PBF Energy 2026 Guidance Information January 2026

Statements in this presentation relating to future plans, results, performance, expectations, achievements and the like are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve known and unknown risks, uncertainties and other factors, many of which may be beyond the control of PBF Energy Inc. and PBF Holding Company LLC (including their subsidiaries, collectively, the “Company” or “PBFEnergy”), that may cause actual results to differ materially from any future results, performance or achievements expressed or implied by the forward- looking statements. Factors and uncertainties that may cause actual results to differ include but are not limited to the risks disclosed in the company's filings with the Securities and Exchange Commission (“SEC”), our ability to operate safely, reliably, sustainably and in an environmentally responsible manner; our ability to successfully diversify our operations; the risks and uncertainties associated with the fire on February 1, 2025 at our Martinez refinery, including our expectations with respect to the full restart of the Martinez refinery, the timing of such restart, the throughput of the Martinez refinery, anticipated costs and anticipated amount and timing of insurance recoveries related to the fire, the extent to which our financial losses related to the Martinez fire are covered by our insurance and the results and consequences of any governmental and regulatory investigations related to the fire; the risk that our expansion into the renewable fuels space, including renewable diesel production, may not occur on expected timeframes or at all, and we may not realize expected benefits from any such projects; the company’s expectations with respect to the joint venture relating to St. Bernard Renewables LLC (“SBR”); the joint venture’s plans, objectives, expectations and intentions with respect to future earnings and operations of SBR; our expectations with respect to our capital spending and turnaround projects; risks associated with our obligation to buy Renewable Identification Numbers and related market risks related to the price volatility thereof; the possibility that we might reduce or not pay further dividends in the future; certain developments in the global oil markets and their impact on the global macroeconomic conditions; risks relating to the securities markets generally; the impact of changes in inflation, interest rates and capital costs; and the impact of market conditions, unanticipated developments, regulatory approvals, changes in laws and other events that negatively impact the company. All forward-looking statements speak only as of the date hereof. The Company undertakes no obligation to revise or update any forward-looking statements except as may be required by applicable law. See the Appendix for reconciliations of the differences between the financial measures in accordance with U.S. generally accepted accounting principles (“GAAP”) and non-GAAP financial measures used in this presentation, including various estimates of EBITDA (earnings before interest, income taxes, depreciation and amortization), and their most directly comparable GAAP financial measures. 2

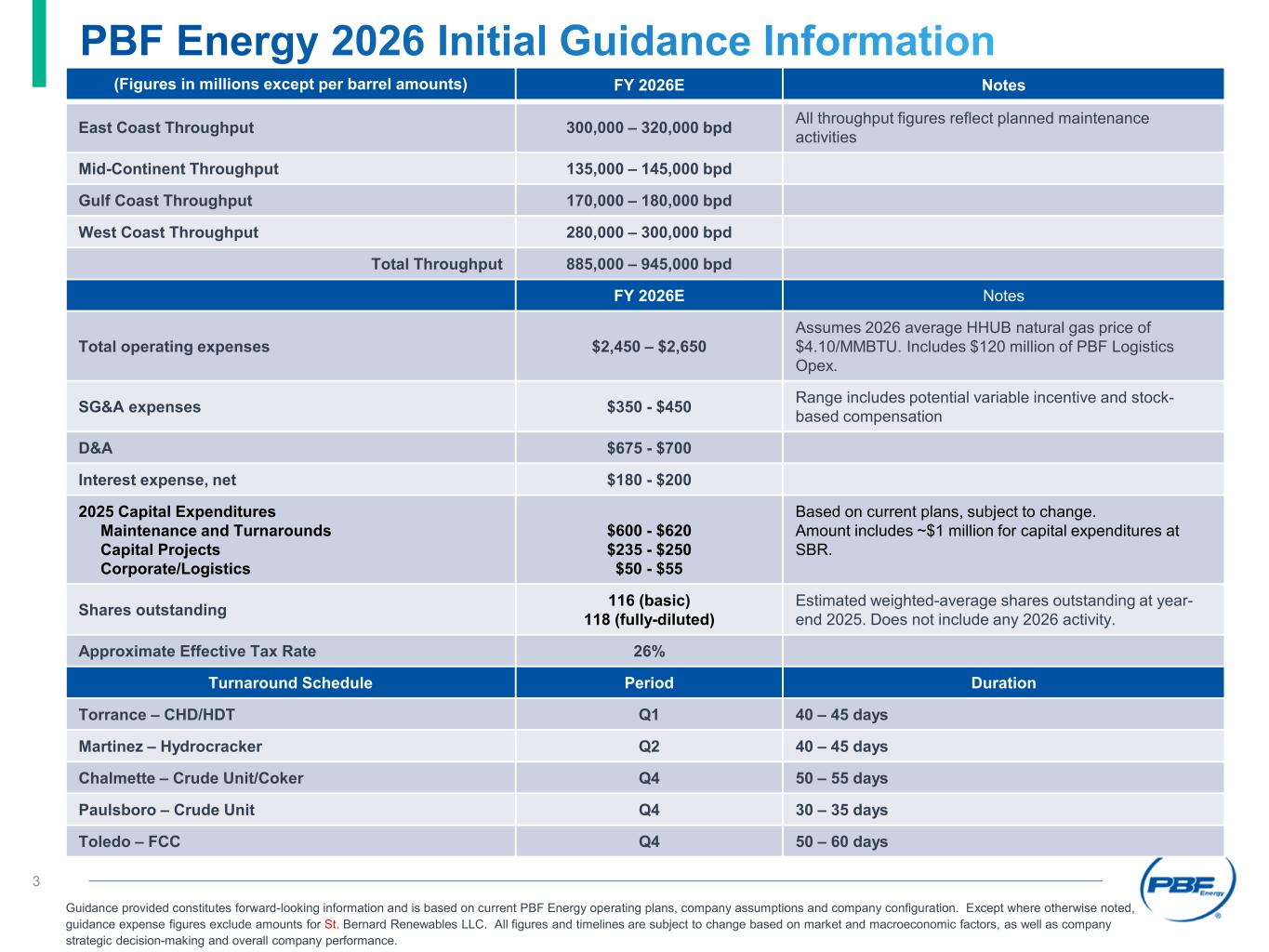

(Figures in millions except per barrel amounts) FY 2026E Notes East Coast Throughput 300,000 – 320,000 bpd All throughput figures reflect planned maintenance activities Mid-Continent Throughput 135,000 – 145,000 bpd Gulf Coast Throughput 170,000 – 180,000 bpd West Coast Throughput 280,000 – 300,000 bpd Total Throughput 885,000 – 945,000 bpd FY 2026E Notes Total operating expenses $2,450 – $2,650 Assumes 2026 average HHUB natural gas price of $4.10/MMBTU. Includes $120 million of PBF Logistics Opex. SG&A expenses $350 - $450 Range includes potential variable incentive and stock- based compensation D&A $675 - $700 Interest expense, net $180 - $200 2025 Capital Expenditures Maintenance and Turnarounds Capital Projects Corporate/Logistics $600 - $620 $235 - $250 $50 - $55 Based on current plans, subject to change. Amount includes ~$1 million for capital expenditures at SBR. Shares outstanding 116 (basic) 118 (fully-diluted) Estimated weighted-average shares outstanding at year- end 2025. Does not include any 2026 activity. Approximate Effective Tax Rate 26% Turnaround Schedule Period Duration Torrance – CHD/HDT Q1 40 – 45 days Martinez – Hydrocracker Q2 40 – 45 days Chalmette – Crude Unit/Coker Q4 50 – 55 days Paulsboro – Crude Unit Q4 30 – 35 days Toledo – FCC Q4 50 – 60 days Guidance provided constitutes forward-looking information and is based on current PBF Energy operating plans, company assumptions and company configuration. Except where otherwise noted, guidance expense figures exclude amounts for St. Bernard Renewables LLC. All figures and timelines are subject to change based on market and macroeconomic factors, as well as company strategic decision-making and overall company performance. 3

Indicative calculation of regional refining benchmarks(1) in dollars per barrel: • East Coast • Dated Brent (NYH) 2-1-1 • Calculated as: (1*RBOB) + (1*ULSD) – (2*Dated Brent) • Mid-Continent • WTI (Chicago) 4-3-1 • Calculated as: (3*CBOB) + (0.5*ULSD) + (0.5*GC Jet) – (4*WTI) • Gulf Coast • LLS (Gulf Coast) 2-1-1 • Calculated as: (1*87 Conv) + (1*ULSD) – (2*LLS) • West Coast • Southern California • ANS (West Coast) 4-3-1 • Calculated as: (3*CARBOB) + (0.5* LA Diesel) + (0.5 LA Jet) – (4*ANS) • Northern California • ANS (West Coast) 3-2-1 • Calculated as: (2*CARBOB) + (0.25*CARB Diesel) + (0.75 SF Jet) – (3*ANS) 5 (1) Actual realized refinery gross margin on a per barrel basis can differ from indicative regional benchmarks for reasons described in our filings with the SEC.