Q2 SELECT FINANCIAL INFORMATION

2 Disclaimer Neither Ready Capital Corporation (the "Company“) nor any of its representatives or affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained in this presentation and the Company and its representatives disclaim all liability to potential investors relating to, or resulting from, the use of this information. Nothing contained in this document is or shall be relied upon as a promise or representation as to the past, current or future performance of Company. There is no guarantee that any of the estimates, targets or projections illustrated in these materials and any presentation of which they form a part will be achieved. Any references herein to any of the Company’s past or present investments or its past or present performance, have been provided for illustrative purposes only. It should not be assumed that these investments were or will be profitable or that any future investments by the Company will be profitable or will equal the performance of these investments. Past performance is not indicative of future results and there can be no assurance that the Company will achieve comparable results in the future. This presentation contains statements that constitute "forward-looking statements," as such term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are intended to be covered by the safe harbor provided by the same. These statements are based on management's current expectations and beliefs and are subject to a number of trends and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements; the Company can give no assurance that its expectations will be attained. Factors that could cause actual results to differ materially from the Company's expectations include, but are not limited to, applicable regulatory changes; general volatility of the capital markets; changes in the Company’s investment objectives and business strategy; the availability of financing on acceptable terms or at all; the availability, terms and deployment of capital; the availability of suitable investment opportunities; changes in the interest rates or the general economy; increased rates of default and/or decreased recovery rates on investments; changes in interest rates, interest rate spreads, the yield curve or prepayment rates; changes in prepayments of Company’s assets; the degree and nature of competition, including competition for the Company's target assets; and other factors, including those set forth in the Risk Factors section of the Company's most recent Annual Report on Form 10-K filed with the SEC, and other reports filed by the Company with the SEC, copies of which are available on the SEC's website, www.sec.gov. The Company undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law. This presentation also contains market statistics and industry data which are subject to uncertainty and are not necessarily reflective of market conditions. These have been derived from third party sources and have not been independently verified by the Company or its affiliates. All material presented is compiled from sources believed to be reliable and current, but accuracy cannot be guaranteed. All data is as of June 30, 2025, unless otherwise noted.

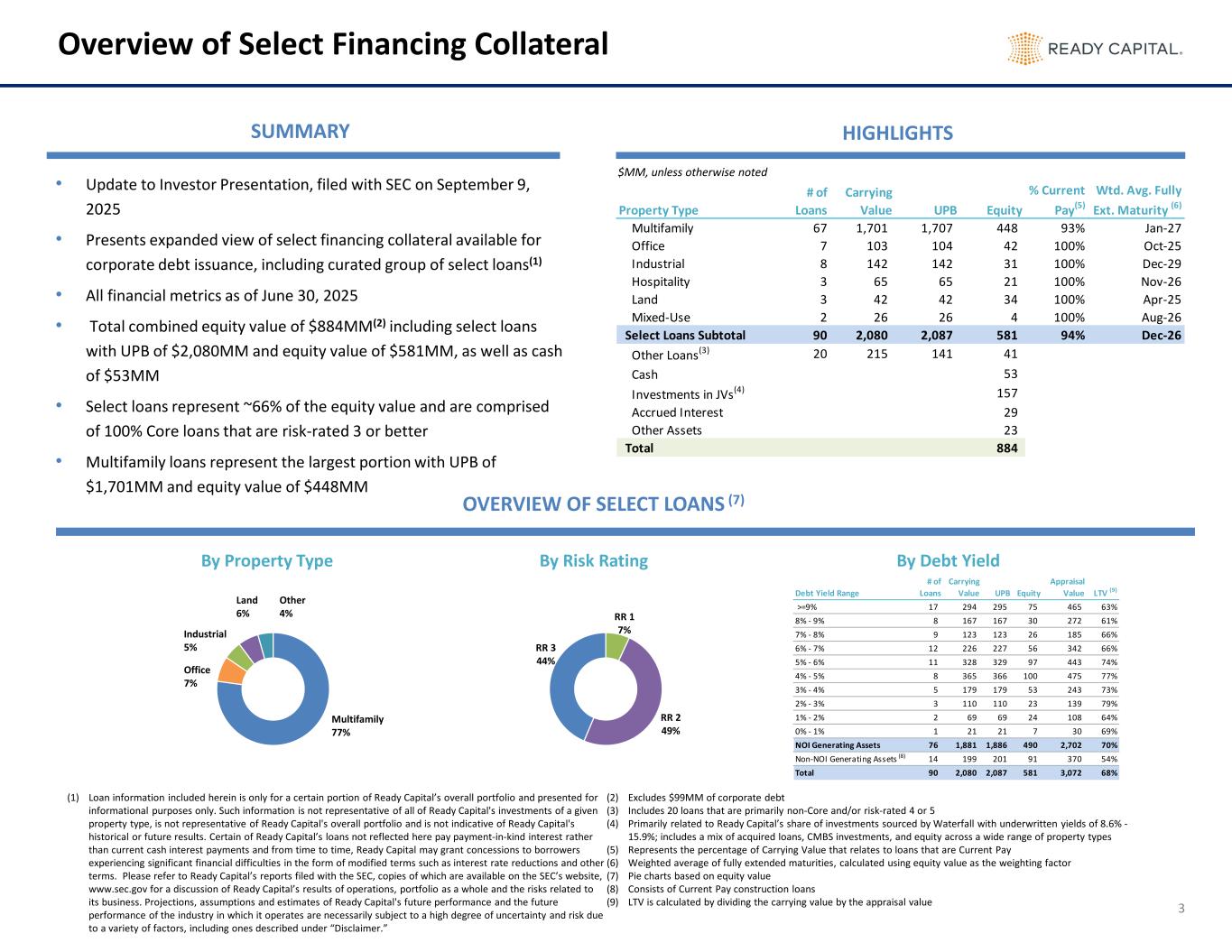

Debt Yield Range # of Loans Carrying Value UPB Equity Appraisal Value LTV (9) >=9% 17 294 295 75 465 63% 8% - 9% 8 167 167 30 272 61% 7% - 8% 9 123 123 26 185 66% 6% - 7% 12 226 227 56 342 66% 5% - 6% 11 328 329 97 443 74% 4% - 5% 8 365 366 100 475 77% 3% - 4% 5 179 179 53 243 73% 2% - 3% 3 110 110 23 139 79% 1% - 2% 2 69 69 24 108 64% 0% - 1% 1 21 21 7 30 69% NOI Generating Assets 76 1,881 1,886 490 2,702 70% Non-NOI Generating Assets 14 199 201 91 370 54% Total 90 2,080 2,087 581 3,072 68% Property Type # of Loans Carrying Value UPB Equity % Current Pay(5) Wtd. Avg. Fully Ext. Maturity (6) Multifamily 67 1,701 1,707 448 93% Jan-27 Office 7 103 104 42 100% Oct-25 Industrial 8 142 142 31 100% Dec-29 Hospitality 3 65 65 21 100% Nov-26 Land 3 42 42 34 100% Apr-25 Mixed-Use 2 26 26 4 100% Aug-26 Select Loans Subtotal 90 2,080 2,087 581 94% Dec-26 Other Loans(3) 20 215 141 41 Cash 53 Investments in JVs(4) 157 Accrued Interest 29 Other Assets 23 Total 884 Overview of Select Financing Collateral SUMMARY HIGHLIGHTS OVERVIEW OF SELECT LOANS (7) • Update to Investor Presentation, filed with SEC on September 9, 2025 • Presents expanded view of select financing collateral available for corporate debt issuance, including curated group of select loans(1) • All financial metrics as of June 30, 2025 • Total combined equity value of $884MM(2) including select loans with UPB of $2,080MM and equity value of $581MM, as well as cash of $53MM • Select loans represent ~66% of the equity value and are comprised of 100% Core loans that are risk-rated 3 or better • Multifamily loans represent the largest portion with UPB of $1,701MM and equity value of $448MM By Property Type Multifamily 77% Office 7% Industrial 5% Land 6% Other 4% $MM, unless otherwise noted 3 By Risk Rating RR 1 7% RR 2 49% RR 3 44% (1) Loan information included herein is only for a certain portion of Ready Capital’s overall portfolio and presented for informational purposes only. Such information is not representative of all of Ready Capital's investments of a given property type, is not representative of Ready Capital's overall portfolio and is not indicative of Ready Capital's historical or future results. Certain of Ready Capital’s loans not reflected here pay payment-in-kind interest rather than current cash interest payments and from time to time, Ready Capital may grant concessions to borrowers experiencing significant financial difficulties in the form of modified terms such as interest rate reductions and other terms. Please refer to Ready Capital’s reports filed with the SEC, copies of which are available on the SEC’s website, www.sec.gov for a discussion of Ready Capital’s results of operations, portfolio as a whole and the risks related to its business. Projections, assumptions and estimates of Ready Capital's future performance and the future performance of the industry in which it operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including ones described under “Disclaimer.” (2) Excludes $99MM of corporate debt (3) Includes 20 loans that are primarily non-Core and/or risk-rated 4 or 5 (4) Primarily related to Ready Capital’s share of investments sourced by Waterfall with underwritten yields of 8.6% - 15.9%; includes a mix of acquired loans, CMBS investments, and equity across a wide range of property types (5) Represents the percentage of Carrying Value that relates to loans that are Current Pay (6) Weighted average of fully extended maturities, calculated using equity value as the weighting factor (7) Pie charts based on equity value (8) Consists of Current Pay construction loans (9) LTV is calculated by dividing the carrying value by the appraisal value (8) By Debt Yield

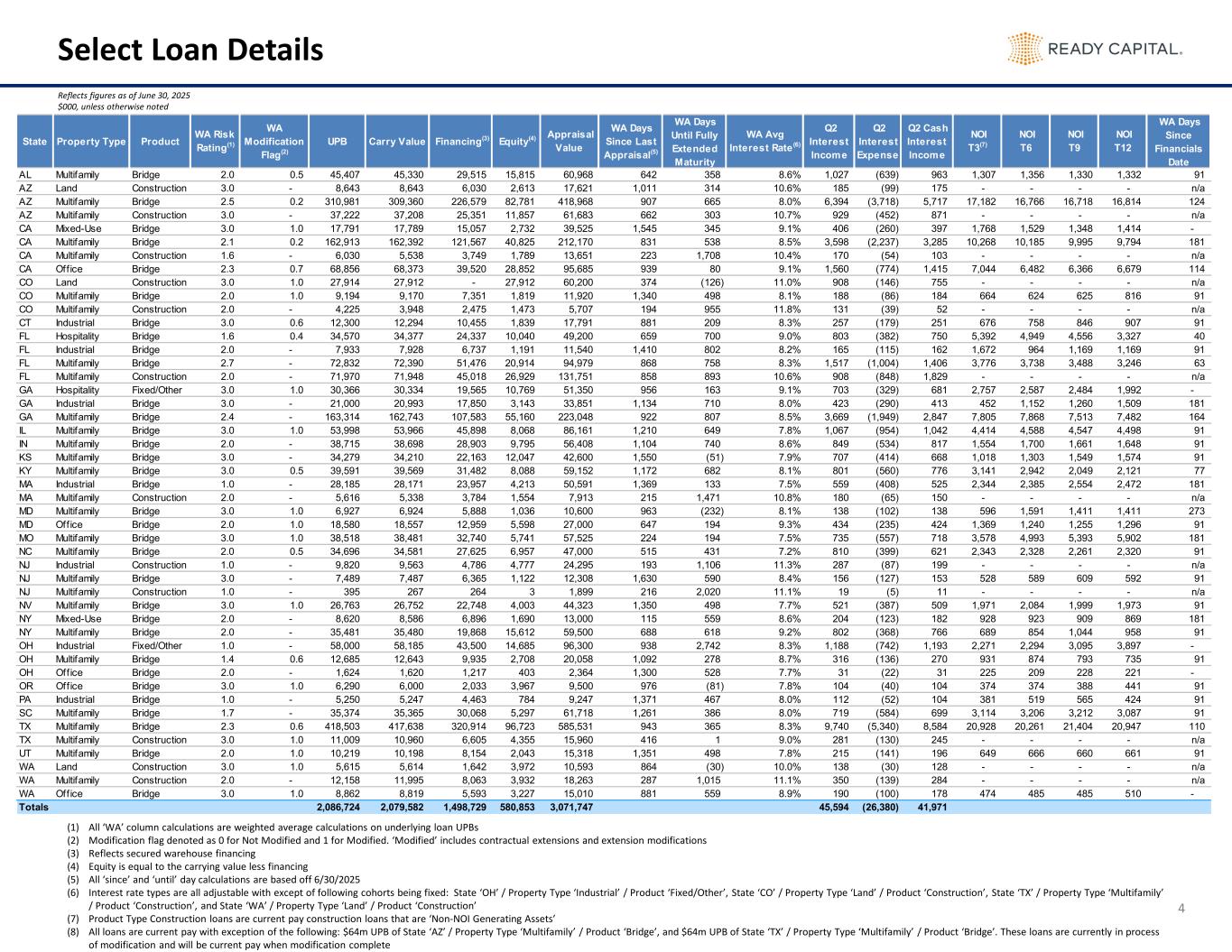

Select Loan Details Reflects figures as of June 30, 2025 $000, unless otherwise noted 4 (1) All ‘WA’ column calculations are weighted average calculations on underlying loan UPBs (2) Modification flag denoted as 0 for Not Modified and 1 for Modified. ‘Modified’ includes contractual extensions and extension modifications (3) Reflects secured warehouse financing (4) Equity is equal to the carrying value less financing (5) All ‘since’ and ‘until’ day calculations are based off 6/30/2025 (6) Interest rate types are all adjustable with except of following cohorts being fixed: State ‘OH’ / Property Type ‘Industrial’ / Product ‘Fixed/Other’, State ‘CO’ / Property Type ‘Land’ / Product ‘Construction’, State ‘TX’ / Property Type ‘Multifamily’ / Product ‘Construction’, and State ‘WA’ / Property Type ‘Land’ / Product ‘Construction’ (7) Product Type Construction loans are current pay construction loans that are ‘Non-NOI Generating Assets’ (8) All loans are current pay with exception of the following: $64m UPB of State ‘AZ’ / Property Type ‘Multifamily’ / Product ‘Bridge’, and $64m UPB of State ‘TX’ / Property Type ‘Multifamily’ / Product ‘Bridge’. These loans are currently in process of modification and will be current pay when modification complete State Property Type Product WA Risk Rating(1) WA Modification Flag(2) UPB Carry Value Financing(3) Equity(4) Appraisal Value WA Days Since Last Appraisal(5) WA Days Until Fully Extended Maturity WA Avg Interest Rate(6) Q2 Interest Income Q2 Interest Expense Q2 Cash Interest Income NOI T3(7) NOI T6 NOI T9 NOI T12 WA Days Since Financials Date AL Multifamily Bridge 2.0 0.5 45,407 45,330 29,515 15,815 60,968 642 358 8.6% 1,027 (639) 963 1,307 1,356 1,330 1,332 91 AZ Land Construction 3.0 - 8,643 8,643 6,030 2,613 17,621 1,011 314 10.6% 185 (99) 175 - - - - n/a AZ Multifamily Bridge 2.5 0.2 310,981 309,360 226,579 82,781 418,968 907 665 8.0% 6,394 (3,718) 5,717 17,182 16,766 16,718 16,814 124 AZ Multifamily Construction 3.0 - 37,222 37,208 25,351 11,857 61,683 662 303 10.7% 929 (452) 871 - - - - n/a CA Mixed-Use Bridge 3.0 1.0 17,791 17,789 15,057 2,732 39,525 1,545 345 9.1% 406 (260) 397 1,768 1,529 1,348 1,414 - CA Multifamily Bridge 2.1 0.2 162,913 162,392 121,567 40,825 212,170 831 538 8.5% 3,598 (2,237) 3,285 10,268 10,185 9,995 9,794 181 CA Multifamily Construction 1.6 - 6,030 5,538 3,749 1,789 13,651 223 1,708 10.4% 170 (54) 103 - - - - n/a CA Office Bridge 2.3 0.7 68,856 68,373 39,520 28,852 95,685 939 80 9.1% 1,560 (774) 1,415 7,044 6,482 6,366 6,679 114 CO Land Construction 3.0 1.0 27,914 27,912 - 27,912 60,200 374 (126) 11.0% 908 (146) 755 - - - - n/a CO Multifamily Bridge 2.0 1.0 9,194 9,170 7,351 1,819 11,920 1,340 498 8.1% 188 (86) 184 664 624 625 816 91 CO Multifamily Construction 2.0 - 4,225 3,948 2,475 1,473 5,707 194 955 11.8% 131 (39) 52 - - - - n/a CT Industrial Bridge 3.0 0.6 12,300 12,294 10,455 1,839 17,791 881 209 8.3% 257 (179) 251 676 758 846 907 91 FL Hospitality Bridge 1.6 0.4 34,570 34,377 24,337 10,040 49,200 659 700 9.0% 803 (382) 750 5,392 4,949 4,556 3,327 40 FL Industrial Bridge 2.0 - 7,933 7,928 6,737 1,191 11,540 1,410 802 8.2% 165 (115) 162 1,672 964 1,169 1,169 91 FL Multifamily Bridge 2.7 - 72,832 72,390 51,476 20,914 94,979 868 758 8.3% 1,517 (1,004) 1,406 3,776 3,738 3,488 3,246 63 FL Multifamily Construction 2.0 - 71,970 71,948 45,018 26,929 131,751 858 893 10.6% 908 (848) 1,829 - - - - n/a GA Hospitality Fixed/Other 3.0 1.0 30,366 30,334 19,565 10,769 51,350 956 163 9.1% 703 (329) 681 2,757 2,587 2,484 1,992 - GA Industrial Bridge 3.0 - 21,000 20,993 17,850 3,143 33,851 1,134 710 8.0% 423 (290) 413 452 1,152 1,260 1,509 181 GA Multifamily Bridge 2.4 - 163,314 162,743 107,583 55,160 223,048 922 807 8.5% 3,669 (1,949) 2,847 7,805 7,868 7,513 7,482 164 IL Multifamily Bridge 3.0 1.0 53,998 53,966 45,898 8,068 86,161 1,210 649 7.8% 1,067 (954) 1,042 4,414 4,588 4,547 4,498 91 IN Multifamily Bridge 2.0 - 38,715 38,698 28,903 9,795 56,408 1,104 740 8.6% 849 (534) 817 1,554 1,700 1,661 1,648 91 KS Multifamily Bridge 3.0 - 34,279 34,210 22,163 12,047 42,600 1,550 (51) 7.9% 707 (414) 668 1,018 1,303 1,549 1,574 91 KY Multifamily Bridge 3.0 0.5 39,591 39,569 31,482 8,088 59,152 1,172 682 8.1% 801 (560) 776 3,141 2,942 2,049 2,121 77 MA Industrial Bridge 1.0 - 28,185 28,171 23,957 4,213 50,591 1,369 133 7.5% 559 (408) 525 2,344 2,385 2,554 2,472 181 MA Multifamily Construction 2.0 - 5,616 5,338 3,784 1,554 7,913 215 1,471 10.8% 180 (65) 150 - - - - n/a MD Multifamily Bridge 3.0 1.0 6,927 6,924 5,888 1,036 10,600 963 (232) 8.1% 138 (102) 138 596 1,591 1,411 1,411 273 MD Office Bridge 2.0 1.0 18,580 18,557 12,959 5,598 27,000 647 194 9.3% 434 (235) 424 1,369 1,240 1,255 1,296 91 MO Multifamily Bridge 3.0 1.0 38,518 38,481 32,740 5,741 57,525 224 194 7.5% 735 (557) 718 3,578 4,993 5,393 5,902 181 NC Multifamily Bridge 2.0 0.5 34,696 34,581 27,625 6,957 47,000 515 431 7.2% 810 (399) 621 2,343 2,328 2,261 2,320 91 NJ Industrial Construction 1.0 - 9,820 9,563 4,786 4,777 24,295 193 1,106 11.3% 287 (87) 199 - - - - n/a NJ Multifamily Bridge 3.0 - 7,489 7,487 6,365 1,122 12,308 1,630 590 8.4% 156 (127) 153 528 589 609 592 91 NJ Multifamily Construction 1.0 - 395 267 264 3 1,899 216 2,020 11.1% 19 (5) 11 - - - - n/a NV Multifamily Bridge 3.0 1.0 26,763 26,752 22,748 4,003 44,323 1,350 498 7.7% 521 (387) 509 1,971 2,084 1,999 1,973 91 NY Mixed-Use Bridge 2.0 - 8,620 8,586 6,896 1,690 13,000 115 559 8.6% 204 (123) 182 928 923 909 869 181 NY Multifamily Bridge 2.0 - 35,481 35,480 19,868 15,612 59,500 688 618 9.2% 802 (368) 766 689 854 1,044 958 91 OH Industrial Fixed/Other 1.0 - 58,000 58,185 43,500 14,685 96,300 938 2,742 8.3% 1,188 (742) 1,193 2,271 2,294 3,095 3,897 - OH Multifamily Bridge 1.4 0.6 12,685 12,643 9,935 2,708 20,058 1,092 278 8.7% 316 (136) 270 931 874 793 735 91 OH Office Bridge 2.0 - 1,624 1,620 1,217 403 2,364 1,300 528 7.7% 31 (22) 31 225 209 228 221 - OR Office Bridge 3.0 1.0 6,290 6,000 2,033 3,967 9,500 976 (81) 7.8% 104 (40) 104 374 374 388 441 91 PA Industrial Bridge 1.0 - 5,250 5,247 4,463 784 9,247 1,371 467 8.0% 112 (52) 104 381 519 565 424 91 SC Multifamily Bridge 1.7 - 35,374 35,365 30,068 5,297 61,718 1,261 386 8.0% 719 (584) 699 3,114 3,206 3,212 3,087 91 TX Multifamily Bridge 2.3 0.6 418,503 417,638 320,914 96,723 585,531 943 365 8.3% 9,740 (5,340) 8,584 20,928 20,261 21,404 20,947 110 TX Multifamily Construction 3.0 1.0 11,009 10,960 6,605 4,355 15,960 416 1 9.0% 281 (130) 245 - - - - n/a UT Multifamily Bridge 2.0 1.0 10,219 10,198 8,154 2,043 15,318 1,351 498 7.8% 215 (141) 196 649 666 660 661 91 WA Land Construction 3.0 1.0 5,615 5,614 1,642 3,972 10,593 864 (30) 10.0% 138 (30) 128 - - - - n/a WA Multifamily Construction 2.0 - 12,158 11,995 8,063 3,932 18,263 287 1,015 11.1% 350 (139) 284 - - - - n/a WA Office Bridge 3.0 1.0 8,862 8,819 5,593 3,227 15,010 881 559 8.9% 190 (100) 178 474 485 485 510 - Totals 2,086,724 2,079,582 1,498,729 580,853 3,071,747 45,594 (26,380) 41,971