SunCoke Energy, Inc. Q3 2025 Earnings Conference Call

2 2Forward-Looking Statements This presentation should be reviewed in conjunction with the third quarter 2025 earnings release of SunCoke Energy, Inc. (SunCoke) and conference call held on November 4, 2025 at 11:00 a.m. ET. This presentation contains “forward-looking statements” (as defined in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended). Forward-looking statements often may be identified by the use of such words as "believe," "expect," "plan," "project," "intend," "anticipate," "estimate," "predict," "potential," "continue," "may," "will," "should," or the negative of these terms, or similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Any statements made in this presentation or during the related conference call that are not statements of historical fact, including statements about our full-year consolidated and segment 2025 guidance, our 2025 key initiatives, future dividends and the timing of such dividend payments, anticipated transaction benefits and synergies of the Phoenix Global acquisition and expected timing of Phoenix Global's integration, the intended hosting and timing of any investor conferences, the effect of restrictive trade regulations, including tariffs, on us or our major customers, business partners and/or suppliers, and expected future financial performance are forward-looking statements and should be evaluated as such. Forward-looking statements represent only our present beliefs regarding future events, many of which are inherently uncertain and involve significant known and unknown risks and uncertainties (many of which are beyond the control of SunCoke) that could cause our actual results and financial condition to differ materially from the anticipated results and financial condition indicated in such forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and uncertainties described in Item 1A (“Risk Factors”) of our Annual Report on Form 10- K for the most recently completed fiscal year, as well as those described from time to time in our other reports and filings with the Securities and Exchange Commission (SEC). In accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, SunCoke has included in its filings with the SEC cautionary language identifying important factors (but not necessarily all the important factors) that could cause actual results to differ materially from those expressed in any forward-looking statement made by SunCoke. For information concerning these factors and other important information regarding the matters discussed in this presentation, see SunCoke’s SEC filings, copies of which are available free of charge on SunCoke's website at www.suncoke.com or on the SEC’s website at www.sec.gov. All forward-looking statements included in this presentation or made during the related conference call are expressly qualified in their entirety by such cautionary statements. Unpredictable or unknown factors not discussed in this presentation also could have material adverse effects on forward-looking statements. Forward-looking statements are not guarantees of future performance, but are based upon the current knowledge, beliefs and expectations of SunCoke management, and upon assumptions by SunCoke concerning future conditions, any or all of which ultimately may prove to be inaccurate. You should not place undue reliance on these forward-looking statements, which speak only as of the date of the earnings release. SunCoke does not intend, and expressly disclaims any obligation, to update or alter its forward-looking statements (or associated cautionary language), whether as a result of new information, future events, or otherwise, after the date of the earnings release except as required by applicable law.

3 3Q3 2025 Highlights ✓ Delivered Q3 '25 Consolidated Adjusted EBITDA(1) of $59.1M ✓ Completed the acquisition of Phoenix Global on August 1st, 2025 ➢ Integration progressing well, expect to start recognizing synergies in 2026 ➢ Results of Phoenix Global reported under the new Industrial Services segment, which also includes former Logistics segment ✓ Extended Granite City cokemaking contract with U.S. Steel through December 31st, 2025 ✓ Declared 25th consecutive quarterly cash dividend of $0.12 per share, payable on December 1st, 2025 ✓ Updating FY 2025 Consolidated Adjusted EBITDA(1) guidance range to $220M - $225M inclusive of: ➢ Five months of Phoenix Global results ➢ Breach of contract by one of our coke customers, resulting in deferral of ~200Kt coke sales(2) ▪ Actively pursuing enforcement of contract (1) See appendix for a definition and reconciliation of Adjusted EBITDA (2) Any changes to the assumptions related to the deferral of coke sales could impact our guidance range

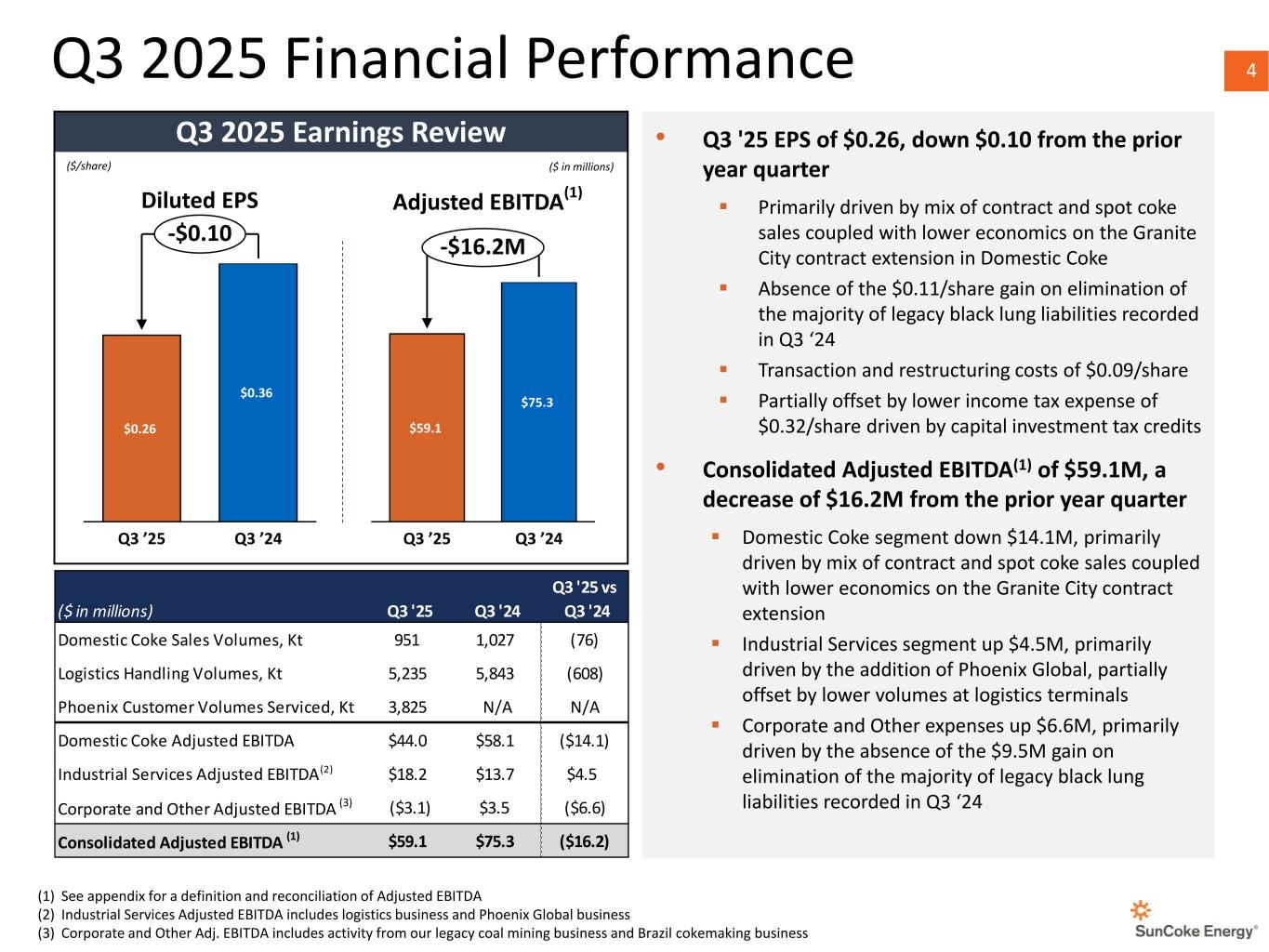

4 4Q3 2025 Financial Performance (1) See appendix for a definition and reconciliation of Adjusted EBITDA (2) Industrial Services Adjusted EBITDA includes logistics business and Phoenix Global business (3) Corporate and Other Adj. EBITDA includes activity from our legacy coal mining business and Brazil cokemaking business ($/share) ($ in millions) Adjusted EBITDA (1) $59.1 $75.3 Q3 ’25 Q3 ’24 -$16.2M Q3 2025 Earnings Review • Q3 '25 EPS of $0.26, down $0.10 from the prior year quarter ▪ Primarily driven by mix of contract and spot coke sales coupled with lower economics on the Granite City contract extension in Domestic Coke ▪ Absence of the $0.11/share gain on elimination of the majority of legacy black lung liabilities recorded in Q3 ‘24 ▪ Transaction and restructuring costs of $0.09/share ▪ Partially offset by lower income tax expense of $0.32/share driven by capital investment tax credits • Consolidated Adjusted EBITDA(1) of $59.1M, a decrease of $16.2M from the prior year quarter ▪ Domestic Coke segment down $14.1M, primarily driven by mix of contract and spot coke sales coupled with lower economics on the Granite City contract extension ▪ Industrial Services segment up $4.5M, primarily driven by the addition of Phoenix Global, partially offset by lower volumes at logistics terminals ▪ Corporate and Other expenses up $6.6M, primarily driven by the absence of the $9.5M gain on elimination of the majority of legacy black lung liabilities recorded in Q3 ‘24 $0.26 $0.36 Q3 ’25 Q3 ’24 -$0.10 Diluted EPS ($ in millions) Q3 '25 Q3 '24 Q3 '25 vs Q3 '24 Domestic Coke Sales Volumes, Kt 951 1,027 (76) Logistics Handling Volumes, Kt 5,235 5,843 (608) Phoenix Customer Volumes Serviced, Kt 3,825 N/A N/A Domestic Coke Adjusted EBITDA $44.0 $58.1 ($14.1) Industrial Services Adjusted EBITDA(2) $18.2 $13.7 $4.5 Corporate and Other Adjusted EBITDA (3) ($3.1) $3.5 ($6.6) Consolidated Adjusted EBITDA (1) $59.1 $75.3 ($16.2)

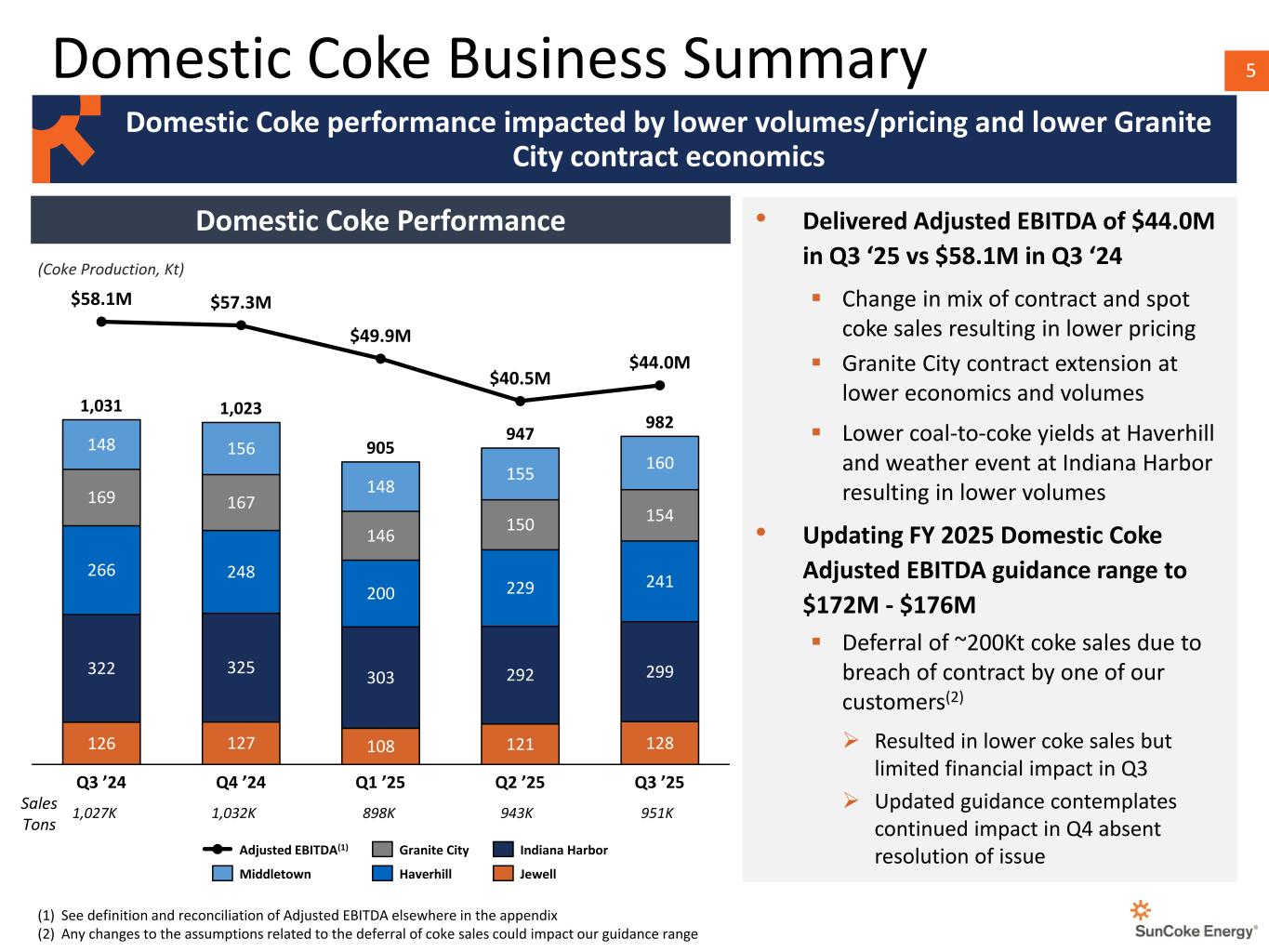

5 Domestic Coke Performance Domestic Coke Business Summary Domestic Coke performance impacted by lower volumes/pricing and lower Granite City contract economics 126 127 108 121 128 322 325 303 292 299 266 248 200 229 241 169 167 146 150 154 148 156 148 155 160 $58.1M $57.3M $49.9M $40.5M $44.0M Q3 ’24 Q4 ’24 Q1 ’25 Q2 ’25 Q3 ’25 1,031 1,023 905 947 982 Adjusted EBITDA(1) Middletown Granite City Haverhill Indiana Harbor Jewell Sales Tons (Coke Production, Kt) • Delivered Adjusted EBITDA of $44.0M in Q3 ‘25 vs $58.1M in Q3 ‘24 ▪ Change in mix of contract and spot coke sales resulting in lower pricing ▪ Granite City contract extension at lower economics and volumes ▪ Lower coal-to-coke yields at Haverhill and weather event at Indiana Harbor resulting in lower volumes • Updating FY 2025 Domestic Coke Adjusted EBITDA guidance range to $172M - $176M ▪ Deferral of ~200Kt coke sales due to breach of contract by one of our customers(2) ➢ Resulted in lower coke sales but limited financial impact in Q3 ➢ Updated guidance contemplates continued impact in Q4 absent resolution of issue (1) See definition and reconciliation of Adjusted EBITDA elsewhere in the appendix (2) Any changes to the assumptions related to the deferral of coke sales could impact our guidance range 943K1,027K 951K898K1,032K

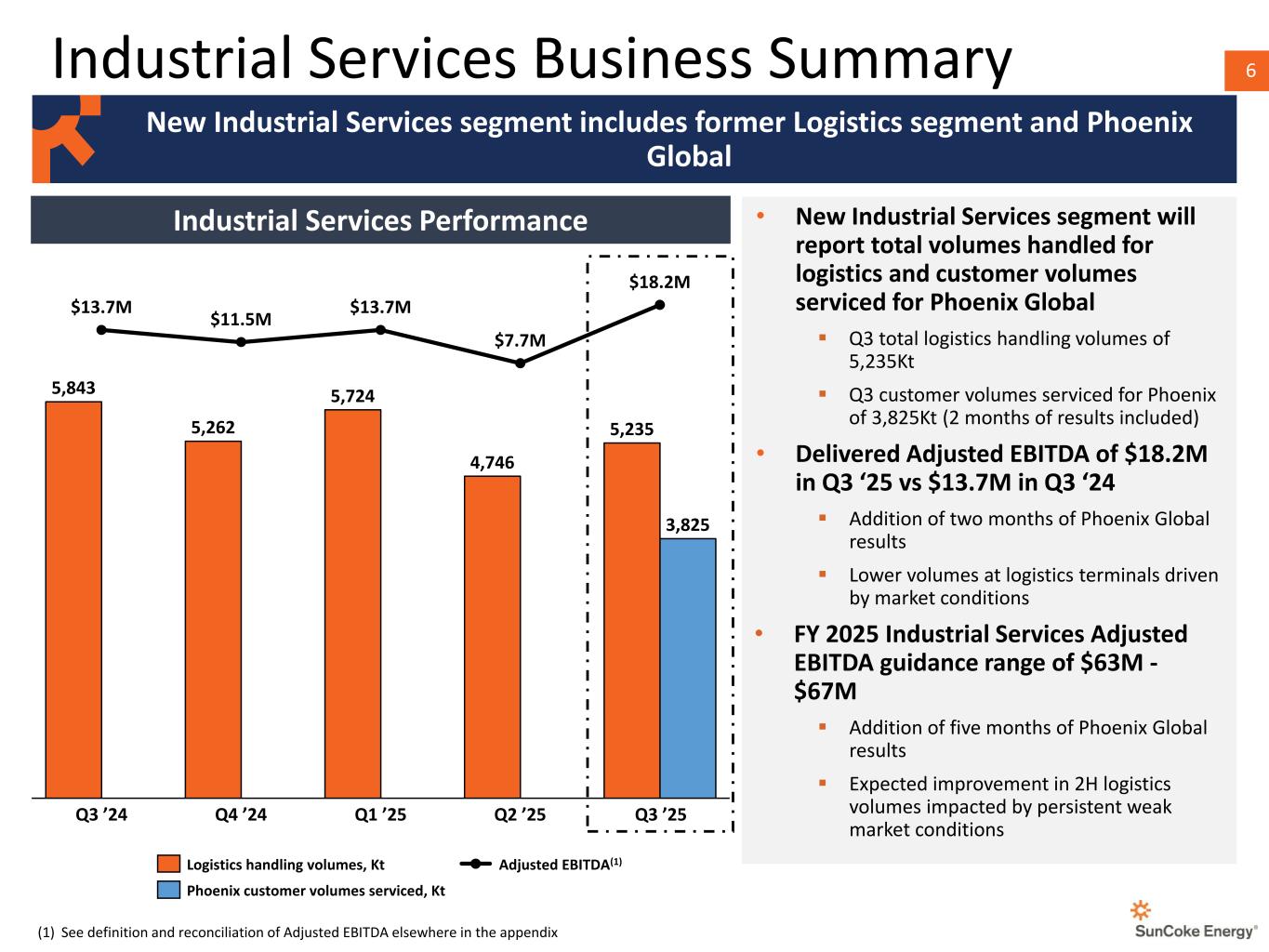

6Industrial Services Business Summary New Industrial Services segment includes former Logistics segment and Phoenix Global • New Industrial Services segment will report total volumes handled for logistics and customer volumes serviced for Phoenix Global ▪ Q3 total logistics handling volumes of 5,235Kt ▪ Q3 customer volumes serviced for Phoenix of 3,825Kt (2 months of results included) • Delivered Adjusted EBITDA of $18.2M in Q3 ‘25 vs $13.7M in Q3 ‘24 ▪ Addition of two months of Phoenix Global results ▪ Lower volumes at logistics terminals driven by market conditions • FY 2025 Industrial Services Adjusted EBITDA guidance range of $63M - $67M ▪ Addition of five months of Phoenix Global results ▪ Expected improvement in 2H logistics volumes impacted by persistent weak market conditions (1) See definition and reconciliation of Adjusted EBITDA elsewhere in the appendix Industrial Services Performance 5,843 5,262 5,724 4,746 5,235 3,825 $13.7M $11.5M $13.7M $7.7M $18.2M Q3 ’24 Q4 ’24 Q1 ’25 Q2 ’25 Q3 ’25 Logistics handling volumes, Kt Phoenix customer volumes serviced, Kt Adjusted EBITDA(1)

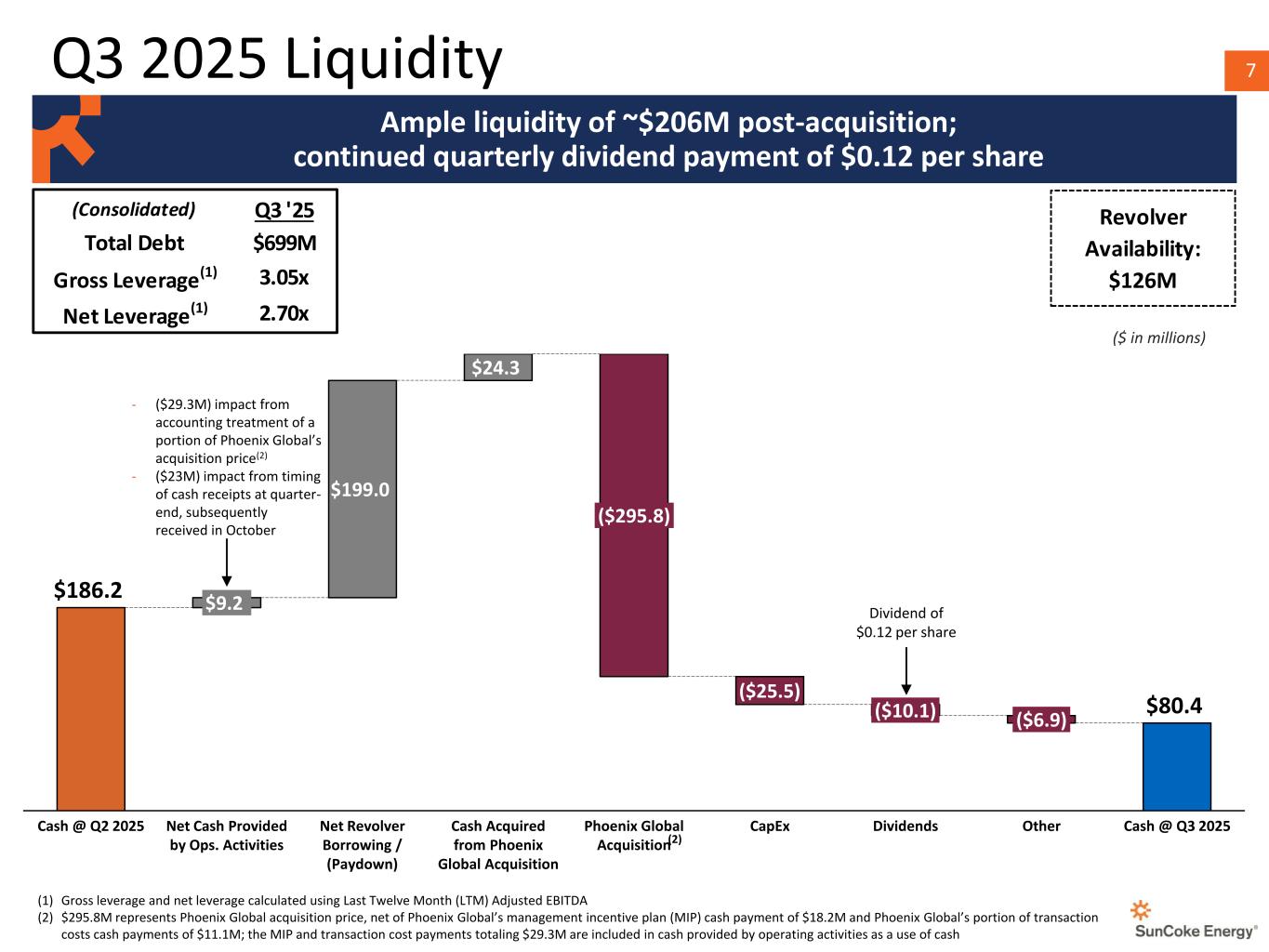

7 $186.2 $80.4 $199.0 $24.3 Cash @ Q2 2025 $9.2 Net Cash Provided by Ops. Activities Net Revolver Borrowing / (Paydown) Cash Acquired from Phoenix Global Acquisition ($295.8) Phoenix Global Acquisition ($25.5) CapEx ($10.1) Dividends ($6.9) Other Cash @ Q3 2025 (1) Gross leverage and net leverage calculated using Last Twelve Month (LTM) Adjusted EBITDA (2) $295.8M represents Phoenix Global acquisition price, net of Phoenix Global’s management incentive plan (MIP) cash payment of $18.2M and Phoenix Global’s portion of transaction costs cash payments of $11.1M; the MIP and transaction cost payments totaling $29.3M are included in cash provided by operating activities as a use of cash ($ in millions) Dividend of $0.12 per share (Consolidated) Q3 '25 Total Debt $699M Gross Leverage(1) 3.05x Net Leverage(1) 2.70x Revolver Availability: $126M Ample liquidity of ~$206M post-acquisition; continued quarterly dividend payment of $0.12 per share Q3 2025 Liquidity - ($29.3M) impact from accounting treatment of a portion of Phoenix Global’s acquisition price(2) - ($23M) impact from timing of cash receipts at quarter- end, subsequently received in October (2)

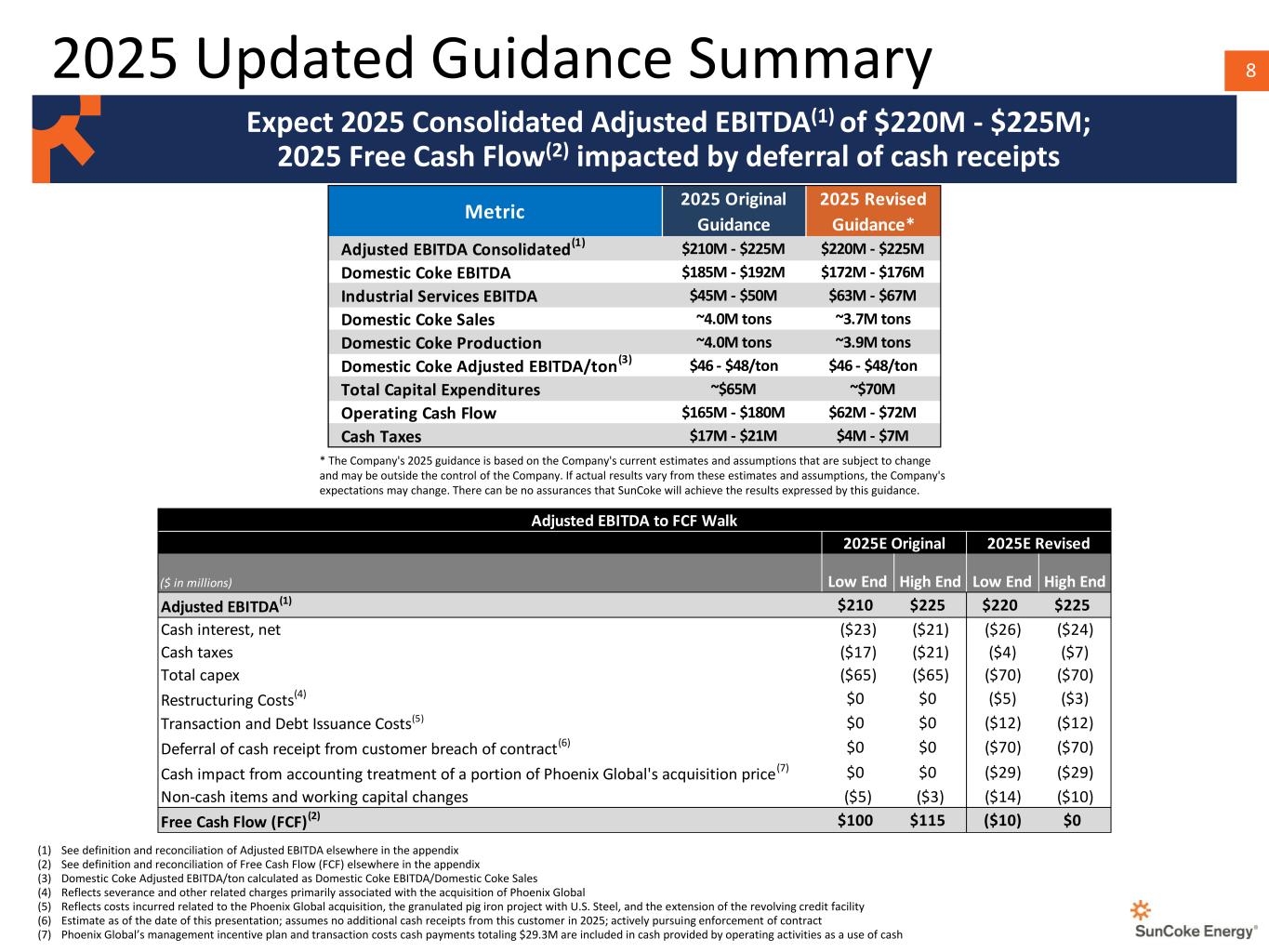

82025 Updated Guidance Summary Expect 2025 Consolidated Adjusted EBITDA(1) of $220M - $225M; 2025 Free Cash Flow(2) impacted by deferral of cash receipts (1) See definition and reconciliation of Adjusted EBITDA elsewhere in the appendix (2) See definition and reconciliation of Free Cash Flow (FCF) elsewhere in the appendix (3) Domestic Coke Adjusted EBITDA/ton calculated as Domestic Coke EBITDA/Domestic Coke Sales (4) Reflects severance and other related charges primarily associated with the acquisition of Phoenix Global (5) Reflects costs incurred related to the Phoenix Global acquisition, the granulated pig iron project with U.S. Steel, and the extension of the revolving credit facility (6) Estimate as of the date of this presentation; assumes no additional cash receipts from this customer in 2025; actively pursuing enforcement of contract (7) Phoenix Global’s management incentive plan and transaction costs cash payments totaling $29.3M are included in cash provided by operating activities as a use of cash * The Company's 2025 guidance is based on the Company's current estimates and assumptions that are subject to change and may be outside the control of the Company. If actual results vary from these estimates and assumptions, the Company's expectations may change. There can be no assurances that SunCoke will achieve the results expressed by this guidance. ($ in millions) Low End High End Low End High End Adjusted EBITDA(1) $210 $225 $220 $225 Cash interest, net ($23) ($21) ($26) ($24) Cash taxes ($17) ($21) ($4) ($7) Total capex ($65) ($65) ($70) ($70) Restructuring Costs(4) $0 $0 ($5) ($3) Transaction and Debt Issuance Costs(5) $0 $0 ($12) ($12) Deferral of cash receipt from customer breach of contract(6) $0 $0 ($70) ($70) Cash impact from accounting treatment of a portion of Phoenix Global's acquisition price(7) $0 $0 ($29) ($29) Non-cash items and working capital changes ($5) ($3) ($14) ($10) Free Cash Flow (FCF)(2) $100 $115 ($10) $0 Adjusted EBITDA to FCF Walk 2025E Revised2025E Original 2025 Original 2025 Revised Guidance Guidance* Adjusted EBITDA Consolidated(1) $210M - $225M $220M - $225M Domestic Coke EBITDA $185M - $192M $172M - $176M Industrial Services EBITDA $45M - $50M $63M - $67M Domestic Coke Sales ~4.0M tons ~3.7M tons Domestic Coke Production ~4.0M tons ~3.9M tons Domestic Coke Adjusted EBITDA/ton (3) $46 - $48/ton $46 - $48/ton Total Capital Expenditures ~$65M ~$70M Operating Cash Flow $165M - $180M $62M - $72M Cash Taxes $17M - $21M $4M - $7M Metric

9 9 • Further develop foundry and spot blast coke customer books • Expand product and customer base in Industrial Services segment Strengthen Customer Bases for Coke and Industrial Services Businesses 2025 Key Initiatives • $220M - $225M Adjusted EBITDA(1)(2) Achieve 2025 Financial Objectives Continued Safety and Environmental Excellence • Continue to deliver strong safety and environmental performance • Successfully execute on operational and capital plan • Continue to provide reliable, high-quality products and services to our customers • Successfully integrate the Phoenix Global acquisition Deliver Operational Excellence and Optimize Asset Utilization • Continue to pursue balanced capital allocation including growth opportunities, and returning capital to shareholders Execute on Well-Established Capital Allocation Priorities (1) See appendix for a definition and reconciliation of Adjusted EBITDA (2) Any changes to the assumptions related to the deferral of coke sales could impact our guidance range

APPENDIX

11 11 In order to assist readers in understanding the core operating results that our management uses to evaluate the business, we describe our non- GAAP measures referenced in this presentation below. In addition to U.S. GAAP measures, this presentation contains certain non-GAAP financial measures. These non-GAAP financial measures should not be considered as alternatives to the measures derived in accordance with U.S. GAAP. Non-GAAP financial measures have important limitations as analytical tools, and you should not consider them in isolation or as substitutes for results as reported under U.S. GAAP. Additionally, other companies may calculate non-GAAP metrics differently than we do, thereby limiting their usefulness as a comparative measure. Because of these and other limitations, you should consider our non-GAAP measures only as supplemental to other U.S. GAAP-based financial performance measures, including revenues and net income. Reconciliations to the most comparable GAAP financial measures are included at the end of this Appendix. DEFINITIONS EBITDA represents earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA represents earnings before interest, taxes, depreciation and amortization (“EBITDA”), adjusted for any impairments, restructuring costs, gains or losses on extinguishment of debt, gains or losses on derivative instruments, site closure costs and/or transaction costs ("Adjusted EBITDA"). EBITDA and Adjusted EBITDA do not represent and should not be considered alternatives to net income or operating income under U.S. GAAP and may not be comparable to other similarly titled measures in other businesses. Management believes Adjusted EBITDA is an important measure in assessing operating performance. Adjusted EBITDA provides useful information to investors because it highlights trends in our business that may not otherwise be apparent when relying solely on U.S. GAAP measures and because it eliminates items that have less bearing on our operating performance. EBITDA and Adjusted EBITDA are not measures calculated in accordance with U.S. GAAP, and they should not be considered a substitute for net income, or any other measure of financial performance presented in accordance with U.S. GAAP. Adjusted EBITDA/Ton represents Adjusted EBITDA divided by tons sold/handled. Free Cash Flow (FCF) represents operating cash flow adjusted for capital expenditures. Management believes FCF is an important measure of liquidity. FCF is not a measure calculated in accordance with GAAP, and it should not be considered a substitute for operating cash flow or any other measure of financial performance presented in accordance with GAAP. NON-GAAP FINANCIAL MEASURES

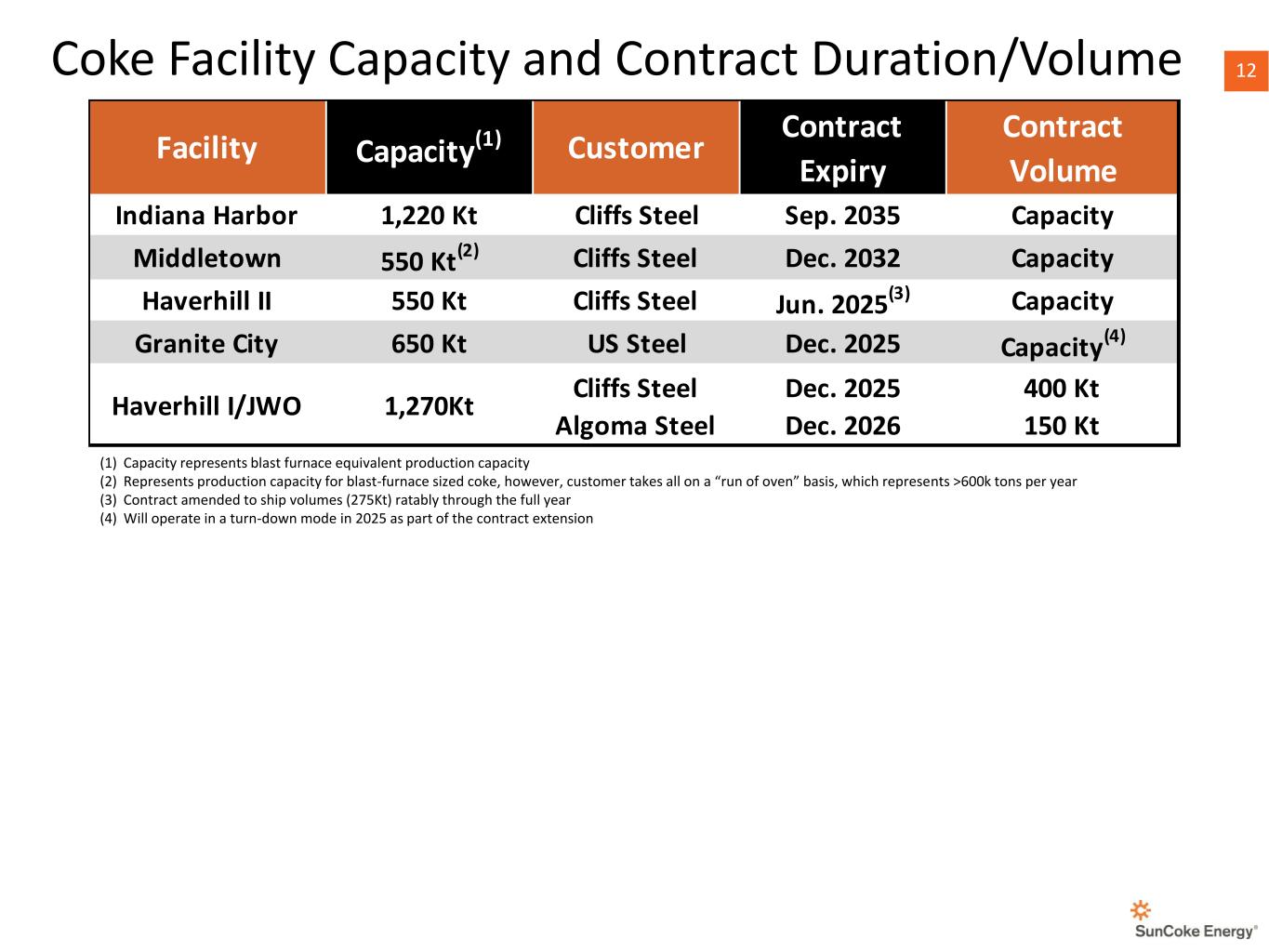

12 12Coke Facility Capacity and Contract Duration/Volume (1) Capacity represents blast furnace equivalent production capacity (2) Represents production capacity for blast-furnace sized coke, however, customer takes all on a “run of oven” basis, which represents >600k tons per year (3) Contract amended to ship volumes (275Kt) ratably through the full year (4) Will operate in a turn-down mode in 2025 as part of the contract extension Facility Capacity(1) Customer Contract Expiry Contract Volume Indiana Harbor 1,220 Kt Cliffs Steel Sep. 2035 Capacity Middletown 550 Kt(2) Cliffs Steel Dec. 2032 Capacity Haverhill II 550 Kt Cliffs Steel Jun. 2025(3) Capacity Granite City 650 Kt US Steel Dec. 2025 Capacity (4) Haverhill I/JWO 1,270Kt Cliffs Steel Algoma Steel Dec. 2025 Dec. 2026 400 Kt 150 Kt

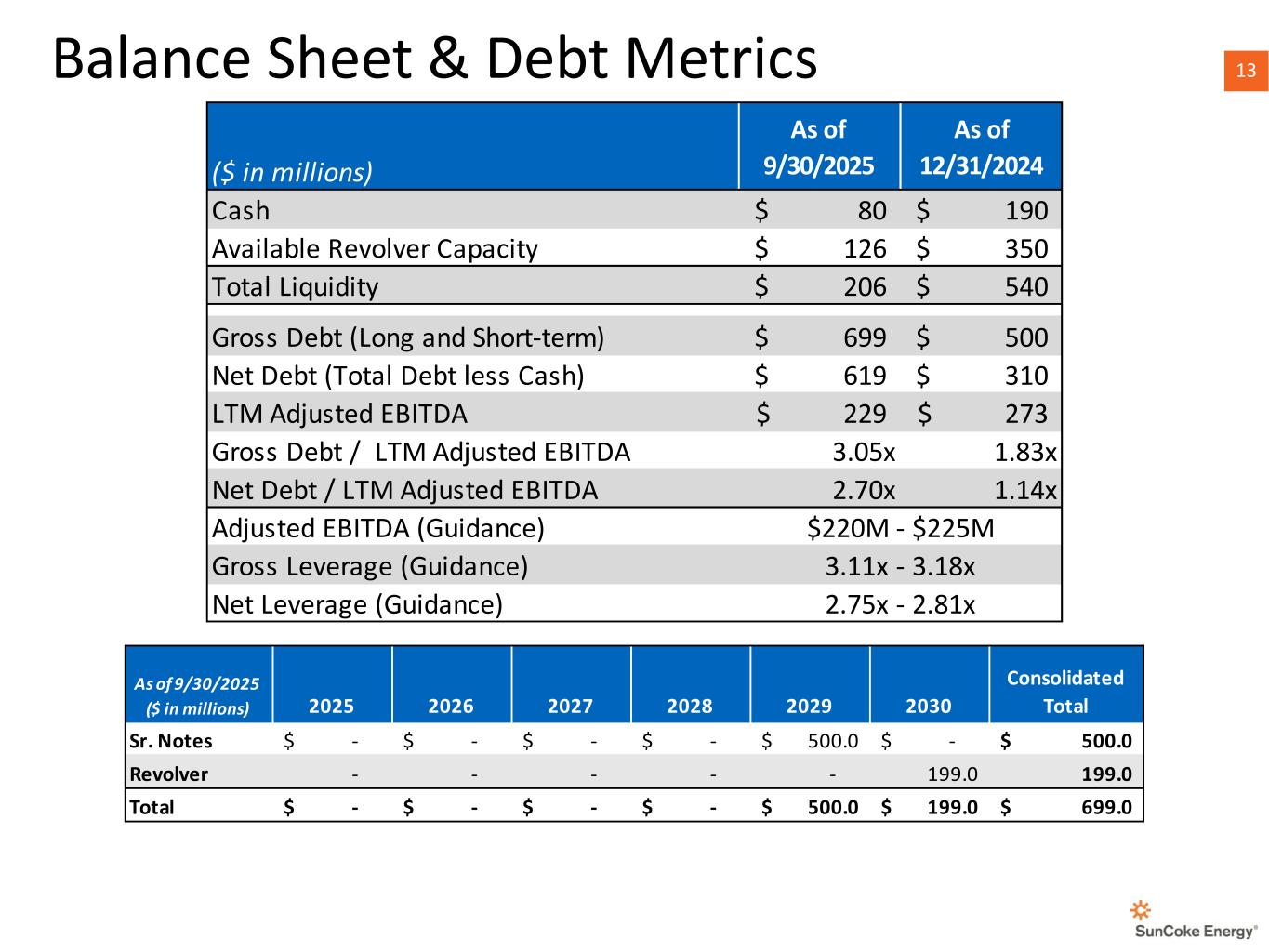

13 13Balance Sheet & Debt Metrics ($ in millions) As of 9/30/2025 As of 12/31/2024 Cash 80$ 190$ Available Revolver Capacity 126$ 350$ Total Liquidity 206$ 540$ Gross Debt (Long and Short-term) 699$ 500$ Net Debt (Total Debt less Cash) 619$ 310$ LTM Adjusted EBITDA 229$ 273$ Gross Debt / LTM Adjusted EBITDA 3.05x 1.83x Net Debt / LTM Adjusted EBITDA 2.70x 1.14x Adjusted EBITDA (Guidance) Gross Leverage (Guidance) Net Leverage (Guidance) $220M - $225M 3.11x - 3.18x 2.75x - 2.81x 2025 2026 2027 2028 2029 2030 Consolidated Total Sr. Notes -$ -$ -$ -$ 500.0$ -$ 500.0$ Revolver - - - - - 199.0 199.0 Total -$ -$ -$ -$ 500.0$ 199.0$ 699.0$ As of 9/30/2025 ($ in millions)

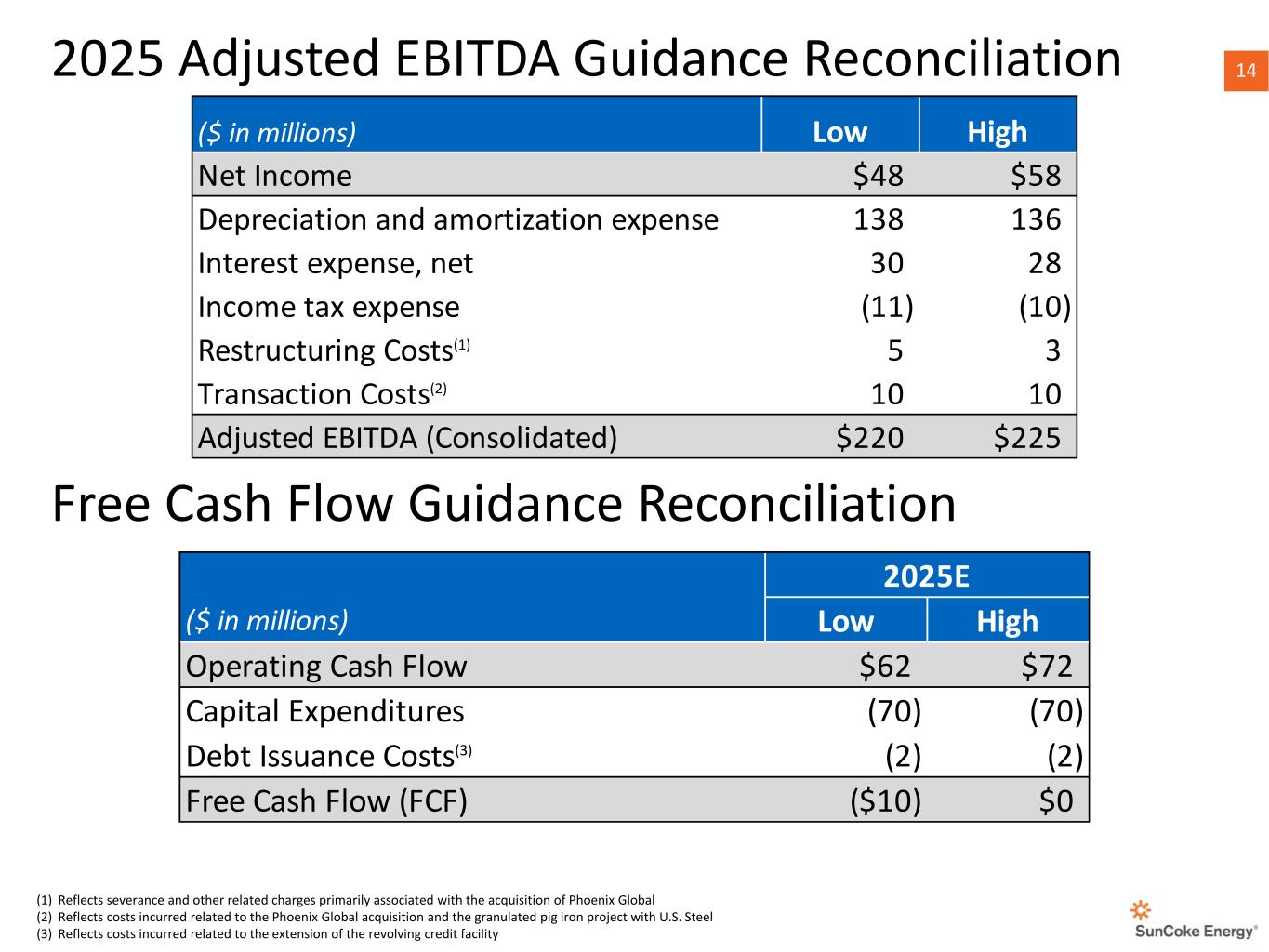

14 142025 Adjusted EBITDA Guidance Reconciliation Free Cash Flow Guidance Reconciliation (1) Reflects severance and other related charges primarily associated with the acquisition of Phoenix Global (2) Reflects costs incurred related to the Phoenix Global acquisition and the granulated pig iron project with U.S. Steel (3) Reflects costs incurred related to the extension of the revolving credit facility Low High Net Income $48 $58 Depreciation and amortization expense 138 136 Interest expense, net 30 28 Income tax expense (11) (10) Restructuring Costs(1) 5 3 Transaction Costs(2) 10 10 Adjusted EBITDA (Consolidated) $220 $225 ($ in millions) ($ in millions) Low High Operating Cash Flow $62 $72 Capital Expenditures (70) (70) Debt Issuance Costs(3) (2) (2) Free Cash Flow (FCF) ($10) $0 2025E

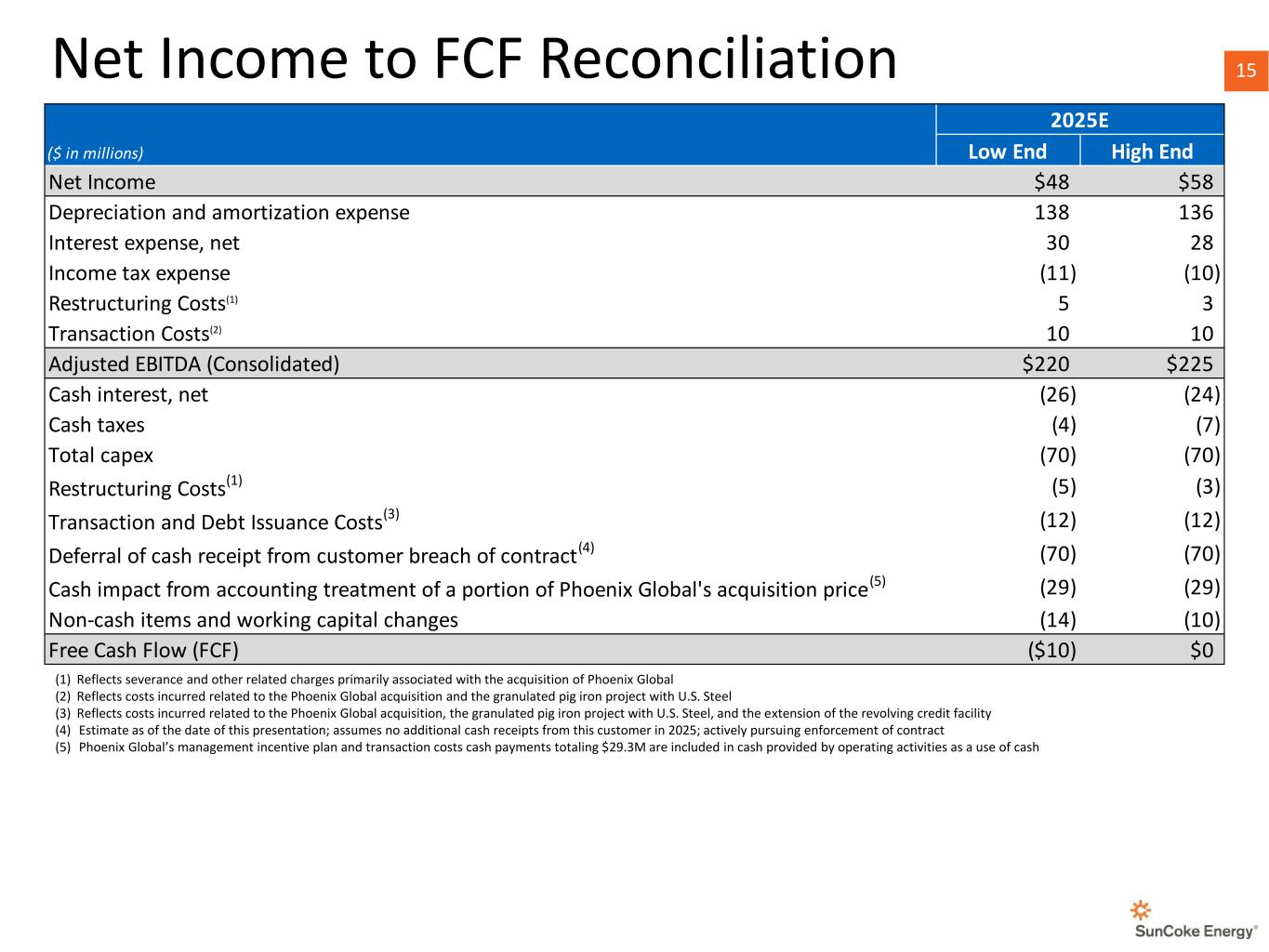

15 15Net Income to FCF Reconciliation (1) Reflects severance and other related charges primarily associated with the acquisition of Phoenix Global (2) Reflects costs incurred related to the Phoenix Global acquisition and the granulated pig iron project with U.S. Steel (3) Reflects costs incurred related to the Phoenix Global acquisition, the granulated pig iron project with U.S. Steel, and the extension of the revolving credit facility (4) Estimate as of the date of this presentation; assumes no additional cash receipts from this customer in 2025; actively pursuing enforcement of contract (5) Phoenix Global’s management incentive plan and transaction costs cash payments totaling $29.3M are included in cash provided by operating activities as a use of cash Low End High End Net Income $48 $58 Depreciation and amortization expense 138 136 Interest expense, net 30 28 Income tax expense (11) (10) Restructuring Costs(1) 5 3 Transaction Costs(2) 10 10 Adjusted EBITDA (Consolidated) $220 $225 Cash interest, net (26) (24) Cash taxes (4) (7) Total capex (70) (70) Restructuring Costs(1) (5) (3) Transaction and Debt Issuance Costs(3) (12) (12) Deferral of cash receipt from customer breach of contract(4) (70) (70) Cash impact from accounting treatment of a portion of Phoenix Global's acquisition price(5) (29) (29) Non-cash items and working capital changes (14) (10) Free Cash Flow (FCF) ($10) $0 ($ in millions) 2025E

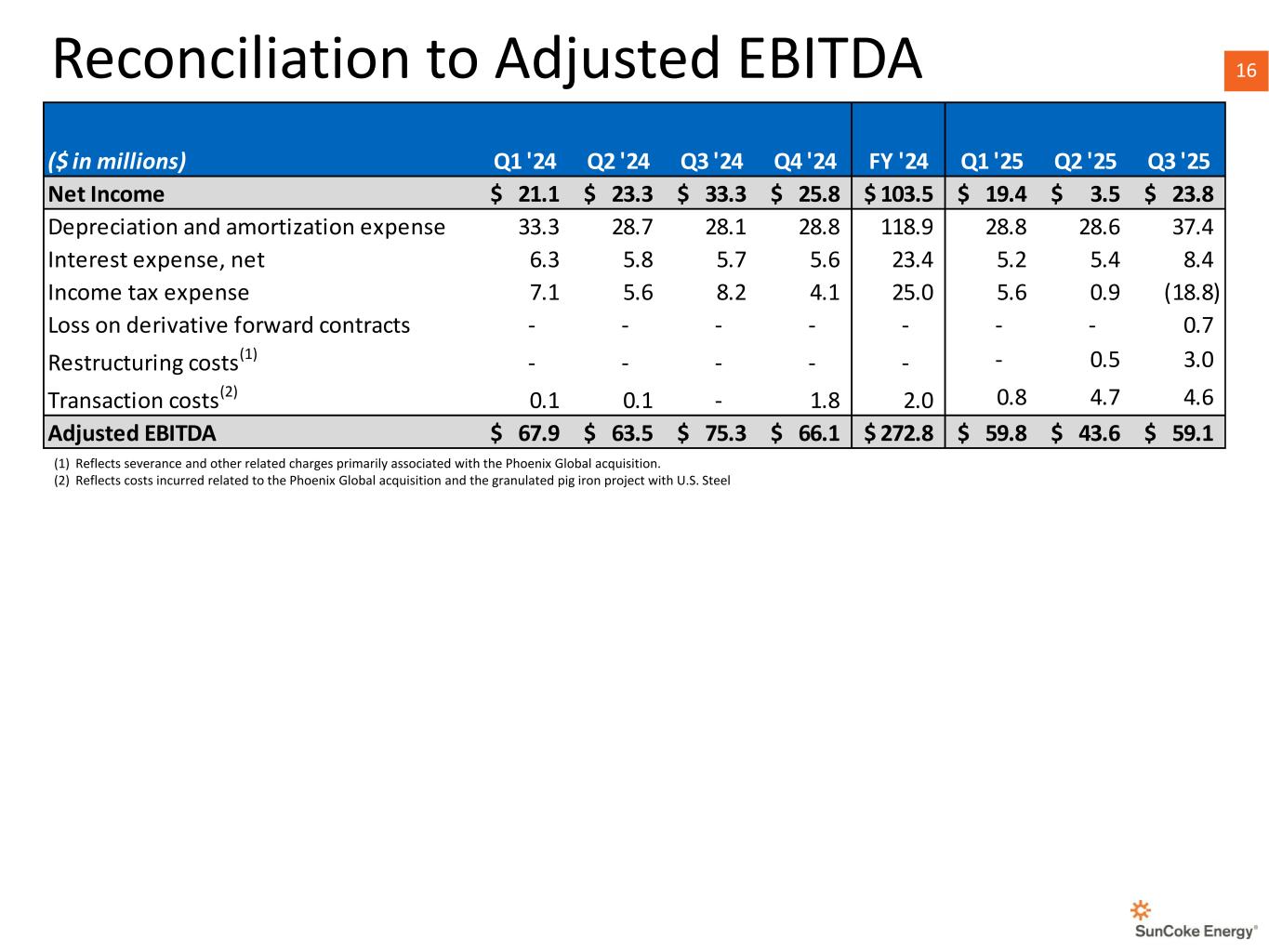

16 16Reconciliation to Adjusted EBITDA (1) Reflects severance and other related charges primarily associated with the Phoenix Global acquisition. (2) Reflects costs incurred related to the Phoenix Global acquisition and the granulated pig iron project with U.S. Steel 2025 Q2 2025 Q3 ($ in millions) Q1 '24 Q2 '24 Q3 '24 Q4 '24 FY '24 Q1 '25 Q2 '25 Q3 '25 Net Income 21.1$ 23.3$ 33.3$ 25.8$ 103.5$ 19.4$ 3.5$ 23.8$ Depreciation and amortization expense 33.3 28.7 28.1 28.8 118.9 28.8 28.6 37.4 Interest expense, net 6.3 5.8 5.7 5.6 23.4 5.2 5.4 8.4 Income tax expense 7.1 5.6 8.2 4.1 25.0 5.6 0.9 (18.8) Loss on derivative forward contracts - - - - - - - 0.7 Restructuring costs(1) - - - - - - 0.5 3.0 Transaction costs(2) 0.1 0.1 - 1.8 2.0 0.8 4.7 4.6 Adjusted EBITDA 67.9$ 63.5$ 75.3$ 66.1$ 272.8$ 59.8$ 43.6$ 59.1$

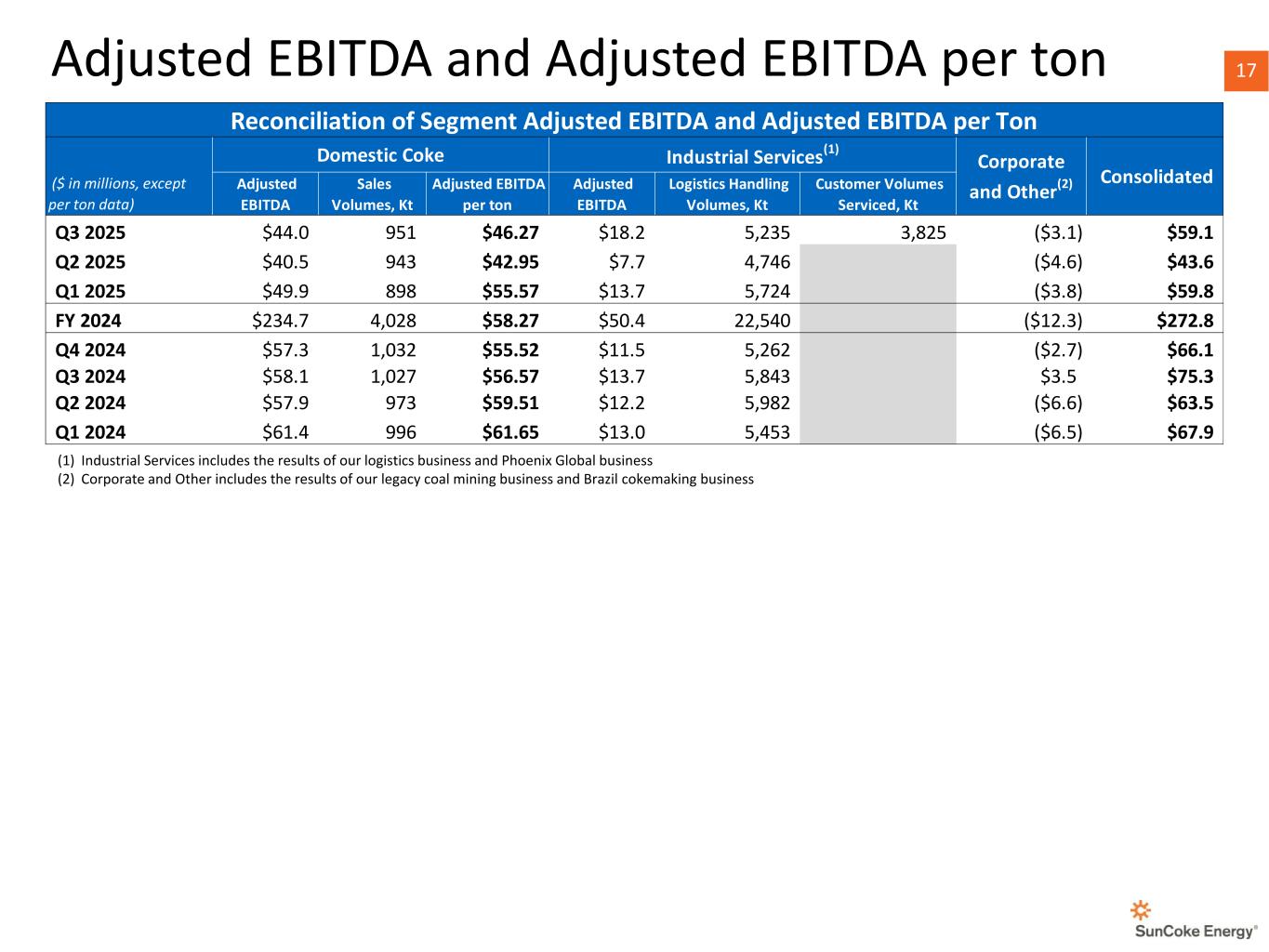

17 17Adjusted EBITDA and Adjusted EBITDA per ton (1) Industrial Services includes the results of our logistics business and Phoenix Global business (2) Corporate and Other includes the results of our legacy coal mining business and Brazil cokemaking business ($ in millions, except per ton data) Adjusted EBITDA Sales Volumes, Kt Adjusted EBITDA per ton Adjusted EBITDA Logistics Handling Volumes, Kt Customer Volumes Serviced, Kt Q3 2025 $44.0 951 $46.27 $18.2 5,235 3,825 ($3.1) $59.1 Q2 2025 $40.5 943 $42.95 $7.7 4,746 ($4.6) $43.6 Q1 2025 $49.9 898 $55.57 $13.7 5,724 ($3.8) $59.8 FY 2024 $234.7 4,028 $58.27 $50.4 22,540 ($12.3) $272.8 Q4 2024 $57.3 1,032 $55.52 $11.5 5,262 ($2.7) $66.1 Q3 2024 $58.1 1,027 $56.57 $13.7 5,843 $3.5 $75.3 Q2 2024 $57.9 973 $59.51 $12.2 5,982 ($6.6) $63.5 Q1 2024 $61.4 996 $61.65 $13.0 5,453 ($6.5) $67.9 Domestic Coke Industrial Services(1) Corporate and Other (2) Consolidated Reconciliation of Segment Adjusted EBITDA and Adjusted EBITDA per Ton