C O N S O L I D A T E D F I N A N C I A L S T A T E M E N T S Flame Aggregator, LLC

Flame Aggregator, LLC Consolidated Financial Statements Period Ended June 30, 2025 (Unaudited), and the Year Ended December 31, 2024 Consolidated Statements Consolidated Balance Sheets ...........................................................................................................1 Consolidated Statements of Operations and Comprehensive Income (Loss) ..................................3 Consolidated Statements of Cash Flows ..........................................................................................4 Consolidated Statements of Changes in Members’ Equity .............................................................5 Notes to Consolidated Financial Statements....................................................................................6

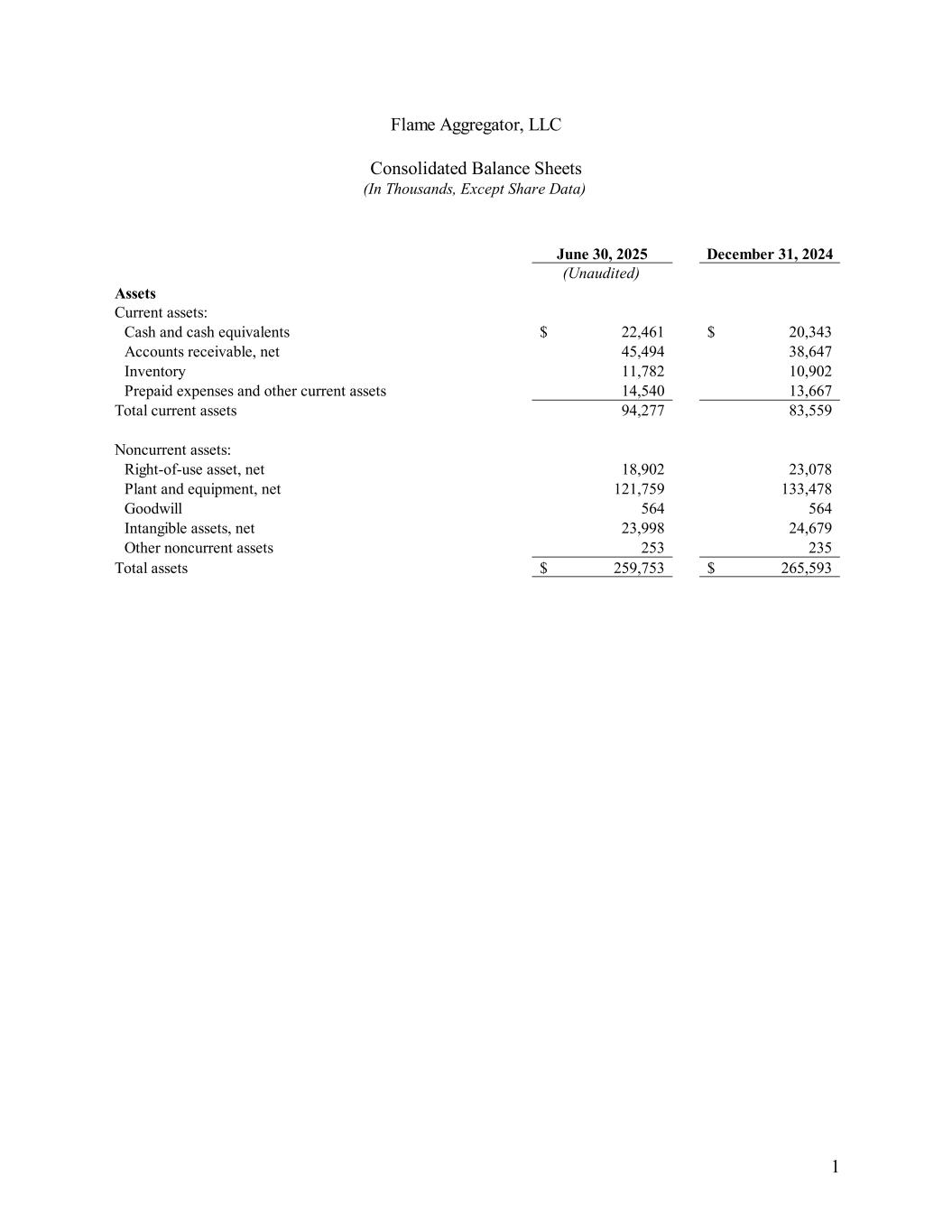

1 June 30, 2025 December 31, 2024 (Unaudited) Assets Current assets: Cash and cash equivalents 22,461$ 20,343$ Accounts receivable, net 45,494 38,647 Inventory 11,782 10,902 Prepaid expenses and other current assets 14,540 13,667 Total current assets 94,277 83,559 Noncurrent assets: Right-of-use asset, net 18,902 23,078 Plant and equipment, net 121,759 133,478 Goodwill 564 564 Intangible assets, net 23,998 24,679 Other noncurrent assets 253 235 Total assets 259,753$ 265,593$ (In Thousands, Except Share Data) Flame Aggregator, LLC Consolidated Balance Sheets

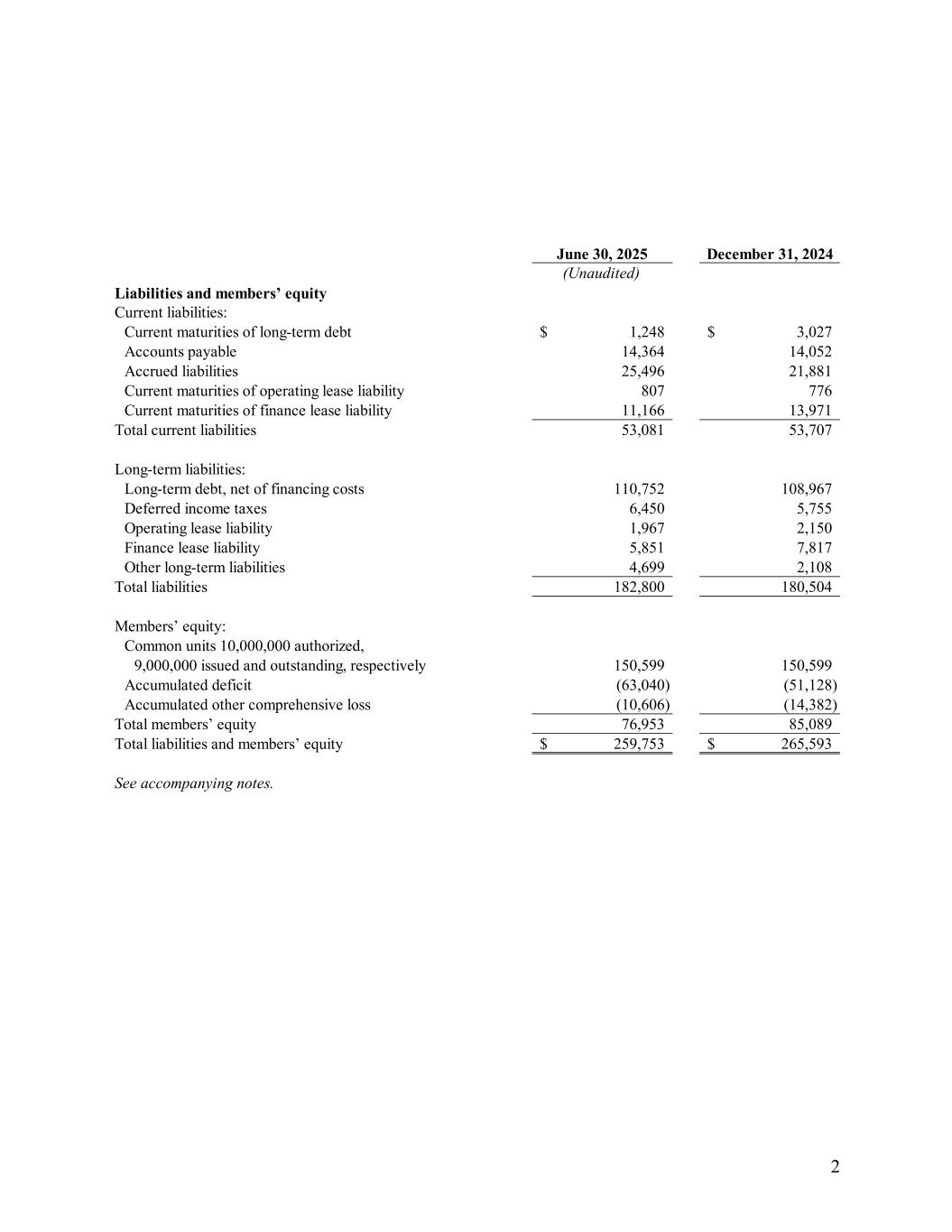

2 June 30, 2025 December 31, 2024 (Unaudited) Liabilities and members’ equity Current liabilities: Current maturities of long-term debt 1,248$ 3,027$ Accounts payable 14,364 14,052 Accrued liabilities 25,496 21,881 Current maturities of operating lease liability 807 776 Current maturities of finance lease liability 11,166 13,971 Total current liabilities 53,081 53,707 Long-term liabilities: Long-term debt, net of financing costs 110,752 108,967 Deferred income taxes 6,450 5,755 Operating lease liability 1,967 2,150 Finance lease liability 5,851 7,817 Other long-term liabilities 4,699 2,108 Total liabilities 182,800 180,504 Members’ equity: Common units 10,000,000 authorized, 9,000,000 issued and outstanding, respectively 150,599 150,599 Accumulated deficit (63,040) (51,128) Accumulated other comprehensive loss (10,606) (14,382) Total members’ equity 76,953 85,089 Total liabilities and members’ equity 259,753$ 265,593$ See accompanying notes. Flame Aggregator, LLC Consolidated Balance Sheets (In Thousands, Except Share Data)

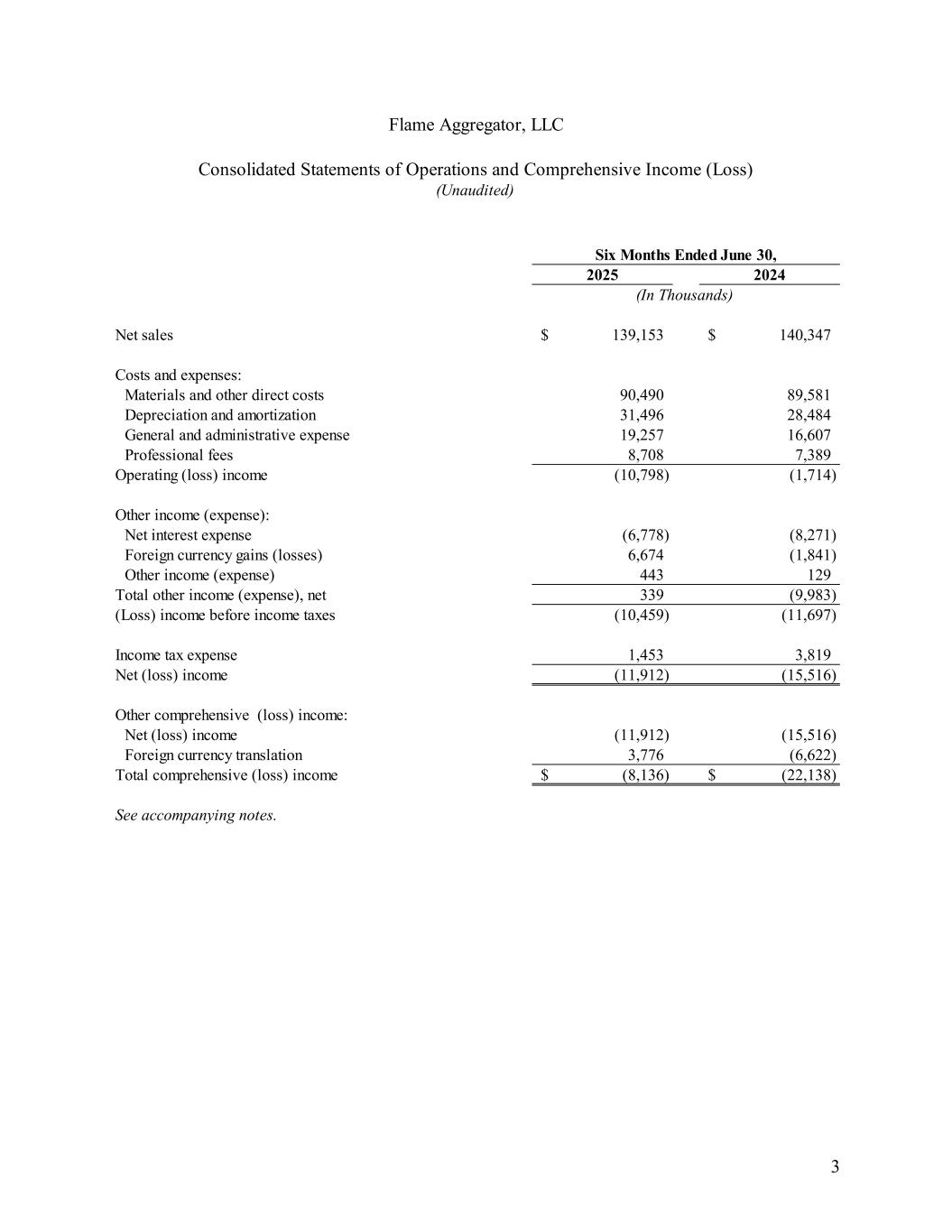

3 Flame Aggregator, LLC Consolidated Statements of Operations and Comprehensive Income (Loss) Six Months Ended June 30, 2025 2024 Net sales 139,153$ 140,347$ Costs and expenses: Materials and other direct costs 90,490 89,581 Depreciation and amortization 31,496 28,484 General and administrative expense 19,257 16,607 Professional fees 8,708 7,389 Operating (loss) income (10,798) (1,714) Other income (expense): Net interest expense (6,778) (8,271) Foreign currency gains (losses) 6,674 (1,841) Other income (expense) 443 129 Total other income (expense), net 339 (9,983) (Loss) income before income taxes (10,459) (11,697) Income tax expense 1,453 3,819 Net (loss) income (11,912) (15,516) Other comprehensive (loss) income: Net (loss) income (11,912) (15,516) Foreign currency translation 3,776 (6,622) Total comprehensive (loss) income (8,136)$ (22,138)$ See accompanying notes. (Unaudited) (In Thousands)

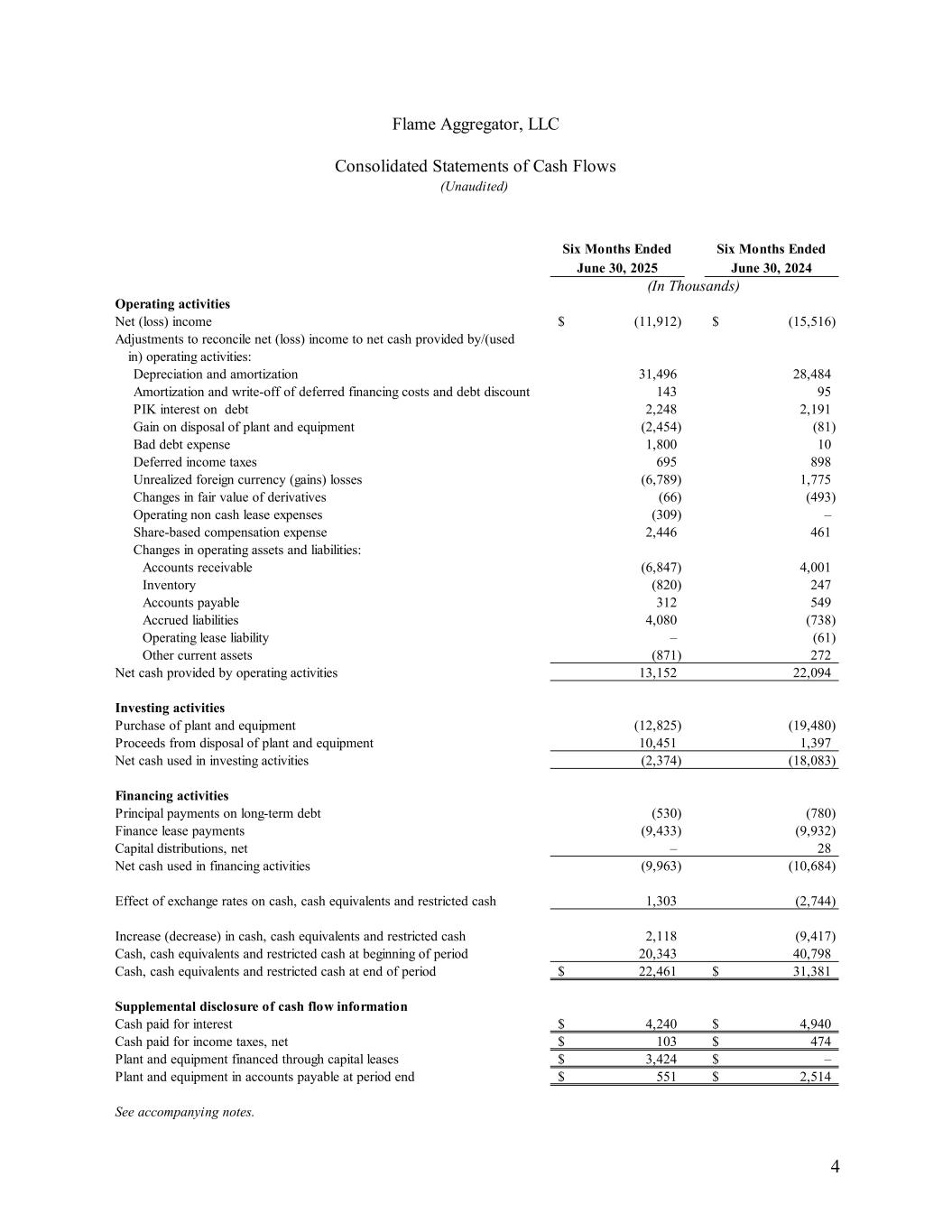

4 Six Months Ended Six Months Ended June 30, 2025 June 30, 2024 Operating activities Net (loss) income (11,912)$ (15,516)$ Adjustments to reconcile net (loss) income to net cash provided by/(used in) operating activities: Depreciation and amortization 31,496 28,484 Amortization and write-off of deferred financing costs and debt discount 143 95 PIK interest on debt 2,248 2,191 Gain on disposal of plant and equipment (2,454) (81) Bad debt expense 1,800 10 Deferred income taxes 695 898 Unrealized foreign currency (gains) losses (6,789) 1,775 Changes in fair value of derivatives (66) (493) Operating non cash lease expenses (309) – Share-based compensation expense 2,446 461 Changes in operating assets and liabilities: Accounts receivable (6,847) 4,001 Inventory (820) 247 Accounts payable 312 549 Accrued liabilities 4,080 (738) Operating lease liability – (61) Other current assets (871) 272 Net cash provided by operating activities 13,152 22,094 Investing activities Purchase of plant and equipment (12,825) (19,480) Proceeds from disposal of plant and equipment 10,451 1,397 Net cash used in investing activities (2,374) (18,083) Financing activities Principal payments on long-term debt (530) (780) Finance lease payments (9,433) (9,932) Capital distributions, net – 28 Net cash used in financing activities (9,963) (10,684) Effect of exchange rates on cash, cash equivalents and restricted cash 1,303 (2,744) Increase (decrease) in cash, cash equivalents and restricted cash 2,118 (9,417) Cash, cash equivalents and restricted cash at beginning of period 20,343 40,798 Cash, cash equivalents and restricted cash at end of period 22,461$ 31,381$ Supplemental disclosure of cash flow information Cash paid for interest 4,240$ 4,940$ Cash paid for income taxes, net 103$ 474$ Plant and equipment financed through capital leases 3,424$ –$ Plant and equipment in accounts payable at period end 551$ 2,514$ See accompanying notes. Flame Aggregator, LLC Consolidated Statements of Cash Flows (Unaudited) (In Thousands)

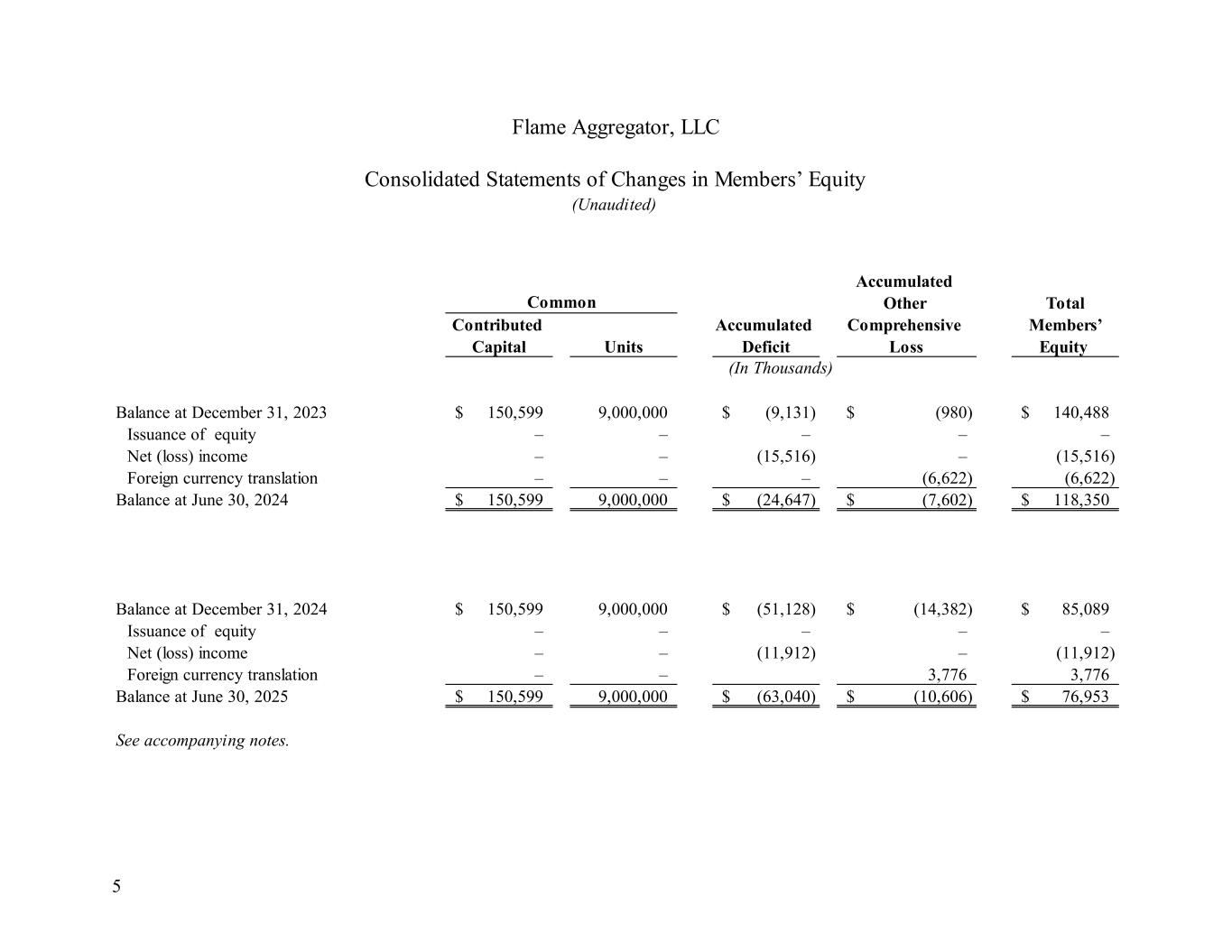

5 Accumulated Other Total Contributed Accumulated Comprehensive Members’ Capital Units Deficit Loss Equity Balance at December 31, 2023 150,599$ 9,000,000 (9,131)$ (980)$ 140,488$ Issuance of equity – – – – – Net (loss) income – – (15,516) – (15,516) Foreign currency translation – – – (6,622) (6,622) Balance at June 30, 2024 150,599$ 9,000,000 (24,647)$ (7,602)$ 118,350$ Balance at December 31, 2024 150,599$ 9,000,000 (51,128)$ (14,382)$ 85,089$ Issuance of equity – – – – – Net (loss) income – – (11,912) – (11,912) Foreign currency translation – – 3,776 3,776 Balance at June 30, 2025 150,599$ 9,000,000 (63,040)$ (10,606)$ 76,953$ See accompanying notes. Flame Aggregator, LLC Consolidated Statements of Changes in Members’ Equity (Unaudited) Common (In Thousands)

6 Flame Aggregator, LLC Notes to Consolidated Financial Statements (In Thousands, Except Share Data) June 30, 2025 and Year Ended 2024 1. Nature of Business Flame Aggregator, LLC (the “Company”) is a holding company that indirectly owns 100% of the outstanding units of Metal Services LLC, d/b/a Phoenix Services LLC (“Phoenix”). Phoenix is primarily engaged in providing mill services, including slag handling and metal recovery operations, for the steel industry, both domestically and overseas. Within the U.S., Phoenix operates in a broad geography, mostly in the Mid-Atlantic, South, and Midwest. Phoenix also currently has similar operations in Romania, South Africa, Slovakia, Spain, and Brazil through a majority owned Dutch subsidiary. Flame Aggregator LLC conducts its business exclusively through its indirectly wholly owned operating subsidiary, Metal Services LLC and its subsidiaries. References to the financial position and results of operations relate to the financial position and results of operations of Flame Aggregator, LLC. References to the “Company,” “we,” “us,” or “our” in these consolidated financial statements are to Flame Aggregator, LLC, together with its consolidated subsidiaries. 2. Acquisition by SunCoke Energy Inc On May 28, 2025, the Company announced that it had entered into a definitive merger agreement (Merger Agreement) with a direct, wholly owned subsidiary of SunCoke Energy, Inc. (SunCoke), pursuant to which SunCoke agreed to acquire all of the common units of the Company (the Transaction) for $325 million in cash, subject to customary adjustments for net working capital, cash and cash equivalents, indebtedness, and unpaid transaction expenses. On August 1, 2025, pursuant to the terms of the Merger Agreement, SunCoke completed the acquisition of the Company. In connection with closing, the Company’s unitholders received $325 million in cash adjusted for net working capital, cash and cash equivalents, indebtedness, and unpaid transaction expenses. Additionally, the Company’s Equity Incentive Plan (Incentive Plan) participants received $18,236, settling all Incentive Plan obligations, which terminated the Incentive Plan. Concurrently with the closing of the Transaction, the Company’s outstanding First Lien Exit Facility and Notes Payable were settled using funds provided by SunCoke pursuant to the Merger Agreement. The Company incurred total transaction costs of $11,136 in connection with the Transaction.

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 7 3. Summary of Significant Accounting Policies Basis of Presentation The accompanying unaudited consolidated financial statements included herein have been prepared in accordance with accounting principles generally accepted in the U.S. (“US GAAP”) for interim reporting. The financial statements are presented on a consolidated basis. All intercompany accounts and transactions have been eliminated. Certain information and disclosures normally included in financial statements have been omitted. In management’s opinion, the financial statements reflect all adjustments, which are of a normal recurring nature, necessary for a fair presentation of the results of operations, financial position and cash flows for the periods presented. The results of operations for the period ended June 30, 2025 are not necessarily indicative of the operating results expected for the entire year. These unaudited interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2024. Use of Estimates The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. The Company bases its estimates on its experience and on various assumptions that are believed to be reasonable under the circumstances at the time. Actual amounts could differ from estimates under different assumptions or conditions. Concentration of Credit Risk Financial instruments that potentially subject the Company to credit risk consist primarily of accounts receivable. Accounts receivable are stated at amounts believed by management to be the net realizable value. Credit is extended to customers based on an evaluation of credit reports, payment practices, and, in most cases, financial condition. The Company provides an allowance for doubtful accounts based upon past history and considers economic circumstances surrounding particular customers. The Company writes off accounts receivable when it becomes apparent the amounts will not be collected. Accounts receivable are considered past due when payment has not been received within the standard payment terms; however, the Company does not accrue interest on past due accounts receivable.

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 8 3. Summary of Significant Accounting Policies (continued) Four customers accounted for 66% and 71% of accounts receivable as of June 30, 2025 and December 31, 2024, respectively. During the six months ended June 30, 2025 and the six months ended June 30, 2024 the Company had three customers that accounted for 62% and 64%, respectively, of consolidated net sales. Recent Accounting Pronouncements In December 2023, the FASB issued ASU 2023-09, “Income Taxes (Topic 740): Improvement to Income Tax Disclosures.” ASU 2023-09 requires additional disclosures aimed at enhancing the transparency and decision usefulness of income tax disclosures. This ASU is effective for fiscal years beginning after December 15, 2024, on a prospective basis. The Company is required to adopt the guidance for the fiscal year ending December 31, 2025, and does not expect this ASU to have a material impact on the Company’s disclosures. In November 2024, the FASB issued ASU 2024-03, “Income Statement—Reporting Comprehensive Income (Topic 220): Disaggregation of Income Statement Expenses.” ASU 2024- 03 requires additional disclosures aimed at enhancing the transparency and decision usefulness of income statement expenses. This ASU is effective for fiscal years beginning after December 15, 2026 as well as interim periods beginning after December 15, 2027 and requires retrospective application to all prior periods presented in the financial statements. The Company is currently evaluating the impact of the guidance on the related disclosures. 4. Prepaid Expenses and Other Current Assets Prepaid expenses include insurance and expenses, vendor deposits, assets held for sale, and the fair value of foreign currency derivatives. At June 30, 2025, and December 31, 2024, the Company had $1.8 million and $1.7 million, respectively, of idle equipment that was held for sale, and classified in other current assets.

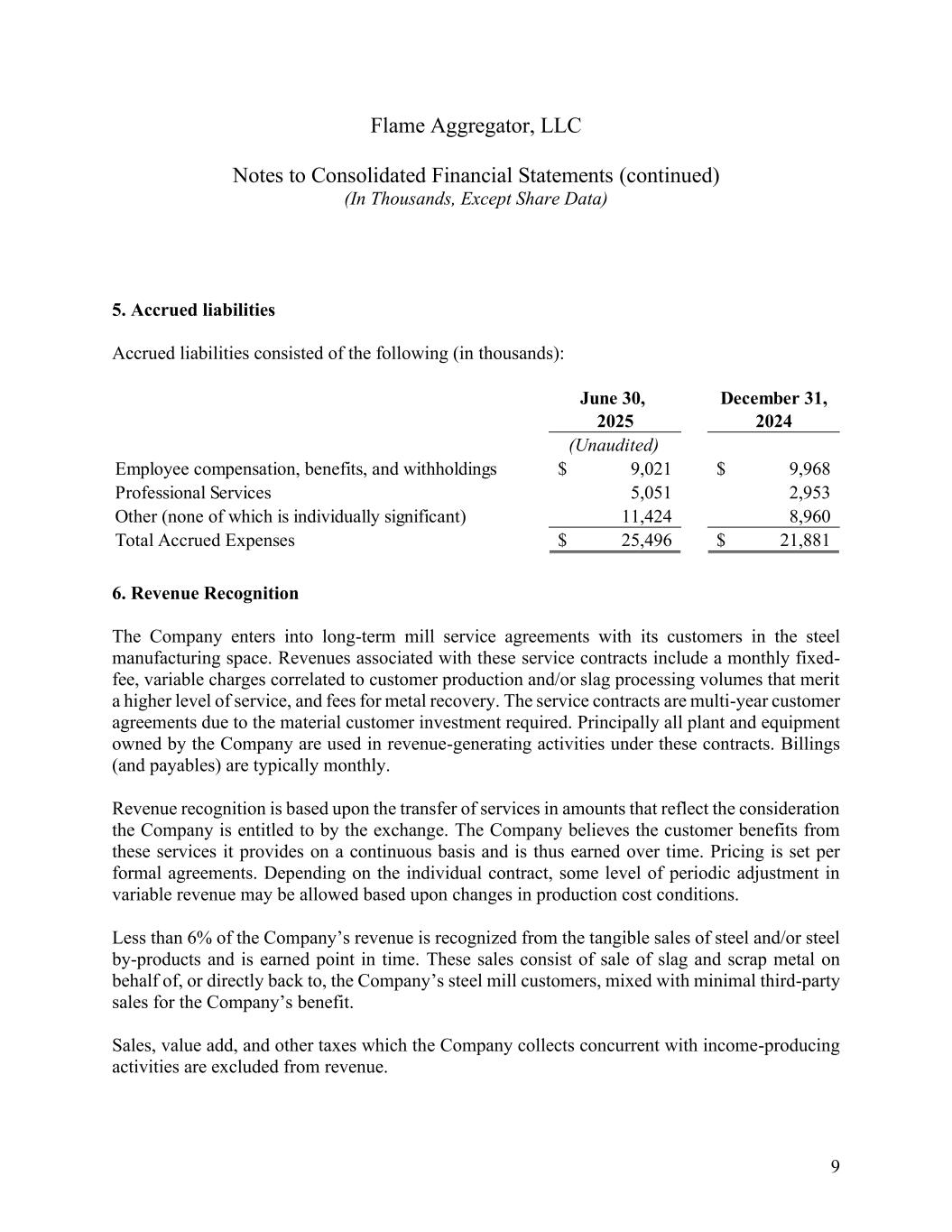

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 9 5. Accrued liabilities Accrued liabilities consisted of the following (in thousands): 6. Revenue Recognition The Company enters into long-term mill service agreements with its customers in the steel manufacturing space. Revenues associated with these service contracts include a monthly fixed- fee, variable charges correlated to customer production and/or slag processing volumes that merit a higher level of service, and fees for metal recovery. The service contracts are multi-year customer agreements due to the material customer investment required. Principally all plant and equipment owned by the Company are used in revenue-generating activities under these contracts. Billings (and payables) are typically monthly. Revenue recognition is based upon the transfer of services in amounts that reflect the consideration the Company is entitled to by the exchange. The Company believes the customer benefits from these services it provides on a continuous basis and is thus earned over time. Pricing is set per formal agreements. Depending on the individual contract, some level of periodic adjustment in variable revenue may be allowed based upon changes in production cost conditions. Less than 6% of the Company’s revenue is recognized from the tangible sales of steel and/or steel by-products and is earned point in time. These sales consist of sale of slag and scrap metal on behalf of, or directly back to, the Company’s steel mill customers, mixed with minimal third-party sales for the Company’s benefit. Sales, value add, and other taxes which the Company collects concurrent with income-producing activities are excluded from revenue. June 30, December 31, 2025 2024 (Unaudited) Employee compensation, benefits, and withholdings 9,021$ 9,968$ Professional Services 5,051 2,953 Other (none of which is individually significant) 11,424 8,960 Total Accrued Expenses 25,496$ 21,881$

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 10 7. Income Taxes We compute income tax expense for each quarter based on the estimated annual effective tax rate for the year, adjusted for certain discrete items. Our effective tax rate typically differs from the federal statutory tax rate due to business operations in foreign jurisdictions and the mixture of earnings attributed to those operations, Brazilian SUDENE tax holiday currently in effect, local country withholding tax obligations, and current period movement in existing uncertain tax positions. On July 4, 2025, H.R. 1, commonly known as the One Big Beautiful Bill Act (the “OBBB”), was signed into law. This includes significant changes to the federal corporate tax provisions and extends certain otherwise expiring provisions of the 2017 Tax Cuts and Jobs Act. Among other things, the legislation restores 100% bonus depreciation for eligible property, reinstates expensing for domestic research and experimental expenditures, imposes new limitations on interest expense deductibility, and expands disallowed deductions for certain employee remuneration. The OBBB also includes provisions that could impact our international business and which are still being evaluated. ASU 2023-09 Income Taxes (Topic 740) requires the effects of changes in tax rates and laws on deferred tax balances to be recognized in the period in which the relevant legislation is enacted. The OBBB was passed subsequent to the date of our financial statements and may affect the Company’s tax assets and liabilities in future periods. During the six months ended June 30, 2025 income tax expense was $1.5 million compared to $3.8 million for the same period in 2024. For the six months ended June 30, 2025, the effective tax rate was -13.9% compared to -32.6% for the same period in 2024. The change in the effective tax rate was primarily due to local country withholding tax obligations and movement in existing uncertain tax positions. 8. Derivatives The Company has operations in multiple international locations and generates income from operations in multiple currencies, principally the Brazilian real and South African rand. Therefore, the Company has risk exposure to unfavorable changes in the foreign currencies, with a resulting impact on its financial performance denominated in U.S. dollars. The Company’s risk management policy permits the use of derivatives to manage this exposure.

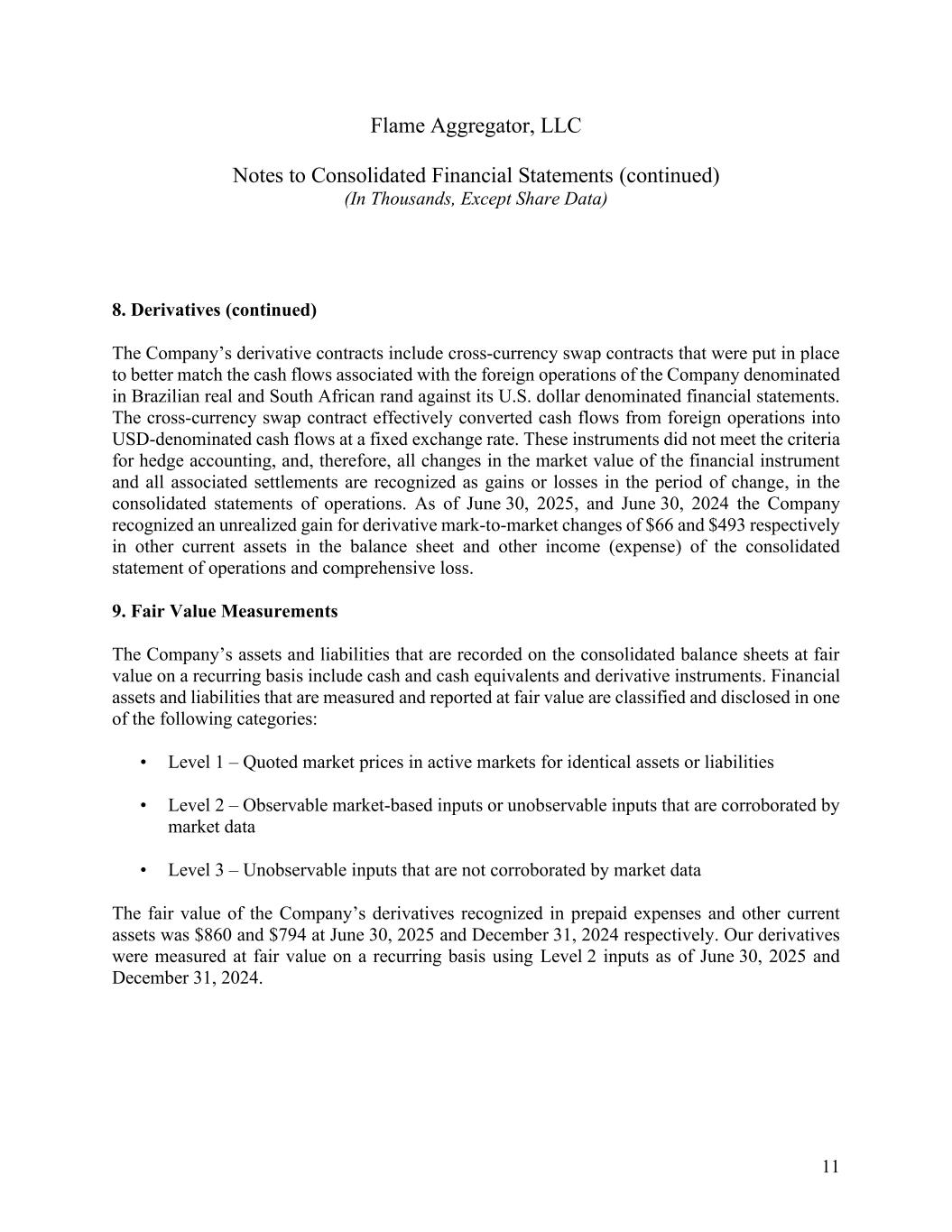

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 11 8. Derivatives (continued) The Company’s derivative contracts include cross-currency swap contracts that were put in place to better match the cash flows associated with the foreign operations of the Company denominated in Brazilian real and South African rand against its U.S. dollar denominated financial statements. The cross-currency swap contract effectively converted cash flows from foreign operations into USD-denominated cash flows at a fixed exchange rate. These instruments did not meet the criteria for hedge accounting, and, therefore, all changes in the market value of the financial instrument and all associated settlements are recognized as gains or losses in the period of change, in the consolidated statements of operations. As of June 30, 2025, and June 30, 2024 the Company recognized an unrealized gain for derivative mark-to-market changes of $66 and $493 respectively in other current assets in the balance sheet and other income (expense) of the consolidated statement of operations and comprehensive loss. 9. Fair Value Measurements The Company’s assets and liabilities that are recorded on the consolidated balance sheets at fair value on a recurring basis include cash and cash equivalents and derivative instruments. Financial assets and liabilities that are measured and reported at fair value are classified and disclosed in one of the following categories: • Level 1 – Quoted market prices in active markets for identical assets or liabilities • Level 2 – Observable market-based inputs or unobservable inputs that are corroborated by market data • Level 3 – Unobservable inputs that are not corroborated by market data The fair value of the Company’s derivatives recognized in prepaid expenses and other current assets was $860 and $794 at June 30, 2025 and December 31, 2024 respectively. Our derivatives were measured at fair value on a recurring basis using Level 2 inputs as of June 30, 2025 and December 31, 2024.

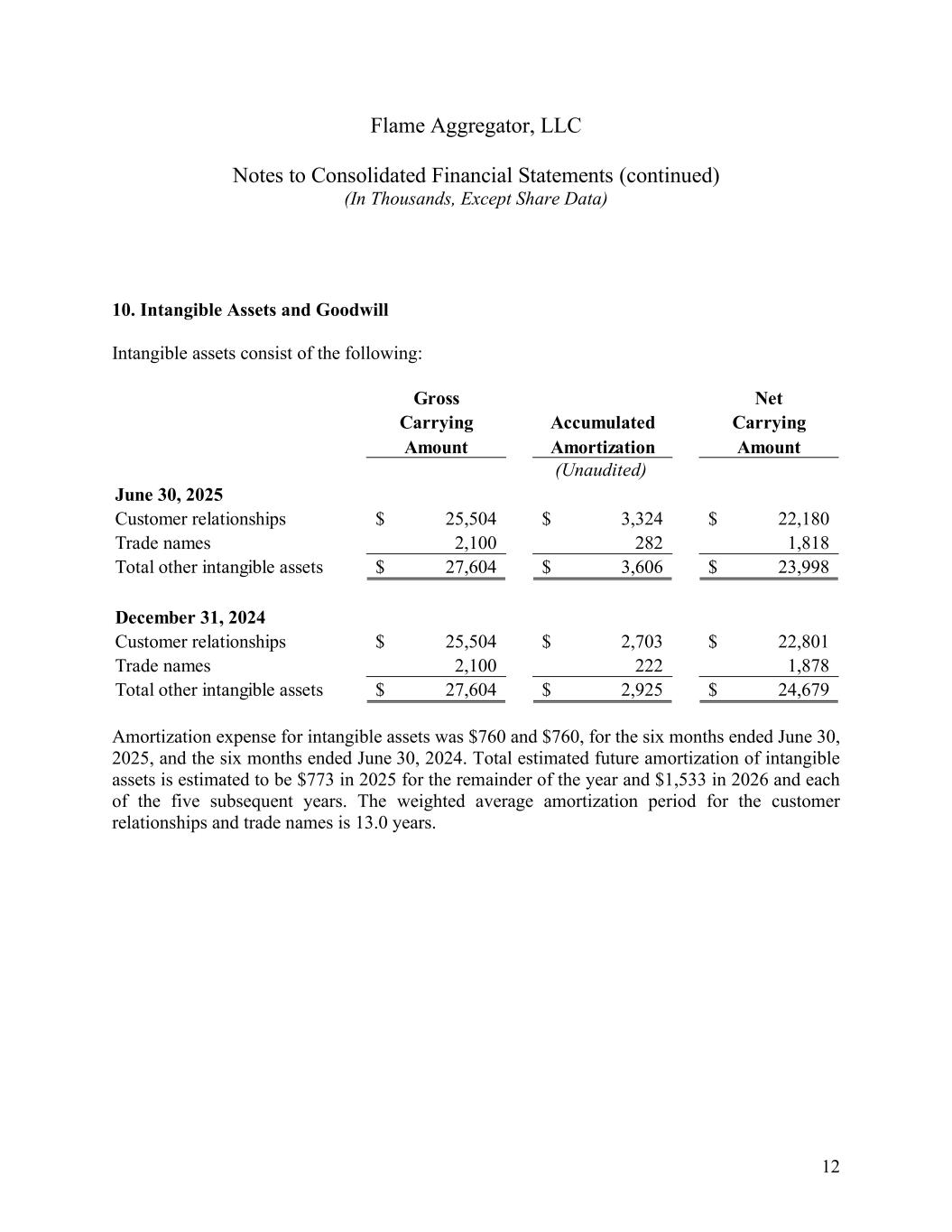

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 12 10. Intangible Assets and Goodwill Intangible assets consist of the following: Amortization expense for intangible assets was $760 and $760, for the six months ended June 30, 2025, and the six months ended June 30, 2024. Total estimated future amortization of intangible assets is estimated to be $773 in 2025 for the remainder of the year and $1,533 in 2026 and each of the five subsequent years. The weighted average amortization period for the customer relationships and trade names is 13.0 years. Gross Net Carrying Accumulated Carrying Amount Amortization Amount June 30, 2025 Customer relationships 25,504$ 3,324$ 22,180$ Trade names 2,100 282 1,818 Total other intangible assets 27,604$ 3,606$ 23,998$ December 31, 2024 Customer relationships 25,504$ 2,703$ 22,801$ Trade names 2,100 222 1,878 Total other intangible assets 27,604$ 2,925$ 24,679$ (Unaudited)

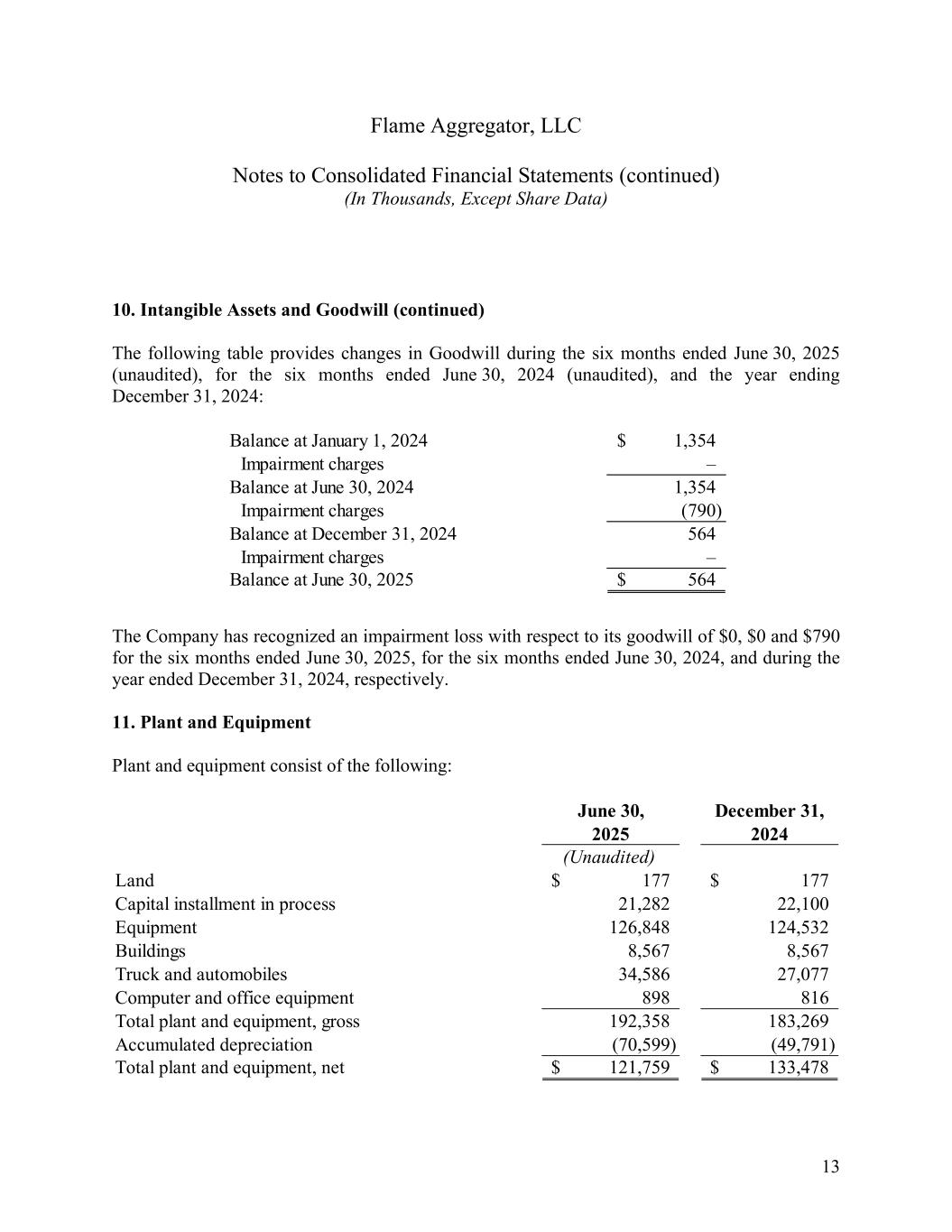

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 13 10. Intangible Assets and Goodwill (continued) The following table provides changes in Goodwill during the six months ended June 30, 2025 (unaudited), for the six months ended June 30, 2024 (unaudited), and the year ending December 31, 2024: The Company has recognized an impairment loss with respect to its goodwill of $0, $0 and $790 for the six months ended June 30, 2025, for the six months ended June 30, 2024, and during the year ended December 31, 2024, respectively. 11. Plant and Equipment Plant and equipment consist of the following: Balance at January 1, 2024 1,354$ Impairment charges – Balance at June 30, 2024 1,354 Impairment charges (790) Balance at December 31, 2024 564 Impairment charges – Balance at June 30, 2025 564$ June 30, December 31, 2025 2024 (Unaudited) Land 177$ 177$ Capital installment in process 21,282 22,100 Equipment 126,848 124,532 Buildings 8,567 8,567 Truck and automobiles 34,586 27,077 Computer and office equipment 898 816 Total plant and equipment, gross 192,358 183,269 Accumulated depreciation (70,599) (49,791) Total plant and equipment, net 121,759$ 133,478$

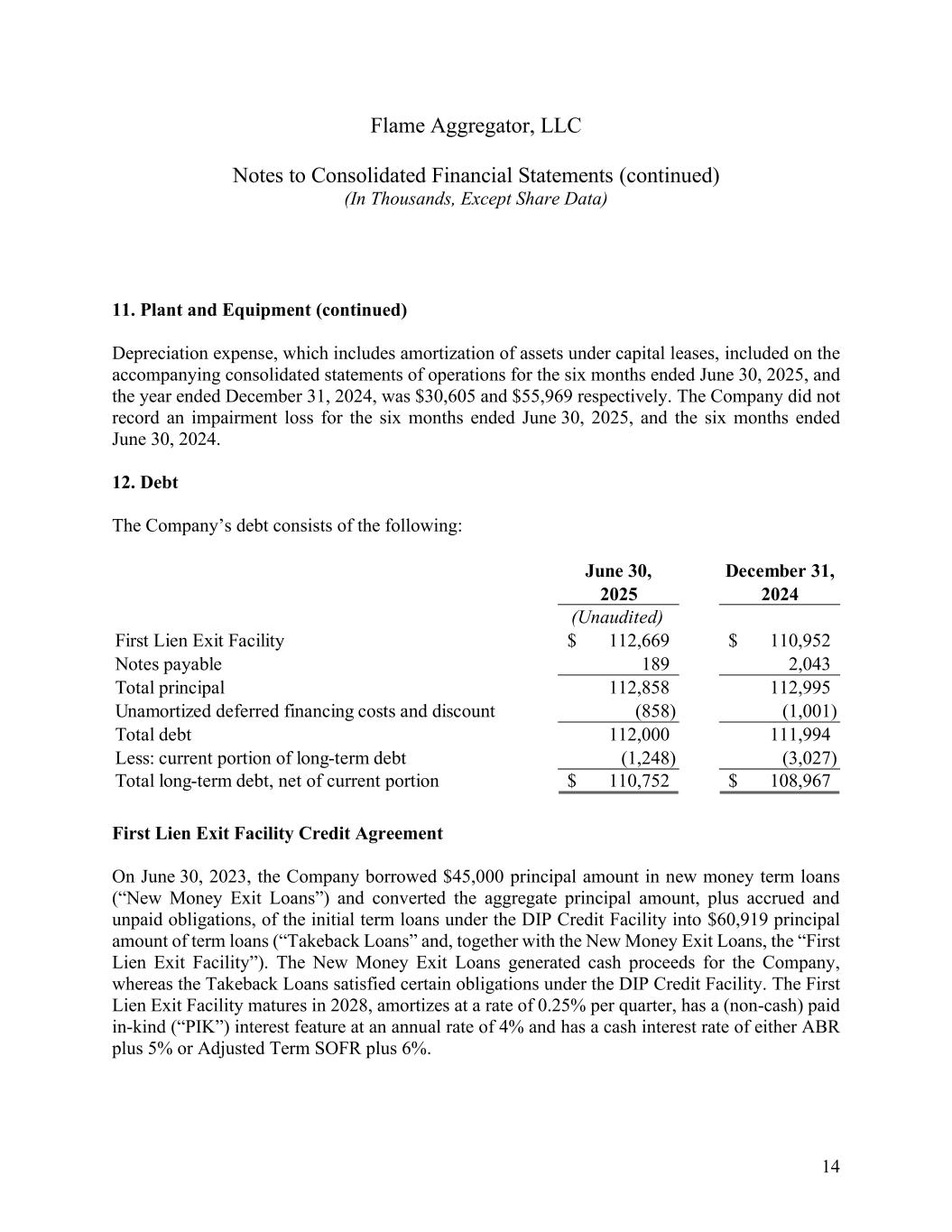

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 14 11. Plant and Equipment (continued) Depreciation expense, which includes amortization of assets under capital leases, included on the accompanying consolidated statements of operations for the six months ended June 30, 2025, and the year ended December 31, 2024, was $30,605 and $55,969 respectively. The Company did not record an impairment loss for the six months ended June 30, 2025, and the six months ended June 30, 2024. 12. Debt The Company’s debt consists of the following: First Lien Exit Facility Credit Agreement On June 30, 2023, the Company borrowed $45,000 principal amount in new money term loans (“New Money Exit Loans”) and converted the aggregate principal amount, plus accrued and unpaid obligations, of the initial term loans under the DIP Credit Facility into $60,919 principal amount of term loans (“Takeback Loans” and, together with the New Money Exit Loans, the “First Lien Exit Facility”). The New Money Exit Loans generated cash proceeds for the Company, whereas the Takeback Loans satisfied certain obligations under the DIP Credit Facility. The First Lien Exit Facility matures in 2028, amortizes at a rate of 0.25% per quarter, has a (non-cash) paid in-kind (“PIK”) interest feature at an annual rate of 4% and has a cash interest rate of either ABR plus 5% or Adjusted Term SOFR plus 6%. June 30, December 31, 2025 2024 (Unaudited) First Lien Exit Facility 112,669$ 110,952$ Notes payable 189 2,043 Total principal 112,858 112,995 Unamortized deferred financing costs and discount (858) (1,001) Total debt 112,000 111,994 Less: current portion of long-term debt (1,248) (3,027) Total long-term debt, net of current portion 110,752$ 108,967$

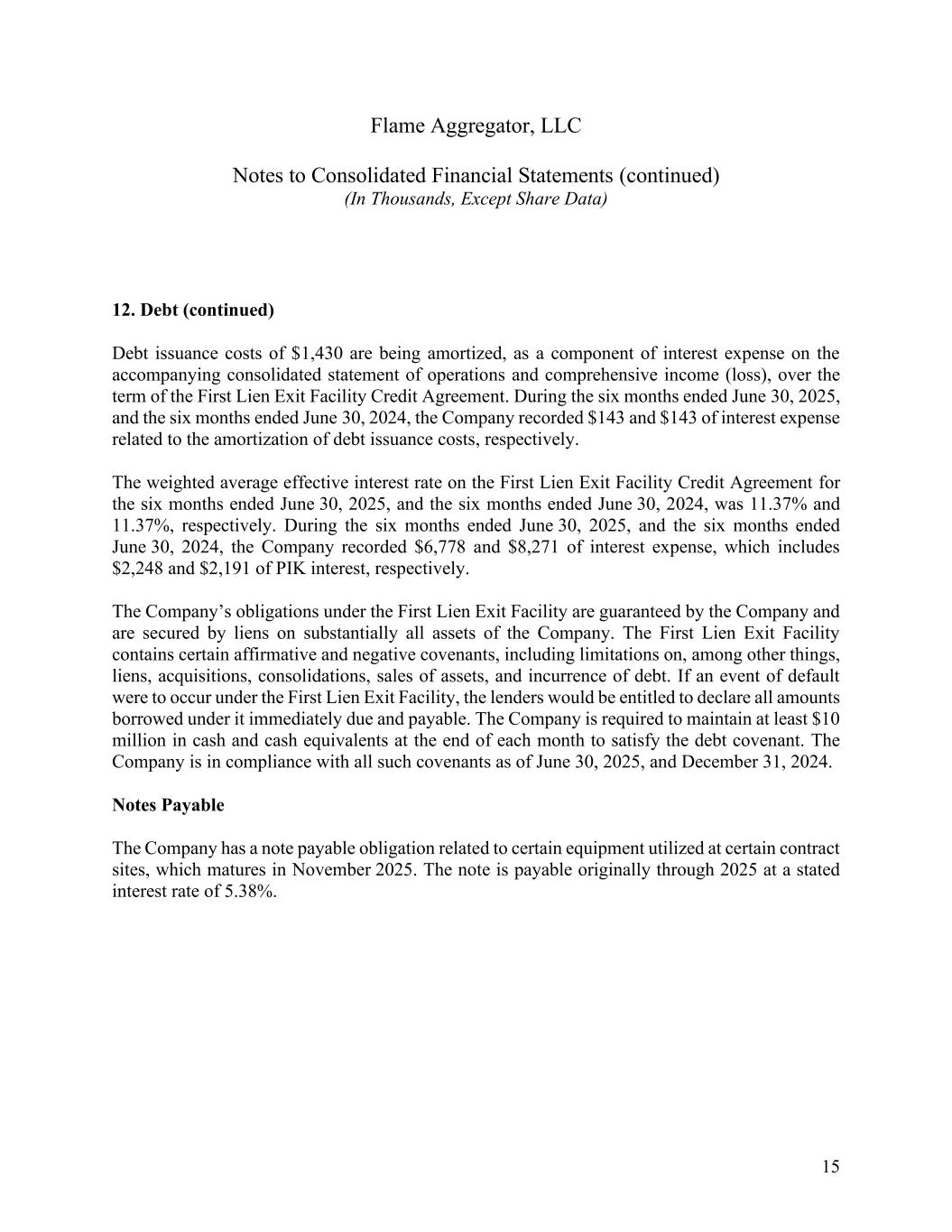

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 15 12. Debt (continued) Debt issuance costs of $1,430 are being amortized, as a component of interest expense on the accompanying consolidated statement of operations and comprehensive income (loss), over the term of the First Lien Exit Facility Credit Agreement. During the six months ended June 30, 2025, and the six months ended June 30, 2024, the Company recorded $143 and $143 of interest expense related to the amortization of debt issuance costs, respectively. The weighted average effective interest rate on the First Lien Exit Facility Credit Agreement for the six months ended June 30, 2025, and the six months ended June 30, 2024, was 11.37% and 11.37%, respectively. During the six months ended June 30, 2025, and the six months ended June 30, 2024, the Company recorded $6,778 and $8,271 of interest expense, which includes $2,248 and $2,191 of PIK interest, respectively. The Company’s obligations under the First Lien Exit Facility are guaranteed by the Company and are secured by liens on substantially all assets of the Company. The First Lien Exit Facility contains certain affirmative and negative covenants, including limitations on, among other things, liens, acquisitions, consolidations, sales of assets, and incurrence of debt. If an event of default were to occur under the First Lien Exit Facility, the lenders would be entitled to declare all amounts borrowed under it immediately due and payable. The Company is required to maintain at least $10 million in cash and cash equivalents at the end of each month to satisfy the debt covenant. The Company is in compliance with all such covenants as of June 30, 2025, and December 31, 2024. Notes Payable The Company has a note payable obligation related to certain equipment utilized at certain contract sites, which matures in November 2025. The note is payable originally through 2025 at a stated interest rate of 5.38%.

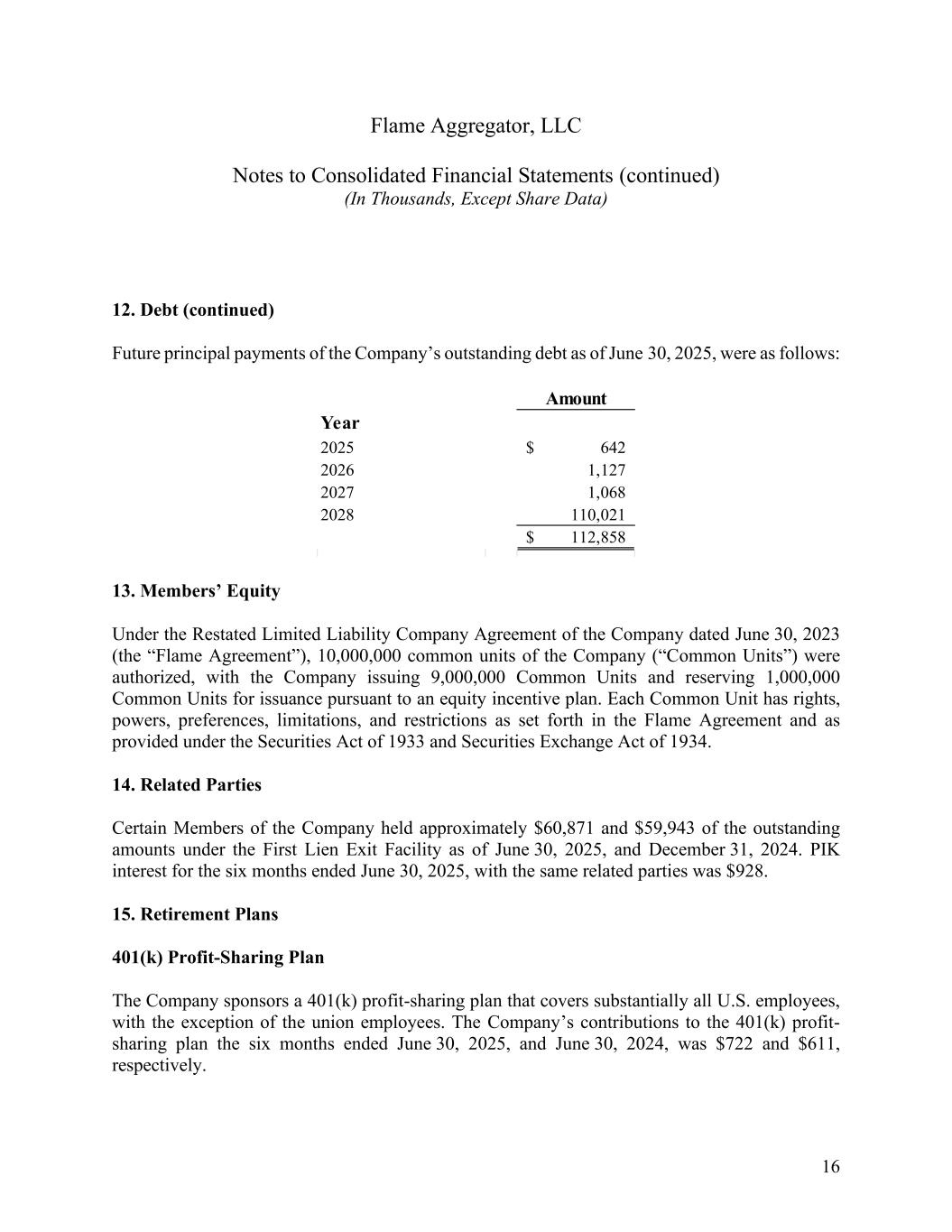

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 16 12. Debt (continued) Future principal payments of the Company’s outstanding debt as of June 30, 2025, were as follows: 13. Members’ Equity Under the Restated Limited Liability Company Agreement of the Company dated June 30, 2023 (the “Flame Agreement”), 10,000,000 common units of the Company (“Common Units”) were authorized, with the Company issuing 9,000,000 Common Units and reserving 1,000,000 Common Units for issuance pursuant to an equity incentive plan. Each Common Unit has rights, powers, preferences, limitations, and restrictions as set forth in the Flame Agreement and as provided under the Securities Act of 1933 and Securities Exchange Act of 1934. 14. Related Parties Certain Members of the Company held approximately $60,871 and $59,943 of the outstanding amounts under the First Lien Exit Facility as of June 30, 2025, and December 31, 2024. PIK interest for the six months ended June 30, 2025, with the same related parties was $928. 15. Retirement Plans 401(k) Profit-Sharing Plan The Company sponsors a 401(k) profit-sharing plan that covers substantially all U.S. employees, with the exception of the union employees. The Company’s contributions to the 401(k) profit- sharing plan the six months ended June 30, 2025, and June 30, 2024, was $722 and $611, respectively. Amount Year 2025 642$ 2026 1,127 2027 1,068 2028 110,021 112,858$

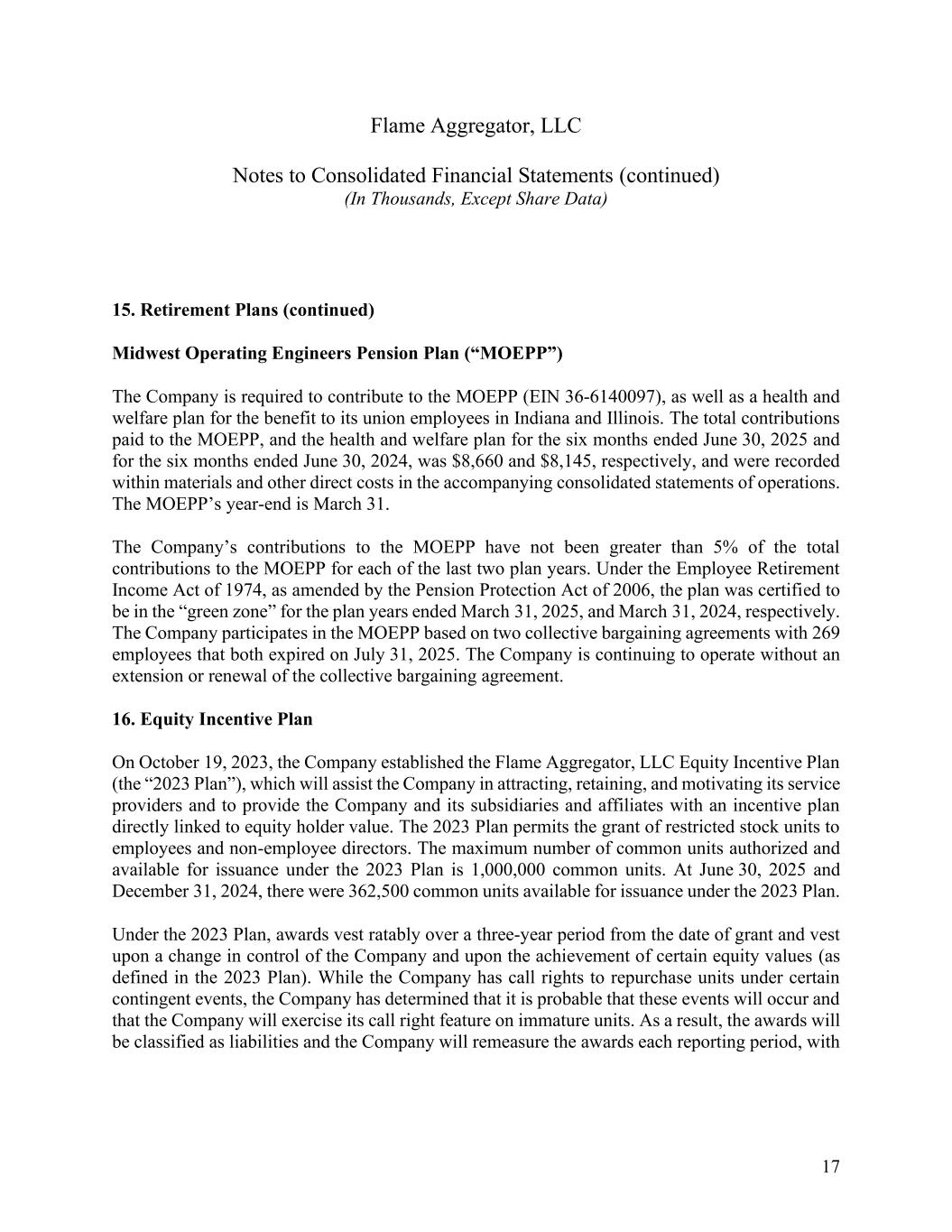

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 17 15. Retirement Plans (continued) Midwest Operating Engineers Pension Plan (“MOEPP”) The Company is required to contribute to the MOEPP (EIN 36-6140097), as well as a health and welfare plan for the benefit to its union employees in Indiana and Illinois. The total contributions paid to the MOEPP, and the health and welfare plan for the six months ended June 30, 2025 and for the six months ended June 30, 2024, was $8,660 and $8,145, respectively, and were recorded within materials and other direct costs in the accompanying consolidated statements of operations. The MOEPP’s year-end is March 31. The Company’s contributions to the MOEPP have not been greater than 5% of the total contributions to the MOEPP for each of the last two plan years. Under the Employee Retirement Income Act of 1974, as amended by the Pension Protection Act of 2006, the plan was certified to be in the “green zone” for the plan years ended March 31, 2025, and March 31, 2024, respectively. The Company participates in the MOEPP based on two collective bargaining agreements with 269 employees that both expired on July 31, 2025. The Company is continuing to operate without an extension or renewal of the collective bargaining agreement. 16. Equity Incentive Plan On October 19, 2023, the Company established the Flame Aggregator, LLC Equity Incentive Plan (the “2023 Plan”), which will assist the Company in attracting, retaining, and motivating its service providers and to provide the Company and its subsidiaries and affiliates with an incentive plan directly linked to equity holder value. The 2023 Plan permits the grant of restricted stock units to employees and non-employee directors. The maximum number of common units authorized and available for issuance under the 2023 Plan is 1,000,000 common units. At June 30, 2025 and December 31, 2024, there were 362,500 common units available for issuance under the 2023 Plan. Under the 2023 Plan, awards vest ratably over a three-year period from the date of grant and vest upon a change in control of the Company and upon the achievement of certain equity values (as defined in the 2023 Plan). While the Company has call rights to repurchase units under certain contingent events, the Company has determined that it is probable that these events will occur and that the Company will exercise its call right feature on immature units. As a result, the awards will be classified as liabilities and the Company will remeasure the awards each reporting period, with

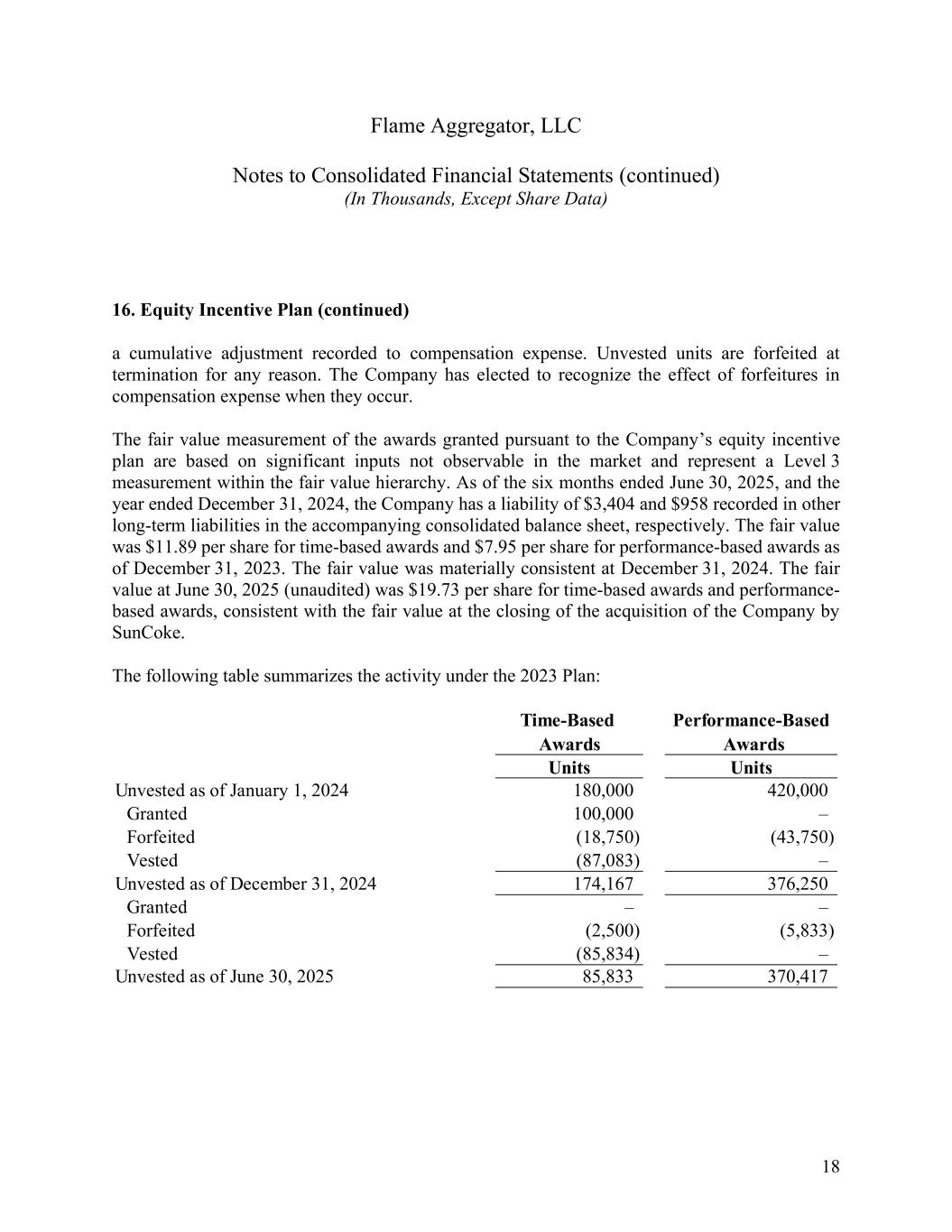

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 18 16. Equity Incentive Plan (continued) a cumulative adjustment recorded to compensation expense. Unvested units are forfeited at termination for any reason. The Company has elected to recognize the effect of forfeitures in compensation expense when they occur. The fair value measurement of the awards granted pursuant to the Company’s equity incentive plan are based on significant inputs not observable in the market and represent a Level 3 measurement within the fair value hierarchy. As of the six months ended June 30, 2025, and the year ended December 31, 2024, the Company has a liability of $3,404 and $958 recorded in other long-term liabilities in the accompanying consolidated balance sheet, respectively. The fair value was $11.89 per share for time-based awards and $7.95 per share for performance-based awards as of December 31, 2023. The fair value was materially consistent at December 31, 2024. The fair value at June 30, 2025 (unaudited) was $19.73 per share for time-based awards and performance- based awards, consistent with the fair value at the closing of the acquisition of the Company by SunCoke. The following table summarizes the activity under the 2023 Plan: Time-Based Performance-Based Awards Awards Units Units Unvested as of January 1, 2024 180,000 420,000 Granted 100,000 – Forfeited (18,750) (43,750) Vested (87,083) – Unvested as of December 31, 2024 174,167 376,250 Granted – – Forfeited (2,500) (5,833) Vested (85,834) – Unvested as of June 30, 2025 85,833 370,417

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 19 16. Equity Incentive Plan (continued) The Company utilizes estimates and assumptions in determining the fair value of each award on the date of grant. The Company estimated their fair value using the Monte Carlo Simulation approach. Estimates and assumptions that require the Company’s judgment include several objective and subjective factors, including probability weighting of events, volatility, time to an exit event, a risk-free interest rate, and a discount for lack of marketability. Changes to the key assumptions used in the valuations could result in different fair values at each valuation date. For the time-based restricted stock unit awards, the Company recorded $2,446 and $461 of compensation expense for the six months ended June 30, 2025, and the six months ended June 30, 2024, respectively, which is included in General and administrative expenses on the accompanying consolidated statement of operations and comprehensive income (loss). As of June 30, 2025 and December 31, 2024, there was $1,702 and $2,100, respectively of unrecognized compensation expense for the time-based awards, which is expected to be recognized over an estimated period of 1.0 years and 1.5 years, respectively. For the restricted stock unit awards where vesting is dependent upon achieving certain performance conditions, the Company has determined that it is not probable that the performance conditions will be achieved and, as such, has not recognized any compensation expense during the six months ended June 30, 2025, and the six months ended June 30, 2024. As of June 30, 2025, and December 31, 2024, there was approximately $7.3 million and $3.0 million of unrecognized compensation expense. 17. Commitments and Contingencies In the ordinary course of business, the Company or its subsidiaries may be named a party to claims and/or legal proceedings. Neither the Company nor its subsidiaries have been named in and are not aware of any matters which management believes will result, either individually or in the aggregate, in a material adverse effect to its financial condition or results of operations. The Company employs 19 employees at a site facility in Illinois who are covered members of the Midwest Operating Engineers Local #150. This collective bargaining agreement expired on July 31, 2025. The Company employs 250 employees at site facilities in Indiana who are covered members of the Midwest Operating Engineers Local #150. This collective bargaining agreement contract extends to a term ending July 31, 2025. The Company is continuing to operate without an extension or renewal of the collective bargaining agreement.

Flame Aggregator, LLC Notes to Consolidated Financial Statements (continued) (In Thousands, Except Share Data) 20 17. Commitments and Contingencies (continued) The Company closed on the sale of its former French businesses in 2023. Due to the inherent complexity of multiple French entities, including the timing for completion of liquidation, the ultimate cash proceeds from the sale cannot be precisely estimated at this time nor does the Company anticipate any additional obligations from the divestiture. Accordingly, no amounts for the proceeds or additional obligations have been reflected in the accompanying consolidated financial statements, as such amounts are not both probable and reasonably estimated. 18. Subsequent Events The Company evaluated, for potential recognition and disclosure, events that occurred prior to the issuance of the accompanying consolidated financial statements through October 16, 2025.