287866247 v5 1 SPROUT SOCIAL, INC. SEVERANCE PLAN AND SUMMARY PLAN DESCRIPTION (Adopted by the Compensation Committee on November __, 2023) 1. Introduction. The purpose of this Sprout Social, Inc. Severance Plan (the “Plan”) is to provide assurances of specified severance benefits to eligible executives of the Company who experience an Involuntary Termination under the circumstances described in the Plan. The Plan is an “employee welfare benefit plan,” as defined in Section 3(1) of the Employee Retirement Income Security Act of 1974, as amended. This document constitutes both the written instrument under which the Plan is maintained and the required summary plan description for the Plan. 2. Important Terms. To help you understand how the Plan works, it is important to know the following terms: 2.1 “Administrator” means (a) prior to the consummation of a Change in Control, the Committee or another duly constituted committee of members of the Board, or officers of the Company as delegated by the Board, or any person to whom the Administrator has delegated any authority or responsibility pursuant to the terms of the Plan, but only to the extent of such delegation, and (b) from and after the consummation of a Change in Control, one or more members of the Board or Committee (as constituted prior to the Change in Control) or other persons designated by the Board or Committee prior to or in connection with the Change in Control (provided that any such persons acting as Administrator may not be Covered Executives). 2.2 “Affiliate” means, at the time of determination, any “parent” or “subsidiary” of the Company as such terms are defined in Rule 405 promulgated under the Securities Act. 2.3 “Base Salary” means, as applicable, a Covered Executive’s annual base salary in effect as of the date of the Involuntary Termination, including any salary reductions under Sections 132(f), 125, or 401(k) of the Code, and excluding overtime, bonuses, benefits-in-kind, allowances or other incentives, and any other forms of extra compensation (for example, commissions); provided, that in the case of termination by a Covered Executive with Good Reason pursuant to Section 2.18(d), “Base Salary” means the Covered Executive’s Base Salary immediately prior to such reduction. No foreign service or expatriate allowances shall be included in determining Base Salary or the amount of Severance Benefits payable under the Plan. 2.4 “Board” means the Board of Directors of the Company. 2.5 “Cause” means any of the following with respect to a Covered Executive: (a) conviction of, or plea of nolo contendere to, a felony or crime involving moral turpitude; (b) fraud on or misappropriation of any funds or property of the Company or an affiliate, customer or vendor of the Company; (c) intentional dishonesty, intentional misconduct, willful violation of any law, rule or regulation (other than minor traffic violations or similar offenses) or material breach of fiduciary duty while acting within the scope of the Covered Executive’s employment with the Company; (d) failure to perform duties set forth in the Employment Agreement, or repeated refusal to perform the reasonable directives of the Company, in either case, which is not cured within 10 days following written notification of such failure from the Company; or (e) material noncompliance with any Company rule, regulation, procedure or policy, which is not cured, to the extent curable, within 10 days following written notification of such violation from the Company, and which violation causes material harm to the Company.

287866247 v5 2 2.6 “Change in Control” has the meaning set forth in the Equity Plan. 2.7 “Change in Control Period” means the time period beginning three (3) months prior to the consummation of a Change in Control and ending twelve (12) months following the consummation of such Change in Control. 2.8 “CIC Involuntary Termination” means an Involuntary Termination that occurs within the Change in Control Period. 2.9 “Code” means the Internal Revenue Code of 1986, as amended. 2.10 “Committee” means the Compensation Committee of the Board. 2.11 “Company” means Sprout Social, Inc., a Delaware corporation. 2.12 “Covered Executive” means each Tier 1 Covered Executive, Tier 2 Covered Executive, and Tier 3 Covered Executive. The Administrator may, in its discretion and from time to time, designate additional employees of the Company to be Covered Executives under the Plan. 2.13 “Disability” means any circumstances resulting in a Covered Executive being incapable of performing such Covered Executive’s duties and responsibilities on behalf of the Company for (a) a continuous period of ninety (90) consecutive days, or (b) periods amounting in the aggregate to one-hundred twenty (120) days within any one period of three-hundred sixty-five (365) days. A determination of Disability shall be made and confirmed in writing by a physician or physicians satisfactory to the Company, and the Covered Executive shall cooperate with any efforts to make such determination. Any such determination shall be conclusive and binding on the parties. Any determination of Disability is not intended to alter any benefits that any party may be entitled to receive under any long-term disability insurance plan carried by either the Company or the Covered Executive with respect to the Covered Executive, which benefits shall be governed solely by the terms of any such insurance plan. 2.14 “Effective Date” means the date of the Committee’s adoption of the Plan. 2.15 “Employment Agreement” means the applicable employment agreement between a Covered Executive and the Company, if any, as may be amended from time to time. 2.16 “ERISA” means the Employee Retirement Income Security Act of 1974, as amended. 2.17 “Equity Plan” means the Sprout Social, Inc. 2019 Incentive Award Plan, as amended from time to time, or any successor plan thereto. 2.18 “Good Reason” means the occurrence, without the Covered Executive’s voluntary written consent, of any of the following circumstances: (a) a material breach by the Company of any material provision of the Employment Agreement; (b) the Company’s relocation of the Company office to which the Covered Executive primarily reports (the “Office”) to a location that increases the distance from the Covered Executive’s principal residence to the Office by more than fifty (50) miles (or, to the extent the Covered Executive works remotely, the Company’s requirement that such Covered Executive report to a Company office that is more than fifty (50) miles from such Covered Executive’s principal residence); (c) a material diminution in the Covered Executive’s authority, duties or responsibilities, provided that any changes in the Covered Executive’s title or to the Covered Executive’s reporting relationship shall not constitute Good Reason hereunder; or (d) any material reduction in the Base Salary (other than in

287866247 v5 3 connection with across-the-board base salary reductions for all or substantially all similarly situated executives of the Company); provided, in each case, that the Covered Executive first provides notice to the Company of the existence of the condition described above within thirty (30) days following the initial existence of the condition, upon the notice of which the Company shall have thirty (30) days during which it may remedy the condition, and provided further that the separation of service must occur within thirty (30) days following the end of such 30-day cure period. 2.19 “Involuntary Termination” means the termination by the Company or any Affiliate of a Covered Executive’s employment other than for Cause (and other than due to death or Disability), or such Covered Executive’s resignation for Good Reason. 2.20 “Non-CIC Involuntary Termination” means an Involuntary Termination that occurs outside of the Change in Control Period. 2.21 “Section 409A” means Section 409A of the Code and the final regulations and any guidance promulgated thereunder. 2.22 “Severance Benefits” means the compensation and other benefits a Covered Executive is eligible to receive pursuant to Section 4, subject to the terms and conditions of the Plan. 2.23 “Tier 1 Covered Executive” means an employee of the Company serving in the role of Chief Executive Officer and who is designated as a “Tier 1 Covered Executive” by the Administrator. 2.24 “Tier 2 Covered Executive” means an employee of the Company who is designated as a “Tier 2 Covered Executive” by the Administrator. Such designation may be by name or corporate level. 2.25 “Tier 3 Covered Executive” means an employee of the Company who is designated as a “Tier 3 Covered Executive” by the Administrator. Such designation may be by name or corporate level. 3. Eligibility for Severance Benefits. An individual is eligible for Severance Benefits under the Plan, in the amount set forth in Section 4, only if he or she is a Covered Executive on the date he or she experiences an Involuntary Termination. Notwithstanding the foregoing, in connection with an individual’s designation and participation as a Covered Executive in the Plan, the Administrator may, in its sole discretion, require as a condition to such designation and participation that such individual execute a participation agreement under the Plan. 4. Severance Benefits. Upon the termination of a Covered Executive’s employment for any reason, the Covered Executive shall be entitled to receive (a) any earned but unpaid base salary, and (b) any vested employee benefits in accordance with the terms of the applicable employee benefit plan or program. In addition, the Covered Executive may be eligible to receive additional payments and benefits, as set forth in more detail below. 4.1 CIC Involuntary Termination. If a Covered Executive experiences a CIC Involuntary Termination, then, subject to the Covered Executive’s compliance with Section 5, the Covered Executive shall receive the following Severance Benefits from the Company at the time set forth in Section 6 below: 4.1.1 Cash Severance Benefits. The Covered Executive will receive the cash Severance Benefits set forth on Exhibit A hereto for a CIC Involuntary Termination, payable, less applicable withholdings and deductions, in the form of continuation payments in regular installments over

287866247 v5 4 the applicable number of months set forth on Exhibit A (such number of months, the “Severance Period”) following the date of the Covered Executive’s CIC Involuntary Termination in accordance with the Company’s normal payroll practices. 4.1.2 Healthcare Continuation Coverage. During the period commencing on the date of the Covered Executive’s CIC Involuntary Termination and concluding at the end of the timeframe specified on Exhibit A, or, if earlier, the date on which the Covered Executive becomes eligible for coverage under any group health plan of a subsequent employer or otherwise (in any case, the “COBRA Period”), subject to the Covered Executive’s valid election to continue healthcare coverage under Section 4980B of the Code and the regulations thereunder, the Company shall, in its sole discretion, either continue to provide coverage to the Covered Executive and the Covered Executive’s dependents, or reimburse the Covered Executive for coverage for the Covered Executive and the Covered Executive’s dependents, under its group health plan (if any), at the same levels and costs in effect on the date of the Covered Executive’s termination (excluding, for purposes of calculating cost, an employee’s ability to pay premiums with pre- tax dollars); provided, however, that if (1) any plan pursuant to which such benefits are provided is not, or ceases prior to the expiration of the continuation coverage period to be, exempt from the application of Section 409A under Treasury Regulation Section 1.409A-1(a)(5), (2) the Company is otherwise unable to continue to cover the Covered Executive or the Covered Executive’s dependents under its group health plans or (3) the Company cannot provide the benefit without violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act),then, in any such case, an amount equal to each remaining Company subsidy shall thereafter be paid to the Covered Executive in substantially equal monthly installments over the COBRA Period (or remaining portion thereof) on the Company’s first regular payroll date of each calendar month, less applicable withholdings and deductions. For the avoidance of doubt, the COBRA continuation period under Section 4980B of the Code shall run concurrently with the period of continued group health plan coverage pursuant to this Section 4.1.2, and to the extent the Company makes cash payments pursuant to this Section 4.1.2, any such cash payments are not required to be used for health coverage. The continued benefits, reimbursement or cash payments provided for in this Section 4.1.2 are referred to herein as the “Continued Benefits.” 4.1.3 Equity Vesting. Each of the Covered Executive’s then outstanding equity awards shall be treated as set forth on Exhibit A. Subject to Section 5, accelerated vesting of equity awards (if any) shall be effective as of the date of the CIC Involuntary Termination. 4.2 Non-CIC Involuntary Termination. If a Covered Executive experiences a Non-CIC Involuntary Termination, then, subject to the Covered Executive’s compliance with Section 5, the Covered Executive shall receive the following Severance Benefits from the Company at the time set forth in Section 6 below: 4.2.1 Cash Severance Benefits. The Covered Executive will receive the cash Severance Benefits set forth on Exhibit A hereto for a Non-CIC Involuntary Termination, payable, less applicable withholdings and deductions, in the form of continuation payments in regular installments over the applicable Severance Period following the date of the Covered Executive’s Non-CIC Involuntary Termination in accordance with the Company’s normal payroll practices. 4.2.2 Healthcare Continuation Coverage. During the applicable COBRA Period, subject to the Covered Executive’s valid election to continue healthcare coverage under Section 4980B of the Code and the regulations thereunder, the Company shall provide the Continued Benefits. 4.2.3 Equity Vesting. Any then-outstanding equity awards held by the Covered Executive will be treated in accordance with the terms of the applicable equity plan and/or award agreement thereunder.

287866247 v5 5 5. Conditions to Receipt of Severance. 5.1 Release Agreement. 5.1.1 As a condition to receiving Severance Benefits under the Plan, each Covered Executive will be required to timely execute and not revoke a general waiver and release of claims agreement in the Company’s customary form (the “Release Agreement”), subject to the terms set forth herein. The Covered Executive will have twenty-one (21) days (or in the event that the Covered Executive’s termination of employment is “in connection with an exit incentive or other employment termination program” (as such phrase is defined in the Age Discrimination in Employment Act of 1967, as amended), forty-five (45) days) following the Covered Executive’s receipt of the Release Agreement to consider whether or not to accept it. If the Release Agreement is signed and delivered by the Covered Executive to the Company, Executive will have seven (7) days from the date of delivery to revoke the Covered Executive’s acceptance of such agreement (the “Revocation Period”). To the extent that any payments of Deferred Compensation Severance Benefits (as defined in Section 7) are delayed pursuant to this Section 5.1, such amounts shall be paid in a lump sum on the first payroll date to occur on or following the sixtieth (60th) day following the date of the Covered Executive’s Involuntary Termination. 5.1.2 If the Covered Executive does not timely execute the Release Agreement or such Release Agreement is revoked by the Covered Executive during the Revocation Period, (i) the Company shall immediately cease paying or providing the Continued Benefits and the Covered Executive shall reimburse the Company for the value of any Continued Benefits already paid or provided, and (ii) any equity awards that vested pursuant to Section 4.1.3 and any shares of Company stock that the Covered Executive received with respect thereto shall immediately be forfeited, without payment therefor, and the Covered Executive shall be required to pay to the Company, immediately upon demand therefor, the amount of any proceeds realized by the Covered Executive from the sale of any such shares. 5.2 No Duplication of Benefits. Nothing in this Plan, a participation agreement, an Employment Agreement or an offer letter from the Company shall entitle a Covered Executive to receive duplicate benefits in connection with a termination of employment. For example, in no event will a Covered Executive be eligible for benefits both under this Plan and an Employment Agreement. In addition, in no event shall a Covered Executive receive benefits under both Sections 4.1 and 4.2 hereof. The obligation of the Company to make payments or provide benefits hereunder is expressly conditioned upon the Covered Executive not receiving duplicate payments. Notwithstanding the foregoing, the Covered Executive’s outstanding equity awards covering Company common stock shall remain subject to the terms of the applicable equity plan under which such awards were granted that may apply upon a Change in Control and/or termination of such executive’s service and no provision of the Plan shall be construed as to limit the actions that may be taken, or to violate the terms, thereunder. 5.3 Certain Reductions. The Administrator will reduce a Covered Executive’s benefits under the Plan by any other statutory severance obligations or contractual severance benefits, obligations for pay in lieu of notice, and any other similar benefits payable to the Covered Executive by the Company (or any successor thereto) that are due in connection with the Covered Executive’s termination and that are in the same form as the benefits provided under the Plan (e.g., equity award vesting credit). Without limitation, this reduction includes a reduction for any benefits required pursuant to (i) any applicable legal requirement, including, without limitation, the Worker Adjustment and Retraining Notification Act of 1988 and any similar state or local laws (collectively, the “WARN Act”), (ii) a written employment, severance or equity award agreement with the Company, (iii) any Company policy or practice providing for the Covered Executive to remain on the payroll for a limited period of time after being given notice of the termination of the Covered Executive’s employment, and (iv) any required salary continuation, notice pay, statutory severance payment, or other payments either required by local law, or owed pursuant to a

287866247 v5 6 collective labor agreement, as a result of the termination of the Covered Executive’s employment. The benefits provided under the Plan are intended to satisfy, to the greatest extent possible, and not to provide benefits duplicative of, any and all statutory, contractual and collective agreement obligations of the Company in respect of the form of benefits provided under the Plan that may arise out of a termination, and the Administrator will so construe and implement the terms of the Plan. Reductions may be applied on a retroactive basis, with benefits previously provided being recharacterized as benefits pursuant to the Company’s statutory or other contractual obligations. The payments pursuant to the Plan are in addition to, and not in lieu of, any unpaid salary, bonuses or employee welfare benefits to which a Covered Executive may be entitled for the period ending with the Covered Executive’s termination. 5.4 Other Requirements. A Covered Executive’s receipt of Severance Benefits pursuant to Sections 4.1 or 4.2 will be subject to the Covered Executive continuing to comply with the provisions of this Section 5 and the terms of any confidential information agreement, proprietary information and inventions agreement, any covenants agreement, any other similar agreement to the foregoing and such other appropriate agreement between the Covered Executive and the Company. Benefits under the Plan shall terminate immediately for a Covered Executive if such Covered Executive, at any time, breaches any such agreement or the provisions of this Section 5. 5.5 Section 280G. Notwithstanding any other provision of this Agreement or any other plan, arrangement, or agreement to the contrary, if any of the payments or benefits provided or to be provided by the Company or its Affiliates to the Covered Executive or for the Covered Executive’s benefit pursuant to the terms of this Plan (“Covered Payments”) constitute parachute payments within the meaning of Section 280G of the Code (such payments, the “Parachute Payments”) and would, but for this Section 5.5, be subject to the excise tax imposed under Section 4999 of the Code (or any successor provision thereto) or any similar tax imposed by state or local law or any interest or penalties with respect to such taxes (collectively, the “Excise Tax”), or not be deductible under Section 280G of the Code, then such Covered Payments shall be reduced to the minimum extent necessary to ensure that no portion of the Covered Payments is subject to the Excise Tax, but only if (i) the net amount of such Covered Payments, as so reduced (and after subtracting the net amount of federal, state and local income and employment taxes on such reduced Covered Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such reduced Covered Payments Payments), is greater than or equal to (ii) the net amount of such Covered Payments without such reduction (but after subtracting the net amount of federal, state and local income and employment taxes on such Covered Payments and the amount of the Excise Tax to which the Covered Executive would be subject in respect of such unreduced Covered Payments and after taking into account the phase out of itemized deductions and personal exemptions attributable to such unreduced Covered Payments). The Covered Payments shall be reduced in a manner that maximizes the Covered Executive’s economic position. In applying this principle, the reduction shall be made in a manner consistent with the requirements of Section 409A, to the extent applicable, and where two or more economically equivalent amounts are subject to reduction but payable at different times, such amounts payable at the later time shall be reduced first but not below zero. 6. Timing of Benefits. Subject to any delay required by Section 7 below, cash Severance Benefits will be paid or will begin being paid within thirty (30) days of the Release becoming effective and irrevocable (such effective date, the “Release Effective Date”) (but no earlier than allowed under Section 409A); provided, however, that if the Revocation Period crosses two calendar years, the Severance Benefits will be paid or will begin being paid in the second of the two years if necessary to avoid taxation under Section 409A. 7. Section 409A. Notwithstanding anything to the contrary in the Plan, no severance payments or benefits will become payable until the Covered Executive has a “separation from service” within the meaning of Section 409A if such payments or benefits would constitute deferred compensation

287866247 v5 7 for purposes of Section 409A (“Deferred Compensation Severance Benefits”). Further, if the Covered Executive is subject to Section 409A and is a “specified employee” within the meaning of Section 409A at the time of the Covered Executive’s separation from service (other than due to death), then any Deferred Compensation Separation Benefits otherwise due to the Covered Executive on or within the six-month period following his or her separation from service will accrue during such six-month period, without interest, and will become payable in a lump sum payment (less applicable withholding taxes) on the date six months and one day following the date of the Covered Executive’s separation from service if necessary to avoid adverse taxation under Section 409A. All subsequent payments of Deferred Compensation Separation Benefits, if any, will be payable in accordance with the payment schedule applicable to each payment or benefit. Notwithstanding anything herein to the contrary, if the Covered Executive dies following his or her separation from service but prior to the six-month anniversary of his or her date of separation, then any payments delayed in accordance with this paragraph will be payable in a lump sum (less applicable withholding taxes) to the Covered Executive’s estate as soon as administratively practicable after the date of his or her death and all other Deferred Compensation Separation Benefits will be payable in accordance with the payment schedule applicable to each payment or benefit. Each payment and benefit payable under the Plan is intended to constitute a separate payment for purposes of Section 409A. It is the intent of the Plan to be exempt from (or if not exempt from, to comply with) the requirements of Section 409A, so that none of the severance payments and benefits to be provided hereunder will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be interpreted to so comply. 8. Withholding. The Company will withhold from any Severance Benefits all federal, state, local and other taxes required to be withheld therefrom and any other required payroll deductions. 9. Administration. The Plan will be administered and interpreted by the Administrator (in their, his or her sole discretion). The Administrator is the “named fiduciary” of the Plan for purposes of ERISA and will be subject to the fiduciary standards of ERISA when acting in such capacity. Any decision made or other action taken by the Administrator prior to a Change in Control with respect to the Plan, and any interpretation by the Administrator prior to a Change in Control of any term or condition of the Plan, or any related document, will be conclusive and binding on all persons and be given the maximum possible deference allowed by law. Following a Change in Control, any decision made or other action taken by the Administrator with respect to the Plan, and any interpretation by the Administrator of any term or condition of the Plan, or any related document that (i) does not affect the benefits payable under the Plan shall not be subject to review unless found to be arbitrary and capricious, or (ii) does affect the benefits payable under the Plan shall not be subject to review unless found to be unreasonable or not to have been made in good faith. In accordance with Section 2.1, the Administrator may, in its sole discretion and on such terms and conditions as it may provide, delegate in writing to one or more officers of the Company all or any portion of its authority or responsibility with respect to the Plan; provided, however, that any Plan amendment or termination or any other action that could reasonably be expected to increase significantly the cost of the Plan must be approved by the Board or the Committee. 10. Eligibility to Participate. To the extent that the Administrator has delegated administrative authority or responsibility to one or more officers of the Company in accordance with Section 2.1 and Section 9, each such officer will not be excluded from participating in the Plan if otherwise eligible, but he or she is not entitled to act or pass upon any matters pertaining specifically to his or her own benefit or eligibility under the Plan. The Administrator will act upon any matters pertaining specifically to the benefit or eligibility of each such officer under the Plan. 11. Amendment or Termination. The Company, by action of the Administrator, reserves the right to amend or terminate the Plan at any time, without advance notice to any Covered Executive and without regard to the effect of the amendment or termination on any Covered Executive or on any other

287866247 v5 8 individual. Any amendment or termination of the Plan will be in writing. Notwithstanding the preceding, the Company may not, without a Covered Executive’s written consent, amend or terminate the Plan in any way, nor take any other action, that (a) prevents that Covered Executive from becoming eligible for Severance Benefits under the Plan or (b) reduces or alters to the detriment of the Covered Executive the Severance Benefits payable, or potentially payable, to the Covered Executive under the Plan (including, without limitation, imposing additional conditions or modifying the timing of payment); provided, that, notwithstanding the foregoing the Company may amend the Plan with such changes as are necessary for compliance with changes in applicable law or regulation. Any action of the Company in amending or terminating the Plan will be taken in a non-fiduciary capacity. For the avoidance of doubt, in the event a Change in Control occurs during the term of the Plan, the Plan shall not terminate until the Change in Control Period has expired and any benefits payable have been paid. 12. Claims Procedure. Claims for benefits under the Plan shall be administered in accordance with Section 503 of ERISA and the Department of Labor Regulations thereunder. Any employee or other person who believes he or she is entitled to any payment under the Plan (a “claimant”) may submit a claim in writing to the Administrator within 90 days of the earlier of (i) the date the claimant learned the amount of their Severance Benefits under the Plan, or (ii) the date the claimant learned that he or she will not be entitled to any benefits under the Plan. In determining claims for benefits, the Administrator or its delegate has the authority to interpret the Plan, to resolve ambiguities, to make factual determinations, and to resolve questions relating to eligibility for and amount of benefits. If the claim is denied (in full or in part), the claimant will be provided a written notice explaining the specific reasons for the denial and referring to the provisions of the Plan on which the denial is based. The notice will also describe any additional information or material that the Administrator needs to complete the review and an explanation of why such information or material is necessary and the Plan’s procedures for appealing the denial (including a statement of the applicant’s right to bring a civil action under Section 502(a) of ERISA following a denial on review of the claim, as described below). The denial notice will be provided within 90 days after the claim is received. If special circumstances require an extension of time (up to 90 days), written notice of the extension will be given to the claimant (or representative) within the initial 90-day period. This notice of extension will indicate the special circumstances requiring the extension of time and the date by which the Administrator expects to render its decision on the claim. If the extension is provided due to a claimant’s failure to provide sufficient information, the time frame for rendering the decision is tolled from the date the notification is sent to the claimant about the failure to the date on which the claimant responds to the request for additional information. The Administrator has delegated the claims review responsibility to the Company’s General Counsel or such other individual designated by the Administrator, except in the case of a claim filed by or on behalf of the Company’s General Counsel or such other individual designated by the Administrator, in which case, the claim will be reviewed by the Company’s Chief Financial Officer. 13. Appeal Procedure. If the claimant’s claim is denied, the claimant (or his or her authorized representative) may apply in writing to an appeals official appointed by the Administrator (which may be a person, committee or other entity) for a review of the decision denying the claim. Review must be requested within 60 days following the date the claimant received the written notice of their claim denial or else the claimant loses the right to review. A request for review must set forth all of the grounds on which it is based, all facts in support of the request, and any other matters that the claimant feels are pertinent. In connection with the request for review, the claimant (or representative) has the right to review and obtain copies of all documents and other information relevant to the claim, upon request and at no charge, and to submit written comments, documents, records and other information relating to his or her claim. The review shall take into account all comments, documents, records and other information submitted by the claimant (or representative) relating to the claim, without regard to whether such information was submitted or considered in the initial benefit determination. The appeals official will provide written notice of its decision on review within 60 days after it receives a review request. If special circumstances require an extension of time (up to 60 days), written notice of the extension will be given to the claimant (or

287866247 v5 9 representative) within the initial 60-day period. This notice of extension will indicate the special circumstances requiring the extension of time and the date by which the appeals official expects to render its decision. If the extension is provided due to a claimant’s failure to provide sufficient information, the time frame for rendering the decision on review is tolled from the date the notification is sent to the claimant about the failure to the date on which the claimant responds to the request for additional information. If the claim is denied (in full or in part) upon review, the claimant will be provided a written notice explaining the specific reasons for the denial and referring to the provisions of the Plan on which the denial is based. The notice shall also include a statement that the claimant will be provided, upon request and free of charge, reasonable access to, and copies of, all documents and other information relevant to the claim and a statement regarding the claimant’s right to bring an action under Section 502(a) of ERISA. The Administrator has delegated the appeals review responsibility to the Company’s General Counsel, except in the case of an appeal filed by or on behalf of the Company’s General Counsel, in which case, the appeal will be reviewed by the Company’s Chief Financial Officer. 14. Judicial Proceedings. No judicial proceeding shall be brought to recover benefits under the Plan until the claims procedures described in Sections 12 and 13 have been exhausted and the Plan benefits requested have been denied in whole or in part. If any judicial proceeding is undertaken to further appeal the denial of a claim or bring any other action under ERISA (other than a breach of fiduciary duty claim), the evidence presented shall be strictly limited to the evidence timely presented to the Administrator or its delegate, unless any new evidence has since been uncovered following completion of the claims procedures described in Sections 12 and 13. In addition, any such judicial proceeding must be filed within one year after the claimant’s receipt of notification that his or her appeal was denied. 15. Source of Payments. All Severance Benefits will be paid in cash from the general funds of the Company; no separate fund will be established under the Plan, and the Plan will have no assets. No right of any person to receive any payment under the Plan will be any greater than the right of any other general unsecured creditor of the Company. 16. Inalienability. In no event may any current or former employee of the Company or any of its Affiliates sell, transfer, anticipate, assign or otherwise dispose of any right or interest under the Plan. At no time will any such right or interest be subject to the claims of creditors nor liable to attachment, execution or other legal process. 17. No Enlargement of Employment Rights. Neither the establishment nor maintenance of the Plan, any amendment of the Plan, nor the making of any benefit payment hereunder, will be construed to confer upon any individual any right to be continued as an employee of the Company. The Company expressly reserves the right to discharge any of its employees at any time, with or without cause. However, as described in the Plan, a Covered Executive may be entitled to benefits under the Plan depending upon the circumstances of his or her termination of employment. 18. Successors. Any successor to the Company of all or substantially all of the Company’s business and/or assets (whether direct or indirect and whether by purchase, merger, consolidation, liquidation or otherwise) will assume the obligations under the Plan and agree expressly to perform the obligations under the Plan in the same manner and to the same extent as the Company would be required to perform such obligations in the absence of a succession. For all purposes under the Plan, the term “Company” will include any successor to the Company’s business and/or assets which become bound by the terms of the Plan by operation of law, or otherwise. 19. Applicable Law. The provisions of the Plan will be construed, administered and enforced in accordance with ERISA. To the extent ERISA is not applicable, the provisions of the Plan will be

287866247 v5 10 governed by the internal substantive laws of the State of Delaware, and construed accordingly, without giving effect to principles of conflicts of laws. 20. Severability. If any provision of the Plan is held invalid or unenforceable, its invalidity or unenforceability will not affect any other provision of the Plan, and the Plan will be construed and enforced as if such provision had not been included. 21. Headings. Headings in the Plan document are for purposes of reference only and will not limit or otherwise affect the meaning hereof. 22. Indemnification. The Company hereby agrees to indemnify and hold harmless the officers and employees of the Company, and the members of its boards of directors, from all losses, claims, costs or other liabilities arising from their acts or omissions in connection with the administration, amendment or termination of the Plan, to the maximum extent permitted by applicable law. This indemnity will cover all such liabilities, including judgments, settlements and costs of defense. The Company will provide this indemnity from its own funds to the extent that insurance does not cover such liabilities. This indemnity is in addition to and not in lieu of any other indemnity provided to such person by the Company. 23. Additional Information. Plan Name: Sprout Social, Inc. Severance Plan Plan Sponsor: Sprout Social, Inc. 131 South Dearborn Street, Suite 700 Chicago, Illinois 60603 (866) 878-3231 Identification Numbers: EIN: 272404165 PLAN NUMBER: 19 Plan Year: Company’s Fiscal Year ending December 31 Plan Administrator: Sprout Social, Inc. 131 South Dearborn Street, Suite 700 Chicago, Illinois 60603 (866) 878-3231 Agent for Service of Sprout Social, Inc. General Counsel 131 South Dearborn Street, Suite 700 Chicago, Illinois 60603 (866) 878-3231 Legal Process: Service of process may also be made upon the Administrator. Type of Plan: Severance Plan/Employee Welfare Benefit Plan Plan Costs: The cost of the Plan is paid by the Employer. 24. Statement of Covered Executive ERISA Rights. As a Covered Executive under the Plan, you have certain rights and protections under ERISA:

287866247 v5 11 (a) You may examine (without charge) all Plan documents, including any amendments and copies of all documents filed with the U.S. Department of Labor. These documents are available for your review at 131 S. Dearborn, Suite 700, Chicago, Illinois 60603. (b) You may obtain copies of all Plan documents and other Plan information upon written request to the Administrator at no charge. In addition to creating rights for Covered Executives, ERISA imposes duties upon the people who are responsible for the operation of the Plan. The people who operate the Plan (called “fiduciaries”) have a duty to do so prudently and in the interests of you and the other Covered Executives. No one, including the Company or any other person, may fire you or otherwise discriminate against you in any way to prevent you from obtaining a benefit under the Plan or exercising your rights under ERISA. If your claim for a severance benefit is denied, in whole or in part, you have a right to know why this was done, to obtain copies of documents relating to the decision without charge, and to appeal any denial, all within certain time schedules. (The claim review procedure is explained in Section 13 and Section 14 above.) Under ERISA, there are steps you can take to enforce the above rights. For instance, if you request a copy of Plan documents and do not receive them within thirty days, you may file suit in a federal court. In such a case, the court may require the Administrator to provide the materials and to pay you up to $110 a day until you receive the materials, unless the materials were not sent because of reasons beyond the control of the Administrator. If you have a claim which is denied or ignored, in whole or in part, you may file suit in a federal court. If it should happen that you are discriminated against for asserting your rights, you may seek assistance from the U.S. Department of Labor, or you may file suit in a federal court. The court will decide who should pay court costs and legal fees. If you are successful, the court may order the person you have sued to pay these costs and fees. If you lose, the court may order you to pay these costs and fees, for example, if it finds your claim is frivolous. If you have any questions regarding the Plan, please contact the Administrator or the Company’s General Counsel. If you have any questions about this statement or about your rights under ERISA, you may contact the nearest office of the Employee Benefits Security Administration, U.S. Department of Labor, listed in your telephone directory, or the Division of Technical Assistance and Inquiries, Employee Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue, N.W. Washington, D.C. 20210. You may also obtain certain publications about your rights and responsibilities under ERISA by calling the publications hotline of the Employee Benefits Security Administration at 1-866-444-3272.

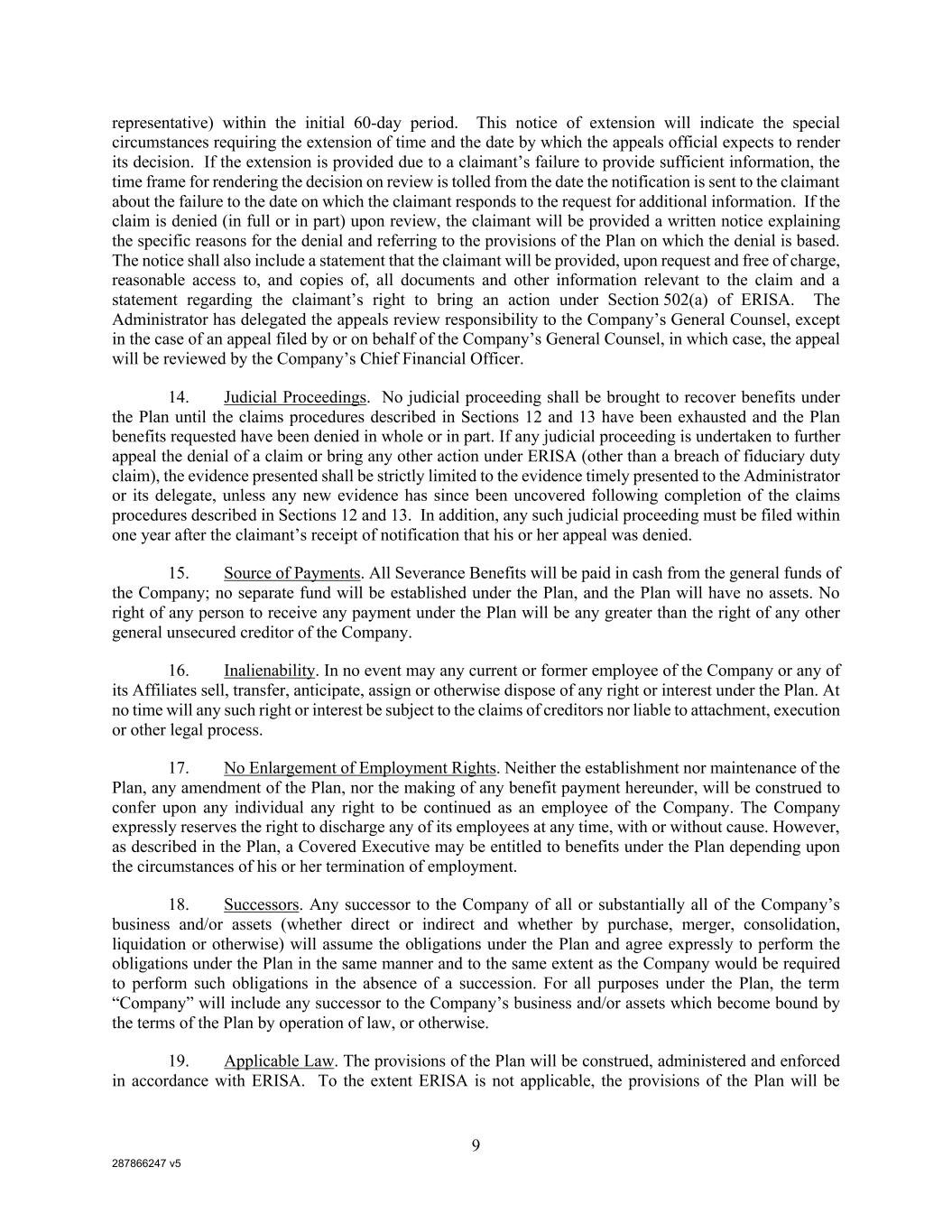

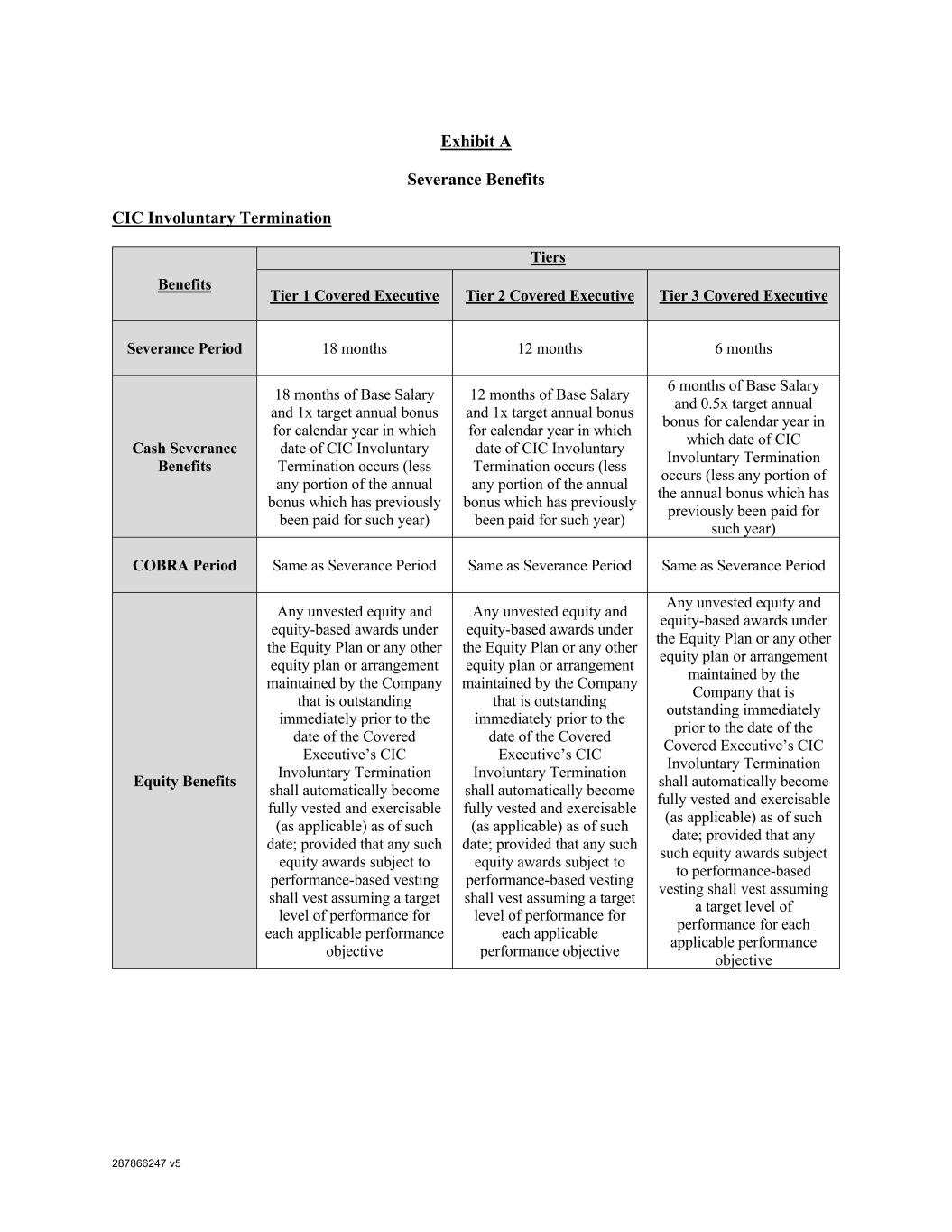

287866247 v5 Exhibit A Severance Benefits CIC Involuntary Termination Benefits Tiers Tier 1 Covered Executive Tier 2 Covered Executive Tier 3 Covered Executive Severance Period 18 months 12 months 6 months Cash Severance Benefits 18 months of Base Salary and 1x target annual bonus for calendar year in which date of CIC Involuntary Termination occurs (less any portion of the annual bonus which has previously been paid for such year) 12 months of Base Salary and 1x target annual bonus for calendar year in which date of CIC Involuntary Termination occurs (less any portion of the annual bonus which has previously been paid for such year) 6 months of Base Salary and 0.5x target annual bonus for calendar year in which date of CIC Involuntary Termination occurs (less any portion of the annual bonus which has previously been paid for such year) COBRA Period Same as Severance Period Same as Severance Period Same as Severance Period Equity Benefits Any unvested equity and equity-based awards under the Equity Plan or any other equity plan or arrangement maintained by the Company that is outstanding immediately prior to the date of the Covered Executive’s CIC Involuntary Termination shall automatically become fully vested and exercisable (as applicable) as of such date; provided that any such equity awards subject to performance-based vesting shall vest assuming a target level of performance for each applicable performance objective Any unvested equity and equity-based awards under the Equity Plan or any other equity plan or arrangement maintained by the Company that is outstanding immediately prior to the date of the Covered Executive’s CIC Involuntary Termination shall automatically become fully vested and exercisable (as applicable) as of such date; provided that any such equity awards subject to performance-based vesting shall vest assuming a target level of performance for each applicable performance objective Any unvested equity and equity-based awards under the Equity Plan or any other equity plan or arrangement maintained by the Company that is outstanding immediately prior to the date of the Covered Executive’s CIC Involuntary Termination shall automatically become fully vested and exercisable (as applicable) as of such date; provided that any such equity awards subject to performance-based vesting shall vest assuming a target level of performance for each applicable performance objective

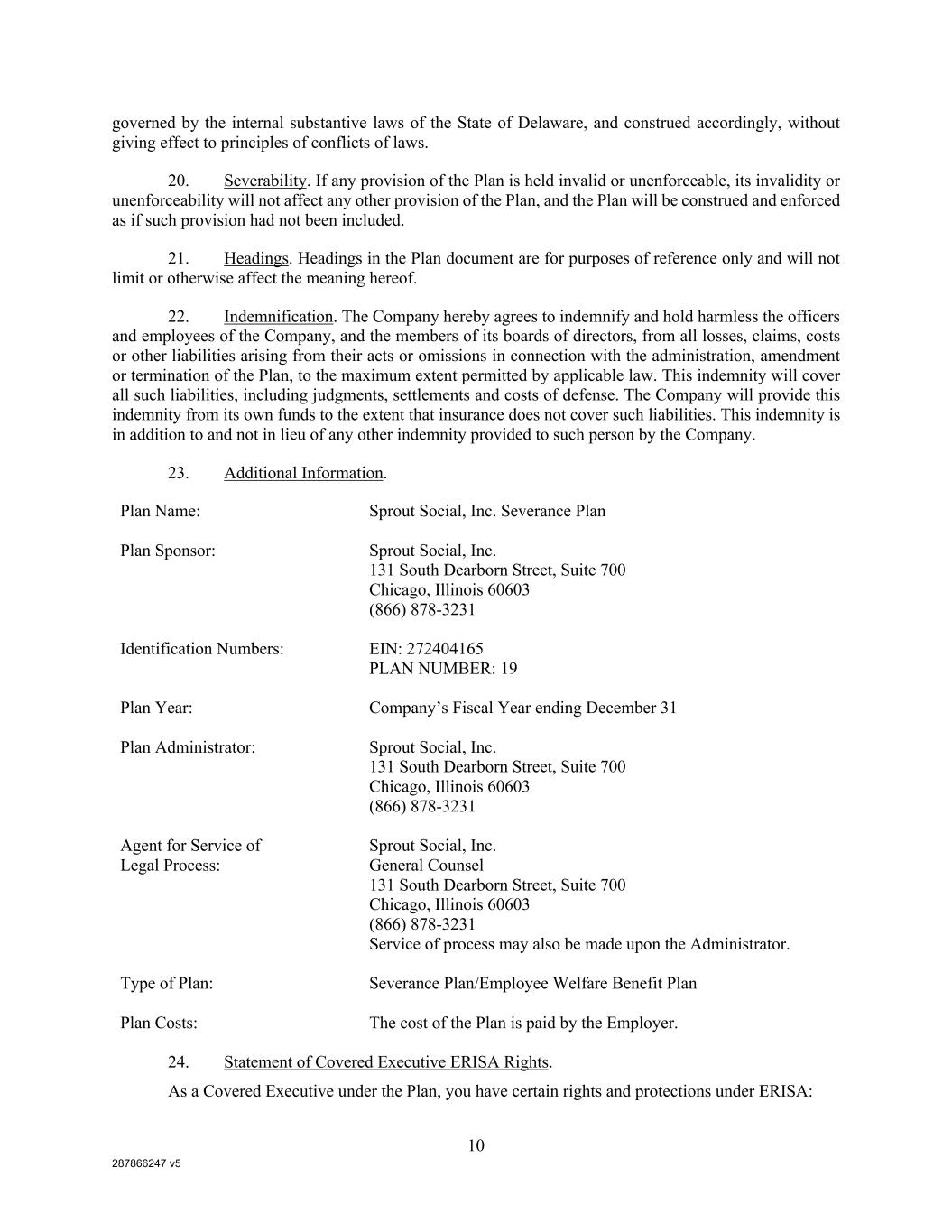

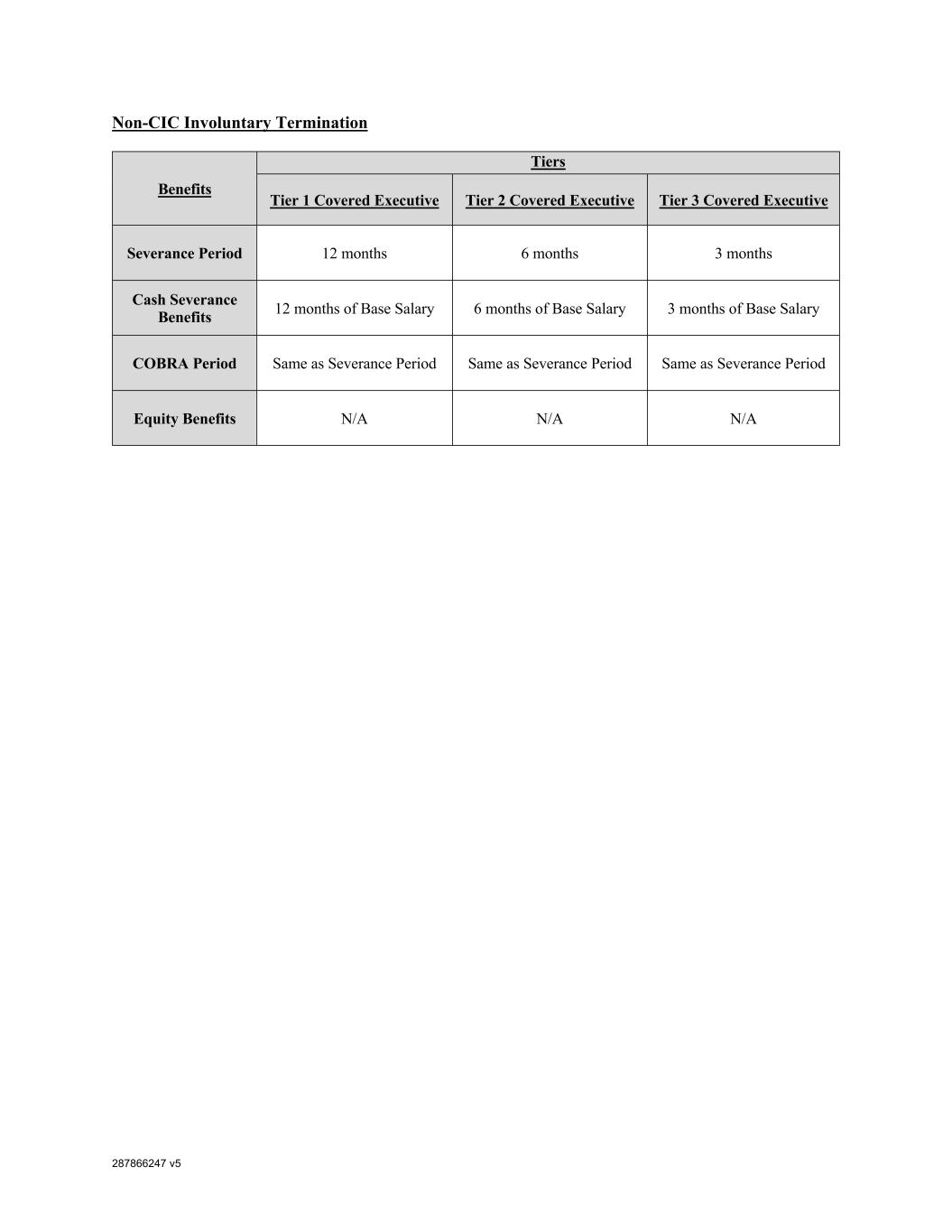

287866247 v5 Non-CIC Involuntary Termination Benefits Tiers Tier 1 Covered Executive Tier 2 Covered Executive Tier 3 Covered Executive Severance Period 12 months 6 months 3 months Cash Severance Benefits 12 months of Base Salary 6 months of Base Salary 3 months of Base Salary COBRA Period Same as Severance Period Same as Severance Period Same as Severance Period Equity Benefits N/A N/A N/A