Exhibit 5.1

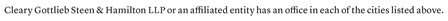

Writer’s Direct Dial: +1 212 225 2650

E-Mail: cbrod@cgsh.com

February 23, 2022

Voya Financial, Inc.

230 Park Avenue

New York, New York 10169

Ladies and Gentlemen:

We have acted as special counsel to Voya Financial, Inc., a Delaware corporation (the “Company”), in connection with the preparation and filing with the Securities and Exchange Commission (the “Commission”) of the Company’s registration statement on Form S-3 (including the documents incorporated by reference therein, the “Registration Statement”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), relating to the offering and sale from time to time, together or separately and in one or more series (if applicable), of the (i) senior debt securities of the Company (the “Senior Debt Securities”) and subordinated debt securities of the Company (the “Subordinated Debt Securities” and, together with the Senior Debt Securities, the “Debt Securities”), (ii) guarantees of the Debt Securities (the “Debt Securities Guarantees”) by Voya Holdings Inc., a Connecticut corporation and a wholly owned subsidiary of the Company (“Voya Holdings”), (iii) guarantees by the Company or Voya Holdings, either independently or together, of debt securities of other subsidiaries, which may be offered for consideration that may include consents or exchanges of existing securities (the “Guarantees”), (iv) shares of common stock, par value $0.01 per share, of the Company (the “Common Stock”), (v) shares of preferred stock, par value $0.01 per share of the Company (the “Preferred Stock”), (vi) fractional interests in Preferred Stock evidenced by depositary receipts (the “Depositary Shares”), (vii) warrants of the Company (the “Warrants”) and (viii) units of the Company consisting of one or more of the foregoing which may or may not be separable (the “Units”). The Debt Securities, Debt Securities Guarantees, Guarantees, Common Stock, Preferred Stock, Depositary Shares, Warrants and Units are referred to herein collectively as the “Securities.” The Securities being registered under the Registration Statement will have an aggregate initial offering price of up to $2,000,000,000 and will be offered on a continuous or delayed basis pursuant to the provisions of Rule 415 under the Securities Act.