Proposed Acquisition of Avadel Pharmaceuticals plc October 22, 2025 .2

NO OFFER OR SOLICITATION This presentation is for information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation of any vote or approval in any jurisdiction, pursuant to the transaction or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In particular, this presentation is not an offer of securities for sale into the United States. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Any securities issued in the acquisition are anticipated to be issued in reliance upon available exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act of 1933, as amended. IMPORTANT ADDITIONAL INFORMATION WILL BE FILED WITH THE SEC In connection with the proposed transaction, Avadel Pharmaceuticals plc (“Avadel”) intends to file with the U.S. Securities and Exchange Commission (the “SEC”) a proxy statement, which will include the scheme document (the “Proxy Statement”). BEFORE MAKING ANY VOTING DECISION, AVADEL’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT, INCLUDING THE SCHEME DOCUMENT AND ANY AMENDMENTS OR SUPPLEMENTS THERETO, AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED ACQUISITION OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT (IF ANY) CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION. Avadel’s shareholders and investors will be able to obtain, without charge, a copy of the Proxy Statement and other relevant documents filed with the SEC (when available) from the SEC’s website at http://www.sec.gov or by directing a written request to 16640 Chesterfield Grove Road #200, Chesterfield, MO 63005, United States, Attention: Investor Relations, or from Avadel’s website, www.avadel.com. PARTICIPANTS IN THE SOLICITATION Avadel and certain of its directors, executive officers and employees may be deemed to be participants in the solicitation of proxies from Avadel shareholders in connection with the transaction and any other matters to be voted on at the Scheme Meeting or the EGM. Information about the directors and executive officers of Avadel, including a description of their direct or indirect interests, by security holdings or otherwise, is set forth in Avadel’s definitive proxy statement on Schedule 14A for its 2025 annual general meeting of shareholders, dated and filed with the SEC on June 18, 2025. Other information regarding the persons who may, under the rules of the SEC, be deemed to be participants in the solicitation of Avadel shareholders, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the Proxy Statement (which will contain the Scheme Document) and other relevant materials to be filed with the SEC in connection with the Acquisition. You may obtain free copies of these documents using the sources indicated above.

STATEMENT REQUIRED BY THE IRISH TAKEOVER RULES The directors of Alkermes accept responsibility for the information contained in this presentation. To the best of the knowledge and belief of the directors of Alkermes (who have taken all reasonable care to ensure that such is the case), the information contained in this presentation for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information. DEALING DISCLOSURE REQUIREMENTS Under the provisions of Rule 8.3(a) of the Takeover Rules, any person who is ‘interested’ in (directly or indirectly) 1% or more of any class of ‘relevant securities’ of Avadel must make an ‘opening position disclosure’ following the commencement of the ‘offer period’. An ‘opening position disclosure’ must contain the details contained in Rule 8.6(a) of the Takeover Rules, including, among other things, details of the person’s ‘interests’ and ‘short positions’ in any ‘relevant securities’ of Avadel. An ‘opening position disclosure’ by a person to whom Rule 8.3(a) applies must be made by no later than 3:30 pm (E.T.) on the day falling ten ‘business days’ following the commencement of the ‘offer period’. Relevant persons who deal in any ‘relevant securities’ prior to the deadline for making an ‘opening position disclosure’ must instead make a ‘dealing’ disclosure as described below. Under the provisions of Rule 8.3(b) of the Takeover Rules, if any person is, or becomes, ‘interested’ in (directly or indirectly) 1% or more of any class of ‘relevant securities’ of Avadel, that person must publicly disclose all ‘dealings’ in any ‘relevant securities’ of Avadel during the ‘offer period’, by no later than 3:30 p.m. (E.T.) on the ‘business day’ following the date of the relevant transaction. If two or more persons cooperate on the basis of any agreement either express or tacit, either oral or written, to acquire an ‘interest’ in ‘relevant securities’ of Avadel or any securities exchange offeror, they will be deemed to be a single person for the purpose of Rule 8.3 of the Takeover Rules. A disclosure table, giving details of the companies in whose ‘relevant securities’ ‘opening position’ and ‘dealings’ should be disclosed can be found on the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie. “Interests” in securities arise, in summary, when a person has long economic exposure, whether conditional or absolute, to changes in the price of securities. In particular, a person will be treated as having an ‘interest’ by virtue of the ownership or control of securities, or by virtue of any option in respect of, or derivative referenced to, securities. Terms in quotation marks are defined in the Takeover Rules, which can be found on the Irish Takeover Panel’s website. If you are in any doubt as to whether or not you are required to disclose an ‘opening position’ or ‘dealing’ under Rule 8, please consult the Irish Takeover Panel’s website at www.irishtakeoverpanel.ie or contact the Irish Takeover Panel on telephone number +353 1 678 9020. NO PROFIT FORECAST / ASSET VALUATIONS No statement in this presentation is intended to constitute a profit forecast, profit estimate or quantified financial benefit statement for any period, nor should any statements be interpreted to mean that earnings or earnings per share will, for the current or future financial years or other periods, will necessarily be greater or lesser than those for the relevant preceding financial periods for Alkermes or Avadel. No statement in this presentation constitutes an asset valuation or a quantified financial benefits statement within the meaning of the Takeover Rules.

GENERAL Appendix I to the Rule 2.7 announcement issued jointly by Alkermes and Avadel on October 22, 2025 contains further details of the sources and bases of information set out in this presentation. Certain financial and other information concerning Avadel contained in this presentation has been extracted from published sources, including Avadel’s corporate presentation dated August 7, 2025, or from audited financial results of Avadel, and has not been independently verified by Alkermes. The release, publication or distribution of this presentation in or into jurisdictions other than Ireland and the United States may be restricted by Law and therefore any persons who are subject to the Law of any jurisdiction other than Ireland and the United States should inform themselves about, and observe, any applicable legal or regulatory requirements. In particular, the ability of persons who are not resident in Ireland or the United States, to vote their Avadel shares with respect to the Scheme at the Scheme Meeting, or to appoint another person as proxy to vote at the Scheme Meeting on their behalf, may be affected by the Laws of the relevant jurisdictions in which they are located. Any failure to comply with the applicable legal or regulatory requirements may constitute a violation of the Laws of any such jurisdiction. To the fullest extent permitted by applicable law, the Alkermes and Avadel persons involved in the proposed transaction disclaim any responsibility or liability for the violation of such restrictions by any person. The release, publication or distribution of this presentation in or into certain jurisdictions may be restricted by the laws of those jurisdictions. Accordingly, copies of this presentation and all other documents relating to the acquisition are not being, and must not be, released, published, mailed or otherwise forwarded, distributed or sent in, into or from any such restricted jurisdictions. Persons receiving such documents (including, without limitation, nominees, trustees and custodians) should observe these restrictions. Failure to do so may constitute a violation of the securities laws of any such jurisdiction. To the fullest extent permitted by applicable law, the companies involved in the proposed Acquisition disclaim any responsibility or liability for the violations of any such restrictions by any person. Any response in relation to the acquisition should be made only on the basis of the information contained in the Scheme Documents or any document by which the Acquisition and the Scheme are made. Alkermes shareholders are advised to read carefully the formal documentation in relation to the proposed Acquisition once the Scheme Documents have been dispatched. NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION. NOTE REGARDING TRADEMARKS Alkermes and its affiliates are the owners of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO® , LYBALVI® and VIVITROL®. LUMRYZ™ is a trademark of Flamel Ireland Limited, a subsidiary of Avadel. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

FORWARD-LOOKING STATEMENTS Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: Alkermes plc’s (“Alkermes”) expectations with respect to terms and timelines of Alkermes’ planned acquisition of Avadel; Alkermes’ expectations regarding the benefits and potential synergies of the planned acquisition; expectations concerning its and the potential combined organization’s future financial and operating performance, business plans or prospects, including estimates, forecasts, targets and plans for LUMRYZTM; and expectations regarding development plans, activities and timelines for, and the potential therapeutic and commercial value of, its and the combined organization’s portfolio of development candidates. Alkermes cautions that forward-looking statements are inherently uncertain. The forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks and uncertainties. These risks, assumptions and uncertainties include, among others: whether the planned acquisition will be pursued or consummated on the anticipated timelines or at all; whether the regulatory approvals, shareholder approvals or other conditions necessary for consummation of the planned acquisition will be obtained, satisfied or waived, as applicable, on the anticipated timelines or at all; there may be adverse effects on the market price of Alkermes’ ordinary shares and/or operating results as a result of the announcement of the planned acquisition or any inability to complete the planned acquisition; even if the acquisition is consummated, the expected benefits and synergies of the acquisition may not be achieved and the businesses of Alkermes and Avadel may not be effectively integrated; there may be significant changes in transaction costs and/or unknown or inestimable liabilities and potential litigation associated with the planned acquisition; whether any general economic, political, market and business conditions, or future exchange and interest rates, changes in tax laws, regulations, rates and policies, may have a negative impact on Alkermes, Avadel or the combined organization following consummation of the planned acquisition; the announcement or pendency of the planned acquisition could result in disruption to the business and make it more difficult to maintain business and operational relationships of Alkermes and Avadel, including the ability of each of Alkermes and Avadel to attract and retain highly qualified management and other clinical and scientific personnel; the possibility that competing offers may be made for Avadel; clinical development activities may not be initiated or completed on expected timelines or at all; the results of development activities may not be positive, or predictive of future results from such activities, results of future development activities or real-world results; Alkermes’ or Avadel’s products or product candidates could be shown to be ineffective or unsafe; the FDA or regulatory authorities outside the U.S. may not agree with Alkermes’ or Avadel’s regulatory approval strategies or may make adverse decisions regarding its products; Alkermes or Avadel may not be able to continue to successfully commercialize their products or support revenue growth from such products; there may be a reduction in payment rate or reimbursement for the Alkermes’ or Avadel’s products or an increase in related financial obligations to government payers; Alkermes and Avadel’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in Alkermes’ Annual Report on Form 10-K for the year ended Dec. 31, 2024 and in subsequent filings made by Alkermes with the SEC, which are available on the SEC’s website at www.sec.gov, and on Alkermes’ website at www.alkermes.com in the ‘Investors – SEC Filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Any forward-looking statements in this presentation are based upon information available to Alkermes and/or its board of directors as of the date of this presentation and, while believed to be true when made, may ultimately prove to be incorrect. Except as required by law, Alkermes and the members of its board of directors disclaim any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. All subsequent written and oral forward-looking statements attributable to Alkermes or its board of directors or any person acting on behalf of any of them are expressly qualified in their entirety by this paragraph.

Acquisition of Avadel Offers Strong Strategic and Financial Benefits* 1 Augments revenue growth profile and diversifies Alkermes’ commercial portfolio with a new high-growth product, LUMRYZ™ (sodium oxybate) 2 Accelerates Alkermes’ commercial entry into sleep medicine market and provides strong foundation for the potential launch of alixorexton 3 Expected to be immediately accretive and enhance profitability upon closing 4 Positions the combined organization to accelerate innovation and expand leadership in development of treatments for sleep disorders and other neurological disorders 5 Drives operational efficiencies and synergies as Alkermes prepares for the potential commercial launch of alixorexton 6 Expands development pipeline in sleep disorders * Assumes closing of the proposed transaction

Avadel Pharmaceuticals plc: A Leader in Sleep Medicine Nasdaq: AVDL Successfully developed and obtained regulatory approval for LUMRYZ™ (sodium oxybate) for the treatment of cataplexy or excessive daytime sleepiness in patients 7 years of age or older with narcolepsy Secured LUMRYZ Orphan Drug Exclusivity in narcolepsy and Orphan Drug Designation in idiopathic hypersomnia (currently in phase 3 development) Built and scaled commercial infrastructure to support launch and drive uptake Generated >$300 million in net revenues since launch of LUMRYZ (as of 6/30/25) Achieved profitability and positive cash flow in Q2 2025 Strong balance sheet Source: Avadel Pharmaceuticals Corporate Presentation Aug. 7, 2025

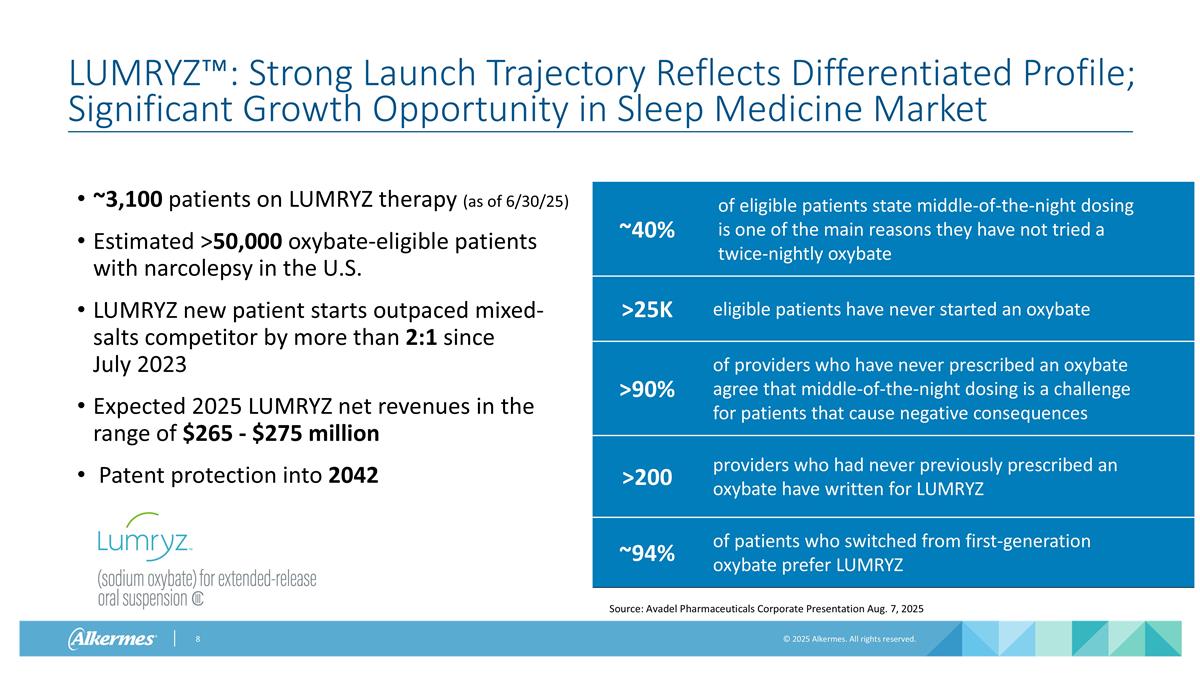

LUMRYZ™: Strong Launch Trajectory Reflects Differentiated Profile; Significant Growth Opportunity in Sleep Medicine Market ~3,100 patients on LUMRYZ therapy (as of 6/30/25) Estimated >50,000 oxybate-eligible patients with narcolepsy in the U.S. LUMRYZ new patient starts outpaced mixed-salts competitor by more than 2:1 since July 2023 Expected 2025 LUMRYZ net revenues in the range of $265 - $275 million Patent protection into 2042 ~40% of eligible patients state middle-of-the-night dosing is one of the main reasons they have not tried a twice-nightly oxybate >25K eligible patients have never started an oxybate >90% of providers who have never prescribed an oxybate agree that middle-of-the-night dosing is a challenge for patients that cause negative consequences >200 providers who had never previously prescribed an oxybate have written for LUMRYZ ~94% of patients who switched from first-generation oxybate prefer LUMRYZ Source: Avadel Pharmaceuticals Corporate Presentation Aug. 7, 2025

Avadel: Proven Commercial Capabilities Provide Strong Foundation for Growth

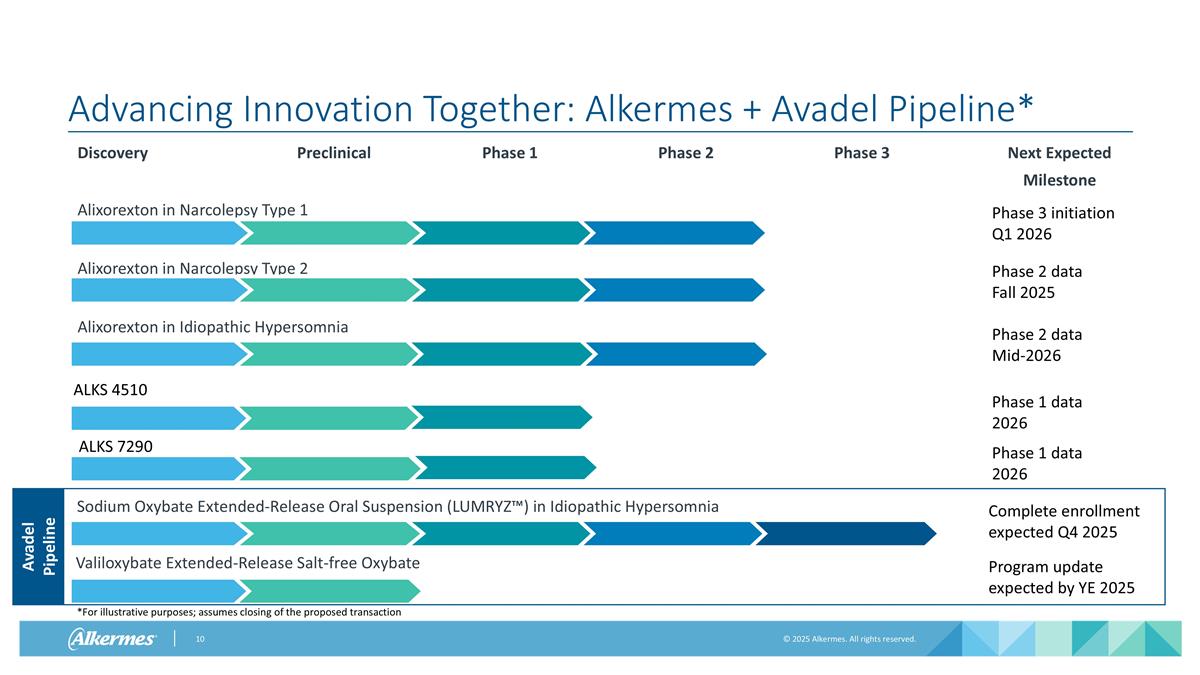

Advancing Innovation Together: Alkermes + Avadel Pipeline* Discovery Preclinical Phase 1 Phase 2 Phase 3 Next Expected Milestone Alixorexton in Narcolepsy Type 1 Phase 3 initiation Q1 2026 Phase 2 Data Alixorexton in Narcolepsy Type 2 Phase 2 data Fall 2025 Alixorexton in Idiopathic Hypersomnia Phase 2 data Mid-2026 Phase 1 data 2026 Phase 1 data 2026 ALKS 4510 ALKS 7290 Avadel Pipeline Valiloxybate Extended-Release Salt-free Oxybate Sodium Oxybate Extended-Release Oral Suspension (LUMRYZ™) in Idiopathic Hypersomnia Program update expected by YE 2025 Complete enrollment expected Q4 2025 *For illustrative purposes; assumes closing of the proposed transaction

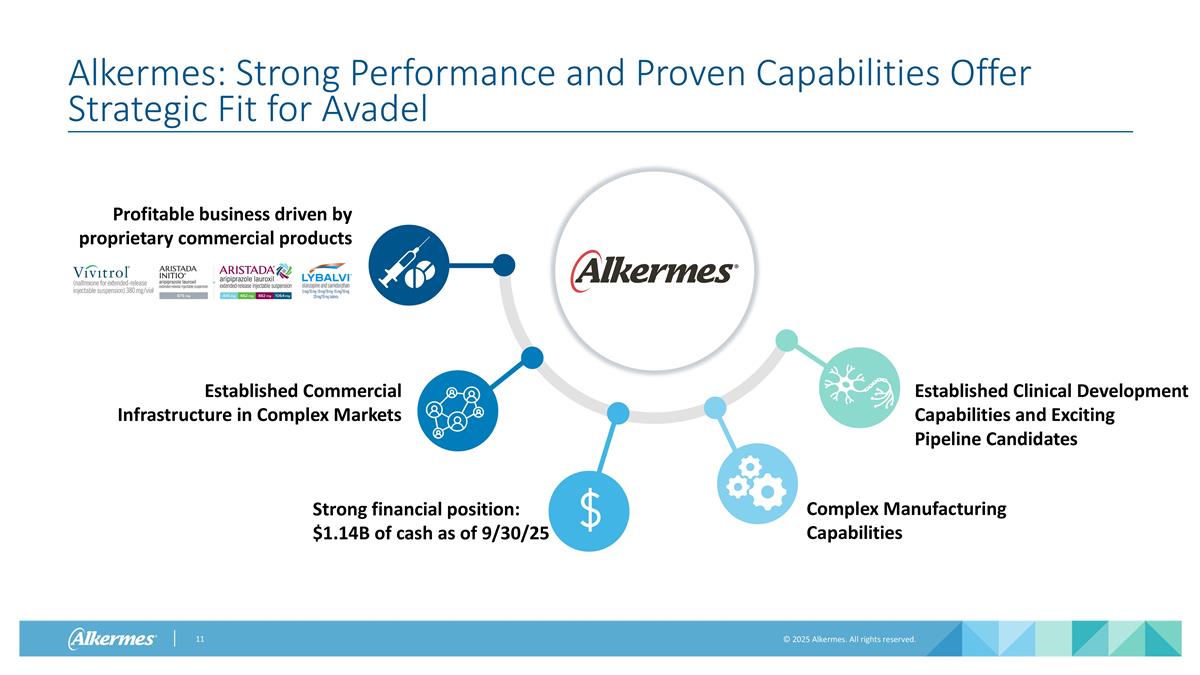

Alkermes: Strong Performance and Proven Capabilities Offer Strategic Fit for Avadel Profitable business driven by proprietary commercial products Established Commercial Infrastructure in Complex Markets Complex Manufacturing Capabilities Established Clinical Development Capabilities and Exciting Pipeline Candidates Strong financial position: $1.14B of cash as of 9/30/25

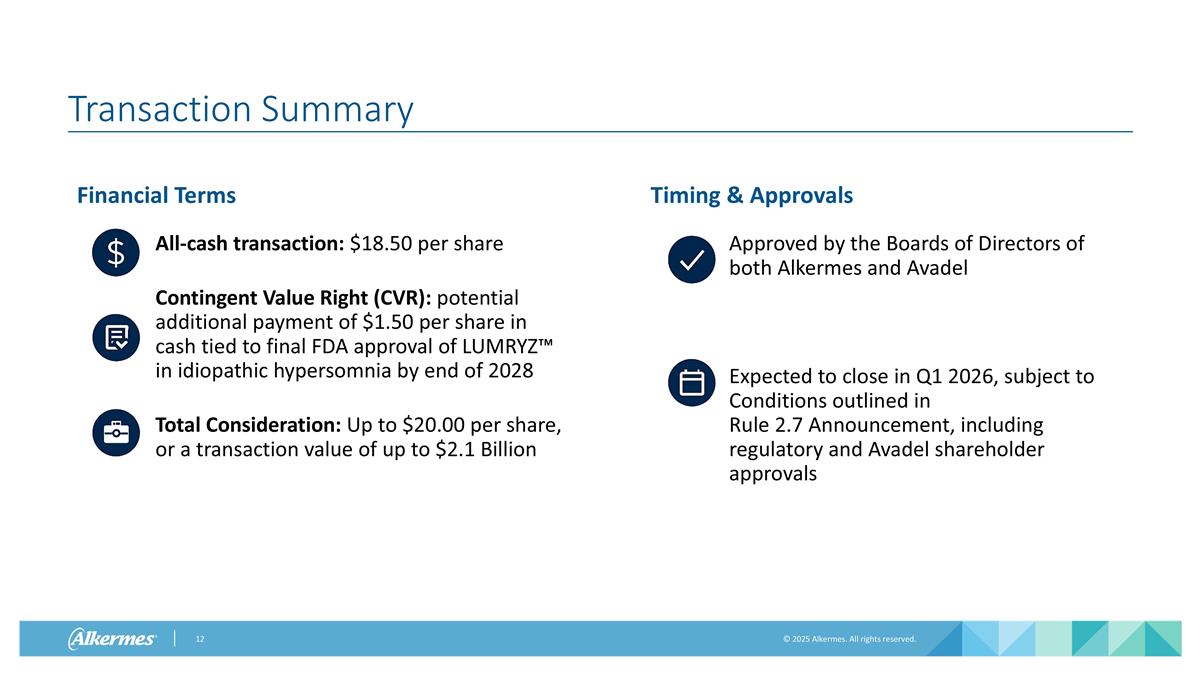

Transaction Summary Financial Terms All-cash transaction: $18.50 per share Contingent Value Right (CVR): potential additional payment of $1.50 per share in cash tied to final FDA approval of LUMRYZ™ in idiopathic hypersomnia by end of 2028 Total Consideration: Up to $20.00 per share, or a transaction value of up to $2.1 Billion Timing & Approvals Approved by the Boards of Directors of both Alkermes and Avadel Expected to close in Q1 2026, subject to Conditions outlined in Rule 2.7 Announcement, including regulatory and Avadel shareholder approvals

www.alkermes.com