Strategic Acquisition of J-W Power Company December 2025 .2

Transaction Overview USA Compression Partners LP (“USAC”) to acquire J-W Power Company (“J-W”) for $860 million $430 million cash, to be funded with borrowings under USAC’s existing credit facility ~18.3 million USAC common units to be issued to the seller1 Represents an attractive ~5.8x Adjusted EBITDA multiple2 Strengthens position as a leading provider of compression services J-W is a large privately-held provider of compression services in the United States J-W owns and operates >800,0003 active horsepower (“HP”) with a focus on mid-to-large HP Complementary business model aligns with USAC’s strategy and objectives J-W provides additional geographic coverage across the most active lower 48 plays Highly diversified customer base with long-term relationships extending over 25 years Combines companies with a rich history focused on key pillars of people, culture, equipment and service Transaction expected to close in 1Q 2026 Closing subject to customary closing conditions, including regulatory approval 1 Based on 10-day VWAP as of 11/26/2025 with a collar of $23.25 - $23.50, effective price utilized $23.50 2 Based on 2026E Adjusted EBITDA for compressor rental, Aftermarket Service (AMS) and manufacturing businesses | Excludes potential future transaction synergies 3 As of October 31, 2025, ~847,000 revenue-generating HP

Strategic Rationale Enhanced Scale and Complementary Footprint Increased size and scale with ~4.4MM pro forma active HP Diversifies business lines including larger aftermarket services and parts distribution Additional optionality associated with specialized manufacturing services Expands Customer Reach with Long-Term Relationships Extensive customer base of top-tier customers with durable demand for compression J-W provides diversified operations in all major U.S. basins with over 300 customers J-W cash flow underpinned by fixed-fee, term contracts tied to a high-quality customer base Improves Geographic Presence and Diversification Enhances USAC’s geographic diversification in key regions such as the Rockies, Mid-Con, Gulf Coast and Northeast J-W provides in-place infrastructure and operations in every key U.S. production region Favorable Transaction Economics Adjusted EBITDA multiple of approximately 5.8x1 Meaningful near-term accretion on a Distributable Cash Flow basis Deleveraging transaction that accelerates path to sub-4.0x leverage 1 Based on 2026E Adjusted EBITDA for compressor rental, AMS and manufacturing businesses | Excludes potential future transaction synergies

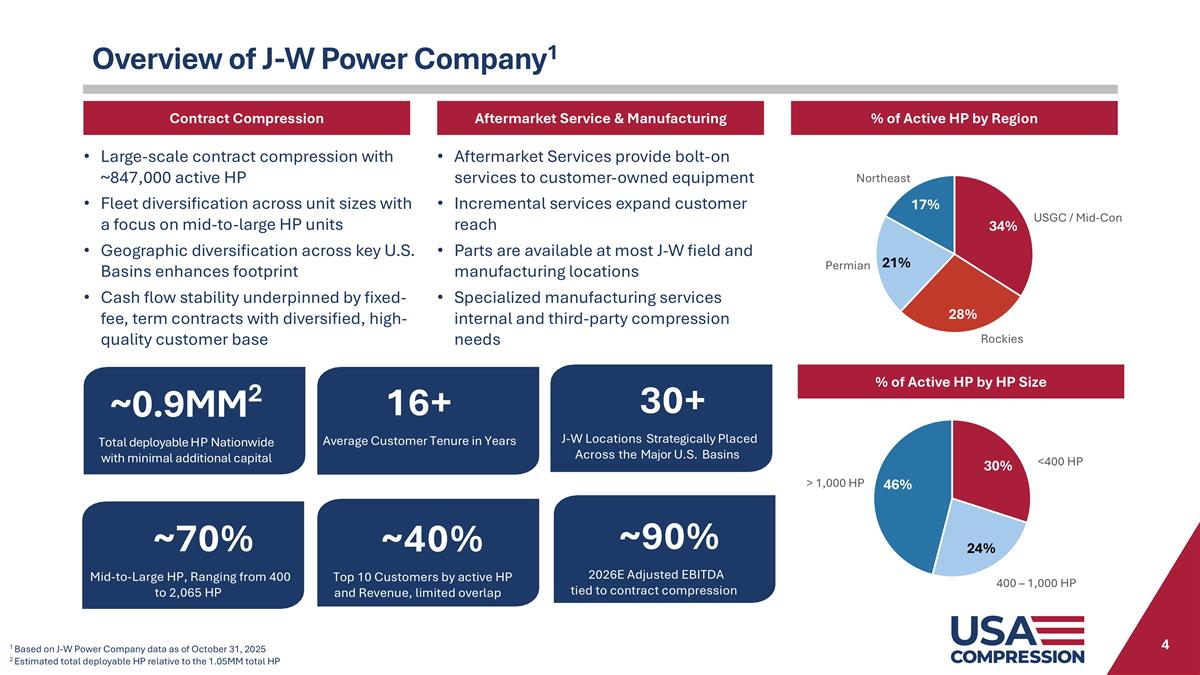

Overview of J-W Power Company1 ~0.9MM2 Total deployable HP Nationwide with minimal additional capital 30+ J-W Locations Strategically Placed Across the Major U.S. Basins ~40% Top 10 Customers by active HP and Revenue, limited overlap Contract Compression % of Active HP by Region Aftermarket Service & Manufacturing Large-scale contract compression with ~847,000 active HP Fleet diversification across unit sizes with a focus on mid-to-large HP units Geographic diversification across key U.S. Basins enhances footprint Cash flow stability underpinned by fixed-fee, term contracts with diversified, high-quality customer base Aftermarket Services provide bolt-on services to customer-owned equipment Incremental services expand customer reach Parts are available at most J-W field and manufacturing locations Specialized manufacturing services internal and third-party compression needs 1 Based on J-W Power Company data as of October 31, 2025 2 Estimated total deployable HP relative to the 1.05MM total HP USGC / Mid-Con Permian Northeast 16+ Average Customer Tenure in Years ~70% Mid-to-Large HP, Ranging from 400 to 2,065 HP ~90% 2026E Adjusted EBITDA tied to contract compression ~0.8MM Active HP 400 – 1,000 HP > 1,000 HP <400 HP % of Active HP by HP Size Rockies

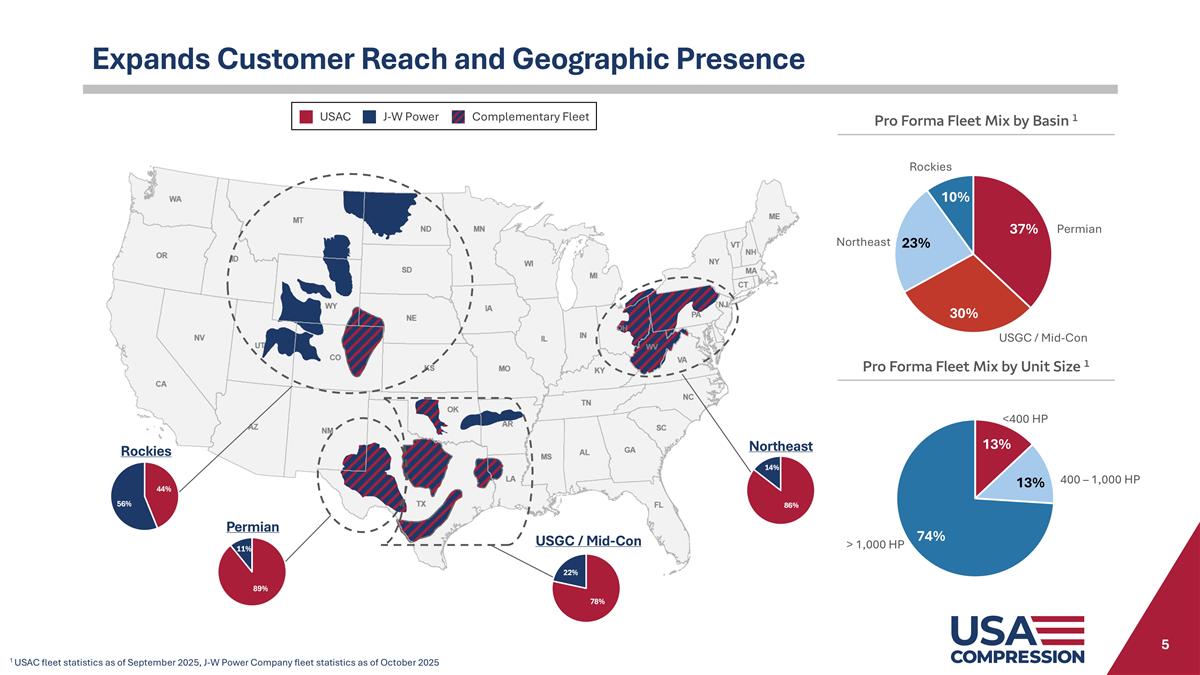

Expands Customer Reach and Geographic Presence Pro Forma Fleet Mix by Basin 1 Pro Forma Fleet Mix by Unit Size 1 USGC / Mid-Con Permian Complementary Fleet USAC J-W Power USGC / Mid-Con Rockies Northeast Permian 1 USAC fleet statistics as of September 2025, J-W Power Company fleet statistics as of October 2025 Rockies Northeast 400 – 1,000 HP > 1,000 HP <400 HP

Forward-Looking Statements and Disclaimer Forward Looking Statements This presentation contains forward-looking statements related to the operations of the Partnership that are based on management’s current expectations, estimates, and projections about its operations. You can identify many of these forward-looking statements by words such as “believe,” “expect,” “intend,” “project,” “anticipate,” “estimate,” “continue,” “if,” “outlook,” “will,” “could,” “should,” or similar words or the negatives thereof. Forward-looking statements include, among other things, statements about the potential benefits of the proposed transaction; the prospective performance and outlook of the Partnership’s business, performance and opportunities following the completion of the transaction, including the ability of the parties to complete the proposed transaction and the expected timing of completion of the proposed transaction; as well as any assumptions underlying any of the foregoing. You are cautioned not to place undue reliance on any forward-looking statements, which can be affected by assumptions used or by known risks or uncertainties. Consequently, no forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors noted below and other cautionary statements in this presentation. The risk factors and other factors noted throughout this presentation could cause actual results to differ materially from those contained in any forward-looking statement. Known material factors that could cause the Partnership’s actual results to differ materially from the results contemplated by such forward-looking statements include, among others, risks related to the ability of the parties to complete the proposed transaction on the proposed terms and schedule, including obtaining required regulatory approvals; risks associated with the proposed transaction, such as that the expected benefits of the proposed transaction will not occur; risks related to future opportunities and plans for the Partnership, including uncertainty regarding the expected financial performance and results of the Partnership following completion of the proposed transaction; disruption from the proposed transaction, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; and the possibility that if the Partnership does not achieve the perceived benefits of the proposed transaction as rapidly or to the extent anticipated by financial analysts or investors, the market price of the Partnership’s common units could decline, as well as other risks related to the Partnership’s business and the factors described in Part I, Item 1A of the Partnership’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the Securities and Exchange Commission (the “SEC”) on February 11, 2025, Part II Item 1A of the Partnership’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, which was filed with the SEC on May 6, 2025, and subsequently filed reports. All forward-looking statements speak only as of the date of this presentation and are expressly qualified in their entirety by the foregoing cautionary statements. Unless legally required, the Partnership undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. Unpredictable or unknown factors not discussed herein also could have material adverse effects on forward-looking statements. Non-GAAP Financial Information This presentation refers to the Non-GAAP financial measure of Distributable Cash Flow. The Partnership defines Distributable Cash Flow as net income (loss) plus non-cash interest expense, non-cash income tax expense (benefit), depreciation and amortization expense, unit-based compensation expense (benefit), impairment of assets, impairment of goodwill, certain transaction expenses, severance charges and other employee costs, loss (gain) on disposition of assets, loss on extinguishment of debt, change in fair value of derivative instrument, proceeds from insurance recovery, and other, less distributions on preferred units and maintenance capital expenditures. Management believes Distributable Cash Flow is an important measure of operating performance because it allows management, investors, and others to compare the cash flows that the Partnership generates (after distributions on Preferred Units but prior to any retained cash reserves established by the Partnership’s general partner and the effect of the Distribution Reinvestment Plan) to the cash distributions that the Partnership expects to pay its common unitholders. This presentation also references a forward-looking estimate of Adjusted EBITDA projected to be generated by J-W Power Company for its 2026 fiscal year. The Partnership defines J-W Power Company’s EBITDA as net income (loss) before net interest expense, depreciation and amortization expense, and income tax expense (benefit). The Partnership defines J-W Power Company’s Adjusted EBITDA as EBITDA plus impairment of assets, impairment of goodwill, interest income on capital leases, severance charges and other employee costs, certain transaction expenses, loss (gain) on disposition of assets, loss on extinguishment of debt, loss (gain) on derivative instrument, and other. The Partnership is unable to reconcile this estimated Adjusted EBITDA to projected net income (loss) and projected net cash provided by operating activities, the most comparable financial measures calculated in accordance with GAAP because components of the required calculations cannot be reasonably estimated, such as changes to current assets and liabilities, unknown future events, and estimating certain future GAAP measures. The inability to project certain components of the calculation would significantly affect the accuracy of the reconciliations. These non-GAAP financial measures should not be considered alternatives to, or more meaningful indicators of, J-W Power Company’s or the Partnership’s financial measures as prepared in accordance with GAAP. The Partnership’s methods of determining these non-GAAP financial measures may differ from the methods used by other companies and may not be comparable.