|

|

April 19, 2016

VIA EDGAR TRANSMISSION

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, N.E.

Washington, DC 20549

Attn: Justin Dobbie

Re: Ignite Restaurant Group, Inc.

Preliminary Proxy Statement on Schedule 14A

Filed April 6, 2016

File No. 001-35549

Dear Mr. Dobbie:

On behalf of Ignite Restaurant Group, Inc. (the “Company” or “Ignite”), set forth below are responses of the Company to the comments of the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) contained in the letter dated April 14, 2016 (the “Comment Letter”) relating to the Company’s Preliminary Statement on Schedule 14A, File No. 001-35549, filed on April 6, 2016 (the “Preliminary Statement”). Capitalized terms used herein and otherwise not defined herein shall have the meanings assigned to such terms in the Preliminary Statement or the exhibits thereto, as applicable.

Concurrently with this response letter, the Company is providing its proposed changes to the Preliminary Statement in response to the Comment Letter. Upon confirmation from the Staff as to the adequacy of the proposed changes, the Company intends to include these changes in the filing of its Definitive Proxy Statement.

The headings and numbered paragraphs of this letter correspond to the headings and paragraph numbers contained in the Comment Letter, and to facilitate your review, we have reproduced the text of the Staff’s comments in boldfaced print below, followed by the Company’s response to each comment. References in this letter to page numbers and section headings refer to page numbers and section headings in the Preliminary Statement.

|

U.S. Securities and Exchange Commission |

April 19, 2016 |

General

|

1. |

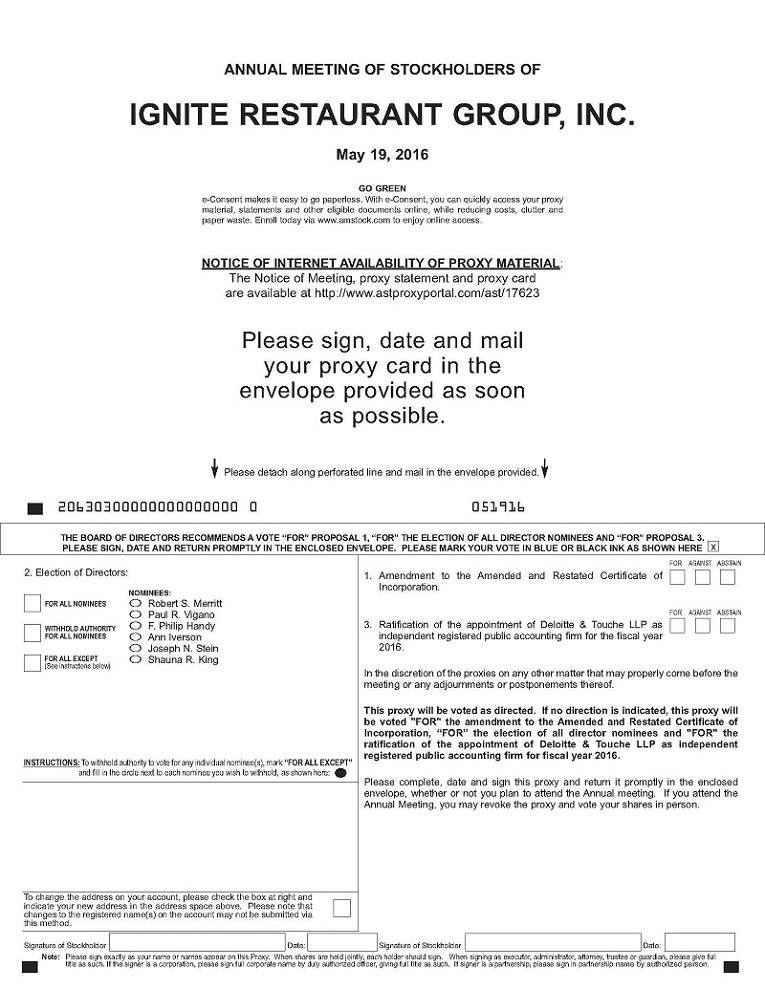

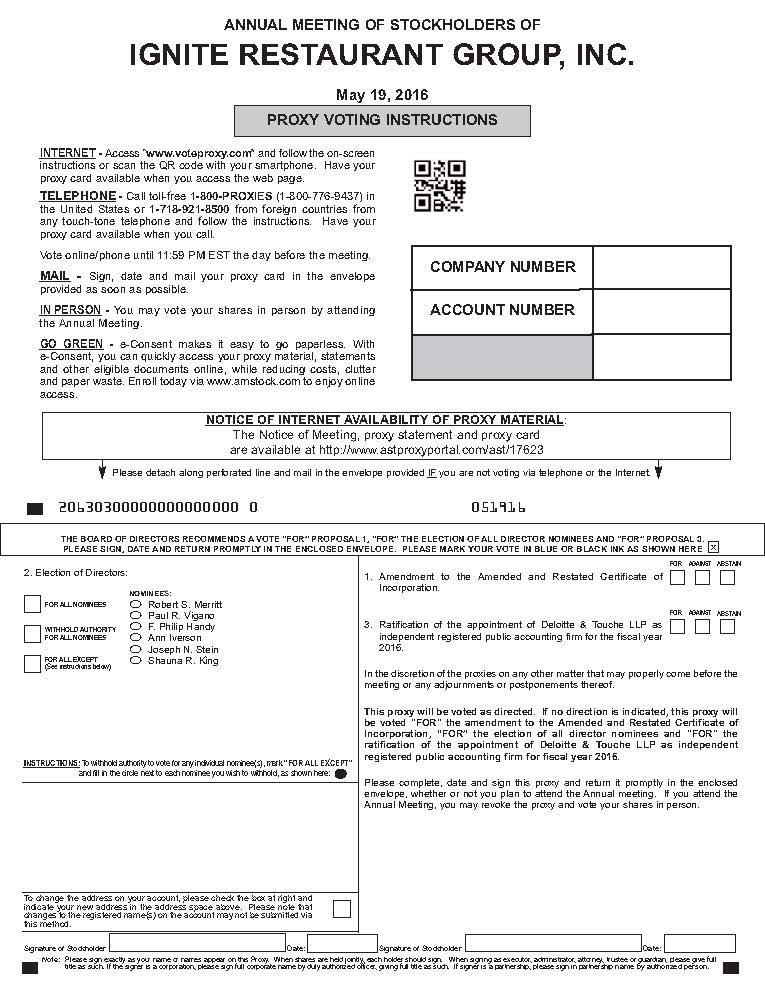

Please file the form of the proxy card that will accompany your proxy statement with your next amendment to your preliminary proxy statement as required by Rule 14a-6 of Regulation 14A. | |

| Response: In response to the Staff’s comments, the Company will include the proxy card in the filing of our definitive proxy and has included it also with this filing (see Attachment I). |

Proposal 1 – Amendment to the Amended and Restated Certificate of Incorporation, page 10

|

2. |

Please revise to disclose here whether vacancies which occur during the year may be filled by the board of directors to serve only until the next annual meeting or may be so filled for the remainder of the full term. | |

| Response: In response to the Staff’s comments, the Company has revised the disclosure to proposal 1 by inserting the following in the first paragraph of page 11 of the definitive proxy filing (see Attachment II): “Any vacancy on the board of directors, however occurring, including a vacancy resulting from an increase in the size of the board, may only be filled by the board of directors. A director elected to fill a vacancy will serve until the election of the class for which the vacancy occurred.” |

Please direct any questions concerning this letter to Ms. Leslie Oguchi at (713) 366-7501.

|

U.S. Securities and Exchange Commission |

April 19, 2016 |

In addition, on behalf of Ignite Restaurant Group, Inc. (the “Company”) and in connection with the filing of the Preliminary Revised Proxy Statement on Schedule 14 (the “Proxy Statement”), the undersigned hereby acknowledges that:

|

● |

the Company is responsible for the adequacy and accuracy of the disclosure in the Proxy Statement; | |

|

● |

staff of the Division of Corporation Finance (the “Staff”) comments or changes to disclosure in response to Staff comments do not foreclose the U.S. Securities and Exchange Commission (the “Commission”) from taking any action with respect to the Proxy Statement; and | |

|

● |

the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

|

|

|

Very truly yours, |

|

|

|

|

|

|

|

|

|

/s/ Brad A. Leist |

|

|

|

|

Brad A. Leist |

|

|

|

|

Senior Vice President and Chief Financial Officer |

|

|

cc: |

Mr. Robert Merritt (Ignite Restaurant Group, Inc.) |

|

|

Ms. Sonia Bednarowski (Securities and Exchange Commission) |

|

|

Ms. Shauna King (Ignite Restaurant Group, Inc.) |

|

|

Ms. Leslie Oguchi (Ignite Restaurant Group, Inc.) |

Attachment I

Attachment II

Standing for One-Year Terms Ending at 2017 Annual Meeting (Class I)

● Mr. Stein and Mr. Vigano

Standing for Two-Year Terms Ending at 2018 Annual Meeting (Class II)

● Ms. King and Mr. Handy

Standing for Three-Year Terms Ending at 2019 Annual Meeting (Class III)

● Mr. Merritt and Ms. Iverson

If the proposed amendment to article six of the Amended and Restated Certificate of Incorporation is adopted, at the 2017 annual meeting of stockholders, the Class I directors would be elected for three-year terms expiring at the 2020 annual meeting of stockholders; at the 2018 annual meeting of stockholders, the Class II directors would be elected for two-year terms expiring at the 2020 annual meeting of stockholders; and at the 2019 annual meeting of stockholders, the Class III directors would be elected for one-year terms expiring at the 2020 annual meeting of stockholders. Any vacancy on the board of directors, however occurring, including a vacancy resulting from an increase in the size of the board, may only be filled by the board of directors. A director elected to fill a vacancy will serve until the election of the class for which the vacancy occurred. Accordingly, beginning with the 2020 annual meeting of stockholders, directors would be elected for a term expiring at the next annual meeting of stockholders. See the discussion below under “Election of Directors” for more details.

The board is proposing to reinstitute a classified board for one full election cycle before phasing it out in 2020 . The board of directors believes that the longer time required to elect a majority of a classified board will help assure continuity and stability of corporate policies since a majority of the directors will always have prior experience as directors of the Company. The board of directors is recommending a classified board with a phase-out provision because it believes that after a full election cycle, the then-current board of directors and stockholders should have an opportunity to re-evaluate whether a staggered board is still prudent. Accordingly, any action to reinstitute a classified board in 2020 or thereafter would be subject to stockholder approval.

In addition to the benefit of continuity and stability, the board of directors believes a classified board may provide greater protection to stockholders in the event a transaction was proposed to acquire the Company which the board of directors thought was not in your best interest. There have been many instances of accumulation of substantial stock in companies by third parties as a prelude to proposing a takeover or a restructuring or sale of all or part of the target company. These actions may be undertaken by the third party without advance notice to or consultation with management of the corporation. In many cases, the purchaser seeks representation on a company’s board of directors in order to increase the likelihood that the purchaser’s proposal will be implemented by that company. If the company resists these efforts, the purchaser may commence a proxy contest to have its nominees elected to the board. In some cases, the purchaser may not truly be interested in taking over the target corporation, but uses the challenge of a proxy contest and/or a takeover bid as a means of effecting a purchase of the purchaser’s stock at a substantial premium over market price. Our board of directors believes that the prospect of removal of the Company’s entire board in these situations would severely curtail its ability to negotiate effectively with any such purchaser for the benefit of all stockholders. The board of directors could be deprived of the time and information necessary to evaluate the takeover proposal, to study alternative proposals and to help ensure that the best price is obtained for the benefit of all stockholders in any transaction which may ultimately be undertaken. With a classified board, at least two elections will be required to effect a change of control of the board of directors, which will enhance the board’s leverage to negotiate effectively with any proposed acquirer. The board of directors emphasizes that it knows of no such acquisition or takeover proposals at the present time nor is it soliciting any such proposals. Our board of directors simply believes the classified board is in the best interests of the Company to be prepared for the future.

The classification of directors may, however, have the effect of extending the period of time to effect a change in control of the membership of the board of directors even if the reason for such a change might be dissatisfaction with the performance of incumbent directors. Nonetheless, for the reasons stated above, the board believes a classified board is in the best interests of the Company.

If the amendment to the Amended and Restated Certificate of Incorporation to classify the board of directors is approved, article six of the Amended and Restated Certificate of Incorporation will be replaced in its entirety by the proposed article six. A copy of the proposed article six is attached as Exhibit A .

The board of directors recommends that you vote FOR the amendment.

PROPOSAL 2 — ELECTION OF DIRECTORS

Currently, our board of directors consists of six directors in three classes, with three directors in Class I, one director in Class II and two directors in Class III.

The terms of all the directors expire at the Annual Meeting. If the proposed amendment to the Amended and Restated Certificate of Incorporation to reinstitute a classified board of directors is approved by the stockholders, the directors will immediately be divided into classes, such that, Mr. Stein and Mr. Vigano will be our Class I directors and will hold office for a one-year term until the annual meeting of stockholders to be held in 2017; Ms. King and Mr. Handy will be our Class II directors and will hold office for a two-year term until the annual