Forward-Looking Statements and Other Information This presentation may include

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements relating to the completion of the merger. Any statements made in this presentation that are not

statements of historical fact, including statements about beliefs and expectations of Squarespace, Inc. (the “Company”, “we” or “our”), are forward-looking statements and should be evaluated as such. Forward-looking statements include, but are

not limited to, statements about the Company’s outlook for the future fiscal periods, the Company’s market position, and potential market opportunities. Forward-looking statements generally relate to future events or the Company’s future

financial or operating performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,”

“anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or phrases or other comparable words or phrases of a future or forward-looking nature. The Company bases these

forward-looking statements on its current expectations, plans and assumptions that the Company has made in light of its experience in the industry, as well as its perceptions of historical trends, current conditions, expected future developments

and other factors the Company believes are appropriate under the circumstances at such time. These statements are not guarantees of future performance or results and the Company does not give any assurance that it will achieve its expectations.

The forward-looking statements are subject to and involve risks, uncertainties and assumptions, and you should not place undue reliance on these forward-looking statements. Although the Company believes that these forward-looking statements are

based on reasonable assumptions at the time they are made, many factors could affect the Company’s actual results or results of operations and could cause actual results to differ materially from those expressed in the forward-looking statements.

Further information on risks that could cause actual results to differ materially from forecasted results are included in the Company’s filings with the U.S. Securities and Exchange Commission (“SEC”), including the Company’s Annual Report on

Form 10-K filed on February 28, 2024 with the SEC. The Company undertakes no obligation and does not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by applicable law. All written and oral forward-looking statements made in connection with this presentation attributable to the Company or persons acting on the Company’s behalf are expressly qualified in their entirety by the above paragraph.

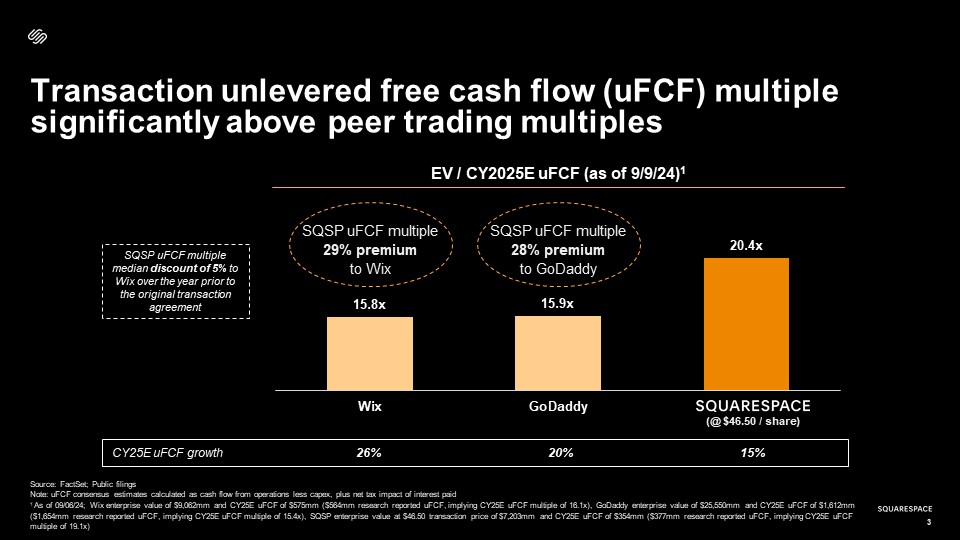

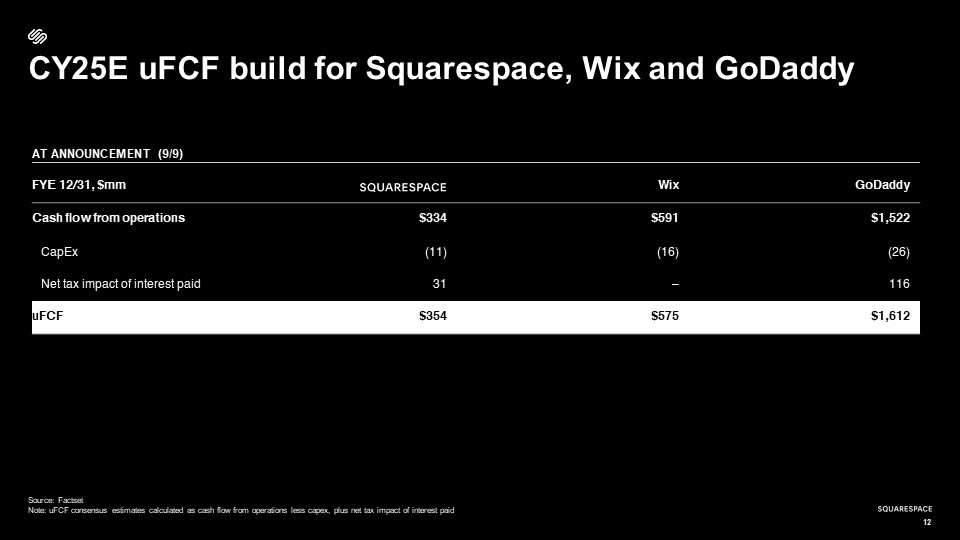

This presentation contains non-GAAP financial measures such as adjusted EBITDA and unlevered free cash flow. These measures are not prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) and

have important limitations as analytical tools. Non-GAAP financial measures are supplemental, should only be used in conjunction with results presented in accordance with GAAP and should not be considered in isolation or as a substitute for such

GAAP results. General This presentation contains statistical data that we obtained from third party publications, surveys and reports. Although we have not independently verified the accuracy or completeness of the data contained in these

industry publications, surveys and reports, we believe the publications, surveys such reports are generally reliable, although such information is inherently subject to uncertainties and may be imprecise. This presentation contains additional

trademarks, tradenames and service marks of other companies that are the property of their respective owners. Certain monetary amounts, percentages and other figures included in this presentation have been subject to rounding adjustments. Certain

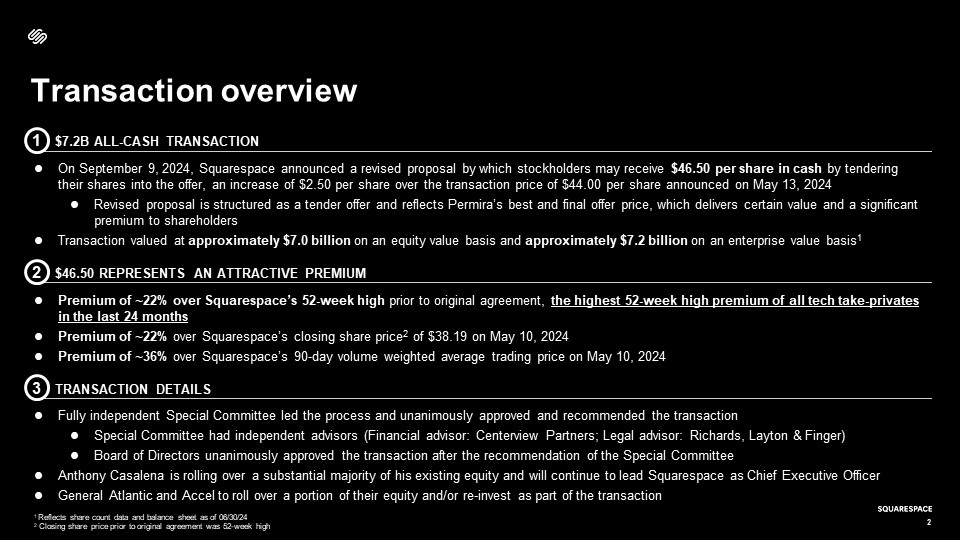

other amounts that appear in this presentation may not sum due to rounding. This presentation may be deemed to be solicitation material in connection with the proposed acquisition of the Company by Permira pursuant to a definitive Agreement and

Plan of Merger (the “Merger Agreement”) between Spaceship Purchaser, Inc., Spaceship Group MergerCo, Inc. and the Company. In connection with the proposed merger, the Company has filed relevant materials with the SEC, including a proxy statement

which has been mailed or otherwise disseminated to the Company's stockholders. STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE

SEC, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE COMPANY AND THE PROPOSED MERGER. Stockholders may obtain free copies of the definitive proxy statement, any amendments or supplements thereto and other

documents containing important information about the Company or the proposed merger, once such documents are filed with the SEC, free of charge at the SEC’s website at www.sec.gov, or from the Company at https://investors.squarespace.com. This

document does not constitute a solicitation of proxy, an offer to purchase or a solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as

amended. 13 Disclaimer