Third Quarter 2025 Financial Results & Business Update October 28, 2025 .2

Forward-Looking Statements and Non-GAAP Financial Information Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: Alkermes plc’s (the “Company”) expectations with respect to its current and future financial, commercial and operating performance, business plans or prospects, including its expected revenue and profitability. The Company cautions that forward-looking statements are inherently uncertain. The forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks, assumptions and uncertainties. These risks, assumptions and uncertainties include, among others: whether the Company is able to achieve its financial expectations; the Company’s commercial activities may not result in the benefits that the Company anticipates; clinical development activities may not be initiated or completed on expected timelines or at all; the results of the Company’s development activities may not be positive, or predictive of future results from such activities, results of future development activities or real-world results; the Company’s products or product candidates could be shown to be ineffective or unsafe; the U.S. Food and Drug Administration or regulatory authorities outside the U.S. may not agree with the Company’s regulatory approval strategies or may make adverse decisions regarding the Company’s products; potential changes in the cost, scope, design or duration of the Company’s development programs; the unfavorable outcome of arbitration, litigation, including so-called “Paragraph IV” litigation and other patent litigation which may lead to competition from generic manufacturers, or other proceedings or disputes related to the Company’s products or products using the Company’s proprietary technologies; the Company and its licensees may not be able to continue to successfully commercialize their products or support revenue growth from such products; there may be a reduction in payment rate or reimbursement for the Company’s products or an increase in the Company’s financial obligations to government payers; the Company’s products may prove difficult to manufacture, be precluded from commercialization by the proprietary rights of third parties, or have unintended side effects, adverse reactions or incidents of misuse; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2024 and in subsequent filings made by the Company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov, and on the Company’s website at www.alkermes.com in the ‘Investors – SEC Filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Non-GAAP Financial Measures: This presentation includes information about certain financial measures that are not prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”), including EBITDA (earnings before interest, taxes, depreciation and amortization) and Adjusted EBITDA, which excludes from earnings share-based compensation expense in addition to the components of EBITDA. The Company provides these non-GAAP financial measures of the Company’s performance to investors because management believes that these non-GAAP financial measures, when viewed with the Company’s results under GAAP and the accompanying reconciliations, are useful in identifying underlying trends in ongoing operations. These non-GAAP measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similar measures presented by other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures, to the extent reasonably determinable, can be found in the Appendix of this presentation. Note Regarding Trademarks: The Company and its affiliates are the owners of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO® , LYBALVI® and VIVITROL®. INVEGA SUSTENNA® is a registered trademark of Johnson & Johnson or its affiliated companies. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

Q3 2025 Financial and Operational Performance

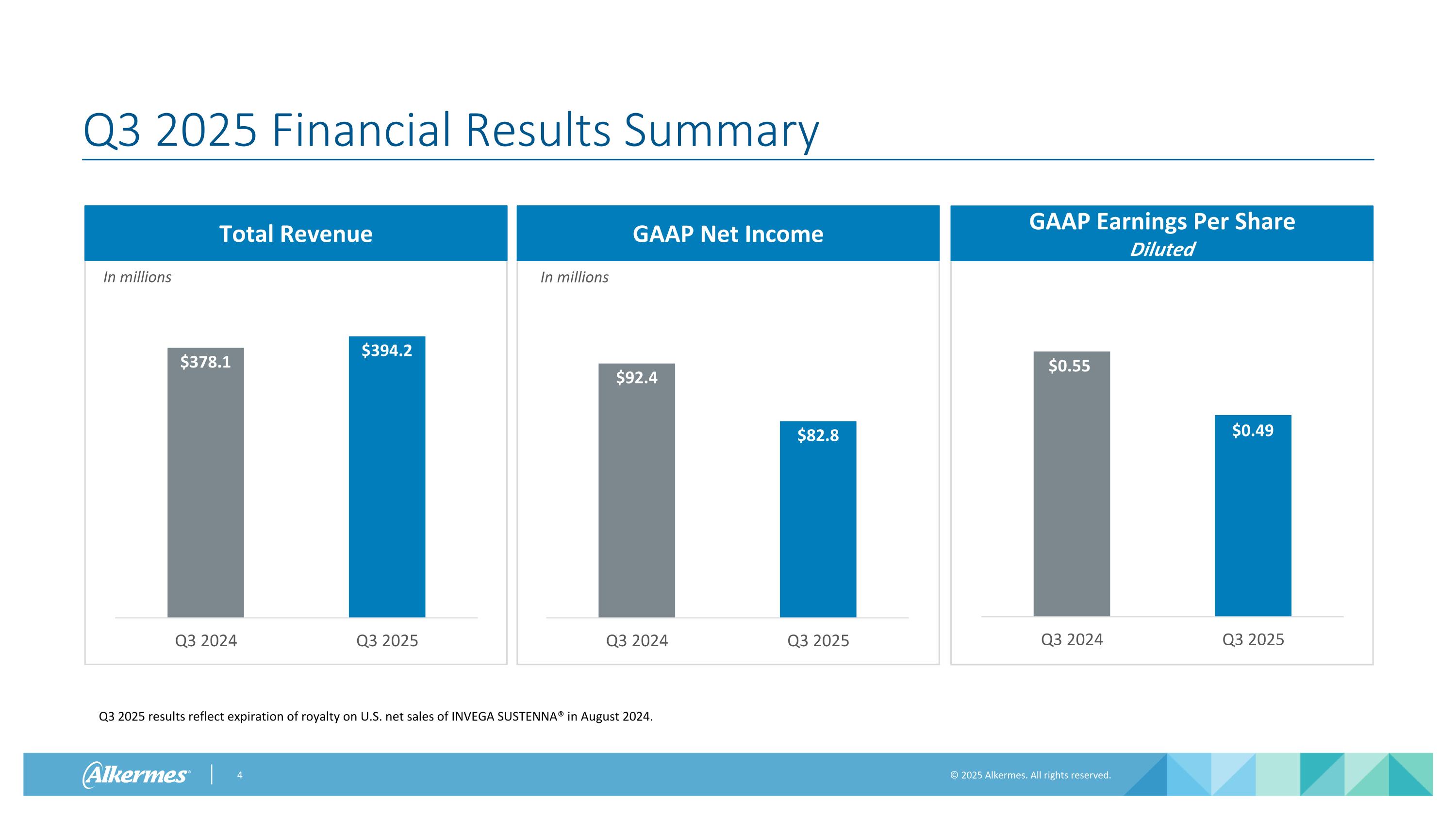

In millions Q3 2025 Financial Results Summary Total Revenue In millions GAAP Net Income GAAP Earnings Per Share Diluted Q3 2025 results reflect expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024.

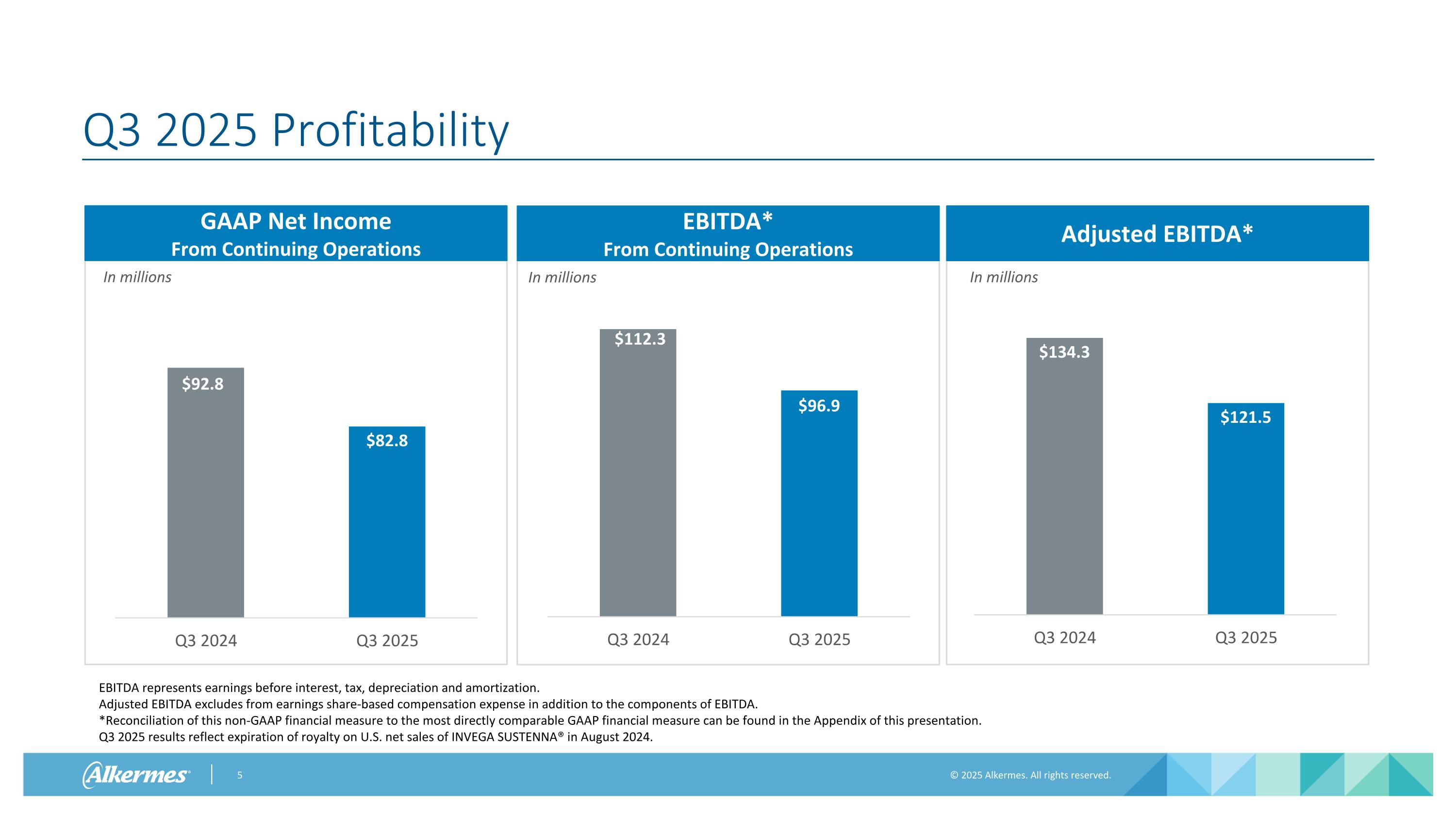

In millions Q3 2025 Profitability GAAP Net Income From Continuing Operations In millions Adjusted EBITDA* EBITDA* From Continuing Operations In millions EBITDA represents earnings before interest, tax, depreciation and amortization. Adjusted EBITDA excludes from earnings share-based compensation expense in addition to the components of EBITDA. *Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Appendix of this presentation. Q3 2025 results reflect expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024.

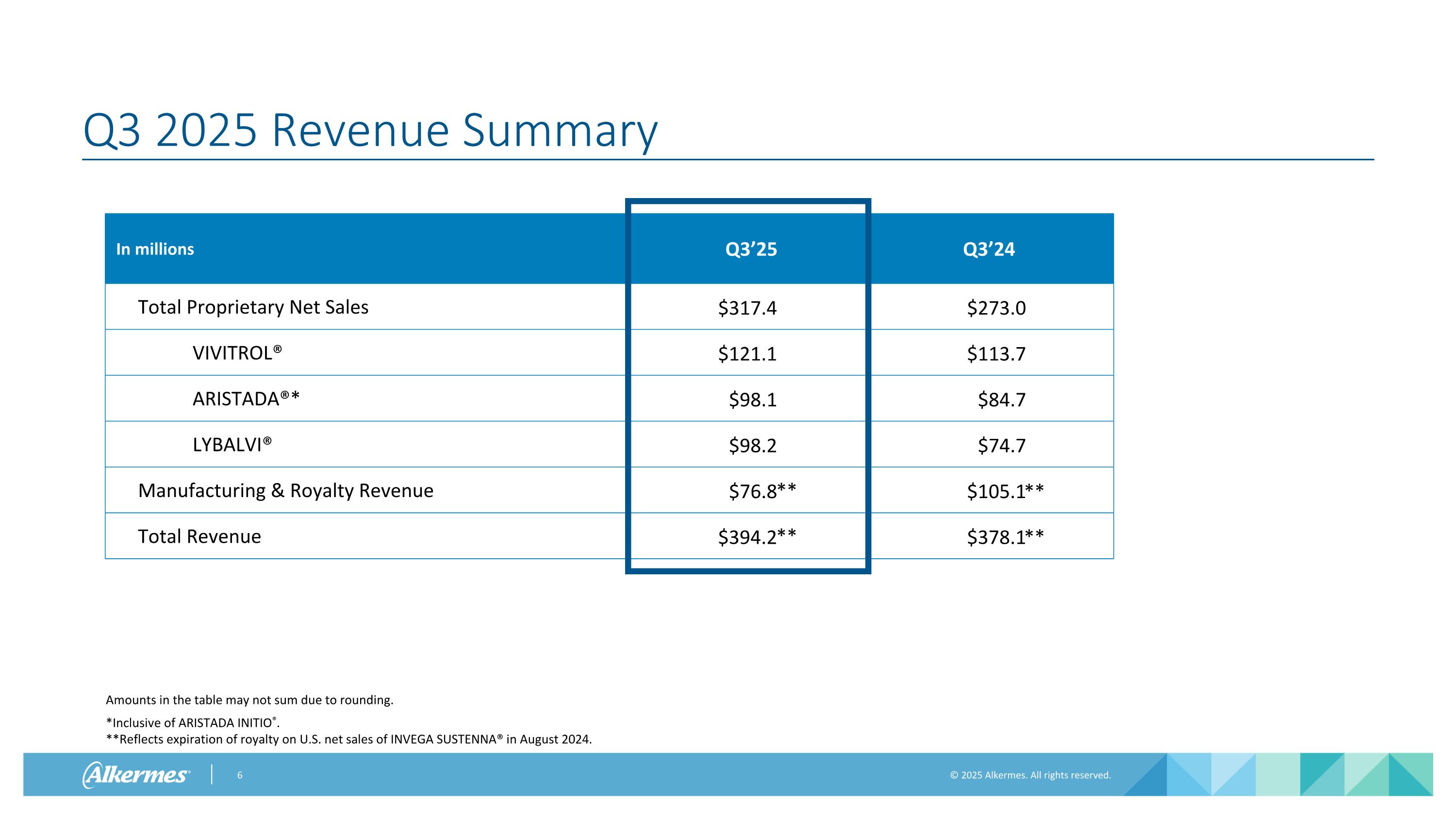

Q3 2025 Revenue Summary In millions Q3’25 Q3’24 Total Proprietary Net Sales $317.4 $273.0 VIVITROL® $121.1 $113.7 ARISTADA®* $98.1 $84.7 LYBALVI® $98.2 $74.7 Manufacturing & Royalty Revenue $76.8 $105.1 Total Revenue $394.2 $378.1 *Inclusive of ARISTADA INITIO®. **Reflects expiration of royalty on U.S. net sales of INVEGA SUSTENNA® in August 2024. ** ** Amounts in the table may not sum due to rounding. ** **

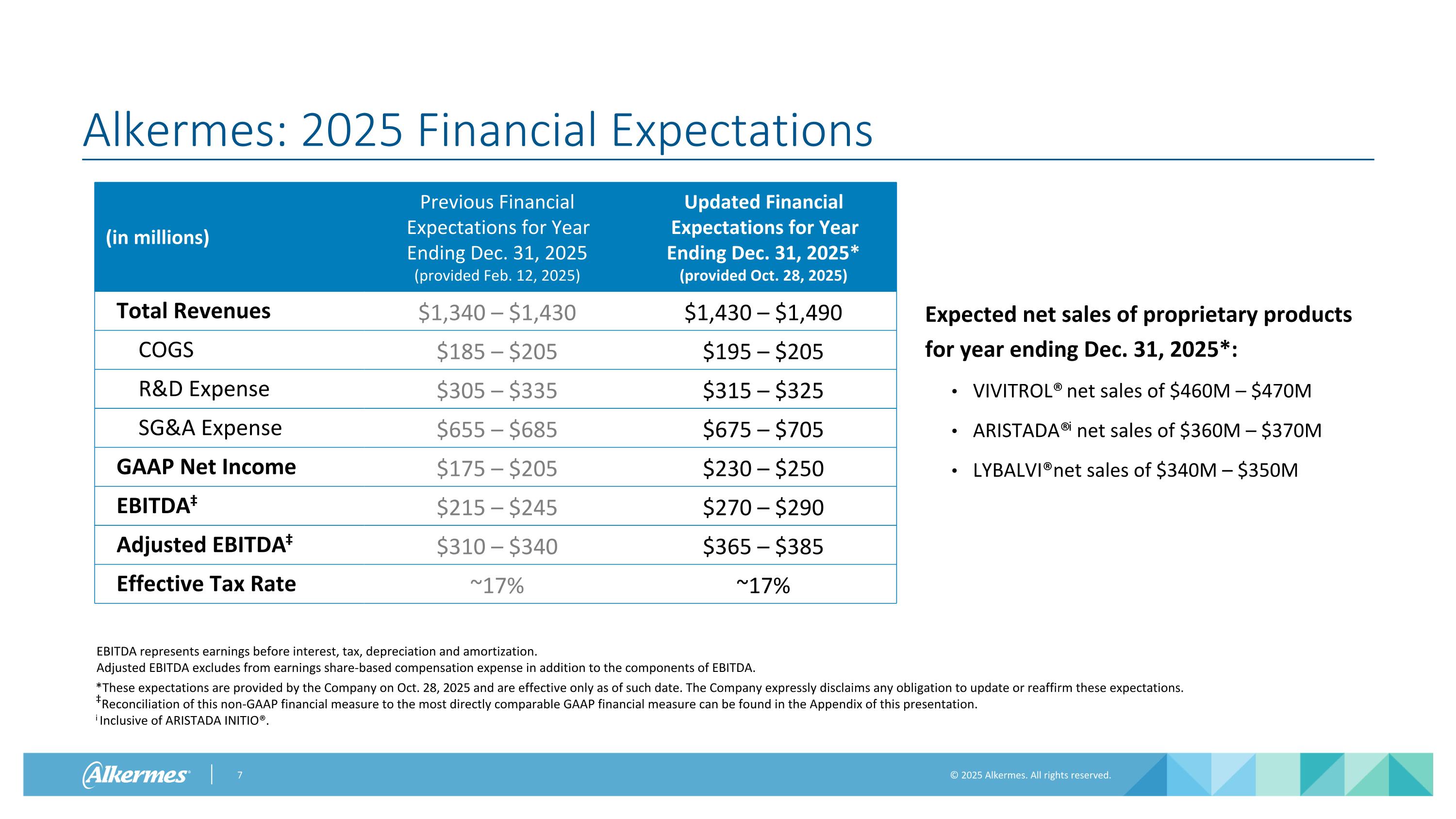

Alkermes: 2025 Financial Expectations *These expectations are provided by the Company on Oct. 28, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. ‡Reconciliation of this non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the Appendix of this presentation. i Inclusive of ARISTADA INITIO®. (in millions) Previous Financial Expectations for Year Ending Dec. 31, 2025 (provided Feb. 12, 2025) Updated Financial Expectations for Year Ending Dec. 31, 2025* (provided Oct. 28, 2025) Total Revenues $1,340 – $1,430 $1,430 – $1,490 COGS $185 – $205 $195 – $205 R&D Expense $305 – $335 $315 – $325 SG&A Expense $655 – $685 $675 – $705 GAAP Net Income $175 – $205 $230 – $250 EBITDA‡ $215 – $245 $270 – $290 Adjusted EBITDA‡ $310 – $340 $365 – $385 Effective Tax Rate ~17% ~17% Expected net sales of proprietary products for year ending Dec. 31, 2025*: VIVITROL® net sales of $460M – $470M ARISTADA®i net sales of $360M – $370M LYBALVI® net sales of $340M – $350M EBITDA represents earnings before interest, tax, depreciation and amortization. Adjusted EBITDA excludes from earnings share-based compensation expense in addition to the components of EBITDA.

Q3 2025 Commercial Review

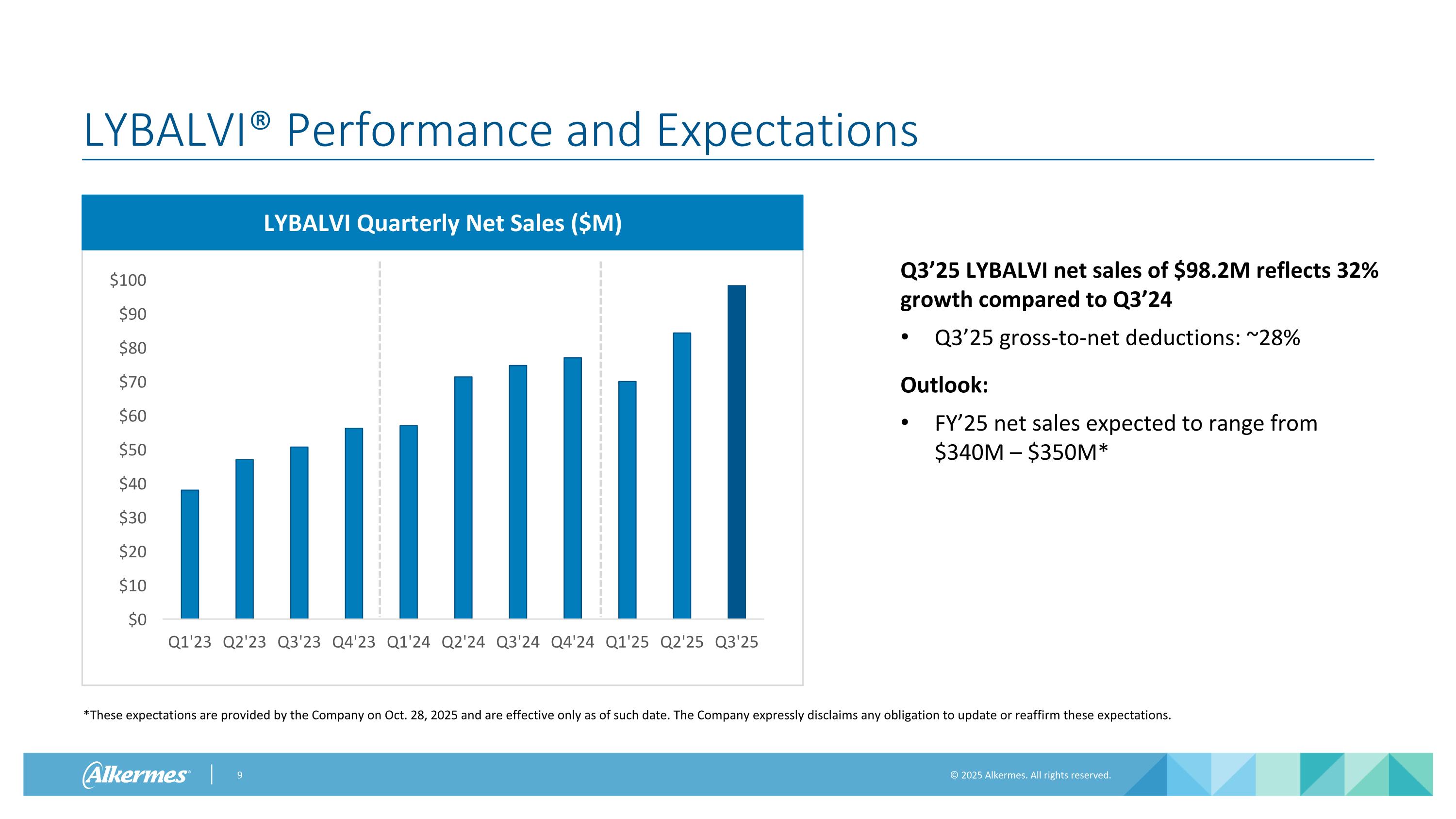

LYBALVI® Performance and Expectations *These expectations are provided by the Company on Oct. 28, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. LYBALVI Quarterly Net Sales ($M) Q3’25 LYBALVI net sales of $98.2M reflects 32% growth compared to Q3’24 Q3’25 gross-to-net deductions: ~28% Outlook: FY’25 net sales expected to range from $340M – $350M*

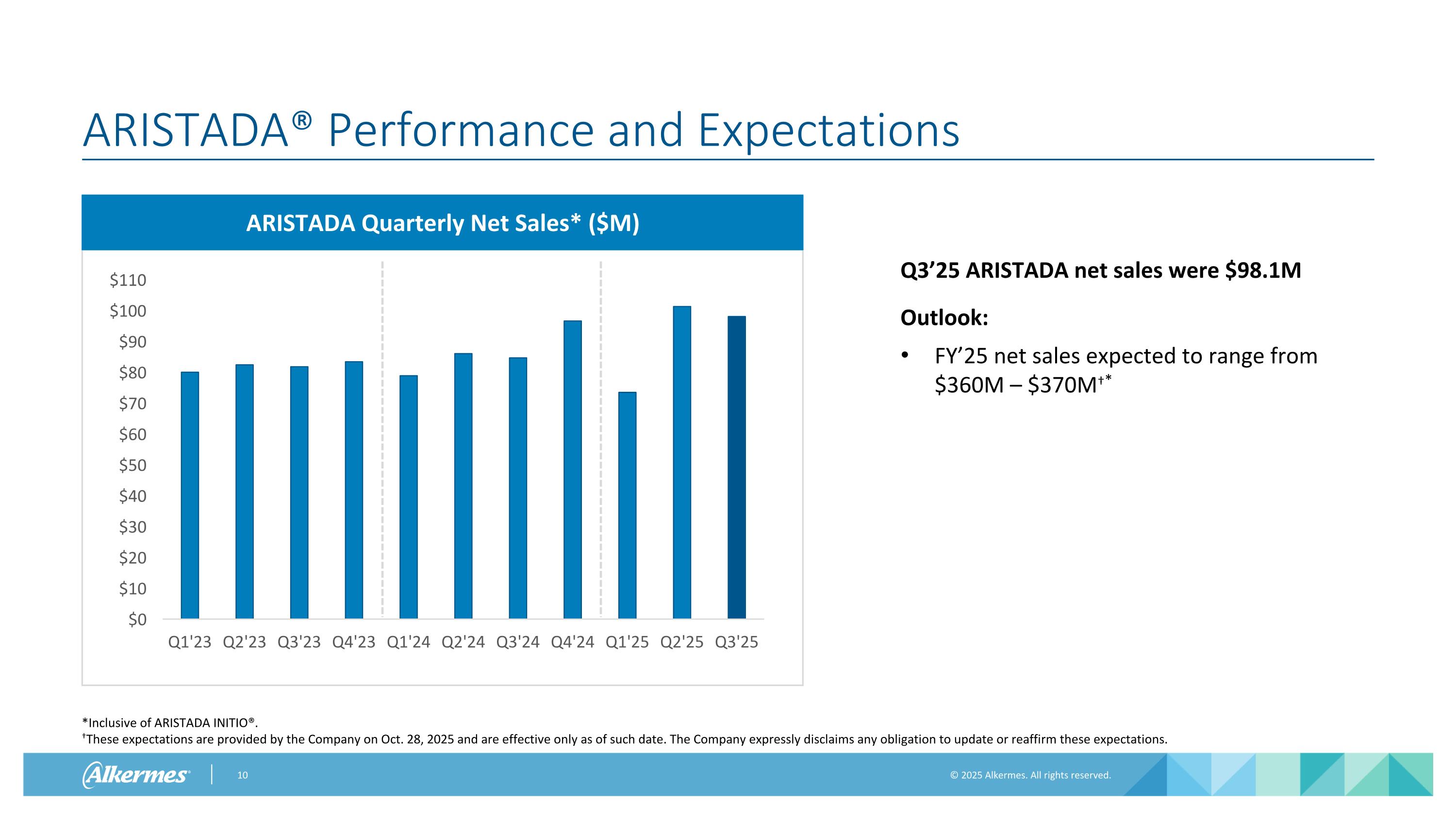

ARISTADA® Performance and Expectations ARISTADA Quarterly Net Sales* ($M) Q3’25 ARISTADA net sales were $98.1M Outlook: FY’25 net sales expected to range from $360M – $370M†* *Inclusive of ARISTADA INITIO®. †These expectations are provided by the Company on Oct. 28, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations.

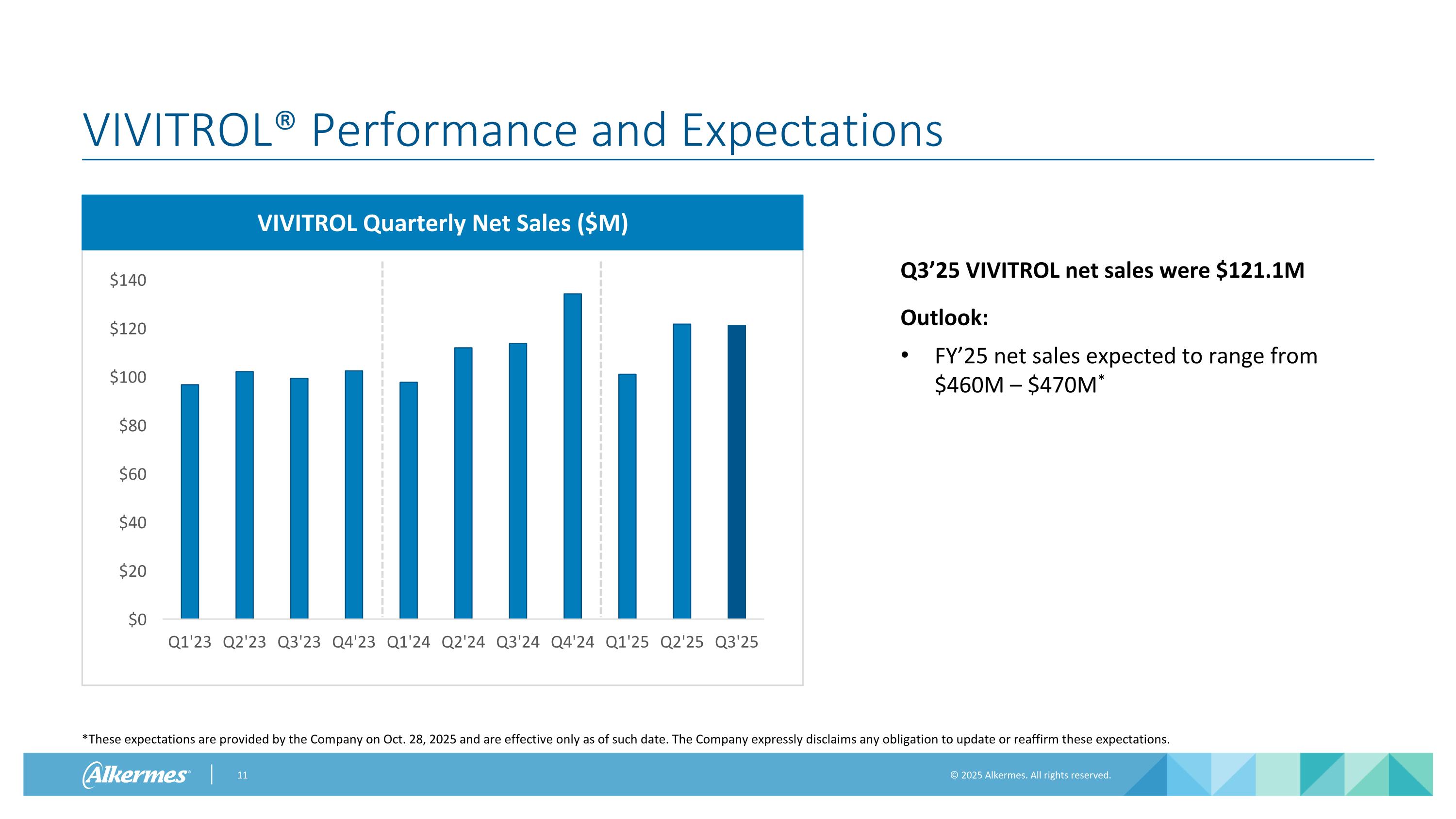

VIVITROL® Performance and Expectations VIVITROL Quarterly Net Sales ($M) *These expectations are provided by the Company on Oct. 28, 2025 and are effective only as of such date. The Company expressly disclaims any obligation to update or reaffirm these expectations. Q3’25 VIVITROL net sales were $121.1M Outlook: FY’25 net sales expected to range from $460M – $470M*

Appendix

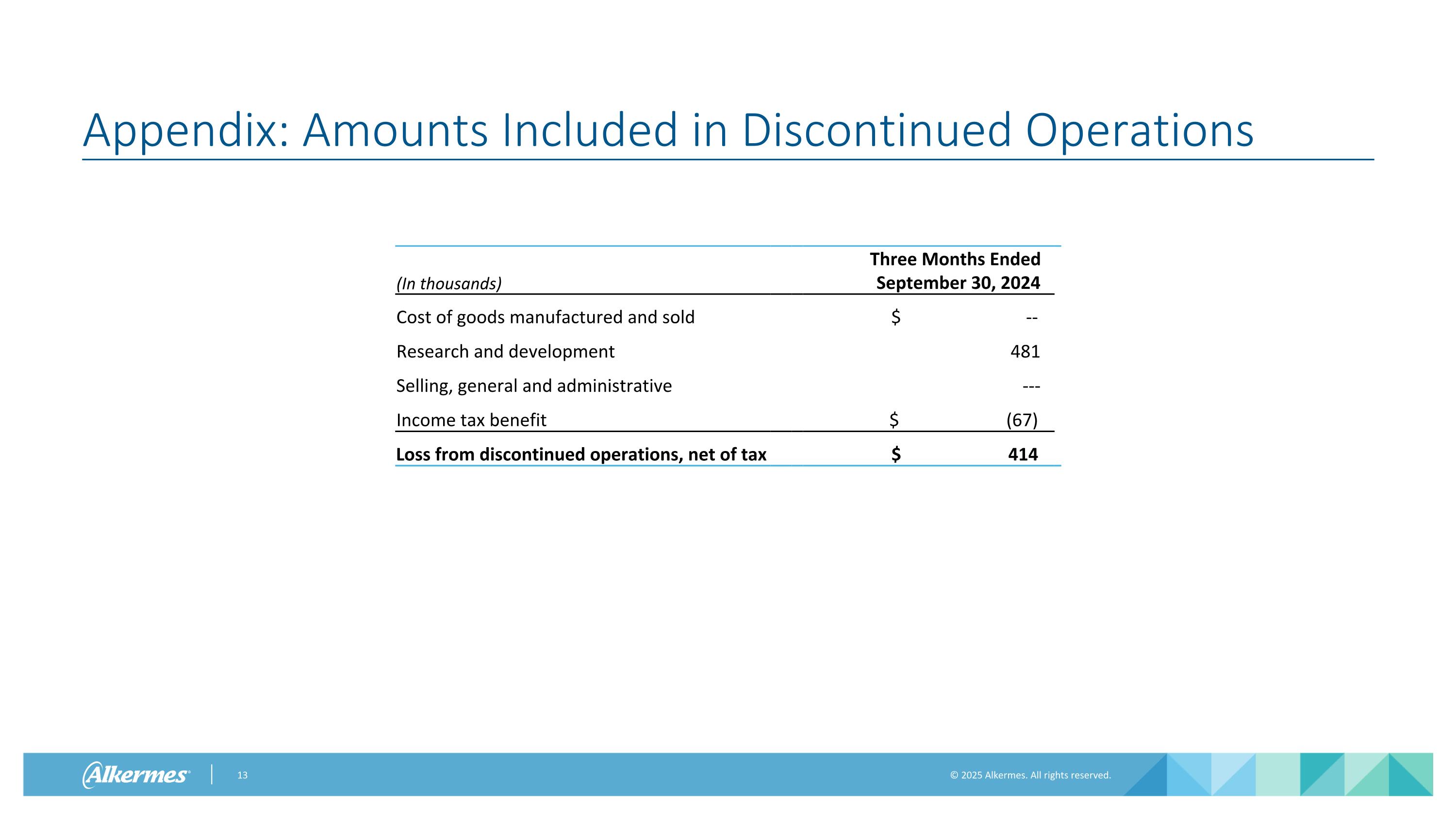

Appendix: Amounts Included in Discontinued Operations (In thousands) Year Ended December 31, 2023 Three Months Ended September 30, 2024 Cost of goods manufactured and sold $ -- Research and development 481 Selling, general and administrative --- Income tax benefit $ (67) Loss from discontinued operations, net of tax $ 414

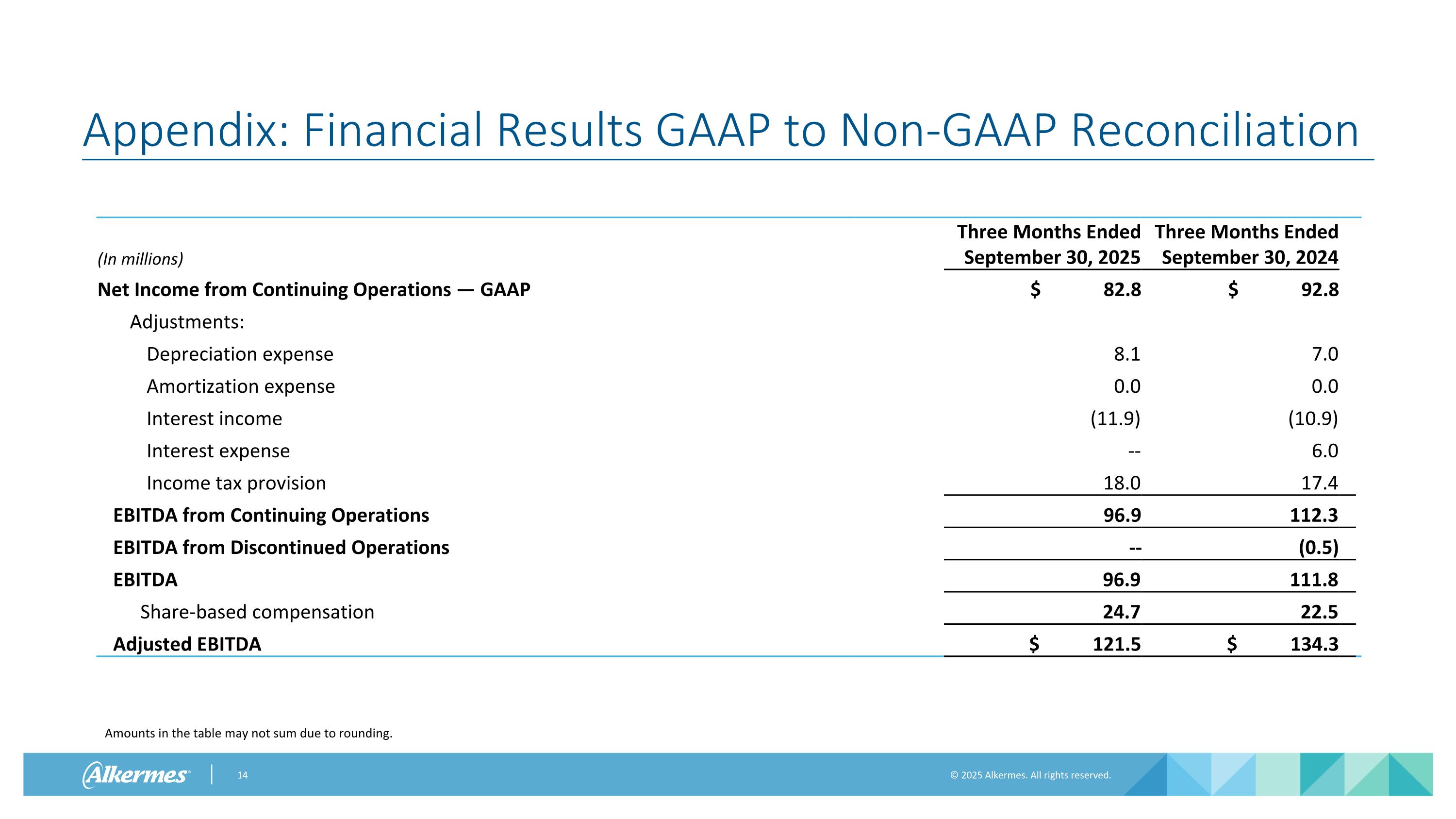

Appendix: Financial Results GAAP to Non-GAAP Reconciliation (In millions) Three Months Ended September 30, 2025 Three Months Ended September 30, 2024 Net Income from Continuing Operations — GAAP $ 82.8 $ 92.8 Adjustments: Depreciation expense 8.1 7.0 Amortization expense 0.0 0.0 Interest income (11.9) (10.9) Interest expense -- 6.0 Income tax provision 18.0 17.4 EBITDA from Continuing Operations 96.9 112.3 EBITDA from Discontinued Operations -- (0.5) EBITDA 96.9 111.8 Share-based compensation 24.7 22.5 Adjusted EBITDA $ 121.5 $ 134.3 Amounts in the table may not sum due to rounding.

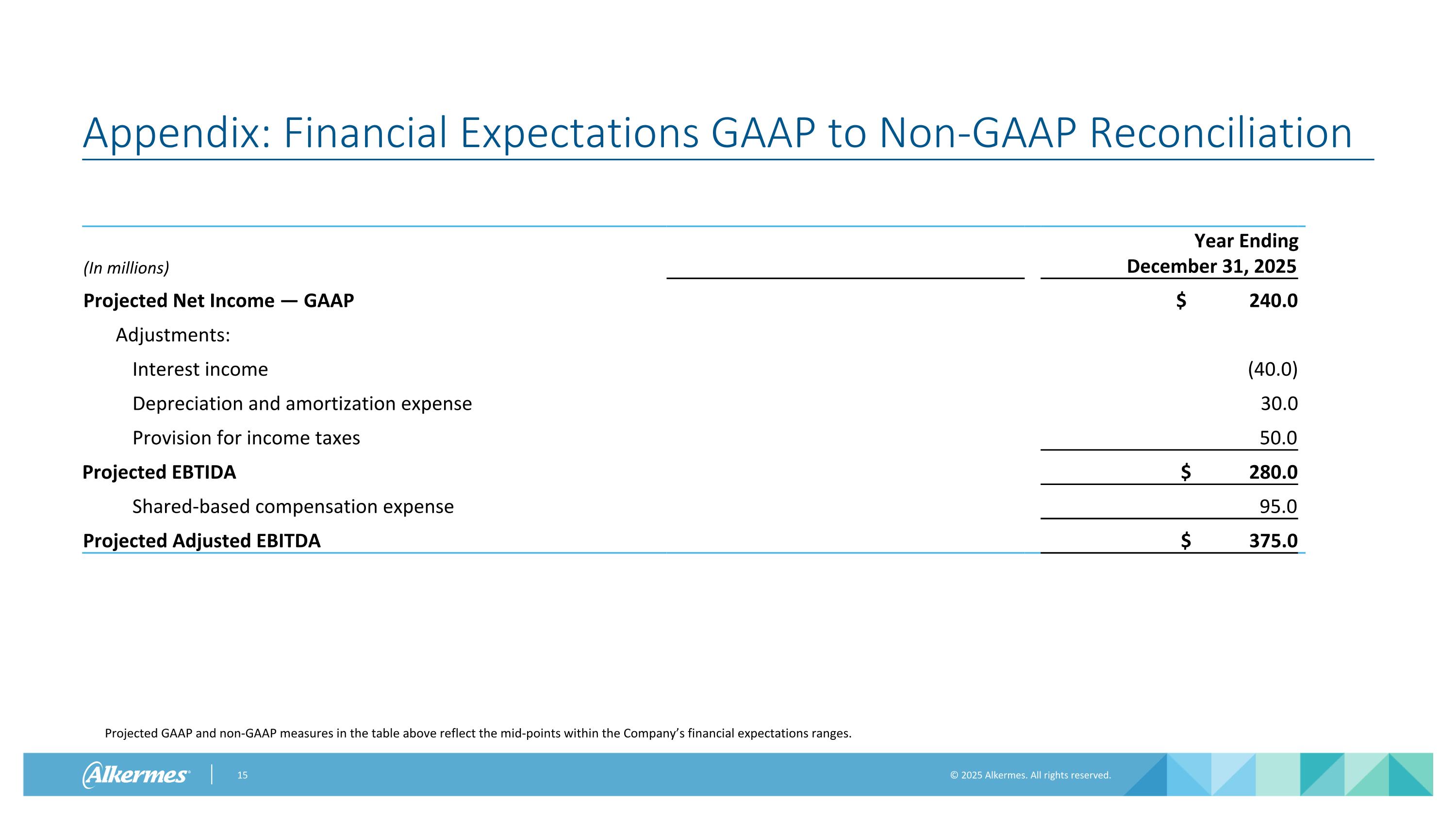

Appendix: Financial Expectations GAAP to Non-GAAP Reconciliation Projected GAAP and non-GAAP measures in the table above reflect the mid-points within the Company’s financial expectations ranges. (In millions) Year Ended December 31, 2023 Year Ending December 31, 2025 Projected Net Income — GAAP $ 240.0 Adjustments: Interest income (40.0) Depreciation and amortization expense 30.0 Provision for income taxes 50.0 Projected EBTIDA $ 280.0 Shared-based compensation expense 95.0 Projected Adjusted EBITDA $ 375.0

www.alkermes.com