EXECUTION VERSION DATED 2025 THE PERSONS NAMED IN SCHEDULE 1 SPROUT SOCIAL LIMITED AND SPROUT SOCIAL INC. __________________________________________ PUT AND CALL OPTION AGREEMENT __________________________________________

TABLE OF CONTENTS 1. DEFINITIONS AND INTERPRETATION 1 2. GRANT OF THE OPTIONS 7 3. OPTION PERIOD 7 4. EXERCISE OF PUT OPTION 8 5. EXERCISE OF CALL OPTION 8 6. CONSIDERATION 9 7. BUYER’S GUARANTEE 9 8. R&D TAX CREDIT CLAIMS: 9 9. CALADAN VENTURES OPTION EXERCISE 10 10. OPTION COMPLETION 10 11. EXECUTION OF TRANSFER DOCUMENTS 10 12. BUYER’S PROTECTION 11 13. SELLERS’ PROTECTION 11 14. SET-OFF 11 15. GENERAL 12 SCHEDULE 1 19 THE SELLERS 19 SCHEDULE 2 24 CALCULATION OF [***] 24 SCHEDULE 3 26 DETERMINATION OF OPTION CONSIDERATION 26 SCHEDULE 4 28 CONDUCT OF BUSINESS DURING YEAR 1 AND YEAR 2 28 SCHEDULE 5 31 FORM OF OPTION CONSIDERATION STATEMENT 31 SCHEDULE 6 32 BUYER’S GUARANTEE 32 THIS AGREEMENT is dated 2025 BETWEEN: (1) SPROUT SOCIAL LIMITED, a company incorporated under the laws of Ireland with company registration number 551726 and its registered office at Block A, George’s Quay, Dublin 2, Ireland (the “Buyer”); (2) SPROUT SOCIAL INC., a company incorporated under the laws of Delaware with its registered office at 131 South Dearborn Street, Suite 700, Chicago, IL 60603, U.S. (the “Buyer’s Guarantor”); and (3) THE PERSONS NAMED IN SCHEDULE 1 (the “Sellers”). BACKGROUND (A) The Buyer and the Sellers have entered into a share purchase agreement on or about the date hereof (the “Share Purchase Agreement”) pursuant to which the Buyer will acquire the Sale Shares (as defined the Share Purchase Agreement) from the Sellers. 1

(B) The Sellers (save for NDRC, Tribal Nominee, Hawksford and the Nominee) are the legal and beneficial owner of the Option Shares (as defined below) and have agreed to enter into a put and call option with the Buyer on the terms of this Agreement. (C) NDRC is the legal owner of the Option Shares held by NDRC and (acting under power of attorney on behalf of DCCS being the beneficial owner of the Option Shares held by NDRC) has agreed to enter into a put and call option with the Buyer on the terms of this Agreement. (D) The Tribal Nominee is the legal owner of the Option Shares held by Tribal and the Tribal Beneficial Owners are the beneficial owners of the Option Shares held by Tribal and have agreed to enter into a put and call option with the Buyer on the terms of this Agreement. (E) Hawksford is the legal owner of the Option Shares held by Hawksford and (acting under authority granted on behalf of the Cantor Beneficial Owners being the beneficial owners of the Option Shares held by Hawksford) has agreed to enter into a put and call option with the Buyer on the terms of this Agreement. (F) The Nominee is the legal owner of the Option Shares held by the Nominee and (acting under power of attorney on behalf of the ESOP Holders being the beneficial owners of the Option Shares held by Nominee) has agreed to enter into a put and call option with the Buyer on the terms of this Agreement. (G) The Buyer has agreed to enter into a put and call option with the Sellers on the terms of this Agreement. (H) The Buyer’s Guarantor has agreed to guarantee certain payment obligations of the Buyer under this Agreement. (I) Terms used but not defined herein shall have the meaning given to them in the Share Purchase Agreement. IT IS AGREED as follows: 1. DEFINITIONS AND INTERPRETATION 1.1 Unless otherwise specified, in this Agreement: “Accounting Expert” means an accountant in an agreed top four international accountancy firm practising in Ireland, independent of the Parties, appointed by agreement between the Buyer and the Sellers’ Representative and EI or, in the absence of such agreement within five Business Days of either the Buyer or the Sellers’ Representative and EI notifying the other of its wish to appoint an Accounting Expert, such an accountant nominated by the President for the time being of the Institute of Chartered Accountants of Ireland on the application of either the Buyer or the Sellers’ Representative and EI; “Agreement” means this agreement and the schedules hereto; “[***]” is calculated in accordance with Schedule 2; “Barrister” means a barrister of not less than 10 years standing, having experience in claims similar to the relevant Notified Claim, as agreed by the Sellers’ Representative and EI and the Buyer, or failing such agreement within 10 Business Days of receipt of a request to do so from either party, as appointed by the President for the time being of the Law Society of Ireland on the application of either party; 2

“Business Day” means a day (other than a Saturday or a Sunday or public holiday in Ireland or the State of Illinois) on which clearing banks are open to the general public for business in Dublin and Chicago; “Buyer’s Group” has the meaning given to it in the Share Purchase Agreement; “Caladan Ventures Option Exercise” means the completion of the sale and purchase of the Option Shares held by Caladan Ventures Unlimited Company as described in Clause 9; “Call Options” means the First Call Option and the Second Call Option; “[***] Development Services Contract” means the contract between [***] and NewsWhip US Inc. effective as of 1 December 2024 and available in the Dataroom at 4.1.39; “Company” means NewsWhip Group Holdings Limited, a company incorporated in Ireland with registered number 731059 and having its registered office at Huckletree D2, The Academy, 42 Pearse Street, Dublin, Ireland; “Completion Account Principles” has the meaning given to it in the Share Purchase Agreement; “Core Warranties” has the meaning given to that term in the Share Purchase Agreement; “Core Warranty Claim” means a claim by the Buyer for a breach of any one or more of the Core Warranties; “Data Room” has the meaning given to it in the Share Purchase Agreement; “Disputed Items” has the meaning given to that term in Schedule 3; “Dispute Notice” has the meaning given to that term in paragraph 3(b) of Schedule 3; “Encumbrance” means any mortgage, charge, pledge, lien, option, restriction, assignment, hypothecation, right of first refusal, right of pre-emption, or right to acquire or restrict, any adverse claim or right or third party right or interest, any other encumbrance or security interest of any kind, and any other type of preferential arrangement (including, without limitation, title transfer and retention arrangements) having a similar effect; “End Date” means 30 June 2027; “Estimated Liability” means in relation to a Notified Claim, a genuine and bona fide estimate of the amount of the Sellers’ liability to the Buyer if the Notified Claim were to be resolved in the Buyer’s favour, as agreed or determined in accordance with clause 22.5; “Exercise Notice” means the written notice given in accordance with Clause 4.1 or Clause 5.1; “First Call Option” has the meaning given in Clause 2.2(a); “First Option Consideration” means an amount equal to [***]; “First Option Shares” means [***]; 3

“First Put Option” has the meaning given in Clause 2.1(a). “Group” means the Company and each Subsidiary together with any other subsidiaries of the Company and the term “Group Company” means any one of them; “Notified Claim” means any Uninsured Risk Claim or any Core Warranty Claim which has been notified to the Sellers in accordance with the terms of the Share Purchase Agreement prior to the payment of the Option Consideration; “Option Consideration” means the consideration payable for the Option Shares; “Option Consideration Statement” has the meaning given in Schedule 5; “Option Completion” means the completion of the sale, purchase and payment of the Option Shares as described in Clause 9; “Option Period” means the time during which the Options are capable of exercise, as set out in Clause 3.1 and Clause 3.2, respectively; “Option Shares” means the First Option Shares and the Second Option Shares or any of them; “Option(s)” means the Put Options and the Call Options or either of them; “Party” means a Party to this Agreement; “Put Options” means the means the First Put Option and the Second Put Option; “R&D Tax Credits” means the research and development tax credits which are calculated in accordance with section 766C and section 766D TCA by reference to qualifying group expenditure on research and development as defined in section 766(1)(a) incurred by any Group Company on research and development activities prior to the date of this Agreement and which are paid to any Group Company by Irish Revenue Commissioners after the date of this Agreement; “R&D Receipts” means any cash amounts received by any Group Company in respect of the R&D Tax Credits following the date of this Agreement and solely to the extent that such R&D Tax Credits relate to qualifying expenditure (in accordance with Section 766 of the TCA) incurred by any Group Company on or prior to Completion; “Second Call Option” has the meaning given in Clause 2.2(b); “Second Option Consideration” means an amount equal to: [***]; “Second Option Shares” means [***]; “Second Put Option” has the meaning given in Clause 2.1(b); “Share Purchase Agreement” has the meaning given to it in the Background; “Sellers’ Representative” has the meaning given to that term in the Share Purchase Agreement; “Sellers’ Solicitors” means Philip Lee LLP of Connaught House, One Burlington Road, Dublin 4, Ireland; 4

“Settled Claim” means any Uninsured Risk Claim or any Core Warranty Claim which: (a) has been agreed in writing between the Parties; (b) has been finally determined as to both liability and quantum by a court of competent jurisdiction or competent Tax Authority where either there is no right of appeal or from whose judgment the relevant party is debarred (by passage of time or otherwise) from making an appeal; or (c) has been unconditionally withdrawn by the Buyer in writing (but only to the extent of such withdrawal); “Subsidiary” means a subsidiary of the Company listed in Part 2 Schedule 2 of the Share Purchase Agreement; “Tax Authority” and “Taxation Authority” means, in Ireland, the Revenue Commissioners, and any other local, municipal, governmental, state, federal or other fiscal authority or body anywhere in the world responsible for the collection or management of any Tax; “Tax Deed” means the deed of tax covenant entered into between the Covenantors (which has the meaning given to it in said Deed) and the Buyer on or about the date of this Agreement; “Uninsured Risk Claim” has the meaning given to it in the Share Purchase Agreement; “Warranty Claim” has the meaning given in the Share Purchase Agreement; “Working Hours” means 9.00 am to 5.00 pm on a Business Day; “Year 1” means the period from 1 July 2025 to 30 June 2026; “Year 1 [***]” means the [***] for Year 1, calculated in accordance with Schedule 2; “Year 2” means the period from 1 July 2026 to 30 June 2027; and “Year 2 [***]” the [***] for Year 2, calculated in accordance with Schedule 2. 1.2 In this Agreement, unless the context otherwise requires: (a) a document in the “Agreed Form” is a reference to a document in a form agreed by or on behalf of the Parties; (b) where a Party is required to use “all reasonable endeavours” that Party should explore all avenues reasonably open to it, and explore them all to the extent reasonable, but the Party is neither obliged to disregard its own commercial interests, nor required to continue trying to comply if it is clear that all further efforts would be futile; (c) reference to: (i) a “Party” includes its personal representatives, successors and assigns; 5

(ii) a “person” includes any individual, firm, company, government, state or agency of a state, local authority, government body, association, trust, joint venture, consortium, partnership or other entity (whether or not having a separate legal personality) and that person’s personal representatives, successors and assigns; (iii) a “company” will be construed so as to include any company, corporation or body corporate, wherever and however incorporated or established; (iv) a “Clause”, “sub-Clause”, “paragraph”, “sub-paragraph” or “Schedule”, unless otherwise specified, is a reference to a clause, sub-clause, paragraph, sub-paragraph of, or schedule to, this Agreement; (v) “writing” or similar expressions includes, unless otherwise specified, transmission by email but excludes fax; (vi) the singular include the plural and vice versa and references to one gender includes all genders; (vii) “day” or a “Business Day” will mean a period of 24 hours running from midnight to midnight; (viii) a “month” will mean a calendar month; (ix) times are to time in Ireland; (x) any document, instrument or agreement (including this Agreement) is a reference to that document, instrument or agreement as amended, varied, novated or supplemented for the time being, provided that to the extent that any such amendment, variation, novation or supplement requires the consent of a Party under this Agreement, it will not be taken into account for the purposes of this Agreement until all such consents have been obtained; (xi) any references to “holding company” or “subsidiary” (as the case may be) are as defined in Sections 7 and 8 of the Companies Act; (xii) the formulation “to the extent that” shall mean “if, but only to the extent that”; and (d) a reference to a statute or statutory provision will be construed as a reference to the laws of Ireland unless otherwise specified and includes: (i) any subordinate legislation made under it including all regulations, by-laws, orders and codes made thereunder; (ii) any repealed statute or statutory provision which it re-enacts (with or without modification); and (iii) any statute or statutory provision which modifies, consolidates, re- enacts or supersedes it, in each case, prior to the date of this Agreement. 6

1.3 The rule known as the ejusdem generis rule will not apply to this Agreement and accordingly general words introduced by the word “other”, “including”, “include” or “in particular” or any similar expression will not be given a restrictive meaning because of the fact that they are preceded by words indicating a particular class of acts, matters or things and will be construed as illustrative and will not limit the sense of the words preceding those terms. 1.4 The table of contents and headings in this Agreement are inserted for convenience only. They will be ignored in the interpretation of this Agreement. 1.5 Where any Party to this Agreement is more than one person then: (a) reference to that Party will refer to each of those persons or any of them as the case may be; and (b) the benefits contained in this Agreement in favour of such Party will be construed and take effect as conferred in favour of all such persons collectively and each of them separately. 1.6 The Parties have participated jointly in the negotiating and drafting of this Agreement. If an ambiguity or question of intent or interpretation arises, this Agreement will be construed as if drafted jointly by the Parties and no presumption or burden of proof will arise favouring or disfavouring a Party by the authorship of any of the provisions of this Agreement. 1.7 Where any provision of this Agreement specifies a notice period or other period of time and the day on which such period will end is not a Business Day, such period will be construed so as to end on the next Business Day. 1.8 Where any conversion between United States dollars and another currency is required or permitted to be made pursuant to the provisions of this Agreement (a “Conversion Calculation”), the conversion rate to be used for the purposes of the Conversion Calculation shall be the mean of the United States dollar exchange rate for such currency for each of the twenty Business Days immediately prior to the date on which the Conversion Calculation is made and in each case as calculated by the Exchange Rate office of the Central Bank of Ireland. Provided that, if the exchange rate on the date of the Conversion Calculation differs by more than five percent (±5%) from the average exchange rate for such currency over the three calendar months immediately preceding the Conversion Calculation date (each as determined by the Exchange Rate Office of the Central Bank of Ireland), then the conversion rate to be used shall instead be the average exchange rate over such three-month period. 1.9 The Background and Schedules to this Agreement will be deemed to form part of this Agreement and the Schedules will have the same force and effect as if set out in the body of this Agreement and references to this Agreement include the Schedules. 2. GRANT OF THE OPTIONS 2.1 In consideration of each of the Sellers granting the Buyer the Call Options referred to in Clause 2.2, the Buyer grants to the Sellers: (a) an option to require the Buyer to purchase the First Option Shares on the terms set out in this Agreement (the “First Put Option”); and (b) an option to require the Buyer to purchase the Second Option Shares on the terms set out in this Agreement (the “Second Put Option”). 7

2.2 In consideration of Buyer granting to the Sellers the Put Options referred to in Clause 2.1, each of the Sellers grants to the Buyer: (a) an option to purchase the First Option Shares on the terms set out in this Agreement (the “First Call Option”); and (b) an option to purchase the Second Option Shares on the terms set out in this Agreement (“Second Call Option”). 2.3 The relevant Option Shares will be sold by each Seller as legal and beneficial owners (save in respect of Nominee, NDRC, the Hawksford Nominee and the Tribal Nominee who will sell such shares as legal owners only with authority to transfer the beneficial ownership thereof) free from all Encumbrances and with all rights attached to them at each Option Completion or Caladan Option Completion as the case may be. 3. OPTION PERIOD 3.1 Put Option Periods (a) Save in respect of the First Put Option granted to Caladan Ventures Unlimited Company which may be exercised immediately from the date of this Agreement, the First Put Option may only be exercised after 30 June 2026 and may not be exercised later than 30 September 2026. (b) Save in respect of the Second Put Option granted to Caladan Ventures Unlimited Company which may be exercised immediately from the date of this Agreement, the Second Put Option may only be exercised after 30 June 2027 and may not be exercised later than 30 September 2027. 3.2 Call Option Periods (a) Save in respect of the First Call Option granted by Caladan Ventures Unlimited Company which may be exercised immediately from the date of this Agreement, the First Call Option may only be exercised after the 30 June 2026 and may not be exercised later than 30 July 2026. (b) Save in respect of the Second Call Option granted by Caladan Ventures Unlimited Company which may be exercised immediately from the date of this Agreement, the Second Call Option may only be exercised after the 30 June 2027 and may not be exercised later than 30 July 2027. 4. EXERCISE OF PUT OPTION 4.1 Each Put Option will be exercised only by the Sellers’ Representative, NDRC and EI giving the Buyer an Exercise Notice in accordance with 15.17(e) which will include: (a) the date on which the Exercise Notice is given; (b) a statement to the effect that the Sellers’ Representative. NDRC and EI is exercising the relevant Put Option on behalf of all of the Sellers; and (c) a signature by or on behalf of the Sellers’ Representative. EI and NDRC. 4.2 Each Put Option may be exercised only in respect of all (and not some only) of the relevant Option Shares. 8

4.3 Once given, an Exercise Notice in respect of a Put Option may not be revoked without the written consent of the Buyer. 5. EXERCISE OF CALL OPTION 5.1 Each Call Option will be exercised only by the Buyer giving the Sellers’ Representative, EI and NDRC an Exercise Notice in accordance with Clause 15.17(e) which will include: (a) the date on which the Exercise Notice is given; (b) a statement to the effect that the Buyer is exercising the Call Option; and (c) a signature by or on behalf of the Buyer. 5.2 Each Call Option may be exercised only in respect of all (and not some only) of the relevant Option Shares. 5.3 Once given, an Exercise Notice in respect of a Call Option may not be revoked without the written consent of the Sellers’ Representative and EI. 6. CONSIDERATION 6.1 Subject to Clause 6.3, the Option Consideration payable by the Buyer will be satisfied in cash at the relevant Option Completion and will be calculated in accordance with Clause 6.2. 6.2 Subject to Clause 14, the total price payable by the Buyer to the Sellers in respect of: (a) the First Option Shares following exercise of the First Call Option or First Put Option will be an amount equal to the First Option Consideration; and (b) the Second Option Shares following exercise of the Second Call Option or Second Put Option will be an amount equal to the Second Option Consideration. 6.3 Any Option Consideration payable to Caladan Ventures Unlimited Company shall not be paid on Caladan Ventures Option Exercise, but instead shall be paid on such date as all other Sellers are due their respective Option Consideration (if any) in accordance with Clause 10. 7. BUYER’S GUARANTEE The Guarantor irrevocably and unconditionally guarantees to the Seller the due and punctual performance and observance of each of the Buyer’s payment obligations arising under this Agreement on the terms set out in Schedule 6. 8. R&D TAX CREDIT CLAIMS 8.1 The Buyer shall, and shall procure that each relevant Group Company shall: (a) use reasonable care and attention in preparing and submitting all necessary filings, tax returns, and elections for the purposes of claiming that any R&D Tax Credits relating (in whole or in part) to qualifying R&D expenditure incurred prior to Completion in a proper and timely manner; 9

(b) save for any action or decision necessary or desirable for the Buyer’s management of its tax affairs including the affairs of the Group, not take any action (or omit to take any action) that would unreasonably delay, compromise, or invalidate the ability of any Group Company to receive the R&D Receipts; and (c) comply with the provisions of clause 9.1 of the Tax Deed (Making of Tax Returns for the Group for Periods up to and including Completion) in preparing and submitting all necessary filings, tax returns and elections for the purposes of claiming any R&D Tax Credits relating (in whole or in part) to qualifying R&D expenditure incurred prior to Completion and the Sellers shall comply with clause 9.2 of the Tax Deed in connection with such filings, returns and elections. 8.2 If a Group Company receives R&D Receipts after the End Date but prior to the third anniversary of this Agreement which have not been reflected in the Second Option Consideration, the Buyer shall, within 60 days of the third anniversary of this Agreement, pay or procure the payment of such amounts to the Sellers’ Solicitors and receipt by the Sellers’ Solicitors of such amounts shall be an absolute discharge to the Buyer of its obligations to pay such amount. Any such amounts paid by the Buyer under this Clause 8.2 shall: (i) so far as possible, be treated as an adjustment to the Deal Value to the extent of the payment; and (ii) be deemed to form part of the Option Consideration solely for the purposes of the Buyer’s right of set-off under Clause 14. 9. CALADAN VENTURES OPTION EXERCISE 9.1 Caladan Ventures Option Exercise will take place immediately following the date of this Agreement or such other date as the Buyer and the Sellers’ Representative may agree. 9.2 The Sellers’ Representative will procure that there be delivered to the Buyer: (a) a stock transfer form in respect of each Caladan Ventures Unlimited Company’s relevant Option Shares duly completed in favour of the Buyer (or such persons as the Buyer may direct); and (b) share certificate(s) (or, in the case of any share certificates found to be missing, an indemnity) in respect of the relevant Option Shares. 10. OPTION COMPLETION 10.1 Option Completion will take place on the date falling 15 days after the relevant Option Consideration is agreed or determined in accordance Schedule 3 or such other date as the Buyer and the Sellers’ Representative and EI may agree (“Scheduled Option Completion Date”) provided always that, where the Buyer is seeking recovery under the W&I Insurance Policy in accordance with paragraph 2(c)(ii) of Schedule 6 of the Share Purchase Agreement, Option Completion shall be deferred until the earlier of: (i) such time as the W&I Insurer has refused or denied cover, upon which the Buyer shall be entitled to avail of its right of set-off under Clause 14; (ii) such time as the W&I Insurer has accepted cover; or (iii) such time as the Buyer will be deemed to have complied with its obligation to first seek recourse to the fullest extent possible under the W&I Insurance Policy pursuant to paragraph 2(c)(ii) of Schedule 6 of the Share Purchase Agreement (which will be deemed to have occurred if the Buyer has been seeking recourse under the W&I Insurance Policy for a period of six months without the W&I Insurer having refused, denied or accepted cover). Notwithstanding the foregoing, it is hereby agreed that Option Completion may not be 10

deferred pursuant to this Clause 10.1 for more than six months from the Scheduled Option Completion Date. 10.2 At each Option Completion, the Buyer will pay, subject to any set-off required or permitted by Clause 14, to the Sellers’ Solicitors by electronic transfer, and receipt by the Sellers’ Solicitors of the Option Consideration will constitute full and final discharge of the Buyer’s obligation to pay the Option Consideration. 10.3 The Sellers’ Representative, NDRC and EI will procure that there be delivered to the Buyer at each Option Completion save in respect of the Option Shares held by Caladan Ventures (noting the same will have been addressed in accordance with Clause 12): (a) a stock transfer form in respect of each Seller’s relevant Option Shares duly completed in favour of the Buyer (or such persons as the Buyer may direct); and (b) share certificate(s) (or, in the case of any share certificates found to be missing, an indemnity) in respect of the relevant Option Shares. 11. EXECUTION OF TRANSFER DOCUMENTS 11.1 If the Buyer has complied with its obligation to pay the relevant Option Consideration in accordance with Clause 10.2 and the Sellers’ Representative fails to comply with its obligations under Clause 10.3 in respect of any Seller, the Sellers’ Representative or any director of the Company or any director of the Buyer may give a good discharge for the Option Consideration on behalf of the relevant Seller (save for EI) and may execute and deliver to the Buyer a transfer of the relevant Option Shares on behalf of the relevant Seller (save for EI). 11.2 Each Seller (save for EI) hereby: (a) irrevocably and by way of security for its obligations under this Agreement appoints the Sellers’ Representative or any one director of the Company or any one director of the Buyer or any other person nominated in writing by the Buyer as its attorney following the exercise of the relevant Option to execute, on such Seller’s behalf, a transfer of the Option Shares in favour of the Buyer (or as the Buyer directs) and to execute such other documents and do all such other acts as may be necessary to transfer title to the Option Shares to the Buyer (or as it directs); and (b) authorises the directors of the Company and the Buyer to approve the registration of such transfers or other documents. 12. BUYER’S PROTECTION Each Seller will not, without the prior written consent of the Buyer sell, transfer or otherwise dispose of, or mortgage, charge, pledge or otherwise encumber its legal or beneficial interest in any of the Option Shares (or any interest in any of them). 13. SELLERS’ PROTECTION The Buyer shall, from immediately following the date of this Agreement and until the End Date, comply with the provisions of Schedule 4. 11

14. SET-OFF 14.1 The Parties agree and acknowledge that the Buyer will be entitled to a right of set-off against the Option Consideration (which, for the purposes of this Clause 14, will be deemed to include any amounts paid by the Buyer under Clause 6.3) as set out in this Clause 14. 14.2 The Buyer will be entitled to deduct from the Option Consideration the amount of any Settled Claim that may exist at the date on which the Option Consideration falls due to be paid to the Sellers. 14.3 If any Notified Claim is still ongoing at the date upon which the Option Consideration is due and payable, and it has either been agreed in writing by the Buyer and the Sellers’ Representative and EI that the Notified Claim has a reasonable prospect of success, or has been determined or referred for determination in accordance with Clause 14.5, the Buyer may withhold from the Option Consideration an amount equal to the lower of: (i) the Estimated Liability; and (ii) the amount of the Option Consideration then due (the “Withheld Amount”). 14.4 Where the provisions of Clause 14.3 apply, the Buyer and the Sellers’ Representative and EI shall use all reasonable endeavours to agree the Estimated Liability in respect of the Notified Claim and whether the Notified Claim has a reasonable prospect of success as soon as possible and in any event within the period of 20 days following the date on which payment of the Option Consideration was due (in which case the Buyer shall not be in breach of its obligation to pay the Option Consideration for so long as the process in this Clause 14.4 is ongoing and for a period of 5 Business Days thereafter). 14.5 In the absence of such agreement, the following procedure shall apply: (a) the determination of the Estimated Liability and whether the Notified Claim has a reasonable prospect of success shall be referred to a Barrister at the request of either party; (b) the Barrister shall be requested to provide his / her determination of the Estimated Liability and whether the Notified Claim has a reasonable prospect of success within 15 Business Days of his/her appointment (or such other period as the Buyer and the Sellers’ Representative and EI may otherwise agree with the Barrister); (c) the Barrister shall act as an expert and not as arbitrator and his/her determination regarding the amount of the Estimated Liability shall, in the absence of manifest error, be final and binding on the Parties for the purposes of determining the Withheld Amount only; and (d) the Barrister’s fees in making his/her determination of the Estimated Liability and the prospect of success of the Notified Claim shall be borne equally by the Buyer on the one hand and the Sellers on the other hand or as the Barrister may otherwise direct having regard to the respective conduct of the parties. 14.6 For the avoidance of doubt, the maximum amount that may be deducted by the Buyer under Clause 14.2 or withheld by the Buyer under Clause 14.3 is an amount equal to the Option Consideration less the amount equal to the Option Consideration already paid. 14.7 If a Notified Claim subsequently becomes a Settled Claim in favour of the Buyer: 12

(a) where the actual amount of the Settled Claim is equal to or greater than the Withheld Amount, the Withheld Amount shall belong to the Buyer; and (b) where the actual amount of the Settled Claim is less than the Withheld Amount, the Buyer shall (within 20 Business Days of the claim becoming a Settled Claim) pay to the Sellers an amount equal to the amount by which the Withheld Amount exceeds the amount of the Settled Claim, and the balance of the Withheld Amount shall belong to the Buyer. 14.8 If the Notified Claim subsequently becomes a Settled Claim in favour of the Sellers or is withdrawn or abandoned by the Buyer, then the Withheld Amount shall belong to the Sellers, and the Buyer shall (within 20 Business Days of the claim becoming a Settled Claim or being withdrawn or abandoned) pay to the Sellers an amount equal to the Withheld Amount. 15. GENERAL 15.1 Effect of Option Completion Except to the extent already performed, all the provisions of this Agreement shall, so far as they are capable of being performed or observed, continue in full force and effect notwithstanding Option Completion. 15.2 Announcements and Confidentiality of Agreement (a) Save in respect of EI, no public announcement, communication or circular concerning the transactions referred to in this Agreement shall be made or despatched at any time by any Party without the prior written consent of the other Parties (such consent not to be unreasonably withheld or delayed), provided always that the Buyer may make or despatch any public announcement, communication or circular where required by law (including pursuant to any regulation binding on it). (b) Save in respect of EI, each Party shall treat as strictly confidential all information received or obtained as a result of entering into or performing this Agreement which relates to the provisions or subject matter of this Agreement or the transactions contemplated by it, to any other Party or to the negotiations relating to this Agreement. (c) Any Party may disclose information (other than Confidential Information) which would otherwise be confidential by virtue of this Clause 15.2 if and to the extent: (i) it is required to do so by law or by any securities exchange or regulatory or governmental body (including any Tax Authority) to which it is subject wherever situated, whether or not the requirement for disclosure of information has the force of law; (ii) it considers it necessary to disclose the information to its professional advisers, statutory auditors and / or bankers provided that it does so on a confidential basis; (iii) the information has come into the public domain other than as a result of breach of this Agreement; or (iv) the Party to whom such information relates has given its consent in writing. 13

15.3 Adequacy of Damages Damages would not be an adequate remedy for any breach by a Party of this Agreement and accordingly the other Party will be entitled, without proof of special damages and without prejudice to any other rights or remedies that such other Party may have, to the remedies of injunction, specific performance or other equitable relief for any threatened or actual breach of this Agreement. 15.4 Remedies and Waivers (a) Save as otherwise provided in this Agreement, no delay or omission by a Party in exercising any right, power or remedy provided by law or under this Agreement shall: (i) affect that right, power or remedy; or (ii) operate as a waiver of it. (b) Save as otherwise provided in this Agreement, the exercise or partial exercise of any right, power or remedy provided by law or under this Agreement shall not preclude any other or further exercise of it or the exercise of any other right, power or remedy. (c) Save as otherwise provided in this Agreement, the rights, powers and remedies provided in this Agreement are cumulative and not exclusive of any rights, powers and remedies provided by law 15.5 Severability (a) If at any time any provision of this Agreement is or becomes illegal, invalid or unenforceable in any respect under the law of any jurisdiction, that shall not affect or impair: (i) the legality, validity or enforceability in that jurisdiction of any other provision of this Agreement; or (ii) the legality, validity or enforceability under the law of any other jurisdiction of that or any other provision of this Agreement. (b) If any invalid, unenforceable or illegal provision of this Agreement would be valid, enforceable and legal if some part of it were deleted, the provision shall apply with the minimum modification necessary to make it legal, valid and enforceable. 15.6 No Partnership or Agency Nothing in this Agreement and no action taken by the Parties pursuant to this Agreement shall constitute, or be deemed to constitute, a partnership, association, joint venture or other cooperative entity between the Parties nor shall it make a Party the agent of any other Party for any purpose. Save to the extent expressly provided to the contrary in this Agreement, no Party has, pursuant to this Agreement, any authority or power to bind or to contract in the name of any other Party. 15.7 Further Assurance Without limitation or prejudice to the Sellers’ obligations under this Agreement, at any time after Option Completion, for a period of 12 months, the Sellers (other than 14

EI) shall, following written request, do and execute, or procure to be done and executed, all necessary acts, deeds, documents and things which the Buyer may, acting reasonably, consider necessary to give full effect to this Agreement, where such act, deed, document or thing is not otherwise required to be done by the Sellers under this Agreement. 15.8 Entire Agreement (a) This Agreement (together with the Share Purchase Agreement) constitutes the complete, entire and exclusive agreement and understanding between the Parties relating to its subject matter. (b) This Clause 15.8 is without prejudice to the right of the Buyer to make any claim or claims against the Sellers or any other person pursuant to this Agreement for misrepresentation. (c) This Clause 15.8 will not exclude any liability for, or remedy in respect of, fraudulent misrepresentation by any Party. 15.9 Variation This Agreement may only be varied in writing (including electronic methods of writing) signed by or on behalf of each Party. 15.10 Assignment, Transfer, etc. (a) Subject to Clause 15.10(b), no Party may assign, mortgage, charge, create a trust in respect of, transfer or otherwise dispose of or purport to do any of the foregoing in respect of all or any of its rights or permit the assumption of its obligations under this Agreement. (b) The Buyer may, on giving notice to the Sellers’ Representative and EI, at any time assign the benefit of any provision of this Agreement (together with any causes of action) provided that any such assignment shall not operate to increase any Seller’s liability, to any other member of the Buyer’s Group, provided further that if such assignee subsequently ceases to be a member of the Buyer’s Group, the Buyer shall procure that, prior to its ceasing to be a member of the Buyer’s Group, such assignee reassigns the rights under this Agreement and as have been assigned to it to the Buyer or (upon giving further written notice to the Sellers’ Representative and EI) to another member of the Buyer’s Group. 15.11 Costs Each Party shall pay its own costs and expenses in connection with the negotiation, preparation, execution, registration and implementation of this Agreement and the Transaction Documents. The Buyer shall pay all stamp duties and registration fees applicable to any document to which it is a party which arise as a result of the acquisition of the Options Shares pursuant to this Agreement. 15.12 Counterparts and Manner of Execution (a) This Agreement may be executed in any number of counterparts, and by the Parties on separate counterparts, but shall not be effective until each Party has executed at least one counterpart, whereupon this shall have the same effect as if the signatures on the counterparts were on a single original of this Agreement. 15

(b) Each counterpart shall constitute a duplicate original of this Agreement but all the counterparts shall together constitute one and the same instrument. (c) Transmission of an executed counterpart of this Agreement (or of the executed signature page of a counterpart of this Agreement) by personal delivery, email or other means of electronic transmission (in PDF, JPEG or other readable format) or commercial courier shall take effect as delivery of an executed counterpart of this Agreement. 15.13 Electronic Signatures (a) The Parties consent to the execution by or on behalf of each other Party to the Transaction Documents by electronic signature, provided that such manner of execution is permitted by law. (b) The Parties: (i) agree that an executed copy of each Transaction Document may be retained in electronic form; and (ii) acknowledge that such electronic form shall constitute an original of each Transaction Document and may be relied upon as evidence of that Transaction Document. 15.14 Governing law This Agreement and any dispute or claim arising out of or in connection with it or its subject matter, formation, existence, negotiation, validity, termination or enforceability (including non-contractual obligations, disputes or claims) (“Dispute”) shall be governed by and construed in accordance with the laws of Ireland. 15.15 Jurisdiction (a) Each of the Parties irrevocably agrees that the courts of Ireland shall have exclusive jurisdiction to settle any Dispute and, for such purposes, irrevocably submits to the exclusive jurisdiction of such courts. Any proceeding, suit or action arising out of or in connection with this Agreement (the “Proceedings”) shall therefore be brought in the courts of Ireland. (b) Each of the Parties irrevocably waives any right it may have to object to Proceedings being brought in the courts of Ireland or to claim that the action has been brought in an inconvenient forum or to claim that those courts do not have jurisdiction 15.16 Sellers’ Representative The provisions of clause 14.14 (Sellers’ Representative) of the Share Purchase Agreement apply mutatis mutandis to this Agreement. 15.17 Notices (a) Any notice or other communication under this Agreement shall only be effective if it is in writing and in English or accompanied by a properly prepared translation into English and, where given or made under Clause 15.17(c)(i), (ii) or (iii), a copy is also issued by email in accordance with Clause 15.17(c)(iv). Any notice or other communication under this Agreement that is delivered by fax shall not be effective for any purpose. 16

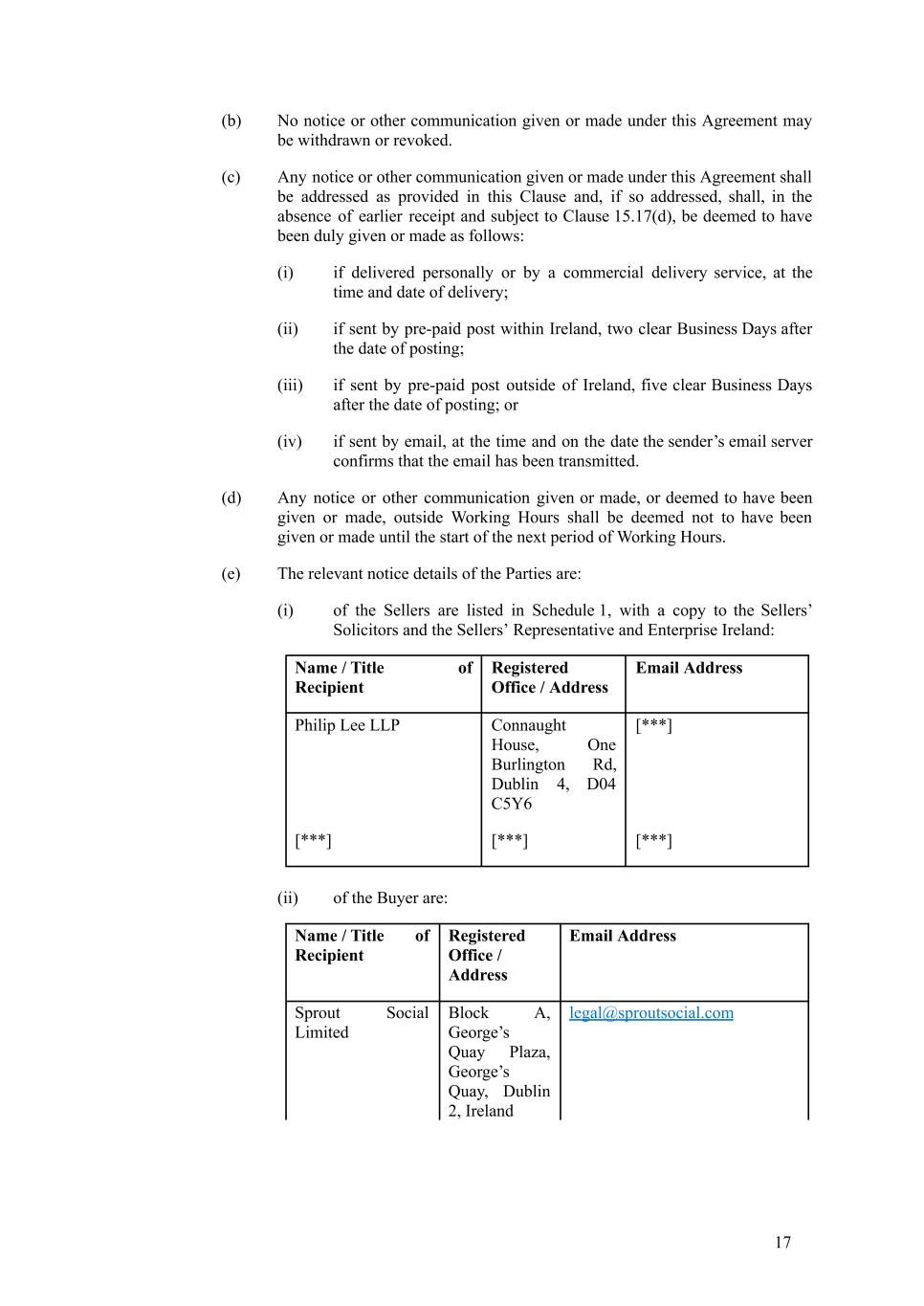

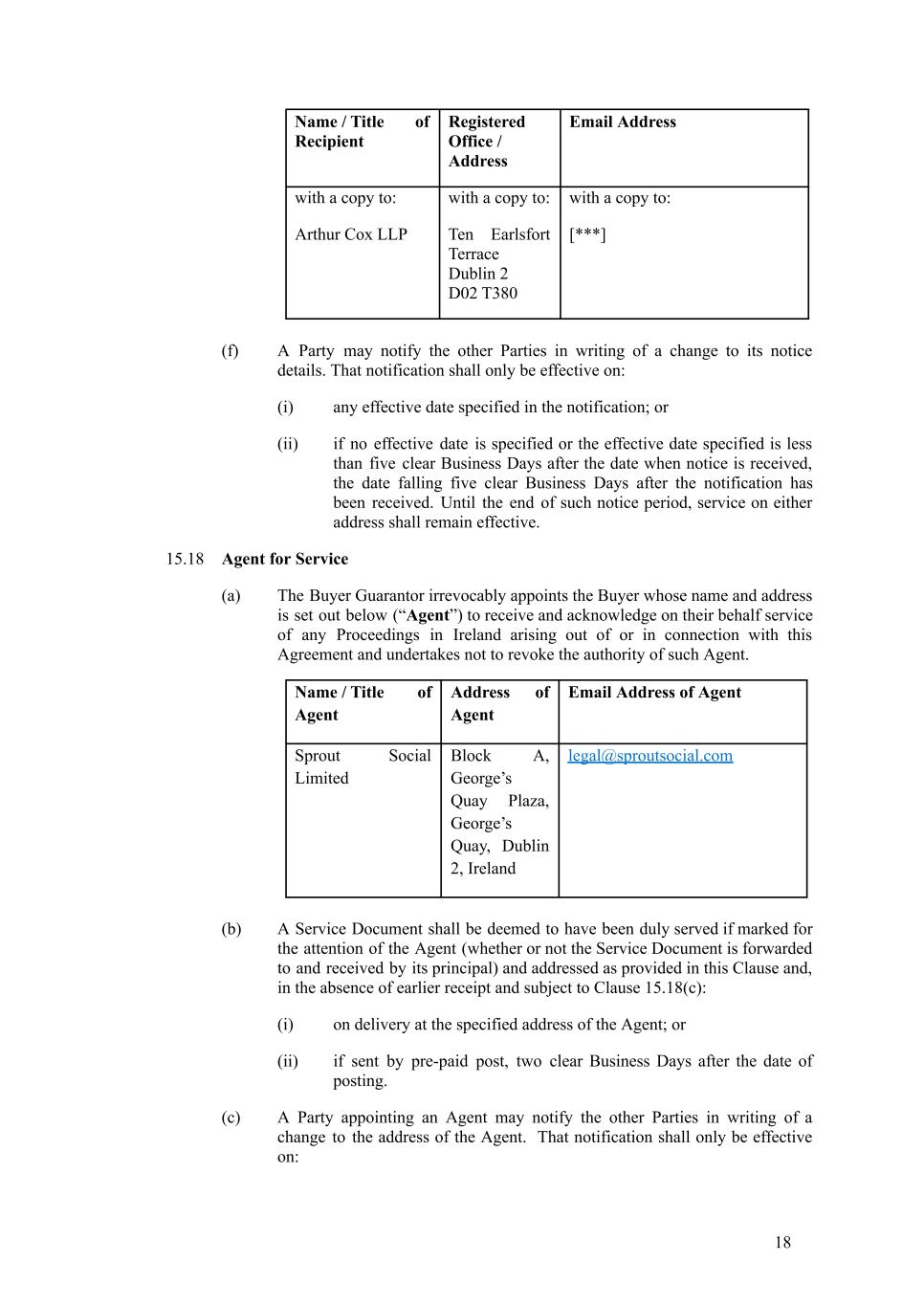

(b) No notice or other communication given or made under this Agreement may be withdrawn or revoked. (c) Any notice or other communication given or made under this Agreement shall be addressed as provided in this Clause and, if so addressed, shall, in the absence of earlier receipt and subject to Clause 15.17(d), be deemed to have been duly given or made as follows: (i) if delivered personally or by a commercial delivery service, at the time and date of delivery; (ii) if sent by pre-paid post within Ireland, two clear Business Days after the date of posting; (iii) if sent by pre-paid post outside of Ireland, five clear Business Days after the date of posting; or (iv) if sent by email, at the time and on the date the sender’s email server confirms that the email has been transmitted. (d) Any notice or other communication given or made, or deemed to have been given or made, outside Working Hours shall be deemed not to have been given or made until the start of the next period of Working Hours. (e) The relevant notice details of the Parties are: (i) of the Sellers are listed in Schedule 1, with a copy to the Sellers’ Solicitors and the Sellers’ Representative and Enterprise Ireland: Name / Title of Recipient Registered Office / Address Email Address Philip Lee LLP Connaught House, One Burlington Rd, Dublin 4, D04 C5Y6 [***] [***] [***] [***] (ii) of the Buyer are: Name / Title of Recipient Registered Office / Address Email Address Sprout Social Limited Block A, George’s Quay Plaza, George’s Quay, Dublin 2, Ireland legal@sproutsocial.com 17

Name / Title of Recipient Registered Office / Address Email Address with a copy to: Arthur Cox LLP with a copy to: Ten Earlsfort Terrace Dublin 2 D02 T380 with a copy to: [***] (f) A Party may notify the other Parties in writing of a change to its notice details. That notification shall only be effective on: (i) any effective date specified in the notification; or (ii) if no effective date is specified or the effective date specified is less than five clear Business Days after the date when notice is received, the date falling five clear Business Days after the notification has been received. Until the end of such notice period, service on either address shall remain effective. 15.18 Agent for Service (a) The Buyer Guarantor irrevocably appoints the Buyer whose name and address is set out below (“Agent”) to receive and acknowledge on their behalf service of any Proceedings in Ireland arising out of or in connection with this Agreement and undertakes not to revoke the authority of such Agent. Name / Title of Agent Address of Agent Email Address of Agent Sprout Social Limited Block A, George’s Quay Plaza, George’s Quay, Dublin 2, Ireland legal@sproutsocial.com (b) A Service Document shall be deemed to have been duly served if marked for the attention of the Agent (whether or not the Service Document is forwarded to and received by its principal) and addressed as provided in this Clause and, in the absence of earlier receipt and subject to Clause 15.18(c): (i) on delivery at the specified address of the Agent; or (ii) if sent by pre-paid post, two clear Business Days after the date of posting. (c) A Party appointing an Agent may notify the other Parties in writing of a change to the address of the Agent. That notification shall only be effective on: 18

(i) any effective date specified in the notification; or (ii) if no effective date is specified or the effective date specified is less than five clear Business Days after the date when notice is received, the date falling five clear Business Days after the notification has been received. Until the end of such notice period, service on either address shall remain effective. (d) If the Agent at any time ceases for any reason to act as such or no longer has an address in Ireland, the Party appointing such Agent will appoint a replacement agent having an address for service in Ireland and will notify the other Parties in writing of the name, address and email address of the replacement agent. Until any Party receives such notification, they will be entitled to treat the Agent named above as the Agent of the Party appointing the Agent for the purposes of this Clause 15.18(d). The provisions of this Clause 15.18(d) applying to service on the Agent apply equally to service on a replacement agent. (e) For the purpose of this Clause 15.18 “Service Document” means a writ, summons, order, judgment or other document relating to or issued in connection with any Proceedings. 19

IN WITNESS WHEREOF this Agreement has been entered into on the date stated at the beginning of it. 20

Schedule 1 [***]

Schedule 2 [***]

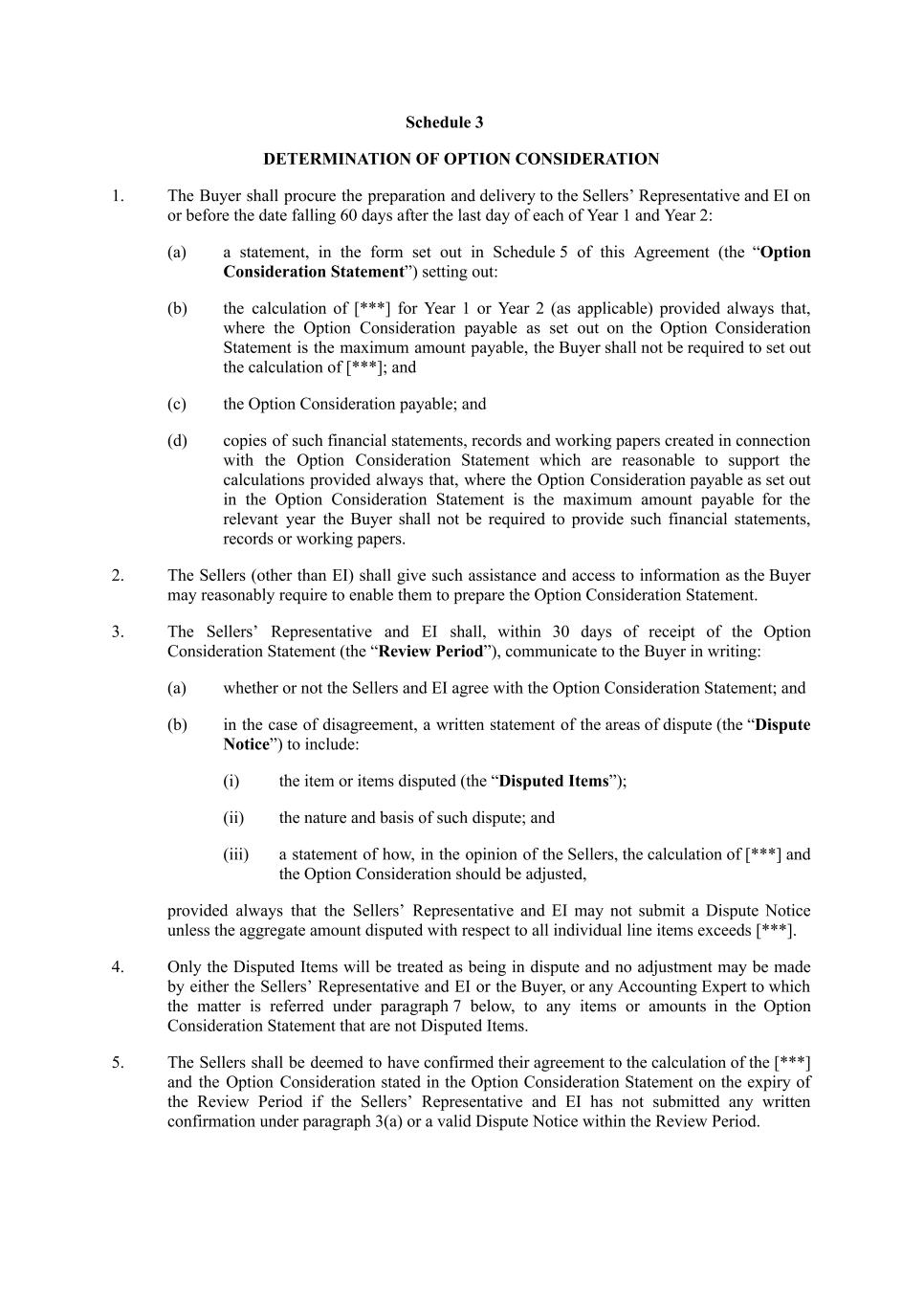

Schedule 3 DETERMINATION OF OPTION CONSIDERATION 1. The Buyer shall procure the preparation and delivery to the Sellers’ Representative and EI on or before the date falling 60 days after the last day of each of Year 1 and Year 2: (a) a statement, in the form set out in Schedule 5 of this Agreement (the “Option Consideration Statement”) setting out: (b) the calculation of [***] for Year 1 or Year 2 (as applicable) provided always that, where the Option Consideration payable as set out on the Option Consideration Statement is the maximum amount payable, the Buyer shall not be required to set out the calculation of [***]; and (c) the Option Consideration payable; and (d) copies of such financial statements, records and working papers created in connection with the Option Consideration Statement which are reasonable to support the calculations provided always that, where the Option Consideration payable as set out in the Option Consideration Statement is the maximum amount payable for the relevant year the Buyer shall not be required to provide such financial statements, records or working papers. 2. The Sellers (other than EI) shall give such assistance and access to information as the Buyer may reasonably require to enable them to prepare the Option Consideration Statement. 3. The Sellers’ Representative and EI shall, within 30 days of receipt of the Option Consideration Statement (the “Review Period”), communicate to the Buyer in writing: (a) whether or not the Sellers and EI agree with the Option Consideration Statement; and (b) in the case of disagreement, a written statement of the areas of dispute (the “Dispute Notice”) to include: (i) the item or items disputed (the “Disputed Items”); (ii) the nature and basis of such dispute; and (iii) a statement of how, in the opinion of the Sellers, the calculation of [***] and the Option Consideration should be adjusted, provided always that the Sellers’ Representative and EI may not submit a Dispute Notice unless the aggregate amount disputed with respect to all individual line items exceeds [***]. 4. Only the Disputed Items will be treated as being in dispute and no adjustment may be made by either the Sellers’ Representative and EI or the Buyer, or any Accounting Expert to which the matter is referred under paragraph 7 below, to any items or amounts in the Option Consideration Statement that are not Disputed Items. 5. The Sellers shall be deemed to have confirmed their agreement to the calculation of the [***] and the Option Consideration stated in the Option Consideration Statement on the expiry of the Review Period if the Sellers’ Representative and EI has not submitted any written confirmation under paragraph 3(a) or a valid Dispute Notice within the Review Period.

6. If the Sellers’ Representative and EI submit a valid Dispute Notice to the Buyer within the Review Period, the Buyer and the Sellers’ Representative and EI shall negotiate in good faith and shall use reasonable endeavours to resolve the Disputed Items. If the Buyer and the Sellers’ Representative and EI resolve the Disputed Items, the Option Consideration Statement (as amended by agreement between the Buyer and the Sellers’ Representative and EI) shall then become final and binding on the Parties. 7. If the Buyer and the Sellers’ Representative and EI fail to resolve the Disputed Items within 30 days of the date of receipt by the Buyer of a valid Dispute Notice, either the Buyer or the Sellers’ Representative and EI may refer the Disputed Items to an Accounting Expert for determination. 8. The Accounting Expert shall act on the following basis: (a) the Accounting Expert shall act as an expert and not as an arbitrator and the provisions of the Arbitration Act 2010 shall not apply to them / their determination; (b) the Accounting Expert shall make their determination as soon as possible but in any event, unless otherwise agreed between the Buyer and the Sellers’ Representative and EI, within 20 Business Days of the matter being referred to them under paragraph 7; (c) in giving their determination, the Accounting Expert shall provide a report in writing which states what adjustments (if any) are necessary to be made to the calculation of [***] and the Option Consideration in respect of the Disputed Items; (d) each of the Buyer and the Sellers’ Representative and EI shall give and shall procure that the Accounting Expert has full access to the information and documentation in their respective possession or control that the Accounting Expert may reasonably require for the purposes of making their determination; (e) the fees and expenses of the Accounting Expert shall be borne equally by the Buyer and the Sellers and, if the fees are paid in full by either Party, the appropriate proportion shall be due from the other Party as a debt due on demand; and (f) the determination of [***] and the Option Consideration by the Accounting Expert shall (save in the case of fraud or manifest error) be final and binding on the Parties. All determinations by the Accounting Expert shall be in writing, shall explain the reasons for such determination and shall be delivered to the Buyer and the Sellers’ Representative and EI at the same time. 9. The relevant [***] and the relevant Option Consideration will be deemed to have been determined: (a) if the Buyer agrees the calculation with the Sellers’ Representative and EI, on the day that they confirm such agreement in writing; (b) if the Sellers’ Representative and EI fails to provide the Buyer with either: (i) written confirmation in accordance with paragraph 3(a) of this Schedule 3; or (ii) a Dispute Notice, on the expiry of the Review Period; (c) if a dispute is resolved under the process envisaged by paragraph 6 of this Schedule 3, on the date of such resolution (or as otherwise agreed between the Parties); or

(d) if the Accounting Expert makes the determination, on the date that the Accounting Expert notifies the Buyer and the Sellers’ Representative and EI of their determination.

Schedule 4 [***]

Schedule 5 FORM OF OPTION CONSIDERATION STATEMENT [Insert date] The Sellers’ Representative and Enterprise Ireland [Insert Address] Re: Put and Call Option Agreement in connection with Newswhip Group Holdings Limited (the “Company”) dated [insert date] between the Sellers (as defined therein) and [the Buyer] (the “Agreement”) To whom it may concern, We refer to the Agreement. We hereby certify that: 1. [the aggregate amount of the [***] for [Year 1]/[Year 2] is USD[ ● ]; and] 2. the Option Consideration payable under the Agreement upon exercise of the [First Option]/[Second Option] is USD[ ● ]. [In support of this Option Consideration Statement, we enclose copies of the following documents [list financial statements, records and working papers created in connection with the calculations of the [***] and the Option Consideration which are reasonable to support the calculations].] Please confirm your agreement to the above calculations by returning a countersigned copy of this letter to [ ● ]. Yours faithfully, Signed: __________________________________ Authorised signatory for and on behalf of [Buyer] AGREED AND ACCEPTED Signed: __________________________________ Sellers’ Representative and Enterprise Ireland

Schedule 6 BUYER’S GUARANTEE 1. Subject to paragraph 2 of this Schedule 6 (a) in consideration of each Seller agreeing to sell or procure the transfer the Option Shares set out opposite his/her/its name in Schedule 1 on the terms and subject to the conditions set out in this Agreement, the Buyer’s Guarantor, at the request of the Buyer, hereby unconditionally and irrevocably guarantees to that Seller the due and punctual performance and observance by the Buyer of all of its obligations to pay that Seller’s respective entitlement to the Option Consideration, pursuant to, and subject to, the Transaction Documents, (to the extent payable in accordance with the Transaction Documents) on demand (each such obligation a “Buyer’s Payment Obligation” and, together, the “Buyer’s Payment Obligations”), and further, for the same consideration, agrees to pay to that Seller on demand the amount of, and to indemnify and keep indemnified that Seller in respect of, any loss, cost or expense which that Seller may incur by reason of any breach by the Buyer of any of the Buyer’s Payment Obligations. The liability of the Buyer’s Guarantor under this Agreement shall not be released or diminished by any variation of the terms of the Transaction Documents (save where agreed in accordance with the terms of the Transaction Documents), or any forbearance, neglect or delay in seeking performance of the obligations hereby imposed or any granting of time for such performance, save for where such failure to take reasonable steps to enforce the obligations materially prejudices the Guarantor; (b) if and whenever the Buyer defaults for any reason whatsoever in the performance of any of the Buyer’s Payment Obligations, the Buyer’s Guarantor shall forthwith upon demand unconditionally perform (or procure performance of) and satisfy (or procure satisfaction of) each Buyer’s Payment Obligation in regard to which such default has been made in the manner prescribed by this Agreement and so that the same benefits shall be conferred on the relevant Seller as would have been received if the relevant Buyer’s Payment Obligation(s) had been duly performed and satisfied by the Buyer; (c) this guarantee is to be a continuing guarantee and accordingly is to remain in force until the Buyer’s Payment Obligations have been performed or satisfied regardless of the legality, validity or enforceability of any provisions of this Agreement and notwithstanding the winding-up, liquidation, dissolution or other incapacity of the Buyer or any change in the status, control or ownership of the Buyer. This guarantee is in addition to, without limiting and not in substitution for, any rights or security which the relevant Seller may now or after the date of this Agreement have or hold for the performance and observance of the Buyer’s Payment Obligations. This guarantee shall not be discharged by any intermediate discharge or payment of or on account of the Buyer’s Payment Obligations or any of them; and (d) as a separate and independent stipulation, the Buyer’s Guarantor agrees that any of the Buyer’s Payment Obligations which may not be enforceable against or recoverable by the relevant Seller from the Buyer by reason of any legal limitation, disability or incapacity on or of the Buyer or any fact or circumstance (other than any limitation imposed by this Agreement) shall nevertheless be enforceable against and recoverable from the Buyer’s Guarantor by the relevant Seller as though the same had been incurred by the Buyer’s Guarantor and the Buyer’s Guarantor were the sole or principal obligor and not merely as a surety in respect thereof and shall be performed or paid by the Buyer’s Guarantor on demand; and

(e) if the Buyer’s Guarantor is compelled by law to make any deduction or withholding, which the Buyer would not be compelled to make if it were the entity making the payment, the Buyer’s Guarantor will promptly pay to the relevant Seller such additional amounts as will result in the net amount received by the relevant Seller being equal to the full amount which would have been received had there been no deduction or withholding. 2. Each provision of the guarantee contained in this Schedule 6 is severable from the others, and this Agreement, and if at any time one or more provisions becomes illegal, invalid or unenforceable the validity, legality and enforceability of the remaining provisions hereof shall not in any way be affected or impaired thereby. 3. The obligations of the Buyer’s Guarantor under this guarantee will not be affected by any act, omission, matter or thing which, but for this paragraph 7 contained in this Schedule 6, would reduce, release or prejudice such obligations under this Agreement or prejudice or diminish those obligations in whole or in part (whether or not known to it), including: (a) any time, waiver or consent or concession granted to, or composition with the Buyer or the Buyer’s Guarantor; or (b) the release of the Buyer or the Buyer’s Guarantor under the terms of any composition or arrangement with any creditor of the Buyer or the Buyer’s Guarantor; or (c) any incapacity or lack of power, authority or legal personality of or dissolution or change in the members or status or constitution of the Buyer or the Buyer’s Guarantor; or (d) save where agreed in accordance with the terms of this Agreement, any amendment, extension, restatement (in each case, however fundamental and of whatsoever nature) or replacement of this Agreement; (e) any unenforceability, illegality or invalidity or non provability of the Buyer’s Payment Obligations; or (f) any insolvency or similar proceedings in respect of the Buyer’s Guarantor or the Buyer, in any relevant jurisdiction; or (g) any merger or amalgamation (however effected) relating to the Buyer or the Buyer’s Guarantor; or (h) any judgment obtained against the Buyer; or (i) any other act, event or omission which but for this provision would or might operate to impair, discharge or otherwise affect the Buyer’s Guarantor’s obligations under this guarantee including, without limitation, any repudiation by the Buyer of all or any part of the Buyer’s Payment Obligations. 4. The Parties acknowledge and agree that, notwithstanding the provisions of paragraph 1(a): (a) upon any Buyer’s Payment Obligation having been unconditionally paid, discharged, performed or satisfied in full; or (b) in respect of any Buyer’s Payment Obligation under Clause 6.2, in the event that the Buyer is not be required to pay to the relevant Seller, and such Seller is not otherwise be entitled to receive, his/her/its proportion of the Option Consideration,

this guarantee shall immediately be fully and unconditionally released in respect of such Buyer’s Payment Obligation and the Buyer’s Guarantor shall immediately be discharged from all past, present and future liability to the relevant Seller under the guarantee in respect of such Buyer’s Payment Obligation and also from all actions, claims and demands under or in connection with the guarantee in respect of such Buyer’s Payment Obligation, PROVIDED HOWEVER, if following such release and discharge any payment by the Buyer or the Buyer’s Guarantor or any discharge, release or settlement given by any of the Sellers, whether in respect of the obligations of the Buyer or the Buyer’s Guarantor is avoided or reduced as a result of the insolvency of the Buyer: (c) the liability of the Buyer’s Guarantor shall continue as if the payment, discharge, release, settlement, avoidance, adjustment or reduction had not occurred; (d) each of the Sellers shall be entitled to recover the value or amount of that payment from the Buyer’s Guarantor, as if the payment, discharge, release, settlement, avoidance, adjustment or reduction had not occurred; and (e) each of the Sellers shall be entitled to enforce this guarantee subsequently as if such payment, discharge, release, settlement, avoidance, adjustment or reduction had not occurred and any such payment had not been made. 5. The total amount recoverable from the Guarantor under this Schedule 6, will not exceed an amount equal to the Option Consideration payable in accordance with the terms of this Agreement.