Exhibit 4.1

TERMS OF

Series B Convertible Preferred Shares,

par value US$0.00005 per share,

OF

GDS HOLDINGS LIMITED

The designations, powers, preferences and relative, participating, optional or other special rights, and the qualifications, limitations or restrictions thereof, to be attached to the Series B Convertible Preferred Shares, par value US$0.00005 per share, of GDS Holdings Limited (the “Company”) are set out below:

Section 1. Designation. The shares of such series shall be designated “Series B Convertible Preferred Shares,” and the number of shares constituting such series of preferred shares shall be 300,000 (the “Series B Convertible Preferred Shares”). The number of Series B Convertible Preferred Shares may be increased or decreased by resolution of the Board and the approval by the Holders of at least 75% of the then outstanding Series B Convertible Preferred Shares, voting as a separate class, together with any approval of members required for increasing the authorized share capital of the Company in accordance with the Memorandum and Articles (as herein defined); provided that no decrease shall reduce the number of Series B Convertible Preferred Shares to a number less than the number of shares of such series then outstanding.

Section 2. Currency; Board lot. All Series B Convertible Preferred Shares shall be denominated in United States currency, and all payments and distributions thereon or with respect thereto shall be made in United States currency. All references herein to “US$” or “dollars” or “US dollars” refer to United States currency. The Series B Convertible Preferred Shares shall be issued in board lots of 200 shares.

Section 3. Ranking. The Series B Convertible Preferred Shares shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank senior to each other class or series of shares of the Company that the Company may issue in the future the terms of which do not expressly provide that such class or series ranks equally with, or senior to, the Series B Convertible Preferred Shares, with respect to dividend rights and/or rights upon liquidation, winding up or dissolution, including, without limitation, the Class A ordinary shares of the Company, par value US$0.00005 per share (the “Class A Ordinary Shares”) and the Class B ordinary shares of the Company, par value US$0.00005 per share (the “Class B Ordinary Shares”, together with the Class A Ordinary Shares, the “Ordinary Shares”) (such junior shares being referred to hereinafter collectively as “Junior Shares”). The Series B Convertible Preferred Shares shall rank equally with the Company’s issued and outstanding Series A Convertible Preferred Shares, which were issued on March 13, 2019.

The Series B Convertible Preferred Shares shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank equally with each other class or series of shares of the Company that the Company may issue in the future the terms of which expressly provide that such class or series shall rank equally with the Series B Convertible Preferred Shares with respect to dividend rights and rights upon liquidation, winding up or dissolution (“Parity Shares”).

The Series B Convertible Preferred Shares shall, with respect to dividend rights and rights upon liquidation, winding up or dissolution, rank junior to each other class or series of shares of the Company that the Company may issue in the future the terms of which expressly provide that such class or series shall rank senior to the Series B Convertible Preferred Shares with respect to dividend rights and rights upon liquidation, winding up or dissolution. The Series B Convertible Preferred Shares shall also rank junior to the Company’s existing and future indebtedness.

Section 4. Dividends.

(a) The Holders of Series B Convertible Preferred Shares shall be entitled to receive, in priority to the holders of the Junior Shares, to the fullest extent permitted by law, cumulative preferred dividends per Series B Convertible Preferred Share of an amount equal to (i) if such dividend is paid in cash, 3.75% per annum (as may be adjusted as described below, the “Regular Dividend Rate”) or (ii) if such dividend is paid in PIK Shares (as defined herein), 4.75% per annum (as may be adjusted as described below, the “PIK Rate”), in each case, of the Stated Value (as herein defined) of each Series B Convertible Preferred Share, payable quarterly in arrears in accordance with Section 4(b), before any dividends shall be declared, set apart for or paid on the Junior Shares (such preferred dividends, the “Regular Dividends”). For purposes hereof, the term “Stated Value” shall mean US$1,000 per Series B Convertible Preferred Share, as may be adjusted as described in Section 4(c). In the event that the Company has not redeemed all of the Series B Convertible Preferred Shares outstanding as of the sixth anniversary of the Issue Date pursuant to Section 8(a), the Regular Dividends for such outstanding Series B Convertible Preferred Shares, notwithstanding Section 4(e) below, shall become payable in cash only thereafter, and the Regular Dividend Rate shall, as of the immediately succeeding Regular Dividend Period (as herein defined) following the sixth anniversary of the Issue Date, be increased by an additional 3.0% per annum of the Stated Value of each share of Series B Convertible Preferred Shares, and such adjusted Regular Dividend Rate shall be further increased by 50 basis points per each Regular Dividend Period thereafter for so long as any Series B Convertible Preferred Shares remain outstanding.

(b) Regular Dividends shall be payable quarterly in arrears on March 15, June 15, September 15 and December 15 of each year (unless any such day is not a Business Day, in which event such Regular Dividends shall be payable on the next succeeding Business Day, without accrual to the actual payment date), commencing on March 15, 2026 (each such payment date being a “Regular Dividend Payment Date,” and the period from the Issue Date to the first Regular Dividend Payment Date and each such quarterly period thereafter being a “Regular Dividend Period”). The amount of Regular Dividends payable on the Series B Convertible Preferred Shares for any period shall be computed on the basis of a 360-day year and a 30-day month.

(c) Regular Dividends shall begin to accrue and be cumulative from the Issue Date (and with respect to PIK Shares (as herein defined), from the relevant Regular Dividend Payment Date in respect of which such PIK Shares were issued or were scheduled to be issued). For the avoidance of doubt, dividends shall accumulate whether or not in any Regular Dividend Period there have been funds of the Company legally available for the payment of such dividends, and furthermore, if a Regular Dividend, or any portion thereof, has accrued but has not been paid out in cash or in PIK Shares, then such Regular Dividend shall be paid out and issued, or deemed issued, in PIK Shares.

(d) Except as otherwise provided herein, if at any time the Company pays less than the total amount of Regular Dividends then accumulated with respect to the Series B Convertible Preferred Shares, such payment shall be distributed pro rata among the Holders thereof based upon the Stated Value on all Series B Convertible Preferred Shares held by each such Holder. When Regular Dividends are not paid in full upon the Series B Convertible Preferred Shares, all Regular Dividends declared on Series B Convertible Preferred Shares and any other Parity Shares shall be paid pro rata so that the amount of Regular Dividends so declared on the Series B Convertible Preferred Shares and each such other class or series of Parity Shares shall in all cases bear to each other the same ratio as accumulated Regular Dividends (for the full amount of dividends that would be payable for the most recently payable dividend period if dividends were declared in full on non-cumulative Parity Shares) on the Series B Convertible Preferred Shares and such other class or series of Parity Shares bear to each other.

-2-

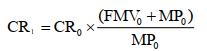

(e) The Regular Dividends may, at the option of the Company in its sole and absolute discretion, to the fullest extent permitted by law and except where required pursuant to Section 4(a) to be paid in cash only, be paid in cash or in additional duly authorized, validly issued and fully paid and non-assessable Series B Convertible Preferred Shares in lieu of cash (such additional Series B Convertible Preferred Shares, the “PIK Shares”), or a combination thereof. With respect to the payment of any Regular Dividends (or any portion thereof) in PIK Shares, the number of PIK Shares to be issued in payment of such Regular Dividend (or such portion thereof) with respect to each outstanding Series B Convertible Preferred Share shall be calculated as the Stated Value per Series B Convertible Preferred Share times the PIK Rate but minus the cash dividend (per each Series B Convertible Preferred Share) already made during the relevant Regular Dividend Period divided by the Stated Value per Series B Convertible Preferred Shares. The payment of any Regular Dividend (or any portion thereof) in PIK Shares may be issued in the form of fractional Series B Convertible Preferred Shares, provided, however, for the avoidance of doubt, that in connection with any conversion of Series B Convertible Preferred Shares into Class A Ordinary Shares or ADSs, any amounts corresponding to a fractional Class A Ordinary Share or ADS shall be paid in cash (unless there are no legally available funds with which to make such cash payment, in which event such cash payment shall be made as soon as possible thereafter).

(f) Each Regular Dividend shall be payable to the Holders of record of Series B Convertible Preferred Shares as they appear on the register of members of the Company at the Close of Business on the fifteenth (15th) day preceding the Regular Dividend Payment Date (each, a “Regular Dividend Payment Record Date”) (unless any such day is not a Business Day, in which event the Regular Dividend Payment Record Date shall be the next succeeding Business Day).

(g) From and after the time, if any, that the Company shall have failed to pay all accumulated and unpaid Regular Dividends for all prior Regular Dividend Periods in accordance with this Section 4, no dividends shall be declared or paid or set apart for payment, or other distribution declared or made, upon any Junior Shares, nor shall any Junior Shares be redeemed, purchased or otherwise acquired for any consideration (nor shall any moneys be paid to or made available for a sinking fund for the redemption of any such Junior Shares) by the Company, directly or indirectly until all such Regular Dividends have been paid in full without the consent of the Holders of at least 75% of the then outstanding Series B Convertible Preferred Shares; provided, however, that the foregoing limitation shall not apply to:

(1) purchases, redemptions or other acquisitions of Junior Shares in connection with any employment contract, benefit plan or other similar arrangement with or for the benefit of any one or more employees, officers, directors, managers or consultants of or to the Company or any of its Subsidiaries;

(2) an exchange, redemption, reclassification or conversion of any class or series of Junior Shares for any other class or series of Junior Shares including, without limitation, the exchange of Class A Ordinary Shares for Class B Ordinary Shares (or vice versa) in accordance with the provisions of the Memorandum and Articles; or

(3) any dividend in the form of shares, warrants, options or other rights where the dividended shares or the shares issuable upon exercise of such warrants, options or other rights is the same share as that on which the dividend is being paid or ranks equal or junior to that share.

Section 5. Liquidation, Dissolution or Winding Up.

(a) Upon any voluntary or involuntary liquidation, dissolution or winding up of the Company (each, a “Liquidation”), after satisfaction of all liabilities and obligations to creditors of the Company and before any distribution or payment shall be made to holders of any Junior Shares, each Holder of Series B Convertible Preferred Shares shall be entitled to receive, out of the assets of the Company or proceeds thereof (whether capital or surplus) legally available therefor, an amount per Series B Convertible Preferred Share equal to the greater of:

-3-

(1) the Stated Value per Series B Convertible Preferred Share, plus an amount equal to any Regular Dividends accumulated but unpaid thereon (whether or not declared) after the immediately preceding Regular Dividend Payment Date to but excluding the date of Liquidation; and

(2) the payment such Holders would have received had such Holders, immediately prior to such Liquidation, converted their Series B Convertible Preferred Shares into Class A Ordinary Shares (at the then applicable Conversion Rate) pursuant to Section 7, (the greater of (1) and (2) is referred to herein as the “Liquidation Preference”). Holders of Series B Convertible Preferred Shares will not be entitled to any other amounts from the Company after they have received the full amounts provided for in this Section 5(a) and will have no right or claim to any of the Company’s remaining assets.

(b) If, in connection with any distribution described in Section 5(a) above, the assets of the Company or proceeds thereof are not sufficient to pay in full the Liquidation Preference payable on the Series B Convertible Preferred Shares and the corresponding amounts payable on the Parity Shares, then such assets, or the proceeds thereof, shall be paid pro rata in accordance with the full respective amounts which would be payable on such shares if all amounts payable thereon were paid in full.

(c) For purposes of this Section 5, the merger or consolidation of the Company with or into any other Company or other entity, or the sale, conveyance, lease or other disposition of all or substantially all of the assets of the Company, shall not constitute a liquidation, dissolution or winding up of the Company.

Section 6. Voting Rights.

(a) The Holders of the Series B Convertible Preferred Shares shall be entitled to (i) vote with the holders of the Ordinary Shares on all matters submitted for a vote of holders of Ordinary Shares, (ii) a number of votes per Series B Convertible Preferred Share equal to the number of Class A Ordinary Share into which each such Series B Convertible Preferred Share is then convertible at the time of the related record date and (iii) notice of all shareholders’ meetings (or pursuant to any action by written consent) in accordance with the Memorandum and Articles as if the Holders of Series B Convertible Preferred Shares were holders of Class A Ordinary Shares. Except as provided by law or by the provisions of Section 6(b), Holders of Series B Convertible Preferred Shares shall vote together with the holders of Ordinary Shares as a single class.

(b) For so long as any Series B Convertible Preferred Shares remain outstanding, the Company shall not, without first obtaining the written consent or affirmative vote at a meeting called for that purpose by Holders of at least 75% of the then outstanding Series B Convertible Preferred Shares, take any of the following actions:

(1) amend or modify the rights, preferences, privileges or voting powers of the Series B Convertible Preferred Shares;

(2) change, amend, alter or repeal any provisions of the Memorandum and Articles in a manner that materially and adversely affects the rights, preferences, privileges or voting powers of the Series B Convertible Preferred Shares differently from the other classes of Capital Shares; or

-4-

(3) increase or decrease the number of authorized Series B Convertible Preferred Shares or issue any additional Series B Convertible Preferred Shares (except that the issuance by the Company of any PIK Shares in accordance with the terms hereof shall not require any such written consent or affirmative vote of such Holders of Series B Convertible Preferred Shares pursuant to this Section 6(b)(3));

provided that, for the avoidance of doubt, (A) the issuance by the Company of any new Capital Shares with any right, preference, privilege or power which is on parity with, or senior to, the Series B Convertible Preferred Shares shall not be deemed to require such written consent or affirmative vote of such Holders of Series B Convertible Preferred Shares pursuant to Section 6(b) (and, for the avoidance of doubt, such new Capital Shares shall be deemed to be on parity with, or senior to, the Series B Convertible Preferred Shares if the terms thereof grant to the Holders thereof any or all of (x) the right to receive dividends, (y) the right to receive distributions upon liquidation, dissolution or winding up, and (z) the right to redeem such new Capital Shares, in each case on parity with or in priority to the Series B Convertible Preferred Shares), and (B) the granting, to such Holders of such new Capital Shares, of any such other right, preference, privilege or power as are deemed by Board (in its sole and absolute discretion) to be customary in equity financings, shall not be deemed to require such written consent or affirmative vote of such Holders of Series B Convertible Preferred Shares pursuant to Section 6(b).

Section 7. Conversion.

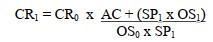

(a) Optional Conversion. Holders of the Series B Convertible Preferred Shares may not convert their Series B Convertible Preferred Shares at any time on or prior to March 31, 2027 (the “Non-Conversion Period”). A Holder may surrender all or any portion of its Series B Convertible Preferred Shares for conversion at any time during any calendar quarter commencing after the calendar quarter ending March 31, 2027 until the calendar quarter ending on September 30, 2031 (and only during any such calendar quarter), if the Last Reported Sale Price of the Class A Ordinary Shares (translated into US dollars at the prevailing exchange rate) for at least 20 Trading Days (whether or not consecutive) during the period of 30 consecutive Trading Days ending on, and including, the last Trading Day of the immediately preceding calendar quarter is greater than or equal to 130% of the Conversion Price on each applicable Trading Day. After September 30, 2031, each Holder of Series B Convertible Preferred Shares shall have the right, at such Holder’s option, to convert any or all of such Holder’s Series B Convertible Preferred Shares. The Series B Convertible Preferred Shares to be converted shall be converted into a number of Class A Ordinary Shares (subject to the Holder’s election to receive ADSs in lieu of Class A Ordinary Shares, as set forth herein) equal to the product of (i) the aggregate Stated Value of the Series B Convertible Preferred Shares to be converted divided by the Stated Value per Series B Convertible Preferred Share multiplied by (ii) the Conversion Rate then in effect, plus cash in lieu of fractional shares, as set out in Section 9(i), plus an amount in cash per Series B Convertible Preferred Share equal to accrued but unpaid dividends on such Series B Convertible Preferred Share after the immediately preceding Regular Dividend Payment Date to but excluding the applicable Optional Conversion Date (as herein defined), out of funds legally available therefor (the “Conversion Obligation”); provided, however, that if, during the Non-Conversion Period, the Company exercises its optional redemption right under Section 8(b), Section 8(d) or Section 8(j), notwithstanding the restrictions of the Non-Conversion Period set forth in the first sentence of this Section 7(a), the Holder shall have the right to convert any of all of such Holder’s Series B Convertible Preferred Shares during such period; provided further that if any such conversion occurs prior to the Resale Restriction Termination Date, any Class A Ordinary Shares issued upon such conversion shall be subject to the restrictions described in Section 20 hereof.

-5-

(b) When converting the Series B Convertible Preferred Shares, the Holders may elect to receive ADSs in lieu of any Class A Ordinary Shares deliverable upon conversion by specifying in the relevant Notice of Conversion such election, provided that such election shall apply to all (but not part) of the Class A Ordinary Shares deliverable upon conversion. If a Holder elects to receive ADSs in lieu of any Class A Ordinary Shares deliverable upon conversion, the Company shall deliver ADSs equal to the number of Class A Ordinary Shares deliverable upon conversion as described above (without taking into account any fractional shares) divided by the number of Class A Ordinary Shares then represented by one ADS immediately after the close of business as of the relevant Conversion Date, rounded down to the nearest whole number. Regardless of whether a Holder elects to receive Class A Ordinary Shares in lieu of any ADS deliverable upon conversion, the Company shall not issue any fractional ADS upon conversion of the Series B Convertible Preferred Shares and shall instead pay cash in lieu of any fractional ADS issuable upon conversion based on the VWAP for the relevant Conversion Date.

If the Holder has requested to receive Class A Ordinary Shares in the Notice of Conversion, to the extent permitted under applicable law and the rules and procedures of CCASS, the Company shall take all necessary action to enable the Class A Ordinary Shares, if any, deliverable to such Holder, in settlement upon conversion to be delivered to such Holder’s designated Hong Kong stock account in CCASS for so long as the Class A Ordinary Shares are listed on the Hong Kong Stock Exchange; provided that, if such Holder elects in the Notice of Conversion to receive Class A Ordinary Shares outside of CCASS or if the restrictive legend on the Series B Convertible Preferred Share has not been removed prior to the Conversion Date, the Company shall make share certificate or certificates representing such number of Class A Ordinary Shares available for collection at the office of the Hong Kong Share Registrar or, if so requested in the relevant Notice of Conversion, cause the Hong Kong Share Registrar to mail (at the risk, and, if sent at the Holder’s request otherwise than by ordinary mail, at the expense, of the Person to whom such certificate or certificates are sent) such certificate or certificates to the Person and at the place specified in the Notice of Conversion. Any Holder who elects to receive ADSs upon conversion shall comply with the procedures of the Depositary and ADS Depositary in effect at that time to convert such Series B Convertible Preferred Shares. In connection with the conversion of any Series B Convertible Preferred Shares, the Holder shall complete, manually sign (or via the e-signature of an authorized signatory of the Holder) and deliver a duly completed irrevocable notice to the Company as set forth in the Form of Notice of Conversion (a “Notice of Conversion”) and state in writing therein the number of Series B Convertible Preferred Shares to be converted and the name or names (with addresses) in which such Holder wishes any Class A Ordinary Shares or ADSs to be registered upon settlement of the Conversion Obligation, including, (x) if applicable, provided that the Holder makes to the Company the Non-Affiliate Representation, the Holder’s election to receiving Class A Ordinary Shares upon conversion and, (y) if the Holder prefers to receive the Class A Ordinary Shares through CCASS, its Hong Kong stock account in CCASS, and the name or names (with addresses) in which such Holder wishes the certificate or certificates for any Class A Ordinary Shares to be delivered upon settlement of the Conversion Obligation to be registered, (2) surrender such Series B Convertible Preferred Shares to the Company, (3) if required, furnish appropriate endorsements and transfer documents, and (4) comply with the procedures of the ADS Depositary in effect at that time to convert such Series B Convertible Preferred Shares.

When converting any Series B Convertible Preferred Shares, the Holder will be deemed to represent to the Company that such Holder is not an “affiliate” (as defined in Rule 144) of the Company and has not been an “affiliate” of the Company during the three months immediately preceding the Conversion Date (such representation, the “Non-Affiliate Representation”). In addition, a converting Holder must complete in the Notice of Conversion a representation that the Holder is not an “affiliate” (as defined in Rule 144) of the Company and has not been an “affiliate” of the Company during the three months immediately preceding the Conversion Date. Any Holder unable to make such representation will be required to receive Class A Ordinary Shares on the Company’s Cayman Islands register of members, and will not receive either freely tradeable ADSs or Class A Ordinary Shares that settle through CCASS.

-6-

(c) If the Company elects to:

| (i) | issue to all or substantially all holders of the Class A Ordinary Shares (directly or in the form of ADSs) any rights, options or warrants (other than rights issued pursuant to a stockholder rights plan, so long as such rights have not separated from the Class A Ordinary Shares and are not exercisable until the occurrence of a triggering event, except that such rights will be deemed to be distributed under this clause (A) upon their separation from the Class A Ordinary Shares or upon the occurrence of such triggering event) entitling them, for a period of not more than 45 calendar days after the announcement date of such issuance, to subscribe for or purchase Class A Ordinary Shares (directly or in the form of ADSs) at a price per share that is less than the average of the Last Reported Sale Prices of the ADSs, divided by the number of Class A Ordinary Shares then represented by one ADS, for the 10 consecutive Trading Day period ending on, and including, the Trading Day immediately preceding the date of announcement of such issuance; or |

| (ii) | distribute to all or substantially all holders of the Class A Ordinary Shares (directly or in the form of ADSs) the Company’s assets, securities or rights to purchase securities of the Company, which distribution has a per share value, as determined by the Board of Directors, exceeding 10% of (i) the Last Reported Sale Price of the ADSs on the Trading Day preceding the date of announcement for such distribution, divided by (ii) the number of Class A Ordinary Shares then represented by one ADS, |

then, in either case, the Company shall notify the Holders of the Series B Convertible Preferred Shares in writing at least 50 Scheduled Trading Days prior to the Ex-Dividend Date for such issuance or distribution (or, if later in the case of any such separation of rights issued pursuant to a stockholder rights plan or the occurrence of any such triggering event under a stockholder rights plan, as soon as reasonably practicable after the Company becomes aware that such separation or triggering event has occurred or will occur). Once the Company has given such notice, a holder may surrender all or any portion of its Series B Convertible Preferred Shares for conversion at any time until the earlier of (1) the close of business on the Business Day immediately preceding the Ex-Dividend Date for such issuance or distribution and (2) the Company’s announcement that such issuance or distribution will not take place, in each case, even if the Series B Convertible Preferred Shares are not otherwise convertible at such time. A Holder may not exercise this right to convert if it participates, at the same time and upon the same terms as Holders of the Class A Ordinary Shares and solely as a result of holding the Series B Convertible Preferred Shares, in such issuance or distribution described in this clause (ii) without having to convert its Series B Convertible Preferred Shares as if it held a number of Class A Ordinary Shares equal to the applicable Conversion Rate in effect on the record date for such issuance or distribution multiplied by the principal amount (expressed in thousands) of Series B Convertible Preferred Shares held by such Holder.

If (1) a transaction or event that constitutes a Fundamental Change or a Make-Whole Fundamental Change occurs, regardless of whether a Holder has the right to require the Company to repurchase the Series B Convertible Preferred Shares pursuant to Section 8(c), or (2) if the Company is a party to a consolidation, merger, binding share exchange, or transfer or lease of all or substantially all of its assets pursuant to which the ADSs would be converted into cash, securities or other assets, all or any portion of a Holder’s Series B Convertible Preferred Shares may be surrendered for conversion at any time from the Effective Date of such transaction until 35 Trading Days after the Effective Date of such transaction or, if such transaction also constitutes a Fundamental Change until the close of business on the second Business Day immediately prior to the related Fundamental Change Repurchase Date. The Company shall notify Holders of such transaction in writing no later than such Effective Date. If the Company does not provide such notice by the Effective Date of such transaction, then the last day on which the Series B Convertible Preferred Shares are convertible shall be extended by the number of Business Days from, and including, the Effective Date thereof to, but excluding, the date the Company provides the notice.

-7-

(d) If the Company calls any or all of the Series B Convertible Preferred Share for redemption pursuant to Section 8(a), Section 8(b), Section 8(d), Section 8(j), then a Holder may surrender any or all of its Series B Convertible Preferred Shares so called for conversion at any time prior to the close of business on the second Scheduled Trading Day prior to the redemption date, even if the Series B Convertible Preferred Shares are not otherwise convertible at such time. After that time, the right to convert such Series B Convertible Preferred Shares on account of the Company’s delivery of the Redemption Notice shall expire, unless the Company defaults in the payment of the relevant redemption price on the redemption date, in which case a Holder may convert any or all of its Series B Convertible Preferred Shares called for redemption until the relevant redemption price has been paid or duly provided for.

(e) Optional Conversion Procedures. A Holder must do each of the following in order to convert its Series B Convertible Preferred Shares pursuant to Section 7(a):

(1) complete and manually sign (or via the e-signature of an authorized signatory of the Holder) the Notice of Conversion provided by the Conversion Agent (as herein defined), and deliver such notice to the Conversion Agent; and

(2) if required, furnish appropriate endorsements and transfer documents in form and substance reasonably acceptable to the Company.

The Company shall, if required, pay any documentary, stamp, issue, transfer or similar tax not payable by the Company pursuant to Section 7(i).

The “Optional Conversion Date” means the date on which a Holder complies in all respects with the procedures set forth in this Section 7(e).

(f) Effect of Conversion. Effective immediately prior to the Close of Business on the Optional Conversion Date (the applicable “Conversion Date”) applicable to any Series B Convertible Preferred Shares, dividends shall no longer accrue or be declared on any such Series B Convertible Preferred Shares and such Series B Convertible Preferred Shares shall cease to be outstanding.

(g) Record holder of Underlying Securities as of Conversion Date. The Person or Persons entitled to receive the Class A Ordinary Shares (or ADSs in lieu of Class A Ordinary Shares) and, to the extent applicable, cash, issuable upon conversion of Series B Convertible Preferred Shares on a Conversion Date shall be treated for all purposes as the record Holder(s) of such Class A Ordinary Shares and/or cash as of the Close of Business on such Conversion Date. As promptly as practicable on or after the Conversion Date and compliance by the applicable Holder with the relevant conversion procedures contained in Section 7(e) (and in any event no later than five Trading Days thereafter in the case of Class A Ordinary Shares, or seven Trading Days thereafter in the case of ADSs), the Company shall allot and issue the number of whole Class A Ordinary Shares issuable upon conversion (and deliver payment of cash in lieu of fractional shares) and enter the name of the applicable Holder in the register of members of the Company in respect of such Class A Ordinary Shares so allotted and issued. Such delivery of Class A Ordinary Shares and, if applicable, cash shall be made, at the option of the applicable Holder, in certificated form or by book-entry. Any such certificate or certificates shall be delivered by the Company to the appropriate Holder on a book-entry basis or by mailing certificates evidencing the Class A Ordinary Shares to the Holders at their respective addresses as set forth in the Notice of Conversion. If fewer than all of the Series B Convertible Preferred Shares held by any Holder hereto are converted pursuant to Section 7(b), then a new certificate representing the unconverted Series B Convertible Preferred Shares shall be issued to such Holder concurrently with the issuance of the certificates (or book-entry shares) representing the applicable Class A Ordinary Shares. In the event that a Holder shall not by written notice designate the name in which Class A Ordinary Shares and, to the extent applicable, cash in lieu of fractional shares, to be delivered upon conversion of Series B Convertible Preferred Shares should be registered or paid, or the manner in which such Class A Ordinary Shares and, if applicable, cash should be delivered, the Company shall be entitled to register and deliver such Class A Ordinary Shares and, if applicable, cash in the name of the Holder and in the manner shown on the records of the Company.

-8-

(h) Status of Converted or Acquired Shares. Series B Convertible Preferred Shares duly converted in accordance with the terms hereof, or otherwise acquired by the Company in any manner whatsoever, shall be cancelled promptly after the acquisition thereof. All such Class B Ordinary Shares shall upon their cancellation become authorized but unissued preferred shares of the Company, without designation as to series, until such shares are once more designated as part of a particular series by the Board pursuant to the provisions of the Memorandum and Articles.

(i) Taxes.

(1) The Company and its paying agent shall be entitled to withhold taxes on all payments (and deemed distributions, if any) on the Series B Convertible Preferred Shares or Class A Ordinary Shares or other securities issued upon conversion of the Series B Convertible Preferred Shares to the extent required by law. Prior to the date of any such payment, each Holder of Series B Convertible Preferred Shares or Class A Ordinary Shares or other securities issued upon conversion of the Series B Convertible Preferred Shares shall deliver to the Company or its paying agent a duly executed, valid, accurate and properly completed Internal Revenue Service Form W-9 or an appropriate Internal Revenue Service Form W-8, as applicable. If the information on any such form provided by the Holder changes, or any such form becomes obsolete, expired or inaccurate in any respect, or upon the Company’s reasonable request, the Holder shall provide the Company with an updated version of such form.

(2) Absent a change in law or Internal Revenue Service practice, or a contrary determination (as defined in Section 1313(a) of the United States Internal Revenue Code of 1986, as amended (the “Code”)), the Company and each Holder of Series B Convertible Preferred Shares agrees not to treat the Series B Convertible Preferred Shares (based on their terms as set forth herein) as “preferred stock” within the meaning of Section 305 of the Code and Treasury Regulation Section 1.305-5 for United States federal income tax and withholding tax purposes and shall not take any position inconsistent with such treatment.

(3) The Company shall pay any documentary, stamp, issue, transfer or similar tax due on the issue of Class A Ordinary Shares upon conversion of the Series B Convertible Preferred Shares. However, the Company shall not be required to pay any tax that may be payable in respect of any transfer involved in the issue and delivery of Class A Ordinary Shares or Series B Convertible Preferred Shares in a name other than that of the Holder of the Series B Convertible Preferred Shares to be converted, and no such issue or delivery shall be made unless and until the person requesting such issue and delivery has paid to the Company the amount of any such tax, or has established to the satisfaction of the Company that such tax has been paid.

Each Holder of Series B Convertible Preferred Shares and the Company agree to cooperate with each other in connection with any redemption, in whole or in part, of the Series B Convertible Preferred Shares and to use good faith efforts, at such Holders’ expense, to structure such redemption so that such redemption may be treated as a sale or exchange pursuant to Section 302 of the Code; provided that nothing in this Section 7(i) shall require the Company to purchase any Series B Convertible Preferred Shares, and provided further that the Company makes no representation or warranty in this Section 7(i) regarding the tax treatment of any redemption of Series B Convertible Preferred Shares.

-9-

(j) Increased Conversion Rate Applicable to Certain Series B Convertible Preferred Shares Surrendered in Connection with Make-Whole Fundamental Change, Trigger Event, Tax Redemption, Cleanup Redemption or Optional Redemption by the Company after 2029 upon Certain Trading Thresholds

| (1) | If a Make-Whole Fundamental Change occurs while the Series B Convertible Preferred Shares are outstanding and a Holder elects to convert its Series B Convertible Preferred Shares in connection with such Make-Whole Fundamental Change the Company shall, under the circumstances described below, increase the Conversion Rate for the Series B Convertible Preferred Shares so surrendered for conversion by a number of additional Class A Ordinary Shares (the “Additional Shares”), as set forth below. |

| (2) | Upon surrender of the Series B Convertible Preferred Shares for conversion in connection with a Make-Whole Fundamental Change, the Company shall satisfy the related Conversion Obligation by settlement in Class A Ordinary Shares, in accordance with Section 7; provided, however, that if, at the effective time of a Make-Whole Fundamental Change described in clause (b) of the definition of Change of Control, the reference property following such Make-Whole Fundamental Change is composed entirely of cash, for any conversion of Series B Convertible Preferred Shares following the Effective Date of such Make-Whole Fundamental Change, the Conversion Obligation shall be calculated based solely on the Share Price for the transaction and shall be deemed to be an amount of cash per Series B Convertible Preferred Shares equal to the Conversion Rate (including any adjustment for Additional Shares), multiplied by such Share Price. |

| (3) | The number of Additional Shares, if any, by which the Conversion Rate shall be increased shall be determined by reference to the table below, based on (i) the date on which the Make-Whole Fundamental Change occurs or becomes effective (the “Effective Date”) and (ii) the price paid (or deemed to be paid) per Share in the Make-Whole Fundamental Change (which, if relevant, being as translated into US dollars at the prevailing exchange rate the “Share Price”). If the Holders of the Series B Convertible Preferred Shares receive in exchange for their shares only cash in a Make-Whole Fundamental Change described in clause (b) of the definition of Change of Control, the Share Price shall be the cash amount paid per Share. Otherwise, the Share Price shall be the average of the Last Reported Sale Prices of the Class A Ordinary Shares over the ten Trading Day period ending on, and including, the Trading Day immediately preceding the Effective Date of the Make-Whole Fundamental Change. |

| (4) | The Share Prices set forth in the column headings of the table below shall be adjusted as of any date on which the Conversion Rate of the Series B Convertible Preferred Shares is otherwise adjusted. The adjusted Share Prices shall equal the Share Prices applicable immediately prior to such adjustment, multiplied by a fraction, the numerator of which is the Conversion Rate immediately prior to such adjustment giving rise to the Share Price adjustment and the denominator of which is the Conversion Rate as so adjusted. The number of Additional Shares set forth in the table below shall be adjusted in the same manner and at the same time as the Conversion Rate as set forth in Section 9. |

| (5) | The following table sets forth the number of Additional Shares to be received per Series B Convertible Preferred Shares pursuant to this Section 7(j) for each Share Price and Effective Date set forth below , provided that for any Effective Date following February 6, 2032, the same number of Additional Shares to be received per Series B Convertible Preferred Shares pursuant to this Section 7(j) shall apply as those set out for February 6, 2032: |

-10-

| Effective Date | Share Price | |||||||||||

| 5.79 | 6.00 | 6.50 | 6.80 | 7.00 | 8.00 | 9.00 | 10.20 | 12.50 | 15.00 | 20.00 | 25.00 | |

| February 6, 2026 | 25.7230 | 23.6633 | 19.6154 | 17.6456 | 16.4843 | 12.0188 | 9.0256 | 6.5363 | 3.5656 | 1.7440 | 0.1880 | 0.0000 |

| February 6, 2027 | 25.7230 | 22.7817 | 18.5831 | 16.5794 | 15.4129 | 11.0363 | 8.2122 | 5.9275 | 3.2416 | 1.5913 | 0.1670 | 0.0000 |

| February 6, 2028 | 25.7230 | 21.6450 | 17.2323 | 15.1779 | 14.0000 | 9.7413 | 7.1467 | 5.1324 | 2.8152 | 1.3847 | 0.1380 | 0.0000 |

| February 6, 2029 | 25.7230 | 20.4767 | 15.6862 | 13.5265 | 12.3157 | 8.1650 | 5.8556 | 4.1804 | 2.3168 | 1.1500 | 0.1055 | 0.0000 |

| February 6, 2030 | 25.7230 | 19.2883 | 13.8123 | 11.4515 | 10.1729 | 6.1463 | 4.2411 | 3.0137 | 1.7064 | 0.8600 | 0.0665 | 0.0000 |

| February 6, 2031 | 25.7230 | 18.2233 | 11.3031 | 8.5235 | 7.1157 | 3.4338 | 2.2356 | 1.6137 | 0.9528 | 0.4940 | 0.0270 | 0.0000 |

| February 6, 2032 | 25.7230 | 18.2233 | 6.8569 | 0.0706 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

The exact Share Prices and Effective Dates may not be set forth in the table above, in which case:

| i. | if the Share Price is between two Share Prices in the table above or the Effective Date is between two Effective Dates in the table, the number of Additional Shares shall be determined by a straight-line interpolation between the number of Additional Shares set forth for the higher and lower Share Prices and the earlier and later Effective Dates, as applicable, based on a 365-day year; |

| ii. | if the Share Price is greater than US$25.00 per Share (subject to adjustment in the same manner as the Share Prices set forth in the column headings of the table above), no Additional Shares shall be added to the Conversion Rate; and |

| iii. | if the Share Price is less than US$5.79 per Share (subject to adjustment in the same manner as the Share Prices set forth in the column headings of the table above), no Additional Shares shall be added to the Conversion Rate. |

Notwithstanding the foregoing, in no event shall the Conversion Rate per Series B Convertible Preferred Shares exceed 172.7116 shares, subject to adjustment in the same manner as the Conversion Rate pursuant to Section 9.

| (6) | Nothing in this Section 7(h) shall prevent an adjustment to the Conversion Rate pursuant to Section 9. |

If the Holder elects to convert its Series B Convertible Preferred Shares in connection with the Company’s election to (a) redeem the Series B Convertible Preferred Share in respect of a Change in Tax Law pursuant to Section 8(d), (b) redeem the Series B Convertible Preferred Share at the Company’s option upon a Trigger Event pursuant to Section 8(b)(i) or at the Company’s option for the reason described in Section 8(b)(ii), or (c) redeem the Series B Convertible Preferred Share for clean-up pursuant to Section 8(j), in each case, the Conversion Rate shall be increased by a number of additional Shares determined pursuant to this Section 7(j). The Company shall settle conversions of Series B Convertible Preferred Share as described in Section 7.

-11-

A conversion shall be deemed to be “in connection with” the Company’s election to (i) redeem the Series B Convertible Preferred Share in respect of a Change in Tax Law pursuant to Section 8(d), (ii) redeem the Series B Convertible Preferred Share at the Company’s option upon a Trigger Event pursuant to Section 8(b)(i) or at the Company’s option for the reason described in Section 8(b)(ii), or (iii) redeem the Series B Convertible Preferred Share for clean-up pursuant to Section 8(j) if the Company receives the relevant conversion during the period from, and including, the date the Company provides the related Redemption Notice to Holders until the close of business on the second Scheduled Trading Day immediately preceding the related redemption date (or, if the Company fails to pay the relevant redemption price, such later date on which the Company pays the relevant redemption price).

For the avoidance of doubt, the Company will only adjust the Conversion Rate with respect to any Series B Convertible Preferred Shares called for Optional Redemption and not with respect to the Series B Convertible Preferred Shares not called for Optional Redemption. If the Company elects to redeem less than all of the outstanding Series B Convertible Preferred Shares, then Holders of the Series B Convertible Preferred Shares not called for Optional Redemption will not be entitled to an increased Conversion Rate for such Series B Convertible Preferred Shares as described herein on account of the redemption.

The number of additional Shares by which the Conversion Rate will be increased in the event a Holder elects to convert in connection with the Company election to redeem the Series B Convertible Preferred Shares pursuant to Section 8(b), Section 8(d) and Section 8(j) hereof will be determined by reference to the table in clause (5) above based on the Redemption Reference Date and the Redemption Reference Price (each as defined below), but determined as if (x) the Holder had elected to convert its Series B Convertible Preferred Shares in connection with a Make-Whole Fundamental Change, (y) the applicable “Redemption Reference Date” were the “Effective Date” as specified above and (z) the applicable “Redemption Reference Price” were the “Share price” as specified above (and subject, for the avoidance of doubt, to the two paragraphs immediately following such table). “Redemption Reference Date” means the date the Company delivers the relevant Redemption Notice. “Redemption Reference Price” means, for any conversion in connection with the Company’s election to redeem the Series B Convertible Preferred Shares in respect of a Change in Tax Law pursuant to Section 8(d), redeem the Series B Convertible Preferred Shares at the Company’s option pursuant to Section 8(b) or redeem the Series B Convertible Preferred Shares for cleanup purposes pursuant to Section 8(j), as the case may be, the average of the Last Reported Sale Prices (translated into US Dollars based on the prevailing exchange rate) of the Class A Ordinary Shares over the 10 consecutive Trading Day period ending on, and including the Trading Day immediately preceding, the date the Company delivers the relevant redemption notice.

Section 8. Redemption and Repurchase.

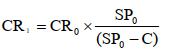

(a) Optional Redemption by the Company after February 6, 2032. The Series B Convertible Preferred Shares may be redeemed by the Company, in whole but not in part, at the option of the Company, upon giving notice of redemption pursuant to Section 8(d), at a redemption price per share equal to the sum of the Stated Value per Series B Convertible Preferred Share to be redeemed plus an amount per share equal to accrued but unpaid dividends on such Series B Convertible Preferred Shares after the immediately preceding Regular Dividend Payment Date to but excluding the date of redemption out of funds legally available therefor.

-12-

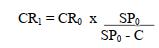

(b) Optional Redemption by the Company upon a Trigger Event and Optional Redemption by the Company after February 13, 2029 upon Certain Trading Thresholds. The Series B Convertible Preferred Shares may be redeemed by the Company, in whole but not in part, (i) at any time upon the occurrence of a Trigger Event; or (ii) if, at any time beginning on February 13, 2029, the VWAP per Class A Ordinary Share of the Company , translated into US Dollars based on the prevailing exchange rate, equals or exceeds US$10.20 (adjusted as described in Section 9) for at least twenty (20) Trading Days in any period of thirty (30) consecutive Trading Days (“VWAP”), at the Company’s election, in each case, at a redemption price per share equal to the sum of the Stated Value per Series B Convertible Preferred Share to be redeemed plus an amount per share equal to accrued but unpaid dividends on such Series B Convertible Preferred Shares after the immediately preceding Regular Dividend Payment Date to but excluding the date of redemption out of funds legally available therefor.

(c) Repurchase at the Option of the Holder Upon a Fundamental Change.

(1) Upon the occurrence of a Fundamental Change, each Holder of Series B Convertible Preferred Shares shall have the right to require the Company to repurchase, by irrevocable, written notice to the Company, all or any portion of such Holder’s Series B Convertible Preferred Shares at a purchase price per Series B Convertible Preferred Share equal to the sum of (x) 100% multiplied by the Stated Value per Series B Convertible Preferred Share plus (y) an amount equal to accrued but unpaid dividends on such Series B Convertible Preferred Share after the immediately preceding Regular Dividend Payment Date to but excluding the date of repurchase (the “Fundamental Change Repurchase Price”); provided that, in each case (but, for the avoidance of doubt, not in the event where such Holder actually converts its Series B Convertible Preferred Shares into Class A Ordinary Shares), the Company shall only be required to pay the Fundamental Change Repurchase Price after (i) the Satisfaction of the Indebtedness Obligations and (ii) to the extent such repurchase can be made out of funds legally available therefor.

(2) Within 30 days of the occurrence of a Fundamental Change, the Company shall send notice by first class mail, postage prepaid, addressed to the Holders of record of the Series B Convertible Preferred Shares at their respective last addresses appearing in the register of members of the Company stating (1) that a Fundamental Change has occurred, (2) that all Series B Convertible Preferred Shares tendered prior to a Business Day no earlier than 30 days nor later than 60 days from the date such notice is mailed shall be accepted for repurchase and (3) the procedures that Holders of the Series B Convertible Preferred Shares must follow in order for their Series B Convertible Preferred Shares to be repurchased, including the place or places where certificates for such Series B Convertible Preferred Shares are to be surrendered for payment of the repurchase price. Any notice mailed as provided in this Subsection shall be conclusively presumed to have been duly given, whether or not the Holder receives such notice, but failure duly to give such notice by mail, or any defect in such notice or in the mailing thereof, to any Holder of Series B Convertible Preferred Shares designated for repurchase shall not affect the validity of the proceedings for the repurchase of any other Series B Convertible Preferred Shares.

-13-

(d) Redemption for Taxation Reasons.

| (1) | The Series B Convertible Preferred Shares may be redeemed at the Company’s option, as a whole but not in part (except in respect of certain Holders that elect otherwise as described below) (a “Tax Redemption”), at the Tax Redemption Price, if the Company has or would become obligated to pay to the Holder of any Series B Convertible Preferred Shares any Additional Amounts as a result of (i) any change or amendment that is not publicly announced before, and that becomes effective on or after, the Issue Date or, in the case of a Successor Company, the date such Successor Company assumes all of the Company’s obligations under the Series B Convertible Preferred Shares, or in the case of a jurisdiction that becomes a Relevant Taxing Jurisdiction on a date that is after the Issue Date, after such date upon which such jurisdiction becomes a Relevant Taxing Jurisdiction, in the laws or any rules or regulations of a Relevant Taxing Jurisdiction, or (ii) any change that is not publicly announced before, and that becomes effective on or after, the Issue Date or, in the case of a Successor Company, the date such Successor Company assumes all of the Company’s obligations under the Series B Convertible Preferred Shares, or in the case of a jurisdiction that becomes a Relevant Taxing Jurisdiction on a date that is after the Issue Date, after such date upon which such jurisdiction becomes a Relevant Taxing Jurisdiction, in an interpretation, administration or application of such laws, rules or regulations by any legislative body, court, governmental agency, taxing authority or regulatory or administrative authority of such Relevant Taxing Jurisdiction (including the enactment of any legislation and the announcement or publication of any judicial decision or regulatory or administrative interpretation or determination) (each such change or amendment, a “Change in Tax Law”); provided that the Company cannot avoid these obligations by taking commercially reasonable measures available to it (provided that changing the Company’s jurisdiction of organization or domicile shall not be considered a commercially reasonable measure) and further provided that, prior to or simultaneously with the Tax Redemption Notice, the Company delivers to the Holders an Opinion of Counsel of recognized standing in the Relevant Taxing Jurisdiction attesting that the Company has or would become obligated to pay such Additional Amounts as a result of a Change in Tax Law and an Officers’ Certificate attesting that the Company’s obligation to pay Additional Amounts cannot be avoided by taking commercially reasonable measures available to it. |

| (2) | If the Tax Redemption Date falls after a Regular Dividend Payment Record Date and on or prior to the immediately following Regular Dividend Payment Date, the Company shall, on or, at its election, before such Regular Dividend Payment Date, pay the full amount of accrued and unpaid dividends, and any Additional Amounts with respect to such dividends, due on such Regular Dividend Payment Date to the Holders of the Series B Convertible Preferred Shares on the Regular Dividend Payment Record Date corresponding to such Regular Dividend Payment Date. |

| (3) | Notwithstanding anything to the contrary herein, neither the Company nor any successor Person may redeem any of the Series B Convertible Preferred Shares pursuant to this Section 8(d) in the case that Additional Amounts are payable in respect of PRC withholding tax and any other tax collected at source at the Applicable PRC Rate or less solely as a result of the Company or its successor Person being considered a PRC tax resident under the PRC Enterprise Income Tax Law. |

(e) Notice of Tax Redemption.

| (1) | In the event that the Company exercises its Tax Redemption right pursuant to Section 8(d), it shall fix a date for redemption (the “Tax Redemption Date”), and it shall send, or cause to be sent, a written notice of such Tax Redemption (a “Tax Redemption Notice”) (provided that if, in accordance with Section 8(d), the Company elects to settle all conversions of Series B Convertible Preferred Shares with a Conversion Date that occurs during the period from, and including the date the Tax Redemption Notice is sent to the close of business on the second Scheduled Trading Day immediately before the Tax Redemption Date, then the Company will provide such written notice not less than 30 nor more than 60 calendar days before the Tax Redemption Date) to each Holder of Series B Convertible Preferred Shares. The Tax Redemption Date must be a Business Day. |

-14-

| (2) | The Company shall not give any Tax Redemption Notice earlier than 70 days prior to the earliest date on or from which the Company would be obligated to pay any Additional Amounts, and at the time the Company gives the Tax Redemption Notice, the circumstances creating the Company’s obligation to pay such Additional Amounts must remain in effect. Simultaneously with providing such notice, the Company shall publish a notice containing this information on its website or through such other public medium as it may use at that time. |

| (3) | The Tax Redemption Notice, if sent in the manner herein provided, shall be conclusively presumed to have been given duly, whether or not the Holder receives such notice. In any case, failure to give such Tax Redemption Notice or any defect in the Tax Redemption Notice to the Holder of any Series B Convertible Preferred Shares designated for redemption shall not affect the validity of the proceedings for the redemption of any other Series B Convertible Preferred Share. |

| (4) | Each Tax Redemption Notice shall specify: | |

| i. | the Tax Redemption Date; | |

| ii. | the Tax Redemption Price; | |

| iii. | the settlement method that will apply to all conversions with a Conversion Date that occurs on or after the date the Company sends such Tax Redemption Notice and before the close of business on the second Scheduled Trading Day immediately before the related Tax Redemption Date; | |

| iv. | the place or places where such Series B Convertible Preferred Shares are to be surrendered for payment of the Tax Redemption Price; | |

| v. | that on the Tax Redemption Date, the Tax Redemption Price will become due and payable upon each Series B Convertible Preferred Share to be redeemed, and that the dividends thereon, if any, shall cease to accrue on and after the Tax Redemption Date; | |

| vi. | that Holders may surrender their Series B Convertible Preferred Shares for conversion at any time prior to the close of business on the second Scheduled Trading Day immediately preceding the Tax Redemption Date; | |

| vii. | the procedures a converting Holder must follow to convert its Series B Convertible Preferred Shares; | |

| viii. | that Holders have the right to elect not to have their Series B Convertible Preferred Shares redeemed by delivery to the Company, with a copy to the paying agent, of a written notice to that effect not later than the close of business on the second Scheduled Trading Day immediately preceding the Tax Redemption Date; | |

| ix. | that Holders who wish to elect not to have their Series B Convertible Preferred Shares redeemed must satisfy the requirements set forth herein; | |

| x. | that, at and after the Tax Redemption Date, Holders who elect not to have their Series B Convertible Preferred Shares redeemed (a) will not receive any Additional Amounts with respect to payments or deliveries (including dividends and any consideration due in respect of the Fundamental Change Repurchase Price, and whether payable in cash, Class A Ordinary Shares or otherwise) made with respect to such Holders’ Series B Convertible Preferred Shares solely as a result of the Change in Tax Law that resulted in the obligation to pay such Additional Amounts after the Tax Redemption Date and (b) all future payments (including dividends and any consideration due in respect of the Fundamental Change Repurchase Price, and whether payable in cash, Class A Ordinary Shares or otherwise) with respect to the Series B Convertible Preferred Shares will be subject to the deduction or withholding of any taxes of the Relevant Taxing Jurisdiction required by law to be deducted or withheld as a result of such Change in Tax Law; and |

-15-

| xi. | the Conversion Rate and, if applicable, the number of Class A Ordinary Shares added to the Conversion Rate in accordance with Section 7(j). |

A Tax Redemption Notice shall be irrevocable and shall not be subject to conditions. In the case of a Tax Redemption, a Holder may convert its Series B Convertible Preferred Shares at any time until the close of business on the second Scheduled Trading Day preceding the Tax Redemption Date.

(f) Payment of Series B Convertible Preferred Shares Called for Tax Redemption.

| (1) | If any Tax Redemption Notice has been given in respect of the Series B Convertible Preferred Shares, the Series B Convertible Preferred Shares shall become due and payable on the Tax Redemption Date at the place or places stated in the Tax Redemption Notice and at the applicable Tax Redemption Price. On presentation and surrender of the Series B Convertible Preferred Shares at the place or places stated in the Tax Redemption Notice, the Series B Convertible Preferred Shares shall be paid and redeemed by the Company at the applicable Tax Redemption Price. |

| (2) | Prior to 10:00 a.m., New York City time on the Tax Redemption Date, the Company shall segregate and hold in trust an amount of cash in immediately available funds, sufficient to pay the Tax Redemption Price of all of the Series B Convertible Preferred Shares to be redeemed on such Tax Redemption Date. Payment for the Series B Convertible Preferred Shares to be redeemed shall be made on the Tax Redemption Date for such Series B Convertible Preferred Shares. |

(g) Holders’ Right to Avoid Tax Redemption.

Notwithstanding anything to the contrary in Section 8(d), if the Company has given a Tax Redemption Notice, each Holder of Series B Convertible Preferred Shares will have the right to elect that such Holder’s Series B Convertible Preferred Shares will not be subject to a Tax Redemption. If a Holder elects not to be subject to a Tax Redemption, the Company will not be required to pay any Additional Amounts in respect of any payment made with respect to such Holder’s Series B Convertible Preferred Shares solely as a result of the Change in Tax Law that resulted in the obligation to pay such Additional Amounts (including dividends and any consideration due in respect of the Fundamental Change Repurchase Price, and whether payable in cash, Class A Ordinary Shares or otherwise) after the Tax Redemption Date, and all future payments (including dividends and any consideration due in respect of the Fundamental Change Repurchase Price, and whether payable in cash, Class A Ordinary Shares or otherwise) with respect to such Holder’s Series B Convertible Preferred Shares will be subject to the deduction or withholding of any taxes of the Relevant Taxing Jurisdiction required by law to be deducted or withheld as a result of such Change in Tax Law. The obligation to pay Additional Amounts to any electing Holder for periods up to the Tax Redemption Date shall remain subject to the exceptions set forth under Section 8(i). Where no election is made or deemed to be made, the Holder will have its Series B Convertible Preferred Shares redeemed without any further action. Holders electing to not have their Series B Convertible Preferred Shares redeemed must exercise their option to elect to avoid a Tax Redemption by written notice to the Company (with a copy to the paying agent) no later than the close of business on the second Scheduled Trading Day immediately preceding the Tax Redemption Date, provided that a Holder that has complied with the requirements set forth in Section 7(d) prior to the close of business on the second Scheduled Trading Day immediately preceding the Tax Redemption Date will be deemed to have delivered a notice of its election to avoid a Tax Redemption.

-16-

(h) Withdrawal of Notice of Election to Avoid a Tax Redemption.

A Holder may withdraw any notice of election to avoid a Tax Redemption, by delivering to the Company a written notice of withdrawal prior to the close of business on the second Scheduled Trading Day immediately preceding the Tax Redemption Date (or, if the Company fails to pay the Tax Redemption Price on the Tax Redemption Date, such later date on which the Company pays the Tax Redemption Price).

(i) Additional Amounts. All payments and deliveries made by, or on behalf of, the Company or any successor to the Company under or with respect to the Series B Convertible Preferred Shares, shall be made without withholding, deduction or reduction for any other collection at source for, or on account of, any present or future taxes, duties, assessments or governmental charges of whatever nature imposed or levied (including any penalties and interest related thereto) (the “Applicable Taxes”), unless such withholding, deduction or reduction is required by law or by other regulation or governmental policy having the force of law (“Applicable Tax Law”). In the event that any such withholding, deduction or reduction is required with respect to any such payments or deliveries (but excluding, for the avoidance of doubt, any payments or deliveries that are made upon conversion of the Series B Convertible Preferred Share, whether made in Class A Ordinary Shares, cash or other consideration (including any payments of cash for any fractional shares or other consideration)) by or within (x) the Cayman Islands, Hong Kong or the People’s Republic of China (or, in each case, any political subdivision or taxing authority thereof or therein), (y) any jurisdiction in which the Company or any successor is, for tax purposes, incorporated, organized or resident or doing business (or any political subdivision or taxing authority thereof or therein) or (z) any jurisdiction from or through which payment is made or deemed made (or any political subdivision or taxing authority thereof or therein) (each of (x), (y) and (z), as applicable, a “Relevant Taxing Jurisdiction”), the Company shall pay or deliver to the Holder of each Series B Convertible Preferred Share such additional amounts of cash or other consideration, as applicable (the “Additional Amounts”), as may be necessary to ensure that the net amount received by the beneficial owners of the Series B Convertible Preferred Shares after such withholding, deduction or reduction (and after deducting any Applicable Taxes imposed by the Relevant Taxing Jurisdiction on the Additional Amounts) will equal the amounts that would have been received by such beneficial owners had no such withholding, deduction or reduction been required; provided that no Additional Amounts will be payable:

i. for or on account of:

(A) any Applicable Taxes that would not have been imposed but for:

| (1) | the existence of any present or former connection between the relevant Holder or beneficial owner of such Series B Convertible Preferred Shares and the Relevant Taxing Jurisdiction, other than merely acquiring or holding such Series B Convertible Preferred Shares, receiving Class A Ordinary Shares, cash or other consideration upon conversion of such Series B Convertible Preferred Shares, or the receipt of payments or the exercise or enforcement of rights thereunder, including, without limitation, such Holder or beneficial owner being or having been a national, domiciliary or resident of such Relevant Taxing Jurisdiction or treated as a resident thereof or being or having been physically present or engaged in a trade or business therein or having or having had a permanent establishment therein; |

-17-

| (2) | the presentation of such Series B Convertible Preferred Shares (in cases in which presentation is required) more than 30 days after the later of the date on which the payment of the Stated Value of (including the redemption price and the Fundamental Change Repurchase Price, if applicable) or dividends became due and payable pursuant to the terms thereof or was made or duly provided for (except to the extent that the Holder or beneficial owner of such Series B Convertible Preferred Shares would have been entitled to Additional Amounts had such Series B Convertible Preferred Shares been presented on any day on or before the last day of such 30-day period); or |

| (3) | the failure of the Holder or beneficial owner to comply with a timely written request from the Company or any successor of the Company, addressed to the Holder or beneficial owner, to provide, in each case to the extent such Holder or beneficial owner is legally entitled to do so, certification, information, documents or other evidence concerning such Holder’s or beneficial owner’s nationality, residence, identity or connection with the Relevant Taxing Jurisdiction, or to make any declaration or satisfy any other reporting requirement relating to such matters, if and to the extent that due and timely compliance with such request is required by statute, regulation or administrative practice of the Relevant Taxing Jurisdiction to reduce or eliminate any withholding or deduction as to which Additional Amounts would have otherwise been payable to such Holder or beneficial owner; provided that, in the case of Applicable Taxes imposed by the People’s Republic of China, the provision of any certification, information, documents or other evidence described in this clause would not be materially more onerous, in form, in procedure, or in the substance of information disclosed, to a Holder or beneficial owner than comparable information or other reporting requirements imposed under U.S. tax law, regulations and administrative practice (such as U.S. Internal Revenue Service Forms W-8BEN, W-8BEN-E and W-9, or any successor forms), and reasonable procedure for the collection of such documentation has been implemented and is in effect at the time that such written request is received; |

-18-

(B) any estate, inheritance, gift, sale, transfer, personal property or similar Applicable Taxes;

(C) any Applicable Taxes that are payable otherwise than by withholding or deduction from payments under or with respect to the Series B Convertible Preferred Shares;

(D) any Applicable Taxes that are imposed in connection with any payments or deliveries that are made upon conversion of the Series B Convertible Preferred Shares, whether made in Class A Ordinary Shares, cash or other consideration, and including, for the avoidance of doubt, any payments of cash for any fractional shares or other consideration;

(E) any Applicable Taxes required to be withheld or deducted under Sections 1471 to 1474 of the Code (or any amended or successor versions of such Sections that is substantively comparable and not materially more onerous to comply with) (“FATCA”), any regulations or other official guidance thereunder, any intergovernmental agreement or agreement pursuant to Section 1471(b)(1) of the Code entered into in connection with FATCA, or any law, regulation or other official guidance enacted in any jurisdiction implementing FATCA or an intergovernmental agreement; or

(F) any combination of Applicable Taxes referred to in the preceding clauses (A), (B), (C), (D) or (E); or

| ii. | with respect to any payment on such Series B Convertible Preferred Shares, if the Holder is a fiduciary, partnership or Person other than the sole beneficial owner of that payment, to the extent that such payment would be required to be included in the income under the laws of the Relevant Taxing Jurisdiction, for tax purposes, of a beneficiary or settlor with respect to the fiduciary, a member of that partnership or a beneficial owner who would not have been entitled to such Additional Amounts had that beneficiary, settlor, member or beneficial owner been the Holder thereof. |

In addition to the foregoing, the Company will also pay and indemnify the Holders and beneficial owners of the Series B Convertible Preferred Shares for any present or future stamp, issue, registration, transfer, value added, court or documentary taxes, or any other excise or property taxes, charges or similar levies or taxes (including penalties, interest and any other reasonable expenses related thereto) which are levied by any Relevant Taxing Jurisdiction (and in the case of enforcement, any jurisdiction) on the execution, delivery, registration or enforcement of any of the Series B Convertible Preferred Shares or any other document or instrument referred to herein or therein, or the receipt of payments with respect hereto or thereto (limited, solely in the case of taxes, charges or levies (including penalties, interest and any other reasonable expenses related thereto) attributable to the receipt of any payments with respect hereto or thereto, to any such amounts levied by any Relevant Taxing Jurisdiction that are not (x) described in (A), (B), (D) or (E) of clause (i) above (or any combination thereof) or (y) levied on payments described in clause (ii) above). Any such payments and indemnities shall be treated as Additional Amounts payable pursuant to Applicable Tax Law for purposes of Section 8(d) hereof.

-19-

If the Company becomes obligated to pay Additional Amounts with respect to any payment under or with respect to the Series B Convertible Preferred Shares, the Company will deliver to the Holder on a date that is at least 30 days prior to the date of that payment (unless the obligation to pay Additional Amounts arises after the 30th day prior to that payment date, in which case the Company will notify the Holders promptly thereafter) an Officers’ Certificate stating the fact that Additional Amounts will be payable and the amount estimated to be so payable; provided that no such Officers’ Certificate will be required prior to any date of payment if there has been no change with respect to the matters set forth in a prior Officers’ Certificate.

The Company will make all withholdings and deductions required by law and will remit the full amount deducted or withheld to the relevant tax authority in accordance with applicable law. The Company will provide to the applicable Holders of Series B Convertible Preferred Shares, within 60 days after the date the payment of any Applicable Taxes so deducted or withheld is made, an official receipt or, if official receipts are not reasonably obtainable, such other documentation that provides reasonable evidence of the payment of any Applicable Taxes so deducted or withheld. Upon written request, copies of those receipts or other documentation, as the case may be, will be made available to the Holders of Series B Convertible Preferred Shares.

(b) Any reference in the Series B Convertible Preferred Shares in any context to any payment shall be deemed to include any payment of Additional Amounts to the extent that, in such context, Additional Amounts are, were or would be payable in respect thereof.

(c) The foregoing obligations shall survive any transfer by a Holder or a beneficial owner of its Series B Convertible Preferred Shares and will apply mutatis mutandis to any jurisdiction in which any Successor Company is then, for tax purposes, incorporated, organized or resident or doing business (or any political subdivision or taxing authority thereof or therein) or any jurisdiction from or through which payment under or with respect to the Series B Convertible Preferred Shares is made or deemed made by or on behalf of such Successor Company (or any political subdivision or taxing authority thereof or therein).

(d) Notwithstanding anything to the contrary herein, the Company shall be entitled to make any withholding or deduction pursuant to FATCA.

(j) Cleanup Redemption.

(1) The Company may at its option redeem for cash all but not part of the Series B Convertible Preferred Shares at any time, on a redemption date (the “Cleanup Redemption Date”), if less than 10% of the Series B Convertible Preferred Shares originally issued remains outstanding at such time (such redemption, a “Cleanup Redemption”).

(2) Notice of Cleanup Redemption. In the case of any Cleanup Redemption, the Company shall give each Holder of the Series B Convertible Preferred Shares not less than 50 Scheduled Trading Days’ but no more than 70 Scheduled Trading Days’ written notice (a “Cleanup Redemption Notice”) prior to the Cleanup Redemption Date, and the redemption drice will be equal to 100% of the Stated Value of the Series B Convertible Preferred Shares to be redeemed (the “Cleanup Redemption Price”), plus accrued and unpaid dividends, if any, to, but excluding, the Cleanup Redemption Date (unless the Cleanup Redemption Date falls prior to the immediately succeeding Regular Dividend Payment Date, in which case the Company shall pay on the Regular Dividend Payment Date the full amount of accrued and unpaid dividends, if any, to the Holder of record as of the close of business on such Regular Record Date, and the Cleanup Redemption Price shall be equal to 100% of the Stated Value of the Series B Convertible Preferred Shares to be redeemed). The Cleanup Redemption Date must be a Business Day. The Company shall send to each Holder written Cleanup Redemption Notice containing certain information, including:

-20-

| i. | the Cleanup Redemption Date; | |

| ii. | the Cleanup Redemption Price; | |

| iii. | the settlement method that will apply to all conversions with a Conversion Date that occurs on or after the date the Company sends such Cleanup Redemption Notice and before the close of business on the second Scheduled Trading Day immediately before the related Cleanup Redemption Date; | |

| iv. | that on the Cleanup Redemption Date, the Cleanup Redemption Price will become due and payable for each Series B Convertible Preferred Share to be redeemed, and that interest thereon, if any, shall cease to accrue on and after the Cleanup Redemption Date unless the Company defaults in the payment of the Cleanup Redemption Price; | |

| v. | the place or places where the Series B Convertible Preferred Shares subject to such redemption are to be surrendered for payment of the Cleanup Redemption Price; | |