Please wait

0001525769DEF 14Afalseiso4217:USDiso4217:USDxbrli:sharesxbrli:pure00015257692024-02-052025-02-040001525769play:MorrisMember2024-04-240001525769play:QuartieriMember2024-04-240001525769play:MulleadyMember2024-04-240001525769play:BautistaMember2024-04-240001525769play:WehnerMember2024-04-240001525769play:MorrisMember2024-02-052025-02-040001525769play:SheehanMember2024-02-052025-02-040001525769play:JenkinsMember2024-02-052025-02-040001525769play:MorrisMember2023-01-302024-02-040001525769play:SheehanMember2023-01-302024-02-040001525769play:JenkinsMember2023-01-302024-02-0400015257692023-01-302024-02-040001525769play:MorrisMember2022-01-312023-01-290001525769play:SheehanMember2022-01-312023-01-290001525769play:JenkinsMember2022-01-312023-01-2900015257692022-01-312023-01-290001525769play:MorrisMember2021-02-012022-01-300001525769play:SheehanMember2021-02-012022-01-300001525769play:JenkinsMember2021-02-012022-01-3000015257692021-02-012022-01-300001525769play:MorrisMember2020-02-032021-01-310001525769play:SheehanMember2020-02-032021-01-310001525769play:JenkinsMember2020-02-032021-01-3100015257692020-02-032021-01-310001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:PeoMemberplay:SheehanMember2024-02-052025-02-040001525769ecd:PeoMemberplay:MorrisMember2024-02-052025-02-040001525769ecd:PeoMemberplay:MorrisMember2023-01-302024-02-040001525769ecd:PeoMemberplay:MorrisMember2022-01-312023-01-290001525769ecd:PeoMemberplay:SheehanMember2022-01-312023-01-290001525769ecd:PeoMemberplay:SheehanMember2021-02-012022-01-300001525769ecd:PeoMemberplay:JenkinsMember2021-02-012022-01-300001525769ecd:PeoMemberplay:JenkinsMember2020-02-032021-01-310001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-02-032021-01-310001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-02-032021-01-310001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-02-032021-01-310001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-02-032021-01-310001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-02-032021-01-310001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-02-032021-01-310001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-02-032021-01-310001525769ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2024-02-052025-02-040001525769ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2023-01-302024-02-040001525769ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2022-01-312023-01-290001525769ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2021-02-012022-01-300001525769ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2020-02-032021-01-31000152576922024-02-052025-02-04000152576912024-02-052025-02-04000152576932024-02-052025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

___________________________

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

| | | | | |

| o | Preliminary Proxy Statement |

| |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| x | Definitive Proxy Statement |

| |

| o | Definitive Additional Materials |

| |

| o | Soliciting Material Under Rule 14a-12 |

DAVE & BUSTER’S ENTERTAINMENT, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| x | No fee required. |

| |

| o | Fee paid previously with preliminary materials. |

| |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

2025

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

Wednesday, June 18, 2025, 4:30 p.m., Central Daylight Time

Virtual Meeting, for details visit www.meetnow.global/MF52AG5

May 8, 2025

To Our Shareholders:

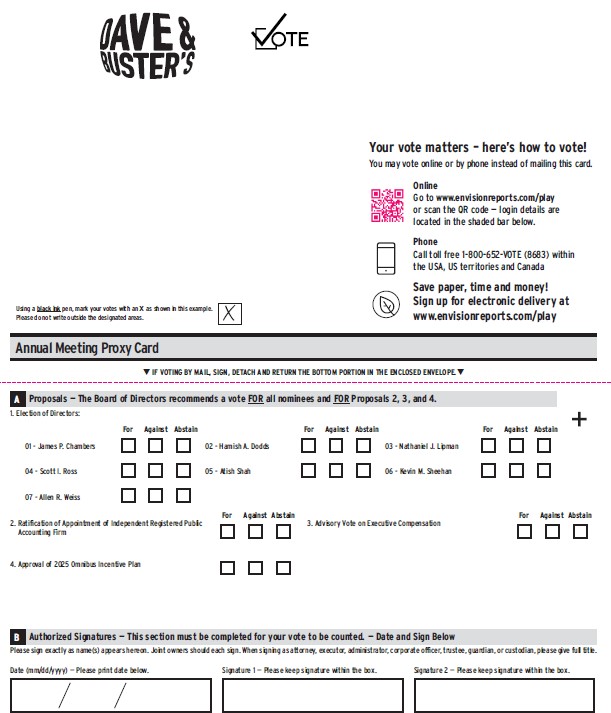

On behalf of the Board of Directors, it is our pleasure to cordially invite you to participate in the 2025 Annual Meeting of Shareholders of Dave & Buster’s Entertainment, Inc. (the “Annual Meeting”) on June 18, 2025, at 4:30 p.m. Central Daylight Time. The Annual Meeting will be conducted solely online via live webcast at www.meetnow.global/MF52AG5. You will be able to listen to the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the Annual Meeting. Please check in early to ensure that you can access the Annual Meeting on your computer or other electronic device. You will find information regarding the matters expected to be addressed at the Annual Meeting described in detail in the accompanying Notice of Annual Meeting of Shareholders and Proxy Statement. There is no physical location for the Annual Meeting.

Your vote is important to us. While we invite you to listen online to the meeting and exercise your right to vote your shares online during the meeting, we recognize that many of you may not be able to listen or may choose not to do so. Whether or not you plan to listen, we respectfully request you vote as soon as possible over the internet, by telephone, or, upon your request, after receipt of paper copies of the proxy materials. We encourage you to vote by internet. Your vote will mean that you are represented at the Annual Meeting regardless of whether you participate online during the meeting. You may also request a paper copy of the proxy card to submit your vote if you prefer. If you have voted by internet, by mail or by telephone and later decide to attend the Annual Meeting virtually, you may do so and vote during the Annual Meeting.

Thank you for being a shareholder and we look forward to seeing you at the meeting.

Sincerely,

Kevin Sheehan

Interim Chief Executive Officer

| | | | | |

| DAVE & BUSTER’S ENTERTAINMENT, INC. 1221 S. Belt Line Road, #500 Coppell, Texas 75019 |

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

To Our Shareholders:

NOTICE IS HEREBY GIVEN that the 2025 Annual Meeting of Shareholders of Dave & Buster’s Entertainment, Inc. (the “Annual Meeting”) will be held virtually at the time and location noted below for the following purposes:

| | | | | | | | | | | | | | |

| When: | | 4:30 p.m. Central Daylight Time Wednesday, June 18, 2025 | | Items of Business: •To elect seven (7) directors, each to serve until the 2026 annual meeting of shareholders and until his successor has been elected and qualified, or until his earlier death, resignation or removal. •To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2025. •To approve, on an advisory basis, the compensation of our named executive officers. •To approve the Dave and Buster’s Entertainment, Inc. 2025 Omnibus Incentive Plan. •To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

| Where: | | The Annual Meeting will be held virtually. |

| | |

| Webpage: | | www.meetnow.global/MF52AG5 |

Who Can Vote: |

| | |

Only shareholders of record at the close of business on April 28, 2025 are entitled to notice of, and to vote at, the meeting or any adjournment or postponement thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Beginning on or around May 8, 2025, we sent a Notice Regarding the Availability of Proxy Materials to all shareholders entitled to vote at the Annual Meeting, together with instructions on how to access our proxy materials over the internet and how to vote.

By Order of the Board of Directors,

Rodolfo Rodriguez, Jr.

Senior Vice President, Chief Legal Officer and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 18, 2025.

| | |

The Company’s Proxy Statement and 2024 Annual Report

are available at www.envisionreports.com/play. |

DAVE & BUSTER’S ENTERTAINMENT, INC.

Proxy Statement

For the Annual Meeting of Shareholders

To Be Held on June 18, 2025

TABLE OF CONTENTS

2025 Proxy Statement Summary

This summary highlights selected information on Dave and Buster’s Entertainment, Inc., a Delaware corporation (sometimes referred to herein as “we”, “us”, “our” or the “Company”) that is provided in more detail throughout this proxy statement (the “Proxy Statement”). This summary does not contain all of the information you should consider before voting, and you should read the entire Proxy Statement before casting your vote. Beginning on or around May 8, 2025, we sent a Notice Regarding the Availability of Proxy Materials to all shareholders entitled to vote at the Company’s 2025 Annual Meeting of Shareholders (the “Annual Meeting”), together with instructions on how to access our proxy materials over the internet and how to vote.

| | |

Annual Meeting Information |

| | | | | | | | | | | |

Date: | Wednesday, June 18, 2025 | | Voting Only shareholders as of the Record Date (April 28, 2025) are entitled to vote. Participating Online During the Annual Meeting If you are a registered shareholder (your shares are held in your name), you register by following the instructions set forth at www.meetnow.global/MF52AG5 or in the FAQs section of this Proxy Statement (page 69). If you are a beneficial shareholder (your shares are held in the name of your bank, brokerage firm or other nominee), you will need to obtain a “legal proxy” from the registered shareholder (your bank, brokerage firm or other nominee) to register to vote at the Annual Meeting and follow the instructions set forth in the FAQs section of this Proxy Statement (page 69). |

| | |

Time: | 4:30 p.m. Central Daylight Time | |

| | |

Place: | The Annual Meeting will be held virtually. | |

| | |

Webpage: | www.meetnow.global/MF52AG5 | |

| | |

Record Date: | Monday, April 28, 2025 | |

| | | | | | | | | | | | | | | | | | | | |

Vote via Internet Follow the instructions on your Notice or Proxy Card | | Vote via Phone Call the number on your Notice or Proxy Card | | Vote via Mail Follow the instructions on your Notice or Proxy Card | | Vote Online during the Annual Meeting Register to participate in the Annual Meeting virtually and vote online |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 1 |

| | |

Proposals Before the Shareholders |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Proposals | | Description | | Board Voting

Recommendation | | Votes

Required | | Page

Reference |

| 1 | | Election of Directors | | FOR each

nominee | | Majority of Votes Cast | | |

| | | | | | | | |

| 2 | | Ratification of Appointment of

Independent Registered Public Accounting Firm | | FOR | | Majority of Votes Cast | | |

| | | | | | | | |

| 3 | | Advisory Vote on Executive Compensation | | FOR | | Majority of Votes Cast | | |

| | | | | | | | |

| 4 | | Approval of the 2025 Omnibus Incentive Plan | | FOR | | Majority of Votes Cast | | |

| | | | | | | | |

| | |

| Information about the Board of Directors at 2024 Fiscal Year End: |

| | | | | | | | | | | | | | | | | |

| Independence, Committees and Meetings |

| Director | Board of

Directors | Audit

Committee | Compensation

Committee | Nominating

and Corporate

Governance

Committee | Finance

Committee |

| James P. Chambers | I, VC | | C | | M |

| Hamish A. Dodds | I | M | | | C |

| Michael J. Griffith | LID | | M | M | |

| Gail Mandel | I | M | | M | |

| Scott I. Ross* | I | | | M | M |

| Atish Shah | I | C | | M | |

| Kevin M. Sheehan | ICEO, COB | | | | M |

| Jennifer Storms | I | | M | C | |

| Number of Meetings in Fiscal 2024 | 8 | 5 | 7 | 4 | 14 |

| | | | | | | | |

| I | – | Independent Director |

| LID | – | Lead Independent Director |

| ICEO | – | Interim Chief Executive Officer |

| COB | – | Chair of the Board |

| C | – | Committee Chair |

| M | – | Committee Member |

| VC | – | Vice Chair |

| * | | Appointed to the board of directors (the “Board” or the “Board of Directors”) on January 30, 2025. |

| | |

| | |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 2 |

| | |

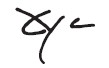

Board Skills and Core Competencies of Current Board Members: |

Our Board is comprised of directors who have a variety of skills and core competencies as noted in the chart below:

| | |

Corporate Governance Highlights: |

We are committed to maintaining strong corporate governance practices that promote and protect the long-term interests of our shareholders. Our practices are designed to provide effective oversight and management of our Company as well as meet our regulatory and NASDAQ requirements, including the following:

| | | | | |

üLead Independent Director | üStrong Director Attendance Record |

üAudit, Compensation, and Nominating and Corporate Governance Committees comprised of only Independent Directors | üShare Ownership Requirements for Directors and Executive Officers |

üRegular Executive Sessions of Independent Directors | üDirector Overboarding Policy |

üCommitment to Board Refreshment | üMandatory Director Retirement Age |

üAnnual Director Elections | üAnnual Board and Committee Evaluations |

üMajority Voting in Uncontested Director Elections | üContinued Engagement with Our Shareholders |

üCommitment to Director Education | üNo Shareholder Rights Plan |

| |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 3 |

| | |

Fiscal 2024 Business Performance Highlights: |

•Revenue of $2.1 billion decreased 3.3% from fiscal 2023.

•Comparable store sales decreased 7.2% compared to the same calendar period in fiscal 2023.

•Net income totaled $58.3 million, or $1.46 per diluted share, compared to net income of $126.9 million, or $2.88 per diluted share in fiscal 2023.

•Adjusted EBITDA* of $506.2 million, compared to Adjusted EBITDA* of $555.6 in fiscal 2023.

•The Company opened a total of 14 new venues (11 Dave & Buster's and three Main Events) in fiscal 2024. In December 2024, the Company opened its first franchise location in Bengaluru, India.

* Adjusted EBITDA is a non-GAAP financial measure. See Appendix A for more information. | | |

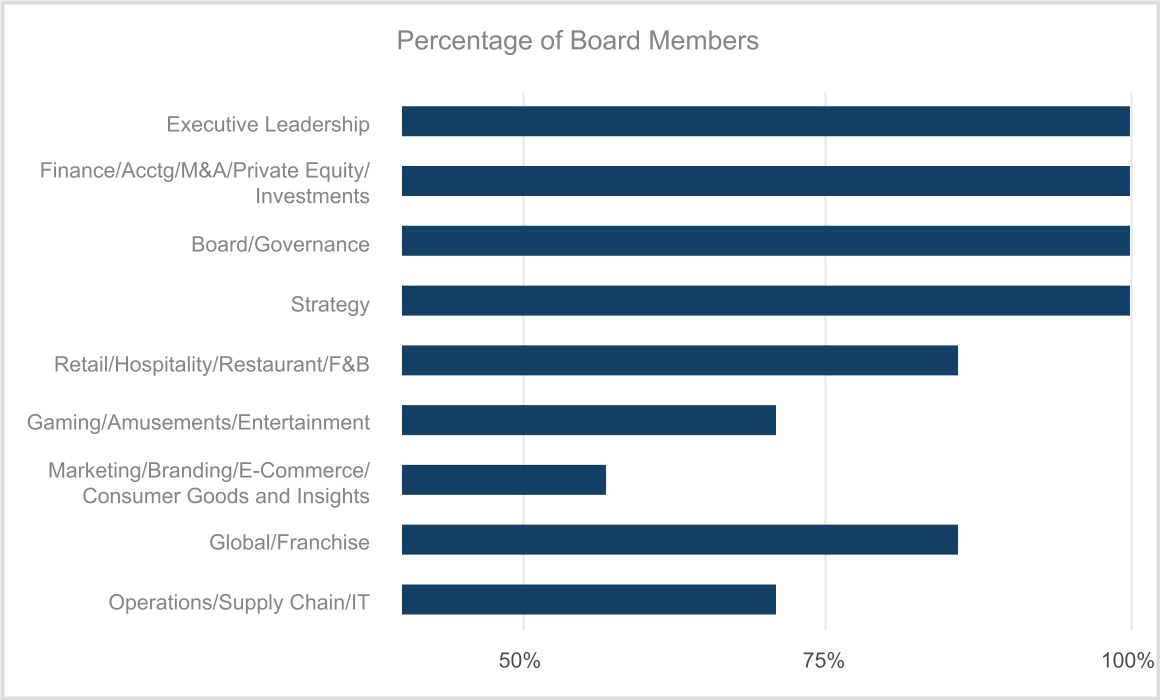

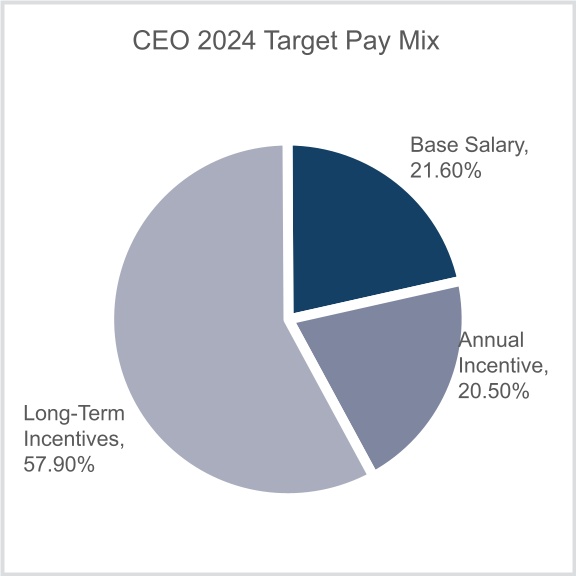

Fiscal 2024 Executive Compensation Highlights and Key Practices: |

•We continued to receive strong support from shareholders for our executive compensation practices, with 95% of the votes cast voting to approve the compensation paid to our named executive officers at the 2024 annual meeting of shareholders.

•In designing our fiscal 2024 executive compensation, we maintained our focus on our three core values for compensation: pay for performance, market-competitive pay and sustained shareholder value creation.

| | |

| Fiscal 2024 Corporate Social Responsibility Highlights: |

•We remain committed to thoughtful environmental sustainability, social and governance practices. To this end, we:

◦published corporate responsibility reports including our alignment to Sustainability Accounting Standards Board standards for restaurants and entertainment companies in April 2023 and April 2024.

◦completed a physical risk analysis in 2024.

◦published our 2025 update to our corporate responsibility report in early May 2025.

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 4 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Board of Directors currently consists of eight (8) members. Based on the recommendation of the Nominating and Corporate Governance Committee, the Board of Directors has nominated seven (7) nominees for election to the Board of Directors. If elected at the Annual Meeting, each of the nominees will serve until our 2026 annual meeting of shareholders and until his successor is duly elected and qualified, or until his earlier death, resignation or removal. If any of the nominees is unable or unwilling to be a candidate for election by the time of the Annual Meeting (a contingency which the Board does not expect to occur), the shareholders may vote for a substitute nominee chosen by the present Board to fill a vacancy. In the alternative, the shareholders may vote for just the remaining nominees leaving a vacancy that may be filled later by the Board. Alternatively, the Board may reduce its size.

On April 28, 2025, Michael J. Griffith, Gail Mandel and Jennifer Storms notified the Company of their decision to not stand for reelection to the Board of Directors at the Annual Meeting. Mr. Griffith, Ms. Mandel and Ms. Storms will continue to serve as directors until the Annual Meeting. In connection with the decisions of Mr. Griffith, Ms. Mandel and Ms. Storms to not stand for reelection at the Annual Meeting, the Board of Directors determined to decrease the number of directors on the Board of Directors from eight (8) to seven (7), effective as of the date of the Annual Meeting.

We are furnishing below certain biographical information about each of the seven (7) nominees for director. Also included is a description of the experience, qualifications, attributes and skills of each nominee.

| | | | | | | | | | | |

| James P. Chambers |

DIRECTOR SINCE: 2020 | AGE: 39 | |

COMMITTEES: Compensation & Finance | DIRECTOR STATUS: INDEPENDENT — Vice Chair |

CURRENT POSITION: | | | |

–Co-Founder and Partner of Hill Path Capital, LP, a private investment firm investing in the equity and debt of public and private companies since 2016. Leadership, Strategy, Investments, Leisure & Hospitality, Entertainment, Finance and Governance |

PRIOR BUSINESS EXPERIENCE: | | |

–Apollo Global Management, Inc. a global alternative investment management firm: •Principal (2011-2016) Leadership, Strategy, Leisure & Hospitality, Entertainment, Finance and Governance – Goldman Sachs & Co., Inc, a multinational investment bank and financial services company: •Analyst, Consumer Retail Group, Investment Banking Division (2009-2011) Leadership, Strategy, Retail, Investment, Finance, Food & Beverage |

CURRENT PUBLIC COMPANY BOARDS: | | |

–Dave & Buster’s Entertainment, Inc. | –United Parks & Resorts, Inc. | –One Group Hospitality |

PRIOR COMPANY BOARDS: | | |

–CEC Entertainment, Inc. (n/k/a CEC Entertainment, LLC) | –Great Wolf Resorts, Inc. | –Principal Maritime Tankers Corp. | –Principal Chemical Carriers, LLC |

EDUCATION: | | | |

–B.A. Political Science and Certificate in Markets and Management, Duke University |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 5 |

| | | | | |

| Hamish A. Dodds |

DIRECTOR SINCE: 2017 | AGE: 68 |

COMMITTEES: Audit & Finance | DIRECTOR STATUS: INDEPENDENT |

RECENT POSITION: | |

–President and Chief Executive Officer of Hard Rock International, an owner, operator, and franchisor of restaurants, hotels, casinos, and live music venues in over seventy countries (Mar. 2004-February 2017) Leadership, Strategy, Operations, Finance, Global, Franchise, Entertainment, Gaming, Food & Beverage |

PRIOR BUSINESS EXPERIENCE: | |

–cbc (The Central American Bottling Corporation) (also known as CabCorp), a multi-Latin beverage company in more than 33 countries with strategic partners PepsiCo, Ambev and Beliv: •Chief Executive Officer (2002-2003) •Non-executive Director (2003-2010) Leadership, Strategy, Board Governance, Global, Distribution, Food & Beverage – PepsiCo, Inc., a multinational food, snack and beverage corporation: •Various management and financial positions including Division President and General Manager for beverage operations across Latin America, Europe and Middle East/North Africa (1989-2002) Accounting, Finance, Food & Beverage, Operations, Global –The Burton Group (now Arcadia Group) (an UK multinational retailing company) and Overseas Containers, Ltd. (an UK container shipping company): •Multiple management and financial positions (1982-1989) Accounting, Finance, Consumer Goods, Retail |

PUBLIC COMPANY BOARDS: | |

– Dave & Buster’s Entertainment, Inc. (Apr. 2017-present)

| –Pier 1 Imports, Inc. (Apr. 2010-Sep. 2020) |

PRIVATE COMPANY BOARDS: | |

–Fogo de Chao (Oct. 2018-Oct. 2023) | |

OTHER POSITIONS/MEMBERSHIPS: | |

–US Advisory Board, IESE Business School –Fellow Member, Chartered Management Accountants |

EDUCATION: | |

–B.A. Business Studies, Robert Gordon University, Scotland |

ACCOLADES: | |

–Honorary Doctorate, Business Administration, Robert Gordon University (2011) |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 6 |

| | | | | | | | |

| Nathaniel J. Lipman | | |

New Nominee Standing for Election at Annual Meeting | AGE: 60 |

| DIRECTOR STATUS: INDEPENDENT |

PRIOR BUSINESS EXPERIENCE: | | |

–Wolcott Holdings, LLC, a family investment office (Feb. 2022-present) –Tenerity, Inc. (f/k/a Affinion Group Holdings, Inc. and CX Loyalty, Inc.), a global provider of customer loyalty platforms and solutions •Senior Advisor (Apr. 2015-Jan. 2024) •Executive Chairman (Jul. 2012-Apr. 2015) •Chairman and Chief Executive Officer (Oct. 2005-Jul. 2012) Leadership, Strategy, Leisure & Hospitality, Finance and Governance, International, Marketing –Cendant Corporation, a global provider of customer loyalty platforms and solutions •President and Chief Executive Officer, Marketing Services Division (Apr. 2004-Oct. 2005) •President and Chief Executive Officer, Trilegiant (Cendant’s domestic membership business) (2002-Apr. 2004) •Senior Vice President, Corporate Development and Strategic Planning (June 1999-2002) Leadership, Strategy, Leisure & Hospitality, Finance and Governance, International, Marketing –Planet Hollywood, Inc., an international restaurant and entertainment brand •Executive Vice President, Strategic Development (Aug. 1996-May 1999) Leadership, Strategy, Leisure & Hospitality, Finance and Governance, International –House of Blues Entertainment, Inc., an international music entertainment brand •General Counsel (Apr. 1995-Jul. 1996) Leadership, Strategy, Leisure & Hospitality, Finance and Governance, International –The Walt Disney Company, a global entertainment company •Senior Corporate Counsel (May 1993-Apr. 1995) Leisure & Hospitality, Mergers & Acquisitions –Skadden, Arps, Slate, Meagher and Flom, LLP, an international law firm •Associate (Oct. 1989-May 1993) Mergers & Acquisitions

|

PUBLIC COMPANY BOARDS: | | |

–United Parks & Resorts Inc. (Jan. 2024-present) | –Apollo Strategic Growth Capital II, Inc. (2021-2023) | |

PRIVATE COMPANY BOARDS: | |

–Trusted Media Brands, Inc. (2018-present) | –Apollo Aligned Alternatives, Inc., (Jun. 2022-present) | –PLBY Group, Inc. (Observer) (2022-2023) |

–FTD.com •Chair of the Board (Jul. 2021) •Senior Advisor (Sep. 2019-Sep. 2021) | –Diamond Resorts International, Inc. (2017-2021) | –Redbox Automated Holdings, LLC, (2016-2021) |

EDUCATION: | | |

– B.A., Political Economy, University of California, Berkeley | –J.D., University of California, Los Angeles | |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 7 |

| | | | | | | | | | | |

| Scott Ross |

DIRECTOR SINCE: 2025 | AGE: 44 | |

COMMITTEES: Finance & Nominating and Corporate Governance | DIRECTOR STATUS: INDEPENDENT |

CURRENT POSITION: | | | |

–Founder and Managing Partner of Hill Path Capital, LP, a private investment firm investing in the equity and debt of public and private companies since 2016. Leadership, Strategy, Investments, Leisure & Hospitality, Entertainment, Finance and Governance |

PRIOR BUSINESS EXPERIENCE: | | |

–Apollo Global Management, Inc. a global alternative investment management firm: •Principal (2004-2008/2009-2014) Leadership, Strategy, Leisure & Hospitality, Entertainment, Finance and Governance – Goldman Sachs & Co., Inc, a multinational investment bank and financial services company: •Analyst, Principal Finance Group, Fixed Income, Currencies, and Commodities Division (Jun. 2002-Dec. 2004) Leadership, Strategy, Investment, Finance –Shumway Capital Partners, an investment company: •Analyst (Aug. 2008-Sep. 2009) Leadership, Strategy, Investment, Finance |

PUBLIC COMPANY BOARDS: | | |

–Current: Dave & Buster’s Entertainment, Inc. | –United Parks & Resorts, Inc. | –The One Group Hospitality, Inc. |

OTHER COMPANY BOARDS: | | |

–Prior: CEC Entertainment, Inc. | –Great Wolf Resorts, Inc. | –EVERTEC, Inc. | –Diamond Eagle Acquisition Corp. |

EDUCATION: | | | |

–B.A. Economics, Georgetown University (magna cum laude) |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 8 |

| | | | | | | | |

| Atish Shah | | |

DIRECTOR SINCE: 2021 | | AGE: 52 |

COMMITTEES: Audit & Nominating and Corporate Governance | DIRECTOR STATUS: INDEPENDENT |

CURRENT POSITION: | | |

–Executive Vice President, Chief Financial Officer and Treasurer of Xenia Hotels & Resorts, Inc., a NYSE-listed REIT investing in luxury and upper upscale hotels and resorts since April 2016. Leadership, Strategy, Investments, Leisure & Hospitality, Finance and Governance |

PRIOR BUSINESS EXPERIENCE: | | |

–Hyatt Hotels Corporation, a global hospitality company managing and franchising luxury and business hotels, resorts and vacation properties: • Multiple leadership positions (2009-2016), including Senior Vice President & Interim CFO (2015-2016) and Senior Vice President, Strategy, FP&A, Investor Relations (2012-2016) Leadership, Strategy, Leisure & Hospitality, Franchising, Finance and Governance –Lowe Enterprises, a private real estate company managing more than $6 billion in assets. • Senior Vice President, Portfolio Management (2008-2009) Leadership, Strategy, Investment, Finance – Hilton Hotels Corporation, a global hospitality company managing and franchising a broad portfolio of hotels and resorts. •Multiple investor relations, finance and e-business positions (1998-2007) Strategy, Investment, Finance, E-Commerce, Leisure & Hospitality –Coopers & Lybrand, LLP (n/k/a PwC), a Big Eight public accounting firm. • Associate, Hospitality Consulting Practice (1997-1998) Investment, Finance |

PUBLIC COMPANY BOARDS: | | |

–Current: Dave & Buster’s Entertainment, Inc. |

OTHER POSITIONS/MEMBERSHIPS: | |

– Director, Visit Orlando |

EDUCATION: | | |

– B.S. with honors, Cornell University | – M.M. Hospitality, Cornell University | –M.B.A.-The Wharton School, University of Pennsylvania |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 9 |

| | | | | |

| Kevin M. Sheehan | |

DIRECTOR SINCE: 2011 | AGE: 71 |

COMMITTEES: Finance | DIRECTOR STATUS: NOT INDEPENDENT — Chairman and Interim Chief Executive Officer |

CURRENT POSITIONS: | |

–Chair of the Board of Dave & Buster’s Entertainment, Inc. since April 2021 (and also served as Interim CEO from October 2021 to June 2022). Leadership, Strategy, Board Governance, Finance, Operations, Food & Beverage, Amusements/Gaming, Marketing, Consumer Insights, Global –Chair and Principal Owner of Mellon Stud Ventures, a family investment company with wide range of businesses since 2016. Leadership, Strategy, Board Governance, Finance, Global, Investments, Hospitality, Marketing |

PRIOR BUSINESS EXPERIENCE: | |

–Margaritaville at Sea, a cruise line owned by Mellon Stud Ventures •Chair and Principal Owner (2016-Oct. 2023) Leadership, Strategy, Board Governance, Hospitality, Finance, Global, Consumer Insights, Marketing –Scientific Games Corporation, a global leader in the gaming and lottery industries •Director (Oct. 2018) •Senior Advisor (Jun. 2018-Sep. 2018) •President and Chief Executive Officer (Aug. 2016-Jun. 2018) Leadership, Strategy, Board Governance, Gaming, Finance – Robert B. Willumstad School of Business, Adelphi University, a New York metropolitan area business school •John J. Phelan, Jr. Distinguished Visiting Professor of Business (February 2015-June 2016) •Distinguished Visiting Professor-Accounting, Finance and Economics (2005-2008) Strategy, Finance, Accounting – NCL Corporation, Ltd, a leading global cruise line operator: •Chief Executive Officer (November 2008-January 2015) •President (August 2010-January 2015; August 2008-March 2009) •Chief Financial Officer (2007-2010) Leadership, Strategy, Food & Beverage, Hospitality, Finance, Global, Consumer Insights, Marketing – Cerberus Capital Management LP (2006-2007), a global leader in private equity investments: •Consultant Finance, Private Equity, Strategic –Clayton Dubilier & Rice (2005-2006), one of the oldest private equity investment firms in the world: •Consultant Finance, Private Equity, Strategic – Cendant Corporation, a global business and consumer services provider: •Various executive roles, including, Chair and Chief Executive Officer of the Vehicle Services Division (including global responsibility for Avis Rent A Car, Budget Rent A Car, Budget Truck, PHH Fleet Management and Wright Express) (1996-2005) Leadership, Strategy, Finance, Global, Consumer Insights, Marketing |

PUBLIC COMPANY BOARDS: | |

–Dave & Buster’s Entertainment, Inc. (2011-present) | –Gannett Co., Inc., Director (2013-present), Lead Director (May 2019-present) |

– Navistar International Corporation (2018-2021) | –Hertz Global Holdings (2018-2021) |

OTHER POSITIONS/MEMBERSHIPS: | |

–Certified Public Accountant | |

EDUCATION: | |

–B.S. Hunter College | –M.B.A. New York University Graduate School of Business |

ACCOLADES: | |

–Named “Miami Ultimate CEO” by South Florida Business Journal (2011) – Ernst & Young Entrepreneur of the Year (2014 – Florida Region) |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 10 |

| | | | | | | | |

Allen R. Weiss | | |

New Nominee Standing for Election at Annual Meeting | AGE: 71 |

| DIRECTOR STATUS: INDEPENDENT |

PRIOR BUSINESS EXPERIENCE: | | |

–The Walt Disney Company, a global entertainment company (1972-2011) (Retired) •President, Worldwide Operations, Walt Disney Parks and Resorts (2005-Nov. 2011) •President, Walt Disney World Resort (1995-2005) •Executive Vice President, Walt Disney World Resort (1991-1995) •Vice President, Resort Operations Support (1987-1991) Leadership, Strategy, Leisure & Hospitality, Finance and Governance, International, Marketing

|

PUBLIC COMPANY BOARDS: | | |

–Dick’s Sporting Goods, Inc. (Jan. 2012-Aug. 2020)

| –Apollo Education Group, Inc. (Mar. 2012-Jan. 2017) | |

PRIVATE COMPANY BOARDS: | | |

–Alticor, Inc. (2012-Present) | –CEC Entertainment, Inc., n/k/a CEC Entertainment, LLC (Jun. 2014-Dec. 2020) | –ClubCorp (now Invited Clubs) (Feb. 2018-Apr. 2020) |

–Diamond Resorts International, Inc. (Nov. 2016-May 2021) | | |

EDUCATION: | | |

– B.S., Business Administration, University of Central Florida | – M.B.A., Crummer Graduate School of Business, Rollins College | –Certified Public Accountant |

| | |

The Board of Directors recommends a vote FOR the election of each of the nominated directors. |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 11 |

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has appointed KPMG LLP (“KPMG”) as the Company’s independent registered public accounting firm to conduct the audit of our consolidated financial statements and the effectiveness of our internal controls over financial reporting for the fiscal year 2025 and recommends that the shareholders vote for ratification of this appointment. KPMG has been engaged as our independent registered public accounting firm since 2010, and the Audit Committee and the Board believe that the continued retention of KPMG as the Company’s independent registered public accounting firm for the 2025 fiscal year is in the best interests of the Company and its shareholders. As a matter of good corporate governance, the Audit Committee has requested the Board of Directors to submit the selection of KPMG as the Company’s independent registered public accounting firm for fiscal 2025 to shareholders for ratification. In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection but may still decide to retain KPMG. Even if the selection of KPMG is ratified by the shareholders, the Audit Committee has the discretion to select another auditor at any time if it determines that a change would be in the best interests of the Company or its shareholders. We expect representatives of KPMG to be present at the Annual Meeting. They will have the opportunity to make a statement at the Annual Meeting if they desire to do so and will be available to respond to appropriate questions.

The following table sets forth the fees (dollars shown are in thousands) for professional audit services and fees for other services provided to the Company by KPMG, for fiscal 2024, which ended on February 4, 2025, and fiscal 2023, which ended on February 4, 2024:

| | | | | | | | | | | |

| Fiscal 2024 | | Fiscal 2023 |

Audit Fee (1) | $ | 1,230 | | | $ | 1,155 | |

Audit-Related Fees (2) | 89 | | | 400 | |

Tax Fees (3) | 131 | | | 33 | |

| Total | $ | 1,450 | | | $ | 1,588 | |

(1)Includes fees for services for the audit of the Company’s annual financial statements, the reviews of the interim financial statements, audit of the Company’s internal control over financial reporting, and assistance with Securities and Exchange Commission (“SEC”) filings.

(2)Fiscal 2024 and fiscal 2023 includes real time assessment of the ERP system the Company implemented in fiscal 2024.

(3)Includes transfer pricing study.

The Audit Committee has established a policy whereby the outside auditors are required to annually provide service-specific fee estimates and seek pre-approval of all audit, audit-related, tax and other services prior to the performance of any such services. Individual engagements anticipated to exceed the pre-approved thresholds must be separately approved by the Audit Committee. For both fiscal 2024 and 2023, the Audit Committee pre-approved 100% of all services provided by KPMG and concluded that the provision of such services by KPMG was compatible with such firm’s independence.

| | |

The Board of Directors recommends a vote FOR the ratification of the appointment of KPMG. |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 12 |

PROPOSAL NO. 3

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As required by Section 14A of the Securities Exchange Act of 1934 (as amended, the "Exchange Act") and the related SEC rules, we are asking you to approve, on an advisory, non-binding basis, the compensation awarded to our named executive officers, as we have described in the Executive Compensation section of this Proxy Statement. The vote on this matter is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the policies and practices described in this Proxy Statement.

As described in detail in the Compensation Discussion and Analysis section beginning on page 26, the Compensation Committee oversees our executive compensation program and compensation awarded, adopting changes to the program and awarding compensation as appropriate to reflect the Company’s circumstances and to promote the main objectives of the program. These objectives include: to align pay to performance; to provide market-competitive pay; and to create sustained shareholder value. We are asking you to indicate your support for our named executive officer compensation. We believe that the information we have provided in this Proxy Statement demonstrates that our compensation program is designed appropriately and works to attract, retain and motivate a highly successful team to manage our Company and to ensure that the interests of our executive officers, including our named executive officers, are aligned with your interest in long-term value creation.

Accordingly, we ask you to approve the following resolution at the Annual Meeting:

RESOLVED, that the shareholders of Dave & Buster’s Entertainment, Inc. approve the compensation awarded to the Company’s named executive officers, as disclosed in this Proxy Statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, the compensation tables and the accompanying narrative discussion.

Although your vote is non-binding, the Board and Compensation Committee will review the voting results and consider your concerns in their continued evaluation of the Company’s compensation program. Because this vote is advisory in nature, it will not affect any compensation already paid or awarded to any named executive officer, it will not be binding or overrule any decision by the Board, and it will not restrict or limit the ability of the shareholders to make proposals for inclusion in proxy materials related to executive compensation.

At the 2022 annual meeting of shareholders, our shareholders voted in favor of holding an advisory vote to approve executive compensation every year. The Board considered these voting results and decided to adopt a policy providing for an annual advisory shareholder vote to approve our executive compensation. The next shareholder advisory vote to approve executive compensation will occur at the 2026 annual meeting of shareholders.

| | |

The Board of Directors recommends an advisory vote FOR the approval of our executive compensation. |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 13 |

PROPOSAL NO. 4

APPROVAL OF 2025 OMNIBUS

INCENTIVE PLAN

On December 5, 2024, upon recommendation of our Compensation Committee, our Board of Directors adopted, subject to shareholder approval at the annual meeting, the Dave & Buster’s Entertainment, Inc. 2025 Omnibus Incentive Plan (as amended from time to time, the “2025 Plan”), covering the issuance of up to 4,000,000 shares of Common Stock of the Company. The purpose of the Plan is to strengthen our ability to attract, retain and motivate officers, employees, non-employee directors and consultants providing services to the Company and to promote the success of the Company’s business by providing participants with appropriate incentives.

The use of equity incentive awards has historically been a key component of our compensation programs. We previously awarded stock-based compensation instruments, including performance awards and restricted stock units, under the 2014 Omnibus Incentive Plan (the "2014 Plan"). However, the 2014 Plan expired in October 2024 and we accordingly propose to replace the 2014 Plan with the 2025 Plan.

The shares authorized for issuance pursuant to the 2025 Plan would include an aggregate of 483,986 shares granted to our employees, including our executive officers, as a contingent retention award in December 2024, as well as contingent awards granted to Interim CEO Kevin Sheehan pursuant to his letter agreement with the Company dated December 9, 2024 (the “Contingent Awards”), all of which are contingent upon shareholder approval of this Proposal No. 4 to approve the 2025 Plan. The Contingent Awards consist of 253,086 shares subject to time-based restricted stock units (“RSUs”), 127,990 shares subject to performance-based restricted stock units (“PSUs”), and 102,910 shares subject to stock options, which are intended to retain and reward grantees based on their continued service and/or the Company's performance.

If the 2025 Plan is not approved by our shareholders, all of the Contingent Awards will automatically be forfeited and we will be unable to make new equity grants to motivate and retain key personnel or incentivize non-employee directors to serve on our Board of Directors, which could have an adverse impact on our business. We would also be at a disadvantage against our competitors for attracting, retaining, and motivating individuals critical to our success. We will also be compelled to replace equity incentive awards with cash awards, which may not align the interests of our executives and employees with those of our shareholders as effectively as equity incentive awards. Therefore, the approval of the 2025 Plan is essential to our future performance and long-term success.

Accordingly, the Board of Directors has approved, and is asking the Company’s shareholders to approve, the 2025 Plan. In general, shareholder approval of the 2025 Plan is necessary in order for us to meet the shareholder approval requirements of the NASDAQ, and grant stock options that qualify as incentive stock options, or ISOs, as defined under Section 422 of the Code. As of April 21, 2025 the closing price of our common stock as reported on NASDAQ was $19.46 per share.

A summary of the 2025 Plan is set forth below. The summary of the 2025 Plan is qualified in its entirety by the full text of the 2025 Plan, which is included in this Proxy Statement as Appendix B.

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 14 |

Highlights of the Shareholder Proposal

| | | | | |

1 What is the 2025 Omnibus Incentive Plan? | •The 2025 Plan is intended to be the primary vehicle used to promote the three-core values that make up Dave and Buster’s executive compensation philosophy: (1) pay for performance, (2) market competitive pay, and (3) sustained shareholder value creation. •Annual and long-term incentive compensation plans, including the Executive Incentive Plan, will be created and administered under the 2025 Plan. |

| |

2 Who participates in the Plan? | •The 2025 Plan will not be limited to executives. It is a broad-based plan with approximately 23,420 team members eligible for participation as of February 4, 2025, including our ten (10) executive officers, as well as seven (7) non-employee directors, eligible for cash and/or equity-based incentives. •These incentives are critical to how we attract, reward, and motivate the critical talent, at all levels of the organization, needed to achieve and exceed the Company’s key strategic objectives. We have already granted an aggregate of 483,986 Contingent Awards, which are contingent upon shareholder approval of this Proposal No. 4, in order to motivate and retain some of our key team members. •The equity-based incentives that can be granted under this plan are intended to align our employees’ interests with those of our shareholders and foster an employee ownership culture as well as promote retention of key talent. |

| | | | | |

3 How many shares are being requested? | •We are seeking shareholder approval for four million shares under the 2025 Plan. •We estimate this will allow us to continue to make responsible and market competitive equity-based awards up to the next two to three years and assumes the achievement of target financial and market performance under Dave and Buster’s long-term performance-based incentives. •The estimated reserve life of two to three years is materially lower than the three to five-year reserve commonly requested by other publicly traded companies. |

| |

4 How does the historical share usage compare to markets? | •Dave and Buster’s has a history of responsible share usage. We thoughtfully manage share dilution and closely monitor our annual run rate and overhang to ensure we only grant an appropriate number of equity-based incentives we believe are necessary to attract, reward, motivate and retain employees, officers, consultants and non-employee directors. •Run Rate. Our emphasis on responsible share usage is evidenced by our historical run rate, which has been conservative relative to our peer group. Our two-year average is significant less than that of the peer group median. Run rate is defined as the total number of shares distributed expressed as a percent of the weighted average common shares outstanding for each fiscal year. Peer group data based on available public SEC filings as of May 8, 2025. |

| 2-Year Run Rate 2023 2024 Avg |

| Dave and Buster’s 0.8% 0.7% 0.7% |

| Peer Group Median 1.2% 1.3% 1.3% |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 15 |

| | | | | |

| •Overhang. Overhang is a common measure of equity dilution. We define overhang as the sum of the number of outstanding shares and the number of shares available for future grant divided by the sum of the number of outstanding and unvested shares and the number of shares available for future grant. For the calendar year ending December 31, 2024, D&B’s overhang of 4.3% was the lowest among peer companies, with median peer overhang at 13.2%.

|

| Overhang 2024 |

| Dave and Buster’s 4.3% |

| Peer Group Median 13.2% |

| |

| |

| |

| | | | | |

5 What key features are included in the 2025 Plan? | •The 2025 Plan includes key governance features and market best practices that serve to protect shareholder interests, such as:

O No Liberal Share Counting. The 2025 Plan prohibits the reuse of shares withheld or delivered to satisfy the exercise price of a stock option or to satisfy tax withholding requirements with respect to stock options or stock awards. O No Stock Option Repricing without Shareholder Approval. The 2025 Plan prohibits stock option repricing, and the cash buyout of underwater stock options, in the absence of shareholder approval. O No Excise Tax Gross-Up. The 2025 Plan does not provide for any tax gross-ups. O No Single-Trigger Equity Vesting. The 2025 Plan does not provide for an automatic vesting of equity awards upon a change in control. O No Evergreen Provision. There is no automatic increase in the shares available for grant in this plan. ▪Limit on Non-Employee Director Awards. The sum of the grant date fair value of all equity-based awards and the maximum amount that may become payable pursuant to all cash-based awards that may be as compensation for services as a non-employee director during any calendar year may not exceed $750,000. ▪Independent plan administrator The Compensation Committee, consisting of independent members of our board of directors, is charged with the administration of the 2025 Plan. O Clawback. Cash and equity-based awards made under this plan are subject to the Company’s clawback policy. O Dividend Treatment. The plan prohibits payment of any dividends or dividend equivalents in respect of shares underlying an unvested award before the underlying award vests. |

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 16 |

Summary of the Plan

A summary of the principal provisions of the 2025 Plan is set forth below. The summary is qualified by reference to the full text of the 2025 Plan, which is attached as Appendix B to this Proxy Statement.

Eligibility and Administration

Persons eligible for awards under the 2025 Plan are (i) all employees of the Company and its subsidiaries and affiliates, (ii) non-employee directors and (iii) certain independent contractors. The 2025 Plan is administered by the Compensation Committee of our Board of Directors (or, with respect to awards granted to non-employee directors, our Board of Directors), each of which may delegate its duties and responsibilities to committees of our directors and/or officers (referred to collectively as the plan administrator below), subject to certain limitations that may be imposed under Section 16 of the Exchange Act and other laws, as applicable. The plan administrator has the authority to make all determinations and interpretations under, prescribe all forms for use with, and adopt rules for the administration of, the 2025 Plan, subject to its express terms and conditions. The plan administrator also sets the terms and conditions of all awards under the 2025 Plan, including any vesting and vesting acceleration conditions.

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 17 |

Shares Available and Limitations on Awards

If our stockholders approve the 2025 Plan, the number of shares available for issuance under the 2025 Plan will be equal to 4,000,000 shares of our common stock. The maximum number of shares that may be issued under the 2025 Plan upon the exercise of ISOs is 4,000,000. The shares issued under the 2025 Plan may consist, in whole or in part, of authorized and unissued shares, treasury shares or shares purchased in the open market or otherwise.

If all or any part of an award under the 2025 Plan is forfeited, expires, lapses or is terminated, is converted into an award in respect of shares of another entity in connection with a spin-off or other similar event, exchanged or settled for cash, surrendered, repurchased, or otherwise terminates without issuance of shares (in whole or in part), in a manner that results in us acquiring the underlying shares at a price not greater than the price paid by the participant for such shares or not issuing the underlying shares, such unused shares subject to the award at such time will be available for future grants under the 2025 Plan. In addition, the following items will not be counted against the shares available for issuance under the 2025 Plan: (i) the payment of dividends or dividend equivalents in cash in conjunction with any outstanding awards; and (ii) shares issued in assumption of, or in substitution for, any outstanding awards of any entity acquired in any form of combination by us or any of our subsidiaries, except shares acquired upon the exercise of ISOs will count against the maximum number of shares that may be issued under the 2025 Plan pursuant to the exercise of ISOs.

The following types of shares will not be added back to the shares available for issuance under the 2025 Plan: (i) shares tendered by a participant or withheld by us in payment of the exercise price of an option; (ii) shares tendered by a participant or withheld to satisfy any tax withholding obligation with respect to an award; (iii) shares subject to a stock appreciation right, or SAR, that are not issued in connection with the stock settlement of the SAR on exercise; and (iv) shares purchased on the open market with the cash proceeds from the exercise of options.

In addition, under the 2025 Plan, the sum of the grant date fair value (determined as of the grant date in accordance with applicable financial accounting rules) of all equity-based awards and the maximum amount that may become payable pursuant to all cash-based awards that may be granted to a service provider as compensation for services as a non-employee director during any calendar year may not exceed $750,000.

Awards

The 2025 Plan provides that the plan administrator may grant or issue stock options, including ISOs and nonqualified stock options, or NSOs, SARs, restricted stock, restricted stock units, or RSUs, other stock-based awards, cash-based awards, dividend equivalents, or any combination thereof. Each award will be set forth in a separate agreement with the person receiving the award and will indicate the type, terms and conditions of the award.

• Stock Options. Stock options provide for the purchase of shares of our common stock in the future at an exercise price set on the grant date. ISOs, by contrast to NSOs, may provide tax deferral beyond exercise and favorable capital gains tax treatment to their holders if certain holding period and other requirements of the Internal Revenue Code are satisfied. The exercise price of a stock option generally will not be less than 100% of the fair market value of the underlying share on the date of grant (or 110% in the case of ISOs granted to certain significant stockholders), except with respect to certain substitute options granted in connection with a corporate transaction. The term of a stock option may not be longer than ten years (or five years in the case of ISOs granted to certain significant stockholders). Vesting conditions determined by the plan administrator may apply to stock options and may include continued service, performance and/or other conditions.

• SARs. SARs entitle their holder, upon exercise, to receive from us an amount equal to the appreciation of the shares subject to the award between the grant date and the exercise date. The exercise price of a SAR will generally not be less than 100% of the fair market value of the underlying share on the date of grant (except with respect to certain substitute SARs granted in connection with a corporate transaction), and the term of a SAR may not be longer than ten years. SARs may be granted in connection with stock options, or separately. Vesting conditions determined by the plan administrator may apply to SARs and may include continued service, performance and/or other conditions.

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 18 |

• Restricted Stock and RSUs. Restricted stock is an award of nontransferable shares of our common stock that remain forfeitable unless and until specified conditions are met, and which may be subject to a purchase price. RSUs are contractual promises to deliver shares of our common stock in the future, which may also remain forfeitable unless and until specified conditions are met. Delivery of the shares underlying RSUs may be deferred under the terms of the award or at the election of the participant, if the plan administrator permits such a deferral. Conditions applicable to restricted stock and RSUs may be based on continuing service, the attainment of performance goals and/or such other conditions as the plan administrator may determine. With respect to a restricted stock award, dividends which are paid prior to vesting shall only be paid out to the extent that the vesting conditions are subsequently satisfied and the share of restricted stock vests.

• Other Stock or Cash Based Awards. Other stock-based awards and cash-based awards are awards of fully vested shares of our common stock, cash and/or other awards valued wholly or partially by referring to, or otherwise based on, shares of our common stock. Other stock-based awards and cash-based awards can be granted alone or in addition to any other awards granted under the 2025 Plan. The plan administrator will determine the terms and conditions of other stock-based or cash-based awards, which may include vesting conditions based on continued service, performance and/or other conditions.

• Dividend Equivalents. Dividend equivalents represent the right to receive the equivalent value of dividends paid on shares of our common stock and may be granted in tandem with awards other than stock options or SARs. Dividend equivalents may not be paid on awards granted under the 2025 Plan subject to vesting unless and until such awards have vested.

Any award may be granted as a performance-based award, meaning that the award will be subject to vesting and/or payment based on the attainment of specified performance goals. Performance-based awards include any of the foregoing awards that are granted subject to vesting and/or payment based on the attainment of specified performance goals or other criteria the plan administrator may determine, which may or may not be objectively determinable. Performance criteria upon which performance goals are established by the plan administrator may include but are not limited to: (a) consolidated earnings before or after taxes (including earnings before interest, taxes, depreciation and amortization (“EBITDA”)); (b) net income before or after taxes; (c) operating income; (d) earnings per Share; (e) book value per Share; (f) return on shareholders’ equity; (g) expense management; (h) return on investment; (i) improvements in capital structure; (j) profitability of an identifiable business unit or product; (k) maintenance or improvement of profit margins; (l) stock price; (m) market share; (n) revenues or sales; (o) costs; (p) cash flow (including, but not limited to, operating cash flow and free cash flow); (q) working capital; (r) return on assets; (s) attainment of objectives relating to store remodels or repair and maintenance; (t) staff training; (u) corporate social responsibility policy implementation; (v) economic value added; (w) debt reduction; (x) completion of acquisitions or divestitures; (y) operating efficiency; (z) sales per square foot; (aa) revenue mix; (bb) capital expenditures versus budgeted expenditures (total, exclusive of IT/Games, or maintenance only); (cc) operating income; (dd) income from franchise units; (ee) unit‑level EBITDA less G&A expenses; (ff) manager’s operating contribution; (gg) regional operating contribution; (hh) profitability of various revenue streams; (ii) cash flow per share (before and after dividends or before and after debt payments); (jj) total shareholder return (relative to industry/peer group and/or absolute); (kk) lease executions; (ll) franchise unit growth; (mm) employee turnover/retention (for entire population or a subset of employee population); (nn) employee satisfaction; (oo) guest satisfaction (overall and/or specific metrics); (pp) guest traffic; (qq) guest loyalty (including but not limited to participation and satisfaction); (rr) attainment of strategic and operational initiatives (MBOs); (ss) marketing/brand awareness scores; (tt) third‑party operational/compliance audits; (uu) balanced scorecard; (vv) culinary product pipeline goals; (ww) guest experience; (xx) inventory turnover; (yy) brand positioning goals; (zz) comparable store sales (aaa) return on invested capital; (bbb) new store openings; (ccc) development pipeline goals; (ddd) attainment of objectives relating to acquisitions or divestitures; (eee) attainment of specified business expansion goals; (fff) expansion of specified programs or initiatives; and (ggg) any other metric as may be determined by the plan administrator.

Certain Transactions

The plan administrator has broad discretion to take action under the 2025 Plan, as well as make adjustments to the number and kind of shares or other property that may be issued under the 2025 Plan or outstanding awards, as well as the terms and conditions of awards under the 2025 Plan, to prevent the dilution or enlargement of intended benefits in the event of certain transactions and events affecting our common stock, such as stock dividends, stock splits, mergers, acquisitions, consolidations, recapitalizations, reorganizations

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 19 |

and other corporate transactions. In the event of a corporate transaction, including a change of control (each as defined in the 2025 Plan), the plan administrator may in its discretion provide for: (a) continuation or assumption of outstanding awards under the 2025 Plan by the Company (if it is the surviving company or corporation) or by the surviving company or corporation or its parent; (b) substitution by the surviving company or corporation or its parent of awards with substantially the same terms for such outstanding awards; (c) accelerated exercisability, vesting and/or lapse of restrictions under outstanding awards immediately prior to the occurrence of such event; (d) upon written notice, provide that any outstanding awards must be exercised, to the extent then exercisable, during a reasonable period of time immediately prior to the scheduled consummation of the event, or such other period as determined by the plan administrator (contingent upon the consummation of the event), and at the end of such period, such awards shall terminate to the extent not so exercised within the relevant period; and (e) cancellation of all or any portion of outstanding awards for fair value (as determined in the sole discretion of the plan administrator and which may be zero) which, in the case of options and SARs or similar awards, if the plan administrator so determines, may equal the excess, if any, of the value of the consideration to be paid in the transaction to holders of the same number of shares subject to such awards (or, if no such consideration is paid, the fair market value of the shares subject to such outstanding awards or portion thereof being cancelled over the aggregate exercise price or grant price, as applicable, with respect to such awards or portion thereof being cancelled (which may be zero)).

In addition, in the event of certain non-reciprocal transactions with our stockholders known as “equity restructurings,” the plan administrator will make equitable adjustments to the 2025 Plan and outstanding awards.

Amendments; Duration

The plan administrator may amend, alter, suspend, discontinue, or terminate (an “Action”) the 2025 Plan or any portion thereof or any award (or award agreement) thereunder at any time; provided, that no such Action shall be made without shareholder approval (i) if such approval is necessary to comply with any tax or regulatory requirement applicable to the 2025 Plan, (ii) if such Action increases the number of shares available under the 2025 Plan, (iii) if such Action results in a material increase in benefits permitted under the 2025 Plan (but excluding increases that are immaterial or that are minor and to benefit the administration of the 2025 Plan, to take account of any changes in applicable law, or to obtain or maintain favorable tax, exchange, or regulatory treatment for the Company) or a change in eligibility requirements under the 2025 Plan, or (iv) for any Action that results in a reduction of the exercise price or grant price of an option or SAR, or cancellation of an option or SAR in exchange for cash, or for other awards, with a lower exercise price or grant price. Further, the written consent of the affected participant is required if such Action would materially diminish the rights of the participant under a previously granted award. However, the plan administrator may amend the Plan, any Award or any award agreement without consent in such manner as it deems necessary to comply with applicable laws, including without limitation, the Dodd-Frank Wall Street Reform and Consumer Protection Act.

No ISOs may be granted pursuant to the 2025 Plan after the tenth anniversary of December 5, 2024, the date our Board of Directors approved the 2025 Plan.

Adjustments, Claw-Back Provisions, Transferability and Participant Payments

The plan administrator may modify awards granted to participants who are foreign nationals or employed outside the United States or establish subplans or procedures to address differences in laws, rules, regulations or customs of such foreign jurisdictions.. All awards will be subject to the provisions of any claw-back policy implemented by our company to the extent set forth in such claw-back policy and/or in the applicable award agreement. With limited exceptions for estate planning, certain beneficiary designations and the laws of descent and distribution, awards under the 2025 Plan are generally non-transferable prior to vesting, and are exercisable only by the participant, unless otherwise determined by the plan administrator. With regard to tax withholding, exercise price and purchase price obligations arising in connection with awards under the 2025 Plan, the plan administrator may, in its discretion, accept cash or check, shares of our common stock that meet specified conditions, selling shares issuable pursuant to an award on the public market or such other consideration as it deems suitable.

| | | | | |

| Dave & Buster’s Entertainment, Inc. | 20 |

Material U.S. Federal Income Tax Consequences

The following is a general summary under current law of the principal United States federal income tax consequences related to awards under the 2025 Plan. This summary deals with the general federal income tax principles that apply and is provided only for general information. Some kinds of taxes, such as state, local and foreign income taxes and federal employment taxes, are not discussed. This summary is not intended as tax advice to participants, who should consult their own tax advisors.

•Nonqualified Stock Options. If a participant is granted an NSO under the 2025 Plan, the participant should not have taxable income on the grant of the option. Generally, the participant should recognize ordinary income at the time of exercise in an amount equal to the fair market value of the shares acquired on the date of exercise, less the exercise price paid for the shares. The participant’s basis in the common stock for purposes of determining gain or loss on a subsequent sale or disposition of such shares generally will be the fair market value of our common stock on the date the participant exercises such option. Any subsequent gain or loss will be taxable as a long-term or short-term capital gain or loss. We or our subsidiaries or affiliates generally should be entitled to a federal income tax deduction at the time and for the same amount as the participant recognizes ordinary income.

•Incentive Stock Options. A participant should not recognize taxable income upon grant or exercise of an ISO. However, the excess of the fair market value of the shares of our common stock received upon exercise over the option exercise price is an item of tax preference income potentially subject to the alternative minimum tax. If stock acquired upon exercise of an ISO is held for a minimum of two years from the date of grant and one year from the date of exercise and otherwise satisfies the ISO requirements, the gain or loss (in an amount equal to the difference between the fair market value on the date of disposition and the exercise price) upon disposition of the stock will be treated as a long-term capital gain or loss, and we will not be entitled to any deduction. If the holding period requirements are not met, the ISO will be treated as one that does not meet the requirements of the Code for ISOs and the participant will recognize ordinary income at the time of the disposition equal to the excess of the fair market value of the shares at the time of exercise over the exercise price (or if less, the amount realized in the disposition over the exercise price), with any remaining gain or loss being treated as capital gain or capital loss. We or our subsidiaries or affiliates generally are not entitled to a federal income tax deduction upon either the exercise of an ISO or upon disposition of the shares acquired pursuant to such exercise, except to the extent that the participant recognizes ordinary income on disposition of the shares.

•Other Awards. The current federal income tax consequences of other awards authorized under the 2025 Plan generally follow certain basic patterns: SARs are taxed and deductible in substantially the same manner as NSOs; nontransferable restricted stock subject to a substantial risk of forfeiture results in income recognition equal to the excess of the fair market value over the price paid, if any, only at the time the restrictions lapse (unless the recipient elects to accelerate recognition as of the date of grant through a Code Section 83(b) election, in which case ordinary income is recognized on the date of grant in an amount equal to the excess of the fair market value of the shares on the date of grant over the price paid, if any); and restricted stock units, dividend equivalents and other stock-based awards or cash-based awards are generally subject to tax at the time of payment. We or our subsidiaries or affiliates generally should be entitled to a federal income tax deduction at the time and for the same amount as the participant recognizes ordinary income.

•Limitation on the Employer’s Compensation Deduction. Section 162(m) of the Code limits the deduction certain employers may take for otherwise deductible compensation payable to certain executive officers of the employer to the extent the compensation paid to such an officer for the year exceeds $1 million. Prior to the TCJA, the deduction limit did not apply to certain “performance-based” compensation which conformed to certain conditions stated under the Code and related regulations. As part of the TCJA, the ability to rely on this qualified “performance-based” compensation exception was eliminated.