EXECUTION VERSION DATED 2025 THE PERSONS NAMED IN SCHEDULE 1 SPROUT SOCIAL LIMITED __________________________________________ SHARE PURCHASE AGREEMENT __________________________________________

TABLE OF CONTENTS 1. DEFINITIONS AND INTERPRETATION 1 2. SALE AND PURCHASE 15 3. CONSIDERATION 16 4. ADJUSTMENT OF CONSIDERATION 17 5. COMPLETION 18 6. WARRANTIES 19 7. W&I INSURANCE POLICY 21 8. LIMITATIONS ON THE SELLERS’ LIABILITY 21 9. PAYMENTS UNDER THIS AGREEMENT 21 10. USE OF CONFIDENTIAL INFORMATION BY SELLERS 22 11. FURTHER UNDERTAKINGS BY COVENANTORS 22 12. SELLERS’ OBLIGATIONS PRIOR TO REGISTRATION OF STOCK TRANSFER FORMS 23 13. WAIVER OF CLAIMS 24 14. GENERAL 24 SCHEDULE 1 33 THE SELLERS AND THE SHARES 33 SCHEDULE 2 40 INFORMATION CONCERNING THE GROUP 40 Part 1 : The Company 40 Part 2 : The Subsidiaries 47 SCHEDULE 3 50 COMPLETION ARRANGEMENTS 50 Part 1 : Sellers’ Obligations 50 Part 2 : Buyer’s Obligations 54 SCHEDULE 4 55 COMPLETION ACCOUNTS 55 Part 1 : Definitions 55 Part 2 : Preparation of Completion Accounts 56 Part 3 : Completion Accounts Principles 58 Part 4 : Sample Working Capital Exhibit 60 SCHEDULE 5 61 WARRANTIES 61 Part 1 : General Warranties 61 Part 2 : Tax Warranties 93 SCHEDULE 6 96 LIMITATIONS ON LIABILITY 96 SCHEDULE 7 101 COMPANY AI 101 SCHEDULE 8 102 DISCLOSURE SCHEDULE 102 SCHEDULE 9 103 LIST OF TERRITORIES 103

AGREED FORM DOCUMENTS 1. Letters of resignation from directors and company secretary of the relevant Group Companies 1. Dunport Pay-Off Letter 2. Deeds of release in respect of all security whatsoever created by any Group Company in relation to the Dunport Debt 3. Tax Deed 4. Put and Call Option Agreement 5. Harbert Warrant Deed of Cancellation

THIS AGREEMENT is made on 2025 BETWEEN: (1) THE PERSONS NAMED IN Schedule 1 (the “Sellers”); and (2) SPROUT SOCIAL LIMITED, a company incorporated under the laws of Ireland with company registration number 551726 and its registered office at Block A, George’s Quay Plaza, George’s Quay, Dublin 2, Dublin, Ireland (the “Buyer”). BACKGROUND: (A) Subject to Clause 2.1, the Sellers are the legal and/or beneficial owners of the Shares (which comprise the Sale Shares and the Option Shares), as set out in Schedule 1. (B) The ESOP Holders are the beneficial owners of the Shares of which the Nominee is the legal owner as set out opposite the name of the Nominee in Schedule 1. (C) The Sellers have agreed to sell and the Buyer has agreed to purchase the Shares on the terms and subject to the conditions of this Agreement. The sale and purchase of the Sale Shares will take place on Completion in accordance with the terms of this Agreement, with the sale and purchase of the Option Shares taking place during the two-year period following Completion pursuant to the Put and Call Option Agreement. (D) The Shares represent the entire issued share capital of the Company. IT IS AGREED as follows: 1. DEFINITIONS AND INTERPRETATION 1.1 Definitions Unless otherwise specified, in this Agreement: “2002 Act” means the Competition Act 2002; “Actions” has the meaning given to that term in Part 1 of Schedule 5; “Affiliate” means, in relation to any party, any subsidiary or holding company of that party, and any subsidiary of such holding company, in each case for the time being; “Agreement” means this agreement and the Schedules; “AI Contracts” has the meaning given to that term in Part 1 of Schedule 5; “AI Inputs” means any and all data, writings, works of authorship, graphics, pictures, recordings, any electronic or other information, text or numerals, audio or visual content, or materials of any nature or description which enable or support the Artificial Intelligence to generate AI Outputs; “AI Outputs” means any and all services, products, data, writings, works of authorship, graphics, pictures, recordings, any electronic or other information, data, text or numerals, audio or visual content, or materials of any nature or description generated, derived or produced by or on behalf of any Group Company from any Artificial Intelligence or AI Inputs; 1

“Approved” means exempt approved by the Revenue Commissioners for the purposes of Section 774 of the TCA and reference to “Approval” shall be construed accordingly; “Artificial Intelligence” means a machine-based system, software, hardware, tool, algorithm or aid that is designed to operate with a degree of autonomy, including but not limited to on a self-improving or generative basis, that can carry out, or was developed with the objective of carrying out, tasks considered to require human intelligence or which would otherwise be performed by a human and that can, for explicit or implicit objectives, generate outputs including but not limited to predictions, recommendations, content or decisions, with limited or no human intervention; “Balance Sheet” means the audited consolidated balance sheet of the Group, comprised in the Financial Statements; “Business” means the business of developing, marketing, licensing, selling, and providing media intelligence and social media analytics software, platforms, and services, including tools, services, and technology used (a) to help organisations monitor and predict how stories, topics, or narratives will spread online; (b) for analysing engagement trends, content virality, and audience behaviour across social and digital media; (c) for public relations, brand monitoring, crisis management, content strategy, influencer tracking, audience analytics, or related communications and marketing, or editorial applications; (d) for developing or applying artificial intelligence, including generative AI, predictive models, or agent-based technologies, in connection with any of the activities described in (a) through (c), including automated monitoring, narrative detection, insight generation, or decision-support tools, and (e) for any other services or solutions that are the same as, or substantially similar to, those provided by the Group as at Completion or which are being developed by the Group as at Completion, including those described at page 18 of the CIM contained at 12.1 of the Data Room; “Business Day” means a day (other than a Saturday or Sunday or public holiday in Ireland and the State of Illinois) on which clearing banks are open for business in Dublin and the State of Illinois; “Business Privacy Policies” means the internal and external policies, procedures, notices and practices adopted by the Group or any Group Company relating to the collection, use, storage, disclosure, transfer and protection of Personal Data; “Buyer’s Group” means the Buyer and each subsidiary for the time being of the Buyer, each holding company of the Buyer and each subsidiary of each such holding company (which, from Completion, will include the Company and the Subsidiaries); “Buyer’s Relief” has the meaning given to that term in the Tax Deed; “Buyer’s Solicitors” means Arthur Cox LLP of Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland; “Cantor Beneficial Owners” means each of the holders of the beneficial interest in the Cantor Shares; “Cantor Sale Shares” means the shares listed in the column entitled ‘No. and Class of Sale Shares’ opposite the Hawksford Nominee’s name in Schedule 1; 2

“Cantor Shares” means the shares listed opposite the Hawksford Nominee’s name in Schedule 1; “Cash” means, as at the Completion Date, the aggregated amount of any cash held by the Group on hand or credited to an account with a bank or other financial institution to which the Group is beneficially entitled, including cheques, deposited into a bank account (which have not cleared at Completion), and cash equivalents (being short-term, highly liquid investments that are readily convertible to known amounts of cash to which the Group is beneficially entitled), all free and clear, less any and all outstanding cheques written against any bank account of the Group. “Cash” shall include any payments made to the Group upon the exercise of any outstanding options, warrants or other convertible securities of the Group immediately prior to Completion (net of all Taxes payable by the Group in respect of such payments) and shall exclude any Restricted Cash; “CGL Guarantee” means the contingent grant liability of €615,959 in favour of EI relating to a R&D Grant for the Company with a liability termination date of 09/03/2027; “CGT Clearance Certificate” has the meaning given to that term in Part 1 of Schedule 3; “Claim” means a claim under the Tax Deed and / or a Warranty Claim; “Claim Notice” means a notice in writing from the Buyer to the Sellers’ Representative and EI of any Claim which sets out the Buyer’s bona fide estimate of the alleged loss (save where such loss is not reasonably capable of estimation at such time); “Coca Cola Development Services Contract” means the contract between The Coca-Cola Company and NewsWhip US Inc. effective as of 1 December 2024 and available in the Data Room at 4.1.39; “Companies Act” means the Companies Act 2014; “Company” means NewsWhip Group Holdings Limited, particulars of which are set out in Part 1 of Schedule 2; “Company AI” has the meaning given to that term in Part 1 of Schedule 5; “Company Owned IP” means any and all Intellectual Property Rights, including Registered IP, that are owned or purported to be owned by the Group or each Group Company; “Company Software” means the software that embodies any Company Owned IP or that is used in the operation, design, development, production, distribution, testing, provision, maintenance or support of any Product, including tools and toolsets developed by or on behalf of the Group; “Competition Authority” includes any relevant government body, agency or court for the purposes of Competition Law; “Competition Law” means the laws of any jurisdiction which governs the conduct of companies or individuals in relation to anti-competitive arrangements or practices, including, but not limited to, cartels, pricing, resale pricing, market sharing, bid-rigging, terms of trading, purchase or supply, joint ventures, dominant or monopoly positions and the control of acquisitions or mergers; 3

“Completion” means completion of the sale and purchase of the Sale Shares in accordance with this Agreement; “Completion Accounts” means: (a) the unaudited consolidated balance sheet of the Group as at the Completion Date; and (b) a statement of the Cash, Debt and Working Capital of the Group as at the Completion Date, prepared and agreed or determined in accordance with the provisions of Schedule 4; “Completion Consideration” has the meaning given to that term in Clause 3.2; “Completion Date” means the date on which Completion takes place being the date of this Agreement; “Confidential Information” means all information not in the public domain used in or otherwise relating to the Business or a Group Company about their respective customers, business, assets, suppliers, counterparties or affairs including information relating to: (a) marketing, customers, sales targets, sales statistics, market share statistics, prices, market research reports and surveys and advertising or other promotional materials; (b) future projects, business development or planning, commercial relationships and negotiations; (c) formulas, designs, specifications, drawings, Know-How, manuals and instructions; or (d) technical or other expertise; “Connected Person” and “Connected” means a person who would be connected with another person for the purposes of Section 220 of the Companies Act if that other person was a director of a company; “Consideration” means the aggregate of the Estimated Consideration as adjusted in accordance with Clause 4.2; “Contract” means any agreement or commitment, whether conditional or unconditional and whether by deed, under hand, oral or otherwise, and any arrangement or understanding; “Core Warranties” means the Warranties contained in paragraphs 1 and 2(a)(i), (ii) and (iii) of Part 1 of Schedule 5 and “Core Warranty” means any of them; “Core Warranty Claim” means a claim for a breach of any one or more of the Core Warranties; “Covenantors” means each of [***] , [***] , [***] , [***] , [***] , [***] , [***] and [***] ; “DAC6” has the meaning given to that term in Part 2 of Schedule 5; 4

“Data Partners” means contractually obligated third-parties, including without limitation, customers, suppliers, contractors and vendors that have access to Personal Information or IT systems; “Data Protection Legislation” has the meaning given to that term in Part 1 of Schedule 5; “Data Room” means the “Project Clover” virtual data site at https://app.idealsvdr.com/project/5/Project_Clover_o4k0n/documents/all maintained by iDeals which has been populated by the Sellers and made available to the Buyer and its advisers for inspection on 23 June 2025, and with the last materials being uploaded by Sellers on 29 July 2025; “DCCS” means the Department of Culture, Communications and Sport or any successor departments in Ireland; “De Minimis Claim” has the meaning given to that term in Schedule 6; “Deal Value” means the aggregate of the Consideration and the Option Consideration; “Debt” means, as at the Completion Date, all payment, borrowing, liability or indebtedness obligations of the Group, including: (a) the Dunport Debt and any fees, break costs or similar ancillary payments required to be made in connection with the repayment of the Dunport Debt and any reasonable fees charged by Dunport’s legal counsel in connection with the repayment of the Dunport Debt and the release of any related security; (b) the W&I Contribution Amount; (c) indebtedness obligations to any bank, credit institution, hedge fund or finance company, including (i) obligations under capitalised leases; (ii) letters of credit, bankers acceptances; (iii) deferred purchase price for property or services; (iv) obligations under interest rate swap, hedging or similar agreements; and (v) other non-trade liabilities; (d) indebtedness obligations to any other person (including any member of the relevant Seller’s Group) provided, however, that Debt shall not include any trade payables incurred in the ordinary course of business or any Intra-Group Payables; (e) deferred revenue relating to the [***] development services contracts; (f) the cost of servicing any long-term (meaning having a term of 12 months or more) deferred revenue, any tax debt warehoused in connection with Covid-19, and the Company’s term debt with Dunport; 5

(g) any fees, costs and expenses payable by any Group Company in connection with the Transaction, including legal, accounting, investment banking, financial advisory and third party fees and expenses; (h) any bonuses, severance payments or change of control payments payable by any Group Company in connection with the Transaction to employees, directors, officers, vendors, suppliers or other service providers, including all Tax payable by any Group Company in connection with such payments (including employer Taxes); (i) any Taxes payable by any Group Company in connection with the cash out of any equity incentive awards where such cost is being borne by the Buyer; (j) [***] in relation to customer overpayments; (k) any accrued and unpaid monitoring fees relating to board members or board observers up to Completion; (l) [***] relating to US sales taxes; (m) any accrued and unpaid staff bonuses relating to performance prior to Completion; (n) any payment due to Harbert in exchange for the cancelation of the Harbert Warrant; (o) [***] in relation to visa related employee bonus payments; and (p) accrued corporation tax to Completion payable by NewsWhip Media Inc. in the US included in the estimated amount of [***] . “Defined Benefit Scheme” has the meaning given to that term by Section 2 of the Pensions Act; “Defined Contribution Scheme” has the meaning given to that term by Section 2 of the Pensions Act; “Disclosure Schedule” means Schedule 8 to this Agreement, which sets out statements qualifying the General Warranties and Tax Warranties by those matters which are Fairly Disclosed in Schedule 8; “Dispute” has the meaning given to it in Clause 14.6; “Dunport” means Dunport Capital Management Designated Activity Company a company incorporated in Ireland with registration number 603001 having its registered office at Riverside One, 37-42 Sir John Rogerson’s Quay, Dublin 2, Ireland; “Dunport Debt” means, as at the Completion Date, the indebtedness obligations in an amount of [***] , owed by the Group to Dunport under or in connection with the senior facility agreement dated 19 May 2025 between, amongst others, NewsWhip Media Limited and Dunport; “EI” means Enterprise Ireland of Eastpoint Business Park, The Plaza, Dublin 3; “EI Core Warranties” means each of the the Warranties contained in paragraphs 1(a)(i) (Power and Authority), 1(b) (Binding Agreements), 2(a)(ii) (Ownership, 2(a)(iii) (No Encumbrance); 6

“EI Core Warranty Claim” means a claim for a breach of any one or more of the EI Core Warranties; “Encumbrance” means any mortgage, charge, pledge, lien, option, restriction, assignment, hypothecation, right of first refusal, right of pre-emption, or right to acquire or restrict, any adverse claim or right or third party right or interest, any other encumbrance or security interest of any kind, and any other type of preferential arrangement (including title transfer and retention arrangements) having a similar effect; “ESOP Exercise Amount” means the amount payable to the Group by the optionholders under the outstanding ESOP options to be exercised immediately prior to Completion; “ESOP Holders” means the beneficial owners of the Shares that are legally owned by the Nominee, as set out in Schedule 1; “ESOP Sale Shares” means the shares listed in the column entitled ‘No. and Class of Sale Shares’ opposite the Nominee’s name in Schedule 1; “ESOP Shares” means the shares listed opposite the Nominee’s name in Schedule 1; “Estimated Cash” means [***] ; “Estimated Debt” means [***] and the USD equivalent of [***] ; “Estimated Consideration” means an amount equal to the sum of: (a) USD55,000,000 (fifty five million US dollars); (b) plus the Estimated Cash; (c) less the Estimated Debt; (d) plus the amount by which the Estimated Working Capital exceeds the Target Working Capital or less the amount by which the Target Working Capital exceeds the Estimated Working Capital, as applicable; “Estimated Working Capital ” means [***] ; “Fairly Disclosed” means facts, matters or other information fairly and accurately disclosed in the Disclosure Schedule in such a manner and with sufficient detail to enable a prudent buyer to identify the nature and extent of the matter disclosed and to make an informed assessment of the fact, matter or information concerned; “Financial Statements” means the audited Balance Sheet and audited consolidated profit and loss account of the Group as at the Last Financial Year End Date together with the related cashflow statements, directors’ reports and statutory auditors’ reports and includes all other consolidated statements, notes and other documents attached to the foregoing and forming part of them in accordance with any legal requirement or otherwise; “General Warranties” means all of the Warranties other than the Core Warranties and the Tax Warranties and “General Warranty” means any of them; 7

“Group” means the Company and each Subsidiary together with any other subsidiaries of the Company and the term “Group Company” means any one of them; “Holdback Amount” means an amount equal to [***] ; “Harbert” means Harbert European Growth Capital Fund II SCSp of 5, Rue Guillane Kroll, L- 1882 Luxembourg; “Harbert Warrant” means the warrant instrument dated 18 January 2023 between (1) Harbert and (2) the Company; “Harmful Code” means any “back door,” “drop dead device,” “time bomb,” “horse,” “virus,” “malware,” or “worm” (as such terms are commonly understood in the software industry) or any other code, computer instructions or techniques, software routines, or hardware components designed or intended to have, or capable of performing, any of the following functions: (A) disrupting, disabling, harming or otherwise impeding in any manner the operation of, or permitting or causing unauthorized access to, an IT system, network, or other device or any information contained thereon or processed thereby; or (B) damaging or destroying any data or file in an unauthorized manner; “Hawksford Nominee” means Hawksford Nominees Ireland Limited of Block A, 5th Floor, The Atrium, Blackthorn Road, Sandyford, Dublin 18, who holds the legal interest in the Cantor Shares; “Information Technology” means all material computer systems, communication systems, software, hardware and other related technology used, owned by or licensed to any Group Company in connection with the operation of the Business; “Institutional Investors” means each of Hawksford, Tribal Nominees and AIB Seed Capital Fund Limited Partnership; “Intellectual Property” or “IP” means patents (including supplementary protection certificates and the right to claim priority), trademarks, service marks, registered designs, utility models, design rights, topography rights, copyrights (including copyright in computer programs), database rights, inventions, Know-How, Confidential Information, business or trade names, get-up, domain names, and all other IP and neighbouring rights and rights of a similar or corresponding character (including all associated goodwill), enforceable anywhere in the world (whether or not the same are registered or capable of registration) and all applications for, or for the protection of, any of the foregoing; “Intellectual Property Rights” or “IP Rights” means all Intellectual Property used, or required to be used, by any Group Company in, or in connection with, the Business; “Intra-Group Payables” means all outstanding payables and receivables between any Group Company and another Group Company as at the Completion Date; “Irish Tax Reference Number” means an activated Tax Reference Number for the purposes of the Stamp Duty (E-stamping of Instruments and Self-Assessment) Regulations 2012; “Know-How” means all information and techniques (not publicly known) owned by a Group Company or used, by a Group Company in, or in connection with, the 8

Business, held in any form (including paper, electronically stored data, magnetic media, film and microfilm) including that comprised in or derived from drawings, data, reports, project reports, formulae, specifications, testing procedures, test results, component lists, instructions, manuals, brochures, catalogues and process descriptions, market forecasts, lists and particulars of customers and suppliers; “Last Financial Year End Date” means 31 December 2024; “Licensed Intellectual Property” has the meaning given to that term in Part 1 of Schedule 5; “Losses” means any debts, obligations and other liabilities (whether absolute or contingent, liquidated or unliquidated, due or to become due, accrued or not accrued), losses (save for indirect or consequential loss), damages, Taxes, deficiencies, judgments, assessments, fines, fees, penalties, reasonable and properly incurred out of pocket expenses (including external amounts paid in settlement, interest, court costs, reasonable and properly incurred costs of investigators, reasonable and properly incurred fees and expenses of attorneys, accountants, financial advisors, consultants and other experts, and other reasonable and properly incurred expenses of litigation), in each case that may be imposed or otherwise incurred or suffered; “Management Accounts” means the unaudited consolidated profit and loss account and consolidated balance sheet and cashflow statement of the Group for each month beginning on the next day following the Last Financial Year End Date and ended on 30 June 2025, a copy of which are contained at folder 1.2.10 of the Data Room; “Material Contract” means: (a) the 20 Contracts between the Group and a customer having the highest revenue for the Group in either of the year ended on the Last Financial Year End Date or the period of the Management Accounts; and (b) the 10 Contracts between the Group and a supplier having the highest expenditure for the Group in either of the year ended on the Last Financial Year End Date or the period of the Management Accounts; and (c) all contracts between the Group and the following suppliers: Meta, Youtube, Linkedin and OpenAI; “NDRC” means NDRC Investment DAC (company registration number 681879) acting on trust and on behalf of DCCS with a registered office at unit 1, the CHQ Building, Custom House Quay, Dublin 1 D01 Y6H7; “NDRC Core Warranties” means each of the Core Warranties save for the Warranties contained in Paragraph 2(a)(ii); “Nominee” means NewsWhip Nominees Limited; “NDRC Sale Shares” means the [***] Ordinary Shares of [***] each in the Company held by NDRC on trust for and on behalf of DCCS; “NDRC Shares” means [***] Ordinary Shares of [***] each and [***] E Ordinary Shares of [***] each and [***] F Ordinary Shares each held by NDRC on trust for and on behalf of the DCCS; “Option Consideration” means the consideration payable for the Option Shares as determined in accordance with the Put and Call Option Agreement; 9

“Option Shares” means the shares listed in the fifth column in Schedule 1; “Party” means any party to this Agreement; “Pension Scheme” means the Newswhip Media Limited section of the master trust defined contribution occupational pension scheme known as the Zurich Master Trust pursuant to participation agreement dated 21 July 2023; “Pensions Act” means the Pensions Act 1990 to 2018 (as amended) and any statutory modification or re-enactment thereof for the time being in force and any statutory regulations made thereunder and the European Union (Occupational Pension Schemes) Regulations 2021; “Personal Data”, “Processing”, “Data Subject” and “Personal Data Breach” have the meanings given to those terms in the Data Protection Legislation; “Personal Information” means any and all information that (i) identifies, relates to, describes, is capable of being associated with, or could reasonably be linked, directly or indirectly, with a particular individual, or (ii) any other information defined as “personal data,” “personally identifiable information,” “personal information,” or similar designation under applicable Legal Requirements; “Planning Acts” means the Local Government (Planning and Development) Acts 1963 to 1999, the Planning and Development Acts 2000 to 2023, the Building Bye-Laws, the Building Control Acts 1990 to 2020 (the “Building Control Acts”) and all regulations made under the Building Control Acts including the Building Control Regulations 1997 to 2021 and the Building Regulations 1997 to 2022; “Policies” has the meaning given to that term in Part 1 of Schedule 5; “Prior Scheme” means the Newswhip Media Limited Group Pension Scheme with Pensions Authority Number PB349792 and Revenue approval number SF103166; “Privacy and Security Requirements” means material compliance with (A) applicable Information Privacy and Security Laws, (B) all contractual obligations concerning privacy, data protection or information security matters in contracts to which each Group Company is a party, and where such privacy obligations are required, (C) all industry standards with which each Group Company purports to or is otherwise required to comply (D) all requirements of self-regulatory organizations or certifications to which each Group Company belongs or that apply to each Group Company, and (E) all Business Privacy Policies, in each case as amended from time to time; “Pro Rata Portion” means the percentage set out opposite that Seller’s name in the final column of the table in Schedule 1 as may be adjusted to reflect any post-Completion adjustment to the Consideration as provided for in this Agreement or the Put and Call Option Agreement; “Proceedings” has the meaning given to that term in Clause 14.7; “Put and Call Option Agreement” means the put and call option agreement in the Agreed Form in respect of the Option Shares to be entered into between the Sellers and the Buyer on Completion; “PRSA” has the meaning given to it in Section 91 of the Pensions Act; 10

“R&D Tax Credits” means the research and development tax credits which are calculated by reference to qualifying expenditure incurred by any Group Company on qualifying research and development activities prior to the date of this Agreement and which are due to be paid to any Group Company after the date of this Agreement; “Restricted Cash” means all cash held by the Group that has not been spent or is not freely usable because such cash is subject to restrictions or limitations on use or dividend, or Taxes imposed on dividends thereof which shall include any cash held by the Group; “Restricted Person” means a person or entity that is (i) listed or referred to on, or owned or controlled (directly or indirectly) by a person or entity listed or referred to on, or acting on behalf of a person or entity listed or referred to on, any Sanctions List; (ii) resident in, incorporated under the laws of, or acting on behalf of a person or entity resident in or organised under the laws of, any country or territory that is the target of and/or subject to any comprehensive country- or territory-wide Sanctions (being, as at the date of this agreement, Crimea, Cuba, Iran, North Korea and Syria); or (iii) otherwise a target of Sanctions; “Revenue Commissioners” means Irish Revenue Commissioners; “Sale Shares” means the Shares other than the Option Shares; “Sanctions” means the economic, financial and trade embargoes and sanctions laws, regulations, rules, export controls and/or restrictive measures administered, enacted or enforced by any Sanctions Authority (in all cases, from time to time in effect); “Sanctions Authority” means the (i) United Nations (including the United Nations Security Council), the United States, the European Union, any Member State of the European Union and the United Kingdom; and (ii) the respective governmental, judicial, public or regulatory agencies, authorities or bodies of any of the foregoing, including, the Office of Foreign Assets Control of the U.S. Department of the Treasury, the United States Department of State, the European Commission and the Office of Financial Sanctions Implementation of Her Majesty’s Treasury; “SDCA” means the Stamp Duties Consolidation Act 1999; “Sellers’ Representative” has the meaning given to that term in Clause 14.14(a); “Sellers’ Solicitors” means Philip Lee LLP of Connaught House, One Burlington Road, Dublin 4, Ireland; “Seller’s Group” means each Seller (being a company) and each subsidiary for the time being of such Seller, each holding company of such Seller and each subsidiary of each such holding company, excluding any Group Company; “Shares” means the entire issued share capital of the Company further particulars of which are set out in Schedule 1 and which are to be purchased by the Buyer under the terms of this Agreement; “Shareholders’ Agreement” means the amended and restated shareholders’ agreement entered in to by the Company and the Sellers dated 18 January 2023; “Subsidiary” means a subsidiary of the Company listed in Part 2 of Schedule 2 and “Subsidiaries” means all those Subsidiaries; “Target Working Capital” means [***] ; 11

“Tax” and “Taxation” have the meaning given to those terms in the Tax Deed; “Tax Authority” and “Taxation Authority” means, in Ireland, the Revenue Commissioners, and any other local, municipal, governmental, state, federal or other fiscal authority or body anywhere in the world responsible for the collection or management of any Tax; “Tax Claim” means a claim under the Tax Deed; “Tax Deed” means the deed of tax covenant in the Agreed Form between the Sellers and the Buyer; “Tax Documents” has the meaning given to that term in Part 2 of Schedule 5; “Tax Warranties” means the warranties contained in Part 2 of Schedule 5; “Tax Warranty Claim” means a claim for a breach of any one or more of the Tax Warranties; “TCA” means Taxes Consolidation Act 1997 (as amended); “Territory” means the countries in which the Group is carrying on business as at Completion as listed in Schedule 9; “Threshold” has the meaning given to that term in Schedule 6; “Transaction Documents” means this Agreement and the appended Disclosure Schedules, the Tax Deed, the Put and Call Option Agreement and all other documents for delivery by the Sellers at Completion specified in Schedule 3 as being in the Agreed Form; “Treaty” has the meaning given to that term in Part 1 of Schedule 5; “Tribal Nominee” means Tribal Ventures Nominees Limited of 23 South William Street, Dublin 2, Dublin, Ireland, who holds the legal interest in the Tribal Shares; “Tribal Beneficial Owners” means each of the holders of the beneficial interest in the Tribal Shares; “Tribal Sale Shares” means the shares listed in the column entitled ‘No. and Class of Sale Shares’ opposite the Tribal Nominee’s name in Schedule 1; “Tribal Shares” means the shares listed opposite Tribal Nominee’s name in Schedule 1; “True-Up Date” means the date that is five Business Days after the date on which the Cash, Debt and Working Capital are agreed between the Buyer and the Sellers’ Representative or otherwise determined in accordance with the provisions of Schedule 4; “Uninsured Risk Claim” means a claim for breach of Warranty or pursuant to the Tax Deed that is not covered by the W&I Insurance Policy; “USD” or “US dollars” means the lawful currency of the United States of America; “VAT” means Value Added Tax; 12

“VATCA” means Value Added Tax Consolidation Act 2010; “W&I Contribution Amount” means [***] , being an amount equal to 50% of the total costs payable (which shall include the premium and any fees due to the broker) in respect of the W&I Insurance Policy; “W&I Insurance Policy” means the insurance policy in the name and in favour of the Buyer; “W&I Policy Extract” means a copy of the sections of the W&I Insurance Policy relating to subrogation and the no claims declaration; “Warranties” means the warranties contained in Schedule 5 and “Warranty” means any of them; “Warrantors” means each of [***] and [***]; “Warranty Claim” means a claim by the Buyer for a breach of Warranty; “Waste” has the meaning given to that term in the Waste Management Act 1996 and Directive 2008/98/EC on waste; “Working Capital” means, as at the Completion Date, the current assets of the Group (excluding Cash) less the current liabilities of the Group (excluding Debt) and for the avoidance of doubt shall exclude the R&D Tax Credits; and “Working Hours” means 9.00 am to 5.00 pm on a Business Day. 1.2 Interpretation Unless otherwise specified, in this Agreement: (a) a document in the “Agreed Form” is a reference to a document in a form agreed by or on behalf of the Parties; (b) where a Party is required to use “all reasonable endeavours” that Party should explore all avenues reasonably open to it, and explore them all to the extent reasonable, but the Party is neither obliged to disregard its own commercial interests, nor required to continue trying to comply if it is clear that all further efforts would be futile; (c) a reference to: (i) a “Party” includes its personal representatives, successors in title and permitted assigns; (ii) a “person” includes any individual, firm, body corporate, association, government, state or agency of a state, local authority, government body, association or partnership, trust, joint venture, consortium, partnership or other entity (whether or not having a separate legal personality) and that person’s personal representatives, successors and assigns; (iii) a “company” shall be construed so as to include any company, corporation or body corporate, wherever and however incorporated or established; 13

(iv) a “Clause”, “sub-Clause”, “paragraph”, “sub-paragraph” or “Schedule”, unless otherwise specified, is a reference to a clause, sub-clause, paragraph, sub-paragraph of, or schedule to, this Agreement; (v) “indemnify” and “indemnifying” any person against any circumstance includes indemnifying and keeping them harmless (on demand) from all actions, claims, demands, awards, penalties, fines and proceedings (including any liability to Taxation) from time to time made against them and all loss or damage and all payments, costs or expenses (including legal and other professional costs) made or incurred by that person as a consequence of or which would not have arisen but for that circumstance; (vi) “writing” or similar expressions includes, unless otherwise specified, transmission by email but excludes fax; (vii) the singular includes the plural and vice versa and references to one gender includes all genders; (viii) “day” or a “Business Day” shall mean a period of 24 hours running from midnight to midnight; (ix) a “month” shall mean a calendar month; (x) times are to time in Ireland; (xi) any document, instrument or agreement (including this Agreement) is a reference to that document, instrument or agreement as amended, varied, novated or supplemented for the time being, provided that to the extent that any such amendment, variation, novation or supplement requires the consent of a Party under this Agreement, it shall not be taken into account for the purposes of this Agreement until all such consents have been obtained; (xii) any references to “holding company” or “subsidiary” (as the case may be) are as defined in Sections 7 and 8 of the Companies Act; (xiii) the formulation “to the extent that” shall mean “if, but only to the extent that”; and (d) a reference to a statute or statutory provision shall be construed as a reference to the laws of Ireland unless otherwise specified and includes: (i) any subordinate legislation made under it including all regulations, by-laws, orders and codes made thereunder; (ii) any repealed statute or statutory provision which it re-enacts (with or without modification); and (iii) any statute or statutory provision which modifies, consolidates, re-enacts or supersedes it, in each case, prior to the date of this Agreement. 1.2 The rule known as the ejusdem generis rule shall not apply to this Agreement and accordingly general words introduced by the word “other”, “including”, “include” or 14

“in particular” or any similar expression shall not be given a restrictive meaning by reason of the fact that they are preceded by words indicating a particular class of acts, matters or things and shall be construed as illustrative and shall not limit the sense of the words preceding those terms. 1.3 The table of contents and headings in this Agreement are inserted for convenience only. They shall be ignored in the interpretation of this Agreement. 1.4 Any reference to a person’s knowledge, information, belief or awareness is deemed to include knowledge, information, belief or awareness which the person would have had if such person had made reasonable and prudent enquiries of the appropriate persons who have knowledge of such matters in the relevant Group Company. 1.5 Except where expressly specified otherwise: (a) the Warranties, agreements, liabilities and obligations contained in this Agreement on the part of any Parties shall be construed and take effect as several Warranties, agreements liabilities and obligations only (and not jointly or jointly and severally); (b) reference to that Party shall refer to each of those persons or any of them as the case may be; and (c) the benefits contained in this Agreement in favour of such Party shall be construed and take effect as conferred in favour of all such persons collectively and each of them separately. 1.6 Several liability means that a Seller shall only be liable for its Pro Rata Portion and shall not in any way be responsible or liable whatsoever for any other Seller. 1.7 The Parties have participated jointly in the negotiating and drafting of this Agreement. If an ambiguity or question of intent or interpretation arises, this Agreement shall be construed as if drafted jointly by the Parties and no presumption or burden of proof shall arise favouring or disfavouring a Party by virtue of the authorship of any of the provisions of this Agreement. 1.8 Where any conversion between United States dollars and another currency is required or permitted to be made pursuant to the provisions of this Agreement (a “Conversion Calculation”), the conversion rate to be used for the purposes of the Conversion Calculation shall be the mean of the United States dollar exchange rate for such currency for each of the twenty Business Days immediately prior to the date on which the Conversion Calculation is made and in each case as calculated by the Exchange Rate office of the Central Bank of Ireland provided that, if the exchange rate on the date of the Conversion Calculation differs by more than five percent (±5%) from the average exchange rate for such currency over the three calendar months immediately preceding the Conversion Calculation date (each as determined by the Exchange Rate Office of the Central Bank of Ireland), then the conversion rate to be used shall instead be the average exchange rate over such three-month period. 1.9 Where any provision of this Agreement specifies a notice period or other period of time and the day on which such period shall end is not a Business Day, such period shall be construed so as to end on the next following Business Day. 1.10 The Background and Schedules to this Agreement shall be deemed to form part of this Agreement and the Schedules shall have the same force and effect as if set out in the body of this Agreement and references to this Agreement include the Schedules. 15

2. SALE AND PURCHASE 2.1 With effect from Completion: (a) each Seller (other than the Hawksford Nominee, Tribal Nominee, the Tribal Beneficial Owners, the Nominee. NDRC and the ESOP Holders) shall sell as legal and beneficial owner and the Buyer shall purchase the Sale Shares listed opposite such Seller’s name in Schedule 1 (other than the Cantor Shares, the Tribal Shares and the Nominee Shares) free from all Encumbrances together with all rights of any nature whatsoever attaching or accruing to them now or after the date of this Agreement; (b) Tribal Nominee shall sell as legal owner and the Tribal Beneficial Owners shall sell as beneficial owner, and the Buyer shall purchase beneficial and legal title to, the Tribal Sale Shares free from all Encumbrances together with all rights of any nature whatsoever attaching or accruing to them now or after the date of this Agreement; (c) the Nominee shall sell as legal owner and and on the written authority of the ESOP Holders shall sell as beneficial owner, and the Buyer shall purchase beneficial and legal title to, the ESOP Sale Shares free from all Encumbrances together with all rights of any nature whatsoever attaching or accruing to them now or after the date of this Agreement; (d) the Hawksford Nominee shall sell as legal owner and and on the written authority of the Cantor Beneficial Owners granted to Cantor, who in turn has appointed the Hawksford Nominee as trustee in respect of the Cantor Shares, shall sell as beneficial owner, and the Buyer shall purchase beneficial and legal title to, the Cantor Sale Shares free from all Encumbrances together with all rights of any nature whatsoever attaching or accruing to them now or after the date of this Agreement; and (e) NDRC shall sell as legal owner and (and under power of attorney on behalf of DCCS) shall sell as beneficial owner all the NDRC Sale Shares, and the Buyer shall purchase the beneficial and legal title to the NDRC Sale Shares free from all Encumbrances together with all rights of any nature whatsoever attaching or accruing to them now or after the date of the Agreement. 2.2 Each Seller hereby irrevocably waives all rights of pre-emption and other restrictions on transfer over the Shares or interests in the Shares conferred on them or any other person under the Companies Act, the constitution of the Company or otherwise and shall procure the irrevocable waiver of all rights of pre-emption as may be required to give effect to this Agreement, and further consents to the transaction the subject of this Agreement for all purposes including any shareholder agreements that exist in relation to any Group Company. 2.3 The Sellers hereby terminate any and all shareholder agreements relating to any Group Company and its affairs, including the Shareholders’ Agreement, with effect from Completion. 3. CONSIDERATION 3.1 The total purchase price of the Sale Shares is the Consideration. 3.2 On Completion the Buyer shall pay an amount equal to: 16

(a) the Estimated Consideration; (b) less the Holdback Amount; (c) less the ESOP Exercise Amount, (the “Completion Consideration”) to the Sellers’ Solicitors and receipt by the Sellers’ Solicitors of the Completion Consideration shall be an absolute discharge to the Buyer of its obligations to pay such amount. 3.3 The portion of the Consideration that each Seller shall be entitled to receive is the amount payable in accordance with each Seller’s Pro Rata Portion as set out in Schedule 1. 3.4 The Buyer shall not be concerned to see that the Deal Value paid by the Buyer (including any amounts to be paid in accordance with Clause 4.2 or Clause 4.3) is applied to the Sellers in their Pro Rata Portion as set out in Schedule 1. The Sellers acknowledge and agree that this is a matter agreed as between themselves and receipt by the Sellers’ Solicitors of the Completion Consideration and/or the Option Consideration will be an absolute discharge of the Buyer’s obligation to pay such amounts. 3.5 The Parties agree to adhere to the provisions of the Put and Call Option Agreement to the extent they apply to them. 4. ADJUSTMENT OF CONSIDERATION 4.1 The Completion Accounts shall be agreed or determined in accordance with the provisions of Schedule 4. 4.2 On the True-Up Date, the Estimated Consideration shall be adjusted, subject to Clause 4.3, on a dollar-for-dollar basis as follows: (a) if the amount of the Cash is: (i) less than the Estimated Cash, the Sellers shall pay to the Buyer, as a reduction in the Estimated Consideration, an amount equal to the shortfall; or (ii) greater than the Estimated Cash, the Buyer shall pay to the Sellers, as an increase in the Estimated Consideration, an amount equal to the excess; (b) if the amount of the Debt is: (i) less than the Estimated Debt, the Buyer shall pay to the Sellers, as an increase in the Estimated Consideration, an amount equal to the shortfall; or (ii) greater than the Estimated Debt, the Sellers shall pay to the Buyer, as a reduction in the Estimated Consideration, an amount equal to the excess; (c) if the amount of the Working Capital is: 17

(i) less than the Estimated Working Capital, the Sellers shall pay to the Buyer, as a reduction in the Estimated Consideration, an amount equal to the shortfall; or (ii) greater than the Estimated Working Capital, the Buyer shall pay to the Seller, as an increase in the Estimated Consideration, an amount equal to the excess. 4.3 If the net effect of the provisions of Clause 4.2 is that: (a) the Sellers are obliged to pay an amount to the Buyer which is equal to or greater than the Holdback Amount, then: (i) the Buyer will retain the Holdback Amount and shall have no obligation to pay it to the Sellers; and (ii) the Sellers’ liability to pay the Buyer pursuant to Clause 4.2 shall be reduced by an amount equal to the Holdback Amount; (b) the Sellers are obliged to pay an amount to the Buyer which is less than the Holdback Amount, then the Buyer shall retain that part of the Holdback Amount equal to the amount which the Sellers are obliged to pay to the Buyer in accordance with Clause 4.2 and shall pay the balance of the Holdback Amount to the Sellers’ Solicitors; or (c) the Buyer is obliged to pay an amount to the Sellers, then the Buyer shall pay to the Sellers’ Solicitors such amount as is determined in accordance with Clause 4.2 plus the Holdback Amount. 4.4 Any payments to be made pursuant to Clause 4.2 and Clause 4.3 shall be made in cash: (a) on the True-Up Date; and (b) by electronic transfer of funds for same day value to the account of the Buyer as notified by the Buyer to the Sellers’ Representative for that purpose or, as the case may be, the client account of the Sellers’ Solicitors. 5. COMPLETION 5.1 Completion shall take place at the offices of the Buyer’s Solicitors on the date of this Agreement. 5.2 On Completion: (a) the Sellers (other than EI, NDRC and each of the Institutional Investors) shall procure that a board meeting of each Group Company is held at which the matters set out in paragraph 1 of Part 1 of Schedule 3 are carried out and shall comply with paragraph 3 of Part 1 of Schedule 3; (b) the Sellers (other than EI, NDRC and each of the Institutional Investors) shall deliver or procure to be delivered to the Buyer those items set out in paragraph 2 of Part 1 of Schedule 3; and (c) EI, NDRC and each of the Institutional Investors shall deliver to the Buyer those items, in respect of itself and its Sale Shares only, set out paragraphs 2(b)and 2(c) of Part 1 of Schedule 3. 18

5.3 At Completion, the Buyer shall deliver those items set out in Part 2 of Schedule 3. 5.4 The Buyer shall not be obliged to complete this Agreement unless: (a) the Sellers comply fully with all their obligations under this Clause 5; and (b) the purchase of all of the Sale Shares is completed in accordance with the provisions of this Agreement on the Completion Date. 6. WARRANTIES 6.1 Subject to Clause 8 and Schedule 6: (a) each Seller (save for EI and NDRC) severally warrants to the Buyer that each of the Core Warranties (in so far as such Core Warranties relate solely to such Seller and such Seller’s Shares and such that no Seller gives any Core Warranties in relation to any other Seller or any Group Company) is true and accurate at the date of this Agreement; (b) EI warrants to the Buyer that each of the EI Core Warranties (in so far as such EI Core Warranties relate solely to EI and EI’s Shares) is true and accurate at the date of this Agreement; (c) NDRC warrants to the Buyer that each of the NDRC Core Warranties (in so far as such NDRC Core Warranties relate solely to NDRC and the NDRC Shares) is true and accurate at the date of this Agreement; and (d) each Warrantor warrants to the Buyer on a several basis in relation to each Group Company that each of the General Warranties and the Tax Warranties is true and accurate at the date of this Agreement, save as Fairly Disclosed in the Disclosure Schedule. 6.2 The Sellers acknowledge that the Buyer is entering into the Transaction Documents in reliance (inter alia) on each of the Warranties. For the avoidance of doubt, each party acknowledges and agrees that in entering into the Transaction Documents it shall have no rights or remedies in respect of, any statement, representation, assurance or warranty that is not set out in the Transaction Documents. 6.3 Save in the case of fraud, the Sellers (except for EI and NDRC) agree with the Buyer that the Sellers shall waive and not enforce any right which the Sellers may have in respect of any misrepresentation, inaccuracy, neglect or omission in or from any information or advice supplied or given by any Group Company or any officer, employee or adviser of or to any Group Company for the purpose of assisting the Sellers to give any of the Warranties or to prepare the Disclosure Schedule. 6.4 Each of the Warranties shall be construed separately and independently and (except where the Agreement expressly provides otherwise) shall not be limited or restricted by reference to or inference from a provision of this Agreement or another Warranty. 6.5 The rights and remedies of the Buyer in respect of a breach of any of the Warranties shall not be affected by the sale and purchase of the Shares. 6.6 Subject to Clause 7 and without prejudice to the right of the Buyer to claim on any other basis or take advantage of any other remedies available to it, the Sellers undertake to, severally and not jointly, indemnify, save and hold harmless the Buyer and each member of the Buyer’s Group from and against all Losses paid, suffered, sustained or incurred in connection with, arising out of, resulting from, or incident to: 19

(a) any Warranty being breached or proven to be untrue (subject to the limitations set out in Schedule 6); and (b) any fraud or fraudulent representation on the part of any Warrantor or the Company (which shall not be subject to any limitation in time or amount). 6.7 The Buyer warrants to the Sellers that: (a) the Buyer is a company which is duly incorporated and validly existing under the laws of its jurisdiction of incorporation and has the requisite power and authority to enter into this Agreement and each of the other Transaction Documents to which it is party, and to perform its obligations hereunder and thereunder, which have been duly authorised by all requisite corporate action. This Agreement and each of the other Transaction Documents to which the Buyer is party form or will on execution form valid and binding obligations of the Buyer, enforceable against it in accordance with their terms; (b) the Buyer is entering into this Agreement and the other Transaction Documents to which it is a party on its own behalf and not on behalf of any other person(s); (c) the execution, delivery and performance by the Buyer of this Agreement and the other Transaction Documents shall not: (i) violate any provision of any order, judgment or decree of any court, governmental agency or regulatory body applicable to the Buyer; or (ii) be a breach of any provision of the Buyer’s constitution or be a material breach of or constitute a default under any agreement or instrument to which the Buyer is a party; (d) no permit, authorisation, consent or approval of or by any person is required in connection with the execution, delivery or performance of this Agreement and each of the other Transaction Documents to which it is party by the Buyer; (e) no order has been made, petition presented, or resolution passed for its winding up or for the appointment of a provisional liquidator of the Buyer; (f) it is not unable to pay its debts nor has it stopped paying its debts as they fall due; (g) the Buyer has not been and is not in examinership/administration proceeding; (h) no receiver, receiver and manager or administrative receiver stands appointed over the whole or part of its business or assets; (i) it has not entered into, or has it proposed to enter into, any composition or arrangement with, or for, its creditors; and (j) it has not been nor has it received notice of any action being taken to have the Buyer struck off from any statutory or governmental register; and (k) it has not formulated nor is it in the process or formulating a Warranty Claim, or a Tax Claim. 20

6.8 Unless specifically provided otherwise in this Agreement, all warranties, conditions and other terms implied by statute or common law are expressly excluded to the fullest extent permitted by law. 7. W&I INSURANCE POLICY 7.1 The Parties acknowledge that the Buyer has the benefit of the W&I Insurance Policy which, subject to the limitations stated therein, provides insurance cover in respect of Warranties (save for Uninsured Risk Claims). 7.2 The Buyer acknowledges and agrees that the W&I Insurance Policy shall serve as the sole recourse for the Buyer with respect to Claims (other than Core Warranty Claims and Uninsured Risk Claims) and, save in the case of fraud, the Buyer shall not be entitled to proceed with any Claims (save for Core Warranty Claims and Uninsured Risk Claims) against any Seller and/or Warrantor. 7.3 The maximum aggregate liability of Sellers (including the Warrantors) in respect of all Claims (other than Core Warranty Claims and Unisured Risk Claims) shall not exceed [***] (including all costs, charges, fees and expenses incurred by the Buyer or the Group in connection with any such Claim). 7.4 The Buyer shall deliver a copy of the W&I Policy Extract to the Sellers’ Representative on Completion, and the Buyer warrants to each Seller that: (a) prior to or on the date of this Agreement, it has incepted the W&I Insurance Policy on the basis that the W&I Insurance Policy must contain the terms set out in Clause 7.5; and (b) no excess will be payable by the any of the Sellers under the W&I Insurance Policy. 7.5 The Buyer warrants to the Sellers that the W&I Insurance Policy contains no rights of subrogation against the Sellers other than in the event of any fraudulent act or omission on the part of the Sellers (or any of them, in which case the rights of subrogation will be in respect of the relevant Seller(s) only) and the Buyer shall not agree to any amendment, variation or waiver of the W&I Insurance Policy which would have the effect of increasing the liability of any Seller without the prior written consent of that Seller. 7.6 If there is any conflict or inconsistency between this Clause 7, on the one hand, and any other provision of this Agreement, Transaction Document and/or the W&I Insurance Policy, on the other hand, this Clause 7 prevails to the extent of the conflict or inconsistency and otherwise so as to give full effect to the express terms of this Clause 7. 8. LIMITATIONS ON THE SELLERS’ LIABILITY The provisions, limitations and restrictions set out in Schedule 6 shall apply to any Warranty Claim. 9. PAYMENTS UNDER THIS AGREEMENT 9.1 All sums payable by the Sellers to the Buyer under this Agreement shall be paid in full without any set-off, counterclaim, deduction or withholding (other than any deduction or withholding required by law) and each Seller waives any right of set-off, counterclaim or retention which it might otherwise have. 21

9.2 If any deductions and / or withholdings are required by law to be made from any sums payable from the Sellers to the Buyer under this Agreement, the Sellers shall pay to the Buyer such additional sums as shall, after the deductions and / or withholdings are made, leave the Buyer with the same net amount as it would have been entitled to receive if no such deductions and / or withholdings had been required to be made. 9.3 Any payments made by the Sellers to the Buyer, or the Buyer to the Sellers, under this Agreement shall, so far as possible, be treated as an adjustment to the Deal Value for the acquisition of the Shares to the extent of the payment. 9.4 The provisions of Clause 7 (Manner of Making Claims) of the Tax Deed shall apply mutatis mutandis to Tax Warranty Claims. 10. USE OF CONFIDENTIAL INFORMATION BY SELLERS 10.1 The Sellers (save for EI, NDRC and each Institutional Investor) shall not, and shall procure that none of their Connected Persons shall, at any time after the date of this Agreement, make use of or disclose for their own benefit or for or on behalf of or to any other person any Confidential Information which may be within or may come to their knowledge.10.2. The Sellers (save for EI, NDRC and each Institutional Investor) shall, and shall procure that each of their Connected Persons shall, use all reasonable endeavours to prevent the disclosure of any Confidential Information. 10.2 Clause 10.1 shall not apply to: (a) disclosure of any Confidential Information to officers or employees of the Buyer or any Group Company whose province it is to know about the Confidential Information; (b) disclosure of any Confidential Information required by law; (c) disclosure of any Confidential Information to any professional adviser for the purposes of advising the Sellers and on terms that this Clause 10 shall apply to any use or disclosure by the professional adviser; or (d) any Confidential Information which comes into the public domain otherwise than by breach of this Clause 10 by the Sellers or by any member of a Seller’s Group. 11. FURTHER UNDERTAKINGS BY COVENANTORS 11.1 The Covenantors shall not and shall procure that none of their Connected Persons shall, either alone or jointly with, through or as manager, adviser, consultant or agent for any person, directly or indirectly: (a) for a period of two years after the Completion Date carry on, or be employed, engaged, concerned or interested in, or assist, any business competing, directly or indirectly, with any part or all of the Business in the Territory; (b) for a period of two years after the Completion Date in competition with any part or all of the Business either seek to procure orders from, or do business with, or procure directly or indirectly any other person to seek to procure orders from or do business with, any person who has been a client or customer of any Group Company in any part or all of the Business at any time during the period of 12 months before the date of this Agreement; 22

(c) for a period of two years after the Completion Date engage, employ, solicit, or contact with a view to the engagement or employment by any person, any employee, officer or manager of any Group Company, provided that this restriction does not apply where a person responds to a general advertisement published by a Seller or a member of a Seller’s Group that is targeted to a wide audience of potential applicants; (d) do or say anything which is harmful to the reputation of any Group Company or which may lead any person to cease to deal with any Group Company in connection with any part or all of the Business on substantially equivalent terms to those previously offered or at all; (e) for a period of two years after the Completion Date seek to contract with or engage, in such a way as to adversely affect the business of any Group Company as carried on at the date of this Agreement, any person who has been contracted with or engaged to manufacture, assemble, supply or deliver products, goods, materials or services to any Group Company at any time during the period of 12 months before the date of this Agreement with the intent that each of the foregoing provisions of this Clause 11.1 shall constitute an entirely separate and independent restriction on the Covenantors; or (f) at any time after Completion, use in the course of any business any trade or service mark, business or domain name, design or logo which at Completion, was or had been used in respect of the Business or which is capable of confusion with trade or service marks, business or domain names, designs or logos used by or otherwise proprietary to the Buyer or any Group Company. 11.2 It is agreed between the Parties that, while the restrictions set out in Clause 11.1 are considered fair and reasonable, if it should be found that any of the restrictions be void or unenforceable as going beyond what is fair and reasonable in all the circumstances and if by deleting part of the wording or substituting a shorter period of time or different geographical limit or a more restricted range of activities for any of the periods of time, geographical limits or ranges of activities set out in Clause 11.1 it would not be void or unenforceable then there shall be substituted such next less extensive period or limit or activity or such deletions shall be made as shall render Clause 11.1 valid and enforceable. 12. SELLERS’ OBLIGATIONS PRIOR TO REGISTRATION OF STOCK TRANSFER FORMS Prior to registration of stock transfer forms in respect of the Shares in the register of members of the Company and after Completion, the Sellers (save for EI, NDRC and each Institutional Investor) shall co-operate in any manner required by the Buyer for the convening, holding at short notice and conduct of general meetings of each Company, shall execute on a timely basis all resolutions proxy forms, appointments of representatives, documents of consent to short notice and such like that the Buyer may require, and shall generally act in all respects as the nominee and at the direction of the Buyer in respect of the Shares sold by them and all rights and interests attaching to the Shares and shall issue letters of direction to the registered holders of any of the Shares who hold such Shares as their nominee requiring them to act on the instructions of the Buyer for the purposes set out in this Clause 12. For the purposes of giving effect to the terms of this Clause 12, each Seller (save for EI, NDRC and each Institutional Investor) irrevocably and unconditionally appoints the Buyer with effect on and from Completion as its attorney and on its behalf (and to the complete and irrevocable exclusion of any rights the Sellers may have in such regard) lawfully to exercise all voting and other rights and receive all the benefits and entitlements which may at Completion or at any time in the future attach to the Sale Shares and to execute such documents under hand or as a deed as may 23

be required subsequent to Completion for assuring to or vesting in the Buyer (as applicable) the full legal and beneficial ownership of the Sale Shares. 13. WAIVER OF CLAIMS Each of the Sellers (save for EI, NDRC and each Institutional Investor) hereby irrevocably and unconditionally confirms and acknowledges that, with effect from Completion: 13.1 neither it nor its Connected Persons nor its Affiliates have any claim or right of action of any kind, on account of or arising out of any matter, cause or event, in any jurisdiction, against any Group Company and, to the extent that any such claim exists or may exist, whether or not presently known to any Party or to the law, the Sellers irrevocably waive such claim and release and forever discharge each Group Company and each member of the Buyer’s Group and each of its respective directors, officers, agents, affiliates and employees from all and any liability in respect thereof; and 13.2 neither it nor its Connected Persons nor its Affiliates are owed any monies by any Group Company and any loans from a Group Company to any director of that Group Company or any Connected Person or Affiliate of any director have been fully paid and settled without any tax liabilities arising for the relevant Group Company or the Buyer. 14. GENERAL 14.1 Effect of Completion Except to the extent already performed, all the provisions of this Agreement shall, so far as they are capable of being performed or observed, continue in full force and effect notwithstanding Completion. 14.2 Variation This Agreement may only be varied in writing (including electronic methods of writing) signed by or on behalf of each Party. 14.3 Further Assurance Without limitation or prejudice to the Sellers’ obligations under this Agreement, at any time after Completion, for a period of 12 months, the Sellers (save for EI and NDRC) shall, following written request, do and execute, or procure to be done and executed, all necessary acts, deeds, documents and things which the Buyer may, acting reasonably, consider necessary to give full effect to transfer the Shares to the Buyer. 14.4 Announcements and Confidentiality of Agreement (a) No public announcement, communication or circular concerning the transactions referred to in this Agreement shall be made or despatched at any time by any Party (save for EI, NDRC and each Institutional Investor) without the prior written consent of the other Parties (such consent not to be unreasonably withheld or delayed), provided always that the Buyer may make or despatch any public announcement, communication or circular where required by law (including pursuant to any regulation binding on it). (b) Each Party (save for EI, NDRC and each Institutional Investor) shall treat as strictly confidential all information received or obtained as a result of entering into or performing theTransaction Documents which relates to the provisions 24

or subject matter of the Transaction or the transactions contemplated by it, to any other Party or to the negotiations relating to the Transaction Documents. (c) Any Party may disclose information (other than Confidential Information) which would otherwise be confidential by virtue of this Clause 14.4 if and to the extent: (i) it is required to do so by law or by any securities exchange or regulatory or governmental body (including any Tax Authority) to which it is subject wherever situated, whether or not the requirement for disclosure of information has the force of law; (ii) it considers it necessary to disclose the information to its professional advisers, statutory auditors and / or bankers provided that it does so on a confidential basis; (iii) the information has come into the public domain other than as a result of breach of this Agreement; or (iv) the Party to whom such information relates has given its consent in writing. 14.5 Remedies and Waivers (a) Save as otherwise provided in this Agreement, no delay or omission by a Party in exercising any right, power or remedy provided by law or under this Agreement shall: (i) affect that right, power or remedy; or (ii) operate as a waiver of it. (b) Save as otherwise provided in this Agreement, the exercise or partial exercise of any right, power or remedy provided by law or under this Agreement shall not preclude any other or further exercise of it or the exercise of any other right, power or remedy. (c) Save as otherwise provided in this Agreement, the rights, powers and remedies provided in this Agreement are cumulative and not exclusive of any rights, powers and remedies provided by law. 14.6 Governing Law This Agreement and any dispute or claim arising out of or in connection with it or its subject matter, formation, existence, negotiation, validity, termination or enforceability (including non-contractual obligations, disputes or claims) (“Dispute”) shall be governed by and construed in accordance with the laws of Ireland. 14.7 Jurisdiction (a) Each of the Parties irrevocably agrees that the courts of Ireland shall have exclusive jurisdiction to settle any Dispute and, for such purposes, irrevocably submits to the exclusive jurisdiction of such courts. Any proceeding, suit or action arising out of or in connection with this Agreement (the “Proceedings”) shall therefore be brought in the courts of Ireland. 25

(b) Each of the Parties irrevocably waives any right it may have to object to Proceedings being brought in the courts of Ireland or to claim that the action has been brought in an inconvenient forum or to claim that those courts do not have jurisdiction. 14.8 Severance (a) If at any time any provision of this Agreement is or becomes illegal, invalid or unenforceable in any respect under the law of any jurisdiction, that shall not affect or impair: (i) the legality, validity or enforceability in that jurisdiction of any other provision of this Agreement; or (ii) the legality, validity or enforceability under the law of any other jurisdiction of that or any other provision of this Agreement. (b) If any invalid, unenforceable or illegal provision of this Agreement would be valid, enforceable and legal if some part of it were deleted, the provision shall apply with the minimum modification necessary to make it legal, valid and enforceable. 14.9 Assignment (a) Subject to Clause 14.9(b), no Party may assign, mortgage, charge, create a trust in respect of, transfer or otherwise dispose of or purport to do any of the foregoing in respect of all or any of its rights or permit the assumption of its obligations under this Agreement. (b) The Buyer may, on giving notice to the Sellers’ Representative, at any time assign the benefit of any provision of this Agreement and / or the Tax Deed (together with any causes of action) to any other member of the Buyer’s Group, provided that if such assignee subsequently ceases to be a member of the Buyer’s Group, the Buyer shall procure that, prior to its ceasing to be a member of the Buyer’s Group, such assignee reassigns the rights under this Agreement and / or the Tax Deed as have been assigned to it to the Buyer or (upon giving further written notice to the Sellers’ Representative) to another member of the Buyer’s Group. 14.10 No Partnership or Agency Nothing in this Agreement and no action taken by the Parties pursuant to this Agreement shall constitute, or be deemed to constitute, a partnership, association, joint venture or other cooperative entity between the Parties nor shall it make a Party the agent of any other Party for any purpose. Save to the extent expressly provided to the contrary in this Agreement, no Party has, pursuant to this Agreement, any authority or power to bind or to contract in the name of any other Party. 14.11 Costs Each Party shall pay its own costs and expenses in connection with the negotiation, preparation, execution, registration and implementation of this Agreement and the Transaction Documents. The Buyer shall pay all stamp duties and registration fees applicable to any document to which it is a party which arise as a result of the acquisition of the Shares pursuant to this Agreement. 26

14.12 Counterparts and Manner of Execution (a) This Agreement may be executed in any number of counterparts, and by the Parties on separate counterparts, but shall not be effective until each Party has executed at least one counterpart, whereupon this shall have the same effect as if the signatures on the counterparts were on a single original of this Agreement. (b) Each counterpart shall constitute a duplicate original of this Agreement but all the counterparts shall together constitute one and the same instrument. (c) Transmission of an executed counterpart of this Agreement (or of the executed signature page of a counterpart of this Agreement) by personal delivery, email or other means of electronic transmission (in PDF, JPEG or other readable format) or commercial courier shall take effect as delivery of an executed counterpart of this Agreement. 14.13 Electronic Signatures (a) The Parties consent to the execution by or on behalf of each other Party to the Transaction Documents by electronic signature, provided that such manner of execution is permitted by law. (b) The Parties: (i) agree that an executed copy of each Transaction Document may be retained in electronic form; and (ii) acknowledge that such electronic form shall constitute an original of each Transaction Document and may be relied upon as evidence of that Transaction Document. 14.14 Sellers’ Representative (a) The Sellers (save for EI and NDRC) hereby appoint [***] and [***] (the “Sellers’ Representatives” and each a “Sellers’ Representative”) with full and irrevocable power and authority, on behalf of the Sellers (save for EI) (or any one of them) to: (i) represent the Sellers (save for EI and NDRC) in respect of any provision of this Agreement under which the Sellers (individually or jointly) are required or entitled to give, make or receive any written notice, consent, application, election, submission, instruction, information or other communication; and (ii) act on behalf of the Sellers (save for EI and NDRC) in relation to all matters which this Agreement expressly provides to be agreed or done by the Sellers or by the Sellers’ Representative. (b) Any notice, consent, application, election, submission, instruction, decision, communication, act, agreement or document of the Sellers’ Representative shall constitute a notice, consent, application, election, submission, instruction, decision, communication, act, agreement or document of all the Sellers (save for EI and NDRC) and shall be binding, final and conclusive upon all of the Sellers (save for EI and NDRC) and the Buyer shall not be required to enquire further in respect of any such matters. 27

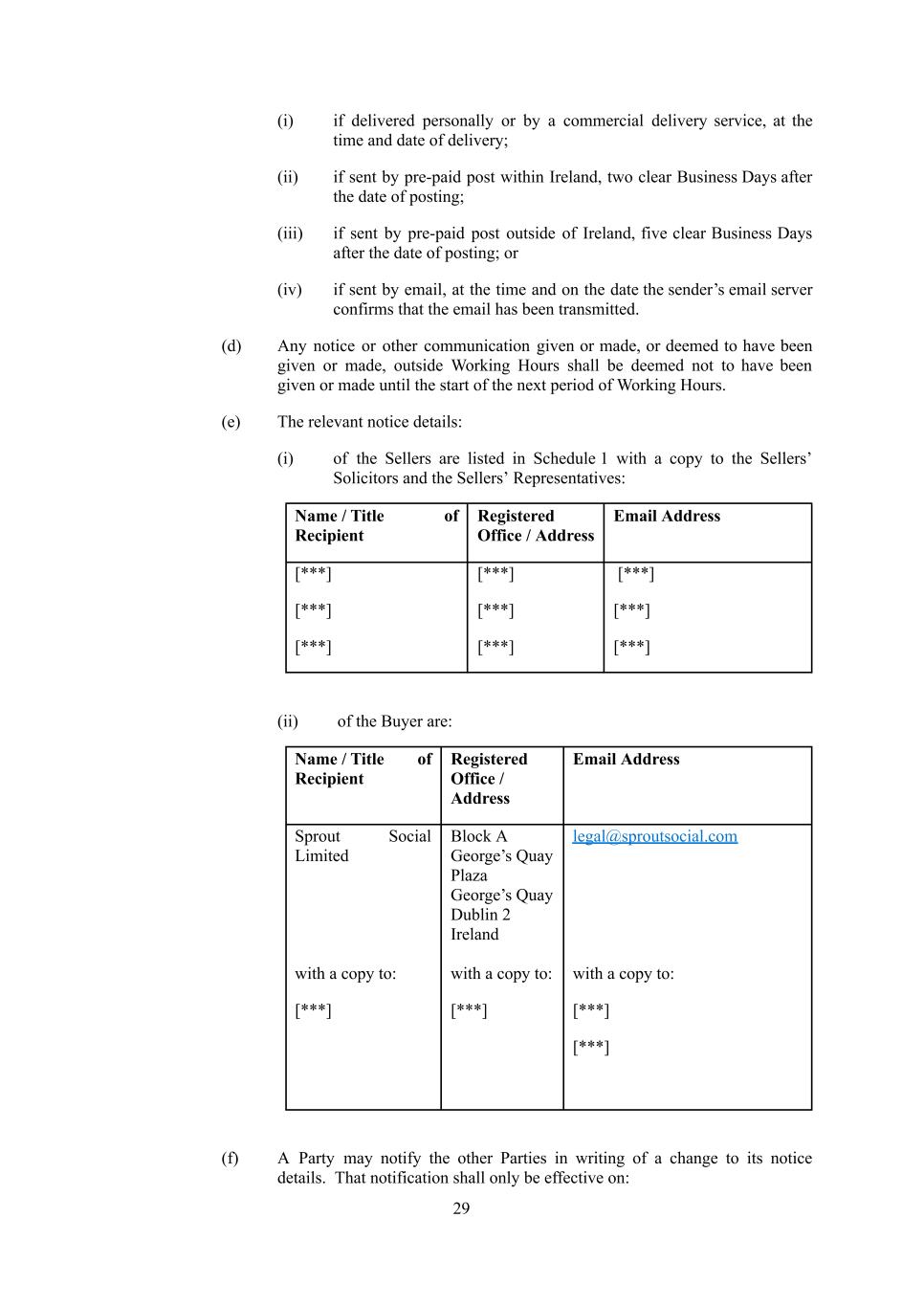

(c) The Sellers (save for EI and NDRC) shall procure that the Sellers’ Representative shall take such action as is required to be taken by the Sellers or the Sellers’ Representative in accordance with the terms of this Agreement. (d) The Parties agree that the “Sellers” will be construed as meaning “Sellers’ Representative” (save for EI and NDRC) with respect to any notice or communication to be given or received, or claim that may be made, under this Agreement. Notwithstanding Clause 14.15, the service of any notice or other communication by the Buyer on the Sellers’ Representative shall constitute valid service on each of the Sellers (save for EI and NDRC) as the case may be. (e) The Sellers (save for EI and NDRC), collectively holding at least 75% of the Option Shares may appoint a replacement Sellers’ Representative in place of the person named in Clause 14.14(a) and notify the Buyer in writing of the substitute’s full name and address within Ireland. (f) Until the Buyer receives notification under Clause 14.14(e) it will be entitled to treat the person named in Clause 14.14(a) (or any replacement Sellers’ Representative previously notified to the Buyer under Clause 14.14(e)) as the Sellers’ Representative for the purposes of this Clause 14.14. (g) If either Seller Represenative ceases to be employed or engaged by a Group Company, there shall be no requirement for a replacement to be appointed, so long as there remains at least one Seller Represenative. (h) Each of the Sellers (save for EI and NDRC) undertakes at all times to indemnify and keep indemnified the Sellers’ Representative against all or any actions, proceedings, claims, costs, expenses and liabilities whatsoever arising from the exercise or purported exercise of the powers conferred or purported to be conferred on the Sellers’ Representative by this Clause 14.14. (i) Each of the parties (save for EI and NDRC) acknowledges that the Sellers’ Representative, in exercising the powers and authorities conferred by this Clause 14.14, shall not be acting, and shall not be construed as acting, as the agent or trustee of any Seller and shall not assume, or be deemed to have assumed, any obligation of a fiduciary or other nature. 14.15 Notices (a) Any notice or other communication under this Agreement shall only be effective if it is in writing and in English or accompanied by a properly prepared translation into English and, where given or made under Clause 14.15(c)(i), (ii) or (iii), a copy is also issued by email in accordance with Clause 14.15(iv). Any notice or other communication under this Agreement that is delivered by fax shall not be effective for any purpose. (b) No notice or other communication given or made under this Agreement may be withdrawn or revoked. (c) Any notice or other communication given or made under this Agreement shall be addressed as provided in this Clause and, if so addressed, shall, in the absence of earlier receipt and subject to Clause 14.15(d), be deemed to have been duly given or made as follows: 28