Transformative Combination with First Majestic Silver Corporate

Presentation September 2024 NYSE/TSX: GATO

Disclaimer 2 Cautionary Note Regarding Forward-Looking

Statements Certain statements contained herein regarding Gatos Silver Inc. (“Gatos” or the “Company”) and First Majestic Silver Corp. (“First Majestic”) and their respective operations constitute “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are intended to be covered by the safe harbor created by such sections and other

applicable laws and “forward-looking information” under applicable Canadian securities legislation. These statements relate to future events or the future performance, business prospects or opportunities of Gatos and/or First Majestic

that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions made in good faith in light of management’s experience and perception of historical trends, current conditions and expected

future developments. Forward-looking statements include, but are not limited to, statements with respect to: closing of the Transaction and the terms and timing related thereto; the anticipated benefits of the Transaction to Gatos,

First Majestic and their respective shareholders including increased shareholder value; the timing and receipt of required shareholder, stock exchange and regulatory approvals; satisfaction of the conditions to completion of the

Transaction; the anticipated timing of mailing proxy statements and circulars regarding the Transaction; liquidity, enhanced value and capital markets profile of First Majestic; cash flow and revenue estimates; future growth potential

for Gatos, First Majestic and their respective businesses; life of mine estimates; the future price of silver and other metals, asset quality and geographic spread; the future price of silver and other metals; the global supply and

market for precious metals, revenue, the estimation of mineral reserves and resources; the realization of mineral reserve estimates, and the timing and amount of estimated future production, recovery rates, costs of production and

all-in sustaining costs; capital expenditures; costs and timing of the development of new deposits and exploration programs; expected listing of shares on the New York Stock Exchange and the Toronto Stock Exchange; and exploration

programs. Assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon guidance

and forward-looking statements as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur. Generally, these forward-looking statements can be identified by the use of

forward-looking terminology such as "plans", “seeks”, “continues”, “projects”, “predicts”, “potential”, “targets”, "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends",

"anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved".

Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Gatos or First Majestic to be materially different

from those expressed or implied by such forward looking statements, including but not limited to: satisfaction or waiver of all applicable closing conditions for the Transaction on a timely basis or at all, including, without

limitation, receipt of all necessary shareholder, stock exchange and regulatory approvals or consents and lack of material changes with respect to First Majestic and Gatos and their respective businesses, all as more particularly set

forth in the Definitive Agreement; the timing of the closing of the Transaction and the failure of the Transaction to close for any reason; the outcome of any legal proceedings that may be instituted against Gatos or First Majestic

Gatos and others related to the Transaction; unanticipated difficulties or expenditures relating to the Transaction; risks relating to the value of the consideration to be issued in connection with the Transaction; the diversion of

management’s time on pending Transaction-related issues; the synergies expected from the Transaction not being realized; risks related to the integration of businesses; fluctuations in security markets; the duration and effects of

COVID-19, and any other global pandemics on operations and workforce, and the effects on global economies and society; general economic conditions including inflation risks; risks related to international operations; risks related to

joint venture operations; actual results of current exploration activities; actual results and costs of current reclamation activities; conclusions of economic evaluations; changes in project parameters as plans continue to be

refined; commodity prices; future prices of metals; possible variations in ore reserves, grade or recovery rates; actual performance of plant, equipment or processes relative to specifications and expectations; accidents; labour

relations; relations with local communities; and other risks of the mining industry; delays in obtaining governmental approvals or financing or in the completion of development or construction activities; changes in national and local

government, legislation, taxation, controls, regulations and political or economic developments; government regulation; operating or technical difficulties in connection with mining or development activities; risks and hazards

associated with the business of mineral exploration, development and mining (including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins and flooding); exchange rate fluctuations;

requirements for additional capital; risks relating to the credit worthiness or financial condition of suppliers, refiners and other parties with whom Gatos or First Majestic does business; limitations on insurance coverage; inability

to obtain adequate insurance to cover risks and hazards; outcomes of pending litigation; and the presence of laws and regulations that may impose restrictions on mining, including those currently enacted or pending in Mexico, whether

or not currently in force; employee relations; relationships with and claims by local communities and indigenous populations; availability and increasing costs associated with mining inputs and labour; the speculative nature of

mineral exploration and development, including the risks of obtaining and maintaining necessary licenses, permits and approvals from government authorities; diminishing quantities or grades of mineral reserves as properties are mined;

Gatos’ and First Majestic’s title to properties, changes in climate conditions and extreme weather events, as well as those factors discussed in (a) the section entitled "Description of the Business - Risk Factors" in First Majestic’s

most recently filed Annual Information Form for the year ended December 31, 2023, available under its profile on www.sedarplus.ca, and as an exhibit to its most recently filed Form 40-F on file with the United States Securities and

Exchange Commission in Washington, D.C., available on EDGAR at www.sec.gov/edgar or on First Majestic’s website and (b) the Gatos’ Annual Report on Form 10-K for the year ended December 31, 2023, available on EDGAR at

www.sec.gov/edgar or on Gatos’ website. First Majestic is not affirming or adopting any statements or reports attributed to Gatos (including prior mineral reserve and resource declaration) in this presentation or made by Gatos outside

of this presentation. Gatos is not affirming or adopting any statements or reports attributed to First Majestic (including prior mineral reserve and resource declaration) in this presentation or made by First Majestic outside of this

presentation. Although Gatos and First Majestic have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that

cause results not to be as anticipated, estimated or intended. First Majestic and Gatos believe that the expectations reflected in these forward-looking statements are reasonable, but there can be no assurance that such statements

will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. These statements

speak only as of the date hereof. Gatos and First Majestic do not undertake to update any forward-looking statements that are incorporated by reference herein, except in accordance with applicable securities laws. Non-GAAP Financial

Performance Measures This presentation includes reference to certain financial measures which are not standardized measures under the parties’ respective financial reporting frameworks. These measures include all-in sustaining costs

(or “AISC”) per payable silver equivalent ounce and free cash flow. The parties believe that these measures, together with measures determined in accordance with GAAP or IFRS, provide investors with an improved ability to evaluate the

underlying performance of First Majestic and Gatos. These measures are widely used in the mining industry as a benchmark for performance but do not have any standardized meaning prescribed under IFRS, and therefore they may not be

comparable to similar measures disclosed by other companies. The data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with

IFRS. For a complete description of how Gatos calculates such measures and a reconciliation of certain measures to GAAP terms, please see “Non-GAAP Measures” in Gatos’s Annual Report on Form 10-K for the year ended December 31, 2023

filed with the SEC on February 20, 2024, as amended by Amendment No. 1 to such annual report filed with the SEC on May 6, 2024 at www.sec.gov/edgar. For a reconciliation of certain of these measures, see the Appendix at the end of

this presentation. For a complete description of how First Majestic calculates such measures and a reconciliation of certain measures to GAAP terms please see “Non-GAAP Measures” in First Majestic’s most recent management discussion

and analysis filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Disclaimer 3 Important Information for Investors and Shareholders about the

Transaction and Where to Find It This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities of First

Majestic or Gatos or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities of Gatos or First Majestic in any jurisdiction in contravention of applicable law. This

presentation may be deemed to be soliciting material relating to the transaction. In connection with the proposed transaction between Gatos and First Majestic pursuant to the Definitive Agreement and subject to future developments, First

Majestic will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4 that is expected to include a Proxy Statement of Gatos that will also constitute a Prospectus of First Majestic (the “Proxy

Statement/Prospectus”) and other documents. First Majestic will also file a management proxy circular in connection with the transaction with applicable Canadian securities regulatory authorities. This presentation is not a substitute for any

registration statement, proxy statement, prospectus or other document Gatos or First Majestic may file with the SEC or Canadian securities regulatory authorities in connection with the pending Transaction. Gatos plans to mail to the Gatos

stockholders the definitive Proxy Statement/Prospectus in connection with the transaction and First Majestic will deliver its proxy circular to First Majestic shareholders. INVESTORS AND SECURITY HOLDERS OF GATOS AND FIRST MAJESTIC ARE URGED

TO READ THE PROXY STATEMENT/PROSPECTUS AND MANAGEMENT PROXY CIRCULAR, RESPECTIVELY, AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC OR CANADIAN SECURITIES REGULATORY AUTHORITIES CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY

BECOME AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE TRANSACTION BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT FIRST MAJESTIC, GATOS, THE TRANSACTION AND RELATED MATTERS. Investors and security holders

will be able to obtain free copies of the Proxy Statement/Prospectus (when available), the filings with the SEC that will be incorporated by reference into the Proxy Statement/Prospectus and other documents filed with the SEC by Gatos and

First Majestic containing important information about Gatos or First Majestic Gatos and the Transaction through the website maintained by the SEC at www.sec.gov. Investors will also be able to obtain free copies of the management proxy

circular and other documents filed with Canadian securities regulatory authorities by First Majestic, through the website maintained by the Canadian Securities Administrators at www.sedarplus.com. In addition, investors and security holders

will be able to obtain free copies of the documents filed by First Majestic with the SEC and Canadian securities regulatory authorities on First Majestic’s website at www.firstmajestic.com or by contacting First Majestic’s investor relations

team. Copies of the documents filed with the SEC by Gatos will be available free of charge on Gatos’s website or by contacting Gatos’ investor relations team. Participants in the Merger Solicitation Gatos, First Majestic and certain of

their respective directors, executive officers and employees may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be

deemed participants in the solicitation of the stockholders of Gatos and the shareholders of First Majestic in connection with the transaction, including a description of their respective direct or indirect interests, by security holdings or

otherwise, will be included in the Proxy Statement/Prospectus described above and other relevant documents when it is filed with the SEC and Canadian securities regulatory authorities in connection with the transaction. Additional information

regarding Gatos’s directors and executive officers is also included in Gatos’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 20, 2024, as amended by Amendment No. 1 to such annual report filed

with the SEC on May 6, 2024 and Gatos’ 2024 Proxy Statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 25, 2024, and information regarding First Majestic’s directors and executive officers is also

included in First Majestic’s Notice of Annual Meeting of Shareholders and 2024 Proxy Statement, which was filed with the SEC and Canadian securities regulatory authorities on April 15, 2024. These documents are available free of charge as

described above. Notice Regarding Mineral Disclosure The mineral resource and reserve estimates and LOM plan presented in respect of Gatos are based on a variety of estimates and assumptions relating to, among other things, geological

interpretation, statistical inferences, commodity prices, mining methodologies, operating and capital costs, plant throughput and processing recoveries and operating conditions. In particular, material assumptions and risks include those

described in our press release dated September 6, 2023 and in the technical reports filed by Gatos in October 2023 on EDGAR and SEDAR+ (the “2023 Technical Report”), including metal prices, as well as Gatos’ ability to reduce operating costs,

increase ramp development rates and dewater the mine in a cost-effective manner. There can be no assurance that the assumptions will actualize or be correct, and changes to any of these assumptions or our inability to achieve these

assumptions may result in actual results to deviate significantly from those in this presentation. Inferred mineral resources are subject to uncertainty as to their existence and as to their economic and legal feasibility. The level of

geological uncertainty associated with an inferred mineral resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic

viability. For further information regarding the mineral resource and reserve estimates presented in respect of First Majestic, see its Annual Information Form and Form 40-F for the year ended December 31, 2023 filed on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov/edgar, respectively. Qualified Persons Scientific and technical disclosure in this press release in respect of Gatos was approved by Anthony (Tony) Scott, P.Geo., Senior Vice President of Corporate

Development and Technical Services of Gatos who is a “Qualified Person” as defined in S-K 1300 and NI 43-101. All dollar amounts are expressed in, and references to “$” refer to, United States dollars unless otherwise noted. Silver

equivalent production figures use price assumptions to “convert” by products to equivalent silver ounces (contained metal, multiplied by by-product metal price, divided by silver price).

4 Consolidates three world-class, producing silver mining districts in Mexico

under one banner Cerro Los Gatos, San Dimas and Santa Elena collectively provide the foundation of a diversified, intermediate primary silver producer 1 Enhances production profile with strong margins Combined annual production of 30-32

Moz AgEq, including 15-16 Moz Ag at all-in sustaining costs of US$18.00-US$20.00/oz AgEq (1) 2 Bolsters free cash flow generation Gatos expected to immediately contribute annual free cash flow of ~US$70M to the combined entity

(2) 3 Leverages a highly experienced combined team with a strong track record of value creation in Mexico Over 20 years of experience operating in Mexico, with an emphasis on socially responsible mining, community engagement and value

creation 4 Maintains peer-leading exposure to silver Over 50% of pro forma revenue derived from silver compared to an average of ~30% for intermediate silver producing peers (3) 5 Creates a 350,000 ha highly prospective land package

which has yielded a history of exploration success Cerro Los Gatos contributes 103,000 ha of unencumbered and underexplored land with significant new discovery potential 6 Results in a larger company with a strengthened balance sheet,

leading trading liquidity and improved capital markets profile Pro forma market cap approaching US$3B, average daily trading liquidity of ~US$49M, and well-positioned to deliver increased shareholder value 7 Realizes meaningful

synergies Corporate cost savings, supply chain and procurement efficiencies, cross-pollination of expertise, and acceleration/optimization of internal projects and exploration programs all expected to deliver meaningful value creation for

all shareholders 8 Creating the Leading Intermediate Primary Silver ProducerTransaction Highlights

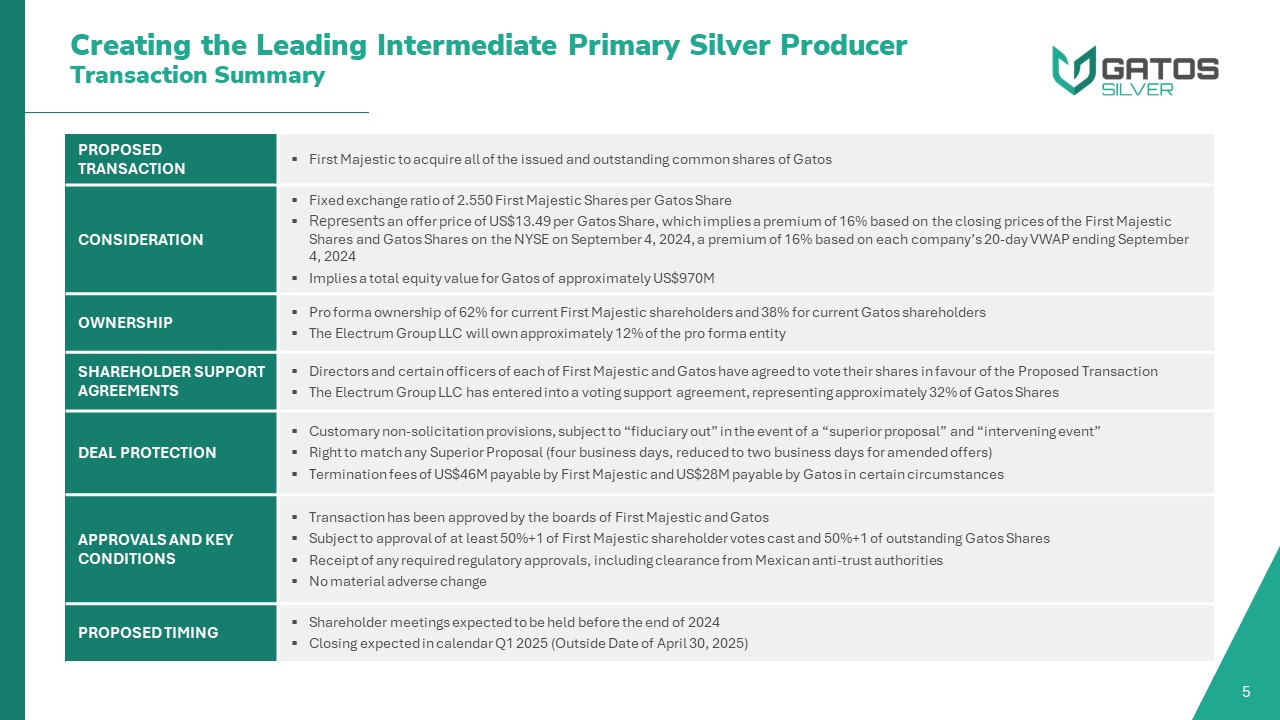

5 Proposed Transaction First Majestic to acquire all of the issued and

outstanding common shares of Gatos Consideration Fixed exchange ratio of 2.550 First Majestic Shares per Gatos Share Represents an offer price of US$13.49 per Gatos Share, which implies a premium of 16% based on the closing prices of the

First Majestic Shares and Gatos Shares on the NYSE on September 4, 2024, a premium of 16% based on each company’s 20-day VWAP ending September 4, 2024 Implies a total equity value for Gatos of approximately US$970M Ownership Pro forma

ownership of 62% for current First Majestic shareholders and 38% for current Gatos shareholders The Electrum Group LLC will own approximately 12% of the pro forma entity Shareholder Support Agreements Directors and certain officers of

each of First Majestic and Gatos have agreed to vote their shares in favour of the Proposed Transaction The Electrum Group LLC has entered into a voting support agreement, representing approximately 32% of Gatos Shares Deal

protection Customary non-solicitation provisions, subject to “fiduciary out” in the event of a “superior proposal” and “intervening event” Right to match any Superior Proposal (four business days, reduced to two business days for amended

offers) Termination fees of US$46M payable by First Majestic and US$28M payable by Gatos in certain circumstances Approvals and Key Conditions Transaction has been approved by the boards of First Majestic and Gatos Subject to approval of

at least 50%+1 of First Majestic shareholder votes cast and 50%+1 of outstanding Gatos Shares Receipt of any required regulatory approvals, including clearance from Mexican anti-trust authorities No material adverse change Proposed

timing Shareholder meetings expected to be held before the end of 2024 Closing expected in calendar Q1 2025 (Outside Date of April 30, 2025) Creating the Leading Intermediate Primary Silver ProducerTransaction Summary

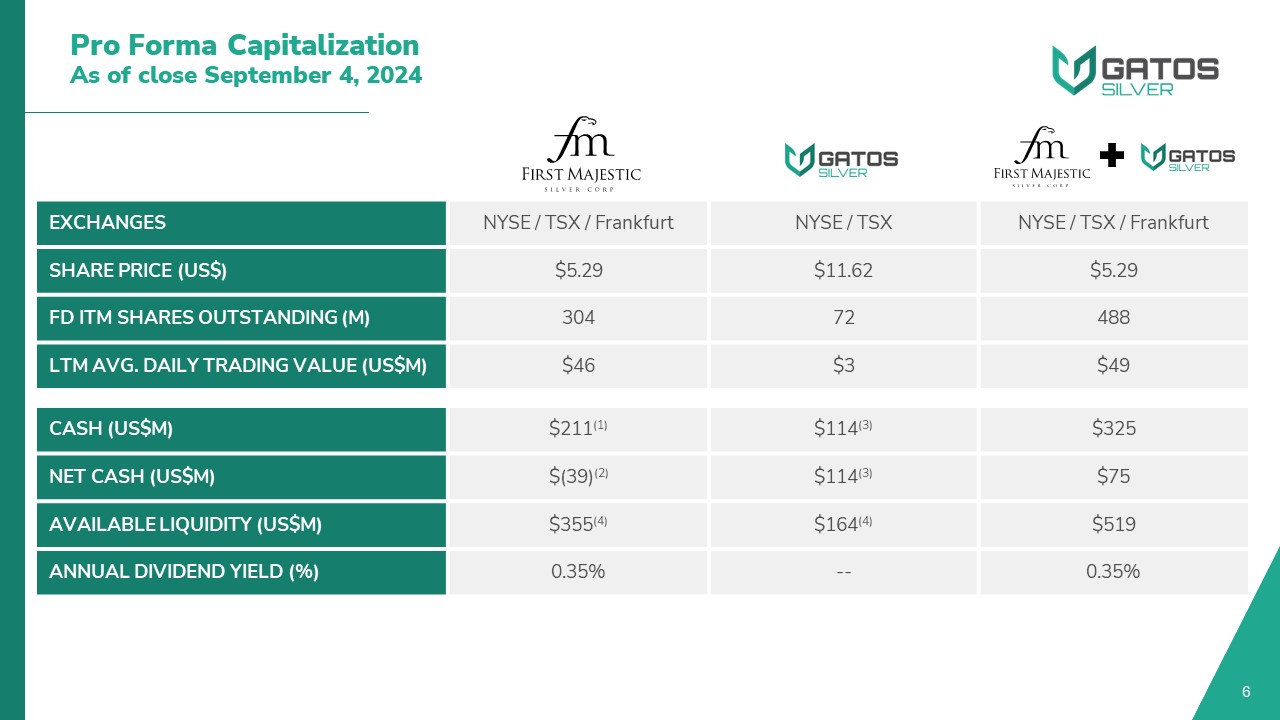

6 Exchanges NYSE / TSX / Frankfurt NYSE / TSX NYSE / TSX / Frankfurt Share

Price (US$) $5.29 $11.62 $5.29 FD ITM Shares Outstanding (M) 304 72 488 LTM AVG. Daily trading Value (US$M) $46 $3 $49 Cash (US$M) $211(1) $114(3) $325 Net Cash (US$M) $(39)(2) $114(3) $75 Available liquidity

(US$M) $355(4) $164(4) $519 Annual Dividend Yield (%) 0.35% -- 0.35% Pro Forma CapitalizationAs of close September 4, 2024

7 Attractive premium of 16%(1) on a spot and 20-day VWAP basis Meaningful

equity participation in a leading intermediate primary silver producer with a highly diversified portfolio, including three world-class, mining districts Unique opportunity to gain production diversification while combining Cerro Los Gatos

with complementary, high-quality assets Combination provides enhanced capital markets presence and trading liquidity Superior financial strength and flexibility to support advancement of continued margin improvement, growth projects and

exploration programs Combined land package of approximately 350,000 hectares with significant exploration potential Benefits to Gatos Shareholders Ability to leverage First Majestic's long-term good standing with local governments, unions

and community Transaction Benefits to Shareholders

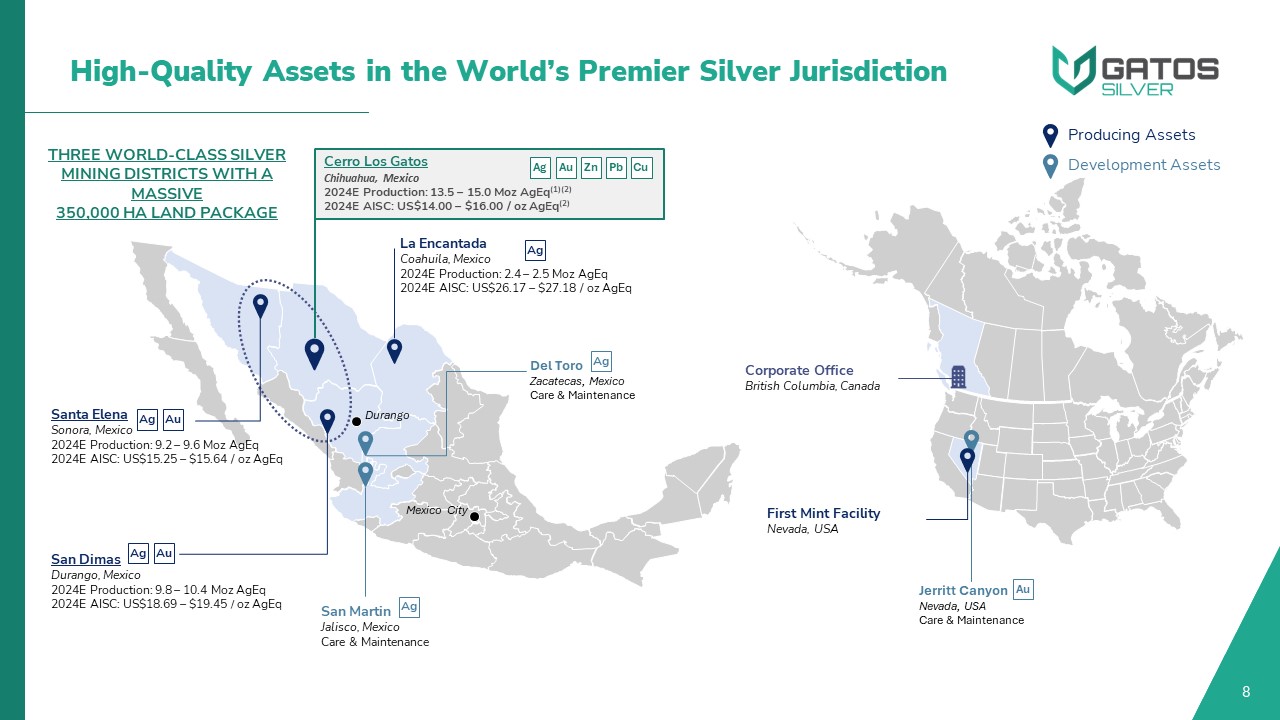

First Mint Facility Nevada, USA 8 Santa Elena Sonora, Mexico 2024E

Production: 9.2 – 9.6 Moz AgEq 2024E AISC: US$15.25 – $15.64 / oz AgEq Ag Au San Dimas Durango, Mexico 2024E Production: 9.8 – 10.4 Moz AgEq 2024E AISC: US$18.69 – $19.45 / oz AgEq Ag Au Del Toro Zacatecas, Mexico Care &

Maintenance Ag San Martin Jalisco, Mexico Care & Maintenance Ag Cerro Los Gatos Chihuahua, Mexico 2024E Production: 13.5 – 15.0 Moz AgEq(1)(2) 2024E AISC: US$14.00 – $16.00 / oz AgEq(2) Ag Au Zn Pb Cu Mexico

City Durango Producing Assets Development Assets Jerritt Canyon Nevada, USA Care & Maintenance Au Corporate Office British Columbia, Canada La Encantada Coahuila, Mexico 2024E Production: 2.4 – 2.5 Moz AgEq 2024E AISC:

US$26.17 – $27.18 / oz AgEq Ag THREE WORLD-CLASS SILVER MINING DISTRICTS WITH A MASSIVE 350,000 HA LAND PACKAGE High-Quality Assets in the World’s Premier Silver Jurisdiction

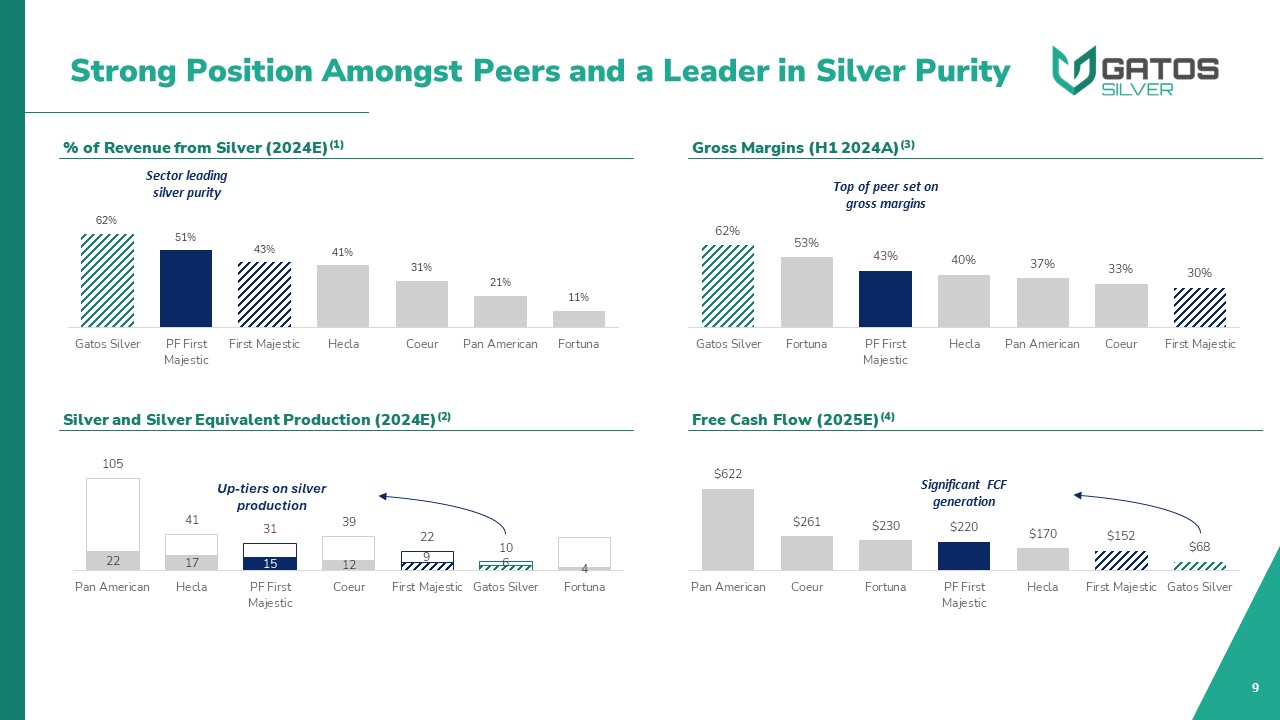

Strong Position Amongst Peers and a Leader in Silver Purity 9 % of Revenue

from Silver (2024E)(1) Silver and Silver Equivalent Production (2024E)(2) Free Cash Flow (2025E)(4) Sector leading silver purity Top of peer set on gross margins Significant FCF generation Up-tiers on silver production Gross Margins

(H1 2024A)(3)

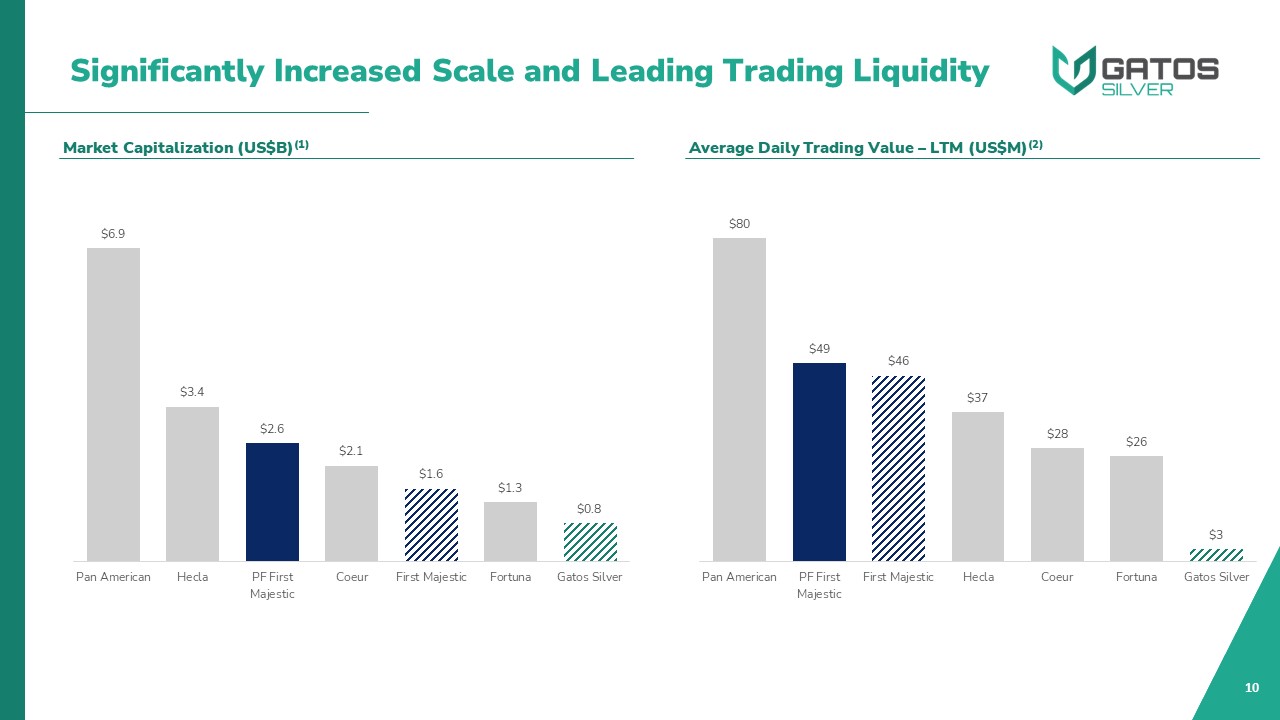

Significantly Increased Scale and Leading Trading Liquidity 10 Market

Capitalization (US$B)(1) Average Daily Trading Value – LTM (US$M)(2)

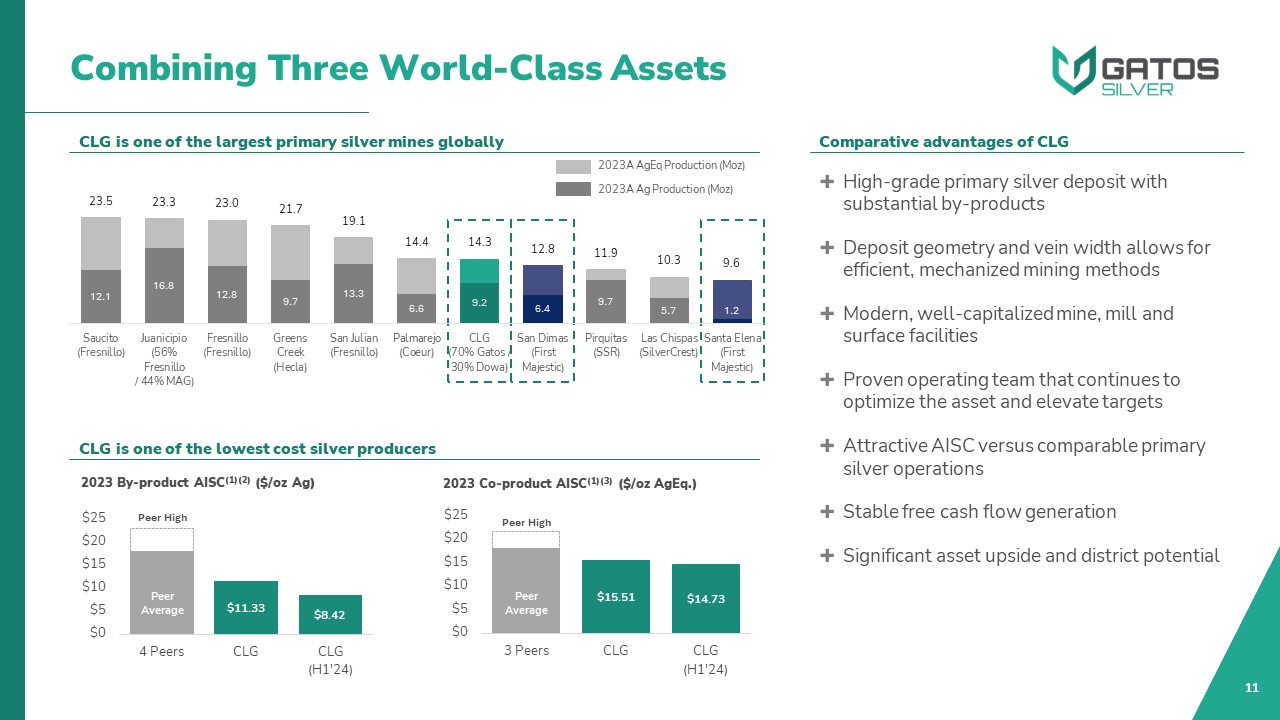

Combining Three World-Class Assets 11 CLG is one of the largest primary silver

mines globally CLG is one of the lowest cost silver producers High-grade primary silver deposit with substantial by-products Deposit geometry and vein width allows for efficient, mechanized mining methods Modern, well-capitalized mine,

mill and surface facilities Proven operating team that continues to optimize the asset and elevate targets Attractive AISC versus comparable primary silver operations Stable free cash flow generation Significant asset upside and district

potential Comparative advantages of CLG 2023 By-product AISC(1)(2) ($/oz Ag) 2023 Co-product AISC(1)(3) ($/oz AgEq.) 2023A AgEq Production (Moz) 2023A Ag Production (Moz) Peer Average Peer High Peer Average Peer High

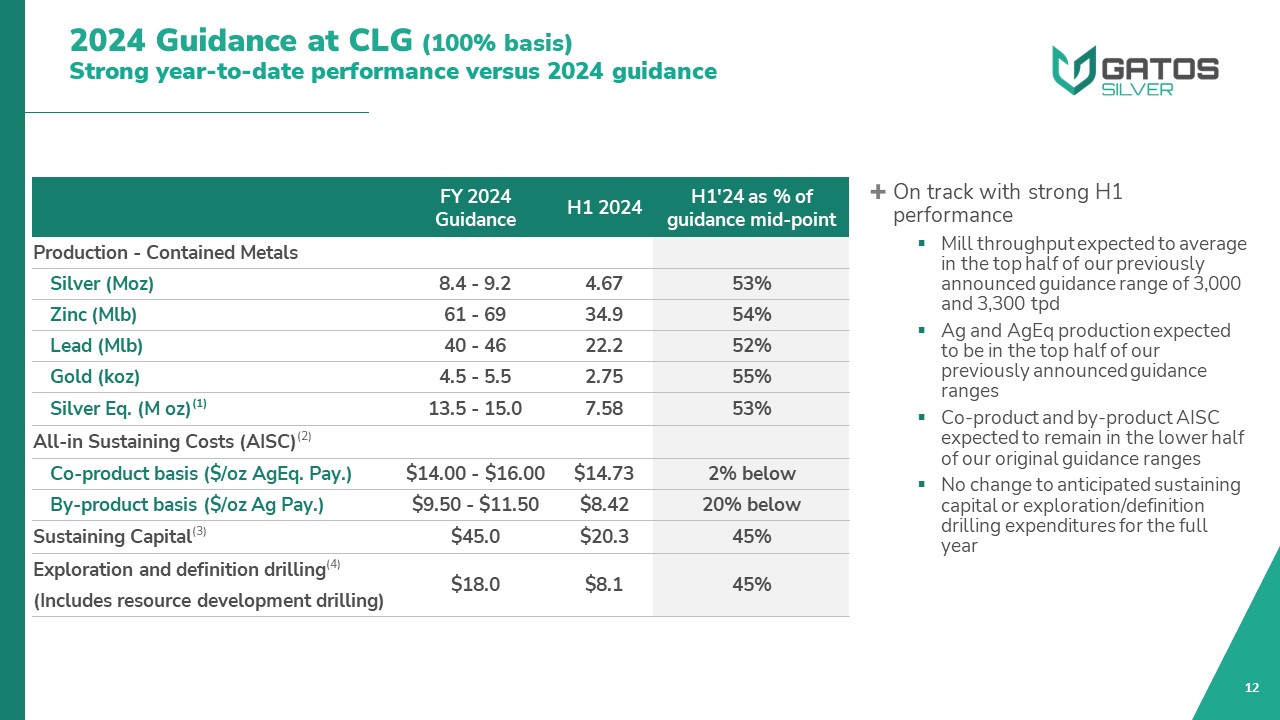

2024 Guidance at CLG (100% basis)Strong year-to-date performance versus 2024

guidance On track with strong H1 performance Mill throughput expected to average in the top half of our previously announced guidance range of 3,000 and 3,300 tpd Ag and AgEq production expected to be in the top half of our previously

announced guidance ranges Co-product and by-product AISC expected to remain in the lower half of our original guidance ranges No change to anticipated sustaining capital or exploration/definition drilling expenditures for the full

year 12 FY 2024 Guidance H1 2024 H1'24 as % of guidance mid-point Production - Contained Metals Silver (Moz) 8.4 - 9.2 4.67 53% Zinc (Mlb) 61 - 69 34.9 54% Lead (Mlb) 40 - 46 22.2 52% Gold (koz) 4.5 -

5.5 2.75 55% Silver Eq. (M oz)(1) 13.5 - 15.0 7.58 53% All-in Sustaining Costs (AISC)(2) Co-product basis ($/oz AgEq. Pay.) $14.00 - $16.00 $14.73 2% below By-product basis ($/oz Ag Pay.) $9.50 - $11.50 $8.42 20%

below Sustaining Capital(3) $45.0 $20.3 45% Exploration and definition drilling(4) $18.0 $8.1 45% (Includes resource development drilling)

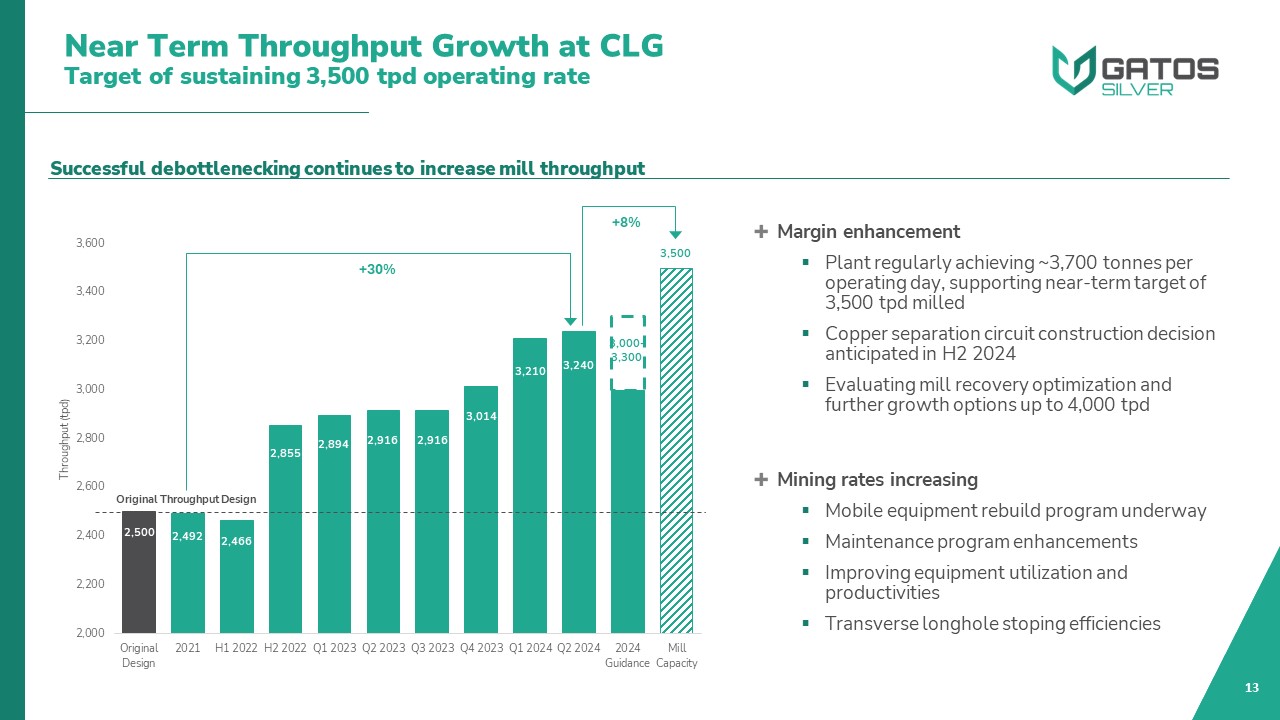

Near Term Throughput Growth at CLGTarget of sustaining 3,500 tpd operating

rate 13 Successful debottlenecking continues to increase mill throughput Margin enhancement Plant regularly achieving ~3,700 tonnes per operating day, supporting near-term target of 3,500 tpd milled Copper separation circuit

construction decision anticipated in H2 2024 Evaluating mill recovery optimization and further growth options up to 4,000 tpd Mining rates increasing Mobile equipment rebuild program underway Maintenance program enhancements Improving

equipment utilization and productivities Transverse longhole stoping efficiencies Original Throughput Design +8% +30%

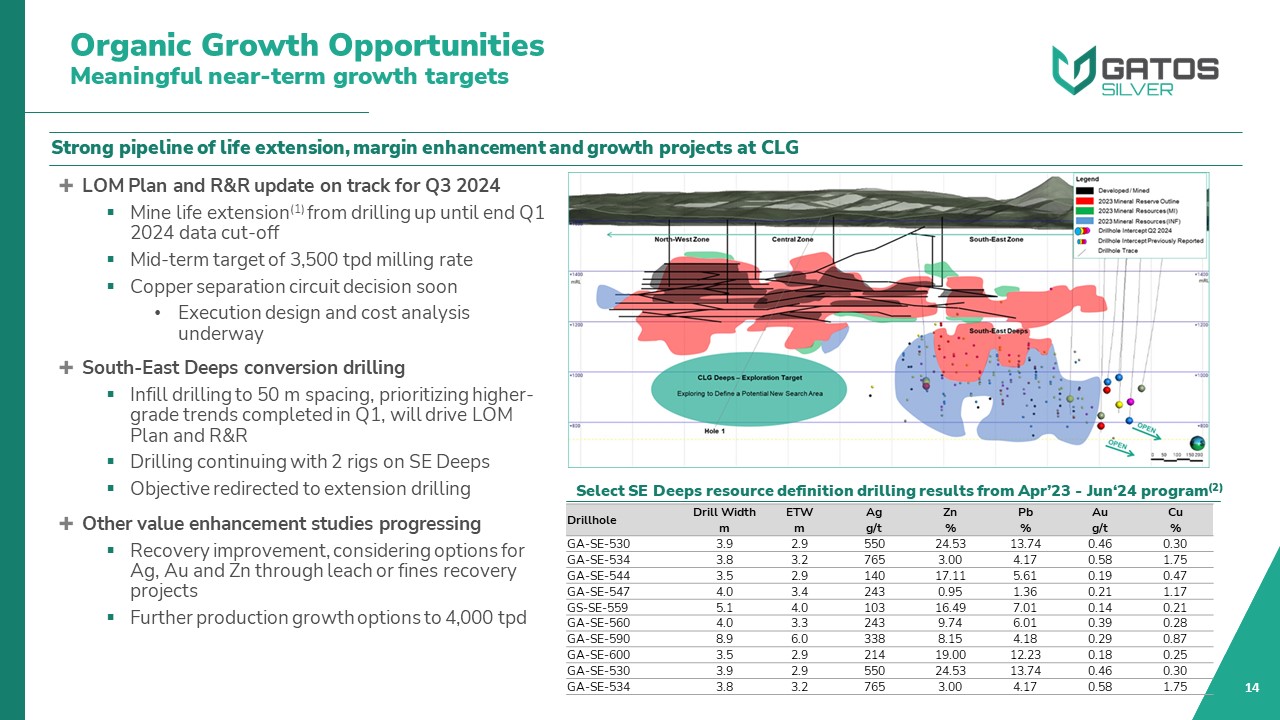

Organic Growth OpportunitiesMeaningful near-term growth targets 14 LOM Plan

and R&R update on track for Q3 2024 Mine life extension(1) from drilling up until end Q1 2024 data cut-off Mid-term target of 3,500 tpd milling rate Copper separation circuit decision soon Execution design and cost analysis

underway South-East Deeps conversion drilling Infill drilling to 50 m spacing, prioritizing higher-grade trends completed in Q1, will drive LOM Plan and R&R Drilling continuing with 2 rigs on SE Deeps Objective redirected to extension

drilling Other value enhancement studies progressing Recovery improvement, considering options for Ag, Au and Zn through leach or fines recovery projects Further production growth options to 4,000 tpd Strong pipeline of life extension,

margin enhancement and growth projects at CLG Select SE Deeps resource definition drilling results from Apr’23 - Jun‘24 program(2) Drillhole Drill

Width ETW Ag Zn Pb Au Cu m m g/t % % g/t % GA-SE-530 3.9 2.9 550 24.53 13.74 0.46 0.30 GA-SE-534 3.8 3.2 765 3.00 4.17 0.58 1.75 GA-SE-544 3.5 2.9 140 17.11 5.61 0.19 0.47 GA-SE-547 4.0 3.4 243 0.95 1.36 0.21 1.17 GS-SE-559 5.1 4.0 103 16.49 7.01 0.14 0.21 GA-SE-560 4.0 3.3 243 9.74 6.01 0.39 0.28 GA-SE-590 8.9 6.0 338 8.15 4.18 0.29 0.87 GA-SE-600 3.5 2.9 214 19.00 12.23 0.18 0.25 GA-SE-530 3.9 2.9 550 24.53 13.74 0.46 0.30 GA-SE-534 3.8 3.2 765 3.00 4.17 0.58 1.75

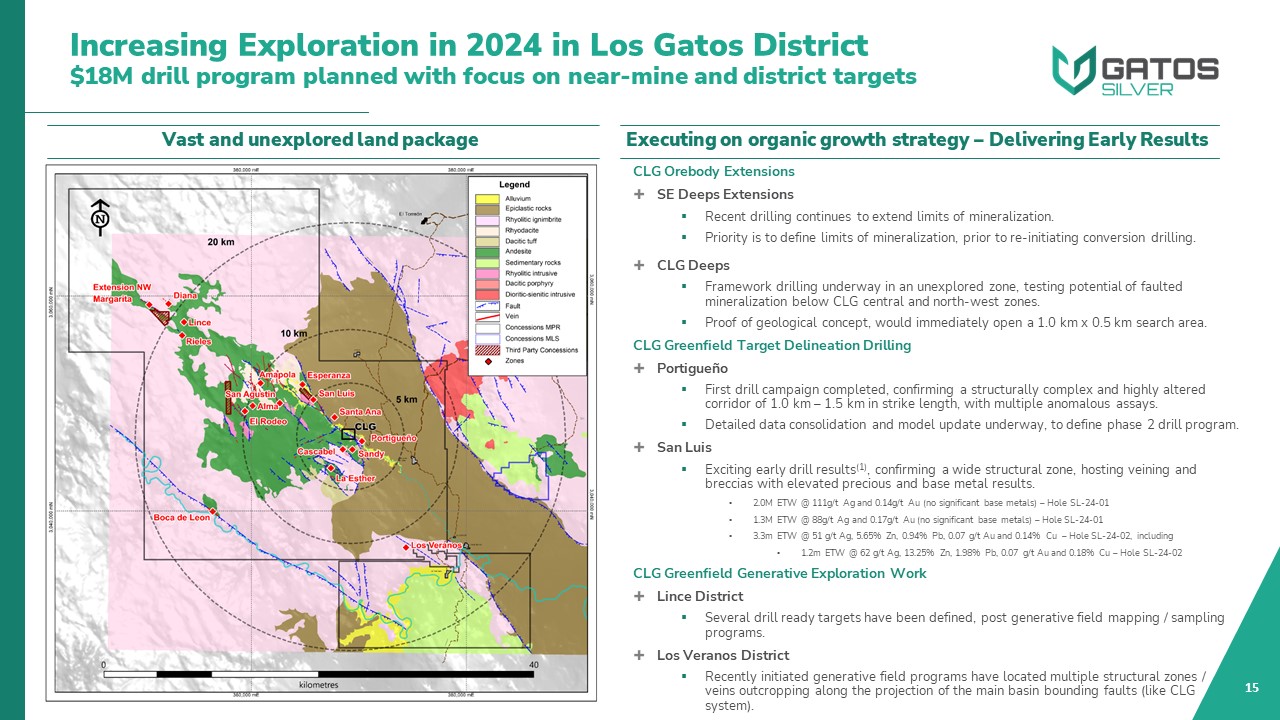

Increasing Exploration in 2024 in Los Gatos District$18M drill program planned

with focus on near-mine and district targets 15 Vast and unexplored land package Executing on organic growth strategy – Delivering Early Results CLG Orebody Extensions SE Deeps Extensions Recent drilling continues to extend limits of

mineralization. Priority is to define limits of mineralization, prior to re-initiating conversion drilling. CLG Deeps Framework drilling underway in an unexplored zone, testing potential of faulted mineralization below CLG central and

north-west zones. Proof of geological concept, would immediately open a 1.0 km x 0.5 km search area. CLG Greenfield Target Delineation Drilling Portigueño First drill campaign completed, confirming a structurally complex and highly

altered corridor of 1.0 km – 1.5 km in strike length, with multiple anomalous assays. Detailed data consolidation and model update underway, to define phase 2 drill program. San Luis Exciting early drill results(1), confirming a wide

structural zone, hosting veining and breccias with elevated precious and base metal results. 2.0M ETW @ 111g/t Ag and 0.14g/t Au (no significant base metals) – Hole SL-24-01 1.3M ETW @ 88g/t Ag and 0.17g/t Au (no significant base metals) –

Hole SL-24-01 3.3m ETW @ 51 g/t Ag, 5.65% Zn, 0.94% Pb, 0.07 g/t Au and 0.14% Cu – Hole SL-24-02, including 1.2m ETW @ 62 g/t Ag, 13.25% Zn, 1.98% Pb, 0.07 g/t Au and 0.18% Cu – Hole SL-24-02 CLG Greenfield Generative Exploration

Work Lince District Several drill ready targets have been defined, post generative field mapping / sampling programs. Los Veranos District Recently initiated generative field programs have located multiple structural zones / veins

outcropping along the projection of the main basin bounding faults (like CLG system).

Creating the Leading Intermediate Primary Silver Producer Consolidates three

world-class, producing silver mining districts in Mexico under one banner Enhances production profile with strong margins Bolsters free cash flow generation Leverages a highly experienced combined team with a strong track record of value

creation in Mexico Maintains peer-leading exposure to silver Creates a 350,000 ha highly prospective land package which has yielded a history of exploration success Results in a larger company with a strengthened balance sheet, leading

trading liquidity and improved capital markets profile Realizes meaningful synergies 2024 Outlook at CLG Continue delivering strong operating performance and margins Progress towards target milling rate of 3,500 tpd with focus on managing

site unit costs Quarterly cash distributions from the LGJV expected to continue Near-term mine life extension and margin enhancement Targeting mine life extension from conversion of SE Deeps in Q3 2024(1) Advancing copper separation

circuit and mill recovery optimization projects Near-mine and district exploration drilling 9 drill rigs focused on San Luis and Central Deeps targets, and continuing resource definition and expansion at CLG Transformative Combination with

First Majestic SilverOutlook and Future Catalysts 16

17 NYSE / TSX: GATO www.gatossilver.com

18 Appendix

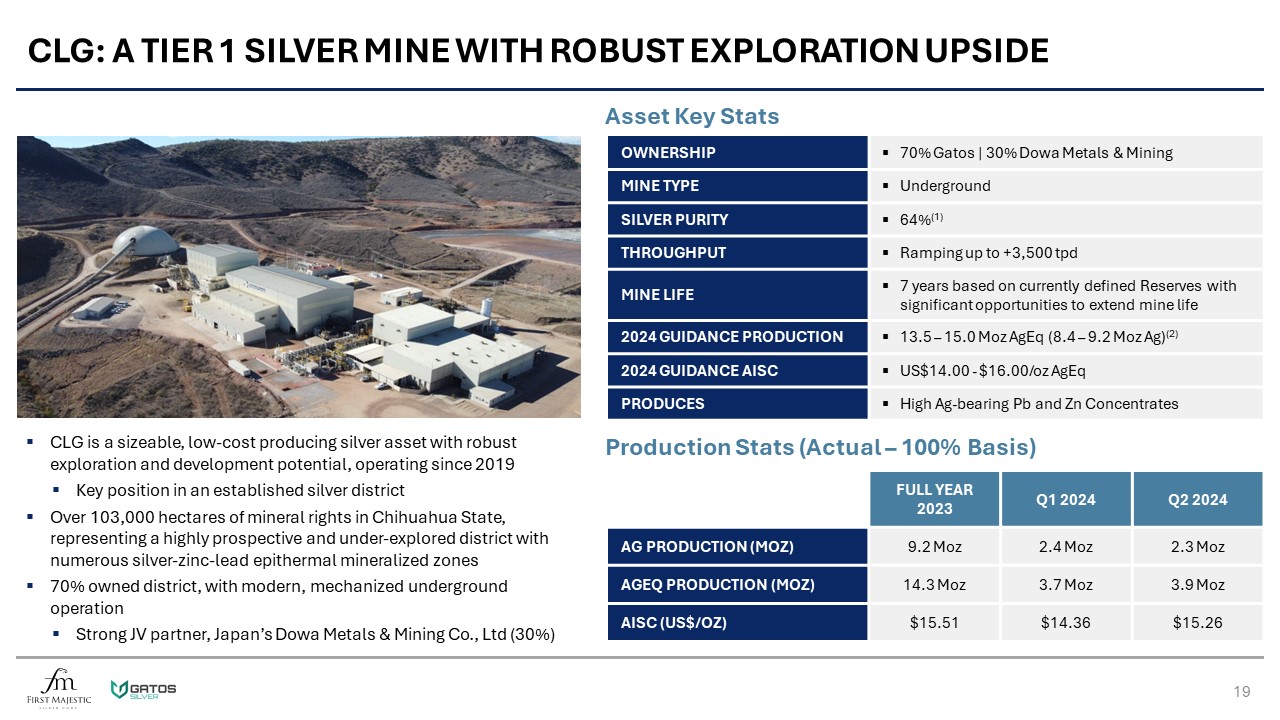

19 CLG: a Tier 1 Silver Mine with Robust Exploration Upside CLG is a sizeable,

low-cost producing silver asset with robust exploration and development potential, operating since 2019 Key position in an established silver district Over 103,000 hectares of mineral rights in Chihuahua State, representing a highly

prospective and under-explored district with numerous silver-zinc-lead epithermal mineralized zones 70% owned district, with modern, mechanized underground operation Strong JV partner, Japan’s Dowa Metals & Mining Co., Ltd

(30%) Ownership 70% Gatos | 30% Dowa Metals & Mining Mine type Underground Silver purity 64%(1) Throughput Ramping up to +3,500 tpd Mine life 7 years based on currently defined Reserves with significant opportunities to extend

mine life 2024 Guidance Production 13.5 – 15.0 Moz AgEq (8.4 – 9.2 Moz Ag)(2) 2024 Guidance AISC US$14.00 - $16.00/oz AgEq Produces High Ag-bearing Pb and Zn Concentrates FULL YEAR 2023 Q1 2024 Q2 2024 ag production (Moz) 9.2

Moz 2.4 Moz 2.3 Moz AgEq production (Moz) 14.3 Moz 3.7 Moz 3.9 Moz AISC (us$/oz) $15.51 $14.36 $15.26 Asset Key Stats Production Stats (Actual – 100% Basis)

Santa Elena Silver-Gold Mine 20 Ownership 100% First Majestic Mine

type Underground Throughput 2,650 tpd 2024 Guidance Production 9.2 – 9.6 Moz AgEq (1.3M – 1.4 Moz Ag + 94 – 99 koz Au) 2024 Guidance AISC US$15.25 - $15.64/oz AgEq Produces 100% Doré Ownership FULL YEAR 2023 Q1 2024 Q2 2024 ag

production (Moz) 1.2 Moz 0.4 Moz 0.4 Moz AgEq production (Moz) 9.6 Moz 2.3 Moz 2.6 Moz AISC (us$/oz) $14.83 $14.70 $15.07 Continued strong metallurgical recoveries due to the operational optimization of the new dual circuit

plant Exploration drilling focused in the search of a new mineralized vein Upgraded the LNG facility to 24MW (from 12MW) to power the Ermitaño mine and dual-circuit processing plant Certified ISO 9001 Assay Lab on site, increasing

reliability as well as reducing costs and allowing for faster assay turnaround times Asset Key Stats Production Stats (Actual)

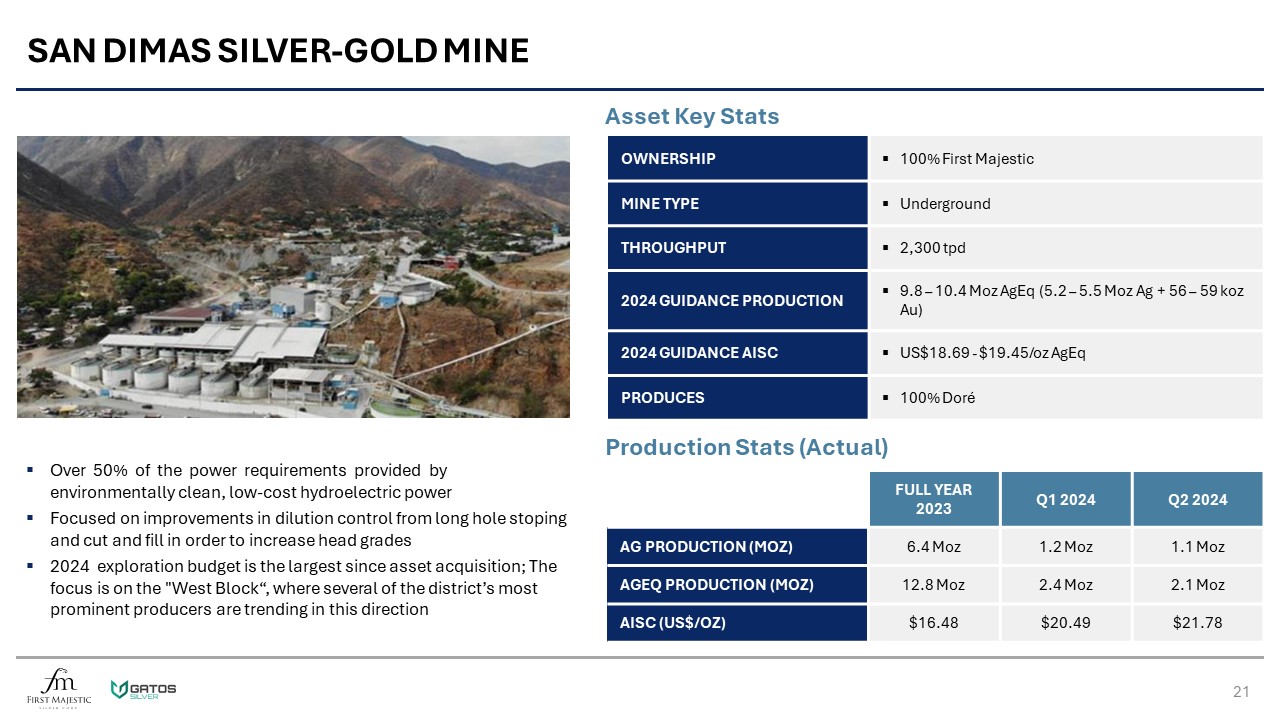

San Dimas Silver-Gold Mine 21 Ownership 100% First Majestic Mine

type Underground Throughput 2,300 tpd 2024 Guidance Production 9.8 – 10.4 Moz AgEq (5.2 – 5.5 Moz Ag + 56 – 59 koz Au) 2024 Guidance AISC US$18.69 - $19.45/oz AgEq Produces 100% Doré Ownership FULL YEAR 2023 Q1 2024 Q2 2024 ag

production (Moz) 6.4 Moz 1.2 Moz 1.1 Moz AgEq production (Moz) 12.8 Moz 2.4 Moz 2.1 Moz AISC (us$/oz) $16.48 $20.49 $21.78 Over 50% of the power requirements provided by environmentally clean, low-cost hydroelectric power Focused

on improvements in dilution control from long hole stoping and cut and fill in order to increase head grades 2024 exploration budget is the largest since asset acquisition; The focus is on the "West Block“, where several of the district’s

most prominent producers are trending in this direction Asset Key Stats Production Stats (Actual)

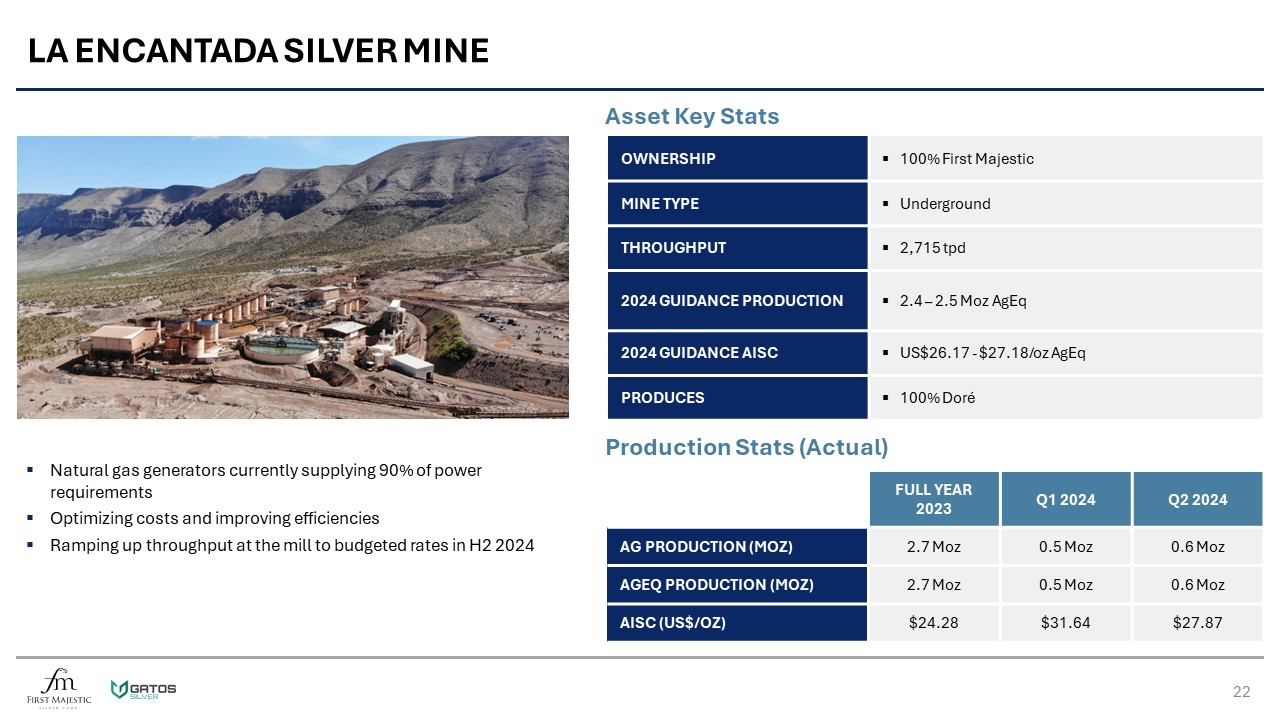

La Encantada Silver Mine 22 Ownership 100% First Majestic Mine

type Underground Throughput 2,715 tpd 2024 Guidance Production 2.4 – 2.5 Moz AgEq 2024 Guidance AISC US$26.17 - $27.18/oz AgEq Produces 100% Doré Ownership FULL YEAR 2023 Q1 2024 Q2 2024 ag production (Moz) 2.7 Moz 0.5

Moz 0.6 Moz AgEq production (Moz) 2.7 Moz 0.5 Moz 0.6 Moz AISC (us$/oz) $24.28 $31.64 $27.87 Natural gas generators currently supplying 90% of power requirements Optimizing costs and improving efficiencies Ramping up throughput at

the mill to budgeted rates in H2 2024 Asset Key Stats Production Stats (Actual)

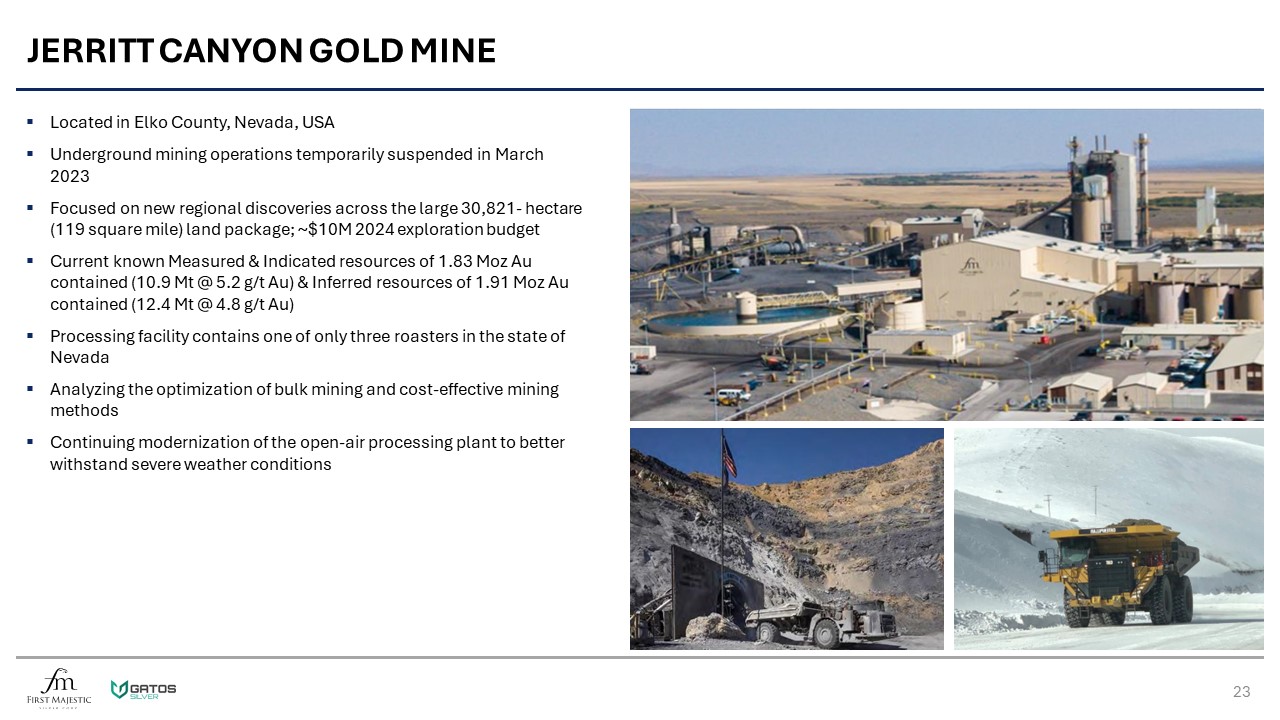

Jerritt Canyon Gold Mine 23 Located in Elko County, Nevada, USA Underground

mining operations temporarily suspended in March 2023 Focused on new regional discoveries across the large 30,821- hectare (119 square mile) land package; ~$10M 2024 exploration budget Current known Measured & Indicated resources of

1.83 Moz Au contained (10.9 Mt @ 5.2 g/t Au) & Inferred resources of 1.91 Moz Au contained (12.4 Mt @ 4.8 g/t Au) Processing facility contains one of only three roasters in the state of Nevada Analyzing the optimization of bulk mining

and cost-effective mining methods Continuing modernization of the open-air processing plant to better withstand severe weather conditions

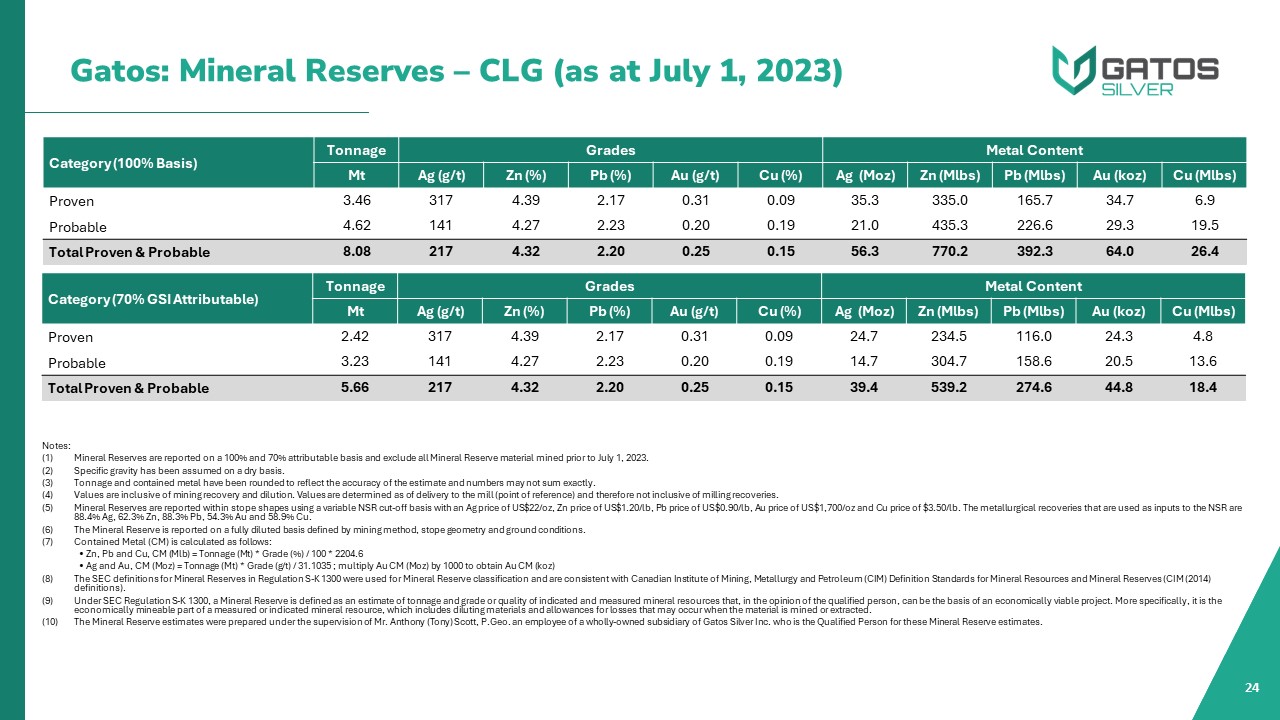

Category (100% Basis) Tonnage Grades Metal Content Mt Ag (g/t) Zn (%) Pb

(%) Au (g/t) Cu (%) Ag (Moz) Zn (Mlbs) Pb (Mlbs) Au (koz) Cu (Mlbs) Proven 3.46 317 4.39 2.17 0.31 0.09 35.3 335.0 165.7 34.7 6.9 Probable 4.62 141 4.27 2.23 0.20 0.19 21.0 435.3 226.6 29.3 19.5 Total Proven

& Probable 8.08 217 4.32 2.20 0.25 0.15 56.3 770.2 392.3 64.0 26.4 Notes: Mineral Reserves are reported on a 100% and 70% attributable basis and exclude all Mineral Reserve material mined prior to July 1, 2023. Specific

gravity has been assumed on a dry basis. Tonnage and contained metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. Values are inclusive of mining recovery and dilution. Values are determined as

of delivery to the mill (point of reference) and therefore not inclusive of milling recoveries. Mineral Reserves are reported within stope shapes using a variable NSR cut-off basis with an Ag price of US$22/oz, Zn price of US$1.20/lb, Pb

price of US$0.90/lb, Au price of US$1,700/oz and Cu price of $3.50/lb. The metallurgical recoveries that are used as inputs to the NSR are 88.4% Ag, 62.3% Zn, 88.3% Pb, 54.3% Au and 58.9% Cu. The Mineral Reserve is reported on a fully

diluted basis defined by mining method, stope geometry and ground conditions. Contained Metal (CM) is calculated as follows: • Zn, Pb and Cu, CM (Mlb) = Tonnage (Mt) * Grade (%) / 100 * 2204.6 • Ag and Au, CM (Moz) = Tonnage (Mt) * Grade

(g/t) / 31.1035 ; multiply Au CM (Moz) by 1000 to obtain Au CM (koz) The SEC definitions for Mineral Reserves in Regulation S-K 1300 were used for Mineral Reserve classification and are consistent with Canadian Institute of Mining,

Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions). Under SEC Regulation S-K 1300, a Mineral Reserve is defined as an estimate of tonnage and grade or quality of indicated

and measured mineral resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a measured or indicated mineral resource, which

includes diluting materials and allowances for losses that may occur when the material is mined or extracted. The Mineral Reserve estimates were prepared under the supervision of Mr. Anthony (Tony) Scott, P.Geo. an employee of a

wholly-owned subsidiary of Gatos Silver Inc. who is the Qualified Person for these Mineral Reserve estimates. Category (70% GSI Attributable) Tonnage Grades Metal Content Mt Ag (g/t) Zn (%) Pb (%) Au (g/t) Cu (%) Ag (Moz) Zn

(Mlbs) Pb (Mlbs) Au (koz) Cu (Mlbs) Proven 2.42 317 4.39 2.17 0.31 0.09 24.7 234.5 116.0 24.3 4.8 Probable 3.23 141 4.27 2.23 0.20 0.19 14.7 304.7 158.6 20.5 13.6 Total Proven &

Probable 5.66 217 4.32 2.20 0.25 0.15 39.4 539.2 274.6 44.8 18.4 Gatos: Mineral Reserves – CLG (as at July 1, 2023) 24

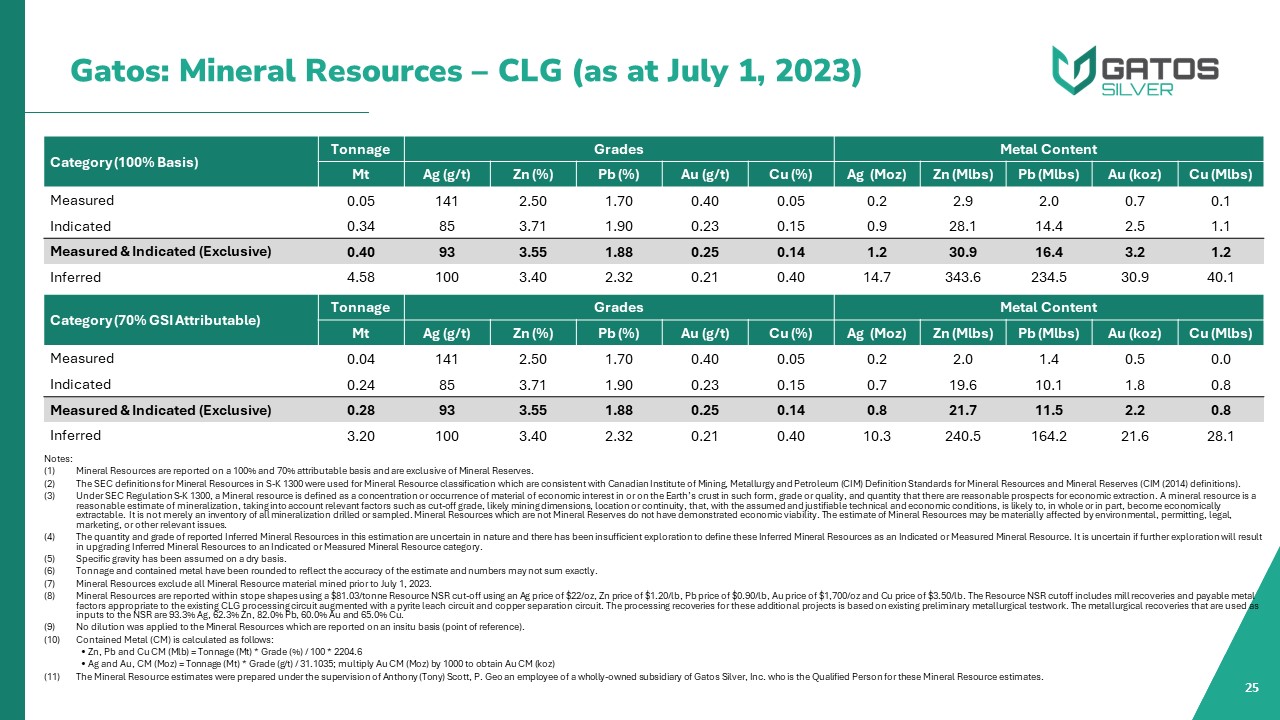

Notes: Mineral Resources are reported on a 100% and 70% attributable basis and

are exclusive of Mineral Reserves. The SEC definitions for Mineral Resources in S-K 1300 were used for Mineral Resource classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition

Standards for Mineral Resources and Mineral Reserves (CIM (2014) definitions). Under SEC Regulation S-K 1300, a Mineral resource is defined as a concentration or occurrence of material of economic interest in or on the Earth’s crust in such

form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining

dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or

sampled. Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral Resource. It

is uncertain if further exploration will result in upgrading Inferred Mineral Resources to an Indicated or Measured Mineral Resource category. Specific gravity has been assumed on a dry basis. Tonnage and contained metal have been rounded

to reflect the accuracy of the estimate and numbers may not sum exactly. Mineral Resources exclude all Mineral Resource material mined prior to July 1, 2023. Mineral Resources are reported within stope shapes using a $81.03/tonne Resource

NSR cut-off using an Ag price of $22/oz, Zn price of $1.20/lb, Pb price of $0.90/lb, Au price of $1,700/oz and Cu price of $3.50/lb. The Resource NSR cutoff includes mill recoveries and payable metal factors appropriate to the existing CLG

processing circuit augmented with a pyrite leach circuit and copper separation circuit. The processing recoveries for these additional projects is based on existing preliminary metallurgical testwork. The metallurgical recoveries that are

used as inputs to the NSR are 93.3% Ag, 62.3% Zn, 82.0% Pb, 60.0% Au and 65.0% Cu. No dilution was applied to the Mineral Resources which are reported on an insitu basis (point of reference). Contained Metal (CM) is calculated as follows:

• Zn, Pb and Cu CM (Mlb) = Tonnage (Mt) * Grade (%) / 100 * 2204.6 • Ag and Au, CM (Moz) = Tonnage (Mt) * Grade (g/t) / 31.1035; multiply Au CM (Moz) by 1000 to obtain Au CM (koz) The Mineral Resource estimates were prepared under the

supervision of Anthony (Tony) Scott, P. Geo an employee of a wholly-owned subsidiary of Gatos Silver, Inc. who is the Qualified Person for these Mineral Resource estimates. Category (100% Basis) Tonnage Grades Metal Content Mt Ag

(g/t) Zn (%) Pb (%) Au (g/t) Cu (%) Ag (Moz) Zn (Mlbs) Pb (Mlbs) Au (koz) Cu

(Mlbs) Measured 0.05 141 2.50 1.70 0.40 0.05 0.2 2.9 2.0 0.7 0.1 Indicated 0.34 85 3.71 1.90 0.23 0.15 0.9 28.1 14.4 2.5 1.1 Measured & Indicated

(Exclusive) 0.40 93 3.55 1.88 0.25 0.14 1.2 30.9 16.4 3.2 1.2 Inferred 4.58 100 3.40 2.32 0.21 0.40 14.7 343.6 234.5 30.9 40.1 Category (70% GSI Attributable) Tonnage Grades Metal Content Mt Ag (g/t) Zn (%) Pb

(%) Au (g/t) Cu (%) Ag (Moz) Zn (Mlbs) Pb (Mlbs) Au (koz) Cu (Mlbs) Measured 0.04 141 2.50 1.70 0.40 0.05 0.2 2.0 1.4 0.5 0.0 Indicated 0.24 85 3.71 1.90 0.23 0.15 0.7 19.6 10.1 1.8 0.8 Measured & Indicated

(Exclusive) 0.28 93 3.55 1.88 0.25 0.14 0.8 21.7 11.5 2.2 0.8 Inferred 3.20 100 3.40 2.32 0.21 0.40 10.3 240.5 164.2 21.6 28.1 Gatos: Mineral Resources – CLG (as at July 1, 2023) 25

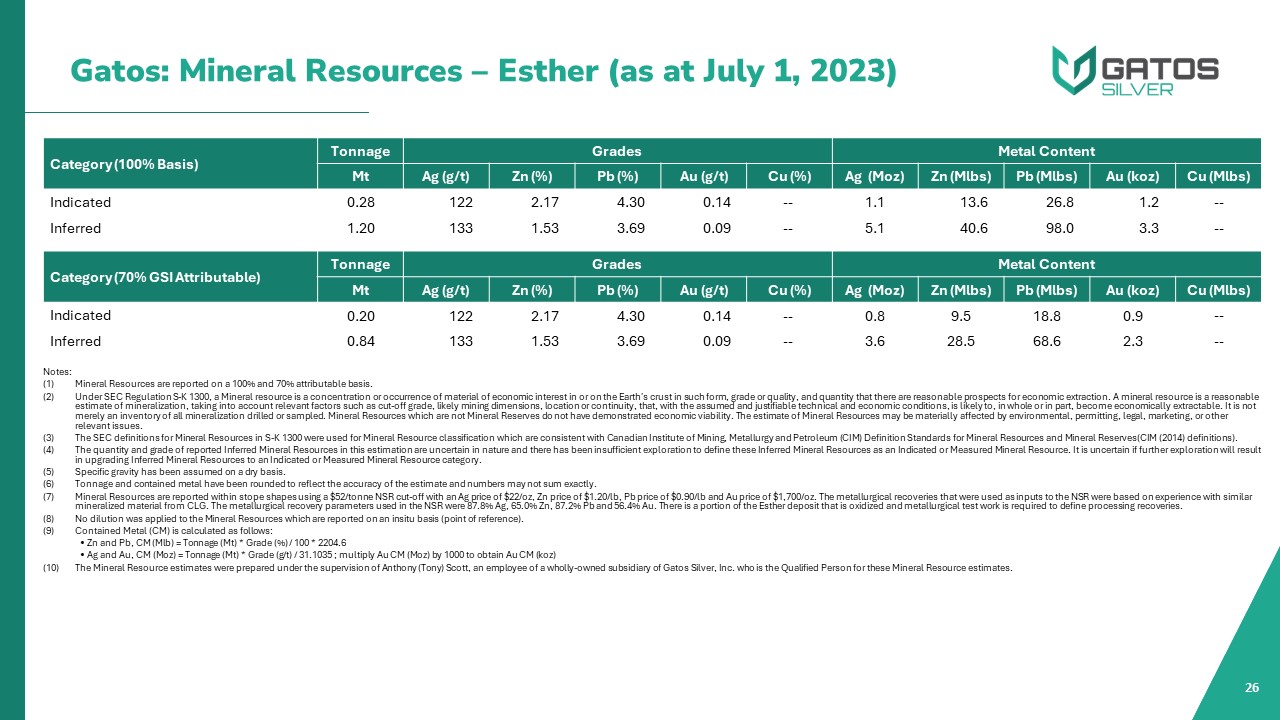

Notes: Mineral Resources are reported on a 100% and 70% attributable

basis. Under SEC Regulation S-K 1300, a Mineral resource is a concentration or occurrence of material of economic interest in or on the Earth's crust in such form, grade or quality, and quantity that there are reasonable prospects

for economic extraction. A mineral resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and

justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. Mineral Resources which are not Mineral

Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The SEC definitions for Mineral Resources

in S-K 1300 were used for Mineral Resource classification which are consistent with Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves(CIM (2014) definitions).

The quantity and grade of reported Inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these Inferred Mineral Resources as an Indicated or Measured Mineral

Resource. It is uncertain if further exploration will result in upgrading Inferred Mineral Resources to an Indicated or Measured Mineral Resource category. Specific gravity has been assumed on a dry basis. Tonnage and contained

metal have been rounded to reflect the accuracy of the estimate and numbers may not sum exactly. Mineral Resources are reported within stope shapes using a $52/tonne NSR cut-off with an Ag price of $22/oz, Zn price of $1.20/lb, Pb

price of $0.90/lb and Au price of $1,700/oz. The metallurgical recoveries that were used as inputs to the NSR were based on experience with similar mineralized material from CLG. The metallurgical recovery parameters used in the NSR

were 87.8% Ag, 65.0% Zn, 87.2% Pb and 56.4% Au. There is a portion of the Esther deposit that is oxidized and metallurgical test work is required to define processing recoveries. No dilution was applied to the Mineral Resources

which are reported on an insitu basis (point of reference). Contained Metal (CM) is calculated as follows: • Zn and Pb, CM (Mlb) = Tonnage (Mt) * Grade (%) / 100 * 2204.6 • Ag and Au, CM (Moz) = Tonnage (Mt) * Grade (g/t) /

31.1035 ; multiply Au CM (Moz) by 1000 to obtain Au CM (koz) The Mineral Resource estimates were prepared under the supervision of Anthony (Tony) Scott, an employee of a wholly-owned subsidiary of Gatos Silver, Inc. who is the

Qualified Person for these Mineral Resource estimates. Category (100% Basis) Tonnage Grades Metal Content Mt Ag (g/t) Zn (%) Pb (%) Au (g/t) Cu (%) Ag (Moz) Zn (Mlbs) Pb (Mlbs) Au (koz) Cu (Mlbs) Indicated 0.28 122

2.17 4.30 0.14 -- 1.1 13.6 26.8 1.2 -- Inferred 1.20 133 1.53 3.69 0.09 -- 5.1 40.6 98.0 3.3 -- Category (70% GSI Attributable) Tonnage Grades Metal Content Mt Ag (g/t) Zn

(%) Pb (%) Au (g/t) Cu (%) Ag (Moz) Zn (Mlbs) Pb (Mlbs) Au (koz) Cu (Mlbs) Indicated 0.20 122 2.17 4.30 0.14 -- 0.8 9.5 18.8 0.9 -- Inferred 0.84 133 1.53 3.69 0.09

-- 3.6 28.5 68.6 2.3 -- Gatos: Mineral Resources – Esther (as at July 1, 2023) 26

People, Community and Environment StewardshipResolute focus on safety,

communities and the environment 27 CLG is a leader in mine safety performance in Mexico Lost-time injury frequency rate of 0.44, 52% lower than the country average of 0.92(1) 50 different community development projects

implemented Invested in a childcare centre in San Jose del Sitio, together with the local municipality, to support local families and encourage female employment Constructed a landfill facility in conjunction with local municipalities to

dispose of community waste from the surrounding communities Implemented 10 local health programs benefitting ~1,200 people Offered educational programs with ~200 participants Zero reportable environmental incidents Recipient of the “ESR

Award” for the 6th consecutive year, recognizing socially responsible companies in Mexico(2) 2023 CLG Highlights

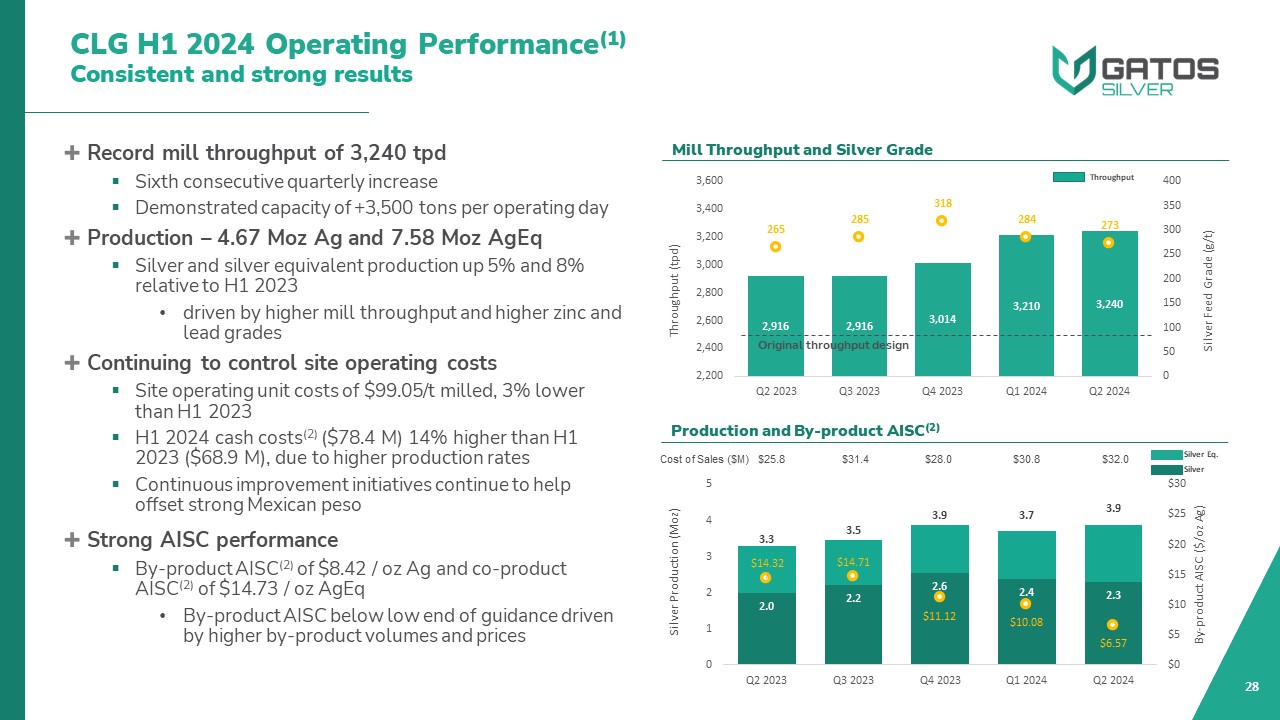

28 Mill Throughput and Silver Grade Silver Silver Eq. Production and

By-product AISC(2) Cost of Sales ($M) $25.8 $31.4 $28.0 $30.8 $32.0 Throughput CLG H1 2024 Operating Performance(1)Consistent and strong results Original throughput design Record mill throughput of 3,240 tpd Sixth consecutive

quarterly increase Demonstrated capacity of +3,500 tons per operating day Production – 4.67 Moz Ag and 7.58 Moz AgEq Silver and silver equivalent production up 5% and 8% relative to H1 2023 driven by higher mill throughput and higher zinc

and lead grades Continuing to control site operating costs Site operating unit costs of $99.05/t milled, 3% lower than H1 2023 H1 2024 cash costs(2) ($78.4 M) 14% higher than H1 2023 ($68.9 M), due to higher production rates Continuous

improvement initiatives continue to help offset strong Mexican peso Strong AISC performance By-product AISC(2) of $8.42 / oz Ag and co-product AISC(2) of $14.73 / oz AgEq By-product AISC below low end of guidance driven by higher

by-product volumes and prices

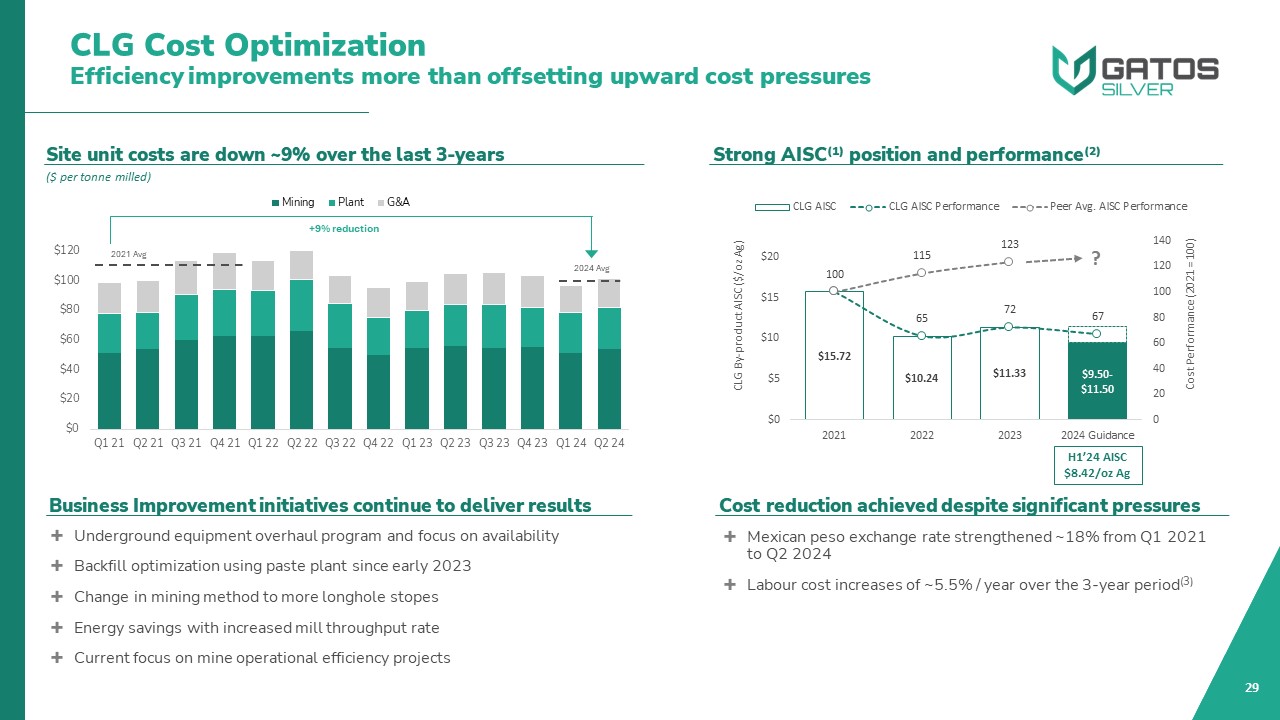

CLG Cost OptimizationEfficiency improvements more than offsetting upward cost

pressures 29 Site unit costs are down ~9% over the last 3-years Underground equipment overhaul program and focus on availability Backfill optimization using paste plant since early 2023 Change in mining method to more longhole

stopes Energy savings with increased mill throughput rate Current focus on mine operational efficiency projects Strong AISC(1) position and performance(2) Business Improvement initiatives continue to deliver results ? Mexican peso

exchange rate strengthened ~18% from Q1 2021 to Q2 2024 Labour cost increases of ~5.5% / year over the 3-year period(3) Cost reduction achieved despite significant pressures ($ per tonne milled) +9% reduction H1’24 AISC $8.42/oz Ag

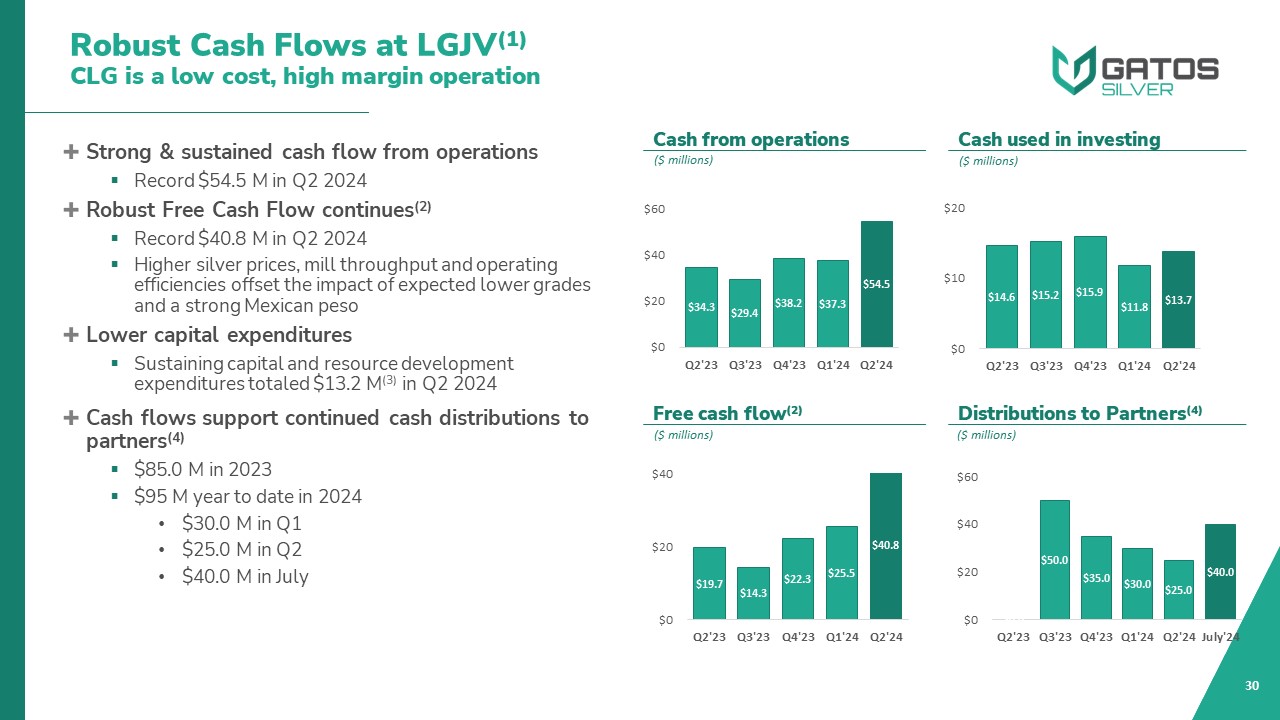

Robust Cash Flows at LGJV(1)CLG is a low cost, high margin operation 30 Cash

from operations Cash used in investing Free cash flow(2) Distributions to Partners(4) ($ millions) ($ millions) ($ millions) ($ millions) Strong & sustained cash flow from operations Record $54.5 M in Q2 2024 Robust Free Cash

Flow continues(2) Record $40.8 M in Q2 2024 Higher silver prices, mill throughput and operating efficiencies offset the impact of expected lower grades and a strong Mexican peso Lower capital expenditures Sustaining capital and resource

development expenditures totaled $13.2 M(3) in Q2 2024 Cash flows support continued cash distributions to partners(4) $85.0 M in 2023 $95 M year to date in 2024 $30.0 M in Q1 $25.0 M in Q2 $40.0 M in July

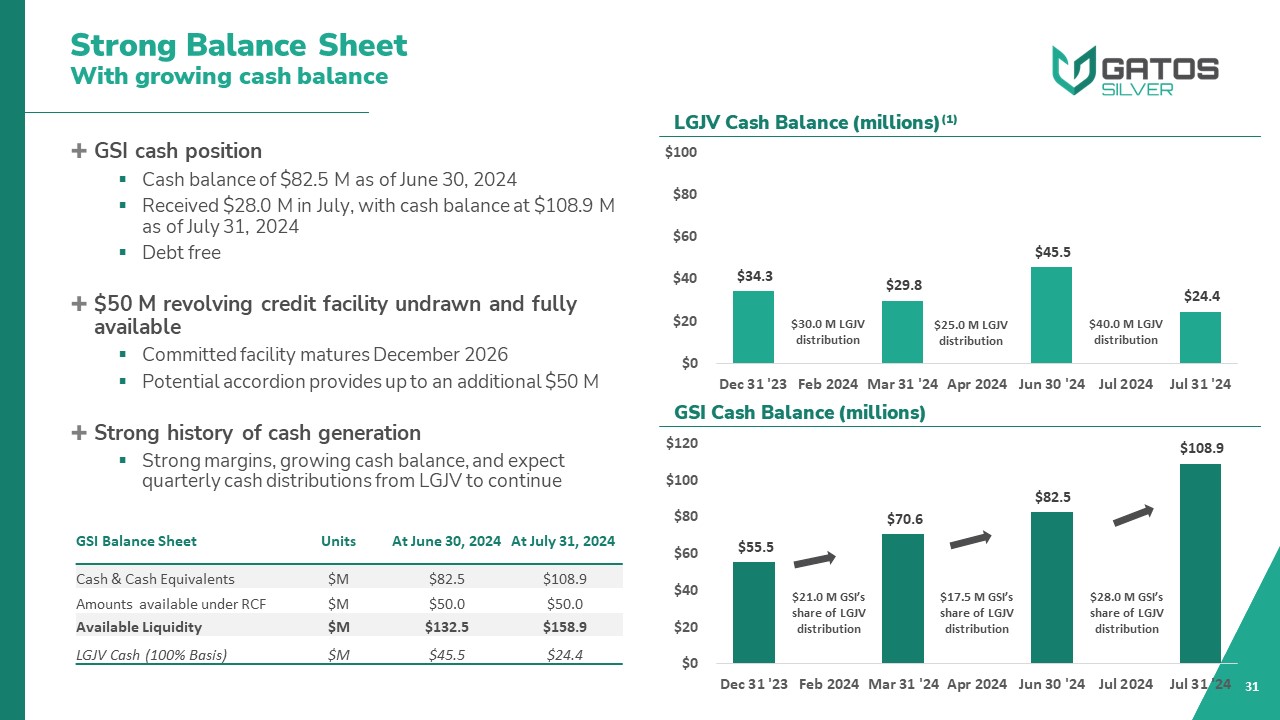

Strong Balance SheetWith growing cash balance 31 LGJV Cash Balance

(millions)(1) $30.0 M LGJV distribution GSI Cash Balance (millions) $21.0 M GSI’s share of LGJV distribution $17.5 M GSI’s share of LGJV distribution $28.0 M GSI’s share of LGJV distribution GSI cash position Cash balance of $82.5 M

as of June 30, 2024 Received $28.0 M in July, with cash balance at $108.9 M as of July 31, 2024 Debt free $50 M revolving credit facility undrawn and fully available Committed facility matures December 2026 Potential accordion provides

up to an additional $50 M Strong history of cash generation Strong margins, growing cash balance, and expect quarterly cash distributions from LGJV to continue GSI Balance Sheet Units At June 30, 2024 At July 31, 2024 Cash & Cash

Equivalents $M $82.5 $108.9 Amounts available under RCF $M $50.0 $50.0 Available Liquidity $M $132.5 $158.9 LGJV Cash (100% Basis) $M $45.5 $24.4 $25.0 M LGJV distribution $40.0 M LGJV distribution

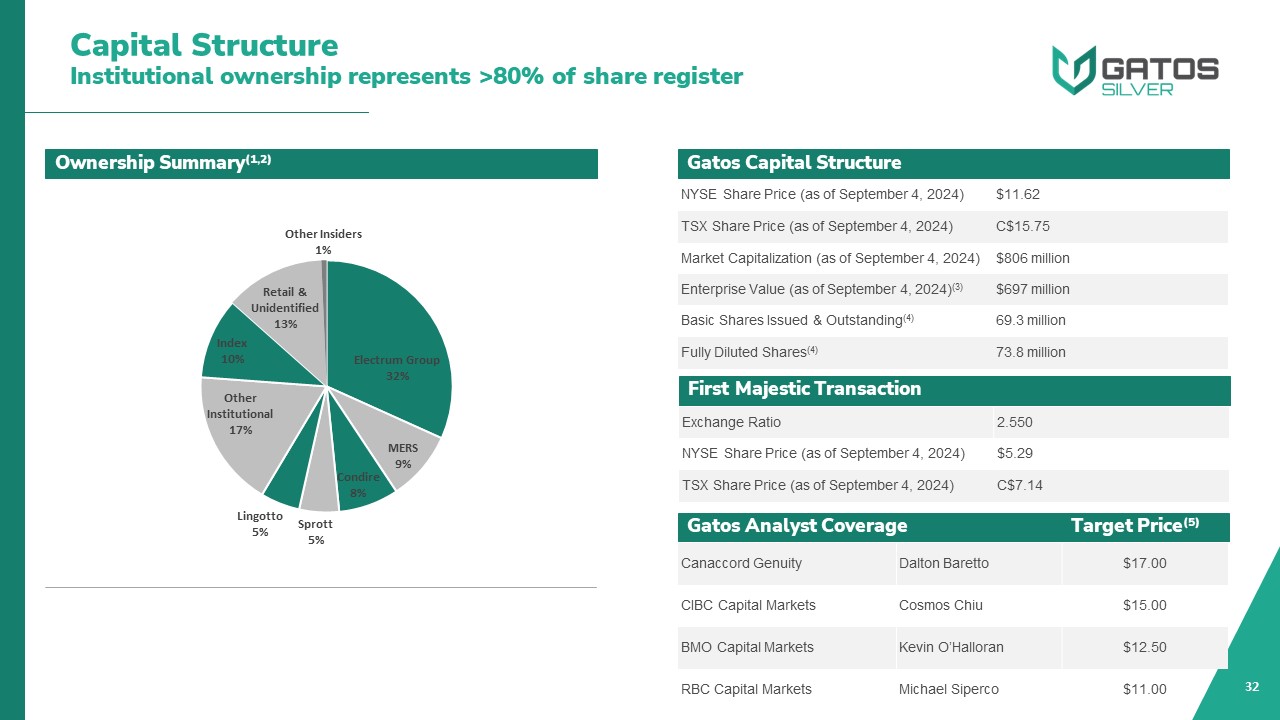

Capital Structure Institutional ownership represents >80% of share

register 32 Ownership Summary(1,2) Gatos Capital Structure NYSE Share Price (as of September 4, 2024) $11.62 TSX Share Price (as of September 4, 2024) C$15.75 Market Capitalization (as of September 4, 2024) $806 million Enterprise

Value (as of September 4, 2024)(3) $697 million Basic Shares Issued & Outstanding(4) 69.3 million Fully Diluted Shares(4) 73.8 million Gatos Analyst Coverage Target Price(5) Canaccord Genuity Dalton Baretto $17.00 CIBC Capital

Markets Cosmos Chiu $15.00 BMO Capital Markets Kevin O’Halloran $12.50 RBC Capital Markets Michael Siperco $11.00 First Majestic Transaction Exchange Ratio 2.550 NYSE Share Price (as of September 4, 2024) $5.29 TSX Share Price

(as of September 4, 2024) C$7.14

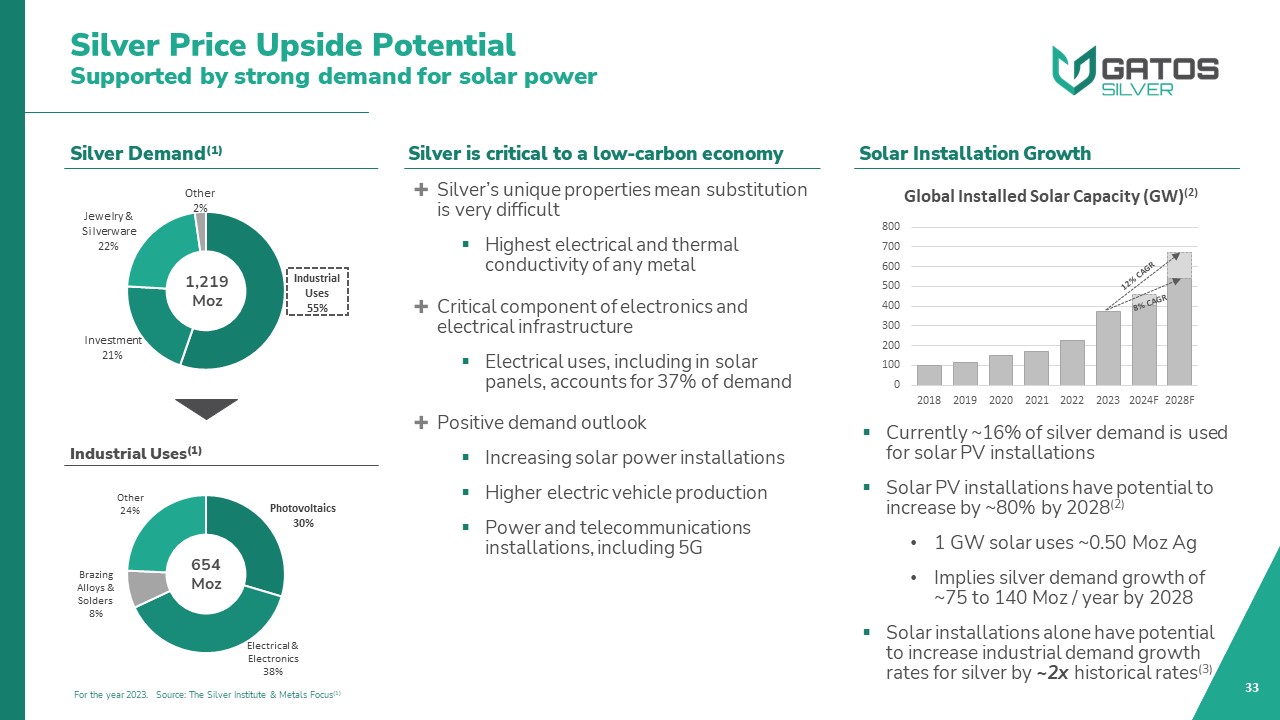

Silver Price Upside PotentialSupported by strong demand for solar

power 33 Silver Demand(1) For the year 2023. Source: The Silver Institute & Metals Focus(1) 1,219 Moz Industrial Uses(1) 654 Moz Silver is critical to a low-carbon economy Silver’s unique properties mean substitution is very

difficult Highest electrical and thermal conductivity of any metal Critical component of electronics and electrical infrastructure Electrical uses, including in solar panels, accounts for 37% of demand Positive demand outlook Increasing

solar power installations Higher electric vehicle production Power and telecommunications installations, including 5G Currently ~16% of silver demand is used for solar PV installations Solar PV installations have potential to increase by

~80% by 2028(2) 1 GW solar uses ~0.50 Moz Ag Implies silver demand growth of ~75 to 140 Moz / year by 2028 Solar installations alone have potential to increase industrial demand growth rates for silver by ~2x historical rates(3) Global

Installed Solar Capacity (GW)(2) 8% CAGR 12% CAGR Solar Installation Growth

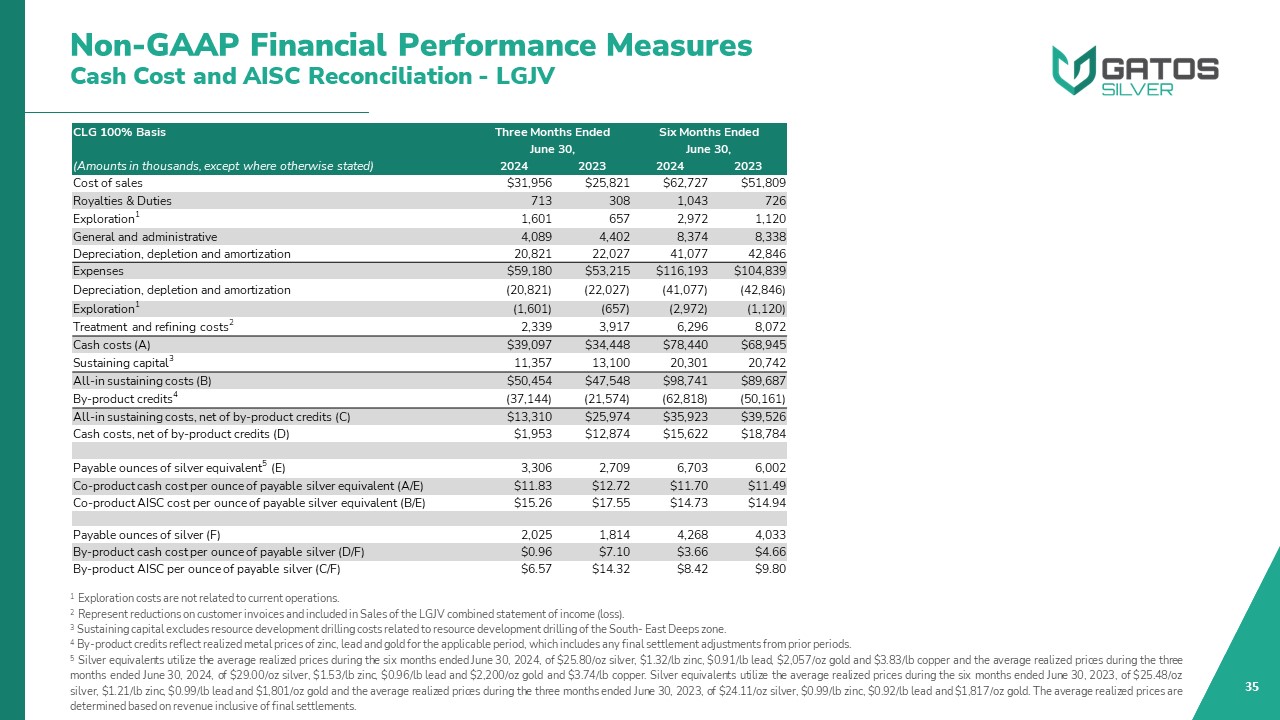

Non-GAAP Financial Performance Measures 34 We use certain measures that are

not defined by GAAP to evaluate various aspects of our business. These non-GAAP financial measures are intended to provide additional information only and do not have any standardized meaning prescribed by GAAP and should not be considered in

isolation or as a substitute for measures of performance prepared in accordance with GAAP. The measures are not necessarily indicative of operating profit or cash flow from operations as determined under GAAP. Cash Costs and All-In

Sustaining Costs Cash costs and all-in sustaining costs (“AISC”) are non-GAAP measures. AISC was calculated based on guidance provided by the World Gold Council (“WGC”). WGC is not a regulatory industry organization and does not have the

authority to develop accounting standards for disclosure requirements. Other mining companies may calculate AISC differently as a result of differences in underlying accounting principles and policies applied, as well as definitional

differences of sustaining versus expansionary (i.e. non-sustaining) capital expenditures based upon each company’s internal policies. Current GAAP measures used in the mining industry, such as cost of sales, do not capture all of the

expenditures incurred to discover, develop and sustain production. Therefore, we believe that cash costs and AISC are non-GAAP measures that provide additional information to management, investors and analysts that aid in the understanding of

the economics of the Company’s operations and performance and provides investors visibility by better defining the total costs associated with production. Cash costs include all direct and indirect operating cash costs related directly to

the physical activities of producing metals, including mining, processing and other plant costs, treatment and refining costs, general and administrative costs, royalties and mining production taxes. AISC includes total production cash costs

incurred at the LGJV’s mining operations plus sustaining capital expenditures. The Company believes this measure represents the total sustainable costs of producing silver from current operations and provides additional information of the

LGJV’s operational performance and ability to generate cash flows. As the measure seeks to reflect the full cost of silver production from current operations, new project and expansionary capital at current operations are not included.

Certain cash expenditures such as new project spending, tax payments, dividends, and financing costs are not included. The Company does not provide a reconciliation of forward-looking co-product and by-product AISCs guidance, due to the

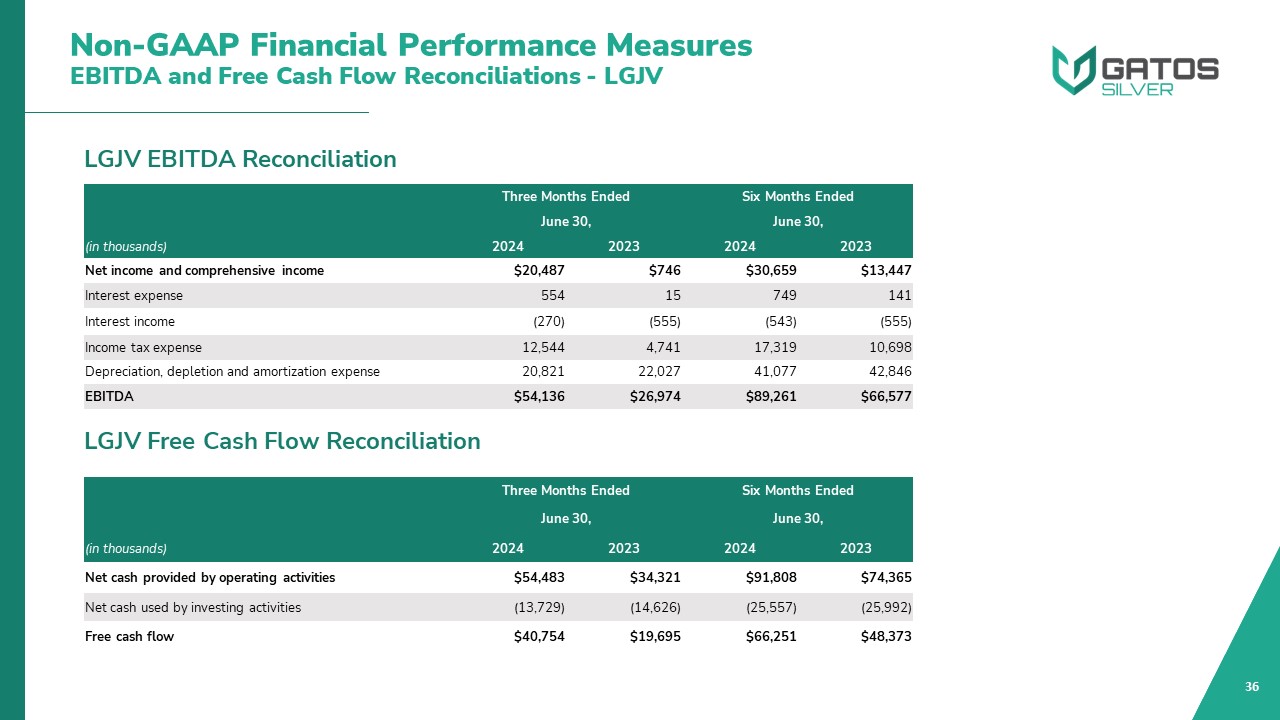

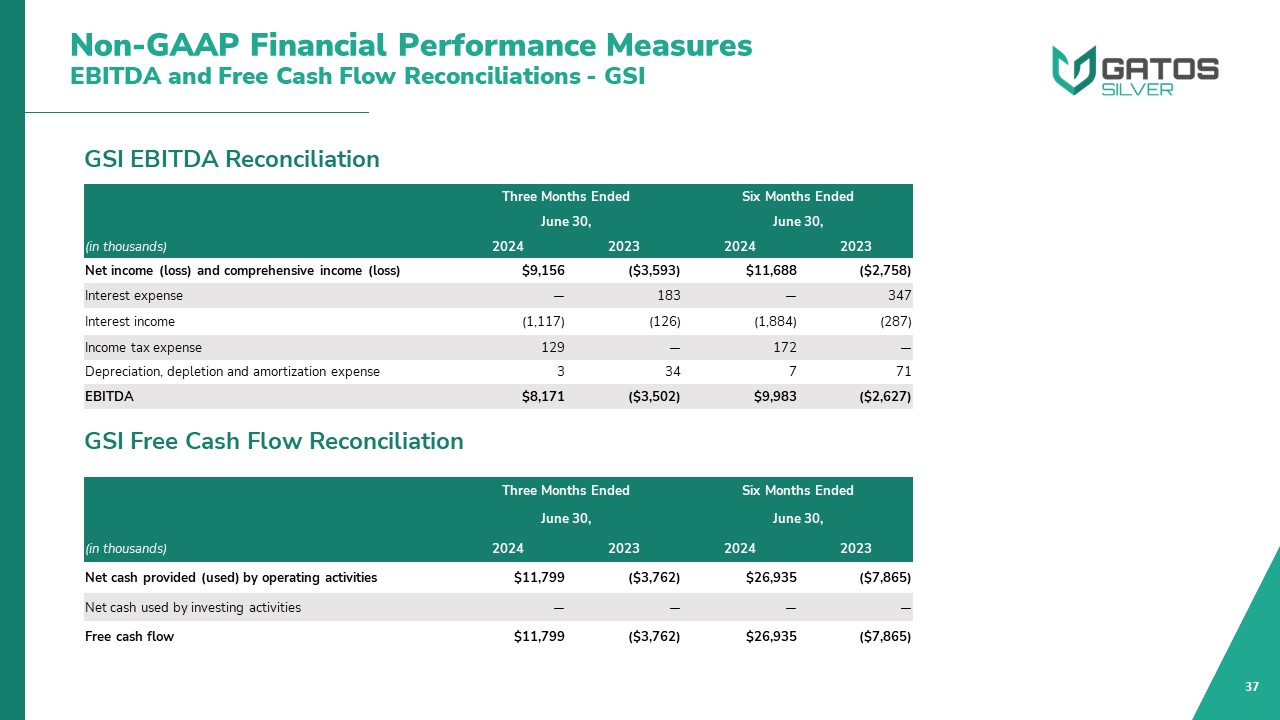

inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. EBITDA Management uses EBITDA to evaluate the Company’s operating performance, to plan and forecast its operations, and assess

leverage levels and liquidity measures. The Company believes the use of EBITDA reflects the underlying operating performance of our core mining business and allows investors and analysts to compare results of the Company to similar results of

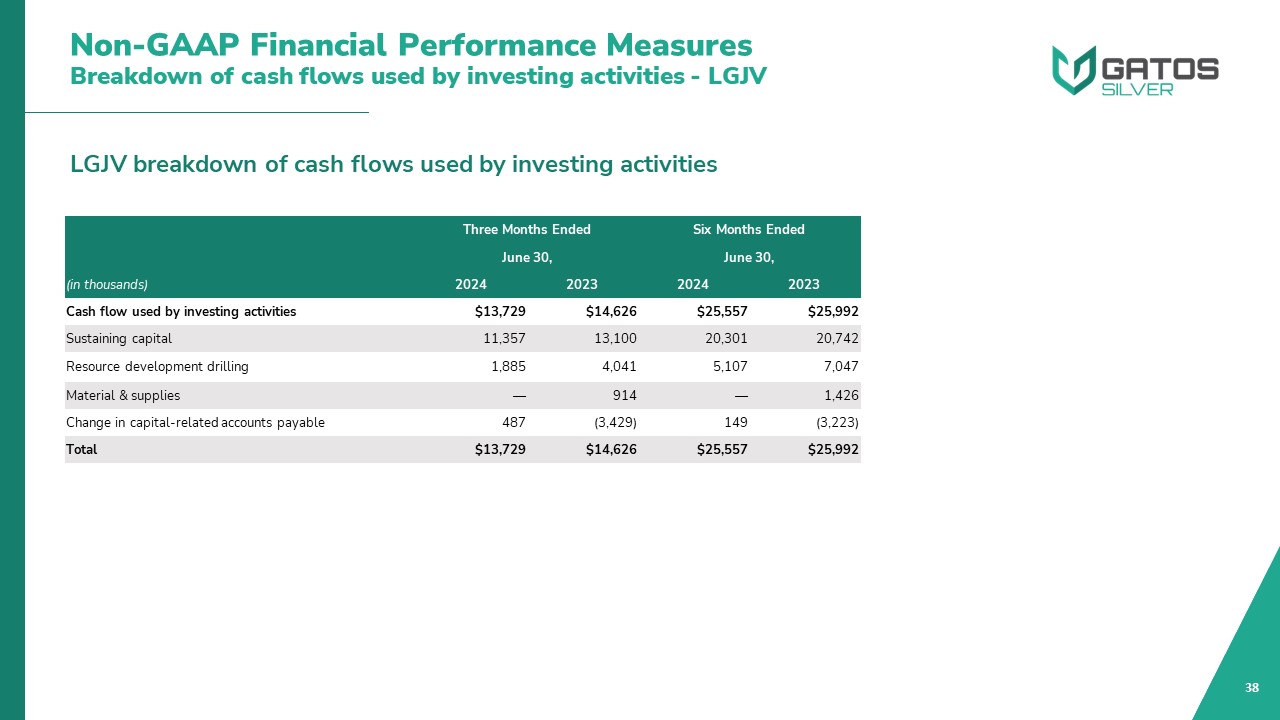

other mining companies. EBITDA does not represent, and should not be considered an alternative to, net income or cash flow from operations as determined under GAAP. Free Cash Flow Management uses Free Cash Flow as a non-GAAP measure to

analyze cash flows generated from operations. Free Cash Flow is Cash provided by (used in) operating activities less Cash Flow (used in) from investing Activities as presented on the Condensed Consolidated Statements of Cash Flows. The

Company believes Free Cash Flow is also useful for investors as one of the bases for comparing the Company’s performance with its competitors. Although Free Cash Flow and similar measures are frequently used as measures of cash flows

generated from operations by other companies, the Company’s calculation of Free Cash Flow is not necessarily comparable to such other similarly titled captions of other companies.

Non-GAAP Financial Performance MeasuresCash Cost and AISC Reconciliation

- LGJV 35 1 Exploration costs are not related to current operations. 2 Represent reductions on customer invoices and included in Sales of the LGJV combined statement of income (loss). 3 Sustaining capital excludes resource

development drilling costs related to resource development drilling of the South- East Deeps zone. 4 By-product credits reflect realized metal prices of zinc, lead and gold for the applicable period, which includes any final

settlement adjustments from prior periods. 5 Silver equivalents utilize the average realized prices during the six months ended June 30, 2024, of $25.80/oz silver, $1.32/lb zinc, $0.91/lb lead, $2,057/oz gold and $3.83/lb copper and

the average realized prices during the three months ended June 30, 2024, of $29.00/oz silver, $1.53/lb zinc, $0.96/lb lead and $2,200/oz gold and $3.74/lb copper. Silver equivalents utilize the average realized prices during the six

months ended June 30, 2023, of $25.48/oz silver, $1.21/lb zinc, $0.99/lb lead and $1,801/oz gold and the average realized prices during the three months ended June 30, 2023, of $24.11/oz silver, $0.99/lb zinc, $0.92/lb lead and

$1,817/oz gold. The average realized prices are determined based on revenue inclusive of final settlements. CLG 100% Basis Three Months Ended Six Months Ended June 30, June 30, (Amounts in thousands, except where otherwise

stated) 2024 2023 2024 2023 Cost of sales $31,956 $25,821 $62,727 $51,809 Royalties & Duties 713 308 1,043 726 Exploration1 1,601 657 2,972 1,120 General and administrative 4,089 4,402 8,374

8,338 Depreciation, depletion and amortization 20,821 22,027 41,077 42,846 Expenses $59,180 $53,215 $116,193 $104,839 Depreciation, depletion and

amortization (20,821) (22,027) (41,077) (42,846) Exploration1 (1,601) (657) (2,972) (1,120) Treatment and refining costs2 2,339 3,917 6,296 8,072 Cash costs (A) $39,097 $34,448 $78,440 $68,945 Sustaining

capital3 11,357 13,100 20,301 20,742 All-in sustaining costs (B) $50,454 $47,548 $98,741 $89,687 By-product credits4 (37,144) (21,574) (62,818) (50,161) All-in sustaining costs, net of by-product credits

(C) $13,310 $25,974 $35,923 $39,526 Cash costs, net of by-product credits (D) $1,953 $12,874 $15,622 $18,784 Payable ounces of silver equivalent5 (E) 3,306 2,709 6,703 6,002 Co-product cash cost per ounce of

payable silver equivalent (A/E) $11.83 $12.72 $11.70 $11.49 Co-product AISC cost per ounce of payable silver equivalent (B/E) $15.26 $17.55 $14.73 $14.94 Payable ounces of silver (F) 2,025 1,814 4,268 4,033

By-product cash cost per ounce of payable silver (D/F) $0.96 $7.10 $3.66 $4.66 By-product AISC per ounce of payable silver (C/F) $6.57 $14.32 $8.42 $9.80

Non-GAAP Financial Performance MeasuresEBITDA and Free Cash Flow Reconciliations

- LGJV 36 LGJV EBITDA Reconciliation LGJV Free Cash Flow Reconciliation Three Months Ended Six Months Ended June 30, June 30, (in thousands) 2024 2023 2024 2023 Net income and comprehensive income $20,487 $746 $30,659

$13,447 Interest expense 554 15 749 141 Interest income (270) (555) (543) (555) Income tax expense 12,544 4,741 17,319 10,698 Depreciation, depletion and amortization expense 20,821 22,027 41,077 42,846

EBITDA $54,136 $26,974 $89,261 $66,577 Three Months Ended Six Months Ended June 30, June 30, (in thousands) 2024 2023 2024 2023 Net cash provided by operating activities $54,483 $34,321 $91,808 $74,365 Net cash

used by investing activities (13,729) (14,626) (25,557) (25,992) Free cash flow $40,754 $19,695 $66,251 $48,373

Non-GAAP Financial Performance MeasuresEBITDA and Free Cash Flow Reconciliations

- GSI 37 GSI EBITDA Reconciliation GSI Free Cash Flow Reconciliation Three Months Ended Six Months Ended June 30, June 30, (in thousands) 2024 2023 2024 2023 Net income (loss) and comprehensive income (loss) $9,156

($3,593) $11,688 ($2,758) Interest expense — 183 — 347 Interest income (1,117) (126) (1,884) (287) Income tax expense 129 — 172 — Depreciation, depletion and amortization expense 3 34 7 71 EBITDA $8,171

($3,502) $9,983 ($2,627) Three Months Ended Six Months Ended June 30, June 30, (in thousands) 2024 2023 2024 2023 Net cash provided (used) by operating activities $11,799 ($3,762) $26,935 ($7,865) Net cash used by

investing activities — — — — Free cash flow $11,799 ($3,762) $26,935 ($7,865)

38 Non-GAAP Financial Performance MeasuresBreakdown of cash flows used by

investing activities - LGJV LGJV breakdown of cash flows used by investing activities Three Months Ended Six Months Ended June 30, June 30, (in thousands) 2024 2023 2024 2023 Cash flow used by investing activities $13,729

$14,626 $25,557 $25,992 Sustaining capital 11,357 13,100 20,301 20,742 Resource development drilling 1,885 4,041 5,107 7,047 Material & supplies — 914 — 1,426 Change in capital-related accounts

payable 487 (3,429) 149 (3,223) Total $13,729 $14,626 $25,557 $25,992

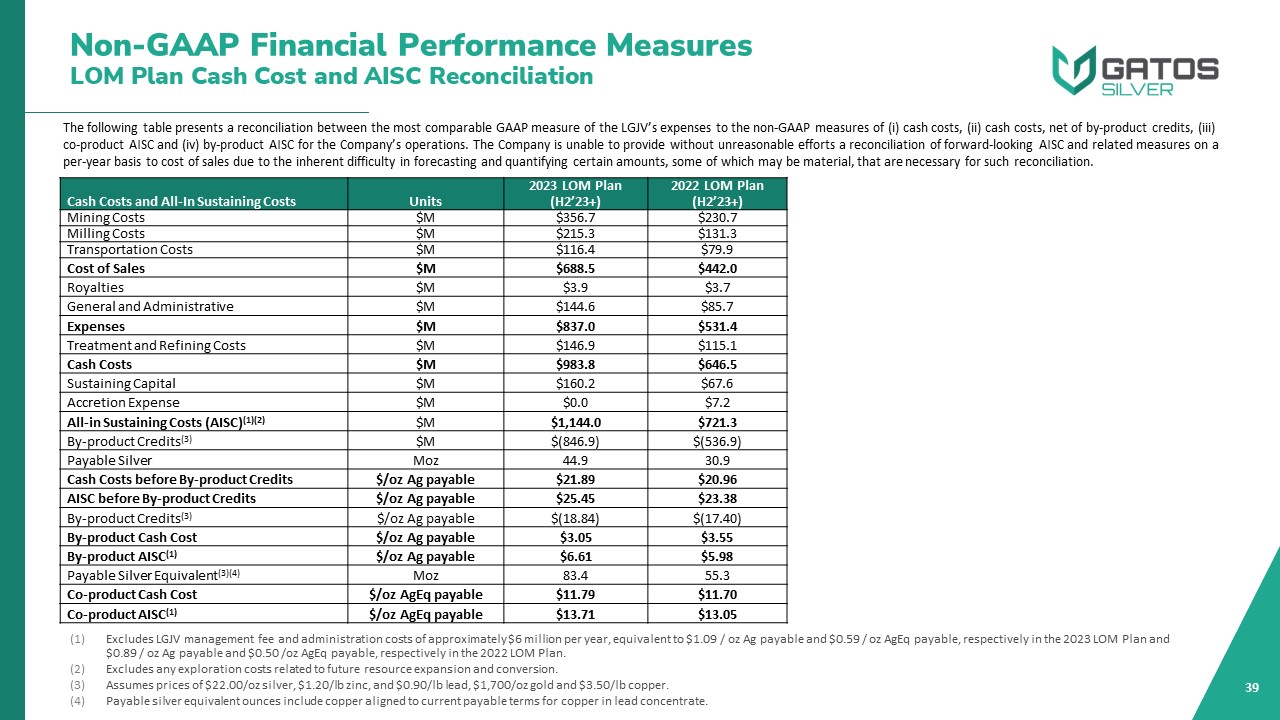

Non-GAAP Financial Performance MeasuresLOM Plan Cash Cost and AISC

Reconciliation 39 Excludes LGJV management fee and administration costs of approximately $6 million per year, equivalent to $1.09 / oz Ag payable and $0.59 / oz AgEq payable, respectively in the 2023 LOM Plan and $0.89 / oz Ag payable and

$0.50 /oz AgEq payable, respectively in the 2022 LOM Plan. Excludes any exploration costs related to future resource expansion and conversion. Assumes prices of $22.00/oz silver, $1.20/lb zinc, and $0.90/lb lead, $1,700/oz gold and $3.50/lb

copper. Payable silver equivalent ounces include copper aligned to current payable terms for copper in lead concentrate. Cash Costs and All-In Sustaining Costs Units 2023 LOM Plan (H2’23+) 2022 LOM Plan (H2’23+) Mining

Costs $M $356.7 $230.7 Milling Costs $M $215.3 $131.3 Transportation Costs $M $116.4 $79.9 Cost of Sales $M $688.5 $442.0 Royalties $M $3.9 $3.7 General and

Administrative $M $144.6 $85.7 Expenses $M $837.0 $531.4 Treatment and Refining Costs $M $146.9 $115.1 Cash Costs $M $983.8 $646.5 Sustaining Capital $M $160.2 $67.6 Accretion Expense $M $0.0 $7.2 All-in Sustaining

Costs (AISC)(1)(2) $M $1,144.0 $721.3 By-product Credits(3) $M $(846.9) $(536.9) Payable Silver Moz 44.9 30.9 Cash Costs before By-product Credits $/oz Ag payable $21.89 $20.96 AISC before By-product Credits $/oz Ag

payable $25.45 $23.38 By-product Credits(3) $/oz Ag payable $(18.84) $(17.40) By-product Cash Cost $/oz Ag payable $3.05 $3.55 By-product AISC(1) $/oz Ag payable $6.61 $5.98 Payable Silver

Equivalent(3)(4) Moz 83.4 55.3 Co-product Cash Cost $/oz AgEq payable $11.79 $11.70 Co-product AISC(1) $/oz AgEq payable $13.71 $13.05 The following table presents a reconciliation between the most comparable GAAP measure of the

LGJV’s expenses to the non-GAAP measures of (i) cash costs, (ii) cash costs, net of by-product credits, (iii) co-product AISC and (iv) by-product AISC for the Company’s operations. The Company is unable to provide without unreasonable efforts

a reconciliation of forward-looking AISC and related measures on a per-year basis to cost of sales due to the inherent difficulty in forecasting and quantifying certain amounts, some of which may be material, that are necessary for such

reconciliation.

Endnotes 40 Slide 4: Creating the Leading Intermediate Primary Silver

Producer Source: Capital IQ, Corporate disclosure Based on First Majestic and Gatos 2024 production guidance, adjusted for First Majestic metal price assumptions and shown on an attributable basis. All-in-sustaining costs or “AISC” are

non-GAAP measures. For further information regarding such measures please refer to each companies’ respective separate public disclosure. Based on analyst consensus estimates for 2024. Free cash flow is a non-GAAP measure. For further

information regarding such measure please refer to each companies’ respective separate public disclosure. Based on mid-point of silver production guidance divided by silver equivalent production guidance. Slide 5: Creating the Leading

Intermediate Primary Silver Producer Source: Bloomberg, Capital IQ, Corporate disclosure Slide 6: Pro Forma Capitalization Source: Capital IQ, Corporate disclosure As at June 30, 2024; First Majestic cash balance of US$152.2M and

marketable securities of US$58.4M As at June 30, 2024; First Majestic cash balance of US$152.2M, marketable securities of US$58.4M and debt of US$250.0M As at June 30, 2024; Gatos Silver cash balance of US$82.5M and 70% of the Los Gatos

Joint Venture’s cash balance of US$45.5M and US$nil debt As at June 30, 2024; First Majestic working cap of US$171.5M, marketable securities of US$58.4M, and US$124.6 of undrawn credit; Gatos consolidated cash balance of US$114.3M and

US$50.0M of undrawn credit Slide 7: Transaction Benefits to Shareholders Source: Corporate disclosure As of close on September 4, 2024, the last trading day before transaction announcement Slide 8: High-Quality Assets in the Word’s

Premier Silver Jurisdiction Source: Corporate disclosure Cerro Los Gatos production shown on a 100% basis; Gatos Silver has a 70% interest in CLG Cerro Los Gatos production and AISC estimates based on 2024 guidance Slide 9: Strong Position

Amongst Peers and a Leader in Silver Purity Source: Capital IQ, Corporate disclosure Mid-point of silver production guidance divided by silver equivalent production guidance Based on latest management guidance Calculated as Cost of Sales

as a % of Revenue from respective peer income statements, before depreciation Based on analyst consensus estimates Slide 10: Significantly Increased Scale and Leading Trading Liquidity Source: Capital IQ, Corporate disclosure PF First

Majestic based on PF shares outstanding at share price prior to announcement Calculated based on trading volume on all exchanges Slide 11: Combining Three World-Class Assets Source: Capital IQ, Corporate disclosure Peer AISC figures are

based on full-year 2023 reporting; peer costs include both silver and gold operations to reflect the cost base of the operating portfolios Peers reporting on a by-product AISC basis include Hecla, Coeur, MAG and Endeavour Silver Peers

reporting on a co-product AISC basis include First Majestic (pre-transaction), Fresnillo, and SilverCrest Slide 12: 2024 Guidance at CLG (100% basis) Silver equivalent production is calculated using prices of $23/oz silver, $1.20/lb zinc,

$0.90/lb lead and $1,800/oz gold to “convert” zinc, lead and gold production contained in concentrate to “equivalent” silver ounces (contained metal, multiplied by price, divided by silver price). For 2023, silver equivalent production was

calculated using prices of $22/oz silver, $1.20/lb zinc, $0.90/lb lead and $1,700/oz gold. For comparative purposes, the calculated silver equivalent production for 2024 guidance at 2023 price assumptions would be 13.7 – 15.3 million

ounces. See Non-GAAP Financial Performance Measures and reconciliations on slides 34-39. See Non-GAAP Financial Performance Measures and reconciliations on slides 34-39. In 2023, $13.5 million was capitalized as resource development

drilling and $2.9 million was expensed as exploration expense. In 2024, $9 million is expected to be capitalized as resource development drilling and $9 million is expected to be expensed as exploration expense. Slide 14: Organic Growth

Opportunities Please refer to forward looking statements on slide 2 regarding potential conversion of inferred resources to indicated or measured. This table presents select drill results only received since the 2023 resource database

cutoff date of June 30, 2024.

Endnotes 41 Slide 15: Increasing Exploration in 2024 in Los Gatos

District Refer to Gatos Silver, Inc. press release dated July 23, 2024, for complete drill intercepts Slide 16: Transformative Combination with First Majestic Silver Please refer to forward looking statements on slide 2 regarding potential

conversion of inferred resources to indicated or measured. Slide 19: CLG: A Tier 1 Silver Mine with Robust Exploration Upside Source: Corporate disclosure Calculated as 2023 Ag production as a % of 2023 AgEq production Shown on a 100%

basis Slide 20: Santa Elena Silver-Gold Mine Source: First Majestic corporate disclosure Slide 21: San Dimas Silver-Gold Mine Source: First Majestic corporate disclosure Slide 22: La Encantada Silver Mine Source: First Majestic

corporate disclosure Slide 23: Jerritt Canyon Gold Mine Source: First Majestic corporate disclosure Slide 27: People, Community and Environment Stewardship CLG’s lost time injury frequency is shown as the incident rate per 200,000 hours

worked. Comparable safety metrics for Mexico are sourced from “Camimex”, the Mexican Mining Chamber considering underground operations for the most recent period available, which is 2022. Camimex reports the lost time injury frequency of 4.6

using the incident rate per 1 million hours worked, which has been converted to the incident rate shown of 0.92 per 200,000 hours worked for comparison purposes. The “Distinto ESR” award, or “Empresa Socialemente Responable” is awarded by

Cemafi – Centro Mexicano para la Filantropia (the Mexican Centre of Philonthropy) and recognizes companies that are differentiated for their strong social responsibility practices considering environmental, social and governance. Slide 28:

CLG H1 2024 Operating Performance LGJV figures are shown on a 100% basis. Gatos Silver’s ownership of the LGJV is 70%. See Non-GAAP Financial Performance Measures and reconciliations on slides 34-39. Slide 29: CLG Cost Optimization See

Non-GAAP Financial Performance Measures and reconciliations on slides 34-39. Peers include Hecla, Coeur, First Majestic, Fresnillo, and Endeavour Silver (SilverCrest and MAG are excluded as they were not in operation in 2021). CLG and Peer

AISC is indexed to 100 for the year 2021. Peer AISC figures for 2023 are based on full-year 2023. Peer costs include both silver and gold operations to reflect the cost base of their operating portfolios. Where peers only report cash costs,

sustaining capital has been included to calculate AISC. Source: Bank of Mexico, salary trends survey. Slide 30: Robust Cash Flows at LGJV LGJV figures are shown on a 100% basis. Gatos Silver’s ownership of the LGJV is 70%. See Non-GAAP

Financial Performance Measures and reconciliations on slides 34-39. See breakdown of cash flows used by investing activities on slide 38. Distributions paid by the LGJV are shown on a 100% basis. Slide 31: Strong Balance Sheet LGJV

figures are shown on a 100% basis. Gatos Silver’s ownership of the LGJV is 70%. Slide 32: Capital Structure Source: S&P Capital IQ as of September 6, 2024. Most position dates are as of June 30, 2024 which are the latest 13F filings.

“Other Insiders” include current directors and management. Index holdings are based on “Passive” investment orientation per S&P Capital IQ. Calculated as market capitalization as of September 4, 2024, less GSI cash and equivalents as of

July 31, 2024 of $108.9 million. As of September 4, 2024. Fully diluted shares include all in-the-money and out-of-the-money stock options, deferred stock units and restricted stock units. As of September 5, 2024. Slide 33: Silver Price

Upside Potential Source: The Silver Institute & Metals Focus Ltd, “World Silver Survey 2024”, published in 2024. Source: International Energy Agency, “Renewables 2023 Report”, published in January 2024. Scenarios reflect the “Main Case”

and “Accelerated Case” presented by the EIA for solar generation additions through 2028. Industrial use growth rates have averaged ~2% for the period 2018 – 2022. Considering silver demand growth needed for projected Accelerated Case solar

installation additions, which would require an additional ~145 Moz / year by 2028, assuming 0.50 Moz / GW installed solar capacity, industrial use growth rates would average ~4% from 2023 through 2028. This assumes all other demand drivers

are unchanged.