EXHIBIT 10.1 CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THIS EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. REDACTED INFORMATION IS INDICATED BY [***]. AMENDED & RESTATED COKE PURCHASE AGREEMENT By and Between HAVERHILL COKE COMPANY LLC, and CLEVELAND-CLIFFS STEEL LLC DATED November 5, 2025

1 AMENDED & RESTATED COKE PURCHASE AGREEMENT THIS AMENDED & RESTATED COKE PURCHASE AGREEMENT (this “Agreement”) dated as of November 5, 2025 (the “Execution Date”), is made by and between Haverhill Coke Company LLC, a Delaware corporation (“Seller”), Cleveland-Cliffs Steel LLC, a Delaware limited liability company (“Purchaser”, and together with Seller are sometimes referred to herein as the “Parties” and individually as a “Party”). WHEREAS, the Parties desire that, as of the Effective Date (as defined below), this Agreement shall replace and supersede in all respects the following: (i) that certain Coke Purchase Agreement, dated as of October 28, 2003, by and between Seller, ISG Cleveland Inc., ISG Indiana Harbor Inc., and ISG Sparrows Point Inc. (as amended from time to time, the “HHO1 Agreement”); (ii) that certain Coke Purchase Agreement, dated as of August 31, 2009, by and between Seller and AK Steel Corporation (as amended from time to time, the “HHO2 Agreement”); and (iii) that certain Amended and Restated Coke Supply Agreement, dated as of October 28, 2003, by and between Jewell Coke Company, L.P., ISG Cleveland Inc., ISG Indiana Harbor Inc., and ISG Sparrows Point Inc. (as amended from time to time, the “Jewell Agreement”). WHEREAS, Purchaser is the successor in interest to each of the parties to the HHO1 Agreement, and Jewell Agreement. NOW THEREFORE, in consideration of the mutual covenants and agreements herein contained, and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the Parties, intending to be legally bound, agree as follows: ARTICLE I DEFINITIONS; BASIC OBLIGATIONS OF THE PARTIES 1.1 Definitions. The definitions of certain capitalized terms used in this Agreement are contained in the attached Appendix A. 1.2 Basic Obligations of the Parties. Subject to the terms and conditions of this Agreement, during the Term, Seller shall sell to Purchaser, and Purchaser shall purchase, accept and pay Seller for, Coke for use by Purchaser and/or its Affiliates in accordance with the Coke Supply and Purchase Obligation for the Contract Price. ARTICLE II TERM 2.1 Initial Term. This Agreement shall be effective as of January 1, 2026 (the “Effective Date”) and shall continue in full force and effect through and including December 31,

2 2028 (the “Initial Term” and, together with any Renewal Terms, the “Term”), unless terminated earlier in accordance with other provisions of this Agreement. 2.2 Renewal Terms. Following expiration of the Initial Term, this Agreement will automatically renew for additional consecutive two (2)-year terms (each, a “Renewal Term”), unless either Party gives written notice of non-renewal to the other Party no later than December 31st of the year prior to the final Contract Year of the Initial Term or the then-current Renewal Term, as applicable (i.e., with respect to the Initial Term, no later than December 31, 2027, and with respect to the first Renewal Term (if applicable), no later than December 31, 2029). ARTICLE III CONTRACT PRICE AND PAYMENT TERMS 3.1 Contract Price. The “Contract Price” is an amount equal to the sum of (i) the Variable Cost per Ton of Coke, (ii) the Coal Cost per Ton of Coke, (iii) applicable Transportation Costs; (iv) applicable Government Impositions, and (v) applicable Taxes. 3.2 Determination of Coke Tonnage. All Coke Tonnage shall be weighed by certified rail scales located on Seller’s property. Provided, however, if for any reason outside of Seller’s reasonable control Seller is unable to obtain weights for the entirety or any portion of any Coke shipment using such rail scales, then the weight of such Coke shipment or, as applicable, portion thereof shall be reasonably determined in accordance with relevant scale data provided by Seller in connection with prior Coke shipments. All Coke Tonnage shall be adjusted to the required moisture content in accordance with the following formula: [***] The actual moisture percentage content of Coke shall be determined in accordance with Section 5.1. 3.3 Variable Cost per Ton of Coke. The “ Variable Cost per Ton of Coke” is [***] per Ton. Beginning with Contract Year starting with January 1, 2027 and each January 1st thereafter through the Term, the Variable Cost per Ton of Coke is subject to increase or decrease annually based upon the Variable Cost Index. 3.4 Coal Cost Per Ton of Coke. (a) The “Coal Cost per Ton of Coke” is: (i) the actual monthly weighted average Coal Costs divided by (ii) the product of: (x) the Moisture Adjusted Coal Blend Tonnage charged to the coke ovens at the Coke Plant set forth in each applicable invoice, taking into account Coal Handling Losses, and (y) the Guaranteed Coke Yield Percentage. The Moisture Adjusted Coal Blend Tonnage shall be the weighted average thereof for each applicable calendar month, and shall account for Coal Blend moisture on a fixed [***] percent [***] basis to be determined in accordance with the following formula: [***]

3 Such actual moisture shall be determined based on sampling of the actual Coal Blend Tonnage immediately prior to coking thereof, and the testing and analysis on a composite basis, all of which shall be performed in accordance with ASTM Standards. The Coal Handling Losses shall be fixed at [***] percent [***] and shall be accounted in accordance with the following formula: [***] (b) Seller’s static scale shall weigh Coal Blend Tonnages immediately prior to coking. Such scale shall have an accuracy of not less than plus or minus (+/-) [***] percent [***] and shall be calibrated in accordance with the manufacturer’s instructions at Seller’s sole cost and expense. Absent Manifest Error, such weight determinations shall be conclusive and binding on the Parties. (c) The Guaranteed Coke Yield Percentage is determined in accordance with the following formula: [***] Seller will re-determine the Guaranteed Coke Yield Percentage whenever the Coal Committee directs Seller to change any of the coals included in any Coal Blend, such that the proportionate share of such coals within such Coal Blend is increased or decreased by [***] percent [***] or more. 3.5 Transportation Costs. The “Transportation Costs” include the actual costs incurred by Seller to transport Coke to each respective Delivery Point, namely (i) costs and charges payable by Seller to Norfolk Southern or, as applicable, other railroad carrier, in accordance with the transportation agreements between them; (ii) demurrage charges actually incurred by Seller in connection with delays caused by Purchaser in the placement or unloading of Coke at any Delivery Point and the return of empty railcars to the Class 1 railroad; and (iii) the actual costs of freeze conditioning agents that are applied to Coke shipments during periods of cold weather at the express, Written request of Purchaser. Notwithstanding the foregoing, for so long as Purchaser has not breached this Agreement, Seller agrees to hold Purchaser harmless with respect to the following charges, which shall not be deemed Transportation Costs: (i) charges payable by Seller to Norfolk Southern as a result of failure to load trainload shipments to meet the loading percentages of capacity specified in the Transportation Agreement(s); (ii) charges payable by Seller to Norfolk Southern as a result of rail cars exceeding the ruling gross weight on rail restriction; (iii) charges payable by Seller to Norfolk Southern for failure to meet minimum train size, except if such charges arise from or relate to Purchaser’s failure to timely turn railcars from its facilities.

4 3.6 Governmental Impositions. Contract Price shall include all Governmental Impositions without markup which Seller is not reasonably able to mitigate to the extent arising from routine performance pursuant to this Agreement or any action or inaction by or on behalf of Purchaser plus actual costs incurred by Seller in the course of such reasonable mitigation. The Parties shall reasonably cooperate in any attempts to mitigate Governmental Impositions. 3.7 Taxes. Taxes related to Coke and Third Party Supplied Coke shall be paid by Purchaser. 3.8 Inventories. Coal inventory will be accounted for on a first-in, first-out basis in accordance with GAAP. 3.9 Terms of Payment/Invoicing. (a) On or promptly following the date of each Shipment during the Term, Seller will submit to Purchaser in Writing an invoice for such Shipment. The invoiced amount shall be (i) the product of (A) the Coke Tonnage for all such shipments as determined in accordance with Section 3.2, multiplied by (B) the Contract Price then in effect (based upon Seller’s good faith estimate of the Coal Costs), less (ii) (subject to Section 3.9(b)) any price adjustments to the Contract Price as determined in accordance with Sections 5.1 and 5.2, to the extent such adjustment can be made at the time of invoice. Each invoice will contain a break-out of the charges to Purchaser and such itemization as reasonably requested by Purchaser. Each invoice shall be delivered by electronic mail, overnight delivery by registered or certified mail (return receipt requested and postage prepaid), or by such other method agreed upon by the Parties in Writing. Each invoice shall contain: (i) adjustments due under Sections 5.1 and 5.2 that were not included in a prior invoice and an explanation of the adjustments; and (ii) adjustments (credits or additional charges, as the case may be) to reflect the actual Coal Costs or prior shipments that were not included in a prior invoice and an explanation of the adjustments. (b) Properly invoiced amounts under this Agreement shall become due and payable in immediately available federally insured wired funds nineteen (19) calendar days after Purchaser’s receipt of the invoice for Coke delivered to the applicable Delivery Point; provided, however, that in the event of a conflict between the invoice and the confirming manifest, the confirming manifest shall govern amounts due. Such payment obligation shall not be subject to any right of set-off. Any late payment shall accrue interest at the Interest Rate from the date such amount becomes due through (but excluding) the date such payment is made. 3.10 By-Products; Credits and other Benefits. Notwithstanding anything in this Agreement to the contrary, Seller shall retain (a) all By-Products and Credits for its own account and (b) all proceeds from the sale or other disposition of By-Products. 3.11 Audit Rights. Purchaser shall have the right during normal working hours of Seller, to review and inspect such books and records of Seller and its Affiliates as Purchaser reasonably deems necessary to verify any amounts payable by Purchaser under this Agreement. Purchaser shall provide Seller with at least two (2) Business Days’ Written notice prior to the commencement of any such review and inspection. Such review and inspection shall take place at the place in

5 which such books and records are customarily maintained and shall be performed in such a manner so as not to unduly interfere with Seller’s operation of its business. ARTICLE IV THE COAL COMMITTEE AND COAL BLEND SELECTION 4.1 Authority. The “Coal Committee” shall select, by majority vote, Coal Blends that conform to the Coal Blend Standards, and may make recommendations to Seller regarding Seller’s acquisition of coals and related testing, blending, handling and delivery procedures. A single representative of Purchaser shall be the chairman of the Coal Committee. Purchaser shall be entitled to exercise one vote, and Seller shall be entitled to exercise one vote with respect to Coal Committee matters. Meetings of the Coal Committee shall be scheduled at intervals and at locations to be mutually agreed upon by the Parties. 4.2 Selection of Coal Blends. (a) The Coal Committee shall select the initial Coal Blend at least three (3) months prior to the commencement of the Term. Thereafter, the Coal Committee shall recommend the Coal Blend for each succeeding Contract Year during the Term at least three (3) months prior to the end of the then current Contract Year and Seller will perform analysis and testing with respect to Coal Blends recommended by the Coal Committee for the purpose of selecting the Coal Blend for the succeeding Contract Year. In connection with the selection of the applicable Coal Blends: (i) The Coal Blend must target at least [***] CSR and [***] Stability in accordance with Seller’s coal blend model. (ii) Purchaser may specify its affiliate coals in the Coal Blend(s); provided however: A. Such coals must be of sufficient quality to meet the Guaranteed Quality Standards; B. Such coals must be purchased at a price that the Parties mutually agree reasonably approximates the then current market price for coal of such quality; and C. Subject to Seller meeting its coke supply obligation to Purchaser for the Contract Year (whether from Seller production or Affiliate coke supply), Seller may sell coke made from the coal blend with Purchaser’s affiliate coal(s) to third parties. (b) Coal Committee Disputes. (i) Coal Committee disputes are to be referred to a third party consultant (the “Third Party Consultant”), within seven (7) days following a Party giving Written notice to the other Party requesting referral of an issue to a Third Party Consultant, for resolution by such Third Party Consultant. The selection of such Third Party Consultant shall be made from a list to be approved by the Coal

6 Committee prior to its selection of the initial Coal Blend. The Coal Committee may, in its sole discretion, supplement or otherwise modify such list from time to time. The Third Party Consultant shall be designated from such list no later than the third (3rd) Business Day following the expiration of the seven (7) day notice period. Within two (2) Business Days following the effectiveness of the designation of a Third Party Consultant, each of the Parties shall submit to the Third Party Consultant a notice (a “Position Notice”) setting forth in detail such Party’s position in respect of the issues in dispute. Such Position Notice shall include supporting documentation, if appropriate. (ii) The Third Party Consultant shall issue its decision as promptly as reasonably possible, but in any event within ten (10) Business Days following the date on which both Position Notices are submitted. In resolving a dispute, the Third Party Consultant shall consider all facts and circumstances it deems reasonable given the nature of the dispute. The decision of the Third Party Consultant shall be final. (iii) The list of Third Party Consultants shall contain qualified consultants with experience in the design, operation and maintenance of coke batteries and coal testing, analysis, processing, shipping and carbonization. A Party may at any time remove a particular consultant from the list by obtaining the other Party’s consent (not to be unreasonably withheld, conditioned or delayed) to such removal. However, neither Party may remove a name or names from the list if such removal would leave the list with less than three (3) then-available Third Party Consultants. During January of each year, the Parties shall review the current list of Third Party Consultants and give notice to the other of any proposed additions to the list and any intended deletions. Proposed additions or deletions shall become effective thirty (30) days after notice is received by the other Party unless Written objection is made by such other Party within such thirty (30) days. 4.3 Seller’s Responsibilities. Seller shall develop good faith estimates of Coal Costs for each Coal Blend evaluated by the Coal Committee, including such costs on a per Ton of Coke basis. Seller shall exercise reasonable commercial efforts to purchase Coal Blends selected by the Coal Committee at the market price for the Coals constituting such Coal Blends, to cause each actual Coal Blend used in the production of Coke to conform to the selected Coal Blend, and to implement the recommendations of the Coal Committee. Unless otherwise authorized in Writing by the Coal Committee, Seller shall not purchase Coal from an Affiliate of Seller, and Coal purchase agreements shall have a term not less than one (1) year each. Seller shall retain the responsibility and authority for daily operating matters involving the Coal Blends and compliance with the Guaranteed Quality Standards, without any requirement to consult with or obtain the approval of the Coal Committee. 4.4 Sampling and Testing. Prior to purchasing any of the Coals comprising any Coal Blend selected by the Coal Committee (except for purchases made for the purpose of sampling and testing thereof), sampling and testing of all such Coals shall be performed in a manner reasonably acceptable to the Parties, and each Party shall be provided with a reasonable opportunity to review and, if appropriate, object to such test results. Such sampling and testing

7 shall include the collection of representative samples of meaningful quantities of each potential Coal to be prepared and tested in a laboratory approved by the Coal Committee for moisture, ash, sulfur, volatile matter, FSI (free swelling index), oxidation (via petrographic techniques and US Steel method), ash mineral analysis (including P205, Na20, K20 and chlorine) and other parameters as agreed to from time to time. Seller and Purchaser will use their commercially reasonable efforts to have the cost of such analysis be to the account of the potential Coal supplier(s). Seller shall arrange for similar sampling and testing to be carried out with respect to Coals actually purchased by Seller for the production of Coke and each Party shall be provided a reasonable opportunity to review and, if appropriate, object to such test results. Upon the reasonable request of Purchaser, Seller shall process blends of Coals for trial purposes at the Coke Plant. 4.5 Good Faith Review. If Seller determines that any selected Coal Blend will not conform to the Coal Blend Standards, then it shall promptly notify the chairman of the Coal Committee in Writing of that opinion, and shall provide evidence in support of that opinion that is reasonably satisfactory to Purchaser. Should the Coal Committee not promptly select a new Coal Blend following such notification by Seller, then the Coal Committee shall appoint, as soon as reasonably possible, a qualified independent laboratory to sample and test the Coals constituting the Coal Blend to determine whether the Coal Blend will conform to the Coal Blend Standards. The cost of such independent laboratory and testing procedures shall be borne equally by the Parties. Such sampling and testing shall be performed in accordance with ASTM Standards. If, following such sampling and testing, Seller reasonably determines that the Coal Blend will not conform to the Coal Blend Standards, and promptly provides Written notice of such determination to the chairman of the Coal Committee, then the Coal Committee shall select another Coal Blend that complies with the Coal Blend Standards. The Parties shall cooperate in good faith to efficiently implement each changeover of the Coal Blend. 4.6 Unsuitability of Selected Coal Blend. If a Coal Blend selected by the Coal Committee does not in practice conform to the Coal Blend Standards, or if sufficient quantities thereof become unavailable, then Seller shall promptly inform Purchaser in Writing of such nonconformity or unavailability and the Coal Committee shall thereafter select, as soon as reasonably possible, a new Coal Blend that conforms to the Coal Blend Standards. If, pending selection of any such Coal Blend by the Coal Committee, the use by Seller of the Coal Blend originally selected by the Coal Committee materially affects the Coke Plant or Seller’s ability to comply with its obligations under this Agreement, then, pending Coal Committee selection of a new Coal Blend, Seller shall have the authority to direct the Coal Committee to utilize another Coal Blend that incorporates the Coals at the Coke Plant or Coals that are otherwise reasonably available to Seller and which, in Seller’s reasonable judgment, meets or reasonably approximates the Coal Blend Standards. ARTICLE V GUARANTEED QUALITY STANDARDS; WARRANTY OF GOOD TITLE 5.1 Coke Sampling, Testing and Analysis. (a) Subject to Section 5.1(d), one (1) representative Coke sample increment will be taken from the loading belt during the loading of each railcar. Each such increment will be

8 a complete cross section cut as taken from the loading belt by the mechanical sampling system. All such samples shall be stored in an open container situated within a controlled, indoor environment prior to the testing and analysis thereof as required in Section 5.1(c). Seller shall retain splits of such Coke samples for not less than thirty (30) calendar days. Upon reasonable notice to Seller, Purchaser shall be entitled to be present during the sampling, preparation, analysis, and loading of Coke Shipments. (b) Coke samples will be prepared on a daily basis by an independent laboratory in accordance with ASTM Standards, or alternative procedures approved in Writing by Seller and Purchaser. (c) Moisture, sulfur, ash, volatile matter and stability will be tested and analyzed on a daily basis, and the results thereof shall be arithmetically averaged, on a Shipment basis, to determine conformity with the Guaranteed Quality Standards applicable thereto. Size will be tested and analyzed based upon composite sampling of two (2) consecutive Shipments, and the results thereof shall determine conformity with the Guaranteed Quality Standards applicable thereto. CSR and ash mineral analysis shall be determined based upon testing and analysis of monthly composite samples. Such testing and analysis shall be performed in accordance with ASTM Standards or other procedures approved by the Parties in Writing, and shall govern for the purposes of determining conformity with the Guaranteed Quality Standards applicable thereto. Except for size and CSR, all daily results (prior to any averaging thereof), and all consolidated results utilized to determine compliance with the Guaranteed Quality Standards, will be provided by Seller to Purchaser promptly in Writing, and prior to the delivery of the applicable Shipment Purchaser shall have the right to conduct an audit of all results of such sampling, preparation, testing and analysis for the purpose of auditing Seller’s compliance with such sampling, preparation, testing and analysis procedures. (d) If, based upon a six (6) month “rolling” average of the moisture content of Coke Shipments, a material discrepancy arises between the measurement thereof as determined by Seller, and the measurement thereof by Purchaser, then the Parties shall promptly meet for the purpose of resolving such discrepancy in good faith. If the Parties are unable to resolve such discrepancy, then available sample splits from such Coke Shipments shall be provided to an independent laboratory (to be mutually agreed upon by the Parties in good faith) for the purpose of determining the basis of any such discrepancy and, as applicable, recommendations for materially improving the measurement of Coke moisture content by Seller or Purchaser. Where appropriate, the Parties shall promptly implement such recommendations, unless otherwise agreed upon by them in Writing; provided, however, that (i) the preparation, testing and analysis of Coke Shipments by Purchaser that give rise to any such material discrepancy shall be in accordance with ASTM Standards, or other procedures approved by the Parties in Writing, and shall not contain or arise from any Manifest Error; and (ii) in the event the implementation of any such recommendations results in increased direct cost to Seller, then fifty percent (50%) of that increased direct cost shall be reimbursed by Purchaser to Seller a monthly basis as an itemized charge incorporated into the special monthly final invoice set forth in Section 3.9(a).

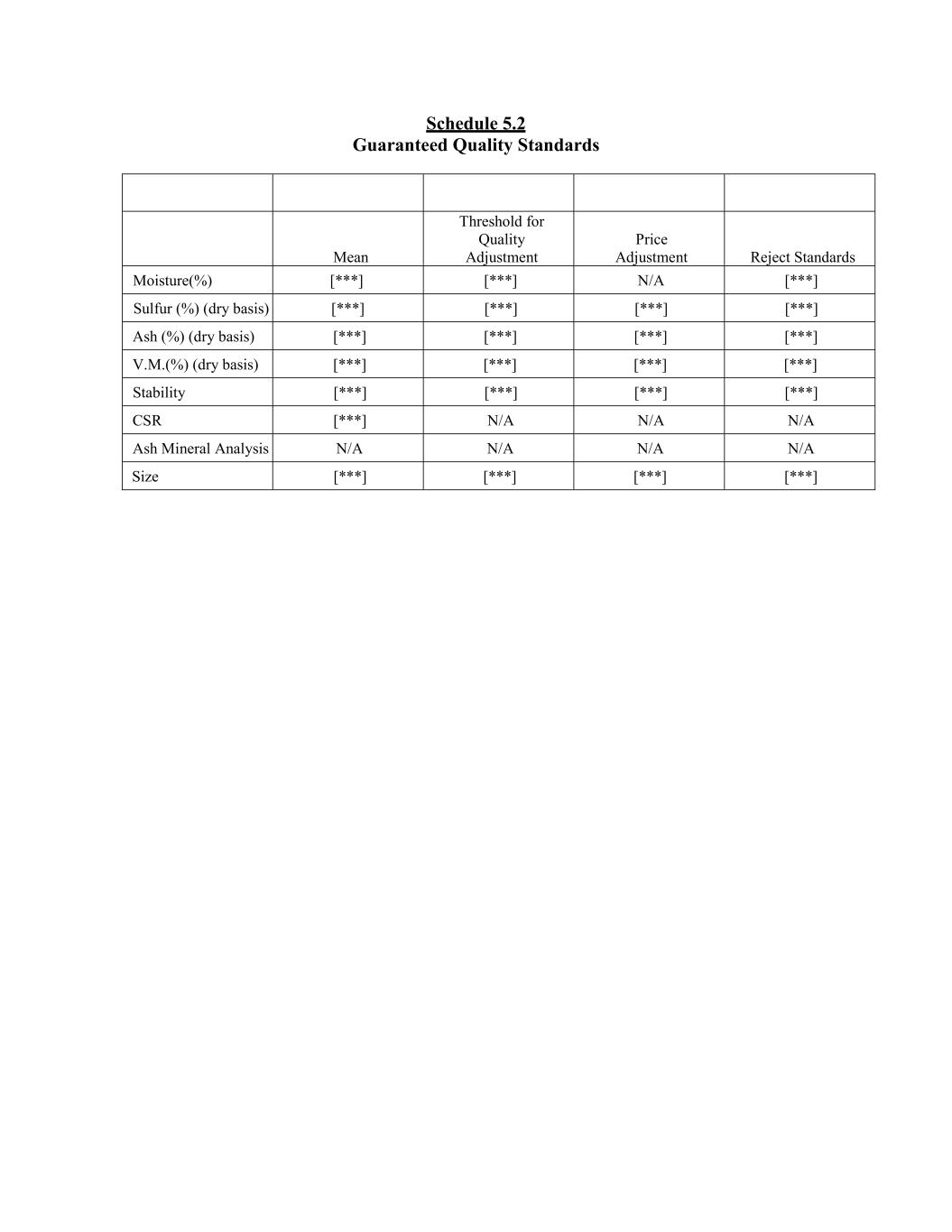

9 5.2 Guaranteed Quality Standards. (a) Subject to Article IV, Coke shall conform to the Guaranteed Quality Standards set forth in Schedule 5.2. Subject to Section 5.2(b), if Coke quality exceeds or, as applicable, is less than the “threshold” Guaranteed Quality Standards (excepting moisture) based upon sampling, preparation, testing and analysis set forth in Section 5.1, then the Contract Price shall be adjusted as set forth in Schedule 5.2. In addition, Seller shall take prompt corrective measures to correct any nonconformity, and shall promptly inform Purchaser in Writing of such corrective measures. (b) Subject to Article IV, if the quality of Coke or Third Party Supplied Coke exceeds or, as applicable, is less than the “reject” Guaranteed Quality Standards set forth in Schedule 5.2 based upon sampling, preparation, testing and analysis set forth in Section 5.1 (“Nonconforming Coke”), then Seller shall take immediate corrective measures prior to the delivery of any further Coke Shipments to Purchaser, and shall promptly notify Purchaser in Writing of such corrective measures. If Nonconforming Coke is consumed or commingled with any other coke acquired by Purchaser, then Purchaser shall pay an amount per Ton for such Coke equal to the sum of (i) Contract Price (as adjusted for quality pursuant to Schedule 5.2) minus (ii) [***] dollars [***] per Ton of such adjusted Contract Price (the “Discounted Coke Price”), and payment for such Nonconforming Coke shall be made in accordance with Section 3.9. However, where Nonconforming Coke is not commingled with other coke acquired by Purchaser, it may be rejected by Purchaser by means of prompt Written notification thereof by Purchaser to Seller or, at Purchaser’s option, may be purchased for the Discounted Coke Price. Upon rejection of such Coke, title to such Coke shall revert to Seller and Seller shall accept all risk of loss, damage, or destruction therefore. (c) Seller shall be required to remove from Purchaser’s facilities any Nonconforming Coke that is properly rejected by Purchaser. Seller will be responsible for all removal costs. Purchaser may require Seller to make up the corresponding shortfall pursuant to a reasonable shipment schedule to be specified by Purchaser. 5.3 Changes to Quality Standards. In conjunction with the annual review of the Coal Blends by the Coal Committee, Purchaser may request revisions to the Guaranteed Quality Standards. Promptly after receipt of Purchaser’s request, Seller shall enter into good faith discussions with Purchaser regarding such changes; provided, however, Seller shall not be required to make any adjustment that would have a material and adverse effect on (i) Coal Blend Standards; (ii) Seller’s economic returns (including the operating or capital costs associated with the Coke Plant, or the “threshold” or “reject” Guaranteed Quality Standards) or, (iii) contracts between Seller and third parties including, without limitation, Coal purchase contracts. Any increase or decrease in costs and charges associated with any such change shall be for the account of Purchaser.

10 5.4 Title. Seller warrants that at the time of delivery of Coke or Third Party Supplied Coke to each respective Delivery Point, it shall have good title and full right and authority to transfer such Coke or Third Party Supplied Coke to Purchaser, and that the title conveyed shall be good and its transfer shall be rightful and that such Coke or Third Party Supplied Coke shall be delivered free from any security interest or other lien or encumbrance. 5.5 Exclusivity. THE WARRANTIES AND REMEDIES EXPRESSLY SET FORTH IN THIS ARTICLE V ARE EXCLUSIVE AND ARE IN LIEU OF ALL OTHER WARRANTIES AND REMEDIES, WHETHER WRITTEN OR ORAL, IMPLIED IN FACT OR IN LAW, AND WHETHER BASED ON STATUTE, CONTRACT, TORT, STRICT LIABILITY OR OTHERWISE. THE WARRANTY OF MERCHANTABILITY AND WARRANTY OF FITNESS FOR A PARTICULAR PURPOSE ARE EXPRESSLY EXCLUDED AND DISCLAIMED. ARTICLE VI OBLIGATIONS RELATED TO COKE SUPPLY 6.1 Coke Supply and Purchase Obligation. (a) Seller shall sell, and Purchaser shall purchase, on a take-or-pay basis, subject to the terms, conditions and requirements of this Agreement, for each Contract Year transpiring during the Term, the Coke Supply and Purchase Obligation for the Base Case Coal Blend, which shall be not less than [***] percent [***], nor more than [***] percent [***], of [***] Tons of Coke. (b) For each Contract Year, Coke loaded into rail cars and released for shipment or placed into stockpile pursuant to Section 7.3 during such Contract Year shall count towards satisfying the Coke Supply and Purchase Obligation for such Contract Year. (c) Notwithstanding anything herein to the contrary, but without limiting or modifying any of Seller’s rights under Section 6.2, Seller may produce, deliver, and sell up to [***] percent [***] of the Coke Supply and Purchase Obligation from Seller Affiliate’s Jewell coke plant; provided that, (i) such Coke conforms to the Guaranteed Quality Standards, (ii) is delivered to the Delivery Point at the Contract Price (for the avoidance of doubt, if the Transportation Costs from the Jewell coke plant to the Delivery Point are greater than the Transportation Costs from the Coke Plant to the Delivery Point, the invoiced amounts for such Shipments will be reduced by such excess Transportation Costs), (iii) Seller provides reasonable advance notice of such deliveries, and (iv) such shipments cannot be more than four (4) trains per month. 6.2 Third Party Supplied Coke. If Seller is unable to produce sufficient Coke at the Coke Plant to meet the Coke Supply and Purchase Obligation during a Contract Year, then Seller shall promptly provide Written notice of same to Purchaser and Seller shall exercise commercially reasonable efforts to obtain Third Party Supplied Coke. Third Party Supplied Coke shall comply with the Guaranteed Quality Standards. The price Purchaser shall pay for Third Party Supplied Coke Tonnage shall be the lesser of (i) the current Contract Price for equivalent Coke Tonnage, subject to adjustment pursuant to Section 5.2; or (ii) in the case of Third Party Supplied Coke Tonnage obtained from a person other than an Affiliate of Seller at a delivered price which is less than the applicable current Contract Price for equivalent Coke Tonnage (as adjusted pursuant to

11 Section 5.2), the actual delivered price to the applicable Delivery Point. Seller shall arrange and pay for the delivery of Third Party Supplied Coke to each Delivery Point designated by Purchaser in Writing, and shall exercise reasonable, good faith efforts to arrange for such deliveries in accordance with Purchaser’s requested Written delivery schedule. Promptly following the delivery to the appropriate Delivery Point of any Third Party Supplied Coke shipment, Seller shall deliver by electronic mail, or by such other method agreed upon by the Parties in Writing, an invoice for each such shipment to Purchaser. Title and risk of loss for such Third Party Supplied Coke shall transfer to Purchaser at the Delivery Point. Payment therefore shall be made in accordance with Section 3.9. 6.3 Purchaser Obtained Coke. Seller shall promptly notify Purchaser in Writing in the event Seller reasonably believes it cannot deliver sufficient Third Party Supplied Coke pursuant to Section 6.2 hereof and the amount of projected shortfall between Third Party Supplied Coke and the Coke Supply and Purchase Obligation. If Seller does not deliver Coke or Third Party Supplied Coke to Purchaser (i) in an amount sufficient to conform to the Coke Supply and Purchase Obligation then Purchaser may make commercially reasonable arrangements to acquire Purchaser Obtained Coke. If the commercially reasonable price of Purchaser Obtained Coke plus the actual, direct costs incurred by Purchaser to deliver such Purchaser Obtained Coke to the applicable Delivery Point is greater than the Contract Price for equivalent Coke Tonnage, then Seller shall reimburse Purchaser for the amount of such excess. In the event Purchaser secures Purchaser Obtained Coke, then Purchaser shall use commercially reasonable efforts to limit its use of Purchaser Obtained Coke to the time period for which Purchaser reasonably believes, based on facts and circumstances disclosed in Writing to Purchaser by Seller, that Seller will not be able to provide Coke or Third Party Supplied Coke sufficient to comply with the Coke Supply and Purchase Obligation. ARTICLE VII DELIVERY OF COKE AND THIRD PARTY SUPPLIED COKE 7.1 Shipments. Coke Shipments shall be by rail carrier selected, arranged and paid for by Seller with insurance coverage for loss or damage to the Coke in transit; provided, that (i) Purchaser may request to use its own private railcars for Coke Shipments by delivering Written notice of such request to Seller at least three (3) months prior to the commencement of the succeeding Contract Year, in which case, the Parties will discuss (but shall not be obligated to agree to) the terms of use of such private railcars, and (ii) in the event the Parties mutually agree on the terms of use of such private railcars, the Parties shall memorialize the terms of use in a letter agreement signed by each Party. Subject to Section 7.3, Seller shall generate and waybill full train shipments with respect to Coke Shipments; provided, the Parties acknowledge that the applicable rail carrier has discretion over whether Coke Shipments are moved in full train shipments or in manifest. Coke shall be loaded onto railcars as it is produced. Each Coke Shipment shall be deemed delivered F.O.B. railcar when it is loaded onto the applicable railcars. If Purchaser is unable or otherwise unwilling to accept such delivery of a Coke Shipment or any portion thereof, then such Shipment or portion thereof shall be deemed to be delivered F.O.B. Haverhill Coke stockpile, in accordance with the provisions for stockpiling set forth in Section 7.3 of this Coke Purchase Agreement. Each of the applicable railcar or the Haverhill Coke stockpile, as applicable, shall be a Delivery Point. Upon transfer of title of Coke to Purchaser at the applicable Delivery Point, Purchaser shall have the right to use, resell, redirect or otherwise dispose of Coke in

12 Purchaser’s sole discretion. For Third Party Supplied Coke the delivery and invoicing terms are set forth in Section 6.2. 7.2 Delivery Point Selection. Purchaser shall designate a representative to select the appropriate Delivery Point (either F.O.B. railcar, or F.O.B. Haverhill Coke stockpile) for each Coke Shipment and, to enable Seller to arrange for shipment, the Purchaser shall identify the end- use plant destination for the Shipment. Delivery Point designations shall be made on a monthly basis pursuant to a common Written delivery schedule prepared by Purchaser and delivered to Seller at least two (2) weeks prior to commencement of such month. 7.3 Stockpiling. Seller will provide Purchaser with appropriate storage at the Coke Plant for up to [***] Tons of Coke. In the event Purchaser directs Seller to stockpile Coke, (a) Purchaser shall pay the Contract Price for such stockpiled Coke Tonnage, which shall be assessable following the stockpiling of such Coke, plus Seller’s actual handling costs associated with the stocking and de-stocking of such Coke, which may be invoiced by Seller as an when incurred, and (b) the moisture content of such Coke Tonnage, or any blending of such Coke Tonnage with other Coke Tonnage performed at Purchaser’s request, shall not be required to conform to the moisture specification set forth in the Guaranteed Quality Standards. Payment of such invoiced amounts shall be in accordance with Section 3.9. Title to Coke stockpiled under this provision shall pass to such Purchaser upon stockpiling. 7.4 Seller’s Rights When Purchaser Wrongfully Refuses Delivery of Coke. (a) If Purchaser refuses or fails to accept any delivery of Coke or Third Party Supplied Coke and such refusal or failure is a breach of such Purchaser’s obligations under this Agreement, then (i) the moisture content of such Coke or Third Party Supplied Coke shall not be required to conform to the moisture specification set forth in the Guaranteed Quality Standards; and (ii) the risk of loss for such Coke or Third Party Supplied Coke shall pass to Purchaser upon such wrongful refusal or failure. (b) Where Purchaser refuses or fails to accept delivery of Coke or Third Party Supplied Coke, and such refusal or failure is a breach of Purchaser’s obligations under this Agreement, Seller may resell the same upon Written notification by Seller to Purchaser of its intention to resell. Where such resale is made in good faith and in a commercially reasonable manner, Seller shall recover the difference between the resale price and the Contract Price together with Incidental Damages, but less expenses saved as a consequence of Purchaser’s breach. Provided, however, if (i) Purchaser subsequently accepts such Coke or Third Party Supplied Coke for delivery prior to any resale; or (ii) Seller is unable, after using commercially reasonable efforts for ninety (90) days, to resell such Coke or Third Party Supplied Coke, then Purchaser shall pay to Seller the Contract Price therefore, together with Incidental Damages. If Coke is resold to a third party at a price higher than Contract Price, Seller shall credit Purchaser the profit minus Incidental Damages incurred by Seller. 7.5 Cooperation on Claims. Should Purchaser suffer loss or damage to Coke supplied hereunder while it is in possession of a carrier, Seller will, at Purchaser’s cost, pursue any reasonable claim sought by Purchaser to recover such losses and shall remit to Purchaser the proceeds of any such claim. Should a carrier detain or assert a lien against Coke supplied hereunder

13 arising out of an act or omission of Seller, Seller will, at Seller’s cost, promptly obtain the release of the Coke or any lien from such carrier. ARTICLE VIII FORCE MAJEURE 8.1 Seller Force Majeure Event(s). (a) “Seller Force Majeure Event(s)” are: (i) acts of God, acts of the public enemy, insurrections, riots, strikes, lockouts, boycotts, picketing or other disputes or differences with workers, floods, interruptions to transportation, embargoes, acts of military authorities, pandemics, epidemics, or other causes of a similar nature which wholly or partly prevent the production, transportation or delivery of Coke; (ii) an outage at the Coke Plant that causes a complete or a material partial shutdown of the Coke Plant that (x) lasts longer than ten (10) consecutive days, and (y) is due to urgent and unforeseen safety requirements or fire, explosion or other accident not resulting from the misconduct of Seller. In the event of such a complete or material partial shutdown of the Coke Plant, the Seller Force Majeure Event shall commence on the twenty-first (21st) day following the complete or material partial shutdown of the Coke Plant; (iii) unavailability of sufficient quantities of Coals (including transportation therefore) utilized in any Coal Blend; or (b) Seller will provide Purchaser with prompt Written notice of the nature and probable duration of each Seller Force Majeure Event and of the extent of its effects on Seller’s performance hereunder, including, without limitation, the estimated amount of Coke, if any, Seller will be able to deliver to Purchaser during such Seller Force Majeure Event; provided that Seller may amend such notice from time to time and at any time to revise the estimated amount of Coke Seller will be able to deliver to Purchaser during such Seller Force Majeure Event. Seller shall be obligated to deliver to Purchaser the amount of Coke that Seller notifies Purchaser it will be able to deliver during each Seller Force Majeure Event; provided that nothing in this Section 8.1(b) shall prohibit or limit Seller from obtaining Third Party Supplied Coke in accordance with Section 6.2. (c) Seller shall use commercially reasonable efforts to attempt to limit the effects and duration of each Seller Force Majeure Event, including (as appropriate) restoring any damaged property necessary to reinstate the obligations of Seller under this Agreement, selecting alternate Coals for a Coal Blend that, in Seller’s reasonable judgment, conforms to or reasonably approximates the Coal Blend Standards, and supporting Purchaser in locating alternate sources of substitute coke Tonnage for the duration of such Seller Force Majeure Event (as set forth herein); provided nothing in this Section shall be deemed to require Seller to resolve any strike or other labor dispute except on terms that are satisfactory to Seller in its sole discretion. Purchaser’s obligation to purchase Coke shall be limited to that portion of the Coke Supply and Purchase Obligation that Seller is able to deliver to Purchaser, including the provision of Third Party

14 Supplied Coke, but in any event not in excess of that which Seller indicated that it could supply to Purchaser in Seller’s notice of Seller Force Majeure Event given pursuant to Section 8.1(b). When Seller’s ability to deliver Coke is no longer suspended as a result of the applicable Seller Force Majeure Event, Seller’s and Purchaser’s obligations under this Agreement will be reinstated with a prorated portion of the Coke Supply and Purchase Obligation while Seller was subject to the applicable Seller Force Majeure Event. 8.2 Purchaser Force Majeure Event(s). (a) “Purchaser Force Majeure Event(s)” are: (i) acts of God, acts of the public enemy, insurrections, strikes, lockouts, boycotts, picketing or other disputes or differences with workers, floods, interruptions to transportation, embargoes, acts of military authorities, pandemics, epidemics, or other causes of a similar nature which in whole or in part prevent Purchaser from being able to accept Coke from Seller; or (ii) an outage of steel or iron making facilities that causes a complete or a material partial shutdown of one or more of the blast furnace(s) that (x) lasts longer than twenty (20) consecutive days, and (y) urgent and unforeseen safety requirements or is due to fire, explosion or other accident not resulting from the misconduct of Purchaser. In the event of such a complete or material partial shutdown, the Purchaser Force Major Event shall commence on the twenty-first (21st) day following the complete or material partial shutdown thereof. (b) Purchaser will provide Seller with prompt Written notice of the nature and probable duration of each Purchaser Force Majeure Event and of the extent of its effects on Purchaser’s performance hereunder, and during such Purchaser Force Majeure Event, Purchaser may reduce its purchase of Coke Tonnage from Seller so long as Purchaser has first stopped accepting or otherwise acquiring coke Tonnage supplied to it from coke plants operated by Purchaser or its Affiliates. For the avoidance of doubt, the imposition or adjustment of any tariffs or other trade-related economic measures and any other forms of economic hardship are not Purchaser Force Majeure Events. (c) Purchaser shall use commercially reasonable efforts to attempt to limit the effects and duration of such Purchaser Force Majeure Event, including restoring any damaged property necessary to fully reinstate the obligations of Purchaser under this Agreement, provided that, nothing in this Section shall be deemed to require Purchaser to resolve any strike or other labor dispute except on terms that are satisfactory to Purchaser in its sole discretion. When Purchaser’s ability to perform is no longer suspended as a result of Purchaser Force Majeure Event(s), Purchaser’s and Seller’s obligations under this Agreement will be reinstated with a prorated Coke Supply and Purchase Obligation while Purchaser was subject to the applicable Purchaser Force Majeure Event.

15 ARTICLE IX DISPUTE RESOLUTION 9.1 Attempt at Resolution. Other than a claim for equitable relief, which may be brought directly to any court of proper jurisdiction, should any claim or dispute arise out of any of the provisions of this Agreement, the Parties shall first attempt in good faith to resolve such claim or dispute within forty-five (45) days after either Party notifies the other that a claim or dispute exists; provided, however, that either Party may elect, at any time and in its sole discretion, to eliminate or truncate this forty-five (45) day dispute resolution period and proceed directly to arbitration in accordance with Section 9.2. If the Parties proceed with the foregoing dispute resolution process and cannot resolve any such dispute within such forty-five (45) day period, either Party may invoke the provisions of Section 9.2. This provision will not limit any Party from exercising any remedy it may have under this Agreement. 9.2 Interpretation and Dispute Resolution. (a) Other than a claim for equitable relief, which may be brought to any court of competent jurisdiction, any claim or controversy between the Parties hereto arising out of or relating to this Agreement or the breach hereof which the Parties are unable to resolve pursuant to Section 9.1, shall be resolved by arbitration in Chicago pursuant to the terms of the Federal Arbitration Act. (b) The arbitration shall be before a panel of three (3) arbitrators. Each Party shall appoint one of the three arbitrators within forty-five (45) days from receipt of notice of intent to arbitrate. The third arbitrator shall be chosen by the two Party-chosen arbitrators. (c) The arbitration award by the arbitrators shall be final and binding, and may include costs, including reasonable attorney’s fees. The Parties hereby submit themselves to the jurisdiction of federal courts located in Cuyahoga County, Ohio for all matters relating to any arbitration hereunder. These courts as well as any other court of competent jurisdiction, shall have jurisdiction with respect to the enforcement of any arbitral award and all other matters relating to any arbitration hereunder. (d) Any arbitration hereunder shall be conducted in accordance with the rules of the American Arbitration Association, unless otherwise agreed by the Parties hereto. (e) Upon settlement of a dispute or arbitration award, if it is determined that an amount is due from one Party to the other, then such amount will promptly be paid to the Party to whom it is due in addition to interest on any such amount accrued form the date such amount is determined to have been due through but excluding the date on which payment of such amount is made, at the Interest Rate, as of the date such amount is determined to have been due. ARTICLE X MUTUAL UNDERTAKINGS; REPRESENTATIONS AND WARRANTIES 10.1 Non-Contravention. The Parties each warrant that this Agreement is not inconsistent with any existing respective legal or contractual obligations of such Party, including,

16 without limitation, any agreements between such Party and that Party’s employees or third parties (such as any collective bargaining agreement(s) by which such Party may be bound). 10.2 Compliance with Current Laws. Neither Purchaser nor Seller shall be excused from its performance obligations under this Agreement by its failure to comply with Current Laws or by the shutdown or curtailment of its facilities resulting from non-compliance with Current Laws. 10.3 Compliance with Future Laws. If EPA or any Governmental Authority orders shutdown or curtailment of the Coke Plant as a result of Future Laws, the affected Party will promptly provide written notice to the other Party and will reasonably cooperate with the other Party to obtain relief from such order, and will work to reach a resolution that will prevent shutdown or curtailment of its operations. Liquidated damages or default will not be assigned to or imposed upon the affected Party for such shutdown or curtailment only if such order results solely from the (i) inability or (ii) magnitude of the incremental costs, to comply with Future Laws. If, as a result of Future Laws, Seller must invest additional capital in the Coke Plant or incur significant new operating expenses, Seller may send Written notice to Purchaser explaining the circumstances in relation to the additional capital and then, the Parties either (x) may mutually agree to continue operating, with mutually agreed upon adjustments to the equipment, implementation schedule and Contract Price or other terms and conditions of this Coke Purchase Agreement, or (y) if the Parties fail to mutually agree upon the proposed adjustments, the Parties will terminate this Agreement by an agreed-upon date. ARTICLE XI DEFAULT AND REMEDIES 11.1 Purchaser Events of Default. Purchaser shall be in default upon the occurrence of one or more of the following events (each a “Purchaser Default”): (a) A Payment Default by Purchaser, which Payment Default remains uncured for ten (10) calendar days following receipt of Written notice by Seller to Purchaser; (b) If Purchaser become Bankrupt; or (c) Subject to Sections 11.1(a)-(b), if Purchaser otherwise fails to perform, observe, or comply with any other agreement, covenant or provision of this Agreement, and such breach has not been corrected, cured or remedied within (x) sixty (60) calendar days after Written notice of such breach has been provided to Purchaser, or (y) if such cure cannot reasonably be completed within such 60 (sixty) day period, and Purchaser commences actions to effect a cure within such 60 (sixty) day period and continues to prosecute such cure with reasonable diligence thereafter, one hundred and twenty (120) days following the commencement of such cure. 11.2 Seller Events of Default. Seller shall be in default upon the occurrence of one or more of the following events (each a “Seller Default”): (a) If Seller does not, within ten (10) Business Day following Purchaser’s delivery of Written notice to Seller regarding Seller’s failure to deliver Coke or Third Party

17 Supplied Coke as required by this Agreement, commence corrective action reasonably acceptable to Purchaser to cure or remedy such failure and cure or remedy such failure within sixty (60) days; (b) If Seller becomes Bankrupt; or (c) Subject to Sections 11.2(a)-(b), if Seller otherwise fails to perform, observe, or comply with any other agreement, covenant or provision of this Agreement, and such breach has not been corrected, cured or remedied within (x) sixty (60) calendar days after Written notice of such breach has been provided to Seller, or (y) if such cure cannot reasonably be completed within such 60 (sixty) day period, Seller commences actions to effect a cure within such 60 (sixty) day period and continues to prosecute such cure with reasonable diligence thereafter, one hundred and twenty (120) days following the commencement of such cure. 11.3 Pursuit of Remedies. Upon the occurrence of a Purchaser Default or Seller Default, as applicable, the non-defaulting Party may pursue its corresponding legal remedies through the procedures set forth in Article IX. 11.4 Seller’s Termination for Breach. Upon the occurrence of (a) a Purchaser Default under Section 11.1(a) that is not cured by Purchaser within ten (10) calendar days, (b) Purchaser becoming Bankrupt, or (c) such other Purchaser Default that is not cured prior to the expiration of the cure period set forth in Section 11.1(c), then, in addition to pursuing its remedies pursuant to Section 11.3, Seller may terminate this Agreement effective immediately upon the delivery of Written notice thereof to Purchaser. Seller’s damages upon such a termination, or upon a rejection of this Agreement by a trustee in bankruptcy, will be equal to the sum of the following (without duplication): (i) any amounts due under this Agreement as of the effective date of termination for Coke delivered but not yet paid for; (ii) all reasonable costs and expenses incurred by Seller as a result of terminating this Agreement that would not have been incurred had the Parties been able to continue to perform under this Agreement including, without limitation, an amount equal to (A) the product of (x) the Variable Cost per Ton of Coke multiplied by (y) the sum of (I) [***] Tons for each full Contract Year remaining in the then current Initial Term or Renewal Term, as applicable, and (II) a pro rata portion (based on the number of days remaining in such Contract Year divided by 365) of [***] Tons for any partial Contract Year remaining in the then current Initial Term or Renewal Term, as applicable, less (B) any Mitigation Proceeds realized by Seller. The Parties acknowledge and agree the actual damages likely to result from a Purchaser Default giving rise to the rights in this Section 11.4 are difficult to estimate on the date of this Agreement and would be difficult for Seller to prove. The Parties intend that the payment of such damages, would serve to compensate Seller for any Purchaser Default, and they do not intend for it to serve as punishment for any such Purchaser Default. 11.5 Purchaser’s Termination for Breach. Upon the occurrence of (a) a Seller Default under Section 11.2(a) that is not cured by Seller prior to the expiration of the cure period set forth in Section 11.2(a), (b) Seller becoming Bankrupt, or (c) such other Seller Default that is not cured prior to the expiration of the cure period set forth in Section 11.2(c), then, in addition to pursuing their remedies pursuant to Section 11.3, Purchaser may terminate this Agreement effective immediately upon the delivery of Written notice thereof to Seller. Purchaser’s damages upon such a termination, or upon a rejection of this Agreement by a trustee in bankruptcy, will be equal to the product of (A) the excess (if any) of (x) the commercially reasonable price of Purchaser

18 Obtained Coke over (y) the Contract Price for equivalent Coke Tonnage (and if (x) is not greater than (y), then this clause (A) will be equal to zero), multiplied by (B) the sum of (x) [***] Tons of replacement coke for each full Contract Year remaining in the then current Initial Term or Renewal Term, as applicable, and (y) a pro rata portion (based on the number of days remaining in such Contract Year divided by 365) of [***] Tons of replacement coke for any partial Contract Year remaining in the then current Initial Term or Renewal Term, as applicable. The Parties acknowledge and agree the actual damages likely to result from a Seller Default giving rise to the rights in this Section 11.5 are difficult to estimate on the date of this Agreement and would be difficult for Purchaser to prove. The Parties intend that the payment of such damages would serve to compensate Purchaser for any Seller Default, and they do not intend for it to serve as punishment for any such Seller Default. 11.6 No Release of Accrued Obligations. No termination of this Agreement shall release either Party from any obligations (including those arising out of a breach of this Agreement) that may have accrued under this Agreement prior to such termination. ARTICLE XII MISCELLANEOUS PROVISIONS 12.1 Notices. All notices, requests and demands to or upon the respective parties hereto to be effective shall be in Writing. Except for invoices, such communications shall be addressed and directed to the Parties listed below as follows, or to such other address or recipient for a Party as may be hereafter notified by such Party hereunder: If to Seller to: If to Purchaser, to: [***] 1011 Warrenville Road Suite 600 Lisle, IL 60532 [***] [***] [***] [***] with copies to: with copies to: SunCoke Energy, Inc. 1011 Warrenville Road Suite 600 Lisle, IL 60532 legal@suncoke.com Cleveland-Cliffs Inc. 200 Public Square, Suite 3300 Cleveland, OH 44114-2315 Attention: General Counsel And by Email to: legalnotices@clevelandcliffs.com 12.2 No Consequential or Exemplary Damages. NEITHER SELLER NOR PURCHASER NOR ANY OF THEIR RESPECTIVE AFFILIATES SHALL BE LIABLE FOR ANY SPECIAL, INDIRECT, CONSEQUENTIAL, PUNITIVE OR EXEMPLARY DAMAGES FOR BREACH OF ANY WARRANTY OR OTHERWISE.

19 12.3 Governing Law. This Agreement shall be construed in accordance with and governed by the laws of the State of Ohio without regard to its conflicts of law provisions, and the rights and remedies of the Parties hereunder will be determined in accordance with such laws. 12.4 Severability. If any provision of this Agreement is found by a court of competent jurisdiction to be prohibited or unenforceable, it shall, as to such jurisdiction, be ineffective only to the extent of such prohibition or unenforceability, and such prohibition or unenforceability shall not invalidate the balance of such provision to the extent it is not prohibited or unenforceable, nor invalidate the other provisions of this Agreement. 12.5 Entire Agreement. This Agreement, including Appendix A, the Schedules attached hereto and the Confidentiality Agreement, constitutes the entire agreement among the Parties concerning the subject matter hereof and supersedes and cancels any prior agreements, representations, warranties, or communications, whether oral or written, among the Parties regarding the transactions contemplated by, and the subject matter of, this Agreement. For the avoidance of doubt, this Agreement expressly supersedes and replaces in all respects the HHO1 Agreement, HHO2 Agreement and the Jewell Agreement. The provisions of this Agreement shall not be reformed, altered, or modified in any way by any practice or course of dealing prior to or during the term of the Agreement, and can only be reformed, altered, or modified by a Writing signed by authorized representatives of the Parties. The Parties specifically acknowledge that they have not been induced to enter into this Agreement by any representation, stipulation, warranty, agreement, or understanding of any kind other than as expressed in this Agreement. 12.6 Survival. The rights and obligations of the Parties pursuant to this Section 12.6, and Article IX, Sections 8.1, 8.2, 11.3, 11.4, 11.5, 11.6, 12.1, 12.2, 12.3, 12.4, 12.5, and 12.7 shall survive the termination of this Agreement. 12.7 Construction of Agreement. This Agreement shall be construed as a contract for the purchase and sale of goods. Defined terms in this Agreement shall include in the singular number the plural and in the plural number the singular. Unless otherwise expressly specified, any agreement, contract or document defined or referred to herein shall mean such agreement, contract or document as the same may hereafter be amended, supplemented or otherwise modified from time to time. The words “include”, “includes”, and “including” shall not be limiting and shall be deemed in all instances to be followed by the phrase “without limitation”. References to “days” shall mean calendar days unless otherwise indicated. References to “dollar,” “dollars” or “$” shall be to the lawful currency of the United States. The word “or” shall not be exclusive. References to any Person includes such Person’s successors and assigns but, if applicable, only if such successors and assigns are permitted by this Agreement. The Schedules to this Agreement shall form part of this Agreement for all purposes. References herein to Sections or Schedules shall mean such Sections or Schedules of or to this Agreement. The captions and headings in this Agreement are for convenience of reference purposes only and have no legal force or effect. Such captions and headings shall not be considered a part of this Agreement for purposes of interpreting, construing or applying this Agreement and will not define, limit, extend, explain or describe the scope or extent of this Agreement or any of its terms and conditions. 12.8 Independent Contractor. Neither Party to this Agreement is the partner, legal representative or agent of the other, nor shall either Party have the right or authority to assume,

20 create or incur any liability or any obligation of any kind implied, against or in the name or on behalf of the other. 12.9 Waivers and Remedies. The failure of either Party to insist in any one or more instances upon strict performance of any of the provisions of this Agreement or to take advantage of any of its rights hereunder shall not be construed as a waiver of any such provisions or the relinquishment of any such rights, but the same shall continue and remain in full force and effect. Except as otherwise expressly limited in this Agreement, all remedies under this Agreement shall be cumulative and in addition to every other remedy provided for herein or by law. 12.10 Assignability. Neither Purchaser nor Seller shall Assign any of its rights or obligations under this Agreement without the prior Written consent of the other Party (such consent shall not be unreasonably withheld or delayed). [Signature page follows]

[Signature Page to Amended & Restated Coke Purchase Agreement] IN WITNESS WHEREOF, the Parties have caused this Amended & Restated Coke Purchase Agreement to be executed by their respective duly authorized officers as of the date first above written. HAVERHILL NORTH COKE COMPANY CLEVELAND-CLIFFS STEEL LLC By: /s/ Mike Hardesty Name: Mike Hardesty Title: Senior Vice President Date: 11/12/2025 By: /s/ Clifford Smith Name: Clifford Smith Title: Executive Vice President and Chief Operating Officer Date: 11/12/2025

Appendix A - 1 APPENDIX A Definitions The definitions of certain capitalized terms are as follows: “Affiliate” means as to any Person, any other Person which, directly or indirectly, controls, or is controlled by, or is under common control with, such Person. For purposes of this definition, “control” of a Person means the power, directly or indirectly, to direct or cause the direction of the management and policies of such Person whether by contract or otherwise. “Agreement” has the meaning set forth in the Preamble of this Agreement. “Assign” or “Assignment” means, as applicable, the sale, lease, transfer or voluntarily disposal of all or a substantial portion of the assets of Seller or Purchaser. “ASTM Standards” means procedures and standards adopted or approved by the American Society for Testing and Materials. “Bankrupt” means, with respect to any Person: (a) such Person applying for or consenting to the appointment of, or the taking of possession by, a receiver, custodian, trustee or liquidator of itself or of all or a substantial part of its property; (b) such Person making a general assignment for the benefit of its creditors; (c) such Person commencing a voluntary case under the Bankruptcy Code (as now or hereafter in effect); (d) such Person filing a petition seeking to take advantage of any other law relating to bankruptcy, insolvency, reorganization, winding-up, or composition or readjustment of debts; (e) such Person taking any action for the purpose of effecting any of the foregoing; or (f) such Person is a defendant, respondent, alleged debtor, or has otherwise had commenced against it, in any court of competent jurisdiction, a proceeding or case under the Bankruptcy Code or a case seeking: (i) its liquidation, reorganization, dissolution or winding-up, or the composition or readjustment of its debts; (ii) the appointment of a trustee, receiver, custodian, liquidator or the like, of such Person or of all or any substantial part of its property; or (iii) similar relief under any law relating to bankruptcy, insolvency, reorganization, winding-up, or composition or adjustment of debts; and such

Appendix A - 2 proceeding or case shall continue undismissed, or an order, judgment or decree approving or ordering any of the foregoing shall be entered and continue unstayed and in effect, for a period of sixty (60) or more calendar days; or an order for relief against such Person shall be entered in a case under the Bankruptcy Code. “Base Case Coal Blend” means a Coal Blend having a volatile matter content of [***] percent [***] and a moisture content of [***] percent [***]. “Breeze” means material that is screened when Seller screens for [***] x [***] Coke. “Business Day” means any day other than a Saturday, Sunday or other day in which commercial banks are authorized to close (or are in fact closed) in Chicago, Illinois. “By-Products” means all output of the Coke Plant excluding blast furnace coke, but including breeze, nut coke, waste heat, and products from such waste heat. “Coal(s)” are metallurgical coking coals or “green” petroleum coke that are reliable and readily available for use in the Coal Blend. “Coal Blend” means a particular blend of not more than [***] Coals plus “green” petroleum coke (not to exceed [***] percent [***] of the total Coal Blend) that is being used or may be used to produce Coke, including the original coal blend selected by the Coal Committee, each new coal blend selected by the Coal Committee, and as applicable, any coal blend utilized independently by Seller. In the case of coal blends selected by the Coal Committee, the actual percentage of each Coal comprising such coal blend shall be blended to within [***] percent [***] of the Coal Blend composition selected by the Coal Committee. “Coal Blend Standards” are the standards for selecting the Coal Blends. Those standards require that Coal Blends that (i) consist of coals having a minimum FSI of [***] that are reliable and readily available for use at the Coke Plant; (ii) actually produce Coke that will reasonably conform to existing or proposed (as applicable) “typical” Guaranteed Quality Standards set forth in Schedule 5.2; (iii) have a volatile matter component of not less than [***] percent [***] and not more than [***] percent [***]; and (iv) allow for safe, reliable and efficient operation of the Coke Plant. “Coal Costs” are costs, expenses and expenditures, including taxes, related, to (i) sampling, testing, selecting, purchasing, storing, handling, transporting, and delivering the Coals to the coal unloading facility at the Coke Plant, and (ii) the Third Party Consultant. Coal Costs do not include overhead or administrative costs of Seller or its Affiliates. “Coal Cost per Ton of Coke” has the meaning set forth in Section 3.4(a). “Coal Committee” means the committee constituted pursuant to and having the authority set forth in Section 4.1. “Coal Handling Losses” are losses associated with the storage and handling of the Coals, shall be deemed to equal [***] percent [***], and shall be determined in the manner set forth in Section 3.4.

Appendix A - 3 “Coke” means blast furnace coke that is produced at the Coke Plant or, as applicable, coke that is, or is a blend of such coke with, Third Party Supplied Coke, and that Seller delivers to Purchaser pursuant to this Agreement and that (i) conforms to the Guaranteed Quality Standards or (ii) that does not conform to the Guaranteed Quality Standards, but in any case is not rejected or is accepted by Purchaser. Coke does not include any By-Products. “Coke Plant” means the coke making plant and related facilities and equipment at Haverhill, Ohio including equipment owned and operated by Seller based upon heat recovery technology that is proprietary to Seller and Seller’s Affiliates. “Coke Supply and Purchase Obligation” is the Tonnage of Coke or Third Party Supplied Coke that Seller is obligated to deliver to Purchaser, and the Tonnage of Coke and Third Party Supplied Coke that Purchaser is obligated to accept and purchase from Seller during the Term as set forth in Section 6.1. “Contract Price” has the meaning set forth in Section 3.1. “Contract Year” means each complete year transpiring during the Term. “Credits” means any and all emissions, tax, or other credits, refunds, offsets, emissions reductions, allowances, designations, certificates, grants or other benefits available to Seller under applicable law in connection with or resulting from Seller’s operation of the Coke Plant or manufacture of coke. “Current Laws” means all applicable laws, regulations, or other legal requirements imposed and being applied by any state, local, federal or foreign Governmental Authority, including environmental laws and regulations (including permits), as of the Execution Date. Notwithstanding the foregoing, Current Laws shall not include changes to 40 C.F.R Part 63 Subparts L and CCCCC published by EPA on July 5, 2024 at 89 Fed. Reg. 55684 through 55757 (the “MACT RTR”). The MACT RTR is currently being reconsidered by the United States Environmental Protection Agency (the “EPA”) and is subject to ongoing litigation and shall instead be considered a Future Law, regardless of whether the MACT RTR is further revised following the Execution Date. “Delivery Point” for non-Third Party Supplied Coke means, as applicable, the railcar onto which Coke is loaded as it is produced for Purchaser’s account once the full train shipment is loaded, or otherwise the [Haverhill Coke stockpile]. For Third Party Supplied Coke the Delivery Point will be the physical plant location of Purchaser reasonably identified by Purchaser. “Discounted Coke Price” has the meaning set forth in Section 5.2(b). “Effective Date” has the meaning set forth in Section 2.1. “EPA” has the meaning set forth in the definition of Current Laws. “Execution Date” has the meaning set forth in the Preamble of this Agreement.

Appendix A - 4 “Future Laws” means all laws, regulations, or legal requirements, permits, or permit modifications enacted, imposed or first being applied by any state, local or federal or foreign Governmental Authority after the Execution Date. “Future Laws” does not include any requirements or actions resulting from Seller’s failure to comply with Current Laws, except to the extent resulting from any action or inaction by Altivia or Purchaser. For the avoidance of doubt, (i) the MACT RTR shall be considered a Future Law, and (ii) any new application of Current Laws that is first applied by a Governmental Authority after the Execution Date shall be considered a Future Law and not a Current Law. “GAAP” means generally accepted accounting principles, consistently applied. “Governmental Authority” means any nation or government, any state or other political subdivision thereof and any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government. “Governmental Imposition” shall means any assessment, charge, impost or levy, however denominated (but not including fines or other penalties for the failure to comply with nontax legal requirements), including any additions that is or may become payable in respect thereof, imposed by any state, local or federal or foreign Governmental Authority that may be imposed on the purchase of coal, the production or sale of Coke, on any asset or transaction of Seller related to the Coke Plant including any value added tax of any type, an energy tax of any type, (with the exception of a tax measured by net income, the Ohio Gross Receipts Tax, or any withholding tax relating to an interest in Seller), a tax of any type on greenhouse gas emissions, or a greenhouse gas emissions pricing or trading system of any type. Governmental Impositions shall not include any assessment, charge, impost, or levy, however denominated, that is solely a result of actions or inaction by Seller (i) prior to the Execution Date or (ii) any failure to comply with Current Laws during the Term. “Guaranteed Coke Yield Percentage” has the meaning set forth in Section 3.4(c). “Guaranteed Quality Standards” are the guaranteed quality parameters for Coke and for Third party Supplied Coke set forth in Schedule 5.2. “HHO1 Agreement” has the meaning set forth in the Recitals of this Agreement. “HHO2 Agreement” has the meaning set forth in the Recitals of this Agreement. “Incidental Damages” are incidental damages allowed under Ohio Revised Code Section 1302.84, or as allowed pursuant to any amendment or recodification thereof. Such damages specifically include, without limitation, commercially reasonable storage and rescreening costs, and degradation and handling losses, incurred by Seller in connection with stockpiling of Coke or Third Party Supplied Coke. “Initial Term” has the meaning set forth in Section 2.1. “Interest Rate” means an interest rate equal to [***] percent [***] above the rate announced by JPMorgan & Co as its prime rate at the date of accrual of the late payment.

Appendix A - 5 “Jewell Agreement” has the meaning set forth in the Recitals of this Agreement. “MACT RTR” has the meaning set forth in the definition of Current Laws. “Manifest Error” means an arithmetical error that is readily apparent. “Mitigation Proceeds” means any (positive) difference between (i) [***] per Ton of Coke sold to third parties plus the sum of (w) net sales proceeds arising from such third party sales and (x) any costs and expenses saved by Seller in connection therewith; less (ii) Incidental Damages incurred by Seller in connection with such third party sales plus the product of (y) the Contract Price multiplied by (z) Coke Tonnage sold to such third parties. “Moisture Adjusted Coal Blend Tonnage” has the meaning set forth in Section 3.4(a). “Nonconforming Coke” has the meaning set forth in Section 5.2(b). “Norfolk Southern” has the meaning set forth in Section 3.2. “Party” or “Parties” has the meaning set forth in the Preamble of this Agreement. “Payment Default” means any failure by Purchaser to pay Seller in accordance with Sections 3.9, 5.1(d) or 7.3. “Person” means and includes any individual, firm, corporation, partnership, limited liability corporation, association, trust or other entity or enterprise or any government or political subdivision or agency, department or instrumentality thereof. “Position Notice” has the meaning set forth in Section 4.2(b)(i). “Purchaser” has the meaning set forth in the Preamble of this Agreement. “Purchaser Default” has the meaning set forth in Section 11.1. “Purchaser Force Majeure Event(s)” has the meaning set forth in Section 8.2. “Purchaser Obtained Coke” means coke obtained by Purchaser that is required by Purchaser to operate the Blast Furnace(s) in the ordinary course of business up to any shortfall in Seller’s delivery of Coke and Third Party Supplied Coke relative to the Coke Supply and Purchase Obligation. “Purchaser Parent” has the meaning set forth in the Recitals of this Agreement. “Purchaser Parent Guaranty” has the meaning set forth in the Recitals of this Agreement. “Renewal Notice” has the meaning set forth in Section 2.2. “Renewal Term” has the meaning set forth in Section 2.2.

Appendix A - 6 “Seller” has the meaning set forth in the Preamble of this Agreement. “Seller Default” has the meaning set forth in Section 11.2. “Seller Force Majeure Event” has the meaning set forth in Section 8.1. “Seller Parent” has the meaning set forth in the Recitals of this Agreement. “Seller Parent Guaranty” has the meaning set forth in the Recitals of this Agreement. “Shipment” means the delivery of a trainload of Coke to Purchaser at the applicable Delivery Point. “Taxes” means any tax imposed by any Governmental Authority in the form of sales, use, excise, value added, environmental, gross receipts or franchise tax (except for property taxes related to the Coke Plant or taxes based on or measured by the net income or net worth of Seller), state and local product tax, state and local inspection fees, or similar taxes, assessments, or fees imposed with respect to the sale or purchase of coke pursuant to this Agreement. If the purchase of any Coke by any Purchaser is exempt from sales or use tax, that Purchaser shall furnish Seller with a valid exemption certificate in form and content reasonably acceptable to Seller. In the event any exemption is subsequently denied by any Governmental Authority, and as a result Seller is assessed for such sales or use tax, then Purchaser shall reimburse Seller for such taxes including all interest and penalties associated therewith. “Term” has the meaning set forth in Section 2.1. “Third Party Consultant” has the meaning set forth in Section 4.2(b)(i). “Third Party Supplied Coke” means coke obtained from sources other than Seller, and includes coke obtained from Seller’s Affiliates. “Ton” or “Tonnage” means a “short” ton of two thousand (2,000) pounds of Coal or Coke, as the case may be. “Transportation Costs” has the meaning set forth in Section 3.5. “Variable Cost Index” means the increase or decrease annually of the Variable Cost per Ton of Coke as determined with the following formula: i. [***] percent [***] multiplied by the cumulative percentage change (which may be a positive or negative amount) in the Employment Cost Index (Employment Cost Index: Total compensation for private industry workers in the Midwest Census Region; Series CIU2010000000230I; as published by the US Bureau of Labor Statistics), as measured from the third quarter of the then current calendar year to the third quarter of 2025; plus ii. [***] percent [***] multiplied by the cumulative percentage change (which may be a positive or negative amount) in the Producer Price Index by Commodity: Final Demand: Final Demand Less Food and Energy (Series PPIFES); as published by

Appendix A - 7 the US Bureau of Labor Statistics as measured from the third quarter of the then current calendar year to the third quarter of 2025; plus iii. [***] percent [***] multiplied by the cumulative percentage change (which may be a positive or negative amount) in the Producer Price Index by Commodity: Intermediate Demand by Commodity Type: Processed Energy Goods (Series WPUID69113; as published by the US Bureau of Labor Statistics) as measured from the third quarter of the then current calendar year to the third quarter of 2025; plus iv. [***] percent [***] multiplied by the cumulative percentage change (which may be a positive or negative amount) in the Producer Price Index by Industry: Lime Manufacturing: Primary Products (Series PCU327410327410P; as published by the US Bureau of Labor Statistics) as measured from the third quarter of the then current calendar year to the third quarter of 2025. “Variable Cost per Ton of Coke” has the meaning set forth in Section 3.3. “Written” or “in Writing” means any form of written communication or a communication by means of e-mail, overnight courier, or registered or certified mail (postage prepaid and return receipt requested), and shall be deemed to have been duly given or made upon receipt, or in the case of any electronic transmission, when confirmation of receipt is obtained.

Schedule 5.2 Guaranteed Quality Standards Mean Threshold for Quality Adjustment Price Adjustment Reject Standards Moisture(%) [***] [***] N/A [***] Sulfur (%) (dry basis) [***] [***] [***] [***] Ash (%) (dry basis) [***] [***] [***] [***] V.M.(%) (dry basis) [***] [***] [***] [***] Stability [***] [***] [***] [***] CSR [***] N/A N/A N/A Ash Mineral Analysis N/A N/A N/A N/A Size [***] [***] [***] [***]