.2

.2

Notices and Disclaimers

Non-GAAP Financial Information

In addition to the financial information prepared in conformity with generally accepted accounting principles in the United States (“GAAP”), Enova International, Inc. (“Enova”) provides historical non-GAAP financial information. Enova presents non-GAAP financial information because such measures are used by management in understanding the activities and business metrics of Enova's operations. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of Enova's business that, when viewed with its GAAP results, provide a more complete understanding of factors and trends affecting its business.

Adjusted Earnings Measures

Enova provides adjusted earnings and adjusted earnings per share, or, collectively, the Adjusted Earnings Measures, which are non-GAAP measures. Management believes that the presentation of these measures provides investors with greater transparency and facilitates comparison of operating results across a broad spectrum of companies with varying capital structures, compensation strategies, derivative instruments and amortization methods, which can provide a more complete understanding of Enova's financial performance, competitive position and prospects for the future. Management utilizes, and also believes that investors utilize, the Adjusted Earnings Measures to assess operating performance, recognizing that such measures may highlight trends in Enova's business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. In addition, management believes that the Adjusted Earnings Measures are useful to management and investors in comparing Enova's financial results during the periods shown without the effect of certain items that are not indicative of Enova’s core operating performance or results of operations.

Management provides such non-GAAP financial information for informational purposes and to enhance understanding of Enova’s GAAP consolidated financial statements. Readers should consider the information in addition to, but not instead of or superior to, Enova’s financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

© Enova International, Inc. 2

© Enova International, Inc. 2

Additional Notices

Important Additional Information will be Filed with the SEC

In connection with the proposed transaction, Enova will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4 (the “registration statement”), which will contain a proxy statement of Grasshopper Bancorp, Inc. (“Grasshopper”) and a prospectus of Enova (the “proxy statement/prospectus”), and Enova may file with the SEC other relevant documents regarding the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROXY STATEMENT/PROSPECTUS CAREFULLY AND IN THEIR ENTIRETY AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC BY ENOVA, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT ENOVA, GRASSHOPPER AND THE PROPOSED TRANSACTION. A definitive copy of the proxy statement/prospectus will be mailed to stockholders of Grasshopper Bank when that document is final. Investors and security holders will be able to obtain the registration statement and the proxy statement/prospectus, as well as other filings containing information about Enova, free of charge from Enova or from the SEC’s website when they are filed by Enova. The documents filed by Enova with the SEC may be obtained free of charge at Enova’s website, at https://ir.enova.com/sec-filings, or by requesting them by mail at Enova International, Inc., Attention: General Counsel, 175 West Jackson Blvd., Suite 600, Chicago, Illinois 60604.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Enova or Grasshopper. However, Enova, Grasshopper and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Grasshopper in respect of the proposed transaction. Information about Enova’s directors and executive officers is available in its Annual Report on Form 10-K for the year ended December 31, 2024 and other documents filed by Enova with the SEC. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. Free copies of this document may be obtained as described in the preceding paragraph.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities of Enova or a solicitation of any vote or approval with respect to the proposed transaction by Enova of Grasshopper Bank, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

© Enova International, Inc. 3

© Enova International, Inc. 3

Additional Notices

Market and Industry Data

Unless otherwise indicated, market data and certain industry forecast data used in this presentation were obtained from third party sources and other publicly available information. In addition, assumptions and estimates of the future performance of Enova’s industries are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause future performance to differ materially from assumptions and estimates.

Enova and Grasshopper Data

Data about Enova provided in this presentation, including financial information, has been prepared by Enova’s management. Data about Grasshopper provided in this presentation, including financial information, has been obtained from Grasshopper’s management.

Combined Company Forward-Looking Data

Neither Enova’s nor Grasshopper’s independent registered public accounting firms have studied, reviewed or performed any procedures with respect to the combined company forward-looking financial data for the purpose of inclusion in this presentation, and, accordingly, neither have expressed an opinion or provided any form of assurance with respect thereto for the purpose of this presentation. These combined company forward-looking financial data are for illustrative purposes only and should not be relied on as necessarily being indicative of future results. The assumptions and estimates underlying the combined company forward-looking financial data are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information, including those in the Cautionary Statement Regarding Forward-Looking Statements, below. Combined company forward-looking financial data is inherently uncertain due to a number of factors outside of Enova’s or Grasshopper’s control. Accordingly, there can be no assurance that the prospective results are indicative of future performance of the combined company after the proposed acquisition or that actual results will not differ materially from those presented in the combined company forward-looking financial data. Inclusion of combined company forward-looking financial data in this presentation should not be regarded as a representation by any person that the results contained in the prospective financial information will be achieved.

© Enova International, Inc. 4

© Enova International, Inc. 4

Safe Harbor Statement

Cautionary Statement Regarding Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. You should not place undue reliance on these statements. These forward-looking statements give current expectations or forecasts of future events and reflect the views and assumptions of senior management with respect to, among other things, projections as to the anticipated benefits of the proposed transaction as well as statements regarding the impact of the proposed transaction on Enova’s and the combined company’s business, financial condition, operations and prospects, the amount and timing of synergies from the proposed transaction and the closing date for the proposed transaction. When used in this communication, terms such as “believes,” “estimates,” “should,” “could,” “would,” “plans,” “expects,” “intends,” “anticipates,” “may,” “forecast,” “project” and similar expressions or variations as they relate to Enova, the combined company or their respective management are intended to identify forward-looking statements.

Forward-looking statements address matters that involve risks and uncertainties that are beyond the ability of Enova to control and, in some cases, predict. Accordingly, there are or will be important factors that could cause the actual results to differ materially from those indicated in these statements. Key factors that could cause the actual financial results, performance or condition to differ from the expectations expressed or implied in such forward-looking statements include, but are not limited to, the following: the occurrence of any event, change or other circumstances that could give rise to the right of one or both of the parties to terminate the definitive merger agreement entered into between Enova and Grasshopper Bank, including the payment of any termination fee due thereunder; the outcome of any legal proceedings that may be instituted against Enova or Grasshopper Bank; the failure to obtain necessary regulatory approvals (and the risk that such approvals may result in the imposition of conditions that could adversely affect the combined company or the expected benefits of the proposed transaction) or stockholder approvals or to satisfy any of the other conditions to the proposed transaction on a timely basis or at all; the ability to obtain or add bank functionality and a bank charter; the possibility that the anticipated benefits and synergies of the proposed transaction are not realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Enova and Grasshopper Bank do business; the possibility that the proposed transaction may be more expensive to complete than anticipated; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business or employee relationships, including those resulting from the announcement or completion of the proposed transaction; changes in Enova’s share price before the closing of the proposed transaction; risks relating to the potential dilutive effect of shares of Enova common stock to be issued in the proposed transaction; and other factors that may affect future results of Enova and the combined company.

The foregoing list of factors is not exhaustive and new factors may emerge or changes to these factors may occur that could impact Enova’s or the combined company’s business and cause actual results to differ materially from those expressed in any of our forward-looking statements. Additional information regarding these and other factors may be contained in Enova’s filings with the SEC. Readers of this communication are encouraged to review Enova’s filings with the SEC, including the risks described under “Risk Factors” contained in Enova’s Form 10-K and any updates to those risk factors contained in subsequent Forms 10-Q, to obtain more detail about Enova’s risks and uncertainties. The forward-looking statements in this communication are made as of the date of this communication, and Enova disclaims any intention or obligation to update or revise any forward-looking statements to reflect events or circumstances occurring after the date of this communication. All forward-looking statements in this communication are expressly qualified in their entirety by the foregoing cautionary statements.

© Enova International, Inc. 5

© Enova International, Inc. 5

Transaction Summary

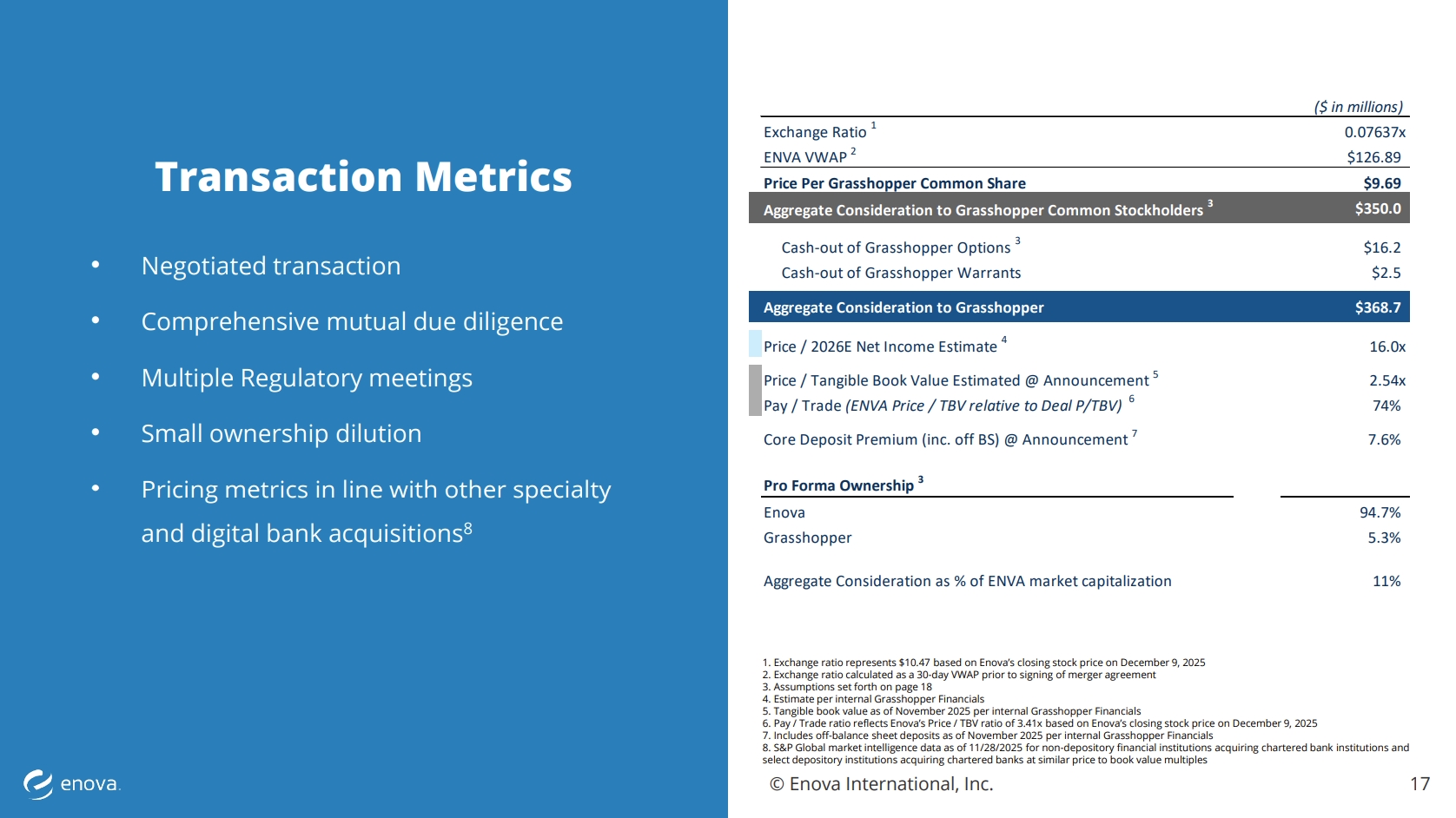

Consideration1 |

• Enova will acquire Grasshopper and its wholly owned subsidiary, Grasshopper Bank, for an aggregate purchase value of approximately $369 million • Price / Tangible Book Value at announcement of 2.54x • A combination of approximately 50% paid in cash and 50% in newly issued ENVA shares, with stock options and warrants to also receive cash • Enova stockholders will own ~94.7% and Grasshopper stockholders will own ~5.3% of the combined company |

Leadership2 |

• Enova will become a Federal Reserve regulated Bank Holding Company (BHC) and Grasshopper Bank will retain its national bank charter (OCC regulated) • David Fisher will serve as Executive Chairman of Enova • Steve Cunningham will be CEO of Enova BHC and the bank • Mike Butler, the current CEO of Grasshopper and Grasshopper Bank, will serve as President of the bank • Grasshopper management will remain as bank employees |

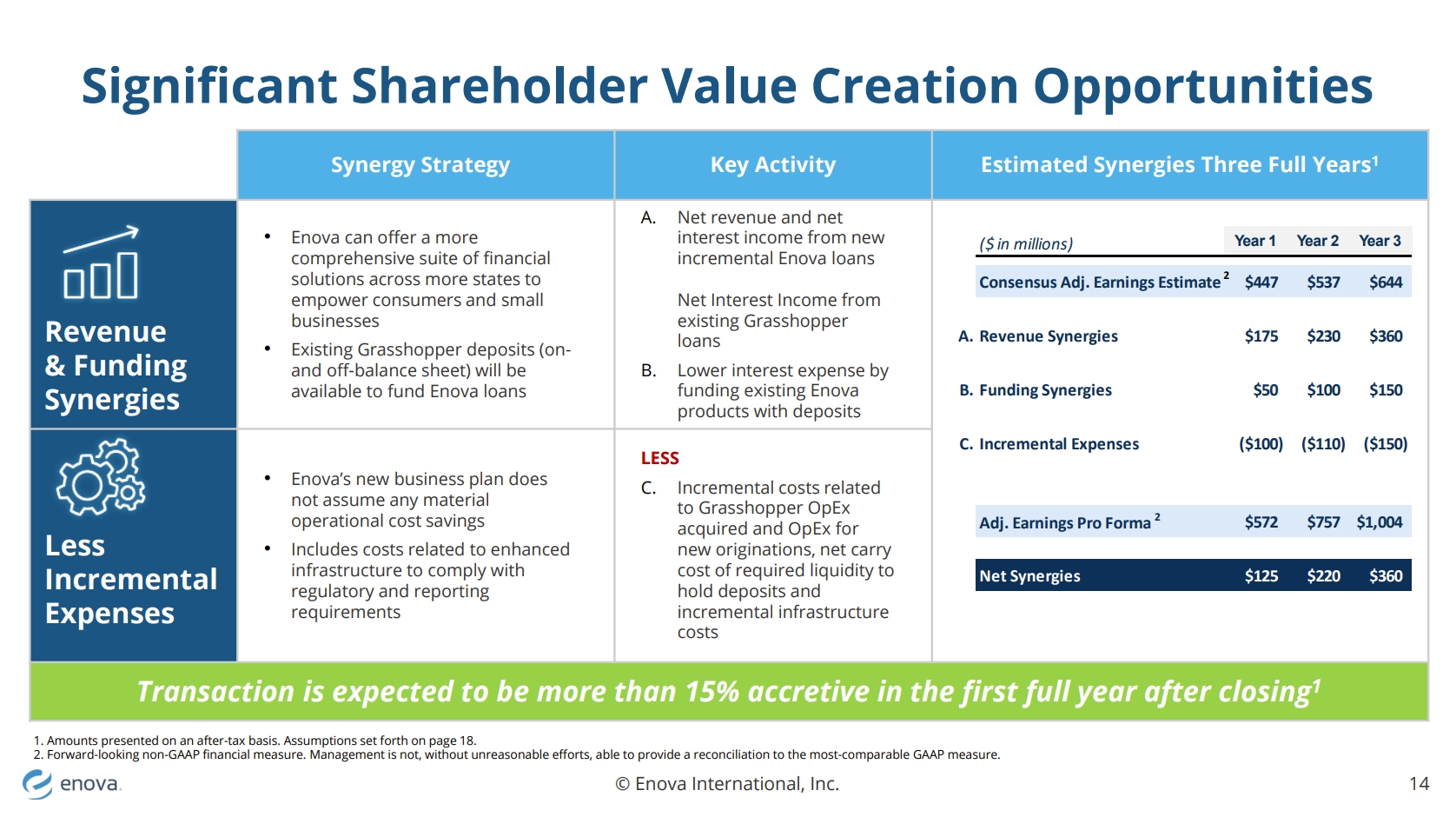

Synergies3 |

• Revenue synergies expected from new opportunities to expand both Enova and Grasshopper existing products • Improvement in funding costs expected by augmenting existing Enova funding with lower cost bank deposit funding • Expected accretion includes costs related to enhanced infrastructure to comply with regulatory and reporting requirements |

Approvals and Closing |

• Transaction subject to regulatory approvals from the OCC and the Federal Reserve; and is subject to customary closing conditions • Transaction subject to Grasshopper stockholders approval with approximately 56%4 having signed voting agreements as of the announcement date • Anticipated closing in the 2nd half of 2026 |

© Enova International, Inc. 9

© Enova International, Inc. 9

Strategic and Financial Benefits

Strategic Benefits |

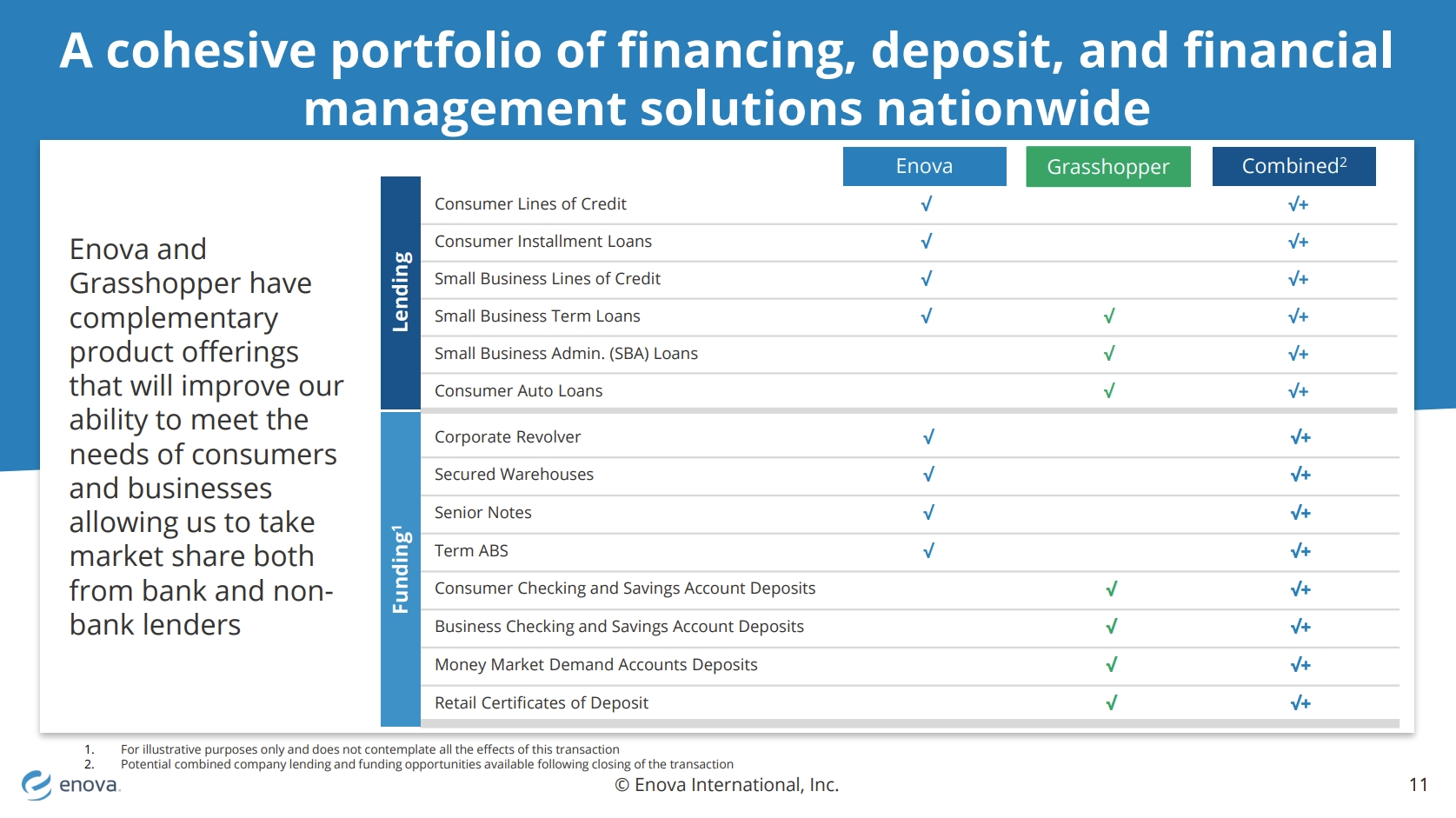

Product and operational simplification • With a unified banking framework under federal bank supervision, Enova plans to offer loan and deposit products across a greater number of States, which will simplify compliance, risk management and back-office operations Significant opportunities to expand and diversify the business • Expands Enova’s ability to deliver a more comprehensive suite of financial products through a national bank charter, expanding access to credit to those who were traditionally underserved by banks • Adds further diversification across industries, products, loan terms, and geography Increased financial inclusion and enhanced ability to serve customers • Expected to broaden financial access by leveraging Enova’s technology and allowing the combined company to serve more individuals and communities with convenient, transparent lending and banking services |

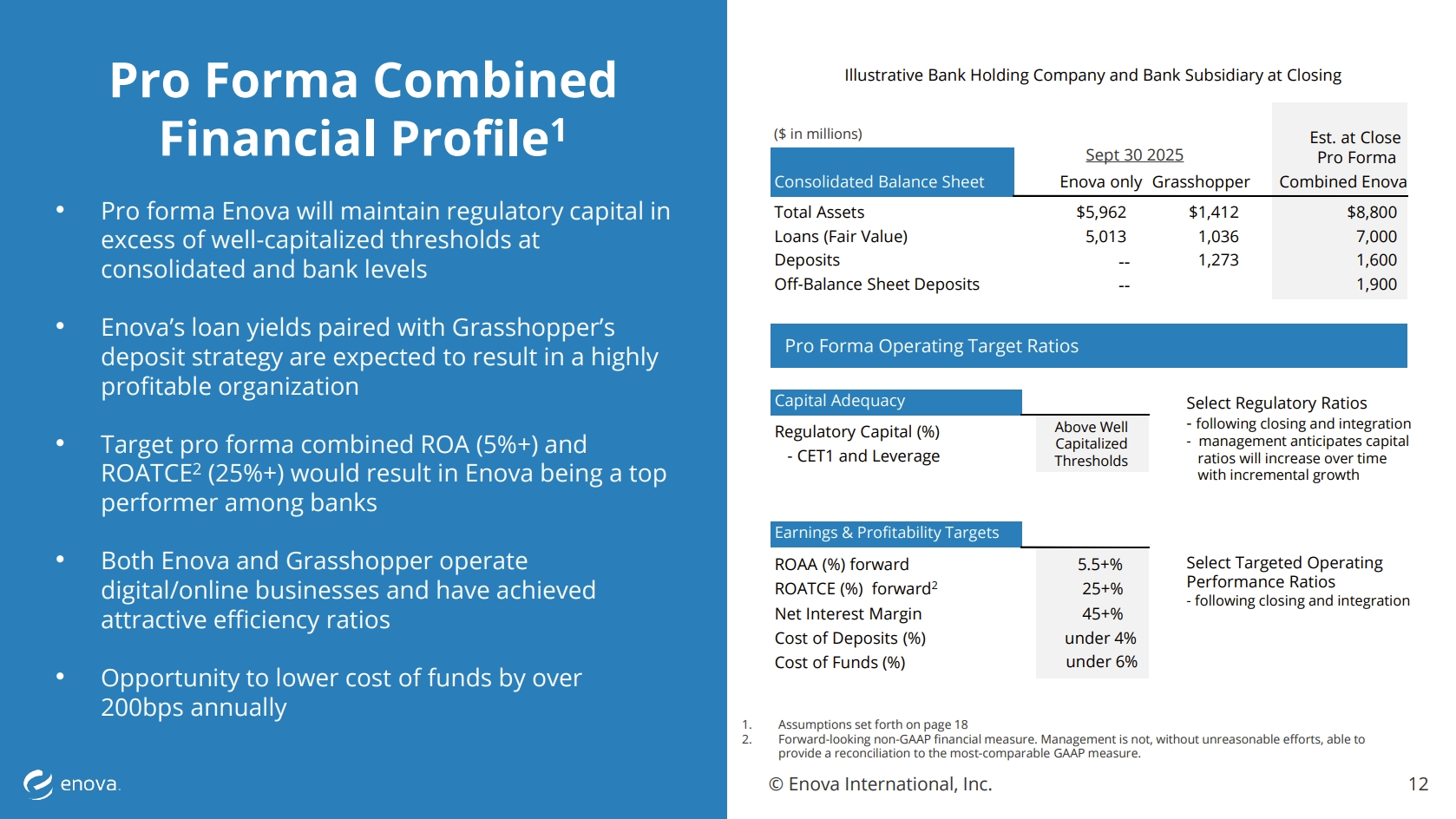

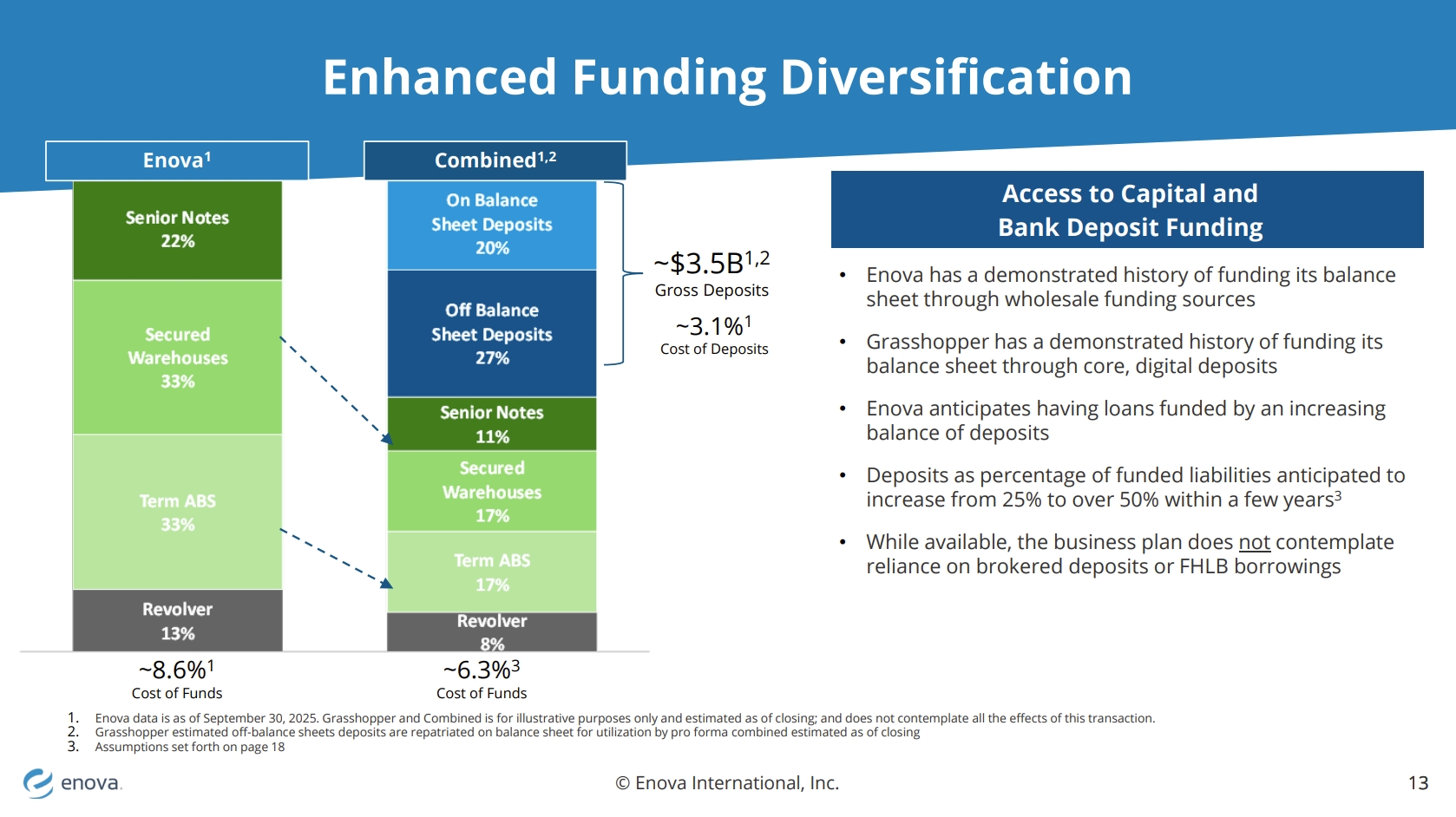

Financial Benefits1 |

Opportunities for significant revenue synergies • Achievable revenue synergies expected through product diversification and geographic expansion • Expected revenue synergy of $175 million to $230 million within the first two years post-closing2 Enhanced balance sheet strength which is expected to lead to funding synergies • Pro forma consolidated entity is expected to have a high-quality balance sheet with strong capital ratios and liquidity, more diversified funding sources, and well-understood asset-quality performance metrics • Deposits will be available to be deployed to fund new originations post-closing • Grasshopper deposit costs are 300 to 400 basis points lower than the cost of Enova’s securitizations Strong first full year expected adjusted EPS accretion of 15+%3 • Durable accretion from both growth and funding synergies • Accretion is not reliant upon significant cost savings or purchase accounting benefit |

© Enova International, Inc. 10

© Enova International, Inc. 10

Key Assumptions

Earnings Estimates |

• Enova based on 2027 Consensus Research estimates; grown at 20% thereafter • Grasshopper based on internal management estimates |

Synergies |

• No reduction in Enova or Grasshopper non-interest expense modeled • Incremental $6 million pre-tax expense associated with enhancing bank technology, risk & compliance infrastructure and personnel • Revenue and funding synergies identified and modeled |

Purchase Accounting |

• Gross credit mark of $15M (~1.1% of loan portfolio) • Loan interest rate mark of $13M (~1.0% of loan portfolio), accreted straight-line over 8 years • HTM securities interest rate mark of $2M (~6.0% of loan portfolio), accreted straight-line over 9 years • Accretion of AOCI of ~$4.6M straight-line over 9 years • Core Deposit Intangible of 2.0% of non-time deposits amortized straight-line over 10 years |

Model Assumptions |

• After-tax deal charges of $32M modeled at close • Assumes a 25% tax rate for illustrative purposes • Anticipated closing in the second half of 2026, subject to customary regulatory and Grasshopper stockholder approvals |

Other |

• Based on common shares outstanding of 24.7M and 36.1M for Enova and Grasshopper respectively, with 1.4M shares of Enova common stock to be issued in the transaction • Consideration for Grasshopper options based on 2.9M outstanding Grasshopper options with a weighted average strike-price of $4.06 • Deposit growth per Grasshopper internal estimate, does not assume additional reliance on brokered deposits |

© Enova International, Inc. 18

© Enova International, Inc. 18