Filed by: Civitas Resources, Inc. Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a - 12 under the Securities Exchange Act of 1934 Subject Company: Civitas Resources, Inc. Commission File No.: 001 - 35371 On November 3, 2025, Civitas Resources, Inc. (" Civitas") utilized the following presentation during a town hall meeting for Civitas employees:

OUR VISION ENDURING & UNIFIED

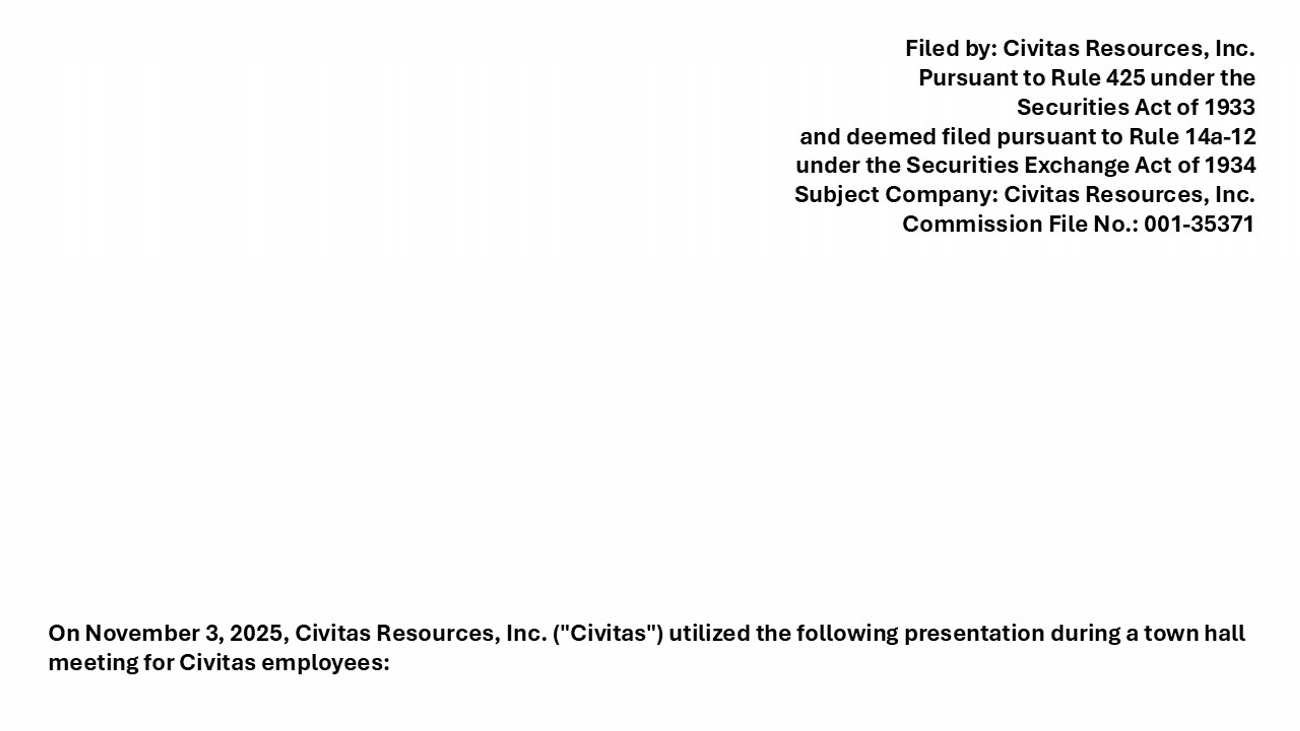

Purposeful and Intentional Unification A transformed SM Energy, where scale, technical exploration, and asset quality converge for value • Combination of strengths and great assets create value for all stakeholders o Operational, financial, technical, and commercial excellence • Enduring the industry’s consolidation efforts to continue a storied legacy • Our approach to integrations • Listen, Learn, and Lean In

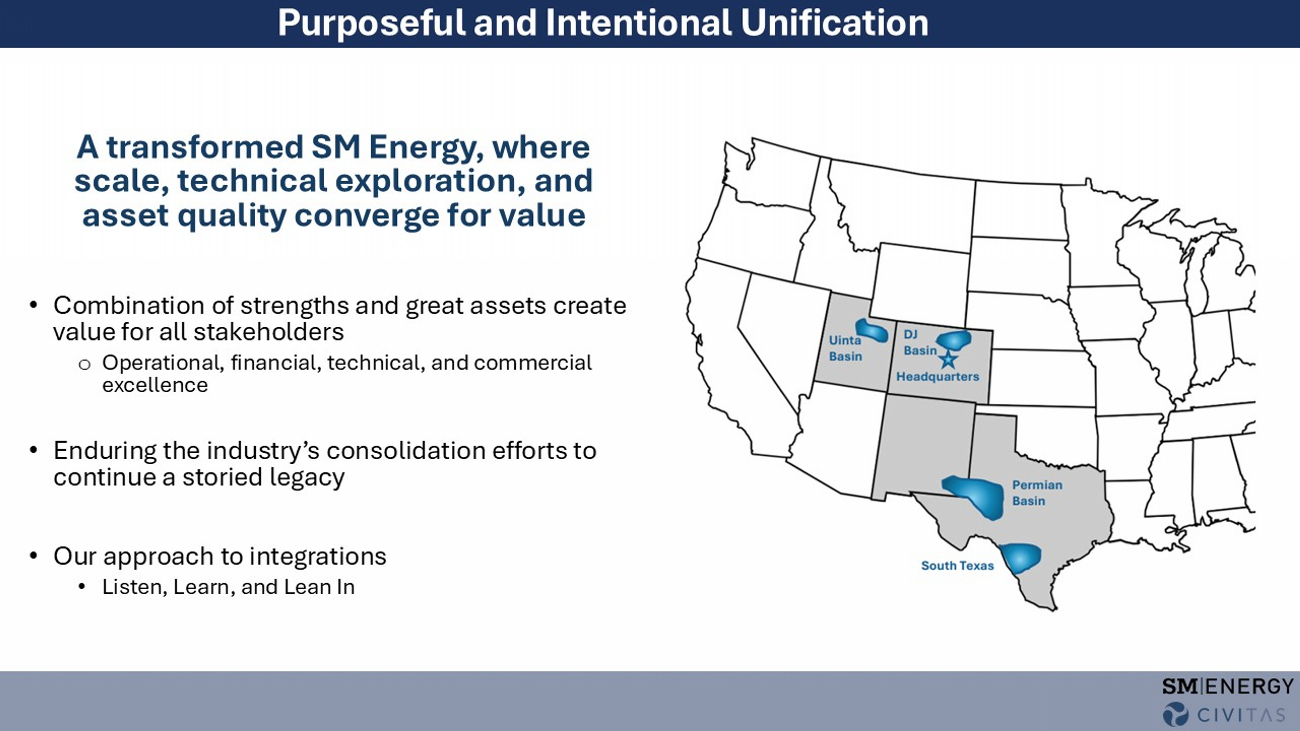

Stronger Together MERGES QUALITY LOCATIONS SHIFTS THE CURVE WELL INVENTORY WELL QUALITY IMPROVED RETURNS MORE OF WHAT MATTERS

Our Future Great Good Value Victory

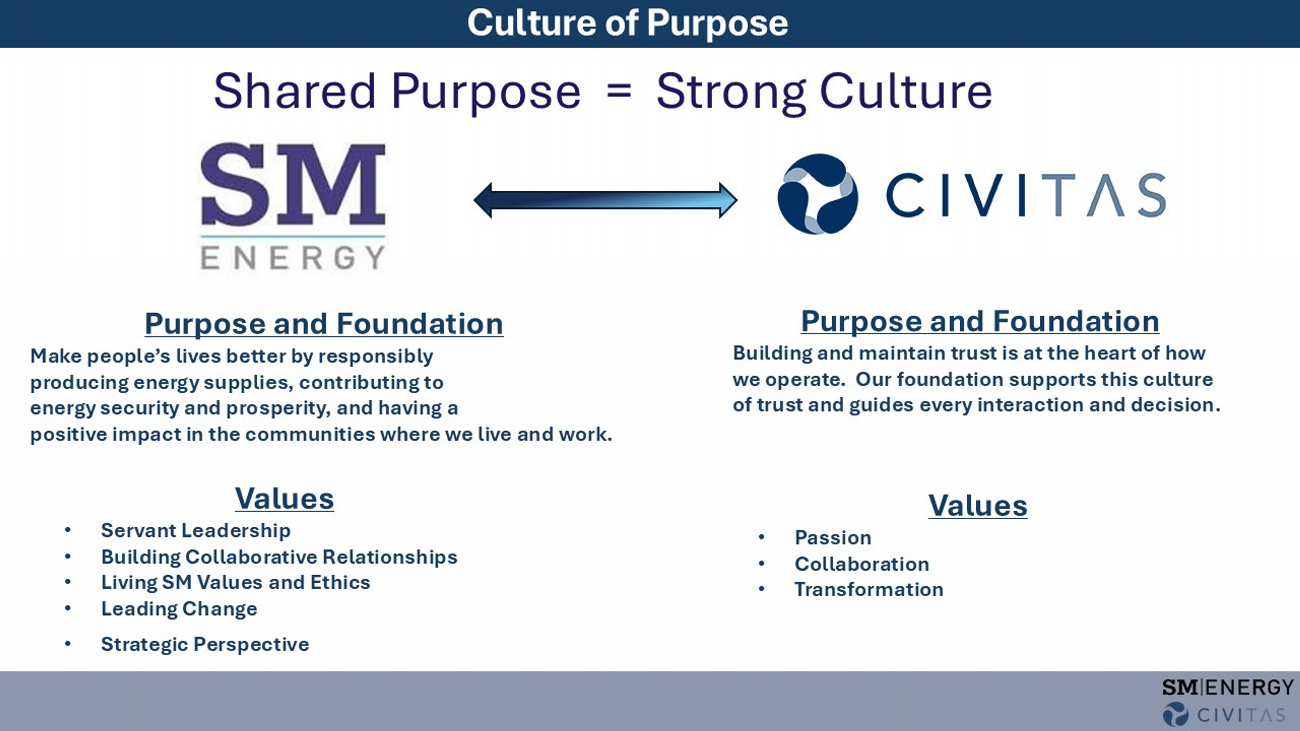

Culture of Purpose Shared Purpose = Strong Culture Values • Servant Leadership • Building Collaborative Relationships • Living SM Values and Ethics • Leading Change • Strategic Perspective Values • Passion • Collaboration • Transformation Purpose and Foundation Make people’s lives better by responsibly producing energy supplies, contributing to energy security and prosperity, and having a positive impact in the communities where we live and work. Purpose and Foundation Building and maintain trust is at the heart of how we operate. Our foundation supports this culture of trust and guides every interaction and decision.

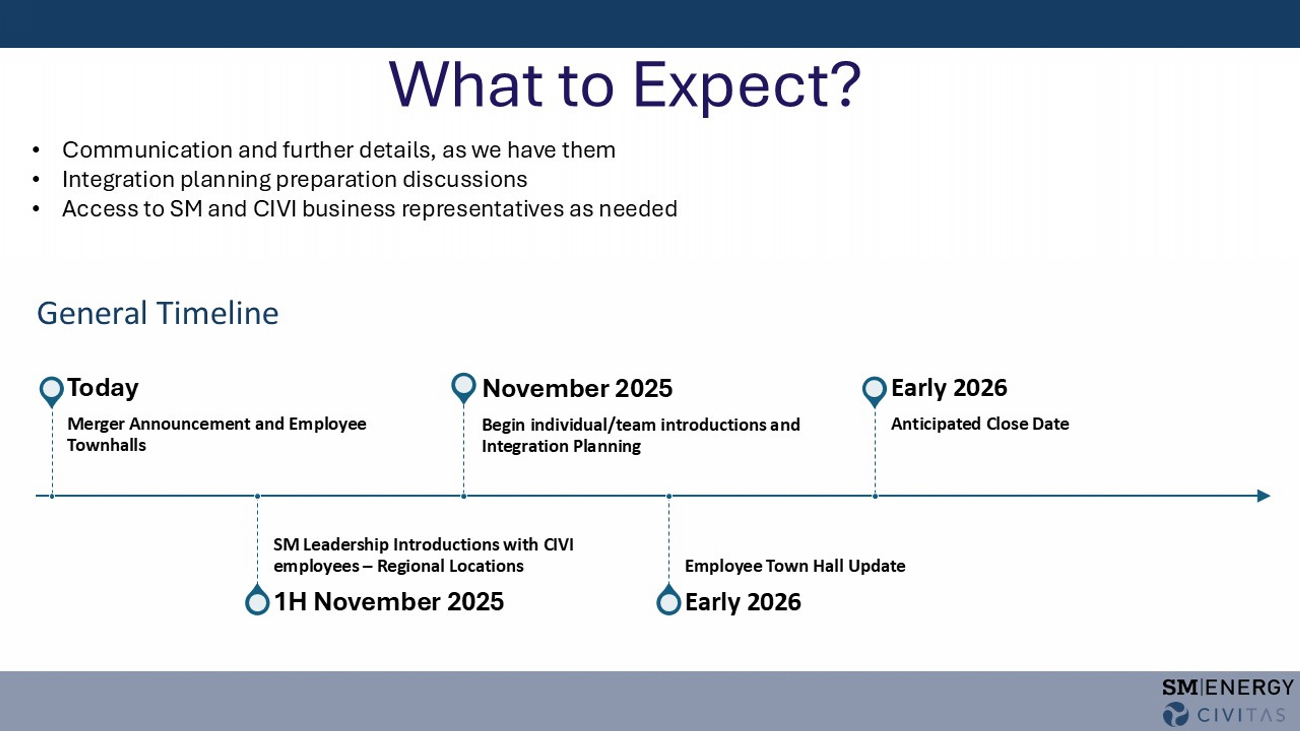

What to Expect? • Communication and further details, as we have them • Integration planning preparation discussions • Access to SM and CIVI business representatives as needed General Timeline Merger Announcement and Employee Townhalls Today SM Leadership Introductions with CIVI employees – Regional Locations 1H November 2025 Begin individual/team introductions and Integration Planning November 2025 Employee Town Hall Update Early 2026 Anticipated Close Date Early 2026

Q & A

Forward - Looking Statements This communication contains “forward - looking statements” within the meaning of Section 27A of the Securities Act of 1933, as ame nded (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this communication that address events or d eve lopments that SM Energy Company (“SM Energy”) and Civitas Resources, Inc. (“Civitas”) expect, believe, or anticipate will or may occur in the future are forward - looking statements. The words “intend,” “ expect,” and similar expressions are intended to identify forward - looking statements. Forward - looking statements in this communication include, but are not limited to, statements regarding the transactions contempl ated by the Agreement and Plan of Merger, dated November 2, 2025 (the “Merger Agreement”), among SM Energy, Civitas and Cars Merger Sub, Inc. (the “Transaction”), pro forma descriptions of the combined c omp any and its operations, integration and transition plans, synergies, opportunities and anticipated future performance. There are a number of risks and uncertainties that could cause actual results to differ m ate rially from the forward - looking statements included in this communication. These include the expected timing and likelihood of completion of the Transaction, including the timing, receipt and terms and cond iti ons of any required governmental and regulatory approvals of the Transaction that could reduce anticipated benefits or cause the parties to abandon the Transaction, the ability to successfully integrate the busine sse s, the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement, the possibility that stockholders of SM Energy or Civitas may not approve the Transactio n, the risk that the parties may not be able to satisfy the conditions to the Transaction in a timely manner or at all, risks related to disruption of management time from ongoing business operations due to the Transacti on, the risk that any announcements relating to the Transaction could have adverse effects on the market price of SM Energy’s common stock or Civitas’ common stock, the risk that the Transaction and its announcement cou ld have an adverse effect on the ability of SM Energy and Civitas to retain customers and retain and hire key personnel and maintain relationships with their suppliers and customers and on their operating result s a nd businesses generally, the risk the pending Transaction could distract management of both entities and they will incur substantial costs, the risk that problems may arise in successfully integrating the busines ses of the companies, which may result in the combined company not operating as effectively and efficiently as expected, the risk that the combined company may be unable to achieve synergies or it may take longer than ex pected to achieve those synergies and other important factors that could cause actual results to differ materially from those projected. All such factors are difficult to predict and are beyond SM Energy’s or Ci vit as’ control, including those detailed in SM Energy’s annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K that are available on its website at sm - energy.com/investors and on the SEC ’s website at http://www.sec.gov, and those detailed in Civitas’ annual reports on Form 10 - K, quarterly reports on Form 10 - Q and current reports on Form 8 - K that are available on Civitas’ website at ir.civitasre sources.com/ investorrelations and on the SEC’s website at http://www.sec.gov. All forward - looking statements are based on assumptions that SM Energy and Civitas believe to be reasonable but that may not prove t o be accurate. Such forward - looking statements are based on assumptions and analyses made by SM Energy and Civitas in light of their perceptions of current conditions, expected future developments, and ot her factors that SM Energy and Civitas believe are appropriate under the circumstances. These statements are subject to a number of known and unknown risks and uncertainties. Forward - looking statements are not guarantees of future performance and actual events may be materially different from those expressed or implied in the forward - looking statements. The forward - looking statements in this communicatio n speak as of the date of this communication. No Offer or Solicitation This communication is for informational purposes only and is not intended to, and shall not, constitute an offer to buy or se ll or the solicitation of an offer to buy or sell any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be un law ful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securitie s A ct.

Additional Information and Where to Find It In connection with the proposed transaction, SM Energy intends to file with the SEC a registration statement on Form S - 4 (the “R egistration Statement”) that will include a joint proxy statement of SM Energy and Civitas and a prospectus of SM Energy (the “Joint Proxy Statement/Prospectus”). Each of SM Energy and Civitas may also file other rel eva nt documents with the SEC regarding the proposed transaction. This communication is not a substitute for the Joint Proxy Statement/Prospectus or Registration Statement or any other document that SM Energy or C ivi tas, as applicable, may file with the SEC in connection with the proposed transaction. After the Registration Statement has been declared effective by the SEC, a definitive Joint Proxy Statement/Prospectus will b e m ailed to the stockholders of each of SM Energy and Civitas. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SM ENERGY AND CIVITAS ARE URGED TO READ THE REGISTRATION STA TEM ENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFUL LY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT SM ENERGY, CIVITAS, THE PROPOSED TRANSACTION AND R ELA TED MATTERS. Investors and security holders will be able to obtain free copies of the Registration Statement and the Joint Proxy Statement/Prospectus, as well as other filings contai nin g important information about SM Energy, Civitas and the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at https://www.sec.gov. Copies of the documen ts filed with the SEC by SM Energy will be available free of charge on SM Energy's website at https://www.sm - energy.com/investors. Copies of the documents filed with the SEC by Civitas will be available free of charge on Civitas’ website at https://ir.civitasresources.com/investorrelations/Overview/default.aspx. The information included on, or accessible through, SM Energy's or Civitas’ website is not incorporated by reference into this communication. Participants in the Solicitation SM Energy, Civitas and certain of their respective directors and executive officers may be deemed to be participants in the s oli citation of proxies in respect of the proposed transaction. Information about the directors and executive officers of SM Energy, including a description of their direct or indirect interests, by security holdings or o the rwise, is set forth in SM Energy's proxy statement for its 2025 Annual Meeting of Stockholders, which was filed with the SEC on April 7, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/893538/00008 935 3825000032/sm - 20250404.htm) and a Form 8 - K filed by SM Energy on September 8, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/893538/000089353825000116/sm - 20250904.htm). Information about the directors and executive officers of Civitas, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in a Form 8 - K filed by Civitas on August 6, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/1509589/000110465925074774/tm2522747d1_8k.htm), a Form 8 - K filed by Civitas on May 7, 20 25 (and which is available at https://www.sec.gov/Archives/edgar/data/1509589/000110465925045550/tm2514090d1_8k.htm), and Civitas’ proxy statement for its 202 5 Annual Meeting of Stockholders, which was filed with the SEC on April 21, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/1509589/000155837025005077/civi - 20241231xdef14a.htm). Ot her information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Joint Proxy S tat ement/Prospectus and other relevant materials to be filed with the SEC regarding the proposed transaction when such materials become available. Investors should read the Joint Proxy Statement/Prospectus carefully when i t b ecomes available before making any voting or investment decisions. You may obtain free copies of these documents from SM Energy and Civitas using the sources indicated above.