C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S Flame Aggregator, LLC Years Ended December 31, 2024 and 2023 With Report of Independent Auditors

Flame Aggregator, LLC Consolidated Financial Statements Years Ended December 31, 2024 and 2023 Contents Report of Independent Auditors.......................................................................................................1 Consolidated Financial Statements Consolidated Balance Sheets ...........................................................................................................4 Consolidated Statements of Operations and Comprehensive Income (Loss) ..................................6 Consolidated Statements of Cash Flows ..........................................................................................7 Consolidated Statements of Changes in Members’ Equity .............................................................8 Notes to Consolidated Financial Statements....................................................................................9

1 Report of Independent Auditors The Members Flame Aggregator, LLC Opinion We have audited the consolidated financial statements of Flame Aggregator, LLC (the “Company”), which comprise the consolidated balance sheets as of December 31, 2024 and 2023, and the related consolidated statements of operations and comprehensive income (loss), changes in members’ equity, and cash flows for the year ended December 31, 2024, and for the period from July 1, 2023 to December 31, 2023 (Successor) and for the period from January 1, 2023 to June 30, 2023 (Predecessor), and the related notes (collectively referred to as the “financial statements”). In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2024 and 2023, and the results of its operations and its cash flows for the year ended December 31, 2024, and the period July 1, 2023 to December 31, 2023 (Successor) and for the period January 1, 2023 to June 30, 2023 (Predecessor), in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Company Reorganization As discussed in Note 2 to the consolidated financial statements, on June 30, 2023, the Bankruptcy Court entered an order confirming the plan of reorganization, which became effective on June 30, 2023. Accordingly, the accompanying consolidated financial statements have been prepared in conformity with Accounting Standards Codification 852-10, Reorganizations, for the Successor Company as a new entity, with assets, liabilities, and a capital structure having carrying amounts not comparable with prior periods as described in Note 2. Ernst & Young LLP One Commerce Square Suite 700 2005 Market Street Philadelphia, PA 19103 Tel: +1 215 448 5000 Fax: +1 215 448 5500 ey.com A member firm of Ernst & Young Global Limited

2 Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free of material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for one year after the date that the financial statements are available to be issued. Auditor’s Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free of material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and, therefore, is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements. In performing an audit in accordance with GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. Accordingly, no such opinion is expressed. A member firm of Ernst & Young Global Limited

3 • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company’s ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. October 15, 2025 A member firm of Ernst & Young Global Limited

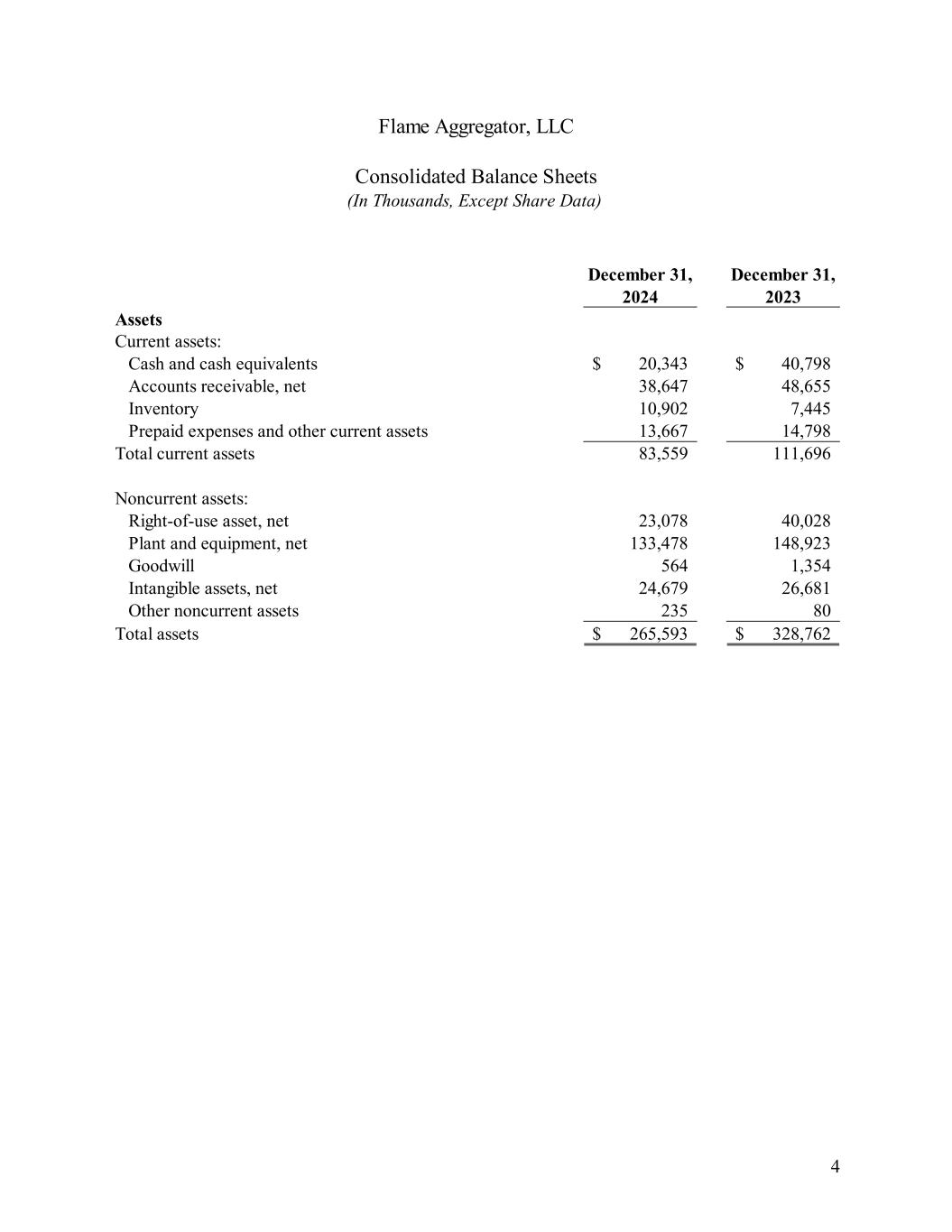

4 December 31, December 31, 2024 2023 Assets Current assets: Cash and cash equivalents 20,343$ 40,798$ Accounts receivable, net 38,647 48,655 Inventory 10,902 7,445 Prepaid expenses and other current assets 13,667 14,798 Total current assets 83,559 111,696 Noncurrent assets: Right-of-use asset, net 23,078 40,028 Plant and equipment, net 133,478 148,923 Goodwill 564 1,354 Intangible assets, net 24,679 26,681 Other noncurrent assets 235 80 Total assets 265,593$ 328,762$ Flame Aggregator, LLC Consolidated Balance Sheets (In Thousands, Except Share Data)

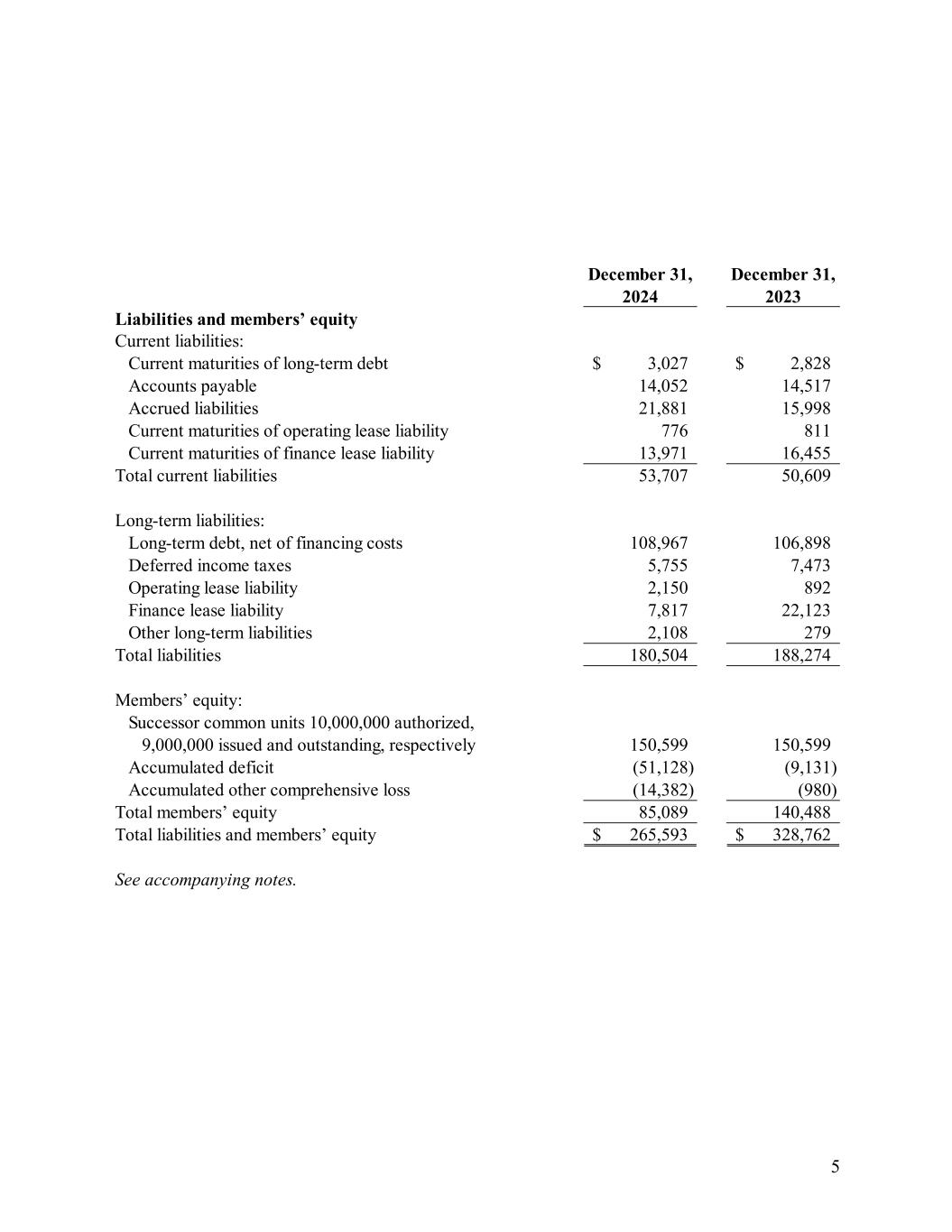

5 December 31, December 31, 2024 2023 Liabilities and members’ equity Current liabilities: Current maturities of long-term debt 3,027$ 2,828$ Accounts payable 14,052 14,517 Accrued liabilities 21,881 15,998 Current maturities of operating lease liability 776 811 Current maturities of finance lease liability 13,971 16,455 Total current liabilities 53,707 50,609 Long-term liabilities: Long-term debt, net of financing costs 108,967 106,898 Deferred income taxes 5,755 7,473 Operating lease liability 2,150 892 Finance lease liability 7,817 22,123 Other long-term liabilities 2,108 279 Total liabilities 180,504 188,274 Members’ equity: Successor common units 10,000,000 authorized, 9,000,000 issued and outstanding, respectively 150,599 150,599 Accumulated deficit (51,128) (9,131) Accumulated other comprehensive loss (14,382) (980) Total members’ equity 85,089 140,488 Total liabilities and members’ equity 265,593$ 328,762$ See accompanying notes.

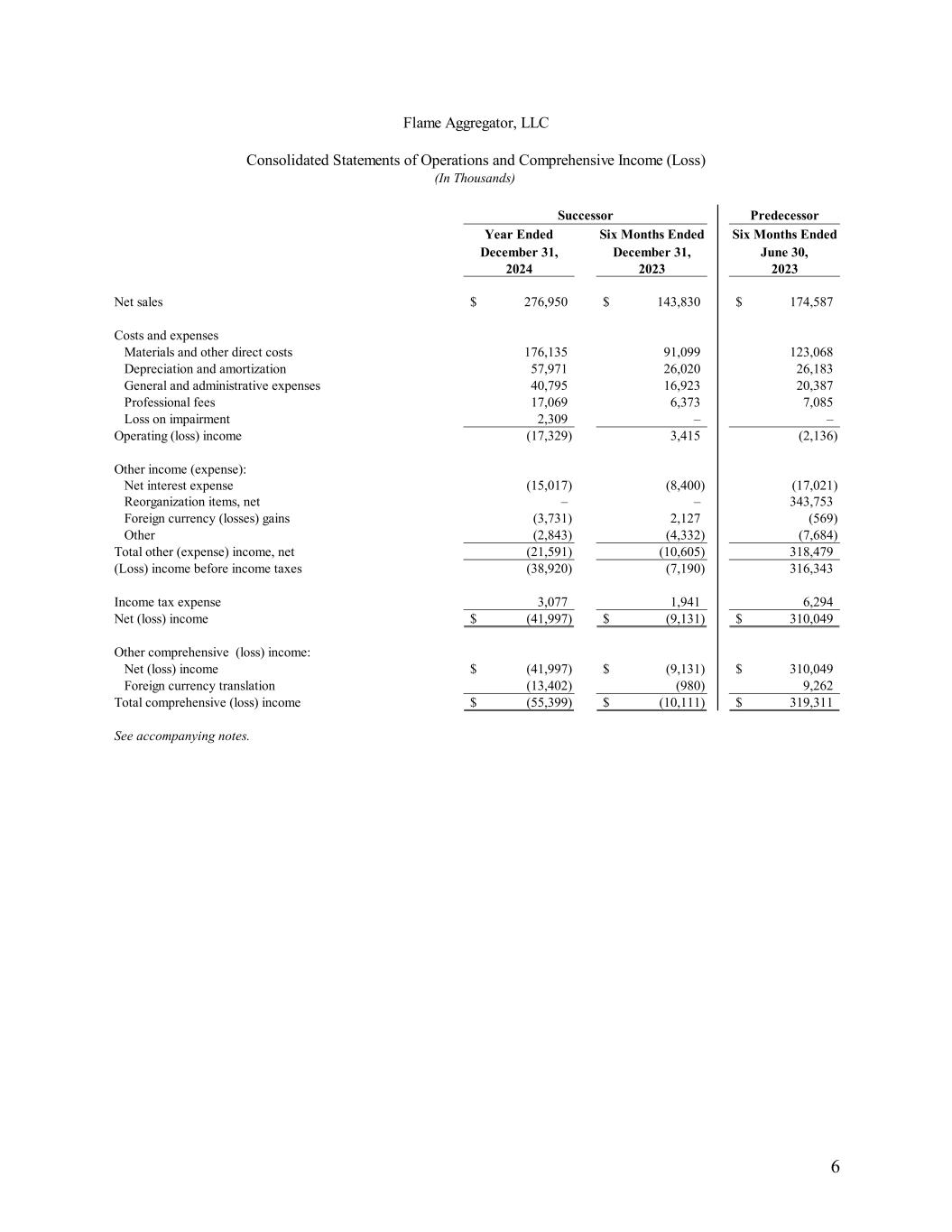

6 Successor Predecessor Year Ended Six Months Ended Six Months Ended December 31, December 31, June 30, 2024 2023 2023 Net sales 276,950$ 143,830$ 174,587$ Costs and expenses Materials and other direct costs 176,135 91,099 123,068 Depreciation and amortization 57,971 26,020 26,183 General and administrative expenses 40,795 16,923 20,387 Professional fees 17,069 6,373 7,085 Loss on impairment 2,309 – – Operating (loss) income (17,329) 3,415 (2,136) Other income (expense): Net interest expense (15,017) (8,400) (17,021) Reorganization items, net – – 343,753 Foreign currency (losses) gains (3,731) 2,127 (569) Other (2,843) (4,332) (7,684) Total other (expense) income, net (21,591) (10,605) 318,479 (Loss) income before income taxes (38,920) (7,190) 316,343 Income tax expense 3,077 1,941 6,294 Net (loss) income (41,997)$ (9,131)$ 310,049$ Other comprehensive (loss) income: Net (loss) income (41,997)$ (9,131)$ 310,049$ Foreign currency translation (13,402) (980) 9,262 Total comprehensive (loss) income (55,399)$ (10,111)$ 319,311$ See accompanying notes. Flame Aggregator, LLC Consolidated Statements of Operations and Comprehensive Income (Loss) (In Thousands)

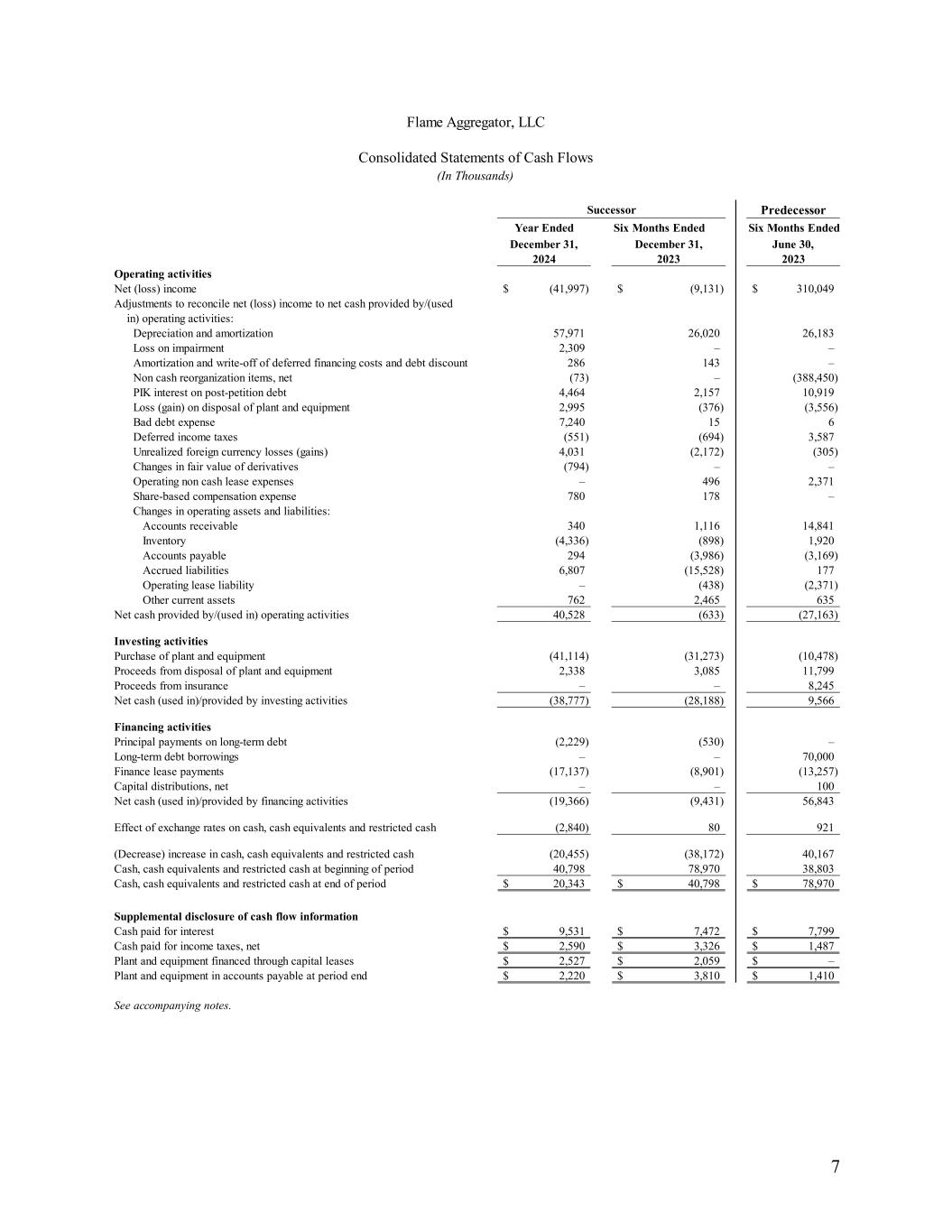

7 Successor Predecessor Year Ended Six Months Ended Six Months Ended December 31, December 31, June 30, 2024 2023 2023 Operating activities Net (loss) income (41,997)$ (9,131)$ 310,049$ Adjustments to reconcile net (loss) income to net cash provided by/(used in) operating activities: Depreciation and amortization 57,971 26,020 26,183 Loss on impairment 2,309 – – Amortization and write-off of deferred financing costs and debt discount 286 143 – Non cash reorganization items, net (73) – (388,450) PIK interest on post-petition debt 4,464 2,157 10,919 Loss (gain) on disposal of plant and equipment 2,995 (376) (3,556) Bad debt expense 7,240 15 6 Deferred income taxes (551) (694) 3,587 Unrealized foreign currency losses (gains) 4,031 (2,172) (305) Changes in fair value of derivatives (794) – – Operating non cash lease expenses – 496 2,371 Share-based compensation expense 780 178 – Changes in operating assets and liabilities: Accounts receivable 340 1,116 14,841 Inventory (4,336) (898) 1,920 Accounts payable 294 (3,986) (3,169) Accrued liabilities 6,807 (15,528) 177 Operating lease liability – (438) (2,371) Other current assets 762 2,465 635 Net cash provided by/(used in) operating activities 40,528 (633) (27,163) Investing activities Purchase of plant and equipment (41,114) (31,273) (10,478) Proceeds from disposal of plant and equipment 2,338 3,085 11,799 Proceeds from insurance – – 8,245 Net cash (used in)/provided by investing activities (38,777) (28,188) 9,566 Financing activities Principal payments on long-term debt (2,229) (530) – Long-term debt borrowings – – 70,000 Finance lease payments (17,137) (8,901) (13,257) Capital distributions, net – – 100 Net cash (used in)/provided by financing activities (19,366) (9,431) 56,843 Effect of exchange rates on cash, cash equivalents and restricted cash (2,840) 80 921 (Decrease) increase in cash, cash equivalents and restricted cash (20,455) (38,172) 40,167 Cash, cash equivalents and restricted cash at beginning of period 40,798 78,970 38,803 Cash, cash equivalents and restricted cash at end of period 20,343$ 40,798$ 78,970$ Supplemental disclosure of cash flow information Cash paid for interest 9,531$ 7,472$ 7,799$ Cash paid for income taxes, net 2,590$ 3,326$ 1,487$ Plant and equipment financed through capital leases 2,527$ 2,059$ –$ Plant and equipment in accounts payable at period end 2,220$ 3,810$ 1,410$ See accompanying notes. Flame Aggregator, LLC Consolidated Statements of Cash Flows (In Thousands)

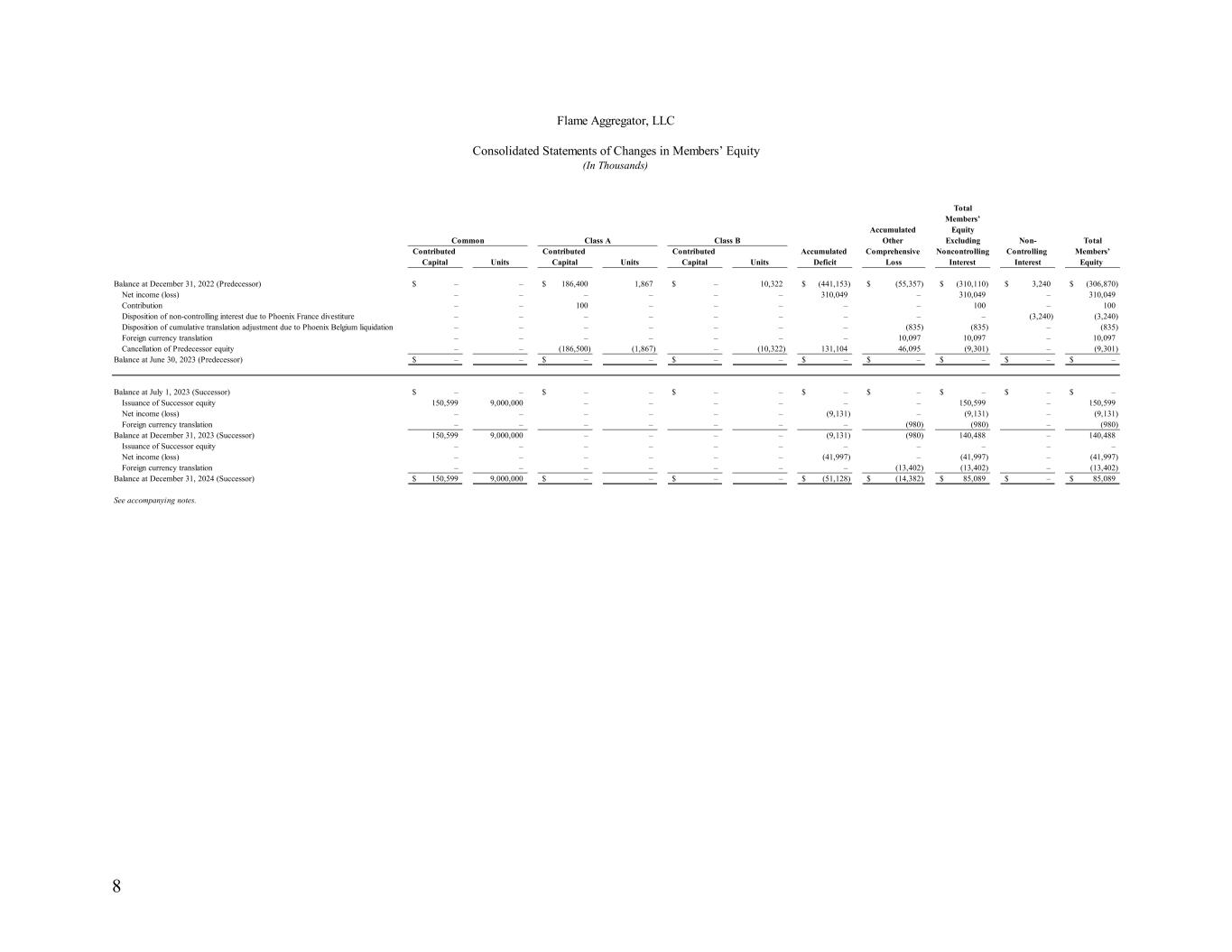

8 Total Members’ Accumulated Equity Other Excluding Non- Total Contributed Contributed Contributed Accumulated Comprehensive Noncontrolling Controlling Members’ Capital Units Capital Units Capital Units Deficit Loss Interest Interest Equity Balance at December 31, 2022 (Predecessor) –$ – 186,400$ 1,867 –$ 10,322 (441,153)$ (55,357)$ (310,110)$ 3,240$ (306,870)$ Net income (loss) – – – – – – 310,049 – 310,049 – 310,049 Contribution – – 100 – – – – – 100 – 100 Disposition of non-controlling interest due to Phoenix France divestiture – – – – – – – – – (3,240) (3,240) Disposition of cumulative translation adjustment due to Phoenix Belgium liquidation – – – – – – – (835) (835) – (835) Foreign currency translation – – – – – – – 10,097 10,097 – 10,097 Cancellation of Predecessor equity – – (186,500) (1,867) – (10,322) 131,104 46,095 (9,301) – (9,301) Balance at June 30, 2023 (Predecessor) –$ – –$ – –$ – –$ –$ –$ –$ –$ Balance at July 1, 2023 (Successor) –$ – –$ – –$ – –$ –$ –$ –$ –$ Issuance of Successor equity 150,599 9,000,000 – – – – – – 150,599 – 150,599 Net income (loss) – – – – – – (9,131) – (9,131) – (9,131) Foreign currency translation – – – – – – – (980) (980) – (980) Balance at December 31, 2023 (Successor) 150,599 9,000,000 – – – – (9,131) (980) 140,488 – 140,488 Issuance of Successor equity – – – – – – – – – – – Net income (loss) – – – – – – (41,997) – (41,997) – (41,997) Foreign currency translation – – – – – – – (13,402) (13,402) – (13,402) Balance at December 31, 2024 (Successor) 150,599$ 9,000,000 –$ – –$ – (51,128)$ (14,382)$ 85,089$ –$ 85,089$ See accompanying notes. Flame Aggregator, LLC Consolidated Statements of Changes in Members’ Equity (In Thousands) Common Class A Class B

9 Flame Aggregator, LLC Notes to Consolidated Financial Statements (In Thousands, Except Share Data) December 31, 2024 and 2023 1. Nature of Business Flame Aggregator, LLC (the “Company”) is a holding company that indirectly owns 100% of the outstanding units of Metal Services LLC, d/b/a Phoenix Services LLC (“Phoenix”). Phoenix is primarily engaged in providing mill services, including slag handling and metal recovery operations, for the steel industry, both domestically and overseas. Within the U.S., Phoenix operates in a broad geography, mostly in the Mid-Atlantic, South, and Midwest. Phoenix also currently has similar operations in Romania, South Africa, Slovakia, Spain, and Brazil through a majority owned Dutch subsidiary. Effective June 30, 2023 (the “Effective Date”), Flame Aggregator LLC conducts its business exclusively through its indirectly wholly owned operating subsidiary, Metal Services LLC and its subsidiaries. Prior to the Effective Date, Phoenix Services TopCo, LLC conducted its business exclusively through its indirect wholly owned operating subsidiary, Metal Services LLC and its subsidiaries. In connection with Phoenix’s emergence from Chapter 11 bankruptcy, Phoenix Services TopCo, LLC was dissolved. Flame Aggregator, LLC is a privately held company that is not listed on a public stock exchange or subject to public company reporting requirements with new ownership and a new board of directors. References to the financial position and results of operations of the “Successor” relate to the financial position and results of operations of Flame Aggregator, LLC after the Effective Date. References to the financial position and results of operations of the “Predecessor” relate to the financial position and results of operations of Phoenix Services Topco, LLC on and prior to the Effective Date. References to the “Company,” “we,” “us,” or “our” in these consolidated financial statements are to Flame Aggregator, LLC, together with its consolidated subsidiaries, when referring to periods following the Effective Date, and to Phoenix Services Topco, LLC, together with its consolidated subsidiaries, when referring to periods prior to and including the Effective Date. 2. Chapter 11 Proceedings From September 27, 2022 (the “Petition Date”) to June 30, 2023 (the “Effective Date”), Phoenix Services Topco, LLC and certain of its domestic subsidiaries (collectively, the “Debtors”) operated their businesses as “debtors-in possession” (“DIP”) under the jurisdiction of the United States Bankruptcy Court for the District of Delaware (“Bankruptcy Court”) and in accordance with the applicable provisions of the United States Bankruptcy Code (the “Bankruptcy Code”) and orders

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 10 2. Chapter 11 Proceedings (continued) of the Bankruptcy Court. During the second quarter of 2023, the Bankruptcy Court approved the Debtors Plan of Reorganization Pursuant to Chapter 11 of the Bankruptcy Code (the “Plan”) and a related proposal form of Disclosure Statement (the “Disclosure Statement”), and the Plan went effective June 30, 2023. As part of the Company’s exiting of operations of specific sites, the Company recognized site shutdown costs of $10.1M in Reorganization items, net in the consolidated statement of operations and comprehensive loss the six months ended June 30, 2023 (Predecessor). In connection with the effectiveness of and pursuant to the terms of the Plan, on the Effective Date, the Debtors prior credit agreements, all member equity interest in Phoenix Services Topco, LLC, including the two primary classes of interests, Class A Interests or Units and Class B Interest or Units, and various other general unsecured claims that pertain to vendor obligations, lease obligations, contractual obligations, and other obligations were either released and extinguished or satisfied and discharged. In conjunction with the satisfaction of certain secured creditor obligations, on the Effective Date, the Company entered into a new debt facility and issued new members’ equity interests in the Company, Flame Aggregator, LLC. The Company applied Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 852, Reorganizations (“ASC 852”) in preparing the consolidated financial statements, which requires the financial statements, for the periods subsequent to the Petition Date cases and up to and including the period of emergence from Chapter 11, to distinguish transactions and events that are directly associated with the reorganization from the ongoing operations of the business. Accordingly, certain charges incurred during the bankruptcy proceedings, such as legal and professional fees incurred directly as a result of the bankruptcy proceeding, the write-off of deferred financing costs related to debt subject to compromise and other related charges are recorded as reorganization items, net in the consolidated statements of operations. Upon emergence, the Company qualified for fresh start accounting. ASC 852 requires that the Company allocate the reorganization value to its individual assets based on their estimated fair values in conformity with FASB ASC 805, Business Combinations (“ASC 805”). Reorganization value represents the fair value of the Successor’s assets before considering liabilities. The application of fresh start accounting resulted in a new basis of accounting, and the Company became a new entity for financial reporting purposes. Accordingly, the Company’s financial

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 11 2. Chapter 11 Proceedings (continued) statements and notes after the Effective Date are not comparable to its financial statements and notes on and prior to that date. Furthermore, the consolidated financial statements and notes have been presented with a black line division to delineate the lack of comparability between the Predecessor and Successor. 3. Summary of Significant Accounting Policies Basis of Presentation The consolidated financial statements have been prepared in United States dollars and in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The financial statements are presented on a consolidated basis. All intercompany accounts and transactions have been eliminated. Use of Estimates The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. The Company bases its estimates on its experience and on various assumptions that are believed to be reasonable under the circumstances at the time. Actual amounts could differ from estimates under different assumptions or conditions. Cash and Cash Equivalents Cash and cash equivalents are defined as all demand deposits and short-term investments with original maturities of 90 days or less, when purchased. Short-term investments are stated at cost, which approximates fair value.

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 12 3. Summary of Significant Accounting Policies (continued) Concentration of Credit Risk Financial instruments that potentially subject the Company to credit risk consist primarily of accounts receivable. Accounts receivable are stated at amounts believed by management to be the net realizable value. Credit is extended to customers based on an evaluation of credit reports, payment practices, and, in most cases, financial condition. The Company provides an allowance for doubtful accounts based upon past history and considers economic circumstances surrounding particular customers. The Company writes off accounts receivable when it becomes apparent the amounts will not be collected. Accounts receivable are considered past due when payment has not been received within the standard payment terms; however, the Company does not accrue interest on past due accounts receivable. Four customers accounted for 71% and 68% of accounts receivable as of December 31, 2024 and December 31, 2023, respectively. During the year ended December 31, 2024, the six months ended December 31, 2023 (Successor), and the six months ended June 30, 2023 (Predecessor), the Company had three customers that accounted for 64%, 66%, and 64%, respectively, of consolidated net sales. Inventory Inventory consists principally of spare parts. Spare parts are valued at cost, inclusive of freight, shipping, and handling as well as any other costs incurred in bringing the inventories to their present location and condition. Inventory is stated at the lower of cost or net realizable value. Other Current Assets Other current assets include prepaid insurance and expenses, vendor deposits, assets held for sale, and the fair value of foreign currency derivatives. At December 31, 2024, and 2023, the Company had $1,700 and $1,600, respectively, of idle equipment that was held for sale, and classified in other current assets.

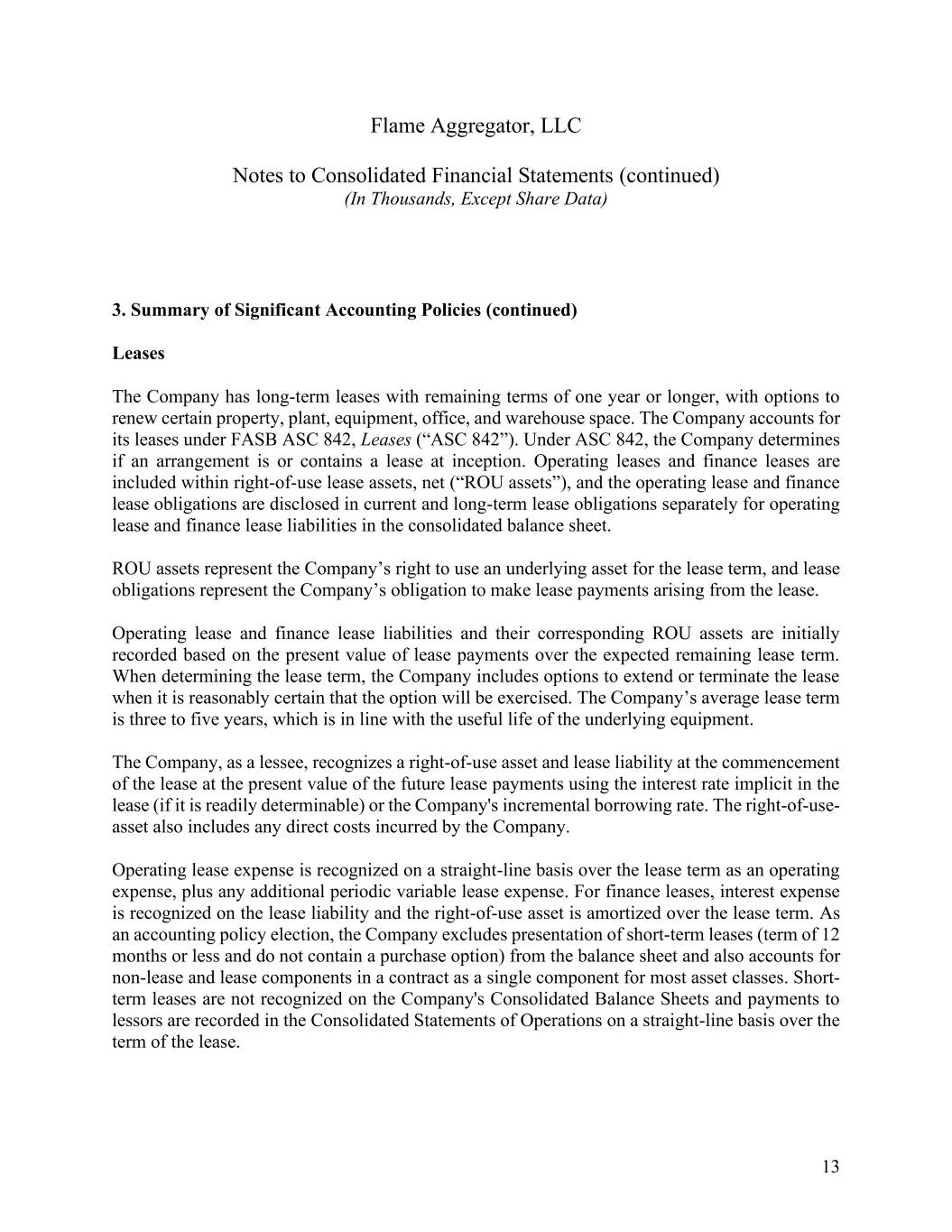

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 13 3. Summary of Significant Accounting Policies (continued) Leases The Company has long-term leases with remaining terms of one year or longer, with options to renew certain property, plant, equipment, office, and warehouse space. The Company accounts for its leases under FASB ASC 842, Leases (“ASC 842”). Under ASC 842, the Company determines if an arrangement is or contains a lease at inception. Operating leases and finance leases are included within right-of-use lease assets, net (“ROU assets”), and the operating lease and finance lease obligations are disclosed in current and long-term lease obligations separately for operating lease and finance lease liabilities in the consolidated balance sheet. ROU assets represent the Company’s right to use an underlying asset for the lease term, and lease obligations represent the Company’s obligation to make lease payments arising from the lease. Operating lease and finance lease liabilities and their corresponding ROU assets are initially recorded based on the present value of lease payments over the expected remaining lease term. When determining the lease term, the Company includes options to extend or terminate the lease when it is reasonably certain that the option will be exercised. The Company’s average lease term is three to five years, which is in line with the useful life of the underlying equipment. The Company, as a lessee, recognizes a right-of-use asset and lease liability at the commencement of the lease at the present value of the future lease payments using the interest rate implicit in the lease (if it is readily determinable) or the Company's incremental borrowing rate. The right-of-use- asset also includes any direct costs incurred by the Company. Operating lease expense is recognized on a straight-line basis over the lease term as an operating expense, plus any additional periodic variable lease expense. For finance leases, interest expense is recognized on the lease liability and the right-of-use asset is amortized over the lease term. As an accounting policy election, the Company excludes presentation of short-term leases (term of 12 months or less and do not contain a purchase option) from the balance sheet and also accounts for non-lease and lease components in a contract as a single component for most asset classes. Short- term leases are not recognized on the Company's Consolidated Balance Sheets and payments to lessors are recorded in the Consolidated Statements of Operations on a straight-line basis over the term of the lease.

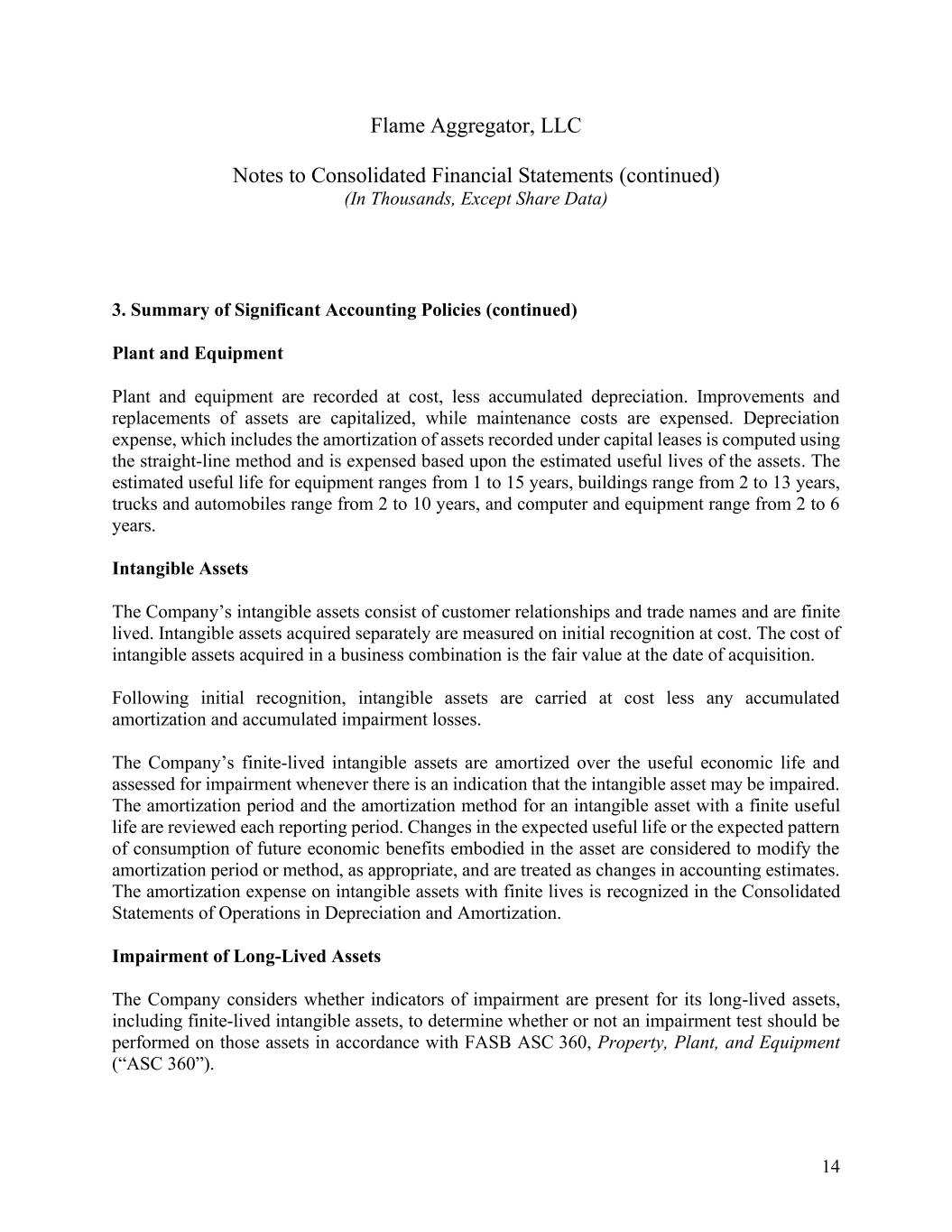

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 14 3. Summary of Significant Accounting Policies (continued) Plant and Equipment Plant and equipment are recorded at cost, less accumulated depreciation. Improvements and replacements of assets are capitalized, while maintenance costs are expensed. Depreciation expense, which includes the amortization of assets recorded under capital leases is computed using the straight-line method and is expensed based upon the estimated useful lives of the assets. The estimated useful life for equipment ranges from 1 to 15 years, buildings range from 2 to 13 years, trucks and automobiles range from 2 to 10 years, and computer and equipment range from 2 to 6 years. Intangible Assets The Company’s intangible assets consist of customer relationships and trade names and are finite lived. Intangible assets acquired separately are measured on initial recognition at cost. The cost of intangible assets acquired in a business combination is the fair value at the date of acquisition. Following initial recognition, intangible assets are carried at cost less any accumulated amortization and accumulated impairment losses. The Company’s finite-lived intangible assets are amortized over the useful economic life and assessed for impairment whenever there is an indication that the intangible asset may be impaired. The amortization period and the amortization method for an intangible asset with a finite useful life are reviewed each reporting period. Changes in the expected useful life or the expected pattern of consumption of future economic benefits embodied in the asset are considered to modify the amortization period or method, as appropriate, and are treated as changes in accounting estimates. The amortization expense on intangible assets with finite lives is recognized in the Consolidated Statements of Operations in Depreciation and Amortization. Impairment of Long-Lived Assets The Company considers whether indicators of impairment are present for its long-lived assets, including finite-lived intangible assets, to determine whether or not an impairment test should be performed on those assets in accordance with FASB ASC 360, Property, Plant, and Equipment (“ASC 360”).

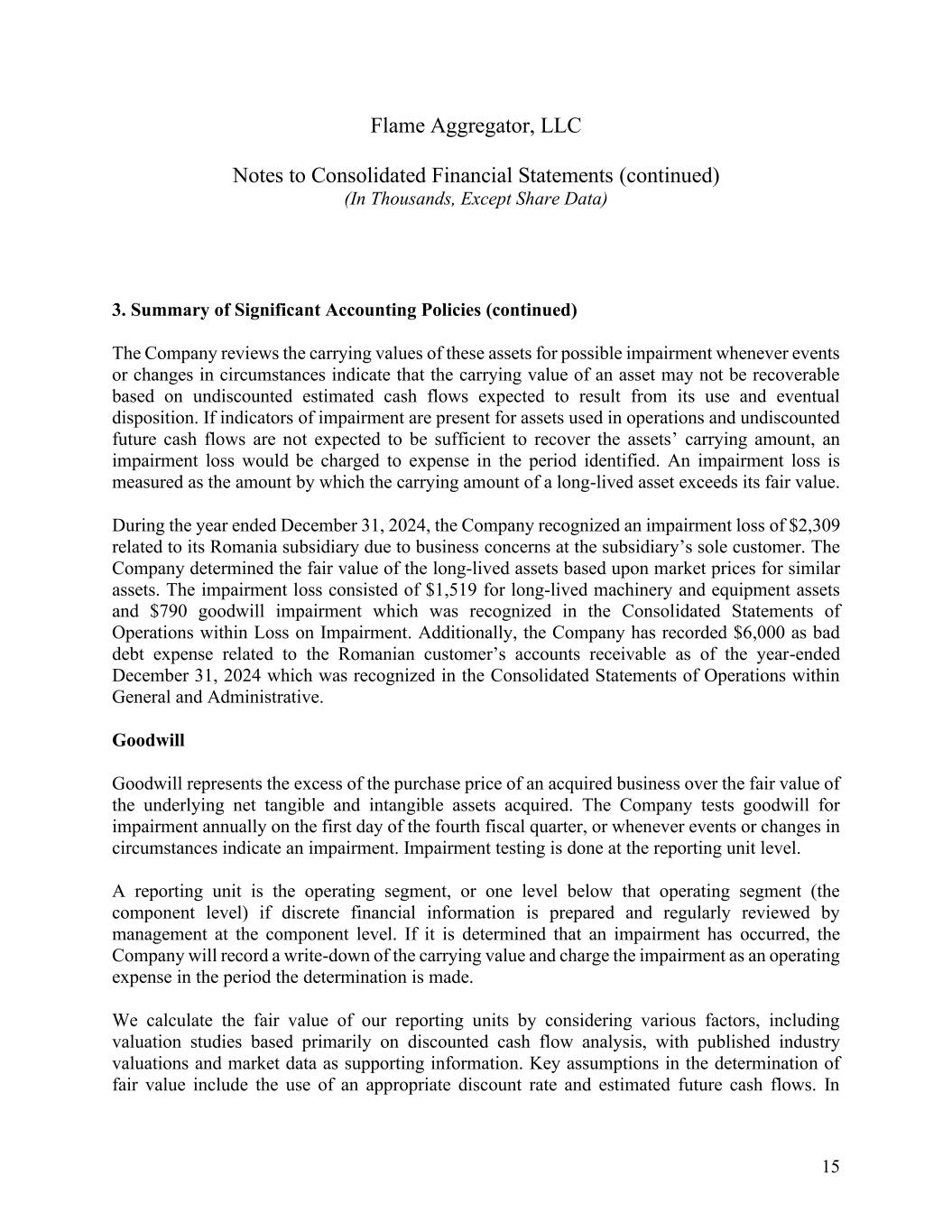

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 15 3. Summary of Significant Accounting Policies (continued) The Company reviews the carrying values of these assets for possible impairment whenever events or changes in circumstances indicate that the carrying value of an asset may not be recoverable based on undiscounted estimated cash flows expected to result from its use and eventual disposition. If indicators of impairment are present for assets used in operations and undiscounted future cash flows are not expected to be sufficient to recover the assets’ carrying amount, an impairment loss would be charged to expense in the period identified. An impairment loss is measured as the amount by which the carrying amount of a long-lived asset exceeds its fair value. During the year ended December 31, 2024, the Company recognized an impairment loss of $2,309 related to its Romania subsidiary due to business concerns at the subsidiary’s sole customer. The Company determined the fair value of the long-lived assets based upon market prices for similar assets. The impairment loss consisted of $1,519 for long-lived machinery and equipment assets and $790 goodwill impairment which was recognized in the Consolidated Statements of Operations within Loss on Impairment. Additionally, the Company has recorded $6,000 as bad debt expense related to the Romanian customer’s accounts receivable as of the year-ended December 31, 2024 which was recognized in the Consolidated Statements of Operations within General and Administrative. Goodwill Goodwill represents the excess of the purchase price of an acquired business over the fair value of the underlying net tangible and intangible assets acquired. The Company tests goodwill for impairment annually on the first day of the fourth fiscal quarter, or whenever events or changes in circumstances indicate an impairment. Impairment testing is done at the reporting unit level. A reporting unit is the operating segment, or one level below that operating segment (the component level) if discrete financial information is prepared and regularly reviewed by management at the component level. If it is determined that an impairment has occurred, the Company will record a write-down of the carrying value and charge the impairment as an operating expense in the period the determination is made. We calculate the fair value of our reporting units by considering various factors, including valuation studies based primarily on discounted cash flow analysis, with published industry valuations and market data as supporting information. Key assumptions in the determination of fair value include the use of an appropriate discount rate and estimated future cash flows. In

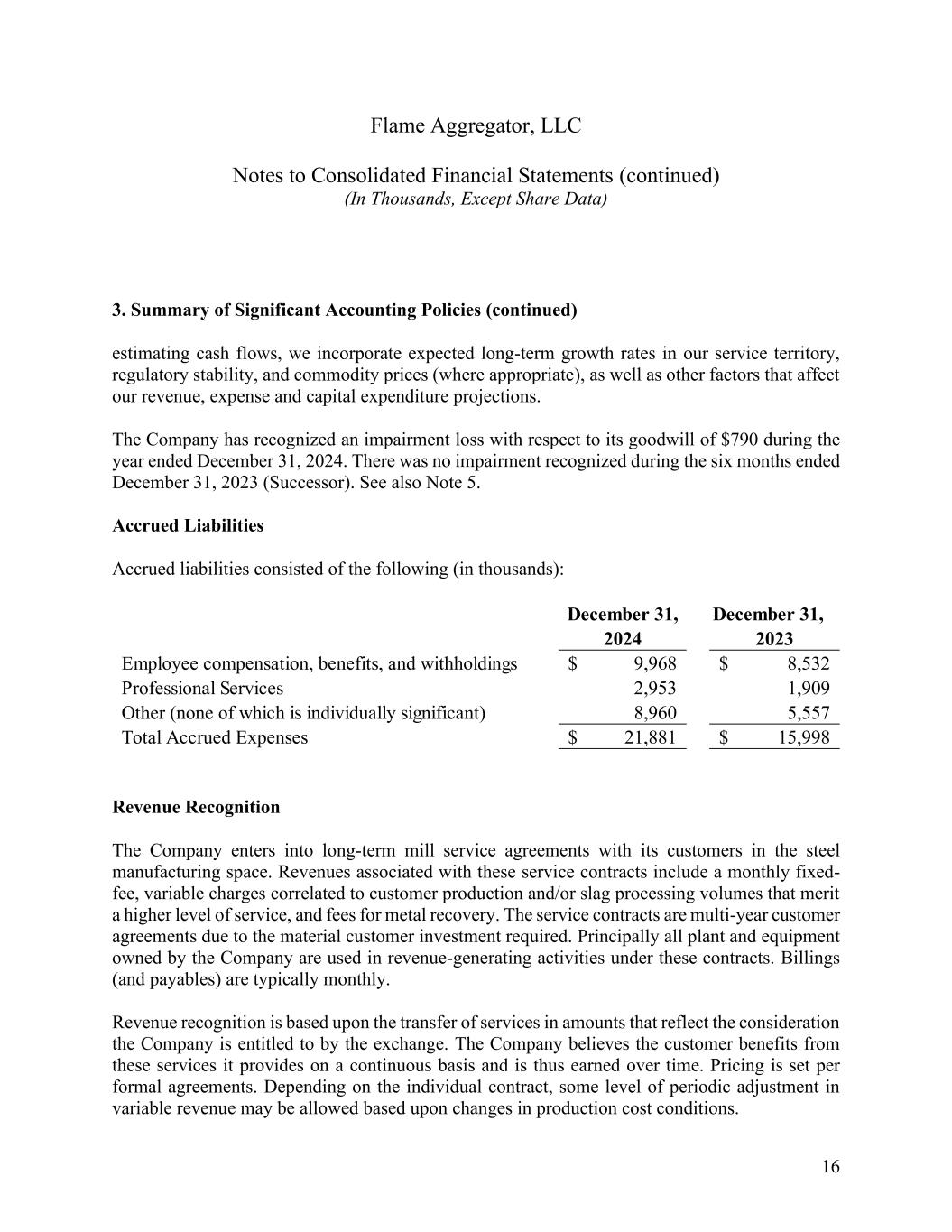

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 16 3. Summary of Significant Accounting Policies (continued) estimating cash flows, we incorporate expected long-term growth rates in our service territory, regulatory stability, and commodity prices (where appropriate), as well as other factors that affect our revenue, expense and capital expenditure projections. The Company has recognized an impairment loss with respect to its goodwill of $790 during the year ended December 31, 2024. There was no impairment recognized during the six months ended December 31, 2023 (Successor). See also Note 5. Accrued Liabilities Accrued liabilities consisted of the following (in thousands): Revenue Recognition The Company enters into long-term mill service agreements with its customers in the steel manufacturing space. Revenues associated with these service contracts include a monthly fixed- fee, variable charges correlated to customer production and/or slag processing volumes that merit a higher level of service, and fees for metal recovery. The service contracts are multi-year customer agreements due to the material customer investment required. Principally all plant and equipment owned by the Company are used in revenue-generating activities under these contracts. Billings (and payables) are typically monthly. Revenue recognition is based upon the transfer of services in amounts that reflect the consideration the Company is entitled to by the exchange. The Company believes the customer benefits from these services it provides on a continuous basis and is thus earned over time. Pricing is set per formal agreements. Depending on the individual contract, some level of periodic adjustment in variable revenue may be allowed based upon changes in production cost conditions. December 31, December 31, 2024 2023 Employee compensation, benefits, and withholdings 9,968$ 8,532$ Professional Services 2,953 1,909 Other (none of which is individually significant) 8,960 5,557 Total Accrued Expenses 21,881$ 15,998$

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 17 3. Summary of Significant Accounting Policies (continued) Less than 6% of the Company’s revenue is recognized from the tangible sales of steel and/or steel by-products and is earned point in time. These sales consist of sale of slag and scrap metal on behalf of, or directly back to, the Company’s steel mill customers, mixed with minimal third-party sales for the Company’s benefit. Sales, value add, and other taxes which the Company collects concurrent with income-producing activities are excluded from revenue. Contract Balances Accounts receivable are recorded when the right to consideration becomes unconditional, with the passage of the receivable term length the only barrier to collection. There are no unbilled services at a period-end. The Company does not receive up-front payments; therefore, there were no contract liabilities recorded due to customer prepayment. Collection terms are 30 to 45 days, with individual customer receivable balances reviewed by management each month. Share-Based Compensation For those equity instruments that are accounted for as liability awards, the Company measures the cost of employee services received in exchange for equity instruments based on the fair market value of the respective equity instrument as measured each reporting date. The fair market value of each instrument, subject to only service conditions, is recognized as compensation expense on a straight-line basis over the requisite service period. Compensation expense relating to awards where vesting is dependent upon achieving certain market and performance-based goals is recognized only if it is probable that the performance condition will be achieved. Compensation expense is adjusted as forfeitures occur. Deferred Financing Costs The Company capitalizes financing costs and amortizes such costs over the terms of the related debt instruments using the effective-interest method.

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 18 3. Summary of Significant Accounting Policies (continued) Income Taxes Deferred tax assets and liabilities reflect the Company’s estimation of the future tax consequences of temporary differences between the carrying amounts of assets and liabilities for book and tax purposes. The Company determines deferred income taxes based on the differences in accounting methods and timing between financial statement and income tax reporting. Accordingly, the Company determines the deferred tax asset or liability for each temporary difference based on the enacted tax rates expected to be in effect when the Company realizes the underlying items of income and expense. The Company considers many factors when assessing the likelihood of future realization of its deferred tax assets, including its recent earnings experience by jurisdiction, expectations of future taxable income, and the carryforward periods available to the Company for tax reporting purposes, as well as other relevant factors. The Company may establish a valuation allowance to reduce deferred tax assets to the amount it believes is more likely than not to be realized. Due to inherent complexities arising from the nature of the Company’s businesses, future changes in income tax law, tax sharing agreements, or variances between the Company’s actual and anticipated operating results, the Company makes certain judgments and estimates. Therefore, actual income taxes could materially vary from these estimates. The Company accounts for uncertain tax positions based on a two-step process of evaluating recognition and measurement criteria. The first step assesses whether the tax position is more likely than not to be sustained upon examination by the tax authority, including resolution of any appeals or litigation, based on the technical merits of the position. If the tax position meets the more likely than not criteria, the portion of the tax benefit greater than 50% likely to be realized upon settlement with the tax authority is recognized in the financial statements. Derivatives The Company has operations in multiple international locations and generates income from operations in multiple currencies, principally the Brazilian real and South African rand. Therefore, the Company has risk exposure to unfavorable changes in the foreign currencies, with a resulting impact on its financial performance denominated in U.S. dollars. The Company’s risk management policy permits the use of derivatives to manage this exposure.

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 19 3. Summary of Significant Accounting Policies (continued) The Company’s derivative contracts include cross-currency swap contracts that were put in place to better match the cash flows associated with the foreign operations of the Company denominated in Brazilian real and South African rand against its U.S. dollar denominated financial statements. The cross-currency swap contract effectively converted cash flows from foreign operations into USD-denominated cash flows at a fixed exchange rate. These instruments did not meet the criteria for hedge accounting, and, therefore, all changes in the market value of the financial instrument and all associated settlements are recognized as gains or losses in the period of change, in the consolidated statements of operations. As of December 31, 2024, the Company recognized an unrealized gain for derivative mark-to-market changes of $794 in other current assets in the balance sheet and other income (expense) of the consolidated statement of operations and comprehensive loss. Foreign Currency The financial statements of the Company’s subsidiaries outside of the United States are measured using the local currency as the functional currency. Assets and liabilities of these subsidiaries are translated at the exchange rates at the balance sheet date. Resulting translation adjustments are recorded in the cumulative adjustment account, a separate component of other comprehensive income (loss). Income and expense items are translated at average monthly exchange rates. Gains and losses from foreign currency transactions are included in net income and are recorded based on the current spot exchange rates at the time of the transaction. Fair Value Measurements The Company’s assets and liabilities that are recorded on the consolidated balance sheets at fair value on a recurring basis include cash and cash equivalents and derivative instruments. Financial assets and liabilities that are measured and reported at fair value are classified and disclosed in one of the following categories: • Level 1 – Quoted market prices in active markets for identical assets or liabilities • Level 2 – Observable market-based inputs or unobservable inputs that are corroborated by market data • Level 3 – Unobservable inputs that are not corroborated by market data

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 20 3. Summary of Significant Accounting Policies (continued) The fair value of the Company’s derivatives recognized in other current assets was $794 at December 31, 2024. Our derivatives were measured at fair value on a recurring basis using Level 2 inputs as of December 31, 2024. There were no derivatives outstanding at December 31, 2023. Recent Accounting Pronouncements In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvement to Income Tax Disclosures.” ASU 2023-09 requires additional disclosures aimed at enhancing the transparency and decision usefulness of income tax disclosures. This ASU is effective for fiscal years beginning after December 15, 2024, on a prospective basis. The Company is required to adopt the guidance for the fiscal year ending December 31, 2025, and does not expect this ASU to have a material impact on the Company's disclosures In November 2024, the FASB issued ASU 2024-03, “Income Statement—Reporting Comprehensive Income (Topic 220): Disaggregation of Income Statement Expenses.” ASU 2024- 03 requires additional disclosures aimed at enhancing the transparency and decision usefulness of income statement expenses. This ASU is effective for fiscal years beginning after December 15, 2026 as well as interim periods beginning after December 15, 2027 and requires retrospective application to all prior periods presented in the financial statements. The Company is currently evaluating the impact of the guidance on the related disclosures. 4. Chapter 11 and Fresh Start Accounting In connection with the Company’s emergence from bankruptcy and in accordance with ASC 852, the Company qualified for and adopted fresh start accounting on the Effective Date and became a new reporting entity for financial reporting purposes. Phoenix was required to apply fresh start accounting because (i) the holders of existing voting shares of the Company prior to its emergence received less than 50% of the outstanding voting shares of the Company following its emergence from bankruptcy and (ii) the reorganization value of the assets immediately prior to confirmation of the Plan was less than the post-petition liabilities and allowed claims. In accordance with ASC 852, with the application of fresh start accounting, the Company allocated its reorganization value to its individual assets based on their estimated fair values in conformity with ASC 805. The reorganization value represents the fair value of the Successor’s assets before considering liabilities. The excess reorganization value over the fair value of identified tangible

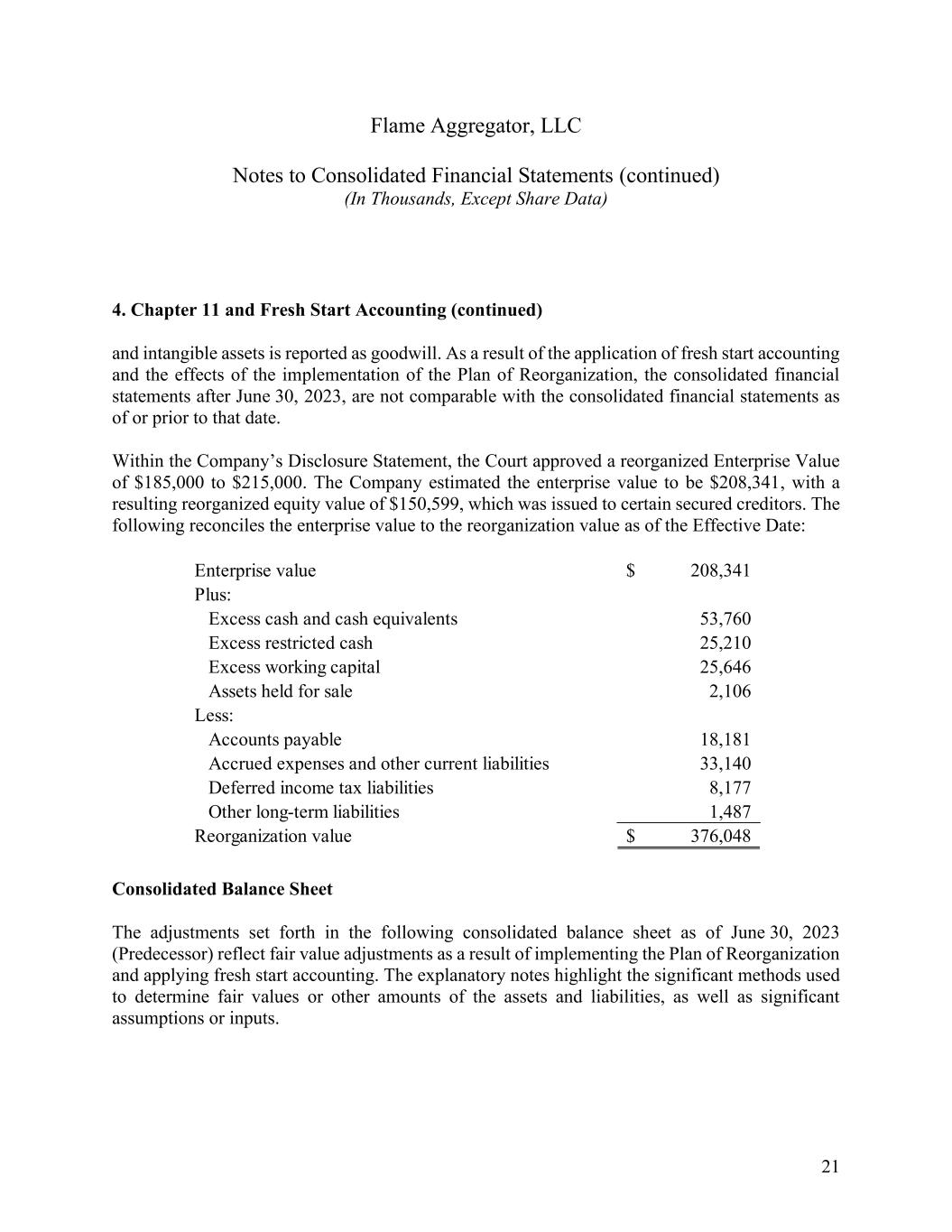

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 21 4. Chapter 11 and Fresh Start Accounting (continued) and intangible assets is reported as goodwill. As a result of the application of fresh start accounting and the effects of the implementation of the Plan of Reorganization, the consolidated financial statements after June 30, 2023, are not comparable with the consolidated financial statements as of or prior to that date. Within the Company’s Disclosure Statement, the Court approved a reorganized Enterprise Value of $185,000 to $215,000. The Company estimated the enterprise value to be $208,341, with a resulting reorganized equity value of $150,599, which was issued to certain secured creditors. The following reconciles the enterprise value to the reorganization value as of the Effective Date: Consolidated Balance Sheet The adjustments set forth in the following consolidated balance sheet as of June 30, 2023 (Predecessor) reflect fair value adjustments as a result of implementing the Plan of Reorganization and applying fresh start accounting. The explanatory notes highlight the significant methods used to determine fair values or other amounts of the assets and liabilities, as well as significant assumptions or inputs. Enterprise value 208,341$ Plus: Excess cash and cash equivalents 53,760 Excess restricted cash 25,210 Excess working capital 25,646 Assets held for sale 2,106 Less: Accounts payable 18,181 Accrued expenses and other current liabilities 33,140 Deferred income tax liabilities 8,177 Other long-term liabilities 1,487 Reorganization value 376,048$

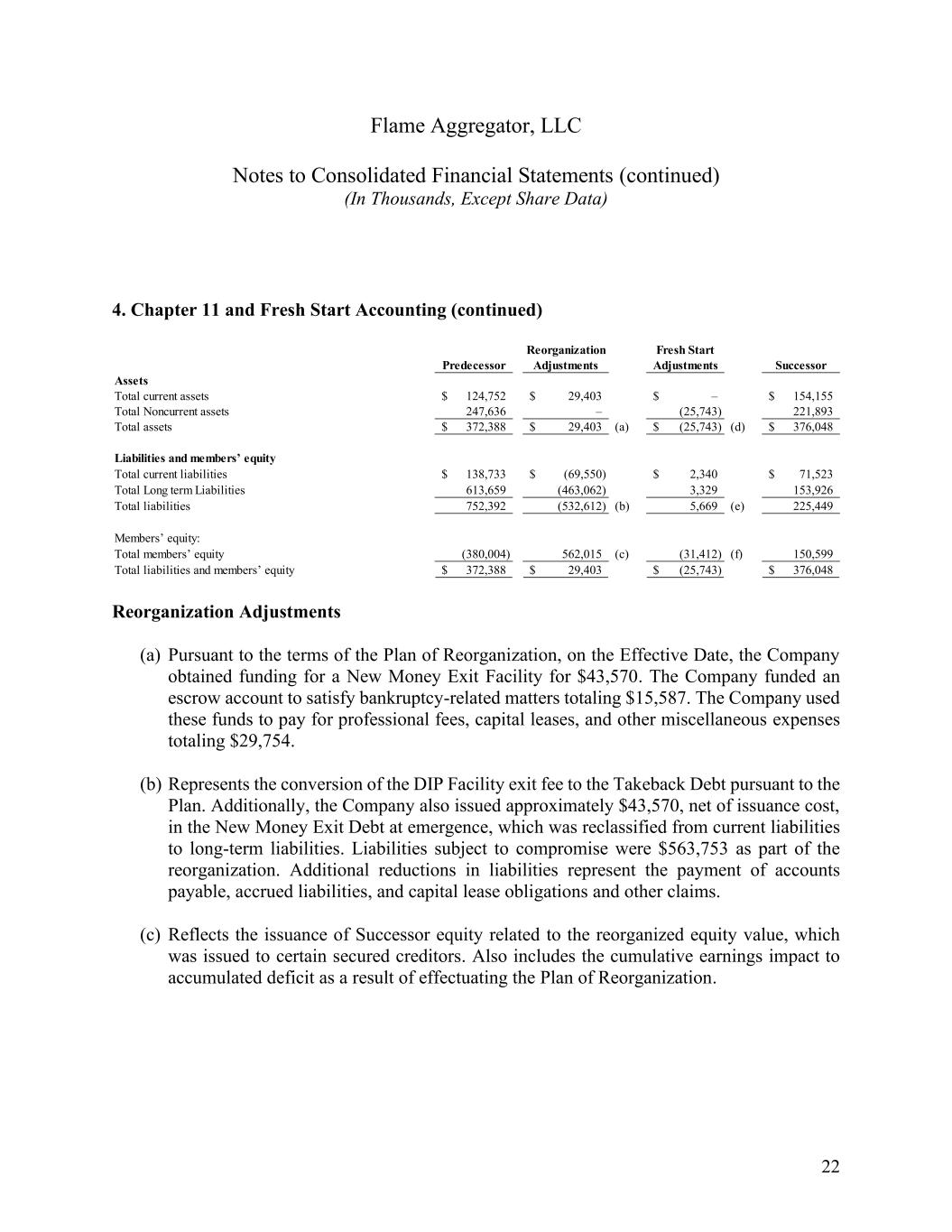

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 22 4. Chapter 11 and Fresh Start Accounting (continued) Reorganization Adjustments (a) Pursuant to the terms of the Plan of Reorganization, on the Effective Date, the Company obtained funding for a New Money Exit Facility for $43,570. The Company funded an escrow account to satisfy bankruptcy-related matters totaling $15,587. The Company used these funds to pay for professional fees, capital leases, and other miscellaneous expenses totaling $29,754. (b) Represents the conversion of the DIP Facility exit fee to the Takeback Debt pursuant to the Plan. Additionally, the Company also issued approximately $43,570, net of issuance cost, in the New Money Exit Debt at emergence, which was reclassified from current liabilities to long-term liabilities. Liabilities subject to compromise were $563,753 as part of the reorganization. Additional reductions in liabilities represent the payment of accounts payable, accrued liabilities, and capital lease obligations and other claims. (c) Reflects the issuance of Successor equity related to the reorganized equity value, which was issued to certain secured creditors. Also includes the cumulative earnings impact to accumulated deficit as a result of effectuating the Plan of Reorganization. Reorganization Fresh Start Predecessor Adjustments Adjustments Successor Assets Total current assets 124,752$ 29,403$ –$ 154,155$ Total Noncurrent assets 247,636 – (25,743) 221,893 Total assets 372,388$ 29,403$ (a) (25,743)$ (d) 376,048$ Liabilities and members’ equity Total current liabilities 138,733$ (69,550)$ 2,340$ 71,523$ Total Long term Liabilities 613,659 (463,062) 3,329 153,926 Total liabilities 752,392 (532,612) (b) 5,669 (e) 225,449 Members’ equity: Total members’ equity (380,004) 562,015 (c) (31,412) (f) 150,599 Total liabilities and members’ equity 372,388$ 29,403$ (25,743)$ 376,048$

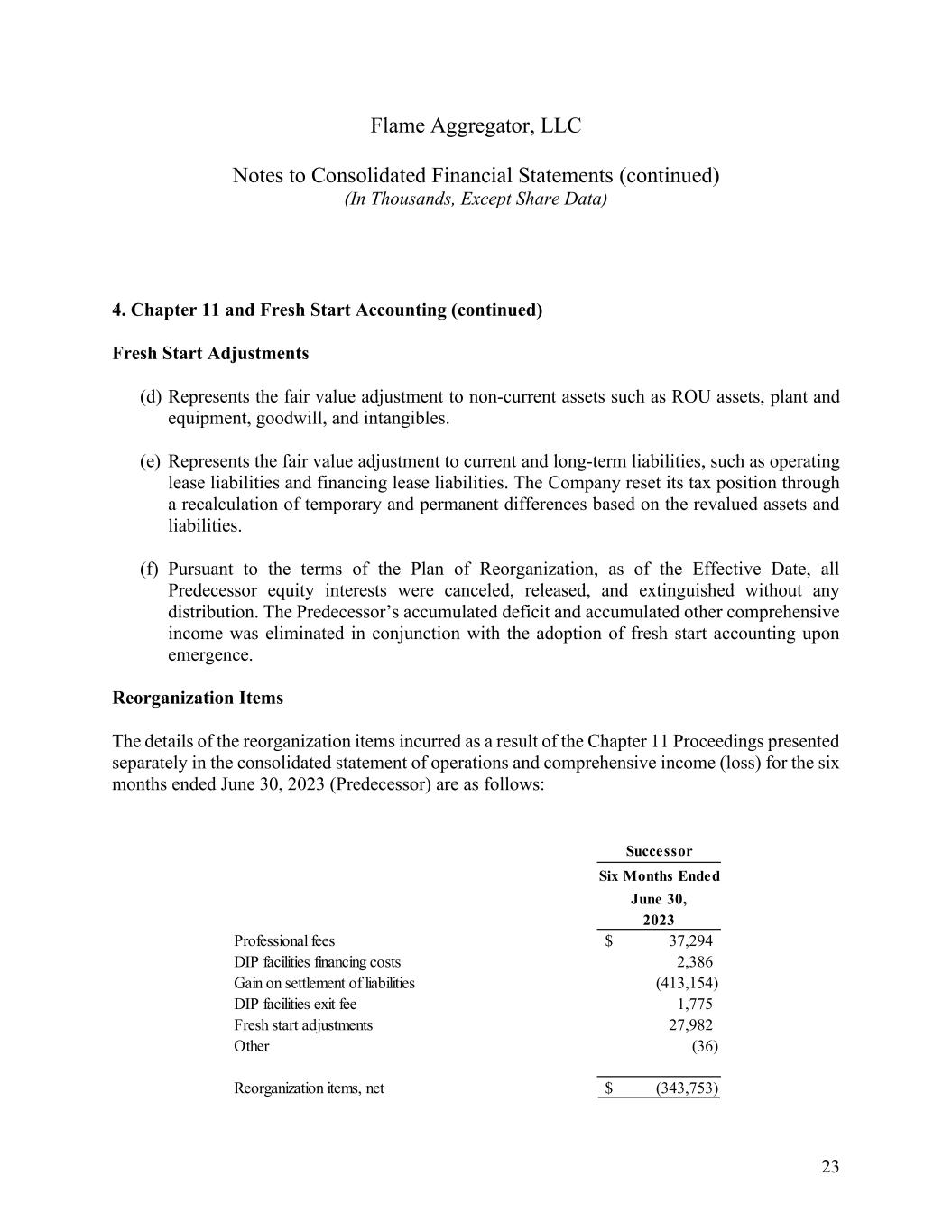

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 23 4. Chapter 11 and Fresh Start Accounting (continued) Fresh Start Adjustments (d) Represents the fair value adjustment to non-current assets such as ROU assets, plant and equipment, goodwill, and intangibles. (e) Represents the fair value adjustment to current and long-term liabilities, such as operating lease liabilities and financing lease liabilities. The Company reset its tax position through a recalculation of temporary and permanent differences based on the revalued assets and liabilities. (f) Pursuant to the terms of the Plan of Reorganization, as of the Effective Date, all Predecessor equity interests were canceled, released, and extinguished without any distribution. The Predecessor’s accumulated deficit and accumulated other comprehensive income was eliminated in conjunction with the adoption of fresh start accounting upon emergence. Reorganization Items The details of the reorganization items incurred as a result of the Chapter 11 Proceedings presented separately in the consolidated statement of operations and comprehensive income (loss) for the six months ended June 30, 2023 (Predecessor) are as follows: Successor Six Months Ended June 30, 2023 Professional fees 37,294$ DIP facilities financing costs 2,386 Gain on settlement of liabilities (413,154) DIP facilities exit fee 1,775 Fresh start adjustments 27,982 Other (36) Reorganization items, net (343,753)$

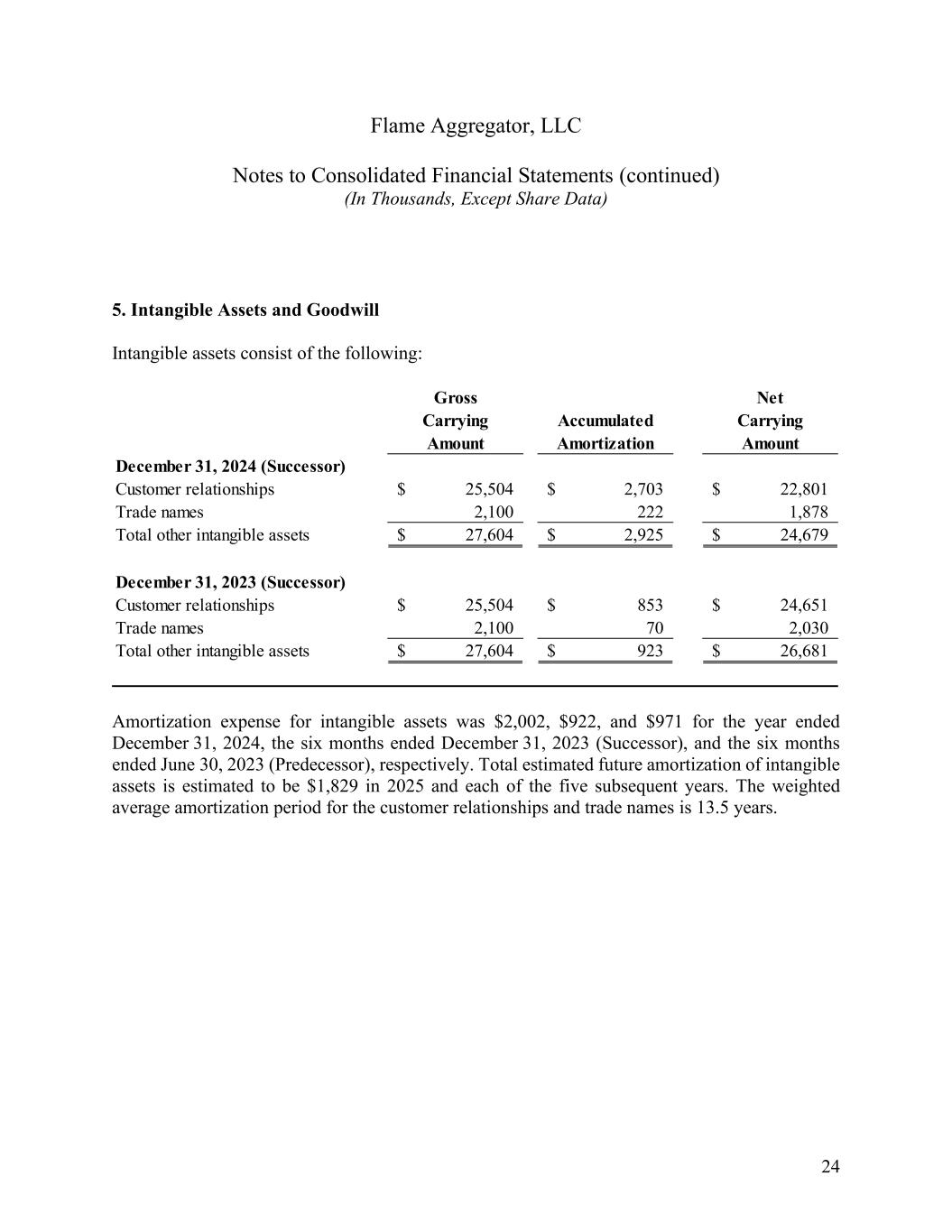

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 24 5. Intangible Assets and Goodwill Intangible assets consist of the following: Amortization expense for intangible assets was $2,002, $922, and $971 for the year ended December 31, 2024, the six months ended December 31, 2023 (Successor), and the six months ended June 30, 2023 (Predecessor), respectively. Total estimated future amortization of intangible assets is estimated to be $1,829 in 2025 and each of the five subsequent years. The weighted average amortization period for the customer relationships and trade names is 13.5 years. Gross Net Carrying Accumulated Carrying Amount Amortization Amount December 31, 2024 (Successor) Customer relationships 25,504$ 2,703$ 22,801$ Trade names 2,100 222 1,878 Total other intangible assets 27,604$ 2,925$ 24,679$ December 31, 2023 (Successor) Customer relationships 25,504$ 853$ 24,651$ Trade names 2,100 70 2,030 Total other intangible assets 27,604$ 923$ 26,681$

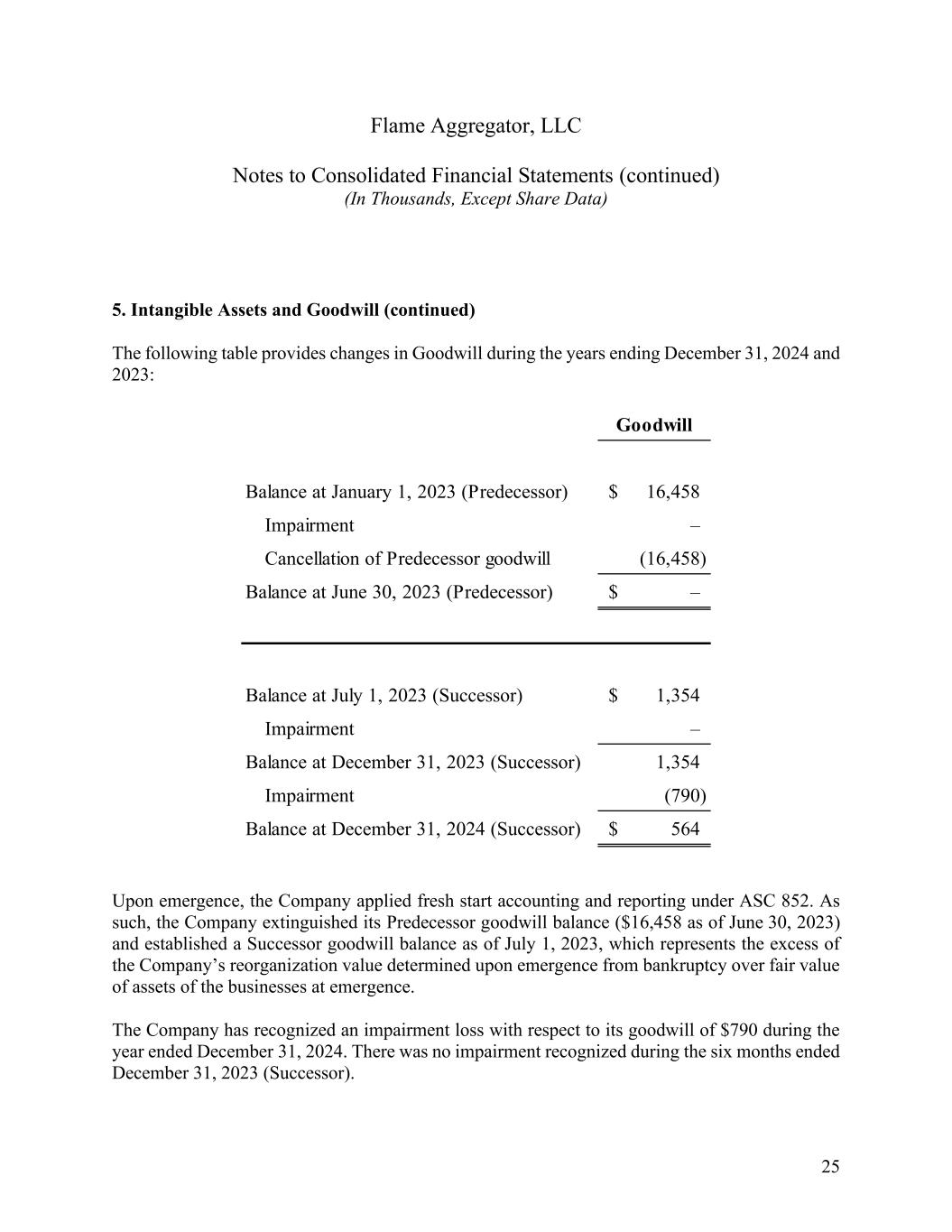

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 25 5. Intangible Assets and Goodwill (continued) The following table provides changes in Goodwill during the years ending December 31, 2024 and 2023: Upon emergence, the Company applied fresh start accounting and reporting under ASC 852. As such, the Company extinguished its Predecessor goodwill balance ($16,458 as of June 30, 2023) and established a Successor goodwill balance as of July 1, 2023, which represents the excess of the Company’s reorganization value determined upon emergence from bankruptcy over fair value of assets of the businesses at emergence. The Company has recognized an impairment loss with respect to its goodwill of $790 during the year ended December 31, 2024. There was no impairment recognized during the six months ended December 31, 2023 (Successor). Goodwill Balance at January 1, 2023 (Predecessor) 16,458$ Impairment – Cancellation of Predecessor goodwill (16,458) Balance at June 30, 2023 (Predecessor) –$ Balance at July 1, 2023 (Successor) 1,354$ Impairment – Balance at December 31, 2023 (Successor) 1,354 Impairment (790) Balance at December 31, 2024 (Successor) 564$

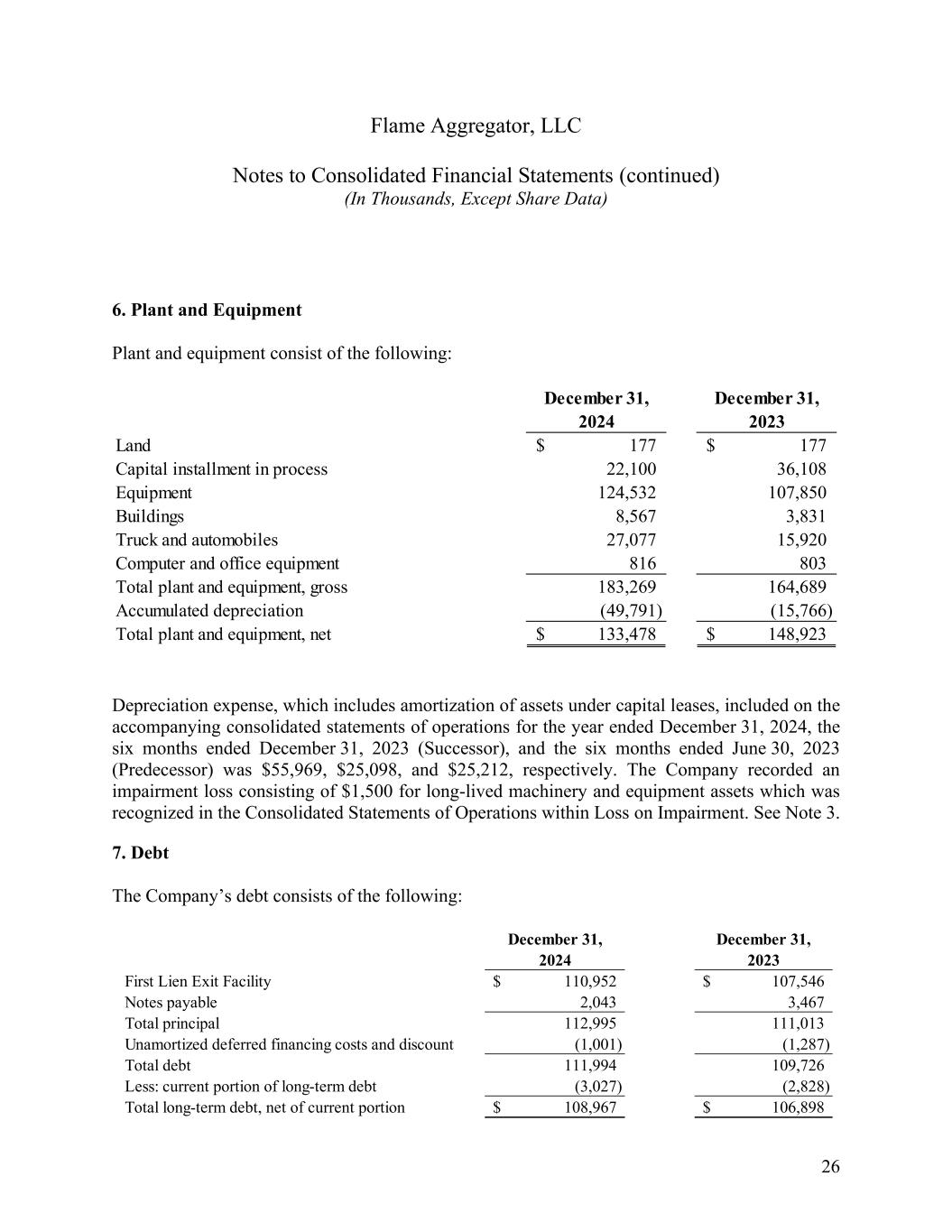

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 26 6. Plant and Equipment Plant and equipment consist of the following: Depreciation expense, which includes amortization of assets under capital leases, included on the accompanying consolidated statements of operations for the year ended December 31, 2024, the six months ended December 31, 2023 (Successor), and the six months ended June 30, 2023 (Predecessor) was $55,969, $25,098, and $25,212, respectively. The Company recorded an impairment loss consisting of $1,500 for long-lived machinery and equipment assets which was recognized in the Consolidated Statements of Operations within Loss on Impairment. See Note 3. 7. Debt The Company’s debt consists of the following: December 31, December 31, 2024 2023 Land 177$ 177$ Capital installment in process 22,100 36,108 Equipment 124,532 107,850 Buildings 8,567 3,831 Truck and automobiles 27,077 15,920 Computer and office equipment 816 803 Total plant and equipment, gross 183,269 164,689 Accumulated depreciation (49,791) (15,766) Total plant and equipment, net 133,478$ 148,923$ December 31, December 31, 2024 2023 First Lien Exit Facility 110,952$ 107,546$ Notes payable 2,043 3,467 Total principal 112,995 111,013 Unamortized deferred financing costs and discount (1,001) (1,287) Total debt 111,994 109,726 Less: current portion of long-term debt (3,027) (2,828) Total long-term debt, net of current portion 108,967$ 106,898$

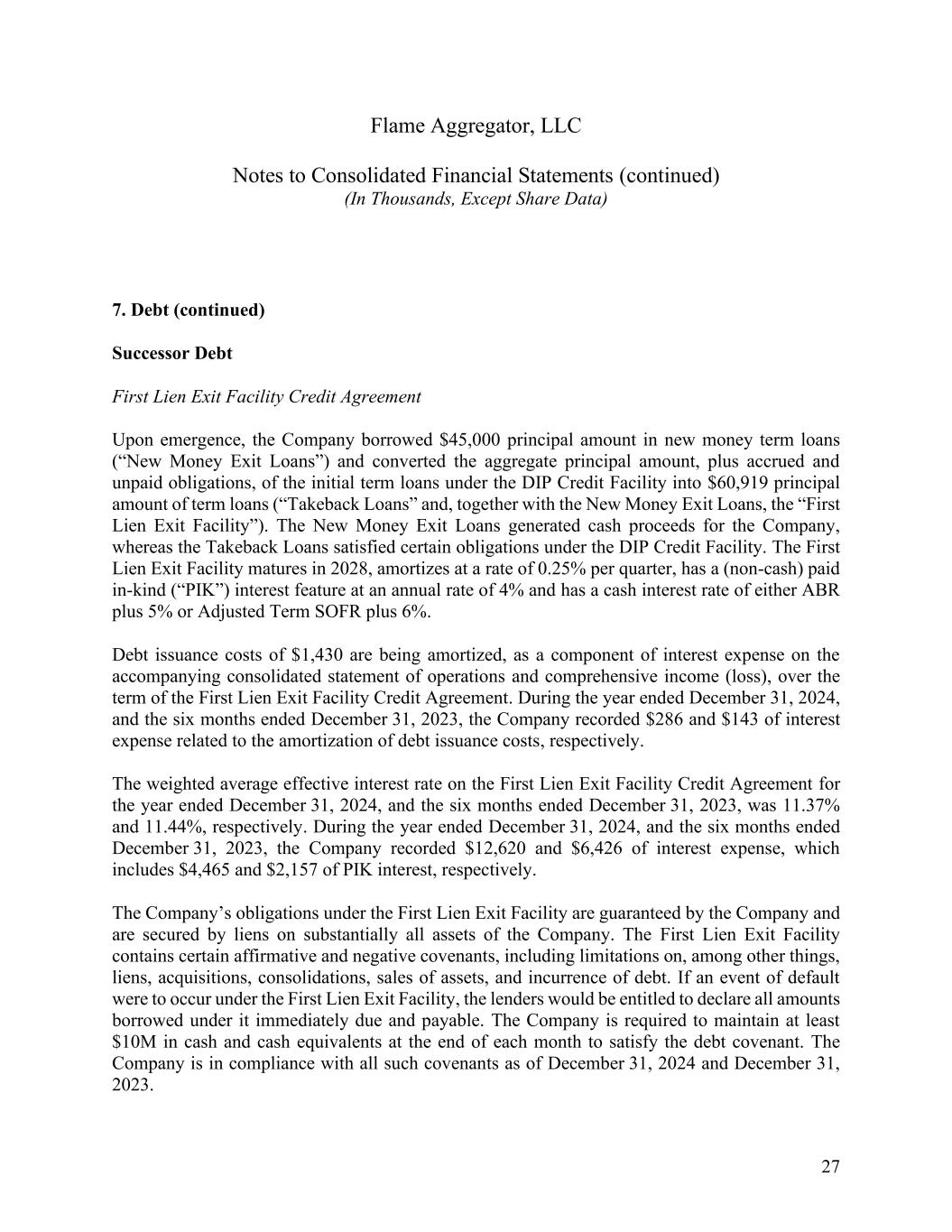

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 27 7. Debt (continued) Successor Debt First Lien Exit Facility Credit Agreement Upon emergence, the Company borrowed $45,000 principal amount in new money term loans (“New Money Exit Loans”) and converted the aggregate principal amount, plus accrued and unpaid obligations, of the initial term loans under the DIP Credit Facility into $60,919 principal amount of term loans (“Takeback Loans” and, together with the New Money Exit Loans, the “First Lien Exit Facility”). The New Money Exit Loans generated cash proceeds for the Company, whereas the Takeback Loans satisfied certain obligations under the DIP Credit Facility. The First Lien Exit Facility matures in 2028, amortizes at a rate of 0.25% per quarter, has a (non-cash) paid in-kind (“PIK”) interest feature at an annual rate of 4% and has a cash interest rate of either ABR plus 5% or Adjusted Term SOFR plus 6%. Debt issuance costs of $1,430 are being amortized, as a component of interest expense on the accompanying consolidated statement of operations and comprehensive income (loss), over the term of the First Lien Exit Facility Credit Agreement. During the year ended December 31, 2024, and the six months ended December 31, 2023, the Company recorded $286 and $143 of interest expense related to the amortization of debt issuance costs, respectively. The weighted average effective interest rate on the First Lien Exit Facility Credit Agreement for the year ended December 31, 2024, and the six months ended December 31, 2023, was 11.37% and 11.44%, respectively. During the year ended December 31, 2024, and the six months ended December 31, 2023, the Company recorded $12,620 and $6,426 of interest expense, which includes $4,465 and $2,157 of PIK interest, respectively. The Company’s obligations under the First Lien Exit Facility are guaranteed by the Company and are secured by liens on substantially all assets of the Company. The First Lien Exit Facility contains certain affirmative and negative covenants, including limitations on, among other things, liens, acquisitions, consolidations, sales of assets, and incurrence of debt. If an event of default were to occur under the First Lien Exit Facility, the lenders would be entitled to declare all amounts borrowed under it immediately due and payable. The Company is required to maintain at least $10M in cash and cash equivalents at the end of each month to satisfy the debt covenant. The Company is in compliance with all such covenants as of December 31, 2024 and December 31, 2023.

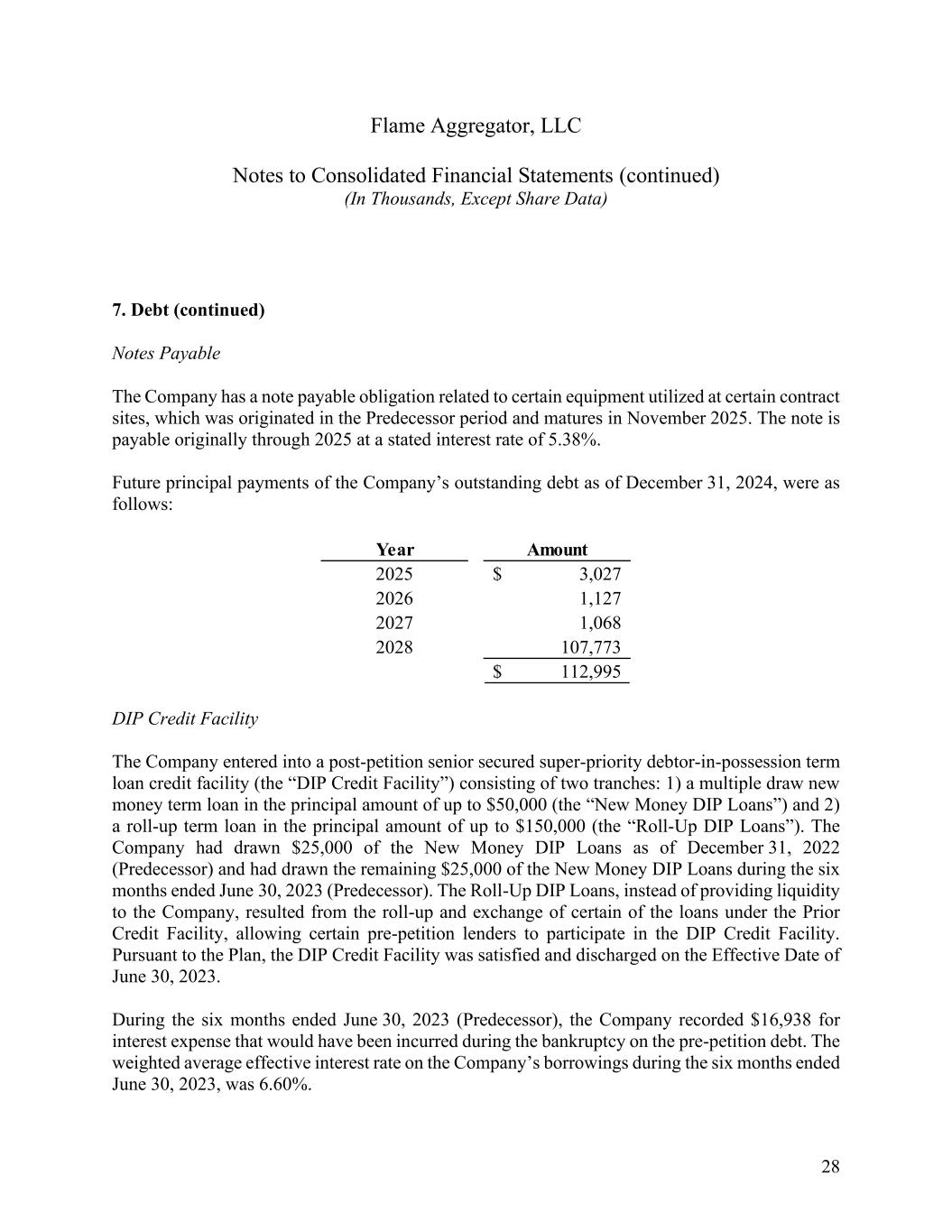

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 28 7. Debt (continued) Notes Payable The Company has a note payable obligation related to certain equipment utilized at certain contract sites, which was originated in the Predecessor period and matures in November 2025. The note is payable originally through 2025 at a stated interest rate of 5.38%. Future principal payments of the Company’s outstanding debt as of December 31, 2024, were as follows: DIP Credit Facility The Company entered into a post-petition senior secured super-priority debtor-in-possession term loan credit facility (the “DIP Credit Facility”) consisting of two tranches: 1) a multiple draw new money term loan in the principal amount of up to $50,000 (the “New Money DIP Loans”) and 2) a roll-up term loan in the principal amount of up to $150,000 (the “Roll-Up DIP Loans”). The Company had drawn $25,000 of the New Money DIP Loans as of December 31, 2022 (Predecessor) and had drawn the remaining $25,000 of the New Money DIP Loans during the six months ended June 30, 2023 (Predecessor). The Roll-Up DIP Loans, instead of providing liquidity to the Company, resulted from the roll-up and exchange of certain of the loans under the Prior Credit Facility, allowing certain pre-petition lenders to participate in the DIP Credit Facility. Pursuant to the Plan, the DIP Credit Facility was satisfied and discharged on the Effective Date of June 30, 2023. During the six months ended June 30, 2023 (Predecessor), the Company recorded $16,938 for interest expense that would have been incurred during the bankruptcy on the pre-petition debt. The weighted average effective interest rate on the Company’s borrowings during the six months ended June 30, 2023, was 6.60%. Year Amount 2025 3,027$ 2026 1,127 2027 1,068 2028 107,773 112,995$

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 29 8. Members’ Equity Under the Restated Limited Liability Company Agreement of the Company dated June 30, 2023 (the “Flame Agreement”), 10,000,000 common units of the Company (“Common Units”) were authorized, with the Company issuing 9,000,000 Common Units and reserving 1,000,000 Common Units for issuance pursuant to an equity incentive plan. Each Common Unit has rights, powers, preferences, limitations, and restrictions as set forth in the Flame Agreement and as provided under the Securities Act of 1933 and Securities Exchange Act of 1934. 9. Related Parties Certain Members of the Company held approximately $59,943 of the outstanding amounts under the First Lien Exit Facility as of December 31, 2024. This amount was an $1,840 increase from the prior year outstanding amounts with the same related parties, as a result of PIK interest recognized during the year ended December 31, 2024. PIK interest for the six months ended December 31, 2023, with the same related parties was $910. 10. Retirement Plans 401(k) Profit-Sharing Plan The Company sponsors a 401(k) profit-sharing plan that covers substantially all U.S. employees, with the exception of the union employees. The Company’s contributions to the 401(k) profit- sharing plan for the year ended December 31, 2024, the six months ended December 31, 2023, (Successor), and the six months ended June 30, 2023 (Predecessor) was $1,292, $541, and $747, respectively. Midwest Operating Engineers Pension Plan (“MOEPP”) The Company is required to contribute to the MOEPP (EIN 36-6140097), as well as a health and welfare plan for the benefit to its union employees in Indiana and Illinois. The total contributions paid to the MOEPP, and the health and welfare plan for the year ended December 31, 2024, the six months ended December 31, 2023 (Successor), and the six months ended June 30, 2023 (Predecessor) were $16,615, $8,098, and $7,646, respectively, and were recorded within materials and other direct costs in the accompanying consolidated statements of operations. The MOEPP’s year-end is March 31.

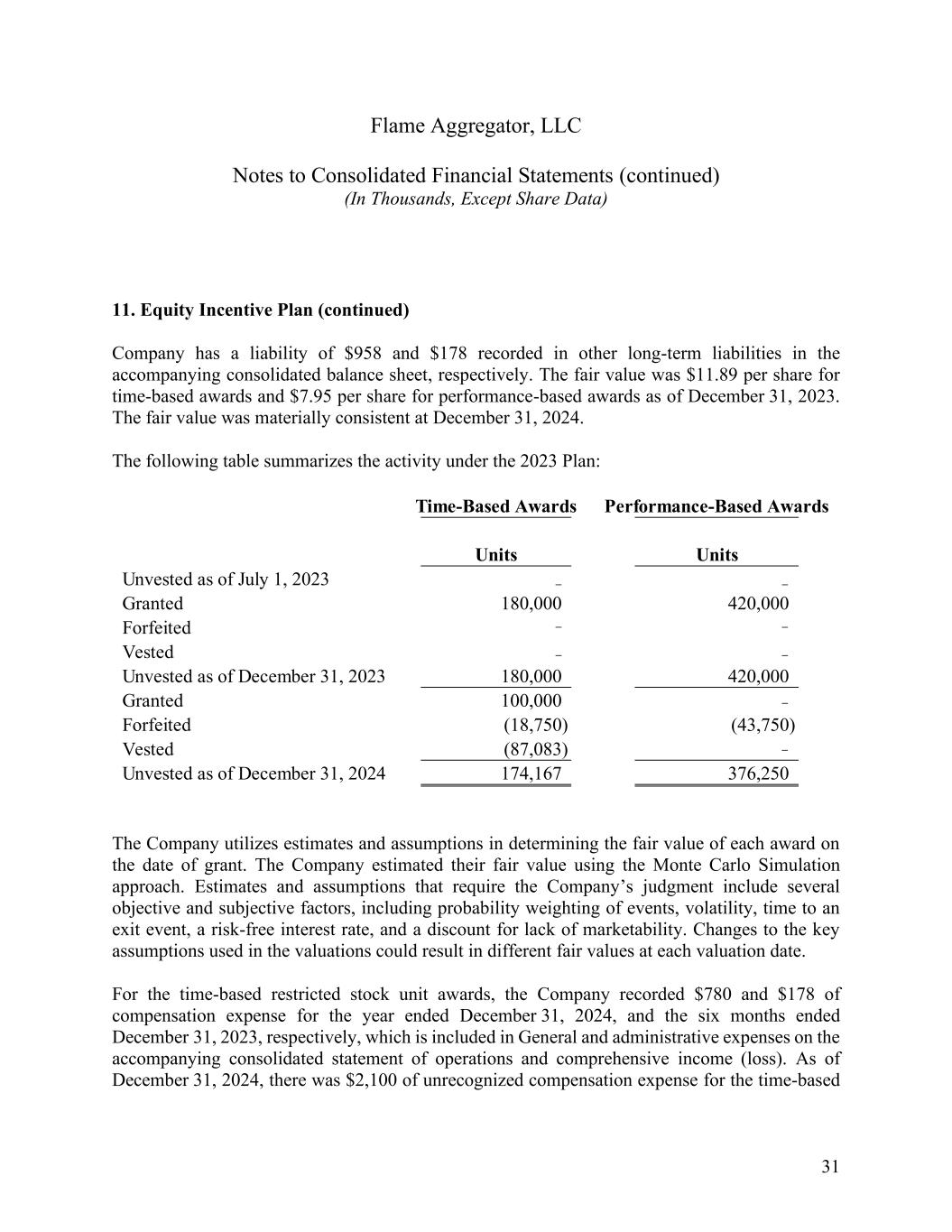

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 30 10. Retirement Plans (continued) The Company’s contributions to the MOEPP have not been greater than 5% of the total contributions to the MOEPP for each of the last two plan years. Under the Employee Retirement Income Act of 1974, as amended by the Pension Protection Act of 2006, the plan was certified to be in the “green zone” for the plan years ended March 31, 2024 and March 31, 2023, respectively. The Company participates in the MOEPP based on two collective bargaining agreements with 261 employees that both expired on July 31, 2025. The Company is continuing to operate without an extension or renewal of the collective bargaining agreement. 11. Equity Incentive Plan Successor Awards On October 19, 2023, and pursuant to the Plan, the Company established the Flame Aggregator, LLC Equity Incentive Plan (the “2023 Plan”), which will assist the Company in attracting, retaining, and motivating its service providers and to provide the Company and its subsidiaries and affiliates with an incentive plan directly linked to equity holder value. The 2023 Plan permits the grant of restricted stock units to employees and non-employee directors. The maximum number of common units authorized and available for issuance under the 2023 Plan is 1,000,000 common units. At December 31, 2024, there were 362,500 common units available for issuance under the 2023 Plan. Under the 2023 Plan, awards vest ratably over a three-year period from the date of grant and vest upon a change in control of the Company and upon the achievement of certain equity values (as defined in the 2023 Plan). While the Company has call rights to repurchase units under certain contingent events, the Company has determined that it is probable that these events will occur and that the Company will exercise its call right feature on immature units. As a result, the awards will be classified as liabilities and the Company will remeasure the awards each reporting period, with a cumulative adjustment recorded to compensation expense. Unvested units are forfeited at termination for any reason. The Company has elected to recognize the effect of forfeitures in compensation expense when they occur. The fair value measurement of the awards granted pursuant to the Company’s equity incentive plan are based on significant inputs not observable in the market and represent a Level 3 measurement within the fair value hierarchy. As of December 31, 2024, and 2023 (Successor), the

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 31 11. Equity Incentive Plan (continued) Company has a liability of $958 and $178 recorded in other long-term liabilities in the accompanying consolidated balance sheet, respectively. The fair value was $11.89 per share for time-based awards and $7.95 per share for performance-based awards as of December 31, 2023. The fair value was materially consistent at December 31, 2024. The following table summarizes the activity under the 2023 Plan: The Company utilizes estimates and assumptions in determining the fair value of each award on the date of grant. The Company estimated their fair value using the Monte Carlo Simulation approach. Estimates and assumptions that require the Company’s judgment include several objective and subjective factors, including probability weighting of events, volatility, time to an exit event, a risk-free interest rate, and a discount for lack of marketability. Changes to the key assumptions used in the valuations could result in different fair values at each valuation date. For the time-based restricted stock unit awards, the Company recorded $780 and $178 of compensation expense for the year ended December 31, 2024, and the six months ended December 31, 2023, respectively, which is included in General and administrative expenses on the accompanying consolidated statement of operations and comprehensive income (loss). As of December 31, 2024, there was $2,100 of unrecognized compensation expense for the time-based Time-Based Awards Performance-Based Awards Units Units Unvested as of July 1, 2023 - - Granted 180,000 420,000 Forfeited - - Vested - - Unvested as of December 31, 2023 180,000 420,000 Granted 100,000 - Forfeited (18,750) (43,750) Vested (87,083) - Unvested as of December 31, 2024 174,167 376,250 ‒ ‒ ‒ ‒ ‒ ‒ ‒ ‒

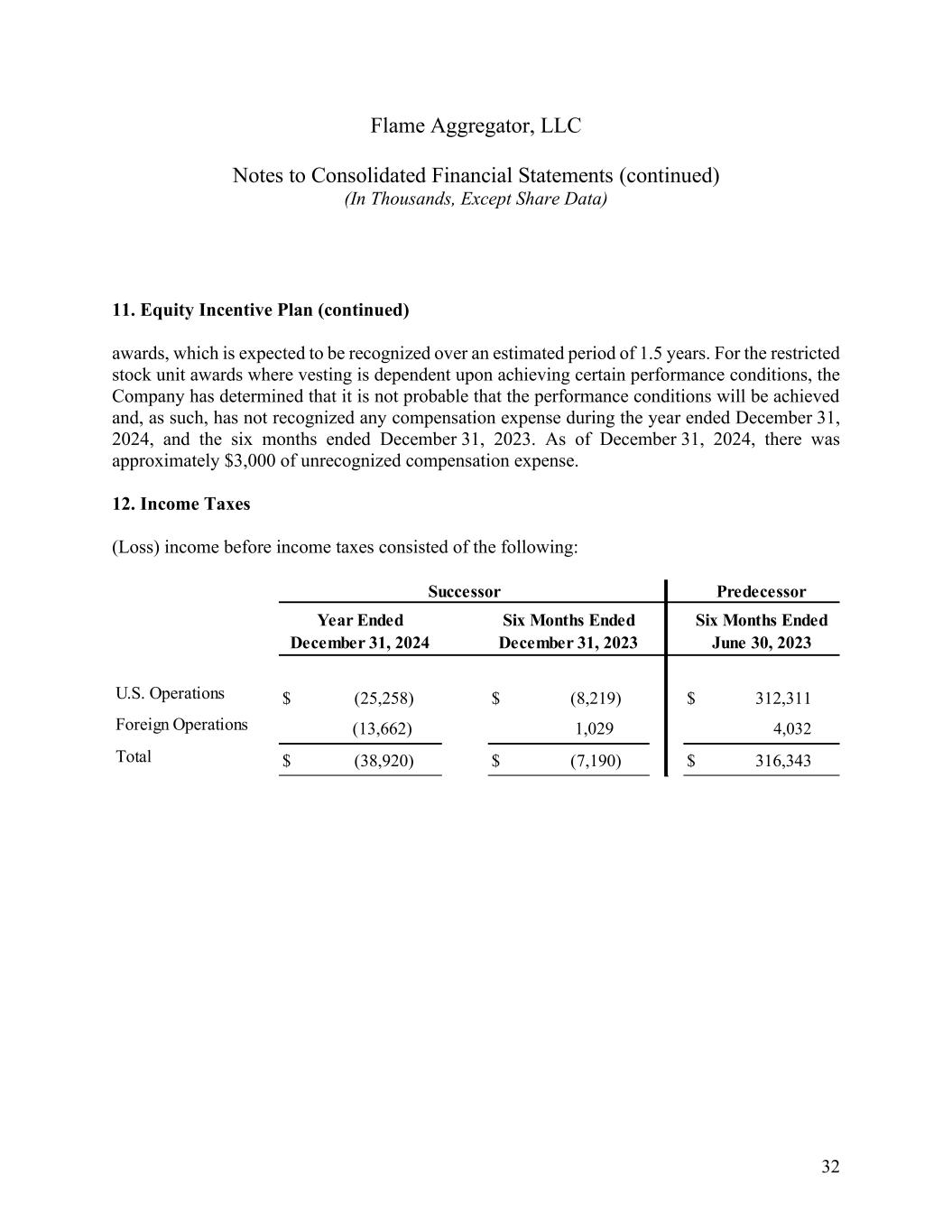

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 32 11. Equity Incentive Plan (continued) awards, which is expected to be recognized over an estimated period of 1.5 years. For the restricted stock unit awards where vesting is dependent upon achieving certain performance conditions, the Company has determined that it is not probable that the performance conditions will be achieved and, as such, has not recognized any compensation expense during the year ended December 31, 2024, and the six months ended December 31, 2023. As of December 31, 2024, there was approximately $3,000 of unrecognized compensation expense. 12. Income Taxes (Loss) income before income taxes consisted of the following: $ (25,258) $ (8,219) $ 312,311 (13,662) 1,029 4,032 $ (38,920) $ (7,190) $ 316,343 Total Successor Foreign Operations Predecessor Six Months Ended December 31, 2023 Six Months Ended June 30, 2023 U.S. Operations Year Ended December 31, 2024 4,032

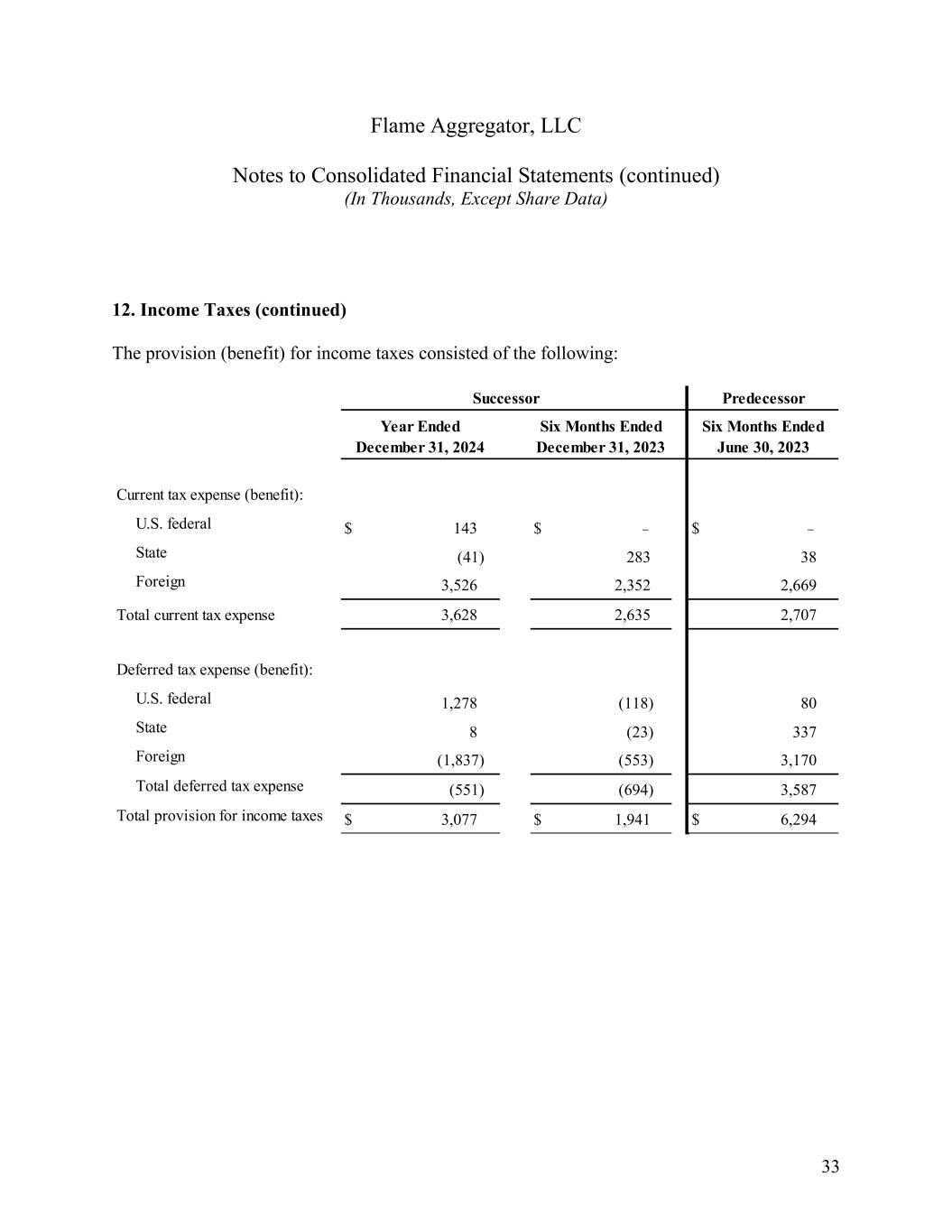

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 33 12. Income Taxes (continued) The provision (benefit) for income taxes consisted of the following: ‒‒ $ 143 $ - $ - (41) 283 38 3,526 2,352 2,669 3,628 2,635 2,707 1,278 (118) 80 8 (23) 337 (1,837) (553) 3,170 (551) (694) 3,587 $ 3,077 $ 1,941 $ 6,294 Total provision for income taxes Deferred tax expense (benefit): U.S. federal State Foreign Total deferred tax expense Total current tax expense Current tax expense (benefit): U.S. federal State Foreign Successor Predecessor Year Ended December 31, 2024 Six Months Ended December 31, 2023 Six Months Ended June 30, 2023 ‒ ‒

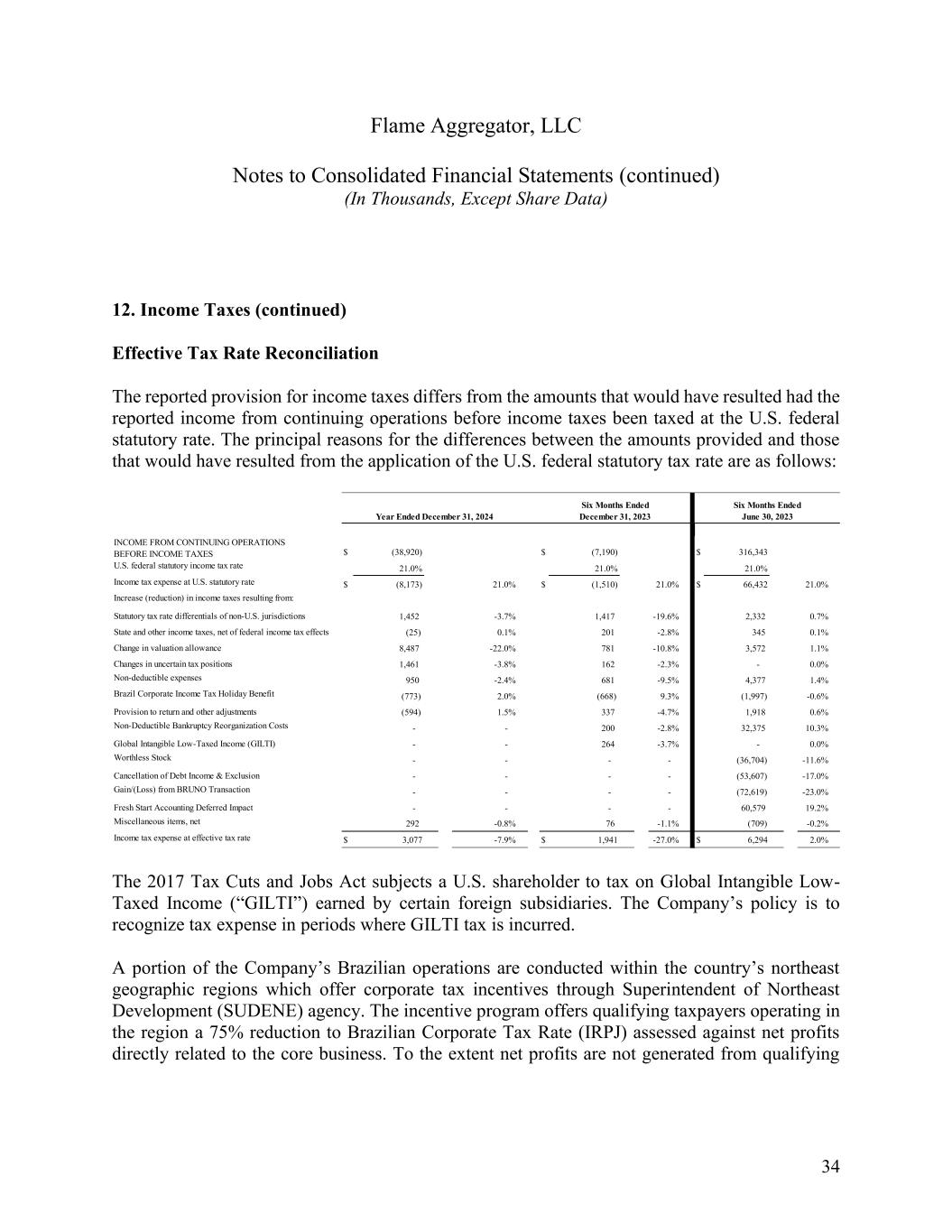

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 34 12. Income Taxes (continued) Effective Tax Rate Reconciliation The reported provision for income taxes differs from the amounts that would have resulted had the reported income from continuing operations before income taxes been taxed at the U.S. federal statutory rate. The principal reasons for the differences between the amounts provided and those that would have resulted from the application of the U.S. federal statutory tax rate are as follows: The 2017 Tax Cuts and Jobs Act subjects a U.S. shareholder to tax on Global Intangible Low- Taxed Income (“GILTI”) earned by certain foreign subsidiaries. The Company’s policy is to recognize tax expense in periods where GILTI tax is incurred. A portion of the Company’s Brazilian operations are conducted within the country’s northeast geographic regions which offer corporate tax incentives through Superintendent of Northeast Development (SUDENE) agency. The incentive program offers qualifying taxpayers operating in the region a 75% reduction to Brazilian Corporate Tax Rate (IRPJ) assessed against net profits directly related to the core business. To the extent net profits are not generated from qualifying INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES $ (38,920) $ (7,190) $ 316,343 U.S. federal statutory income tax rate 21.0% 21.0% 21.0% Income tax expense at U.S. statutory rate $ (8,173) 21.0% $ (1,510) 21.0% $ 66,432 21.0% Increase (reduction) in income taxes resulting from: Statutory tax rate differentials of non-U.S. jurisdictions 1,452 -3.7% 1,417 -19.6% 2,332 0.7% State and other income taxes, net of federal income tax effects (25) 0.1% 201 -2.8% 345 0.1% Change in valuation allowance 8,487 -22.0% 781 -10.8% 3,572 1.1% Changes in uncertain tax positions 1,461 -3.8% 162 -2.3% - 0.0% Non-deductible expenses 950 -2.4% 681 -9.5% 4,377 1.4% Brazil Corporate Income Tax Holiday Benefit (773) 2.0% (668) 9.3% (1,997) -0.6% Provision to return and other adjustments (594) 1.5% 337 -4.7% 1,918 0.6% Non-Deductible Bankruptcy Reorganization Costs - - 200 -2.8% 32,375 10.3% Global Intangible Low-Taxed Income (GILTI) - - 264 -3.7% - 0.0% Worthless Stock - - - - (36,704) -11.6% Cancellation of Debt Income & Exclusion - - - - (53,607) -17.0% Gain/(Loss) from BRUNO Transaction - - - - (72,619) -23.0% Fresh Start Accounting Deferred Impact - - - - 60,579 19.2% Miscellaneous items, net 292 -0.8% 76 -1.1% (709) -0.2% Income tax expense at effective tax rate $ 3,077 -7.9% $ 1,941 -27.0% $ 6,294 2.0% Year Ended December 31, 2024 Six Months Ended December 31, 2023 Six Months Ended June 30, 2023

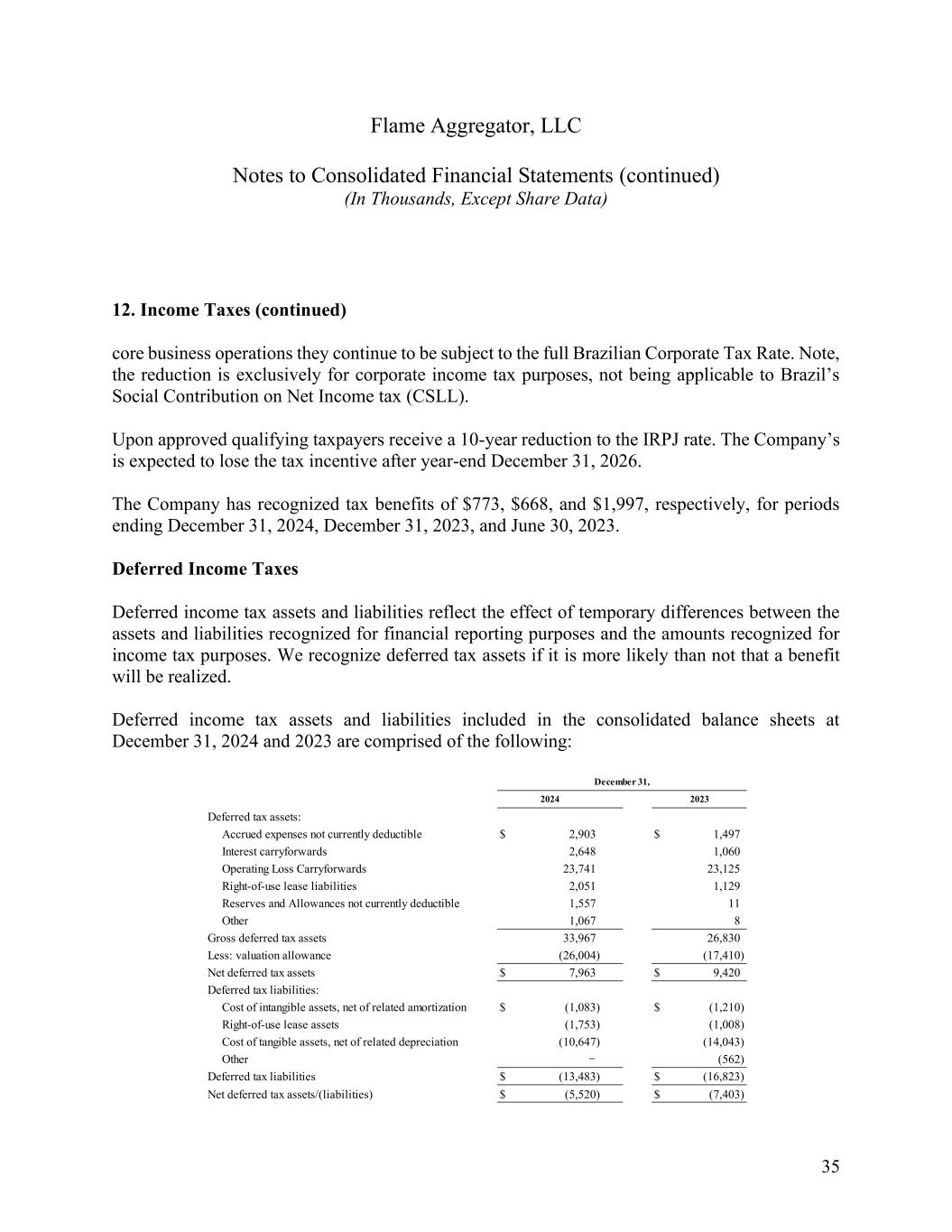

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 35 12. Income Taxes (continued) core business operations they continue to be subject to the full Brazilian Corporate Tax Rate. Note, the reduction is exclusively for corporate income tax purposes, not being applicable to Brazil’s Social Contribution on Net Income tax (CSLL). Upon approved qualifying taxpayers receive a 10-year reduction to the IRPJ rate. The Company’s is expected to lose the tax incentive after year-end December 31, 2026. The Company has recognized tax benefits of $773, $668, and $1,997, respectively, for periods ending December 31, 2024, December 31, 2023, and June 30, 2023. Deferred Income Taxes Deferred income tax assets and liabilities reflect the effect of temporary differences between the assets and liabilities recognized for financial reporting purposes and the amounts recognized for income tax purposes. We recognize deferred tax assets if it is more likely than not that a benefit will be realized. Deferred income tax assets and liabilities included in the consolidated balance sheets at December 31, 2024 and 2023 are comprised of the following: Deferred tax assets: Accrued expenses not currently deductible $ 2,903 $ 1,497 Interest carryforwards 2,648 1,060 Operating Loss Carryforwards 23,741 23,125 Right-of-use lease liabilities 2,051 1,129 Reserves and Allowances not currently deductible 1,557 11 Other 1,067 8 Gross deferred tax assets 33,967 26,830 Less: valuation allowance (26,004) (17,410) Net deferred tax assets $ 7,963 $ 9,420 Deferred tax liabilities: Cost of intangible assets, net of related amortization $ (1,083) $ (1,210) Right-of-use lease assets (1,753) (1,008) Cost of tangible assets, net of related depreciation (10,647) (14,043) Other - (562) Deferred tax liabilities $ (13,483) $ (16,823) Net deferred tax assets/(liabilities) $ (5,520) $ (7,403) December 31, 2024 2023 ‒‒

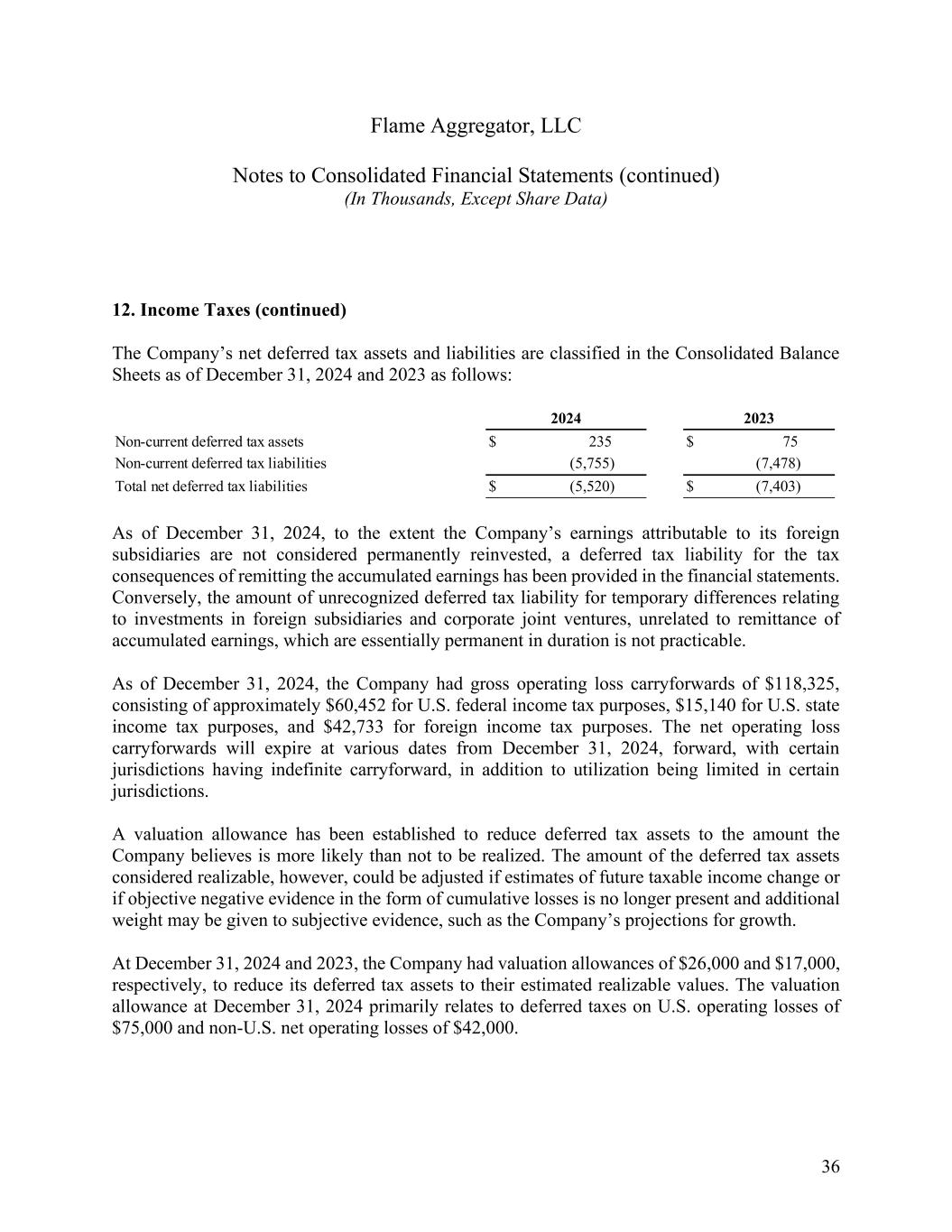

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 36 12. Income Taxes (continued) The Company’s net deferred tax assets and liabilities are classified in the Consolidated Balance Sheets as of December 31, 2024 and 2023 as follows: As of December 31, 2024, to the extent the Company’s earnings attributable to its foreign subsidiaries are not considered permanently reinvested, a deferred tax liability for the tax consequences of remitting the accumulated earnings has been provided in the financial statements. Conversely, the amount of unrecognized deferred tax liability for temporary differences relating to investments in foreign subsidiaries and corporate joint ventures, unrelated to remittance of accumulated earnings, which are essentially permanent in duration is not practicable. As of December 31, 2024, the Company had gross operating loss carryforwards of $118,325, consisting of approximately $60,452 for U.S. federal income tax purposes, $15,140 for U.S. state income tax purposes, and $42,733 for foreign income tax purposes. The net operating loss carryforwards will expire at various dates from December 31, 2024, forward, with certain jurisdictions having indefinite carryforward, in addition to utilization being limited in certain jurisdictions. A valuation allowance has been established to reduce deferred tax assets to the amount the Company believes is more likely than not to be realized. The amount of the deferred tax assets considered realizable, however, could be adjusted if estimates of future taxable income change or if objective negative evidence in the form of cumulative losses is no longer present and additional weight may be given to subjective evidence, such as the Company’s projections for growth. At December 31, 2024 and 2023, the Company had valuation allowances of $26,000 and $17,000, respectively, to reduce its deferred tax assets to their estimated realizable values. The valuation allowance at December 31, 2024 primarily relates to deferred taxes on U.S. operating losses of $75,000 and non-U.S. net operating losses of $42,000. Non-current deferred tax assets $ 235 $ 75 Non-current deferred tax liabilities (5,755) (7,478) Total net deferred tax liabilities $ (5,520) $ (7,403) 2024 2023

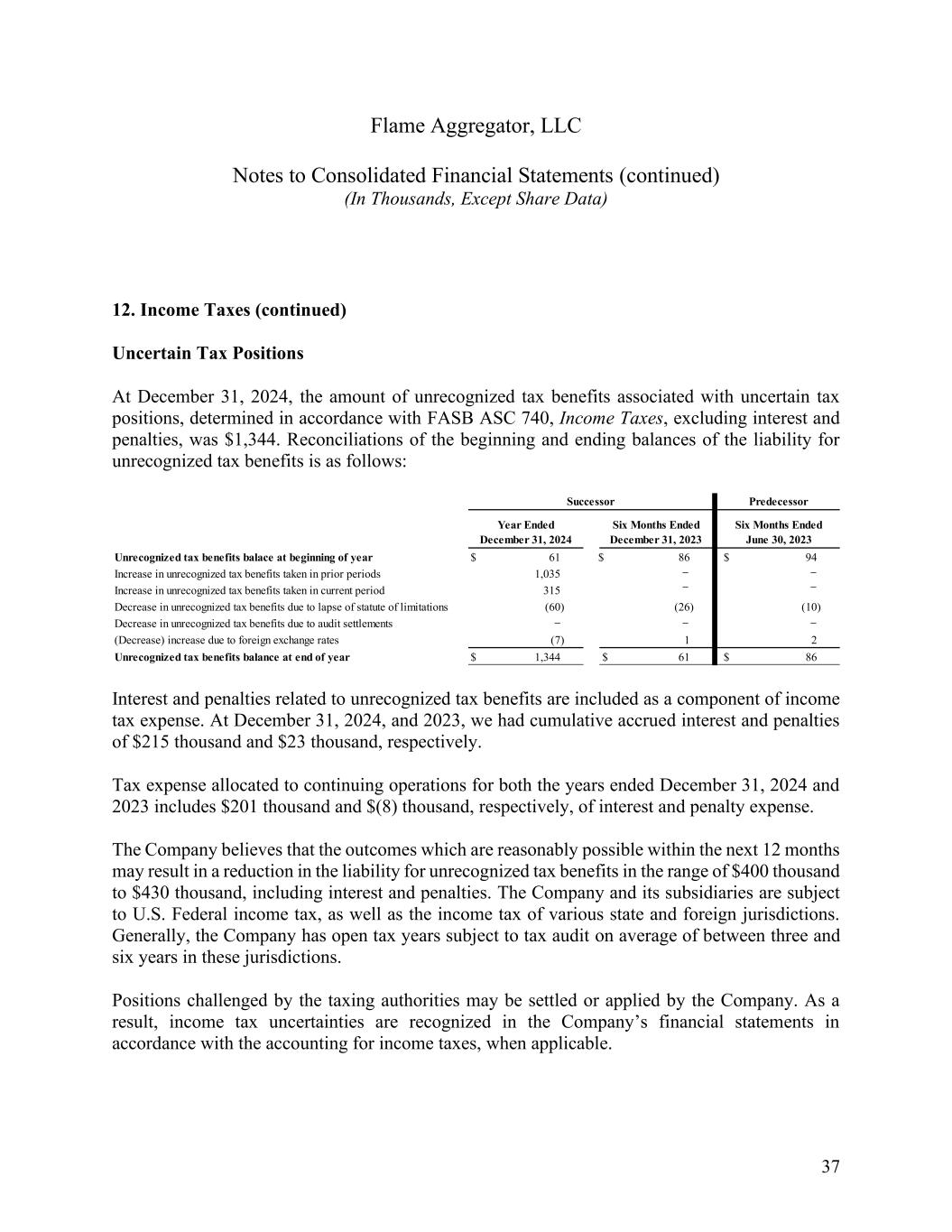

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 37 12. Income Taxes (continued) Uncertain Tax Positions At December 31, 2024, the amount of unrecognized tax benefits associated with uncertain tax positions, determined in accordance with FASB ASC 740, Income Taxes, excluding interest and penalties, was $1,344. Reconciliations of the beginning and ending balances of the liability for unrecognized tax benefits is as follows: Interest and penalties related to unrecognized tax benefits are included as a component of income tax expense. At December 31, 2024, and 2023, we had cumulative accrued interest and penalties of $215 thousand and $23 thousand, respectively. Tax expense allocated to continuing operations for both the years ended December 31, 2024 and 2023 includes $201 thousand and $(8) thousand, respectively, of interest and penalty expense. The Company believes that the outcomes which are reasonably possible within the next 12 months may result in a reduction in the liability for unrecognized tax benefits in the range of $400 thousand to $430 thousand, including interest and penalties. The Company and its subsidiaries are subject to U.S. Federal income tax, as well as the income tax of various state and foreign jurisdictions. Generally, the Company has open tax years subject to tax audit on average of between three and six years in these jurisdictions. Positions challenged by the taxing authorities may be settled or applied by the Company. As a result, income tax uncertainties are recognized in the Company’s financial statements in accordance with the accounting for income taxes, when applicable. $ 61 $ 86 $ 94 1,035 - - 315 - - (60) (26) (10) - - - (7) 1 2 $ 1,344 $ 61 $ 86 Successor Predecessor Unrecognized tax benefits balace at beginning of year Increase in unrecognized tax benefits taken in current period Decrease in unrecognized tax benefits due to lapse of statute of limitations Decrease in unrecognized tax benefits due to audit settlements (Decrease) increase due to foreign exchange rates Unrecognized tax benefits balance at end of year Year Ended December 31, 2024 Six Months Ended December 31, 2023 Six Months Ended June 30, 2023 Increase in unrecognized tax benefits taken in prior periods ‒ ‒ ‒ ‒ ‒ ‒ ‒

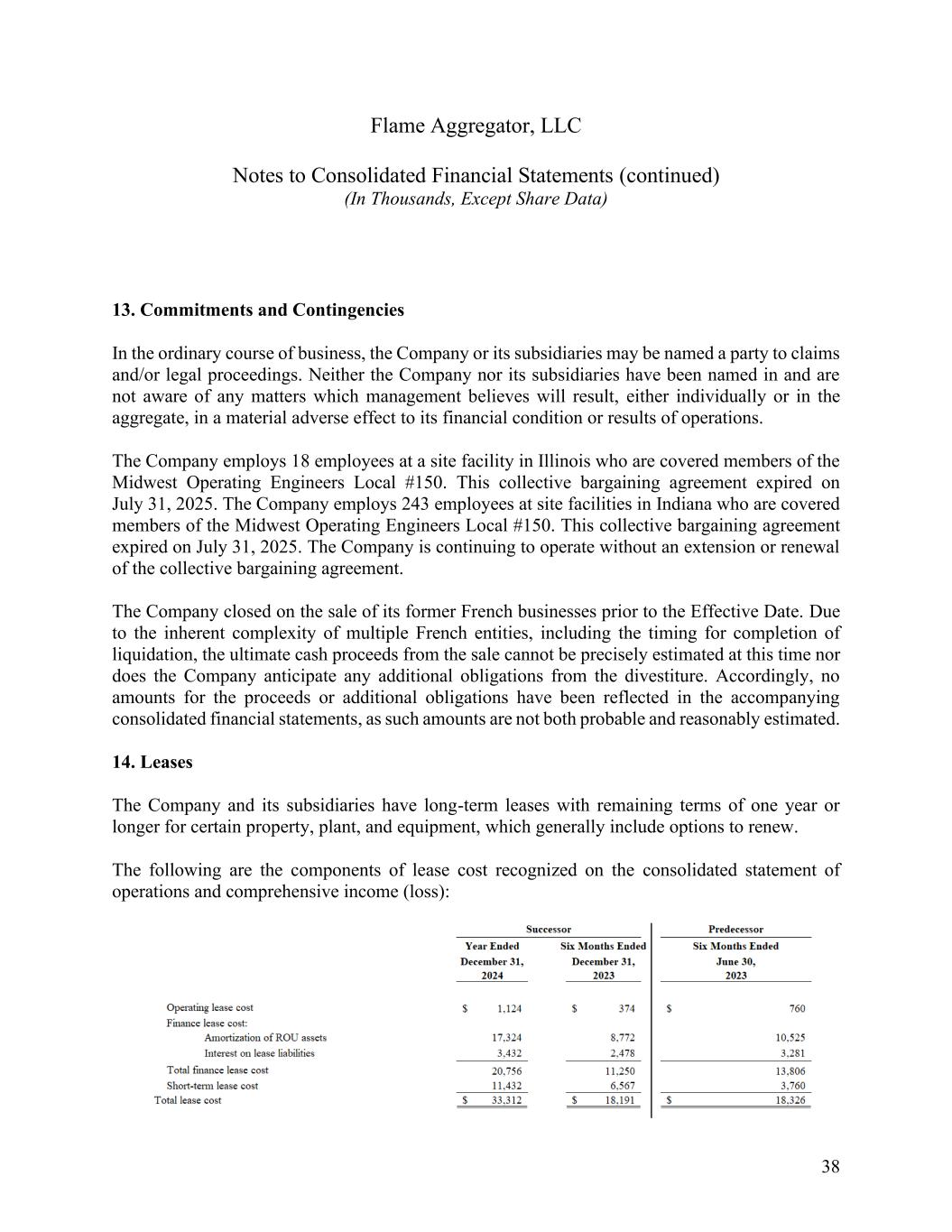

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 38 13. Commitments and Contingencies In the ordinary course of business, the Company or its subsidiaries may be named a party to claims and/or legal proceedings. Neither the Company nor its subsidiaries have been named in and are not aware of any matters which management believes will result, either individually or in the aggregate, in a material adverse effect to its financial condition or results of operations. The Company employs 18 employees at a site facility in Illinois who are covered members of the Midwest Operating Engineers Local #150. This collective bargaining agreement expired on July 31, 2025. The Company employs 243 employees at site facilities in Indiana who are covered members of the Midwest Operating Engineers Local #150. This collective bargaining agreement expired on July 31, 2025. The Company is continuing to operate without an extension or renewal of the collective bargaining agreement. The Company closed on the sale of its former French businesses prior to the Effective Date. Due to the inherent complexity of multiple French entities, including the timing for completion of liquidation, the ultimate cash proceeds from the sale cannot be precisely estimated at this time nor does the Company anticipate any additional obligations from the divestiture. Accordingly, no amounts for the proceeds or additional obligations have been reflected in the accompanying consolidated financial statements, as such amounts are not both probable and reasonably estimated. 14. Leases The Company and its subsidiaries have long-term leases with remaining terms of one year or longer for certain property, plant, and equipment, which generally include options to renew. The following are the components of lease cost recognized on the consolidated statement of operations and comprehensive income (loss):

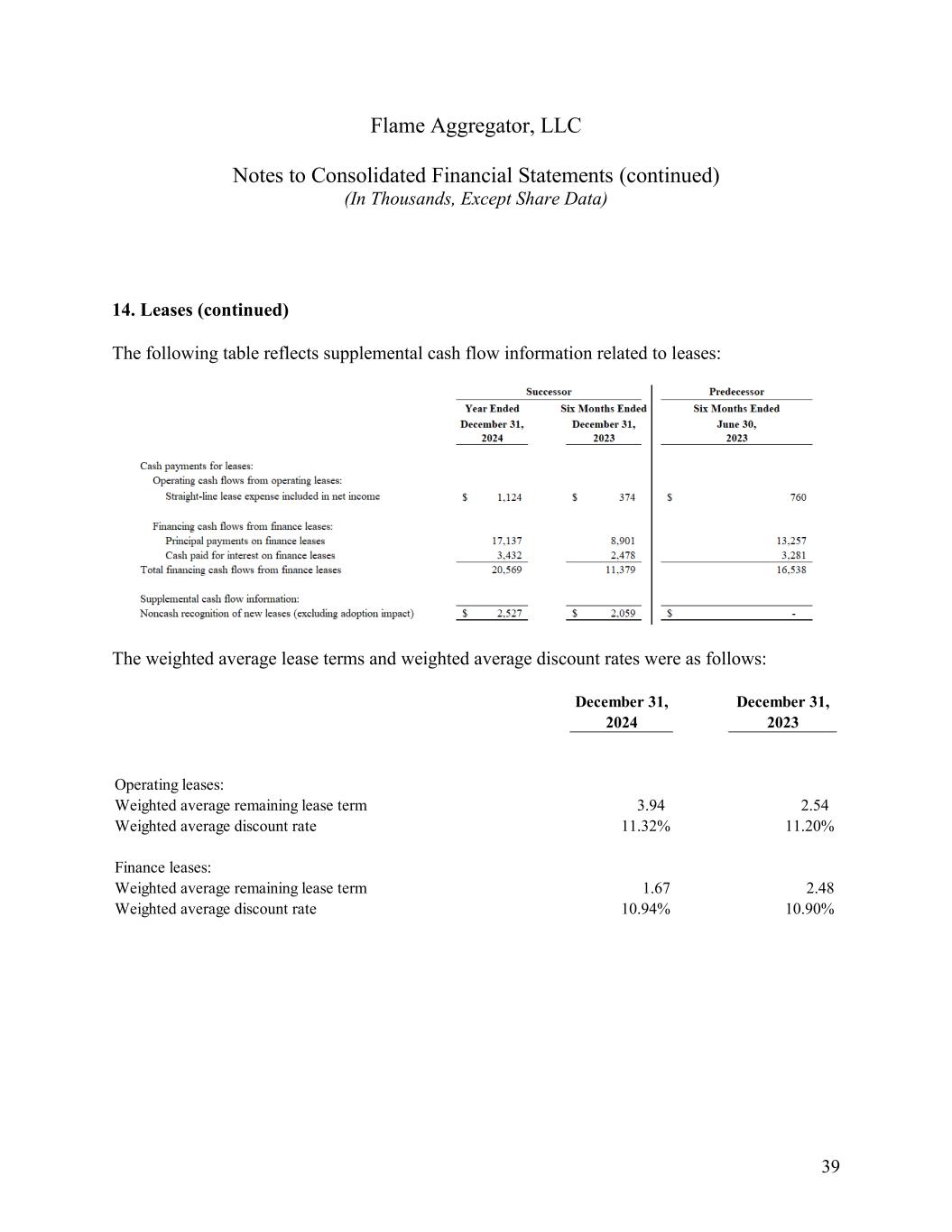

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 39 14. Leases (continued) The following table reflects supplemental cash flow information related to leases: The weighted average lease terms and weighted average discount rates were as follows: December 31, December 31, 2024 2023 Operating leases: Weighted average remaining lease term 3.94 2.54 Weighted average discount rate 11.32% 11.20% Finance leases: Weighted average remaining lease term 1.67 2.48 Weighted average discount rate 10.94% 10.90%

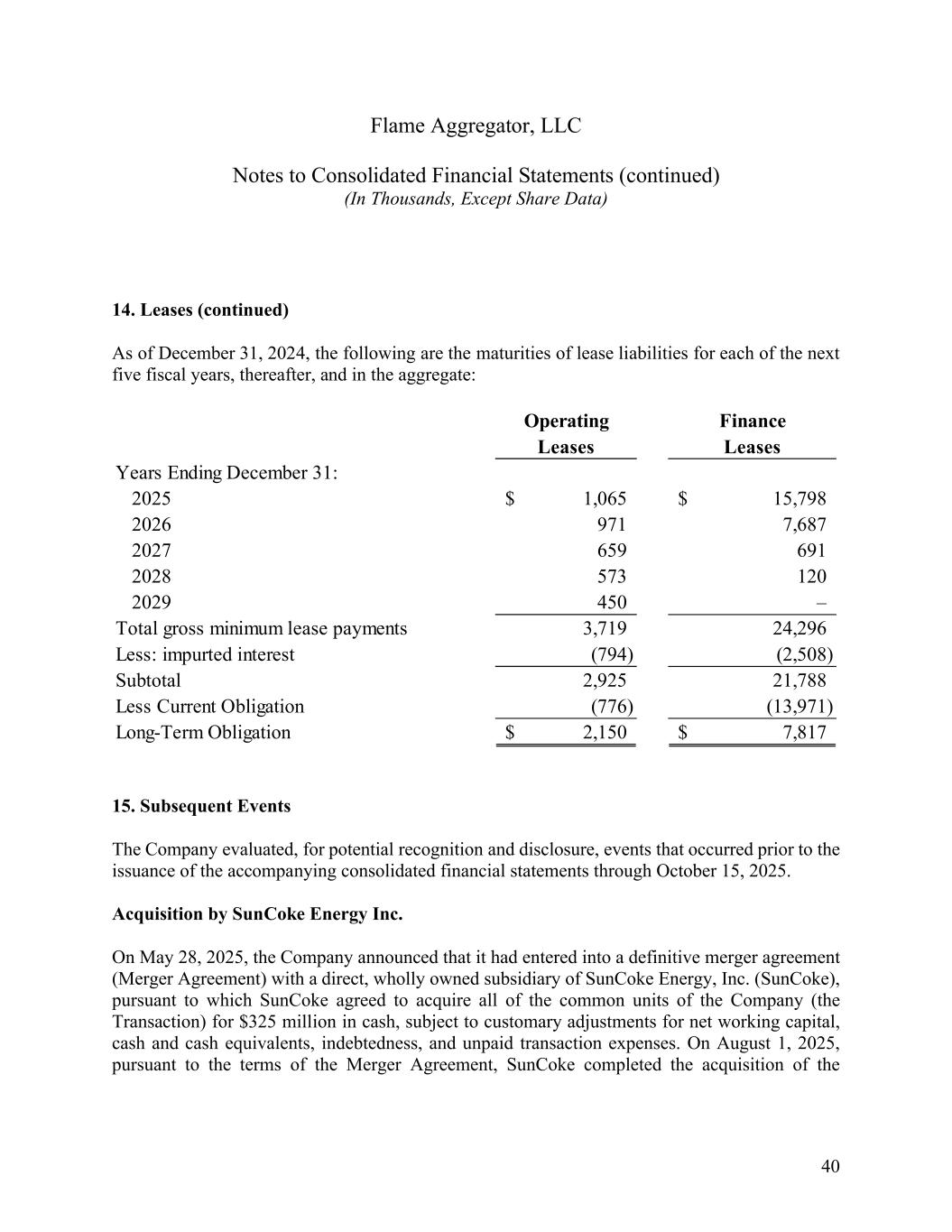

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 40 14. Leases (continued) As of December 31, 2024, the following are the maturities of lease liabilities for each of the next five fiscal years, thereafter, and in the aggregate: 15. Subsequent Events The Company evaluated, for potential recognition and disclosure, events that occurred prior to the issuance of the accompanying consolidated financial statements through October 15, 2025. Acquisition by SunCoke Energy Inc. On May 28, 2025, the Company announced that it had entered into a definitive merger agreement (Merger Agreement) with a direct, wholly owned subsidiary of SunCoke Energy, Inc. (SunCoke), pursuant to which SunCoke agreed to acquire all of the common units of the Company (the Transaction) for $325 million in cash, subject to customary adjustments for net working capital, cash and cash equivalents, indebtedness, and unpaid transaction expenses. On August 1, 2025, pursuant to the terms of the Merger Agreement, SunCoke completed the acquisition of the Operating Finance Leases Leases Years Ending December 31: 2025 1,065$ 15,798$ 2026 971 7,687 2027 659 691 2028 573 120 2029 450 – Total gross minimum lease payments 3,719 24,296 Less: impurted interest (794) (2,508) Subtotal 2,925 21,788 Less Current Obligation (776) (13,971) Long-Term Obligation 2,150$ 7,817$

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 41 15. Subsequent Events (continued) Company. In connection with closing, the Company’s unitholders received $325 million in cash adjusted for net working capital, cash and cash equivalents, indebtedness, and unpaid transaction expenses. Additionally, the Company’s Equity Incentive Plan (Incentive Plan) participants received $18.2 million, settling all Incentive Plan obligations, which terminated the Incentive Plan. Concurrently with the closing of the Transaction, the Company's outstanding First Lien Exit Facility and Notes Payable were settled using funds provided by SunCoke pursuant to the Merger Agreement. The Company incurred total transaction costs of $11 million in connection with the Transaction.