Exhibit 17(a)

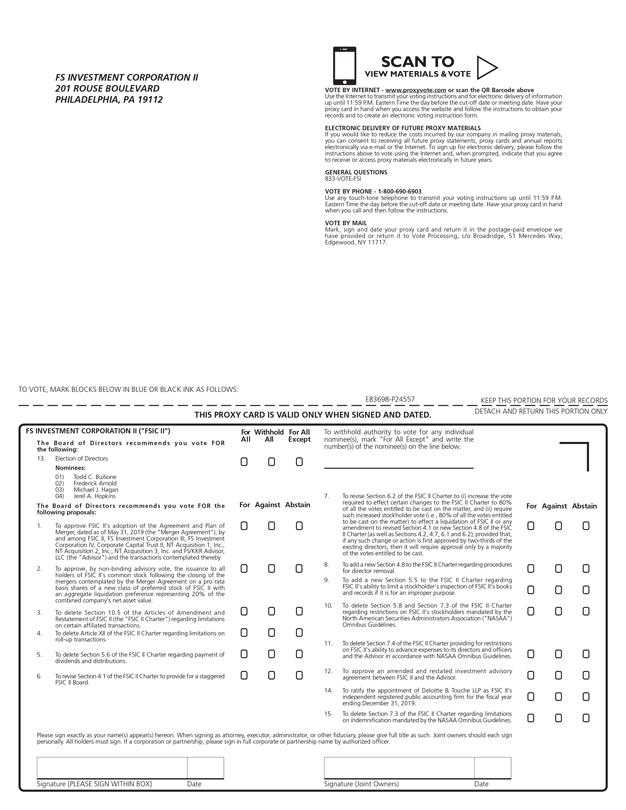

FS INVESTMENT CORPORATION II 201 ROUSE BOULEVARD PHILADELPHIA, PA 19112 VOTE BY INTERNET - www.proxyvote.com or scan the QR Barcode above Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. GENERAL QUESTIONS 833-VOTE-FSI VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: E83698-P24557 KEEP THIS PORTION FOR YOUR RECORDS THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. DETACH AND RETURN THIS PORTION ONLY FS INVESTMENT CORPORATION II ("FSIC II") The Board of Directors recommends you vote FOR the following: 13. Election of Directors Nominees: 01) Todd C. Builione 02) Frederick Arnold 03) Michael J. Hagan 04) Jerel A. Hopkins The Board of Directors recommends you vote FOR the following proposals: 1. To approve FSIC II's adoption of the Agreement and Plan of Merger, dated as of May 31, 2019 (the "Merger Agreement"), by and among FSIC II, FS Investment Corporation III, FS Investment Corporation IV, Corporate Capital Trust II, NT Acquisition 1, Inc., NT Acquisition 2, Inc., NT Acquisition 3, Inc. and FS/KKR Advisor, LLC (the "Advisor") and the transactions contemplated thereby. 2. To approve, by non-binding advisory vote, the issuance to all holders of FSIC II's common stock following the closing of the mergers contemplated by the Merger Agreement on a pro rata basis shares of a new class of preferred stock of FSIC II with an aggregate liquidation preference representing 20% of the combined company's net asset value. 3. To delete Section 10.5 of the Articles of Amendment and Restatement of FSIC II (the "FSIC II Charter") regarding limitations on certain affiliated transactions. 4. To delete Article XII of the FSIC II Charter regarding limitations on roll-up transactions. 5. To delete Section 5.6 of the FSIC II Charter regarding payment of dividends and distributions. 6. To revise Section 4.1 of the FSIC II Charter to provide for a staggered FSIC II Board. For Against Abstain For All Withhold All Except For All To withhold authority to vote for any individual nominee(s), mark "For All Except" and write the number(s) of the nominee(s) on the line below. 7. To revise Section 6.2 of the FSIC II Charter to (i) increase the vote required to effect certain changes to the FSIC II Charter to 80% of all the votes entitled to be cast on the matter, and (ii) require such increased stockholder vote (i.e., 80% of all the votes entitled to be cast on the matter) to effect a liquidation of FSIC II or any amendment to revised Section 4.1 or new Section 4.8 of the FSIC II Charter (as well as Sections 4.2, 4.7, 6.1 and 6.2); provided that, if any such change or action is first approved by two-thirds of the existing directors, then it will require approval only by a majority of the votes entitled to be cast. 8. To add a new Section 4.8 to the FSIC II Charter regarding procedures for director removal. 9. To add a new Section 5.5 to the FSIC II Charter regarding FSIC II's ability to limit a stockholder's inspection of FSIC II's books and records if it is for an improper purpose. 10. To delete Section 5.8 and Section 7.3 of the FSIC II Charter regarding restrictions on FSIC II's stockholders mandated by the North American Securities Administrators Association ("NASAA") Omnibus Guidelines. 11. To delete Section 7.4 of the FSIC II Charter providing for restrictions on FSIC II's ability to advance expenses to its directors and officers and the Advisor in accordance with NASAA Omnibus Guidelines. 12. To approve an amended and restated investment advisory agreement between FSIC II and the Advisor. 14. To ratify the appointment of Deloitte & Touche LLP as FSIC II's independent registered public accounting firm for the fiscal year ending December 31, 2019. 15. To delete Section 7.3 of the FSIC II Charter regarding limitations on indemnification mandated by the NASAA Omnibus Guidelines. Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date

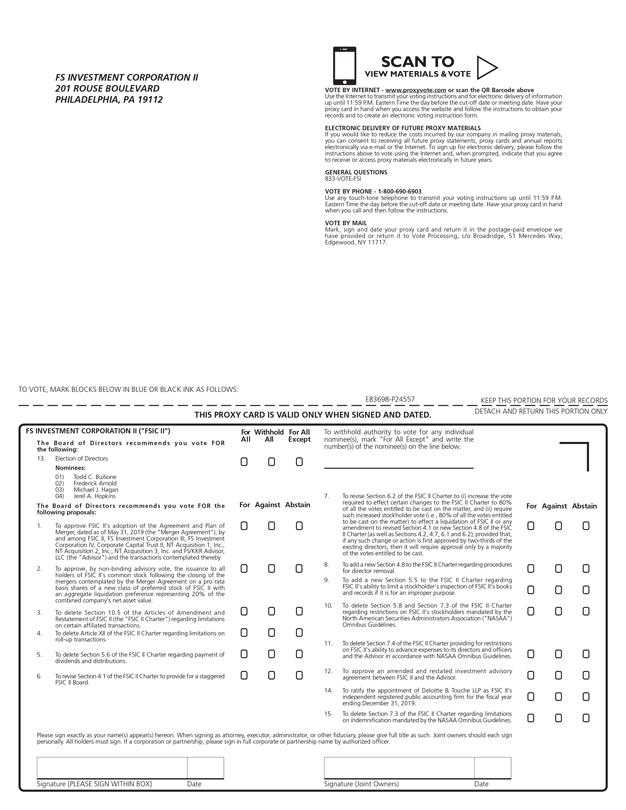

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice and Proxy Statement is available at www.proxyvote.com. E83699-P24557 FS INVESTMENT CORPORATION II Annual Meeting of Stockholders November 6, 2019 This proxy is solicited by the Board of Directors The undersigned hereby appoints Stephen S. Sypherd and Lee Barnard, and each of them, as proxies of the undersigned with full power of substitution in each of them, to attend the Annual Meeting of Stockholders of FS Investment Corporation II, a Maryland corporation ("FSIC II"), to be held at [2:00 p.m., Eastern Time, on August 8, 2019, at the offices of FSIC II, located at 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112, and any adjournments or postponements thereof (the "Annual Meeting"), and vote as designated on the reverse side of this proxy card all of the shares of common stock, par value $0.001 per share, of FSIC II ("Shares") held of record by the undersigned as of any applicable record date. The proxy statement and the accompanying materials are being mailed on or about [TBD], 2019 to stockholders of record as of August 15, 2019 and are available at www.proxyvote.com. All properly executed proxies representing Shares received prior to the Annual Meeting will be voted in accordance with the instructions marked thereon. If no instructions are marked, the Shares will be voted (1) FOR the proposal to adopt the Merger Agreement and approve transactions contemplated thereby, (2) FOR the proposal to approve, on a non-binding advisory basis, the issuance of shares of a new class of preferred stock to FSIC II's common stockholders following the transactions contemplated by the Merger Agreement, (3) FOR each of the ten proposals to reflect in FSIC II's amended and restated charter certain amendments described in proposals 3 through 11 and 15, (4) FOR the proposal to approve an amended and restated investment advisory agreement between FSIC II and its investment adviser, (5) FOR the proposal to elect the director nominees listed in Proposal 13, and (6) FOR the proposal to ratify Deloitte & Touche LLP as FSIC II's independent registered public accounting firm for the fiscal year ending December 31, 2019. If any other business is presented at the Annual Meeting, this proxy will be voted by the proxies in their best judgment, including a motion to adjourn or postpone the Annual Meeting to another time and/or place for the purpose of soliciting additional proxies. At the present time, the board of directors of FSIC II knows of no other business to be presented at the Annual Meeting. Any stockholder who has given a proxy has the right to revoke it at any time prior to its exercise. Any stockholder who executes a proxy may revoke it with respect to a proposal by attending the Annual Meeting and voting his or her Shares in person or by submitting a letter of revocation or a later-dated proxy to FSIC II at the above address prior to the date of the Annual Meeting. Continued and to be signed on reverse side