AUGUST 6, 2025 Carlyle Reports Second Quarter 2025 Financial Results

Carlyle Reports Second Quarter 2025 Financial Results WASHINGTON, D.C. AND NEW YORK – August 6, 2025 – Global investment firm The Carlyle Group Inc. (NASDAQ: CG) today reported its unaudited results for the second quarter ended June 30, 2025. U.S. GAAP Results U.S. GAAP results for Q2 2025 included income before provision for income taxes of $441 million and a margin on income before provision for income taxes of 28.0%. Dividend The Board of Directors has declared a quarterly dividend of $0.35 per common share to holders of record at the close of business on August 18, 2025, payable on August 28, 2025. Conference Call Carlyle will host a conference call at 8:30 a.m. EDT on Wednesday, August 6, 2025, to discuss its second quarter financial results. The call will be available via public webcast from the Shareholders section of Carlyle's website at www.carlyle.com and a replay will be available on our website soon after the call’s completion. About Carlyle Carlyle (NASDAQ: CG) is a global investment firm with deep industry expertise that deploys private capital across its business and conducts its operations through three business segments: Global Private Equity, Global Credit, and Carlyle AlpInvest. With $465 billion of assets under management as of June 30, 2025, Carlyle’s purpose is to invest wisely and create value on behalf of its investors, portfolio companies, and the communities in which we live and invest. Carlyle employs more than 2,300 people in 27 offices across four continents. Further information is available at www.carlyle.com. Follow Carlyle on X @OneCarlyle and LinkedIn at The Carlyle Group. “Carlyle delivered an exceptionally strong second quarter, underscoring the momentum we’ve built across the firm as we execute our strategic plan. We’re delivering record financial results, investing with conviction, and returning significant capital to our investors at a pace and scale that sets Carlyle apart in today’s market. As market activity accelerates, we’re well- positioned to continue driving growth and deliver long-term value for our shareholders.” HARVEY M. SCHWARTZ Chief Executive Officer

This presentation may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our expectations, estimates, beliefs, projections, future plans and strategies, anticipated events or trends, and similar expressions and statements that are not historical facts, including our expectations regarding the performance of our business, our financial results, our liquidity and capital resources, contingencies, and our dividend policy. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. Such forward-looking statements are subject to various risks, uncertainties, and assumptions. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those Forward-Looking Statements indicated in these statements including, but not limited to, those described in this presentation and under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission (“SEC”) on February 27, 2025, as such factors may be updated from time to time in our periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this presentation and in our other periodic filings with the SEC. We undertake no obligation to publicly update or review any forward- looking statements, whether as a result of new information, future developments, or otherwise, except as required by applicable law. This presentation does not constitute an offer for any Carlyle fund. Contacts INVESTOR RELATIONS MEDIA Daniel Harris Brittany Bensaull Kristen Ashton Phone: +1 (212) 813-4527 Phone: +1 (212) 813-4839 Phone: +1 (212) 813-4763 daniel.harris@carlyle.com brittany.bensaull@carlyle.com kristen.ashton@carlyle.com

Second Quarter 2025 Financial Results

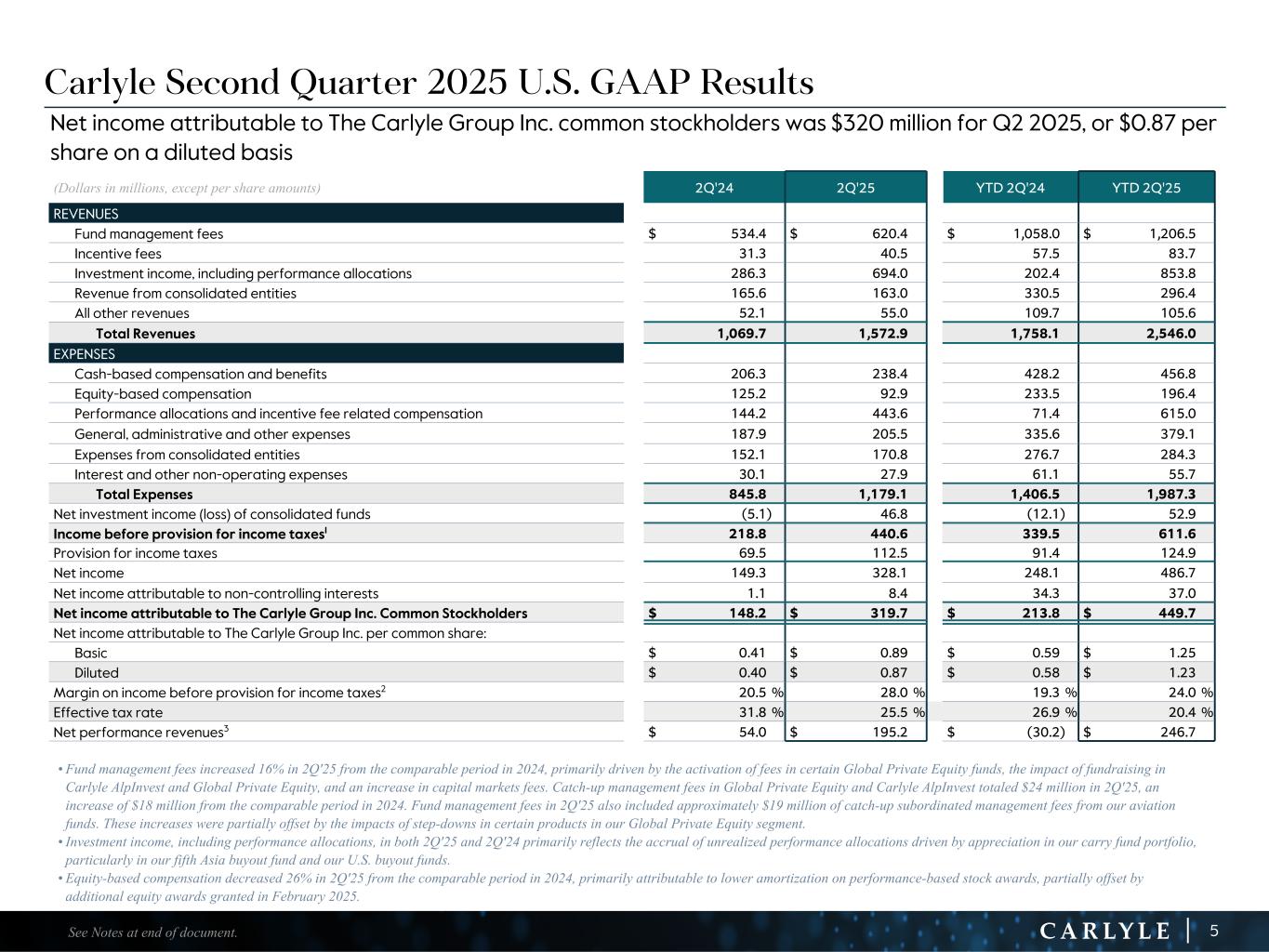

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 5 • Fund management fees increased 16% in 2Q'25 from the comparable period in 2024, primarily driven by the activation of fees in certain Global Private Equity funds, the impact of fundraising in Carlyle AlpInvest and Global Private Equity, and an increase in capital markets fees. Catch-up management fees in Global Private Equity and Carlyle AlpInvest totaled $24 million in 2Q'25, an increase of $18 million from the comparable period in 2024. Fund management fees in 2Q'25 also included approximately $19 million of catch-up subordinated management fees from our aviation funds. These increases were partially offset by the impacts of step-downs in certain products in our Global Private Equity segment. • Investment income, including performance allocations, in both 2Q'25 and 2Q'24 primarily reflects the accrual of unrealized performance allocations driven by appreciation in our carry fund portfolio, particularly in our fifth Asia buyout fund and our U.S. buyout funds. • Equity-based compensation decreased 26% in 2Q'25 from the comparable period in 2024, primarily attributable to lower amortization on performance-based stock awards, partially offset by additional equity awards granted in February 2025. (Dollars in millions, except per share amounts) 2Q'24 2Q'25 YTD 2Q'24 YTD 2Q'25 REVENUES Fund management fees $ 534.4 $ 620.4 $ 1,058.0 $ 1,206.5 Incentive fees 31.3 40.5 57.5 83.7 Investment income, including performance allocations 286.3 694.0 202.4 853.8 Revenue from consolidated entities 165.6 163.0 330.5 296.4 All other revenues 52.1 55.0 109.7 105.6 Total Revenues 1,069.7 1,572.9 1,758.1 2,546.0 EXPENSES Cash-based compensation and benefits 206.3 238.4 428.2 456.8 Equity-based compensation 125.2 92.9 233.5 196.4 Performance allocations and incentive fee related compensation 144.2 443.6 71.4 615.0 General, administrative and other expenses 187.9 205.5 335.6 379.1 Expenses from consolidated entities 152.1 170.8 276.7 284.3 Interest and other non-operating expenses 30.1 27.9 61.1 55.7 Total Expenses 845.8 1,179.1 1,406.5 1,987.3 Net investment income (loss) of consolidated funds (5.1) 46.8 (12.1) 52.9 Income before provision for income taxes1 218.8 440.6 339.5 611.6 Provision for income taxes 69.5 112.5 91.4 124.9 Net income 149.3 328.1 248.1 486.7 Net income attributable to non-controlling interests 1.1 8.4 34.3 37.0 Net income attributable to The Carlyle Group Inc. Common Stockholders $ 148.2 $ 319.7 $ 213.8 $ 449.7 Net income attributable to The Carlyle Group Inc. per common share: Basic $ 0.41 $ 0.89 $ 0.59 $ 1.25 Diluted $ 0.40 $ 0.87 $ 0.58 $ 1.23 Margin on income before provision for income taxes2 20.5 % 28.0 % 19.3 % 24.0 % Effective tax rate 31.8 % 25.5 % 26.9 % 20.4 % Net performance revenues3 $ 54.0 $ 195.2 $ (30.2) $ 246.7 Carlyle Second Quarter 2025 U.S. GAAP Results Net income attributable to The Carlyle Group Inc. common stockholders was $320 million for Q2 2025, or $0.87 per share on a diluted basis See Notes at end of document.

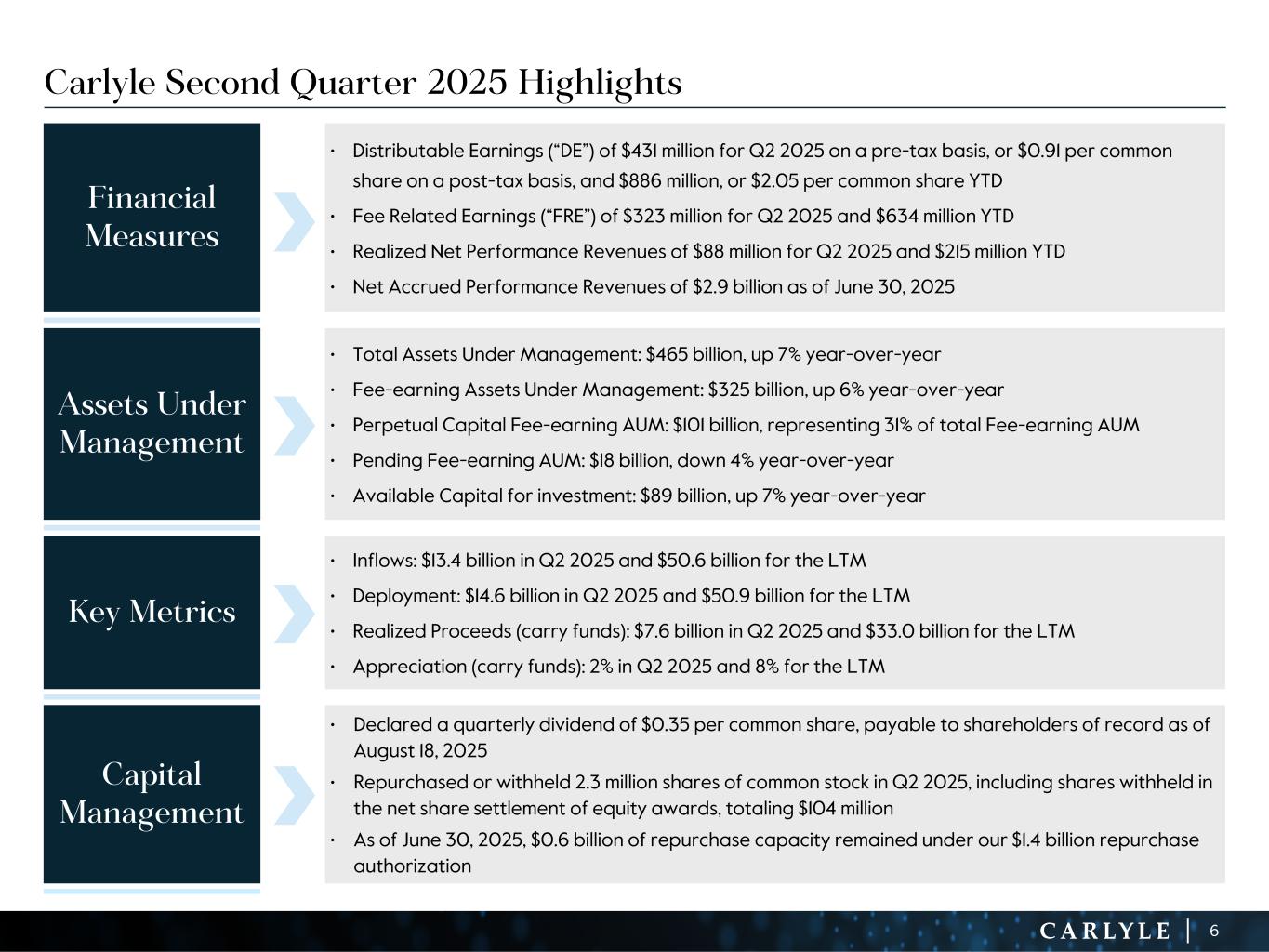

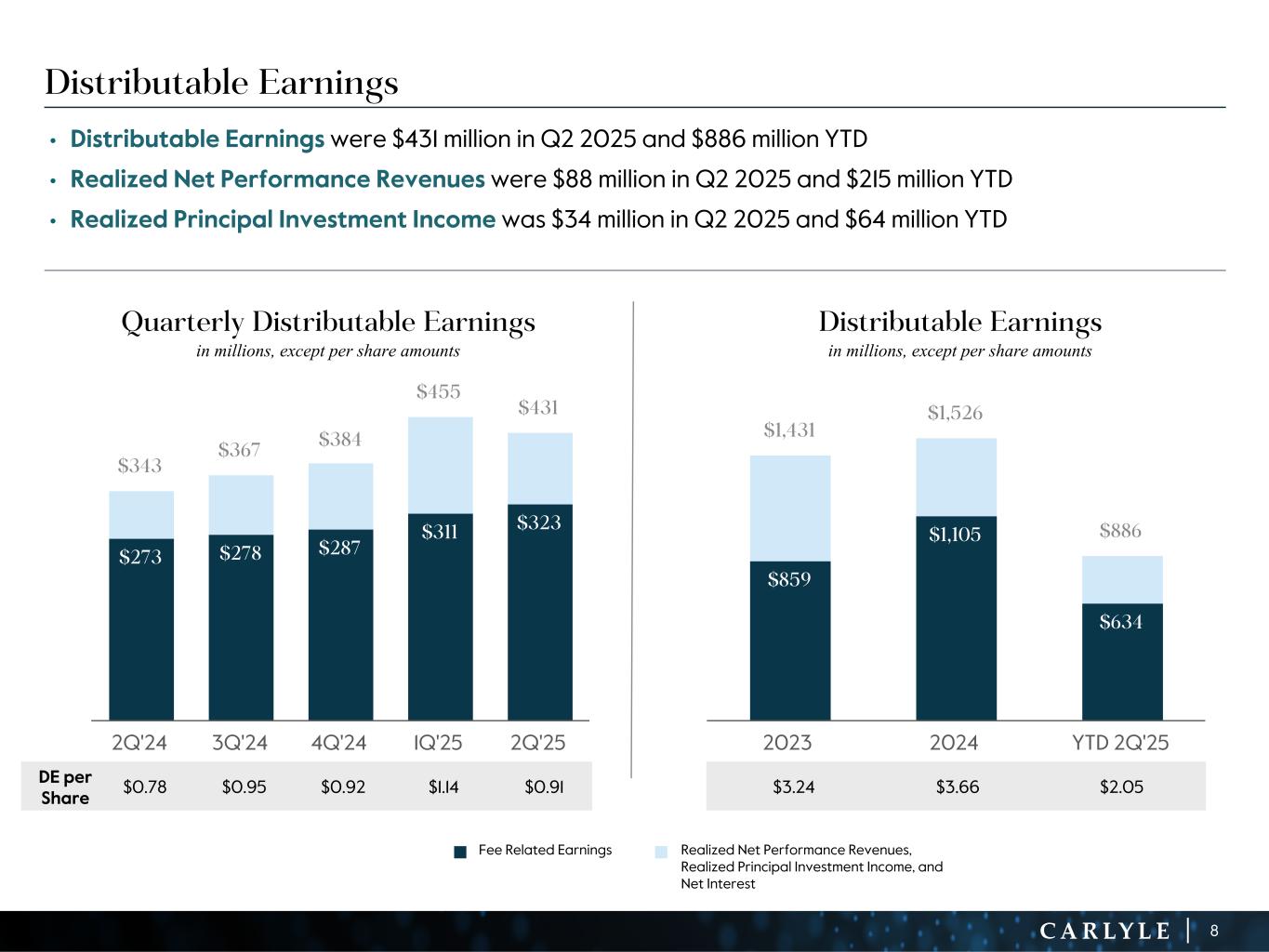

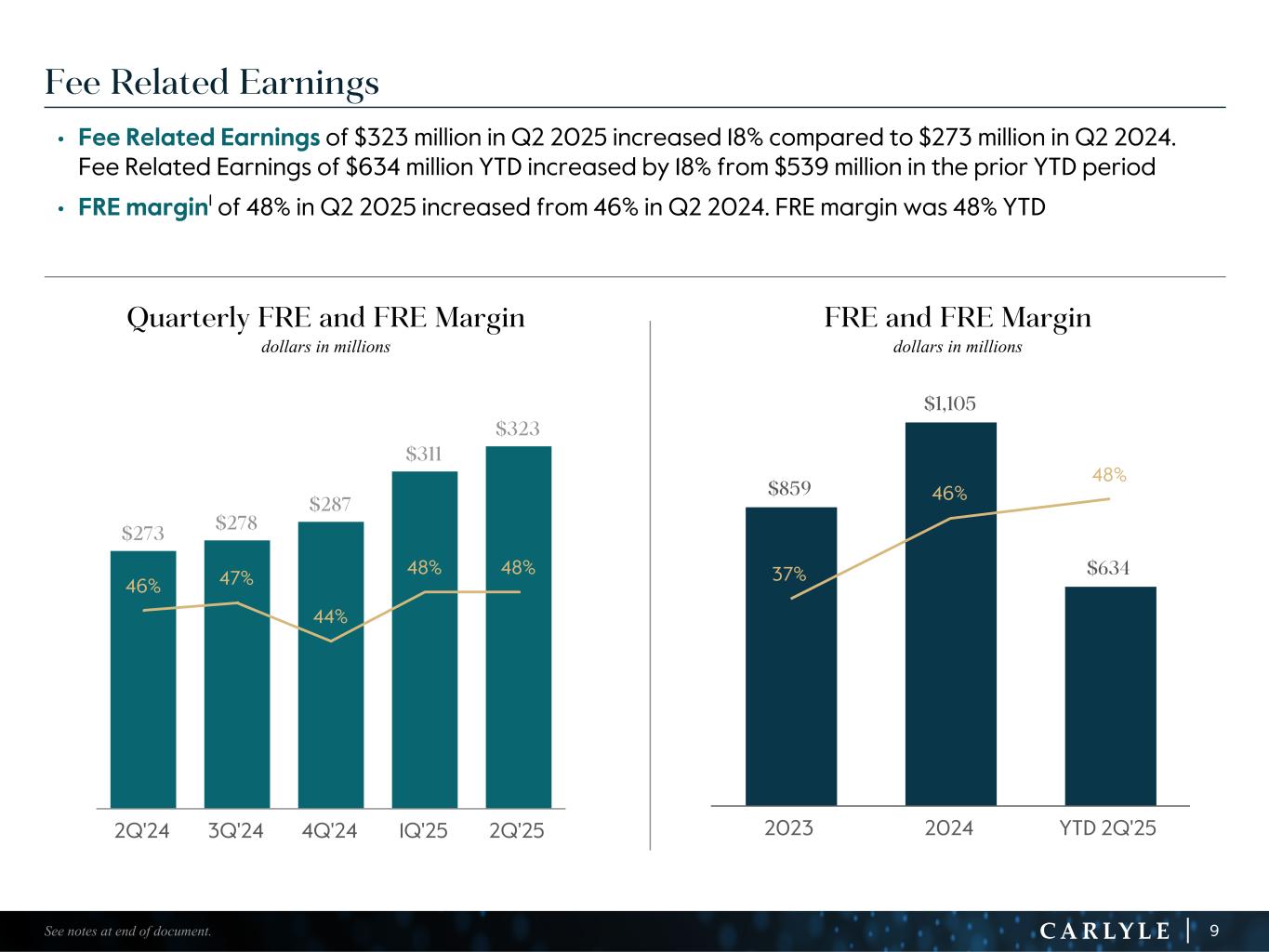

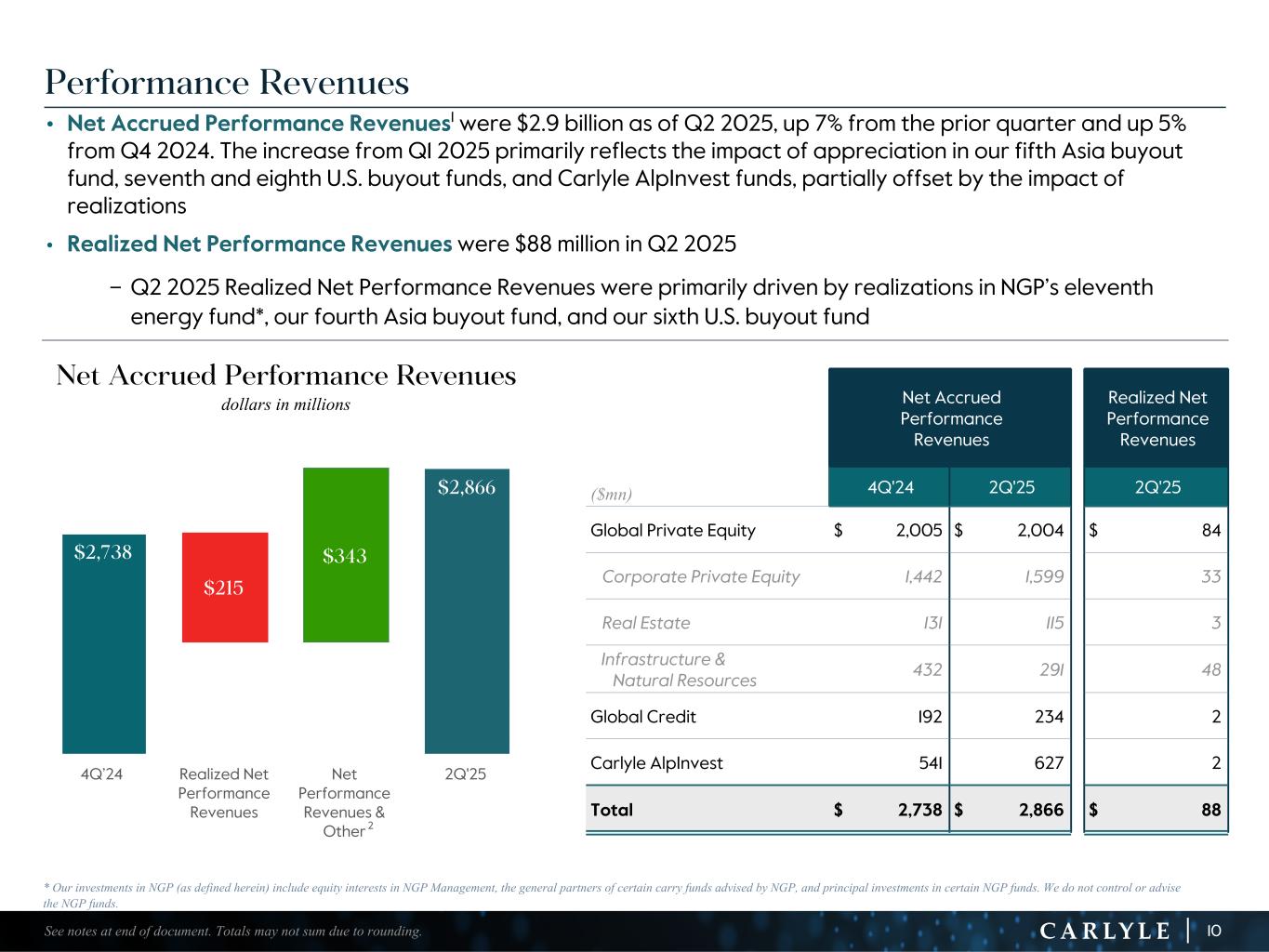

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 6 Financial Measures • Distributable Earnings (“DE”) of $431 million for Q2 2025 on a pre-tax basis, or $0.91 per common share on a post-tax basis, and $886 million, or $2.05 per common share YTD • Fee Related Earnings (“FRE”) of $323 million for Q2 2025 and $634 million YTD • Realized Net Performance Revenues of $88 million for Q2 2025 and $215 million YTD • Net Accrued Performance Revenues of $2.9 billion as of June 30, 2025 Assets Under Management • Total Assets Under Management: $465 billion, up 7% year-over-year • Fee-earning Assets Under Management: $325 billion, up 6% year-over-year • Perpetual Capital Fee-earning AUM: $101 billion, representing 31% of total Fee-earning AUM • Pending Fee-earning AUM: $18 billion, down 4% year-over-year • Available Capital for investment: $89 billion, up 7% year-over-year Key Metrics • Inflows: $13.4 billion in Q2 2025 and $50.6 billion for the LTM • Deployment: $14.6 billion in Q2 2025 and $50.9 billion for the LTM • Realized Proceeds (carry funds): $7.6 billion in Q2 2025 and $33.0 billion for the LTM • Appreciation (carry funds): 2% in Q2 2025 and 8% for the LTM Capital Management • Declared a quarterly dividend of $0.35 per common share, payable to shareholders of record as of August 18, 2025 • Repurchased or withheld 2.3 million shares of common stock in Q2 2025, including shares withheld in the net share settlement of equity awards, totaling $104 million • As of June 30, 2025, $0.6 billion of repurchase capacity remained under our $1.4 billion repurchase authorization Carlyle Second Quarter 2025 Highlights

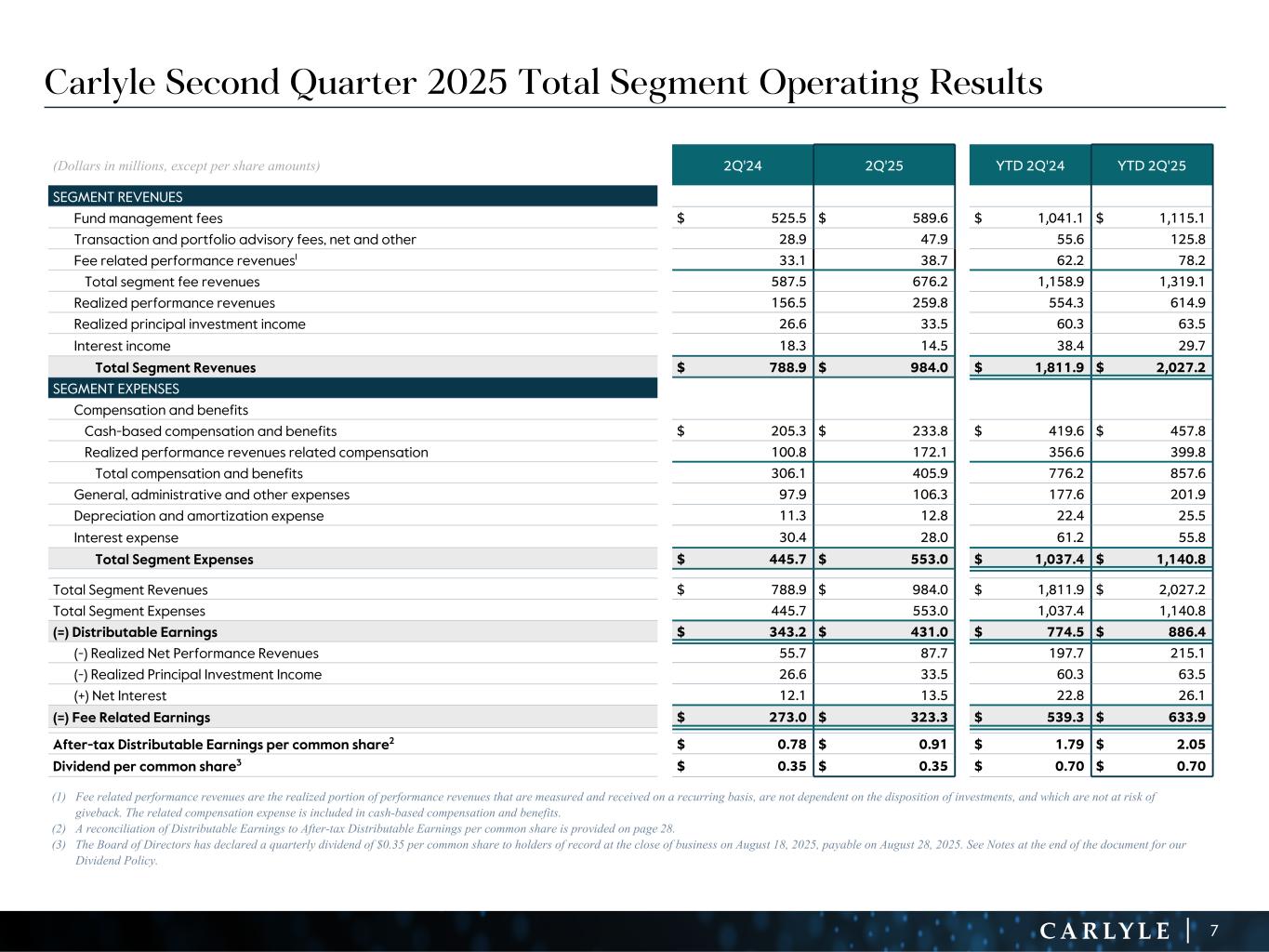

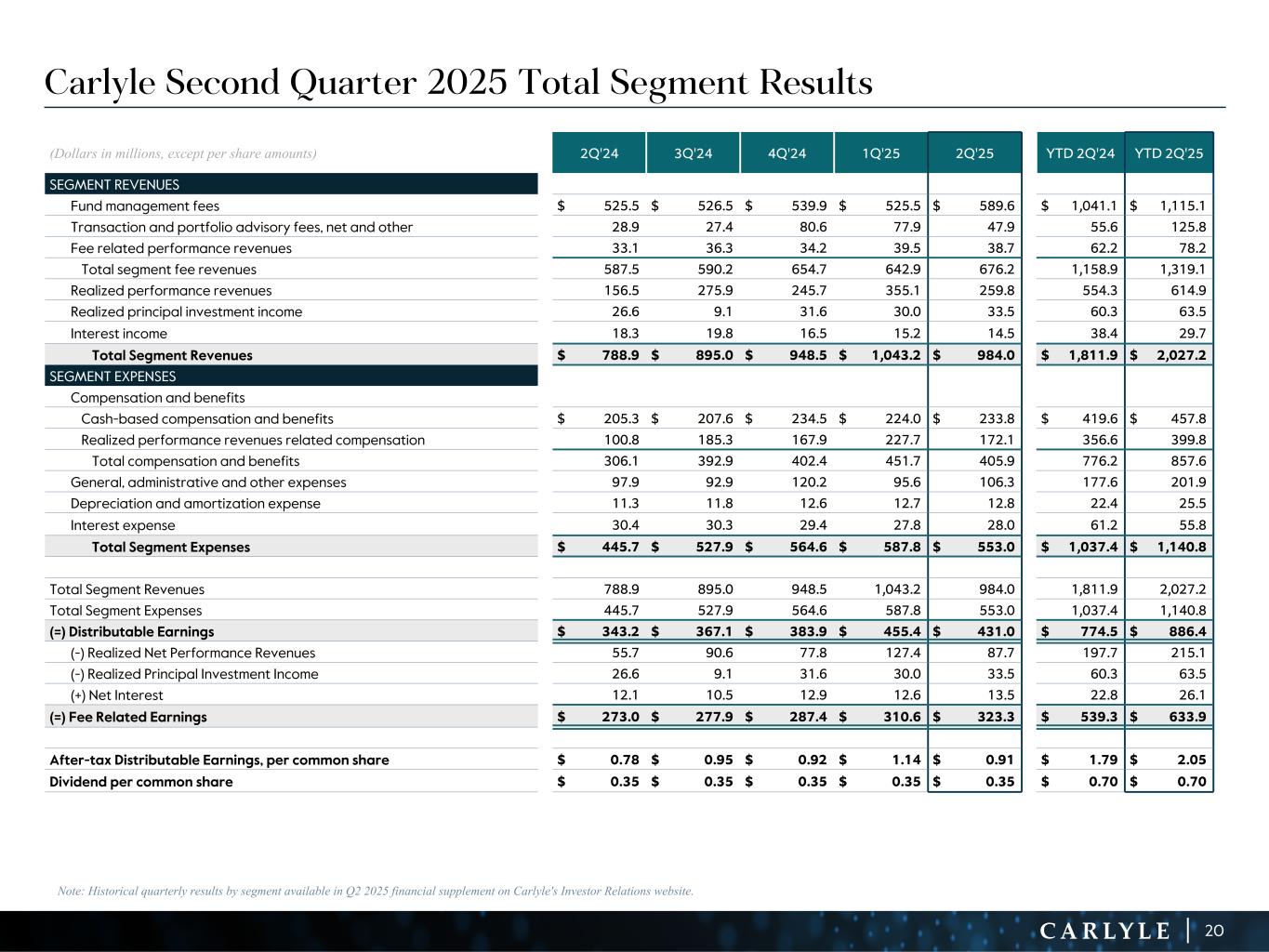

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 7 (1) Fee related performance revenues are the realized portion of performance revenues that are measured and received on a recurring basis, are not dependent on the disposition of investments, and which are not at risk of giveback. The related compensation expense is included in cash-based compensation and benefits. (2) A reconciliation of Distributable Earnings to After-tax Distributable Earnings per common share is provided on page 28. (3) The Board of Directors has declared a quarterly dividend of $0.35 per common share to holders of record at the close of business on August 18, 2025, payable on August 28, 2025. See Notes at the end of the document for our Dividend Policy. Carlyle Second Quarter 2025 Total Segment Operating Results (Dollars in millions, except per share amounts) 2Q'24 2Q'25 YTD 2Q'24 YTD 2Q'25 SEGMENT REVENUES Fund management fees $ 525.5 $ 589.6 $ 1,041.1 $ 1,115.1 Transaction and portfolio advisory fees, net and other 28.9 47.9 55.6 125.8 Fee related performance revenues1 33.1 38.7 62.2 78.2 Total segment fee revenues 587.5 676.2 1,158.9 1,319.1 Realized performance revenues 156.5 259.8 554.3 614.9 Realized principal investment income 26.6 33.5 60.3 63.5 Interest income 18.3 14.5 38.4 29.7 Total Segment Revenues $ 788.9 $ 984.0 $ 1,811.9 $ 2,027.2 SEGMENT EXPENSES Compensation and benefits Cash-based compensation and benefits $ 205.3 $ 233.8 $ 419.6 $ 457.8 Realized performance revenues related compensation 100.8 172.1 356.6 399.8 Total compensation and benefits 306.1 405.9 776.2 857.6 General, administrative and other expenses 97.9 106.3 177.6 201.9 Depreciation and amortization expense 11.3 12.8 22.4 25.5 Interest expense 30.4 28.0 61.2 55.8 Total Segment Expenses $ 445.7 $ 553.0 $ 1,037.4 $ 1,140.8 Total Segment Revenues $ 788.9 $ 984.0 $ 1,811.9 $ 2,027.2 Total Segment Expenses 445.7 553.0 1,037.4 1,140.8 (=) Distributable Earnings $ 343.2 $ 431.0 $ 774.5 $ 886.4 (-) Realized Net Performance Revenues 55.7 87.7 197.7 215.1 (-) Realized Principal Investment Income 26.6 33.5 60.3 63.5 (+) Net Interest 12.1 13.5 22.8 26.1 (=) Fee Related Earnings $ 273.0 $ 323.3 $ 539.3 $ 633.9 After-tax Distributable Earnings per common share2 $ 0.78 $ 0.91 $ 1.79 $ 2.05 Dividend per common share3 $ 0.35 $ 0.35 $ 0.70 $ 0.70

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 8 • Distributable Earnings were $431 million in Q2 2025 and $886 million YTD • Realized Net Performance Revenues were $88 million in Q2 2025 and $215 million YTD • Realized Principal Investment Income was $34 million in Q2 2025 and $64 million YTD Distributable Earnings $859 $1,105 $634 $1,431 $1,526 $886 2023 2024 YTD 2Q'25 Quarterly Distributable Earnings in millions, except per share amounts Distributable Earnings in millions, except per share amounts $273 $278 $287 $311 $323 $343 $367 $384 $455 $431 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 n Fee Related Earnings n Realized Net Performance Revenues, Realized Principal Investment Income, and Net Interest DE per Share $0.78 $0.95 $0.92 $1.14 $0.91 $3.24 $3.66 $2.05

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 9 • Fee Related Earnings of $323 million in Q2 2025 increased 18% compared to $273 million in Q2 2024. Fee Related Earnings of $634 million YTD increased by 18% from $539 million in the prior YTD period • FRE margin1 of 48% in Q2 2025 increased from 46% in Q2 2024. FRE margin was 48% YTD Fee Related Earnings $273 $278 $287 $311 $323 46% 47% 44% 48% 48% 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 See notes at end of document. $859 $1,105 $63437% 46% 48% 2023 2024 YTD 2Q'25 Quarterly FRE and FRE Margin dollars in millions FRE and FRE Margin dollars in millions

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 10 $2,738 $2,523 $2,523 $2,866 $215 $343 4Q’24 Realized Net Performance Revenues Net Performance Revenues & Other 2Q'25 • Net Accrued Performance Revenues1 were $2.9 billion as of Q2 2025, up 7% from the prior quarter and up 5% from Q4 2024. The increase from Q1 2025 primarily reflects the impact of appreciation in our fifth Asia buyout fund, seventh and eighth U.S. buyout funds, and Carlyle AlpInvest funds, partially offset by the impact of realizations • Realized Net Performance Revenues were $88 million in Q2 2025 – Q2 2025 Realized Net Performance Revenues were primarily driven by realizations in NGP’s eleventh energy fund*, our fourth Asia buyout fund, and our sixth U.S. buyout fund Performance Revenues * Our investments in NGP (as defined herein) include equity interests in NGP Management, the general partners of certain carry funds advised by NGP, and principal investments in certain NGP funds. We do not control or advise the NGP funds. Net Accrued Performance Revenues Realized Net Performance Revenues ($mn) 4Q'24 2Q'25 2Q'25 Global Private Equity $ 2,005 $ 2,004 $ 84 Corporate Private Equity 1,442 1,599 33 Real Estate 131 115 3 Infrastructure & Natural Resources 432 291 48 Global Credit 192 234 2 Carlyle AlpInvest 541 627 2 Total $ 2,738 $ 2,866 $ 88 Net Accrued Performance Revenues dollars in millions See notes at end of document. Totals may not sum due to rounding. 2

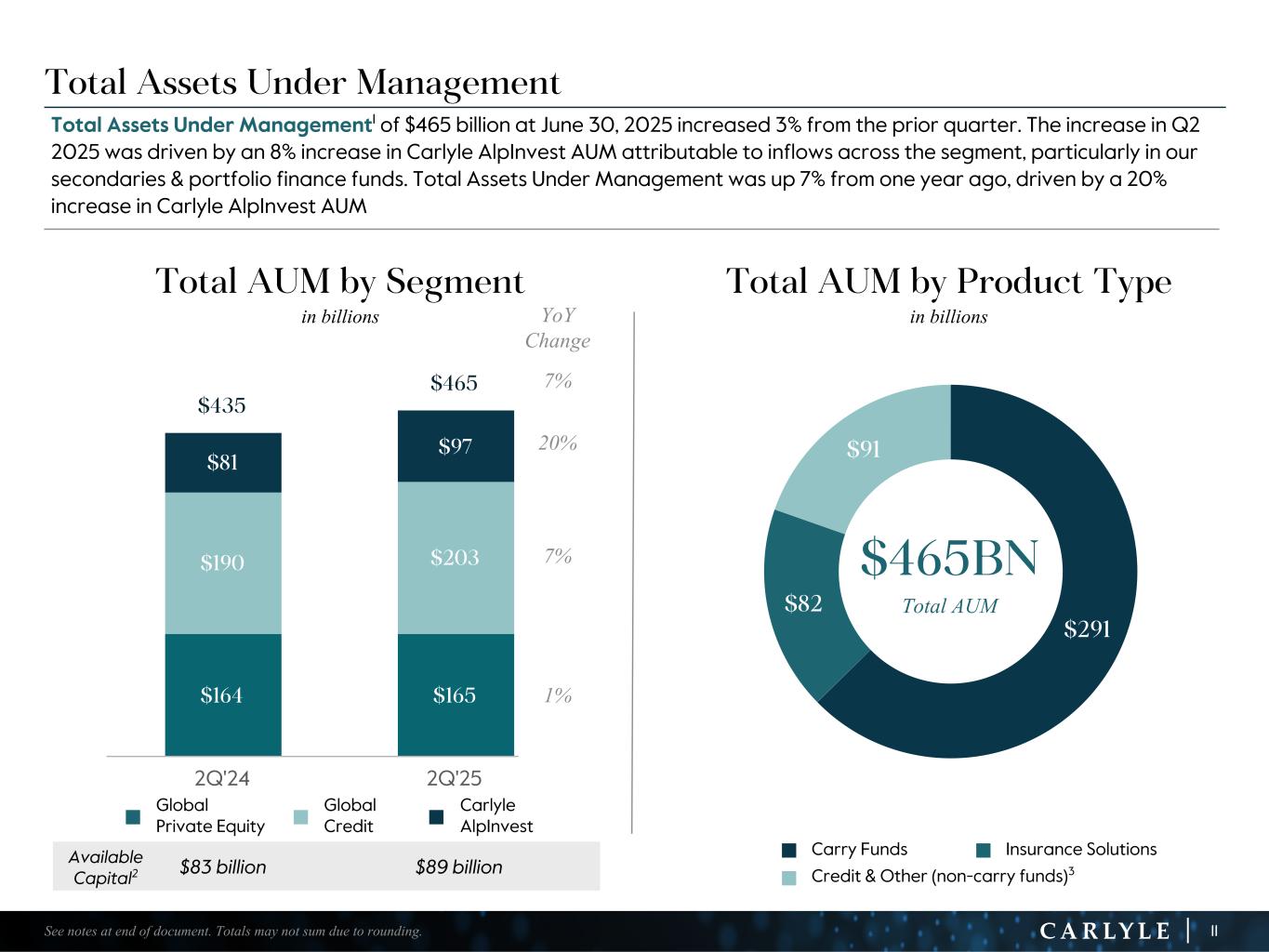

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 11 $291 $82 $91 $164 $165 $190 $203 $81 $97 $435 $465 2Q'24 2Q'25 Total Assets Under Management Total Assets Under Management1 of $465 billion at June 30, 2025 increased 3% from the prior quarter. The increase in Q2 2025 was driven by an 8% increase in Carlyle AlpInvest AUM attributable to inflows across the segment, particularly in our secondaries & portfolio finance funds. Total Assets Under Management was up 7% from one year ago, driven by a 20% increase in Carlyle AlpInvest AUM $465BN Total AUM See notes at end of document. Totals may not sum due to rounding. n Carry Funds n Insurance Solutions n Credit & Other (non-carry funds)3 Total AUM by Segment in billions Total AUM by Product Type in billions Available Capital2 $83 billion $89 billion n Global Private Equity n Global Credit n Carlyle AlpInvest YoY Change 7% 20% 7% 1%

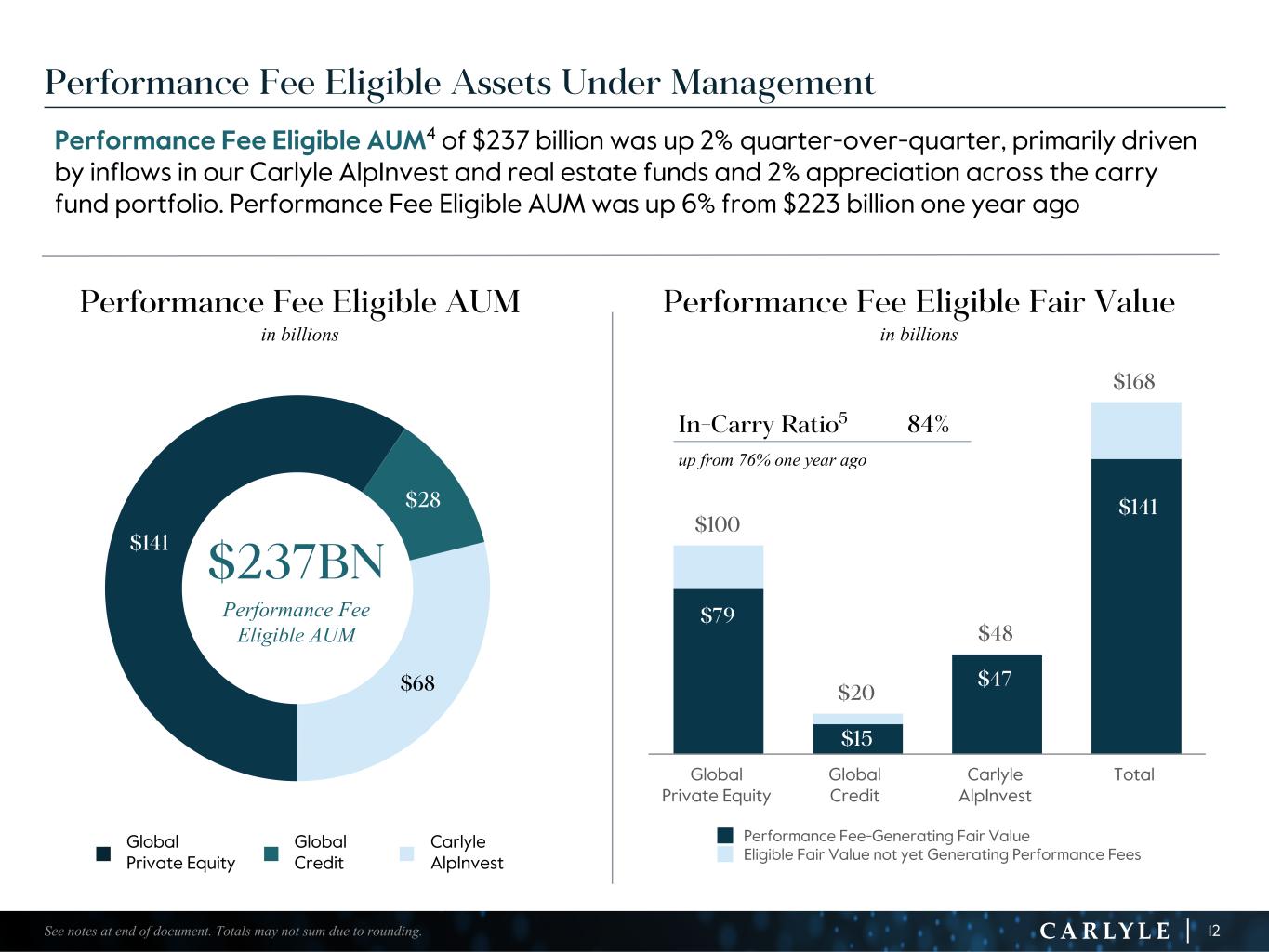

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 12 Performance Fee Eligible AUM4 of $237 billion was up 2% quarter-over-quarter, primarily driven by inflows in our Carlyle AlpInvest and real estate funds and 2% appreciation across the carry fund portfolio. Performance Fee Eligible AUM was up 6% from $223 billion one year ago $100 $20 $48 $168 Performance Fee-Generating Fair Value Eligible Fair Value not yet Generating Performance Fees Global Private Equity Global Credit Carlyle AlpInvest Total Performance Fee Eligible Assets Under Management $141 $28 $68 $237BN Performance Fee Eligible AUM See notes at end of document. Totals may not sum due to rounding. $79 $15 $47 $141 Performance Fee Eligible Fair Value in billions Performance Fee Eligible AUM in billions In-Carry Ratio5 84% up from 76% one year ago n Global Private Equity n Global Credit n Carlyle AlpInvest

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 13 $76 $7 $6 $12 $104 $102 $155 $163 $48 $60 $307 $325 2Q'24 2Q'25 Fee-earning Assets Under Management Fee-earning Assets Under Management6 of $325 billion at June 30, 2025 were up 3% from the prior quarter, driven by a 10% increase in Carlyle AlpInvest and 4% increase in Global Private Equity. Fee-earning Assets Under Management were up 6% from one year ago. Pending FEAUM of $18 billion decreased from $26 billion in the prior quarter, primarily driven by the activation of fees in our tenth U.S. real estate fund See notes at end of document. Totals may not sum due to rounding. Pending FEAUM7 $18 billion $18 billion FEAUM by Segment in billions Perpetual FEAUM in billions, 31% of Total FEAUM n Real Estate n Insurance Solutions n Direct Lending n Other YoY Change 6% 24% 5% (1)% $11 billion increase year-over-year $101BN 8 n Global Private Equity n Global Credit n Carlyle AlpInvest

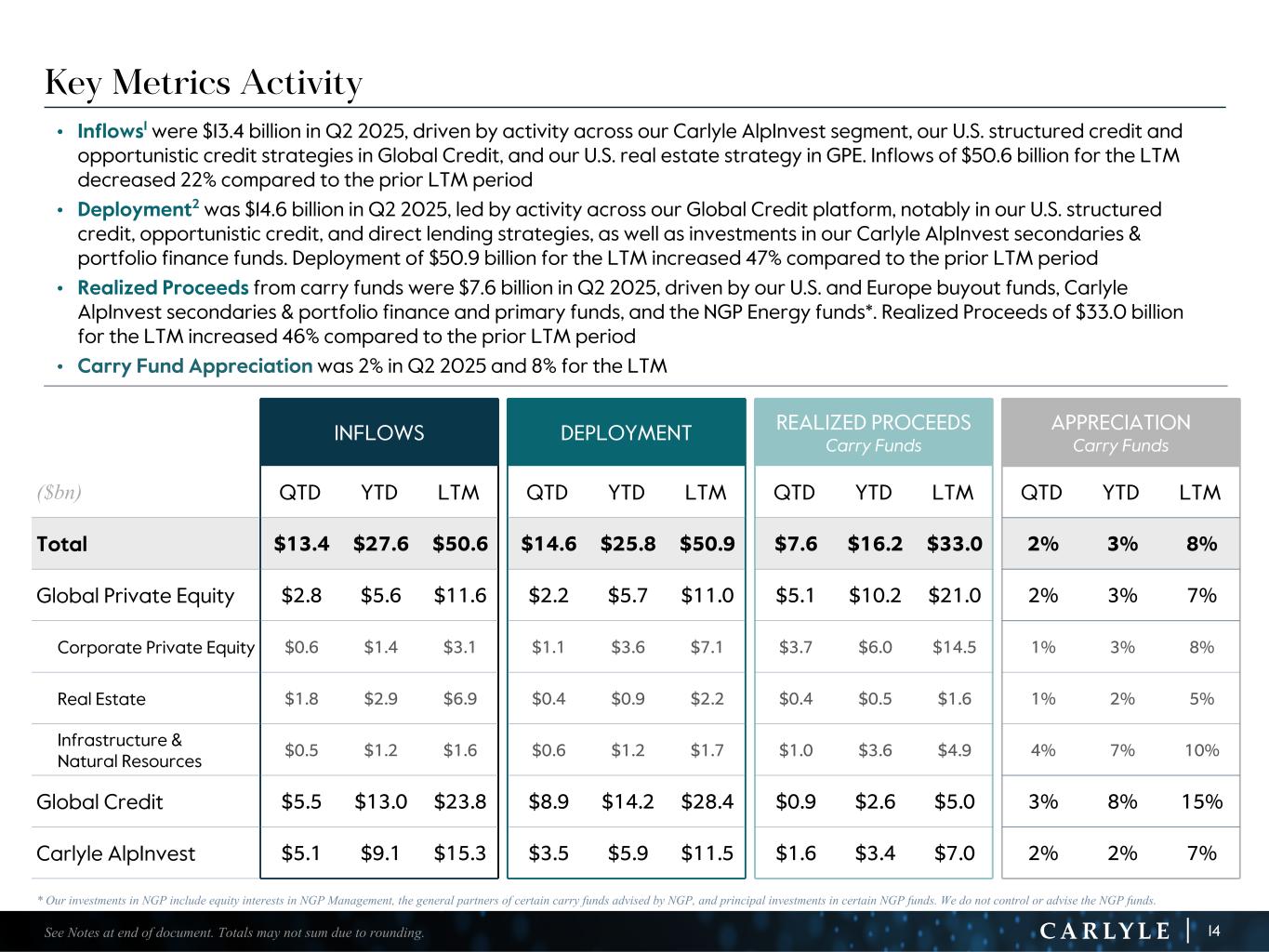

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 14 Key Metrics Activity • Inflows1 were $13.4 billion in Q2 2025, driven by activity across our Carlyle AlpInvest segment, our U.S. structured credit and opportunistic credit strategies in Global Credit, and our U.S. real estate strategy in GPE. Inflows of $50.6 billion for the LTM decreased 22% compared to the prior LTM period • Deployment2 was $14.6 billion in Q2 2025, led by activity across our Global Credit platform, notably in our U.S. structured credit, opportunistic credit, and direct lending strategies, as well as investments in our Carlyle AlpInvest secondaries & portfolio finance funds. Deployment of $50.9 billion for the LTM increased 47% compared to the prior LTM period • Realized Proceeds from carry funds were $7.6 billion in Q2 2025, driven by our U.S. and Europe buyout funds, Carlyle AlpInvest secondaries & portfolio finance and primary funds, and the NGP Energy funds*. Realized Proceeds of $33.0 billion for the LTM increased 46% compared to the prior LTM period • Carry Fund Appreciation was 2% in Q2 2025 and 8% for the LTM INFLOWS DEPLOYMENT REALIZED PROCEEDS Carry Funds APPRECIATION Carry Funds ($bn) QTD YTD LTM QTD YTD LTM QTD YTD LTM QTD YTD LTM Total $13.4 $27.6 $50.6 $14.6 $25.8 $50.9 $7.6 $16.2 $33.0 2% 3% 8% Global Private Equity $2.8 $5.6 $11.6 $2.2 $5.7 $11.0 $5.1 $10.2 $21.0 2% 3% 7% Corporate Private Equity $0.6 $1.4 $3.1 $1.1 $3.6 $7.1 $3.7 $6.0 $14.5 1% 3% 8% Real Estate $1.8 $2.9 $6.9 $0.4 $0.9 $2.2 $0.4 $0.5 $1.6 1% 2% 5% Infrastructure & Natural Resources $0.5 $1.2 $1.6 $0.6 $1.2 $1.7 $1.0 $3.6 $4.9 4% 7% 10% Global Credit $5.5 $13.0 $23.8 $8.9 $14.2 $28.4 $0.9 $2.6 $5.0 3% 8% 15% Carlyle AlpInvest $5.1 $9.1 $15.3 $3.5 $5.9 $11.5 $1.6 $3.4 $7.0 2% 2% 7% See Notes at end of document. Totals may not sum due to rounding. * Our investments in NGP include equity interests in NGP Management, the general partners of certain carry funds advised by NGP, and principal investments in certain NGP funds. We do not control or advise the NGP funds.

Segment Highlights

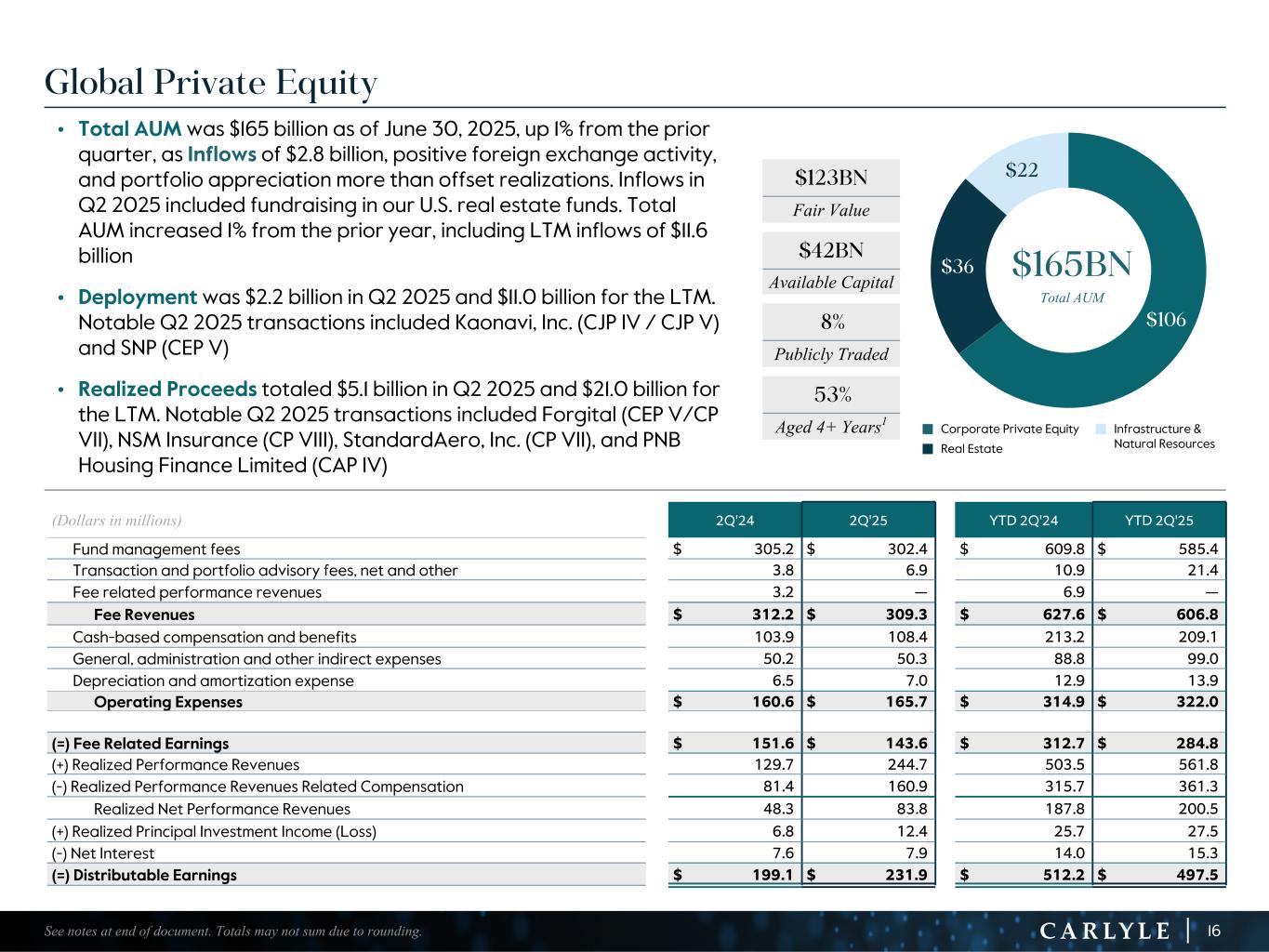

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 16 Global Private Equity • Total AUM was $165 billion as of June 30, 2025, up 1% from the prior quarter, as Inflows of $2.8 billion, positive foreign exchange activity, and portfolio appreciation more than offset realizations. Inflows in Q2 2025 included fundraising in our U.S. real estate funds. Total AUM increased 1% from the prior year, including LTM inflows of $11.6 billion • Deployment was $2.2 billion in Q2 2025 and $11.0 billion for the LTM. Notable Q2 2025 transactions included Kaonavi, Inc. (CJP IV / CJP V) and SNP (CEP V) • Realized Proceeds totaled $5.1 billion in Q2 2025 and $21.0 billion for the LTM. Notable Q2 2025 transactions included Forgital (CEP V/CP VII), NSM Insurance (CP VIII), StandardAero, Inc. (CP VII), and PNB Housing Finance Limited (CAP IV) $106 $36 $22 $165BN Total AUM (Dollars in millions) 2Q'24 2Q'25 YTD 2Q'24 YTD 2Q'25 Fund management fees $ 305.2 $ 302.4 $ 609.8 $ 585.4 Transaction and portfolio advisory fees, net and other 3.8 6.9 10.9 21.4 Fee related performance revenues 3.2 — 6.9 — Fee Revenues $ 312.2 $ 309.3 $ 627.6 $ 606.8 Cash-based compensation and benefits 103.9 108.4 213.2 209.1 General, administration and other indirect expenses 50.2 50.3 88.8 99.0 Depreciation and amortization expense 6.5 7.0 12.9 13.9 Operating Expenses $ 160.6 $ 165.7 $ 314.9 $ 322.0 (=) Fee Related Earnings $ 151.6 $ 143.6 $ 312.7 $ 284.8 (+) Realized Performance Revenues 129.7 244.7 503.5 561.8 (-) Realized Performance Revenues Related Compensation 81.4 160.9 315.7 361.3 Realized Net Performance Revenues 48.3 83.8 187.8 200.5 (+) Realized Principal Investment Income (Loss) 6.8 12.4 25.7 27.5 (-) Net Interest 7.6 7.9 14.0 15.3 (=) Distributable Earnings $ 199.1 $ 231.9 $ 512.2 $ 497.5 See notes at end of document. Totals may not sum due to rounding. $123BN Fair Value $42BN Available Capital 8% Publicly Traded 53% Aged 4+ Years1 n Corporate Private Equity n Infrastructure & Natural Resourcesn Real Estate

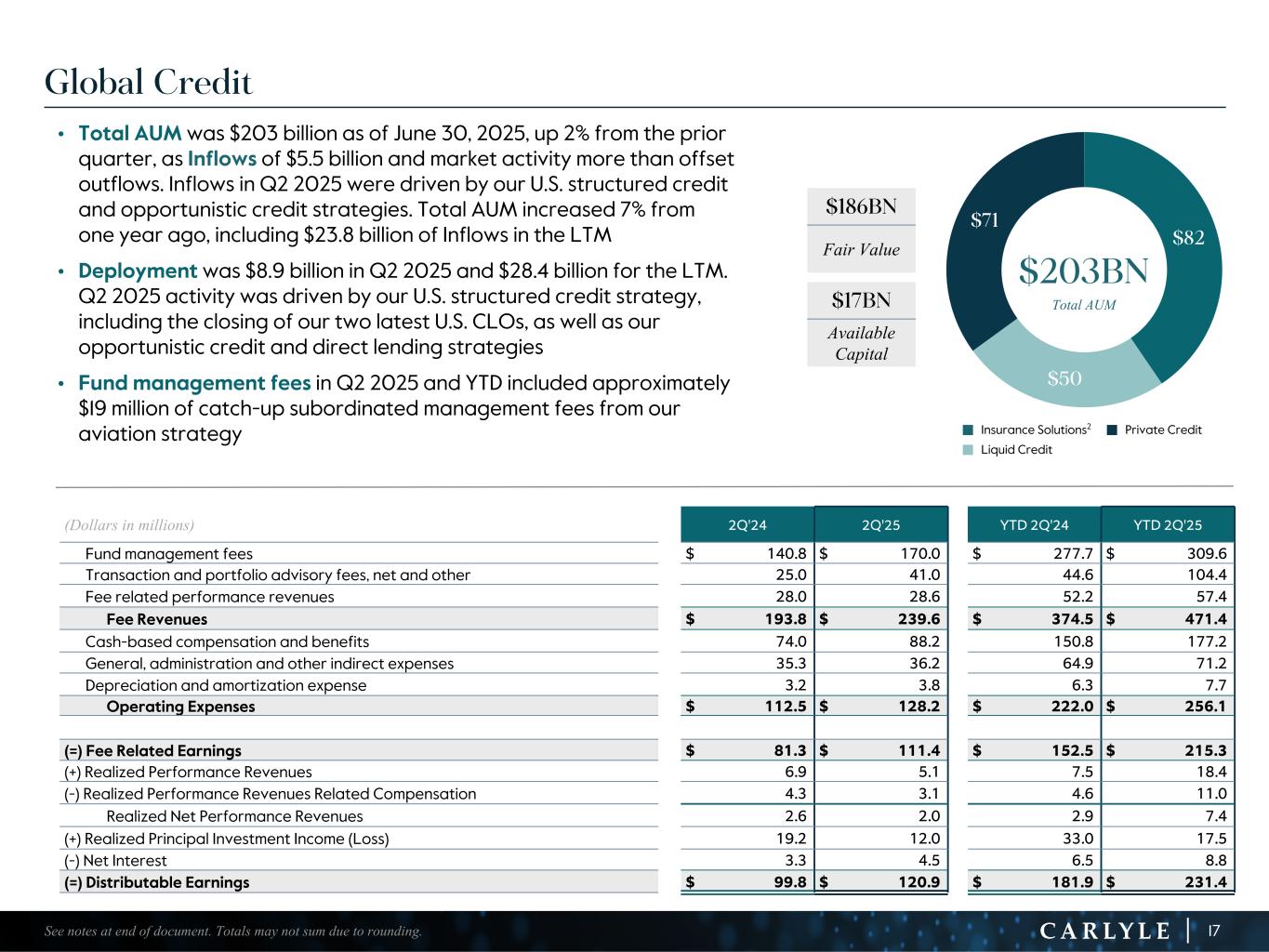

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 17 Global Credit • Total AUM was $203 billion as of June 30, 2025, up 2% from the prior quarter, as Inflows of $5.5 billion and market activity more than offset outflows. Inflows in Q2 2025 were driven by our U.S. structured credit and opportunistic credit strategies. Total AUM increased 7% from one year ago, including $23.8 billion of Inflows in the LTM • Deployment was $8.9 billion in Q2 2025 and $28.4 billion for the LTM. Q2 2025 activity was driven by our U.S. structured credit strategy, including the closing of our two latest U.S. CLOs, as well as our opportunistic credit and direct lending strategies • Fund management fees in Q2 2025 and YTD included approximately $19 million of catch-up subordinated management fees from our aviation strategy (Dollars in millions) 2Q'24 2Q'25 YTD 2Q'24 YTD 2Q'25 Fund management fees $ 140.8 $ 170.0 $ 277.7 $ 309.6 Transaction and portfolio advisory fees, net and other 25.0 41.0 44.6 104.4 Fee related performance revenues 28.0 28.6 52.2 57.4 Fee Revenues $ 193.8 $ 239.6 $ 374.5 $ 471.4 Cash-based compensation and benefits 74.0 88.2 150.8 177.2 General, administration and other indirect expenses 35.3 36.2 64.9 71.2 Depreciation and amortization expense 3.2 3.8 6.3 7.7 Operating Expenses $ 112.5 $ 128.2 $ 222.0 $ 256.1 (=) Fee Related Earnings $ 81.3 $ 111.4 $ 152.5 $ 215.3 (+) Realized Performance Revenues 6.9 5.1 7.5 18.4 (-) Realized Performance Revenues Related Compensation 4.3 3.1 4.6 11.0 Realized Net Performance Revenues 2.6 2.0 2.9 7.4 (+) Realized Principal Investment Income (Loss) 19.2 12.0 33.0 17.5 (-) Net Interest 3.3 4.5 6.5 8.8 (=) Distributable Earnings $ 99.8 $ 120.9 $ 181.9 $ 231.4 $82 $50 $71 $203BN Total AUM See notes at end of document. Totals may not sum due to rounding. $186BN Fair Value $17BN Available Capital n Insurance Solutions2 n Private Credit n Liquid Credit

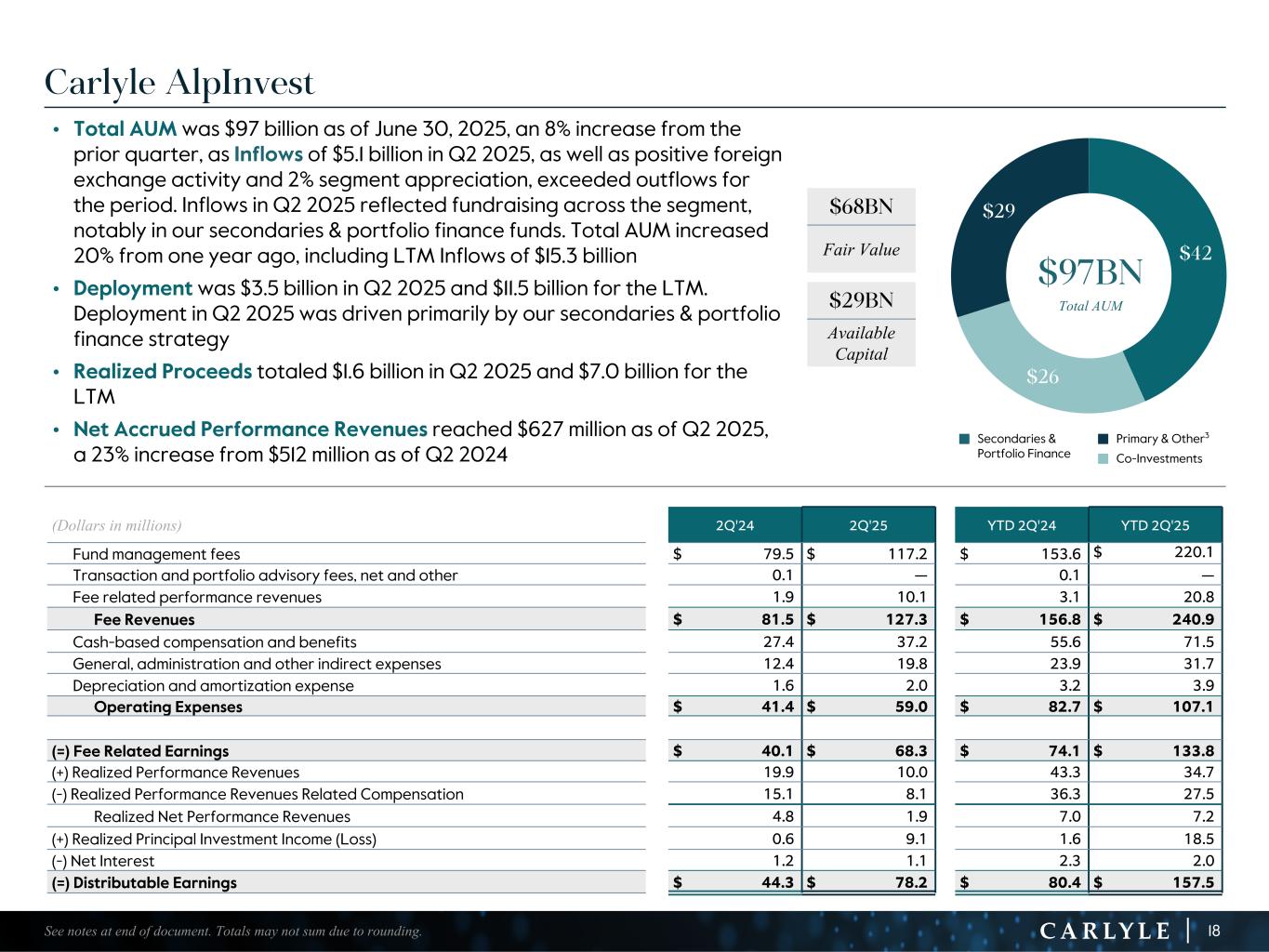

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 18 Carlyle AlpInvest • Total AUM was $97 billion as of June 30, 2025, an 8% increase from the prior quarter, as Inflows of $5.1 billion in Q2 2025, as well as positive foreign exchange activity and 2% segment appreciation, exceeded outflows for the period. Inflows in Q2 2025 reflected fundraising across the segment, notably in our secondaries & portfolio finance funds. Total AUM increased 20% from one year ago, including LTM Inflows of $15.3 billion • Deployment was $3.5 billion in Q2 2025 and $11.5 billion for the LTM. Deployment in Q2 2025 was driven primarily by our secondaries & portfolio finance strategy • Realized Proceeds totaled $1.6 billion in Q2 2025 and $7.0 billion for the LTM • Net Accrued Performance Revenues reached $627 million as of Q2 2025, a 23% increase from $512 million as of Q2 2024 (Dollars in millions) 2Q'24 2Q'25 YTD 2Q'24 YTD 2Q'25 Fund management fees $ 79.5 $ 117.2 $ 153.6 $ 220.1 Transaction and portfolio advisory fees, net and other 0.1 — 0.1 — Fee related performance revenues 1.9 10.1 3.1 20.8 Fee Revenues $ 81.5 $ 127.3 $ 156.8 $ 240.9 Cash-based compensation and benefits 27.4 37.2 55.6 71.5 General, administration and other indirect expenses 12.4 19.8 23.9 31.7 Depreciation and amortization expense 1.6 2.0 3.2 3.9 Operating Expenses $ 41.4 $ 59.0 $ 82.7 $ 107.1 (=) Fee Related Earnings $ 40.1 $ 68.3 $ 74.1 $ 133.8 (+) Realized Performance Revenues 19.9 10.0 43.3 34.7 (-) Realized Performance Revenues Related Compensation 15.1 8.1 36.3 27.5 Realized Net Performance Revenues 4.8 1.9 7.0 7.2 (+) Realized Principal Investment Income (Loss) 0.6 9.1 1.6 18.5 (-) Net Interest 1.2 1.1 2.3 2.0 (=) Distributable Earnings $ 44.3 $ 78.2 $ 80.4 $ 157.5 $42 $26 $29 $97BN Total AUM See notes at end of document. Totals may not sum due to rounding. $68BN Fair Value $29BN Available Capital n Secondaries & Portfolio Finance n Primary & Other3 n Co-Investments

Supplemental Details

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 20 Note: Historical quarterly results by segment available in Q2 2025 financial supplement on Carlyle's Investor Relations website. (Dollars in millions, except per share amounts) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 YTD 2Q'24 YTD 2Q'25 SEGMENT REVENUES Fund management fees $ 525.5 $ 526.5 $ 539.9 $ 525.5 $ 589.6 $ 1,041.1 $ 1,115.1 Transaction and portfolio advisory fees, net and other 28.9 27.4 80.6 77.9 47.9 55.6 125.8 Fee related performance revenues 33.1 36.3 34.2 39.5 38.7 62.2 78.2 Total segment fee revenues 587.5 590.2 654.7 642.9 676.2 1,158.9 1,319.1 Realized performance revenues 156.5 275.9 245.7 355.1 259.8 554.3 614.9 Realized principal investment income 26.6 9.1 31.6 30.0 33.5 60.3 63.5 Interest income 18.3 19.8 16.5 15.2 14.5 38.4 29.7 Total Segment Revenues $ 788.9 $ 895.0 $ 948.5 $ 1,043.2 $ 984.0 $ 1,811.9 $ 2,027.2 SEGMENT EXPENSES Compensation and benefits Cash-based compensation and benefits $ 205.3 $ 207.6 $ 234.5 $ 224.0 $ 233.8 $ 419.6 $ 457.8 Realized performance revenues related compensation 100.8 185.3 167.9 227.7 172.1 356.6 399.8 Total compensation and benefits 306.1 392.9 402.4 451.7 405.9 776.2 857.6 General, administrative and other expenses 97.9 92.9 120.2 95.6 106.3 177.6 201.9 Depreciation and amortization expense 11.3 11.8 12.6 12.7 12.8 22.4 25.5 Interest expense 30.4 30.3 29.4 27.8 28.0 61.2 55.8 Total Segment Expenses $ 445.7 $ 527.9 $ 564.6 $ 587.8 $ 553.0 $ 1,037.4 $ 1,140.8 Total Segment Revenues 788.9 895.0 948.5 1,043.2 984.0 1,811.9 2,027.2 Total Segment Expenses 445.7 527.9 564.6 587.8 553.0 1,037.4 1,140.8 (=) Distributable Earnings $ 343.2 $ 367.1 $ 383.9 $ 455.4 $ 431.0 $ 774.5 $ 886.4 (-) Realized Net Performance Revenues 55.7 90.6 77.8 127.4 87.7 197.7 215.1 (-) Realized Principal Investment Income 26.6 9.1 31.6 30.0 33.5 60.3 63.5 (+) Net Interest 12.1 10.5 12.9 12.6 13.5 22.8 26.1 (=) Fee Related Earnings $ 273.0 $ 277.9 $ 287.4 $ 310.6 $ 323.3 $ 539.3 $ 633.9 After-tax Distributable Earnings, per common share $ 0.78 $ 0.95 $ 0.92 $ 1.14 $ 0.91 $ 1.79 $ 2.05 Dividend per common share $ 0.35 $ 0.35 $ 0.35 $ 0.35 $ 0.35 $ 0.70 $ 0.70 Carlyle Second Quarter 2025 Total Segment Results

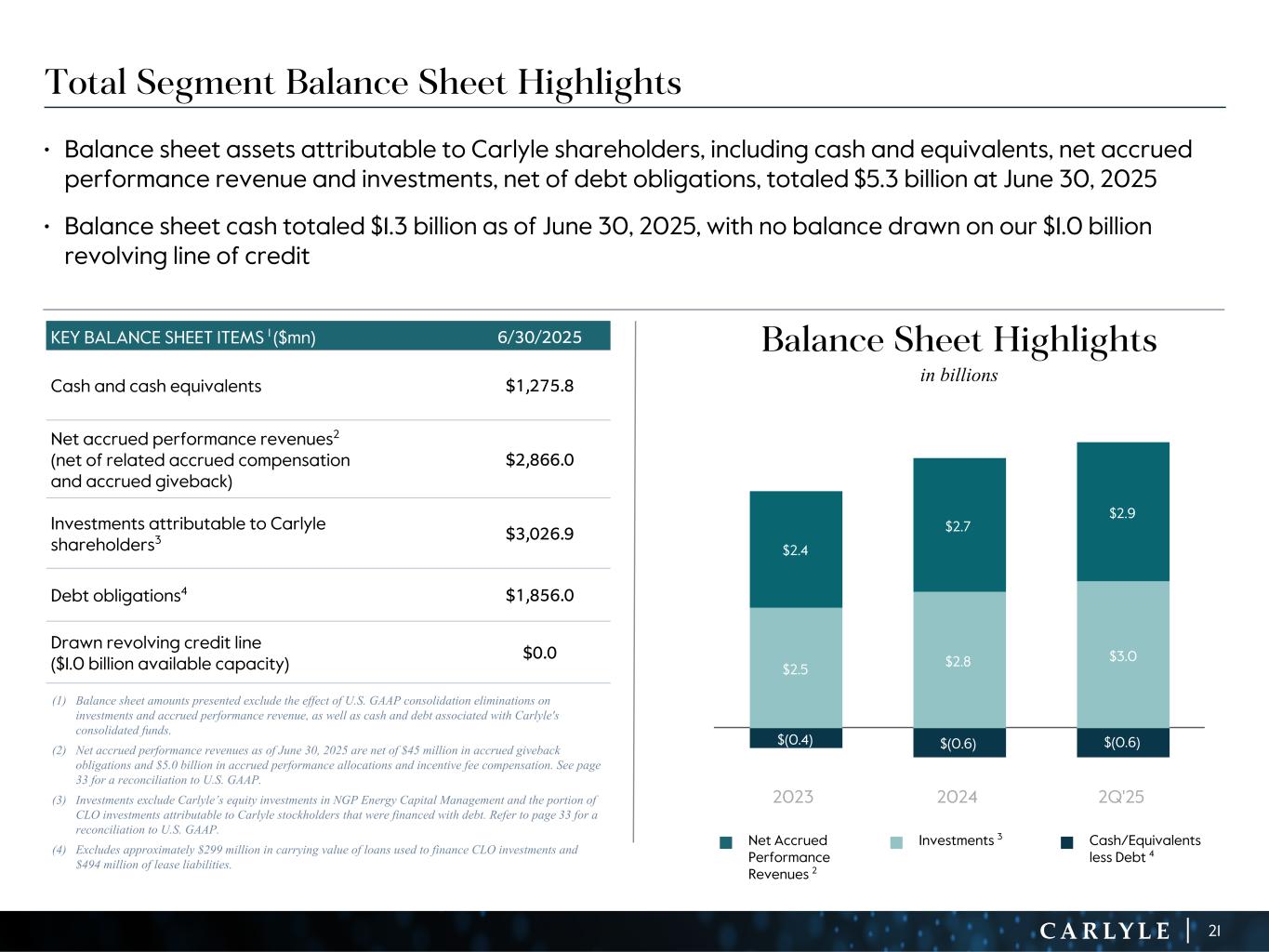

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 21 Total Segment Balance Sheet Highlights • Balance sheet assets attributable to Carlyle shareholders, including cash and equivalents, net accrued performance revenue and investments, net of debt obligations, totaled $5.3 billion at June 30, 2025 • Balance sheet cash totaled $1.3 billion as of June 30, 2025, with no balance drawn on our $1.0 billion revolving line of credit KEY BALANCE SHEET ITEMS 1 ($mn) 6/30/2025 Cash and cash equivalents $1,275.8 Net accrued performance revenues2 (net of related accrued compensation and accrued giveback) $2,866.0 Investments attributable to Carlyle shareholders3 $3,026.9 Debt obligations4 $1,856.0 Drawn revolving credit line ($1.0 billion available capacity) $0.0 (1) Balance sheet amounts presented exclude the effect of U.S. GAAP consolidation eliminations on investments and accrued performance revenue, as well as cash and debt associated with Carlyle's consolidated funds. (2) Net accrued performance revenues as of June 30, 2025 are net of $45 million in accrued giveback obligations and $5.0 billion in accrued performance allocations and incentive fee compensation. See page 33 for a reconciliation to U.S. GAAP. (3) Investments exclude Carlyle’s equity investments in NGP Energy Capital Management and the portion of CLO investments attributable to Carlyle stockholders that were financed with debt. Refer to page 33 for a reconciliation to U.S. GAAP. (4) Excludes approximately $299 million in carrying value of loans used to finance CLO investments and $494 million of lease liabilities. $(0.4) $(0.6) $(0.6) $2.5 $2.8 $3.0 $2.4 $2.7 $2.9 2023 2024 2Q'25 Balance Sheet Highlights in billions n Net Accrued Performance Revenues 2 n Investments 3 n Cash/Equivalents less Debt 4

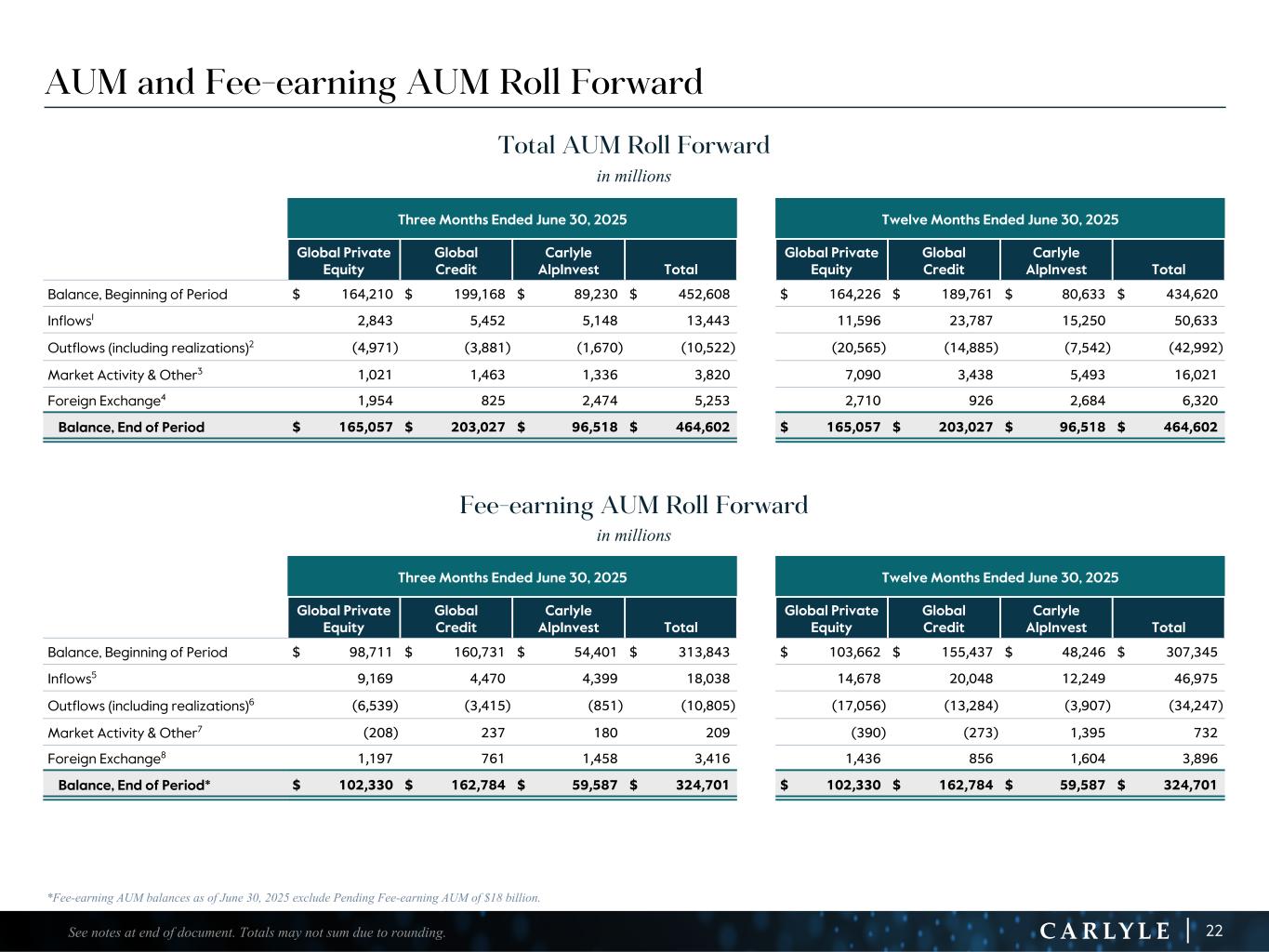

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 22 AUM and Fee-earning AUM Roll Forward Total AUM Roll Forward in millions Three Months Ended June 30, 2025 Twelve Months Ended June 30, 2025 Global Private Equity Global Credit Carlyle AlpInvest Total Global Private Equity Global Credit Carlyle AlpInvest Total Balance, Beginning of Period $ 164,210 $ 199,168 $ 89,230 $ 452,608 $ 164,226 $ 189,761 $ 80,633 $ 434,620 Inflows1 2,843 5,452 5,148 13,443 11,596 23,787 15,250 50,633 Outflows (including realizations)2 (4,971) (3,881) (1,670) (10,522) (20,565) (14,885) (7,542) (42,992) Market Activity & Other3 1,021 1,463 1,336 3,820 7,090 3,438 5,493 16,021 Foreign Exchange4 1,954 825 2,474 5,253 2,710 926 2,684 6,320 Balance, End of Period $ 165,057 $ 203,027 $ 96,518 $ 464,602 $ 165,057 $ 203,027 $ 96,518 $ 464,602 Fee-earning AUM Roll Forward in millions Three Months Ended June 30, 2025 Twelve Months Ended June 30, 2025 Global Private Equity Global Credit Carlyle AlpInvest Total Global Private Equity Global Credit Carlyle AlpInvest Total Balance, Beginning of Period $ 98,711 $ 160,731 $ 54,401 $ 313,843 $ 103,662 $ 155,437 $ 48,246 $ 307,345 Inflows5 9,169 4,470 4,399 18,038 14,678 20,048 12,249 46,975 Outflows (including realizations)6 (6,539) (3,415) (851) (10,805) (17,056) (13,284) (3,907) (34,247) Market Activity & Other7 (208) 237 180 209 (390) (273) 1,395 732 Foreign Exchange8 1,197 761 1,458 3,416 1,436 856 1,604 3,896 Balance, End of Period* $ 102,330 $ 162,784 $ 59,587 $ 324,701 $ 102,330 $ 162,784 $ 59,587 $ 324,701 See notes at end of document. Totals may not sum due to rounding. *Fee-earning AUM balances as of June 30, 2025 exclude Pending Fee-earning AUM of $18 billion.

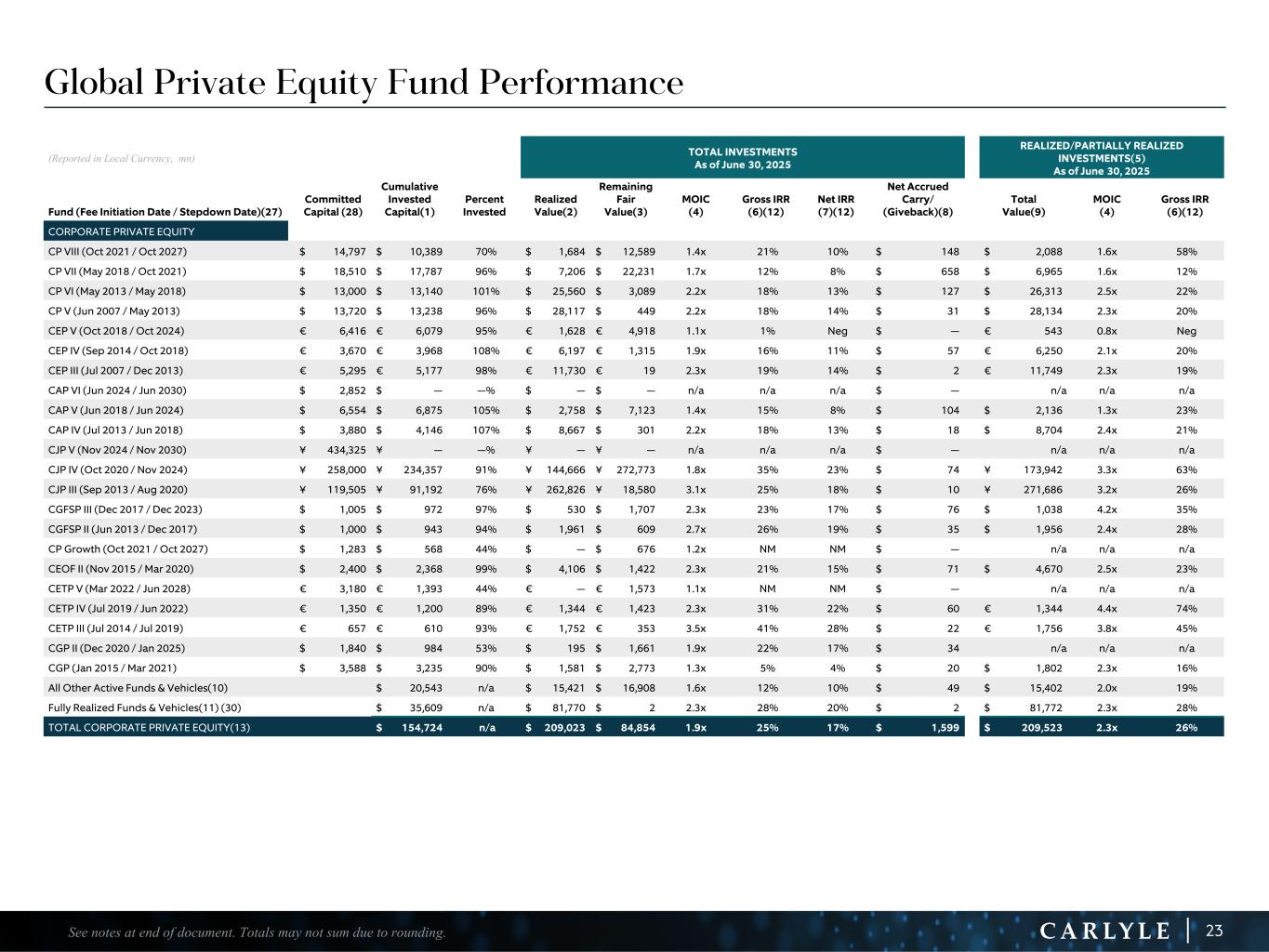

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 23 Global Private Equity Fund Performance (Reported in Local Currency, mn) TOTAL INVESTMENTS As of June 30, 2025 REALIZED/PARTIALLY REALIZED INVESTMENTS(5) As of June 30, 2025 Fund (Fee Initiation Date / Stepdown Date)(27) Committed Capital (28) Cumulative Invested Capital(1) Percent Invested Realized Value(2) Remaining Fair Value(3) MOIC (4) Gross IRR (6)(12) Net IRR (7)(12) Net Accrued Carry/ (Giveback)(8) Total Value(9) MOIC (4) Gross IRR (6)(12) CORPORATE PRIVATE EQUITY CP VIII (Oct 2021 / Oct 2027) $ 14,797 $ 10,389 70% $ 1,684 $ 12,589 1.4x 21% 10% $ 148 $ 2,088 1.6x 58% CP VII (May 2018 / Oct 2021) $ 18,510 $ 17,787 96% $ 7,206 $ 22,231 1.7x 12% 8% $ 658 $ 6,965 1.6x 12% CP VI (May 2013 / May 2018) $ 13,000 $ 13,140 101% $ 25,560 $ 3,089 2.2x 18% 13% $ 127 $ 26,313 2.5x 22% CP V (Jun 2007 / May 2013) $ 13,720 $ 13,238 96% $ 28,117 $ 449 2.2x 18% 14% $ 31 $ 28,134 2.3x 20% CEP V (Oct 2018 / Oct 2024) € 6,416 € 6,079 95% € 1,628 € 4,918 1.1x 1% Neg $ — € 543 0.8x Neg CEP IV (Sep 2014 / Oct 2018) € 3,670 € 3,968 108% € 6,197 € 1,315 1.9x 16% 11% $ 57 € 6,250 2.1x 20% CEP III (Jul 2007 / Dec 2013) € 5,295 € 5,177 98% € 11,730 € 19 2.3x 19% 14% $ 2 € 11,749 2.3x 19% CAP VI (Jun 2024 / Jun 2030) $ 2,852 $ — —% $ — $ — n/a n/a n/a $ — n/a n/a n/a CAP V (Jun 2018 / Jun 2024) $ 6,554 $ 6,875 105% $ 2,758 $ 7,123 1.4x 15% 8% $ 104 $ 2,136 1.3x 23% CAP IV (Jul 2013 / Jun 2018) $ 3,880 $ 4,146 107% $ 8,667 $ 301 2.2x 18% 13% $ 18 $ 8,704 2.4x 21% CJP V (Nov 2024 / Nov 2030) ¥ 434,325 ¥ — —% ¥ — ¥ — n/a n/a n/a $ — n/a n/a n/a CJP IV (Oct 2020 / Nov 2024) ¥ 258,000 ¥ 234,357 91% ¥ 144,666 ¥ 272,773 1.8x 35% 23% $ 74 ¥ 173,942 3.3x 63% CJP III (Sep 2013 / Aug 2020) ¥ 119,505 ¥ 91,192 76% ¥ 262,826 ¥ 18,580 3.1x 25% 18% $ 10 ¥ 271,686 3.2x 26% CGFSP III (Dec 2017 / Dec 2023) $ 1,005 $ 972 97% $ 530 $ 1,707 2.3x 23% 17% $ 76 $ 1,038 4.2x 35% CGFSP II (Jun 2013 / Dec 2017) $ 1,000 $ 943 94% $ 1,961 $ 609 2.7x 26% 19% $ 35 $ 1,956 2.4x 28% CP Growth (Oct 2021 / Oct 2027) $ 1,283 $ 568 44% $ — $ 676 1.2x NM NM $ — n/a n/a n/a CEOF II (Nov 2015 / Mar 2020) $ 2,400 $ 2,368 99% $ 4,106 $ 1,422 2.3x 21% 15% $ 71 $ 4,670 2.5x 23% CETP V (Mar 2022 / Jun 2028) € 3,180 € 1,393 44% € — € 1,573 1.1x NM NM $ — n/a n/a n/a CETP IV (Jul 2019 / Jun 2022) € 1,350 € 1,200 89% € 1,344 € 1,423 2.3x 31% 22% $ 60 € 1,344 4.4x 74% CETP III (Jul 2014 / Jul 2019) € 657 € 610 93% € 1,752 € 353 3.5x 41% 28% $ 22 € 1,756 3.8x 45% CGP II (Dec 2020 / Jan 2025) $ 1,840 $ 984 53% $ 195 $ 1,661 1.9x 22% 17% $ 34 n/a n/a n/a CGP (Jan 2015 / Mar 2021) $ 3,588 $ 3,235 90% $ 1,581 $ 2,773 1.3x 5% 4% $ 20 $ 1,802 2.3x 16% All Other Active Funds & Vehicles(10) $ 20,543 n/a $ 15,421 $ 16,908 1.6x 12% 10% $ 49 $ 15,402 2.0x 19% Fully Realized Funds & Vehicles(11) (30) $ 35,609 n/a $ 81,770 $ 2 2.3x 28% 20% $ 2 $ 81,772 2.3x 28% TOTAL CORPORATE PRIVATE EQUITY(13) $ 154,724 n/a $ 209,023 $ 84,854 1.9x 25% 17% $ 1,599 $ 209,523 2.3x 26% See notes at end of document. Totals may not sum due to rounding.

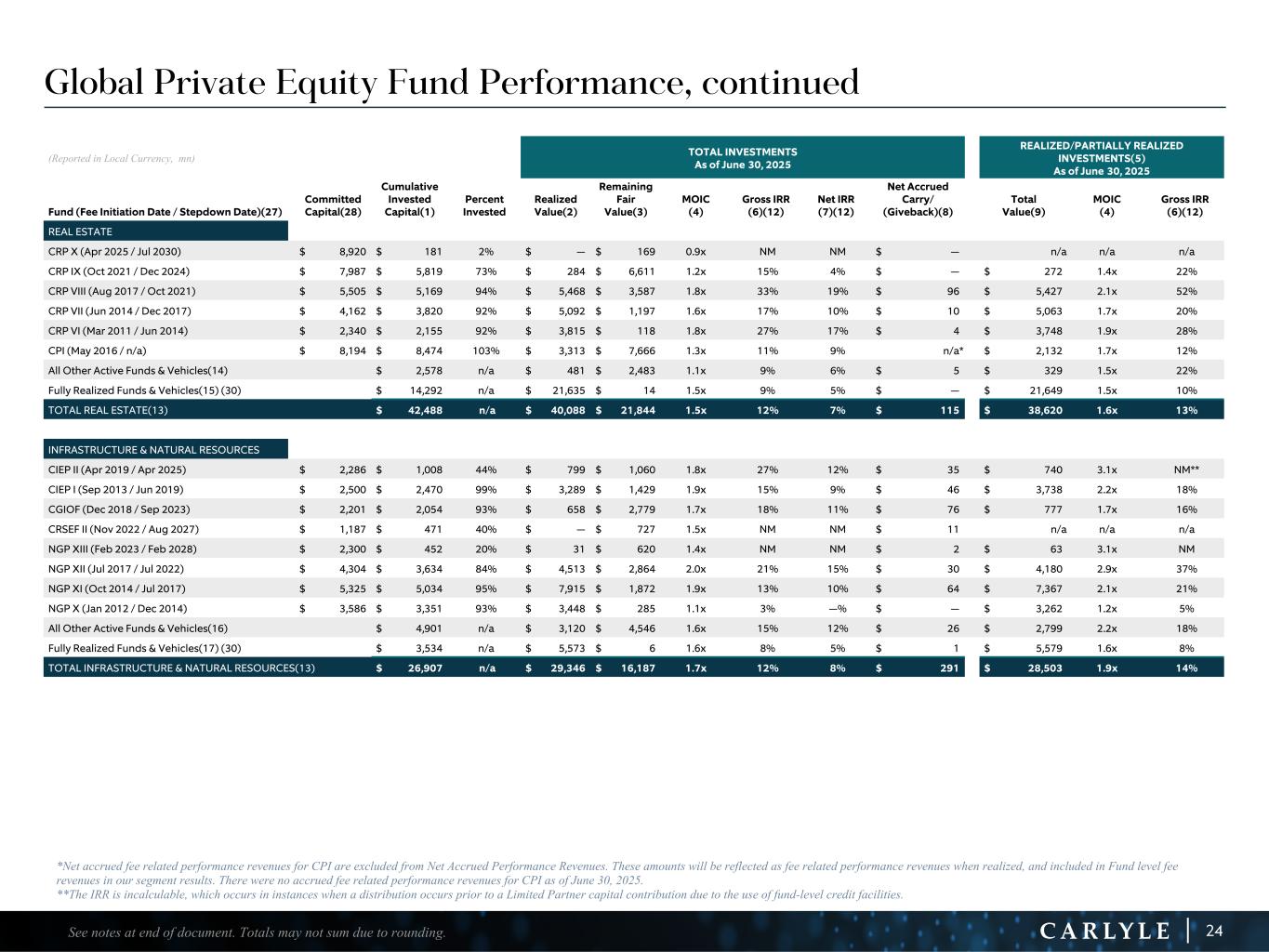

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 24 Global Private Equity Fund Performance, continued (Reported in Local Currency, mn) TOTAL INVESTMENTS As of June 30, 2025 REALIZED/PARTIALLY REALIZED INVESTMENTS(5) As of June 30, 2025 Fund (Fee Initiation Date / Stepdown Date)(27) Committed Capital(28) Cumulative Invested Capital(1) Percent Invested Realized Value(2) Remaining Fair Value(3) MOIC (4) Gross IRR (6)(12) Net IRR (7)(12) Net Accrued Carry/ (Giveback)(8) Total Value(9) MOIC (4) Gross IRR (6)(12) REAL ESTATE CRP X (Apr 2025 / Jul 2030) $ 8,920 $ 181 2% $ — $ 169 0.9x NM NM $ — n/a n/a n/a CRP IX (Oct 2021 / Dec 2024) $ 7,987 $ 5,819 73% $ 284 $ 6,611 1.2x 15% 4% $ — $ 272 1.4x 22% CRP VIII (Aug 2017 / Oct 2021) $ 5,505 $ 5,169 94% $ 5,468 $ 3,587 1.8x 33% 19% $ 96 $ 5,427 2.1x 52% CRP VII (Jun 2014 / Dec 2017) $ 4,162 $ 3,820 92% $ 5,092 $ 1,197 1.6x 17% 10% $ 10 $ 5,063 1.7x 20% CRP VI (Mar 2011 / Jun 2014) $ 2,340 $ 2,155 92% $ 3,815 $ 118 1.8x 27% 17% $ 4 $ 3,748 1.9x 28% CPI (May 2016 / n/a) $ 8,194 $ 8,474 103% $ 3,313 $ 7,666 1.3x 11% 9% n/a* $ 2,132 1.7x 12% All Other Active Funds & Vehicles(14) $ 2,578 n/a $ 481 $ 2,483 1.1x 9% 6% $ 5 $ 329 1.5x 22% Fully Realized Funds & Vehicles(15) (30) $ 14,292 n/a $ 21,635 $ 14 1.5x 9% 5% $ — $ 21,649 1.5x 10% TOTAL REAL ESTATE(13) $ 42,488 n/a $ 40,088 $ 21,844 1.5x 12% 7% $ 115 $ 38,620 1.6x 13% INFRASTRUCTURE & NATURAL RESOURCES CIEP II (Apr 2019 / Apr 2025) $ 2,286 $ 1,008 44% $ 799 $ 1,060 1.8x 27% 12% $ 35 $ 740 3.1x NM** CIEP I (Sep 2013 / Jun 2019) $ 2,500 $ 2,470 99% $ 3,289 $ 1,429 1.9x 15% 9% $ 46 $ 3,738 2.2x 18% CGIOF (Dec 2018 / Sep 2023) $ 2,201 $ 2,054 93% $ 658 $ 2,779 1.7x 18% 11% $ 76 $ 777 1.7x 16% CRSEF II (Nov 2022 / Aug 2027) $ 1,187 $ 471 40% $ — $ 727 1.5x NM NM $ 11 n/a n/a n/a NGP XIII (Feb 2023 / Feb 2028) $ 2,300 $ 452 20% $ 31 $ 620 1.4x NM NM $ 2 $ 63 3.1x NM NGP XII (Jul 2017 / Jul 2022) $ 4,304 $ 3,634 84% $ 4,513 $ 2,864 2.0x 21% 15% $ 30 $ 4,180 2.9x 37% NGP XI (Oct 2014 / Jul 2017) $ 5,325 $ 5,034 95% $ 7,915 $ 1,872 1.9x 13% 10% $ 64 $ 7,367 2.1x 21% NGP X (Jan 2012 / Dec 2014) $ 3,586 $ 3,351 93% $ 3,448 $ 285 1.1x 3% —% $ — $ 3,262 1.2x 5% All Other Active Funds & Vehicles(16) $ 4,901 n/a $ 3,120 $ 4,546 1.6x 15% 12% $ 26 $ 2,799 2.2x 18% Fully Realized Funds & Vehicles(17) (30) $ 3,534 n/a $ 5,573 $ 6 1.6x 8% 5% $ 1 $ 5,579 1.6x 8% TOTAL INFRASTRUCTURE & NATURAL RESOURCES(13) $ 26,907 n/a $ 29,346 $ 16,187 1.7x 12% 8% $ 291 $ 28,503 1.9x 14% See notes at end of document. Totals may not sum due to rounding. *Net accrued fee related performance revenues for CPI are excluded from Net Accrued Performance Revenues. These amounts will be reflected as fee related performance revenues when realized, and included in Fund level fee revenues in our segment results. There were no accrued fee related performance revenues for CPI as of June 30, 2025. **The IRR is incalculable, which occurs in instances when a distribution occurs prior to a Limited Partner capital contribution due to the use of fund-level credit facilities.

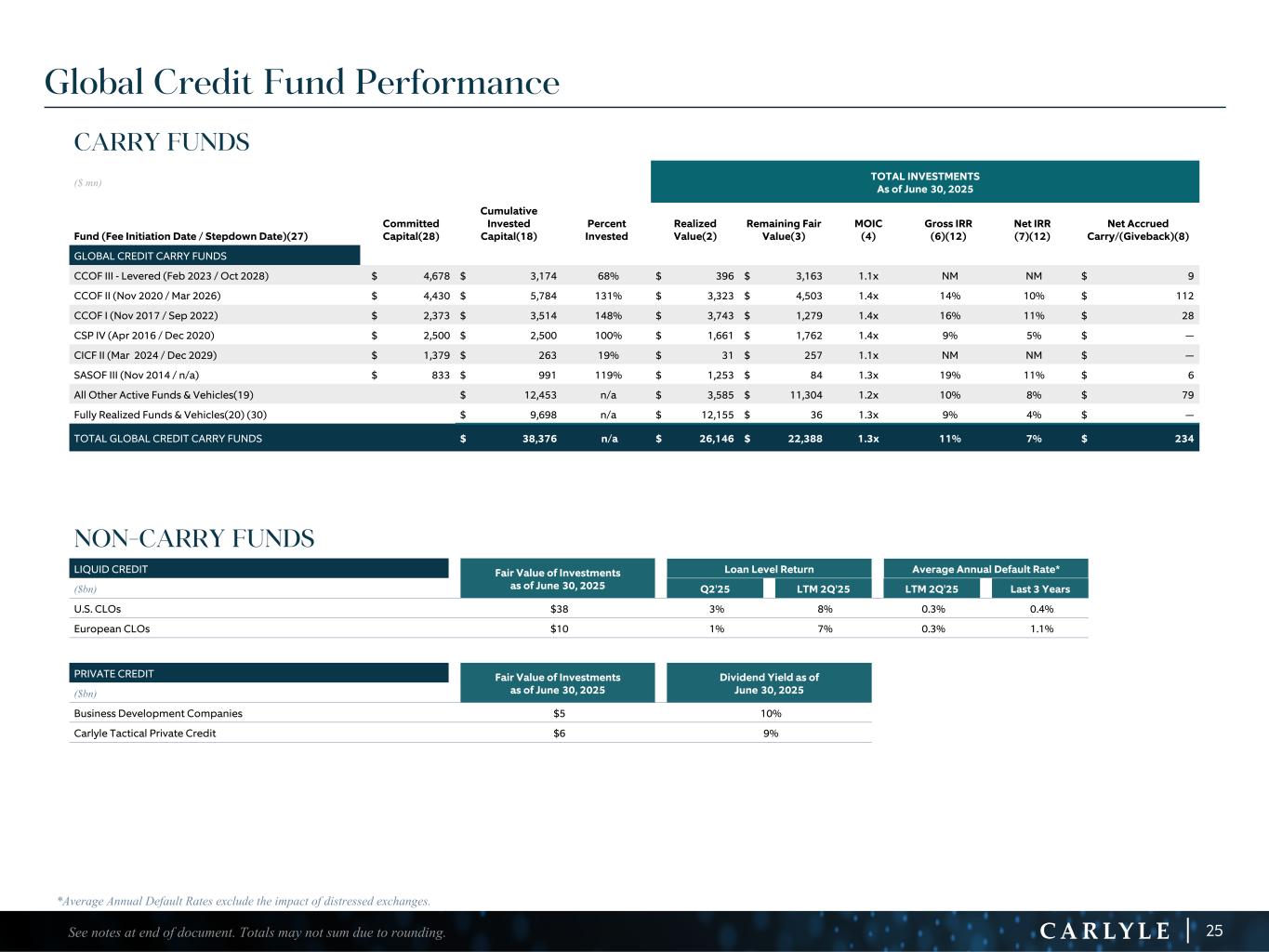

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 25 Global Credit Fund Performance CARRY FUNDS ($ mn) TOTAL INVESTMENTS As of June 30, 2025 Fund (Fee Initiation Date / Stepdown Date)(27) Committed Capital(28) Cumulative Invested Capital(18) Percent Invested Realized Value(2) Remaining Fair Value(3) MOIC (4) Gross IRR (6)(12) Net IRR (7)(12) Net Accrued Carry/(Giveback)(8) GLOBAL CREDIT CARRY FUNDS CCOF III - Levered (Feb 2023 / Oct 2028) $ 4,678 $ 3,174 68% $ 396 $ 3,163 1.1x NM NM $ 9 CCOF II (Nov 2020 / Mar 2026) $ 4,430 $ 5,784 131% $ 3,323 $ 4,503 1.4x 14% 10% $ 112 CCOF I (Nov 2017 / Sep 2022) $ 2,373 $ 3,514 148% $ 3,743 $ 1,279 1.4x 16% 11% $ 28 CSP IV (Apr 2016 / Dec 2020) $ 2,500 $ 2,500 100% $ 1,661 $ 1,762 1.4x 9% 5% $ — CICF II (Mar 2024 / Dec 2029) $ 1,379 $ 263 19% $ 31 $ 257 1.1x NM NM $ — SASOF III (Nov 2014 / n/a) $ 833 $ 991 119% $ 1,253 $ 84 1.3x 19% 11% $ 6 All Other Active Funds & Vehicles(19) $ 12,453 n/a $ 3,585 $ 11,304 1.2x 10% 8% $ 79 Fully Realized Funds & Vehicles(20) (30) $ 9,698 n/a $ 12,155 $ 36 1.3x 9% 4% $ — TOTAL GLOBAL CREDIT CARRY FUNDS $ 38,376 n/a $ 26,146 $ 22,388 1.3x 11% 7% $ 234 See notes at end of document. Totals may not sum due to rounding. NON-CARRY FUNDS LIQUID CREDIT Fair Value of Investments as of June 30, 2025 Loan Level Return Average Annual Default Rate* ($bn) Q2'25 LTM 2Q'25 LTM 2Q'25 Last 3 Years U.S. CLOs $38 3% 8% 0.3% 0.4% European CLOs $10 1% 7% 0.3% 1.1% PRIVATE CREDIT Fair Value of Investments as of June 30, 2025 Dividend Yield as of June 30, 2025($bn) Business Development Companies $5 10% Carlyle Tactical Private Credit $6 9% *Average Annual Default Rates exclude the impact of distressed exchanges.

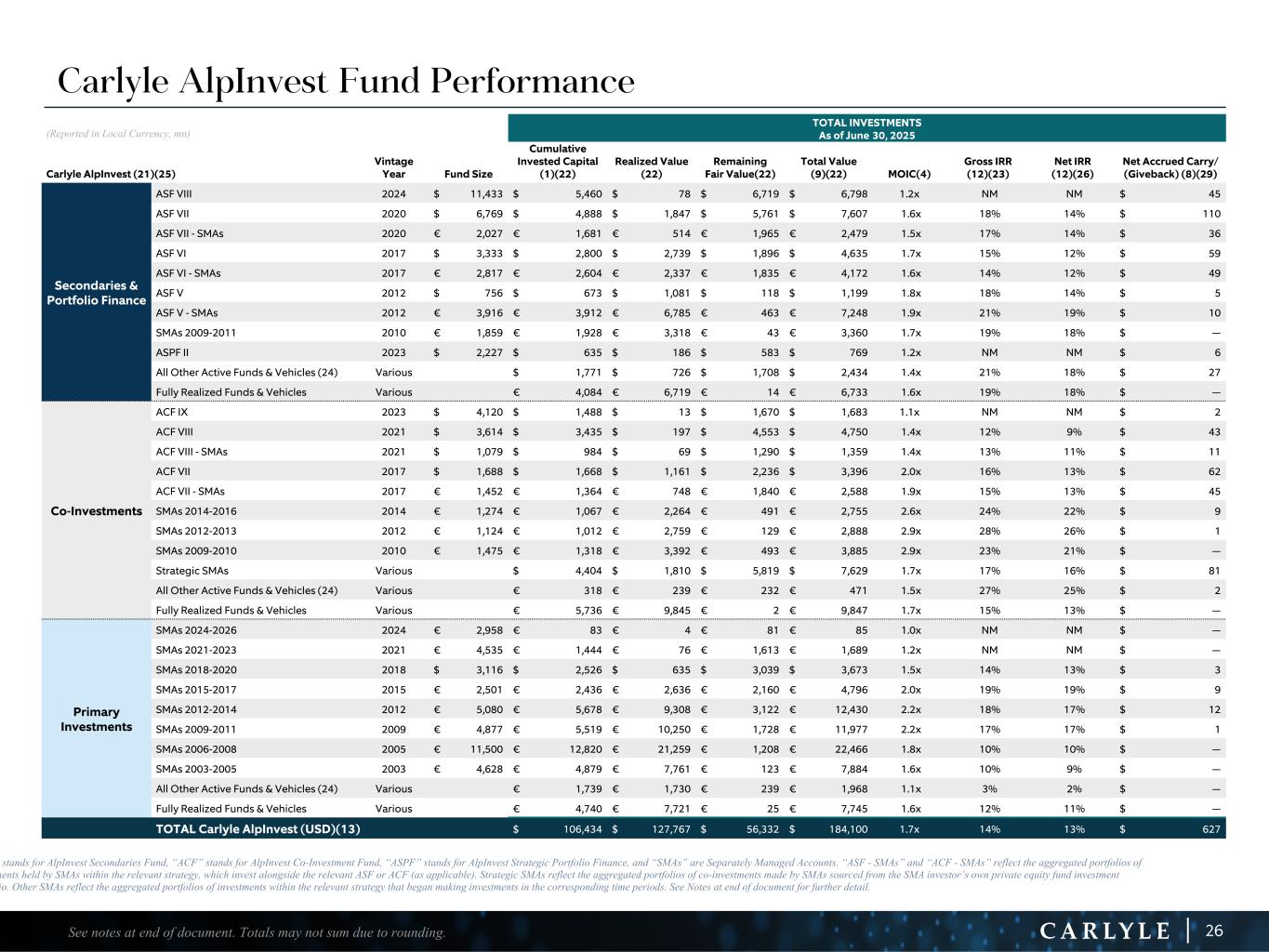

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 26 Carlyle AlpInvest Fund Performance (Reported in Local Currency, mn) TOTAL INVESTMENTS As of June 30, 2025 Carlyle AlpInvest (21)(25) Vintage Year Fund Size Cumulative Invested Capital (1)(22) Realized Value (22) Remaining Fair Value(22) Total Value (9)(22) MOIC(4) Gross IRR (12)(23) Net IRR (12)(26) Net Accrued Carry/ (Giveback) (8)(29) Secondaries & Portfolio Finance ASF VIII 2024 $ 11,433 $ 5,460 $ 78 $ 6,719 $ 6,798 1.2x NM NM $ 45 ASF VII 2020 $ 6,769 $ 4,888 $ 1,847 $ 5,761 $ 7,607 1.6x 18% 14% $ 110 ASF VII - SMAs 2020 € 2,027 € 1,681 € 514 € 1,965 € 2,479 1.5x 17% 14% $ 36 ASF VI 2017 $ 3,333 $ 2,800 $ 2,739 $ 1,896 $ 4,635 1.7x 15% 12% $ 59 ASF VI - SMAs 2017 € 2,817 € 2,604 € 2,337 € 1,835 € 4,172 1.6x 14% 12% $ 49 ASF V 2012 $ 756 $ 673 $ 1,081 $ 118 $ 1,199 1.8x 18% 14% $ 5 ASF V - SMAs 2012 € 3,916 € 3,912 € 6,785 € 463 € 7,248 1.9x 21% 19% $ 10 SMAs 2009-2011 2010 € 1,859 € 1,928 € 3,318 € 43 € 3,360 1.7x 19% 18% $ — ASPF II 2023 $ 2,227 $ 635 $ 186 $ 583 $ 769 1.2x NM NM $ 6 All Other Active Funds & Vehicles (24) Various $ 1,771 $ 726 $ 1,708 $ 2,434 1.4x 21% 18% $ 27 Fully Realized Funds & Vehicles Various € 4,084 € 6,719 € 14 € 6,733 1.6x 19% 18% $ — Co-Investments ACF IX 2023 $ 4,120 $ 1,488 $ 13 $ 1,670 $ 1,683 1.1x NM NM $ 2 ACF VIII 2021 $ 3,614 $ 3,435 $ 197 $ 4,553 $ 4,750 1.4x 12% 9% $ 43 ACF VIII - SMAs 2021 $ 1,079 $ 984 $ 69 $ 1,290 $ 1,359 1.4x 13% 11% $ 11 ACF VII 2017 $ 1,688 $ 1,668 $ 1,161 $ 2,236 $ 3,396 2.0x 16% 13% $ 62 ACF VII - SMAs 2017 € 1,452 € 1,364 € 748 € 1,840 € 2,588 1.9x 15% 13% $ 45 SMAs 2014-2016 2014 € 1,274 € 1,067 € 2,264 € 491 € 2,755 2.6x 24% 22% $ 9 SMAs 2012-2013 2012 € 1,124 € 1,012 € 2,759 € 129 € 2,888 2.9x 28% 26% $ 1 SMAs 2009-2010 2010 € 1,475 € 1,318 € 3,392 € 493 € 3,885 2.9x 23% 21% $ — Strategic SMAs Various $ 4,404 $ 1,810 $ 5,819 $ 7,629 1.7x 17% 16% $ 81 All Other Active Funds & Vehicles (24) Various € 318 € 239 € 232 € 471 1.5x 27% 25% $ 2 Fully Realized Funds & Vehicles Various € 5,736 € 9,845 € 2 € 9,847 1.7x 15% 13% $ — Primary Investments SMAs 2024-2026 2024 € 2,958 € 83 € 4 € 81 € 85 1.0x NM NM $ — SMAs 2021-2023 2021 € 4,535 € 1,444 € 76 € 1,613 € 1,689 1.2x NM NM $ — SMAs 2018-2020 2018 $ 3,116 $ 2,526 $ 635 $ 3,039 $ 3,673 1.5x 14% 13% $ 3 SMAs 2015-2017 2015 € 2,501 € 2,436 € 2,636 € 2,160 € 4,796 2.0x 19% 19% $ 9 SMAs 2012-2014 2012 € 5,080 € 5,678 € 9,308 € 3,122 € 12,430 2.2x 18% 17% $ 12 SMAs 2009-2011 2009 € 4,877 € 5,519 € 10,250 € 1,728 € 11,977 2.2x 17% 17% $ 1 SMAs 2006-2008 2005 € 11,500 € 12,820 € 21,259 € 1,208 € 22,466 1.8x 10% 10% $ — SMAs 2003-2005 2003 € 4,628 € 4,879 € 7,761 € 123 € 7,884 1.6x 10% 9% $ — All Other Active Funds & Vehicles (24) Various € 1,739 € 1,730 € 239 € 1,968 1.1x 3% 2% $ — Fully Realized Funds & Vehicles Various € 4,740 € 7,721 € 25 € 7,745 1.6x 12% 11% $ — TOTAL Carlyle AlpInvest (USD)(13) $ 106,434 $ 127,767 $ 56,332 $ 184,100 1.7x 14% 13% $ 627 See notes at end of document. Totals may not sum due to rounding. “ASF” stands for AlpInvest Secondaries Fund, “ACF” stands for AlpInvest Co-Investment Fund, “ASPF” stands for AlpInvest Strategic Portfolio Finance, and “SMAs” are Separately Managed Accounts. “ASF - SMAs” and “ACF - SMAs” reflect the aggregated portfolios of investments held by SMAs within the relevant strategy, which invest alongside the relevant ASF or ACF (as applicable). Strategic SMAs reflect the aggregated portfolios of co-investments made by SMAs sourced from the SMA investor’s own private equity fund investment portfolio. Other SMAs reflect the aggregated portfolios of investments within the relevant strategy that began making investments in the corresponding time periods. See Notes at end of document for further detail.

Reconciliations & Disclosures

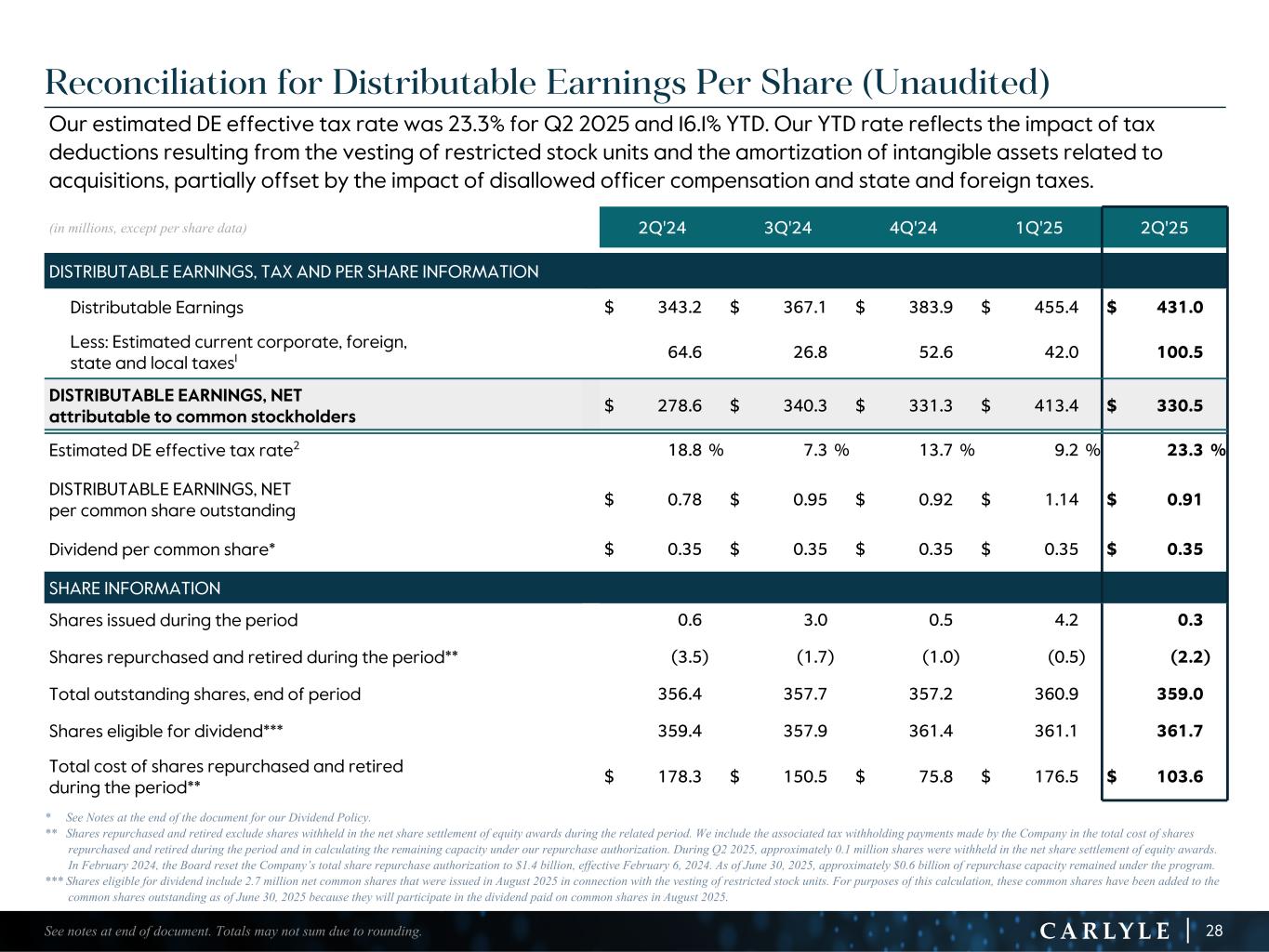

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 28 Reconciliation for Distributable Earnings Per Share (Unaudited) * See Notes at the end of the document for our Dividend Policy. ** Shares repurchased and retired exclude shares withheld in the net share settlement of equity awards during the related period. We include the associated tax withholding payments made by the Company in the total cost of shares repurchased and retired during the period and in calculating the remaining capacity under our repurchase authorization. During Q2 2025, approximately 0.1 million shares were withheld in the net share settlement of equity awards. In February 2024, the Board reset the Company’s total share repurchase authorization to $1.4 billion, effective February 6, 2024. As of June 30, 2025, approximately $0.6 billion of repurchase capacity remained under the program. *** Shares eligible for dividend include 2.7 million net common shares that were issued in August 2025 in connection with the vesting of restricted stock units. For purposes of this calculation, these common shares have been added to the common shares outstanding as of June 30, 2025 because they will participate in the dividend paid on common shares in August 2025. (in millions, except per share data) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 DISTRIBUTABLE EARNINGS, TAX AND PER SHARE INFORMATION Distributable Earnings $ 343.2 $ 367.1 $ 383.9 $ 455.4 $ 431.0 Less: Estimated current corporate, foreign, state and local taxes1 64.6 26.8 52.6 42.0 100.5 DISTRIBUTABLE EARNINGS, NET attributable to common stockholders $ 278.6 $ 340.3 $ 331.3 $ 413.4 $ 330.5 Estimated DE effective tax rate2 18.8 % 7.3 % 13.7 % 9.2 % 23.3 % DISTRIBUTABLE EARNINGS, NET per common share outstanding $ 0.78 $ 0.95 $ 0.92 $ 1.14 $ 0.91 Dividend per common share* $ 0.35 $ 0.35 $ 0.35 $ 0.35 $ 0.35 SHARE INFORMATION Shares issued during the period 0.6 3.0 0.5 4.2 0.3 Shares repurchased and retired during the period** (3.5) (1.7) (1.0) (0.5) (2.2) Total outstanding shares, end of period 356.4 357.7 357.2 360.9 359.0 Shares eligible for dividend*** 359.4 357.9 361.4 361.1 361.7 Total cost of shares repurchased and retired during the period** $ 178.3 $ 150.5 $ 75.8 $ 176.5 $ 103.6 See notes at end of document. Totals may not sum due to rounding. Our estimated DE effective tax rate was 23.3% for Q2 2025 and 16.1% YTD. Our YTD rate reflects the impact of tax deductions resulting from the vesting of restricted stock units and the amortization of intangible assets related to acquisitions, partially offset by the impact of disallowed officer compensation and state and foreign taxes.

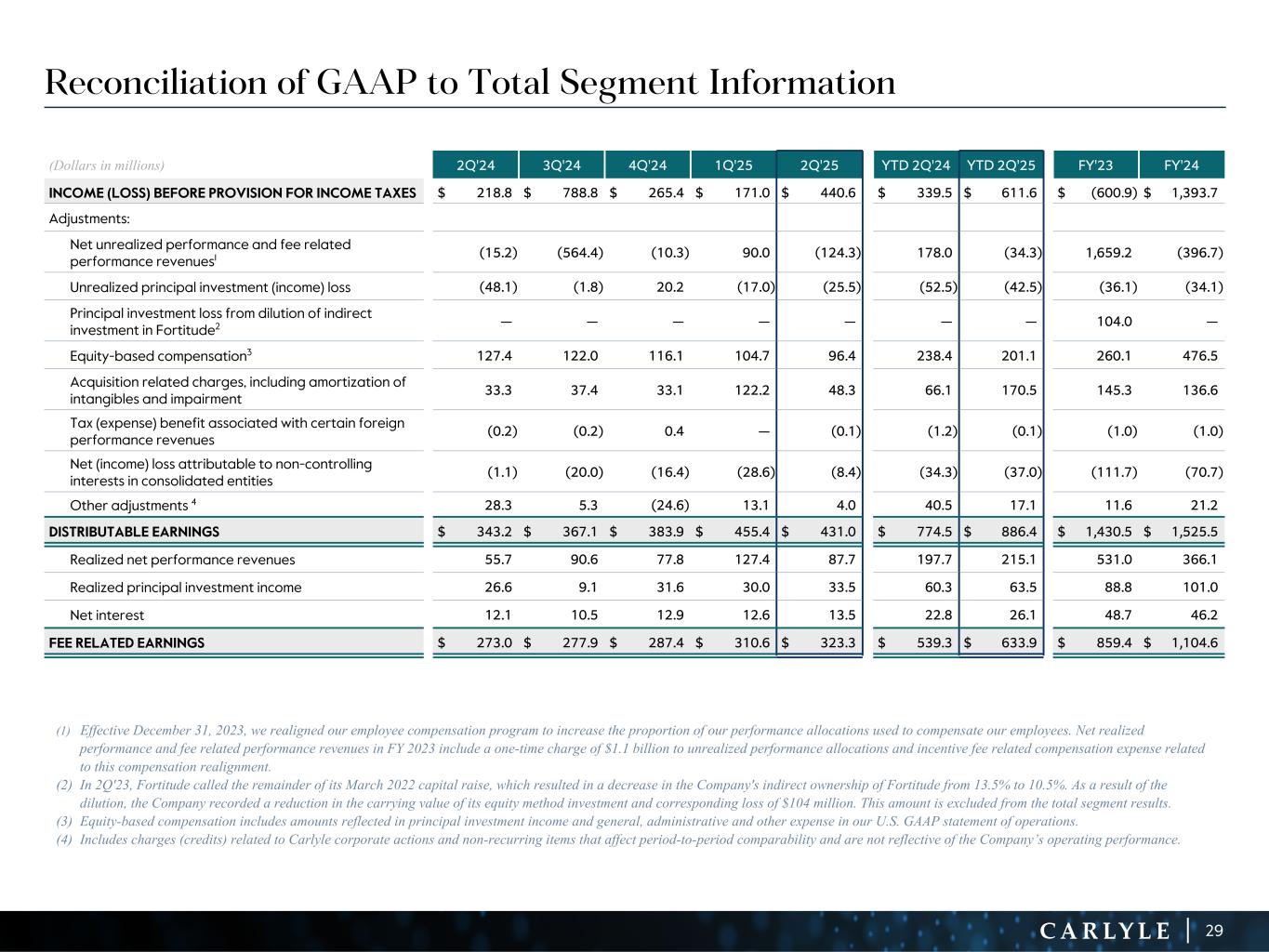

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 29 Reconciliation of GAAP to Total Segment Information (1) Effective December 31, 2023, we realigned our employee compensation program to increase the proportion of our performance allocations used to compensate our employees. Net realized performance and fee related performance revenues in FY 2023 include a one-time charge of $1.1 billion to unrealized performance allocations and incentive fee related compensation expense related to this compensation realignment. (2) In 2Q'23, Fortitude called the remainder of its March 2022 capital raise, which resulted in a decrease in the Company's indirect ownership of Fortitude from 13.5% to 10.5%. As a result of the dilution, the Company recorded a reduction in the carrying value of its equity method investment and corresponding loss of $104 million. This amount is excluded from the total segment results. (3) Equity-based compensation includes amounts reflected in principal investment income and general, administrative and other expense in our U.S. GAAP statement of operations. (4) Includes charges (credits) related to Carlyle corporate actions and non-recurring items that affect period-to-period comparability and are not reflective of the Company’s operating performance. (Dollars in millions) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 YTD 2Q'24 YTD 2Q'25 FY'23 FY'24 INCOME (LOSS) BEFORE PROVISION FOR INCOME TAXES $ 218.8 $ 788.8 $ 265.4 $ 171.0 $ 440.6 $ 339.5 $ 611.6 $ (600.9) $ 1,393.7 Adjustments: Net unrealized performance and fee related performance revenues1 (15.2) (564.4) (10.3) 90.0 (124.3) 178.0 (34.3) 1,659.2 (396.7) Unrealized principal investment (income) loss (48.1) (1.8) 20.2 (17.0) (25.5) (52.5) (42.5) (36.1) (34.1) Principal investment loss from dilution of indirect investment in Fortitude2 — — — — — — — 104.0 — Equity-based compensation3 127.4 122.0 116.1 104.7 96.4 238.4 201.1 260.1 476.5 Acquisition related charges, including amortization of intangibles and impairment 33.3 37.4 33.1 122.2 48.3 66.1 170.5 145.3 136.6 Tax (expense) benefit associated with certain foreign performance revenues (0.2) (0.2) 0.4 — (0.1) (1.2) (0.1) (1.0) (1.0) Net (income) loss attributable to non-controlling interests in consolidated entities (1.1) (20.0) (16.4) (28.6) (8.4) (34.3) (37.0) (111.7) (70.7) Other adjustments 4 28.3 5.3 (24.6) 13.1 4.0 40.5 17.1 11.6 21.2 DISTRIBUTABLE EARNINGS $ 343.2 $ 367.1 $ 383.9 $ 455.4 $ 431.0 $ 774.5 $ 886.4 $ 1,430.5 $ 1,525.5 Realized net performance revenues 55.7 90.6 77.8 127.4 87.7 197.7 215.1 531.0 366.1 Realized principal investment income 26.6 9.1 31.6 30.0 33.5 60.3 63.5 88.8 101.0 Net interest 12.1 10.5 12.9 12.6 13.5 22.8 26.1 48.7 46.2 FEE RELATED EARNINGS $ 273.0 $ 277.9 $ 287.4 $ 310.6 $ 323.3 $ 539.3 $ 633.9 $ 859.4 $ 1,104.6

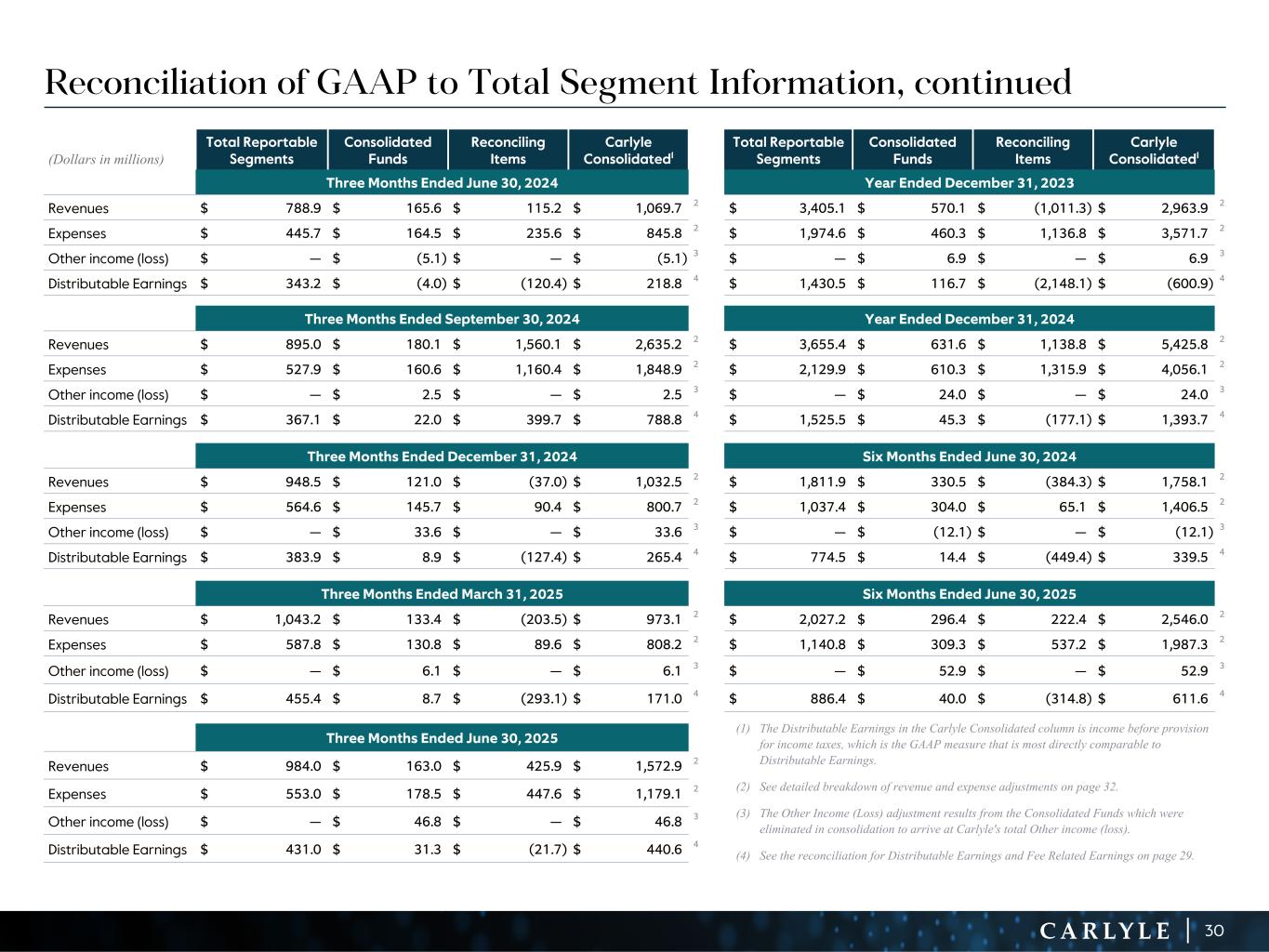

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 30 (Dollars in millions) Total Reportable Segments Consolidated Funds Reconciling Items Carlyle Consolidated1 Total Reportable Segments Consolidated Funds Reconciling Items Carlyle Consolidated1 Three Months Ended June 30, 2024 Year Ended December 31, 2023 Revenues $ 788.9 $ 165.6 $ 115.2 $ 1,069.7 2 $ 3,405.1 $ 570.1 $ (1,011.3) $ 2,963.9 2 Expenses $ 445.7 $ 164.5 $ 235.6 $ 845.8 2 $ 1,974.6 $ 460.3 $ 1,136.8 $ 3,571.7 2 Other income (loss) $ — $ (5.1) $ — $ (5.1) 3 $ — $ 6.9 $ — $ 6.9 3 Distributable Earnings $ 343.2 $ (4.0) $ (120.4) $ 218.8 4 $ 1,430.5 $ 116.7 $ (2,148.1) $ (600.9) 4 Three Months Ended September 30, 2024 Year Ended December 31, 2024 Revenues $ 895.0 $ 180.1 $ 1,560.1 $ 2,635.2 2 $ 3,655.4 $ 631.6 $ 1,138.8 $ 5,425.8 2 Expenses $ 527.9 $ 160.6 $ 1,160.4 $ 1,848.9 2 $ 2,129.9 $ 610.3 $ 1,315.9 $ 4,056.1 2 Other income (loss) $ — $ 2.5 $ — $ 2.5 3 $ — $ 24.0 $ — $ 24.0 3 Distributable Earnings $ 367.1 $ 22.0 $ 399.7 $ 788.8 4 $ 1,525.5 $ 45.3 $ (177.1) $ 1,393.7 4 Three Months Ended December 31, 2024 Six Months Ended June 30, 2024 Revenues $ 948.5 $ 121.0 $ (37.0) $ 1,032.5 2 $ 1,811.9 $ 330.5 $ (384.3) $ 1,758.1 2 Expenses $ 564.6 $ 145.7 $ 90.4 $ 800.7 2 $ 1,037.4 $ 304.0 $ 65.1 $ 1,406.5 2 Other income (loss) $ — $ 33.6 $ — $ 33.6 3 $ — $ (12.1) $ — $ (12.1) 3 Distributable Earnings $ 383.9 $ 8.9 $ (127.4) $ 265.4 4 $ 774.5 $ 14.4 $ (449.4) $ 339.5 4 Three Months Ended March 31, 2025 Six Months Ended June 30, 2025 Revenues $ 1,043.2 $ 133.4 $ (203.5) $ 973.1 2 $ 2,027.2 $ 296.4 $ 222.4 $ 2,546.0 2 Expenses $ 587.8 $ 130.8 $ 89.6 $ 808.2 2 $ 1,140.8 $ 309.3 $ 537.2 $ 1,987.3 2 Other income (loss) $ — $ 6.1 $ — $ 6.1 3 $ — $ 52.9 $ — $ 52.9 3 Distributable Earnings $ 455.4 $ 8.7 $ (293.1) $ 171.0 4 $ 886.4 $ 40.0 $ (314.8) $ 611.6 4 Three Months Ended June 30, 2025 Revenues $ 984.0 $ 163.0 $ 425.9 $ 1,572.9 2 Expenses $ 553.0 $ 178.5 $ 447.6 $ 1,179.1 2 Other income (loss) $ — $ 46.8 $ — $ 46.8 3 Distributable Earnings $ 431.0 $ 31.3 $ (21.7) $ 440.6 4 Reconciliation of GAAP to Total Segment Information, continued (1) The Distributable Earnings in the Carlyle Consolidated column is income before provision for income taxes, which is the GAAP measure that is most directly comparable to Distributable Earnings. (2) See detailed breakdown of revenue and expense adjustments on page 32. (3) The Other Income (Loss) adjustment results from the Consolidated Funds which were eliminated in consolidation to arrive at Carlyle's total Other income (loss). (4) See the reconciliation for Distributable Earnings and Fee Related Earnings on page 29.

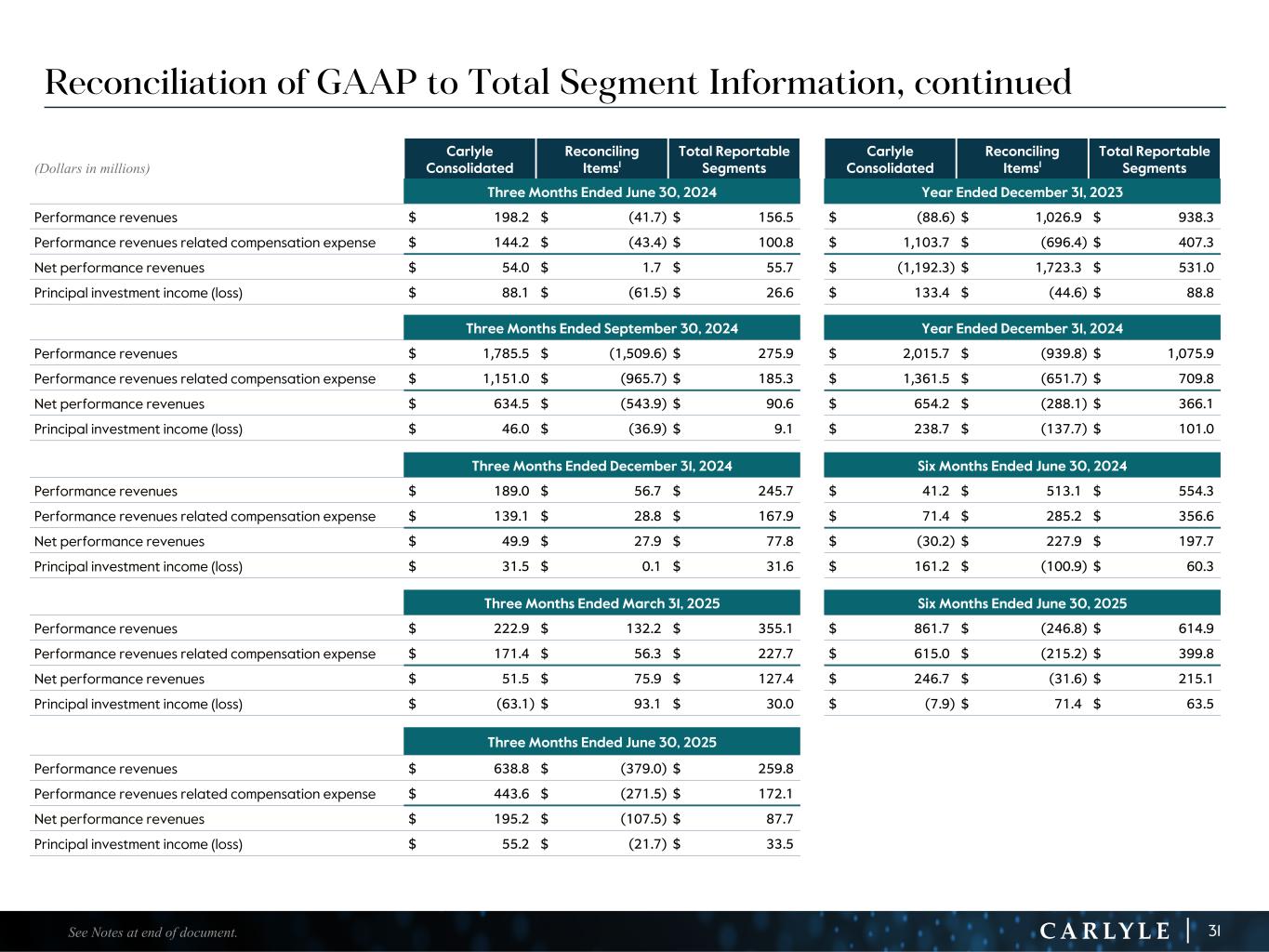

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 31 Reconciliation of GAAP to Total Segment Information, continued (Dollars in millions) Carlyle Consolidated Reconciling Items1 Total Reportable Segments Carlyle Consolidated Reconciling Items1 Total Reportable Segments Three Months Ended June 30, 2024 Year Ended December 31, 2023 Performance revenues $ 198.2 $ (41.7) $ 156.5 $ (88.6) $ 1,026.9 $ 938.3 Performance revenues related compensation expense $ 144.2 $ (43.4) $ 100.8 $ 1,103.7 $ (696.4) $ 407.3 Net performance revenues $ 54.0 $ 1.7 $ 55.7 $ (1,192.3) $ 1,723.3 $ 531.0 Principal investment income (loss) $ 88.1 $ (61.5) $ 26.6 $ 133.4 $ (44.6) $ 88.8 Three Months Ended September 30, 2024 Year Ended December 31, 2024 Performance revenues $ 1,785.5 $ (1,509.6) $ 275.9 $ 2,015.7 $ (939.8) $ 1,075.9 Performance revenues related compensation expense $ 1,151.0 $ (965.7) $ 185.3 $ 1,361.5 $ (651.7) $ 709.8 Net performance revenues $ 634.5 $ (543.9) $ 90.6 $ 654.2 $ (288.1) $ 366.1 Principal investment income (loss) $ 46.0 $ (36.9) $ 9.1 $ 238.7 $ (137.7) $ 101.0 Three Months Ended December 31, 2024 Six Months Ended June 30, 2024 Performance revenues $ 189.0 $ 56.7 $ 245.7 $ 41.2 $ 513.1 $ 554.3 Performance revenues related compensation expense $ 139.1 $ 28.8 $ 167.9 $ 71.4 $ 285.2 $ 356.6 Net performance revenues $ 49.9 $ 27.9 $ 77.8 $ (30.2) $ 227.9 $ 197.7 Principal investment income (loss) $ 31.5 $ 0.1 $ 31.6 $ 161.2 $ (100.9) $ 60.3 Three Months Ended March 31, 2025 Six Months Ended June 30, 2025 Performance revenues $ 222.9 $ 132.2 $ 355.1 $ 861.7 $ (246.8) $ 614.9 Performance revenues related compensation expense $ 171.4 $ 56.3 $ 227.7 $ 615.0 $ (215.2) $ 399.8 Net performance revenues $ 51.5 $ 75.9 $ 127.4 $ 246.7 $ (31.6) $ 215.1 Principal investment income (loss) $ (63.1) $ 93.1 $ 30.0 $ (7.9) $ 71.4 $ 63.5 Three Months Ended June 30, 2025 Performance revenues $ 638.8 $ (379.0) $ 259.8 Performance revenues related compensation expense $ 443.6 $ (271.5) $ 172.1 Net performance revenues $ 195.2 $ (107.5) $ 87.7 Principal investment income (loss) $ 55.2 $ (21.7) $ 33.5 See Notes at end of document.

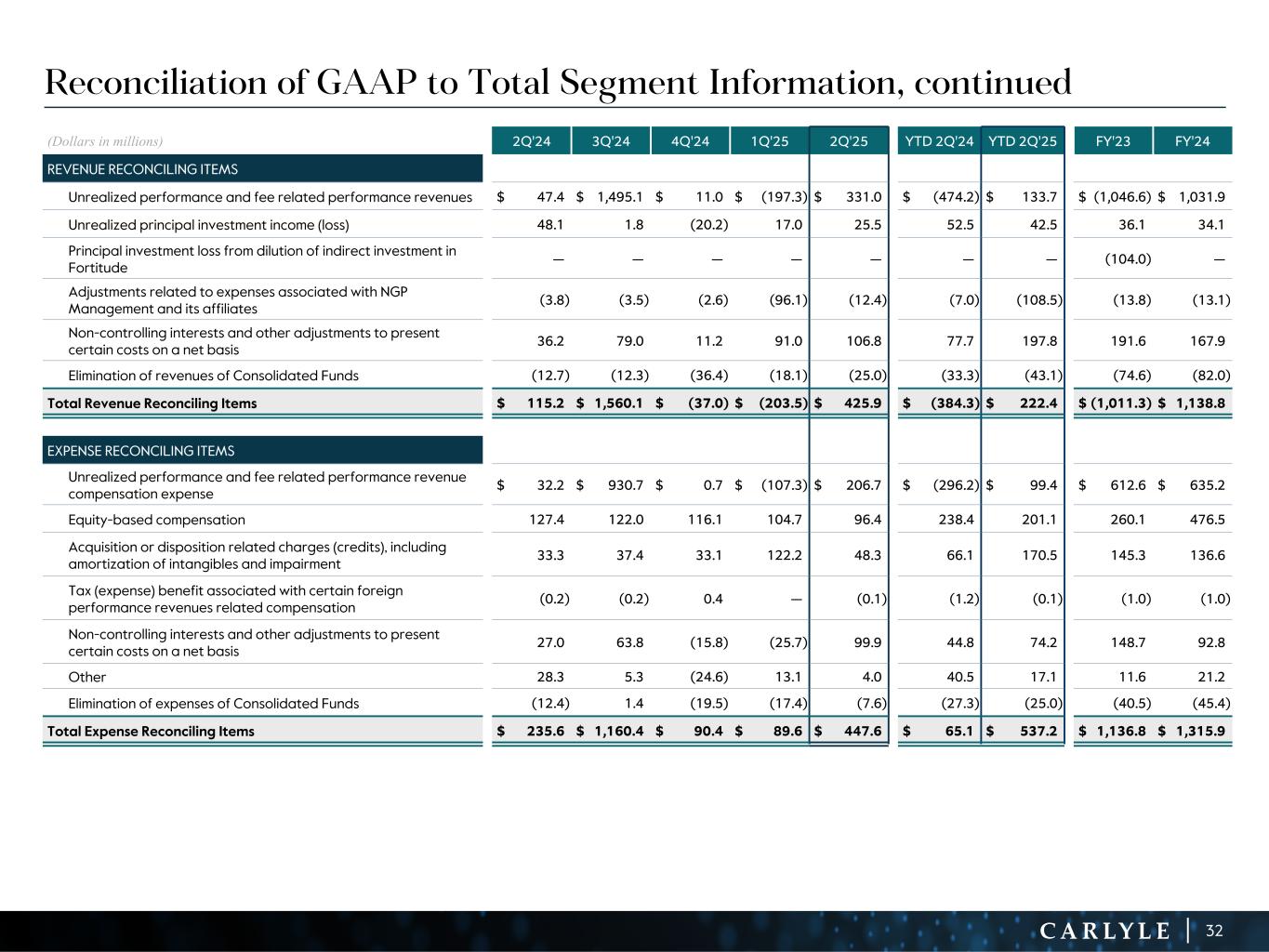

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 32 Reconciliation of GAAP to Total Segment Information, continued (Dollars in millions) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 YTD 2Q'24 YTD 2Q'25 FY'23 FY'24 REVENUE RECONCILING ITEMS Unrealized performance and fee related performance revenues $ 47.4 $ 1,495.1 $ 11.0 $ (197.3) $ 331.0 $ (474.2) $ 133.7 $ (1,046.6) $ 1,031.9 Unrealized principal investment income (loss) 48.1 1.8 (20.2) 17.0 25.5 52.5 42.5 36.1 34.1 Principal investment loss from dilution of indirect investment in Fortitude — — — — — — — (104.0) — Adjustments related to expenses associated with NGP Management and its affiliates (3.8) (3.5) (2.6) (96.1) (12.4) (7.0) (108.5) (13.8) (13.1) Non-controlling interests and other adjustments to present certain costs on a net basis 36.2 79.0 11.2 91.0 106.8 77.7 197.8 191.6 167.9 Elimination of revenues of Consolidated Funds (12.7) (12.3) (36.4) (18.1) (25.0) (33.3) (43.1) (74.6) (82.0) Total Revenue Reconciling Items $ 115.2 $ 1,560.1 $ (37.0) $ (203.5) $ 425.9 $ (384.3) $ 222.4 $ (1,011.3) $ 1,138.8 EXPENSE RECONCILING ITEMS Unrealized performance and fee related performance revenue compensation expense $ 32.2 $ 930.7 $ 0.7 $ (107.3) $ 206.7 $ (296.2) $ 99.4 $ 612.6 $ 635.2 Equity-based compensation 127.4 122.0 116.1 104.7 96.4 238.4 201.1 260.1 476.5 Acquisition or disposition related charges (credits), including amortization of intangibles and impairment 33.3 37.4 33.1 122.2 48.3 66.1 170.5 145.3 136.6 Tax (expense) benefit associated with certain foreign performance revenues related compensation (0.2) (0.2) 0.4 — (0.1) (1.2) (0.1) (1.0) (1.0) Non-controlling interests and other adjustments to present certain costs on a net basis 27.0 63.8 (15.8) (25.7) 99.9 44.8 74.2 148.7 92.8 Other 28.3 5.3 (24.6) 13.1 4.0 40.5 17.1 11.6 21.2 Elimination of expenses of Consolidated Funds (12.4) 1.4 (19.5) (17.4) (7.6) (27.3) (25.0) (40.5) (45.4) Total Expense Reconciling Items $ 235.6 $ 1,160.4 $ 90.4 $ 89.6 $ 447.6 $ 65.1 $ 537.2 $ 1,136.8 $ 1,315.9

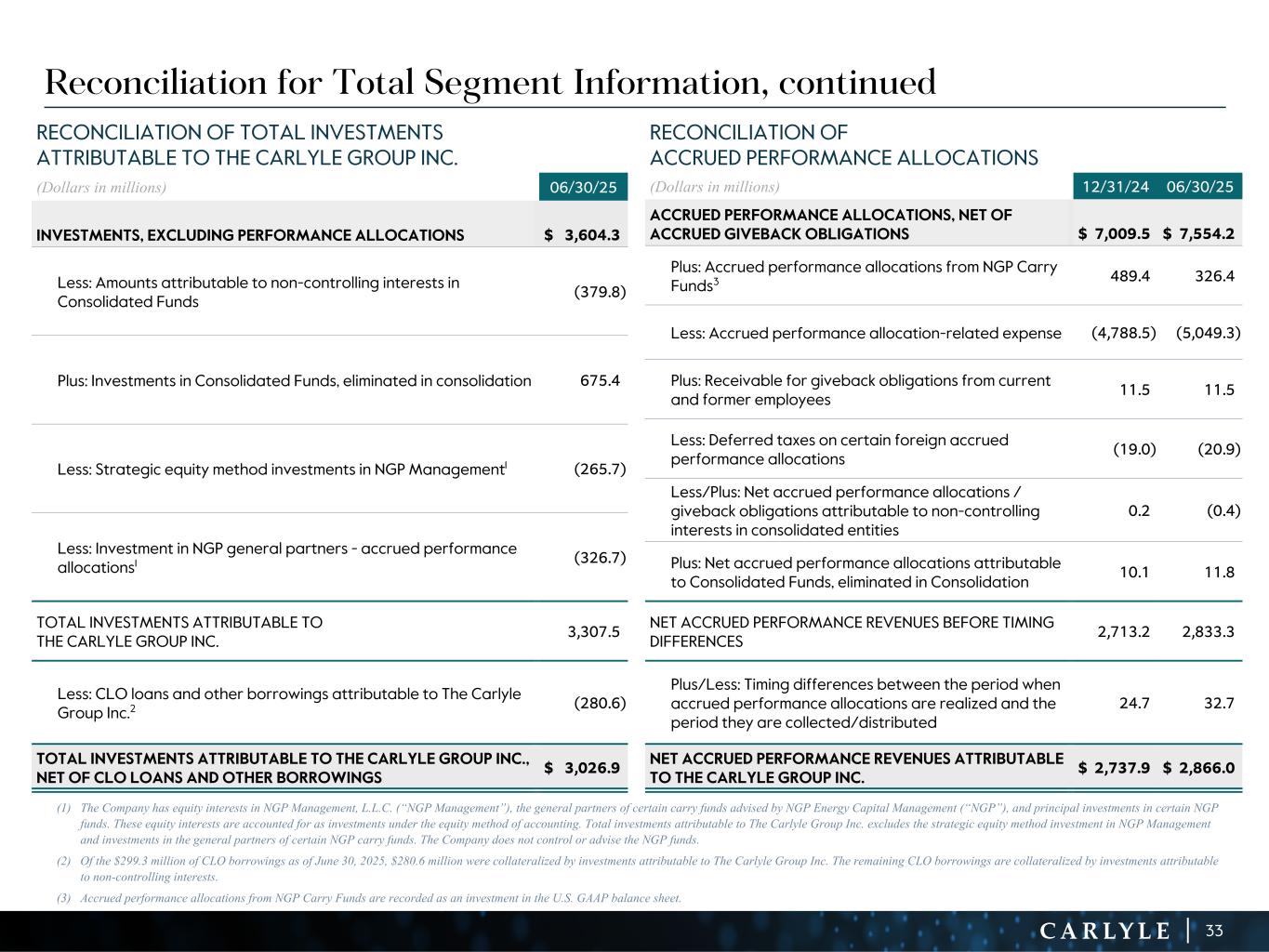

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 33 Reconciliation for Total Segment Information, continued (1) The Company has equity interests in NGP Management, L.L.C. (“NGP Management”), the general partners of certain carry funds advised by NGP Energy Capital Management (“NGP”), and principal investments in certain NGP funds. These equity interests are accounted for as investments under the equity method of accounting. Total investments attributable to The Carlyle Group Inc. excludes the strategic equity method investment in NGP Management and investments in the general partners of certain NGP carry funds. The Company does not control or advise the NGP funds. (2) Of the $299.3 million of CLO borrowings as of June 30, 2025, $280.6 million were collateralized by investments attributable to The Carlyle Group Inc. The remaining CLO borrowings are collateralized by investments attributable to non-controlling interests. (3) Accrued performance allocations from NGP Carry Funds are recorded as an investment in the U.S. GAAP balance sheet. RECONCILIATION OF TOTAL INVESTMENTS ATTRIBUTABLE TO THE CARLYLE GROUP INC. (Dollars in millions) 06/30/25 INVESTMENTS, EXCLUDING PERFORMANCE ALLOCATIONS $ 3,604.3 Less: Amounts attributable to non-controlling interests in Consolidated Funds (379.8) Plus: Investments in Consolidated Funds, eliminated in consolidation 675.4 Less: Strategic equity method investments in NGP Management1 (265.7) Less: Investment in NGP general partners - accrued performance allocations1 (326.7) TOTAL INVESTMENTS ATTRIBUTABLE TO THE CARLYLE GROUP INC. 3,307.5 Less: CLO loans and other borrowings attributable to The Carlyle Group Inc.2 (280.6) TOTAL INVESTMENTS ATTRIBUTABLE TO THE CARLYLE GROUP INC., NET OF CLO LOANS AND OTHER BORROWINGS $ 3,026.9 RECONCILIATION OF ACCRUED PERFORMANCE ALLOCATIONS (Dollars in millions) 12/31/24 06/30/25 ACCRUED PERFORMANCE ALLOCATIONS, NET OF ACCRUED GIVEBACK OBLIGATIONS $ 7,009.5 $ 7,554.2 Plus: Accrued performance allocations from NGP Carry Funds3 489.4 326.4 Less: Accrued performance allocation-related expense (4,788.5) (5,049.3) Plus: Receivable for giveback obligations from current and former employees 11.5 11.5 Less: Deferred taxes on certain foreign accrued performance allocations (19.0) (20.9) Less/Plus: Net accrued performance allocations / giveback obligations attributable to non-controlling interests in consolidated entities 0.2 (0.4) Plus: Net accrued performance allocations attributable to Consolidated Funds, eliminated in Consolidation 10.1 11.8 NET ACCRUED PERFORMANCE REVENUES BEFORE TIMING DIFFERENCES 2,713.2 2,833.3 Plus/Less: Timing differences between the period when accrued performance allocations are realized and the period they are collected/distributed 24.7 32.7 NET ACCRUED PERFORMANCE REVENUES ATTRIBUTABLE TO THE CARLYLE GROUP INC. $ 2,737.9 $ 2,866.0

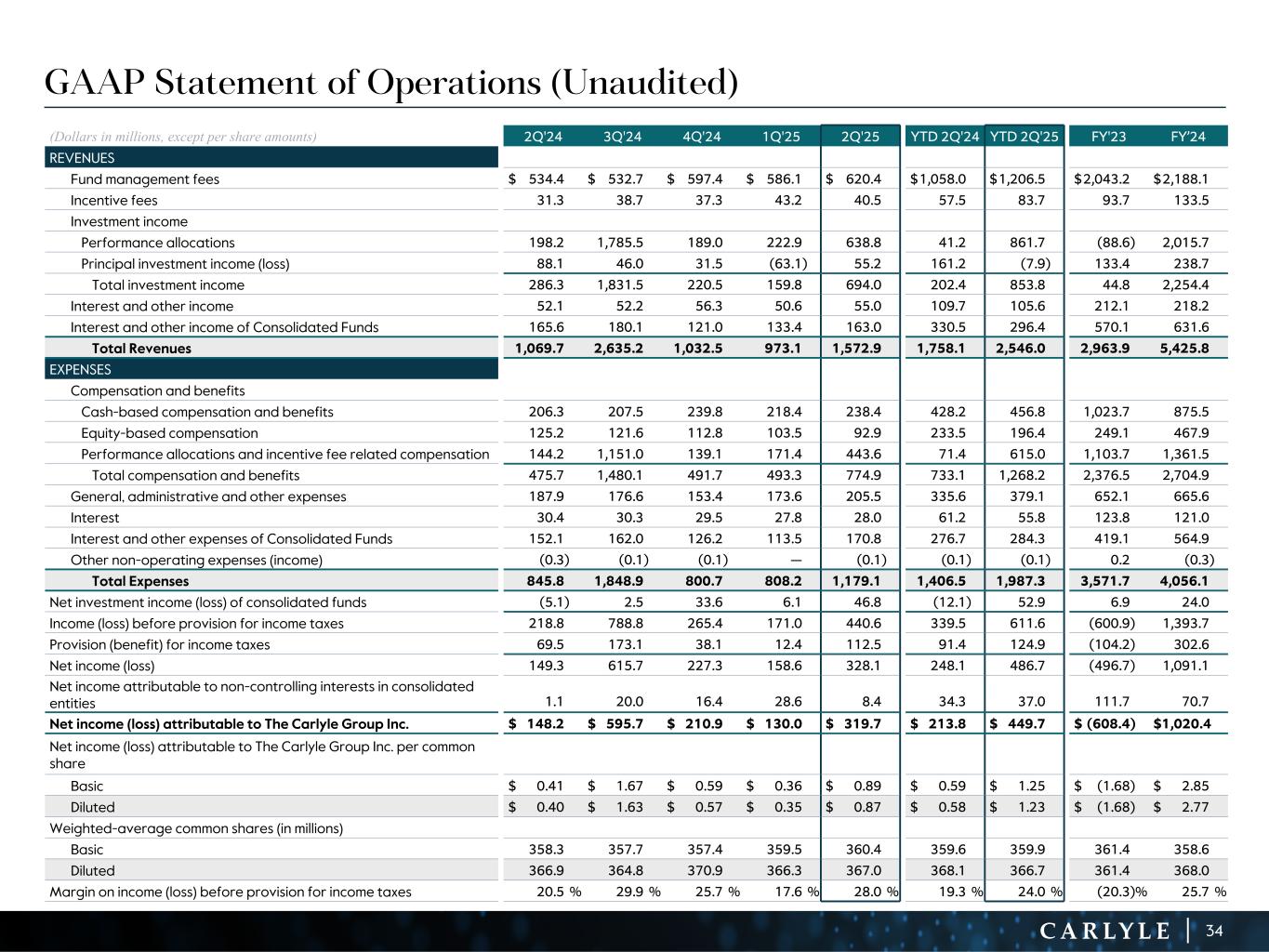

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 34 GAAP Statement of Operations (Unaudited) (Dollars in millions, except per share amounts) 2Q'24 3Q'24 4Q'24 1Q'25 2Q'25 YTD 2Q'24 YTD 2Q'25 FY'23 FY’24 REVENUES Fund management fees $ 534.4 $ 532.7 $ 597.4 $ 586.1 $ 620.4 $ 1,058.0 $ 1,206.5 $ 2,043.2 $ 2,188.1 Incentive fees 31.3 38.7 37.3 43.2 40.5 57.5 83.7 93.7 133.5 Investment income Performance allocations 198.2 1,785.5 189.0 222.9 638.8 41.2 861.7 (88.6) 2,015.7 Principal investment income (loss) 88.1 46.0 31.5 (63.1) 55.2 161.2 (7.9) 133.4 238.7 Total investment income 286.3 1,831.5 220.5 159.8 694.0 202.4 853.8 44.8 2,254.4 Interest and other income 52.1 52.2 56.3 50.6 55.0 109.7 105.6 212.1 218.2 Interest and other income of Consolidated Funds 165.6 180.1 121.0 133.4 163.0 330.5 296.4 570.1 631.6 Total Revenues 1,069.7 2,635.2 1,032.5 973.1 1,572.9 1,758.1 2,546.0 2,963.9 5,425.8 EXPENSES Compensation and benefits Cash-based compensation and benefits 206.3 207.5 239.8 218.4 238.4 428.2 456.8 1,023.7 875.5 Equity-based compensation 125.2 121.6 112.8 103.5 92.9 233.5 196.4 249.1 467.9 Performance allocations and incentive fee related compensation 144.2 1,151.0 139.1 171.4 443.6 71.4 615.0 1,103.7 1,361.5 Total compensation and benefits 475.7 1,480.1 491.7 493.3 774.9 733.1 1,268.2 2,376.5 2,704.9 General, administrative and other expenses 187.9 176.6 153.4 173.6 205.5 335.6 379.1 652.1 665.6 Interest 30.4 30.3 29.5 27.8 28.0 61.2 55.8 123.8 121.0 Interest and other expenses of Consolidated Funds 152.1 162.0 126.2 113.5 170.8 276.7 284.3 419.1 564.9 Other non-operating expenses (income) (0.3) (0.1) (0.1) — (0.1) (0.1) (0.1) 0.2 (0.3) Total Expenses 845.8 1,848.9 800.7 808.2 1,179.1 1,406.5 1,987.3 3,571.7 4,056.1 Net investment income (loss) of consolidated funds (5.1) 2.5 33.6 6.1 46.8 (12.1) 52.9 6.9 24.0 Income (loss) before provision for income taxes 218.8 788.8 265.4 171.0 440.6 339.5 611.6 (600.9) 1,393.7 Provision (benefit) for income taxes 69.5 173.1 38.1 12.4 112.5 91.4 124.9 (104.2) 302.6 Net income (loss) 149.3 615.7 227.3 158.6 328.1 248.1 486.7 (496.7) 1,091.1 Net income attributable to non-controlling interests in consolidated entities 1.1 20.0 16.4 28.6 8.4 34.3 37.0 111.7 70.7 Net income (loss) attributable to The Carlyle Group Inc. $ 148.2 $ 595.7 $ 210.9 $ 130.0 $ 319.7 $ 213.8 $ 449.7 $ (608.4) $ 1,020.4 Net income (loss) attributable to The Carlyle Group Inc. per common share Basic $ 0.41 $ 1.67 $ 0.59 $ 0.36 $ 0.89 $ 0.59 $ 1.25 $ (1.68) $ 2.85 Diluted $ 0.40 $ 1.63 $ 0.57 $ 0.35 $ 0.87 $ 0.58 $ 1.23 $ (1.68) $ 2.77 Weighted-average common shares (in millions) Basic 358.3 357.7 357.4 359.5 360.4 359.6 359.9 361.4 358.6 Diluted 366.9 364.8 370.9 366.3 367.0 368.1 366.7 361.4 368.0 Margin on income (loss) before provision for income taxes 20.5 % 29.9 % 25.7 % 17.6 % 28.0 % 19.3 % 24.0 % (20.3) % 25.7 %

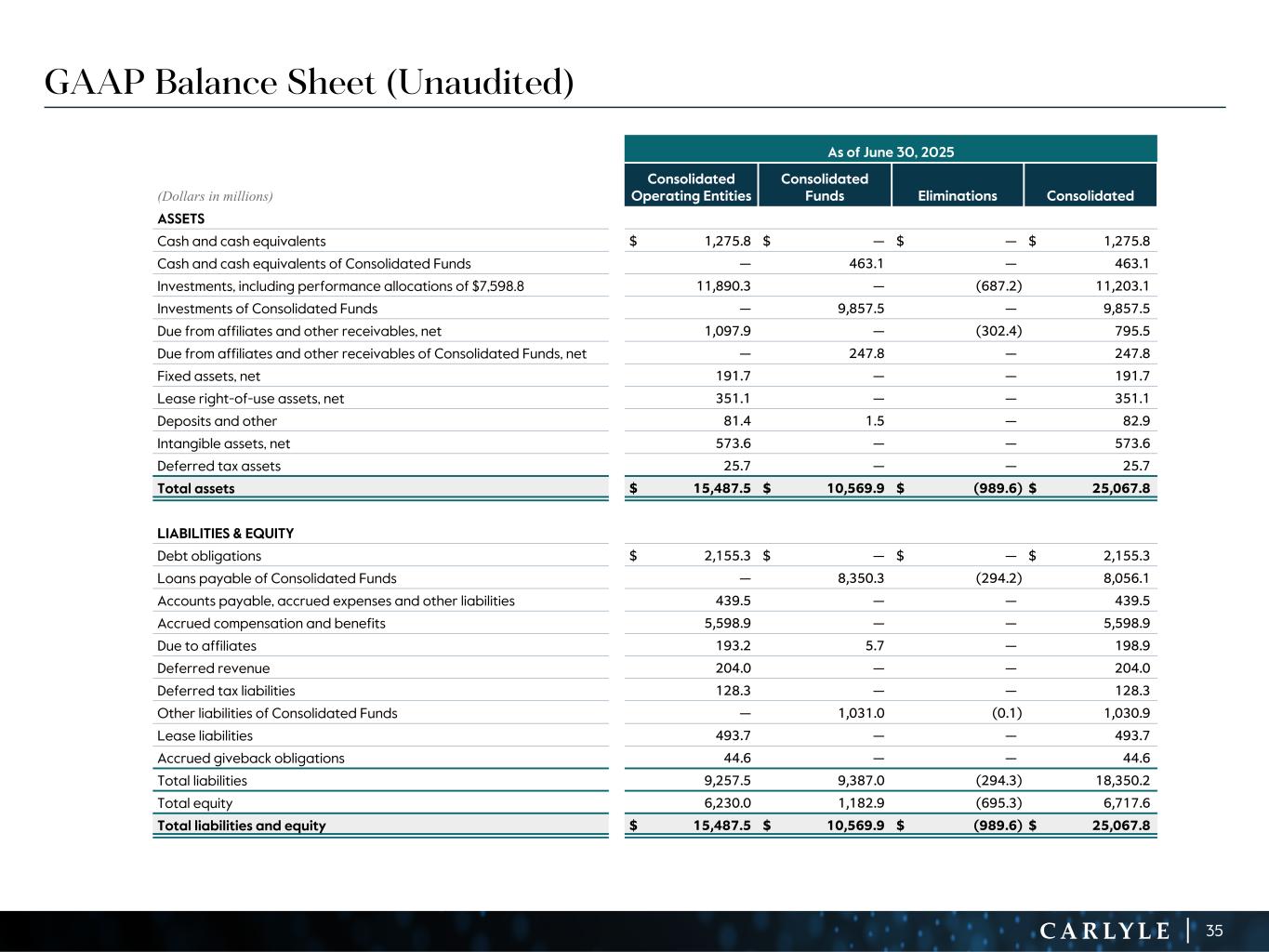

R-14 7 G-19 5 B-19 7 R-88 G-15 9 B-16 5 R-13 6 G-18 0 B-83 R-16 3 G-14 3 B-18 7 R-0 G-74 B-13 6 R-18 5 G-21 1 B-15 3 R-11 8 G-92 B-15 0 R-22 0 G-22 1 B-23 2 R-14 0 G-14 1 B-15 2R-12 0 G-16 9 B-22 2 Old Colors R-88 G-89 B-91 58595B R-23 G-234 B-234 EAEAEA R-208 G-232 B-247 D0E8F7 R-65 G-64 B-66 414042 R-8 G-51 B-94 08335E R-167 G-169 B-171 A7A9AB R-9 G-102 B-112 096670 R-220 G-221 B-222 DCDDDE R-97 G-161 B-224 61A1E0 R-237 G-217 B-157 EDD99D R-147 G-195 B-197 93C3C5 35 As of June 30, 2025 (Dollars in millions) Consolidated Operating Entities Consolidated Funds Eliminations Consolidated ASSETS Cash and cash equivalents $ 1,275.8 $ — $ — $ 1,275.8 Cash and cash equivalents of Consolidated Funds — 463.1 — 463.1 Investments, including performance allocations of $7,598.8 11,890.3 — (687.2) 11,203.1 Investments of Consolidated Funds — 9,857.5 — 9,857.5 Due from affiliates and other receivables, net 1,097.9 — (302.4) 795.5 Due from affiliates and other receivables of Consolidated Funds, net — 247.8 — 247.8 Fixed assets, net 191.7 — — 191.7 Lease right-of-use assets, net 351.1 — — 351.1 Deposits and other 81.4 1.5 — 82.9 Intangible assets, net 573.6 — — 573.6 Deferred tax assets 25.7 — — 25.7 Total assets $ 15,487.5 $ 10,569.9 $ (989.6) $ 25,067.8 LIABILITIES & EQUITY Debt obligations $ 2,155.3 $ — $ — $ 2,155.3 Loans payable of Consolidated Funds — 8,350.3 (294.2) 8,056.1 Accounts payable, accrued expenses and other liabilities 439.5 — — 439.5 Accrued compensation and benefits 5,598.9 — — 5,598.9 Due to affiliates 193.2 5.7 — 198.9 Deferred revenue 204.0 — — 204.0 Deferred tax liabilities 128.3 — — 128.3 Other liabilities of Consolidated Funds — 1,031.0 (0.1) 1,030.9 Lease liabilities 493.7 — — 493.7 Accrued giveback obligations 44.6 — — 44.6 Total liabilities 9,257.5 9,387.0 (294.3) 18,350.2 Total equity 6,230.0 1,182.9 (695.3) 6,717.6 Total liabilities and equity $ 15,487.5 $ 10,569.9 $ (989.6) $ 25,067.8 GAAP Balance Sheet (Unaudited)