IN THE

UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

houston DIVISION

|

|

) | |

| In re: | ) | Chapter 11 |

| ) | ||

| NINE ENERGY SERVICE, INC., et al.,1 | ) | Case No. 26-[●] (___) |

| ) | ||

| Debtors. | ) | (Joint Administration Requested) |

| ) |

DISCLOSURE STATEMENT

FOR THE JOINT PREPACKAGED PLAN OF

REORGANIZATION OF NINE ENERGY SERVICE, INC.

AND ITS

DEBTOR AFFILIATES PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE

| KANE RUSSELL COLEMAN LOGAN PC | KIRKLAND & ELLIS LLP | |||

| John J. Kane (TX Bar No. 24066794) | KIRKLAND & ELLIS INTERNATIONAL LLP | |||

| Kyle Woodard (TX Bar No. 24102661) | Chad J. Husnick, P.C. (pro hac vice pending) | |||

| JaKayla J. DaBera (TX Bar No. 24129114) | 333 West Wolf Point Plaza | |||

| 901 Main Street, Suite 5200 | Chicago, Illinois 60654 | |||

| Dallas, Texas 75202 | Telephone: | (312) 862-2000 | ||

| Telephone: | (713) 425-7400 | Facsimile: | (312) 862-2200 | |

| Facsimile: | (713) 425-7700 | Email: | chad.husnick@kirkland.com | |

| Email: | jkane@krcl.com | |||

| kwoodard@krcl.com | ||||

| jdabera@krcl.com | ||||

| -and- | -and- | |||

| Michael P. Ridulfo (TX Bar No. 16902020) | Ross J. Fiedler (pro hac vice pending) | |||

| Sage Plaza, 5151 San Felipe, Suite 800 | 601 Lexington Avenue | |||

| Houston, Texas 77056 | New York, New York 10022 | |||

| Telephone: | (713) 425-7400 | Telephone: | (212) 446-4800 | |

| Facsimile: | (713) 425-7700 | Facsimile: | (212) 446-4900 | |

| Email: | mridulfo@krcl.com | Email: | ross.fiedler@kirkland.com | |

| Proposed Co-Counsel for the Debtors | Proposed Co-Counsel for the Debtors | |||

| and Debtors in Possession | and Debtors in Possession | |||

| 1 | A complete list of each of the Debtors in these Chapter 11 Cases may be obtained on the website of the Debtors’ claims and noticing agent at https://dm.epiq11.com/NineEnergy. The location of Nine Energy Service, Inc.’s principal place of business and the Debtors’ service address in these Chapter 11 Cases is 2001 Kirby Drive, Suite 200, Houston, TX 77019. |

THIS IS A SOLICITATION OF VOTES TO ACCEPT OR REJECT THE PLAN IN ACCORDANCE WITH BANKRUPTCY CODE SECTION 1125 AND WITHIN THE MEANING OF BANKRUPTCY CODE SECTION 1126, 11 U.S.C. §§ 1125, 1126. THIS DISCLOSURE STATEMENT HAS NOT YET BEEN APPROVED BY THE BANKRUPTCY COURT. THE DEBTORS INTEND TO SUBMIT THIS DISCLOSURE STATEMENT TO THE BANKRUPTCY COURT FOR APPROVAL FOLLOWING COMMENCEMENT OF SOLICITATION AND THE DEBTORS’ FILING FOR RELIEF UNDER CHAPTER 11 OF THE BANKRUPTCY CODE. THE INFORMATION IN THIS DISCLOSURE STATEMENT IS SUBJECT TO CHANGE. THIS DISCLOSURE STATEMENT IS NOT AN OFFER TO SELL ANY SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY ANY SECURITIES.

Important information about this Disclosure Statement

SOLICITATION OF VOTES ON THE JOINT PREPACKAGED PLAN OF REORGANIZATION OF NINE ENERGY SERVICE, INC. AND ITS DEBTOR AFFILIATES PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE FROM THE HOLDERS OF OUTSTANDING:

| VOTING CLASS | NAME OF CLASS UNDER THE PLAN |

| 4 | Senior Secured Notes Claims |

IF YOU ARE IN CLASS 4, YOU ARE RECEIVING THIS DOCUMENT AND THE ACCOMPANYING MATERIALS BECAUSE YOU ARE ENTITLED TO VOTE ON THE PLAN.

|

DELIVERY OF BALLOTS BY HOLDERS OF Senior Secured Notes Claims (as defined herein)

CLASS 4 BALLOTS of the aforementioned parties (such ballots, the “class 4 ballots”) MAY BE RETURNED iN ACCORDANCE WITH THE INSTRUCTIONS PROVIDED on or WITH THE BALLOTS. |

|

IF YOU HAVE ANY QUESTIONS REGARDING THE PROCEDURES FOR VOTING ON THE PLAN:

YOU CAN CONTACT THE CLAIMS AND NOTICING AGENT BY E-MAIL AT: BALLOTING@EPIQGLOBAL.COM (REFERENCING “IN RE: NINE – SOLICITATION INQUIRY” IN THE SUBJECT LINE). YOU

CAN ALSO CONTACT THE CLAIMS AND NOTICING AGENT BY PHONE TOLL- |

ii

Important information about this disclosure statement

THE DEBTORS ARE PROVIDING THIS DISCLOSURE STATEMENT TO HOLDERS OF CLAIMS FOR PURPOSES OF SOLICITING VOTES TO ACCEPT OR REJECT THE JOINT pREPACKAGED PLAN OF REORGANIZATION OF NINE ENERGY SERVICE, INC. AND ITS DEBTOR AFFILIATES PURSUANT TO CHAPTER 11 OF THE BANKRUPTCY CODE (AS MAY BE AMENDED, MODIFIED, OR SUPPLEMENTED FROM TIME TO TIME, AND INCLUDING ALL EXHIBITS AND SUPPLEMENTS THERETO, THE “PLAN”).2 THIS DISCLOSURE STATEMENT HAS NOT YET BEEN APPROVED BY THE BANKRUPTCY COURT. FUTURE APPROVAL OF THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE A GUARANTEE BY THE BANKRUPTCY COURT OF THE ACCURACY OR COMPLETENESS OF THE INFORMATION CONTAINED HEREIN OR AN ENDORSEMENT BY THE BANKRUPTCY COURT OF THE MERITS OF THE PLAN. THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT IS INCLUDED FOR PURPOSES OF SOLICITING VOTES FOR AND CONFIRMATION OF THE PLAN AND MAY NOT BE RELIED UPON OR USED BY ANY ENTITY FOR ANY OTHER PURPOSE.

BEFORE DECIDING WHETHER TO VOTE TO ACCEPT OR REJECT THE PLAN, EACH HOLDER OF A CLAIM ENTITLED TO VOTE ON THE PLAN SHOULD CAREFULLY CONSIDER ALL OF THE INFORMATION IN THIS DISCLOSURE STATEMENT, INCLUDING THE RISK FACTORS DESCRIBED IN ARTICLE IX HEREIN.

the debtors and certain holders of claims support the plan, including over 70% of the Senior Secured Notes Claims and 100% of the Prepetition ABL Claims. The debtors believe that the compromises contemplated under the plan are fair and equitable, maximize the value of the debtors’ estates, and provide the best possible recovery to stakeholders. at this time, the debtors believe the plan represents the best available option for completing the chapter 11 cases. the debtors strongly recommend that you vote to accept the plan.

HOLDERS OF CLAIMS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE. THE DEBTORS URGE EACH HOLDER OF A CLAIM entitled to vote ON the plan TO CONSULT WITH ITS OWN ADVISORS WITH RESPECT TO ANY LEGAL, FINANCIAL, SECURITIES, TAX, OR BUSINESS ADVICE IN REVIEWING THIS DISCLOSURE STATEMENT, THE PLAN, AND THE RESTRUCTURING TRANSACTIONS CONTEMPLATED THEREBY. FURTHERMORE, THE BANKRUPTCY COURT’S APPROVAL OF THE ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT (when and if approved) DOES NOT CONSTITUTE THE BANKRUPTCY COURT’S APPROVAL OF THE PLAN.

| 2 | Capitalized terms used but not otherwise defined in this Disclosure Statement have the meanings ascribed to such terms in the Plan or the RSA, as applicable. The summary of the Plan provided herein is qualified in its entirety by reference to the Plan. In the case of any inconsistency between this Disclosure Statement and the Plan, the Plan shall govern. |

iii

THIS DISCLOSURE STATEMENT CONTAINS, AMONG OTHER THINGS, SUMMARIES OF THE PLAN, CERTAIN STATUTORY PROVISIONS, AND CERTAIN ANTICIPATED EVENTS IN THE debtors’ forthcoming CHAPTER 11 CASES. ALTHOUGH THE DEBTORS BELIEVE THAT THESE SUMMARIES ARE FAIR AND ACCURATE, THESE SUMMARIES ARE QUALIFIED IN THEIR ENTIRETY TO THE EXTENT THAT THEY DO NOT SET FORTH THE ENTIRE TEXT OF SUCH DOCUMENTS OR STATUTORY PROVISIONS OR EVERY DETAIL OF SUCH ANTICIPATED EVENTS. the summaries of the financial information and the documents to this disclosure statement or otherwise incorporated herein by reference are qualified in their entirety by reference to those documents. IN THE EVENT OF ANY INCONSISTENCY OR DISCREPANCY BETWEEN A DESCRIPTION IN THIS DISCLOSURE STATEMENT AND THE TERMS AND PROVISIONS OF THE PLAN, the rsa, OR ANY OTHER DOCUMENTS INCORPORATED HEREIN BY REFERENCE, THE PLAN, the rsa, OR SUCH OTHER DOCUMENTS WILL GOVERN FOR ALL PURPOSES. FACTUAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT HAS BEEN PROVIDED BY THE DEBTORS’ MANAGEMENT EXCEPT WHERE OTHERWISE SPECIFICALLY NOTED. THE DEBTORS DO NOT REPRESENT OR WARRANT THAT THE INFORMATION CONTAINED HEREIN OR ATTACHED HERETO IS WITHOUT ANY MATERIAL INACCURACY OR OMISSION. EXCEPT AS OTHERWISE PROVIDED IN THE PLAN OR IN ACCORDANCE WITH APPLICABLE LAW, THE DEBTORS ARE UNDER NO DUTY TO UPDATE OR SUPpLeMENT THIS DISCLOSURE STATEMENT.

IN PREPARING THIS DISCLOSURE STATEMENT, THE DEBTORS RELIED ON FINANCIAL DATA DERIVED FROM THE DEBTORS’ BOOKS AND RECORDS AND ON VARIOUS ASSUMPTIONS REGARDING THE DEBTORS’ BUSINESS. WHILE THE DEBTORS BELIEVE THAT SUCH FINANCIAL INFORMATION FAIRLY REFLECTS THE FINANCIAL CONDITION OF THE DEBTORS AS OF THE DATE HEREOF AND THAT THE ASSUMPTIONS REGARDING FUTURE EVENTS REFLECT REASONABLE BUSINESS JUDGMENTS, NO REPRESENTATIONS OR WARRANTIES ARE MADE AS TO THE ACCURACY OF THE FINANCIAL INFORMATION CONTAINED HEREIN OR ASSUMPTIONS REGARDING THE DEBTORS’ BUSINESS AND THEIR FUTURE RESULTS AND OPERATIONS. THE DEBTORS EXPRESSLY CAUTION READERS NOT TO PLACE UNDUE RELIANCE ON ANY FORWARD-LOOKING STATEMENTS CONTAINED HEREIN.

THIS DISCLOSURE STATEMENT DOES NOT CONSTITUTE, AND MAY NOT BE CONSTRUED AS, AN ADMISSION OF FACT, LIABILITY, STIPULATION, OR WAIVER. THE DEBTORS or any other Authorized Party MAY SEEK TO INVESTIGATE, FILE, AND PROSECUTE CLAIMS AND MAY OBJECT TO CLAIMS AFTER THE CONFIRMATION OR EFFECTIVE DATE OF THE PLAN IRRESPECTIVE OF WHETHER THIS DISCLOSURE STATEMENT IDENTIFIES ANY SUCH CLAIMS OR OBJECTIONS TO CLAIMS.

THE DEBTORS ARE MAKING THE STATEMENTS AND PROVIDING THE FINANCIAL INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT AS OF THE DATE HEREOF, UNLESS OTHERWISE SPECIFICALLY NOTED. there is no assurance that the statements contained herein will be correct at any time after such date. ALTHOUGH THE DEBTORS MAY SUBSEQUENTLY UPDATE THE INFORMATION IN THIS DISCLOSURE STATEMENT, THE DEBTORS HAVE NO AFFIRMATIVE DUTY TO DO SO, AND EXPRESSLY DISCLAIM ANY DUTY TO PUBLICLY UPDATE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE. HOLDERS OF CLAIMS OR INTERESTS REVIEWING THIS DISCLOSURE STATEMENT SHOULD NOT INFER THAT, AT THE TIME OF THEIR REVIEW, THE FACTS SET FORTH HEREIN HAVE NOT CHANGED SINCE THIS DISCLOSURE STATEMENT WAS FILED. INFORMATION CONTAINED HEREIN IS SUBJECT TO COMPLETION, MODIFICATION, OR AMENDMENT. THE DEBTORS RESERVE THE RIGHT TO FILE or distribute AN AMENDED OR MODIFIED PLAN AND RELATED DISCLOSURE STATEMENT, FROM TIME TO TIME, SUBJECT TO THE TERMS OF THE PLAN and the RSA.

iv

THE DEBTORS HAVE NOT AUTHORIZED ANY ENTITY TO GIVE ANY INFORMATION ABOUT OR CONCERNING THE PLAN or the rsa OTHER THAN THAT WHICH IS CONTAINED IN THIS DISCLOSURE STATEMENT. THE DEBTORS HAVE NOT AUTHORIZED ANY DISCLOSURE or representations CONCERNING THE DEBTORS OR THE VALUE OF THEIR PROPERTY OTHER THAN AS SET FORTH IN THIS DISCLOSURE STATEMENT.

IF THE PLAN IS CONFIRMED BY THE BANKRUPTCY COURT AND THE EFFECTIVE DATE OCCURS, ALL HOLDERS OF CLAIMS OR INTERESTS (INCLUDING THOSE HOLDERS OF CLAIMS OR INTERESTS WHO DO NOT SUBMIT BALLOTS TO ACCEPT OR REJECT THE PLAN, who vote to reject the Plan, or WHO ARE NOT ENTITLED TO VOTE ON THE PLAN) WILL BE BOUND BY THE TERMS OF THE PLAN AND THE RESTRUCTURING TRANSACTIONS CONTEMPLATED THEREBY.

The confirmation and effectiveness of the Plan are subject to certain material conditions precedent described herein and set forth in Article IX of the Plan. There is no assurance that the Plan will be confirmed, or if confirmed, that the conditions required to be satisfied for the Plan to go effective will be satisfied (or waived).

You are encouraged to read the Plan, the RSA, and this Disclosure Statement in their entirety, including Article IX herein, entitled “RISK FACTORS” before submitting your ballot TO vote on the Plan.

THIS DISCLOSURE STATEMENT HAS BEEN PREPARED IN ACCORDANCE WITH SECTION 1125 OF THE BANKRUPTCY CODE AND BANKRUPTCY RULE 3016(b) AND IS NOT NECESSARILY PREPARED IN ACCORDANCE WITH FEDERAL OR STATE SECURITIES LAWS OR OTHER SIMILAR LAWS. This Disclosure Statement has not been approved or disapproved by the United States Securities and Exchange Commission (THE “sec”) or any similar federal, state, local, or foreign regulatory agency, nor has the SEC or any other agency passed upon the accuracy or adequacy of the statements contained in this Disclosure Statement. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Debtors have sought to ensure the accuracy of the financial information provided in this Disclosure Statement; however, the financial information contained in this Disclosure Statement or incorporated herein by reference has not been, and will not be, audited or reviewed by the Debtors’ independent auditors unless explicitly provided otherwise HEREIN.

v

Upon Confirmation of the Plan, certain of the securities described or otherwise contemplated in this Disclosure Statement will be issued without registration under the Securities Act of 1933, AS AMENDED (together with the rules and regulations promulgated thereunder, the “Securities Act”), or similar federal, state, local, or foreign laws in reliance on the exemption set forth in section 1145 of the Bankruptcy Code to the extent permitted under applicable law, section 4(a)(2) of the securities act, regulation d promulgated thereunder (“Regulation D”), regulation s under the securities act (“Regulation S”), and/or other available exemptions from registration. Other Securities may be issued pursuant to other applicable exemptions under the federal securities laws. If exemptions from registration under section 1145 of the Bankruptcy Code, section 4(a)(2) of the securities act, regulation d promulgated thereunder, regulation s under the securities act, or applicable federal securities law do not apply, the Securities described or otherwise contemplated in this disclosure statement may not be offered or sold except UNDER a valid exemption or upon registration under the Securities Act. The Debtors recommend that potential recipients of Securities issued under the Plan consult their own LAWYER concerning their ability to freely trade such Securities in compliance with the federal securities laws and any applicable “Blue Sky” laws. The Debtors make no representation concerning the ability of a person to dispose of such Securities.

The Debtors make statements in this Disclosure Statement that are considered forward-looking statements under federal securities laws. The Debtors consider all statements regarding anticipated or future matters, including the following, to be forward-looking statements. Although the debtors believe the expectations reflected in such forward-looking statements are based on reasonable assumptions, the debtors can give no assurance that their expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. forward-looking statements may include, but are not limited to, statements about:

| · | THE DEBTORS’ PLANS, OBJECTIVES, INTENTIONS, AND EXPECTATIONS; |

| · | THE DEBTORS’ BUSINESS STRATEGY; |

| · | THE DEBTORS’ FINANCIAL STRATEGY, BUDGET, AND PROJECTIONS; |

| · | THE DEBTORS’ FINANCIAL CONDITION, REVENUES, CASH FLOWS, AND EXPENSES; |

| · | THE DEBTORS’ LEVELS OF INDEBTEDNESS, LIQUIDITY, AND COMPLIANCE WITH DEBT COVENANTS; |

| · | THE SUCCESS AND COSTS OF THE DEBTORS’ OPERATIONS; |

| · | UNCERTAINTY REGARDING THE DEBTORS’ FUTURE OPERATING RESULTS; |

| · | THE AMOUNT, NATURE, AND TIMING OF THE DEBTORS’ CAPITAL EXPENDITURES; |

| · | THE AVAILABILITY AND TERMS OF CAPITAL; |

vi

| · | GENERAL ECONOMIC AND BUSINESS CONDITIONS (INCLUDING WITH RESPECT TO NON-U.S. CURRENCY FLUCTUATIONS, TARIFFS, AND/OR TRADE NEGOTIATIONS, PARTICULARLY WITH RESPECT TO ANY NON-U.S. MARKETS WHERE THE DEBTORS CONDUCT BUSINESS); |

| · | THE EFFECTIVENESS OF THE DEBTORS’ RISK MANAGEMENT ACTIVITIES; |

| · | THE DEBTORS’ COUNTERPARTIES’ CREDIT RISK; |

| · | THE OUTCOME OF PENDING AND FUTURE LITIGATION CLAIMS OR ANY REGULATORY PROCEEDINGS; |

| · | THE GOVERNMENTAL REGULATIONS AND TAXATION APPLICABLE TO THE DEBTORS, INCLUDING ANY CHANGES THERETO; |

| · | THE OVERALL HEALTH OF THE OIL AND GAS INDUSTRY AND THE PRICE OF OIL AND NATURAL GAS; |

| · | THE POTENTIAL ADOPTION OF NEW GOVERNMENTAL REGULATIONS; AND |

| · | THE DEBTORS’ ABILITY TO SATISFY FUTURE CASH OBLIGATIONS. |

Statements concerning these and other matters are not guarantees of the Reorganized Debtors’ future performance. There are risks, uncertainties, and other important factors that could cause the Reorganized Debtors’ or company’s actual performance or achievements to be different from those they may project, and the Debtors undertake no obligation to update the projections made herein. These risks, uncertainties, and factors may include the following: the Debtors’ ability to confirm and consummate the Plan; the potential that THE DEBTORS MAY NEED TO PURSUE AN ALTERNATIVE TRANSACTION IF THE PLAN IS NOT CONFIRMED; the Debtors’ ability to reduce their overall financial leverage; the potential adverse impact of the Chapter 11 Cases on the Debtors’ operations, management, and employees; the risks associated with operating the Debtors’ business during the Chapter 11 Cases; THE DEBTORS’ INABILITY TO MAINTAIN RELATIONSHIPS WITH SUPPLIERS, EMPLOYEES, AND other third parties as a result of this chapter 11 filing or those parties’ failure to comply with their contractural obligations; customer responses to the Chapter 11 Cases; the Debtors’ inability to discharge or settle Claims during the Chapter 11 Cases; general economic, business, and market conditions; currency fluctuations; interest rate fluctuations; price increases; exposure to litigation; a decline in the Debtors’ market share due to competition; the Debtors’ ability to implement cost reduction initiatives in a timely manner; financial conditions of the Debtors’ customers; adverse tax changes; limited access to capital resources; changes in domestic and foreign laws and regulations; the possibility that foreign courts will not enforce the confirmation order; trade balance; natural disasters; PANDEMICS; geopolitical instability; government shutdowns; and the effects of governmental regulation on the Debtors’ business.

vii

You are cautioned that all forward-looking statements are necessarily speculative, and there are certain risks and uncertainties that could cause actual events or results to differ materially from those referred to in such forward-looking statements. The projections and forward-looking information contained or incorporated by reference herein and attached hereto are only estimates, and the timing and amount of actual distributions to Holders of Allowed Claims and Allowed Interests, among other things, may be affected by many factors that cannot be predicted. Any analyses, estimates, or recovery projections may or may not turn out to be accurate.

|

Recommendation by the Debtors

each debtor’s board of MANAGERS, BOARD OF DIRECTORS, DIRECTOR, MANAGING DIRECTOR, OR MANAGER, as applicable, has approved the restructuring transactions contemplated by the plan and described in THIS disclosure statement. each Debtor believes that the compromises contemplated by the restructuring transactions are fair and equitable, maximize the value of each Debtor’s ASSETS, and provide the best recovery to the DEBTORS’ STAKEholders. At this time, each Debtor believes that the restructuring transactions represent the best alternative for accomplishing the Debtors’ overall restructuring objectives.

EACH OF THE DEBTORS THEREFORE STRONGLY RECOMMENDS THAT ALL HOLDERS OF CLAIMS WHOSE VOTES ON THE PLAN ARE BEING SOLICITED ACCEPT THE PLAN by returning their ballot so as to be actually received by the Claims and Noticing Agent no later than THE VOTING DEADLINE (march 2, 2026, at 11:59 P.m. (prevailing central Time)) pursuant to the instructions set forth herein and In the SOLICITATION MATERIALS, INCLUDING IN YOUR BALLOT.

|

viii

Special Notice Regarding Federal and State Securities Laws

The Bankruptcy Court has not reviewed this Disclosure Statement or the Plan, and the securities to be issued pursuant to the Plan on or after the Effective Date will not have been the subject of a registration statement filed with the SEC under the Securities Act, any securities regulatory authority of any state under any state securities law (“Blue Sky Laws”), or the securities laws of any other jurisdiction. The Plan has not been approved or disapproved by the SEC, any state regulatory authority, or the regulatory authority of any jurisdiction and neither the SEC, any state regulatory authority, nor any other regulatory authority in any jurisdiction has passed upon the accuracy or adequacy of the information contained in this Disclosure Statement or the Plan. Any representation to the contrary is a criminal offense. The securities may not be offered or sold within the United States or to, or for the account or benefit of, United States persons (as defined in Regulation S under the Securities Act), except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable laws of other jurisdictions.

After the Petition Date, the Debtors will rely on section 1145(a) of the Bankruptcy Code to exempt from registration under the Securities Act and Blue Sky Laws the offer, issuance, and distribution, if applicable, of securities under the Plan, and to the extent such exemption is not available, then such securities will be offered, issued, and distributed under the Plan pursuant to section 4(a)(2) of the Securities Act, Regulation D promulgated thereunder, Regulation S under the Securities Act, and/or other applicable exemptions from registration under the Securities Act and any other applicable securities laws. Neither the Solicitation nor this Disclosure Statement constitutes an offer to sell or the solicitation of an offer to buy securities in any state or jurisdiction in which such offer or solicitation is not authorized.

Securities issued pursuant to the exemption from registration set forth in section 4(a)(2) of the Securities Act, Regulation D promulgated thereunder, Regulation S under the Securities Act, and/or other available exemptions from registration will be considered “restricted securities,” will bear customary legends and transfer restrictions, and may not be transferred except pursuant to an effective registration statement or under an available exemption from the registration requirements of the Securities Act and may be subject to any additional restrictions on the transferability of such securities pursuant to the applicable underlying documentation.

EACH RECIPIENT HEREBY ACKNOWLEDGES THAT IT (A) IS AWARE THAT THE FEDERAL SECURITIES LAWS OF THE UNITED STATES PROHIBIT ANY PERSON (AS DEFINED IN SECTION 101(41) OF THE BANKRUPTCY CODE, A “PERSON”) WHO HAS MATERIAL NON-PUBLIC INFORMATION ABOUT A COMPANY, WHICH IS OBTAINED FROM THE COMPANY OR ITS REPRESENTATIVES, FROM PURCHASING OR SELLING SECURITIES OF SUCH COMPANY OR FROM COMMUNICATING THE INFORMATION TO ANY OTHER PERSON UNDER CIRCUMSTANCES IN WHICH IT IS REASONABLY FORESEEABLE THAT SUCH PERSON IS LIKELY TO PURCHASE OR SELL SUCH SECURITIES AND (B) IS FAMILIAR WITH THE SECURITIES EXCHANGE ACT OF 1934, AS AMENDED (THE “EXCHANGE ACT”), AND THE RULES AND REGULATIONS PROMULGATED THEREUNDER, AND AGREES THAT IT WILL NOT USE OR COMMUNICATE TO ANY PERSON OR ENTITY, UNDER CIRCUMSTANCES WHERE IT IS REASONABLY LIKELY THAT SUCH PERSON OR ENTITY IS LIKELY TO USE OR CAUSE ANY PERSON OR ENTITY TO USE, ANY CONFIDENTIAL INFORMATION IN CONTRAVENTION OF THE EXCHANGE ACT OR ANY OF ITS RULES AND REGULATIONS, INCLUDING RULE 10B-5 PROMULGATED THEREUNDER.

ix

TABLE OF CONTENTS

| Page | |||

| I. | INTRODUCTION | 1 | |

| II. | PRELIMINARY STATEMENT | 2 | |

| III. | QUESTIONS AND ANSWERS REGARDING THIS DISCLOSURE STATEMENT AND THE PLAN | 4 | |

| A. | What is chapter 11? | 4 | |

| B. | Why are the Debtors sending me this Disclosure Statement? | 5 | |

| C. | Why are votes being solicited prior to Bankruptcy Court approval of this Disclosure Statement? | 5 | |

| D. | What are the Restructuring Transactions under the Plan? | 5 | |

| E. | Am I entitled to vote on the Plan? | 5 | |

| F. | Controversy Concerning Impairment. | 6 | |

| G. | Special Provision Governing Unimpaired Claims. | 6 | |

| H. | What is the deadline to vote on the Plan? | 6 | |

| I. | How do I vote for or against the Plan? | 6 | |

| J. | Why is the Bankruptcy Court holding a Combined Hearing? | 7 | |

| K. | What is the purpose of the Combined Hearing? | 7 | |

| L. | Who do I contact if I have additional questions with respect to this Disclosure Statement or the Plan? | 7 | |

| M. | What will I receive from the Debtors if the Plan is consummated? | 7 | |

| N. | What will I receive from the Debtors if I hold an Allowed Administrative Claim, DIP Claim, Professional Fee Claim, or a Priority Tax Claim? | 10 | |

| O. | Are any regulatory approvals required to consummate the Plan? | 12 | |

| P. | What happens to my recovery if the Plan is not confirmed or does not go effective? | 12 | |

| Q. | If the Plan provides that I get a distribution, do I get it upon Confirmation or when the Plan goes effective, and what is meant by “Confirmation,” “Effective Date,” and “Consummation?” | 12 | |

| R. | What are the sources of Cash and other consideration required to fund the Plan? | 12 | |

| S. | Are there risks to owning the New Equity Interests upon the Debtors’ emergence from chapter 11? | 12 | |

| T. | Is there potential litigation related to the Plan? | 13 | |

| U. | What is the Management Incentive Plan and how will it affect the distribution I receive under the Plan? | 13 | |

| V. | Does the Plan preserve Causes of Action? | 13 | |

| W. | Will there be releases, exculpation, and injunction granted to parties in interest as part of the Plan? | 14 | |

| X. | What Are the Consequences of Opting Out of the Releases Provided by the Plan? | 20 | |

| Y. | Does the Bankruptcy Code protect against discriminatory treatment? | 20 | |

| Z. | Will the Company retain documents after any Effective Date? | 20 | |

| AA. | What is the effect of Reimbursement or Contribution? | 20 | |

| BB. | What is the effect of the Plan on the Debtors’ capital structure? | 21 | |

| CC. | What is the effect of the Plan on the Debtors’ ongoing business? | 21 | |

| DD. | Will any party have significant influence over the corporate governance and operations of the Reorganized Debtors? | 21 | |

| EE. | Do the Debtors recommend voting in favor of the Plan? | 21 | |

| FF. | Who Supports the Plan? | 22 | |

x

| IV. | CORPORATE HISTORY AND BUSINESS OPERATIONS | 22 | |

| A. | Corporate History | 22 | |

| B. | The Company’s Business and Operations | 23 | |

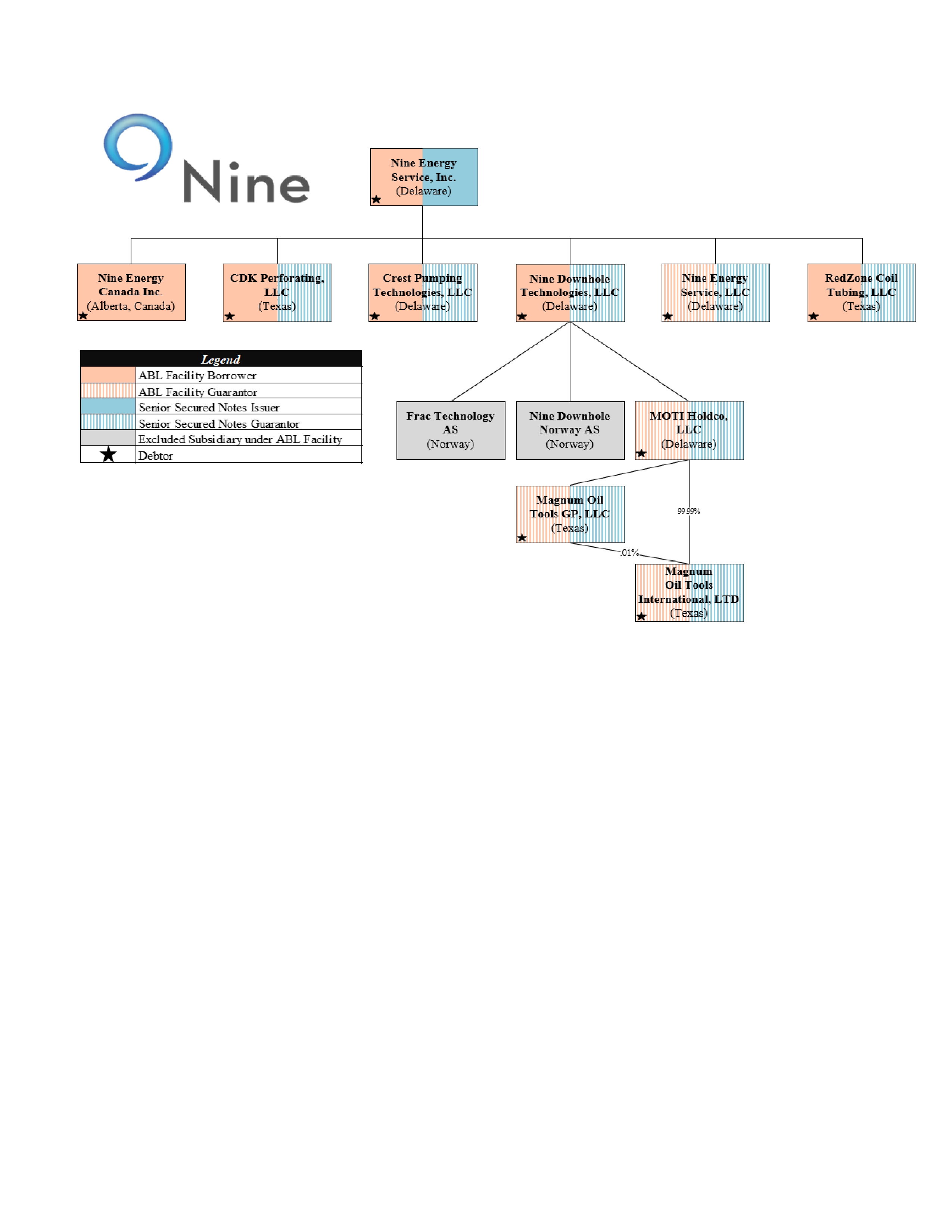

| C. | The Company’s Prepetition Corporate Structure | 25 | |

| D. | The Company’s Prepetition Capital Structure | 25 | |

| V. | EVENTS LEADING TO the CHAPTER 11 CASES | 27 | |

| A. | Prepetition Challenges | 27 | |

| B. | Prepetition Initiatives and the Path Forward in Chapter 11 | 29 | |

| VI. | MATERIAL DEVELOPMENTS AND ANTICIPATED EVENTS OF THE CHAPTER 11 CASES | 33 | |

| A. | First Day Relief | 33 | |

| B. | Proposed Confirmation Schedule | 33 | |

| VII. | THE DEBTORS’ PLAN | 34 | |

| A. | General Settlement of Claims and Interests | 34 | |

| B. | Restructuring Transactions | 35 | |

| C. | Reorganized Debtors | 35 | |

| D. | Sources of Consideration for Plan Distributions | 35 | |

| E. | Corporate Existence | 37 | |

| F. | Vesting of Assets in the Reorganized Debtors | 38 | |

| G. | Cancellation of Existing Securities, Agreements, and Interests | 38 | |

| H. | Corporate Action | 39 | |

| I. | New Organizational Documents | 39 | |

| J. | Directors and Officers of the Reorganized Debtors | 39 | |

| K. | Effectuating Documents; Further Transactions | 40 | |

| L. | Certain Securities Law Matters | 40 | |

| M. | Section 1146 Exemption | 41 | |

| N. | Employee Compensation and Benefits | 42 | |

| O. | Director and Officer Liability Insurance | 42 | |

| P. | Cashless Transactions. | 43 | |

| VIII. | OTHER KEY ASPECTS OF THE PLAN | 43 | |

| A. | Treatment of Executory Contracts and Unexpired Leases | 43 | |

| B. | Provisions Governing Distributions | 46 | |

| C. | Procedures for Resolving Contingent, Unliquidated, and Disputed Claims | 50 | |

| D. | Conditions Precedent to Confirmation and Consummation of the Plan | 52 | |

| E. | Modification, Revocation, or Withdrawal of the Plan | 54 | |

| F. | Other Claims and Interest Classification and Treatment Features | 55 | |

| IX. | RISK FACTORS | 56 | |

| A. | Bankruptcy Law Considerations | 56 | |

| B. | Risks Related to Recoveries Under the Plan | 63 | |

| C. | Risks Related to the Debtors’ and the Reorganized Debtors’ Business | 65 | |

| D. | Risks Related to the Offer and Issuance of Securities Under the Plan | 72 | |

xi

| X. | SOLICITATION AND VOTING PROCEDURES | 73 | |

| A. | Holders of Claims Entitled to Vote on the Plan | 74 | |

| B. | Voting Record Date | 74 | |

| C. | Voting on the Plan. | 74 | |

| D. | Ballots Not Counted. | 74 | |

| E. | Votes Required for Acceptance by a Class. | 75 | |

| F. | Solicitation Procedures. | 75 | |

| XI. | CONFIRMATION OF THE PLAN | 76 | |

| A. | The Combined Hearing. | 76 | |

| B. | Requirements for Confirmation of the Plan | 76 | |

| C. | Best Interests of Creditors/Liquidation Analysis | 76 | |

| D. | Valuation Analysis. | 77 | |

| E. | Feasibility | 77 | |

| F. | Acceptance by Impaired Classes | 77 | |

| G. | Confirmation Without Acceptance by All Impaired Classes | 78 | |

| XII. | CERTAIN SECURITIES LAW MATTERS | 79 | |

| A. | New Equity Interests. | 79 | |

| B. | Exemption from Registration Requirements; Issuance of New Equity Interests and Other Securities Under the Plan. | 79 | |

| C. | Resales of New Equity Interests and Other Securities; Definition of “Underwriter” Under Section 1145(b) of the Bankruptcy Code. | 80 | |

| XIII. | CERTAIN UNITED STATES FEDERAL INCOME TAX CONSEQUENCES OF THE PLAN | 84 | |

| A. | Introduction. | 84 | |

| B. | Certain U.S. Federal Income Tax Consequences of the Plan to the Debtors and Reorganized Debtors. | 85 | |

| C. | Certain U.S. Federal Income Tax Consequences to U.S. Holders of Allowed Class 4 Claims. | 88 | |

| D. | Certain U.S. Federal Income Tax Consequences of the Plan to Non-U.S. Holders of Allowed Claims. | 91 | |

| E. | FACTA. | 94 | |

| F. | U.S. Information Reporting and Back-Up Withholding. | 95 | |

| XIV. | RECOMMENDATION | 95 | |

xii

EXHIBITS3

| EXHIBIT A | Plan of Reorganization |

| EXHIBIT B | RSA |

| EXHIBIT C | Financial Projections |

| EXHIBIT D | Liquidation Analysis |

| EXHIBIT E | Valuation Analysis |

| EXHIBIT F | Organizational Chart |

| 3 | Each Exhibit is incorporated herein by reference. |

xiii

| I. | INTRODUCTION. |

Nine Energy Service, Inc. (“Nine Energy Service”) and its affiliated debtors and debtors in possession in the above-captioned cases (collectively, the “Debtors” and, together with their non-Debtor affiliates, “Nine” or the “Company”), are pursuing proposed restructuring and recapitalization transactions (the “Restructuring Transactions”) pursuant to the terms and conditions set forth in that certain Restructuring Support Agreement by and among the Company and the Consenting Stakeholders (as may be amended, supplemented, or otherwise modified from time to time, and including all schedules, exhibits, and annexes thereto, the “RSA”), attached hereto as Exhibit B.

Pursuant to the RSA, the Debtors have launched a solicitation of votes to accept or reject the Plan (the “Solicitation”) to Holders of Senior Secured Notes Claims. The Debtors intend to submit this disclosure statement (as amended, supplemented, or otherwise modified from time to time, this “Disclosure Statement”) pursuant to section 1125 of the Bankruptcy Code, to Holders of Senior Secured Notes Claims in connection with the Solicitation. A copy of the Plan is attached hereto as Exhibit A and incorporated herein by reference.

In connection with the RSA, and to seek Confirmation and Consummation of the Plan, the Debtors intend to promptly commence voluntary cases (the “Chapter 11 Cases”) under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”).

THE DEBTORS AND THE CONSENTING STAKEHOLDERS THAT HAVE EXECUTED THE RSA, BELIEVE THAT THE COMPROMISES CONTEMPLATED UNDER THE PLAN ARE FAIR AND EQUITABLE, MAXIMIZE THE VALUE OF THE DEBTORS’ ESTATES, AND PROVIDE THE BEST AVAILABLE RECOVERY TO STAKEHOLDERS. AT THIS TIME, THE DEBTORS BELIEVE THE PLAN REPRESENTS THE BEST AVAILABLE OPTION FOR COMPLETING THE CHAPTER 11 CASES. THE DEBTORS STRONGLY RECOMMEND THAT YOU VOTE TO ACCEPT THE PLAN.

1

| II. | PRELIMINARY STATEMENT. |

The Company intends to file the Chapter 11 Cases to implement a comprehensive financial restructuring that will enable it to continue its history of innovation and success.

Nine Energy Service is a publicly traded company listed on the New York Stock Exchange (the “NYSE”) under the symbol “NINE.” Along with its subsidiaries, Nine is an oilfield services (“OFS”) business that supplies cutting edge solutions for unconventional oil and gas resource extraction and development across North America and abroad. The Company partners with exploration and production (“E&P”) customers to design and deploy downhole solutions and technology to prepare horizontal, multistage wells for production. Through its asset-light business model, advanced technological offerings, diversified business lines, and highly experienced management team, Nine provides customers with cost-effective and comprehensive completion solutions designed to maximize production levels and operating efficiencies. Nine’s culture is driven by an intense focus on performance and wellsite execution as well as a commitment to forward-leaning technologies that aid the development of smarter, customized applications that drive efficiencies and reduced emissions for clients.

Headquartered in Houston, Texas, Nine employs approximately 1,100 full-time employees and engages approximately 30 independent contractors. Over a decade of organic growth and targeted acquisitions have brought Nine to where it is today, with an operational reach that extends across all major onshore basins in the United States and Canada, as well as abroad, with a research and development (“R&D”) facility in Norway to help serve the international markets. Nine’s customer-focused approach has solidified its place in the industry as a trusted partner.

Despite the Company’s positive gross profit generation, a confluence of factors contributed to Nine’s present need to comprehensively restructure its balance sheet. First, an overleveraged capital structure created high interest expense costs for the Company over the past several years, which limited Nine’s ability to achieve levered free cash flow and reinvest in its businesses. Second, the oil and gas industry continues to experience challenging macroeconomic conditions, as major oil indexes suffer persistent pricing declines, leading many E&P companies to reduce their drilling and completion programs. Nine’s financial success is highly predicated on active drilling rigs and fracturing fleets. The Company’s management team estimates, out of an abundance of caution, that these conditions will persist through 2026, which will continue to put pressure on the Company’s gross margins. Finally, OFS companies rely on consolidation through merger activity to scale to relevance with both investors and customers, especially as their E&P customers similarly consolidate. For Nine, these growth opportunities remain largely closed off today due to its leverage profile, annualized debt interest expense, and near-term debt maturities.

The combination of macroeconomic and industry-specific challenges limits the Company’s optionality going forward. As Nine falls behind, competitors able to scale through organic growth and acquisition threaten to capture more of the total addressable market. And without the ability to unlock additional liquidity or deleverage, the Company lacks the resources to meaningfully invest in its people, R&D, and assets to maintain a leading technological position in the industry. These headwinds caused consistent declines in the Company’s share price over the last few years, which recently triggered non-compliance with the listing standards of the NYSE.

Understanding that its leverage profile constrained its ability to address issues within its control, Nine engaged restructuring advisors in late 2025 to explore strategic and financial alternatives aimed at refinancing or restructuring its debt obligations with minimal disruption to its business operations. The Company, with the assistance of its advisors, thoroughly evaluated all available options, including out-of-court refinancing opportunities. But in the face of continued industry headwinds and a declining stock price, the Company determined that an in-court restructuring providing for the complete equitization of its Senior Secured Notes would best allow it to substantially deleverage its capital structure and position it for long-term success.

2

In November 2025, the Company and its advisors engaged an ad hoc group of holders of the Company’s Senior Secured Notes (the “Ad Hoc Group”), who organized with Milbank LLP as counsel and Houlihan Lokey Capital, Inc. as financial advisor (collectively, the “Ad Hoc Group Advisors”). The Company submitted a non-binding proposal to the restricted members of the Ad Hoc Group for a comprehensive deleveraging transaction to be effectuated through a quick, prepackaged chapter 11 plan. At the same time, the Company engaged with the Prepetition ABL Lenders on the terms of a financing package to fund both a chapter 11 process and the reorganized Nine’s go-forward operations. Following months of hard-fought, arm’s-length negotiations, the Debtors, the Prepetition ABL Lenders, and members of the Ad Hoc Group holding more than 70% of the claims arising under the Senior Secured Notes (the “Consenting Noteholders”) entered into the RSA.

Nine plans to commence prepackaged Chapter 11 Cases to effectuate the carefully negotiated and comprehensive balance sheet restructuring embodied by the RSA, which will ensure its long-term viability. Pursuant to the RSA, the Company’s existing ABL lenders, White Oak ABL 3, LLC and White Oak Europe ABL Limited (collectively, the “Prepetition ABL Lenders”), and the Ad Hoc Group have agreed to support the Plan and, in the case of the members of the Ad Hoc Group, to vote in favor of the Plan. The key terms of the RSA include:

| · | the Prepetition ABL Lenders will provide a senior secured superpriority asset-based DIP Facility with an aggregate principal commitment of $125 million on the terms set forth in the DIP Documents. The DIP Facility shall be used for (i) working capital and corporate purposes of the Debtors, (ii) bankruptcy-related costs and expenses in respect of the Chapter 11 Cases, (iii) costs and expenses related to the DIP Facility, and (iv) refinancing all Obligations under the Prepetition ABL Facility; |

| · | on the Effective Date, the DIP Facility shall convert into the Exit ABL Facility with an aggregate principal commitment of $135 million and secured by a first lien security interest on substantially all assets of Reorganized Debtors; |

| · | each Holder of an Allowed Prepetition ABL Claim shall be paid in full in cash to the extent not converted into DIP Claims in accordance with the DIP Documents; |

| · | each Holder of Senior Secured Notes Claim shall receive, in full and final satisfaction, settlement, release, and discharge of, and in exchange for, its pro rata share of 100% of the New Equity Interests, which shall be distributed ratably on account of the Allowed Senior Secured Notes Claims and subject to dilution by the Management Incentive Plan; |

| · | General Unsecured Claims will be unimpaired; and |

| · | on the Effective Date, the Nine Energy Equity Interests shall be cancelled, released, discharged, extinguished, and of no further force or effect, and such holder shall not receive any distribution, property, or other value under the Plan on account of such Nine Energy Equity Interests. |

Not only will the Restructuring Transactions contemplated by the RSA and embodied in the Plan deleverage the Company, but they will also provide adequate liquidity upon emergence through an upsized asset-based loan facility, the Exit ABL Facility, provided by the Prepetition ABL Lenders. Critically, all general unsecured creditors, including the Company’s key trade vendors, are unimpaired under the Plan.

3

To fund these cases and instill confidence in the Company’s customers, vendors, and other key stakeholders, the Company negotiated a debtor-in-possession financing package with the Prepetition ABL Lenders, which will provide the Company access to a $125 million asset-based revolving loan facility on terms substantially consistent with the Prepetition ABL Facility. Through the Restructuring Transactions, Nine will emerge from these Chapter 11 Cases healthier and having instilled renewed confidence in key customers, vendors, and other stakeholders that are critical to the Company’s long-term operational goals.

Given the high level of consensus for the Restructuring Transactions and the need to limit the cost and disruption of these Chapter 11 Cases, the Company intends to proceed through these cases quickly and efficiently. The agreement of the Company’s key constituencies to advance these Chapter 11 Cases expeditiously is memorialized by various milestones in the RSA and the DIP Facility. To meet those milestones and minimize the effect of the Chapter 11 Cases on the Company and its businesses, the Debtors successfully launched Solicitation prior to the commencement the Chapter 11 Cases. On February 1, 2026, the Debtors commenced service of the Solicitation Package (as defined herein), including this Disclosure Statement, the Plan, the various exhibits to those documents, a ballot to vote to accept or reject the Plan, and instructions regarding the voting process, pursuant to sections 1125 and 1126(b) of the Bankruptcy Code on holders of Senior Secured Notes entitled to vote on the Plan. The Debtors request that such holders submit their ballots by March 2, 2026 (the “Voting Deadline”). And though Solicitation remains ongoing, the Consenting Noteholders who hold more than 70% of the claims in Class 4 of the Plan—the only Voting Class—have committed to vote in favor of the Plan through the RSA.

The Restructuring Transactions will preserve over 1,000 jobs and maximize the value of the Company for the benefit of all stakeholders. With a deleveraged balance sheet and access to additional liquidity through the Exit ABL Facility, Nine is best positioned to continue to build on over a decade of providing the highest quality and most advanced completion services in the industry.

|

FOR THESE REASONS, THE DEBTORS STRONGLY RECOMMEND THAT HOLDERS OF CLAIMS ENTITLED TO VOTE ON THE PLAN VOTE TO ACCEPT THE PLAN. |

| III. | QUESTIONS AND ANSWERS REGARDING THIS DISCLOSURE STATEMENT AND THE PLAN. |

| A. | What is chapter 11? |

Chapter 11 is the principal business reorganization chapter of the Bankruptcy Code. In addition to permitting debtor rehabilitation, chapter 11 promotes equal treatment for similarly situated creditors and equity holders, subject to the priority of distributions prescribed by the Bankruptcy Code.

The commencement of a chapter 11 case creates an estate that comprises all of the legal and equitable interests of the debtor as of the date the chapter 11 case is commenced. The Bankruptcy Code provides that a debtor may continue to operate its business and remain in possession of its property as a “debtor in possession.”

Consummating a chapter 11 plan is the principal objective of a chapter 11 case. A bankruptcy court’s confirmation of a plan binds the debtor, any person acquiring property under the plan, any creditor or equity holder of the debtor (whether or not such creditor or equity holder voted to accept the plan), and any other entity as may be ordered by the bankruptcy court. Subject to certain limited exceptions, the order issued by a bankruptcy court confirming a plan provides for the treatment of the debtor’s liabilities in accordance with the terms of the confirmed plan.

4

| B. | Why are the Debtors sending me this Disclosure Statement? |

The Debtors are seeking to obtain Bankruptcy Court approval of the Plan. Before soliciting acceptances of the Plan, section 1125 of the Bankruptcy Code requires that the Debtors prepare a disclosure statement containing adequate information sufficient to enable a hypothetical reasonable investor to make an informed decision regarding acceptance of the Plan and to share such Disclosure Statement with all Holders of Claims whose votes on the Plan are being solicited. This Disclosure Statement is being submitted in accordance with these requirements.

| C. | Why are votes being solicited prior to Bankruptcy Court approval of this Disclosure Statement? |

By sending this Disclosure Statement and soliciting votes for the Plan prior to approval by the Bankruptcy Court, the Debtors are preparing to seek Confirmation of the Plan soon after commencing the Chapter 11 Cases. The Debtors will ask the Bankruptcy Court to approve this Disclosure Statement on a final basis together with Confirmation of the Plan at the same hearing, which may be scheduled as shortly as thirty-one (31) days after commencing the Chapter 11 Cases, all subject to the Bankruptcy Court’s approval and availability.

| D. | What are the Restructuring Transactions under the Plan? |

The RSA and the Plan contemplate a recapitalization of the Debtors through which the Debtors will (a) issue and distribute the New Equity Interests and (b) enter into the Exit ABL Facility.

| E. | Am I entitled to vote on the Plan? |

Your ability to vote on, and your distribution under, the Plan, if any, depends on what type of Claim or Interest you hold and whether you held that Claim or Interest as of the Voting Record Date (i.e., as of January 30, 2026). Each category of Holders of Claims or Interests, as set forth in Article III of the Plan pursuant to sections 1122(a) and 1123(a)(1) of the Bankruptcy Code, is referred to as a “Class.” Each Class’s respective voting status is set forth below:

| Class | Claims and Interests | Status | Voting Rights |

| Class 1 | Other Secured Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) |

| Class 2 | Other Priority Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) |

| Class 3 | Prepetition ABL Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) |

| Class 4 | Senior Secured Notes Claims | Impaired | Entitled to Vote |

| Class 5 | General Unsecured Claims | Unimpaired | Not Entitled to Vote (Presumed to Accept) |

| Class 6 | Intercompany Claims | Unimpaired / Impaired | Not Entitled to Vote (Presumed to Accept / Deemed to Reject) |

| Class 7 | Intercompany Interests | Unimpaired / Impaired | Not Entitled to Vote (Presumed to Accept / Deemed to Reject) |

| Class 8 | Nine Energy Equity Interests | Impaired | Not Entitled to Vote (Deemed to Reject) |

| Class 9 | Section 510(b) Claims | Impaired | Not Entitled to Vote (Deemed to Reject) |

5

Except for the Claims addressed in Article II of the Plan, all Claims and Interests are classified in the Classes set forth above in accordance with sections 1122 and 1123(a)(1) of the Bankruptcy Code. A Claim or an Interest, or any portion thereof, is classified in a particular Class only to the extent that any portion of such Claim or Interest qualifies within the description of that Class and is classified in other Classes to the extent that any portion of such Claim or Interest qualifies within the description of such other Classes. A Claim or an Interest also is classified in a particular Class for the purpose of receiving distributions under the Plan only to the extent that such Claim or Interest is an Allowed Claim or Allowed Interest in that Class and has not been paid, released, or otherwise satisfied prior to the Effective Date.

The Plan constitutes a separate Plan for each of the Debtors, and the classification of Claims and Interests set forth therein shall apply separately to each of the Debtors. All of the potential Classes for the Debtors are set forth in the Plan. Such groupings shall not affect any Debtor’s status as a separate legal Entity, change the organizational structure of the Debtors’ business enterprise, constitute a change of control of any Debtor for any purpose, cause a merger or consolidation of any legal Entities, or cause the transfer of any assets, and, except as otherwise provided by or permitted under the Plan, all Debtors shall continue to exist as separate legal Entities after the Effective Date.

Except as otherwise provided in the Plan, nothing under the Plan shall affect the Debtors’ or the Reorganized Debtors’ rights regarding any Unimpaired Claims, including, all rights regarding legal and equitable defenses to, or setoffs or recoupments against, any such Unimpaired Claims.

| F. | Controversy Concerning Impairment. |

If a controversy arises as to whether any Claims or Interests, or any Class of Claims or Interests, are Impaired, the Bankruptcy Court shall, after notice and a hearing, determine such controversy on or before the Confirmation Date or such other date as fixed by the Bankruptcy Court.

| G. | Special Provision Governing Unimpaired Claims. |

Except as otherwise provided in the Plan, nothing under the Plan or the Plan Supplement shall affect the rights of the Debtors or the Reorganized Debtors, as applicable, regarding any Unimpaired Claims, including, all rights regarding legal and equitable defenses to, or setoffs or recoupments against, any such Unimpaired Claims.

| H. | What is the deadline to vote on the Plan? |

The Voting Deadline with respect to the Plan is March 2, 2026, at 11:59 p.m. (prevailing Central Time).

| I. | How do I vote for or against the Plan? |

Detailed instructions regarding how to vote on the Plan are contained on the ballots distributed to Holder of Claims that are entitled to vote on the Plan (the “Ballots”). For your vote to be counted, your Ballot must be properly completed, executed, and delivered as directed, so that the Ballot containing your vote is actually received by the Claims and Noticing Agent on or before the Voting Deadline, i.e., March 2, 2026 at 11:59 p.m., prevailing Central Time.

6

| J. | Why is the Bankruptcy Court holding a Combined Hearing? |

Section 1128(a) of the Bankruptcy Code requires the Bankruptcy Court to hold a hearing on Confirmation of the Plan and recognizes that any party in interest may object to Confirmation of the Plan. Shortly after the commencement of the Chapter 11 Cases, the Debtors will request that the Bankruptcy Court schedule the Combined Hearing, at which time the Debtors will seek, among other things, Confirmation of the Plan. At the Combined Hearing, the Debtors will also seek Bankruptcy Court approval of this Disclosure Statement pursuant to section 1125 of the Bankruptcy Code as containing adequate information of a kind, and in sufficient detail, to enable a hypothetical reasonable investor to make an informed judgment regarding acceptance of the Plan and that the Debtors shared this Disclosure Statement with all Holders of Claims whose votes on the Plan are being solicited. All parties in interest will be served notice of the time, date, and location of the Combined Hearing once scheduled. The Combined Hearing may be adjourned from time to time without further notice.

| K. | What is the purpose of the Combined Hearing? |

The purpose of the Combined Hearing is to seek approval of this Disclosure Statement and confirmation of the Plan. If so approved, the Bankruptcy Court will have held that this Disclosure Statement has provided the Voting Class with adequate information to make an informed decision as to whether to vote to accept or reject the Plan in accordance with section 1125(a)(1) of the Bankruptcy Code.

The confirmation of a plan of reorganization by a bankruptcy court binds the debtor, any issuer of securities under a plan of reorganization, any person acquiring property under a plan of reorganization, any creditor or interest holder of a debtor, and any other person or entity as may be ordered by the bankruptcy court in accordance with the applicable provisions of the Bankruptcy Code. Subject to certain limited exceptions, the order issued by the bankruptcy court confirming a plan of reorganization discharges a debtor from any debt that arose before the confirmation of such plan of reorganization and provides for the treatment of such debt in accordance with the terms of the confirmed plan of reorganization.

| L. | Who do I contact if I have additional questions with respect to this Disclosure Statement or the Plan? |

If you have any questions regarding this Disclosure Statement or the Plan, please contact the Claims and Noticing Agent, Epiq, by calling (877) 269-3874 (Toll free from US / Canada) OR +1 (971) 257-1895 (International), or e-mailing balloting@epiqglobal.com with “In re: Nine – Solicitation Inquiry” in the subject line. Copies of the Plan, this Disclosure Statement, and any other publicly-filed documents in the Chapter 11 Cases are available free of charge, as applicable, by: (a) visiting the Debtors’ restructuring website at https://dm.epiq11.com/NineEnergy after the Petition Date; (b) emailing using balloting@epiqglobal.com (with “In re: Nine – Solicitation Inquiry” in the subject line); or (c) calling the Claims and Noticing Agent at the number(s) listed above. You may also obtain copies of any pleadings filed in the Chapter 11 Cases via PACER at https://www.pacer.gov (for a fee).

| M. | What will I receive from the Debtors if the Plan is consummated? |

The following chart provides a summary of the anticipated distributions to Holders of Claims or Interests under the Plan. Your ability to receive distributions under the Plan depends upon the ability of the Debtors to obtain Confirmation and meet the conditions necessary to consummate the Plan.

Pursuant to the Plan, each Holder of an Allowed Claim or Allowed Interest, as applicable, shall receive the treatment described below in full and final satisfaction, settlement, release, and discharge of and in exchange for such Holder’s Allowed Claim or Allowed Interest, except to the extent different treatment is agreed to by the Debtors or the Reorganized Debtors, as applicable, and the Holder of such Allowed Claim or Allowed Interest, as applicable. Unless otherwise indicated, the Holder of an Allowed Claim or Allowed Interest, as applicable, shall receive such treatment on the Effective Date (or, if payment is not then due, in accordance with such Claim’s terms in the ordinary course of business) or as soon as reasonably practicable thereafter.

7

The allowance, classification, and treatment of all Allowed Claims and Interests and the respective distributions and treatments under the Plan take into account and conform to the relative priority and rights of the Claims and Interests in each Class in connection with any contractual, legal, and equitable subordination rights relating thereto, whether arising under general principles of equitable subordination, section 510(b) of the Bankruptcy Code, or otherwise. Pursuant to section 510 of the Bankruptcy Code, and subject to any applicable consent or approval rights under the RSA, the Debtors, or the Reorganized Debtors, as applicable, reserve the right to re-classify any Allowed Claim or Interest in accordance with any contractual, legal, or equitable subordination rights relating thereto.

|

Summary of Projected Distributions | ||||

| Class | Claim/Interest | Treatment of Claim / Interest | Projected Allowed Amount of Claims |

Estimated Recovery (%) |

| Class 1 | Other Secured Claims |

Except to the extent that a Holder of an Allowed Other Secured Claim agrees to less favorable treatment of its Allowed Claim, each Holder of an Allowed Other Secured Claim shall receive, as determined by the applicable Debtor or Reorganized Debtor with the consent (not to be unreasonably withheld, conditioned, or delayed) of the Required Consenting Stakeholders, either: (i) payment in full in Cash in an amount equal to its Allowed Other Secured Claim;

(ii) the collateral securing its Allowed Other Secured Claim;

(iii) Reinstatement of its Allowed Other Secured Claim; or

(iv) such other treatment rendering its Allowed Other Secured Claim Unimpaired. |

N/A | 100% |

| Class 2 | Other Priority Claims |

Except to the extent that a Holder of an Allowed Other Priority Claim agrees to less favorable treatment of its Allowed Claim, each Holder of an Allowed Other Priority Claim shall receive, as determined by the applicable Debtor or Reorganized Debtor, treatment in a manner consistent with section 1129(a)(9) of the Bankruptcy Code and reasonably acceptable to the Required Consenting Stakeholders.

|

N/A | 100% |

8

|

Summary of Projected Distributions | ||||

| Class | Claim/Interest | Treatment of Claim / Interest | Projected Allowed Amount of Claims |

Estimated Recovery (%) |

| Class 3 | Prepetition ABL Claims | Except to the extent that a Holder of an Allowed Prepetition ABL Claim agrees to less favorable treatment of its Allowed Claim, each Holder of an Allowed Prepetition ABL Claim shall receive payment in full in Cash to the extent not converted into DIP Claims in accordance with the DIP Orders. | $04 | 100% |

| Class 4 | Senior Secured Notes Claims | Except to the extent that a Holder of an Allowed Senior Secured Notes Claim agrees to less favorable treatment of its Allowed Claim, on the Effective Date, each Holder of an Allowed Senior Secured Notes Claim shall receive its pro rata share of 100% of the New Equity Interests, which shall be distributed ratably on account of the Allowed Senior Secured Notes Claims and subject to dilution on account of the Management Incentive Plan. | $319,500,000 | 45% |

| Class 5 | General Unsecured Claims |

Each Holder of an Allowed General Unsecured Claim shall, as determined by the applicable Debtor or Reorganized Debtor with the consent (not to be unreasonably withheld, conditioned, or delayed) of the Required Consenting Stakeholders, either: (i) be Reinstated; or

(ii) receive such other treatment rendering such General Unsecured Claims Unimpaired in accordance with section 1124 of the Bankruptcy Code. |

N/A | 100% |

| Class 6 | Intercompany Claims |

Each Allowed Intercompany Claim shall be, as determined by the applicable Debtor or Reorganized Debtor with the consent (not to be unreasonably withheld, conditioned, or delayed) of the Required Consenting Stakeholders, either: (i) Reinstated;

(ii) set off, settled, discharged, contributed, cancelled, or converted to equity;

(iii) released without any distribution on account of such Allowed Intercompany Claims; or

(iv) otherwise addressed at the Debtor’s election. |

N/A | N/A |

| Class 7 | Intercompany Interests |

On the Effective Date, each Allowed Intercompany Interest shall be, as determined by the applicable Debtor or Reorganized Debtor, with the consent (not to be unreasonably withheld, conditioned, or delayed) of the Required Consenting Stakeholders, either: (i) Reinstated;

(ii) set off, settled, discharged, contributed, cancelled;

(iii) released without any distribution on account of such Allowed Intercompany Interest; or

(iv) otherwise addressed at the Debtors’ election. |

N/A | N/A |

| Class 8 | Nine Energy Equity Interests | All Nine Energy Equity Interests shall be cancelled, released, discharged, extinguished, and of no further force or effect, and such Holders of Nine Energy Equity Interests shall not receive any distribution, property, or other value under the Plan on account of such Nine Energy Equity Interests. | N/A | 0% |

| Class 9 | Section 510(b) Claims | All Section 510(b) Claims will be cancelled, released, discharged, and extinguished, and will be of no further force or effect, and such Holders will not receive any distribution on account of such Section 510(b) Claims. | N/A | 0% |

| 4 | Upon entry of the Interim DIP Order, the Prepetition ABL Claims will roll up into the DIP Facility, at which time all such Prepetition ABL Claims will be refinanced in full. |

9

| N. | What will I receive from the Debtors if I hold an Allowed Administrative Claim, DIP Claim, Professional Fee Claim, or a Priority Tax Claim? |

In accordance with section 1123(a)(1) of the Bankruptcy Code, Administrative Claims, Priority Tax Claims, DIP Claims, and Professional Fee Claims have not been classified and, thus, are excluded from the Classes of Claims and Interests set forth in Article III of the Plan.

| 1. | Administrative Claims. |

Except with respect to the Professional Fee Claims, Restructuring Expenses, and except to the extent that a Holder of an Allowed Administrative Claim and the Debtors against which such Allowed Administrative Claim is asserted agree to less favorable treatment for such Holder, or such Holder has been paid by any Debtors on account of such Allowed Administrative Claim prior to the Effective Date, each Holder of an Allowed Administrative Claim will receive in full and final satisfaction of its Allowed Administrative Claim an amount of Cash equal to the amount of such Allowed Administrative Claim in accordance with the following: (1) if an Administrative Claim is Allowed on or prior to the Effective Date, on the Effective Date or as soon as reasonably practicable thereafter (or, if not then due, when such Allowed Administrative Claim is due or as soon as reasonably practicable thereafter); (2) if such Administrative Claim is not Allowed as of the Effective Date, no later than thirty (30) days after the date on which an order allowing such Administrative Claim becomes a Final Order, or as soon as reasonably practicable thereafter; (3) if such Allowed Administrative Claim is based on liabilities incurred by the Debtors in the ordinary course of their business after the Petition Date in accordance with the terms and conditions of the particular transaction giving rise to such Allowed Administrative Claim without any further action by the Holder of such Allowed Administrative Claim; (4) at such time and upon such terms as may be agreed upon by such Holder and the Debtors or the Reorganized Debtors, as applicable, and subject to the consent of the Required Consenting Stakeholders, not to be unreasonably withheld, conditioned, or delayed; or (5) at such time and upon such terms as set forth in an order of the Bankruptcy Court.

| 2. | Priority Tax Claims. |

Except to the extent that a Holder of an Allowed Priority Tax Claim agrees to less favorable treatment, in full and final satisfaction, settlement, release, and discharge of, and in exchange for, such Allowed Priority Tax Claim, each Holder of an Allowed Priority Tax Claim shall receive, as determined by the applicable Debtor or Reorganized Debtor, Cash equal to the full amount of its Claim or such other treatment in accordance with the terms set forth in section 1129(a)(9)(C), of the Bankruptcy Code and reasonably acceptable to the Required Consenting Stakeholders.

| 3. | DIP Claims. |

All DIP Claims shall be deemed Allowed as of the Effective Date in an amount equal to (a) the principal amount outstanding under the DIP Facility on such date, (b) all interest accrued and unpaid thereon to the date of payment, and (c) all accrued and unpaid fees, premiums, expenses, and non-contingent indemnification obligations payable under the DIP Documents and the DIP Orders.

On the Effective Date, except to the extent that a Holder of an Allowed DIP Claim agrees to less favorable treatment, each Holder of an Allowed DIP Claim shall receive, in full and final satisfaction of such Allowed DIP Claim, its pro rata share of the Exit ABL Facility Loans.

Upon the satisfaction of the Allowed DIP Claims in accordance with the terms of the Plan, or other such treatment as contemplated by Article II.C of the Plan, all guarantees provided and all Liens and security interests granted, in each case, to secure such obligations shall be automatically released, terminated, and of no further force and effect without any further notice to or action, order, or approval of the Bankruptcy Court or any other Entity. The DIP Agent and the DIP Lenders shall take all actions to effectuate and confirm such termination, release, and discharge as reasonably requested by the Debtors or the Reorganized Debtors, as applicable.

| 4. | Professional Fee Claims. |

| (a) | Final Fee Applications and Payment of Professional Fee Claims. |

All requests for payment of Professional Fee Claims for services rendered and reimbursement of expenses incurred prior to the Confirmation Date must be Filed no later than forty-five (45) days after the Effective Date. The Bankruptcy Court shall determine the Allowed amounts of such Professional Fee Claims after notice and a hearing in accordance with the procedures established by the Bankruptcy Court. The Reorganized Debtors shall pay Professional Fee Claims in Cash in the amount the Bankruptcy Court Allows, including from the Professional Fee Escrow Account, as soon as reasonably practicable after such Professional Fee Claims are Allowed, and which Allowed amount shall not be subject to disallowance, setoff, recoupment, subordination, recharacterization, or reduction of any kind, including pursuant to section 502(d) of the Bankruptcy Code. To the extent that funds held in the Professional Fee Escrow Account are insufficient to satisfy the amount of Professional Fee Claims owing to the Professionals, such Professionals shall have an Allowed Administrative Claim for any such deficiency, which shall be satisfied in accordance with Article II.A of the Plan.

10

| (b) | Professional Fee Escrow Account. |

On the Effective Date, the Reorganized Debtors shall establish and fund the Professional Fee Escrow Account with Cash equal to the Professional Fee Amount. The Professional Fee Escrow Account shall be maintained in trust solely for the Professionals until all Professional Fee Claims Allowed by the Bankruptcy Court have been irrevocably paid in full pursuant to one or more Final Orders. Such funds shall not be considered property of the Estates of the Debtors or the Reorganized Debtors. The amount of Allowed Professional Fee Claims owing to the Professionals shall be paid in Cash to such Professionals by the Reorganized Debtors from the Professional Fee Escrow Account as soon as reasonably practicable after such Professional Fee Claims are Allowed; provided that the Debtors’ and the Reorganized Debtors’ obligations to pay Allowed Professional Fee Claims shall not be limited nor be deemed limited to funds held in the Professional Fee Escrow Account. When all such Allowed Professional Fee Claims have been paid in full, any remaining amount in the Professional Fee Escrow Account shall promptly be paid to the Reorganized Debtors without any further notice to or action, order, or approval of the Bankruptcy Court.

| (c) | Professional Fee Amount. |

Professionals shall reasonably estimate in good faith their unpaid Professional Fee Claims and other unpaid fees and expenses incurred in rendering services to the Debtors before and as of the Confirmation Date, and shall deliver such estimate to the Debtors no later than three (3) Business Days before the anticipated Effective Date; provided that such estimates shall not be deemed to limit the amount of the fees and expenses that are the subject of each Professional’s final request for payment of Filed Professional Fee Claims in the Chapter 11 Cases. If a Professional does not provide an estimate, the Debtors or the Reorganized Debtors may estimate the unpaid and unbilled fees and expenses of such Professional.

| (d) | Post-Confirmation Fees and Expenses. |

Except as otherwise specifically provided in the Plan, from and after the Confirmation Date, the Debtors or the Reorganized Debtors as applicable, shall, in the ordinary course of business and without any further notice to or action, order, or approval of the Bankruptcy Court, pay in Cash the reasonable and documented legal, professional, or other fees and expenses related to implementation of the Plan and Consummation incurred by the Debtors. Upon the Confirmation Date, any requirement that Professionals comply with sections 327 through 331, 363, and 1103 of the Bankruptcy Code in seeking retention or compensation for services rendered after such date shall terminate, and the Debtors or the Reorganized Debtors, as applicable, may employ and pay any Professional without any further notice to or action, order, or approval of the Bankruptcy Court.

| 5. | Payment of Restructuring Expenses. |

To the extent not otherwise paid, the Debtors or the Reorganized Debtors, as applicable, shall promptly pay in Cash in full outstanding and invoiced Restructuring Expenses as follows: (i) on the Effective Date, Restructuring Expenses incurred, or estimated to be incurred, during the period prior to the Effective Date to the extent invoiced to the Debtors at least five (5) Business Days in advance of the Effective Date, and (ii) after the Effective Date, any unpaid Restructuring Expenses within five (5) Business Days of receiving an invoice; provided that such Restructuring Expenses shall be paid in accordance with the terms of any applicable engagement letters or other contractual arrangements without the requirement for the filing of retention applications, fee applications, or any other applications in the Chapter 11 Cases, and without any requirement for further notice or Bankruptcy Court review or approval; provided further that, to the extent timely invoiced, Restructuring Expenses that are not paid by the Debtors or the Reorganized Debtors, as applicable, within the timeframes set forth in Article II.D of the Plan, such Restructuring Expenses shall not be deemed waived and shall be included in a subsequent invoice.

11

| O. | Are any regulatory approvals required to consummate the Plan? |

At this time, the Debtors are evaluating which, if any, regulatory approvals are required to consummate the Plan. To the extent any such regulatory approvals or other authorizations, consents, rulings, or documents are necessary to implement and effectuate the Plan, however, it is a condition precedent to the Effective Date that they be obtained.

| P. | What happens to my recovery if the Plan is not confirmed or does not go effective? |

In the event that the Plan is not confirmed or does not go effective, there is no assurance that the Debtors will be able to reorganize their business. It is possible that any alternative may provide Holders of Claims with less than they would have received pursuant to the Plan. For a more detailed description of the consequences of an extended Chapter 11 Case, or of a liquidation scenario, see Article IX.B of this Disclosure Statement, and the Liquidation Analysis attached hereto as Exhibit D.

| Q. | If the Plan provides that I get a distribution, do I get it upon Confirmation or when the Plan goes effective, and what is meant by “Confirmation,” “Effective Date,” and “Consummation?” |

“Confirmation” of the Plan refers to approval of the Plan by the Bankruptcy Court. Confirmation of the Plan does not guarantee that you will receive the distribution indicated under the Plan. After Confirmation of the Plan by the Bankruptcy Court, there are conditions that must be satisfied or waived before the Plan can go effective. Initial distributions to Holders of Allowed Claims will only be made on the date the Plan becomes effective—the “Effective Date”—or as soon as reasonably practicable thereafter, as specified in the Plan. “Consummation” of the Plan refers to the occurrence of the Effective Date. See Article VIII.D of this Disclosure Statement, entitled “Conditions Precedent to Confirmation and Consummation of the Plan,” for a discussion of conditions precedent to Confirmation and Consummation of the Plan.

| R. | What are the sources of Cash and other consideration required to fund the Plan? |

The Debtors and the Reorganized Debtors, as applicable, shall fund distributions under the Plan and the Restructuring Transactions contemplated thereby with: (1) the Debtors’ Cash on hand as of the Effective Date; (2) the New Equity Interests; and (3) the loans under the Exit ABL Facility. Each distribution and issuance referred to in Article VI of the Plan shall be governed by the terms and conditions set forth in the Plan applicable to such distribution or issuance and by the terms and conditions of the instruments or other documents evidencing or relating to such distribution or issuance, which terms and conditions shall bind each Entity receiving such distribution or issuance. The issuance, distribution, or authorization, as applicable, of certain Securities in connection with the Plan, including the New Equity Interests, will be exempt from registration under the Securities Act, as described more fully in Article IV.M of the Plan.

| S. | Are there risks to owning the New Equity Interests upon the Debtors’ emergence from chapter 11? |

Yes. See Article IX of this Disclosure Statement, entitled “Risk Factors,” for a discussion of such risks.

12

| T. | Is there potential litigation related to the Plan? |

Parties in interest may object to the approval of this Disclosure Statement and may object to Confirmation of the Plan, which objections potentially could give rise to litigation. See Article IX.C.7 of this Disclosure Statement, entitled “The Reorganized Debtors May Be Adversely Affected by Potential Litigation, Including Litigation Arising Out of the Chapter 11 Cases.”

In the event that it becomes necessary to confirm the Plan over the rejection of certain Classes, the Debtors may seek Confirmation of the Plan notwithstanding the dissent of such rejecting Classes. The Bankruptcy Court may confirm the Plan pursuant to the “cramdown” provisions of the Bankruptcy Code, which allow the Bankruptcy Court to confirm a plan that has been rejected by an Impaired Class if it determines that the Plan satisfies section 1129(b) of the Bankruptcy Code. See Article XI.G of this Disclosure Statement, entitled “Confirmation Without Acceptance by All Impaired Classes.”

| U. | What is the Management Incentive Plan and how will it affect the distribution I receive under the Plan? |

Following the Effective Date, the New Board shall adopt the Management Incentive Plan, which will provide for the grants of equity and equity-based awards to employees, directors, consultants, and/or other service providers of the Reorganized Debtors, as determined at the discretion of the New Board. The Reorganized Debtors shall reserve a pool of up to 10.00% of fully-diluted New Equity Interests for the Management Incentive Plan. The awardees, terms, and conditions of the Management Incentive Plan shall be determined at the discretion of the New Board.

| V. | Does the Plan preserve Causes of Action? |

The Plan provides for the retention of Causes of Action that are not expressly waived, relinquished, exculpated, released, compromised, or settled.

In accordance with section 1123(b) of the Bankruptcy Code, but subject to Article VIII of the Plan, the Reorganized Debtors shall retain and may enforce all rights to commence and pursue, as appropriate, any and all Causes of Action of the Debtors, whether arising before or after the Petition Date, including any actions specifically enumerated in the Schedule of Retained Causes of Action, and the Reorganized Debtors’ rights to commence, prosecute, or settle such retained Causes of Action shall be preserved notwithstanding the occurrence of the Effective Date or any other provision of the Plan to the contrary, other than the Causes of Action released by the Debtors pursuant to the releases and exculpations contained in the Plan, including in Article VIII of the Plan.

The Reorganized Debtors may pursue such retained Causes of Action, as appropriate, in accordance with the best interests of the Reorganized Debtors. No Entity may rely on the absence of a specific reference in the RSA, the Plan, the Plan Supplement, or this Disclosure Statement to any Cause of Action against it as any indication that the Debtors or the Reorganized Debtors, as applicable, will not pursue any and all available retained Causes of Action against it. The Debtors and the Reorganized Debtors expressly reserve all rights to prosecute any and all retained Causes of Action against any Entity, except as otherwise expressly provided in the Plan. The Reorganized Debtors may settle any such retained Cause of Action without further notice to or action, order, or approval of the Bankruptcy Court. Unless any retained Causes of Action against an Entity are expressly waived, relinquished, exculpated, released, compromised, or settled in the Plan or a Bankruptcy Court order, the Reorganized Debtors expressly reserve all retained Causes of Action, for later adjudication, and, therefore, no preclusion doctrine, including the doctrines of res judicata, collateral estoppel, issue preclusion, claim preclusion, estoppel (judicial, equitable, or otherwise), or laches, shall apply to such retained Causes of Action upon, after, or as a consequence of the Confirmation or Consummation.

13