Creating a New Category for Reimbursed Interventional Dry Eye Treatment Investor Presentation October 2025

Forward-Looking Statements This presentation, together with other statements and information publicly disseminated by the Company, contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which statements are subject to considerable risks and uncertainties. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements other than statements of historical fact, including statements regarding our future results of operations, product development, market opportunity, clinical trial results and timeline, and business strategy and plans. The forward-looking statements in this presentation include, but are not limited to, statements concerning the following: the Company's mission; the Company's projected financial or operational results, including expectations for revenue and gross margins and it plans to provide updated projections in its third quarter earnings release; estimates of the Company’s addressable markets for its products; the Company’s ability to gain share in existing markets and enter into and compete in new markets; the Company’s ability to successfully develop and commercialize its product pipeline; the Company’s ability to compete effectively; the Company’s ability to manage and grow its business, including execution of value creation initiatives; the Company's plans to invest in research and development, clinical and commercial infrastructure; the Company’s intent to continue to engage with third-party payors, clinical societies, and other stakeholders regarding patient access for the TearCare procedure; the Company’s ability to successfully execute its clinical trial roadmap; the Company’s ability to successfully execute its strategic initiatives and objectives; and the Company’s ability to obtain and maintain sufficient reimbursement for its products. These statements often include words such as “anticipate,” “expect,” “suggests,” “plan,” “believe,” “intend,” “estimates,” “targets,” “projects,” “should,” “could,” “would,” “may,” “will,” “forecast” and other similar expressions. Management bases these forward-looking statements on its current expectations, plans and assumptions affecting the Company’s business and industry, and such statements are based on information available to it as of the time such statements are made. Although management believes these forward-looking statements are based upon reasonable assumptions, it cannot guarantee their accuracy or completeness. Forward-looking statements are subject to and involve risks, uncertainties and assumptions that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance, or achievements predicted, assumed or implied by such forward-looking statements. Some of the risks and uncertainties that may cause actual results to materially differ from those expressed or implied by these forward-looking statements are discussed under the caption “Risk Factors” in the Company’s annual and quarterly reports with the U.S. Securities and Exchange Commission, as such may be updated from time to time in subsequent filings. These cautionary statements should not be construed by you to be exhaustive and are made only as of the date of this presentation. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Certain information contained in this presentation relates to, or is based on, studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while the Company believes its own estimates and research are reliable, such estimates and research have not been verified by any independent source. The Company has proprietary rights to trademarks, trade names and service marks appearing in this presentation that are important to its business. Solely for convenience, the trademarks, trade names and service marks may appear in this presentation without the ® and ™ symbols, but any such references are not intended to indicate that the Company forgoes or will not assert, to the fullest extent under applicable law, its rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this presentation are the property of their respective owners. The Company does not intend its use or display of other parties’ trademarks, trade names or service marks to imply, and such use or display should not be construed to imply, a relationship with, or endorsement or sponsorship of the Company by, these other parties. Without limitation, SIGHT SCIENCES™, SIGHT SCIENCES (with design)®, TEARCARE®, SMARTHUBS® and SMARTLIDS® are trademarks of Sight Sciences, Inc. in the United States and other countries. RESTASIS® is a registered trademark of Allergan™ an AbbVie company. LipiFlow® is a registered trademark of Johnson & Johnson.

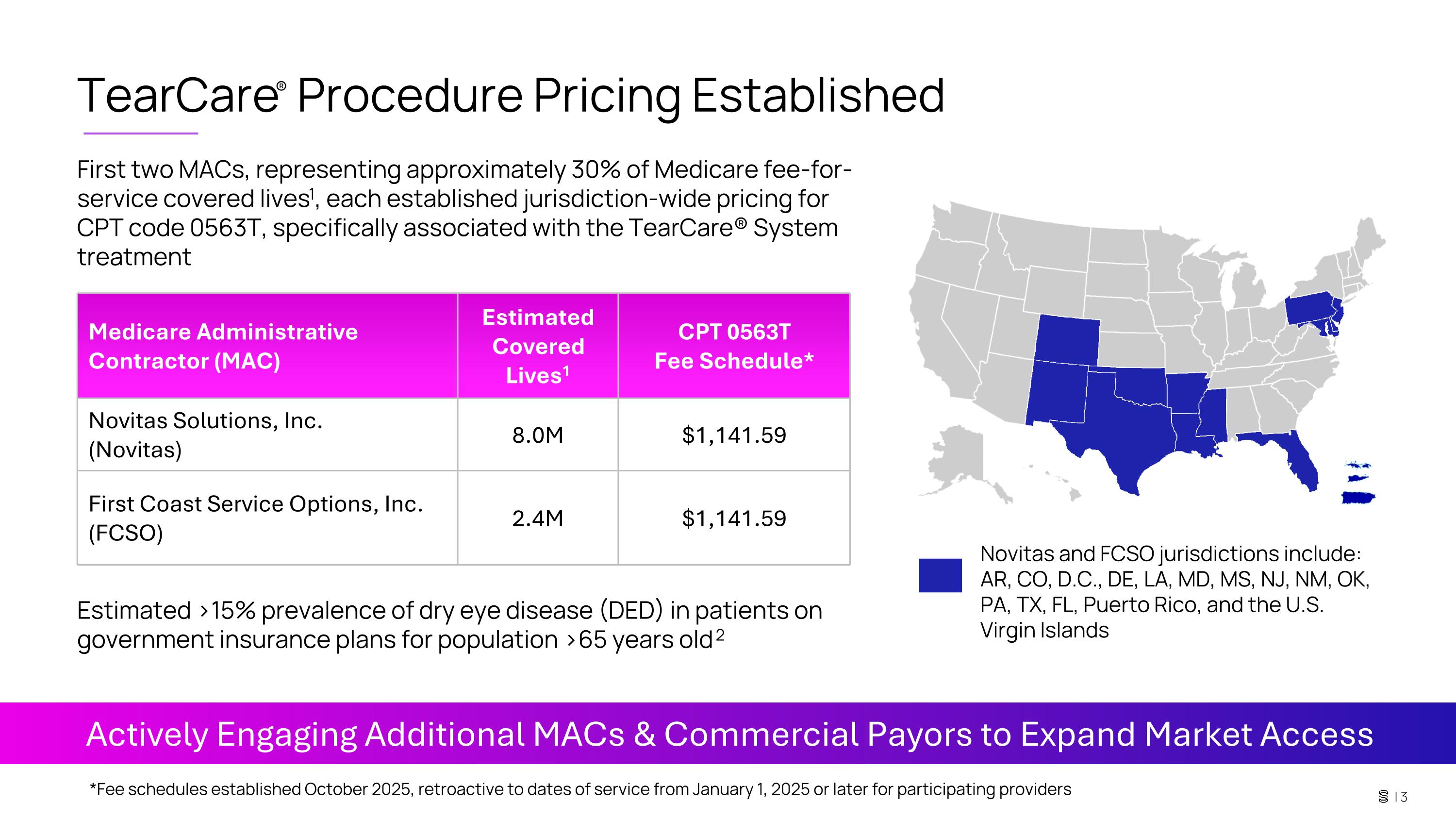

TearCare® Procedure Pricing Established First two MACs, representing approximately 30% of Medicare fee-for-service covered lives1, each established jurisdiction-wide pricing for CPT code 0563T, specifically associated with the TearCare® System treatment Medicare Administrative Contractor (MAC) Estimated Covered Lives1 CPT 0563T Fee Schedule* Novitas Solutions, Inc. (Novitas) 8.0M $1,141.59 First Coast Service Options, Inc. (FCSO) 2.4M $1,141.59 Actively Engaging Additional MACs & Commercial Payors to Expand Market Access Estimated >15% prevalence of dry eye disease (DED) in patients on government insurance plans for population >65 years old 2 *Fee schedules established October 2025, retroactive to dates of service from January 1, 2025 or later for participating providers Novitas and FCSO jurisdictions include: AR, CO, D.C., DE, LA, MD, MS, NJ, NM, OK, PA, TX, FL, Puerto Rico, and the U.S. Virgin Islands

FDA-cleared interventional technology for treating the root cause of meibomian gland associated dry eye disease (DED) 3 1 19.4M US patients diagnosed with DED, >6% prevalence in US population 2, 7 2 Experienced and dedicated dry eye commercial team has driven significant eyecare provider (ECP) and patient adoption at 1,500 locations and with 70k procedures performed 8 3 Two MACs, with 10.4M covered lives, 1 each established jurisdiction-wide pricing regarding CPT code 0563T. We are continuing to engage with other payors to expand market access 4 SAHARA RCT clinical trial demonstrated TearCare statistical superiority in its primary signs endpoint tear breakup time (TBUT) compared to the leading Rx eyedrop and significant improvements in all signs and symptoms 4, 5, 6 5 | 4 Note: TBUT is a clinical measurement for determining tear stability; <10 seconds is considered abnormal TBUT. Establishing the reimbursed interventional dry eye treatment category represents a substantial value creation opportunity

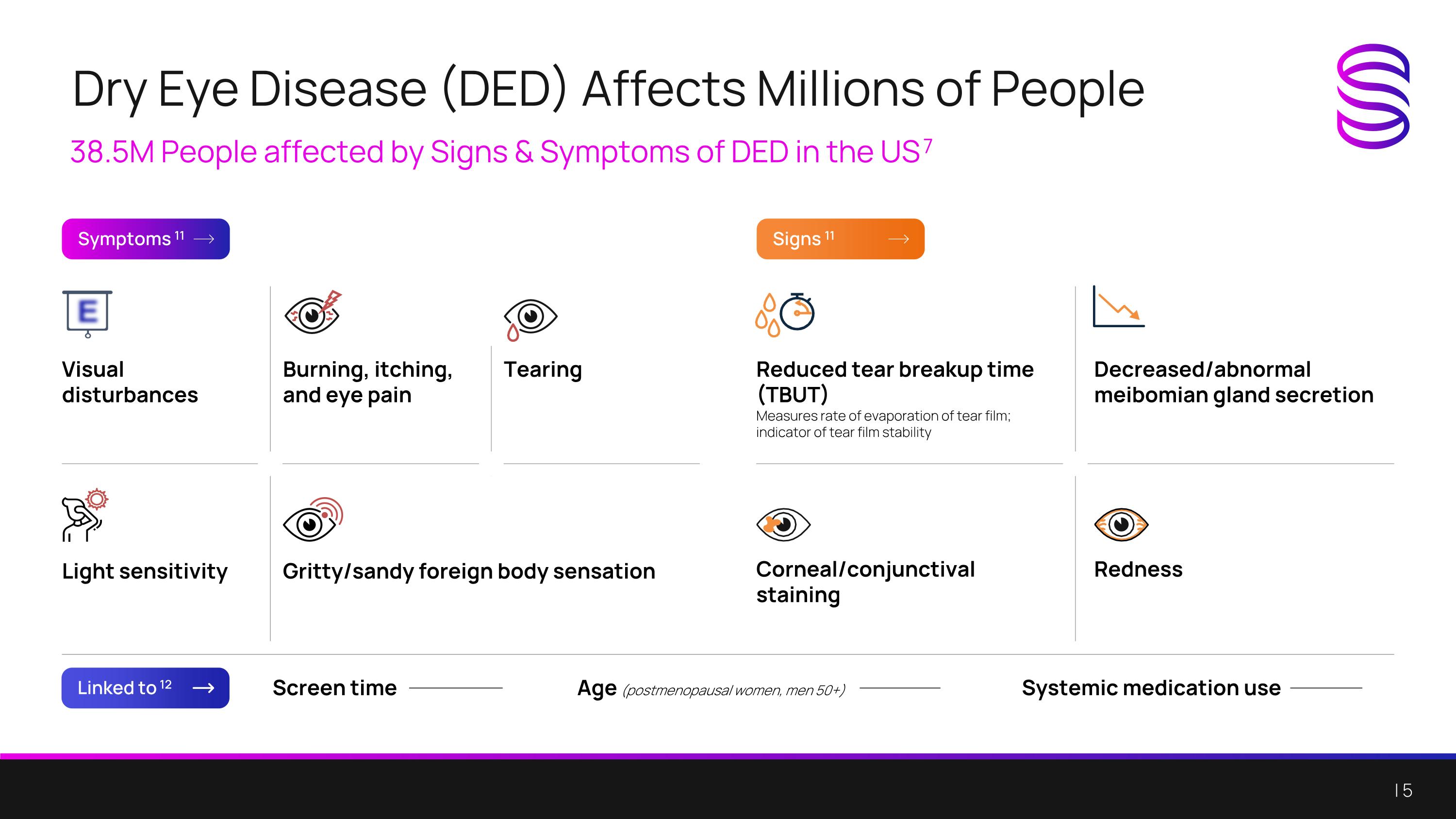

Dry Eye Disease (DED) Affects Millions of People 38.5M People affected by Signs & Symptoms of DED in the US 7 Symptoms 11 Linked to 12 Signs 11 Screen time Age (postmenopausal women, men 50+) Systemic medication use Visual disturbances Burning, itching, and eye pain Tearing Light sensitivity Gritty/sandy foreign body sensation Reduced tear breakup time (TBUT) Measures rate of evaporation of tear film; indicator of tear film stability Decreased/abnormal meibomian gland secretion Corneal/conjunctival staining Redness

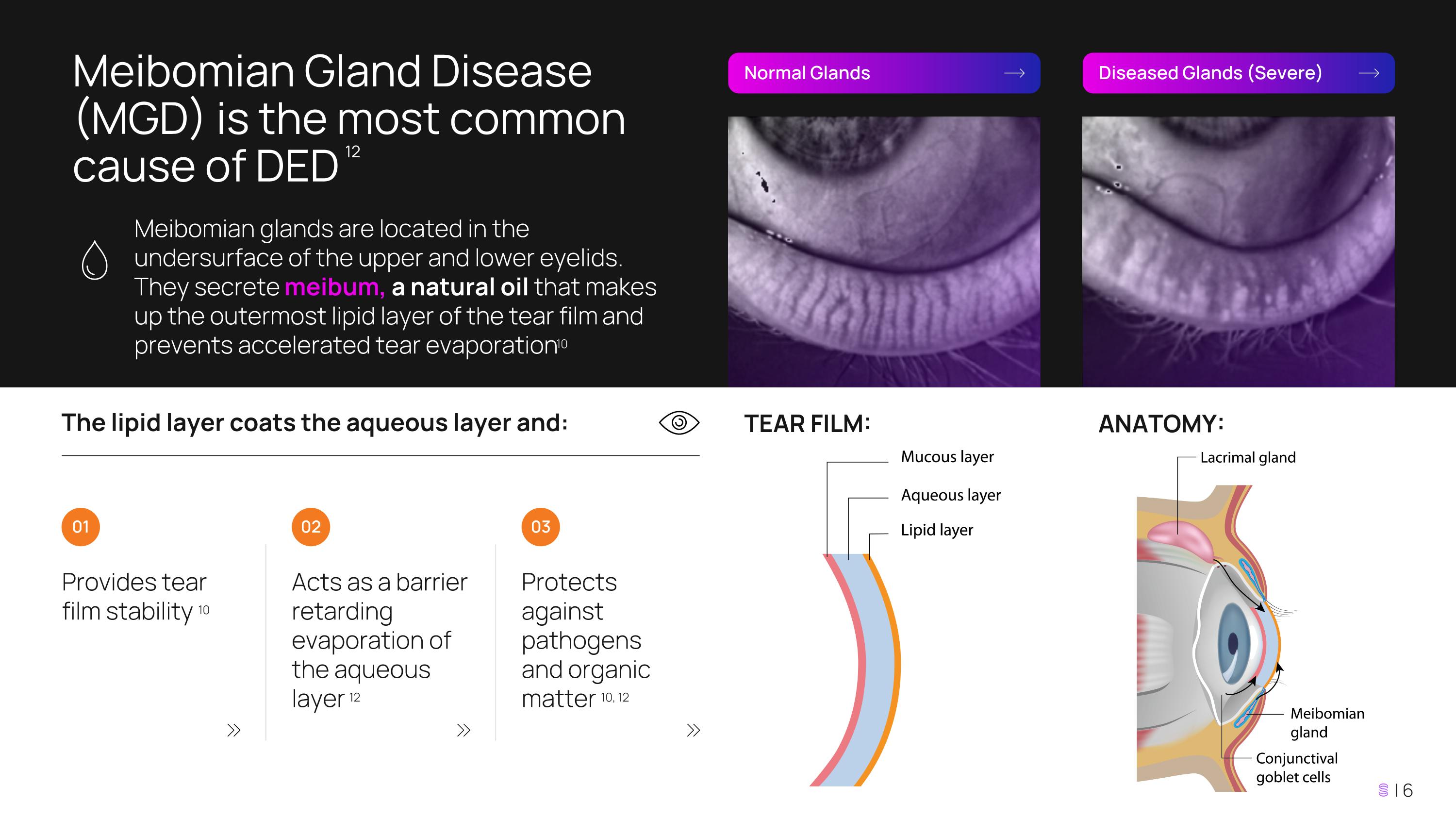

Meibomian Gland Disease (MGD) is the most common cause of DED 12 Meibomian glands are located in the undersurface of the upper and lower eyelids. They secrete meibum, a natural oil that makes up the outermost lipid layer of the tear film and prevents accelerated tear evaporation 10 Normal Glands Diseased Glands (Severe) The lipid layer coats the aqueous layer and: Provides tear film stability 10 Acts as a barrier retarding evaporation of the aqueous layer 12 Protects against pathogens and organic matter 10, 12 01 02 03 TEAR FILM: ANATOMY:

Up to of DED is due to MGD 12 50% of US MGD patients are reported to have moderate to severe symptoms 7 86% MGD is the most important factor that contributes to the severity of dry eye symptoms 12 Effective management of DED involves addressing the underlying MGD, rather than focusing solely on symptomatic relief, to improve patient outcomes 14 01. CHRONIC 02. PROGRESSIVE 03. GLAND DROPOUT IS IRREVERSIBLE 13

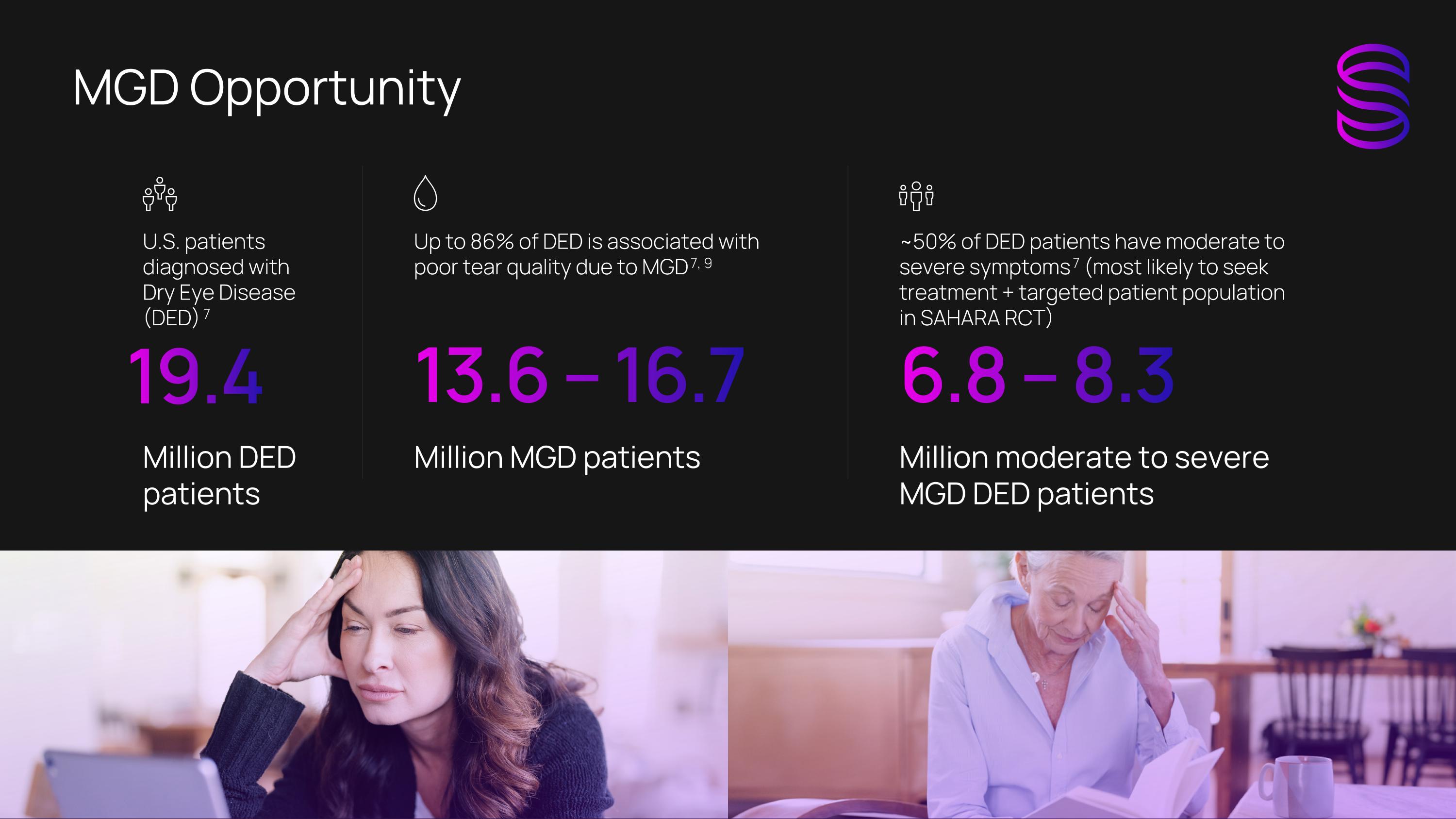

MGD Opportunity U.S. patients diagnosed with Dry Eye Disease (DED) 7 Million DED patients 19.4 Up to 86% of DED is associated with poor tear quality due to MGD 7, 9 Million MGD patients 13.6 – 16.7 ~50% of DED patients have moderate to severe symptoms 7 (most likely to seek treatment + targeted patient population in SAHARA RCT) Million moderate to severe MGD DED patients 6.8 – 8.3

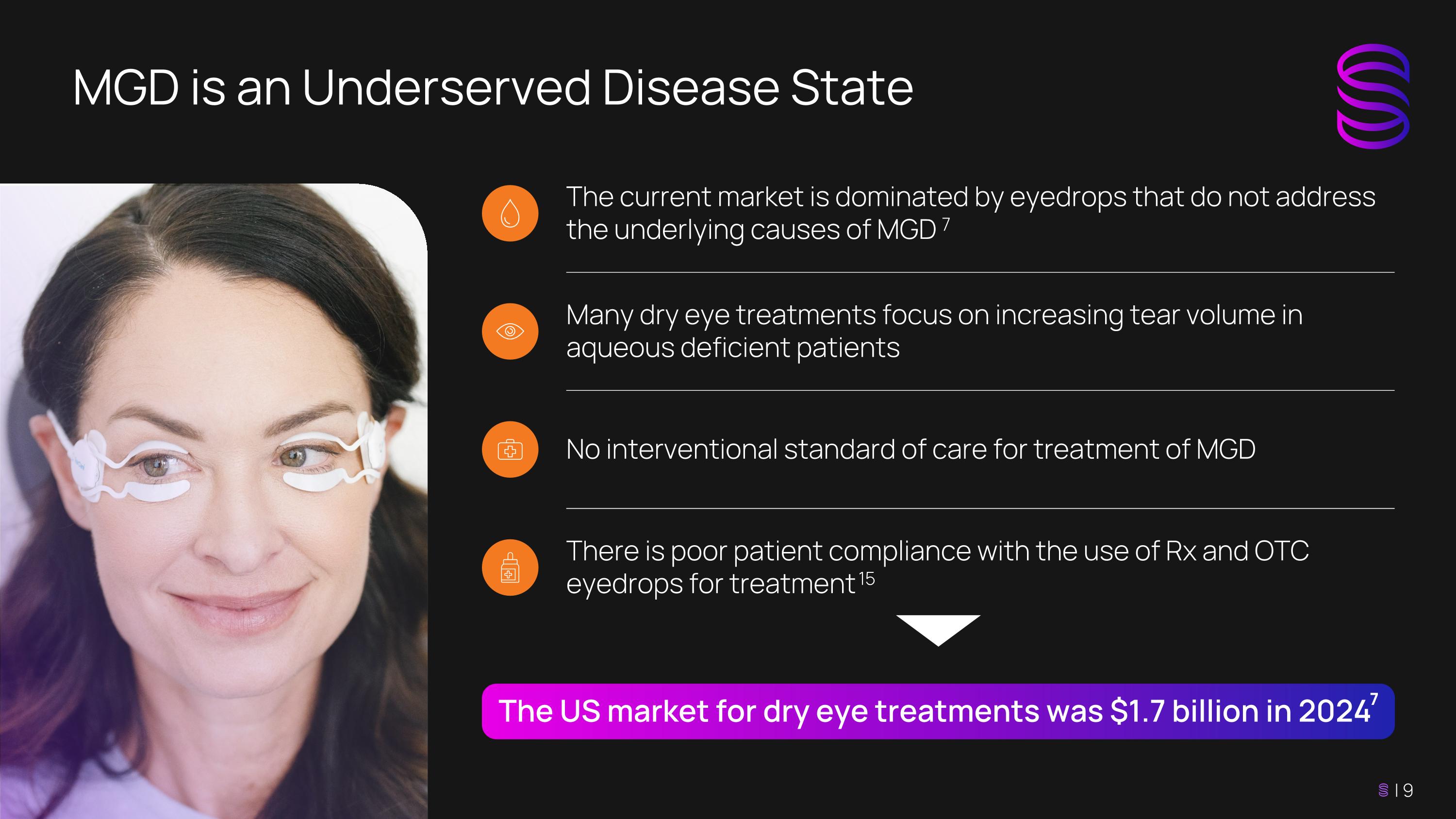

MGD is an Underserved Disease State The current market is dominated by eyedrops that do not address the underlying causes of MGD 7 Many dry eye treatments focus on increasing tear volume in aqueous deficient patients No interventional standard of care for treatment of MGD There is poor patient compliance with the use of Rx and OTC eyedrops for treatment 15 The US market for dry eye treatments was $1.7 billion in 2024 7

TearCare: Targeted + Intuitive Intervention Safe and effective early intervention in treating the root underlying cause for the majority of DED 4, 5, 6 Decreases signs and symptom severity fast and maintains durability over time 4, 5, 6 , 26, 34 Clinically and cost-effective choice for payors as compared to Restasis® 4, 16, 17 Convenient and comfortable for patients 18 Proven product – procedural usability and clinical workflow that integrates with current eyecare providers practices 19 The TearCare System is intended for the application of localized heat therapy in adult patients with evaporative dry eye disease due to meibomian gland disease (MGD), when used in conjunction with manual expression of the meibomian glands. 3 Indication for use:

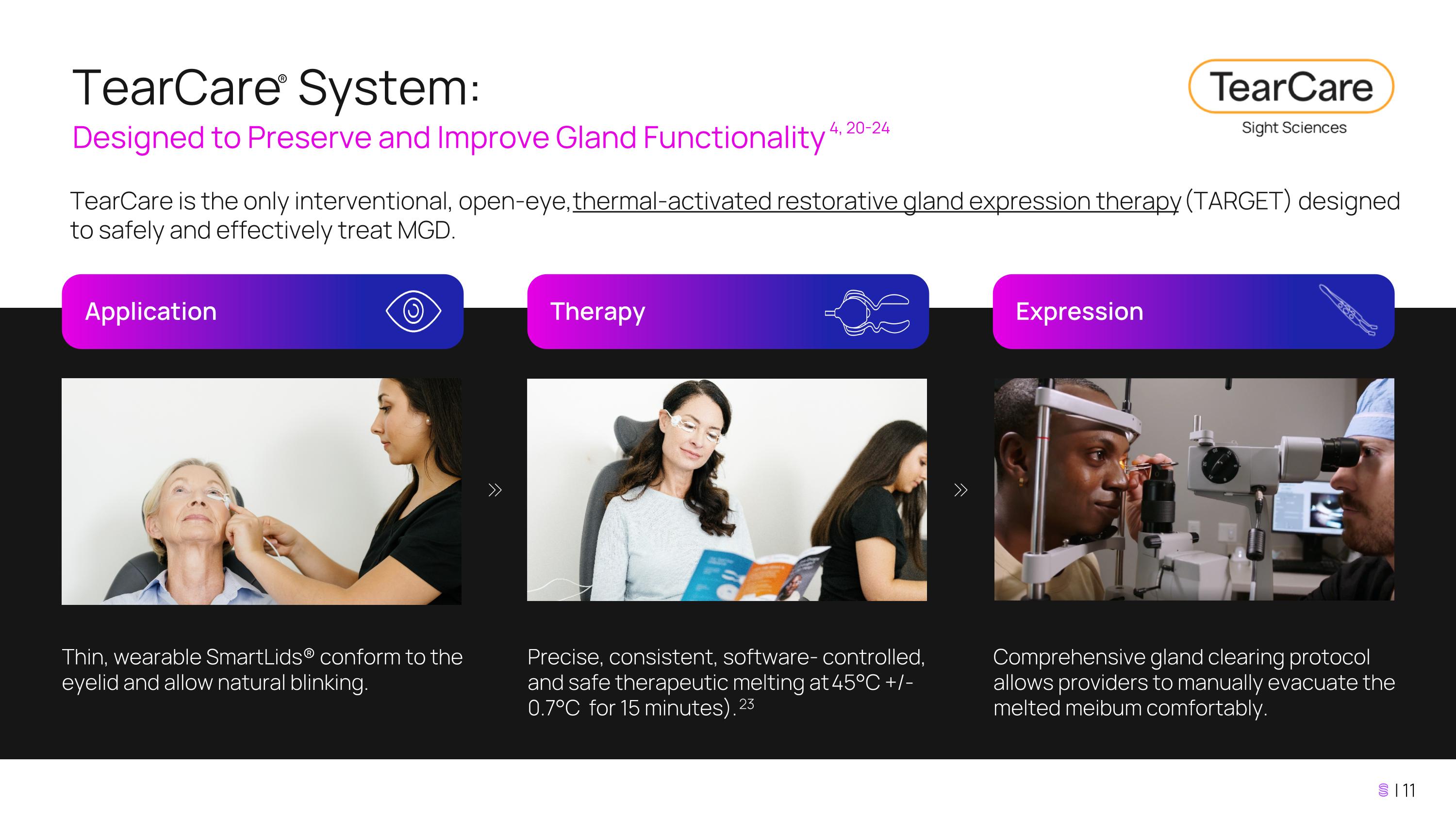

TearCare® System: Designed to Preserve and Improve Gland Functionality 4, 20-24 Application TearCare is the only interventional, open-eye, thermal-activated restorative gland expression therapy (TARGET) designed to safely and effectively treat MGD. Therapy Expression Thin, wearable SmartLids® conform to the eyelid and allow natural blinking. Precise, consistent, software- controlled, and safe therapeutic melting at 45°C +/- 0.7°C for 15 minutes). 23 Comprehensive gland clearing protocol allows providers to manually evacuate the melted meibum comfortably.

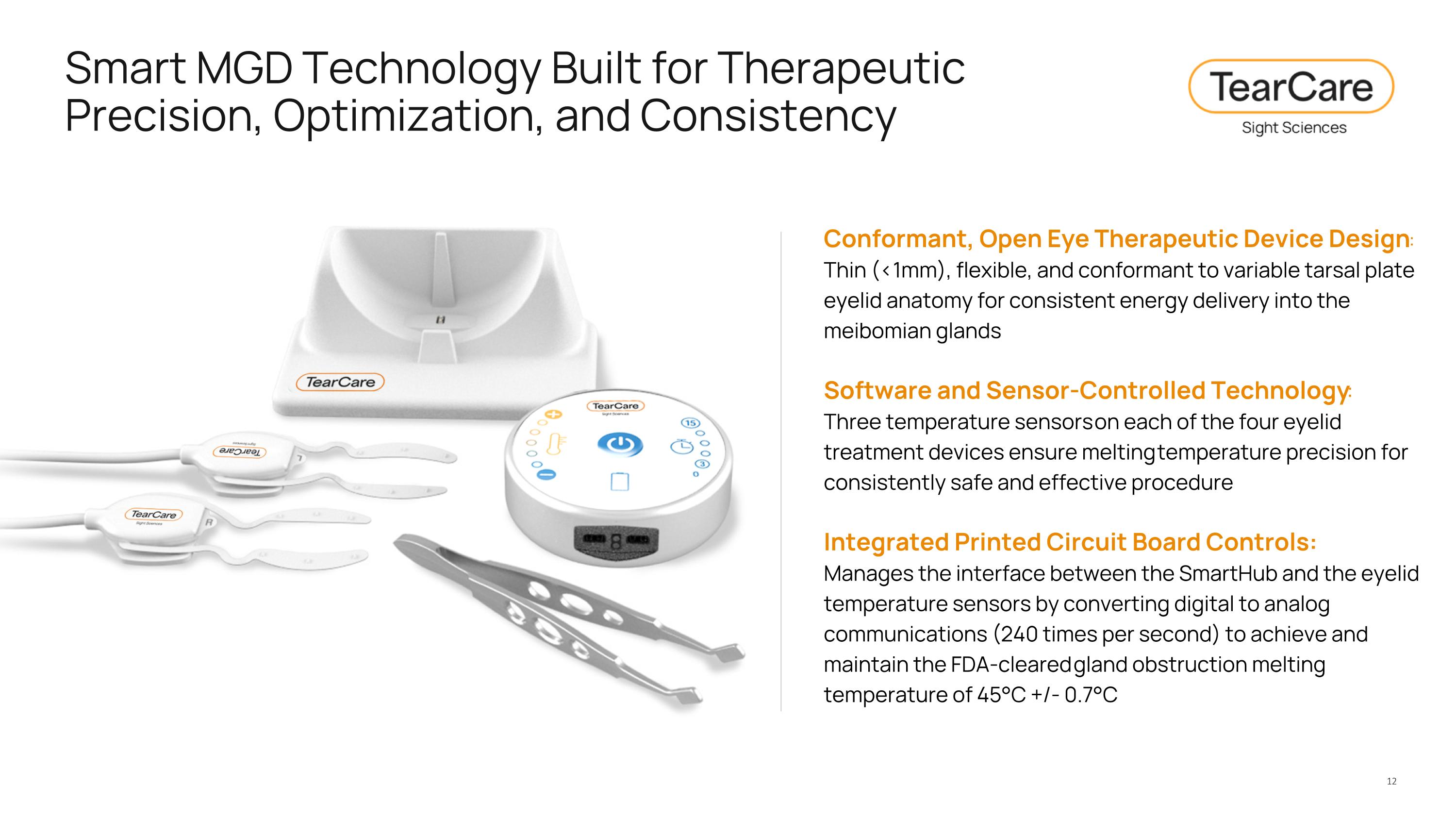

Smart MGD Technology Built for Therapeutic Precision, Optimization, and Consistency Conformant, Open Eye Therapeutic Device Design: Thin (<1mm), flexible, and conformant to variable tarsal plate eyelid anatomy for consistent energy delivery into the meibomian glands Software and Sensor-Controlled Technology: Three temperature sensors on each of the four eyelid treatment devices ensure melting temperature precision for consistently safe and effective procedure Integrated Printed Circuit Board Controls: Manages the interface between the SmartHub and the eyelid temperature sensors by converting digital to analog communications (240 times per second) to achieve and maintain the FDA-cleared gland obstruction melting temperature of 45°C +/- 0.7°C

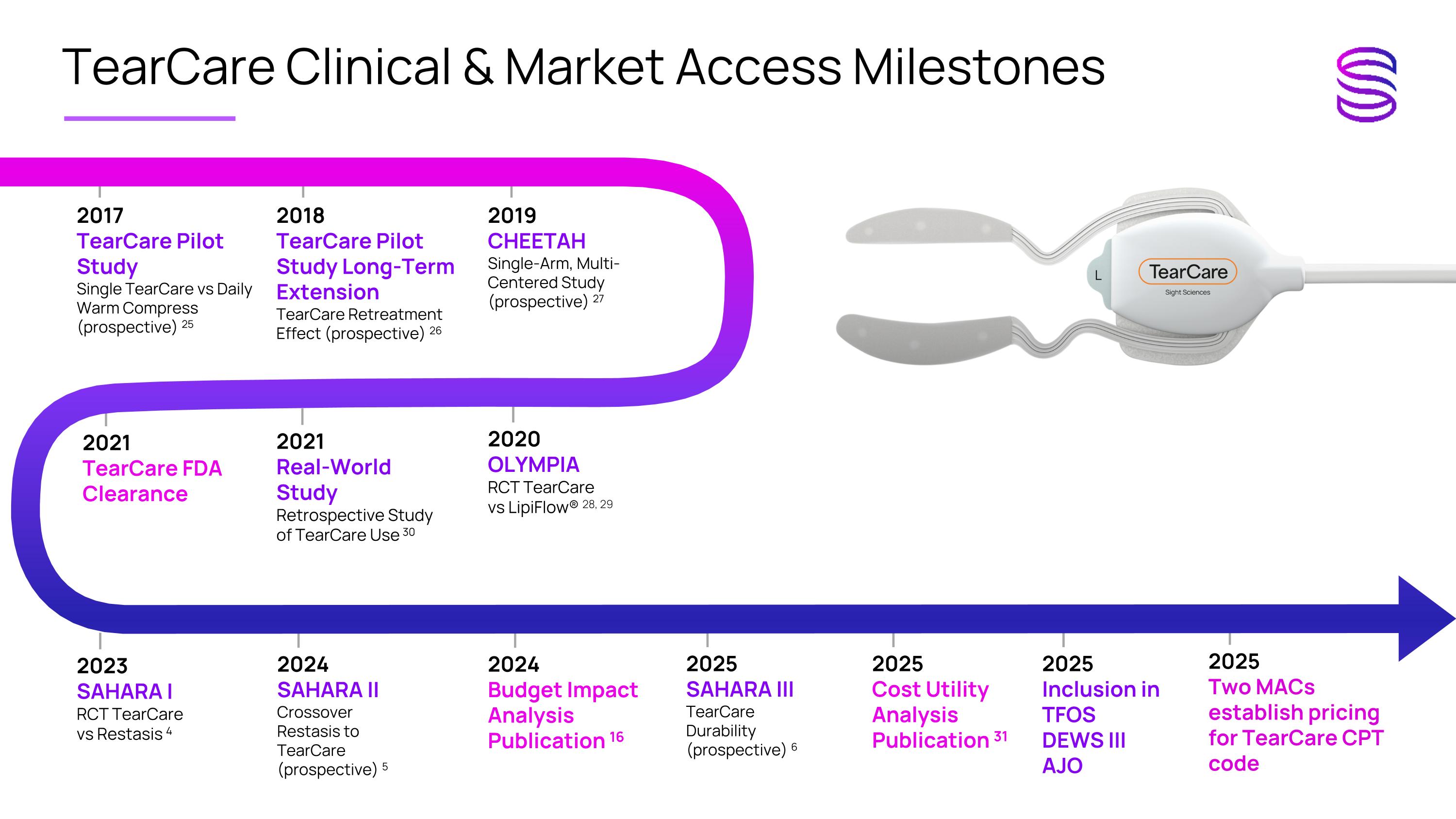

2025 Inclusion in TFOS DEWS III AJO TearCare Clinical & Market Access Milestones 2025 Two MACs establish pricing for TearCare CPT code 2017 TearCare Pilot Study Single TearCare vs Daily Warm Compress (prospective) 25 2018 TearCare Pilot Study Long-Term Extension TearCare Retreatment Effect (prospective) 26 2019 CHEETAH Single-Arm, Multi-Centered Study (prospective) 27 2020 OLYMPIA RCT TearCare vs LipiFlow® 28, 29 2021 TearCare FDA Clearance 2021 Real-World Study Retrospective Study of TearCare Use 30 2023 SAHARA I RCT TearCare vs Restasis 4 2024 SAHARA II Crossover Restasis to TearCare (prospective) 5 2024 Budget Impact Analysis Publication 16 2025 SAHARA III TearCare Durability (prospective) 6 2025 Cost Utility Analysis Publication 31

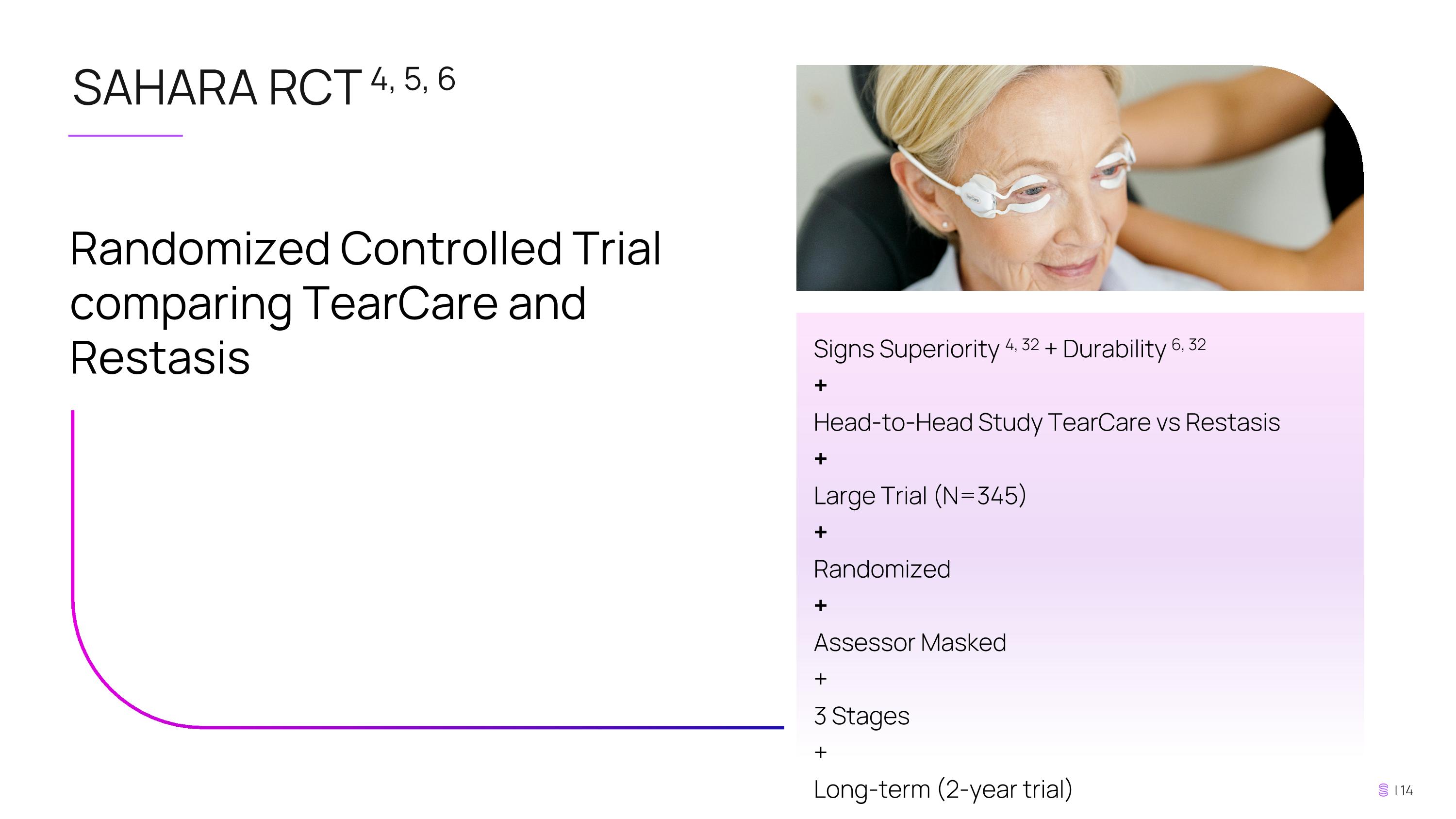

SAHARA RCT 4, 5, 6 Randomized Controlled Trial comparing TearCare and Restasis Signs Superiority 4, 32 + Durability 6, 32 + Head-to-Head Study TearCare vs Restasis + Large Trial (N=345) + Randomized + Assessor Masked + 3 Stages + Long-term (2-year trial)

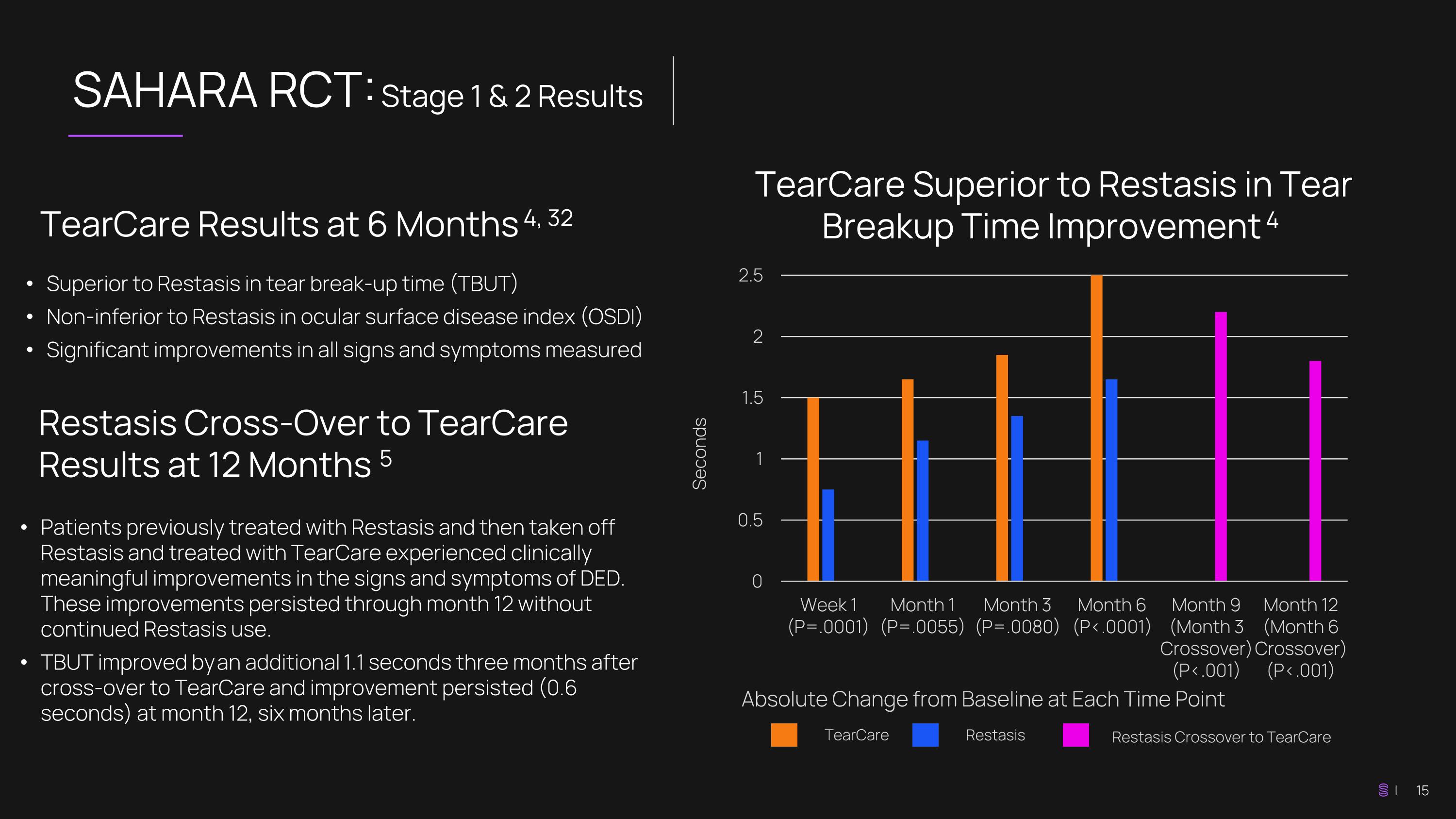

SAHARA RCT: Stage 1 & 2 Results TearCare Superior to Restasis in Tear Breakup Time Improvement 4 TearCare Results at 6 Months 4, 32 Superior to Restasis in tear break-up time (TBUT) Non-inferior to Restasis in ocular surface disease index (OSDI) Significant improvements in all signs and symptoms measured Seconds Absolute Change from Baseline at Each Time Point TearCare Restasis Patients previously treated with Restasis and then taken off Restasis and treated with TearCare experienced clinically meaningful improvements in the signs and symptoms of DED. These improvements persisted through month 12 without continued Restasis use. TBUT improved by an additional 1.1 seconds three months after cross-over to TearCare and improvement persisted (0.6 seconds) at month 12, six months later. Restasis Cross-Over to TearCare Results at 12 Months 5 Restasis Crossover to TearCare

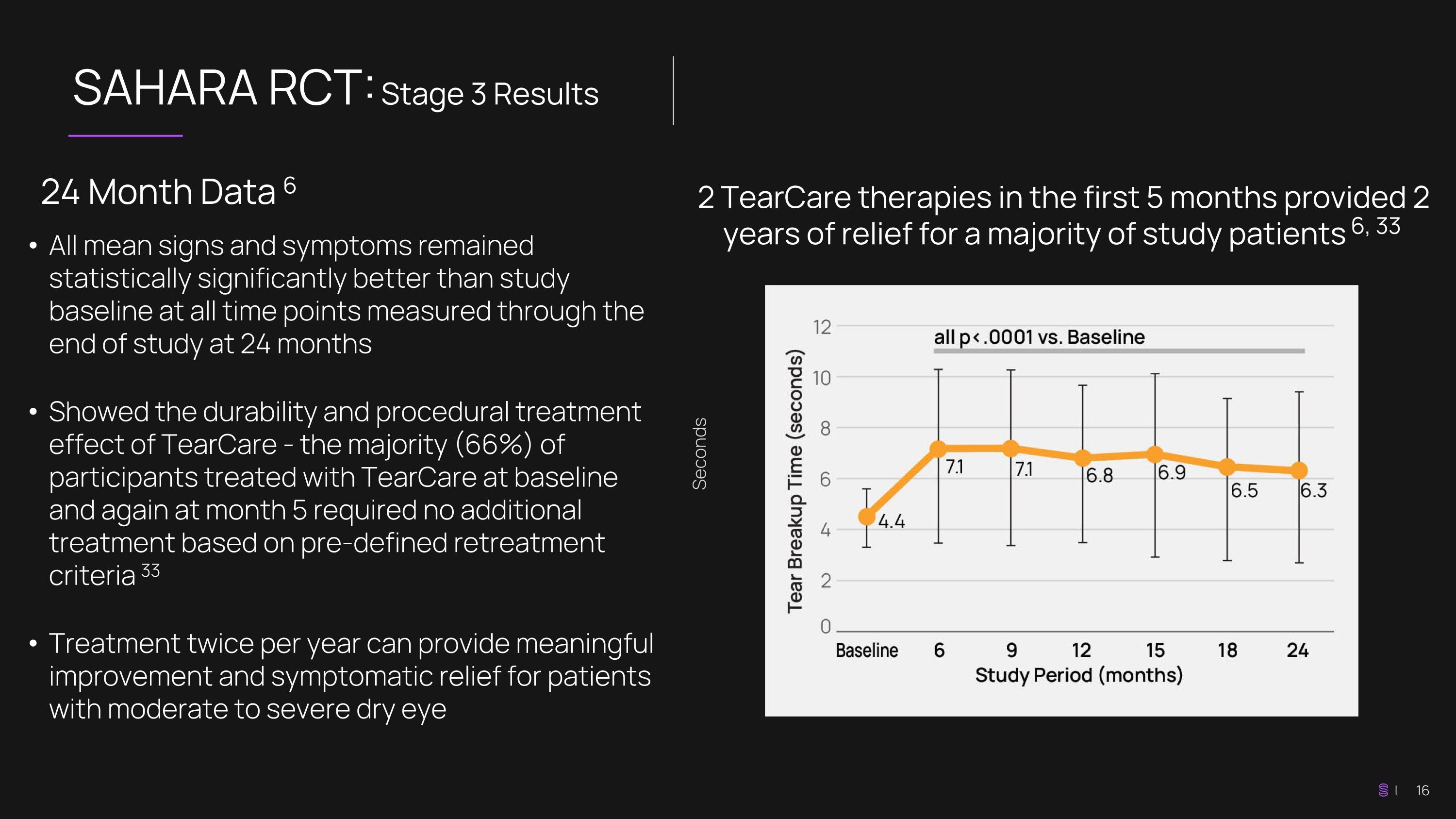

SAHARA RCT: Stage 3 Results 2 TearCare therapies in the first 5 months provided 2 years of relief for a majority of study patients 6, 33 24 Month Data 6 All mean signs and symptoms remained statistically significantly better than study baseline at all time points measured through the end of study at 24 months Showed the durability and procedural treatment effect of TearCare - the majority (66%) of participants treated with TearCare at baseline and again at month 5 required no additional treatment based on pre-defined retreatment criteria 33 Treatment twice per year can provide meaningful improvement and symptomatic relief for patients with moderate to severe dry eye Seconds

Demonstrates clinical efficacy and economic value, showing how TearCare aligns with payor priorities TearCare is a Cost-Effective Choice for Payors 16 Payors can assess upfront costs and forecast potential savings or additional costs over time Comprehensive Financial Perspective Enhanced Payor Decision Making Enhanced Value Proposition Provides a clearer risk-benefit understanding of TearCare Payors can prioritize TearCare investments based on maximizing patient outcomes per unit cost Resource Allocation Budget impact analysis (BIA) shows a 20% market share increase for TearCare as compared to Restasis is associated with savings of approximately $37 million per year for an insurance plan with 1 million covered lives 16

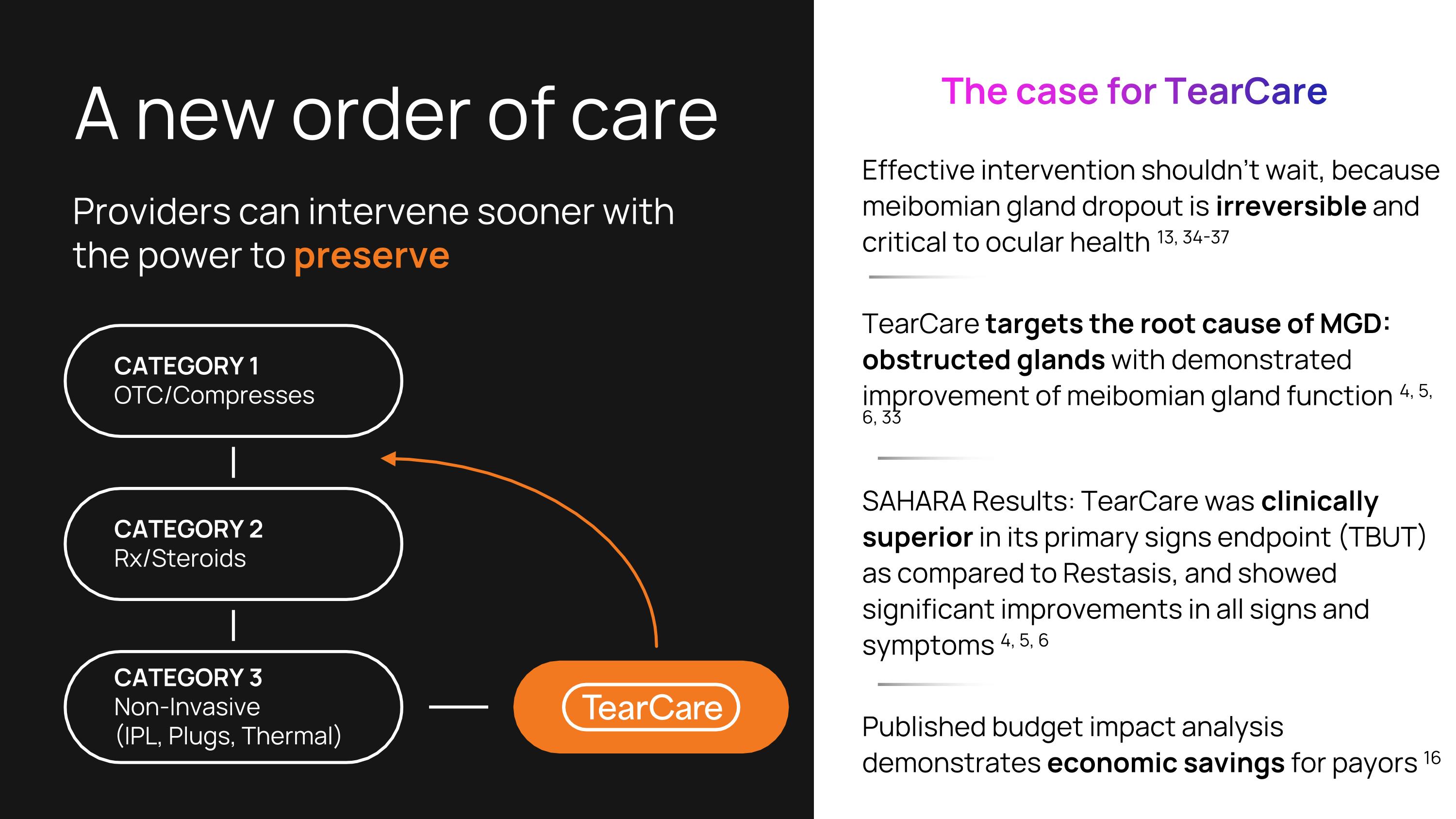

A new order of care Effective intervention shouldn’t wait, because meibomian gland dropout is irreversible and critical to ocular health 13, 34-37 TearCare targets the root cause of MGD: obstructed glands with demonstrated improvement of meibomian gland function 4, 5, 6, 33 SAHARA Results: TearCare was clinically superior in its primary signs endpoint (TBUT) as compared to Restasis, and showed significant improvements in all signs and symptoms 4, 5, 6 Published budget impact analysis demonstrates economic savings for payors 16 Providers can intervene sooner with the power to preserve The case for TearCare CATEGORY 1 OTC/Compresses CATEGORY 2 Rx/Steroids CATEGORY 3 Non-Invasive (IPL, Plugs, Thermal)

Enabling Patient Access is Critical We believe patients should have coverage for interventional MGD therapy—and doctors should be fairly reimbursed for delivering it. That’s why we’re investing in the change required to drive insurance coverage and fair reimbursement for TearCare and the patients it serves.

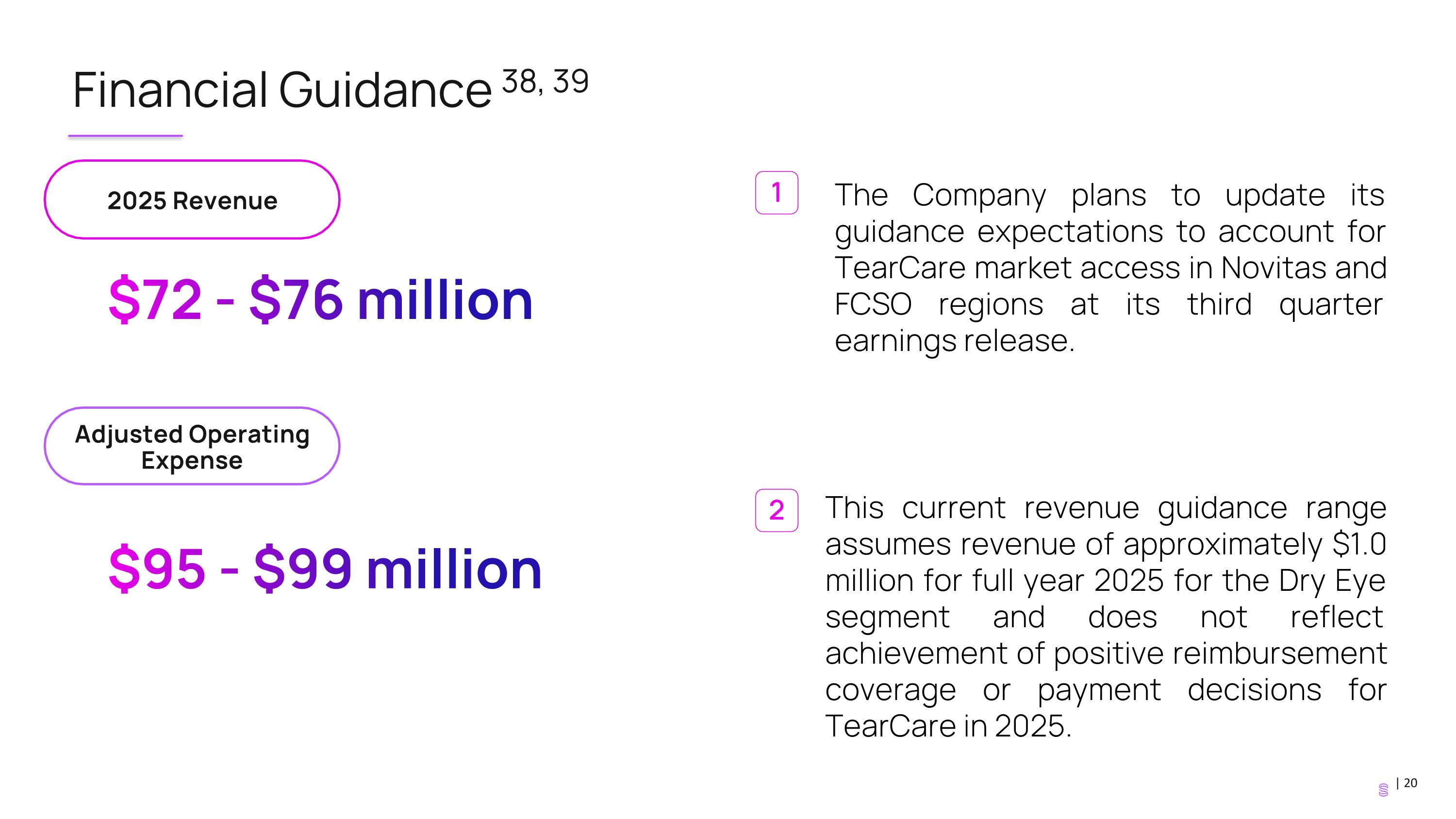

Financial Guidance 38, 39 $72 - $76 million $95 - $99 million 2025 Revenue Adjusted Operating Expense This current revenue guidance range assumes revenue of approximately $1.0 million for full year 2025 for the Dry Eye segment and does not reflect achievement of positive reimbursement coverage or payment decisions for TearCare in 2025. 1 2 The Company plans to update its guidance expectations to account for TearCare market access in Novitas and FCSO regions at its third quarter earnings release.

Thank you! If you have any questions, please contact investor.relations@sightsciences.com © Sight Sciences and/or certain of its affiliates, All rights reserved. Sight Sciences, the Sight Sciences logo and TearCare are trademarks or registered trademarks of Sight Sciences.

Source Appendix Covered lives estimate is derived from publicly available information and includes Medicare fee for service and Medicare fee for service - Medicaid Dual-Eligible beneficiaries. Farrand, KF, Fridman M, Stillman IO, Schaumberg DA. Prevalence of Diagnosed Dry Eye Disease in the United States Among Adults Aged 18 years and Older. Am J Ophthalmol. 2017;182:90 – 98. (Based on 15.78% prevalence in government insurance plans for population >65 years old, and overall diagnosed prevalence of 6.8% and an additional 2.5% reported having experienced DED but had not been diagnosed with DED.) U.S. Food & Drug Administration (FDA) Indications for Use 510k cleared. 510(K) Number: K213045. Ayres BD, Bloomenstein MR, Loh J, et al. A Randomized, Controlled Trial Comparing TearCare® and Cyclosporine Ophthalmic Emulsion for the Treatment of Dry Eye Disease (SAHARA). Clin Ophthalmol. 2023;17:3925-3940. Ayres BD, Bloomenstein MR, Loh J, Chester T, Saenz B, Echegoyen J, Kannarr SR, Rodriguez TC, Dickerson JE Jr. Improved Signs and symptoms of Dry Eye Disease for Restasis® Patients Following a Single TearCare® Treatment: Phase 2 of the SAHARA Study. Clin Ophthalmol. 2024;18:1525-1534. Hovanesian, J; Ayres, BD; Bloomenstein, MR; Loh, J; Chester, T; Saenz, B; Echegoyen, J; Kannarr, SR; Rodriguez, T; Dickerson, J. Durability of the TearCare treatment effect in subjects with dry eye disease: Stage 3 of the Sahara randomized controlled trial. Optometry and Vision Science ():10.1097/OPX.0000000000002278, July 28, 2025. | DOI: 10.1097/OPX.0000000000002278. Market Scope 2024 Dry Eye Products Report. As of June 30, 2025. Sight Sciences, Inc. Internal Sales Data. Estimated as of December 31, 2024, based on review of claims data and Company analytics. Chhadva P, et al. Ophthalmol. 2017;124(11 Suppl):S20-S26. Teo CHY, Ong HS, Liu YC, Tong L. Meibomian gland dysfunction is the primary determinant of dry eye symptoms: Analysis of 2346 patients. Ocul Surf. 2020;18(4):604-612; Dunn JD, Karpecki PM, Meske ME, Reissman D. Evolving knowledge of the unmet needs in dry eye disease. Am J Manag Care. 2021;27(2 Suppl):S23-S32; Uchino M, Yokoi N, Shimazaki J, Hori Y, Tsubota K, On Behalf Of The Japan Dry Eye Society. Adherence to Eye Drops Usage in Dry Eye Patients and Reasons for Non-Compliance: A Web-Based Survey. J Clin Med. 2022;11(2):367. Published 2022 Jan 12. Lemp MA, Crews LA, Bron AJ, Foulks GN, Sullivan BD. Distribution of aqueous-deficient and evaporative dry eye in a clinic-based patient cohort: a retrospective study. Cornea. 2012;31(5):472-478 Yang X, Reneker LW, Zhong X, Huang AJW, Jester JV. Meibomian gland stem/progenitor cells: The hunt for gland renewal. Ocul Surf. 2023;29:497-507. Karpecki PM, Nichols KK, Sheppard JD. Addressing excessive evaporation: an unmet need in dry eye disease. Am J Manag Care. 2023;29(13 Suppl):S239-S247. Teo CHY, et al. Ocular Surface. 2020:18;604-612. Uchino M, Yokoi N, Shimazaki J, Hori Y, Tsubota K, On Behalf Of The Japan Dry Eye Society. Adherence to Eye Drops Usage in Dry Eye Patients and Reasons for Non-Compliance: A Web-Based Survey. J Clin Med. 2022;11(2):367. Published 2022 Jan 12. Ozdemir, S.,et al. Patient. 15, 679-690 (2022). Chester, T., Longo, R., Masseria, C., Riley, P., Patel, C., & Mody, L. (2024). Budget impact analysis (BIA) of the TearCare System for the treatment of meibomian gland dysfunction (MGD)-associated dry eye disease (DED) in the United States (US). Expert Review of Ophthalmology , 20(1), 55-61.

Source Appendix Restasis is a registered trademark of Allergan™ an AbbVie company. Response results from opt-in patient rebate surveys administered by TearCare® from January 2021 through November 2021, Data on file. Top 2 box responses (very/somewhat comfortable). Sight Sciences, Inc. Internal Sales Data. SmartLids cumulative units sold since launch exceeds 70,000 as of June 30, 2025. Blackie CA, Carlson AN, Korb DR. Treatment for meibomian gland dysfunction and dry eye symptoms with a single-dose vectored thermal pulsation: a review. Curr Opin Ophthalmol. 2015 Jul;26(4):306-13. doi: 10.1097/ICU.0000000000000165. PMID: 26058030. Gupta PK, Holland EJ, Hovanesian J., et al. Cornea. 2022 Apr1;41(4):417-426. 16. Holland EJ, Loh J, Bloomenstein M, Thompson V, Wirta D, Dhamdhere K. A comparison of TearCare and LipiFlow systems in reducing dry eye disease symptoms associated with meibomian gland disease. Clin Ophthalmol. 2022 Aug 30; 16:2861-2871. Holland EJ, Loh J, Bloomenstein M, Thompson V, Wirta D, Dhamdhere K. A Comparison of TearCare and Lipiflow Systems in Reducing Dry Eye Disease Symptoms Associated with Meibomian Gland Disease. Clin Ophthalmol. 2022 Aug 30;16:2861-2871. doi: 10.2147/OPTH.S368319. PMID: 36065356; PMCID: PMC9440678. Korb DR, Blackie CA. Restoration of meibomian gland functionality with novel thermodynamic treatment device-a case report. Cornea. 2010 Aug;29(8):930-3. doi: 10.1097/ICO.0b013e3181ca36d6. PMID: 20531168. Michaelov E, McKenna C, Ibrahim P, Nayeni M, Dang A, Mather R. Sjögren’s Syndrome Associated Dry Eye: Impact on Daily Living and Adherence to Therapy. Journal of Clinical Medicine. 2022; 11(10):2809. Badawi D. A novel system, TearCare®, for the treatment of the signs and symptoms of dry eye disease. Clin Ophthalmol. 2018 Apr 10;12:683-694. Badawi D. TearCare® system extension study: evaluation of the safety, effectiveness, and durability through 12 months of a second TearCare® treatment on subjects with dry eye disease. Clin Ophthalmol. 2019 Jan 22;13:189-198. Karpecki P, Wirta D, Osmanovic S, Dhamdhere K. A Prospective, Post-Market, Multicenter Trial (CHEETAH) Suggested TearCare® System as a Safe and Effective Blink-Assisted Eyelid Device for the Treatment of Dry Eye Disease. Clin Ophthalmol. 2020 Dec 30;14:4551-4559. Gupta PK, Holland EJ, Hovanesian J, Loh J, Jackson MA, Karpecki PM, Dhamdhere K. TearCare for the Treatment of Meibomian Gland Dysfunction in Adult Patients With Dry Eye Disease: A Masked Randomized Controlled Trial. Cornea. 2022 Apr 1;41(4):417-426. Holland EJ, Loh J, Bloomenstein M, Thompson V, Wirta D, Dhamdhere K. A Comparison of TearCare and Lipiflow Systems in Reducing Dry Eye Disease Symptoms Associated with Meibomian Gland Disease. Clin Ophthalmol. 2022 Aug 30;16:2861-2871. LipiFlow is a registered trademark of Johnson & Johnson. Chester T, Ferguson T, Chester E. Localized Heat Treatment for Meibomian Gland Dysfunction: A Single-Center Retrospective Analysis of Efficacy over Time. Optom Vis Sci. 2023 Sep 1;100(9):625-630. Lighthizer N, Schwertz BK, Chester T, Longo R, Riley P, Mody L, Patel C. TearCare system versus cyclosporine ophthalmic emulsion for the treatment of moderate-to-severe meibomian gland disease associated dry eye disease in the United States: a cost-utility analysis. Expert Rev Pharmacoecon Outcomes Res. 2025 Jul 31:1-9.

Source Appendix Endpoints for SAHARA include superiority over Restasis at six months in our primary objective endpoint, tear break-up time. Study completed for 24 months to assess duration of effectiveness. In Stage 1, TearCare patients had a second treatment at month 5. In Stage, 2, patients previously treated with Restasis in Stage 1 were taken off Restasis at Month 6 and received a TearCare treatment, and their crossover results were first measured at month 9. 66% of TearCare® patients experienced dry eye relief for 2 years from study baseline. Study baseline refers to assessment at the start of SAHARA prior to any treatment and 5 months prior to the start of the Stage 3 durability stage. Months are measured from Study Baseline. Error bars are ± 1 standard deviation. Ocular Surface Disease Index is a commonly used patient-reported survey to assess dry eye severity. Gutgesell VJ et al. Am J Ophthalmol. 1982;94(3):383-387. Liu S, et al. Invest Ophthalmol Vis Sci. 2011;52(5):2727-2740. doi: 10.1167/iovs.10-6482. Finis D, et al Curr Eye Res. 2015;40(10):982-989. doi:10.3109/02713683.2014.971929. The Company expects full year 2025 revenue of approximately $72.0 to $76.0 million and adjusted operating expenses of $95.0 to $99.0 million, as of the Company’s Form 8-K filing dated August 27, 2025. The Company plans to update its guidance on its next earnings call to reflect TearCare market access. “Adjusted operating expenses” is a non-GAAP financial measure, which is calculated as operating expenses less stock-based compensation expense, depreciation and amortization, restructuring costs, and other one-time costs. For a reconciliation of adjusted operating expenses to operating expenses, please refer to our earnings release issued on August 7, 2025.