4Q 25 Earnings Presentation February 4, 2026 .2

Legal Disclosures This document contains summarized information concerning Regional Management Corp. (the “Company”) and the Company’s business, operations, financial performance, and trends. No representation is made that the information in this document is complete. For additional financial, statistical, and business information, please see the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the U.S. Securities and Exchange Commission (the “SEC”), as well as the Company’s other reports filed with the SEC from time to time. Such reports are or will be available on the Company’s website (www.regionalmanagement.com) and on the SEC’s website (www.sec.gov). The information and opinions contained in this document are provided as of the date of this presentation and are subject to change without notice. This document has not been approved by any regulatory or supervisory authority. This presentation, the related remarks, and the responses to various questions may contain various “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are not statements of historical fact but instead represent the Company’s expectations or beliefs concerning future events. Forward-looking statements include, without limitation, statements concerning financial outlook or future plans, objectives, goals, projections, strategies, events, or performance, and underlying assumptions and other statements related thereto. Words such as “may,” “will,” “should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,” and similar expressions may be used to identify these forward-looking statements. Such forward-looking statements speak only as of the date on which they were made and are about matters that are inherently subject to risks and uncertainties, many of which are outside of the control of the Company. As a result, actual performance and results may differ materially from those contemplated by these forward-looking statements. Therefore, investors should not place undue reliance on such statements. Factors that could cause actual results or performance to differ from the expectations expressed or implied in forward-looking statements include, but are not limited to, the following: managing growth effectively, implementing the Company’s growth strategy, and opening new branches as planned; the Company’s convenience check strategy; the Company’s policies and procedures for underwriting, processing, and servicing loans; the Company’s ability to collect on its loan portfolio; the Company’s insurance operations; exposure to credit risk and repayment risk, which risks may increase in light of adverse or recessionary economic conditions; the implementation of evolving underwriting models and processes, including as to the effectiveness of the Company’s custom scorecards; changes in the competitive environment in which the Company operates or a decrease in the demand for its products; the geographic concentration of the Company’s loan portfolio; the failure of third-party service providers, including those providing information technology products; changes in economic conditions in the markets the Company serves, including levels of unemployment and bankruptcies; the ability to achieve successful acquisitions and strategic alliances; the ability to make technological improvements as quickly as competitors; security breaches, cyber-attacks, failures in information systems, or fraudulent activity; the ability to originate loans; reliance on information technology resources and providers, including the risk of prolonged system outages; changes in current revenue and expense trends, including trends affecting delinquencies and credit losses; any future public health crises, including the impact of such crisis on our operations and financial condition; changes in operating and administrative expenses; the departure, transition, or replacement of key personnel; the ability to timely and effectively implement, transition to, and maintain the necessary information technology systems, infrastructure, processes, and controls to support the Company’s operations and initiatives; changes in interest rates; existing sources of liquidity may become insufficient or access to these sources may become unexpectedly restricted; exposure to financial risk due to asset-backed securitization transactions; risks related to regulation and legal proceedings, including changes in laws or regulations or in the interpretation or enforcement of laws or regulations; changes in accounting standards, rules, and interpretations and the failure of related assumptions and estimates; the impact of changes in tax laws and guidance, including the timing and amount of revenues that may be recognized; risks related to the ownership of the Company's common stock, including volatility in the market price of shares of the Company's common stock; the timing and amount of future cash dividend payments; and anti-takeover provisions in the Company's charter documents and applicable state law. The foregoing factors and others are discussed in greater detail in the Company's filings with the SEC. The Company will not update or revise forward-looking statements to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events or the non-occurrence of anticipated events, whether as a result of new information, future developments, or otherwise, except as required by law. This presentation contains certain non-GAAP measures. Please refer to the Appendix accompanying this presentation for a reconciliation of non-GAAP measures to the most comparable GAAP measures. This presentation also contains certain financial terms and abbreviations. Please refer to the Appendix accompanying this presentation for a glossary of terms and abbreviations. 2

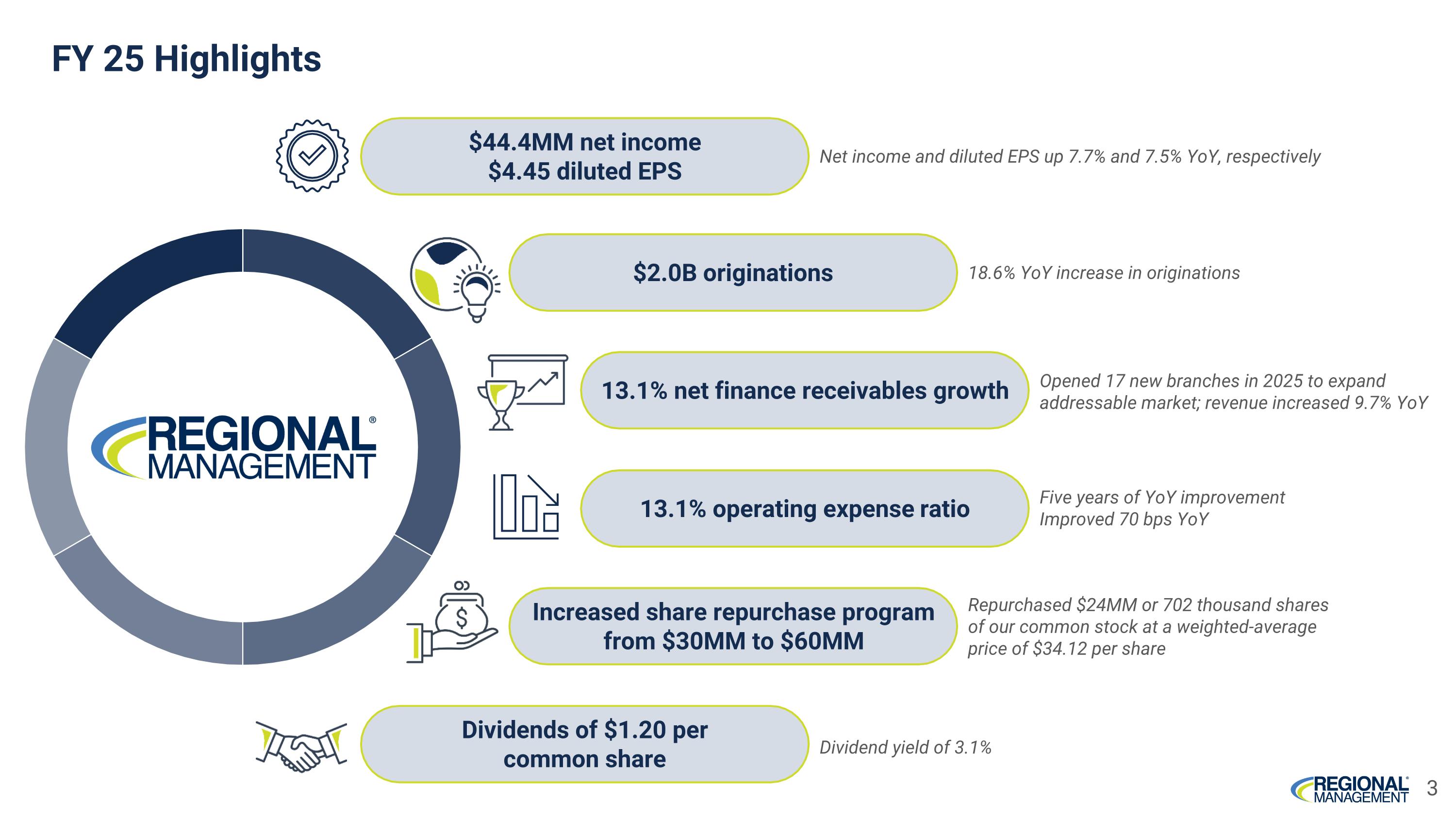

FY 25 Highlights Increased share repurchase program from $30MM to $60MM $44.4MM net income $4.45 diluted EPS 13.1% net finance receivables growth Dividends of $1.20 per common share Repurchased $24MM or 702 thousand shares of our common stock at a weighted-average price of $34.12 per share Dividend yield of 3.1% Opened 17 new branches in 2025 to expand addressable market; revenue increased 9.7% YoY 18.6% YoY increase in originations 13.1% operating expense ratio Five years of YoY improvement Improved 70 bps YoY $2.0B originations Net income and diluted EPS up 7.7% and 7.5% YoY, respectively 3

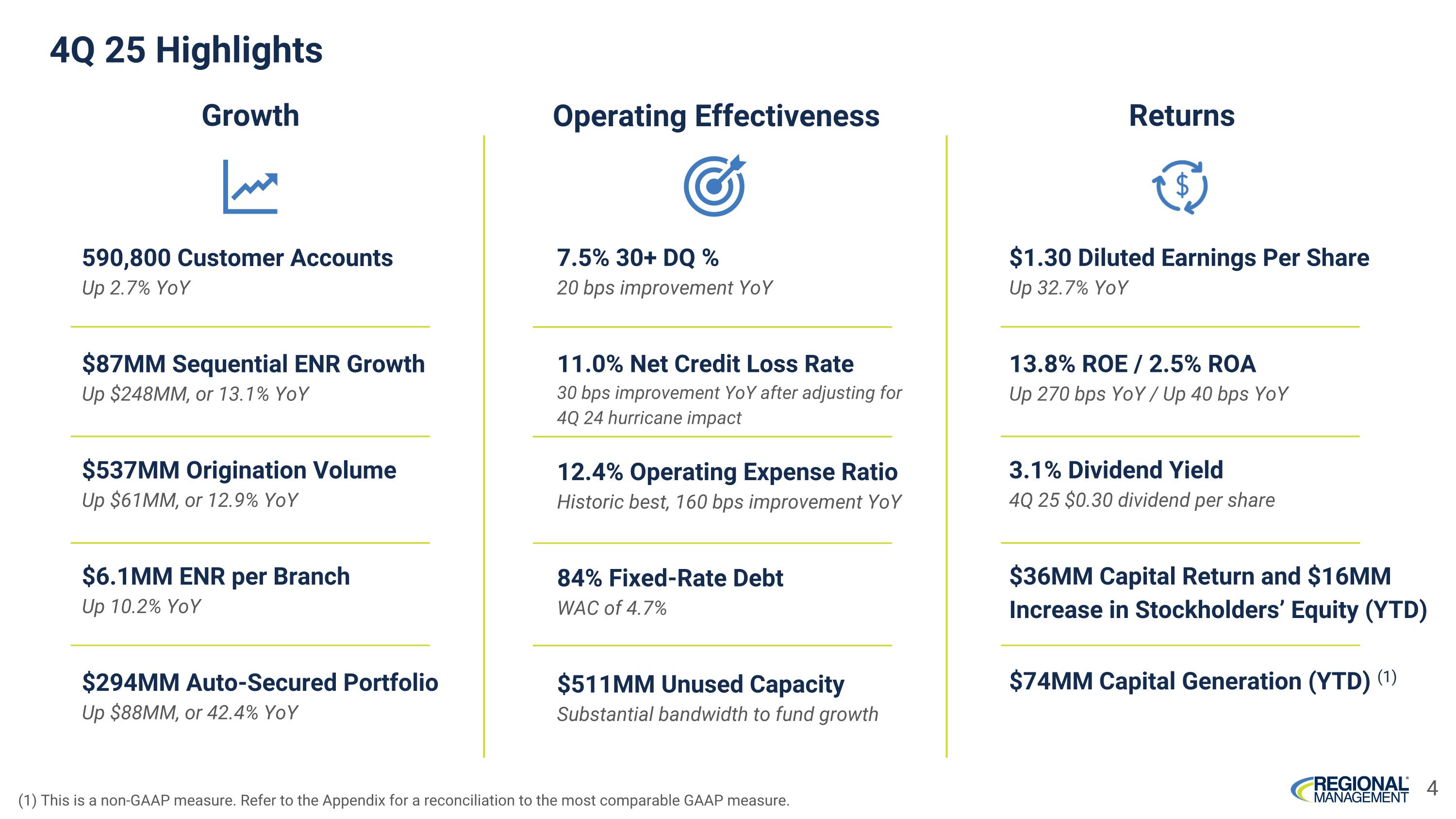

4Q 25 Highlights 590,800 Customer Accounts Up 2.7% YoY $87MM Sequential ENR Growth Up $248MM, or 13.1% YoY $537MM Origination Volume Up $61MM, or 12.9% YoY $6.1MM ENR per Branch Up 10.2% YoY $294MM Auto-Secured Portfolio Up $88MM, or 42.4% YoY 4 Growth Operating Effectiveness Returns 7.5% 30+ DQ % 20 bps improvement YoY 11.0% Net Credit Loss Rate 30 bps improvement YoY after adjusting for 4Q 24 hurricane impact 12.4% Operating Expense Ratio Historic best, 160 bps improvement YoY 84% Fixed-Rate Debt WAC of 4.7% $511MM Unused Capacity Substantial bandwidth to fund growth $1.30 Diluted Earnings Per Share Up 32.7% YoY 13.8% ROE / 2.5% ROA Up 270 bps YoY / Up 40 bps YoY 3.1% Dividend Yield 4Q 25 $0.30 dividend per share $36MM Capital Return and $16MM Increase in Stockholders’ Equity (YTD) $74MM Capital Generation (YTD) (1) (1) This is a non-GAAP measure. Refer to the Appendix for a reconciliation to the most comparable GAAP measure.

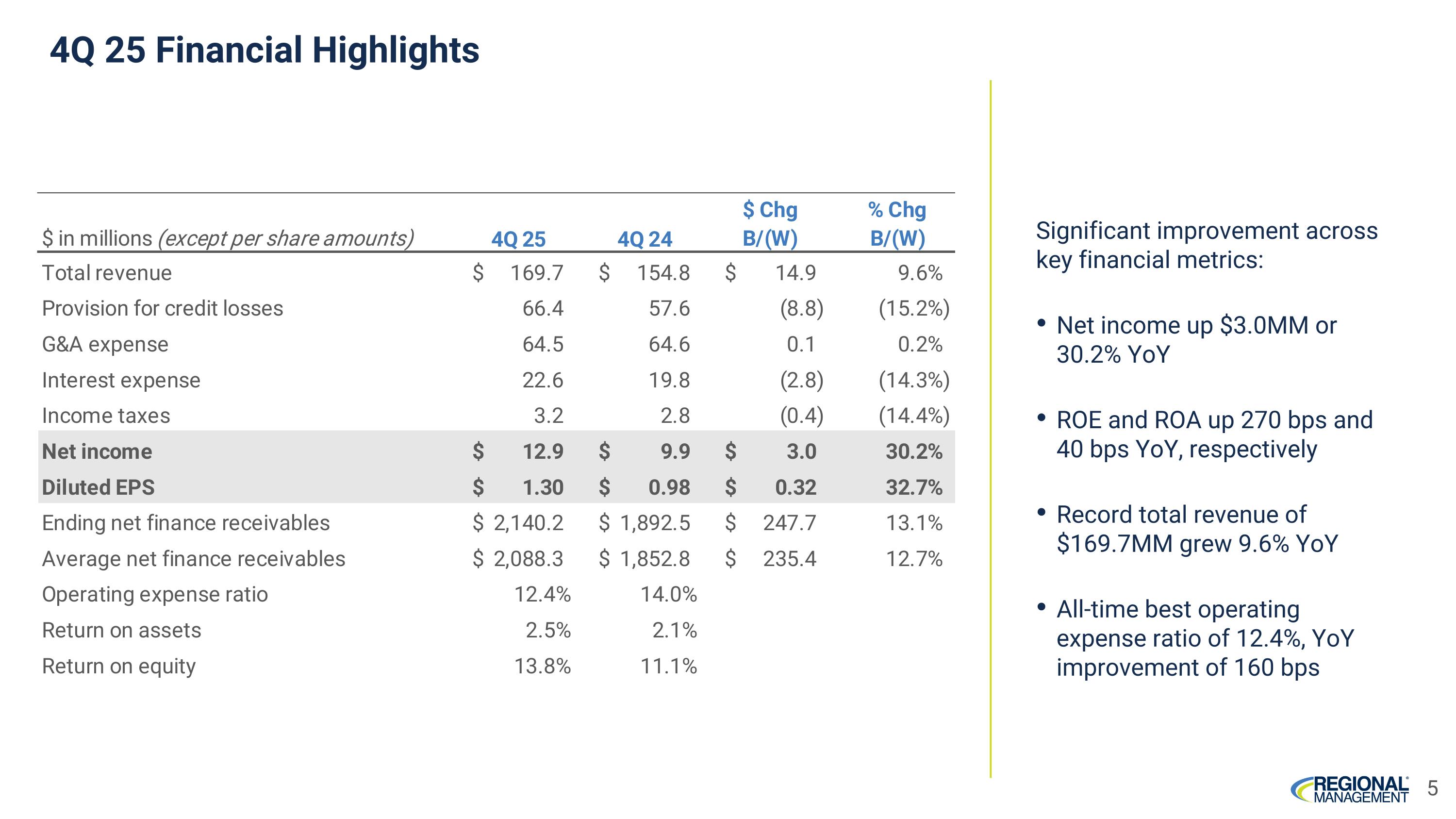

4Q 25 Financial Highlights Significant improvement across key financial metrics: Net income up $3.0MM or 30.2% YoY ROE and ROA up 270 bps and 40 bps YoY, respectively Record total revenue of $169.7MM grew 9.6% YoY All-time best operating expense ratio of 12.4%, YoY improvement of 160 bps 5

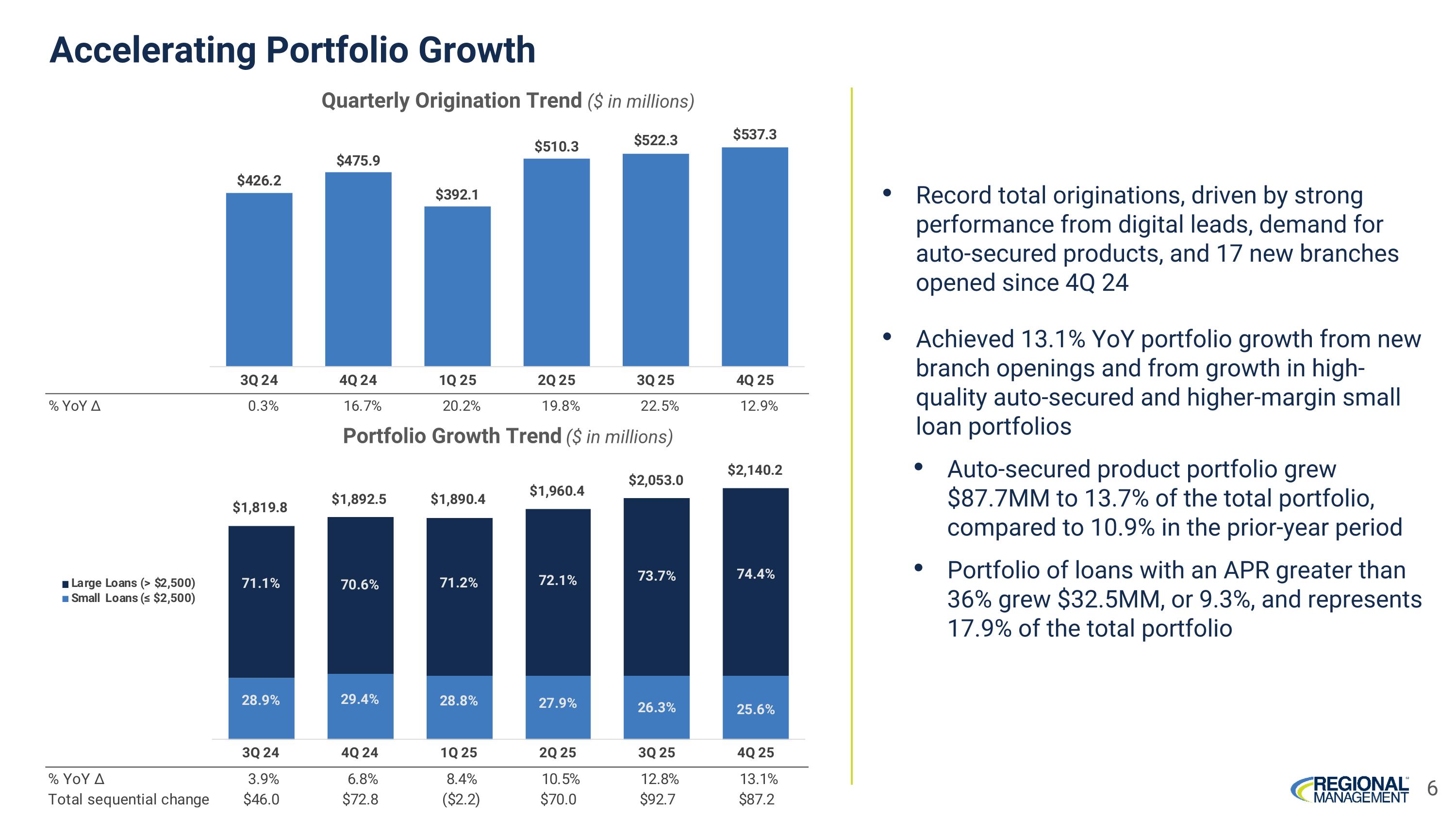

Portfolio Growth Trend ($ in millions) Accelerating Portfolio Growth 6 Record total originations, driven by strong performance from digital leads, demand for auto-secured products, and 17 new branches opened since 4Q 24 Achieved 13.1% YoY portfolio growth from new branch openings and from growth in high-quality auto-secured and higher-margin small loan portfolios Auto-secured product portfolio grew $87.7MM to 13.7% of the total portfolio, compared to 10.9% in the prior-year period Portfolio of loans with an APR greater than 36% grew $32.5MM, or 9.3%, and represents 17.9% of the total portfolio Quarterly Origination Trend ($ in millions)

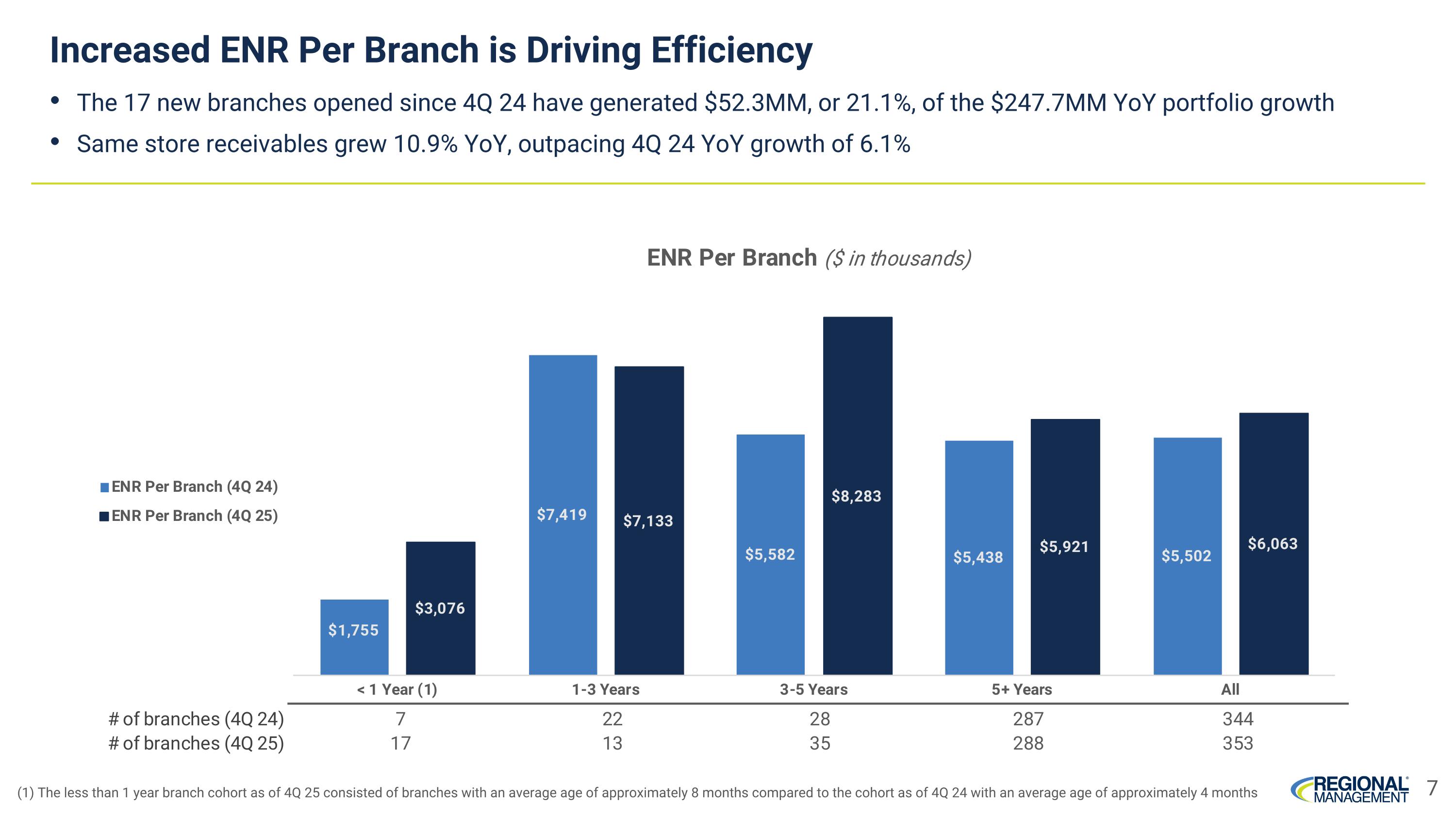

Increased ENR Per Branch is Driving Efficiency The 17 new branches opened since 4Q 24 have generated $52.3MM, or 21.1%, of the $247.7MM YoY portfolio growth Same store receivables grew 10.9% YoY, outpacing 4Q 24 YoY growth of 6.1% 7 (1) The less than 1 year branch cohort as of 4Q 25 consisted of branches with an average age of approximately 8 months compared to the cohort as of 4Q 24 with an average age of approximately 4 months

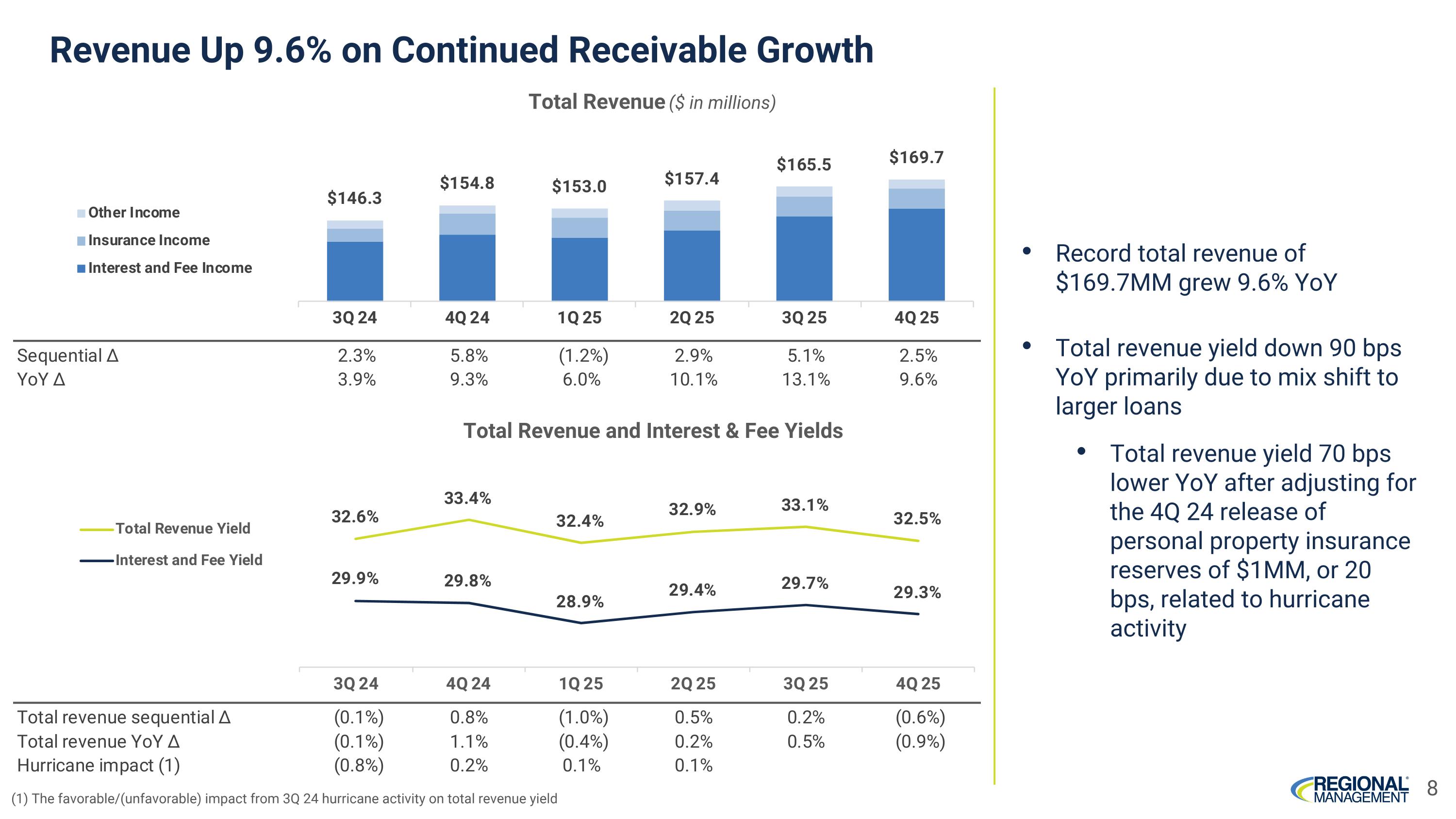

Record total revenue of $169.7MM grew 9.6% YoY Total revenue yield down 90 bps YoY primarily due to mix shift to larger loans Total revenue yield 70 bps lower YoY after adjusting for the 4Q 24 release of personal property insurance reserves of $1MM, or 20 bps, related to hurricane activity 8 Revenue Up 9.6% on Continued Receivable Growth Total Revenue and Interest & Fee Yields Total Revenue ($ in millions) (1) The favorable/(unfavorable) impact from 3Q 24 hurricane activity on total revenue yield

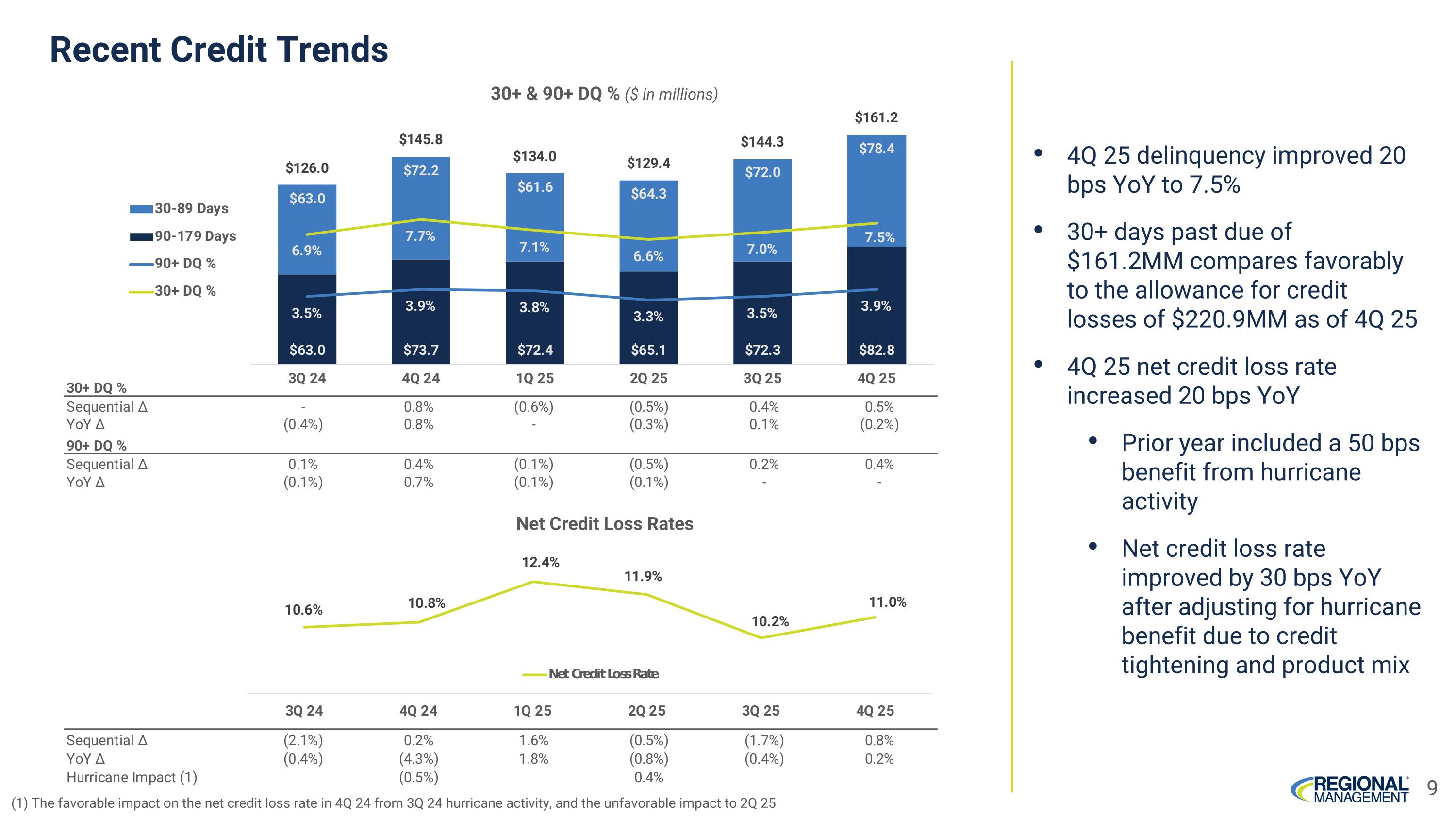

Recent Credit Trends 30+ & 90+ DQ % ($ in millions) Net Credit Loss Rates 9 (1) The favorable impact on the net credit loss rate in 4Q 24 from 3Q 24 hurricane activity, and the unfavorable impact to 2Q 25 4Q 25 delinquency improved 20 bps YoY to 7.5% 30+ days past due of $161.2MM compares favorably to the allowance for credit losses of $220.9MM as of 4Q 25 4Q 25 net credit loss rate increased 20 bps YoY Prior year included a 50 bps benefit from hurricane activity Net credit loss rate improved by 30 bps YoY after adjusting for hurricane benefit due to credit tightening and product mix

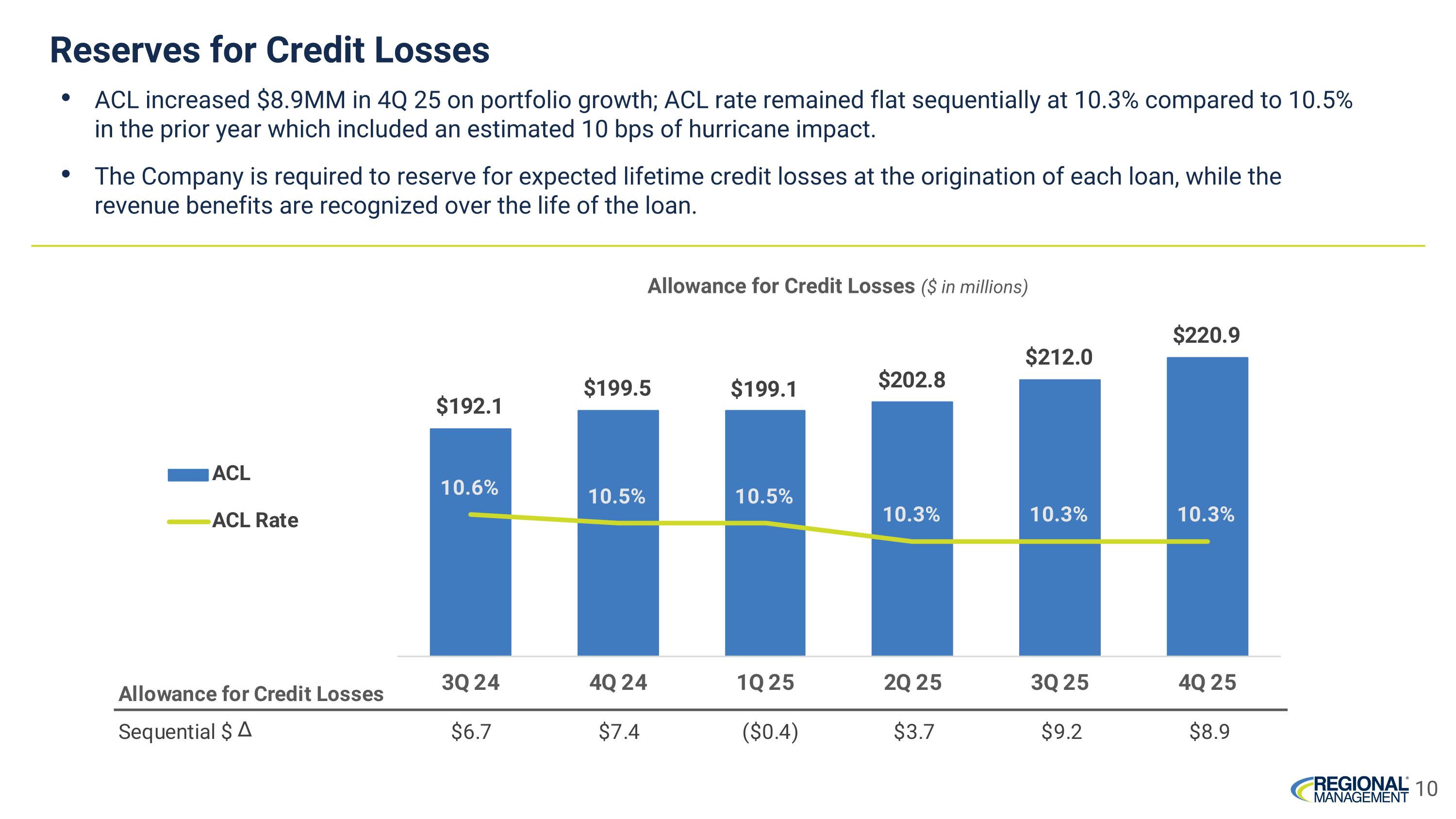

Reserves for Credit Losses ACL increased $8.9MM in 4Q 25 on portfolio growth; ACL rate remained flat sequentially at 10.3% compared to 10.5% in the prior year which included an estimated 10 bps of hurricane impact. The Company is required to reserve for expected lifetime credit losses at the origination of each loan, while the revenue benefits are recognized over the life of the loan. Allowance for Credit Losses ($ in millions) 10

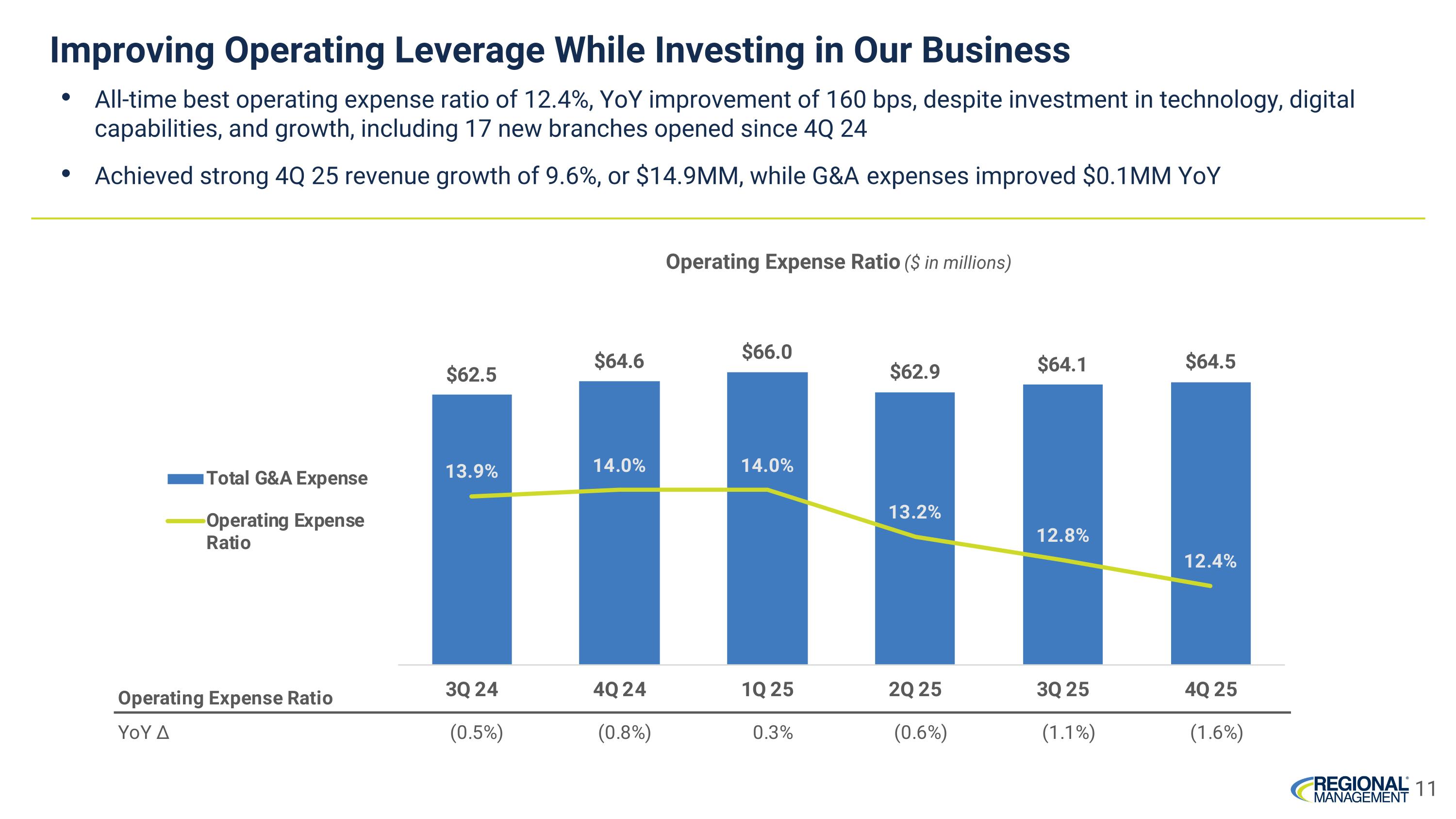

Improving Operating Leverage While Investing in Our Business 11 Operating Expense Ratio ($ in millions) All-time best operating expense ratio of 12.4%, YoY improvement of 160 bps, despite investment in technology, digital capabilities, and growth, including 17 new branches opened since 4Q 24 Achieved strong 4Q 25 revenue growth of 9.6%, or $14.9MM, while G&A expenses improved $0.1MM YoY

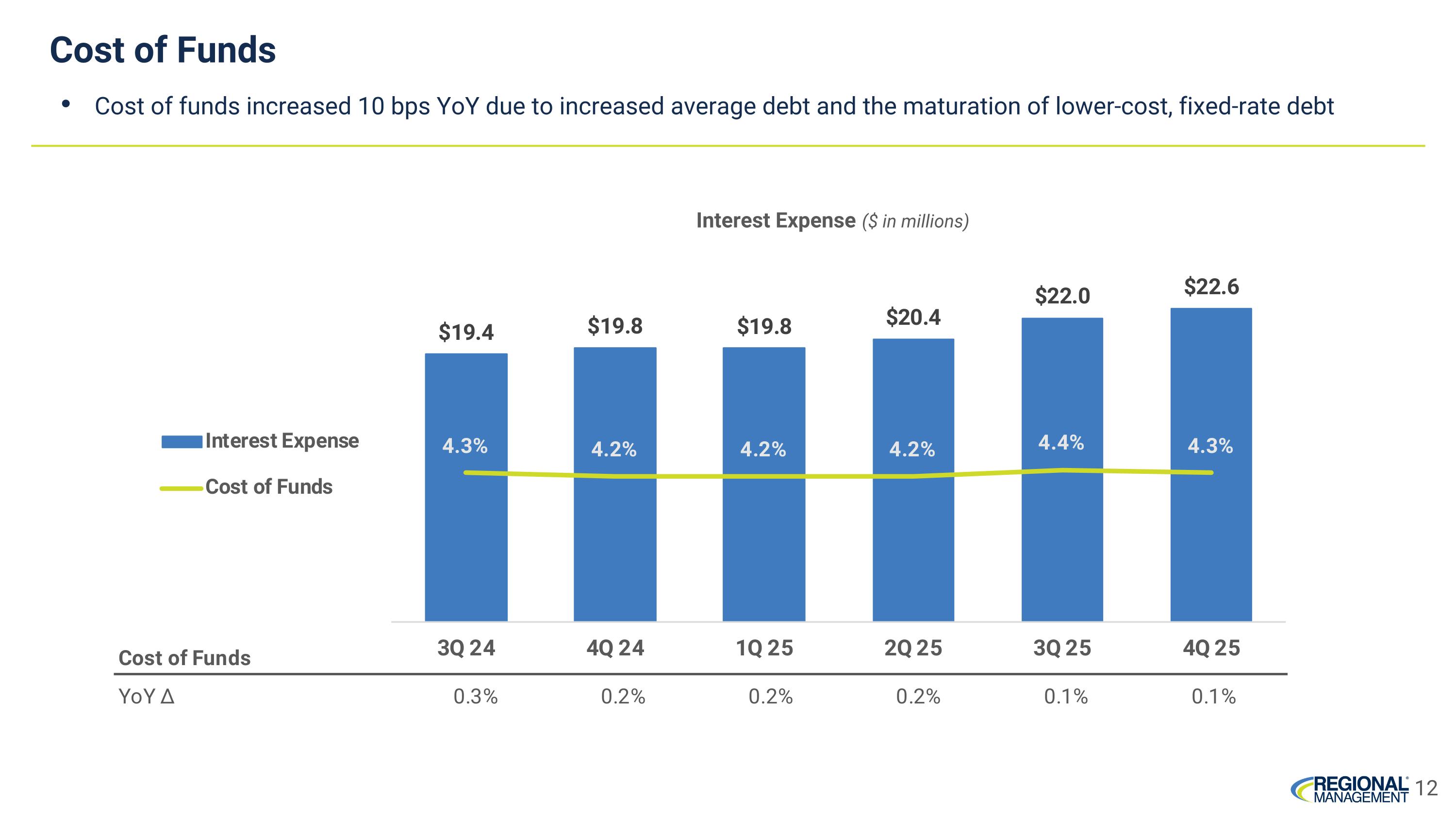

Cost of funds increased 10 bps YoY due to increased average debt and the maturation of lower-cost, fixed-rate debt Cost of Funds 12 Interest Expense ($ in millions)

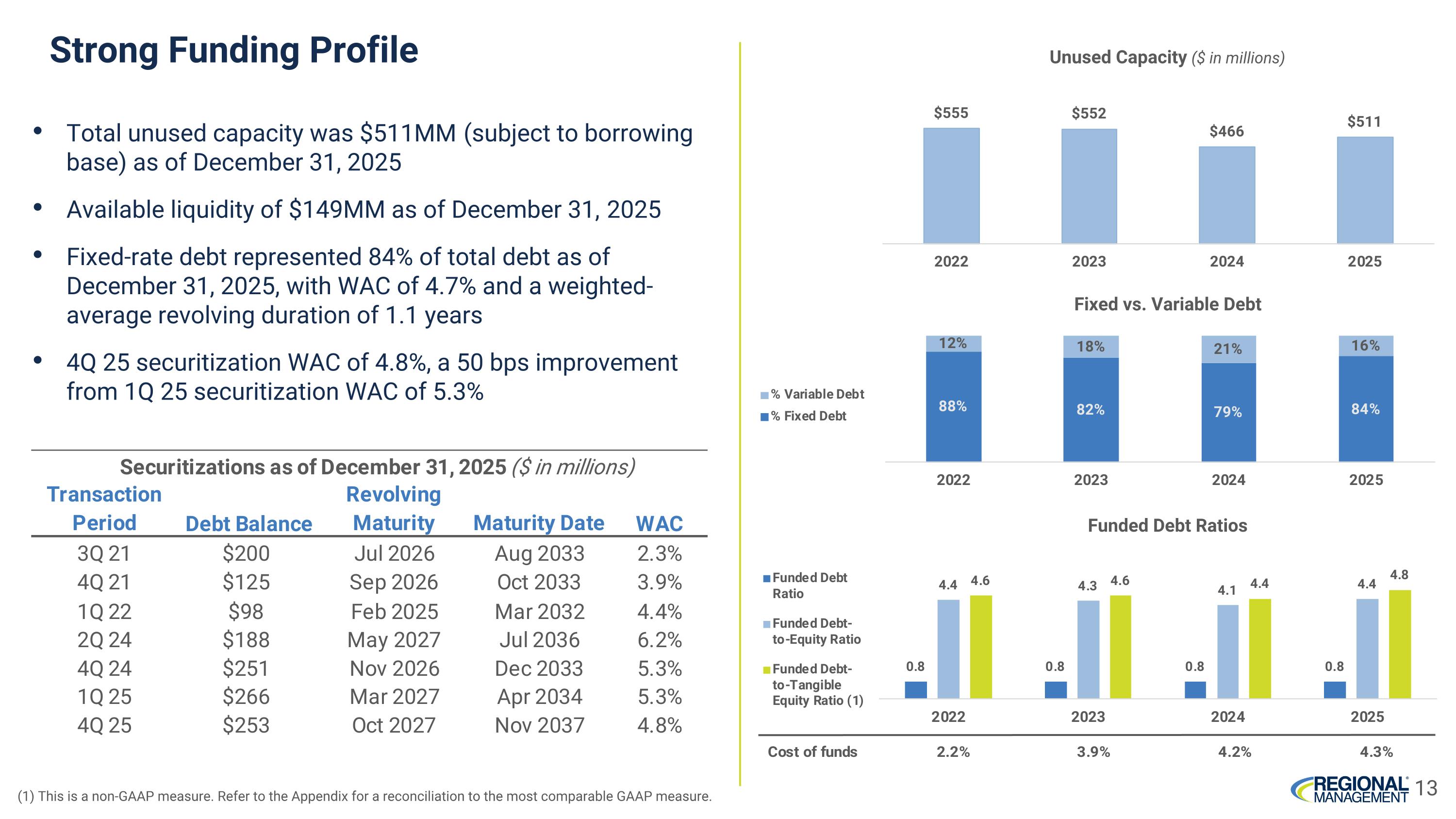

Total unused capacity was $511MM (subject to borrowing base) as of December 31, 2025 Available liquidity of $149MM as of December 31, 2025 Fixed-rate debt represented 84% of total debt as of December 31, 2025, with WAC of 4.7% and a weighted-average revolving duration of 1.1 years 4Q 25 securitization WAC of 4.8%, a 50 bps improvement from 1Q 25 securitization WAC of 5.3% Strong Funding Profile Unused Capacity ($ in millions) Fixed vs. Variable Debt Funded Debt Ratios 13 (1) This is a non-GAAP measure. Refer to the Appendix for a reconciliation to the most comparable GAAP measure.

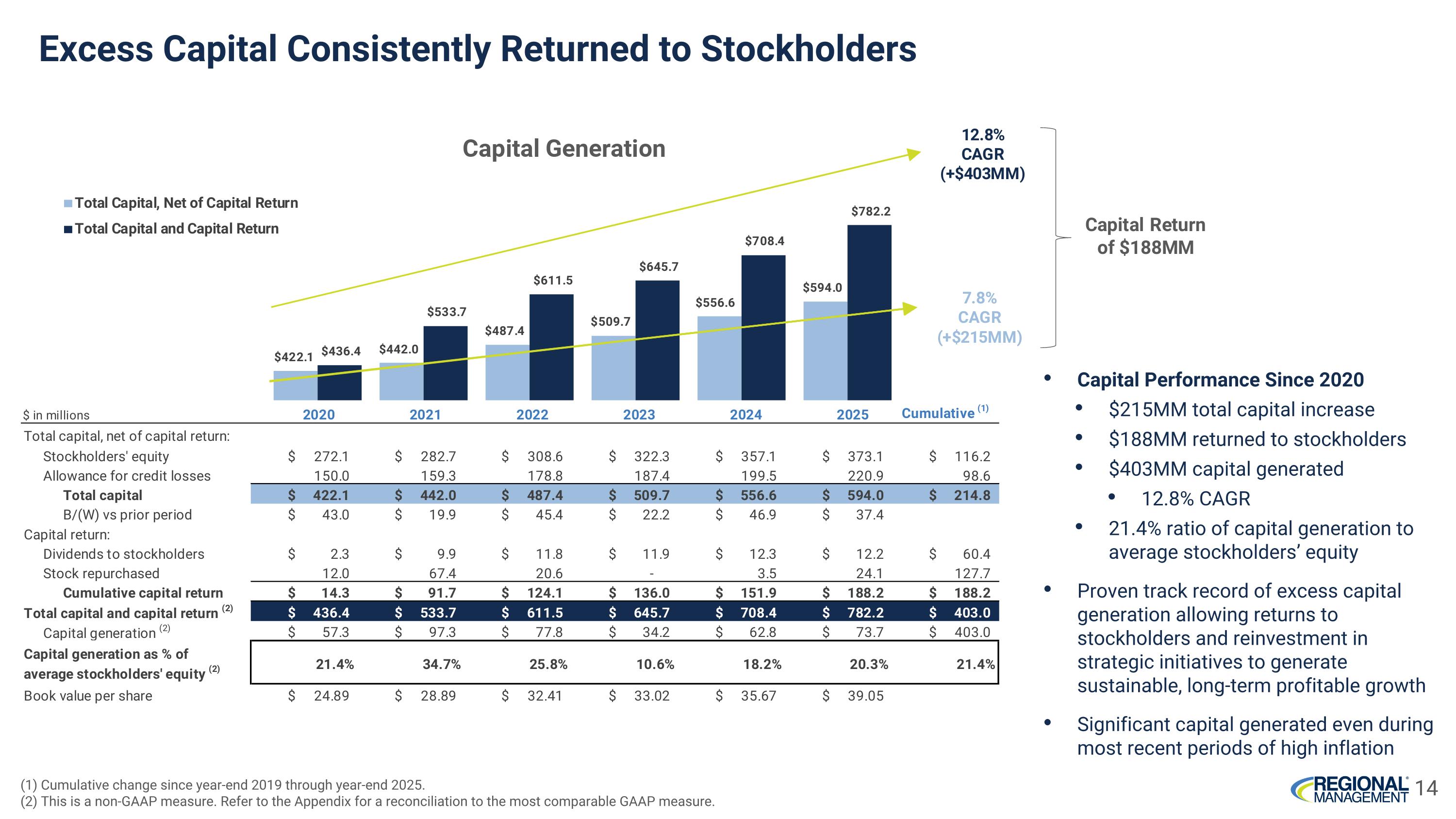

Excess Capital Consistently Returned to Stockholders Capital Performance Since 2020 $215MM total capital increase $188MM returned to stockholders $403MM capital generated 12.8% CAGR 21.4% ratio of capital generation to average stockholders’ equity Proven track record of excess capital generation allowing returns to stockholders and reinvestment in strategic initiatives to generate sustainable, long-term profitable growth Significant capital generated even during most recent periods of high inflation 14 (1) Cumulative change since year-end 2019 through year-end 2025. (2) This is a non-GAAP measure. Refer to the Appendix for a reconciliation to the most comparable GAAP measure.

Appendix 15

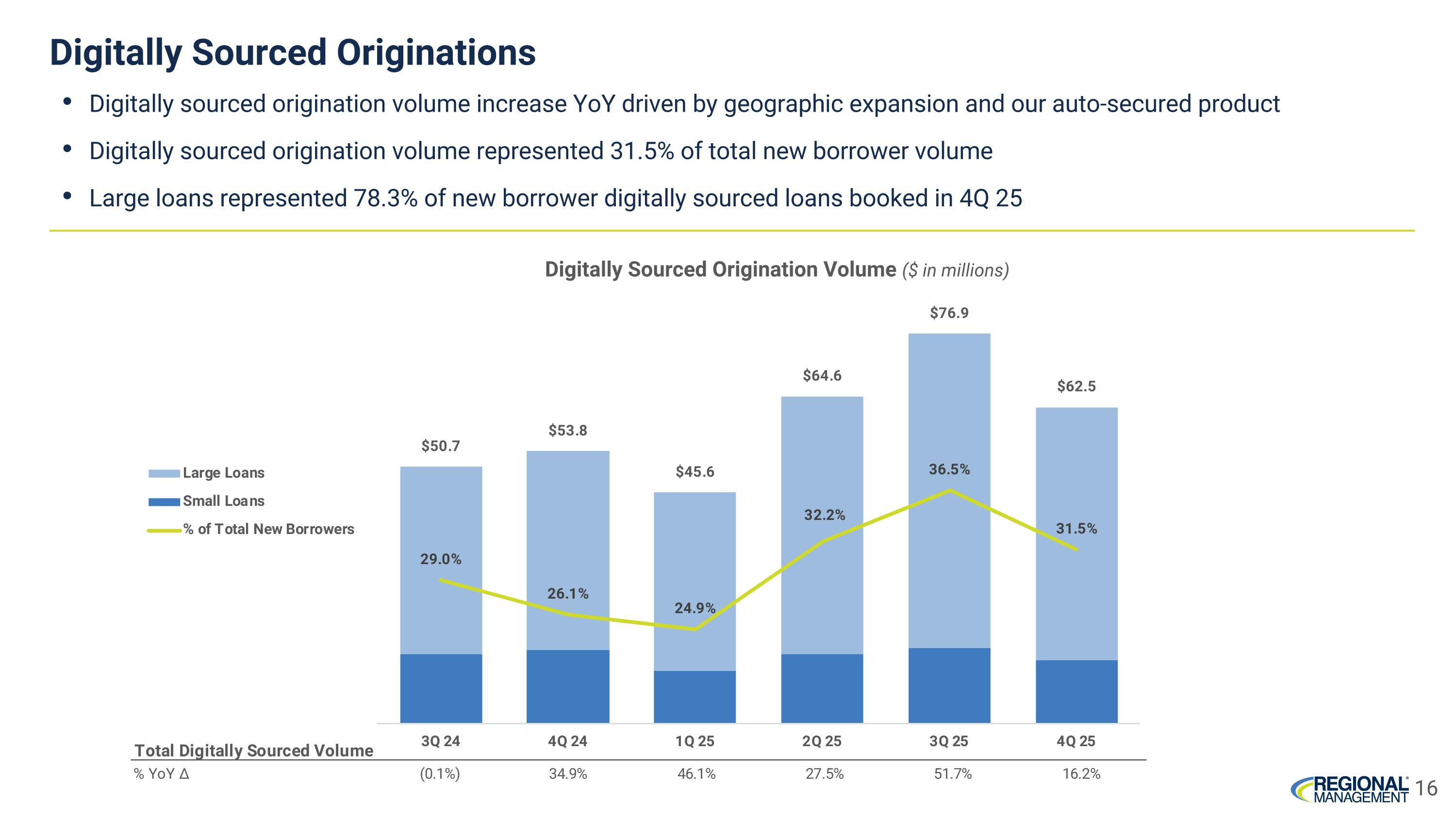

Digitally sourced origination volume increase YoY driven by geographic expansion and our auto-secured product Digitally sourced origination volume represented 31.5% of total new borrower volume Large loans represented 78.3% of new borrower digitally sourced loans booked in 4Q 25 Digitally Sourced Origination Volume ($ in millions) Digitally Sourced Originations 16

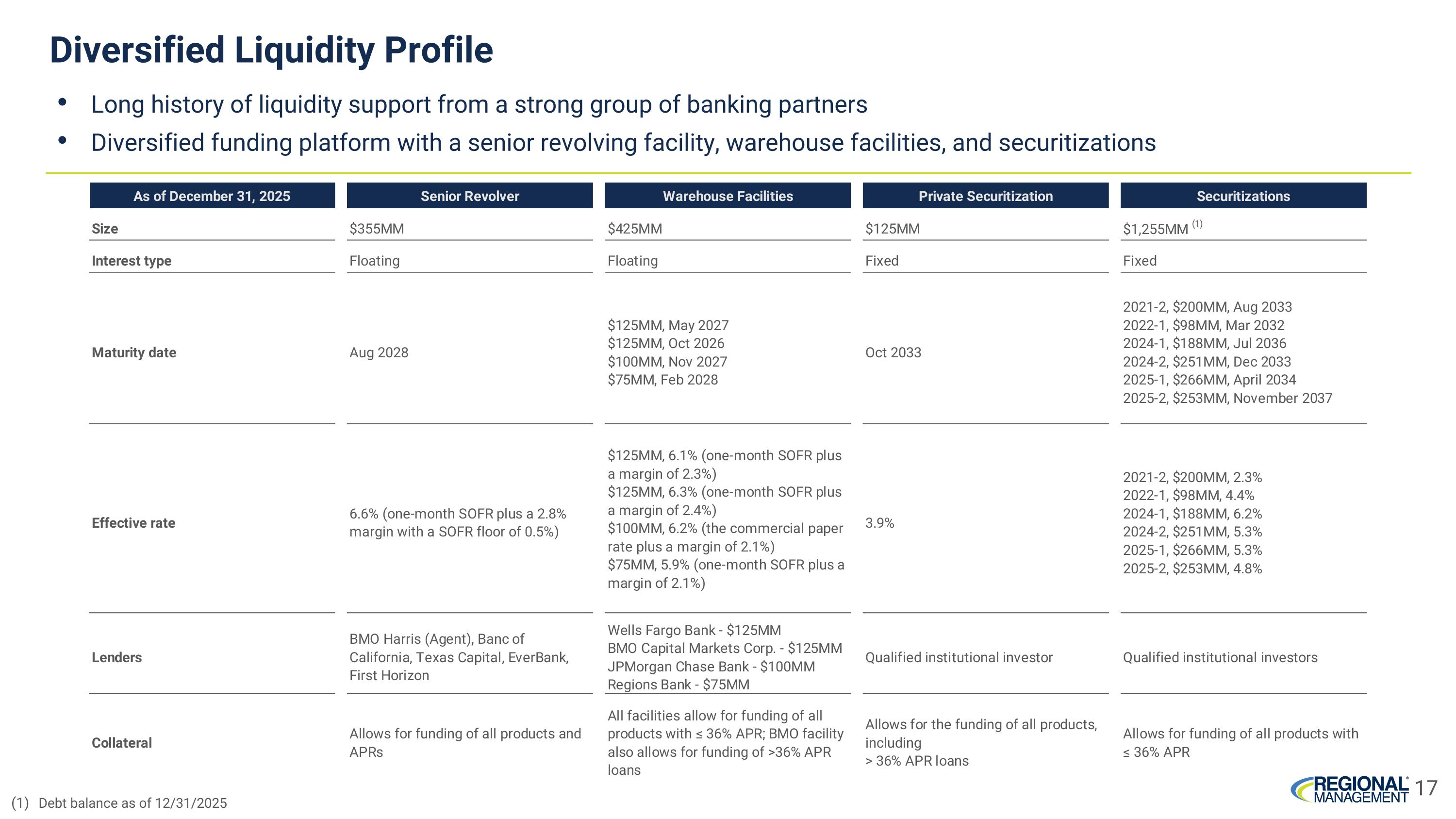

Diversified Liquidity Profile Long history of liquidity support from a strong group of banking partners Diversified funding platform with a senior revolving facility, warehouse facilities, and securitizations 17 Debt balance as of 12/31/2025

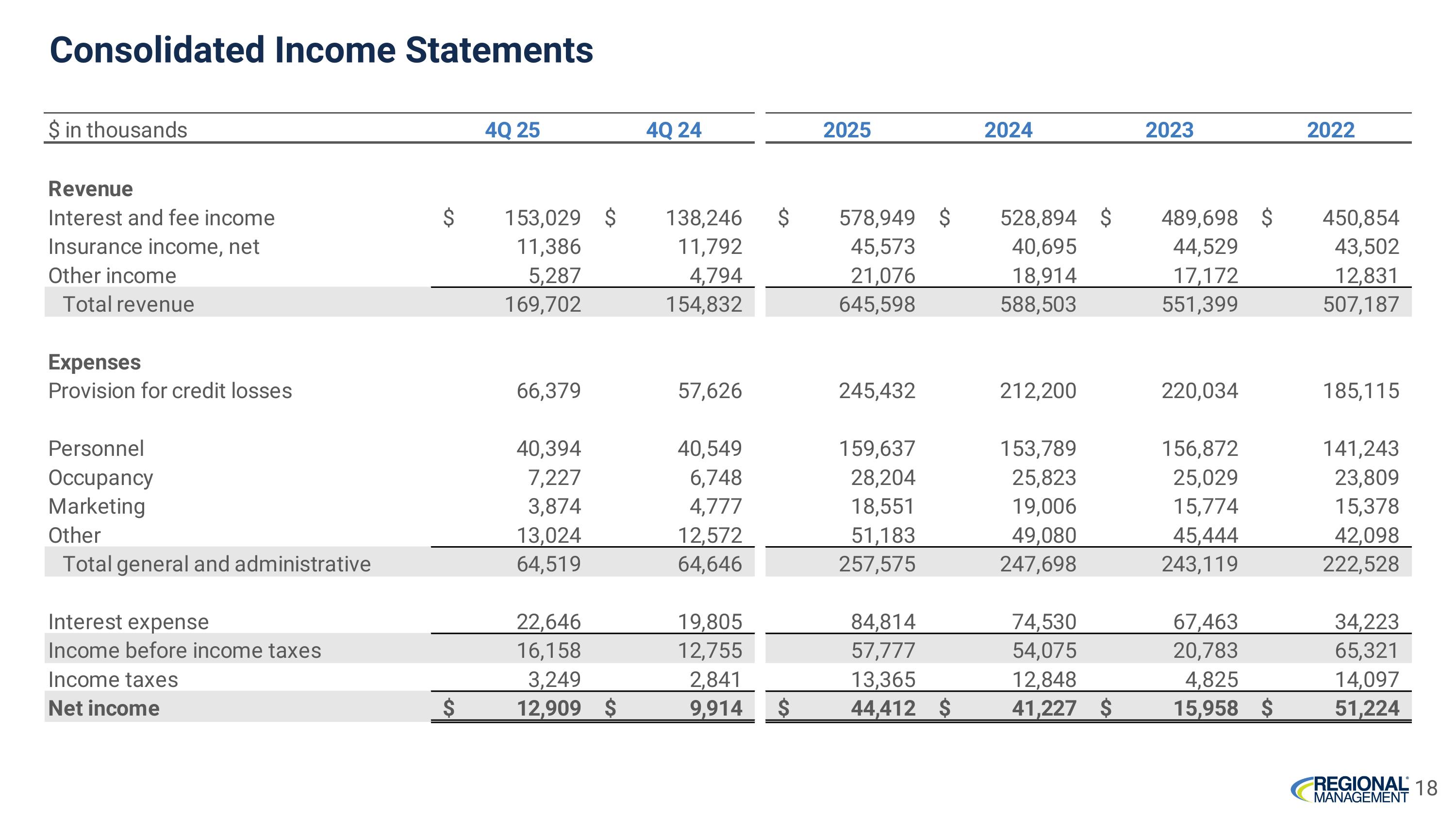

Consolidated Income Statements 18

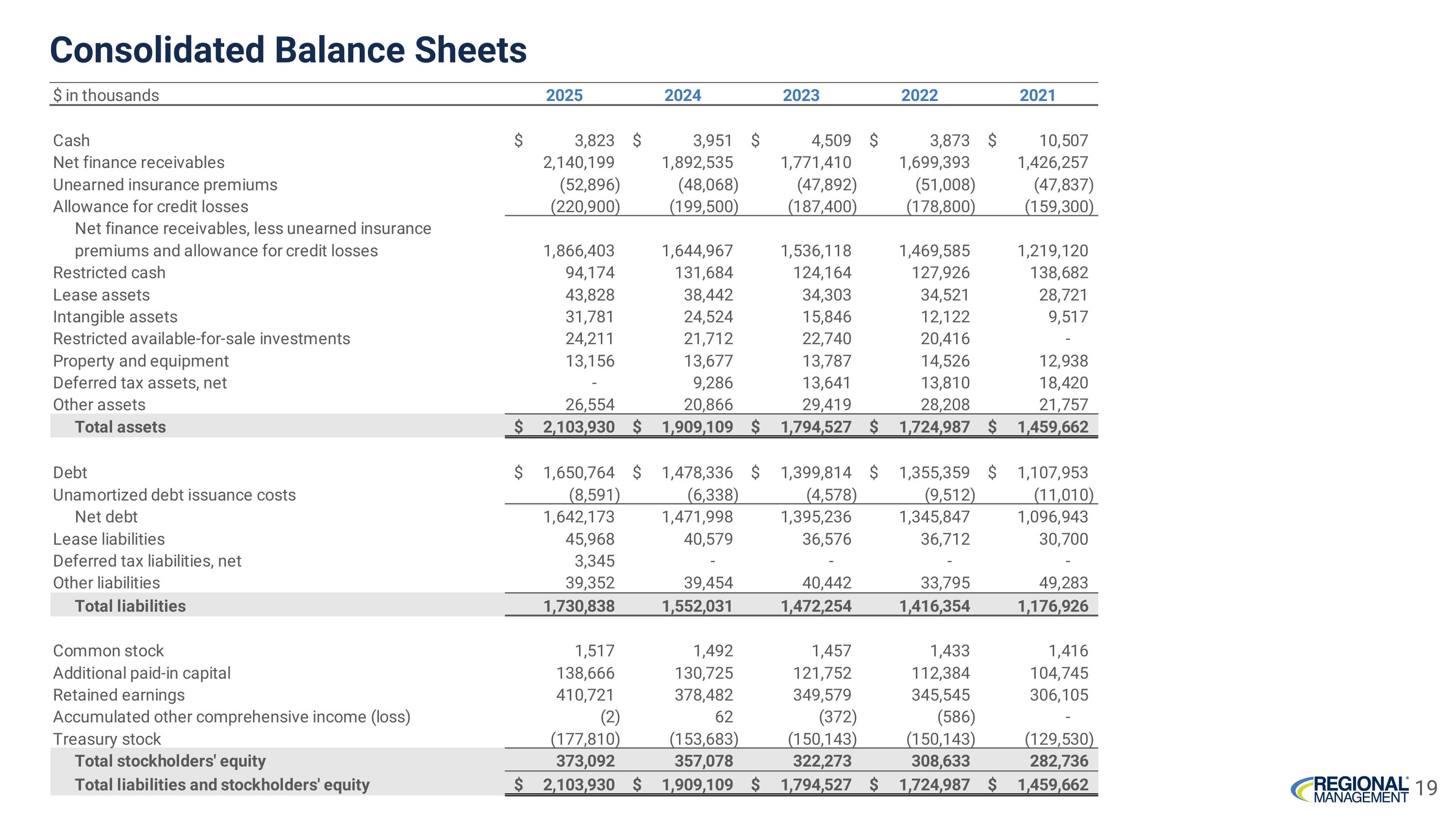

Consolidated Balance Sheets 19

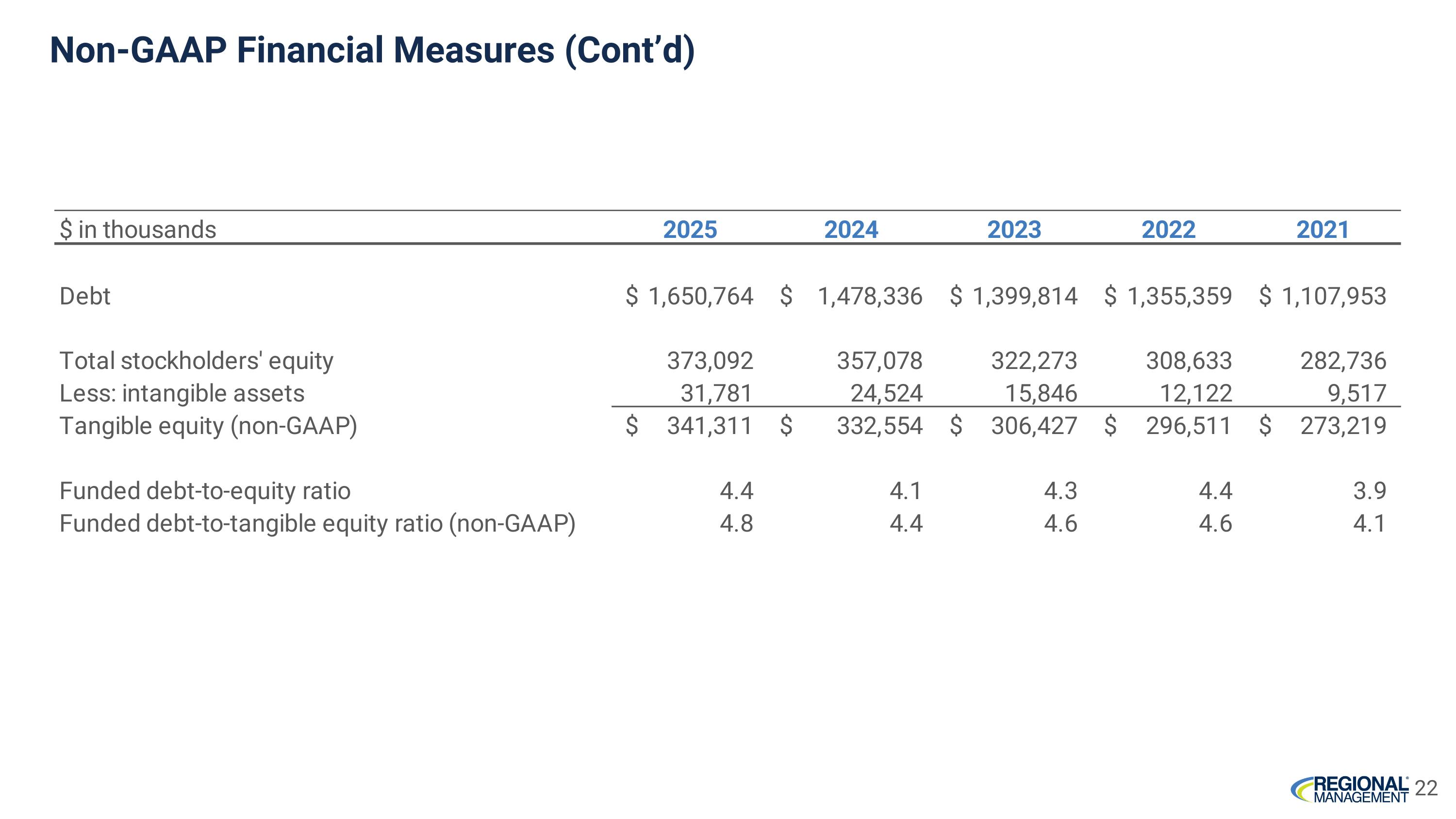

Non-GAAP Financial Measures In addition to financial measures presented in accordance with generally accepted accounting principles (“GAAP”), this presentation contains certain non-GAAP financial measures. The Company’s management utilizes non-GAAP measures as additional metrics to aid in, and enhance, its understanding of the Company’s financial results. The Company believes that these non-GAAP measures provide useful information by excluding certain material items that may not be indicative of our operating results. As a result, the Company believes that the non-GAAP measures that it has presented will aid in the evaluation of the operating performance of the business. Total capital and capital return, capital generation, and capital generation as a % of average stockholders' equity are non-GAAP measures to include stock repurchases and dividends returned to stockholders with total capital. Management uses these measures to evaluate the Company's ability to generate capital to return to stockholders, reinvest in strategic initiatives, and evaluate its capacity to absorb losses. The Company also believes that these capital and absorption measures provide useful information to users of the Company’s financial statements in the evaluation of its ability to generate capital to return to stockholders, reinvest in strategic initiatives, and evaluate its capacity to absorb losses. Tangible equity and the funded debt-to-tangible equity ratio are non-GAAP measures that adjust GAAP measures to exclude intangible assets. Management uses these equity measures to evaluate and manage the Company’s capital and leverage position. The Company also believes that these equity measures are commonly used in the financial services industry and provide useful information to users of the Company’s financial statements in the evaluation of its capital and leverage position. The Company believes that the aforementioned non-GAAP measures will aid users of its financial statements in the evaluation of its operating performance. This non-GAAP financial information should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. In addition, the Company’s non-GAAP measures may not be comparable to similarly titled non-GAAP measures of other companies. The following tables provide reconciliations of GAAP measures to non-GAAP measures. 20

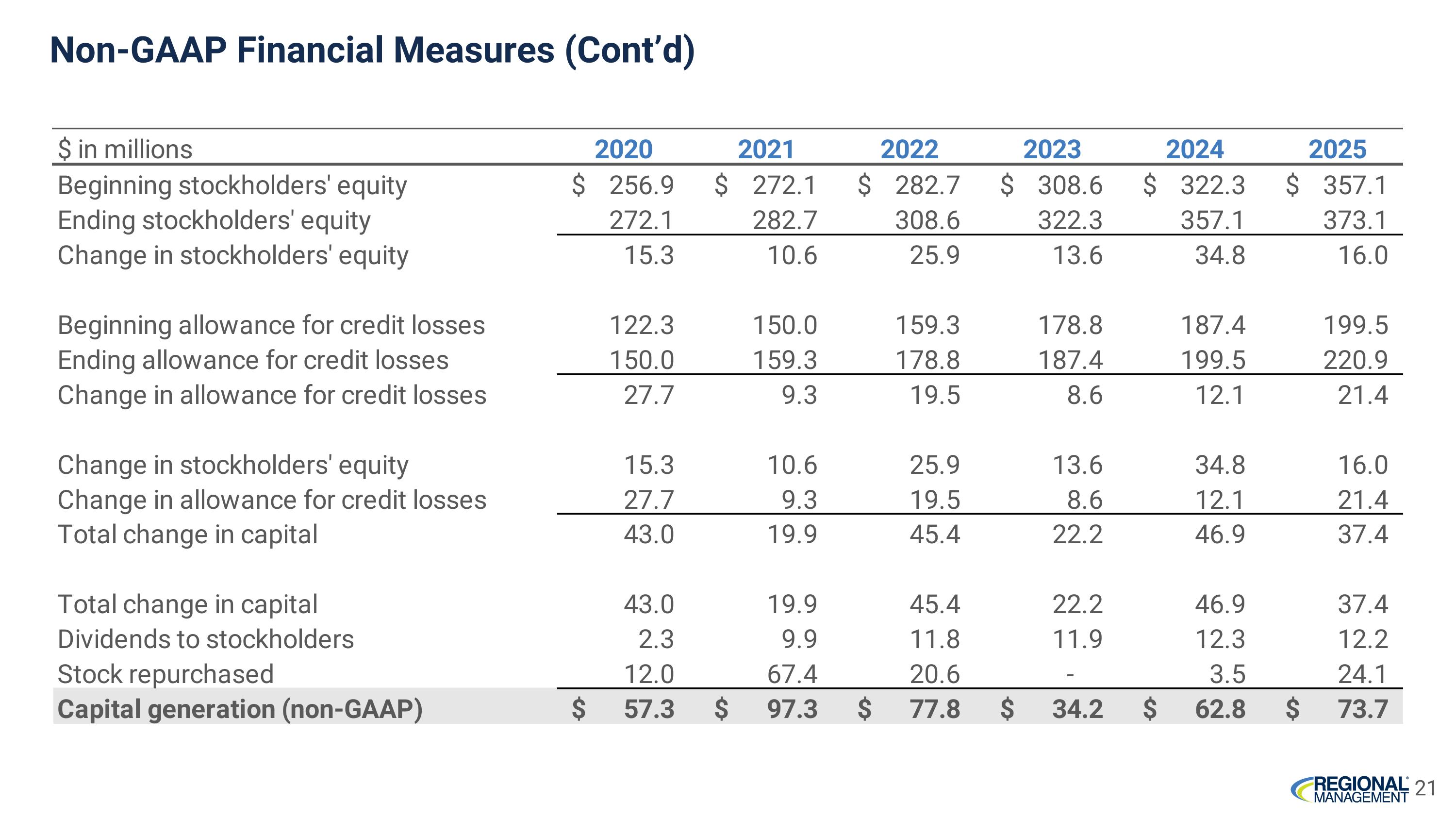

Non-GAAP Financial Measures (Cont’d) 21

Non-GAAP Financial Measures (Cont’d) 22

Glossary 23 ACL – Allowance for Credit Losses Allowance for credit loss rate (ACL rate) – allowance for credit losses as a percentage of ending net finance receivables ANR – average net finance receivables Bps – basis points Capital generation – the year-to-date change in total capital and capital return from the prior year-end Cost of funds – annualized interest expense as a percentage of average net finance receivables Cumulative capital return – dividend and common stock repurchase activity that has occurred since December 31, 2019 Debt balance – the balance for each respective debt agreement, composed of principal balance and accrued interest Dividend yield – annualized dividends per share divided by the closing share price as of the last day of the quarter Delinquency rate (DQ %) – delinquent loans outstanding as a percentage of ending net finance receivables ENR – ending net finance receivables Funded debt ratio – total debt divided by total assets Interest and fee yield – annualized interest and fee income as a percentage of average net finance receivables Net credit loss rate – annualized net credit losses as a percentage of average net finance receivables Operating expense ratio – annualized general and administrative expenses as a percentage of average net finance receivables Return on assets (ROA) – annualized net income as a percentage of average total assets Return on equity (ROE) – annualized net income as a percentage of average stockholders’ equity Same store – comparison of branches with a comparable branch base; the comparable branch base includes those branches open for at least 1 year Total capital – stockholders’ equity plus allowance for credit losses Total revenue yield – annualized total revenue as a percentage of average net finance receivables WAC – weighted-average coupon YoY – year-over-year