Investor Presentation 1Q FY25

Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “explore,” “future,” “intend,” “long-term operating model,” “medium to long-term goals,” “may,” “might,” “outlook,” “plan,” “potential,” “predict,” “project,” “should,” “strategy,” “target,” “will,” “would,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These statements may relate to our market size and growth strategy, our estimated and projected costs, margins, revenue, expenditures and customer and financial growth rates, our Q2 2025, 2025, medium term, and long-term financial outlook and performance against our multi-year financial framework, our medium to longer term goals, our plans and objectives for future operations, growth, initiatives or strategies, including our investments in research and development. By their nature, these statements are subject to numerous uncertainties and risks, including factors beyond our control, that could cause actual results, performance or achievement to differ materially and adversely from those anticipated or implied in the forward-looking statements. These assumptions, uncertainties and risks include that, among others; we may not be able to sustain our revenue and customer growth rate in the future, including due to risks associated with our strategic focus on enterprise customers; price increases have and may continue to negatively impact demand for our products, customer acquisition and retention and reduce the total number of customers or customer additions; our business would be harmed by any significant interruptions, delays or outages in services from our platform, our API providers, or certain social media platforms; if we are unable to attract potential customers through unpaid channels, convert this traffic to free trials or convert free trials to paid subscriptions, our business and results of operations may be adversely affected; we may be unable to successfully enter new markets, manage our international expansion and comply with any applicable international laws and regulations; we may be unable to integrate acquired businesses or technologies successfully or achieve the expected benefits of such acquisitions and investments; unstable market, economic, and political conditions, such as recession risks, effects of inflation, trade tensions, changes in government spending, labor shortages, supply chain issues, high interest rates, and the impacts of current and potential future bank failures and ongoing overseas conflicts, have and could continue to adversely impact our business and that of our existing and prospective customers, which may result in reduced demand for our products; we may not be able to generate sufficient cash to service our indebtedness; covenants in our credit agreement may restrict our operations, and if we do not effectively manage our business to comply with these covenants, our financial condition could be adversely impacted; any cybersecurity-related attack, significant data breach or disruption of the information technology systems or networks on which we rely could negatively affect our business; changing regulations relating to privacy, information security and data protection could increase our costs, affect or limit how we collect and use personal information and harm our brand; and risks related to ongoing legal proceedings. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption “Risk Factors” and elsewhere in our filings with the Securities and Exchange Commission (the “SEC”), including our Annual Report on Form 10-K for the year ended December 31, 2024 filed with the SEC on February 26, 2025, and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2025 to be filed with the SEC, as well as any future reports that we file with the SEC. Moreover, you should interpret many of the risks identified in those reports as being heightened as a result of the current and ongoing instability in market and economic conditions. Forward-looking statements speak only as of the date the statements are made and are based on information available to Sprout Social at the time those statements are made and/or management's good faith belief as of that time with respect to future events. Sprout Social assumes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, except as required by law. Use of Non-GAAP Financial Measures We have provided in this presentation certain financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Our management uses these non-GAAP financial measures internally in analyzing our financial results and believes that use of these non-GAAP financial measures is useful to investors as an additional tool to evaluate ongoing operating results and trends and in comparing our financial results with other companies in our industry, many of which present similar non-GAAP financial measures. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable financial measures prepared in accordance with GAAP and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. A reconciliation of our historical non-GAAP financial measures to the most directly comparable GAAP measures has been provided in the financial statement tables included at the end of this presentation, and investors are encouraged to review these reconciliations. The Company cannot provide reconciliations between its forecasted non-GAAP measures and the most comparable GAAP measures without unreasonable effort due to the unavailability of reliable estimates for certain items. These items are not within the Company’s control and may vary greatly between periods and could significantly impact future financial results. Customer Metrics and Market Data This presentation includes useful customer metrics and other data, which are defined at the back of this presentation. Unless otherwise noted, information in this presentation concerning our industry, including industry statistics and forecasts, competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge of, such industry and markets, which we believe to be reasonable. Projections, forecasts, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty and risk due to a variety of factors. We have not independently verified the accuracy or completeness of the information provided by independent industry and research organizations, other third parties or other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that information nor do we undertake to update such information after the date of this presentation. 2023 Investor Presentation 2

1Q FY2025 Results 3

*All financial metrics are as of or for the quarter ended 3/31/25. Revenue and ACV growth represents year-over-year growth of Q1 2025 over Q1 2024. ~30,000 Customers in 100+ countries 77% Gross Profit 13% Revenue Growth 99% Subscription Revenue 16% ACV Growth Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/23/2025 4

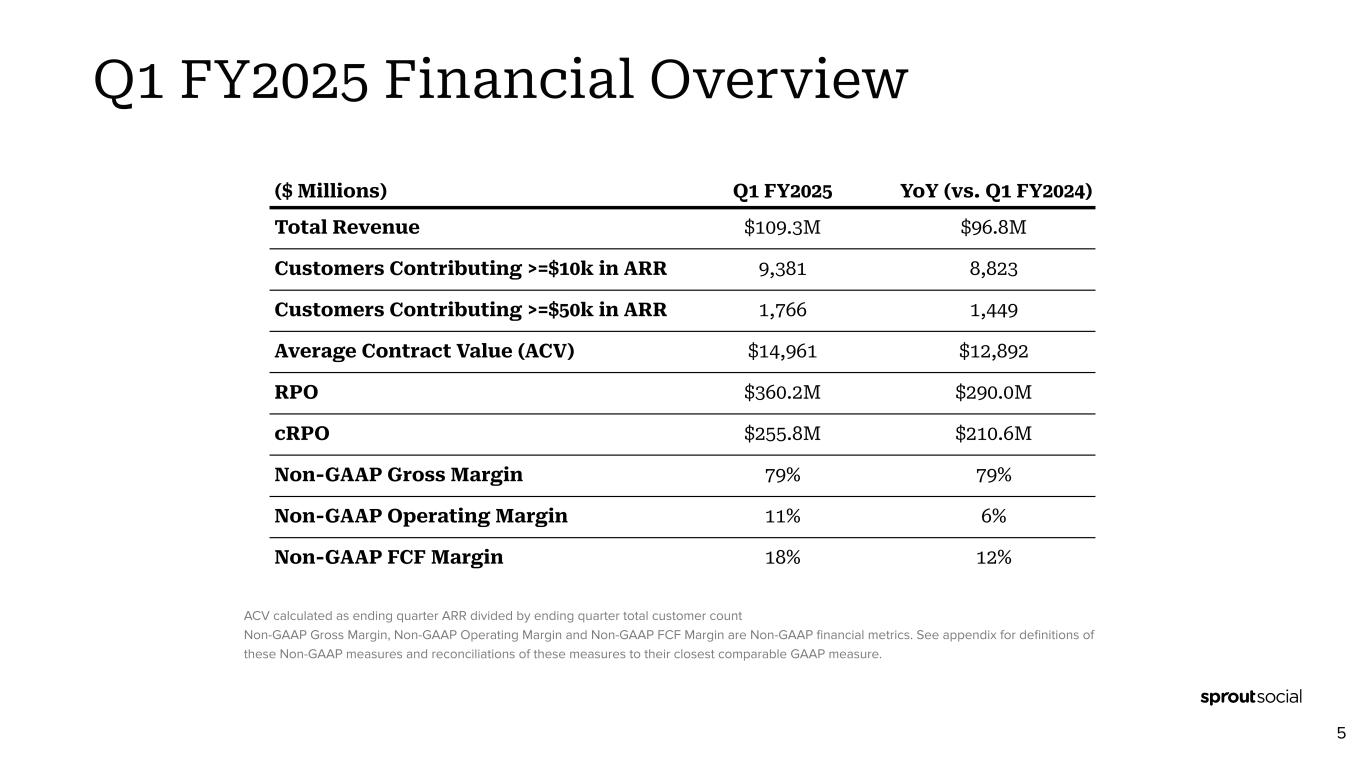

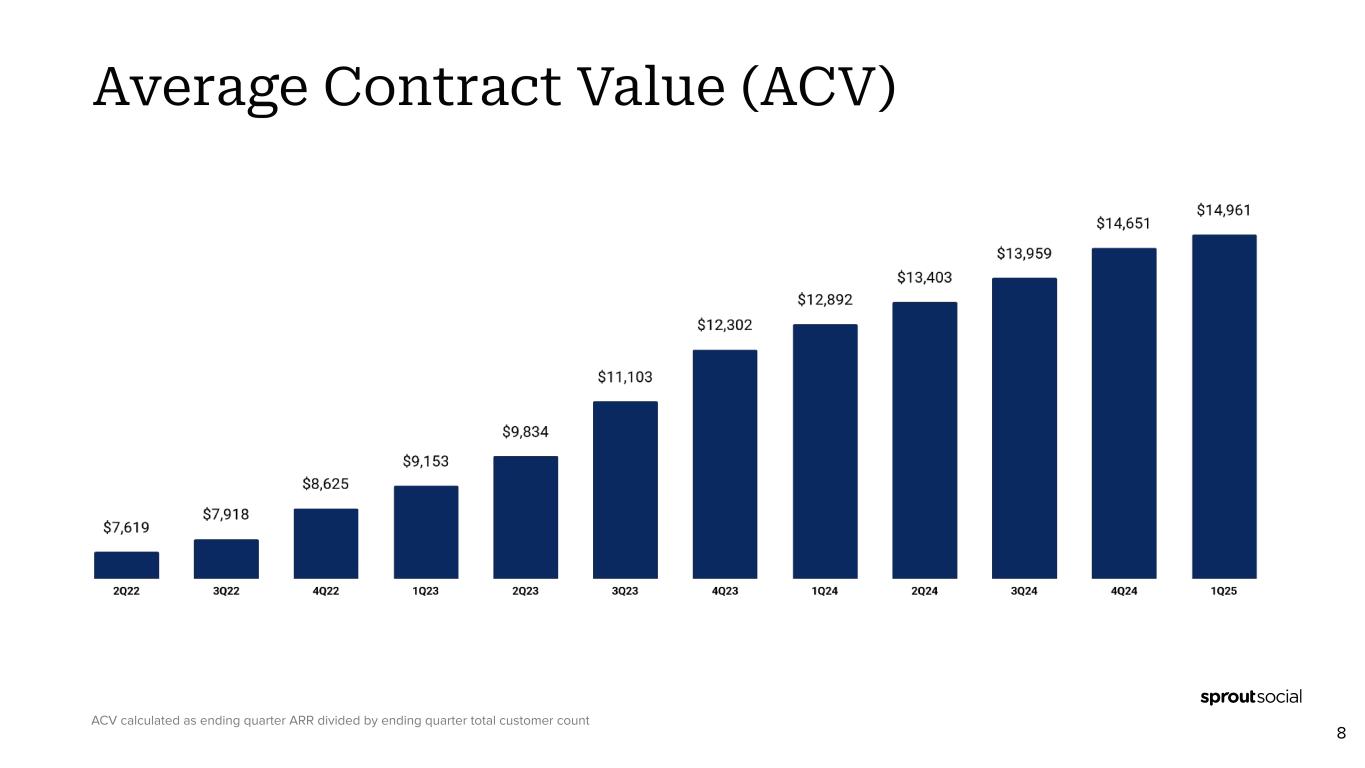

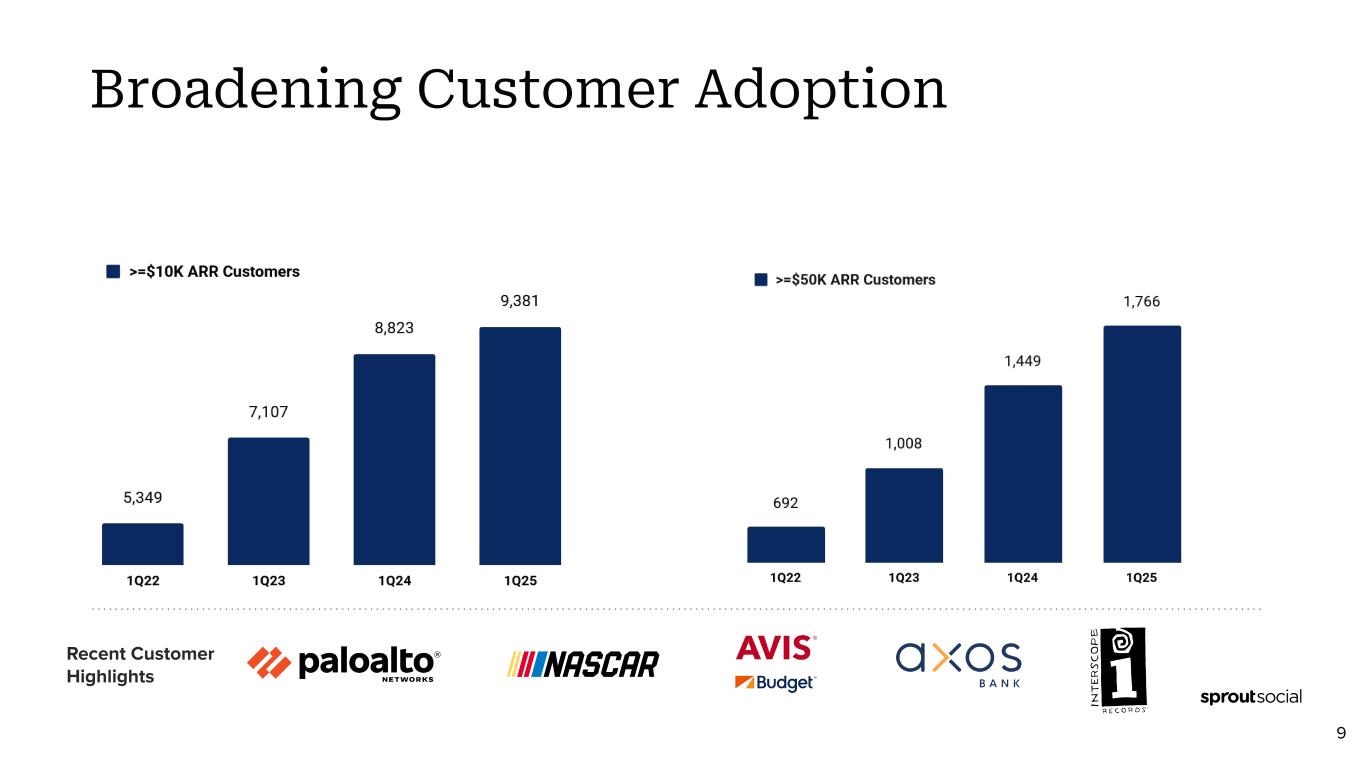

Q1 FY2025 Financial Overview ACV calculated as ending quarter ARR divided by ending quarter total customer count Non-GAAP Gross Margin, Non-GAAP Operating Margin and Non-GAAP FCF Margin are Non-GAAP financial metrics. See appendix for definitions of these Non-GAAP measures and reconciliations of these measures to their closest comparable GAAP measure. Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/28/2025 5 ($ Millions) Q1 FY2025 YoY (vs. Q1 FY2024) Total Revenue $109.3M $96.8M Customers Contributing >=$10k in ARR 9,381 8,823 Customers Contributing >=$50k in ARR 1,766 1,449 Average Contract Value (ACV) $14,961 $12,892 RPO $360.2M $290.0M cRPO $255.8M $210.6M Non-GAAP Gross Margin 79% 79% Non-GAAP Operating Margin 11% 6% Non-GAAP FCF Margin 18% 12%

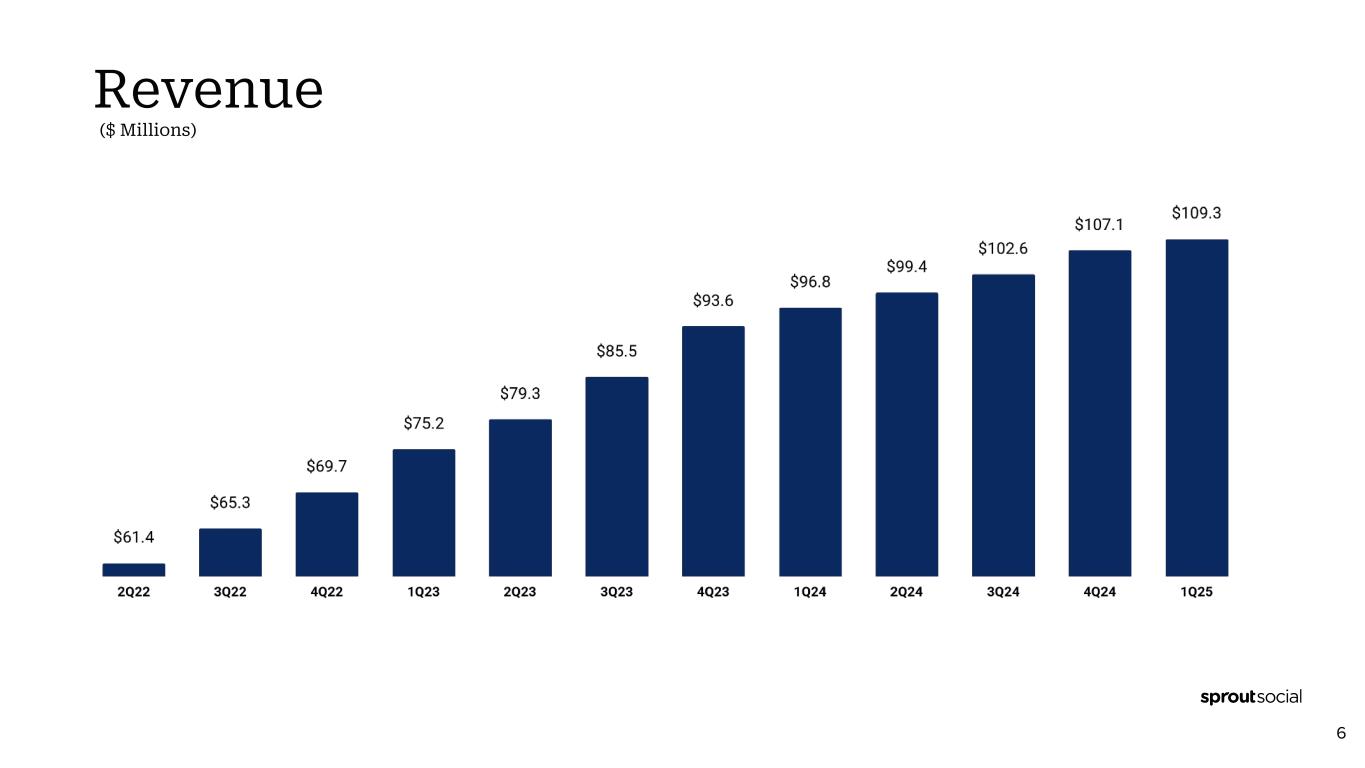

Revenue Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/23/2025 ($ Millions) 6

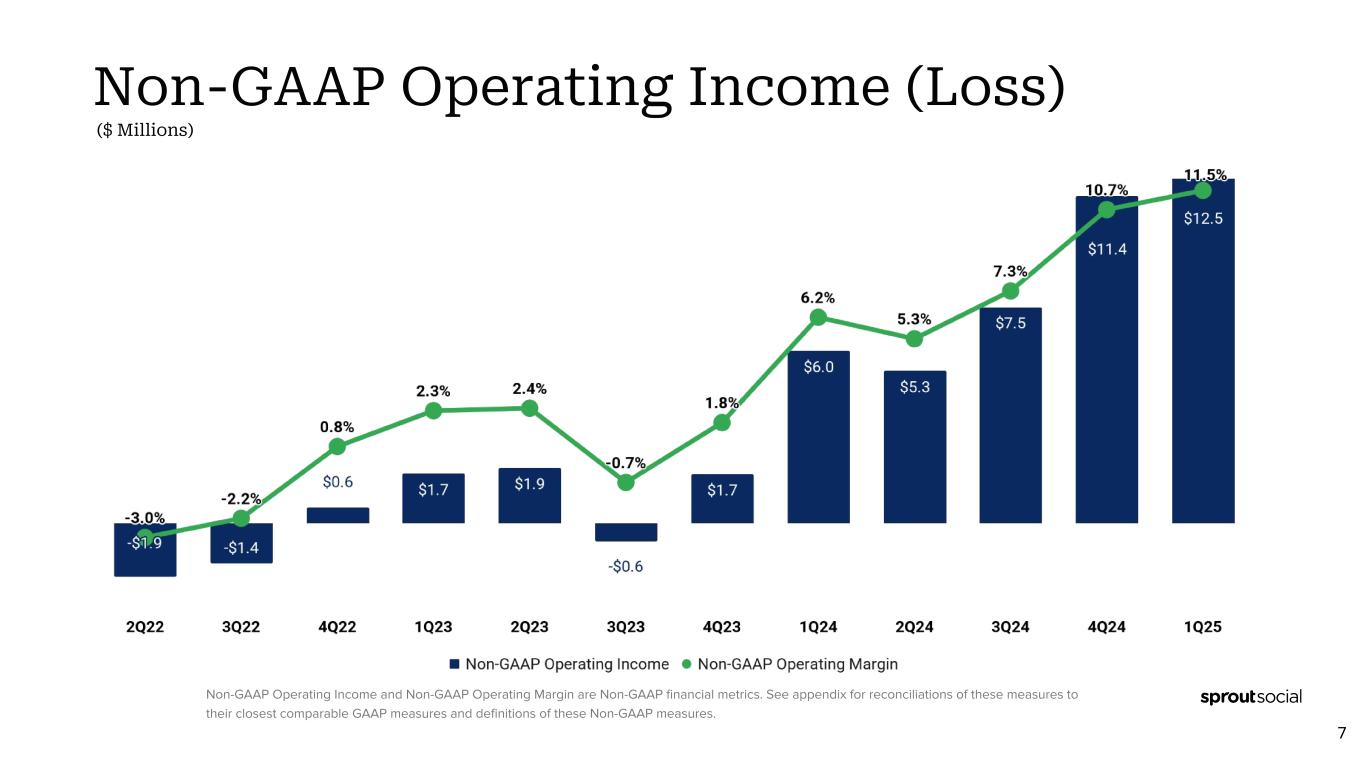

Non-GAAP Operating Income (Loss) Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/23/2025 Non-GAAP Operating Income and Non-GAAP Operating Margin are Non-GAAP financial metrics. See appendix for reconciliations of these measures to their closest comparable GAAP measures and definitions of these Non-GAAP measures. ($ Millions) 7

Average Contract Value (ACV) ACV calculated as ending quarter ARR divided by ending quarter total customer count Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/23/2025 8

Recent Customer Highlights Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/23/2025 Broadening Customer Adoption 9

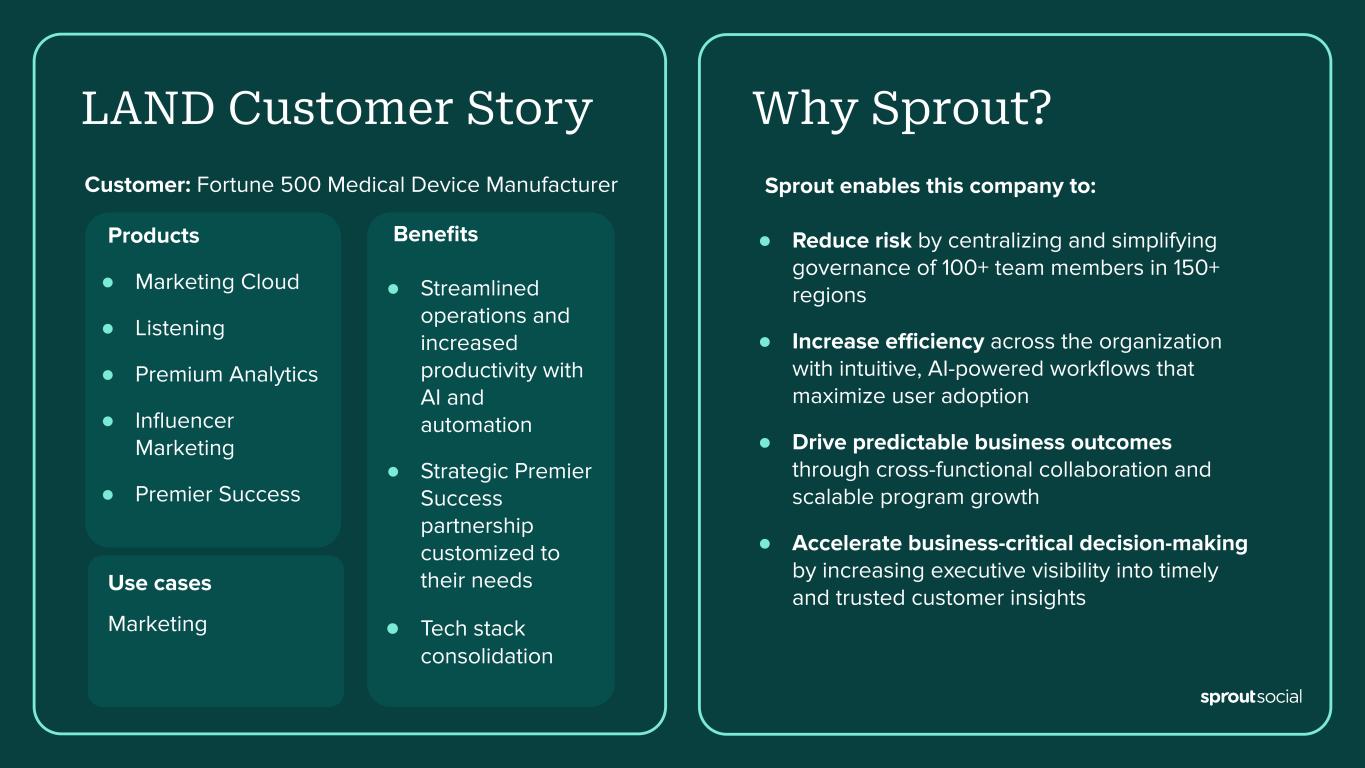

Sprout enables this company to: ● Reduce risk by centralizing and simplifying governance of 100+ team members in 150+ regions ● Increase efficiency across the organization with intuitive, AI-powered workflows that maximize user adoption ● Drive predictable business outcomes through cross-functional collaboration and scalable program growth ● Accelerate business-critical decision-making by increasing executive visibility into timely and trusted customer insights Customer: Fortune 500 Medical Device Manufacturer LAND Customer Story Use cases Marketing Why Sprout? Products ● Marketing Cloud ● Listening ● Premium Analytics ● Influencer Marketing ● Premier Success Benefits ● Streamlined operations and increased productivity with AI and automation ● Strategic Premier Success partnership customized to their needs ● Tech stack consolidation

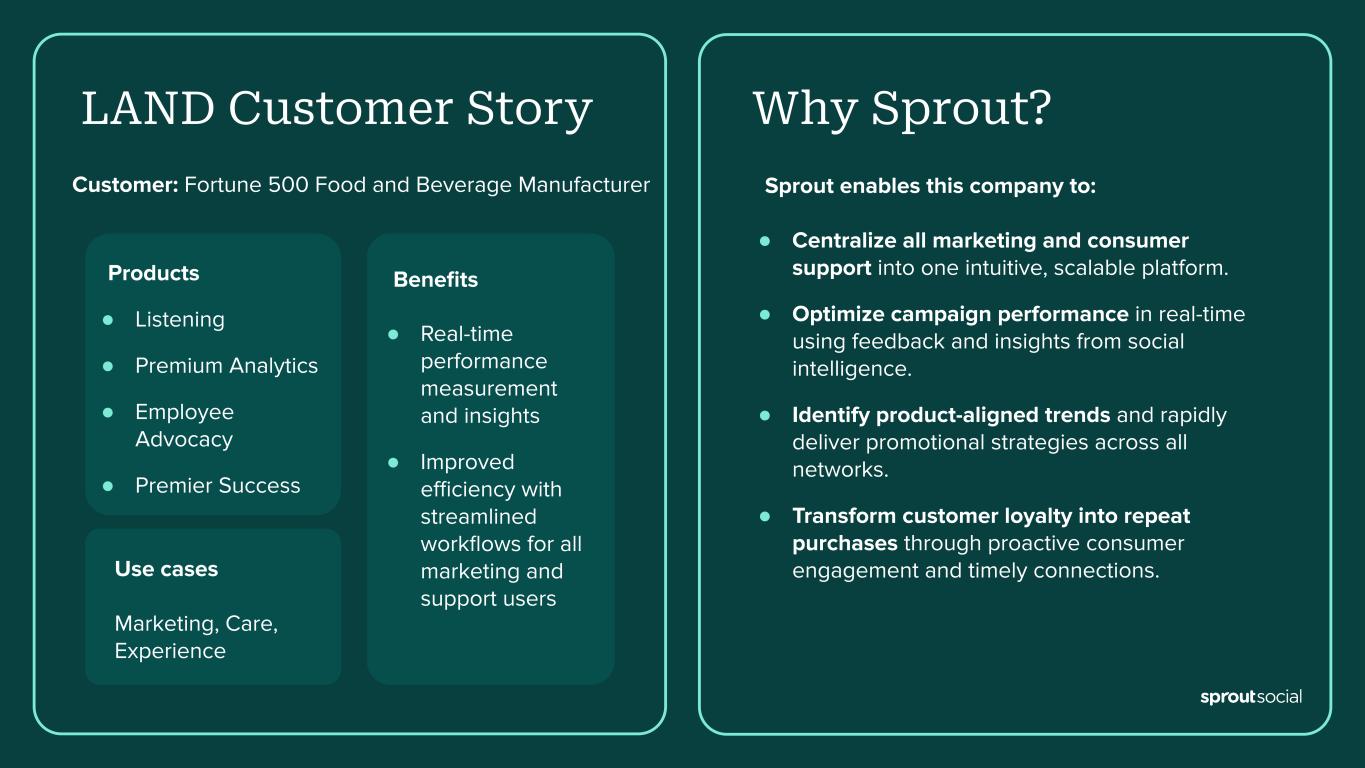

Sprout enables this company to: ● Centralize all marketing and consumer support into one intuitive, scalable platform. ● Optimize campaign performance in real-time using feedback and insights from social intelligence. ● Identify product-aligned trends and rapidly deliver promotional strategies across all networks. ● Transform customer loyalty into repeat purchases through proactive consumer engagement and timely connections. Customer: Fortune 500 Food and Beverage Manufacturer LAND Customer Story Use cases Marketing, Care, Experience Why Sprout? Products ● Listening ● Premium Analytics ● Employee Advocacy ● Premier Success Benefits ● Real-time performance measurement and insights ● Improved efficiency with streamlined workflows for all marketing and support users

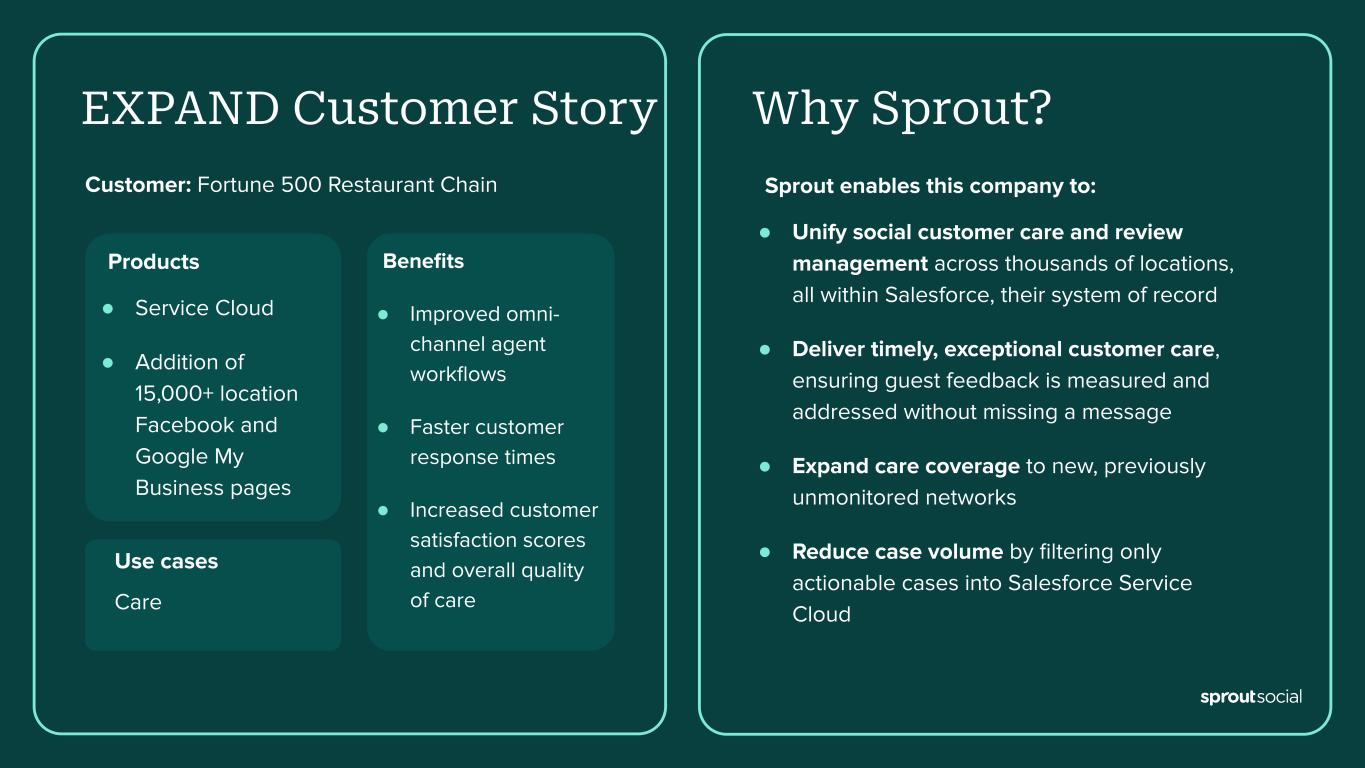

Sprout enables this company to: ● Unify social customer care and review management across thousands of locations, all within Salesforce, their system of record ● Deliver timely, exceptional customer care, ensuring guest feedback is measured and addressed without missing a message ● Expand care coverage to new, previously unmonitored networks ● Reduce case volume by filtering only actionable cases into Salesforce Service Cloud Customer: Fortune 500 Restaurant Chain EXPAND Customer Story Use cases Care Why Sprout? Products ● Service Cloud ● Addition of 15,000+ location Facebook and Google My Business pages Benefits ● Improved omni- channel agent workflows ● Faster customer response times ● Increased customer satisfaction scores and overall quality of care

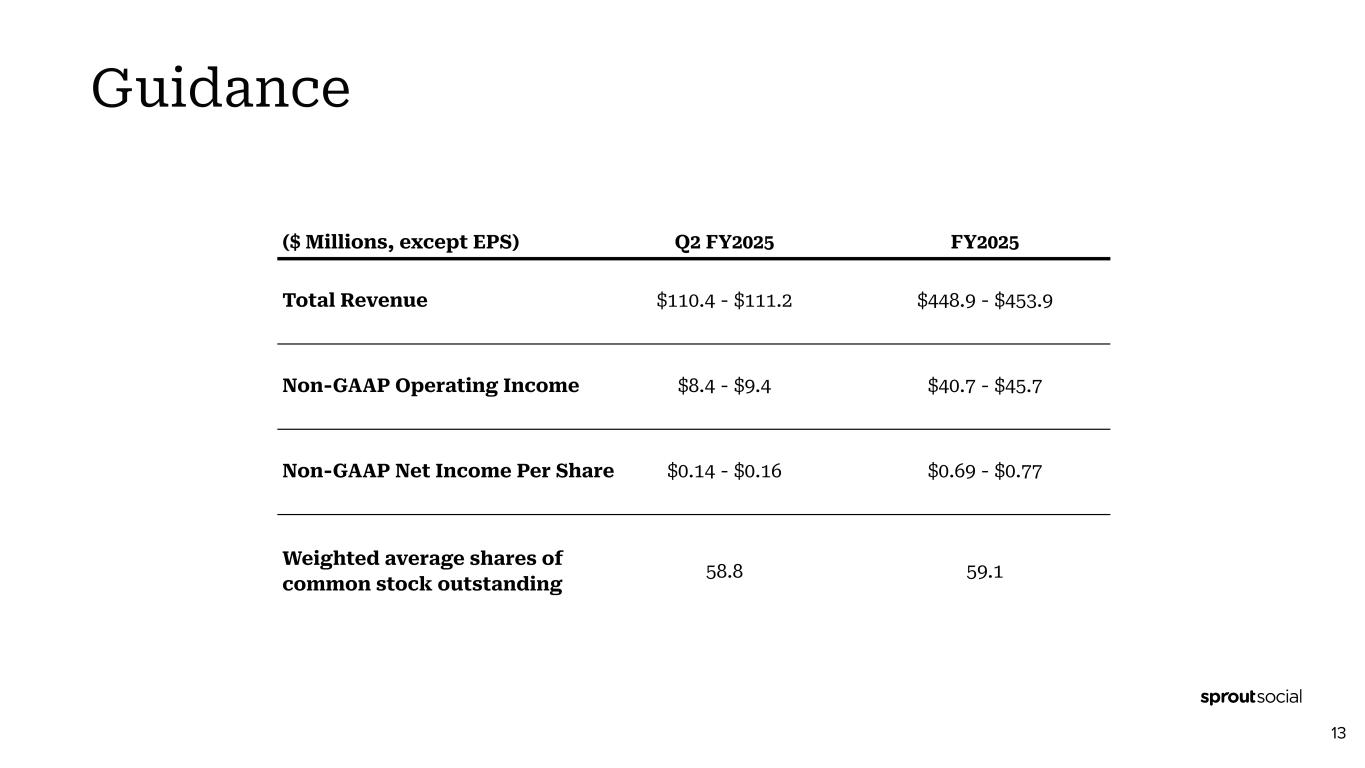

Guidance ($ Millions, except EPS) Q2 FY2025 FY2025 Total Revenue $110.4 - $111.2 $448.9 - $453.9 Non-GAAP Operating Income $8.4 - $9.4 $40.7 - $45.7 Non-GAAP Net Income Per Share $0.14 - $0.16 $0.69 - $0.77 Weighted average shares of common stock outstanding 58.8 59.1 13

Growth Strategy Win The Enterprise Driving increased pipeline creation and strategic logo wins in accounts over >$50K in ARR. Customer Health & Adoption Increasing our focus on customer health and driving improved onboarding and adoption behaviors. Partnerships & Ecosystem Continued partnering with companies like AWS and Salesforce who are able to bring Sprout into larger, strategic accounts. Improved Account Penetration Accessing additional budgets within existing accounts with premium modules and professional services. 14

Empowering businesses to operationalize social Disruptive product led model and fast time to value Recurring SaaS model (99% subscription) Durable moats and barriers to entry Investment Highlights Social system of record, intelligence and action Highly scalable single code base Experienced leadership team Large and rapidly growing TAM 15

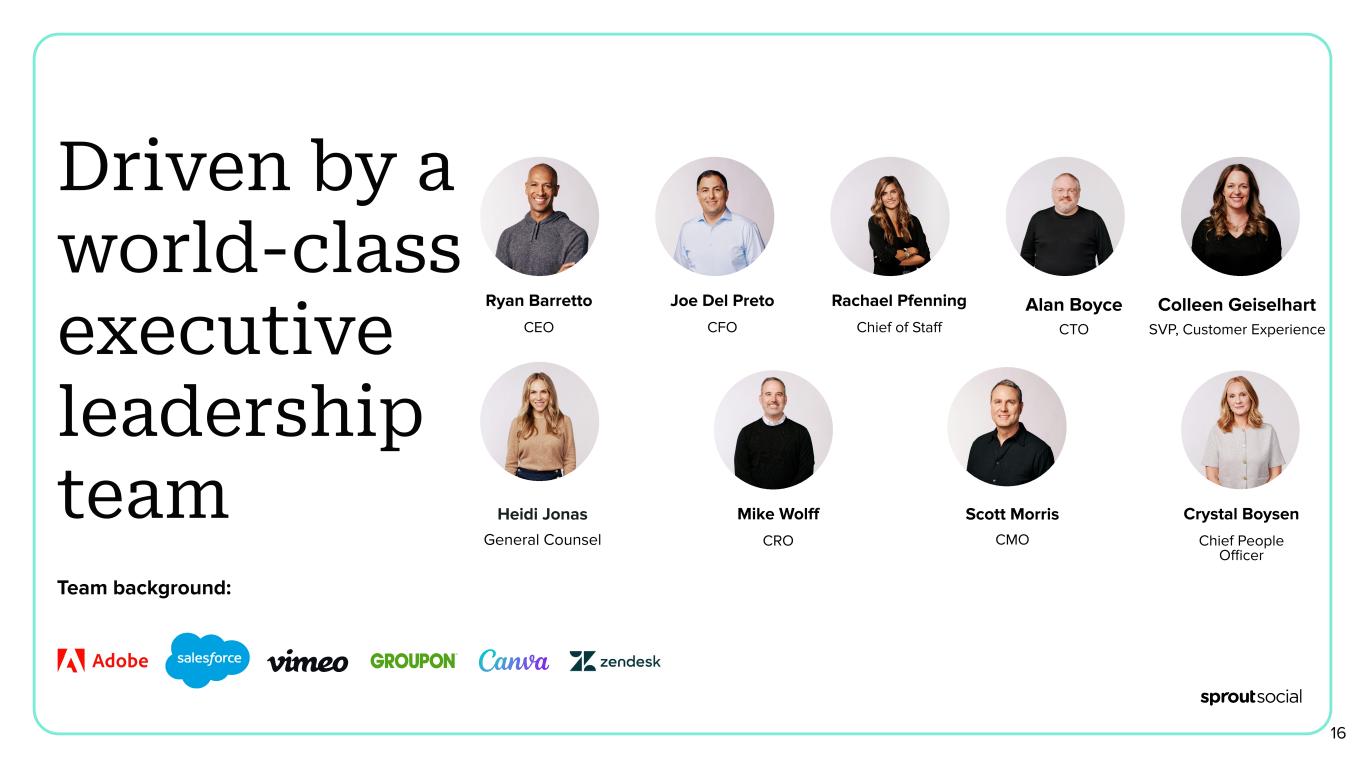

Driven by a world-class executive leadership team Joe Del Preto CFO Mike Wolff CRO Ryan Barretto CEO Rachael Pfenning Chief of Staff Heidi Jonas General Counsel Alan Boyce CTO Team background: Scott Morris CMO Crystal Boysen Chief People Officer 16 Colleen Geiselhart SVP, Customer Experience

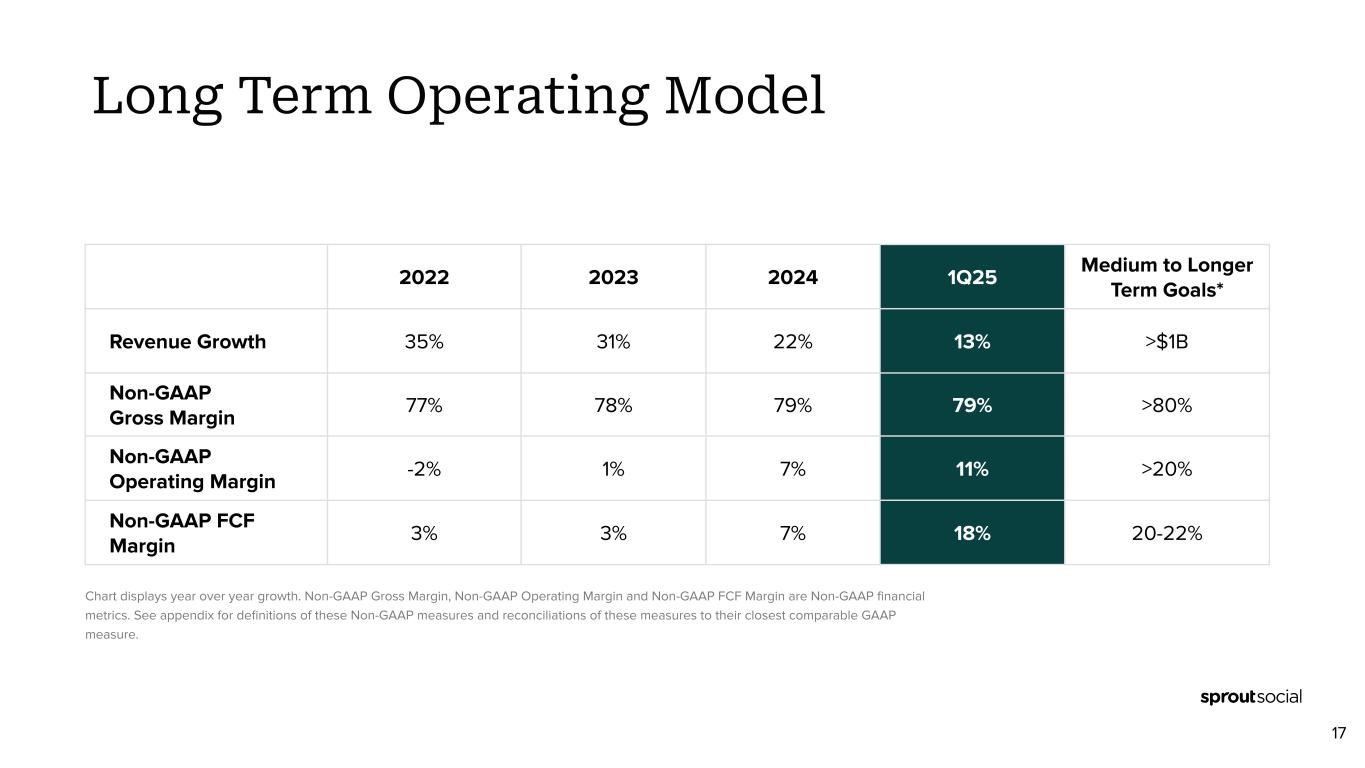

Long Term Operating Model Chart displays year over year growth. Non-GAAP Gross Margin, Non-GAAP Operating Margin and Non-GAAP FCF Margin are Non-GAAP financial metrics. See appendix for definitions of these Non-GAAP measures and reconciliations of these measures to their closest comparable GAAP measure. 2022 2023 2024 1Q25 Medium to Longer Term Goals* Revenue Growth 35% 31% 22% 13% >$1B Non-GAAP Gross Margin 77% 78% 79% 79% >80% Non-GAAP Operating Margin -2% 1% 7% 11% >20% Non-GAAP FCF Margin 3% 3% 7% 18% 20-22% Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/29/2025 17

Corporate Overview 18

Social media has fundamentally transformed the way consumers connect with brands Total Global Social Media Users per Statista, February 2025 With more than consumers using social media 5.24 billion Businesses must adapt or risk becoming irrelevant to nearly half of the world’s population. The ways that business attract, acquire, sell to and service customers is being completely transformed. 19

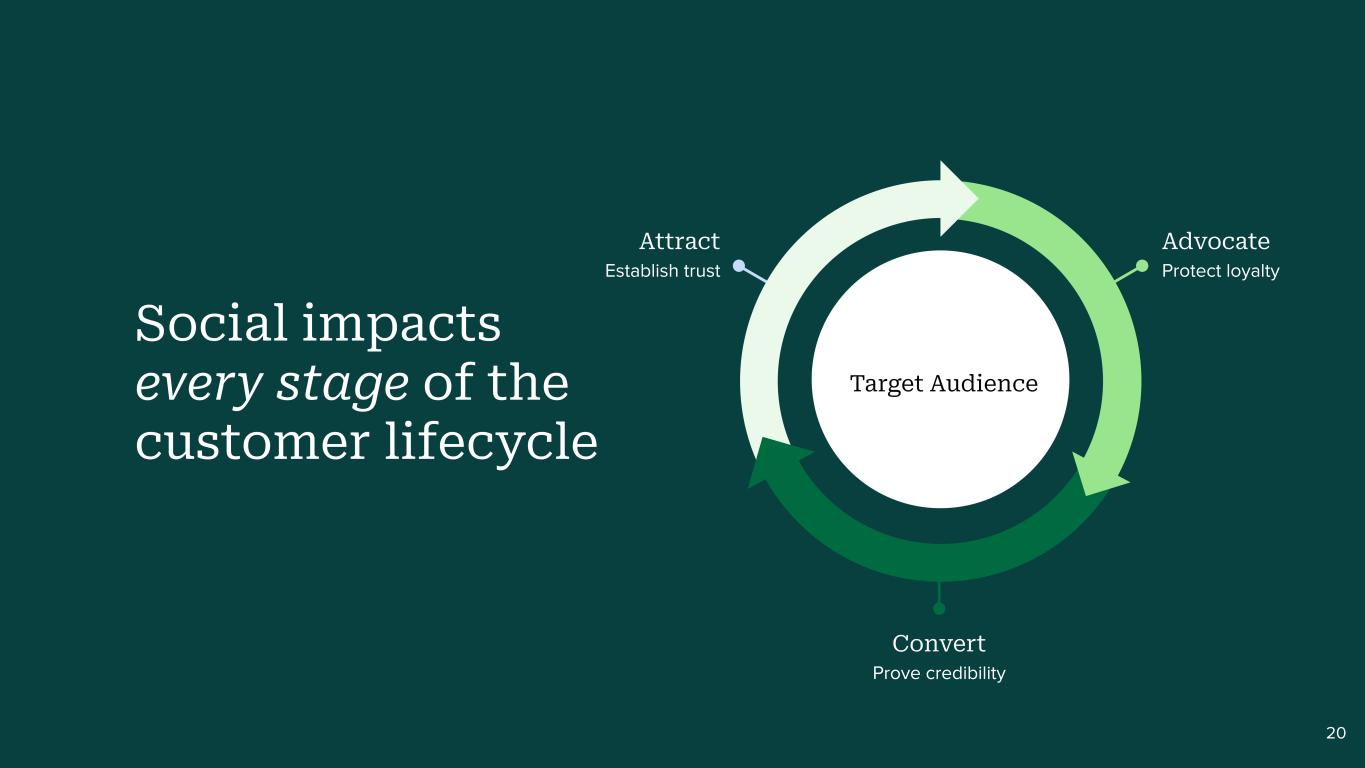

Attract Establish trust Advocate Protect loyalty Convert Prove credibility Target Audience Social impacts every stage of the customer lifecycle 20

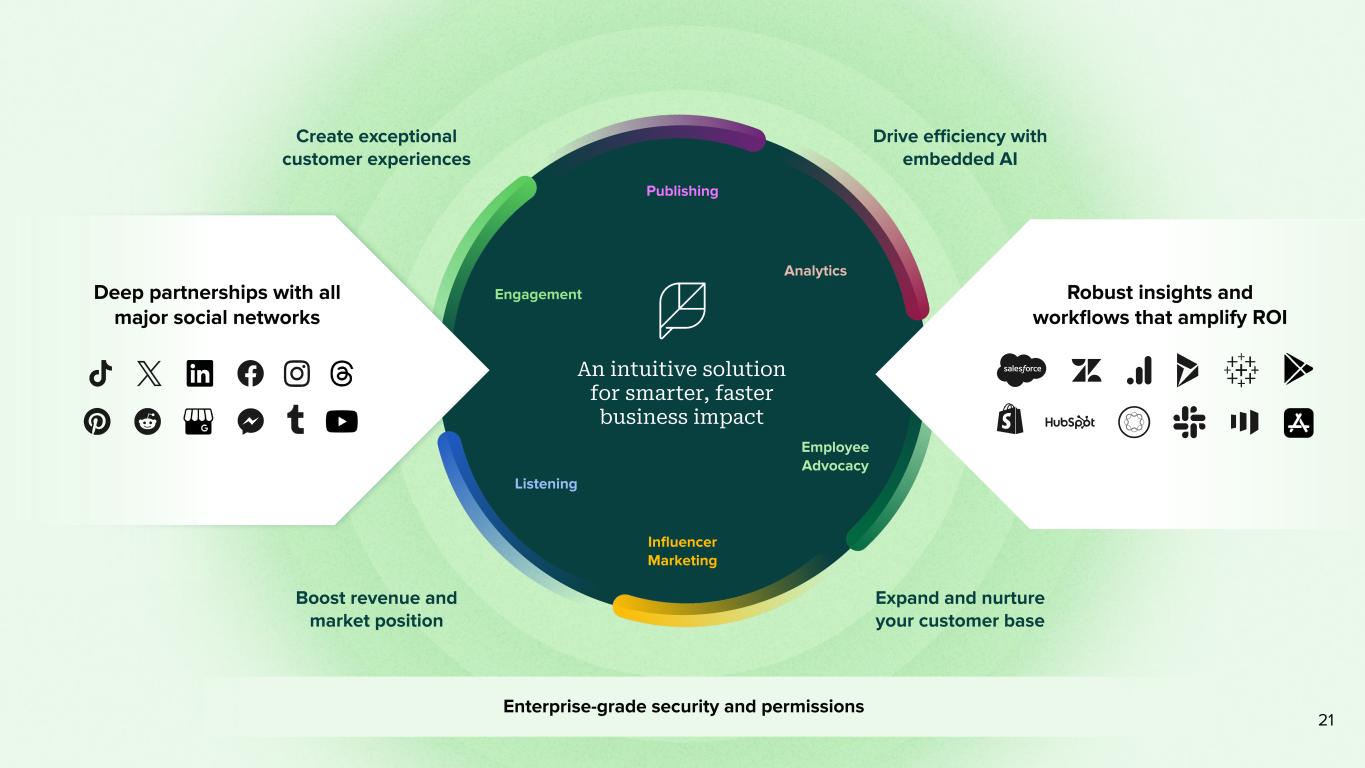

An intuitive solution for smarter, faster business impact Boost revenue and market position Expand and nurture your customer base Create exceptional customer experiences Drive efficiency with embedded AI Deep partnerships with all major social networks Robust insights and workflows that amplify ROI Enterprise-grade security and permissions Listening Employee Advocacy Analytics Engagement Publishing Influencer Marketing 21

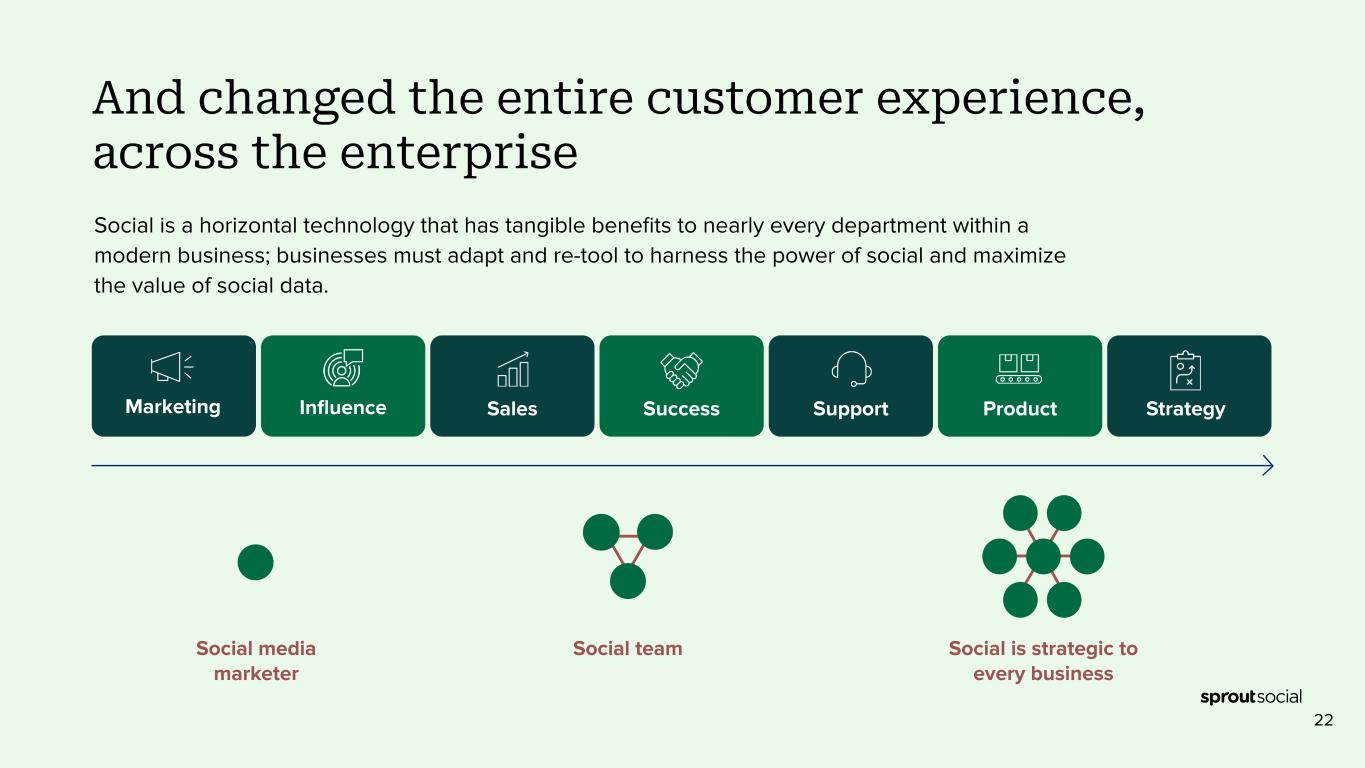

And changed the entire customer experience, across the enterprise Social is a horizontal technology that has tangible benefits to nearly every department within a modern business; businesses must adapt and re-tool to harness the power of social and maximize the value of social data. Social is strategic to every business Social media marketer Social team ProductInfluenceMarketing Sales Success Support Strategy 22

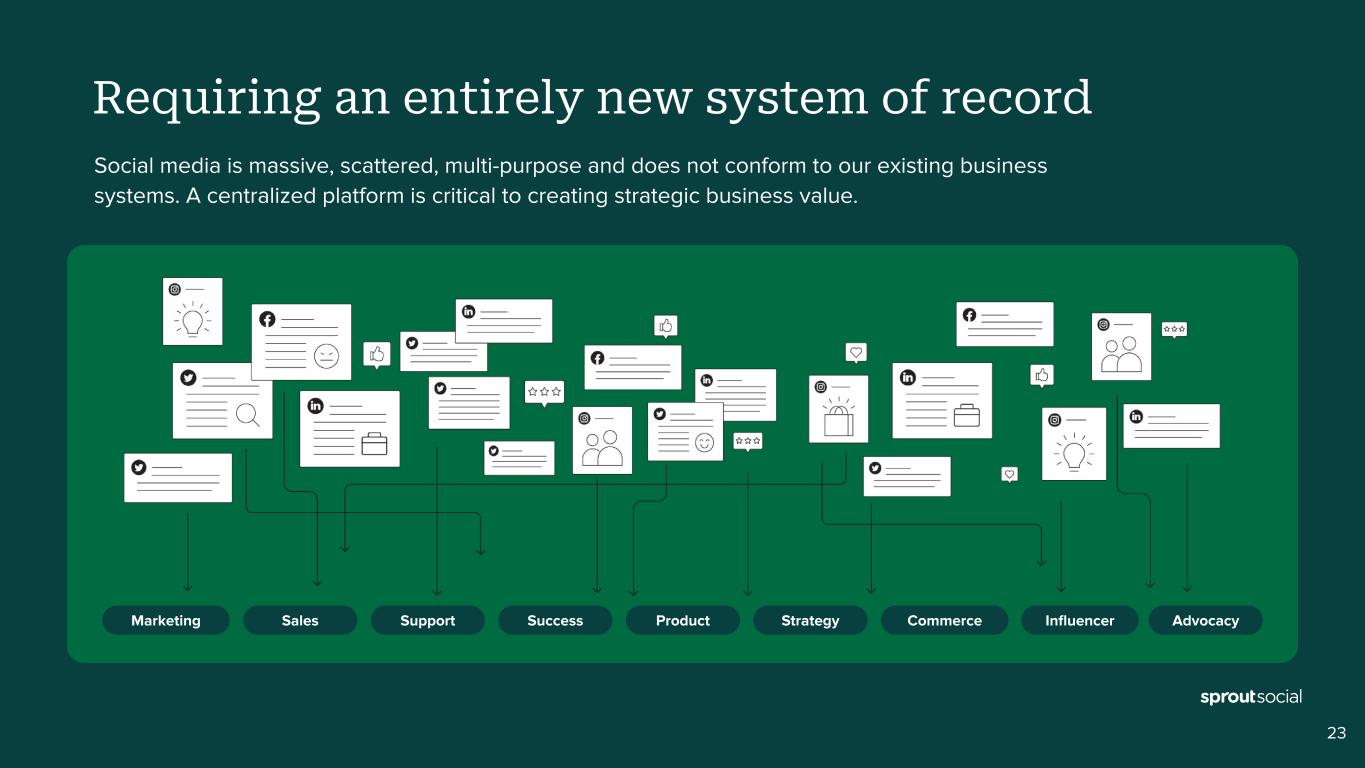

Marketing Sales Support Success Product Strategy Commerce Advocacy Requiring an entirely new system of record Social media is massive, scattered, multi-purpose and does not conform to our existing business systems. A centralized platform is critical to creating strategic business value. Influencer 23

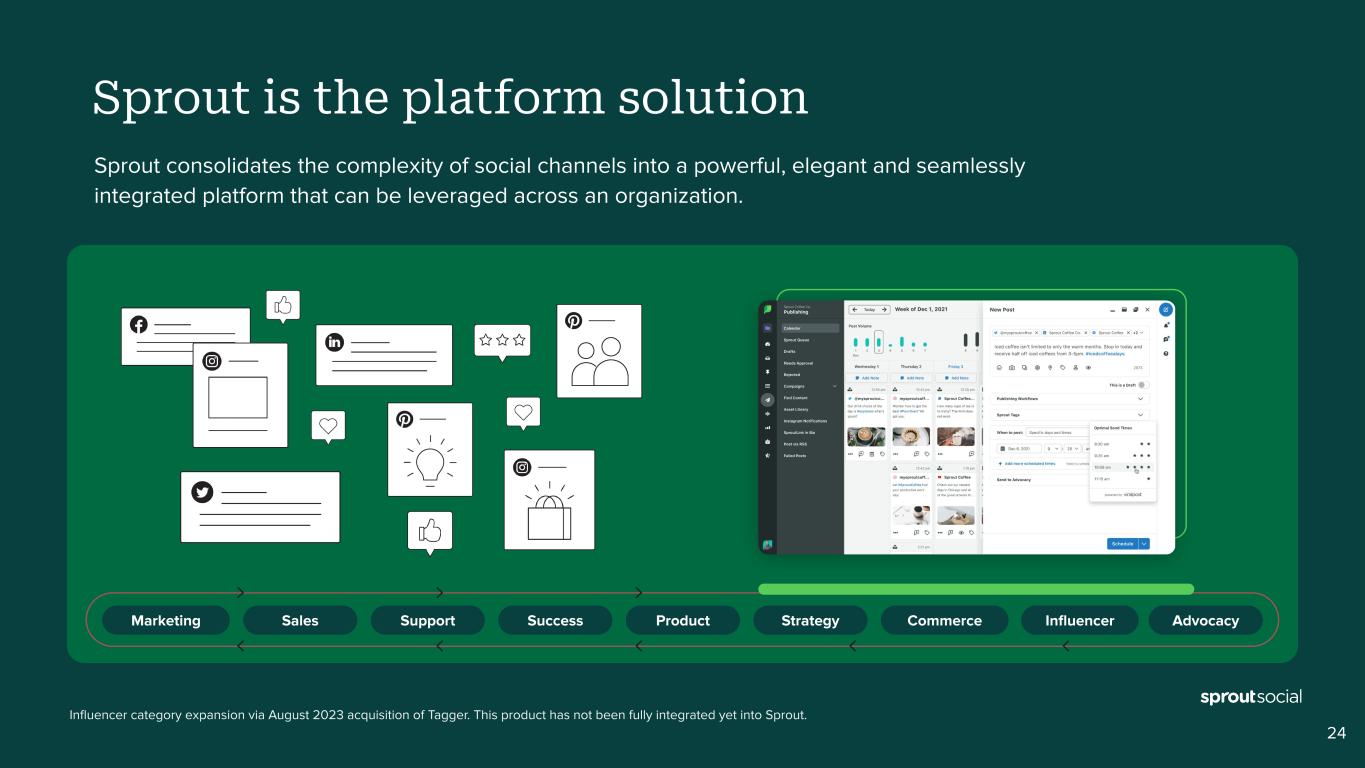

24 Marketing Sales Support Success Product Strategy Commerce Advocacy Sprout is the platform solution Sprout consolidates the complexity of social channels into a powerful, elegant and seamlessly integrated platform that can be leveraged across an organization. Influencer Influencer category expansion via August 2023 acquisition of Tagger. This product has not been fully integrated yet into Sprout.

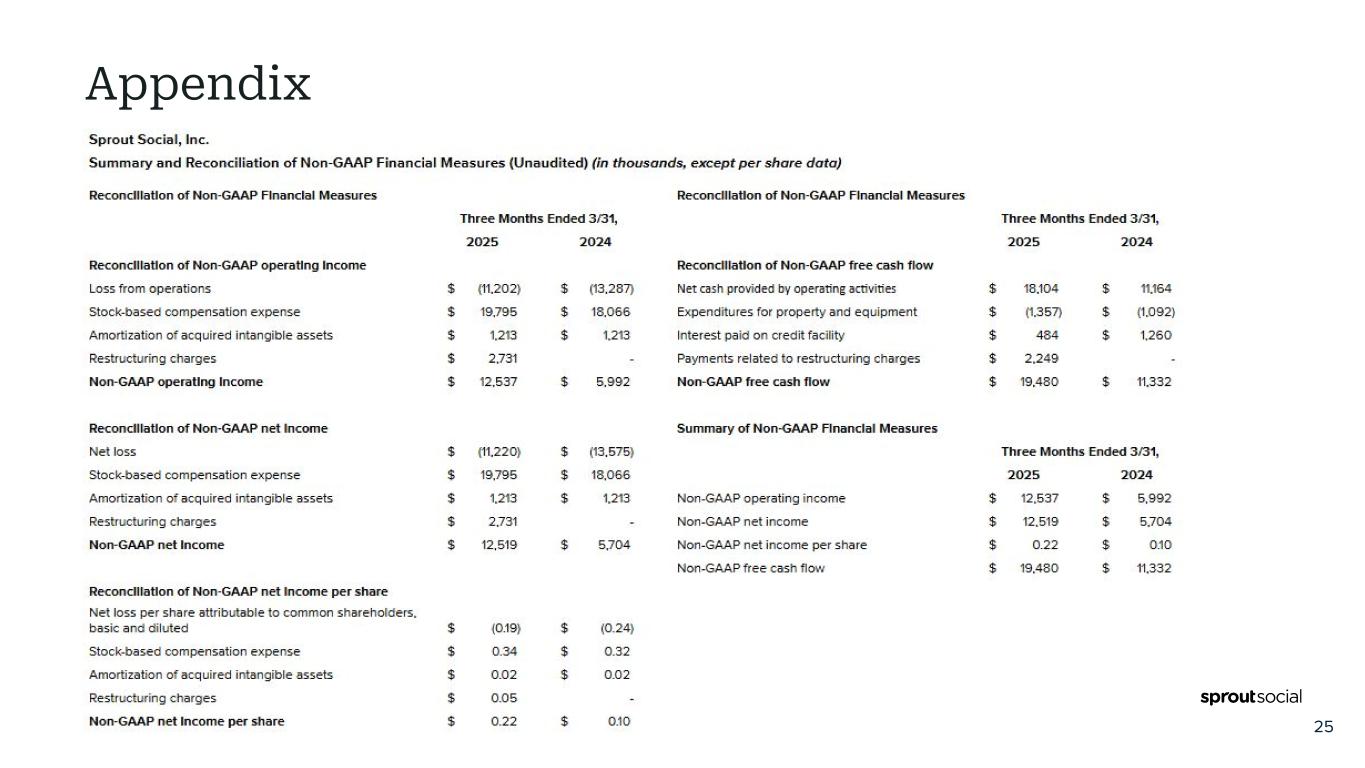

Appendix Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/23/2025 25

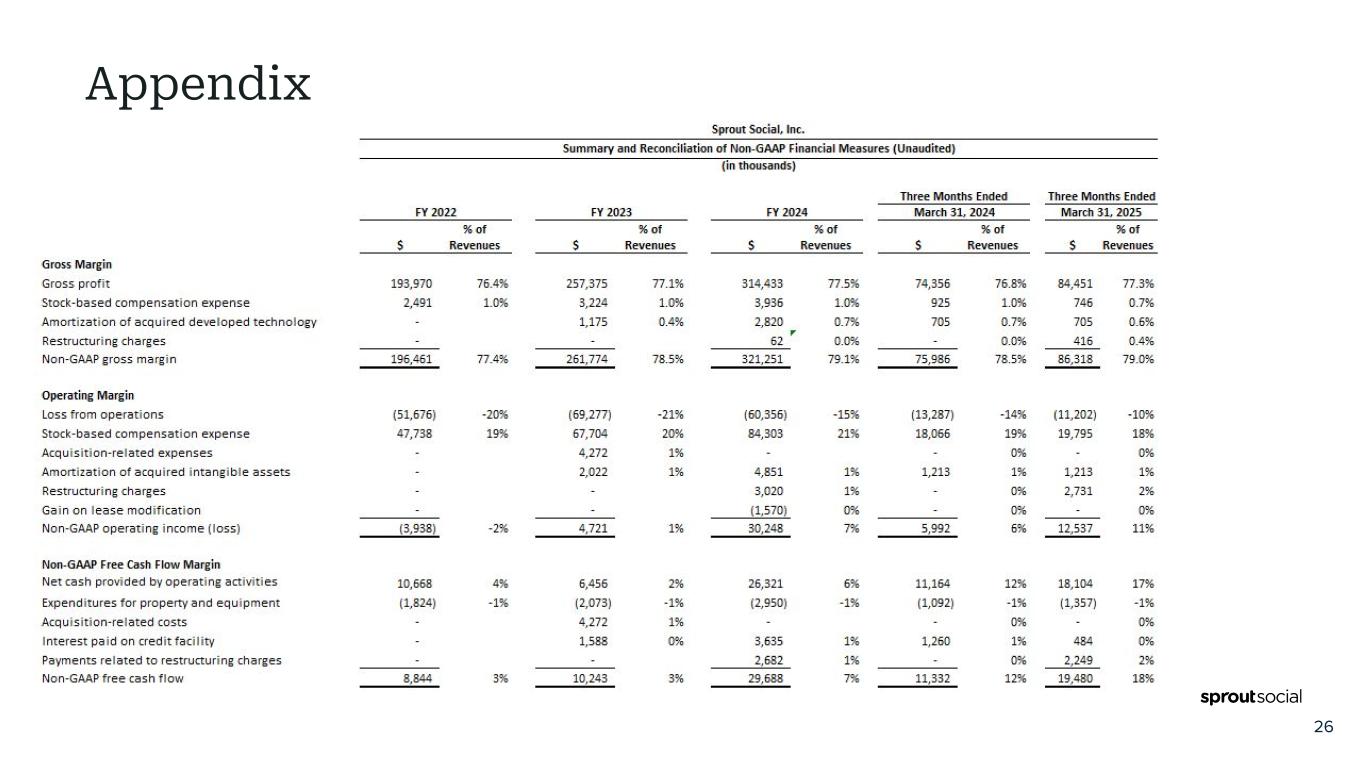

Appendix Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/28/2025 26

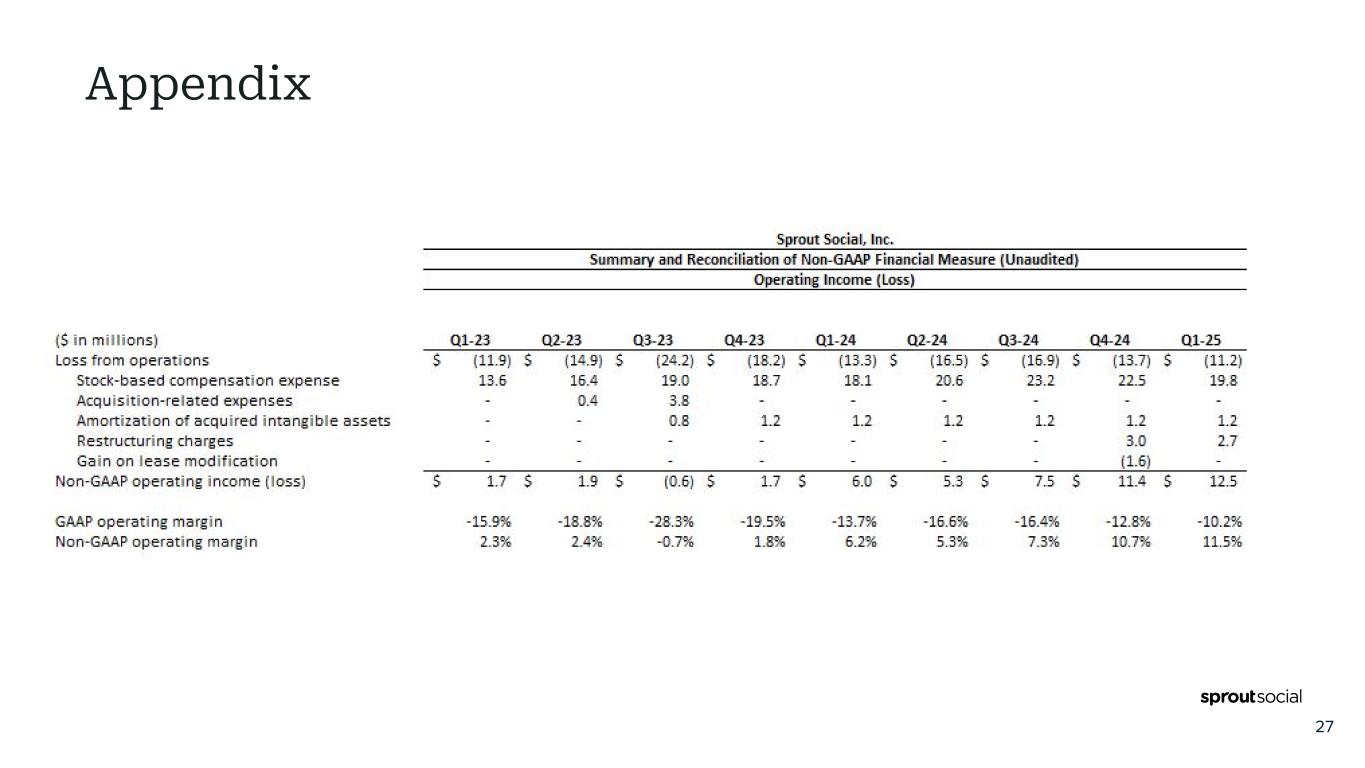

Appendix Fin Reporting Signoff: NAME: Brian Flynn DATE: 4/28/2025 27

Non-GAAP gross profit. We define non-GAAP gross profit as GAAP gross profit, excluding stock-based compensation expense, amortization expense associated with the acquired developed technology from the Tagger Media, Inc. acquisition and restructuring charges. We believe non-GAAP gross profit provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as it eliminates the effect of stock-based compensation, amortization expense and restructuring charges, which are often unrelated to overall operating performance. Non-GAAP gross margin. We define non-GAAP gross margin as non-GAAP gross profit as a percentage of revenue. Non-GAAP operating income (loss). We define non-GAAP operating income (loss) as GAAP loss from operations, excluding stock-based compensation expense, acquisition-related expenses and amortization expense associated with the acquired intangible assets from the Tagger acquisition, restructuring charges and non-cash gains from lease modifications. We believe non-GAAP operating income (loss) provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this non-GAAP financial measure eliminates the effect of stock-based compensation, acquisition-related expenses, amortization expense, restructuring charges and non-cash gains from lease modifications, which are often unrelated to overall operating performance. Non-GAAP operating margin. We define non-GAAP operating margin as non-GAAP operating income (loss) as a percentage of revenue. Non-GAAP net income (loss). We define non-GAAP net income (loss) as GAAP net loss, excluding stock-based compensation expense, acquisition-related expenses, amortization expense associated with the acquired intangible assets from the Tagger acquisition, restructuring charges and non-cash gains from lease modifications. We believe non-GAAP net income (loss) provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this non-GAAP financial measure eliminates the effect of stock-based compensation, acquisition-related expenses, amortization expense and tax expense due to changes in valuation allowances from business acquisitions, restructuring charges and non-cash gains from lease modifications, which are often unrelated to overall operating performance. Non-GAAP net income (loss) per share. We define non-GAAP net income (loss) per share as GAAP net loss per share attributable to common shareholders, basic and diluted, excluding stock-based compensation expense, acquisition-related expenses, amortization expense associated with the acquired intangible assets from the Tagger acquisition, restructuring charges and non-cash gains from lease modifications. We believe non-GAAP net income (loss) per share provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this non-GAAP financial measure eliminates the effect of stock-based compensation, acquisition-related expenses, amortization expense, restructuring charges and non-cash gains from lease modifications, which are often unrelated to overall operating performance. Non-GAAP free cash flow. We define non-GAAP free cash flow as net cash provided by (used in) operating activities less expenditures for property and equipment, acquisition-related costs, interest payments on our revolving credit facility and payments related to restructuring charges. Non-GAAP free cash flow does not reflect our future contractual obligations or represent the total increase or decrease in our cash balance for a given period. We believe non-GAAP free cash flow is a useful indicator of liquidity that provides information to management and investors about the amount of cash provided by our core operations that, after expenditures for property and equipment, acquisition-related costs, interest and payments related to restructuring charges, is available for strategic initiatives. Non-GAAP free cash flow margin (Non-GAAP FCF Margin). We define non-GAAP free cash flow margin as non-GAAP free cash flow as a percentage of revenue. Average Contract Value (ACV). We define ACV as the ending period total ARR divided by the ending period total customer count. Number of customers contributing more than $10,000 in ARR. We define number of customers contributing more than $10,000 in ARR as those on a paid subscription plan that had more than $10,000 in ARR as of a period end. We view the number of customers that contribute more than $10,000 in ARR as a measure of our ability to scale with our customers. We believe this represents potential for future growth, including expanding within our current customer base. Number of customers contributing more than $50,000 in ARR. We define number of customers contributing more than $50,000 in ARR as those on a paid subscription plan that had more than $50,000 in ARR as of a period end. We view the number of customers that contribute more than $50,000 in ARR as a measure of our ability to scale with large customers and attract sophisticated organizations. We believe this represents potential for future growth, including expanding within our current customer base. We calculated our current >$55B Served Addressable Market estimate as follows: (i) utilized data from The US SBA, The US Census Bureau, The OECD and Statista to estimate the total number of businesses in the United States and globally in each of our served market segments (Enterprise, Mid-Market, SMB); (ii) utilized internal data and third party estimates to estimate of the number of such businesses that require a social media management platform (the “Target Businesses”); (iii) calculated the average of our ACV and our estimate of our direct competitors’ ACVs in each segment; and (iv) multiplied the estimated average segment ACVs by the estimated number of Target Businesses in each applicable segment. We calculated our >$120B Total Addressable Market estimate using the methodology above. We then used internal estimates informed by research from the Harris Poll to determine the projected business presence on social media in 2025 that will require a social media management platform, multiplied by our internal projected average segment ACVs in 2025 for Sprout Social and its direct competitors in the applicable segment. Current Penetration of our Served Addressable Market. We estimate the current total revenue of SPT and each of our primary competitors and divide by our current SAM to determine current market penetration. Remaining performance obligations (“RPO”). RPO, or remaining performance obligations, represents contracted revenue that has not yet been recognized, and includes deferred revenue and amounts that will be invoiced and recognized in future periods. Current remaining performance obligations (“cRPO”). cRPO, or current RPO, represents contracted revenue that has not yet been recognized, and includes deferred revenue and amounts that will be invoiced and recognized in the next 12 months. While we no longer believe that ARR and number of customers are key performance indicators of Sprout Social’s business, these metrics are necessary for an understanding of how we define number of customers contributing over $10,000 in ARR and number of customers contributing over $50,000 in ARR. For this purpose, we define ARR as the annualized revenue run-rate of subscription agreements from all customers as of the last date of the specified period and we define a customer as a unique account, multiple accounts containing a common non-personal email domain, or multiple accounts governed by a single agreement or entity. Appendix 28