| Transformational Combination Delivering Superior Stockholder Value November 3, 2025 NYSE: SM | SM-Energy.com NYSE: CIVI | CivitasResources.com |

| 2 Disclaimer Forward-Looking Statements This presentation and the oral statements made in connection therewith relate to a proposed business combination transaction between SM Energy and Civitas contain “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words and phrases such as “anticipate,” “estimate,” “believe,” “budget,” “continue,” “could,” “intend,” “may,” “might,” “plan,” “potential,” “possibly,” “predict,” “seek,” “should,” “will,” “would,” “expect,” “objective,” “projection,” “prospect,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and other similar words can be used to identify forward-looking statements. Forward looking statements relate to future events and anticipated results of operations, business strategies, the anticipated benefits of the proposed transaction, the anticipated impact of the proposed transaction on the combined company’s business and future financial and operating results, the expected amount and timing of synergies and scale from the proposed transaction, the expected closing date for the proposed transaction, and other aspects of our operations or operating results, including expected pro forma combined company operational plans and expected results, expectations for future inventory growth and cash flow generation, plans to continue paying a fixed quarterly dividend of $0.20 per share, and opportunities to reduce debt and interest rates. However, the absence of these words does not mean that the statements are not forward-looking. All such forward-looking statements are based upon current plans, estimates, expectations, and ambitions that are subject to risks, uncertainties, and assumptions, many of which are beyond the control of SM Energy and Civitas, that could cause actual results to differ materially from those expressed or forecast in such forward-looking statements. The following important factors and uncertainties, among others, could cause actual results or events to differ materially from those described in these forward-looking statements: the risk that the approval under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 is not obtained or is obtained subject to conditions that are not anticipated by SM Energy and Civitas; uncertainties as to whether the potential transaction will be consummated on the expected time period or at all, or if consummated, will achieve its anticipated benefits and projected synergies within the expected time period or at all; SM Energy’s ability to integrate Civitas’ operations in a successful manner and in the expected time period; the occurrence of any event, change, or other circumstance that could give rise to the termination of the transaction, including receipt of a competing acquisition proposal; risks that the anticipated tax treatment of the potential transaction is not obtained; unforeseen or unknown liabilities; customer, stockholder, regulatory, and other stakeholder approvals and support; unexpected future capital expenditures; potential litigation relating to the potential transaction that could be instituted against SM Energy and Civitas or their respective directors; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the effect of the announcement, pendency, or completion of the potential transaction on the parties’ business relationships and business generally; risks that the potential transaction disrupts current plans and operations of SM Energy or Civitas and their respective management teams and potential difficulties in SM Energy and Civitas’ ability to retain employees as a result of the transaction; negative effects of this announcement and the pendency or completion of the proposed acquisition on the market price of SM Energy’s or Civitas’ common stock and/or operating results; rating agency actions and SM Energy’s and Civitas’ ability to access short- and long-term debt markets on a timely and affordable basis; various events that could disrupt operations, including severe weather, such as droughts, floods, avalanches, and earthquakes, and cybersecurity attacks, as well as security threats and governmental response to them, and technological changes; labor disputes; changes in labor costs and labor difficulties; the effects of industry, market, economic, political, or regulatory conditions outside of SM Energy’s or Civitas’ control; legislative, regulatory, and economic developments targeting public companies in the oil and gas industry; and the risks described in SM Energy’s and Civitas’ respective periodic and other filings with the U.S. Securities and Exchange Commission (“SEC”), including their most recent Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K. Forward-looking statements represent management’s current expectations and are inherently uncertain and are made only as of the date hereof. Except as required by law, neither SM Energy nor Civitas undertakes or assumes any obligation to update any forward-looking statements, whether as a result of new information or to reflect subsequent events or circumstances or otherwise. Cautionary Note to Investors The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable, and possible reserves that meet the SEC’s definitions for such terms. This presentation and the oral statements made in connection therewith may use certain terms, such as “resources,” “potential resources,” “resource potential,” “estimated net reserves,” “recoverable reserves,” and other similar terms that the SEC guidelines strictly prohibit oil and gas companies from including in filings with the SEC. Such terms do not take into account the certainty of resource recovery, which is contingent on exploration success, technical improvements in drilling access, commerciality, and other factors, and are therefore not indicative of expected future resource recovery and should not be relied upon. Investors are urged to consider carefully the disclosure in SM Energy’s Annual Report on Form10-K for the fiscal year ended December 31, 2024, and Civitas’ Annual Report on Form 10-K for the fiscal year ended December 31, 2024. A copy of SM Energy’s Annual Report on Form 10-K is available free of charge on SM Energy’s website at www.sm-energy.com/investors. A copy of Civitas’ Annual Report on Form 10-K is available free of charge on Civitas’ website at ir.Civitasresources.com/investor-relations. You may also obtain these reports from the SEC by calling 1-800-SEC-0330 or from the SEC’s website at www.sec.gov. |

| 3 Disclaimer (Cont’d) Non-GAAP Financial Measures This presentation includes financial information not prepared in conformity with generally accepted accounting principles (GAAP). Free Cash Flow is a non-GAAP measure. The companies are unable to provide a reconciliation of forward-looking non-GAAP Free Cash Flow because components of the calculation are inherently unpredictable, such as changes to, and timing of, accruals. The inability to project certain components of the calculation would significantly affect the accuracy of a reconciliation. This non-GAAP information should be considered by the reader in addition to, but not instead of, the financial information prepared in accordance with GAAP. No Offer or Solicitation This presentation and the oral statements made in connection therewith are not intended to, and shall not, constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Additional Information and Where to Find It In connection with the proposed transaction, SM Energy intends to file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a joint proxy statement of SM Energy and Civitas and a prospectus of SM Energy (the “Joint Proxy Statement/Prospectus”). Each of SM Energy and Civitas may also file other relevant documents with the SEC regarding the proposed transaction. This communication is not a substitute for the Joint Proxy Statement/Prospectus or Registration Statement or any other document that SM Energy or Civitas, as applicable, may file with the SEC in connection with the proposed transaction. After the Registration Statement has been declared effective by the SEC, a definitive Joint Proxy Statement/Prospectus will be mailed to the stockholders of each of SM Energy and Civitas. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SM ENERGY AND CIVITAS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT SM ENERGY, CIVITAS, THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement/Prospectus, as well as other filings containing important information about SM Energy, Civitas and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by SM Energy will be available free of charge on SM Energy’s website at www.sm-energy.com/investors. Copies of the documents filed with the SEC by Civitas will be available free of charge on Civitas’ website at ir.civitasresources.com/investor-relations. The information included on, or accessible through, SM Energy’s or Civitas’ website is not incorporated by reference into this communication. Participants in the Solicitation SM Energy, Civitas and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of SM Energy, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in SM Energy’s proxy statement for its 2025 Annual Meeting of Stockholders, which was filed with the SEC on April 7, 2025 (and which is available at www.sec.gov/Archives/edgar/data/893538/000089353825000032/sm-20250404.htm) and a Form 8-K filed by SM Energy on September 8, 2025 (and which is available at www.sec.gov/Archives/edgar/data/893538/000089353825000116/sm-20250904.htm). Information about the directors and executive officers of Civitas, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in a Form 8-K filed by Civitas on August 6, 2025 (and which is available at www.sec.gov/Archives/edgar/data/1509589/000110465925074774/tm2522747d1_8k.htm), a Form 8-K filed by Civitas on May 7, 2025 (and which is available at www.sec.gov/Archives/edgar/data/1509589/000110465925045550/tm2514090d1_8k.htm), and Civitas’ proxy statement for its 2025 Annual Meeting of Stockholders, which was filed with the SEC on April 21, 2025 (and which is available at www.sec.gov/Archives/edgar/data/1509589/000155837025005077/civi-20241231xdef14a.htm). Other information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the Joint Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from SM Energy and Civitas using the sources indicated above. |

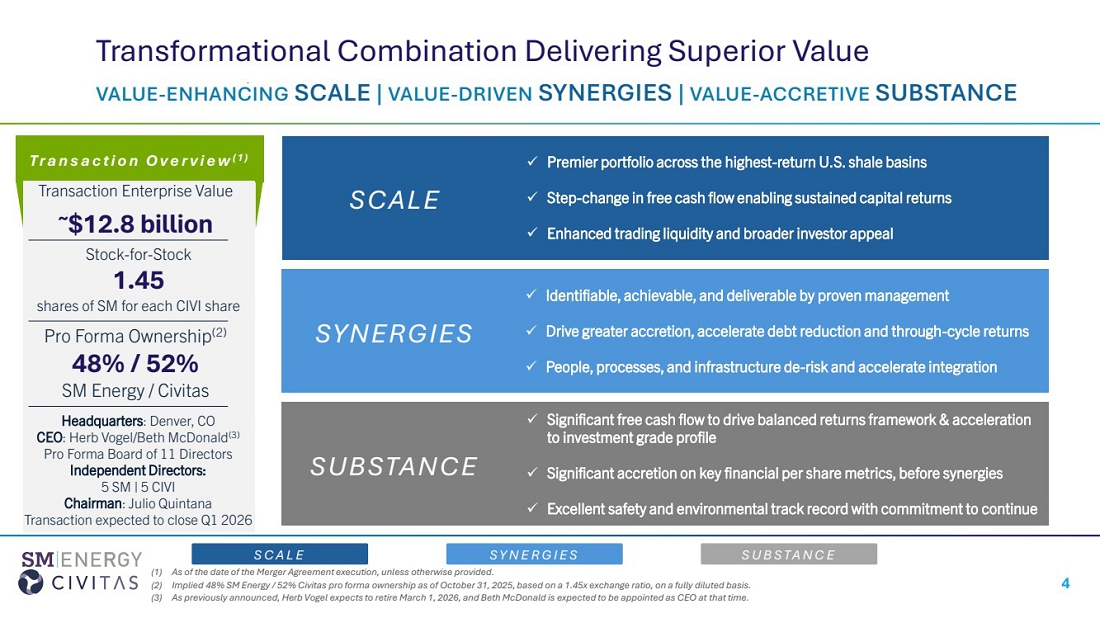

| 4 Transformational Combination Delivering Superior Value VALUE-ENHANCING SCALE | VALUE-DRIVEN SYNERGIES | VALUE-ACCRETIVE SUBSTANCE Tr a n s a c t i o n O v e r v i e w ( 1 ) ✓ Significant free cash flow to drive balanced returns framework & acceleration to Investment Grade profile ✓ Immediately accretive to key financial metrics before synergies SYNERGIES Transaction Enterprise Value ~$12.8 billion Stock-for-Stock 1.45 shares of SM for each CIVI share Pro Forma Ownership(2) 48% / 52% SM Energy / Civitas Headquarters: Denver, CO CEO: Herb Vogel/Beth McDonald(3) Pro Forma Board of 11 Directors Independent Directors: 5 SM | 5 CIVI Chairman: Julio Quintana Transaction expected to close Q1 2026 ✓ Premier portfolio across the highest-return U.S. shale basins ✓ Step-change in free cash flow enabling sustained capital returns ✓ Enhanced trading liquidity and broader investor appeal SCALE SUBSTANCE ✓ Identifiable, achievable, and deliverable by proven management ✓ Drive greater accretion, accelerate debt reduction and through-cycle returns ✓ People, processes, and infrastructure de-risk and accelerate integration ✓ Significant free cash flow to drive balanced returns framework & acceleration to investment grade profile ✓ Significant accretion on key financial per share metrics, before synergies ✓ Excellent safety and environmental track record with commitment to continue (1) As of the date of the Merger Agreement execution, unless otherwise provided. (2) Implied 48% SM Energy / 52% Civitas pro forma ownership as of October 31, 2025, based on a 1.45x exchange ratio, on a fully diluted basis. (3) As previously announced, Herb Vogel expects to retire March 1, 2026, and Beth McDonald is expected to be appointed as CEO at that time. S C A L E S Y N E R G I E S S U B S T A N C E |

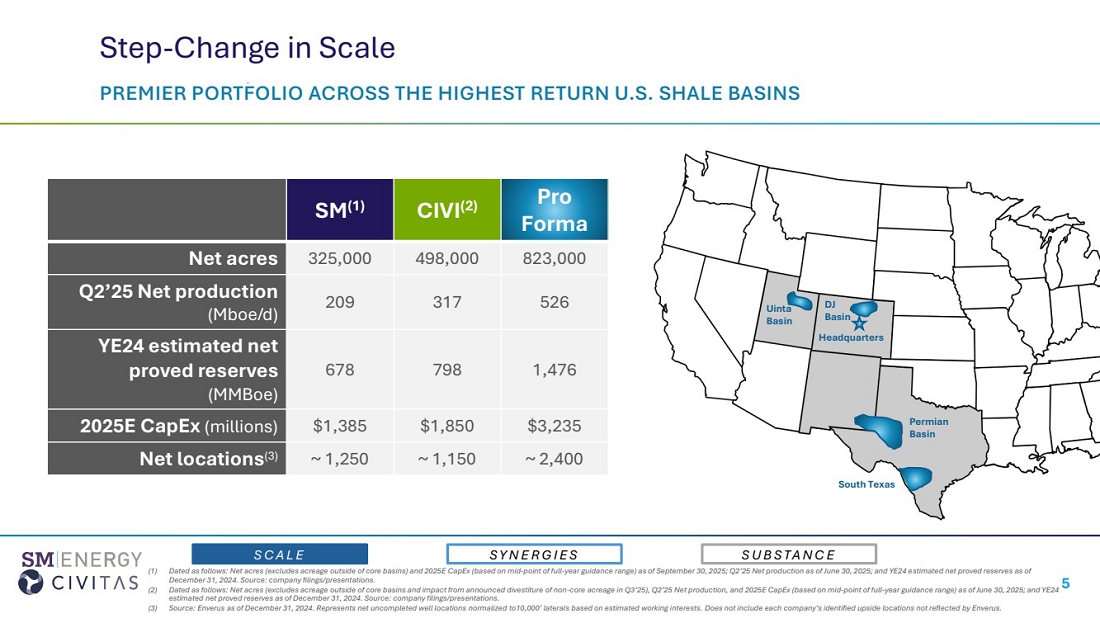

| 5 Step-Change in Scale PREMIER PORTFOLIO ACROSS THE HIGHEST RETURN U.S. SHALE BASINS (1) Dated as follows: Net acres (excludes acreage outside of core basins) and 2025E CapEx (based on mid-point of full-year guidance range) as of September 30, 2025; Q2’25 Net production as of June 30, 2025; and YE24 estimated net proved reserves as of December 31, 2024. Source: company filings/presentations. (2) Dated as follows: Net acres (excludes acreage outside of core basins and impact from announced divestiture of non-core acreage in Q3’25), Q2’25 Net production, and 2025E CapEx (based on mid-point of full-year guidance range) as of June 30, 2025; and YE24 estimated net proved reserves as of December 31, 2024. Source: company filings/presentations. (3) Source: Enverus as of December 31, 2024. Represents net uncompleted well locations normalized to10,000’ laterals based on estimated working interests. Does not include each company’s identified upside locations not reflected by Enverus. S C A L E S Y N E R G I E S S U B S T A N C E SM(1) CIVI(2) Pro Forma Net acres 325,000 498,000 823,000 Q2’25 Net production (Mboe/d) 209 317 526 YE24 estimated net proved reserves (MMBoe) 678 798 1,476 2025E CapEx (millions) $1,385 $1,850 $3,235 Net locations(3) ~ 1,250 ~ 1,150 ~ 2,400 Placeholder South Texas Uinta Basin Permian Basin DJ Basin Headquarters |

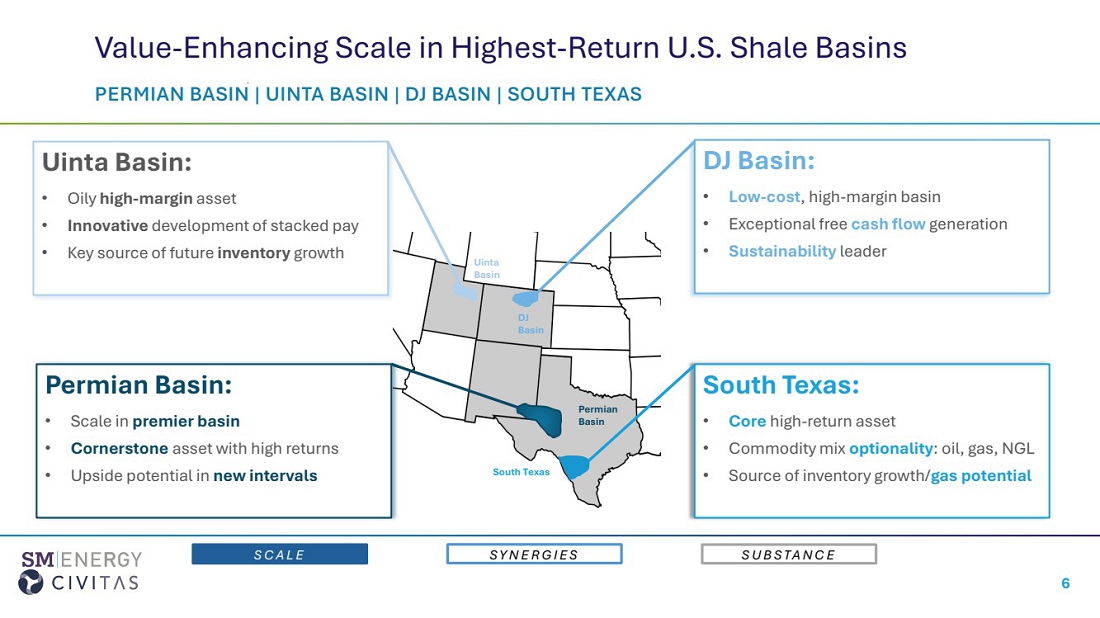

| 6 Value-Enhancing Scale in Highest-Return U.S. Shale Basins PERMIAN BASIN | UINTA BASIN | DJ BASIN | SOUTH TEXAS S C A L E S Y N E R G I E S S U B S T A N C E South Texas Uinta Basin Permian Basin DJ Basin DJ Basin: • Low-cost, high-margin basin • Exceptional free cash flow generation • Sustainability leader South Texas: • Core high-return asset • Commodity mix optionality: oil, gas, NGL • Source of inventory growth/gas potential Permian Basin: • Scale in premier basin • Cornerstone asset with high returns • Upside potential in new intervals Uinta Basin: • Oily high-margin asset • Innovative development of stacked pay • Key source of future inventory growth |

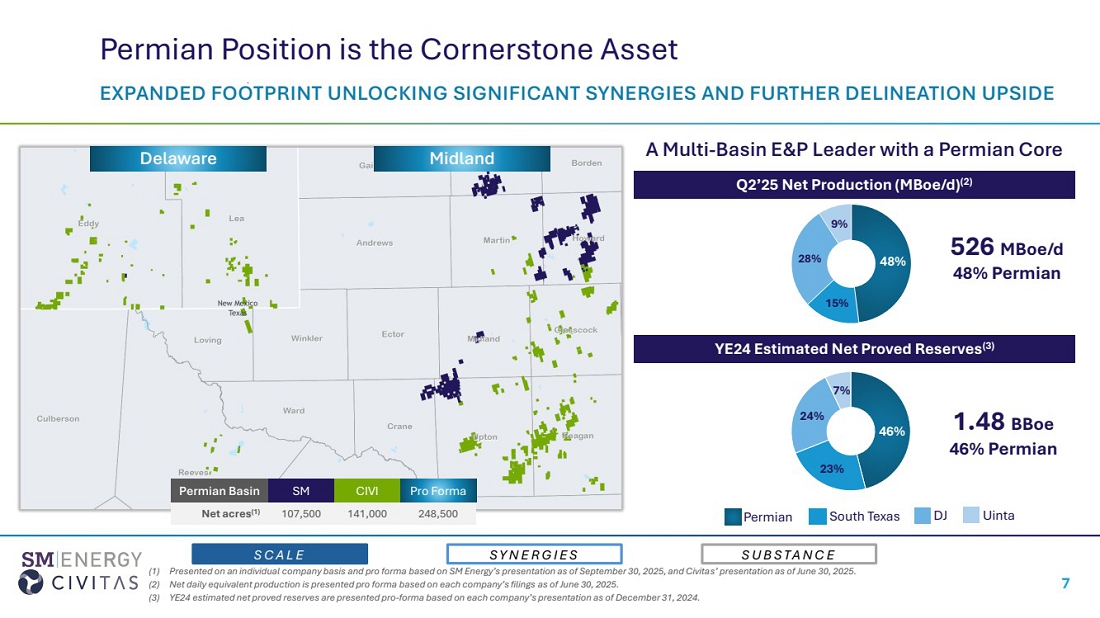

| 7 Permian Position is the Cornerstone Asset EXPANDED FOOTPRINT UNLOCKING SIGNIFICANT SYNERGIES AND FURTHER DELINEATION UPSIDE (1) Presented on an individual company basis and pro forma based on SM Energy’s presentation as of September 30, 2025, and Civitas’ presentation as of June 30, 2025. (2) Net daily equivalent production is presented pro forma based on each company’s filings as of June 30, 2025. (3) YE24 estimated net proved reserves are presented pro-forma based on each company’s presentation as of December 31, 2024. S C A L E S Y N E R G I E S S U B S T A N C E Delaware Midland Permian Basin SM CIVI Pro Forma Net acres(1) 107,500 141,000 248,500 Q2’25 Net Production (MBoe/d)(2) 526 MBoe/d 48% Permian 46% 23% 24% 7% YE24 Estimated Net Proved Reserves(3) 1.48 BBoe 46% Permian A Multi-Basin E&P Leader with a Permian Core Permian South Texas DJ Uinta 48% 15% 28% 9% |

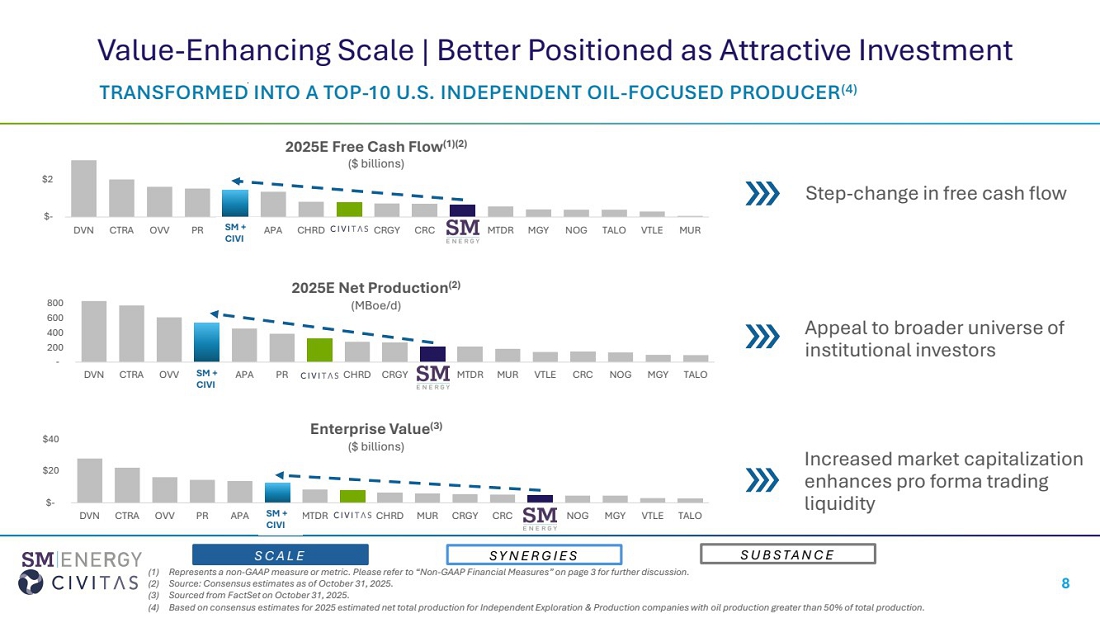

| 8 Value-Enhancing Scale | Better Positioned as Attractive Investment TRANSFORMED INTO A TOP-10 U.S. INDEPENDENT OIL-FOCUSED PRODUCER(4) (1) Represents a non-GAAP measure or metric. Please refer to “Non-GAAP Financial Measures” on page 3 for further discussion. (2) Source: Consensus estimates as of October 31, 2025. (3) Sourced from FactSet on October 31, 2025. (4) Based on consensus estimates for 2025 estimated net total production for Independent Exploration & Production companies with oil production greater than 50% of total production. S C A L E S Y N E R G I E S S U B S T A N C E Step-change in free cash flow - 200 400 600 800 DVN CTRA OVV SM + CIVI APA PR CIVI CHRD CRGY SM MTDR MUR VTLE CRC NOG MGY TALO 2025E Net Production(2) (MBoe/d) $- $20 $40 DVN CTRA OVV PR APA SM + CIVI MTDR CIVI CHRD MUR CRGY CRC SM NOG MGY VTLE TALO Enterprise Value(3) ($ billions) $- $2 DVN CTRA OVV PR SM + CIVI APA CHRD CIVI CRGY CRC SM MTDR MGY NOG TALO VTLE MUR 2025E Free Cash Flow(1)(2) ($ billions) Increased market capitalization enhances pro forma trading liquidity Appeal to broader universe of institutional investors SM + CIVI SM + CIVI SM + CIVI |

| 9 Proven Management and World Class Technical Team DIFFERENTIATED COMBINED TECHNICAL EXPERTISE TO UNLOCK VALUE AND DRIVE SYNERGIES ▪ Interdisciplinary expertise solving complex challenges ▪ Technology-enabled innovative solutions ▪ Collaborative, inquisitive culture that challenges paradigms ▪ Rapid, adaptive deployment of new & emerging technologies S C A L E S Y N E R G I E S S U B S T A N C E ▪ Synergistic integration of people, processes & infrastructure |

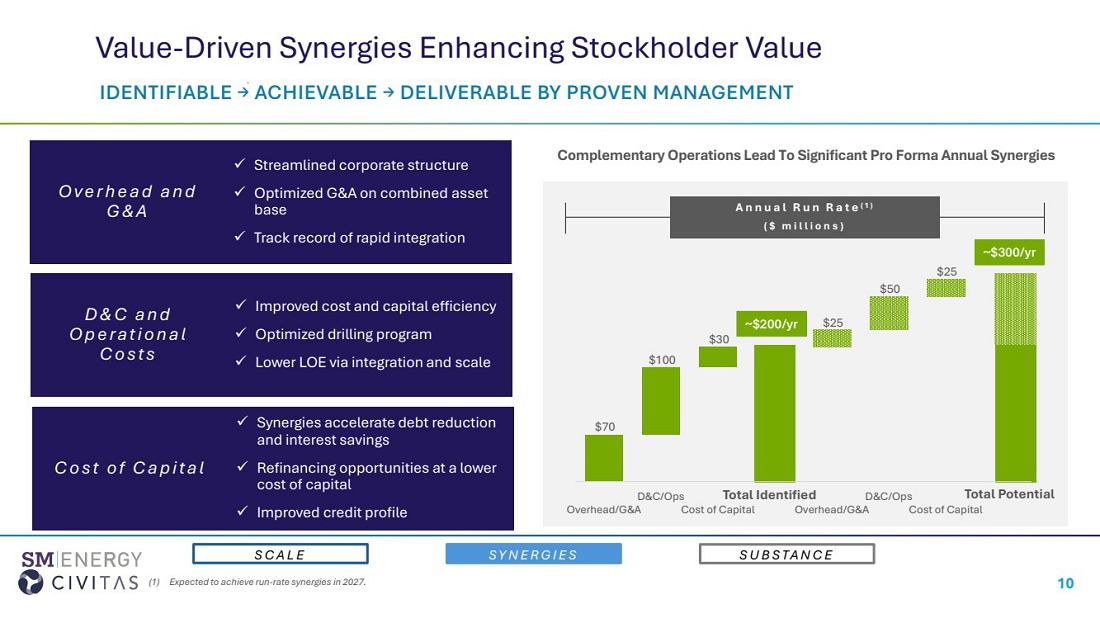

| 10 Value-Driven Synergies Enhancing Stockholder Value IDENTIFIABLE → ACHIEVABLE → DELIVERABLE BY PROVEN MANAGEMENT (1) Expected to achieve run-rate synergies in 2027. Complementary Operations Lead To Significant Pro Forma Annual Synergies S C A L E S Y N E R G I E S S U B S T A N C E ✓ Synergies accelerate debt reduction and interest savings ✓ Refinancing opportunities at a lower cost of capital ✓ Improved credit profile C o s t o f C a p i t a l ✓ Streamlined corporate structure ✓ Optimized G&A on combined asset base ✓ Track record of rapid integration O v e r h e a d a n d G & A ✓ Improved cost and capital efficiency ✓ Optimized drilling program ✓ Lower LOE via integration and scale D & C a n d O p e r a t i o n a l C o s t s ~$200/yr ~$300/yr A n n u a l R u n R a t e (1) ( $ m i l l i o n s ) $70 $100 $30 $25 $50 $25 Overhead/G&A D&C/Ops Cost of Capital Total Identified Overhead/G&A D&C/Ops Cost of Capital Total Identified Total Potential Total Potential |

| 11 Value-Accretive Substance | Significant Free Cash Flow Generation PRIORITIZE DEBT REDUCTION, FIXED DIVIDEND, AND OPPORTUNISTIC BUYBACKS (1) Source: Company generated models (2) At $65 NYMEX WTI / $3.50 Henry Hub. At $60 NYMEX WTI, expected leverage is approximately 1.4x at YE 27. S C A L E S Y N E R G I E S S U B S T A N C E ✓ Sustainable quarterly fixed dividend maintained at $0.20/share ✓ The previously Board-authorized $500 million share repurchase program remains in effect ✓ Prioritize leverage target of 1.0x with opportunistic share buyback potential Stockholder Returns ✓ Prioritized debt reduction | Path to 1.0x net leverage by YE 27(2) ✓ Scale, diversification, and synergy-enhanced free cash flow strengthen credit profile Reducing Leverage ✓ Significant accretion to cash flow, debt-adjusted cash flow, free cash flow, and NAV before synergies ✓ Meaningfully enhanced by $200 - $300 million run-rate synergies potential Per Share Accretion(1) |

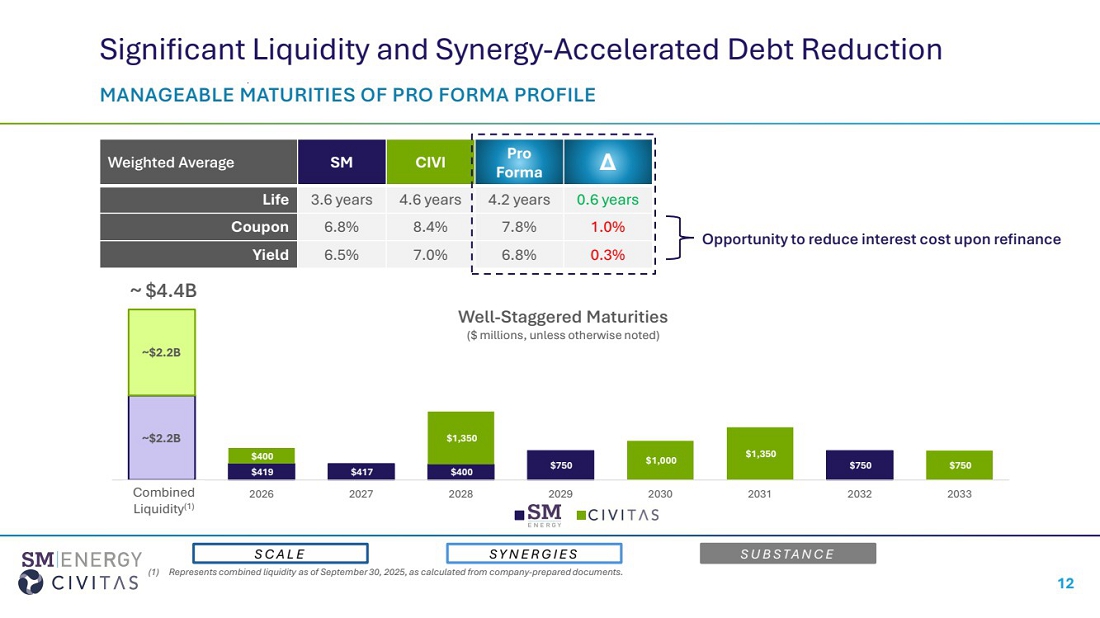

| 12 Significant Liquidity and Synergy-Accelerated Debt Reduction MANAGEABLE MATURITIES OF PRO FORMA PROFILE (1) Represents combined liquidity as of September 30, 2025, as calculated from company-prepared documents. S C A L E S Y N E R G I E S S U B S T A N C E Opportunity to reduce interest cost upon refinance ~ $4.4B Weighted Average SM CIVI Pro Forma Δ Life 3.6 years 4.6 years 4.2 years 0.6 years Coupon 6.8% 8.4% 7.8% 1.0% Yield 6.5% 7.0% 6.8% 0.3% ~$2.2B $419 $417 $400 $750 $750 ~$2.2B $400 $1,350 $1,000 $1,350 $750 Combined Liquidity(1) 2026 2027 2028 2029 2030 2031 2032 2033 Well-Staggered Maturities ($ millions, unless otherwise noted) SM CIVI Combined Liquidity(1) |

| 13 Dependable Leader of Sustainability and Stewardship Note: For additional information please refer to each company’s sustainability disclosures on their respective websites. BUILDING STRONGER COMMUNITIES THROUGH RESPONSIBLE ACTION S C A L E S Y N E R G I E S S U B S T A N C E Sustainable Leadership Responsible Energy Production Top-Tier Stewardship Innovation Safety-First Culture Cultivating Leaders Future-Focused Governance Permian Basin: Committed to top-tier EHS standards for creating a sustainable future Uinta Basin: Focused on stewardship and high margins through 100% recycled water and electric frac fleet DJ Basin: Reducing footprint in the community and producing low-cost energy with minimal emissions South Texas: Increasing returns and lowering emissions through field gas utilization for electric frac fleet |

| 14 Transformational Combination Delivering Superior Value VALUE-ENHANCING SCALE | VALUE-DRIVEN SYNERGIES | VALUE-ACCRETIVE SUBSTANCE (1) Expected to achieve run-rate synergies in 2027. S C A L E S Y N E R G I E S S U B S T A N C E ✓ Differential technical expertise to unlock value and drive synergies ✓ People, processes, and systems de-risk and accelerate integration efforts ✓ Significant free cash flow to drive balanced returns framework & acceleration to Investment Grade profile ✓ Immediately accretive to key financial metrics before synergies SYNERGIES SCALE ✓ Premier portfolio across the highest-return U.S. shale basins ✓ Step-change in free cash flow enabling sustained capital returns ✓ Enhanced trading liquidity and broader investor appeal SUBSTANCE ✓ $200 - $300 million of annual synergies across G&A, operations, and cost of capital(1) ✓ Identifiable, achievable, and deliverable by proven management ✓ Drive greater accretion, accelerate debt reduction, and through-cycle returns ✓ People, processes, and infrastructure de-risk and accelerate integration ✓ Significant free cash flow to drive balanced returns framework & acceleration to investment grade profile ✓ Significant accretion on key financial per share metrics, before synergies ✓ Excellent safety and environmental track record with commitment to continue |