Alkermes 2026: Driving Profitable Growth in Neuroscience and Leading Orexin Innovation January 2026

Forward-Looking Statements Certain statements set forth in this presentation constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended, including, but not limited to, statements concerning: Alkermes plc’s (the “Company” or “Alkermes") expectations with respect to its current and future financial and operating performance, business plans or prospects, including its expected opportunities for growth and value creation and expectations of profitability; the potential therapeutic and commercial value of the Company’s marketed products and development candidates and expectations regarding potential opportunities and competitive positioning for the orexin 2 receptor agonist class in sleep medicine and other disease areas; expectations regarding the timing and anticipated benefits of the planned acquisition of Avadel Pharmaceuticals plc (“Avadel”) and the potential combined organization’s future operating performance; expectations regarding the patent life of LUMRYZTM; the Company’s plans and expectations regarding clinical development activities and strategy, including expansion and advancement of its pipeline, and anticipated timelines and study designs for the development programs for alixorexton, ALKS 4510, ALKS 7290, and the Company’s other development candidates. The Company cautions that forward-looking statements are inherently uncertain. The forward-looking statements are neither promises nor guarantees and they are necessarily subject to a high degree of uncertainty and risk. Actual performance and results may differ materially from those expressed or implied in the forward-looking statements due to various risks, assumptions and uncertainties. These risks, assumptions and uncertainties include, among others: the Company may not be able to achieve its anticipated financial and operating performance and profitability; clinical development activities may not be initiated or completed on expected timelines or at all; the results of the Company’s development activities may not be positive, or predictive of future results from such activities, results of future development activities or real-world results; the Company’s products or product candidates could be shown to be ineffective or unsafe; the U.S. Food and Drug Administration (“FDA”) or regulatory authorities outside the U.S. may not agree with the Company’s regulatory approval strategies or may make adverse decisions regarding the Company’s products; potential changes in the cost, scope and duration of the Company’s development programs; the proposed acquisition of Avadel may not be consummated on the anticipated terms, timelines or at all; even if the proposed acquisition is consummated, the expected benefits of the proposed acquisition may not be achieved; there may be significant changes in transaction costs and/or unknown or inestimable liabilities and potential litigation associated with the proposed acquisition; the Company and its licensees may not be able to continue to successfully commercialize their products or support growth of such products; and those risks, assumptions and uncertainties described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2024 and in subsequent filings made by the Company with the U.S. Securities and Exchange Commission (“SEC”), which are available on the SEC’s website at www.sec.gov, and on the Company’s website at www.alkermes.com in the ‘Investors – SEC filings’ section. Existing and prospective investors are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, the Company disclaims any intention or responsibility for updating or revising any forward-looking statements contained in this presentation. Statement Required by the Irish Takeover Rules: The directors of Alkermes accept responsibility for the information contained in this presentation. To the best of the knowledge and belief of the directors of Alkermes (who have taken all reasonable care to ensure that such is the case), the information contained in this presentation for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information. Note Regarding Trademarks: The Company and its affiliates are the owners of various U.S. federal trademark registrations (®) and other trademarks (TM), including ARISTADA®, ARISTADA INITIO®, LYBALVI® and VIVITROL®. VUMERITY® is a registered trademark of Biogen MA Inc., used by Alkermes under license. LUMRYZ™ is a trademark of Flamel Ireland Limited, a subsidiary of Avadel. Any other trademarks referred to in this presentation are the property of their respective owners. Appearances of such other trademarks herein should not be construed as any indicator that their respective owners will not assert their rights thereto.

Alkermes in 2026: Strong Foundation for Near- and Long-term Growth and Value Creation Commercial business generated total revenues >$1.45B, strong cash flow and profitability in 2025; Planned acquisition of Avadel augments revenue growth profile and profitability Alixorexton: Blockbuster potential in narcolepsy and idiopathic hypersomnia, if approved; recently granted FDA Breakthrough Therapy designation in NT1; entering phase 3 in narcolepsy in Q1 2026 Orexin 2 receptor agonist candidates represent potential new vertical of growth and expansion in multiple disease areas beyond sleep medicine Profitable neuroscience company with late-stage candidate and leadership in exciting new therapeutic category NT1 = narcolepsy type 1

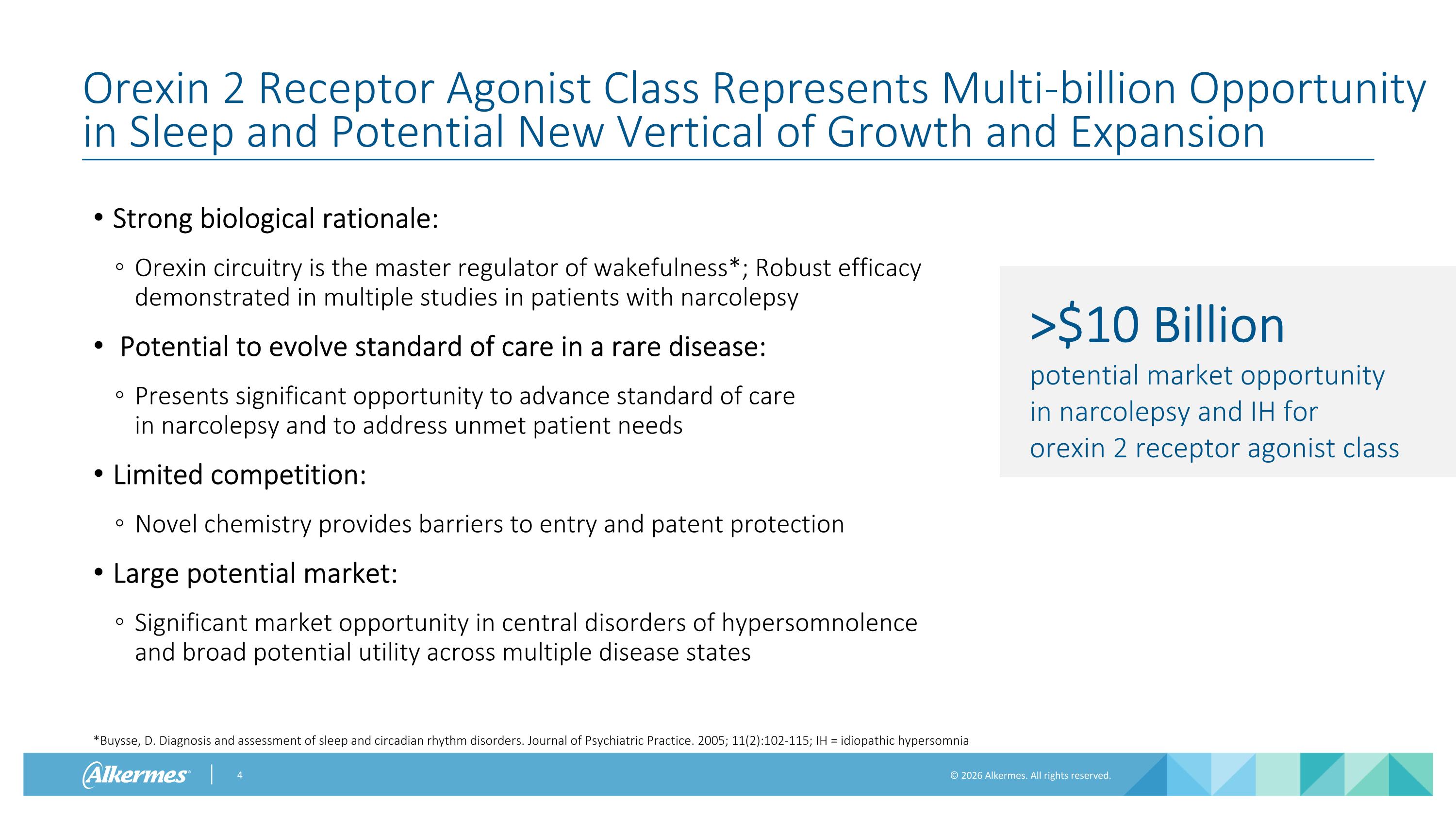

Orexin 2 Receptor Agonist Class Represents Multi-billion Opportunity in Sleep and Potential New Vertical of Growth and Expansion Strong biological rationale: Orexin circuitry is the master regulator of wakefulness*; Robust efficacy demonstrated in multiple studies in patients with narcolepsy Potential to evolve standard of care in a rare disease: Presents significant opportunity to advance standard of care in narcolepsy and to address unmet patient needs Limited competition: Novel chemistry provides barriers to entry and patent protection Large potential market: Significant market opportunity in central disorders of hypersomnolence and broad potential utility across multiple disease states >$10 Billion potential market opportunity in narcolepsy and IH for orexin 2 receptor agonist class *Buysse, D. Diagnosis and assessment of sleep and circadian rhythm disorders. Journal of Psychiatric Practice. 2005; 11(2):102-115; IH = idiopathic hypersomnia

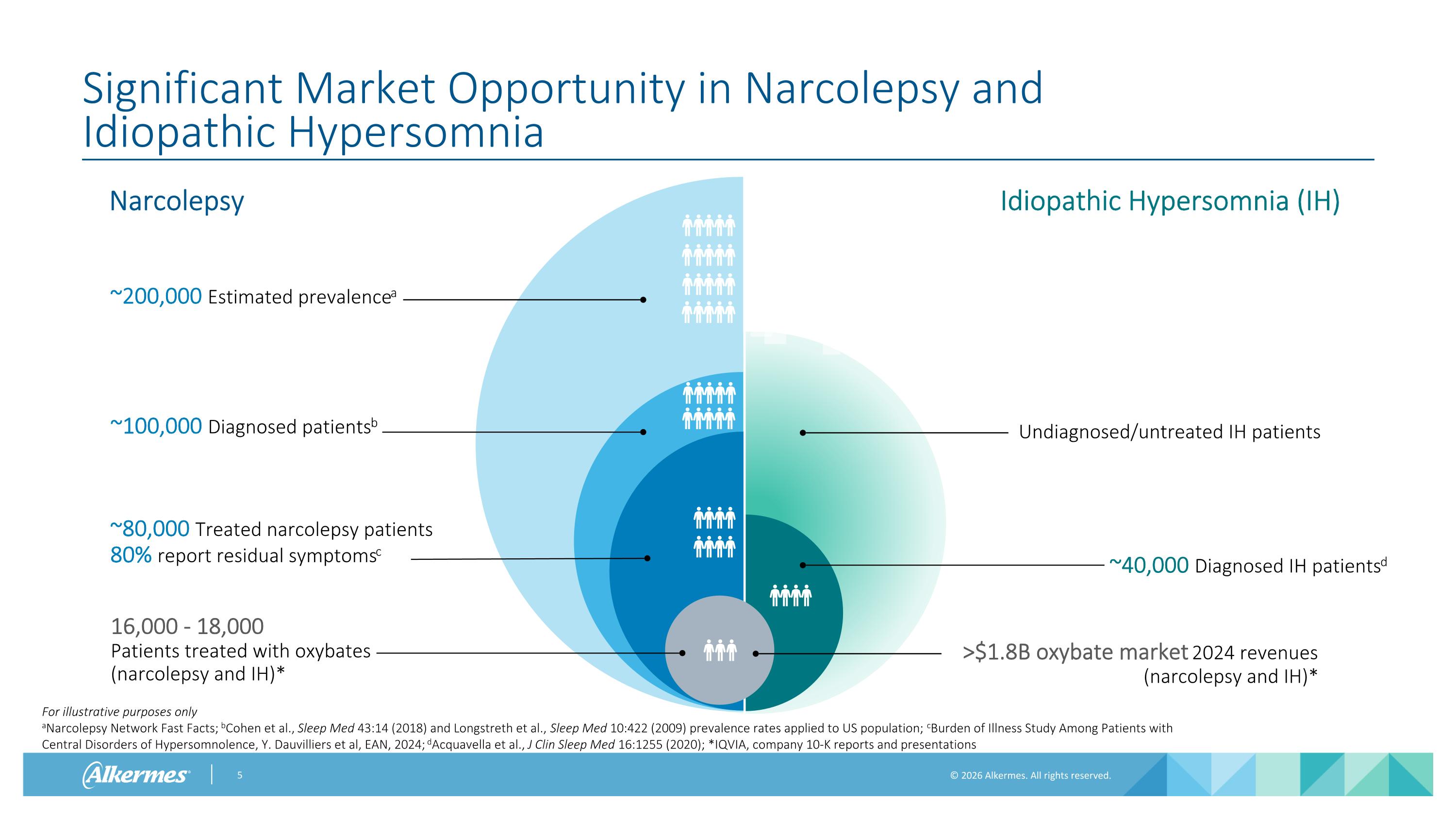

Significant Market Opportunity in Narcolepsy and Idiopathic Hypersomnia ~80,000 Treated narcolepsy patients 80% report residual symptomsc Idiopathic Hypersomnia (IH) Narcolepsy For illustrative purposes only aNarcolepsy Network Fast Facts; bCohen et al., Sleep Med 43:14 (2018) and Longstreth et al., Sleep Med 10:422 (2009) prevalence rates applied to US population; cBurden of Illness Study Among Patients with Central Disorders of Hypersomnolence, Y. Dauvilliers et al, EAN, 2024; dAcquavella et al., J Clin Sleep Med 16:1255 (2020); *IQVIA, company 10-K reports and presentations Undiagnosed/untreated IH patients ~100,000 Diagnosed patientsb ~40,000 Diagnosed IH patientsd ~200,000 Estimated prevalencea 16,000 - 18,000 Patients treated with oxybates (narcolepsy and IH)* >$1.8B oxybate market 2024 revenues (narcolepsy and IH)*

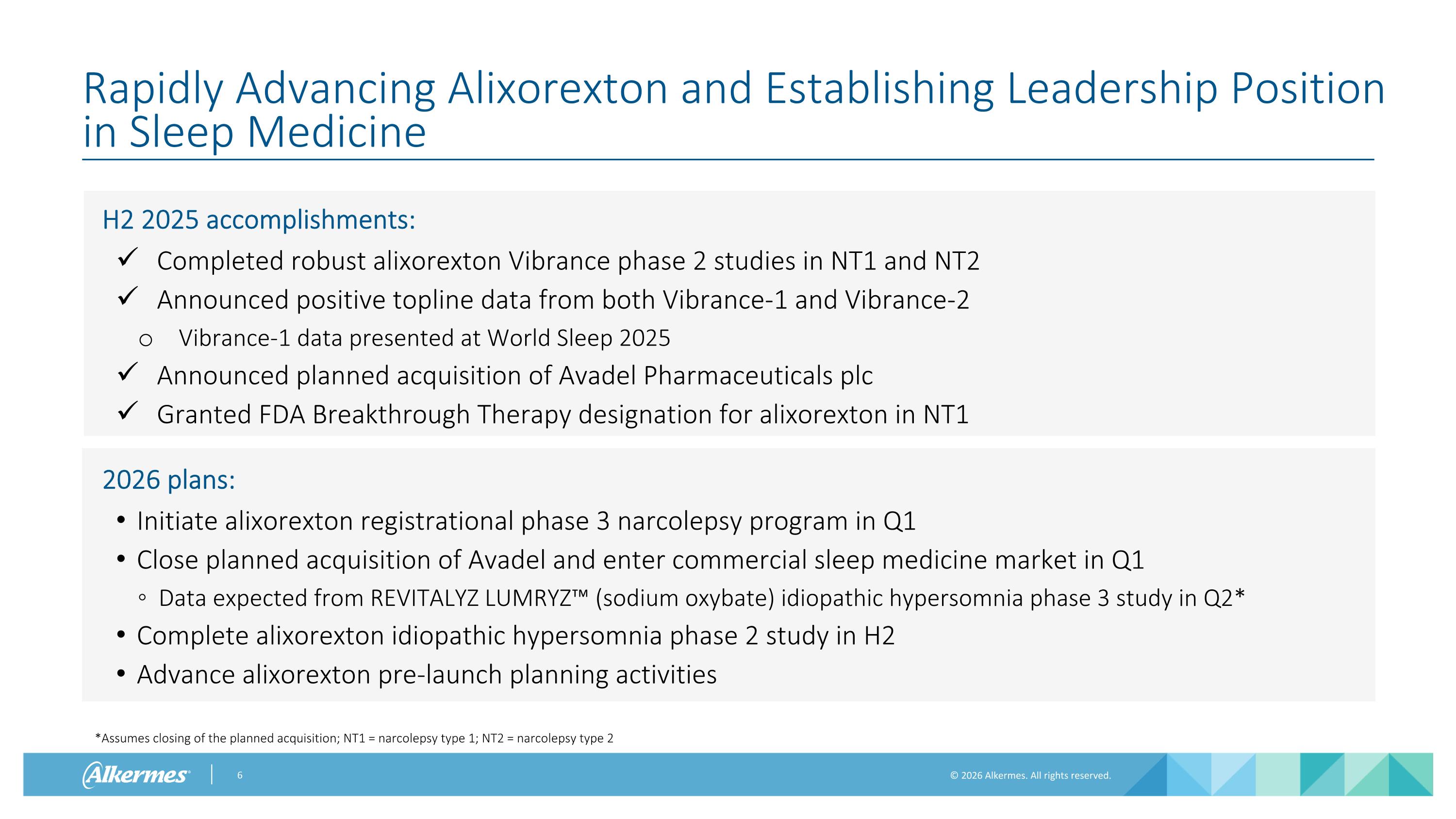

Rapidly Advancing Alixorexton and Establishing Leadership Position in Sleep Medicine H2 2025 accomplishments: Completed robust alixorexton Vibrance phase 2 studies in NT1 and NT2 Announced positive topline data from both Vibrance-1 and Vibrance-2 Vibrance-1 data presented at World Sleep 2025 Announced planned acquisition of Avadel Pharmaceuticals plc Granted FDA Breakthrough Therapy designation for alixorexton in NT1 2026 plans: Initiate alixorexton registrational phase 3 narcolepsy program in Q1 Close planned acquisition of Avadel and enter commercial sleep medicine market in Q1 Data expected from REVITALYZ LUMRYZ™ (sodium oxybate) idiopathic hypersomnia phase 3 study in Q2* Complete alixorexton idiopathic hypersomnia phase 2 study in H2 Advance alixorexton pre-launch planning activities *Assumes closing of the planned acquisition; NT1 = narcolepsy type 1; NT2 = narcolepsy type 2

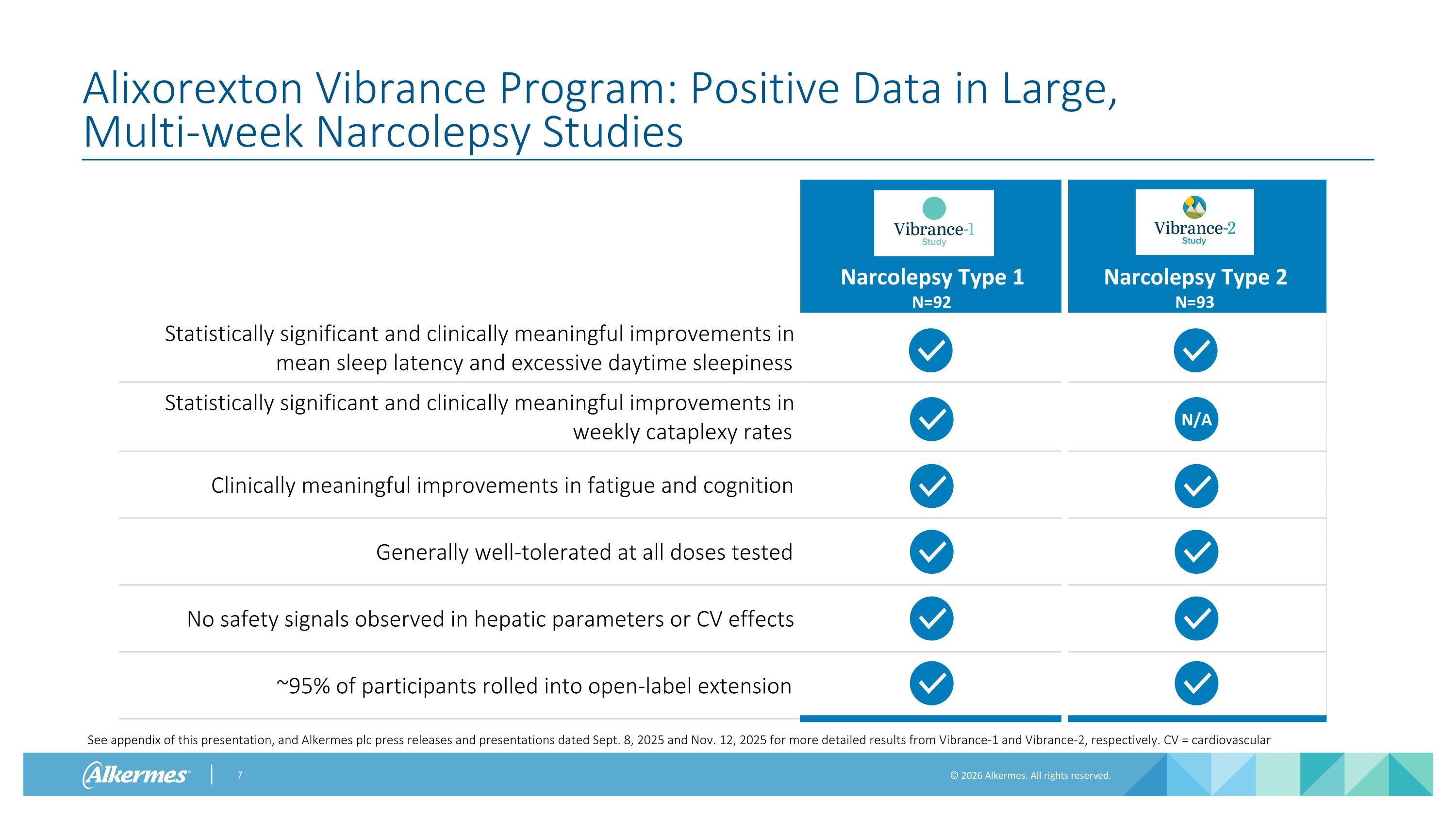

Alixorexton Vibrance Program: Positive Data in Large, Multi-week Narcolepsy Studies Narcolepsy Type 1 N=92 Narcolepsy Type 2 N=93 Statistically significant and clinically meaningful improvements in mean sleep latency and excessive daytime sleepiness Statistically significant and clinically meaningful improvements in weekly cataplexy rates Clinically meaningful improvements in fatigue and cognition Generally well-tolerated at all doses tested No safety signals observed in hepatic parameters or CV effects ~95% of participants rolled into open-label extension N/A See appendix of this presentation, and Alkermes plc press releases and presentations dated Sept. 8, 2025 and Nov. 12, 2025 for more detailed results from Vibrance-1 and Vibrance-2, respectively. CV = cardiovascular

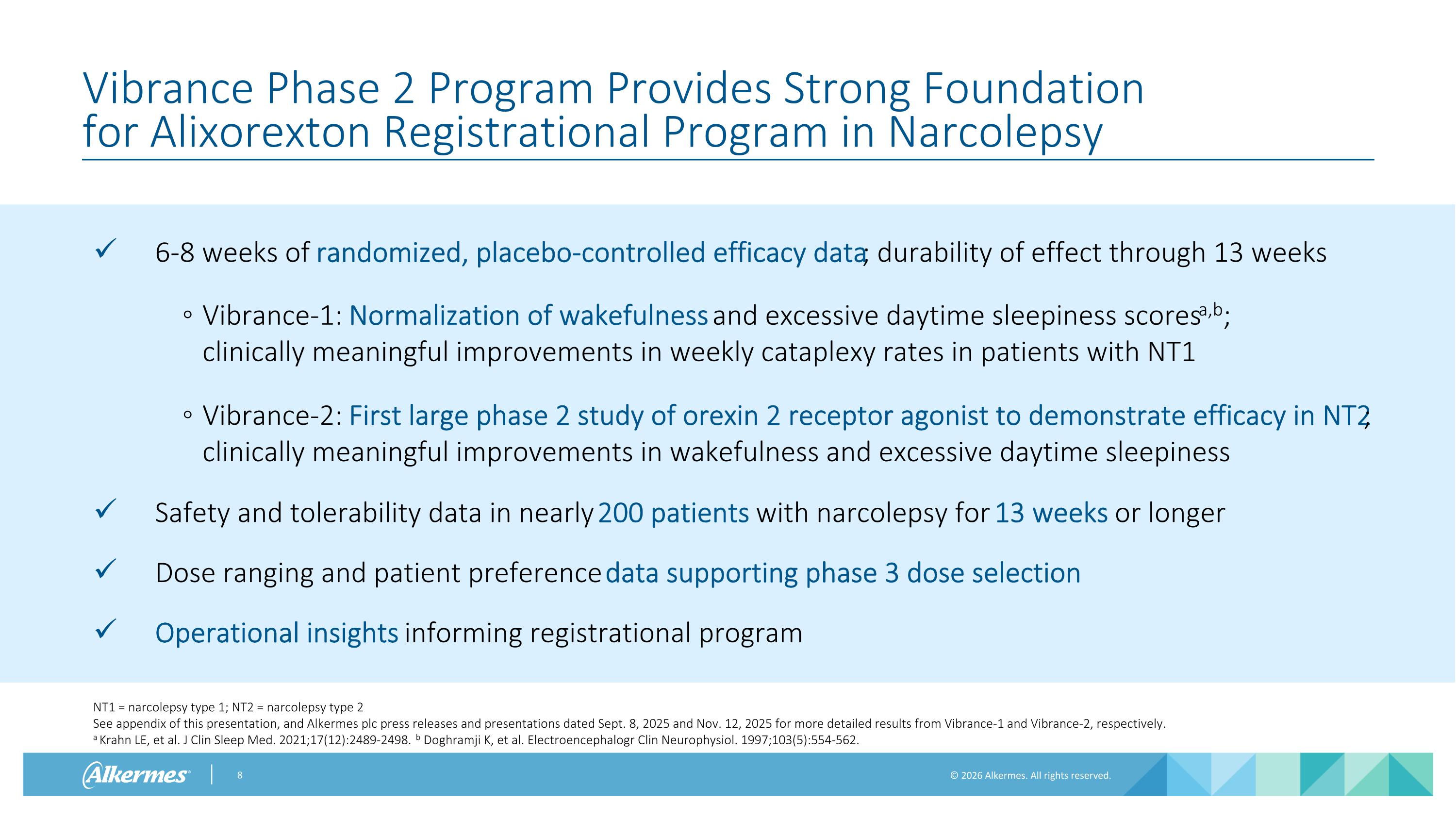

Vibrance Phase 2 Program Provides Strong Foundation for Alixorexton Registrational Program in Narcolepsy 6-8 weeks of randomized, placebo-controlled efficacy data; durability of effect through 13 weeks Vibrance-1: Normalization of wakefulness and excessive daytime sleepiness scoresa,b; clinically meaningful improvements in weekly cataplexy rates in patients with NT1 Vibrance-2: First large phase 2 study of orexin 2 receptor agonist to demonstrate efficacy in NT2; clinically meaningful improvements in wakefulness and excessive daytime sleepiness Safety and tolerability data in nearly 200 patients with narcolepsy for 13 weeks or longer Dose ranging and patient preference data supporting phase 3 dose selection Operational insights informing registrational program NT1 = narcolepsy type 1; NT2 = narcolepsy type 2 See appendix of this presentation, and Alkermes plc press releases and presentations dated Sept. 8, 2025 and Nov. 12, 2025 for more detailed results from Vibrance-1 and Vibrance-2, respectively. a Krahn LE, et al. J Clin Sleep Med. 2021;17(12):2489-2498. b Doghramji K, et al. Electroencephalogr Clin Neurophysiol. 1997;103(5):554-562.

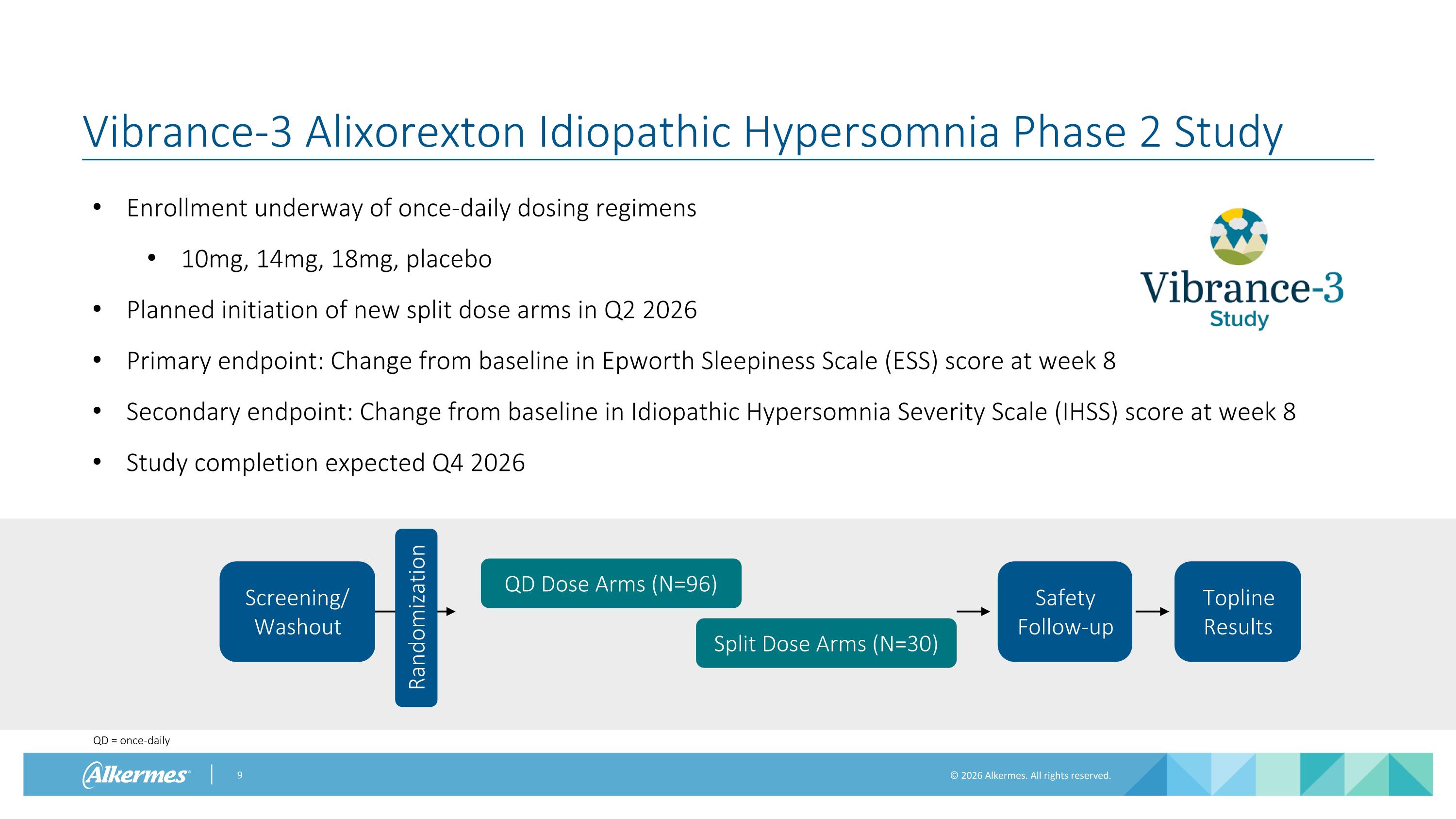

Vibrance-3 Alixorexton Idiopathic Hypersomnia Phase 2 Study Enrollment underway of once-daily dosing regimens 10mg, 14mg, 18mg, placebo Planned initiation of new split dose arms in Q2 2026 Primary endpoint: Change from baseline in Epworth Sleepiness Scale (ESS) score at week 8 Secondary endpoint: Change from baseline in Idiopathic Hypersomnia Severity Scale (IHSS) score at week 8 Study completion expected Q4 2026 QD Dose Arms (N=96) Safety Follow-up Screening/ Washout Randomization Split Dose Arms (N=30) Topline Results QD = once-daily

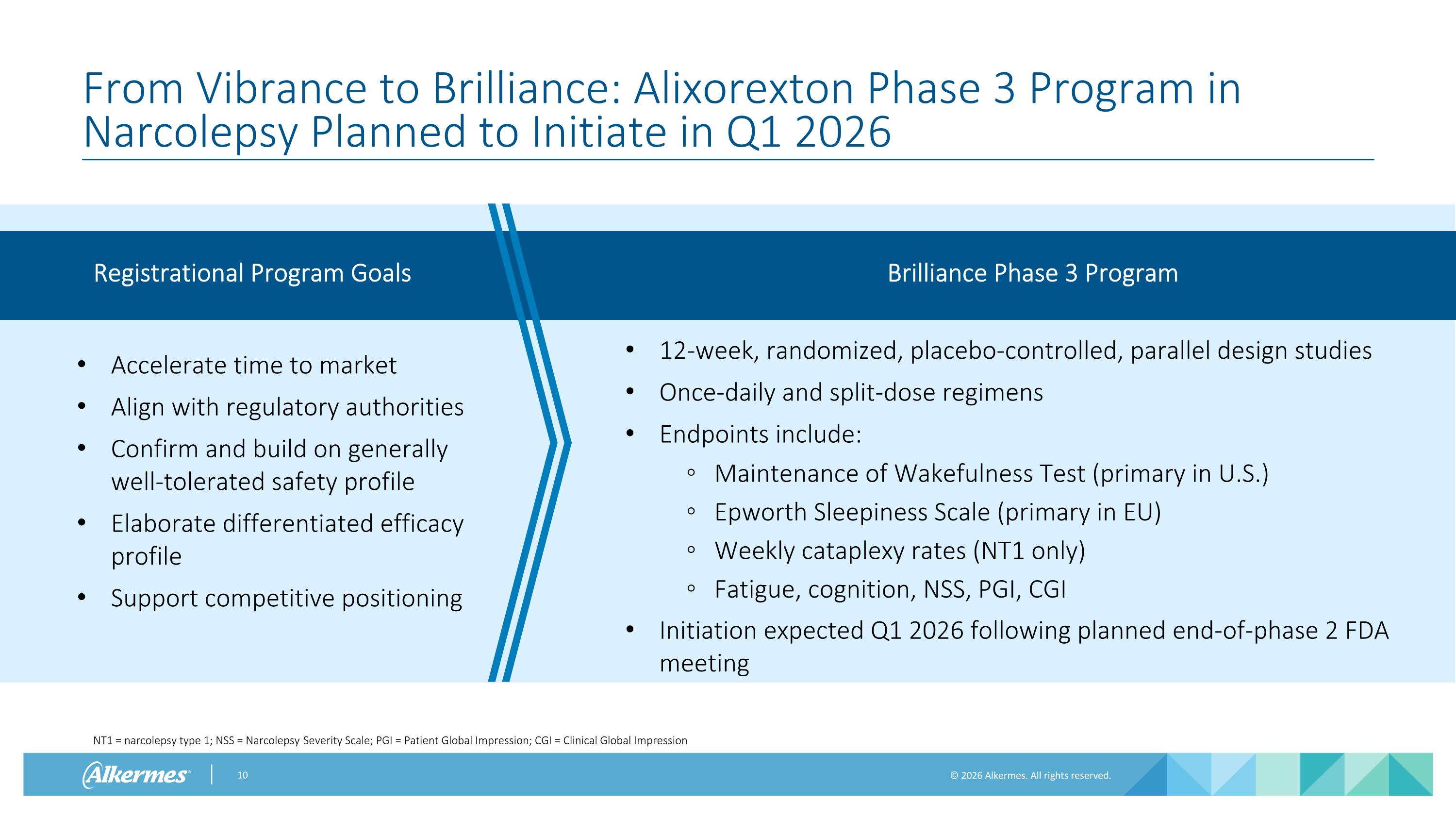

From Vibrance to Brilliance: Alixorexton Phase 3 Program in Narcolepsy Planned to Initiate in Q1 2026 Registrational Program Goals Brilliance Phase 3 Program Accelerate time to market Align with regulatory authorities Confirm and build on generally well-tolerated safety profile Elaborate differentiated efficacy profile Support competitive positioning 12-week, randomized, placebo-controlled, parallel design studies Once-daily and split-dose regimens Endpoints include: Maintenance of Wakefulness Test (primary in U.S.) Epworth Sleepiness Scale (primary in EU) Weekly cataplexy rates (NT1 only) Fatigue, cognition, NSS, PGI, CGI Initiation expected Q1 2026 following planned end-of-phase 2 FDA meeting NT1 = narcolepsy type 1; NSS = Narcolepsy Severity Scale; PGI = Patient Global Impression; CGI = Clinical Global Impression

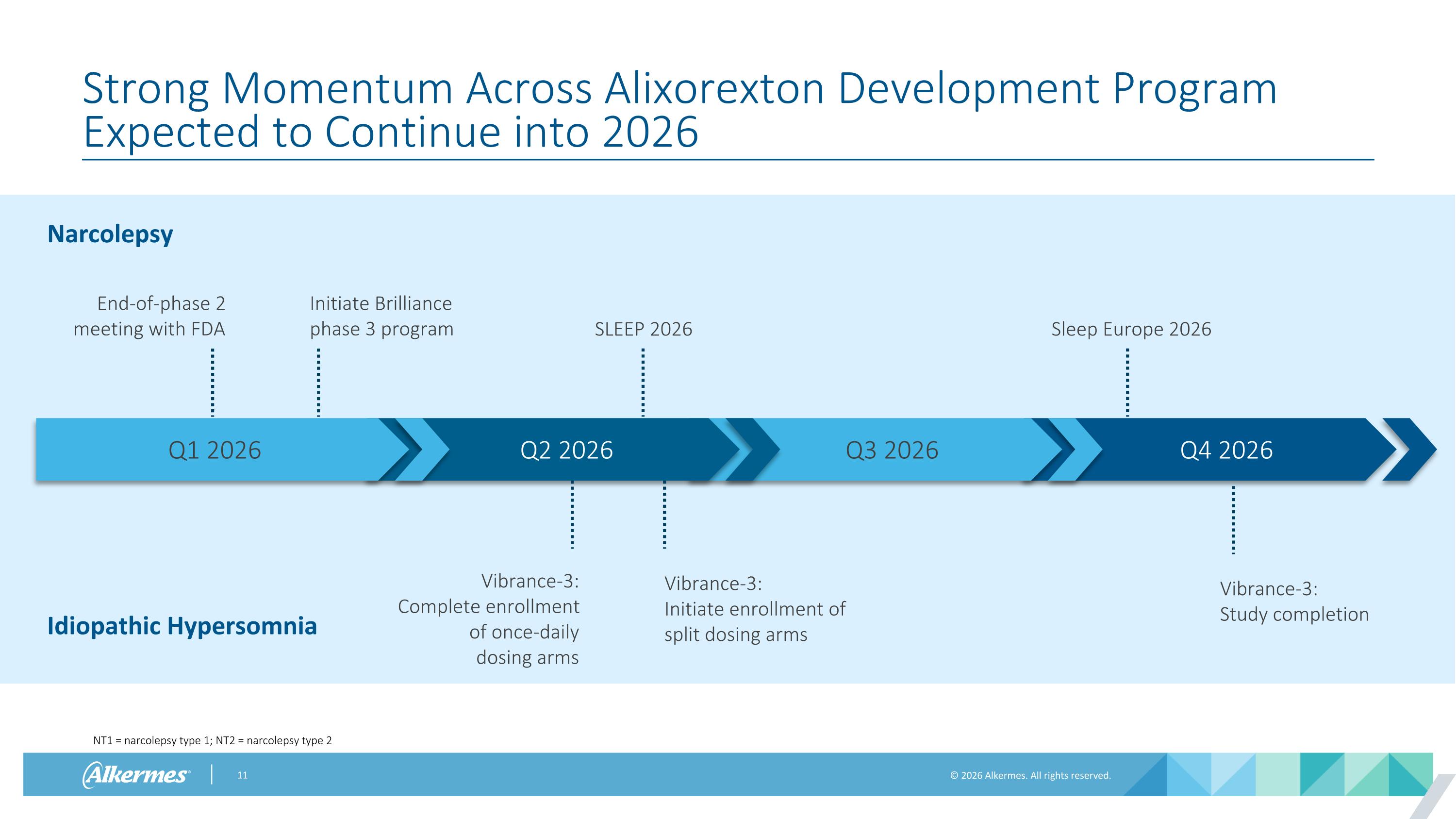

Q4 2026 Q3 2026 Q2 2026 Q1 2026 Strong Momentum Across Alixorexton Development Program Expected to Continue into 2026 Narcolepsy Idiopathic Hypersomnia End-of-phase 2 meeting with FDA Initiate Brilliance phase 3 program SLEEP 2026 Sleep Europe 2026 Vibrance-3: Complete enrollment of once-daily dosing arms Vibrance-3: Initiate enrollment of split dosing arms Vibrance-3: Study completion NT1 = narcolepsy type 1; NT2 = narcolepsy type 2

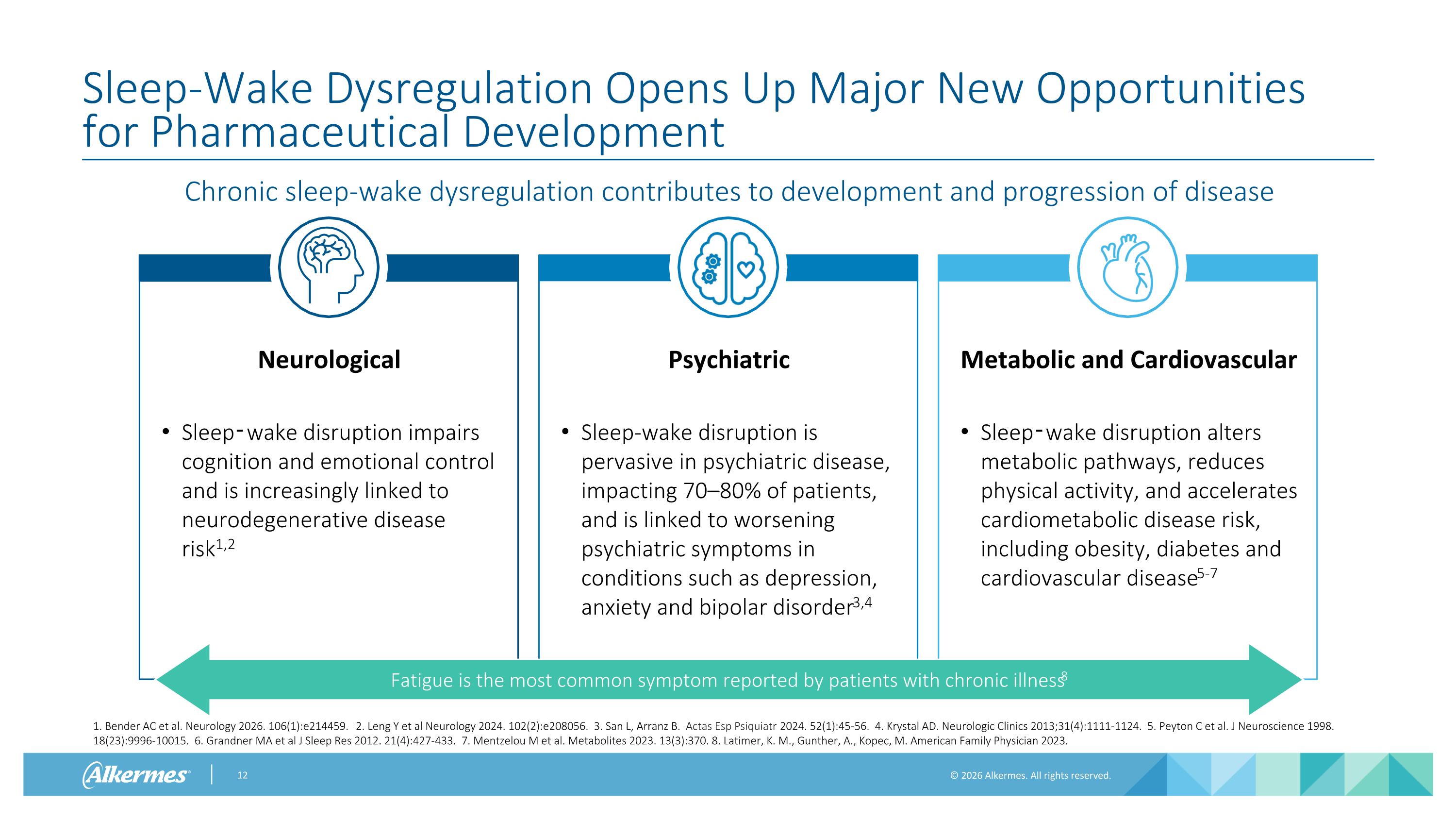

Chronic sleep-wake dysregulation contributes to development and progression of disease Sleep-Wake Dysregulation Opens Up Major New Opportunities for Pharmaceutical Development Neurological Sleep‑wake disruption impairs cognition and emotional control and is increasingly linked to neurodegenerative disease risk1,2 Psychiatric Sleep-wake disruption is pervasive in psychiatric disease, impacting 70–80% of patients, and is linked to worsening psychiatric symptoms in conditions such as depression, anxiety and bipolar disorder3,4 Metabolic and Cardiovascular Sleep‑wake disruption alters metabolic pathways, reduces physical activity, and accelerates cardiometabolic disease risk, including obesity, diabetes and cardiovascular disease5-7 Fatigue is the most common symptom reported by patients with chronic illness8 1. Bender AC et al. Neurology 2026. 106(1):e214459. 2. Leng Y et al Neurology 2024. 102(2):e208056. 3. San L, Arranz B. Actas Esp Psiquiatr 2024. 52(1):45-56. 4. Krystal AD. Neurologic Clinics 2013;31(4):1111-1124. 5. Peyton C et al. J Neuroscience 1998. 18(23):9996-10015. 6. Grandner MA et al J Sleep Res 2012. 21(4):427-433. 7. Mentzelou M et al. Metabolites 2023. 13(3):370. 8. Latimer, K. M., Gunther, A., Kopec, M. American Family Physician 2023.

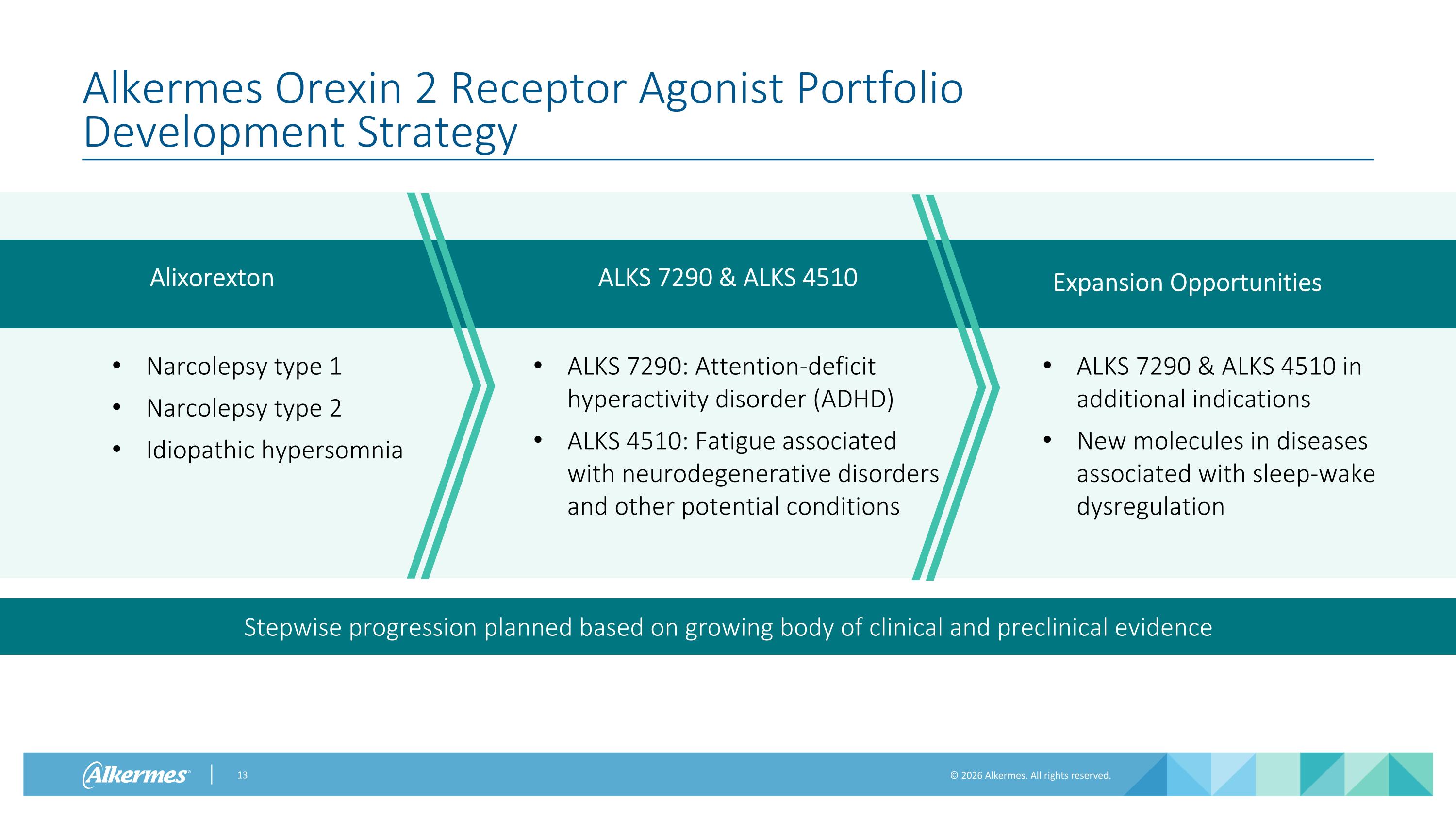

Alkermes Orexin 2 Receptor Agonist Portfolio Development Strategy Stepwise progression planned based on growing body of clinical and preclinical evidence Alixorexton ALKS 7290 & ALKS 4510 Narcolepsy type 1 Narcolepsy type 2 Idiopathic hypersomnia ALKS 7290: Attention-deficit hyperactivity disorder (ADHD) ALKS 4510: Fatigue associated with neurodegenerative disorders and other potential conditions Expansion Opportunities ALKS 7290 & ALKS 4510 in additional indications New molecules in diseases associated with sleep-wake dysregulation

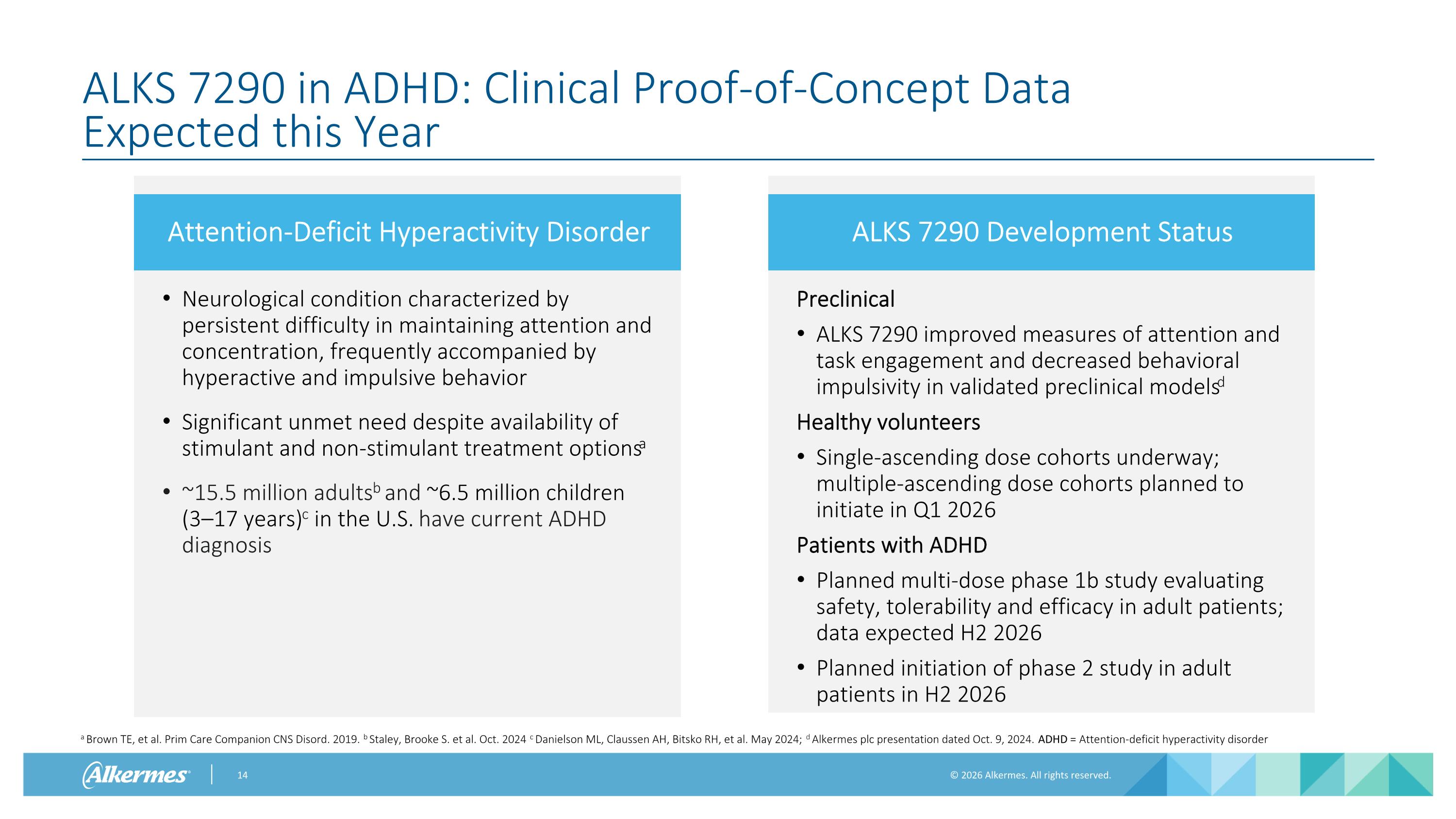

Attention-Deficit Hyperactivity Disorder ALKS 7290 in ADHD: Clinical Proof-of-Concept Data Expected this Year Neurological condition characterized by persistent difficulty in maintaining attention and concentration, frequently accompanied by hyperactive and impulsive behavior Significant unmet need despite availability of stimulant and non-stimulant treatment optionsa ~15.5 million adultsb and ~6.5 million children (3–17 years)c in the U.S. have current ADHD diagnosis ALKS 7290 Development Status Preclinical ALKS 7290 improved measures of attention and task engagement and decreased behavioral impulsivity in validated preclinical modelsd Healthy volunteers Single-ascending dose cohorts underway; multiple-ascending dose cohorts planned to initiate in Q1 2026 Patients with ADHD Planned multi-dose phase 1b study evaluating safety, tolerability and efficacy in adult patients; data expected H2 2026 Planned initiation of phase 2 study in adult patients in H2 2026 a Brown TE, et al. Prim Care Companion CNS Disord. 2019. b Staley, Brooke S. et al. Oct. 2024 c Danielson ML, Claussen AH, Bitsko RH, et al. May 2024; d Alkermes plc presentation dated Oct. 9, 2024. ADHD = Attention-deficit hyperactivity disorder

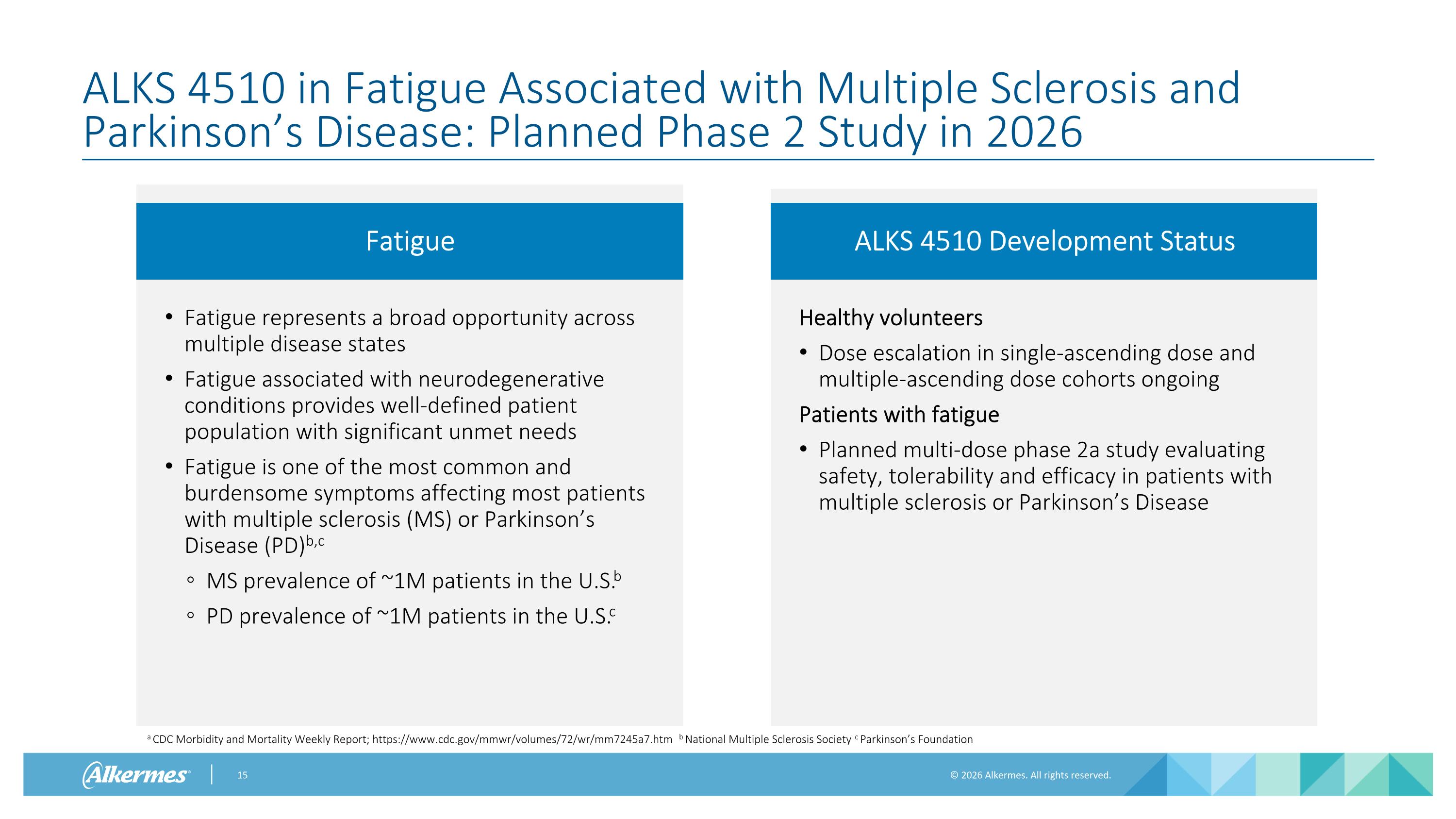

Fatigue ALKS 4510 in Fatigue Associated with Multiple Sclerosis and Parkinson’s Disease: Planned Phase 2 Study in 2026 Fatigue represents a broad opportunity across multiple disease states Fatigue associated with neurodegenerative conditions provides well-defined patient population with significant unmet needs Fatigue is one of the most common and burdensome symptoms affecting most patients with multiple sclerosis (MS) or Parkinson’s Disease (PD)b,c MS prevalence of ~1M patients in the U.S.b PD prevalence of ~1M patients in the U.S.c ALKS 4510 Development Status Healthy volunteers Dose escalation in single-ascending dose and multiple-ascending dose cohorts ongoing Patients with fatigue Planned multi-dose phase 2a study evaluating safety, tolerability and efficacy in patients with multiple sclerosis or Parkinson’s Disease a CDC Morbidity and Mortality Weekly Report; https://www.cdc.gov/mmwr/volumes/72/wr/mm7245a7.htm b National Multiple Sclerosis Society c Parkinson’s Foundation

Profitable Commercial Neuroscience Business with New Potential Growth Driver

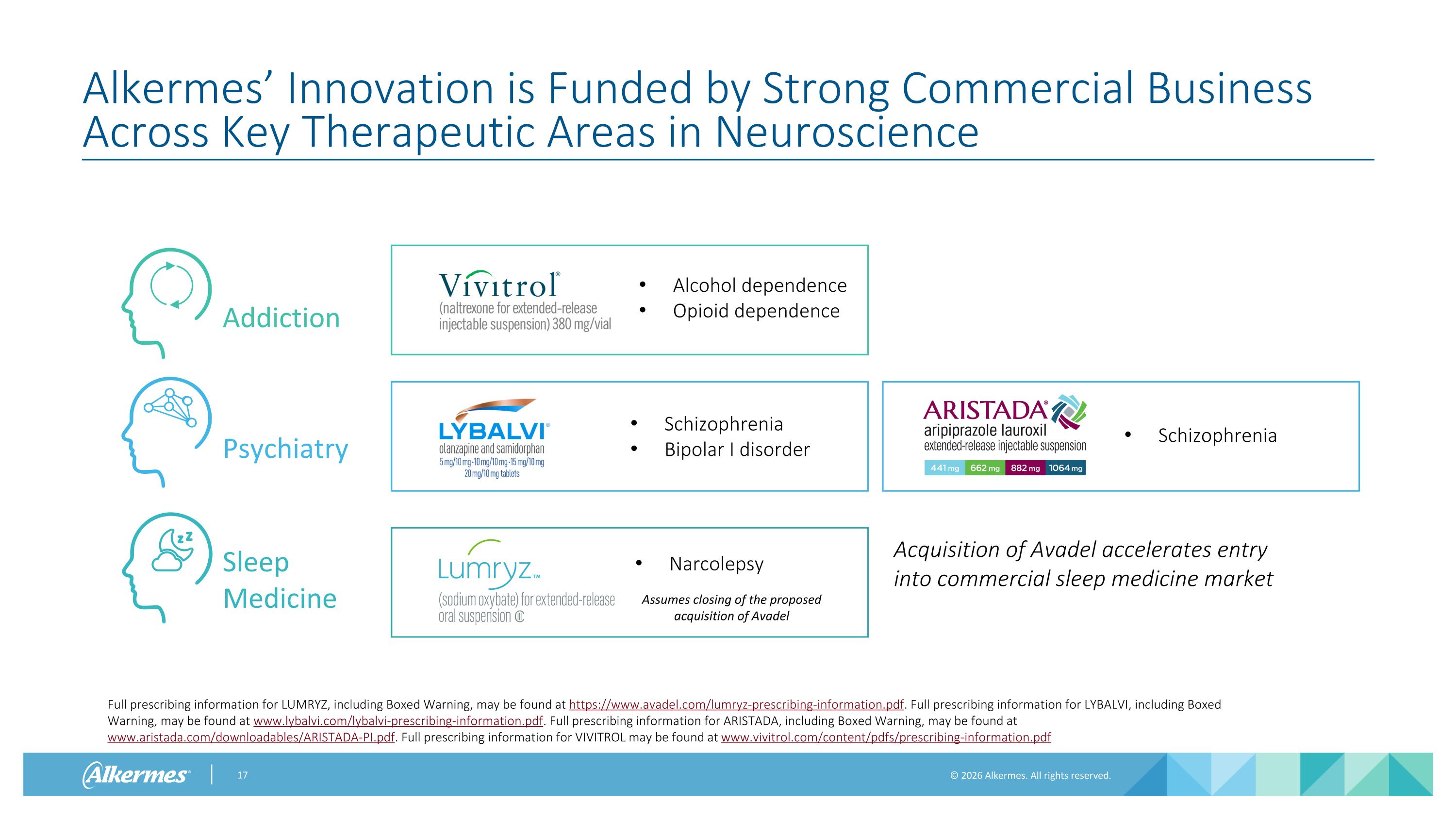

Alkermes’ Innovation is Funded by Strong Commercial Business Across Key Therapeutic Areas in Neuroscience Psychiatry Addiction Sleep Medicine Alcohol dependence Opioid dependence Schizophrenia Bipolar I disorder Schizophrenia Narcolepsy Full prescribing information for LUMRYZ, including Boxed Warning, may be found at https://www.avadel.com/lumryz-prescribing-information.pdf. Full prescribing information for LYBALVI, including Boxed Warning, may be found at www.lybalvi.com/lybalvi-prescribing-information.pdf. Full prescribing information for ARISTADA, including Boxed Warning, may be found at www.aristada.com/downloadables/ARISTADA-PI.pdf. Full prescribing information for VIVITROL may be found at www.vivitrol.com/content/pdfs/prescribing-information.pdf Assumes closing of the proposed acquisition of Avadel Acquisition of Avadel accelerates entry into commercial sleep medicine market

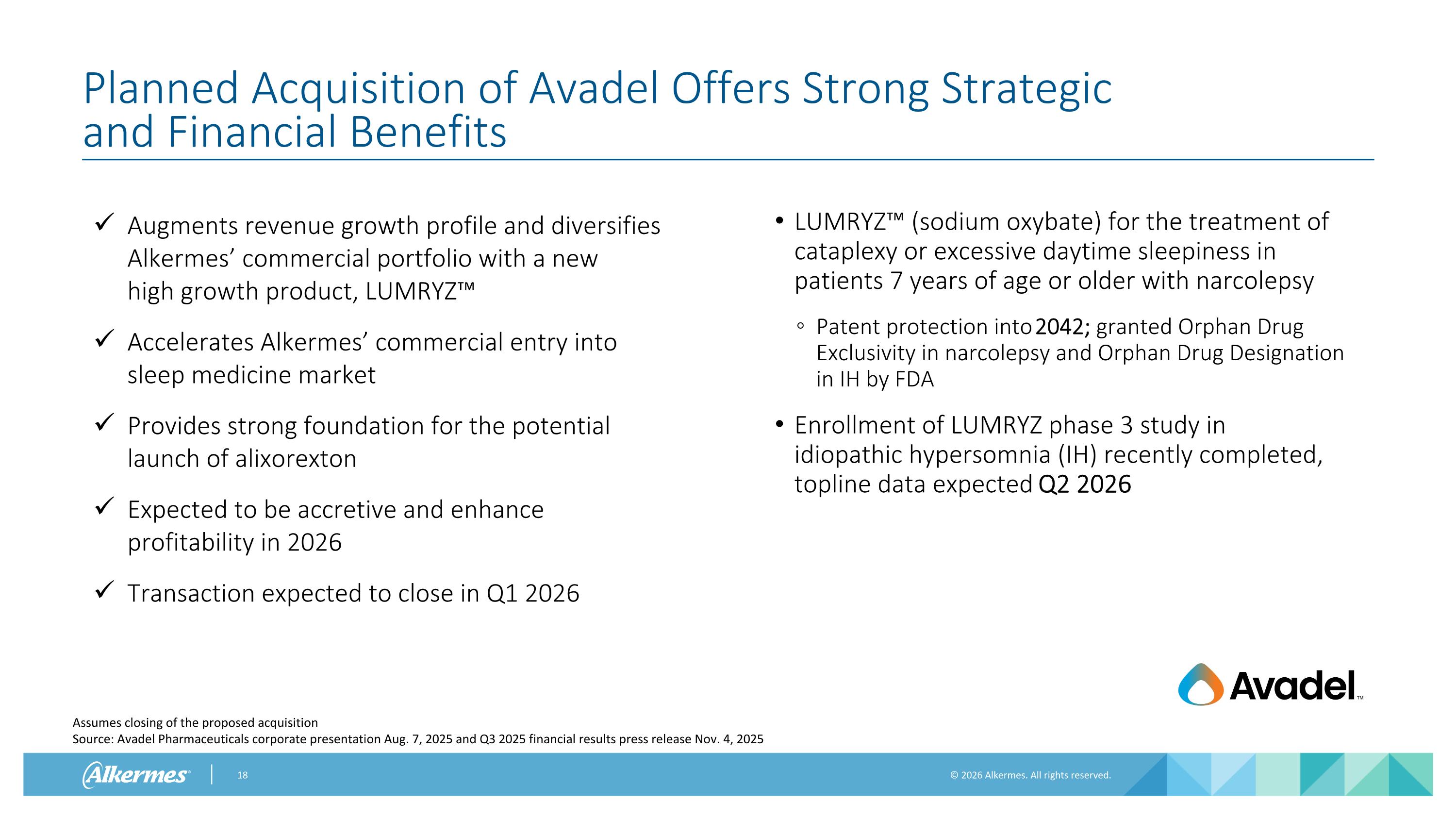

Planned Acquisition of Avadel Offers Strong Strategic and Financial Benefits Assumes closing of the proposed acquisition Source: Avadel Pharmaceuticals corporate presentation Aug. 7, 2025 and Q3 2025 financial results press release Nov. 4, 2025 Augments revenue growth profile and diversifies Alkermes’ commercial portfolio with a new high growth product, LUMRYZ™ Accelerates Alkermes’ commercial entry into sleep medicine market Provides strong foundation for the potential launch of alixorexton Expected to be accretive and enhance profitability in 2026 Transaction expected to close in Q1 2026 LUMRYZ™ (sodium oxybate) for the treatment of cataplexy or excessive daytime sleepiness in patients 7 years of age or older with narcolepsy Patent protection into 2042; granted Orphan Drug Exclusivity in narcolepsy and Orphan Drug Designation in IH by FDA Enrollment of LUMRYZ phase 3 study in idiopathic hypersomnia (IH) recently completed, topline data expected Q2 2026

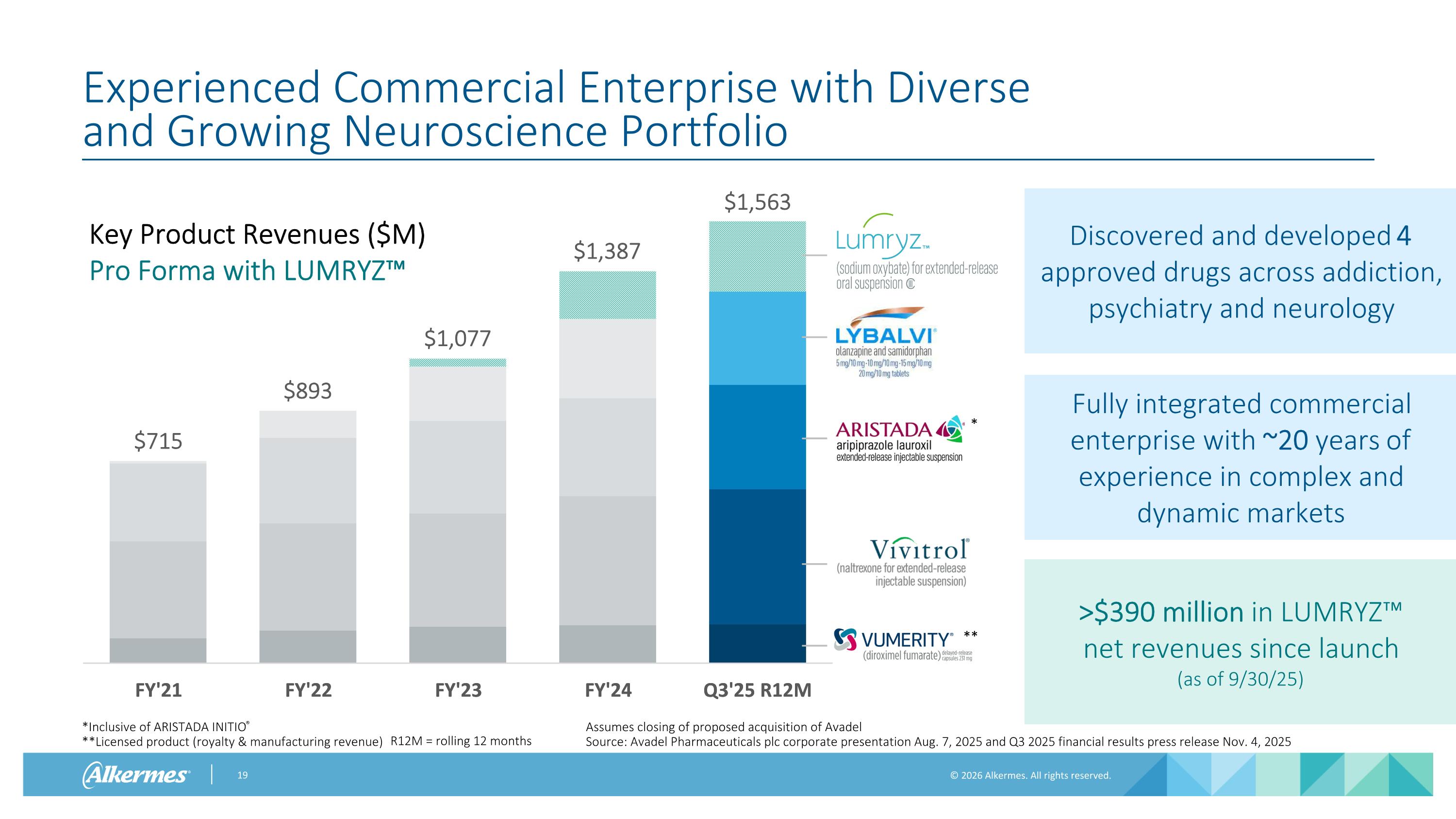

$1,218 $1,315 Experienced Commercial Enterprise with Diverse and Growing Neuroscience Portfolio *Inclusive of ARISTADA INITIO® **Licensed product (royalty & manufacturing revenue) Key Product Revenues ($M) $715 $893 Discovered and developed 4 approved drugs across addiction, psychiatry and neurology Fully integrated commercial enterprise with ~20 years of experience in complex and dynamic markets $1,049 R12M = rolling 12 months * ** Assumes closing of proposed acquisition of Avadel Source: Avadel Pharmaceuticals plc corporate presentation Aug. 7, 2025 and Q3 2025 financial results press release Nov. 4, 2025 Key Product Revenues ($M) Pro Forma with LUMRYZ™ >$390 million in LUMRYZ™ net revenues since launch (as of 9/30/25) $1,077 $1,387 $1,563

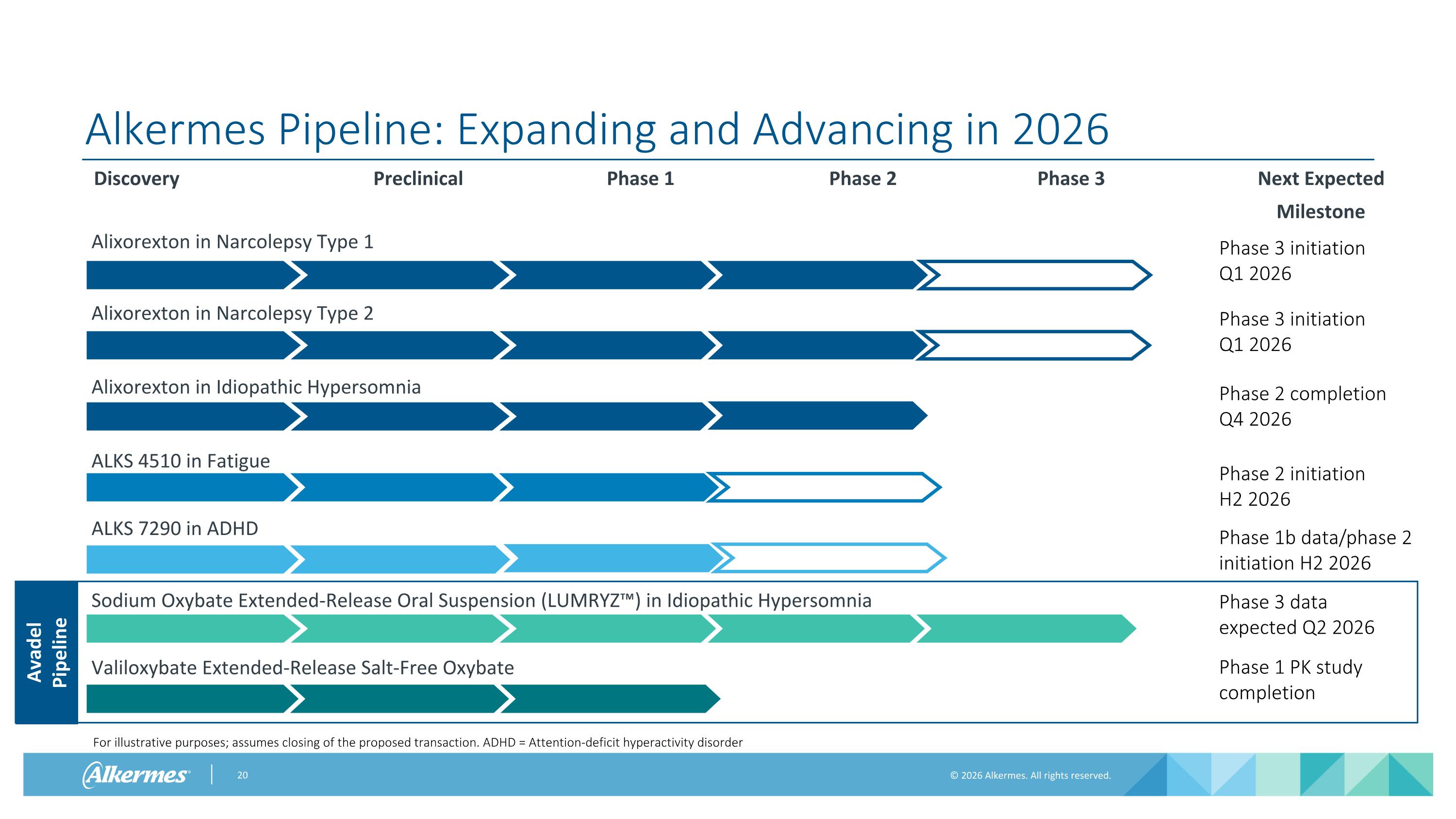

Alkermes Pipeline: Expanding and Advancing in 2026 Discovery Preclinical Phase 1 Phase 2 Phase 3 Next Expected Milestone Phase 3 initiation Q1 2026 Phase 2 Data Phase 3 initiation Q1 2026 Phase 2 completion Q4 2026 Phase 2 initiation H2 2026 Avadel Pipeline Valiloxybate Extended-Release Salt-Free Oxybate Sodium Oxybate Extended-Release Oral Suspension (LUMRYZ™) in Idiopathic Hypersomnia Phase 3 data expected Q2 2026 For illustrative purposes; assumes closing of the proposed transaction. ADHD = Attention-deficit hyperactivity disorder Phase 1 PK study completion Alixorexton in Narcolepsy Type 1 Alixorexton in Narcolepsy Type 2 Alixorexton in Idiopathic Hypersomnia ALKS 4510 in Fatigue ALKS 7290 in ADHD Phase 1b data/phase 2 initiation H2 2026

Alkermes in 2026: Strong Foundation for Near- and Long-term Growth and Value Creation Commercial business generated total revenues >$1.45B, strong cash flow and profitability in 2025; Planned acquisition of Avadel augments revenue growth profile and profitability Alixorexton: Blockbuster potential in narcolepsy and idiopathic hypersomnia, if approved; recently granted FDA Breakthrough Therapy designation in NT1; entering phase 3 in narcolepsy in Q1 2026 Orexin 2 receptor agonist candidates represent potential new vertical of growth and expansion in multiple disease areas beyond sleep medicine Profitable neuroscience company with late-stage candidate and leadership in exciting new therapeutic category NT1 = narcolepsy type 1

Appendix

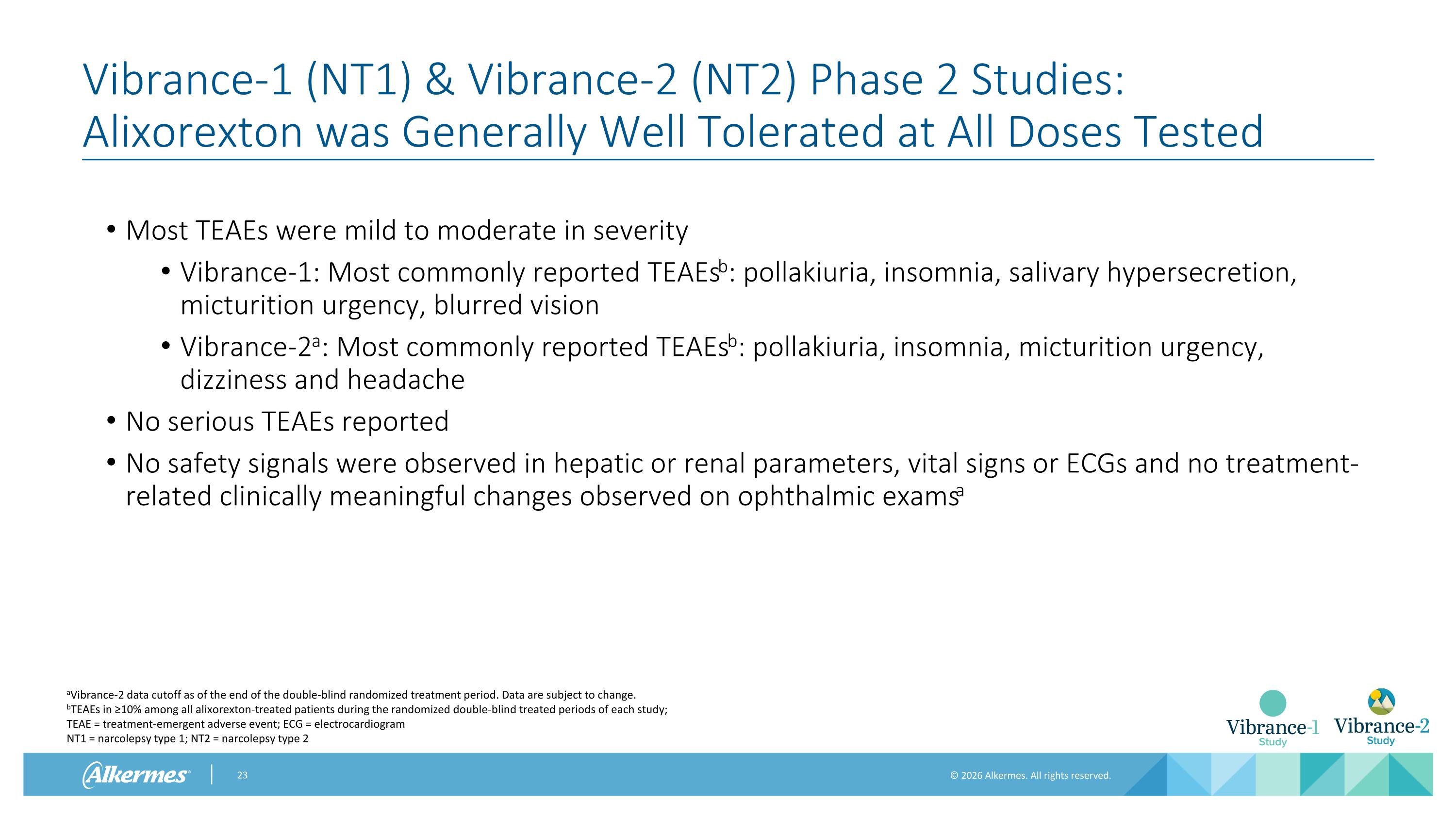

Vibrance-1 (NT1) & Vibrance-2 (NT2) Phase 2 Studies: Alixorexton was Generally Well Tolerated at All Doses Tested Most TEAEs were mild to moderate in severity Vibrance-1: Most commonly reported TEAEsb: pollakiuria, insomnia, salivary hypersecretion, micturition urgency, blurred vision Vibrance-2a: Most commonly reported TEAEsb: pollakiuria, insomnia, micturition urgency, dizziness and headache No serious TEAEs reported No safety signals were observed in hepatic or renal parameters, vital signs or ECGs and no treatment-related clinically meaningful changes observed on ophthalmic examsa aVibrance-2 data cutoff as of the end of the double-blind randomized treatment period. Data are subject to change. bTEAEs in ≥10% among all alixorexton-treated patients during the randomized double-blind treated periods of each study; TEAE = treatment-emergent adverse event; ECG = electrocardiogram NT1 = narcolepsy type 1; NT2 = narcolepsy type 2

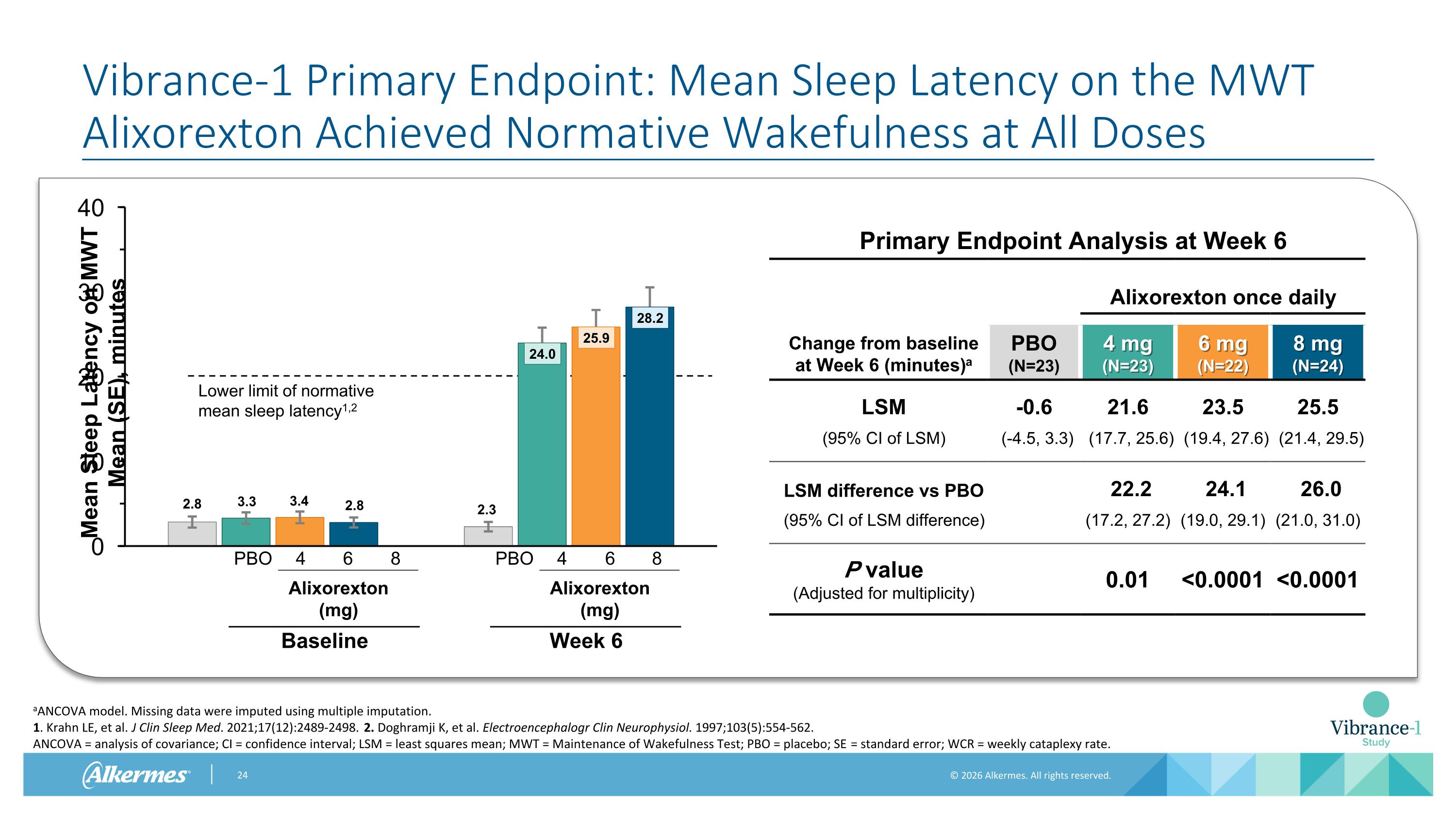

Vibrance-1 Primary Endpoint: Mean Sleep Latency on the MWT Alixorexton Achieved Normative Wakefulness at All Doses Primary Endpoint Analysis at Week 6 Alixorexton once daily Change from baseline at Week 6 (minutes)a PBO (N=23) 4 mg (N=23) 6 mg (N=22) 8 mg (N=24) LSM -0.6 21.6 23.5 25.5 (95% CI of LSM) (-4.5, 3.3) (17.7, 25.6) (19.4, 27.6) (21.4, 29.5) LSM difference vs PBO 22.2 24.1 26.0 (95% CI of LSM difference) (17.2, 27.2) (19.0, 29.1) (21.0, 31.0) P value (Adjusted for multiplicity) 0.01 <0.0001 <0.0001 aANCOVA model. Missing data were imputed using multiple imputation. 1. Krahn LE, et al. J Clin Sleep Med. 2021;17(12):2489-2498. 2. Doghramji K, et al. Electroencephalogr Clin Neurophysiol. 1997;103(5):554-562. ANCOVA = analysis of covariance; CI = confidence interval; LSM = least squares mean; MWT = Maintenance of Wakefulness Test; PBO = placebo; SE = standard error; WCR = weekly cataplexy rate. Lower limit of normative mean sleep latency1,2 4 6 8 PBO Alixorexton (mg) Baseline 4 6 8 PBO Alixorexton (mg) Week 6

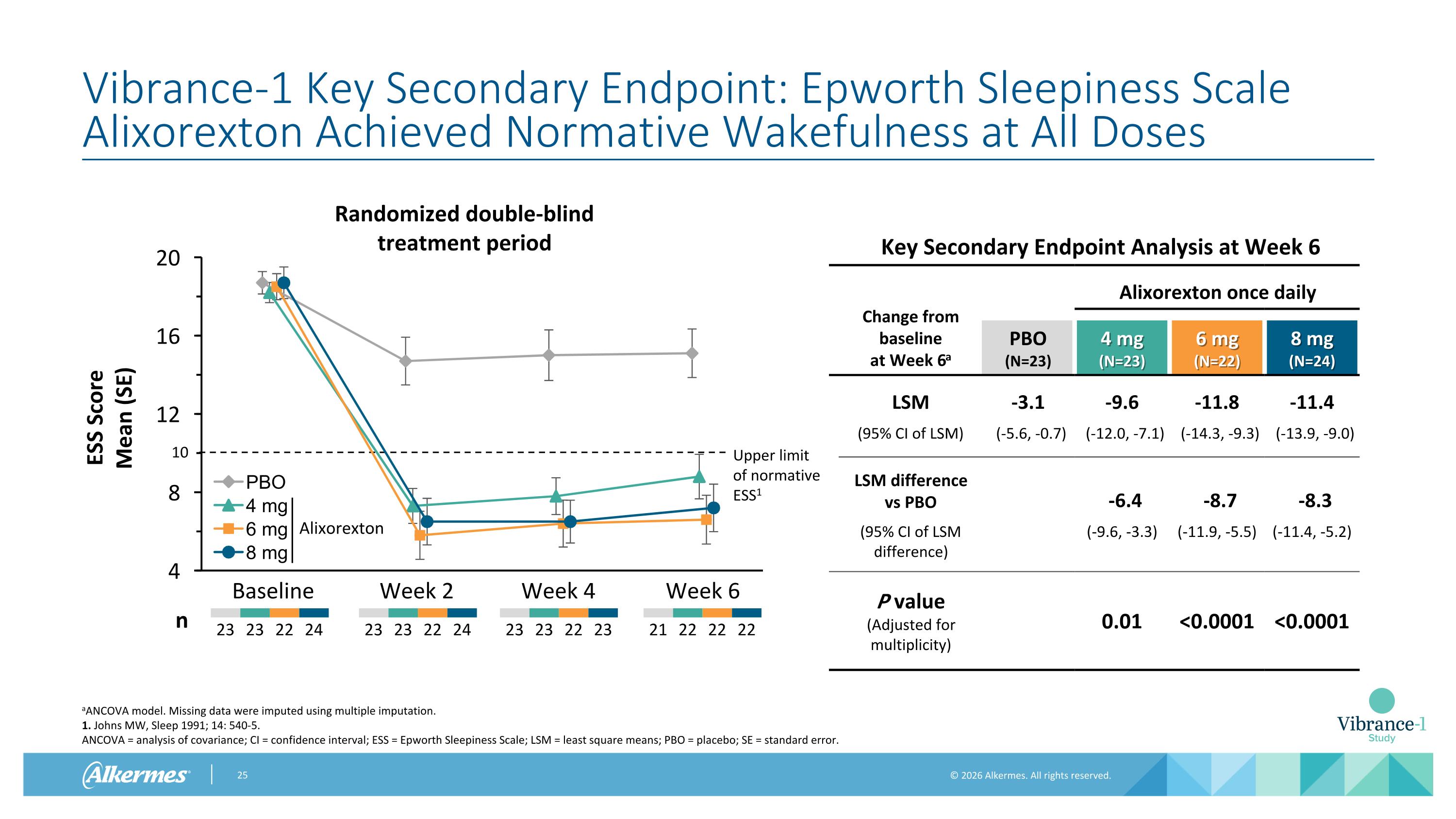

Vibrance-1 Key Secondary Endpoint: Epworth Sleepiness Scale Alixorexton Achieved Normative Wakefulness at All Doses aANCOVA model. Missing data were imputed using multiple imputation. 1. Johns MW, Sleep 1991; 14: 540-5. ANCOVA = analysis of covariance; CI = confidence interval; ESS = Epworth Sleepiness Scale; LSM = least square means; PBO = placebo; SE = standard error. Baseline Week 2 Week 4 Week 6 23 23 22 24 23 23 22 23 23 23 22 24 n Alixorexton 21 22 22 22 Key Secondary Endpoint Analysis at Week 6 Change from baseline at Week 6a Alixorexton once daily PBO (N=23) 4 mg (N=23) 6 mg (N=22) 8 mg (N=24) LSM -3.1 -9.6 -11.8 -11.4 (95% CI of LSM) (-5.6, -0.7) (-12.0, -7.1) (-14.3, -9.3) (-13.9, -9.0) LSM difference vs PBO -6.4 -8.7 -8.3 (95% CI of LSM difference) (-9.6, -3.3) (-11.9, -5.5) (-11.4, -5.2) P value (Adjusted for multiplicity) 0.01 <0.0001 <0.0001 Upper limit of normative ESS1 10 Randomized double-blind treatment period

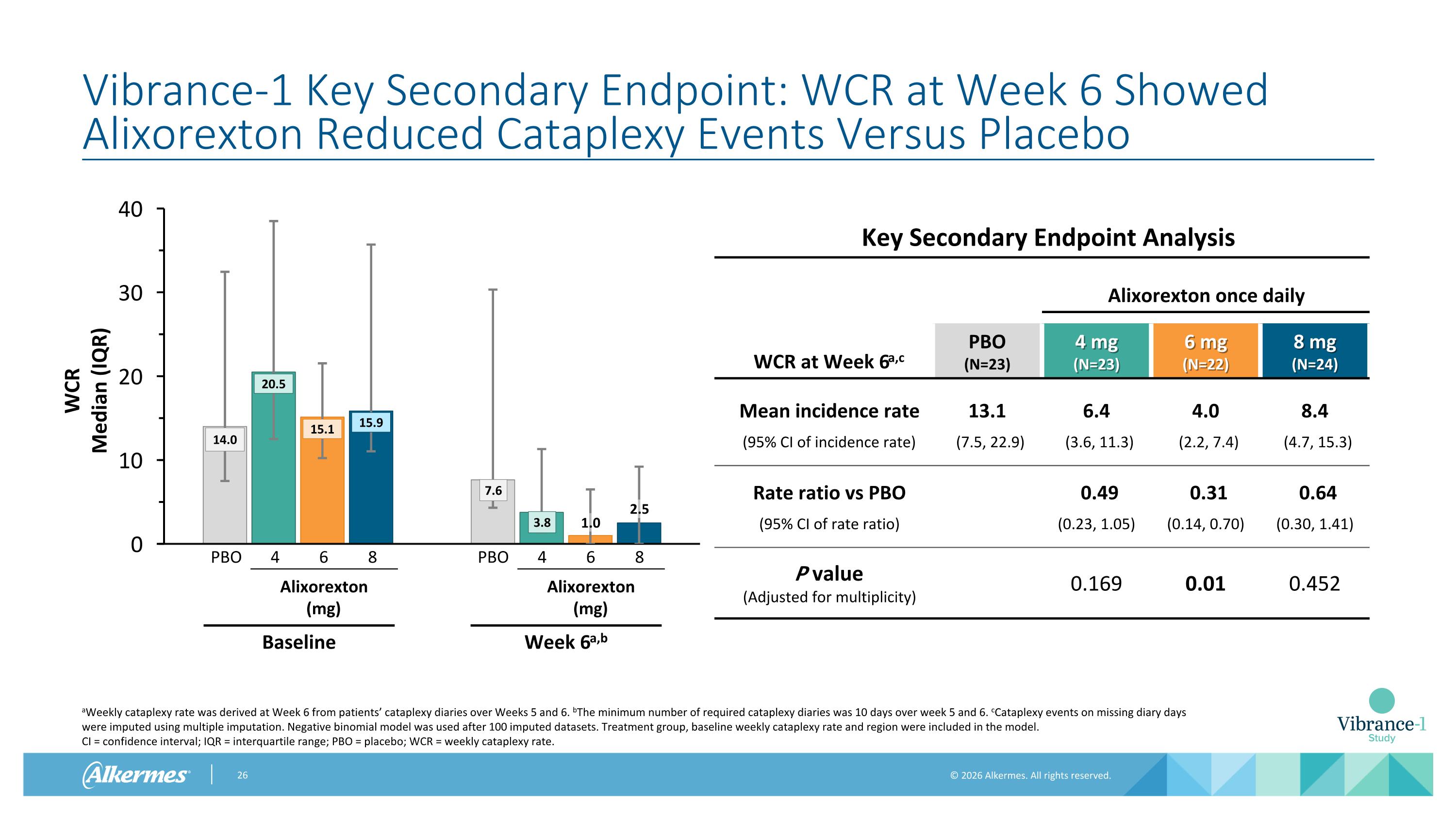

Vibrance-1 Key Secondary Endpoint: WCR at Week 6 Showed Alixorexton Reduced Cataplexy Events Versus Placebo Key Secondary Endpoint Analysis Alixorexton once daily WCR at Week 6a,c PBO (N=23) 4 mg (N=23) 6 mg (N=22) 8 mg (N=24) Mean incidence rate 13.1 6.4 4.0 8.4 (95% CI of incidence rate) (7.5, 22.9) (3.6, 11.3) (2.2, 7.4) (4.7, 15.3) Rate ratio vs PBO 0.49 0.31 0.64 (95% CI of rate ratio) (0.23, 1.05) (0.14, 0.70) (0.30, 1.41) P value (Adjusted for multiplicity) 0.169 0.01 0.452 aWeekly cataplexy rate was derived at Week 6 from patients’ cataplexy diaries over Weeks 5 and 6. bThe minimum number of required cataplexy diaries was 10 days over week 5 and 6. cCataplexy events on missing diary days were imputed using multiple imputation. Negative binomial model was used after 100 imputed datasets. Treatment group, baseline weekly cataplexy rate and region were included in the model. CI = confidence interval; IQR = interquartile range; PBO = placebo; WCR = weekly cataplexy rate. 1.0 2.5 4 6 8 PBO Alixorexton (mg) Baseline 4 6 8 PBO Alixorexton (mg) Week 6a,b

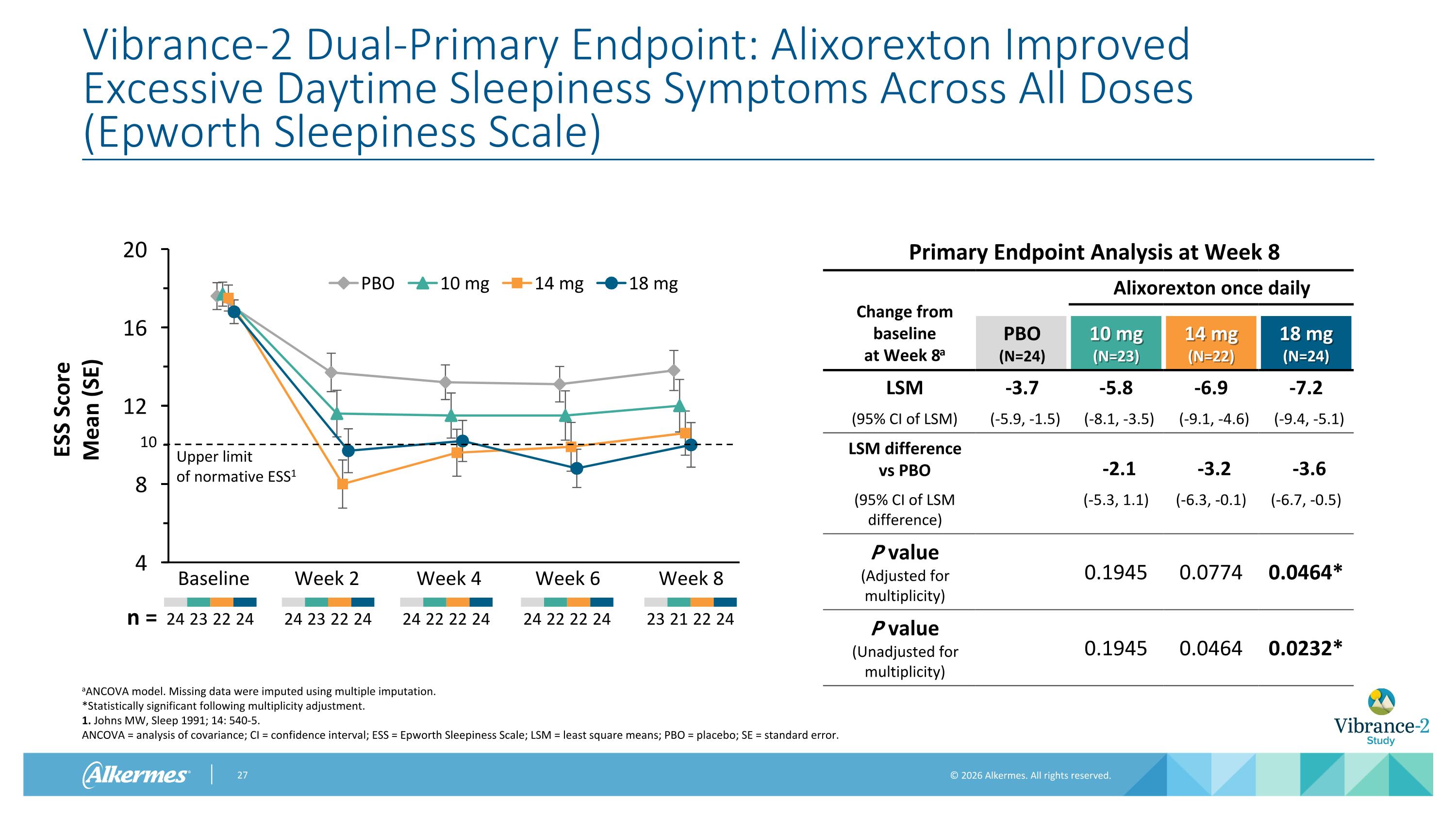

Vibrance-2 Dual-Primary Endpoint: Alixorexton Improved Excessive Daytime Sleepiness Symptoms Across All Doses (Epworth Sleepiness Scale) aANCOVA model. Missing data were imputed using multiple imputation. *Statistically significant following multiplicity adjustment. 1. Johns MW, Sleep 1991; 14: 540-5. ANCOVA = analysis of covariance; CI = confidence interval; ESS = Epworth Sleepiness Scale; LSM = least square means; PBO = placebo; SE = standard error. Baseline Week 2 Week 4 Week 6 24 23 22 24 24 22 22 24 24 23 22 24 n = 24 22 22 24 Upper limit of normative ESS1 10 Week 8 23 21 22 24 Primary Endpoint Analysis at Week 8 Change from baseline at Week 8a Alixorexton once daily PBO (N=24) 10 mg (N=23) 14 mg (N=22) 18 mg (N=24) LSM -3.7 -5.8 -6.9 -7.2 (95% CI of LSM) (-5.9, -1.5) (-8.1, -3.5) (-9.1, -4.6) (-9.4, -5.1) LSM difference vs PBO -2.1 -3.2 -3.6 (95% CI of LSM difference) (-5.3, 1.1) (-6.3, -0.1) (-6.7, -0.5) P value (Adjusted for multiplicity) 0.1945 0.0774 0.0464* P value (Unadjusted for multiplicity) 0.1945 0.0464 0.0232*

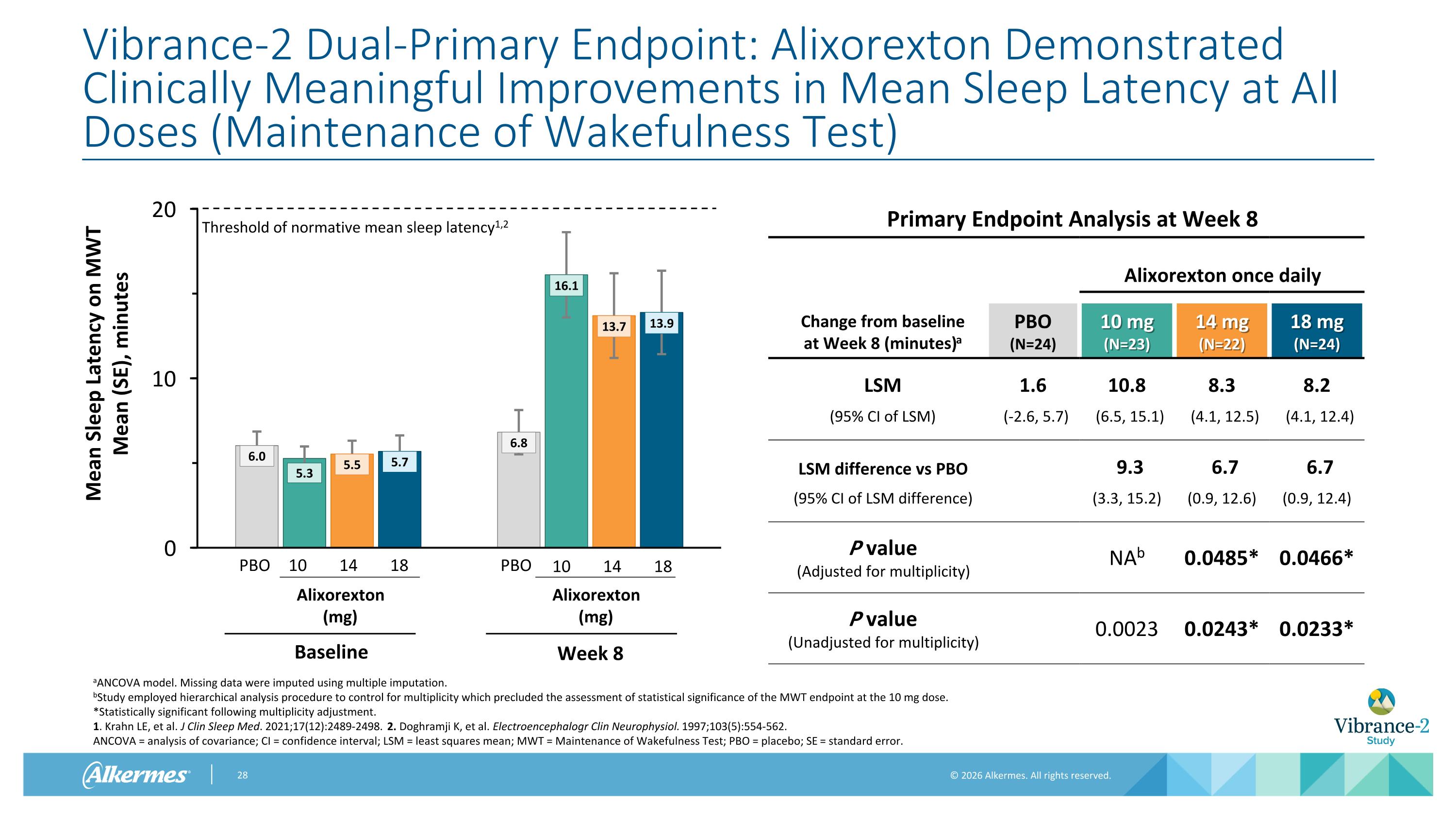

Vibrance-2 Dual-Primary Endpoint: Alixorexton Demonstrated Clinically Meaningful Improvements in Mean Sleep Latency at All Doses (Maintenance of Wakefulness Test) Primary Endpoint Analysis at Week 8 Alixorexton once daily Change from baseline at Week 8 (minutes)a PBO (N=24) 10 mg (N=23) 14 mg (N=22) 18 mg (N=24) LSM 1.6 10.8 8.3 8.2 (95% CI of LSM) (-2.6, 5.7) (6.5, 15.1) (4.1, 12.5) (4.1, 12.4) LSM difference vs PBO 9.3 6.7 6.7 (95% CI of LSM difference) (3.3, 15.2) (0.9, 12.6) (0.9, 12.4) P value (Adjusted for multiplicity) NAb 0.0485* 0.0466* P value (Unadjusted for multiplicity) 0.0023 0.0243* 0.0233* aANCOVA model. Missing data were imputed using multiple imputation. bStudy employed hierarchical analysis procedure to control for multiplicity which precluded the assessment of statistical significance of the MWT endpoint at the 10 mg dose. *Statistically significant following multiplicity adjustment. 1. Krahn LE, et al. J Clin Sleep Med. 2021;17(12):2489-2498. 2. Doghramji K, et al. Electroencephalogr Clin Neurophysiol. 1997;103(5):554-562. ANCOVA = analysis of covariance; CI = confidence interval; LSM = least squares mean; MWT = Maintenance of Wakefulness Test; PBO = placebo; SE = standard error. Threshold of normative mean sleep latency1,2 10 14 18 PBO Alixorexton (mg) Baseline PBO Alixorexton (mg) Week 8 10 14 18

www.alkermes.com