors Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock Investment Trust II: | ||

| Financial Industries Fund | Manulife Asset Management (U.S.), LLC | |

| Regional Bank Fund | Manulife Asset Management (U.S.), LLC | |

| Small Cap Equity Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock Investment Trust III: | ||

| Greater China Opportunities Fund | Manulife Asset Management (N A.) Limited | |

| John Hancock Municipal Securities Trust: | ||

| High Yield Municipal Bond Fund | Manulife Asset Management (U.S.), LLC | |

| Tax-Free Bond Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock Series Trust: | ||

| Mid Cap Equity Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock Sovereign Bond Fund: | ||

| Bond Fund | Manulife Asset Management (U.S.), LLC | |

| John Hancock Strategic Series: | ||

| Strategic Income Fund | Manulife Asset Management (U.S.), LLC | |

30

| John Hancock Tax-Exempt Series Fund: | ||

| Massachusetts Tax-Free Income Fund | Manulife Asset Management (U.S.), LLC | |

| New York Tax-Free Income Fund | Manulife Asset Management (U.S.), LLC | |

| Closed end Funds: | ||