STOPPING NEUROINFLAMMATION AT ITS SOURCE TH 44 ANNUAL J.P. MORGAN HEALTHCARE CONFERENCE JANUARY 2026 Nasdaq: ANNX ©2025 Annexon, Inc. All rights reserved

Forward-Looking Statements This presentation contains forwardlo ‐ oking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. All statements other than statements of historical facts contained in this presentation are forward‐ looking statements. These forward looking statements include, but are not limited to statements regarding the potential therapeutic benefits of our product candidates; our clinical and preclinical programs, timing and commencement of future nonclinical studies and clinical trials and research and development programs, timing of clinical results, anticipated timing and results of regulatory interactions related to our product candidates, including the timing of our planned biologics license application (BLA) submission to the U.S. Food and Drug Administration (FDA); our ability to achieve regulatory approval for our product candidates; the potential for vonaprument to be the first drug approved for dry AMD with GA; the potential for vonaprument and tanruprubart to reset the standard of care; strategic plans for our business and product candidates, including additional indications which we may pursue, our ability to commercialize our product candidates, if approved; the potential for us to deliver significant value for patients and our stakeholders; our financial position, runway and anticipated milestones. In some cases, you can identify forward‐ looking statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “focus,” “goal,” “intend,” “may,” “objective,” “plan,” “positioned,” “potential,” “predict,” “seek,” “should,” “target,” “will,” “would” and the negative of these terms or other similar expressions that are predictions of or indicate future events and future trends. Forward‐ looking statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results and events to differ materially from those anticipated, including, but not limited to, risks and uncertainties related to: our history of net operating losses; our ability to obtain necessary capital to fund our clinical programs; the potential for delays in our clinical trials; the potential for our product candidates to not receive regulatory approval, including if the FDA and comparable foreign regulatory authorities determine that our submission package is not sufficient or require us to provide additional data in patients that are not feasible to obtain; the early stages of certain of clinical development of our product candidates; the effects of public health crises on our clinical programs and business operations; our ability to obtain regulatory approval of and successfully commercialize our product candidates; any undesirable side effects or other properties of our product candidates; our reliance on third‐ party suppliers and manufacturers; the outcomes of any future collaboration agreements; and our ability to adequately maintain intellectual property rights for our product candidates. These and other risks are described in greater detail under the section titled “Risk Factors” and in the other cautionary statements contained in our Annual Report on Form 10K ‐ for year ended December 31, 2024, our subsequent Quarterly Reports on Form 10‐ Q and our other filings with the Securities Exchange Commission. Any forward‐ looking statements that we make in this presentation are made pursuant to the Private Securities Litigation Reform Act of 1995, as amended, and represent our management’s beliefs and assumptions only as of the date of this presentation. Except as required by law, we undertake no obligation to publicly update any forward‐ looking statements, whether as a result of new information, future events or otherwise. This presentation concerns drug candidates that are under clinical investigation, and which have not yet been approved for marketing by the FDA. These are currently limited by federal law to investigational use, and no representation is made as to their safety or effectiveness for the purposes for which they are being investigated. This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates or statistical data. Neither we nor any other person makes any representation as to the accuracy or completeness of such data or undertakes any obligation to update such data after the date of this presentation. 2

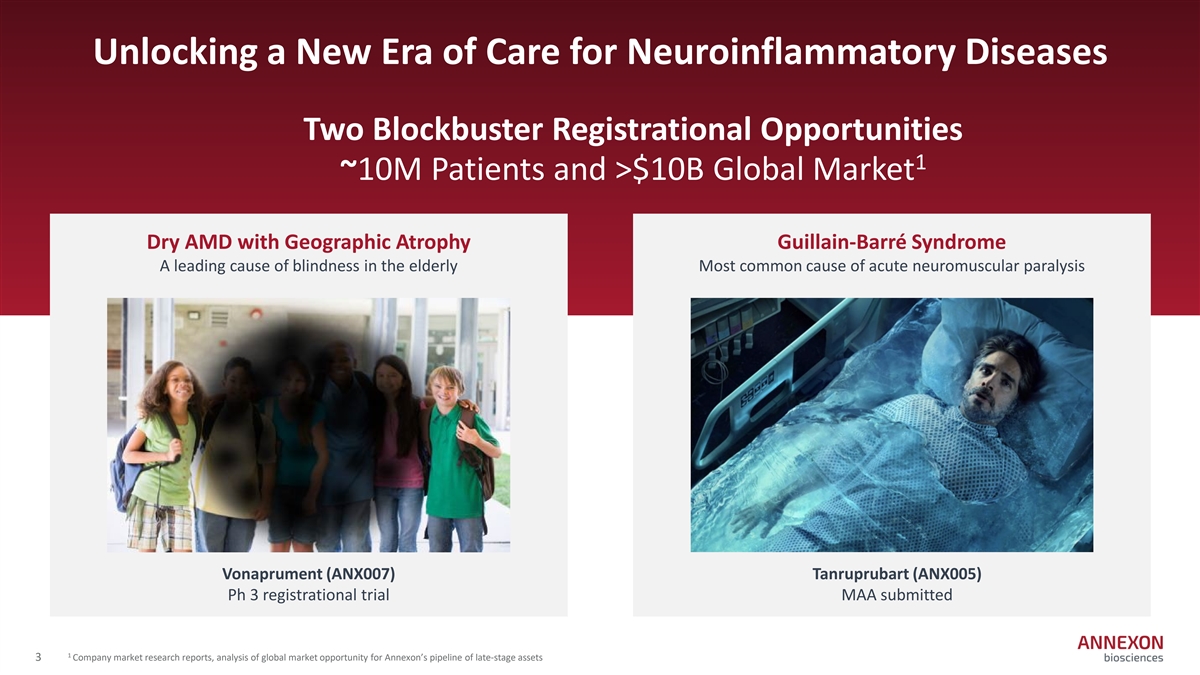

Unlocking a New Era of Care for Neuroinflammatory Diseases Two Blockbuster Registrational Opportunities 1 ~10M Patients and >$10B Global Market Dry AMD with Geographic Atrophy Guillain-Barré Syndrome A leading cause of blindness in the elderly Most common cause of acute neuromuscular paralysis Vonaprument (ANX007) Tanruprubart (ANX005) Ph 3 registrational trial MAA submitted 1 3 Company market research reports, analysis of global market opportunity for Annexon’s pipeline of late‐ stage assets

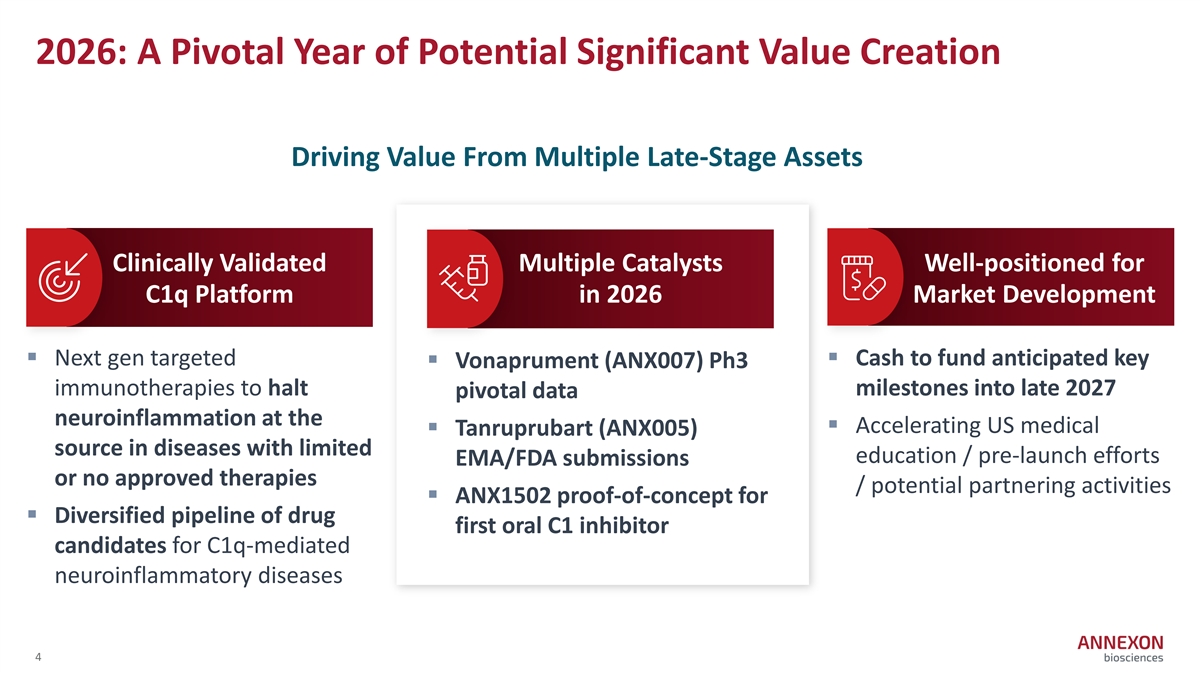

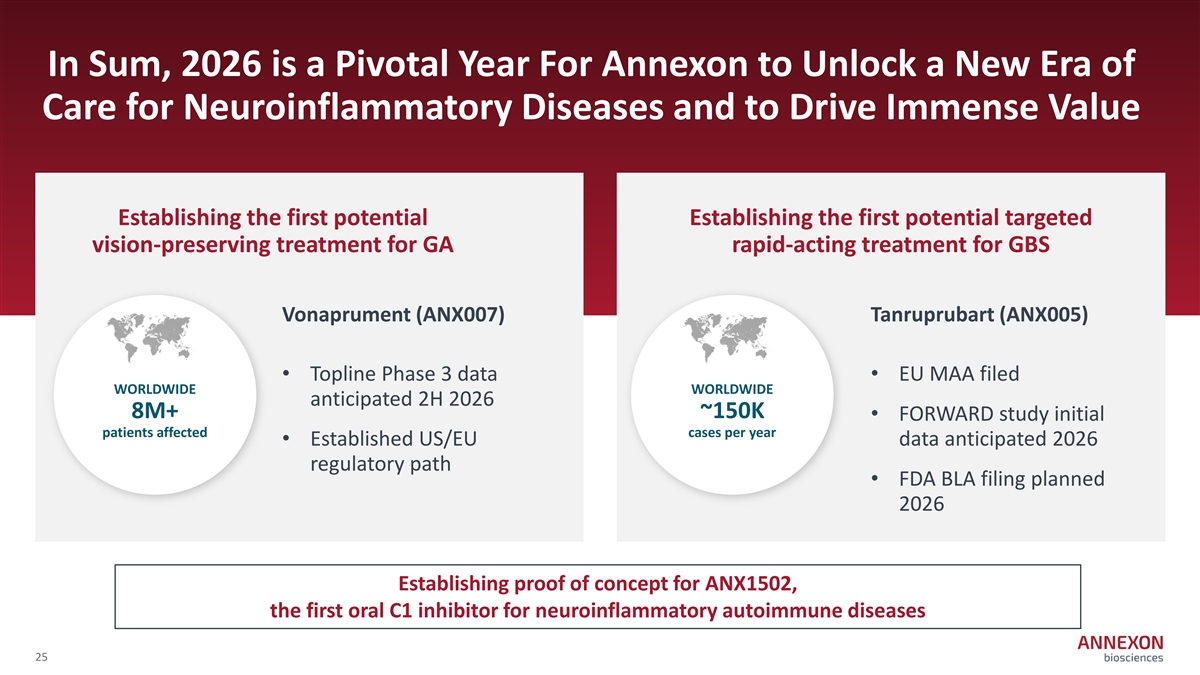

2026: A Pivotal Year of Potential Significant Value Creation Driving Value From Multiple Late-Stage Assets Clinically Validated Multiple Catalysts Well-positioned for C1q Platform in 2026 Market Development § Next gen targeted § Cash to fund anticipated key § Vonaprument (ANX007) Ph3 immunotherapies to halt milestones into late 2027 pivotal data neuroinflammation at the § Accelerating US medical § Tanruprubart (ANX005) source in diseases with limited education / pre‐ launch efforts EMA/FDA submissions or no approved therapies / potential partnering activities § ANX1502 proof-of-concept for § Diversified pipeline of drug first oral C1 inhibitor candidates for C1q‐ mediated neuroinflammatory diseases 4

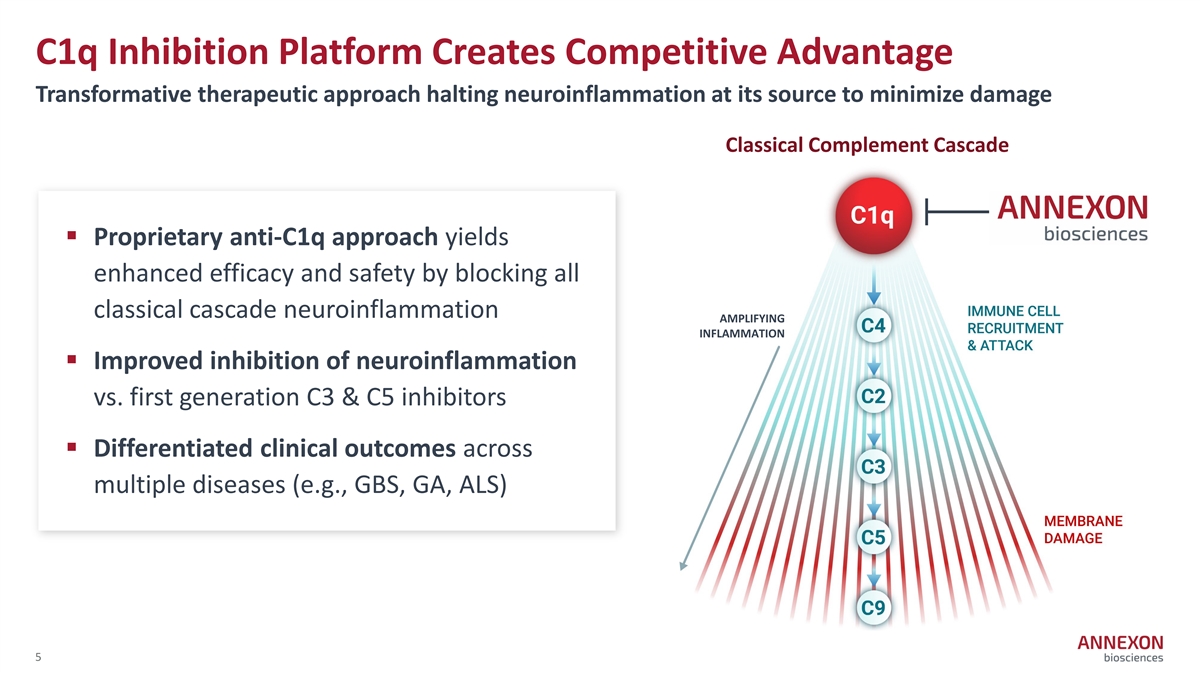

C1q Inhibition Platform Creates Competitive Advantage Transformative therapeutic approach halting neuroinflammation at its source to minimize damage Classical Complement Cascade § Proprietary anti-C1q approach yields enhanced efficacy and safety by blocking all classical cascade neuroinflammation AMPLIFYING INFLAMMATION § Improved inhibition of neuroinflammation vs. first generation C3 & C5 inhibitors § Differentiated clinical outcomes across multiple diseases (e.g., GBS, GA, ALS) 5

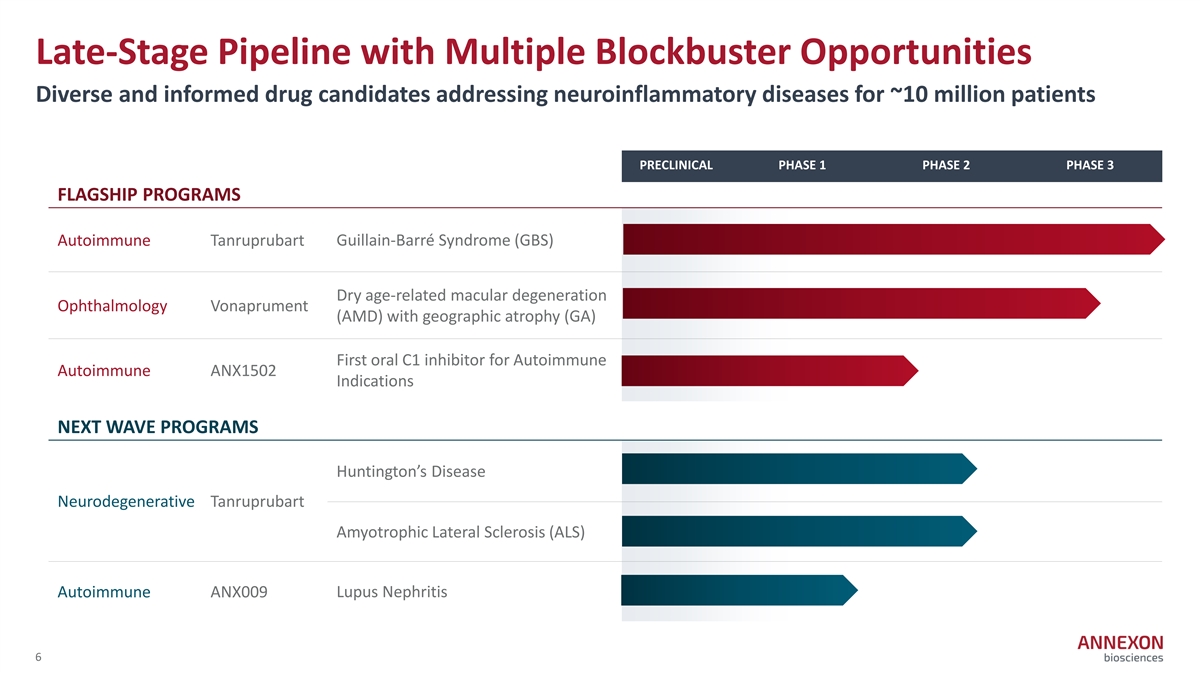

Late-Stage Pipeline with Multiple Blockbuster Opportunities Diverse and informed drug candidates addressing neuroinflammatory diseases for ~10 million patients PRECLINICAL PHASE 1 PHASE 2 PHASE 3 FLAGSHIP PROGRAMS Autoimmune Tanruprubart Guillain‐ Barré Syndrome (GBS) Dry age‐ related macular degeneration Ophthalmology Vonaprument (AMD) with geographic atrophy (GA) First oral C1 inhibitor for Autoimmune Autoimmune ANX1502 Indications NEXT WAVE PROGRAMS Huntington’s Disease Neurodegenerative Tanruprubart Amyotrophic Lateral Sclerosis (ALS) Autoimmune ANX009 Lupus Nephritis 6

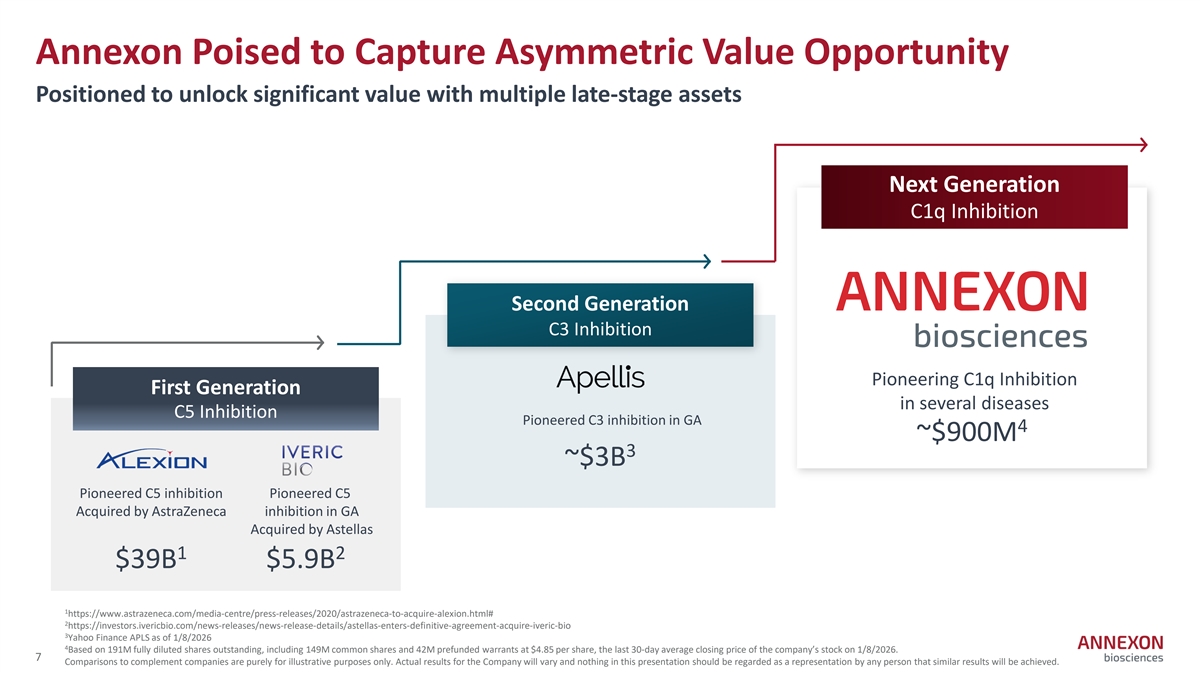

Annexon Poised to Capture Asymmetric Value Opportunity Positioned to unlock significant value with multiple late-stage assets Next Generation C1q Inhibition Second Generation C3 Inhibition Pioneering C1q Inhibition First Generation in several diseases C5 Inhibition Pioneered C3 inhibition in GA 4 ~$900M 3 ~$3B Pioneered C5 inhibition Pioneered C5 Acquired by AstraZeneca inhibition in GA Acquired by Astellas 1 2 $39B $5.9B 1 https://www.astrazeneca.com/media‐ centre/press‐ releases/2020/astrazeneca‐ to‐ acquire‐ alexion.html# 2 https://investors.ivericbio.com/news‐ releases/news‐ release‐ details/astellas‐ enters‐ definitive‐ agreement‐ acquire‐ iveric‐ bio 3 Yahoo Finance APLS as of 1/8/2026 4 Based on 191M fully diluted shares outstanding, including 149M common shares and 42M prefunded warrants at $4.85 per share, the last 30‐ day average closing price of the company’s stock on 1/8/2026. 7 Comparisons to complement companies are purely for illustrative purposes only. Actual results for the Company will vary and nothing in this presentation should be regarded as a representation by any person that similar results will be achieved.

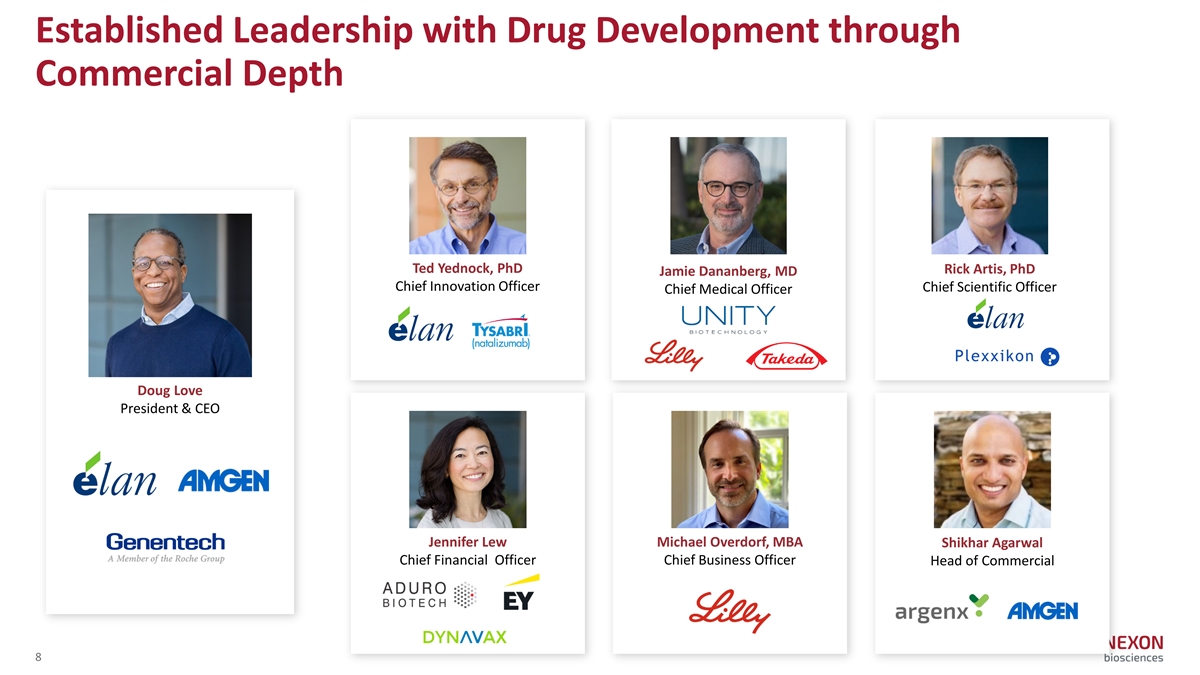

Established Leadership with Drug Development through Commercial Depth Ted Yednock, PhD Rick Artis, PhD Jamie Dananberg, MD Chief Innovation Officer Chief Scientific Officer Chief Medical Officer Doug Love President & CEO Jennifer Lew Michael Overdorf, MBA Shikhar Agarwal Chief Financial Officer Chief Business Officer Head of Commercial 8

Vonaprument: First Potential Treatment to Preserve Vision for Dry AMD with Geographic Atrophy Shifting Treatment Paradigm in 2026

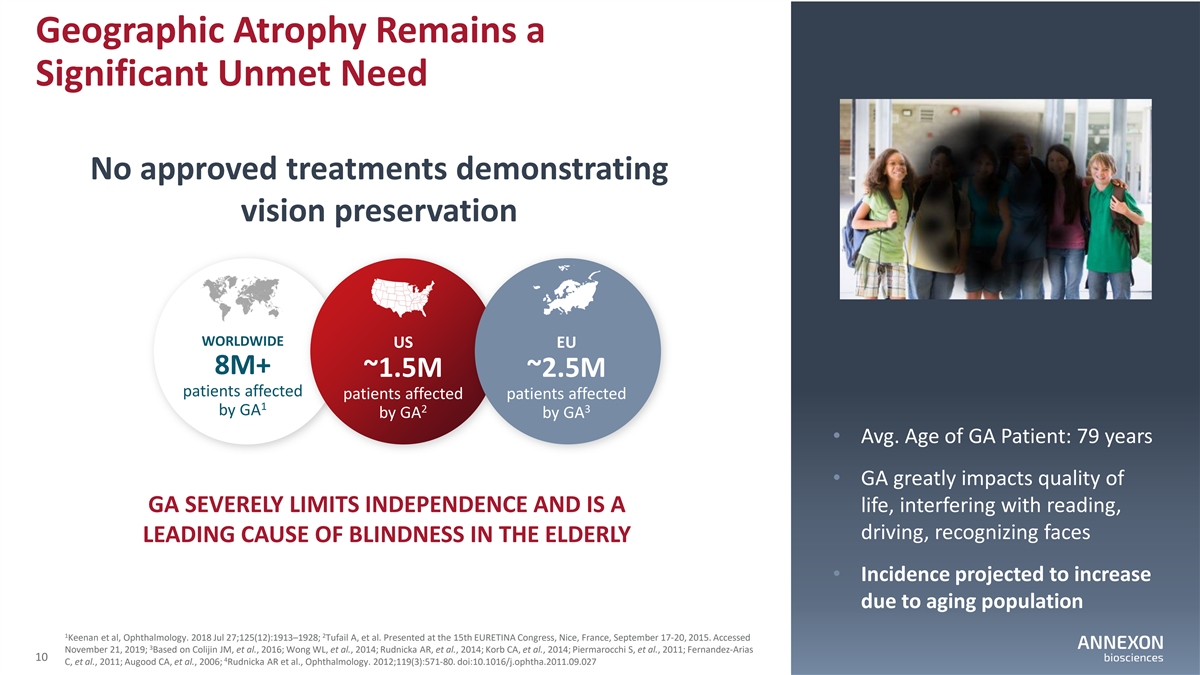

Geographic Atrophy Remains a Significant Unmet Need No approved treatments demonstrating vision preservation WORLDWIDE US EU 8M+ ~1.5M ~2.5M patients affected patients affected patients affected 1 2 3 by GA by GA by GA • Avg. Age of GA Patient: 79 years • GA greatly impacts quality of GA SEVERELY LIMITS INDEPENDENCE AND IS A life, interfering with reading, driving, recognizing faces LEADING CAUSE OF BLINDNESS IN THE ELDERLY • Incidence projected to increase due to aging population 1 2 Keenan et al, Ophthalmology. 2018 Jul 27;125(12):1913–1928; Tufail A, et al. Presented at the 15th EURETINA Congress, Nice, France, September 17‐ 20, 2015. Accessed 3 November 21, 2019; Based on Colijin JM, et al., 2016; Wong WL, et al., 2014; Rudnicka AR, et al., 2014; Korb CA, et al., 2014; Piermarocchi S, et al., 2011; Fernandez‐ Arias 10 4 C, et al., 2011; Augood CA, et al., 2006; Rudnicka AR et al., Ophthalmology. 2012;119(3):571‐ 80. doi:10.1016/j.ophtha.2011.09.027

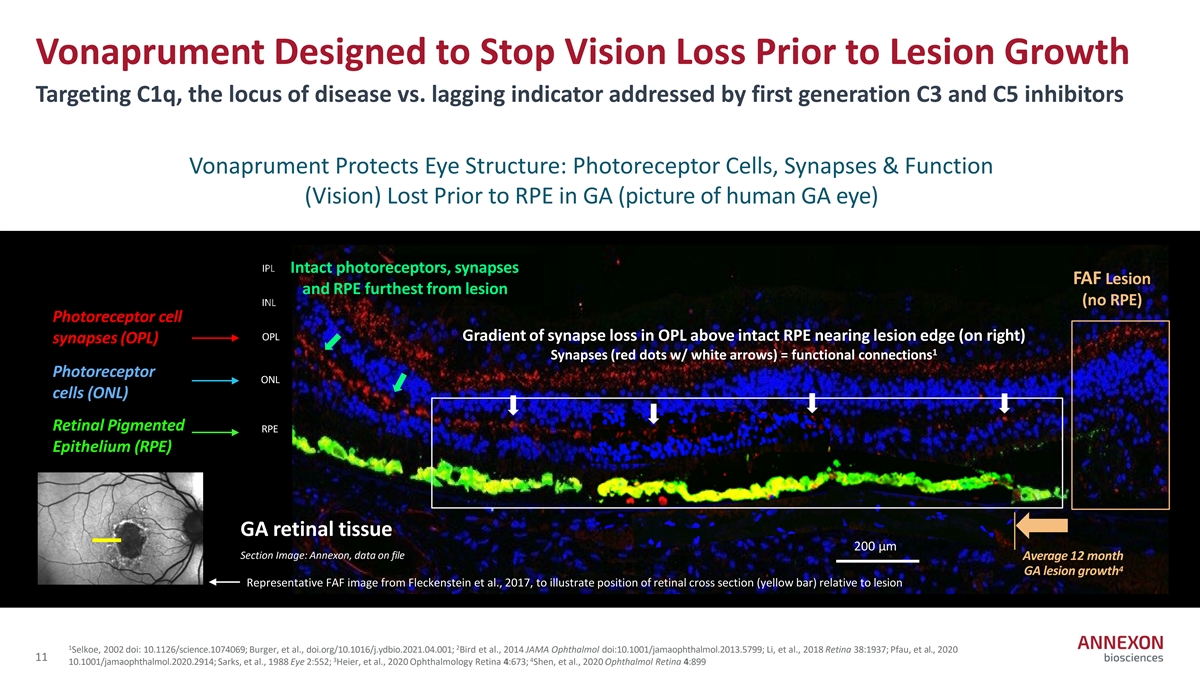

Vonaprument Designed to Stop Vision Loss Prior to Lesion Growth Targeting C1q, the locus of disease vs. lagging indicator addressed by first generation C3 and C5 inhibitors Vonaprument Protects Eye Structure: Photoreceptor Cells, Synapses & Function (Vision) Lost Prior to RPE in GA (picture of human GA eye) IPL Intact photoreceptors, synapses FAF Lesion and RPE furthest from lesion (no RPE) INL Photoreceptor cell OPL Gradient of synapse loss in OPL above intact RPE nearing lesion edge (on right) synapses (OPL) 1 Synapses (red dots w/ white arrows) = functional connections Photoreceptor ONL cells (ONL) Retinal Pigmented RPE Epithelium (RPE) GA retinal tissue 200 µm Section Image: Annexon, data on file 200 mm Average 12 month 4 GA lesion growth Representative FAF image from Fleckenstein et al., 2017, to illustrate position of retinal cross section (yellow bar) relative to lesion 1 2 Selkoe, 2002 doi: 10.1126/science.1074069; Burger, et al., doi.org/10.1016/j.ydbio.2021.04.001; Bird et al., 2014 JAMA Ophthalmol doi:10.1001/jamaophthalmol.2013.5799; Li, et al., 2018 Retina 38:1937; Pfau, et al., 2020 11 3 4 10.1001/jamaophthalmol.2020.2914; Sarks, et al., 1988 Eye 2:552; Heier, et al., 2020 Ophthalmology Retina 4:673; Shen, et al., 2020 Ophthalmol Retina 4:899

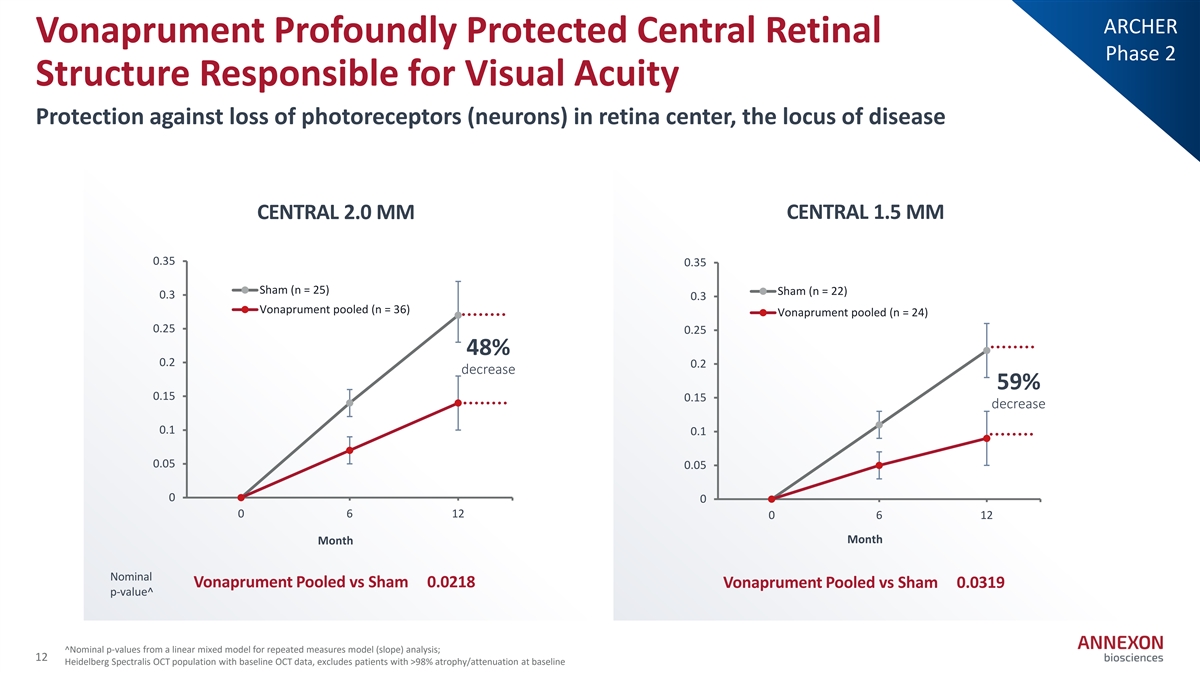

ARCHER Vonaprument Profoundly Protected Central Retinal Phase 2 Structure Responsible for Visual Acuity Protection against loss of photoreceptors (neurons) in retina center, the locus of disease CENTRAL 2.0 MM CENTRAL 1.5 MM 0.35 0.35 Sham (n = 25) Sham (n = 22) 0.3 0.3 Vonaprument pooled (n = 36) Vonaprument pooled (n = 24) 0.25 0.25 48% 0.2 0.2 decrease 59% 0.15 0.15 decrease 0.1 0.1 0.05 0.05 0 0 0 6 12 0 6 12 Month Month Nominal Vonaprument Pooled vs Sham 0.0218 Vonaprument Pooled vs Sham 0.0319 p‐ value^ ^Nominal p‐ values from a linear mixed model for repeated measures model (slope) analysis; 12 Heidelberg Spectralis OCT population with baseline OCT data, excludes patients with >98% atrophy/attenuation at baseline

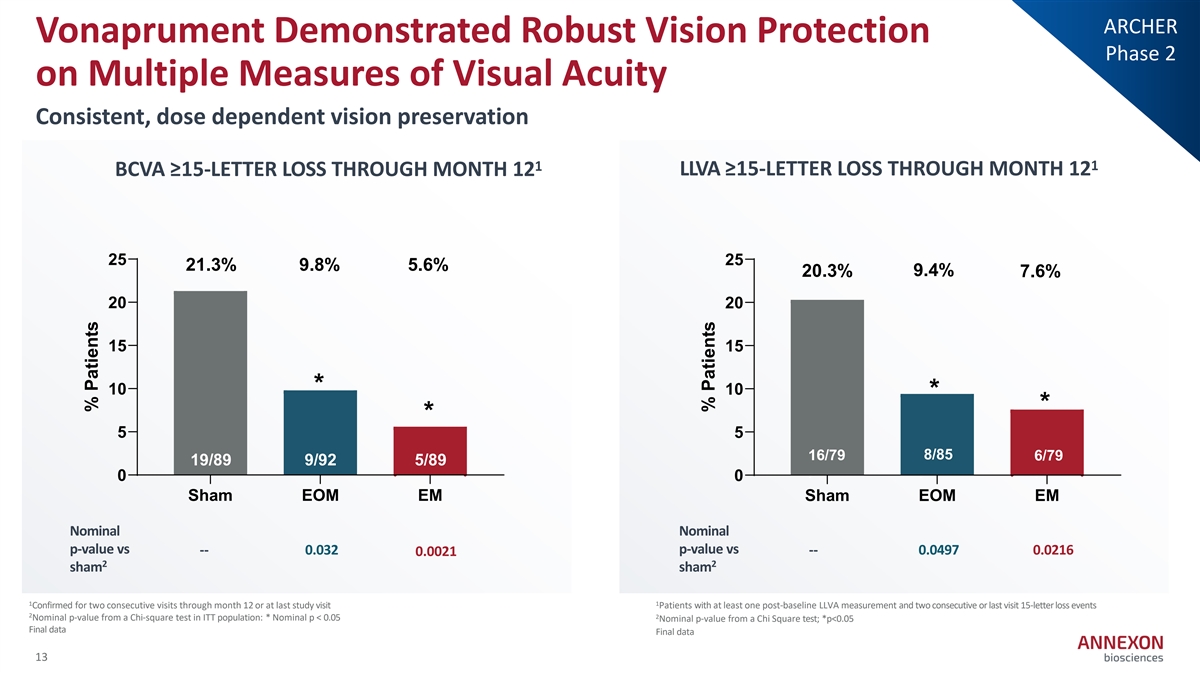

ARCHER Vonaprument Demonstrated Robust Vision Protection Phase 2 on Multiple Measures of Visual Acuity Consistent, dose dependent vision preservation 1 1 BCVA ≥15-LETTER LOSS THROUGH MONTH 12 LLVA ≥15-LETTER LOSS THROUGH MONTH 12 25 25 21.3% 9.8% 5.6% 9.4% 20.3% 7.6% 20 20 15 15 * 10 10 * * * 5 5 16/79 8/85 6/79 19/89 9/92 5/89 16/79 6/79 8/85 0 0 Sham EOM EM Sham EOM EM Nominal Nominal p-value vs p-value vs -- 0.032 -- 0.0497 0.0216 0.0021 2 2 sham sham 1 1 Confirmed for two consecutive visits through month 12 or at last study visit Patients with at least one post‐ baseline LLVA measurement and two consecutive or last visit 15‐ letter loss events 2 2 Nominal p‐ value from a Chi‐ square test in ITT population: * Nominal p < 0.05 Nominal p‐ value from a Chi Square test; *p<0.05 Final data Final data 13 % Patients % Patients

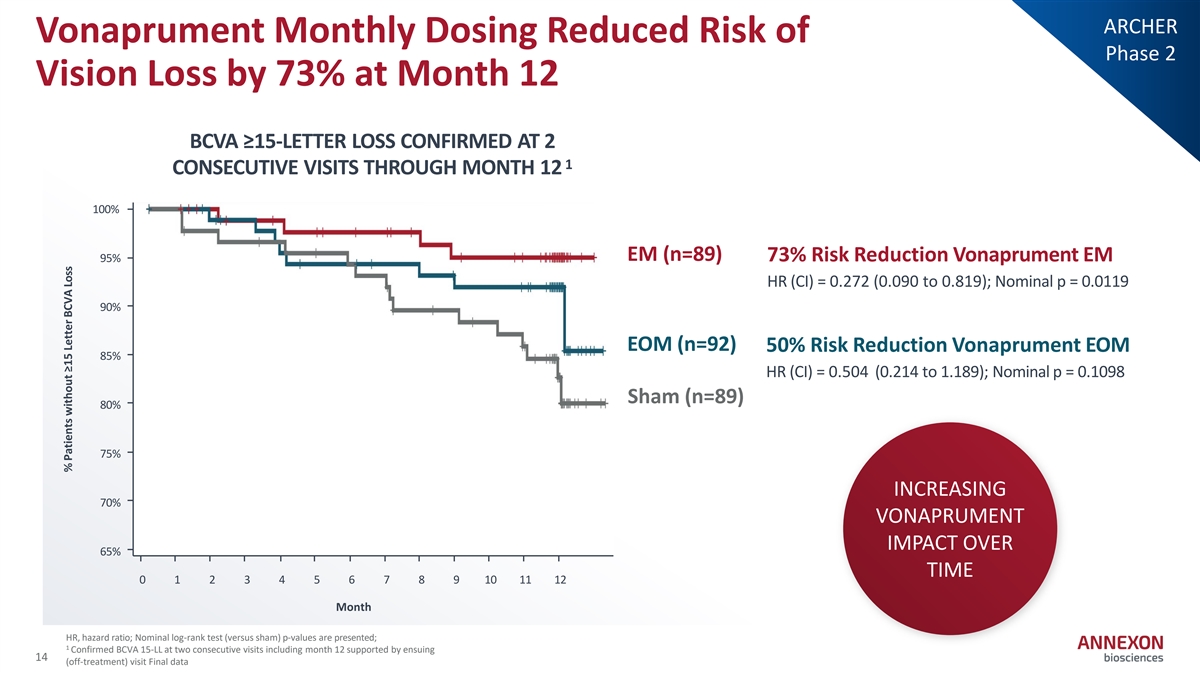

ARCHER Vonaprument Monthly Dosing Reduced Risk of Phase 2 Vision Loss by 73% at Month 12 BCVA ≥15-LETTER LOSS CONFIRMED AT 2 1 CONSECUTIVE VISITS THROUGH MONTH 12 100% EM (n=89) 73% Risk Reduction Vonaprument EM 95% HR (CI) = 0.272 (0.090 to 0.819); Nominal p = 0.0119 90% EOM (n=92) 50% Risk Reduction Vonaprument EOM 85% HR (CI) = 0.504 (0.214 to 1.189); Nominal p = 0.1098 Sham (n=89) 80% 75% INCREASING 70% VONAPRUMENT IMPACT OVER 65% TIME 0 1 2 3 4 5 6 7 8 9 10 11 12 Month HR, hazard ratio; Nominal log‐ rank test (versus sham) p‐ values are presented; 1 Confirmed BCVA 15‐ LL at two consecutive visits including month 12 supported by ensuing 14 (off‐ treatment) visit Final data % Patients without ≥15 Letter BCVA Loss

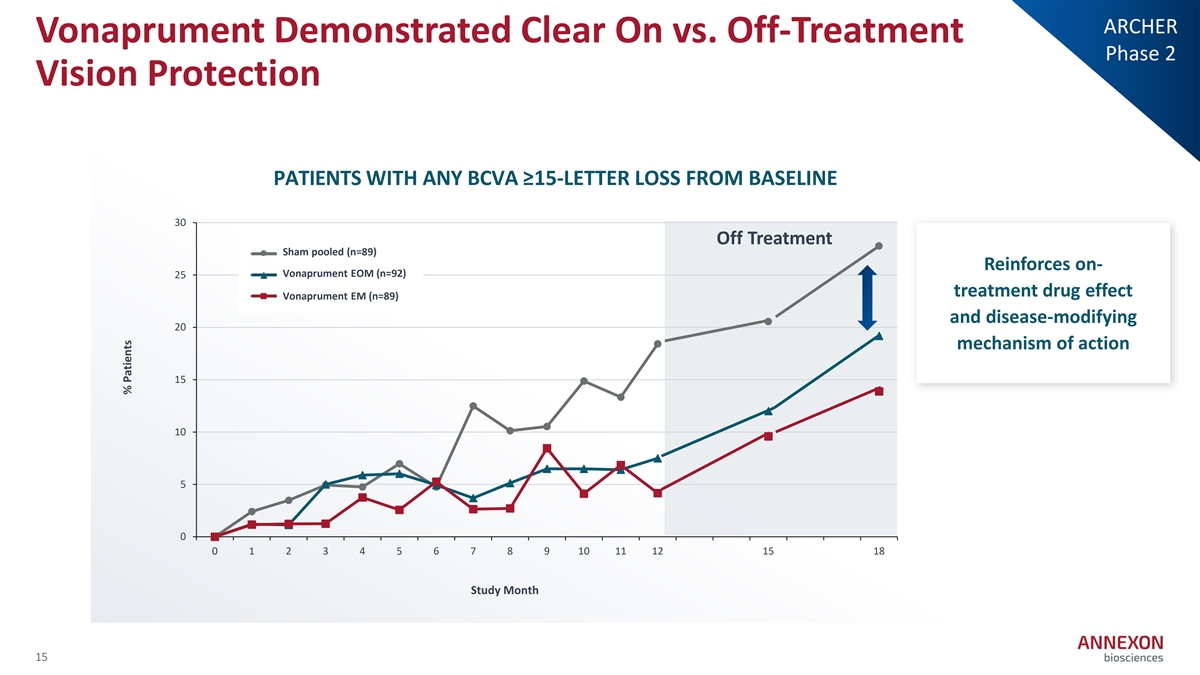

ARCHER Vonaprument Demonstrated Clear On vs. Off-Treatment Phase 2 Vision Protection PATIENTS WITH ANY BCVA ≥15-LETTER LOSS FROM BASELINE 30 Off Treatment Sham pooled (n=89) Sham Pooled (n=89) Reinforces on- A V N oX n007 E aprum OM en ( tn E = O 92) M (n=92) 25 treatment drug effect ANX007 EM (n=89) Vonaprument EM (n=89) and disease-modifying 20 mechanism of action 15 10 5 0 0 1 2 3 4 5 6 7 8 9 10 11 12 15 18 Study Month 15 % Patients

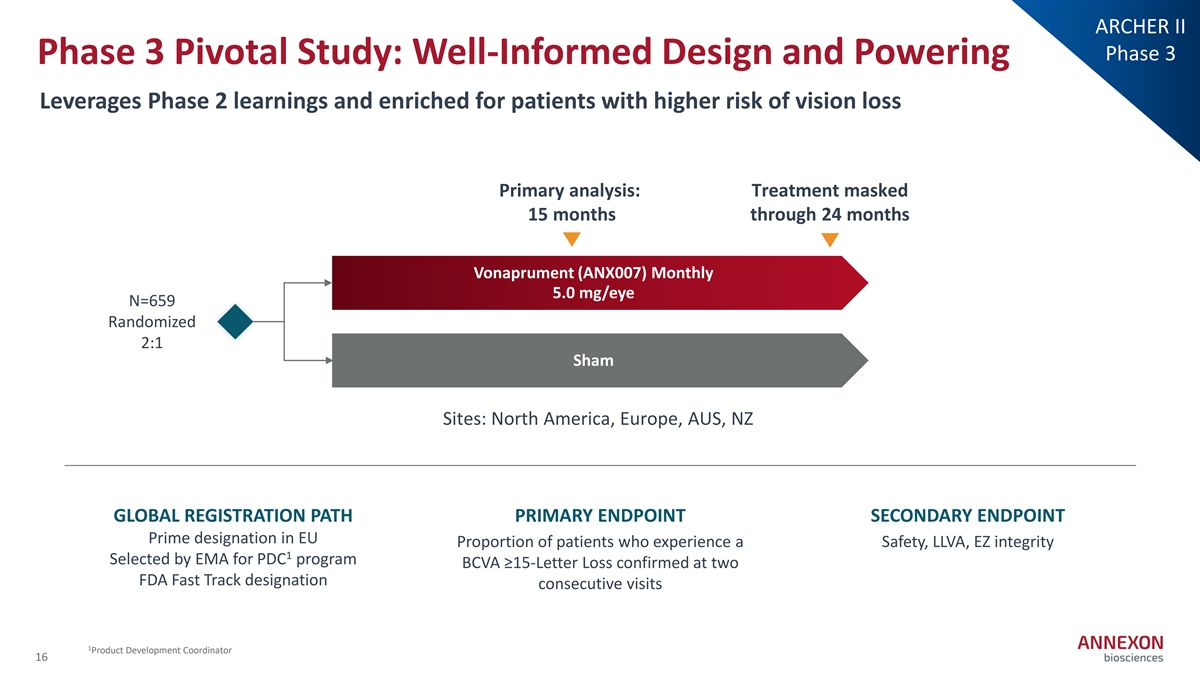

ARCHER II Phase 3 Phase 3 Pivotal Study: Well-Informed Design and Powering Leverages Phase 2 learnings and enriched for patients with higher risk of vision loss Primary analysis: Treatment masked 15 months through 24 months Vonaprument (ANX007) Monthly 5.0 mg/eye N=659 Randomized 2:1 Sham Sites: North America, Europe, AUS, NZ GLOBAL REGISTRATION PATH PRIMARY ENDPOINT SECONDARY ENDPOINT Prime designation in EU Proportion of patients who experience a Safety, LLVA, EZ integrity 1 Selected by EMA for PDC program BCVA ≥15‐ Letter Loss confirmed at two FDA Fast Track designation consecutive visits 1 Product Development Coordinator 16

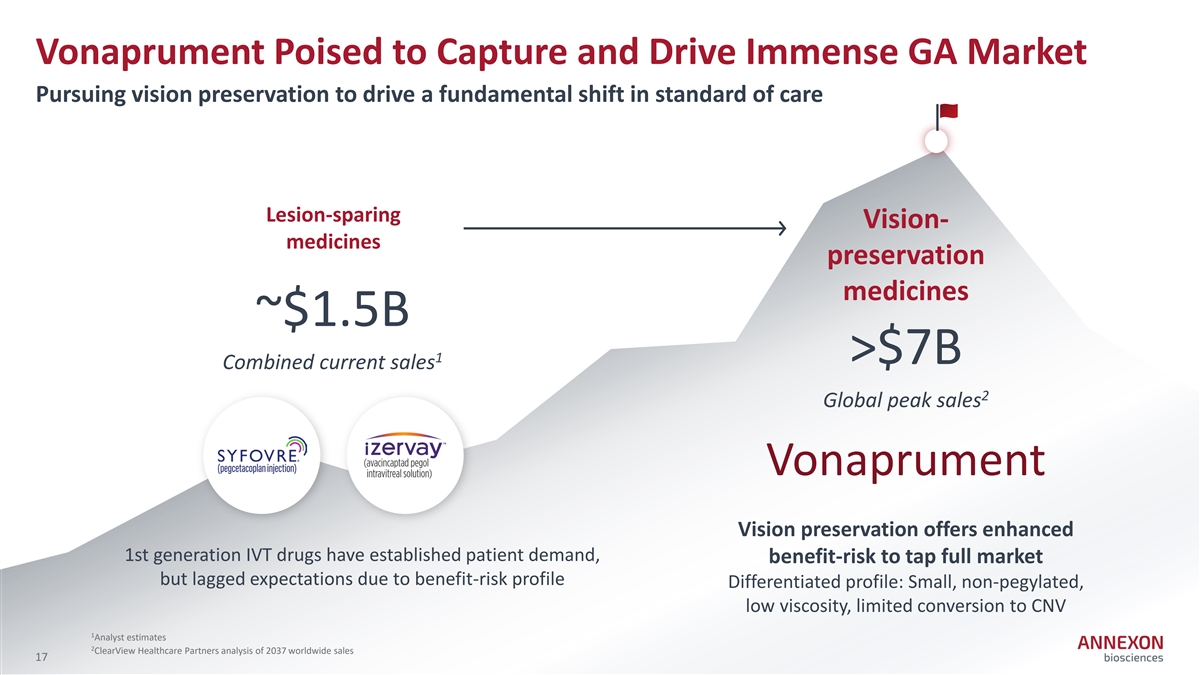

Vonaprument Poised to Capture and Drive Immense GA Market Pursuing vision preservation to drive a fundamental shift in standard of care Lesion-sparing Vision- medicines preservation medicines ~$1.5B 1 >$7B Combined current sales 2 Global peak sales Vonaprument Vision preservation offers enhanced 1st generation IVT drugs have established patient demand, benefit-risk to tap full market but lagged expectations due to benefit‐ risk profile Differentiated profile: Small, non‐ pegylated, low viscosity, limited conversion to CNV 1 Analyst estimates 2 ClearView Healthcare Partners analysis of 2037 worldwide sales 17

Tanruprubart: Potential First‐ in‐ Class Targeted Therapy for Guillain‐ Barré Syndrome Delivering for Patients in 2026

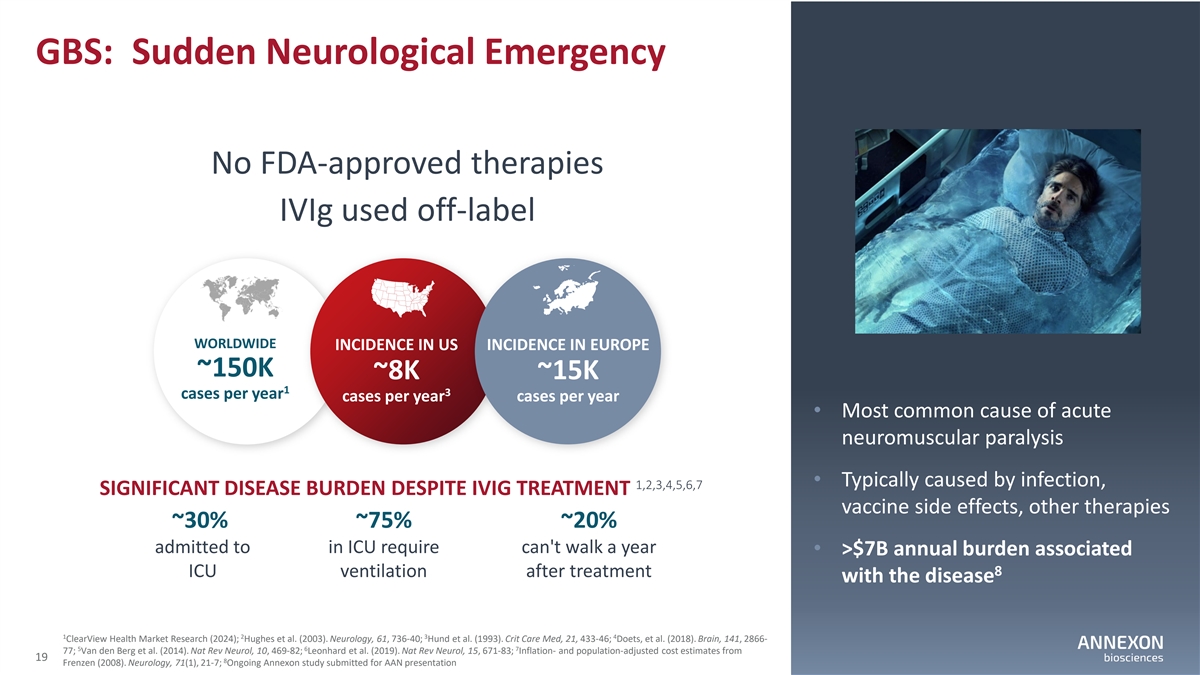

GBS: Sudden Neurological Emergency No FDA‐ approved therapies IVIg used off‐ label WORLDWIDE INCIDENCE IN US INCIDENCE IN EUROPE ~150K ~8K ~15K 1 3 cases per year cases per year cases per year • Most common cause of acute neuromuscular paralysis • Typically caused by infection, 1,2,3,4,5,6,7 SIGNIFICANT DISEASE BURDEN DESPITE IVIG TREATMENT vaccine side effects, other therapies ~30% ~75% ~20% admitted to in ICU require can't walk a year • >$7B annual burden associated 8 ICU ventilation after treatment with the disease 1 2 3 4 ClearView Health Market Research (2024); Hughes et al. (2003). Neurology, 61, 736‐ 40; Hund et al. (1993). Crit Care Med, 21, 433‐ 46; Doets, et al. (2018). Brain, 141, 2866‐ 5 6 7 77; Van den Berg et al. (2014). Nat Rev Neurol, 10, 469‐ 82; Leonhard et al. (2019). Nat Rev Neurol, 15, 671‐ 83; Inflation‐ and population‐ adjusted cost estimates from 19 8 Frenzen (2008). Neurology, 71(1), 21‐ 7; Ongoing Annexon study submitted for AAN presentation

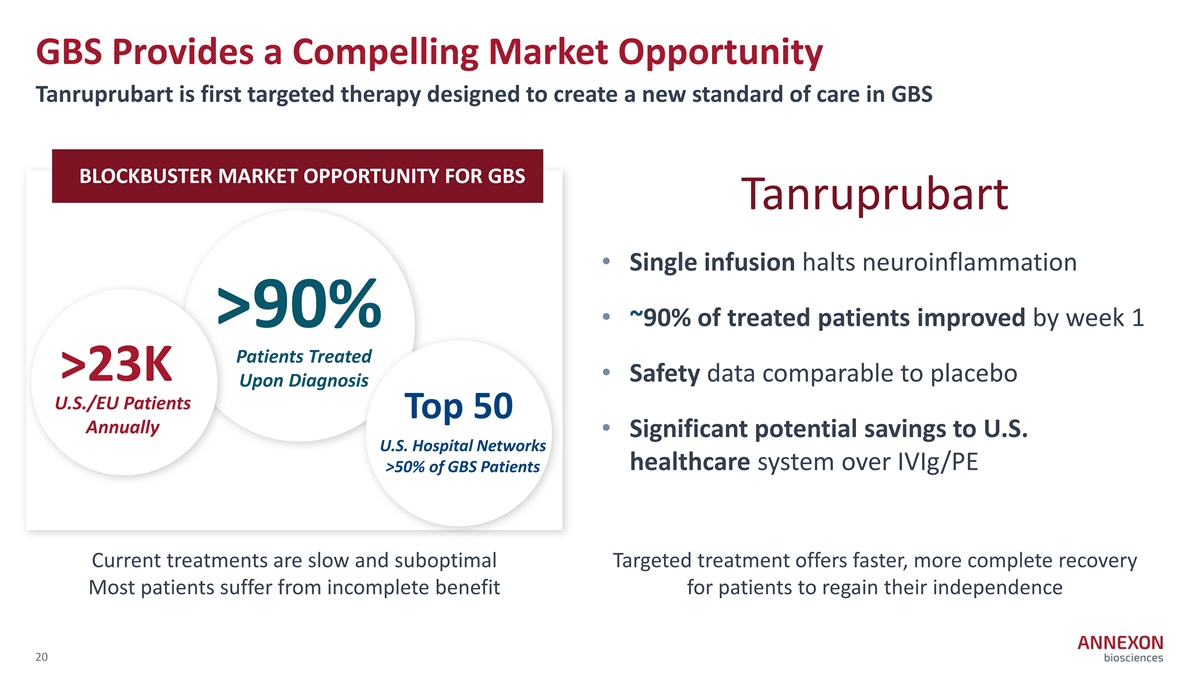

GBS Provides a Compelling Market Opportunity Tanruprubart is first targeted therapy designed to create a new standard of care in GBS BLOCKBUSTER MARKET OPPORTUNITY FOR GBS Tanruprubart • Single infusion halts neuroinflammation • ~90% of treated patients improved by week 1 >90% Patients Treated >23K • Safety data comparable to placebo Upon Diagnosis U.S./EU Patients Top 50 Annually • Significant potential savings to U.S. U.S. Hospital Networks healthcare system over IVIg/PE >50% of GBS Patients Current treatments are slow and suboptimal Targeted treatment offers faster, more complete recovery Most patients suffer from incomplete benefit for patients to regain their independence 20

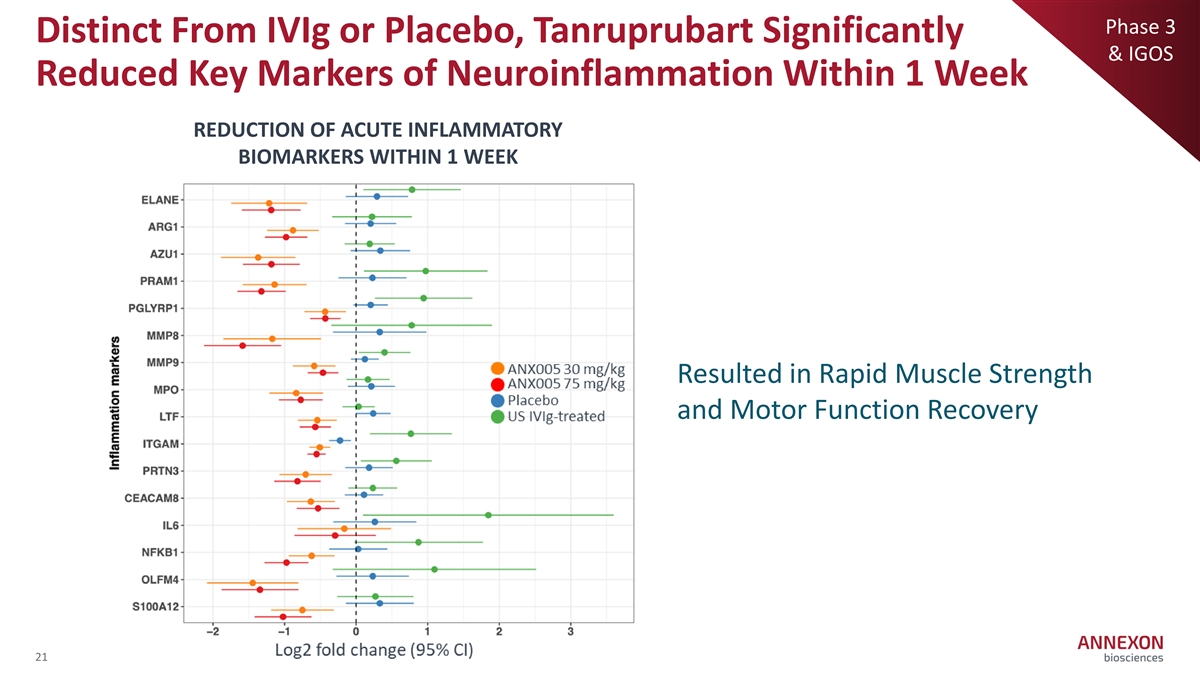

Phase 3 Distinct From IVIg or Placebo, Tanruprubart Significantly & IGOS Reduced Key Markers of Neuroinflammation Within 1 Week REDUCTION OF ACUTE INFLAMMATORY BIOMARKERS WITHIN 1 WEEK Resulted in Rapid Muscle Strength and Motor Function Recovery 21

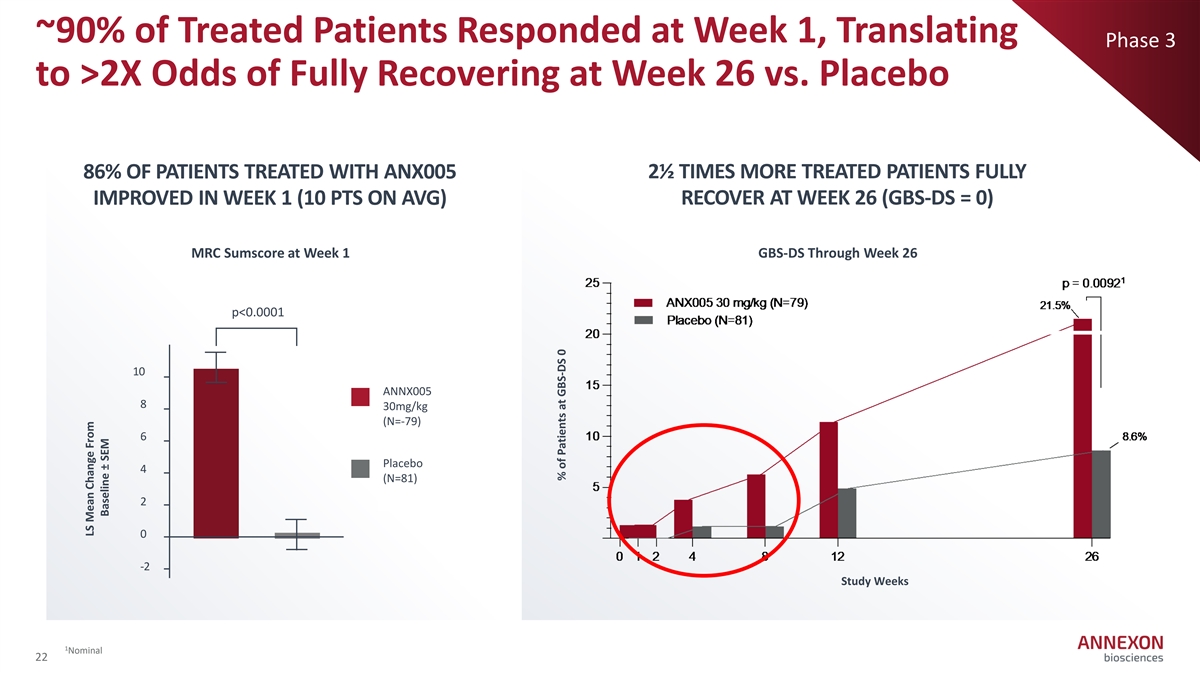

~90% of Treated Patients Responded at Week 1, Translating Phase 3 to >2X Odds of Fully Recovering at Week 26 vs. Placebo 86% OF PATIENTS TREATED WITH ANX005 2½ TIMES MORE TREATED PATIENTS FULLY IMPROVED IN WEEK 1 (10 PTS ON AVG) RECOVER AT WEEK 26 (GBS-DS = 0) MRC Sumscore at Week 1 GBS-DS Through Week 26 p<0.0001 10 ANNX005 8 30mg/kg (N=‐ 79) 6 Placebo 4 (N=81) 2 0 ‐ 2 Study Weeks 1 Nominal 22 LS Mean Change From Baseline ± SEM % of Patients at GBS-DS 0

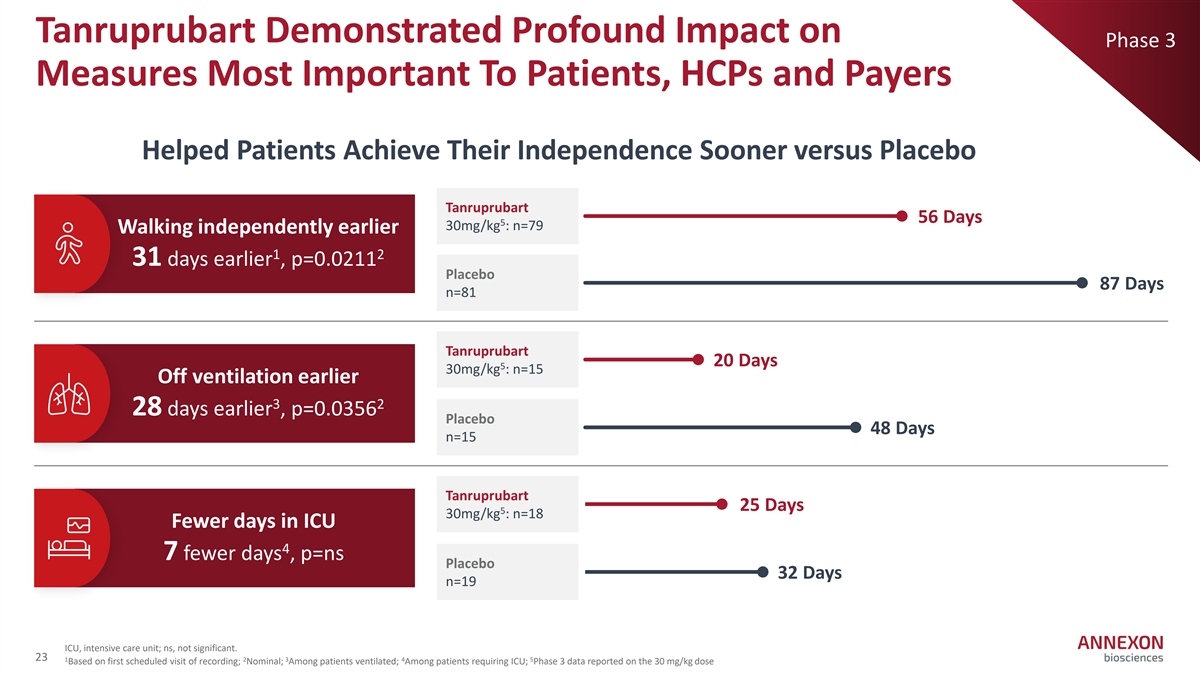

Tanruprubart Demonstrated Profound Impact on Phase 3 Measures Most Important To Patients, HCPs and Payers Helped Patients Achieve Their Independence Sooner versus Placebo Tanruprubart 56 Days 5 30mg/kg : n=79 Walking independently earlier 1 2 31 days earlier , p=0.0211 Placebo 87 Days n=81 Tanruprubart 20 Days 5 30mg/kg : n=15 Off ventilation earlier 3 2 28 days earlier , p=0.0356 Placebo 48 Days n=15 Tanruprubart 25 Days 5 30mg/kg : n=18 Fewer days in ICU 4 7 fewer days , p=ns Placebo 32 Days n=19 ICU, intensive care unit; ns, not significant. 23 1 2 3 4 5 Based on first scheduled visit of recording; Nominal; Among patients ventilated; Among patients requiring ICU; Phase 3 data reported on the 30 mg/kg dose

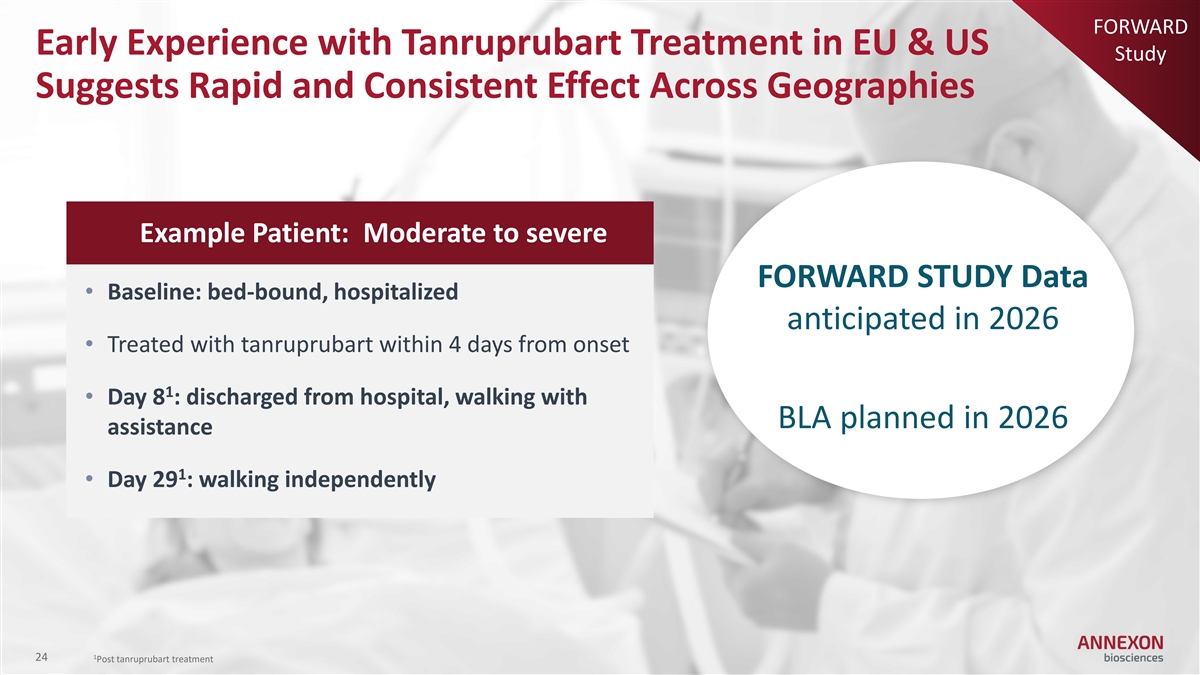

FORWARD Early Experience with Tanruprubart Treatment in EU & US Study Suggests Rapid and Consistent Effect Across Geographies Example Patient: Moderate to severe FORWARD STUDY Data • Baseline: bed-bound, hospitalized anticipated in 2026 • Treated with tanruprubart within 4 days from onset 1 • Day 8 : discharged from hospital, walking with BLA planned in 2026 assistance 1 • Day 29 : walking independently 1 24 Post tanruprubart treatment

In Sum, 2026 is a Pivotal Year For Annexon to Unlock a New Era of Care for Neuroinflammatory Diseases and to Drive Immense Value Establishing the first potential Establishing the first potential targeted vision-preserving treatment for GA rapid-acting treatment for GBS Vonaprument (ANX007) Tanruprubart (ANX005) • Topline Phase 3 data • EU MAA filed WORLDWIDE WORLDWIDE anticipated 2H 2026 8M+ ~150K • FORWARD study initial patients affected cases per year • Established US/EU data anticipated 2026 regulatory path • FDA BLA filing planned 2026 Establishing proof of concept for ANX1502, the first oral C1 inhibitor for neuroinflammatory autoimmune diseases 25

MISSION DRIVEN helping millions of people impacted by devastating neuroinflammatory diseases to LIVE THEIR BEST LIVES