Exhibit 1

Kent Lake Q&A with Investment Community

April 24, 2025

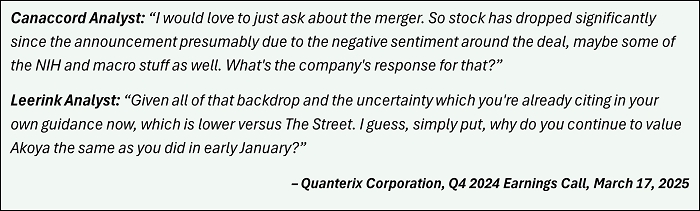

| Q. | How did sell-side analysts interpret the market’s reaction to the merger announcement? |

| A. | On the Q4 2024 earnings call (March 17, 2025), CEO Masoud Toloue was specifically asked about the market’s negative reaction to the merger announcement. He blamed Quanterix’s share price decline on an “NIH-pressured environment.”1 |

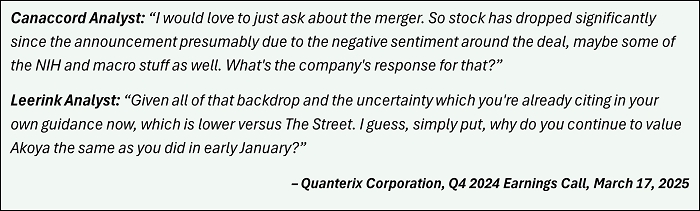

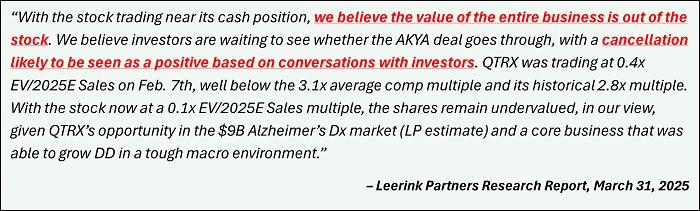

In contrast to Dr. Toloue’s comments, subsequent sell-side research acknowledges that stock price pressure is the result of investor reaction to the proposed merger with Akoya Biosciences.

In fact, the covering analyst at Leerink Partners specifically notes investor feedback indicating that cancellation of the merger could serve as a positive catalyst for the stock, while Canaccord Genuity reports that Quanterix investor sentiment on the Merger is “negative.”

1 Dr. Toloue on the Q4 2024 Earnings Call: “I think a majority of the pressure you see on Quanterix or other companies is exactly hey, tools are indexed to academia, and there tends to be -- or it looks like some paralysis in the market on spending in academia, and I think that's what you're seeing across the board versus sentiment on the deal.”

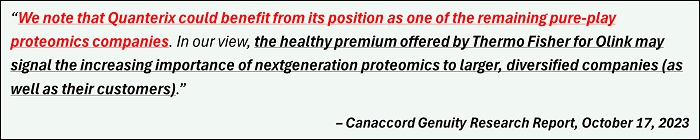

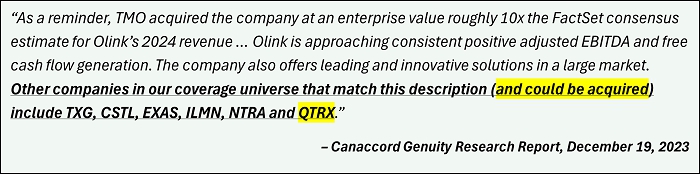

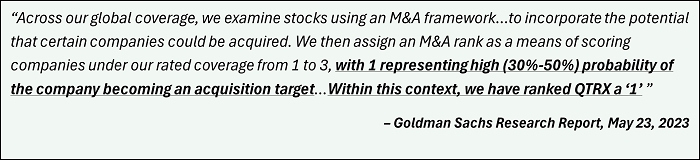

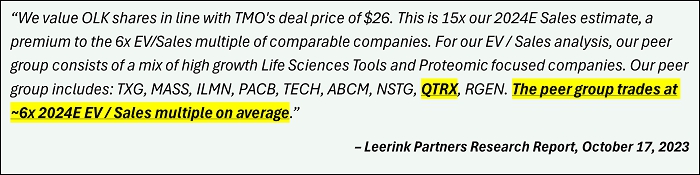

| Q. | Were there indications or rumors suggesting Quanterix was viewed as a potential acquisition target by strategic buyers, especially after proteomics peer company Olink was acquired? |

| A. | Sell-side analyst commentary immediately following the Olink M&A announcement suggests that Quanterix should now be viewed as an attractive M&A target for a strategic: |

Quanterix and Olink are both pure-play proteomics companies and Quanterix was included in the Olink peer group used for valuation comparison by Cannacord Genuity analysts.

Interestingly, in Quanterix’s S-4, the Background of the Merger section discloses that the original Quanterix Transaction Committee was formed on October 17, 20232, with the purpose of evaluating strategic alternatives – the same day Thermo Fisher (TMO) announced its intention to acquire Olink (f/k/a OLK)3. Notably, two of the four members of that original Transaction Committee resigned from the Quanterix Board within the following nine months.4

| Q. | Given the multiple compression among Life Science Tools & Services peers following the merger announcement, why is a valuation of at least 1x TEV/Sales justified for Quanterix as a standalone company. How do we know that Quanterix trading below cash represents the market’s view of impending value destruction due to the AKYA Merger? |

| A. | While NIH funding uncertainty has driven a sector-wide revaluation, Life Science peers have seen EV/Sales multiples compress by -33% on average. By contrast, Quanterix’s multiple has declined over -140% and now trades at a negative enterprise value. A peer- |

2 See Quanterix Form S-4, dated February 13, 2025, Background of the Merger, pg. 132.

3 See Thermo Fisher Scientific press release, dated October 17, 2023, Thermo Fisher Scientific to Acquire Olink, a Leader in Next-Generation Proteomics

4 See Quanterix Form S-4, dated February 13, 2025, pg. 90.

average -33% reduction on Quanterix’s unaffected EV/Sales multiple (1.5x) would imply Quanterix should trade at 1.0x LTM Revenue, or over $10 per share.

| Selected Publicly-Traded Companies | ||||

| Company | TEV / LTM Revenue (01/08/25) | TEV / LTM Revenue (4/15/25) | Multiple Chg. (%) | Share Price Close (4/15/25) |

| 10x Genomics, Inc. (TXG) | 2.5x | 1.1x | -56% | $7.68 |

| Cytek Biosciences, Inc. (CTKB) | 3.1x | 1.1x | -65% | $3.70 |

| Oxford Nanopore Technologies plc (LSE:ONT) | 6.1x | 4.9x | -19% | $1.18 |

| Pacific Biosciences of California, Inc. (PACB) | 6.2x | 4.3x | -30% | $1.14 |

| Standard BioTools Inc. (LAB) | 2.4x | 1.0x | -58% | $1.19 |

| Twist Bioscience Corporation (TWST) | 8.0x | 6.6x | -18% | $34.56 |

| Peer Average Multiple | 4.7x | 3.2x | -33% | |

| Quanterix Corporation (QTRX) | 1.5x | -0.4x | -130% | $5.36 |

| Quanterix at Peer Average Multiple | 3.2x | $18.15 | ||

| % Upside (Downside) | 239% | |||

| Quanterix at Peer Average Multiple Reval. | 1.0x | -33% | $10.44 | |

| % Upside (Downside) | 95% | |||

| Q. | What is Quanterix’s history of achieving guidance, and how does that inform your view that the future projections in the Company’s S-4 are unrealistic? |

| A. | Quanterix never provided guidance prior to 2022. Over the past three years, Quanterix has fallen short of revenue guidance in two out of the three years (2022, 18% shortfall and 2024, 3% shortfall), and exceeded guidance in one year (2023, 15% beat). |

However, we think there is a big difference between the annual guidance that Quanterix gives, and the clearly unrealistic projections that underpin the Merger in the Company S-4.5 This is evident by the stark difference in Quanterix’s growth rates over the past four years versus the growth rates assumed in the S-4. In the four years, 2022 through 2025, Quanterix has grown revenue at a compounded annual rate of 6%6.

5 See Quanterix Form S-4, dated February 13, 2025, pp. 170–171.

6 2025 revenue based on S&P Capital IQ Consensus as of 4/23/25.

In the S-4, Quanterix management projects 2030 revenue of $1.022 billion, compared to 2025 guidance midpoint of $143 million,7 which means Quanterix management is projecting that they will grow the stand-alone Quanterix business at a compounded annual rate of 48% for the five years 2026 through 2030, a growth rate that is 8x higher than their recent historical growth rate of 6%.

Quanterix’s S-4 projected revenue in 2030 of $1.022 billion is also orders of magnitude higher than the sell-side analyst consensus of $293 million,8 further evidence that management projections underpinning the Merger are unrealistic.

On a smaller scale, the unreliable nature of the S-4 projections is already evident in 2025, with management guidance for revenue falling short of their S-4 projections of $155 million by 8%.9

7 See Company Amendment No. 3 to Form S-4, dated April 10, 2025, pg. 154.

8 S&P Capital IQ Consensus as of 4/23/25

9 See Company Amendment No. 3 to Form S-4, dated April 10, 2025, pg. 154.