3Q TWENTY25 INVESTOR PRESENTATION ORIGIN BANCORP, INC.

2 FORWARD-LOOKING STATEMENTS AND NON-GAAP MEASURES This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include information regarding Origin Bancorp, Inc’s (“Origin”, “we”, “our” or the “Company”) future financial performance, business and growth strategies, projected plans and objectives, and any expected purchases of its outstanding common stock, and related transactions and other projections based on macroeconomic and industry trends, including changes to interest rates by the Federal Reserve and the resulting impact on Origin’s results of operations, estimated forbearance amounts and expectations regarding the Company’s liquidity, including in connection with advances obtained from the FHLB, which are all subject to change and may be inherently unreliable due to the multiple factors that impact broader economic and industry trends, and any such changes may be material. Such forward-looking statements are based on various facts and derived utilizing important assumptions and current expectations, estimates and projections about Origin and its subsidiaries, any of which may change over time and some of which may be beyond Origin’s control. Statements or statistics preceded by, followed by or that otherwise include the words “assumes,” “anticipates,” “believes,” “estimates,” “expects,” “foresees,” “intends,” “plans,” “projects,” and similar expressions or future or conditional verbs such as “could,” “may,” “might,” “should,” “will,” and “would” and variations of such terms are generally forward-looking in nature and not historical facts, although not all forward-looking statements include the foregoing words. Further, certain factors that could affect Origin’s future results and cause actual results to differ materially from those expressed in the forward- looking statements include, but are not limited to: (1) the impact of current and future economic conditions generally and in the financial services industry, nationally and within Origin’s primary market areas, including the impact of tariffs, as well as the financial stress on borrowers and changes to customer and client behavior as a result of the foregoing; (2) changes in benchmark interest rates and the resulting impacts on net interest income; (3) deterioration of Origin’s asset quality; (4) factors that can impact the performance of Origin’s loan portfolio, including real estate values and liquidity in Origin’s primary market areas; (5) the financial health of Origin’s commercial borrowers and the success of construction projects that Origin finances; (6) changes in the value of collateral securing Origin’s loans; (7) the impact of generative artificial intelligence; (8) Origin’s ability to anticipate interest rate changes and manage interest rate risk; (9) the impact of heightened regulatory requirements, reduced debit interchange and overdraft income and the possibility of facing related adverse business consequences if our total assets grow in excess of $10 billion as of December 31 of any calendar year; (10) the effectiveness of Origin’s risk management framework and quantitative models; (11) Origin’s inability to receive dividends from Origin Bank and to service debt, pay dividends to Origin’s common stockholders, repurchase Origin’s shares of common stock and satisfy obligations as they become due; (12) the impact of labor pressures; (13) changes in Origin’s operation or expansion strategy or Origin’s ability to prudently manage its growth and execute its strategy; (14) changes in management personnel; (15) Origin’s ability to maintain important customer relationships, reputation or otherwise avoid liquidity risks; (16) increasing costs as Origin grows deposits; (17) operational risks associated with Origin’s business; (18) significant turbulence or a disruption in the capital or financial markets and the effect of market disruption and interest rate volatility on our investment securities; (19) increased competition in the financial services industry, particularly from regional and national institutions, as well as from fintech companies; (20) compliance with governmental and regulatory requirements and changes in laws, rules, regulations, interpretations or policies relating to financial institutions; (21) periodic changes to the extensive body of accounting rules and best practices; (22) further government intervention in the U.S. financial system; (23) a deterioration of the credit rating for U.S. long-term sovereign debt; (24) Origin’s ability to comply with applicable capital and liquidity requirements, including its ability to generate liquidity internally or raise capital on favorable terms, including continued access to the debt and equity capital markets; (25) natural disasters and other adverse weather events, pandemics, acts of terrorism, war, and other matters beyond Origin’s control; (26) developments in our mortgage banking business, including loan modifications, general demand, and the effects of judicial or regulatory requirements or guidance; (27) fraud or misconduct by internal or external actors (including Origin employees); (28) cybersecurity threats or security breaches and the cost of defending against them; (29) Origin’s ability to maintain adequate internal controls over financial and non-financial reporting; and (30) potential claims, damages, penalties, fines, costs and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions. For a discussion of these and other risks that may cause actual results to differ from expectations, please refer to the sections titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Origin’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any updates to those sections set forth in Origin’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Origin’s underlying assumptions prove to be incorrect, actual results may differ materially from what Origin anticipates. Accordingly, you should not place undue reliance on any forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Origin does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise. New risks and uncertainties arise from time to time, and it is not possible for Origin to predict those events or how they may affect Origin. In addition, Origin cannot assess the impact of each factor on Origin’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this communication are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Origin or persons acting on Origin’s behalf may issue. Annualized, pro forma, adjusted, projected, and estimated numbers are used for illustrative purposes only, are not forecasts, and may not reflect actual results. This presentation contains projected financial information with respect to Origin, including with respect to certain goals and strategic initiatives of Origin and the anticipated benefits thereof. This projected financial information constitutes forward-looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to significant business, economic (including interest rate), competitive, and other risks and uncertainties. Actual results may differ materially from the results contemplated by the projected financial information contained herein and the inclusion of such projected financial information in this presentation should not be regarded as a representation by any person that such actions will be taken or accomplished or that the results reflected in such projected financial information with respect thereto will be achieved. Origin reports its results in accordance with generally accepted accounting principles in the United States ("GAAP"). However, management believes that certain supplemental non-GAAP financial measures may provide meaningful information to investors that is useful in understanding Origin's results of operations and underlying trends in its business. However, non-GAAP financial measures are supplemental and should be viewed in addition to, and not as an alternative for, Origin's reported results prepared in accordance with GAAP. The following are the non-GAAP measures used in this presentation: Pre-tax, pre-provision (“PTPP”) earnings, PTPP ROAA, tangible book value per common share, tangible common equity to tangible assets, return on average tangible common equity (“ROATCE”) and core efficiency ratio. Please see “Reconciliation of Non-GAAP Financial Measures” at the end of this presentation for reconciliations of non-GAAP measures to the most directly comparable financial measures calculated in accordance with GAAP. ORIGIN BANCORP, INC. _______

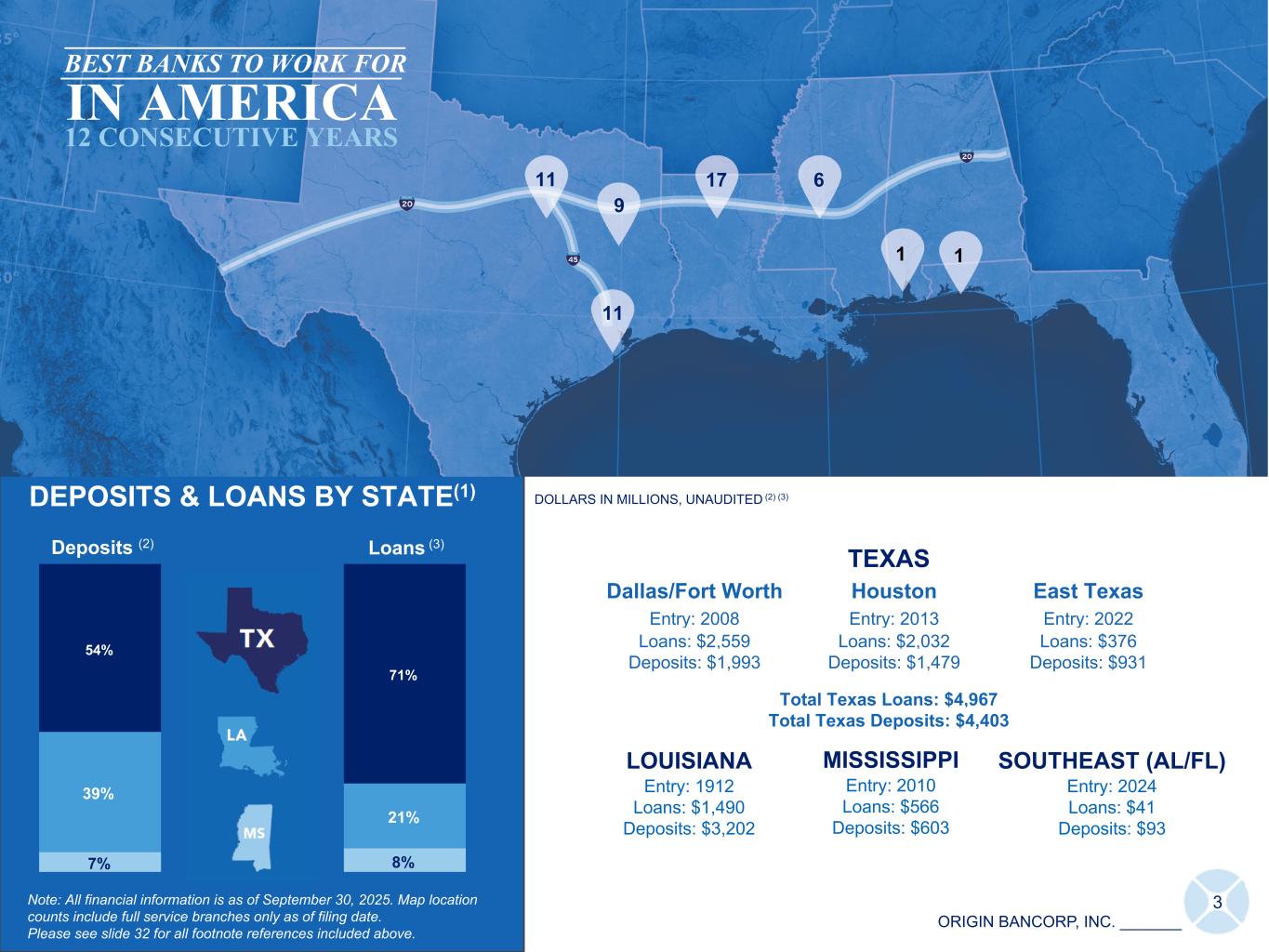

ORIGIN BANCORP, INC. _______ LOUISIANA Entry: 1912 Loans: $1,490 Deposits: $3,202 DOLLARS IN MILLIONS, UNAUDITED (2) (3) 3 DEPOSITS & LOANS BY STATE(1) Note: All financial information is as of September 30, 2025. Map location counts include full service branches only as of filing date. Please see slide 32 for all footnote references included above. MISSISSIPPI Entry: 2010 Loans: $566 Deposits: $603 7% 8% 39% 21% 54% 71% Loans (3)Deposits (2) ICS ICS TEXAS Dallas/Fort Worth Houston East Texas Entry: 2008 Entry: 2013 Entry: 2022 Loans: $2,559 Loans: $2,032 Loans: $376 Deposits: $1,993 Deposits: $1,479 Deposits: $931 Total Texas Loans: $4,967 Total Texas Deposits: $4,403 SOUTHEAST (AL/FL) Entry: 2024 Loans: $41 Deposits: $93 11 11 9 17 6 11 BEST BANKS TO WORK FOR IN AMERICA 12 CONSECUTIVE YEARS

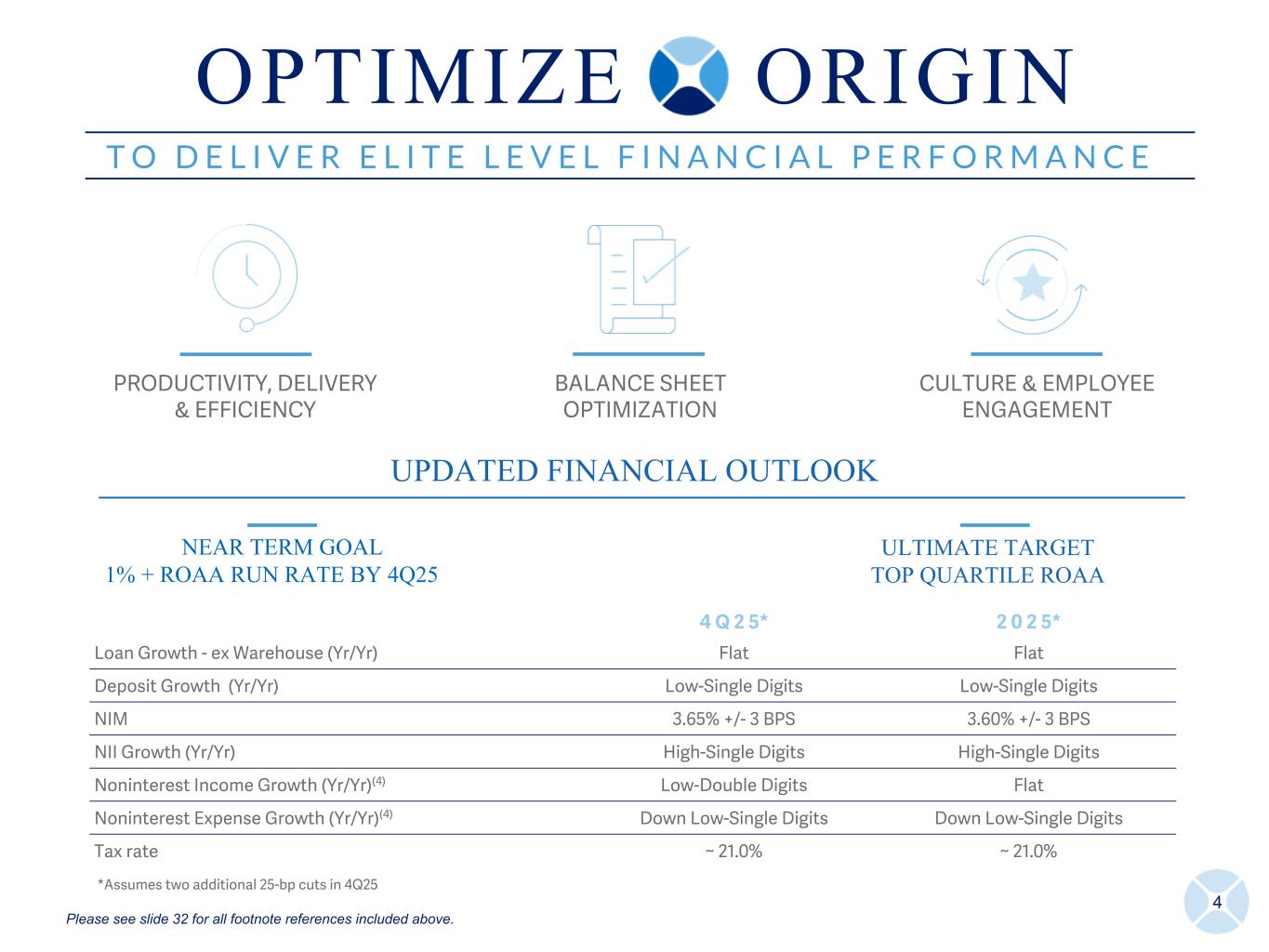

4 T O D E L I V E R E L I T E L E V E L F I N A N C I A L P E R F O R M A N C E PRODUCTIVITY, DELIVERY & EFFICIENCY BALANCE SHEET OPTIMIZATION CULTURE & EMPLOYEE ENGAGEMENT UPDATED FINANCIAL OUTLOOK 4 Q 2 5* 2 0 2 5* Loan Growth - ex Warehouse (Yr/Yr) Flat Flat Deposit Growth (Yr/Yr) Low-Single Digits Low-Single Digits NIM 3.65% +/- 3 BPS 3.60% +/- 3 BPS NII Growth (Yr/Yr) High-Single Digits High-Single Digits Noninterest Income Growth (Yr/Yr)(4) Low-Double Digits Flat Noninterest Expense Growth (Yr/Yr)(4) Down Low-Single Digits Down Low-Single Digits Tax rate ~ 21.0% ~ 21.0% *Assumes two additional 25-bp cuts in 4Q25 NEAR TERM GOAL 1% + ROAA RUN RATE BY 4Q25 ULTIMATE TARGET TOP QUARTILE ROAA O P T I M I Z E O R I G I N Please see slide 32 for all footnote references included above.

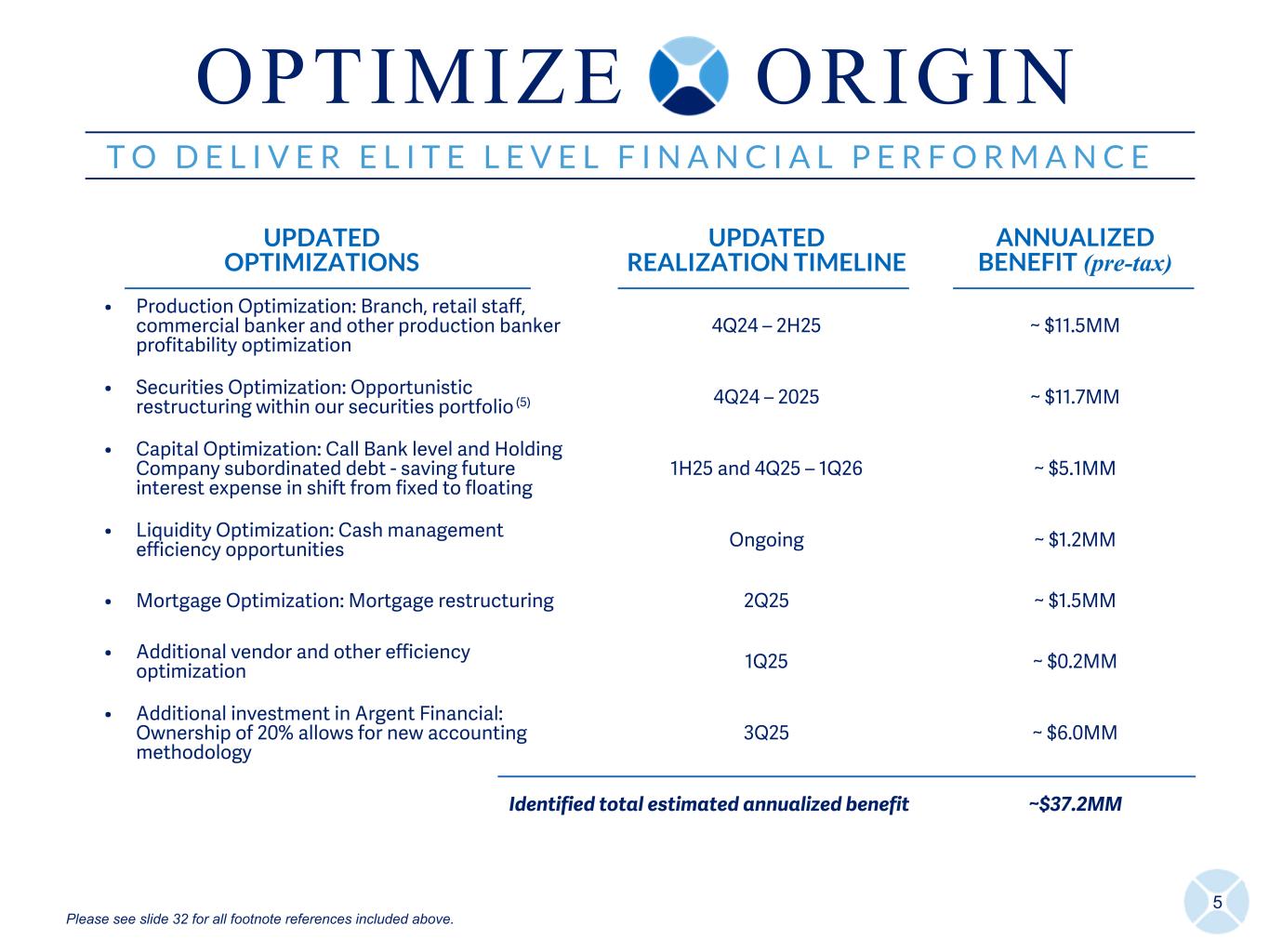

UPDATED OPTIMIZATIONS UPDATED REALIZATION TIMELINE ANNUALIZED BENEFIT (pre-tax) • Production Optimization: Branch, retail staff, commercial banker and other production banker profitability optimization 4Q24 – 2H25 ~ $11.5MM • Securities Optimization: Opportunistic restructuring within our securities portfolio (5) 4Q24 – 2025 ~ $11.7MM • Capital Optimization: Call Bank level and Holding Company subordinated debt - saving future interest expense in shift from fixed to floating 1H25 and 4Q25 – 1Q26 ~ $5.1MM • Liquidity Optimization: Cash management efficiency opportunities Ongoing ~ $1.2MM • Mortgage Optimization: Mortgage restructuring 2Q25 ~ $1.5MM • Additional vendor and other efficiency optimization 1Q25 ~ $0.2MM • Additional investment in Argent Financial: Ownership of 20% allows for new accounting methodology 3Q25 ~ $6.0MM Identified total estimated annualized benefit ~$37.2MM 5 T O D E L I V E R E L I T E L E V E L F I N A N C I A L P E R F O R M A N C E O P T I M I Z E O R I G I N Please see slide 32 for all footnote references included above.

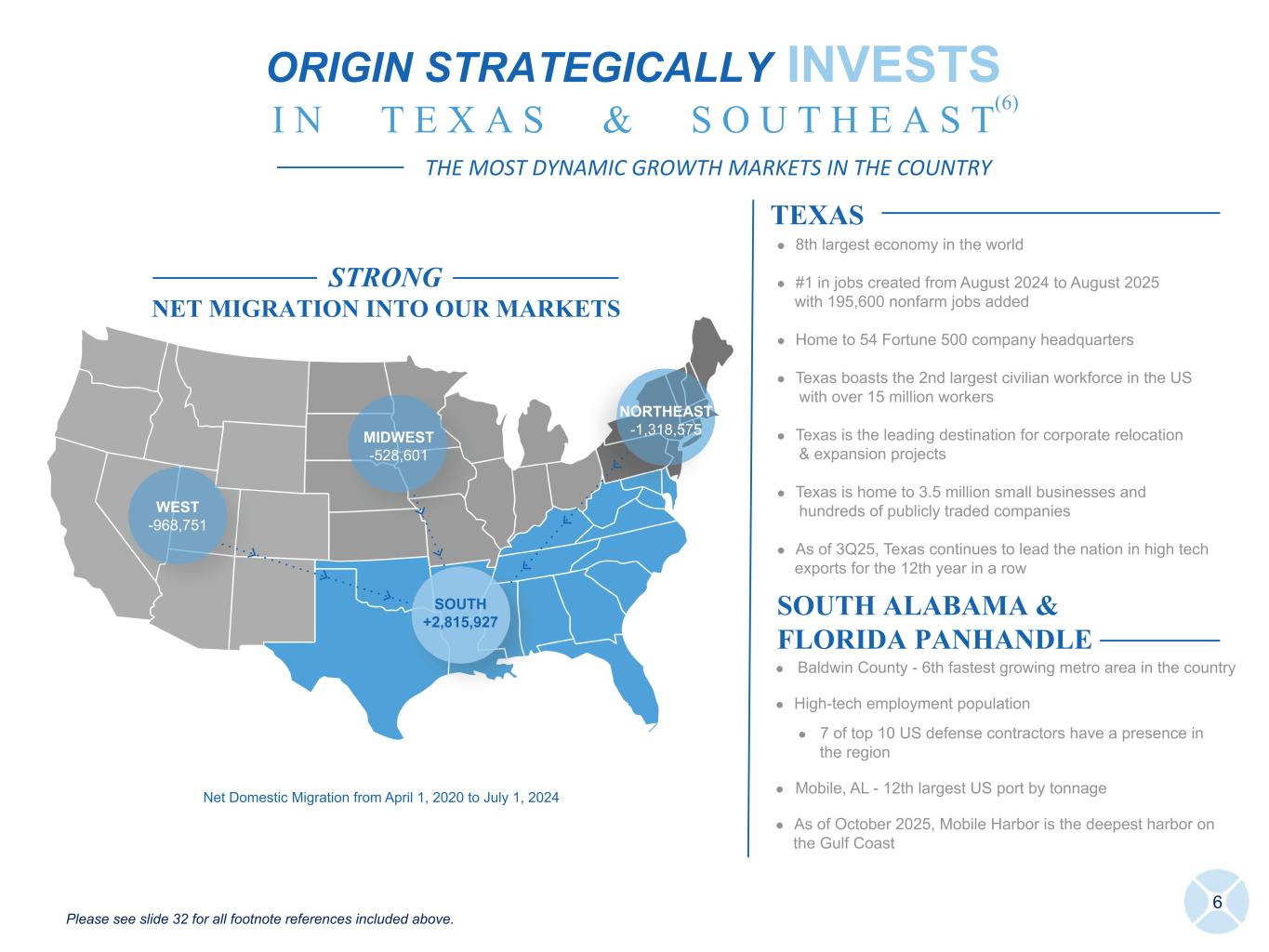

Net Domestic Migration from April 1, 2020 to July 1, 2024 STRONG NET MIGRATION INTO OUR MARKETS WEST -968,751 MIDWEST -528,601 NORTHEAST -1,318,575 SOUTH +2,815,927 6 TEXAS SOUTH ALABAMA & FLORIDA PANHANDLE l Baldwin County - 6th fastest growing metro area in the country l High-tech employment population l 7 of top 10 US defense contractors have a presence in the region l Mobile, AL - 12th largest US port by tonnage l As of October 2025, Mobile Harbor is the deepest harbor on the Gulf Coast l 8th largest economy in the world l #1 in jobs created from August 2024 to August 2025 with 195,600 nonfarm jobs added l Home to 54 Fortune 500 company headquarters l Texas boasts the 2nd largest civilian workforce in the US with over 15 million workers l Texas is the leading destination for corporate relocation & expansion projects l Texas is home to 3.5 million small businesses and hundreds of publicly traded companies l As of 3Q25, Texas continues to lead the nation in high tech exports for the 12th year in a row ORIGIN STRATEGICALLY INVESTS I N T E X A S & S O U T H E A S T THE MOST DYNAMIC GROWTH MARKETS IN THE COUNTRY (6) Please see slide 32 for all footnote references included above.

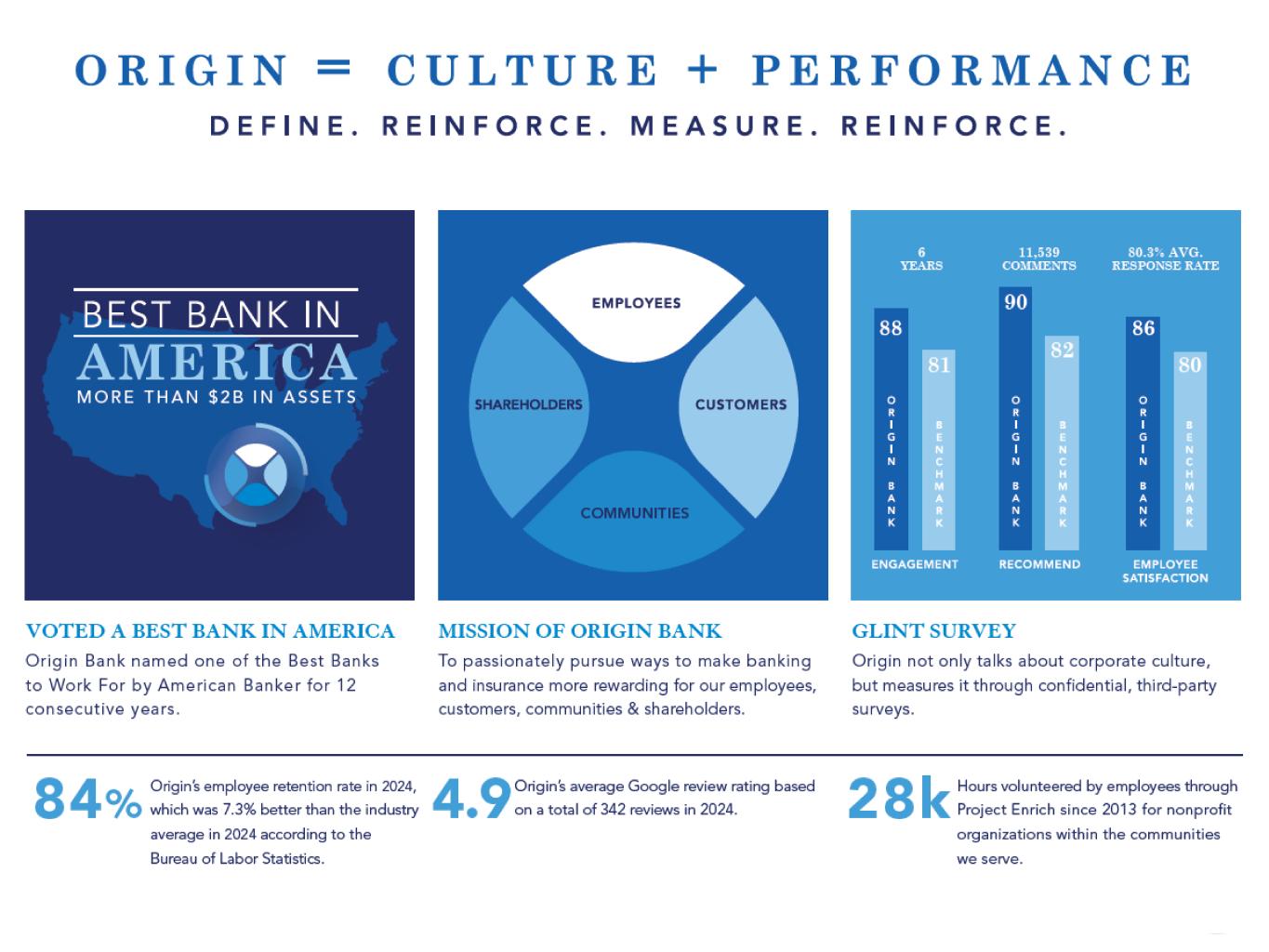

7 ORIGIN BANCORP, INC. _______

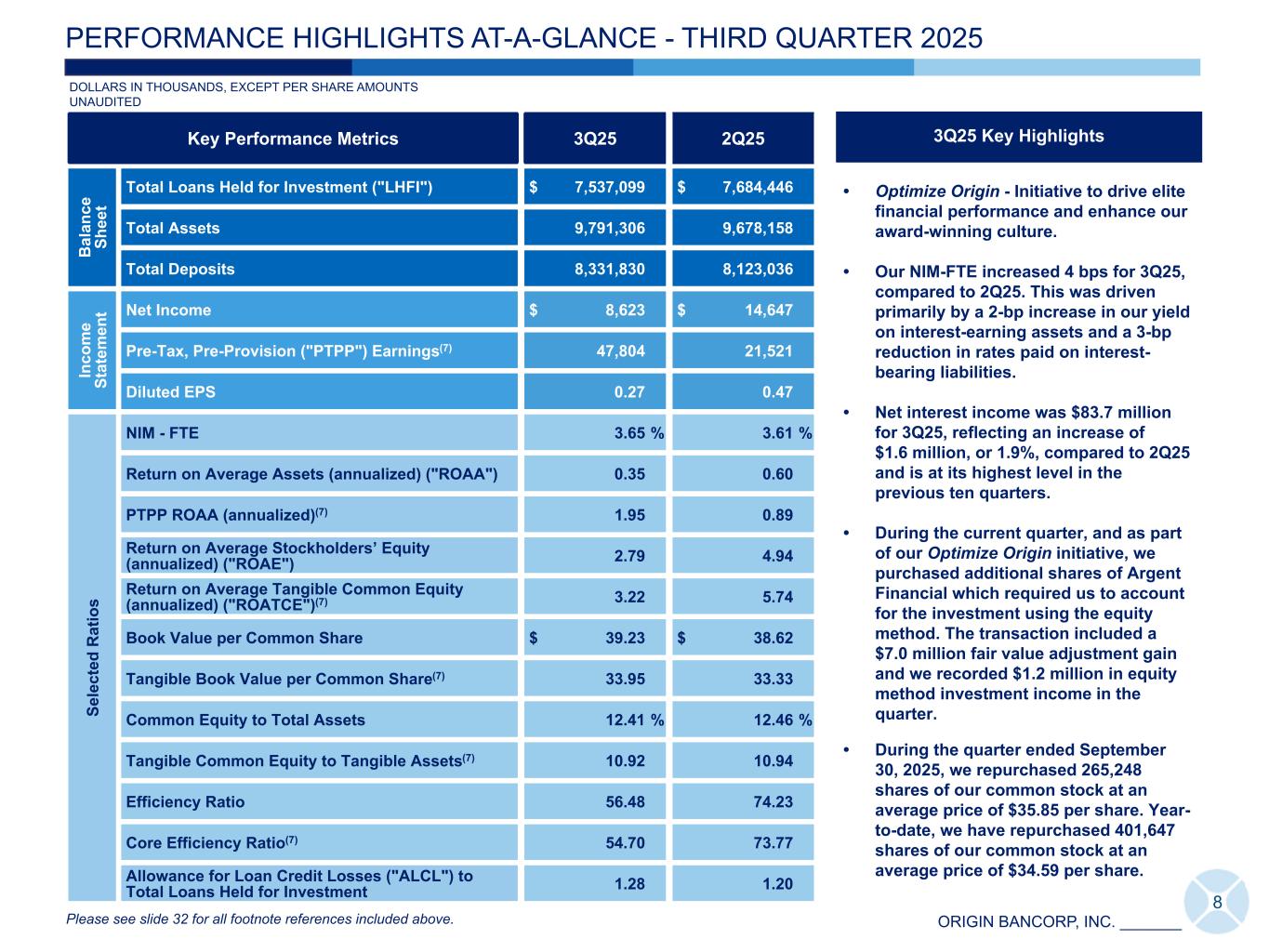

ORIGIN BANCORP, INC. _______ • Optimize Origin - Initiative to drive elite financial performance and enhance our award-winning culture. • Our NIM-FTE increased 4 bps for 3Q25, compared to 2Q25. This was driven primarily by a 2-bp increase in our yield on interest-earning assets and a 3-bp reduction in rates paid on interest- bearing liabilities. • Net interest income was $83.7 million for 3Q25, reflecting an increase of $1.6 million, or 1.9%, compared to 2Q25 and is at its highest level in the previous ten quarters. • During the current quarter, and as part of our Optimize Origin initiative, we purchased additional shares of Argent Financial which required us to account for the investment using the equity method. The transaction included a $7.0 million fair value adjustment gain and we recorded $1.2 million in equity method investment income in the quarter. • During the quarter ended September 30, 2025, we repurchased 265,248 shares of our common stock at an average price of $35.85 per share. Year- to-date, we have repurchased 401,647 shares of our common stock at an average price of $34.59 per share. Key Performance Metrics 3Q25 2Q25 B al an ce Sh ee t Total Loans Held for Investment ("LHFI") $ 7,537,099 $ 7,684,446 Total Assets 9,791,306 9,678,158 Total Deposits 8,331,830 8,123,036 In co m e St at em en t Net Income $ 8,623 $ 14,647 Pre-Tax, Pre-Provision ("PTPP") Earnings(7) 47,804 21,521 Diluted EPS 0.27 0.47 Se le ct ed R at io s NIM - FTE 3.65 % 3.61 % Return on Average Assets (annualized) ("ROAA") 0.35 0.60 PTPP ROAA (annualized)(7) 1.95 0.89 Return on Average Stockholders’ Equity (annualized) ("ROAE") 2.79 4.94 Return on Average Tangible Common Equity (annualized) ("ROATCE")(7) 3.22 5.74 Book Value per Common Share $ 39.23 $ 38.62 Tangible Book Value per Common Share(7) 33.95 33.33 Common Equity to Total Assets 12.41 % 12.46 % Tangible Common Equity to Tangible Assets(7) 10.92 10.94 Efficiency Ratio 56.48 74.23 Core Efficiency Ratio(7) 54.70 73.77 Allowance for Loan Credit Losses ("ALCL") to Total Loans Held for Investment 1.28 1.20 DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS UNAUDITED 8 PERFORMANCE HIGHLIGHTS AT-A-GLANCE - THIRD QUARTER 2025 3Q25 Key Highlights Please see slide 32 for all footnote references included above.

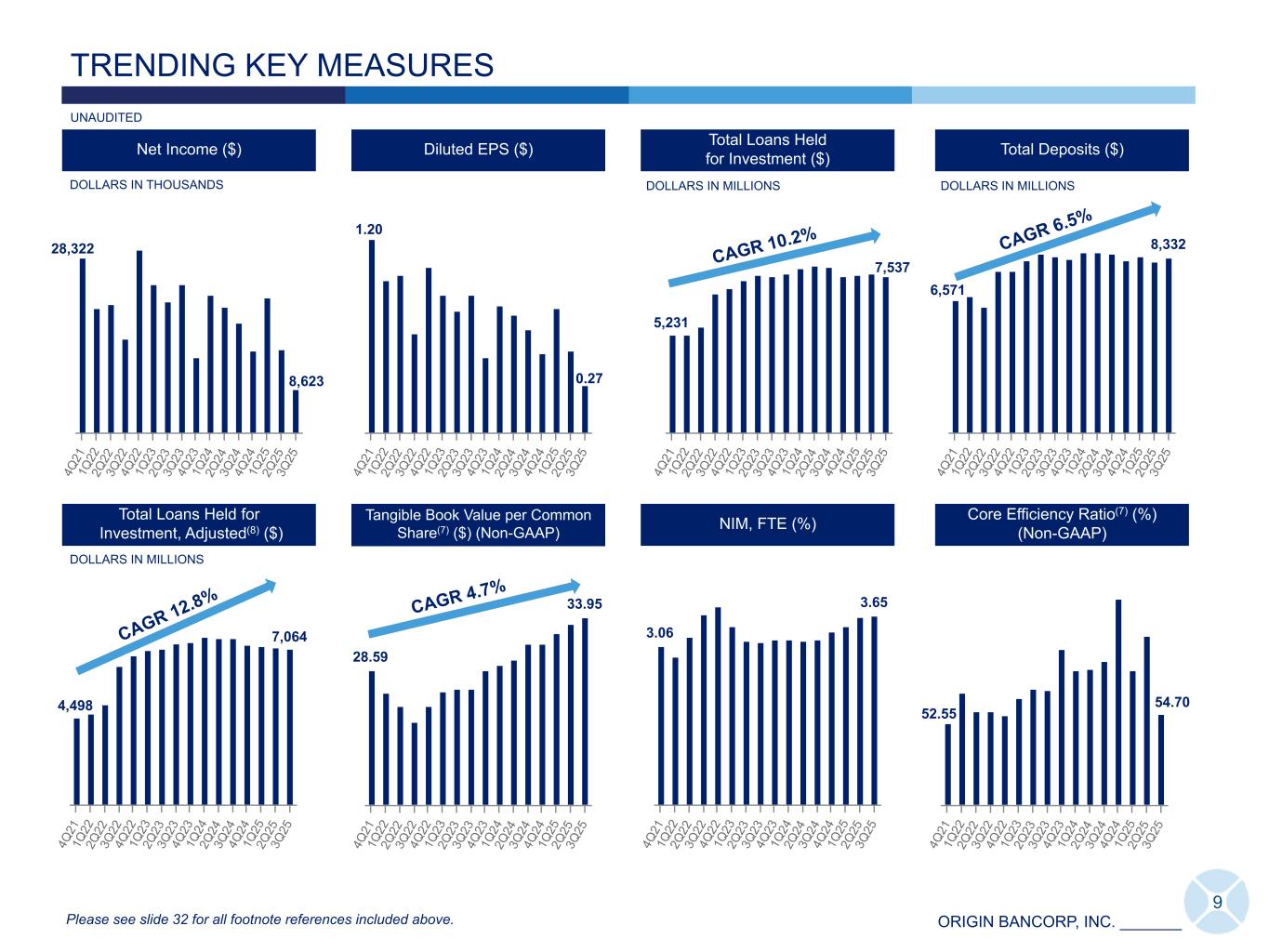

ORIGIN BANCORP, INC. _______ TRENDING KEY MEASURES UNAUDITED Diluted EPS ($)Net Income ($) Total Loans Held for Investment, Adjusted(8) ($) Total Deposits ($) 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 8,332 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 4,498 7,064 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 DOLLARS IN THOUSANDS 9 Total Loans Held for Investment ($) DOLLARS IN MILLIONS 5,231 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 DOLLARS IN MILLIONS DOLLARS IN MILLIONS Please see slide 32 for all footnote references included above. CAGR 10.2% CAGR 12.8% CAGR 6.5% 6,571 28,322 8,623 Core Efficiency Ratio(7) (%) (Non-GAAP) 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 28.59 33.95 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 Tangible Book Value per Common Share(7) ($) (Non-GAAP) 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 Return on Average Assets (%) CAGR 4.7% CAGR (32.0)% 1.20 0.27 7,537 1.49 0.35 3.06 3.65 4Q 21 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3Q 23 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 CAGR 4.8%% NIM, FTE (%) 52.55 54.70

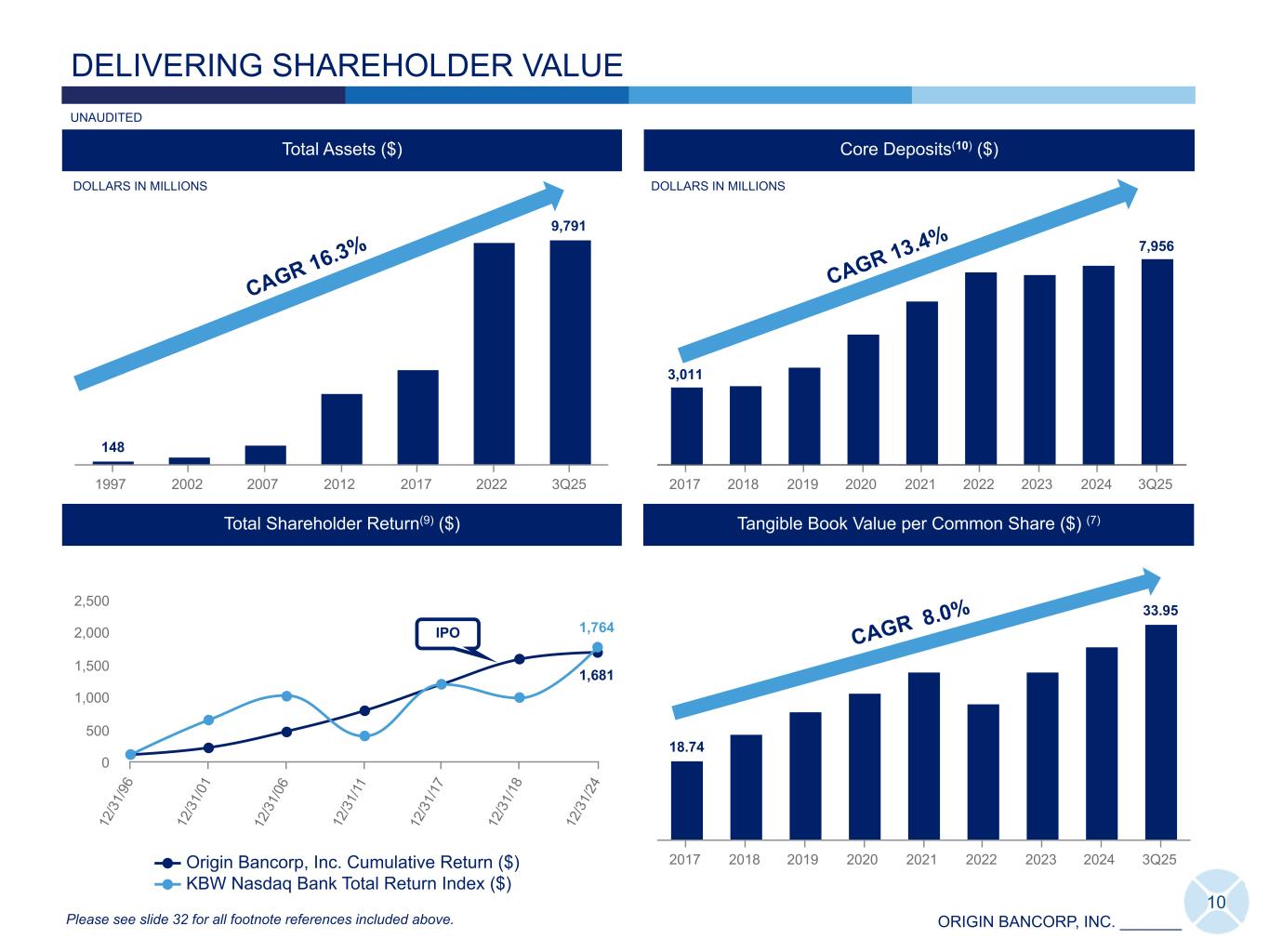

ORIGIN BANCORP, INC. _______ 148 9,791 1997 2002 2007 2012 2017 2022 3Q25 DELIVERING SHAREHOLDER VALUE DOLLARS IN MILLIONS Total Assets ($) Core Deposits(10) ($) 3,011 7,956 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 CAGR 16.3% CAGR 13.4% 10 1,681 1,764 Origin Bancorp, Inc. Cumulative Return ($) KBW Nasdaq Bank Total Return Index ($) 12 /3 1/ 96 12 /3 1/ 01 12 /3 1/ 06 12 /3 1/ 11 12 /3 1/ 17 12 /3 1/ 18 12 /3 1/ 24 0 500 1,000 1,500 2,000 2,500 Total Shareholder Return(9) ($) IPO Please see slide 32 for all footnote references included above. DOLLARS IN MILLIONS UNAUDITED Tangible Book Value per Common Share ($) (7) 18.74 33.95 2017 2018 2019 2020 2021 2022 2023 2024 3Q25 CAGR 8.0%

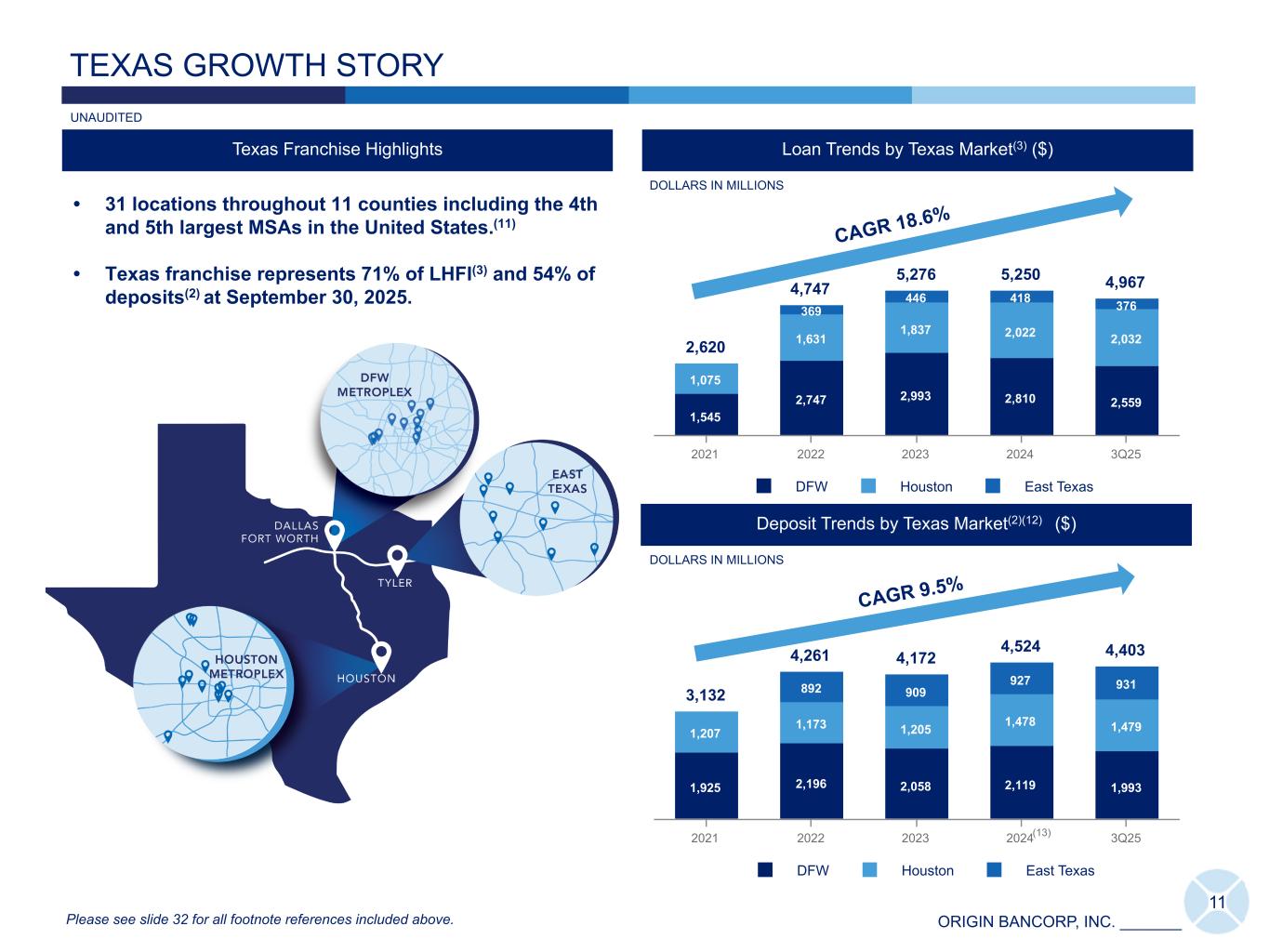

ORIGIN BANCORP, INC. _______ 11 2,620 4,747 5,276 5,250 4,967 1,545 2,747 2,993 2,810 2,559 1,075 1,631 1,837 2,022 2,032 369 446 418 376 DFW Houston East Texas 2021 2022 2023 2024 3Q25 Deposit Trends by Texas Market(2)(12) ($) Loan Trends by Texas Market(3) ($) TEXAS GROWTH STORY Texas Franchise Highlights DOLLARS IN MILLIONS • 31 locations throughout 11 counties including the 4th and 5th largest MSAs in the United States.(11) • Texas franchise represents 71% of LHFI(3) and 54% of deposits(2) at September 30, 2025. 3,132 4,261 4,172 4,524 4,403 1,925 2,196 2,058 2,119 1,993 1,207 1,173 1,205 1,478 1,479 892 909 927 931 DFW Houston East Texas 2021 2022 2023 2024 3Q25 CAGR 18.6% CAGR 9.5% Please see slide 32 for all footnote references included above. DOLLARS IN MILLIONS UNAUDITED (13)

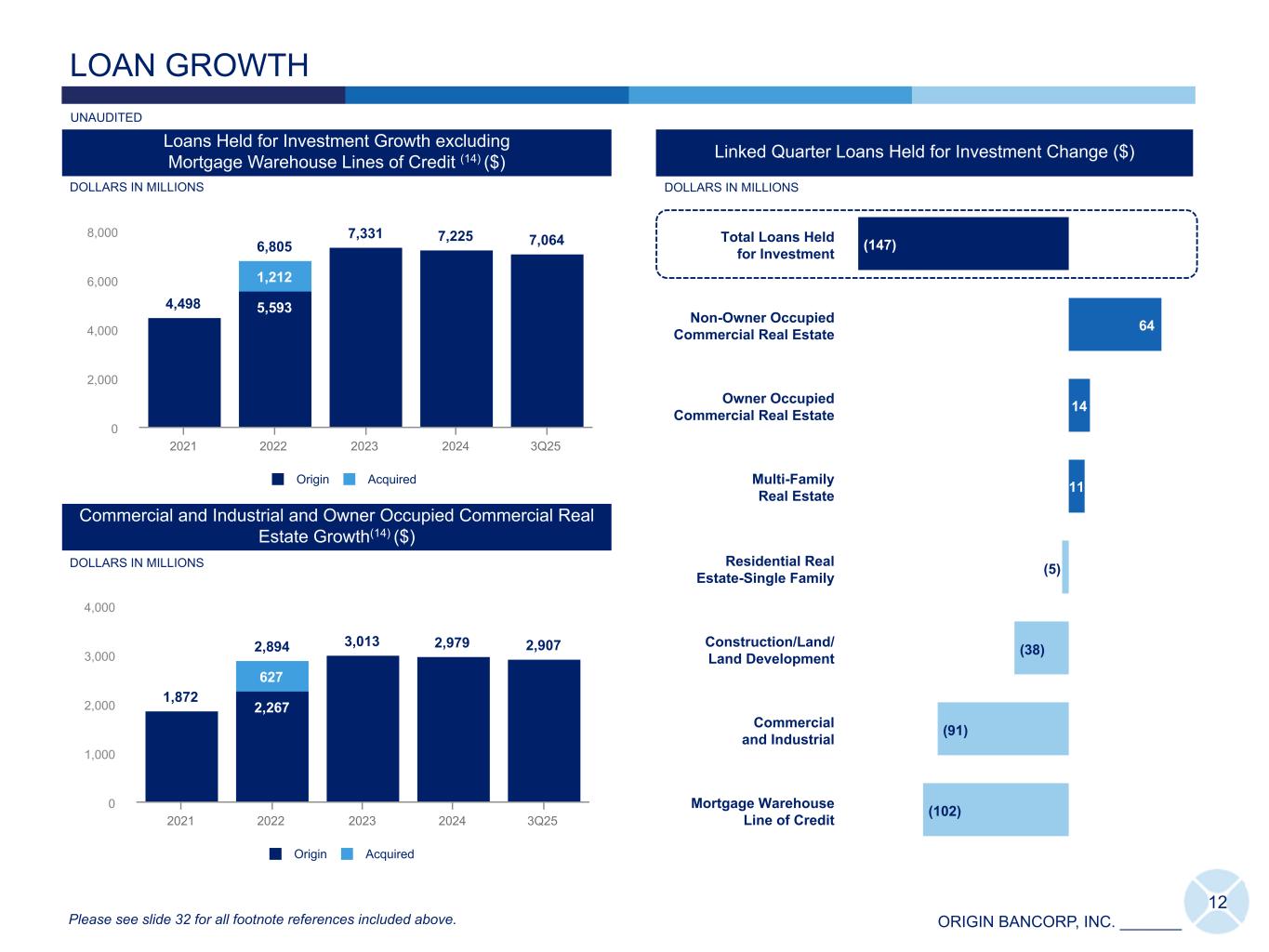

ORIGIN BANCORP, INC. _______ (147) 64 14 11 (5) (38) (91) (102) Total Loans Held for Investment Non-Owner Occupied Commercial Real Estate Owner Occupied Commercial Real Estate Multi-Family Real Estate Residential Real Estate-Single Family Construction/Land/ Land Development Commercial and Industrial Mortgage Warehouse Line of Credit LOAN GROWTH 4,498 6,805 7,331 7,225 7,064 4,498 5,593 7,225 7,0641,212 Origin Acquired 2021 2022 2023 2024 3Q25 0 2,000 4,000 6,000 8,000 DOLLARS IN MILLIONS IDT Loans Held for Investment Growth excluding Mortgage Warehouse Lines of Credit (14) ($) 1,872 2,894 3,013 2,979 2,907 1,872 2,267 2,979 2,907627 Origin Acquired 2021 2022 2023 2024 3Q25 0 1,000 2,000 3,000 4,000 Commercial and Industrial and Owner Occupied Commercial Real Estate Growth(14) ($) Please see slide 32 for all footnote references included above. DOLLARS IN MILLIONS UNAUDITED Linked Quarter Loans Held for Investment Change ($) 12 DOLLARS IN MILLIONS

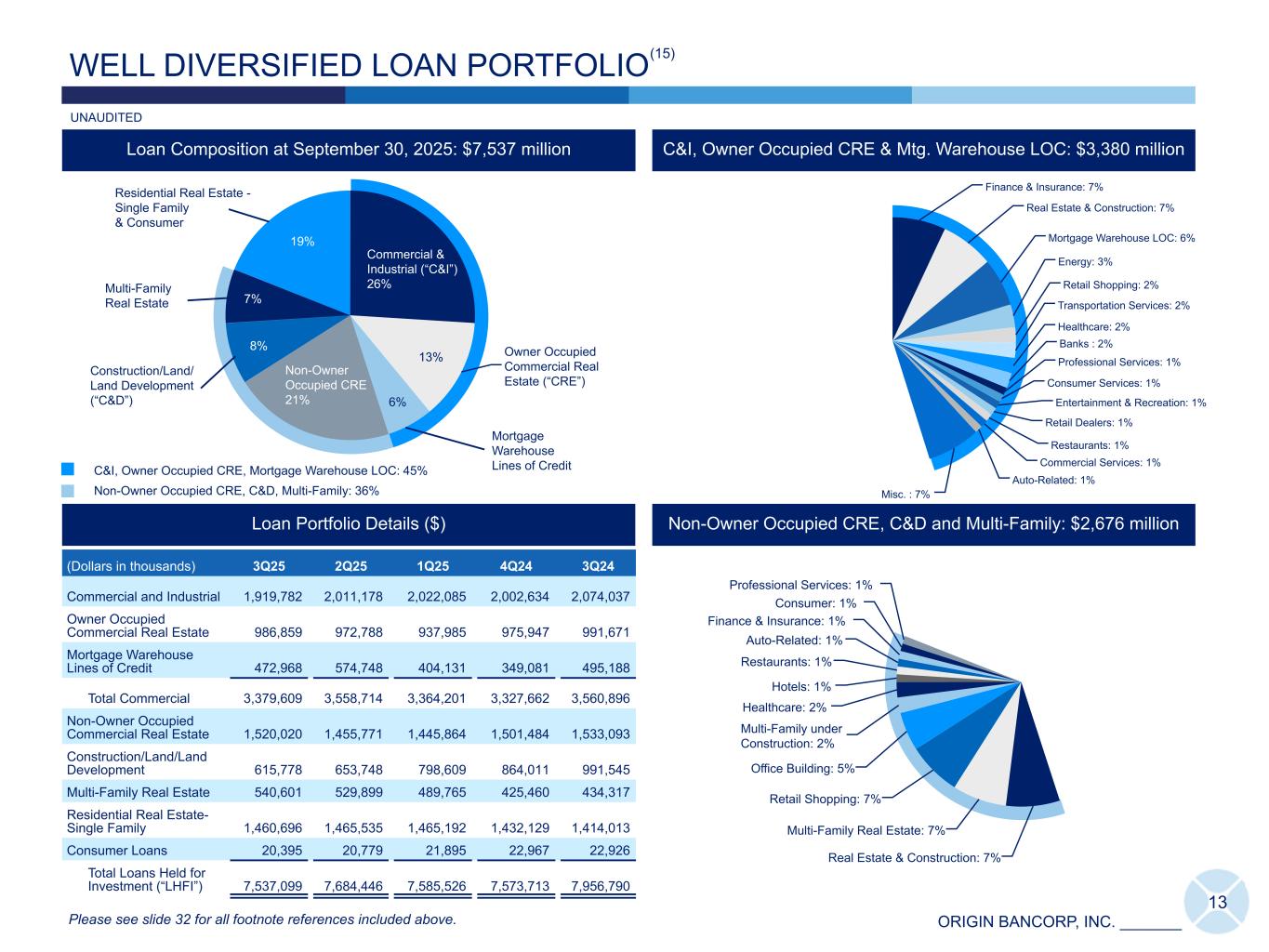

ORIGIN BANCORP, INC. _______ Real Estate & Construction: 7% Multi-Family Real Estate: 7% Retail Shopping: 7% Office Building: 5% Multi-Family under Construction: 2% Healthcare: 2% Hotels: 1% Restaurants: 1% Auto-Related: 1% Finance & Insurance: 1% Consumer: 1% Professional Services: 1% Finance & Insurance: 7% Real Estate & Construction: 7% Mortgage Warehouse LOC: 6% Energy: 3% Retail Shopping: 2% Transportation Services: 2% Healthcare: 2% Banks : 2% Professional Services: 1% Consumer Services: 1% Entertainment & Recreation: 1% Retail Dealers: 1% Restaurants: 1% Commercial Services: 1% Auto-Related: 1% Misc. : 7% Commercial & Industrial (“C&I”) 26% Owner Occupied Commercial Real Estate (“CRE”) Non-Owner Occupied CRE 21% Construction/Land/ Land Development (“C&D”) Multi-Family Real Estate Residential Real Estate - Single Family & Consumer 13 WELL DIVERSIFIED LOAN PORTFOLIO (Dollars in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 Commercial and Industrial 1,919,782 2,011,178 2,022,085 2,002,634 2,074,037 Owner Occupied Commercial Real Estate 986,859 972,788 937,985 975,947 991,671 Mortgage Warehouse Lines of Credit 472,968 574,748 404,131 349,081 495,188 Total Commercial 3,379,609 3,558,714 3,364,201 3,327,662 3,560,896 Non-Owner Occupied Commercial Real Estate 1,520,020 1,455,771 1,445,864 1,501,484 1,533,093 Construction/Land/Land Development 615,778 653,748 798,609 864,011 991,545 Multi-Family Real Estate 540,601 529,899 489,765 425,460 434,317 Residential Real Estate- Single Family 1,460,696 1,465,535 1,465,192 1,432,129 1,414,013 Consumer Loans 20,395 20,779 21,895 22,967 22,926 Total Loans Held for Investment (“LHFI”) 7,537,099 7,684,446 7,585,526 7,573,713 7,956,790 Loan Portfolio Details ($) C&I, Owner Occupied CRE & Mtg. Warehouse LOC: $3,380 million C&I, Owner Occupied CRE, Mortgage Warehouse LOC: 45% Non-Owner Occupied CRE, C&D, Multi-Family: 36% Loan Composition at September 30, 2025: $7,537 million Please see slide 32 for all footnote references included above. UNAUDITED (15) Mortgage Warehouse Lines of Credit 7% 19% 13% 6% 8% Non-Owner Occupied CRE, C&D and Multi-Family: $2,676 million

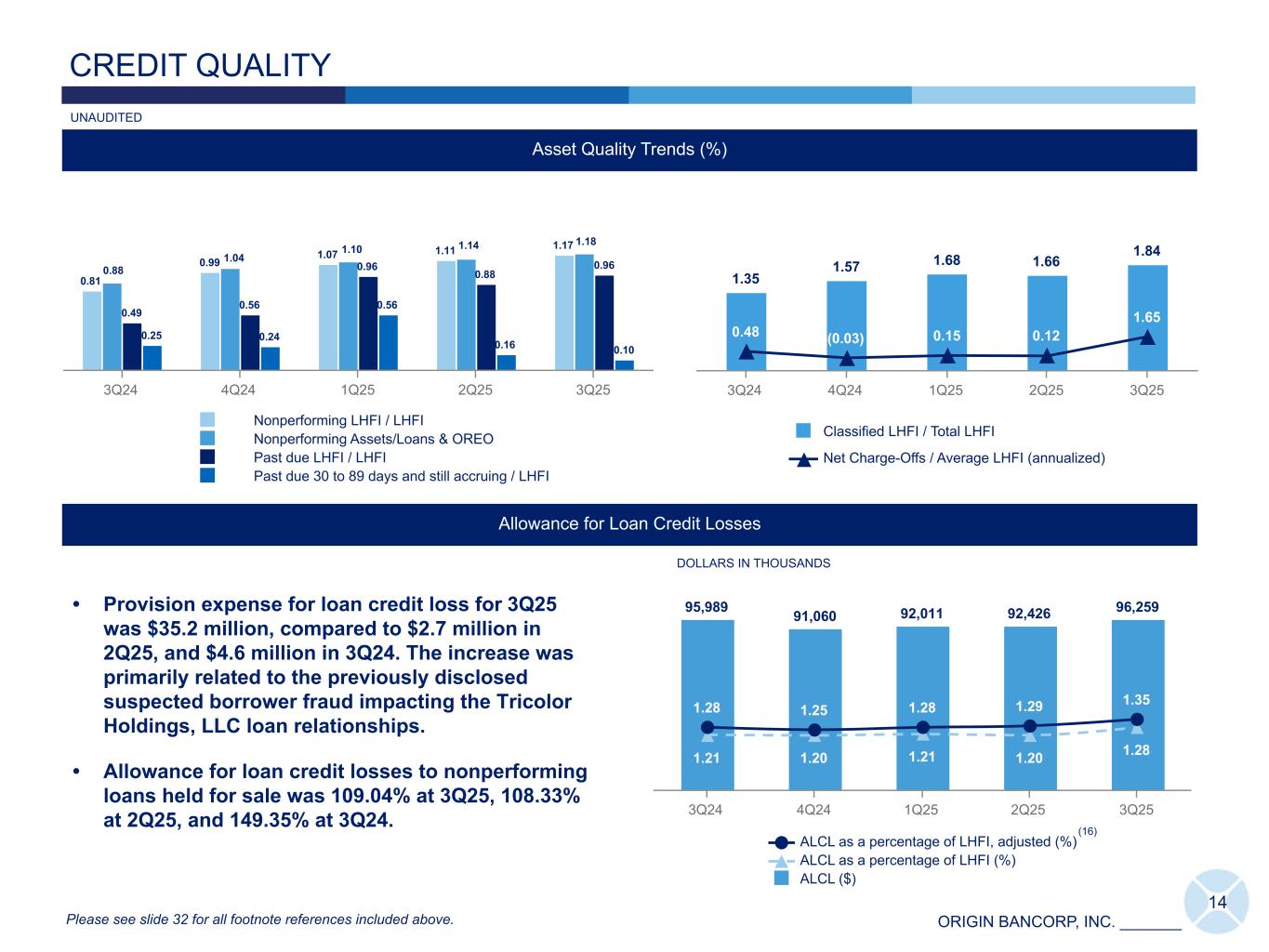

ORIGIN BANCORP, INC. _______ 1.35 1.57 1.68 1.66 1.84 0.48 (0.03) 0.15 0.12 1.65 Classified LHFI / Total LHFI Net Charge-Offs / Average LHFI (annualized) 3Q24 4Q24 1Q25 2Q25 3Q25 0.81 0.99 1.07 1.11 1.17 0.49 0.56 0.96 0.88 0.96 0.25 0.24 0.56 0.16 0.10 Nonperforming LHFI / LHFI Nonperforming Assets/Loans & OREO Past due LHFI / LHFI Past due 30 to 89 days and still accruing / LHFI 3Q24 4Q24 1Q25 2Q25 3Q25 14 CREDIT QUALITY Asset Quality Trends (%) Allowance for Loan Credit Losses 95,989 91,060 92,011 92,426 96,259 1.21 1.20 1.21 1.20 1.28 1.28 1.25 1.28 1.29 1.35 ALCL as a percentage of LHFI, adjusted (%) ALCL as a percentage of LHFI (%) ALCL ($) 3Q24 4Q24 1Q25 2Q25 3Q25 • Provision expense for loan credit loss for 3Q25 was $35.2 million, compared to $2.7 million in 2Q25, and $4.6 million in 3Q24. The increase was primarily related to the previously disclosed suspected borrower fraud impacting the Tricolor Holdings, LLC loan relationships. • Allowance for loan credit losses to nonperforming loans held for sale was 109.04% at 3Q25, 108.33% at 2Q25, and 149.35% at 3Q24. DOLLARS IN THOUSANDS (16) Please see slide 32 for all footnote references included above. UNAUDITED 0.88 1.18 1.04 1.10 1.14

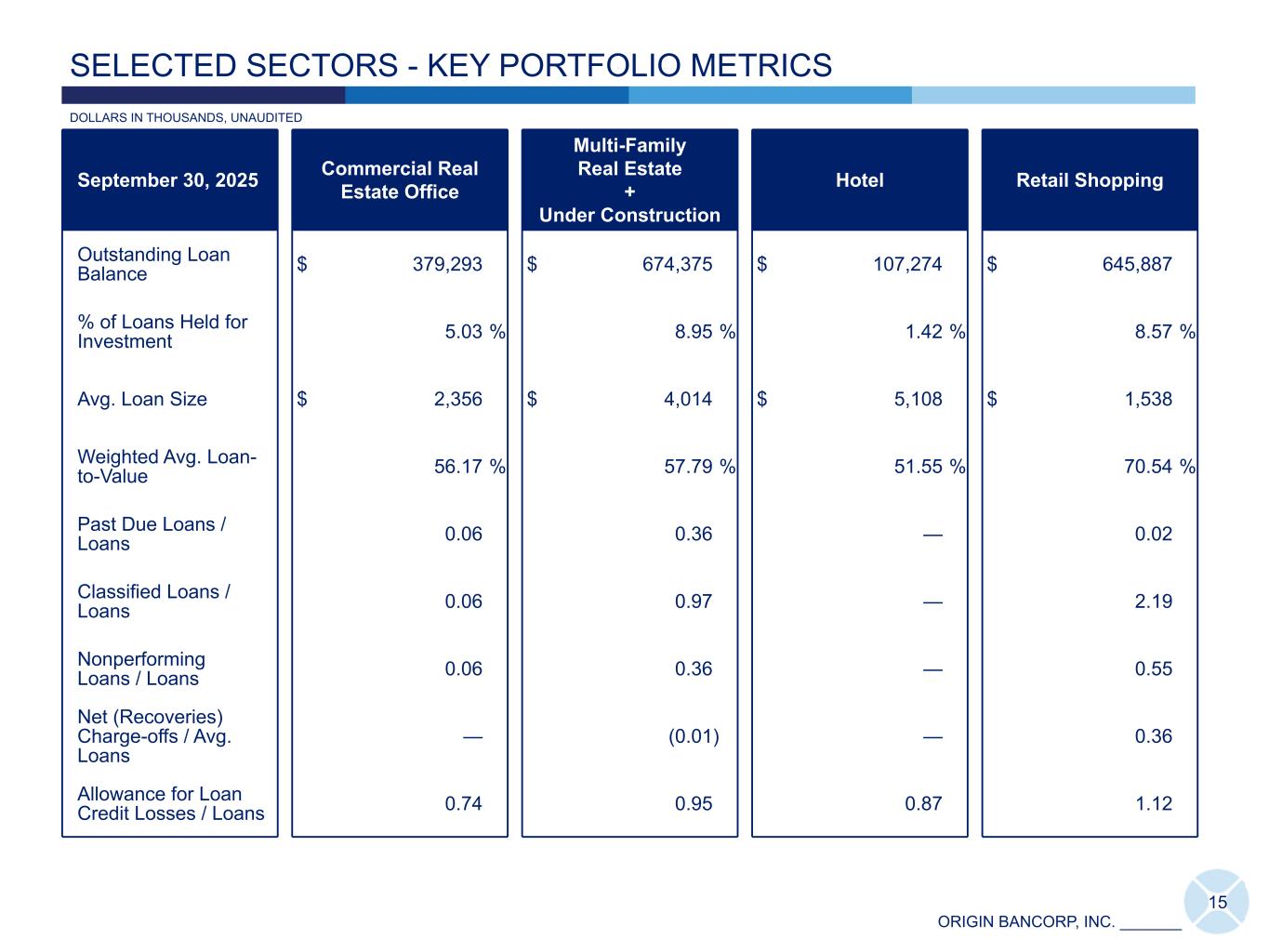

ORIGIN BANCORP, INC. _______ 15 SELECTED SECTORS - KEY PORTFOLIO METRICS September 30, 2025 Commercial Real Estate Office Multi-Family Real Estate + Under Construction Hotel Retail Shopping Outstanding Loan Balance $ 379,293 $ 674,375 $ 107,274 $ 645,887 % of Loans Held for Investment 5.03 % 8.95 % 1.42 % 8.57 % Avg. Loan Size $ 2,356 $ 4,014 $ 5,108 $ 1,538 Weighted Avg. Loan- to-Value 56.17 % 57.79 % 51.55 % 70.54 % Past Due Loans / Loans 0.06 0.36 — 0.02 Classified Loans / Loans 0.06 0.97 — 2.19 Nonperforming Loans / Loans 0.06 0.36 — 0.55 Net (Recoveries) Charge-offs / Avg. Loans — (0.01) — 0.36 Allowance for Loan Credit Losses / Loans 0.74 0.95 0.87 1.12 DOLLARS IN THOUSANDS, UNAUDITED

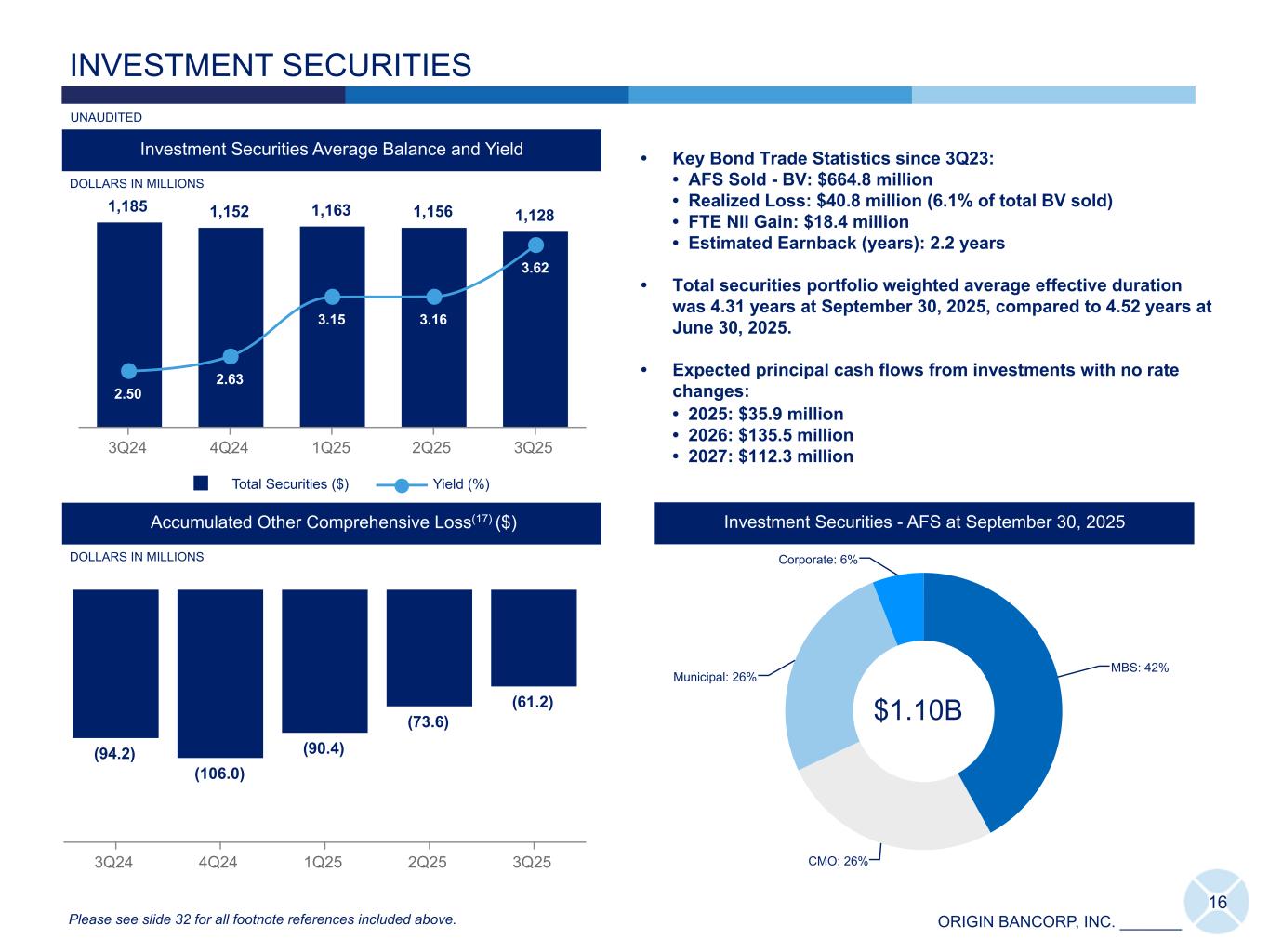

ORIGIN BANCORP, INC. _______ MBS: 42% CMO: 26% Municipal: 26% Corporate: 6% 1,185 1,152 1,163 1,156 1,128 2.50 2.63 3.15 3.16 3.62 Total Securities ($) Yield (%) 3Q24 4Q24 1Q25 2Q25 3Q25 Investment Securities Average Balance and Yield INVESTMENT SECURITIES DOLLARS IN MILLIONS • Key Bond Trade Statistics since 3Q23: • AFS Sold - BV: $664.8 million • Realized Loss: $40.8 million (6.1% of total BV sold) • FTE NII Gain: $18.4 million • Estimated Earnback (years): 2.2 years • Total securities portfolio weighted average effective duration was 4.31 years at September 30, 2025, compared to 4.52 years at June 30, 2025. • Expected principal cash flows from investments with no rate changes: • 2025: $35.9 million • 2026: $135.5 million • 2027: $112.3 million 16 (94.2) (106.0) (90.4) (73.6) (61.2) 3Q24 4Q24 1Q25 2Q25 3Q25 Accumulated Other Comprehensive Loss(17) ($) Investment Securities - AFS at September 30, 2025 Please see slide 32 for all footnote references included above. $1.10B DOLLARS IN MILLIONS UNAUDITED

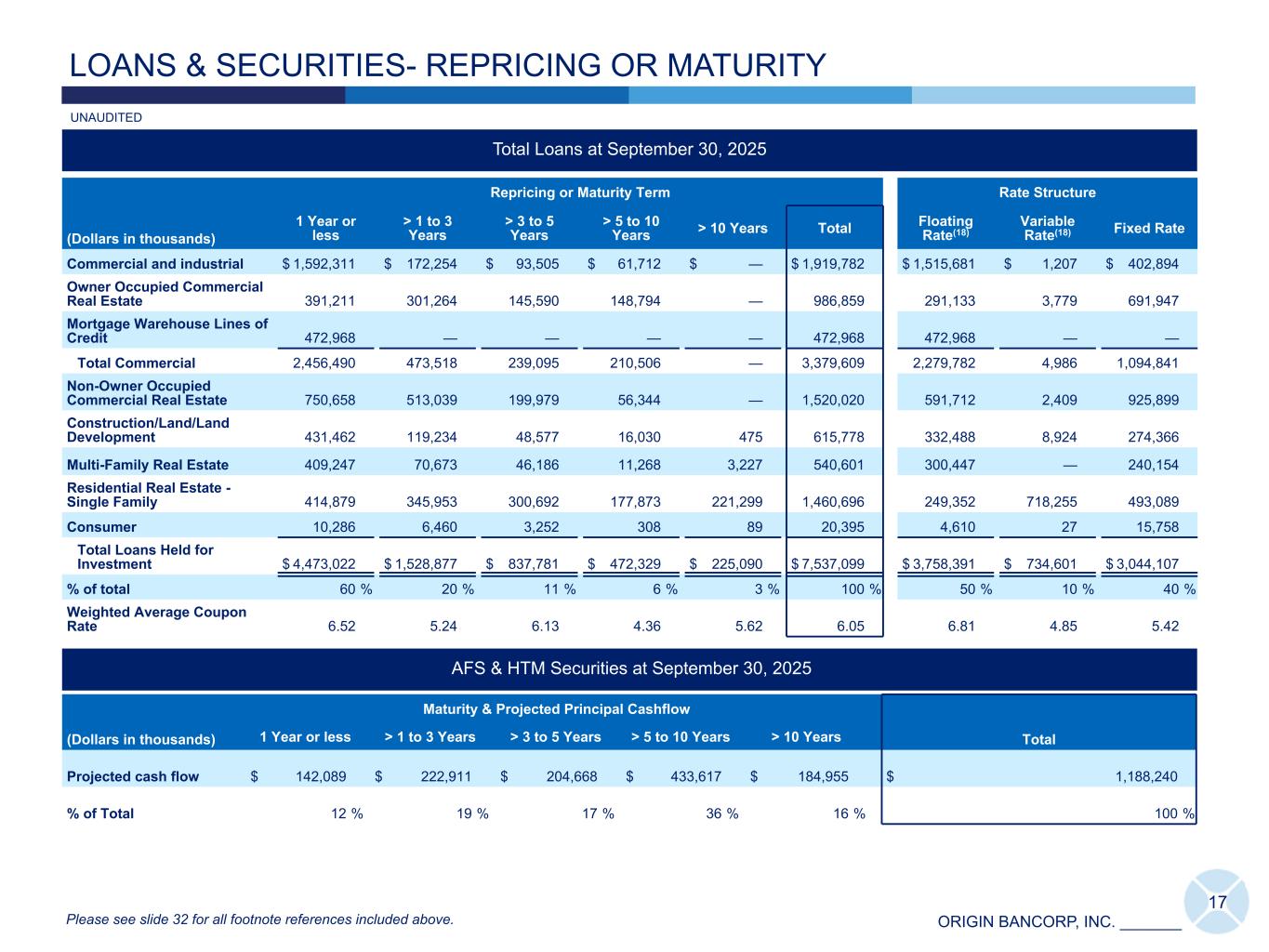

ORIGIN BANCORP, INC. _______ Total Loans at September 30, 2025 (Dollars in thousands) Repricing or Maturity Term Rate Structure 1 Year or less > 1 to 3 Years > 3 to 5 Years > 5 to 10 Years > 10 Years Total Floating Rate(18) Variable Rate(18) Fixed Rate Commercial and industrial $ 1,592,311 $ 172,254 $ 93,505 $ 61,712 $ — $ 1,919,782 $ 1,515,681 $ 1,207 $ 402,894 Owner Occupied Commercial Real Estate 391,211 301,264 145,590 148,794 — 986,859 291,133 3,779 691,947 Mortgage Warehouse Lines of Credit 472,968 — — — — 472,968 472,968 — — Total Commercial 2,456,490 473,518 239,095 210,506 — 3,379,609 2,279,782 4,986 1,094,841 Non-Owner Occupied Commercial Real Estate 750,658 513,039 199,979 56,344 — 1,520,020 591,712 2,409 925,899 Construction/Land/Land Development 431,462 119,234 48,577 16,030 475 615,778 332,488 8,924 274,366 Multi-Family Real Estate 409,247 70,673 46,186 11,268 3,227 540,601 300,447 — 240,154 Residential Real Estate - Single Family 414,879 345,953 300,692 177,873 221,299 1,460,696 249,352 718,255 493,089 Consumer 10,286 6,460 3,252 308 89 20,395 4,610 27 15,758 Total Loans Held for Investment $ 4,473,022 $ 1,528,877 $ 837,781 $ 472,329 $ 225,090 $ 7,537,099 $ 3,758,391 $ 734,601 $ 3,044,107 % of total 60 % 20 % 11 % 6 % 3 % 100 % 50 % 10 % 40 % Weighted Average Coupon Rate 6.52 5.24 6.13 4.36 5.62 6.05 6.81 4.85 5.42 AFS & HTM Securities at September 30, 2025 (Dollars in thousands) Maturity & Projected Principal Cashflow Total1 Year or less > 1 to 3 Years > 3 to 5 Years > 5 to 10 Years > 10 Years Projected cash flow $ 142,089 $ 222,911 $ 204,668 $ 433,617 $ 184,955 $ 1,188,240 % of Total 12 % 19 % 17 % 36 % 16 % 100 % LOANS & SECURITIES- REPRICING OR MATURITY 17 UNAUDITED Please see slide 32 for all footnote references included above.

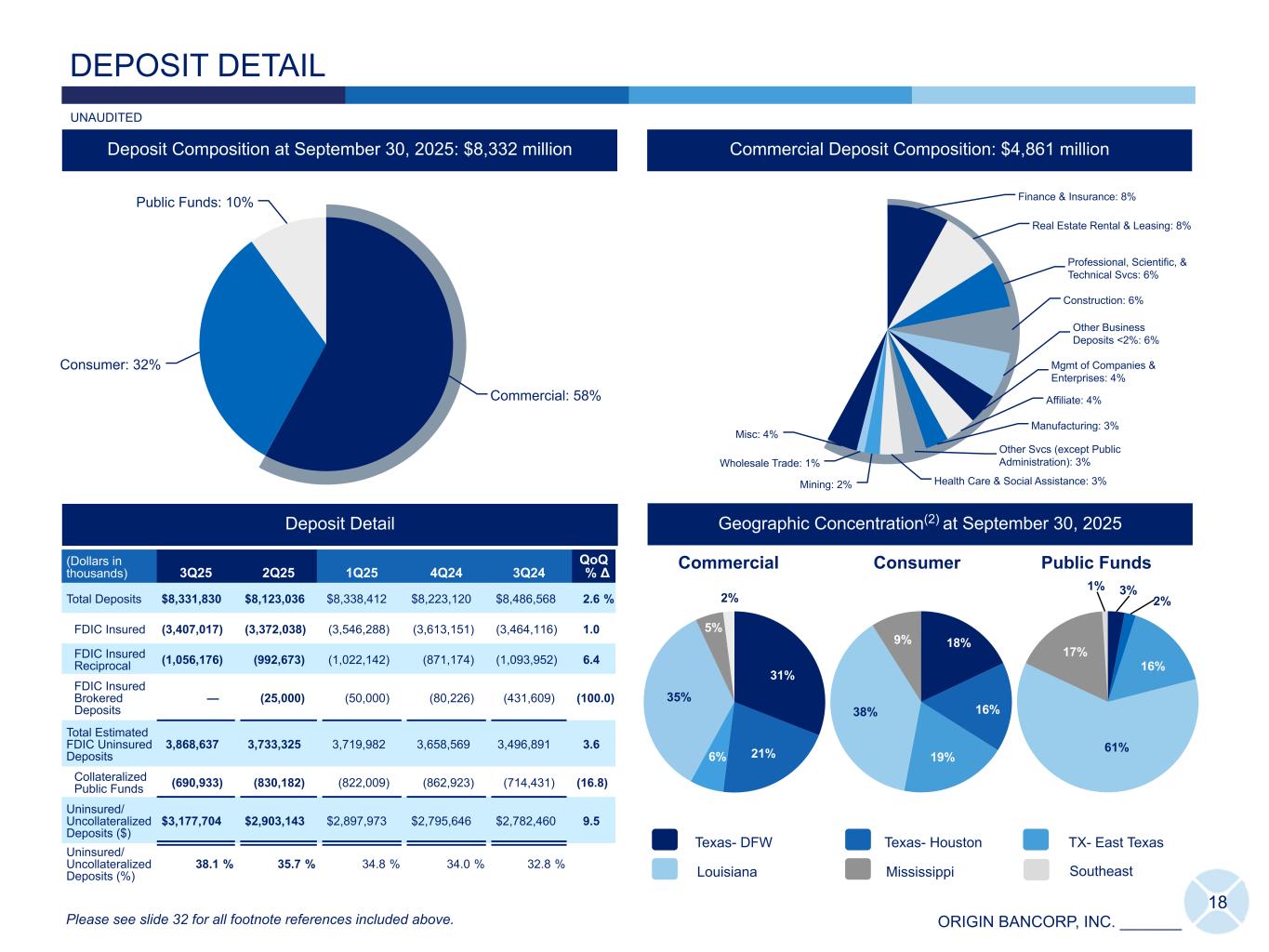

ORIGIN BANCORP, INC. _______ Finance & Insurance: 8% Real Estate Rental & Leasing: 8% Professional, Scientific, & Technical Svcs: 6% Construction: 6% Other Business Deposits <2%: 6% Mgmt of Companies & Enterprises: 4% Affiliate: 4% Manufacturing: 3% Other Svcs (except Public Administration): 3% Health Care & Social Assistance: 3%Mining: 2% Wholesale Trade: 1% Misc: 4% Commercial: 58% Consumer: 32% Public Funds: 10% 31% 21%6% 35% 5% 2% 18 DEPOSIT DETAIL (Dollars in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 QoQ % Δ Total Deposits $ 8,331,830 $ 8,486,568 $ 8,510,842 $ 8,505,464 $ 8,251,125 (1.8) % FDIC Insured (3,464,116) (3,464,116) (3,442,636) (3,447,538) (3,425,268) — FDIC Insured Reciprocal (1,093,952) (1,093,952) (799,221) (801,145) (801,699) — FDIC Insured Brokered Deposits (431,609) (431,609) (636,814) (597,110) (444,989) — Total Estimated FDIC Uninsured Deposits 3,342,153 3,496,891 3,632,171 3,659,671 3,579,169 (4.4) Collateralized Public Funds (714,431) (714,431) (771,419) (836,150) (849,603) — Uninsured/ Uncollateralized Deposits ($) $ 2,627,722 $ 2,782,460 $ 2,860,752 $ 2,823,521 $ 2,729,566 (5.6) Uninsured/ Uncollateralized Deposits (%) 31.5 % 32.8 % 33.6 % 33.2 % 33.1 % Deposit Detail Geographic Concentration(2) at September 30, 2025 Commercial Deposit Composition: $4,861 millionDeposit Composition at September 30, 2025: $8,332 million Commercial Consumer MississippiLouisiana Texas- DFW TX- East TexasTexas- Houston Please see slide 32 for all footnote references included above. UNAUDITED Southeast 18% 16% 19% 38% 9% (Dollars in thousands) 3Q25 2Q25 1Q25 4Q24 3Q24 QoQ % Δ Total Deposits $ 8,331,830 $ 8,123,036 $ 8,338,412 $ 8,223,120 $ 8,486,568 2.6 % FDIC Insured (3,407,017) (3,372,038) (3,546,288) (3,613,151) (3,464,116) 1.0 FDIC Insured Reciprocal (1,056,176) (992,673) (1,022,142) (871,174) (1,093,952) 6.4 FDIC Insured Brokered Deposits — (25,000) (50,000) (80,226) (431,609) (100.0) Total Estimated FDIC Uninsured Deposits 3,868,637 3,733,325 3,719,982 3,658,569 3,496,891 3.6 Collateralized Public Funds (690,933) (830,182) (822,009) (862,923) (714,431) (16.8) Uninsured/ Uncollateralized Deposits ($) $ 3,177,704 $ 2,903,143 $ 2,897,973 $ 2,795,646 $ 2,782,460 9.5 Uninsured/ Uncollateralized Deposits (%) 38.1 % 35.7 % 34.8 % 34.0 % 32.8 % Deposit Detail Public Funds 3% 2% 16% 61% 17% 1%

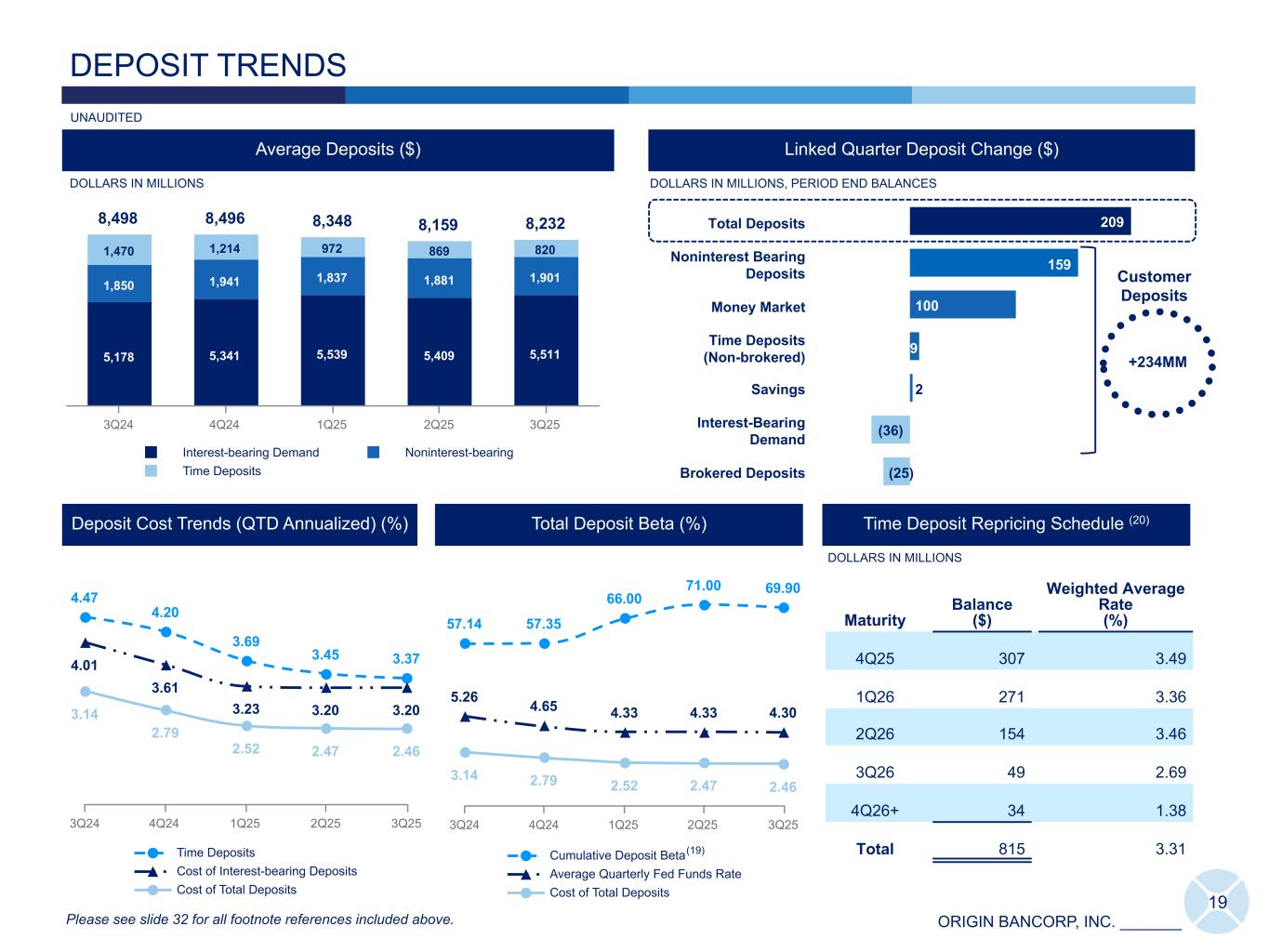

ORIGIN BANCORP, INC. _______ 209 159 100 9 2 (36) (25) Total Deposits Noninterest Bearing Deposits Money Market Time Deposits (Non-brokered) Savings Interest-Bearing Demand Brokered Deposits 4.47 4.20 3.69 3.45 3.374.01 3.61 3.23 3.20 3.203.14 2.79 2.52 2.47 2.46 Time Deposits Cost of Interest-bearing Deposits Cost of Total Deposits 3Q24 4Q24 1Q25 2Q25 3Q25 19 8,498 8,496 8,348 8,159 8,232 5,178 5,341 5,539 5,409 5,511 1,850 1,941 1,837 1,881 1,901 1,470 1,214 972 869 820 Interest-bearing Demand Noninterest-bearing Time Deposits 3Q24 4Q24 1Q25 2Q25 3Q25 Average Deposits ($) DEPOSIT TRENDS IDT Total Deposit Beta (%) DOLLARS IN MILLIONS UNAUDITED Deposit Cost Trends (QTD Annualized) (%) Time Deposit Repricing Schedule (20) Maturity Balance ($) Weighted Average Rate (%) 4Q25 307 3.49 1Q26 271 3.36 2Q26 154 3.46 3Q26 49 2.69 4Q26+ 34 1.38 Total 815 3.31 DOLLARS IN MILLIONS 57.14 57.35 66.00 71.00 69.90 5.26 4.65 4.33 4.33 4.30 3.14 2.79 2.52 2.47 2.46 Cumulative Deposit Beta Average Quarterly Fed Funds Rate Cost of Total Deposits 3Q24 4Q24 1Q25 2Q25 3Q25 Please see slide 32 for all footnote references included above. (19) Linked Quarter Deposit Change ($) DOLLARS IN MILLIONS, PERIOD END BALANCES Customer Deposits +234MM (19)

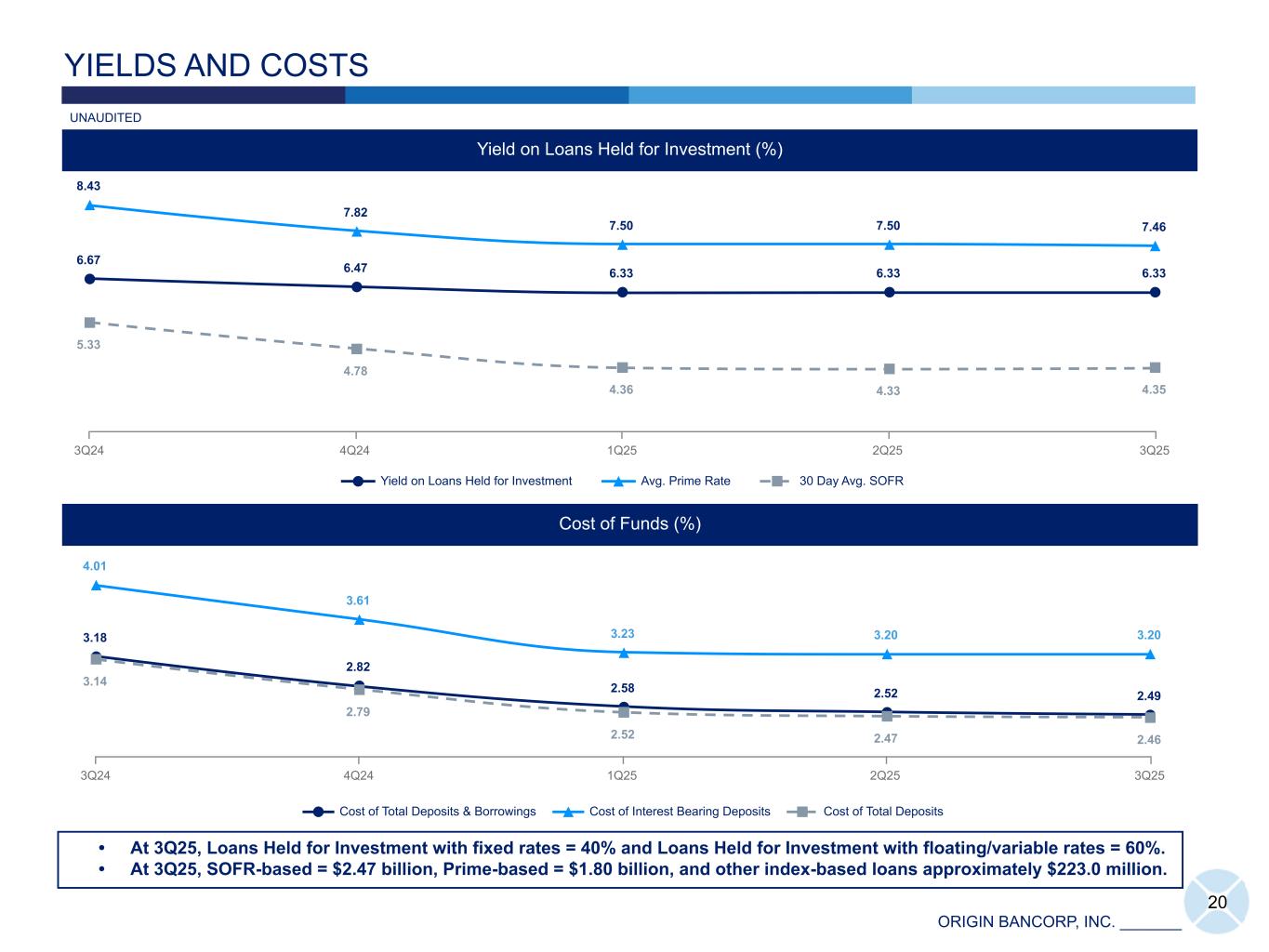

ORIGIN BANCORP, INC. _______ 3.18 2.82 2.58 2.52 2.49 4.01 3.61 3.23 3.20 3.20 3.14 2.79 2.52 2.47 2.46 Cost of Total Deposits & Borrowings Cost of Interest Bearing Deposits Cost of Total Deposits 3Q24 4Q24 1Q25 2Q25 3Q25 20 YIELDS AND COSTS Yield on Loans Held for Investment (%) Cost of Funds (%) • At 3Q25, Loans Held for Investment with fixed rates = 40% and Loans Held for Investment with floating/variable rates = 60%. • At 3Q25, SOFR-based = $2.47 billion, Prime-based = $1.80 billion, and other index-based loans approximately $223.0 million. UNAUDITED 6.67 6.47 6.33 6.33 6.33 8.43 7.82 7.50 7.50 7.46 5.33 4.78 4.36 4.33 4.35 Yield on Loans Held for Investment Avg. Prime Rate 30 Day Avg. SOFR 3Q24 4Q24 1Q25 2Q25 3Q25

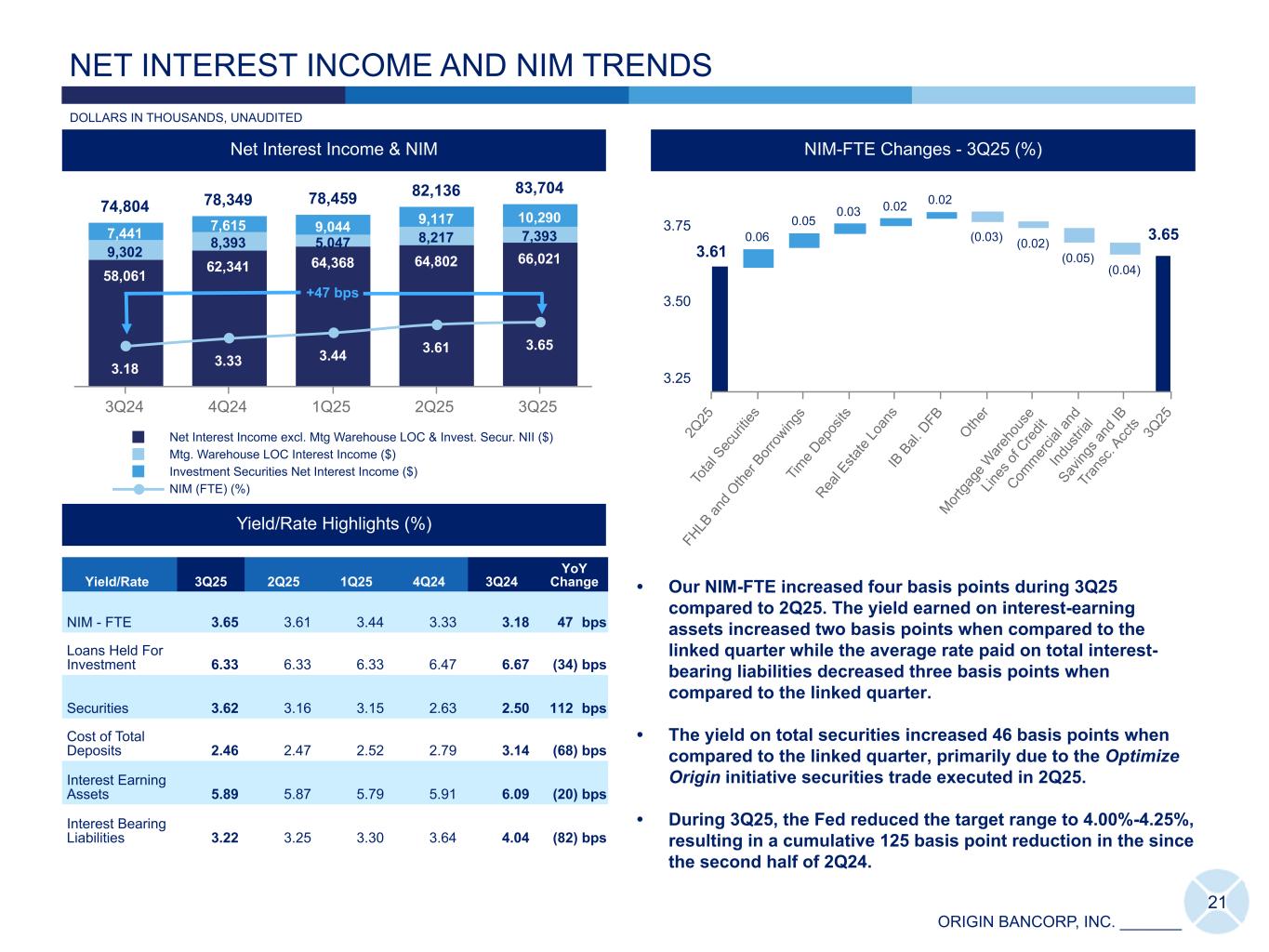

ORIGIN BANCORP, INC. _______ 74,804 78,349 78,459 82,136 83,704 58,061 62,341 64,368 64,802 66,0219,302 8,393 5,047 8,217 7,3937,441 7,615 9,044 9,117 10,290 3.18 3.33 3.44 3.61 3.65 Net Interest Income excl. Mtg Warehouse LOC & Invest. Secur. NII ($) Mtg. Warehouse LOC Interest Income ($) Investment Securities Net Interest Income ($) NIM (FTE) (%) 3Q24 4Q24 1Q25 2Q25 3Q25 21 DOLLARS IN THOUSANDS, UNAUDITED NET INTEREST INCOME AND NIM TRENDS 3.61 0.06 0.05 0.03 0.02 0.02 (0.03) (0.02) (0.05) (0.04) 2Q 25 To tal S ec ur itie s FH LB an d O the r B or ro wing s Tim e D ep os its Rea l E sta te Lo an s IB B al. D FB Othe r Mor tga ge W ar eh ou se Lin es of C re dit Com mer cia l a nd Ind us tria l Sav ing s a nd IB Tr an sc . A cc ts 3Q 25 3.25 3.50 3.75 24.64 29.52 21.01 8.58 2.041.54 2.480.77 2.18 3.65 4.51 5.26 5.33 5.26 4.30 Cumulative NIM-FTE Beta Average Quarterly Fed Funds Rate 3Q22 4Q22 1Q23 2Q23 4Q23 1Q24 3Q24 4Q24 3Q25 NIM Beta - 3Q25 (%) 2.48 2.48 4.99 NIM-FTE Changes - 3Q25 (%) NIM-FTE Changes - 3Q25 (%) 73,32372,989 1,362 1,537 568 432 (298) (3,267) 4Q 23 RE Lo an s C&I MW LO C Othe r FH LB & O the r Bor ro wing s Sav ing s & IB Tr an sa c. Acc ts. 1Q 24 40,000 60,000 80,000 • Our NIM-FTE increased four basis points during 3Q25 compared to 2Q25. The yield earned on interest-earning assets increased two basis points when compared to the linked quarter while the average rate paid on total interest- bearing liabilities decreased three basis points when compared to the linked quarter. • The yield on total securities increased 46 basis points when compared to the linked quarter, primarily due to the Optimize Origin initiative securities trade executed in 2Q25. • During 3Q25, the Fed reduced the target range to 4.00%-4.25%, resulting in a cumulative 125 basis point reduction in the since the second half of 2Q24. Net Interest Income & NIM 3.65 Yield/Rate 3Q25 2Q25 1Q25 4Q24 3Q24 YoY Change NIM - FTE 3.65 3.61 3.44 3.33 3.18 47 bps Loans Held For Investment 6.33 6.33 6.33 6.47 6.67 (34) bps Securities 3.62 3.16 3.15 2.63 2.50 112 bps Cost of Total Deposits 2.46 2.47 2.52 2.79 3.14 (68) bps Interest Earning Assets 5.89 5.87 5.79 5.91 6.09 (20) bps Interest Bearing Liabilities 3.22 3.25 3.30 3.64 4.04 (82) bps Yield/Rate Highlights (%) +47 bps

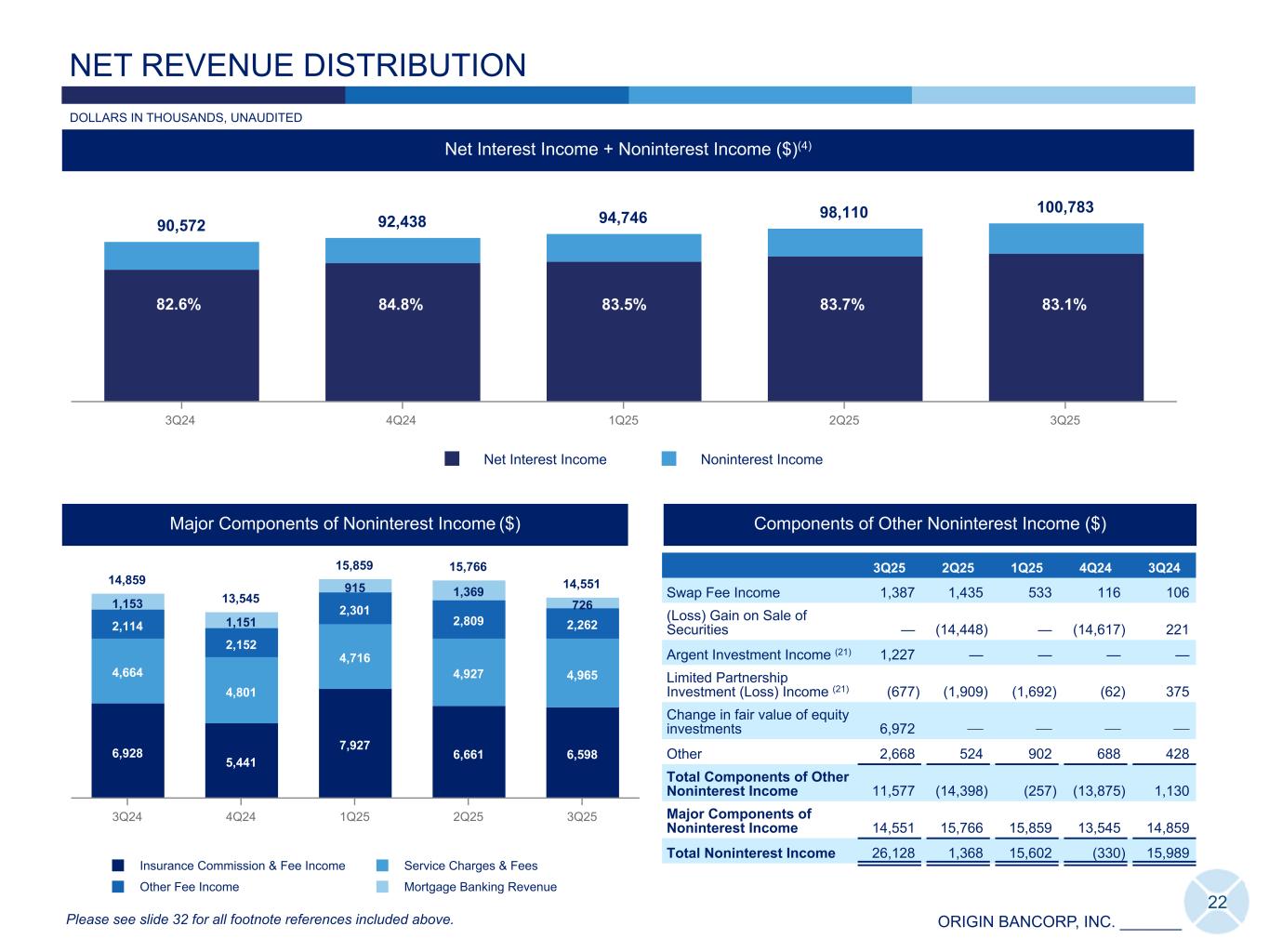

ORIGIN BANCORP, INC. _______ 90,572 92,438 94,746 98,110 100,783 Net Interest Income Noninterest Income 3Q24 4Q24 1Q25 2Q25 3Q25 14,859 13,545 15,859 15,766 14,551 6,928 5,441 7,927 6,661 6,598 4,664 4,801 4,716 4,927 4,965 2,114 2,152 2,301 2,809 2,262 1,153 1,151 915 1,369 726 Insurance Commission & Fee Income Service Charges & Fees Other Fee Income Mortgage Banking Revenue 3Q24 4Q24 1Q25 2Q25 3Q25 22 Major Components of Noninterest Income ($) Net Interest Income + Noninterest Income ($)(4) NET REVENUE DISTRIBUTION Components of Other Noninterest Income ($) 3Q25 2Q25 1Q25 4Q24 3Q24 Swap Fee Income 1,387 1,435 533 116 106 (Loss) Gain on Sale of Securities — (14,448) — (14,617) 221 Argent Investment Income (21) 1,227 — — — — Limited Partnership Investment (Loss) Income (21) (677) (1,909) (1,692) (62) 375 Change in fair value of equity investments 6,972 — — — — Other 2,668 524 902 688 428 Total Components of Other Noninterest Income 11,577 (14,398) (257) (13,875) 1,130 Major Components of Noninterest Income 14,551 15,766 15,859 13,545 14,859 Total Noninterest Income 26,128 1,368 15,602 (330) 15,989 82.6% 83.1% Please see slide 32 for all footnote references included above. DOLLARS IN THOUSANDS, UNAUDITED 83.7%83.5%84.8%

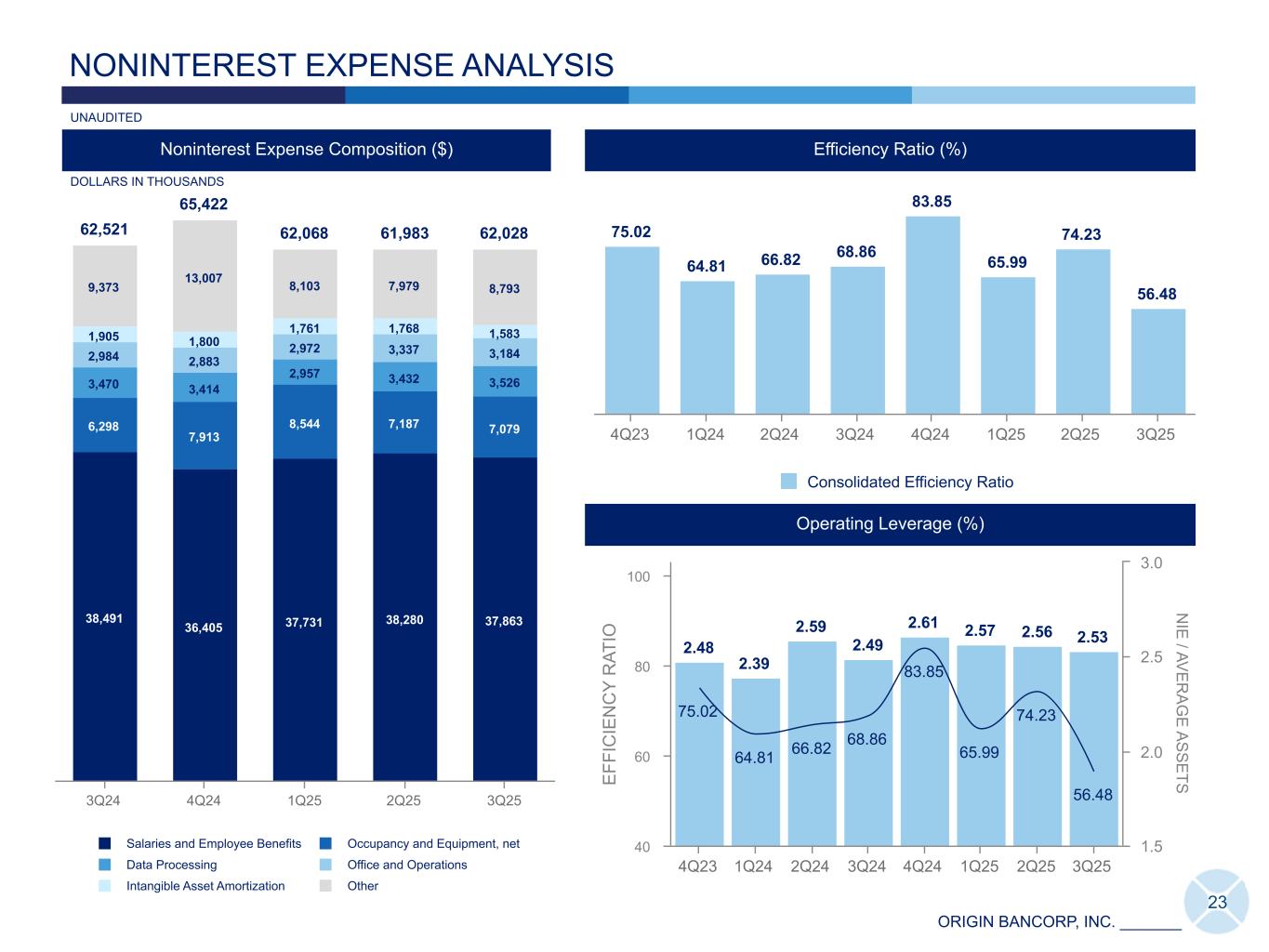

ORIGIN BANCORP, INC. _______ 23 Efficiency Ratio (%) NONINTEREST EXPENSE ANALYSIS DOLLARS IN THOUSANDS Noninterest Expense Composition ($) 75.02 64.81 66.82 68.86 83.85 65.99 74.23 56.48 Consolidated Efficiency Ratio 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 Operating Leverage (%) E FF IC IE N C Y R AT IO N IE / AV E R A G E A S S E TS 2.48 2.39 2.59 2.49 2.61 2.57 2.56 2.53 75.02 64.81 66.82 68.86 83.85 65.99 74.23 56.48 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 3Q25 40 60 80 100 1.5 2.0 2.5 3.0 68 .8 6 67 .4 8 82 .7 9 83 .8 5 65 .3 3 56 .4 8 UNAUDITED 54 .7 0 65 .9 9 74 .2 3 73 .7 7 62,521 65,422 62,068 61,983 62,028 38,491 36,405 37,731 38,280 37,863 6,298 7,913 8,544 7,187 7,079 3,470 3,414 2,957 3,432 3,526 2,984 2,883 2,972 3,337 3,184 1,905 1,800 1,761 1,768 1,583 9,373 13,007 8,103 7,979 8,793 Salaries and Employee Benefits Occupancy and Equipment, net Data Processing Office and Operations Intangible Asset Amortization Other 3Q24 4Q24 1Q25 2Q25 3Q25

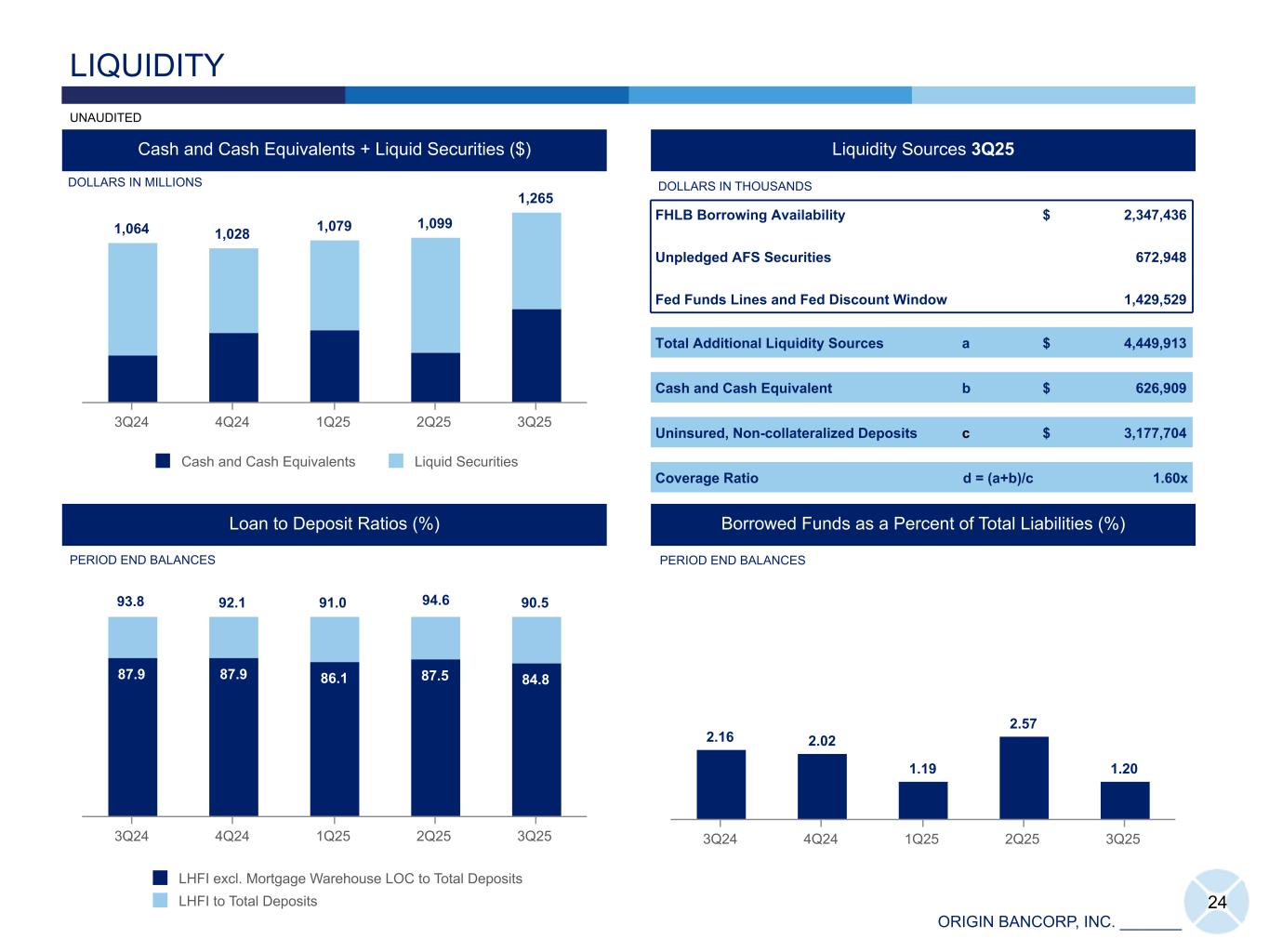

ORIGIN BANCORP, INC. _______ 87.9 87.9 86.1 87.5 84.8 LHFI excl. Mortgage Warehouse LOC to Total Deposits LHFI to Total Deposits 3Q24 4Q24 1Q25 2Q25 3Q25 1,064 1,028 1,079 1,099 1,265 Cash and Cash Equivalents Liquid Securities 3Q24 4Q24 1Q25 2Q25 3Q25 Cash and Cash Equivalents + Liquid Securities ($) 24 LIQUIDITY Loan to Deposit Ratios (%) UNAUDITED Liquidity Sources 3Q25 Borrowed Funds as a Percent of Total Liabilities (%) DOLLARS IN MILLIONS DOLLARS IN THOUSANDS PERIOD END BALANCES PERIOD END BALANCES 2.16 2.02 1.19 2.57 1.20 3Q24 4Q24 1Q25 2Q25 3Q25 FHLB Borrowing Availability $ 2,347,436 Unpledged AFS Securities 672,948 Fed Funds Lines and Fed Discount Window 1,429,529 Total Additional Liquidity Sources a $ 4,449,913 Cash and Cash Equivalent b $ 626,909 Uninsured, Non-collateralized Deposits c $ 3,177,704 Coverage Ratio d = (a+b)/c 1.60x 93.8 92.1 91.0 94.6 90.5

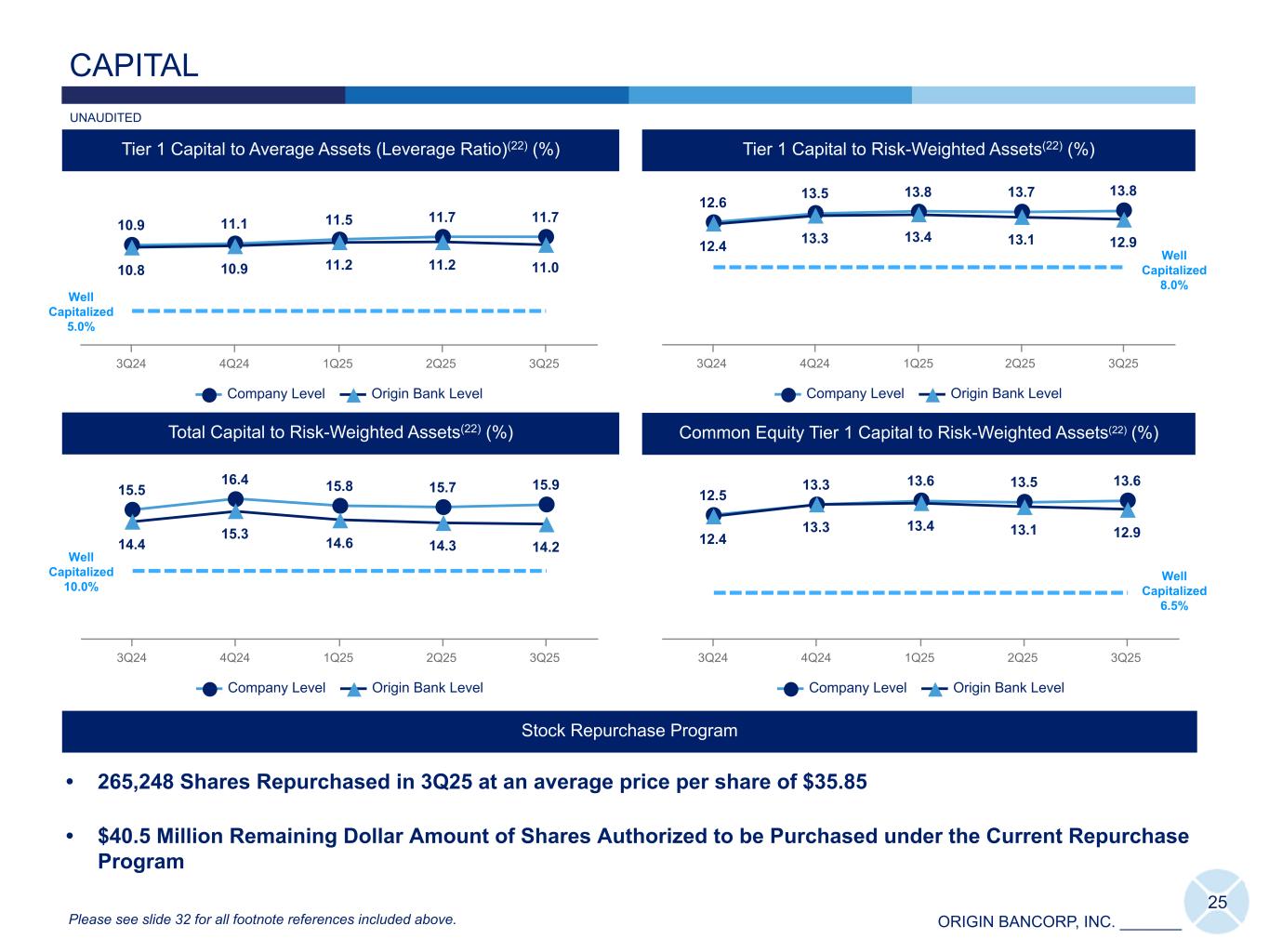

ORIGIN BANCORP, INC. _______ 25 CAPITAL Common Equity Tier 1 Capital to Risk-Weighted Assets(22) (%) ICap ICap Total Capital to Risk-Weighted Assets(22) (%) Tier 1 Capital to Risk-Weighted Assets(22) (%)Tier 1 Capital to Average Assets (Leverage Ratio)(22) (%) Please see slide 32 for all footnote references included above. UNAUDITED Stock Repurchase Program • 265,248 Shares Repurchased in 3Q25 at an average price per share of $35.85 • $40.5 Million Remaining Dollar Amount of Shares Authorized to be Purchased under the Current Repurchase Program 10.9 11.1 11.5 11.7 11.7 10.8 10.9 11.2 11.2 11.0 Company Level Origin Bank Level 3Q24 4Q24 1Q25 2Q25 3Q25 12.6 13.5 13.8 13.7 13.8 12.4 13.3 13.4 13.1 12.9 Company Level Origin Bank Level 3Q24 4Q24 1Q25 2Q25 3Q25 15.5 16.4 15.8 15.7 15.9 14.4 15.3 14.6 14.3 14.2 Company Level Origin Bank Level 3Q24 4Q24 1Q25 2Q25 3Q25 12.5 13.3 13.6 13.5 13.6 12.4 13.3 13.4 13.1 12.9 Company Level Origin Bank Level 3Q24 4Q24 1Q25 2Q25 3Q25 Well Capitalized 5.0% Well Capitalized 8.0% Well Capitalized 6.5% Well Capitalized 10.0%

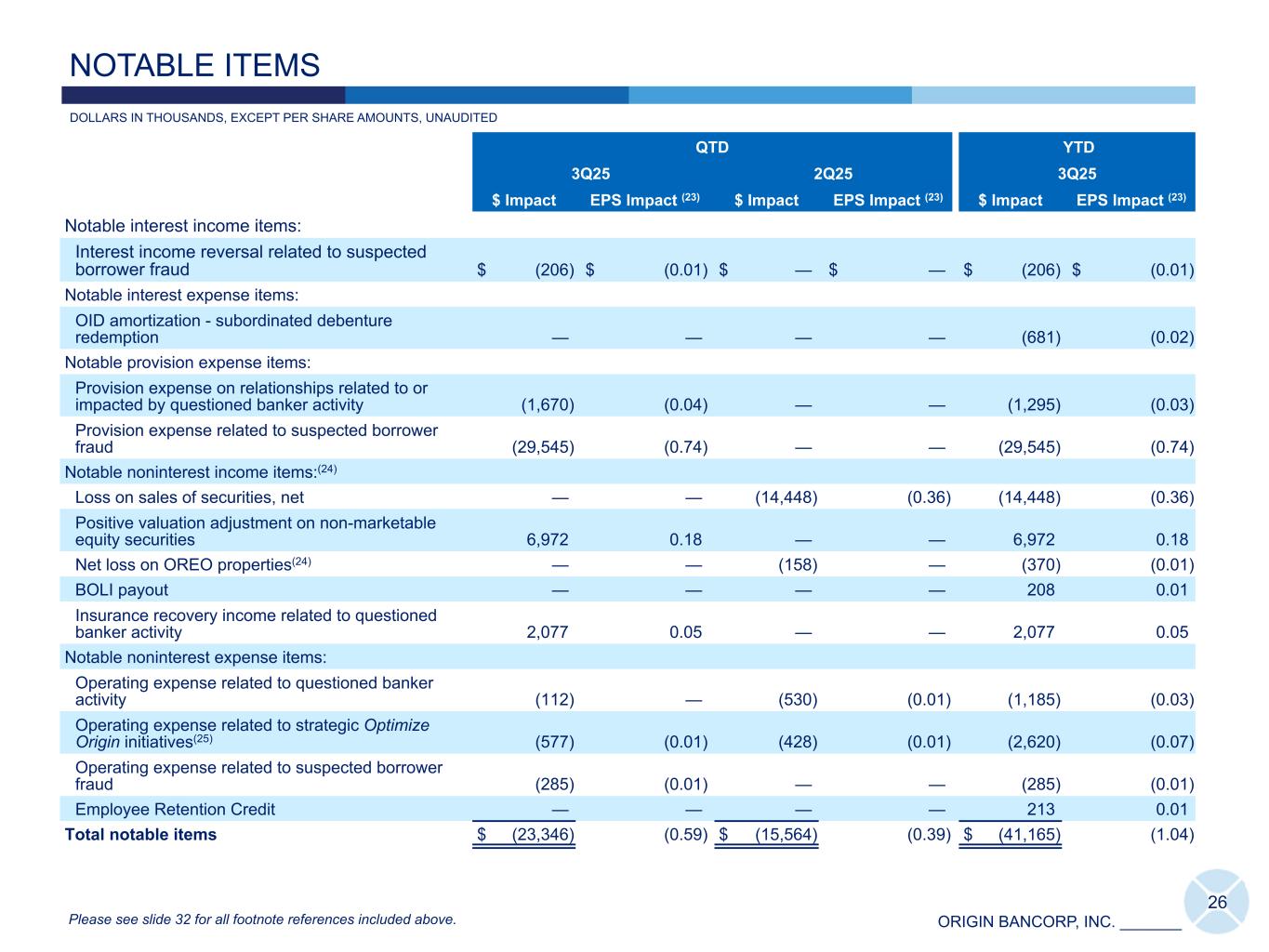

ORIGIN BANCORP, INC. _______ QTD YTD 3Q25 2Q25 3Q25 $ Impact EPS Impact (23) $ Impact EPS Impact (23) $ Impact EPS Impact (23) Notable interest income items: Interest income reversal related to suspected borrower fraud $ (206) $ (0.01) $ — $ — $ (206) $ (0.01) Notable interest expense items: OID amortization - subordinated debenture redemption — — — — (681) (0.02) Notable provision expense items: Provision expense on relationships related to or impacted by questioned banker activity (1,670) (0.04) — — (1,295) (0.03) Provision expense related to suspected borrower fraud (29,545) (0.74) — — (29,545) (0.74) Notable noninterest income items:(24) Loss on sales of securities, net — — (14,448) (0.36) (14,448) (0.36) Positive valuation adjustment on non-marketable equity securities 6,972 0.18 — — 6,972 0.18 Net loss on OREO properties(24) — — (158) — (370) (0.01) BOLI payout — — — — 208 0.01 Insurance recovery income related to questioned banker activity 2,077 0.05 — — 2,077 0.05 Notable noninterest expense items: Operating expense related to questioned banker activity (112) — (530) (0.01) (1,185) (0.03) Operating expense related to strategic Optimize Origin initiatives(25) (577) (0.01) (428) (0.01) (2,620) (0.07) Operating expense related to suspected borrower fraud (285) (0.01) — — (285) (0.01) Employee Retention Credit — — — — 213 0.01 Total notable items $ (23,346) (0.59) $ (15,564) (0.39) $ (41,165) (1.04) 26 DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS, UNAUDITED NOTABLE ITEMS Please see slide 32 for all footnote references included above.

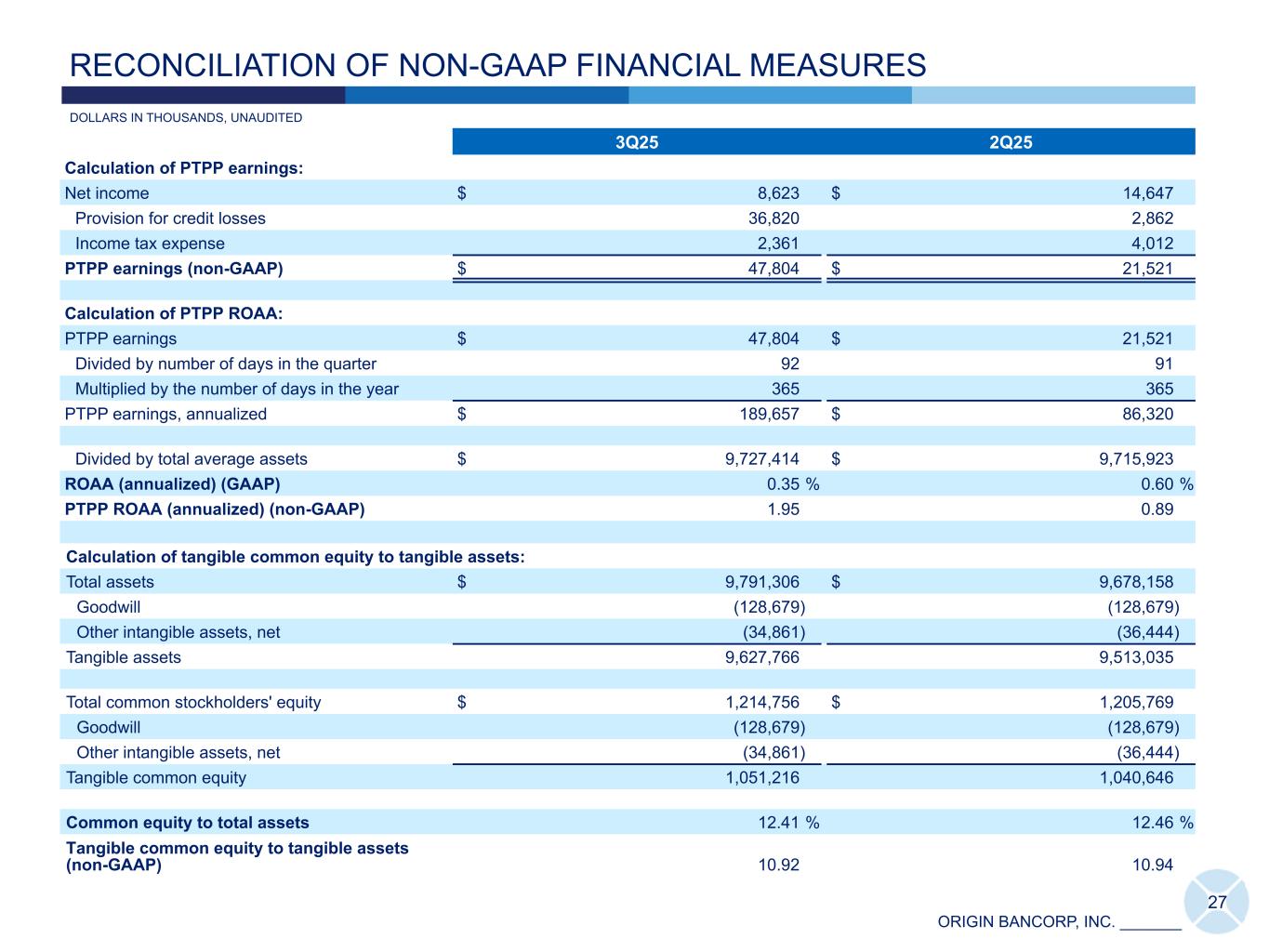

ORIGIN BANCORP, INC. _______ 3Q25 2Q25 Calculation of PTPP earnings: Net income $ 8,623 $ 14,647 Provision for credit losses 36,820 2,862 Income tax expense 2,361 4,012 PTPP earnings (non-GAAP) $ 47,804 $ 21,521 Calculation of PTPP ROAA: PTPP earnings $ 47,804 $ 21,521 Divided by number of days in the quarter 92 91 Multiplied by the number of days in the year 365 365 PTPP earnings, annualized $ 189,657 $ 86,320 Divided by total average assets $ 9,727,414 $ 9,715,923 ROAA (annualized) (GAAP) 0.35 % 0.60 % PTPP ROAA (annualized) (non-GAAP) 1.95 0.89 Calculation of tangible common equity to tangible assets: Total assets $ 9,791,306 $ 9,678,158 Goodwill (128,679) (128,679) Other intangible assets, net (34,861) (36,444) Tangible assets 9,627,766 9,513,035 Total common stockholders' equity $ 1,214,756 $ 1,205,769 Goodwill (128,679) (128,679) Other intangible assets, net (34,861) (36,444) Tangible common equity 1,051,216 1,040,646 Common equity to total assets 12.41 % 12.46 % Tangible common equity to tangible assets (non-GAAP) 10.92 10.94 27 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

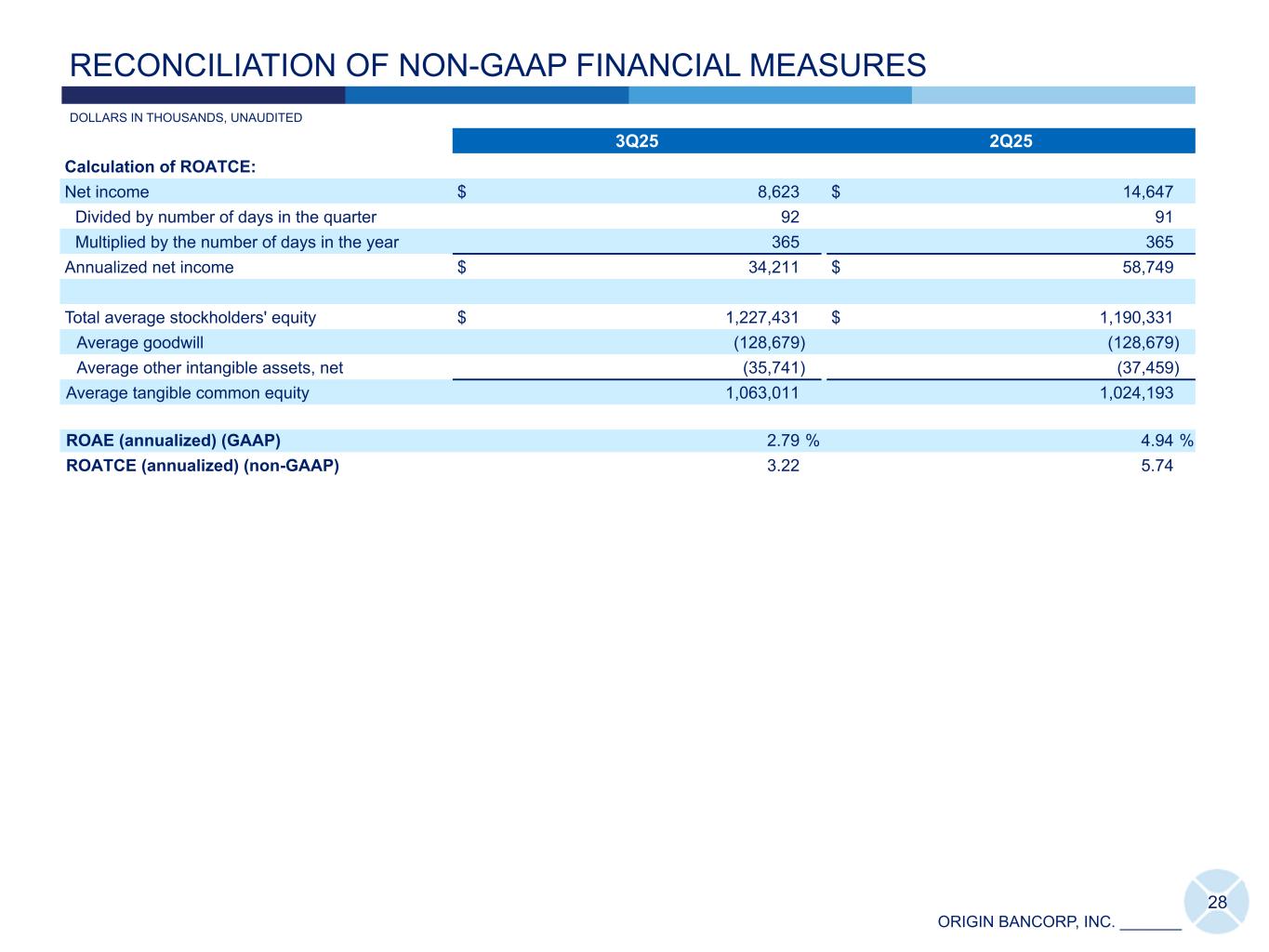

ORIGIN BANCORP, INC. _______ 3Q25 2Q25 Calculation of ROATCE: Net income $ 8,623 $ 14,647 Divided by number of days in the quarter 92 91 Multiplied by the number of days in the year 365 365 Annualized net income $ 34,211 $ 58,749 Total average stockholders' equity $ 1,227,431 $ 1,190,331 Average goodwill (128,679) (128,679) Average other intangible assets, net (35,741) (37,459) Average tangible common equity 1,063,011 1,024,193 ROAE (annualized) (GAAP) 2.79 % 4.94 % ROATCE (annualized) (non-GAAP) 3.22 5.74 28 DOLLARS IN THOUSANDS, UNAUDITED RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

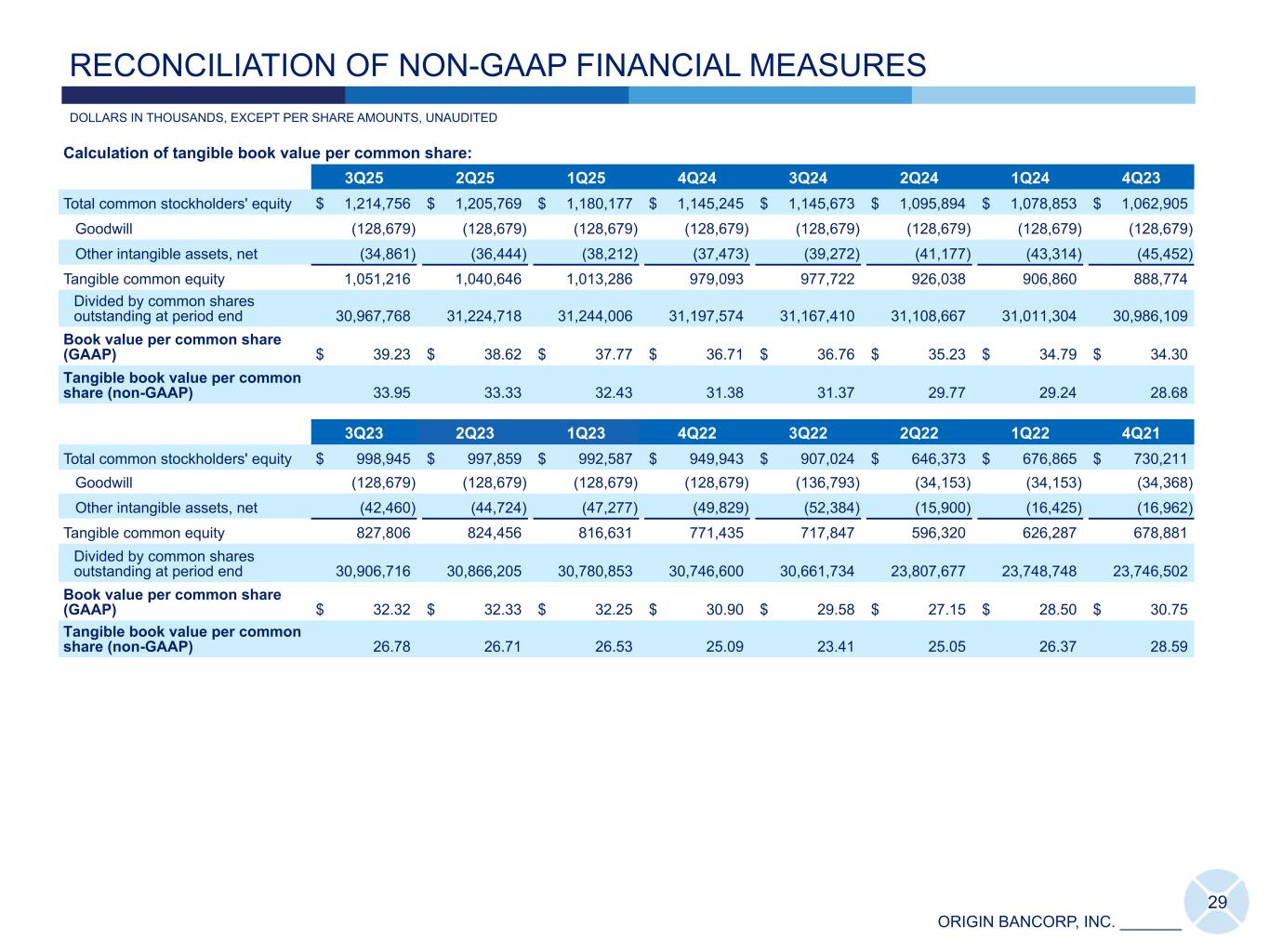

ORIGIN BANCORP, INC. _______ Calculation of tangible book value per common share: 3Q25 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 Total common stockholders' equity $ 1,214,756 $ 1,205,769 $ 1,180,177 $ 1,145,245 $ 1,145,673 $ 1,095,894 $ 1,078,853 $ 1,062,905 Goodwill (128,679) (128,679) (128,679) (128,679) (128,679) (128,679) (128,679) (128,679) Other intangible assets, net (34,861) (36,444) (38,212) (37,473) (39,272) (41,177) (43,314) (45,452) Tangible common equity 1,051,216 1,040,646 1,013,286 979,093 977,722 926,038 906,860 888,774 Divided by common shares outstanding at period end 30,967,768 31,224,718 31,244,006 31,197,574 31,167,410 31,108,667 31,011,304 30,986,109 Book value per common share (GAAP) $ 39.23 $ 38.62 $ 37.77 $ 36.71 $ 36.76 $ 35.23 $ 34.79 $ 34.30 Tangible book value per common share (non-GAAP) 33.95 33.33 32.43 31.38 31.37 29.77 29.24 28.68 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Total common stockholders' equity $ 998,945 $ 997,859 $ 992,587 $ 949,943 $ 907,024 $ 646,373 $ 676,865 $ 730,211 Goodwill (128,679) (128,679) (128,679) (128,679) (136,793) (34,153) (34,153) (34,368) Other intangible assets, net (42,460) (44,724) (47,277) (49,829) (52,384) (15,900) (16,425) (16,962) Tangible common equity 827,806 824,456 816,631 771,435 717,847 596,320 626,287 678,881 Divided by common shares outstanding at period end 30,906,716 30,866,205 30,780,853 30,746,600 30,661,734 23,807,677 23,748,748 23,746,502 Book value per common share (GAAP) $ 32.32 $ 32.33 $ 32.25 $ 30.90 $ 29.58 $ 27.15 $ 28.50 $ 30.75 Tangible book value per common share (non-GAAP) 26.78 26.71 26.53 25.09 23.41 25.05 26.37 28.59 29 RECONCILIATION OF NON-GAAP FINANCIAL MEASURES DOLLARS IN THOUSANDS, EXCEPT PER SHARE AMOUNTS, UNAUDITED

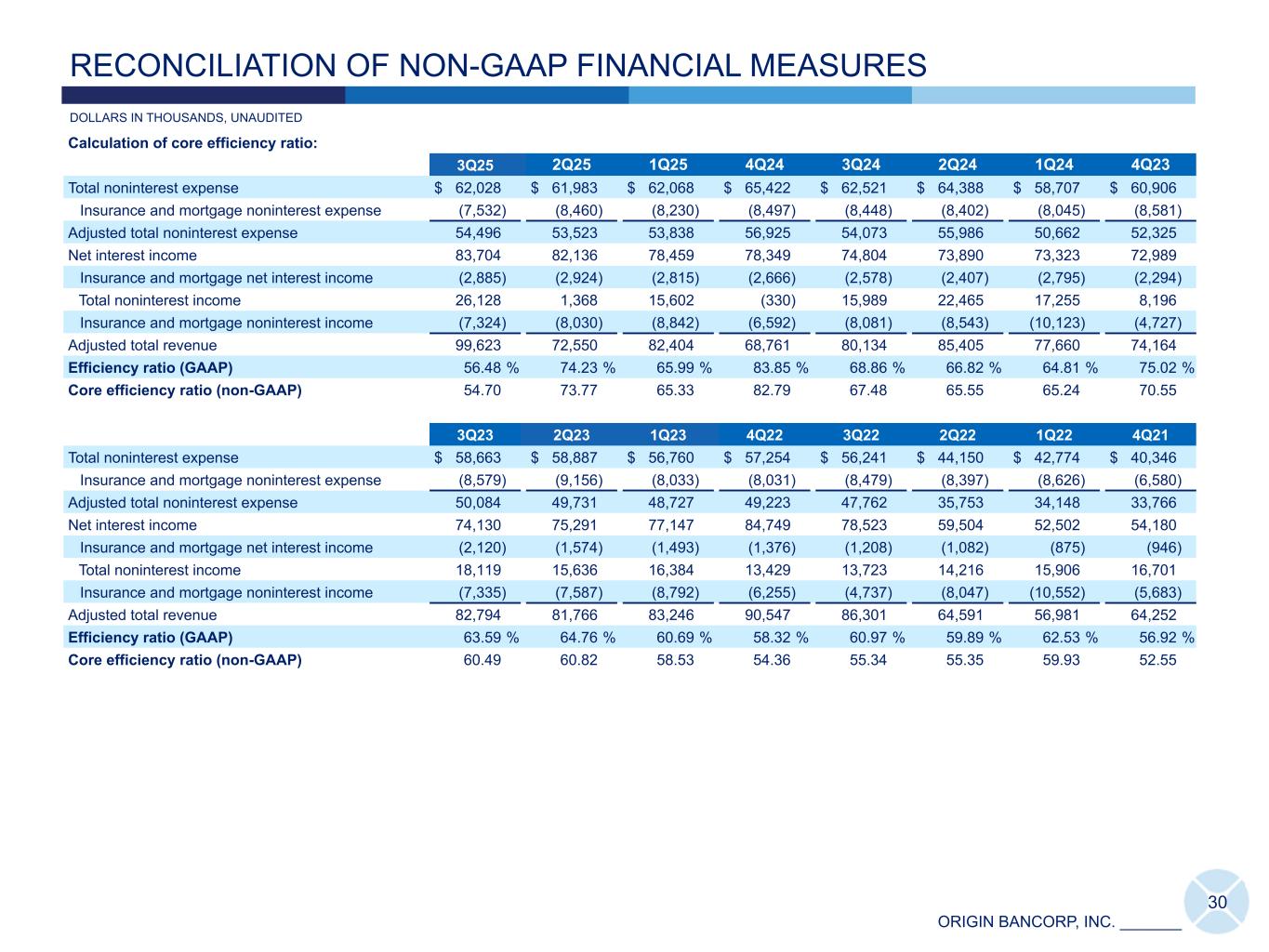

ORIGIN BANCORP, INC. _______ RECONCILIATION OF NON-GAAP FINANCIAL MEASURES DOLLARS IN THOUSANDS, UNAUDITED Calculation of core efficiency ratio: 3Q25 2Q25 1Q25 4Q24 3Q24 2Q24 1Q24 4Q23 Total noninterest expense $ 62,028 $ 61,983 $ 62,068 $ 65,422 $ 62,521 $ 64,388 $ 58,707 $ 60,906 Insurance and mortgage noninterest expense (7,532) (8,460) (8,230) (8,497) (8,448) (8,402) (8,045) (8,581) Adjusted total noninterest expense 54,496 53,523 53,838 56,925 54,073 55,986 50,662 52,325 Net interest income 83,704 82,136 78,459 78,349 74,804 73,890 73,323 72,989 Insurance and mortgage net interest income (2,885) (2,924) (2,815) (2,666) (2,578) (2,407) (2,795) (2,294) Total noninterest income 26,128 1,368 15,602 (330) 15,989 22,465 17,255 8,196 Insurance and mortgage noninterest income (7,324) (8,030) (8,842) (6,592) (8,081) (8,543) (10,123) (4,727) Adjusted total revenue 99,623 72,550 82,404 68,761 80,134 85,405 77,660 74,164 Efficiency ratio (GAAP) 56.48 % 74.23 % 65.99 % 83.85 % 68.86 % 66.82 % 64.81 % 75.02 % Core efficiency ratio (non-GAAP) 54.70 73.77 65.33 82.79 67.48 65.55 65.24 70.55 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Total noninterest expense $ 58,663 $ 58,887 $ 56,760 $ 57,254 $ 56,241 $ 44,150 $ 42,774 $ 40,346 Insurance and mortgage noninterest expense (8,579) (9,156) (8,033) (8,031) (8,479) (8,397) (8,626) (6,580) Adjusted total noninterest expense 50,084 49,731 48,727 49,223 47,762 35,753 34,148 33,766 Net interest income 74,130 75,291 77,147 84,749 78,523 59,504 52,502 54,180 Insurance and mortgage net interest income (2,120) (1,574) (1,493) (1,376) (1,208) (1,082) (875) (946) Total noninterest income 18,119 15,636 16,384 13,429 13,723 14,216 15,906 16,701 Insurance and mortgage noninterest income (7,335) (7,587) (8,792) (6,255) (4,737) (8,047) (10,552) (5,683) Adjusted total revenue 82,794 81,766 83,246 90,547 86,301 64,591 56,981 64,252 Efficiency ratio (GAAP) 63.59 % 64.76 % 60.69 % 58.32 % 60.97 % 59.89 % 62.53 % 56.92 % Core efficiency ratio (non-GAAP) 60.49 60.82 58.53 54.36 55.34 55.35 59.93 52.55 30

ORIGIN BANCORP, INC. _______ GLOSSARY OF TERMS AFS - Available for sale ALCL - Allowance for loan credit losses BOLI - Bank owned life insurance CAGR - Compound annual growth rate C&I - Commercial & industrial loans CMO - Collateralized mortgage obligations CORE DEPOSITS - Total deposits excluding time deposits greater than $250,000, brokered and Certificate of Deposit Account Registry Service deposits CRE - Commercial real estate loans DFW - Dallas/Fort Worth EPS - Earnings per share FDIC - Federal Deposit Insurance Corporation FHLB - Federal Home Loan Bank FTE NII - Fully tax equivalent net interest income GAAP - Generally accepted accounting principals LHFI - Loans held for investment MBS - Mortgage backed securities MSA - Metropolitan Statistical Area NIE - Noninterest expense NIM - Net interest margin NIM - FTE - Net interest margin, fully tax equivalent OID AMORTIZATION - Original issue discount amortization PTPP - Pre-tax, pre-provision PTPP ROAA - Pre-tax, pre-provision return on average assets QTD - Quarter-to-date ROAA - Return on average assets ROAE - Return on average equity ROATCE - Return on average tangible common equity SOFR - Secured Overnight Financing Rate YR/YR - Year over year YTD - Year-to-date 31

ORIGIN BANCORP, INC. _______ 32 PRESENTATION NOTES (1) Excludes the Southeast market, for which deposits and loans represent approximately 1% their respective totals. (2) Excludes Treasury/wholesale deposits of $31.5 million at September 30, 2025. (3) Excludes mortgage warehouse lines of credit (“mortgage warehouse LOC”). (4) Excludes notable items. (5) The annualized benefit is presented on a tax-equivalent yield basis to account for tax-exempt income. (6) Data obtained from Office of the Texas Governor (gov.texas.gov), Texas Workforce Commission (twc.Texas.gov), Bureau of Labor Statistics (bls.gov), Baldwin County Economic Development Council (baldwineda.com), Florida's Great Northwest (floridasgreatnorthwest.com), Bureau of Transportation Statistics (bts.gov) and Port of Mobile, Alabama Port Authority (alports.com). (7) As used in this presentation, PTPP earnings, PTPP ROAA, tangible book value per common share, tangible common equity to tangible assets, ROATCE, and core efficiency ratio are either non-GAAP financial measures or use a non-GAAP contributor in the formula. For a reconciliation of these alternative financial measures to their comparable GAAP measures, see slides 27-30 of this presentation. (8) Total loans held for investment, adjusted excludes mortgage warehouse lines of credit for all periods presented. (9) Origin Bancorp, Inc. and KBW Nasdaq Bank cumulative total shareholder return assumes $100 invested on December 31, 1996, and any dividends are reinvested. Data for Origin Bancorp, Inc. cumulative total shareholder return prior to May 9, 2018, is based upon private stock transactions and is not reflective of open market trades. (10) Core deposits are Total deposits excluding time deposits greater than $250,000, brokered and Certificate of Deposit Account Registry Service deposits. (11) Data obtained from The United States Census Bureau (census.gov). Count is as of most recent practicable date. (12) Periods at or prior to December 31, 2023, were adjusted to include mortgage warehouse deposits in our DFW market. (13) The DFW and Houston markets include $108.0 million of deposits in total that were sold on December 31, 2024, and immediately repurchased on January 1, 2025. (14) The period ended December 31, 2021, excludes PPP loans. (15) Does not include loans held for sale. (16) The ALCL to total LHFI, adjusted is calculated by excluding the ALCL for mortgage warehouse LOC from the total LHFI ALCL in the numerator and excluding the mortgage warehouse LOC from the LHFI in the denominator. Due to their low-risk profile, mortgage warehouse LOC require a disproportionately low allocation of the ALCL. (17) The accumulated other comprehensive loss primarily represents the unrealized loss, net of tax benefit, of available for sale securities and is a component of equity. (18) Floating rate loans typically reprice monthly, while variable rate loans reprice based upon the terms defined within the adjustable rate loan agreement specific to their loan contract. (19) Uses total deposits costs for the month ended August 31, 2024, as the cycle starting point. (20) Projection is based upon September 30, 2025, time deposit balances. (21) Argent investment income and limited partnership investment (loss) income are components of equity method investment (loss) income on the face of the income statement. (22) September 30, 2025, Company level ratios are estimated. (23) The diluted EPS impact is calculated using a 21% effective tax rate. The total of the diluted EPS impact of each individual line item may not equal the calculated diluted EPS impact on the total notable items due to rounding. (24) The $158,000 net loss on OREO properties for the quarter ended June 30, 2025, includes an $8,000 insurance settlement recovery that was included in noninterest income on the face of the income statement and $3,000 in repair costs that was included in noninterest expense. The $370,000 net loss on OREO properties for the nine months ended September 30, 2025, includes a $452,000 insurance settlement recovery that was included in noninterest income on the face of the income statement and a $151,000 repair cost that was included in noninterest expense. (25) The $577,000 operating expense related to strategic Optimize Origin initiatives for the quarter ended September 30, 2025, includes sub-lease income of $27,000 that was included in noninterest income on the face of the interest statement.