Earnings Presentation Q3 2026

Disclaimer Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements that involve substantial risks and uncertainties. All statements contained in this presentation other than statements of historical fact, including statements regarding our future operating results and financial condition, our business strategy and plans, market growth, and our objectives for future operations, are forward-looking statements. The words “believe,” “may,” “will,” “potentially,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “target,” “plan,” “expect,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are made as of the date they were first issued and are based on information available to Wealthfront together with Wealthfront’s expectations, estimates, forecasts, projections, beliefs, and assumptions as of such date. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Wealthfront’s control. Wealthfront’s actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors. Further information on potential risks that could affect actual results is included in Wealthfront’s most recent filings with the Securities and Exchange Commission (the “SEC”), including in the final prospectus Wealthfront filed with the SEC pursuant to Rule 424(b), dated December 11, 2025, copies of which may be obtained by visiting Wealthfront’s Investor Relations website at https://ir.wealthfront.com or the SEC's website at https://www.sec.gov. Past performance is not necessarily indicative of future results. Wealthfront undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Forward-looking statements should not be relied upon as representing Wealthfront’s views as of any date subsequent to the date of this presentation. Non-GAAP Financial Measures We collect and analyze operating and financial data to evaluate the health of our business, allocate our resources, and assess our performance. In addition to total revenue, net income and other results under GAAP, we utilize non-GAAP calculations of adjusted earnings before interest, taxes, depreciation, and amortization (“Adjusted EBITDA”). Adjusted EBITDA is defined as net income, excluding: (i) interest expenses, (ii) provision for (benefit from) income taxes, (iii) depreciation and amortization, (iv) stock-based compensation expense, (v) change in fair value of the convertible note, warrant liabilities, and SAFEs, and (vi) nonrecurring expenses, if any. The above items are excluded from our Adjusted EBITDA measure because these items are non-cash in nature, or because the amount and timing of these items is unpredictable, are not driven by core results of operations and render comparisons with prior periods and competitors less meaningful. We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenue. We define Incremental Adjusted EBITDA margin as the year-over-year change in Adjusted EBITDA divided by the year-over-year change in revenue over the comparable prior year period. We believe Adjusted EBITDA, Adjusted EBITDA Margin, and Incremental Adjusted EBITDA margin provide useful information to investors and others in understanding and evaluating our results of operations, as well as providing a useful measure for period-to-period comparisons of our business performance. Moreover, we have included Adjusted EBITDA, Adjusted EBITDA Margin, and Incremental Adjusted EBITDA margin in this presentation because it is a key measurement used by our management internally to make operating decisions, including those related to operating expenses, evaluate performance, identify trends affecting our business and perform strategic planning and annual budgeting. Free Cash Flow reflects net cash provided from operating activities, less (i) purchases of property, software, and equipment and (ii) capitalized internally developed software. We believe Free Cash Flow allows investors to evaluate the cash generated from our underlying operations in a manner similar to the method used by management. However, the utility of Free Cash Flow as a measure of our liquidity is limited as it does not represent the total increase or decrease in our cash balance for a given period. Free Cash Flow Conversion reflects 1) Free Cash Flow divided by 2) Adjusted EBITDA. Adjusted Operating Expenses reflect GAAP expenses, less (i) stock-based compensation expense and (ii) nonrecurring expenses, if any. The above items are excluded from our Adjusted Operating Expenses because these items are non-cash in nature, or because the amount and timing of these items is unpredictable, are not driven by core results of operations and render comparisons with prior periods and competitors less meaningful. Please refer to the Appendix for a reconciliation of each non-GAAP financial measure presented herein to the most directly comparable financial measure stated in accordance with GAAP. 02

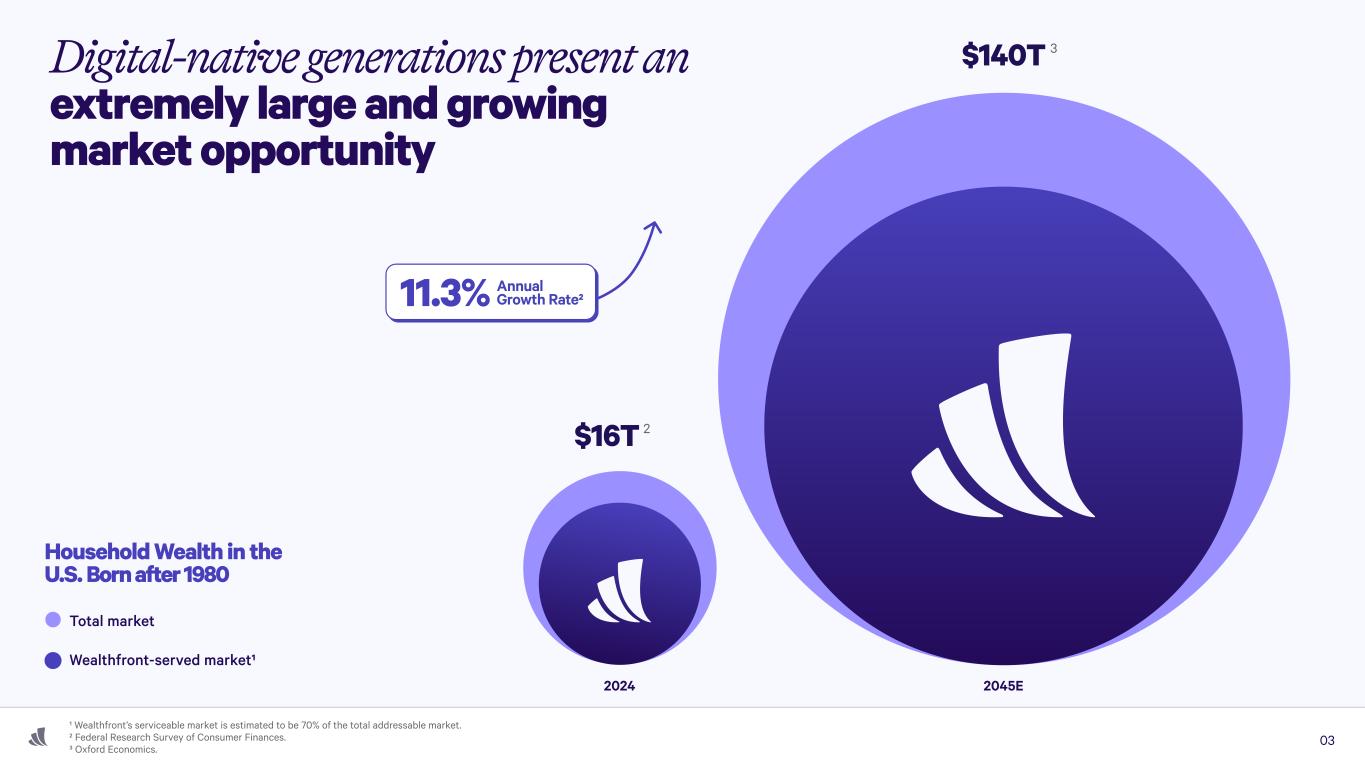

Household Wealth in the U.S. Born after 1980 Digital-native generations present an extremely large and growing market opportunity Total market Wealthfront-served market1 11.3% Annual Growth Rate2 2045E2024 $16T 2 $140T 3 1 Wealthfront’s serviceable market is estimated to be 70% of the total addressable market.

2 Federal Research Survey of Consumer Finances.

3 Oxford Economics. 03

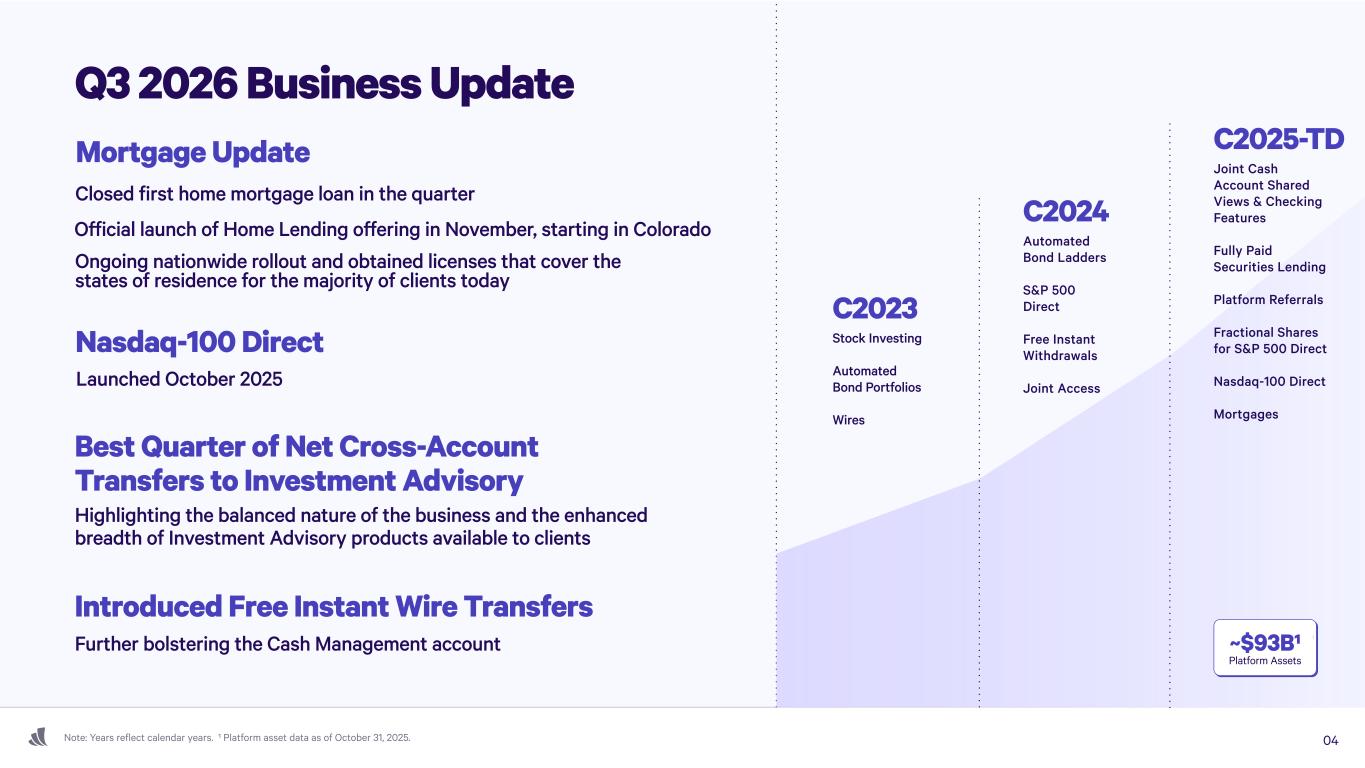

Note: Years reflect calendar years. 1 Platform asset data as of October 31, 2025. Q3 2026 Business Update Mortgage Update Nasdaq-100 Direct Best Quarter of Net Cross-Account

Transfers to Investment Advisory Closed first home mortgage loan in the quarter Launched October 2025 Highlighting the balanced nature of the business and the enhanced breadth of Investment Advisory products available to clients Introduced Free Instant Wire Transfers Further bolstering the Cash Management account Ongoing nationwide rollout and obtained licenses that cover the states of residence for the majority of clients today Official launch of Home Lending offering in November, starting in Colorado C2024 Automated Bond Ladders S&P 500 Direct Free Instant Withdrawals Joint Access C2023 Stock Investing Automated Bond Portfolios Wires C2025-TD Joint Cash Account Shared Views & Checking Features Fully Paid Securities Lending Platform Referrals Fractional Shares for S&P 500 Direct

Nasdaq-100 Direct

Mortgages ~$93B1 Platform Assets 04

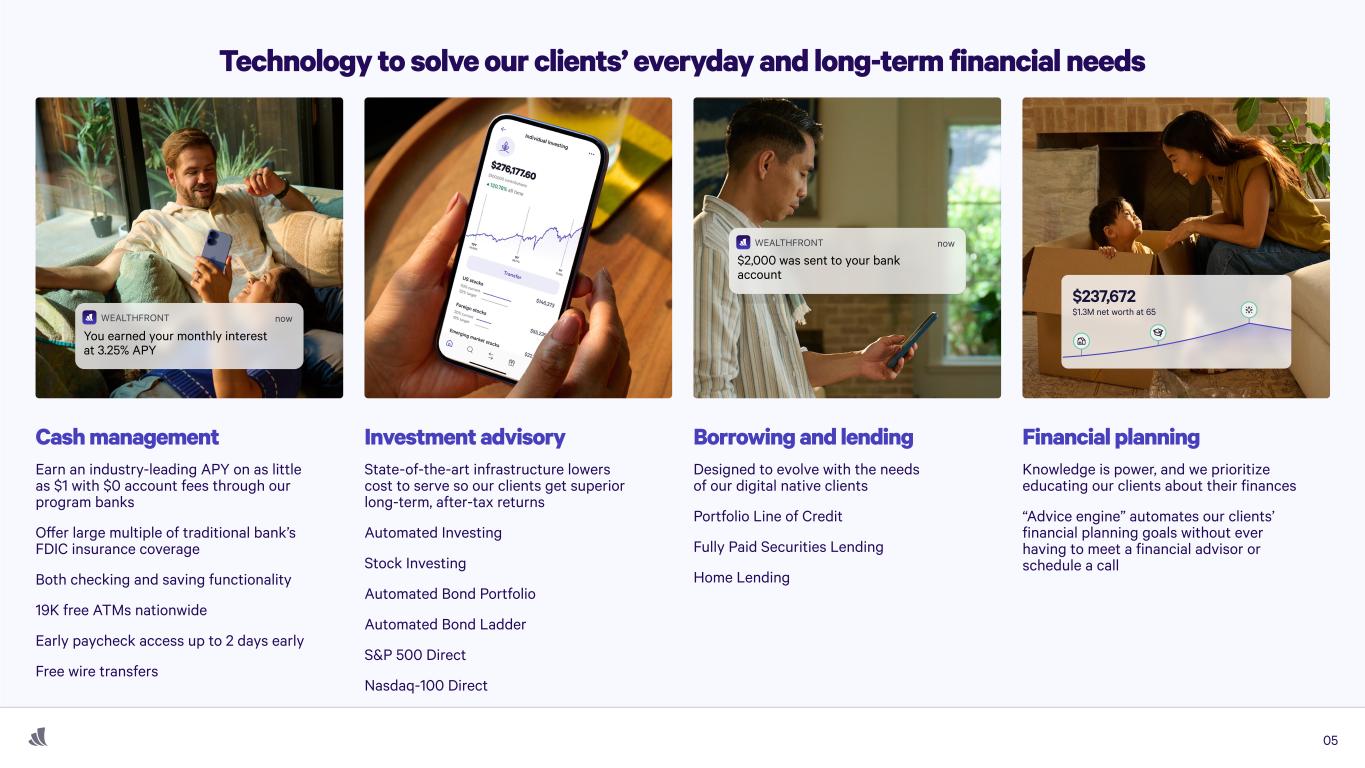

You earned your monthly interest at 3.25% APY Cash management Earn an industry-leading APY on as little as $1 with $0 account fees through our program banks Offer large multiple of traditional bank’s FDIC insurance coverage Both checking and saving functionality 19K free ATMs nationwide Early paycheck access up to 2 days early Free wire transfers Investment advisory State-of-the-art infrastructure lowers cost to serve so our clients get superior long-term, after-tax returns Automated Investing Stock Investing Automated Bond Portfolio Automated Bond Ladder S&P 500 Direct Nasdaq-100 Direct $2,000 was sent to your bank account Borrowing and lending Designed to evolve with the needs of our digital native clients Portfolio Line of Credit Fully Paid Securities Lending Home Lending $237,672 $1.3M net worth at 65 Financial planning Knowledge is power, and we prioritize educating our clients about their finances “Advice engine” automates our clients’ financial planning goals without ever having to meet a financial advisor or schedule a call Technology to solve our clients’ everyday and long-term financial needs 05

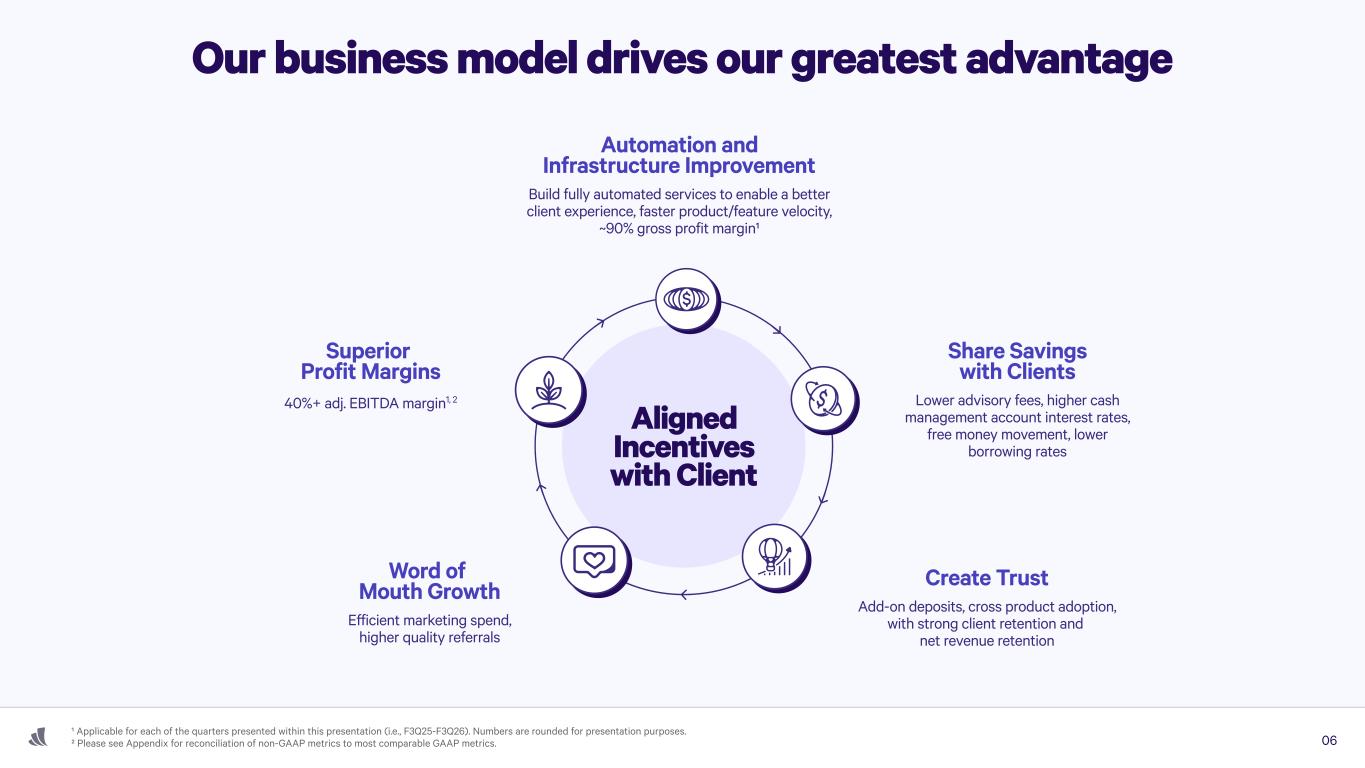

Our business model drives our greatest advantage Automation and Infrastructure Improvement Build fully automated services to enable a better client experience, faster product/feature velocity, ~90% gross profit margin1 Share Savings with Clients Lower advisory fees, higher cash management account interest rates, free money movement, lower borrowing rates Superior

Profit Margins 40%+ adj. EBITDA margin1, 2 Aligned Incentives with Client Create Trust Add-on deposits, cross product adoption, with strong client retention and

net revenue retention Word of Mouth Growth Efficient marketing spend, higher quality referrals 1 Applicable for each of the quarters presented within this presentation (i.e., F3Q25-F3Q26). Numbers are rounded for presentation purposes.

2 Please see Appendix for reconciliation of non-GAAP metrics to most comparable GAAP metrics. 06

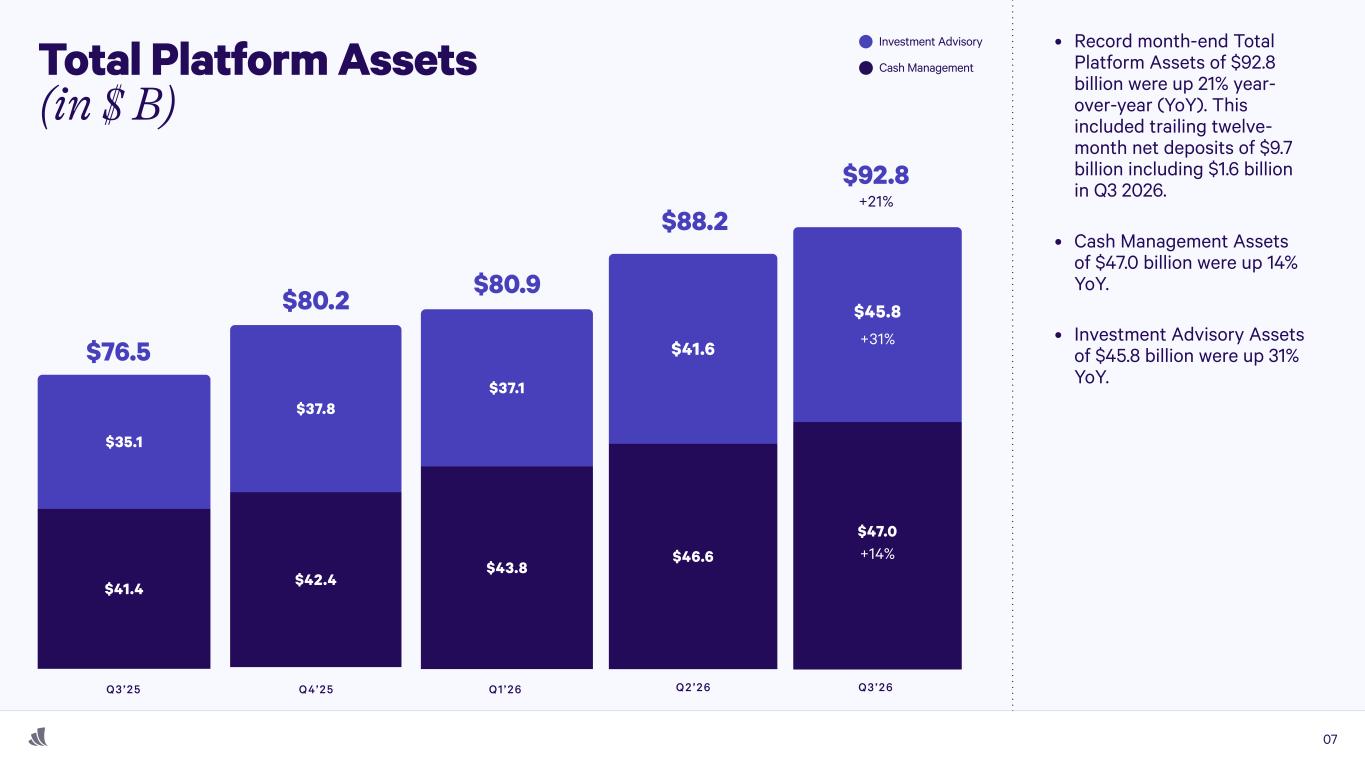

Total Platform Assets (in $ B) Record month-end Total Platform Assets of $92.8 billion were up 21% year- over-year (YoY). This included trailing twelve- month net deposits of $9.7 billion including $1.6 billion in Q3 2026. Cash Management Assets of $47.0 billion were up 14% YoY. Investment Advisory Assets of $45.8 billion were up 31% YoY. Investment Advisory Cash Management Q3 ’25 $76.5 $35.1 $41.4 Q4’25 Q1 ’26 $80.2 $80.9 $37.8 $42.4 $37.1 $43.8 Q2 ’26 Q3 ’26 $88.2 $92.8 $41.6 $46.6 $45.8 +31% $47.0 +14% +21% 07

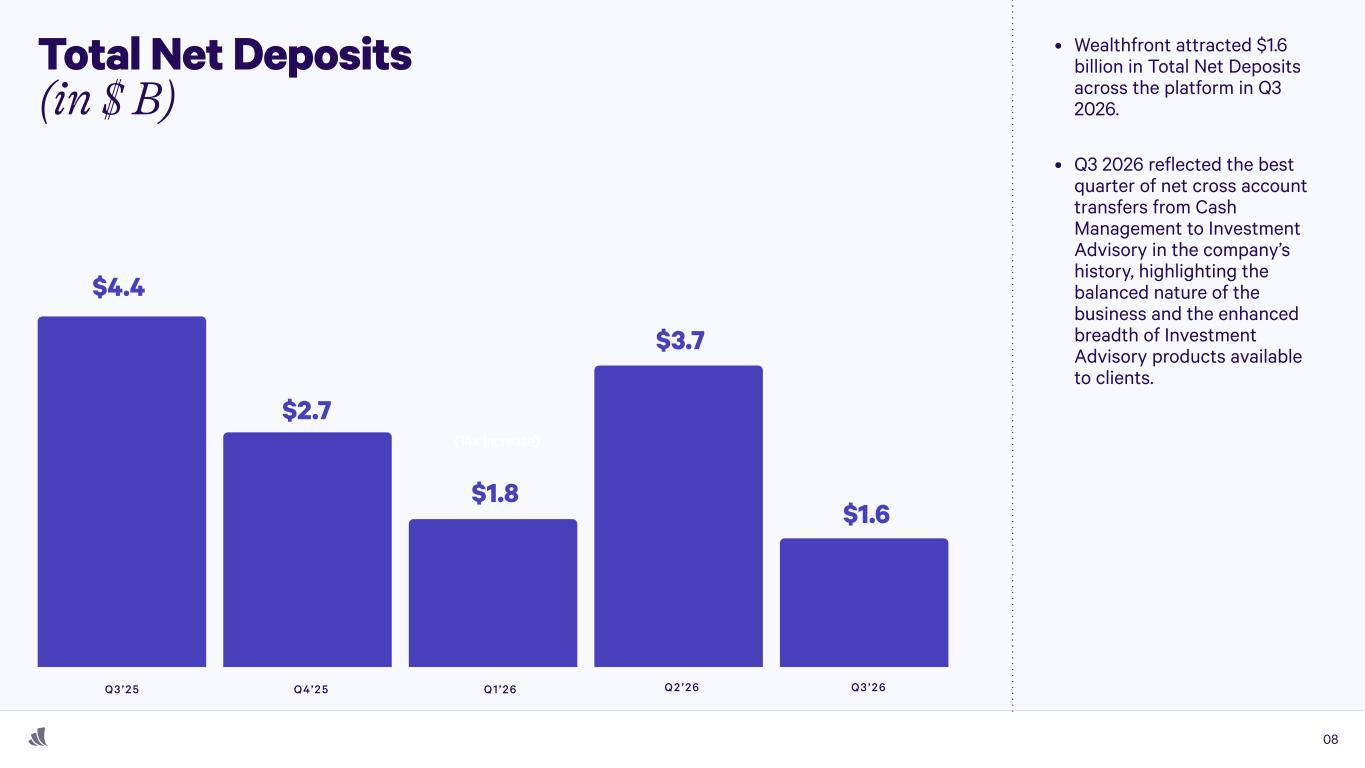

Total Net Deposits (in $ B) (14x Increase) $4.4 $2.7 $1.8 $3.7 $1.6 Wealthfront attracted $1.6 billion in Total Net Deposits across the platform in Q3 2026. Q3 2026 reflected the best quarter of net cross account transfers from Cash Management to Investment Advisory in the company’s history, highlighting the balanced nature of the business and the enhanced breadth of Investment Advisory products available to clients. Q3 ’25 Q4’25 Q1 ’26 Q2 ’26 Q3 ’26 08

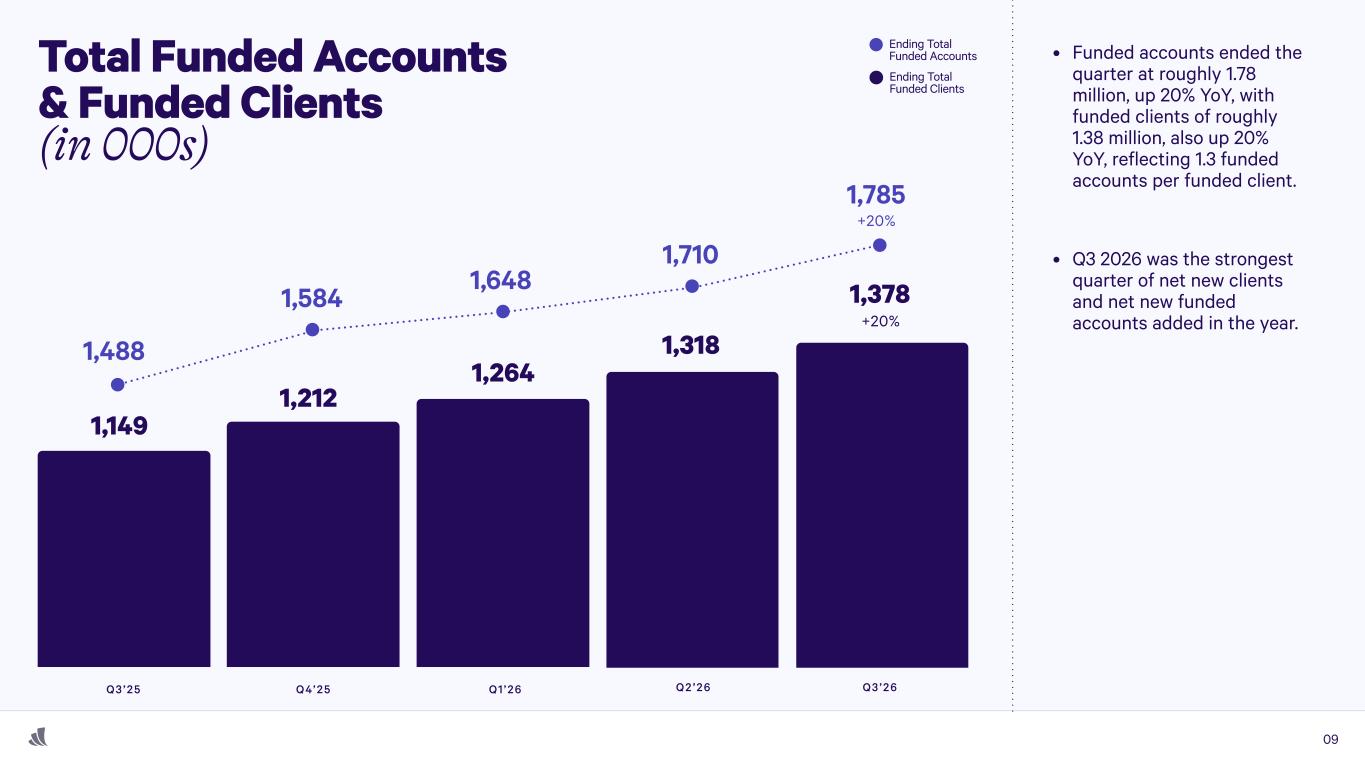

Total Funded Accounts & Funded Clients (in 000s) +20% +20% 1,378 1,149 1,488 1,584 1,648 1,710 1,785 1,212 1,264 1,318 Funded accounts ended the quarter at roughly 1.78 million, up 20% YoY, with funded clients of roughly 1.38 million, also up 20% YoY, reflecting 1.3 funded accounts per funded client. Q3 2026 was the strongest quarter of net new clients and net new funded accounts added in the year. Ending Total Funded Accounts Ending Total Funded Clients Q3 ’25 Q4’25 Q1 ’26 Q2 ’26 Q3 ’26 09

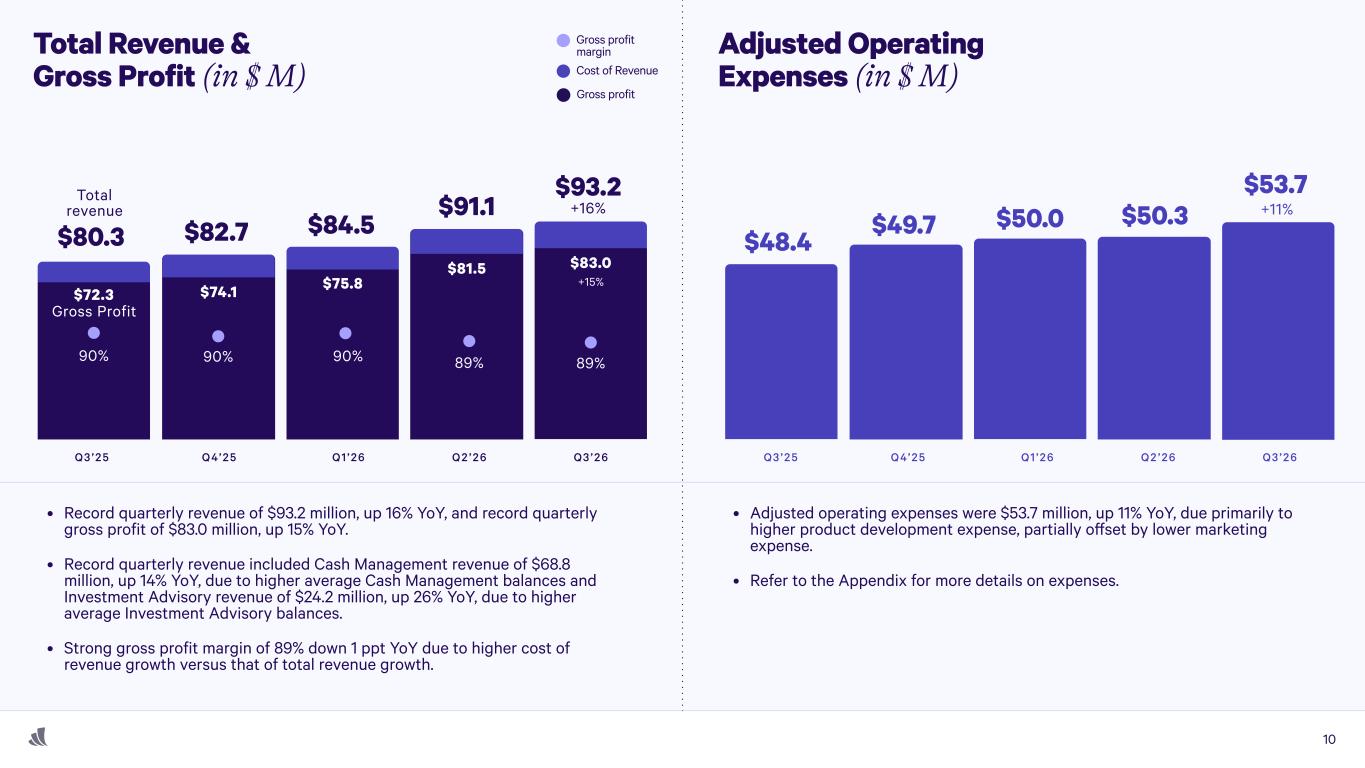

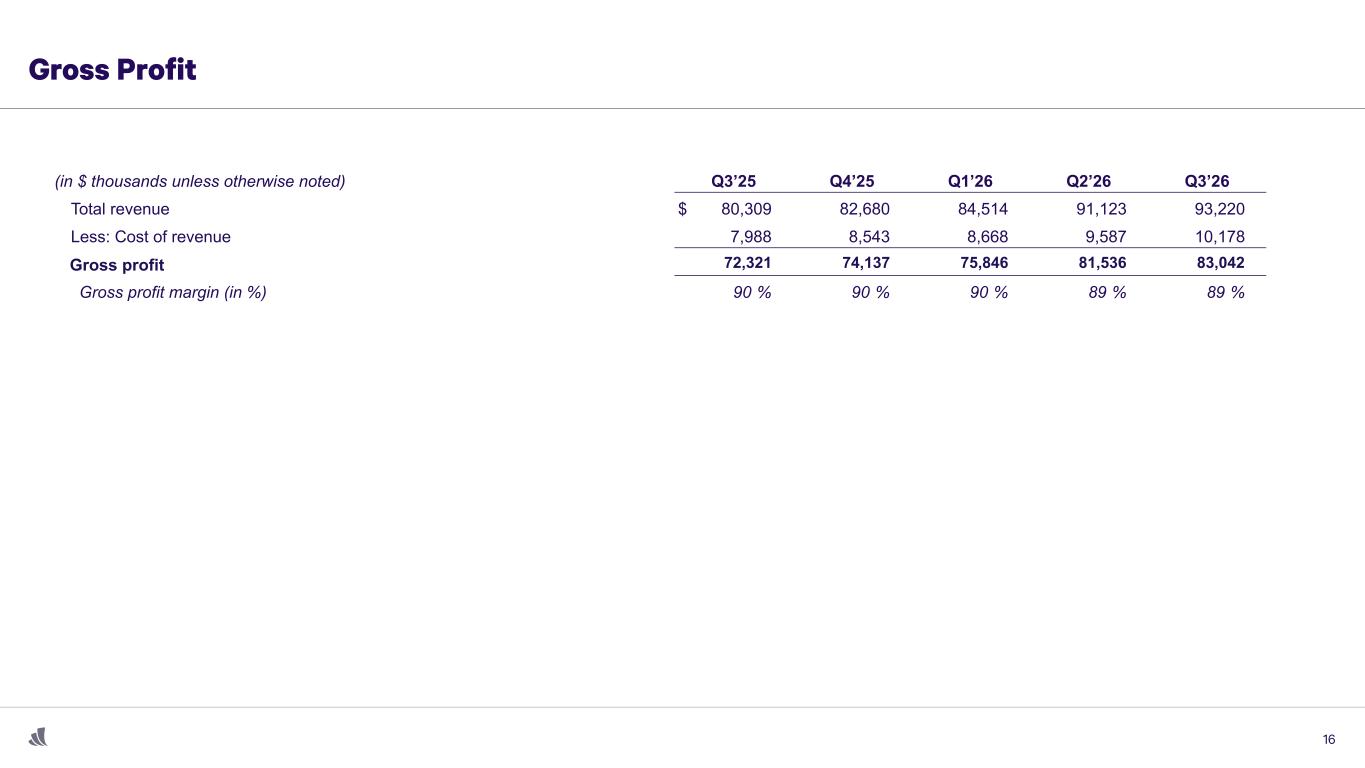

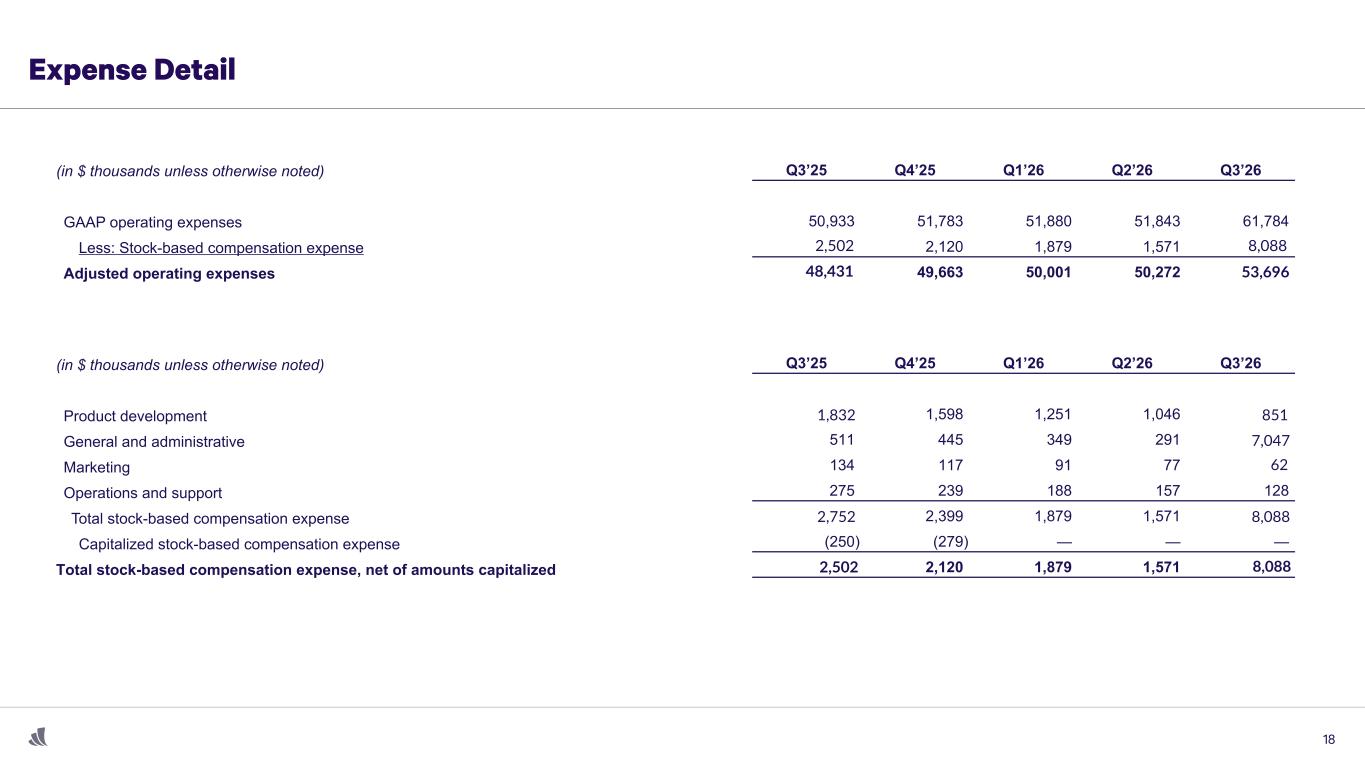

90% $72.3 90% $74.1 90% $75.8 $81.5 89% $83.0 +15% 89% $80.3 $48.4$82.7 $49.7$84.5 $50.0$91.1 $50.3 $93.2 $53.7 Q3 ’25 Q4’25 Q1 ’26 Q2 ’26 Q3 ’26 Total revenue +16% +11% Q3 ’25 Q4’25 Q1 ’26 Q2 ’26 Q3 ’26 Gross Profit Record quarterly revenue of $93.2 million, up 16% YoY, and record quarterly gross profit of $83.0 million, up 15% YoY. Record quarterly revenue included Cash Management revenue of $68.8 million, up 14% YoY, due to higher average Cash Management balances and Investment Advisory revenue of $24.2 million, up 26% YoY, due to higher average Investment Advisory balances. Strong gross profit margin of 89% down 1 ppt YoY due to higher cost of revenue growth versus that of total revenue growth. Adjusted operating expenses were $53.7 million, up 11% YoY, due primarily to higher product development expense, partially offset by lower marketing expense. Refer to the Appendix for more details on expenses. Total Revenue & Gross Profit (in $ M) Adjusted Operating

Expenses (in $ M)Cost of Revenue Gross profit margin Gross profit 10

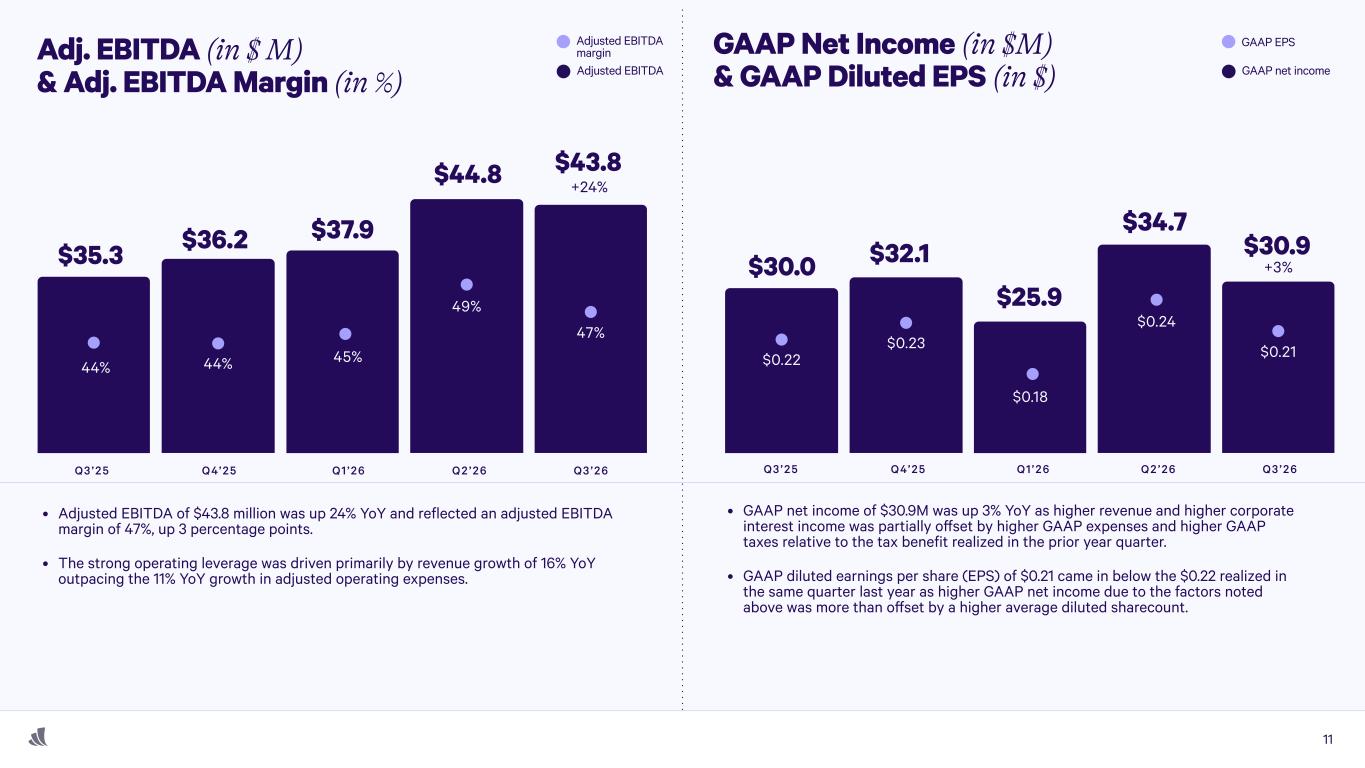

Adjusted EBITDA of $43.8 million was up 24% YoY and reflected an adjusted EBITDA margin of 47%, up 3 percentage points. The strong operating leverage was driven primarily by revenue growth of 16% YoY outpacing the 11% YoY growth in adjusted operating expenses. GAAP net income of $30.9M was up 3% YoY as higher revenue and higher corporate interest income was partially offset by higher GAAP expenses and higher GAAP taxes relative to the tax benefit realized in the prior year quarter. GAAP diluted earnings per share (EPS) of $0.21 came in below the $0.22 realized in the same quarter last year as higher GAAP net income due to the factors noted above was more than offset by a higher average diluted sharecount. 44% 44% $0.23 $0.2245% $0.18 49% $0.24 47% $0.21 $35.3 $36.2 $32.1$30.0 $37.9 $25.9 $44.8 $34.7 $43.8 $30.9 +24% +3% Q3 ’25 Q3 ’25Q4’25 Q4’25Q1 ’26 Q1 ’26Q2 ’26 Q2 ’26Q3 ’26 Q3 ’26 Adjusted EBITDA margin Adjusted EBITDA GAAP EPS GAAP net income Adj. EBITDA (in $ M) & Adj. EBITDA Margin (in %) GAAP Net Income (in $M) & GAAP Diluted EPS (in $) 11

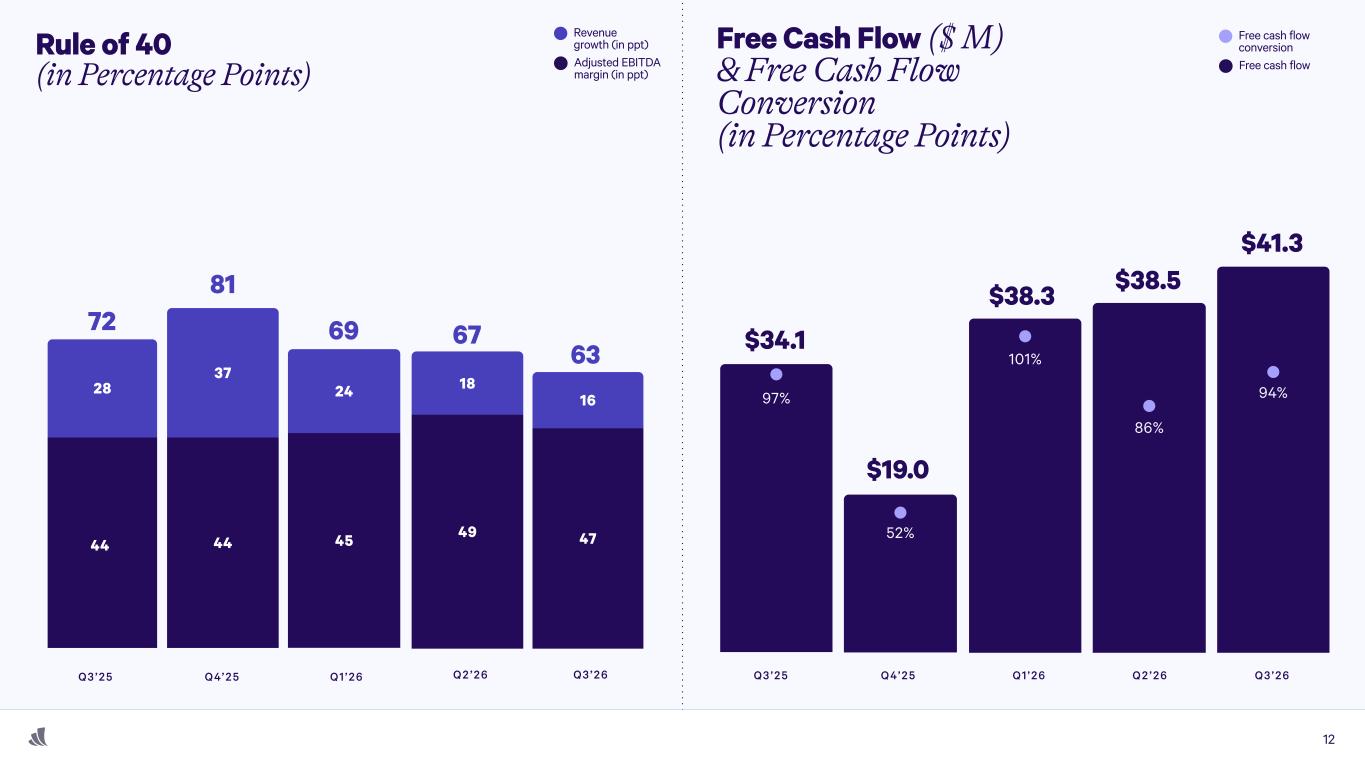

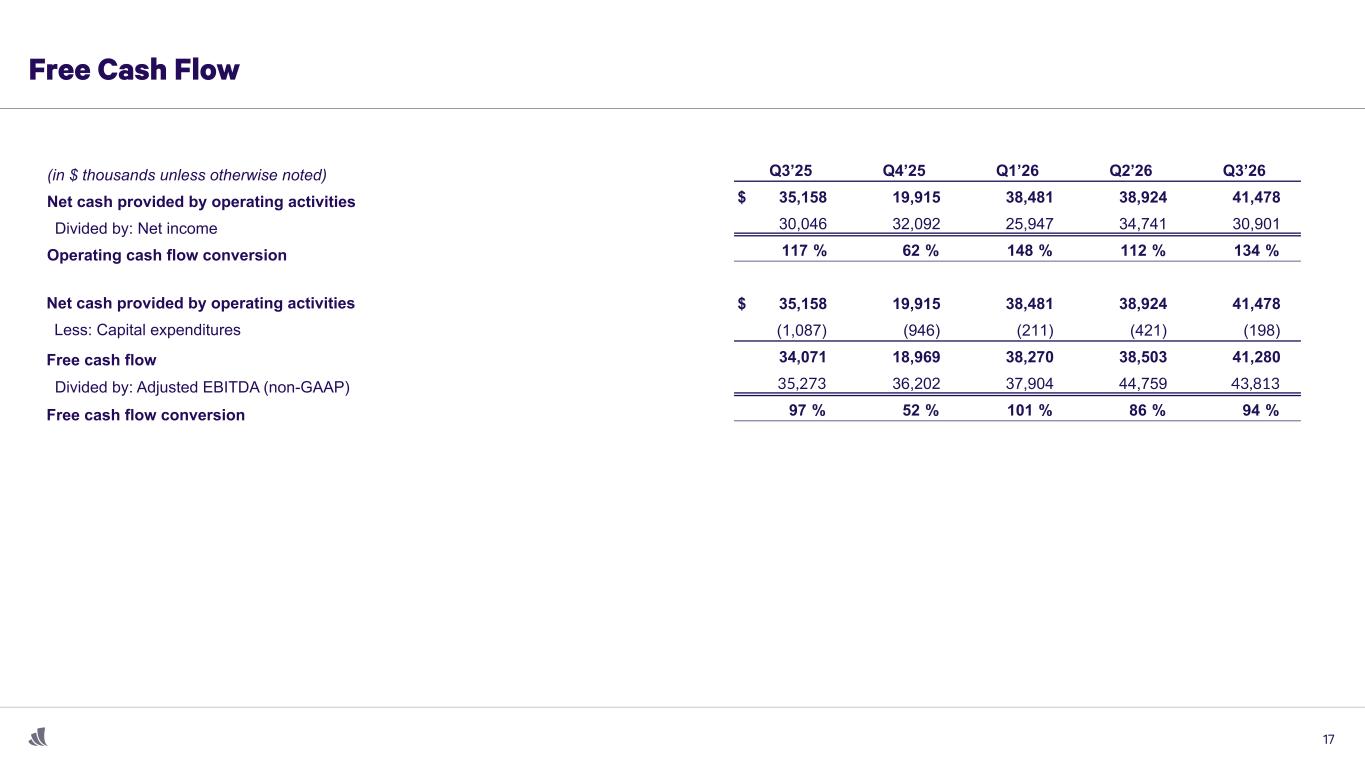

97% 52% 101% 86% 94% $34.1 $19.0 $38.3 $38.5 $41.3 Rule of 40 (in Percentage Points) Free Cash Flow ($ M) & Free Cash Flow

Conversion

(in Percentage Points) Free cash flow conversion Free cash flow Q3 ’25 Q4’25 Q1 ’26 Q2 ’26 Q3 ’26 12 81 72 37 44 69 28 44 67 63 24 45 18 49 16 47 Q2 ’26 Q3 ’26Q3 ’25 Q4’25 Q1 ’26 Revenue growth (in ppt) Adjusted EBITDA margin (in ppt)

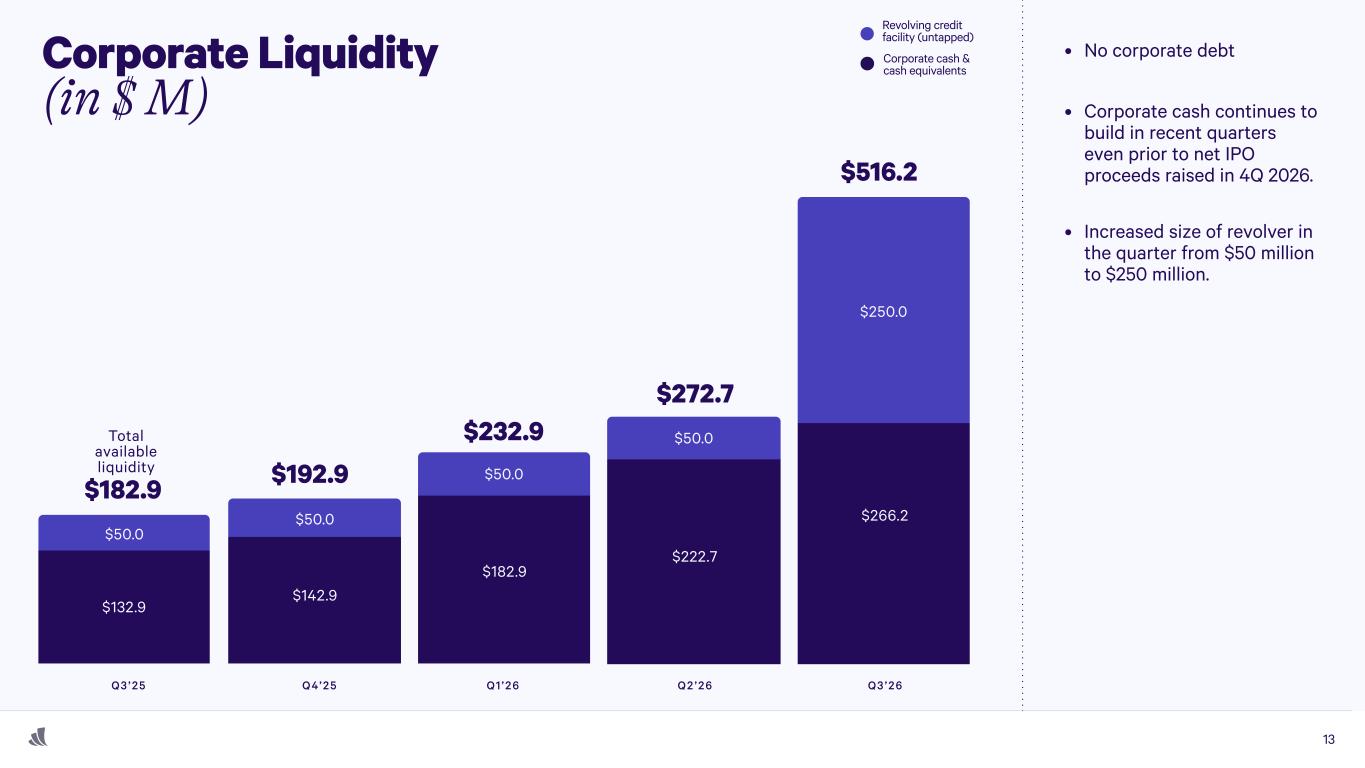

$50.0 $50.0 Total available liquidity $516.2 $272.7 $250.0 $266.2 $232.9 $50.0 $222.7 $50.0 $182.9 $192.9$182.9 $142.9 $132.9 Q3 ’25 Q4’25 Q1 ’26 Q2 ’26 Q3 ’26 No corporate debt Corporate cash continues to build in recent quarters even prior to net IPO proceeds raised in 4Q 2026. Increased size of revolver in the quarter from $50 million to $250 million. Corporate Liquidity (in $ M) Corporate cash & cash equivalents Revolving credit facility (untapped) 13

Appendix

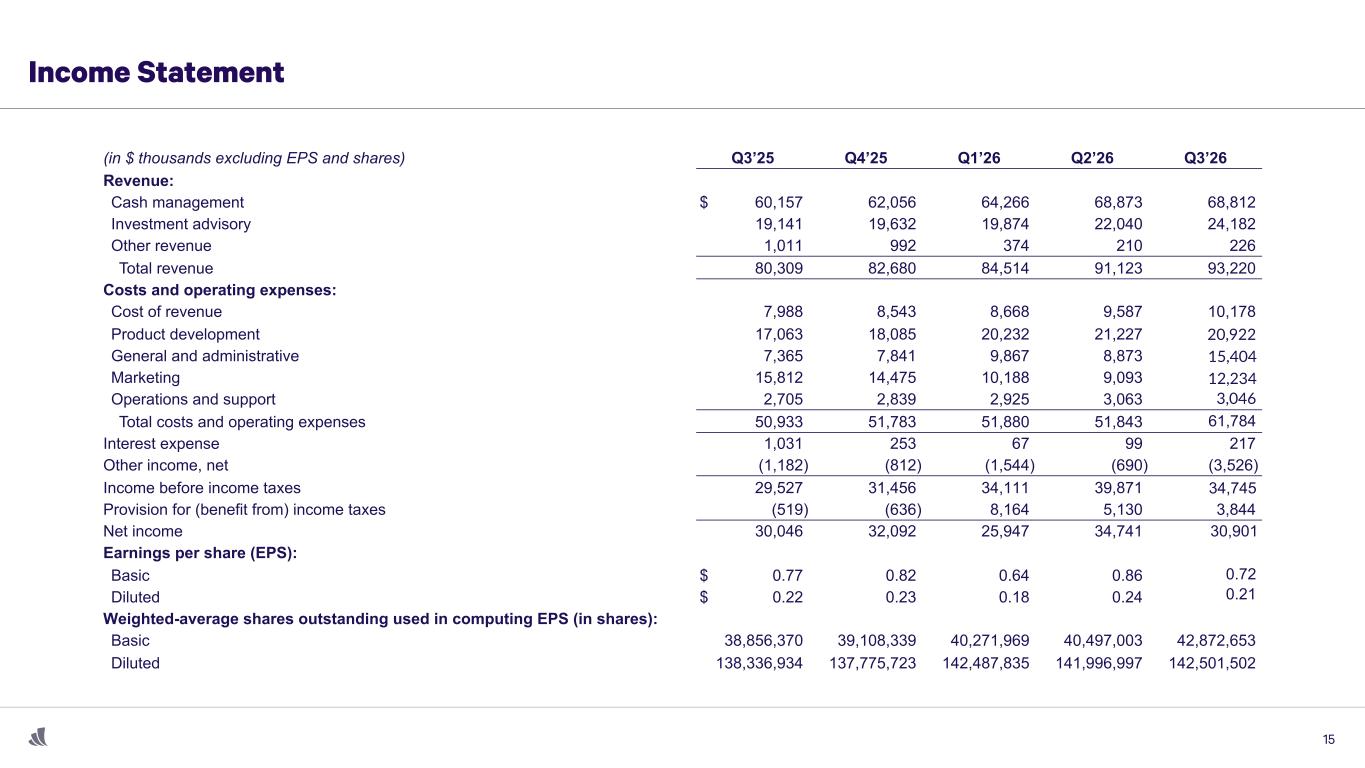

Income Statement 61,784 34,745 30,901 0.72 0.21 20,922 15,404 12,234 3,046 15

Gross Profit Gross profit 72,321 74,137 75,846 81,536 83,042 16

Free Cash Flow 17 43,81335,273

Expense Detail 18 53,69648,431 8,0882,502 7,047 8,0882,752 851 62 1,832 8,0882,502

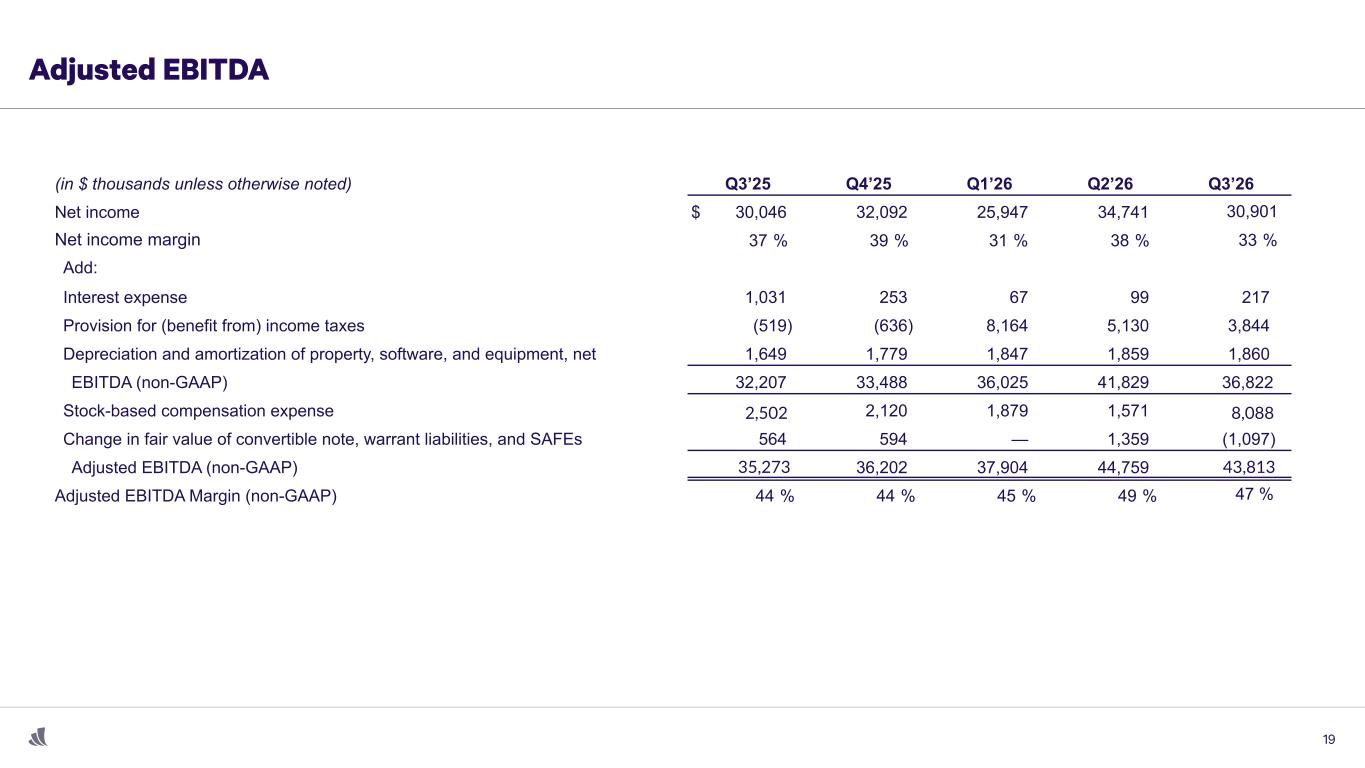

Adjusted EBITDA Add: Net income margin 30,901 47 % 36,822 19 43,81335,273 8,0882,502

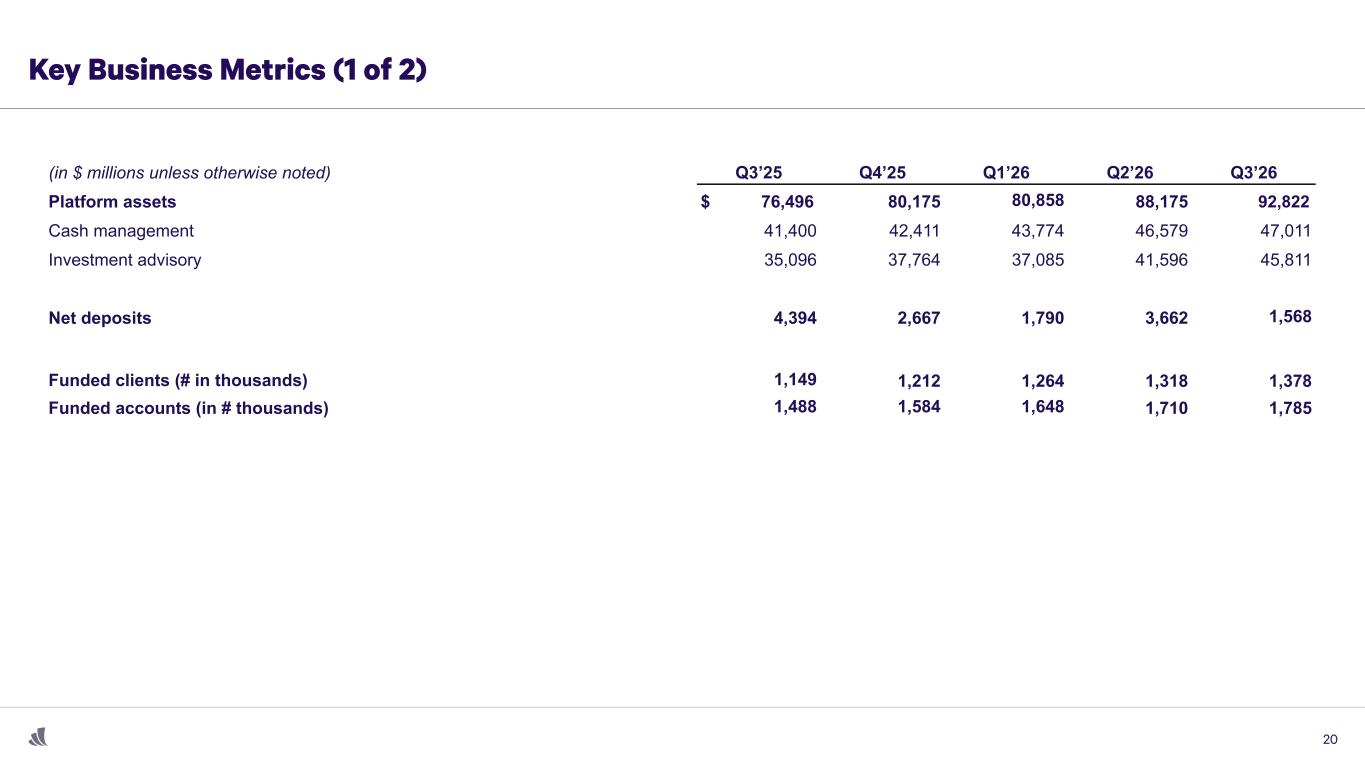

Key Business Metrics (1 of 2) 80,858 1,568 1,488 1,584 1,648 1,149 20 92,822

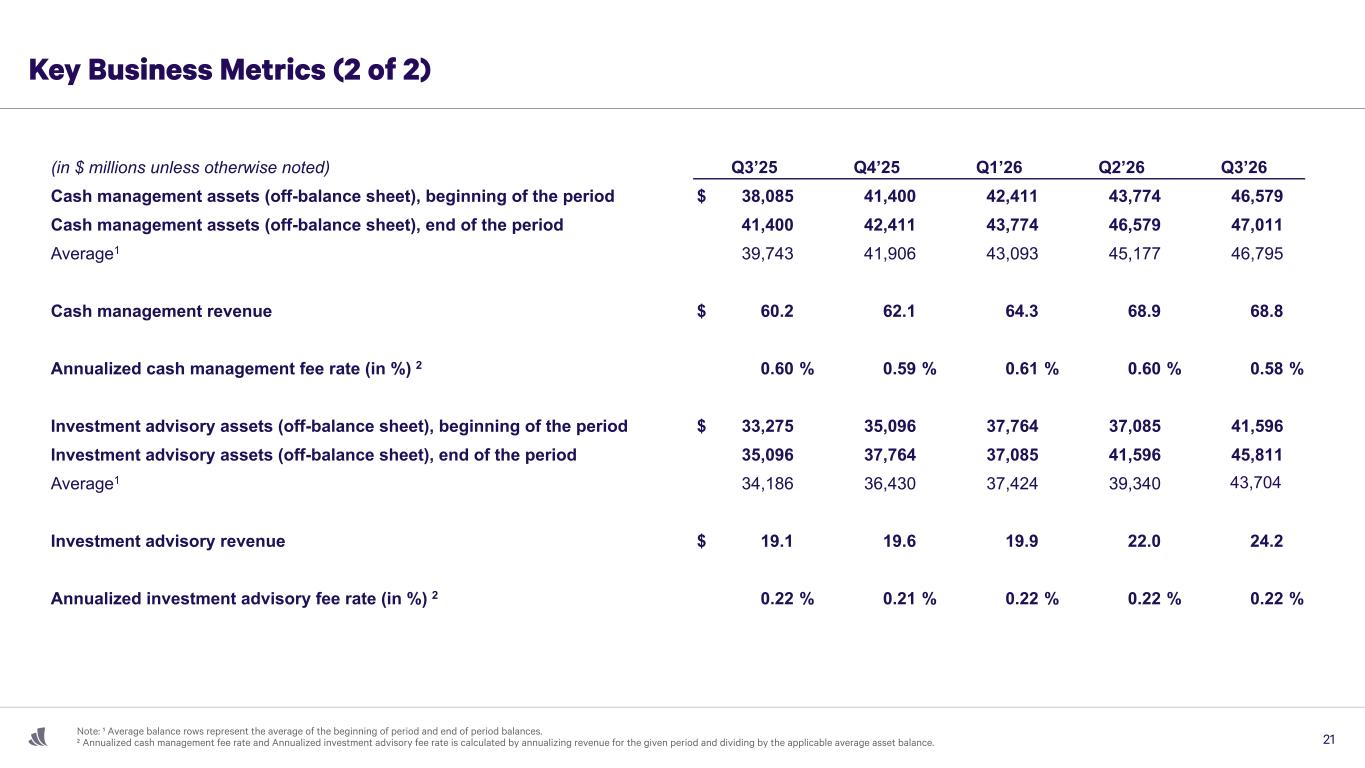

Key Business Metrics (2 of 2) 21 43,704

Definitions Key Business Metrics Platform assets: We define “platform assets” as the total value of financial assets held by clients in their accounts as of a stated date on our platform. Net deposits and changes in value attributable to financial market performance are included in the change in platform assets in any given period. We further break down platform assets into two categories of products: cash management and investment advisory. Net deposits: We define “net deposits” as the value of all assets clients have placed into products on our platform, net of withdrawals, over a defined period of time. We exclude changes in value attributable to financial market performance from this metric. We view net deposits as an important barometer of our ability to scale and grow organically and accumulate assets onto our platform. We view the relevant metric as net deposits on a platform-wide basis, not by individual product. Although net deposits can vary by product based on the economic environment, total net deposits provides a more comprehensive view of our growth because our platform offers diverse financial products that are designed to perform under a wide range of economic conditions, allowing the business to maintain resilience and increase total platform assets across market cycles and through extraordinary events. Funded clients: We define “funded clients” as clients with balances greater than zero or that have been greater than zero on at least one occasion during the 45 consecutive calendar days ending as of the measurement date. Funded clients include clients with a zero balance across all accounts as of the measurement date if they had greater than zero balances in at least one account within 45 calendar days prior to the measurement date. Individuals who shared funded joint accounts are each considered to be a separate funded client. The number of funded clients is as of a stated date and reflects our scale and monetization potential. Funded accounts: We define “funded accounts” as accounts with balances greater than zero or that have been greater than zero on at least one occasion during the 45 consecutive calendar days ending as of the measurement date. Funded accounts include accounts with a zero balance as of the measurement date if they had greater than zero balances within 45 calendar days prior to the measurement date. A shared funded joint account is considered a single funded account. The number of funded accounts is as of a stated date and reflects our scale and monetization potential. 22