Gogo Stock Option Exchange Program Employee Informational Presentation May 2020 Exhibit (a)(1)(I)

The Option Exchange Program is being made pursuant to the terms and conditions set forth in the Gogo Inc. Tender Offer Statement on Schedule TO, including the Offer to Exchange, and other related materials filed with the Securities and Exchange Commission, which are available to you free of charge on the Option Exchange Program website or at www.sec.gov. You should read these materials carefully because they contain important information about the Option Exchange Program, including risks related thereto.

What and Why What is Gogo’s Option Exchange Program? A one-time opportunity for employees to voluntarily exchange unexercised “underwater” options for a lesser amount of new options with a new strike price Why is Gogo offering the exchange? Value to Employees Stock constitutes a key component of our incentive and long-term compensation program We want to create an environment where employees are rewarded for their contributions to the company from increases in the value of our shares Value to Company Retention of employees who are key to our success Reduces potential stockholder dilution, or “overhang” A portion of exchanged shares will be available for future equity awards

What happens next? On April 29, Gogo shareholders approved the Option Exchange Program. It was launched on May 14, 2020 Eligible employees received the offer via their Gogo email Option Exchange Program will be open for 20 US business days Limited time offer – once exchange period closes, no options can be exchanged Option Exchange Program to close on June 12, 2020 at 5pm Central (unless extended) Upon close of the Option Exchange Program, surrendered options will be cancelled, and options will be granted based on the closing stock price on June 12, 2020 (unless extended)

How the Option Exchange Program Works Exchange unexercised underwater stock options for a lesser number of options with a grant date and strike price based on the closing date of the exchange, expected to be June 12, 2020 Replacement options will vest on December 31, 2022, subject to continued employment through such date Replacement options will have a ten-year term from the date of grant Replacement options will also include accelerated vesting and an extension of the exercise period from 90 days to 12 months on termination without cause or in the case of retirement, death or disability

Eligible Option Holders Option Exchange Program is open to all current employees with outstanding unexercised stock options that have a per share exercise price of $2.46 or above Those with an exercise price that is equal to or greater than 150% of the closing price of our common stock on May 13, 2020 The following outstanding stock options are excluded from participation in the Option Exchange Program: Options with a performance-vesting condition with a performance period ending in May 2020 Options with a normal expiration date in June 2020 Options granted in 2020 Options granted to our CEO in his capacity as a non-employee director of the board Former employees and non-employee directors are not eligible to participate in the Option Exchange Program We estimate that approximately 77 employees are eligible to participate in the Option Exchange Program and that an aggregate of approximately 7 million options are available for exchange

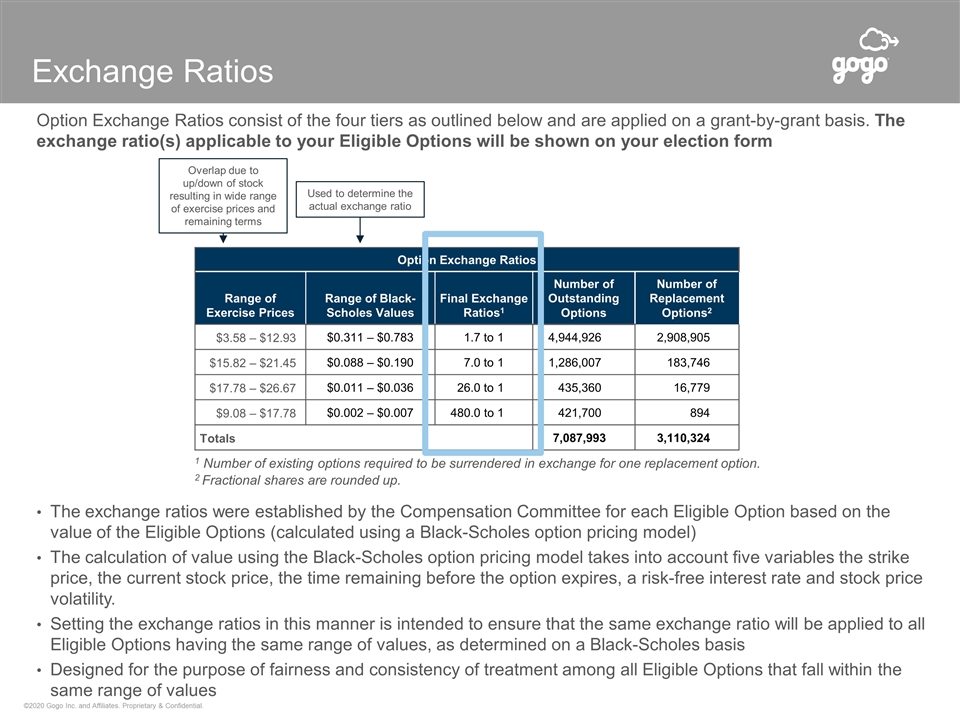

Exchange Ratios Option Exchange Ratios consist of the four tiers as outlined below and are applied on a grant-by-grant basis. The exchange ratio(s) applicable to your Eligible Options will be shown on your election form The exchange ratios were established by the Compensation Committee for each Eligible Option based on the value of the Eligible Options (calculated using a Black-Scholes option pricing model) The calculation of value using the Black-Scholes option pricing model takes into account five variables the strike price, the current stock price, the time remaining before the option expires, a risk-free interest rate and stock price volatility. Setting the exchange ratios in this manner is intended to ensure that the same exchange ratio will be applied to all Eligible Options having the same range of values, as determined on a Black-Scholes basis Designed for the purpose of fairness and consistency of treatment among all Eligible Options that fall within the same range of values Used to determine the actual exchange ratio Overlap due to up/down of stock resulting in wide range of exercise prices and remaining terms Option Exchange Ratios Range of Exercise Prices Range of Black-Scholes Values Final Exchange Ratios1 Number of Outstanding Options Number of Replacement Options2 $3.58 – $12.93 $0.311 – $0.783 1.7 to 1 4,944,926 2,908,905 $15.82 – $21.45 $0.088 – $0.190 7.0 to 1 1,286,007 183,746 $17.78 – $26.67 $0.011 – $0.036 26.0 to 1 435,360 16,779 $9.08 – $17.78 $0.002 – $0.007 480.0 to 1 421,700 894 Totals 7,087,993 3,110,324 1 Number of existing options required to be surrendered in exchange for one replacement option. 2 Fractional shares are rounded up.

Election Process Eligible employees must log into the Option Exchange Program website: https://myoptionexchange.com Elect eligible options to exchange on a grant-by-grant basis Receive confirmation of election Employees can exchange or withdraw elections as often as desired during the 20-day period No election will be treated as a decision not to participate Once the Option Exchange Program has closed, no further elections can be made Replacement options are granted upon the close of the Option Exchange Program with a strike price based on the closing stock price the date the program closes, expected to be June 12, 2020 Replacement options will be granted subject to the terms and conditions of the 2016 Omnibus Plan and the Form of Stock Option Agreement for Replacement Options Questions may be directed to optionexchange@gogoair.com. But it is your obligation to follow the process on the website above

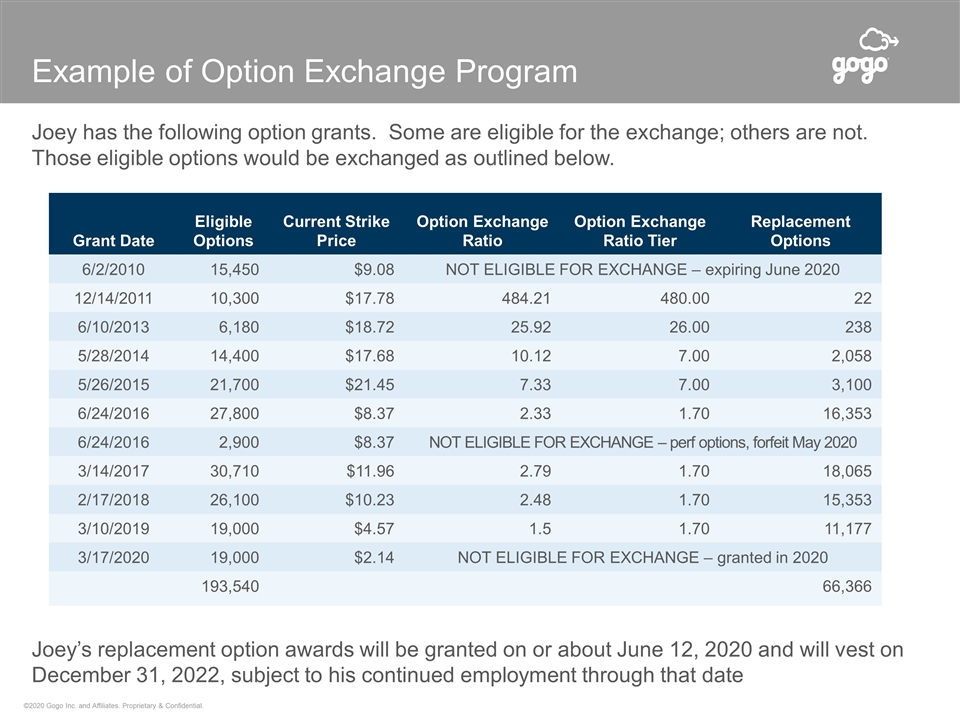

Example of Option Exchange Program Joey has the following option grants. Some are eligible for the exchange; others are not. Those eligible options would be exchanged as outlined below. Joey’s replacement option awards will be granted on or about June 12, 2020 and will vest on December 31, 2022, subject to his continued employment through that date Grant Date Eligible Options Current Strike Price Option Exchange Ratio Option Exchange Ratio Tier Replacement Options 6/2/2010 15,450 $9.08 NOT ELIGIBLE FOR EXCHANGE – expiring June 2020 12/14/2011 10,300 $17.78 484.21 480.00 22 6/10/2013 6,180 $18.72 25.92 26.00 238 5/28/2014 14,400 $17.68 10.12 7.00 2,058 5/26/2015 21,700 $21.45 7.33 7.00 3,100 6/24/2016 27,800 $8.37 2.33 1.70 16,353 6/24/2016 2,900 $8.37 NOT ELIGIBLE FOR EXCHANGE – perf options, forfeit May 2020 3/14/2017 30,710 $11.96 2.79 1.70 18,065 2/17/2018 26,100 $10.23 2.48 1.70 15,353 3/10/2019 19,000 $4.57 1.5 1.70 11,177 3/17/2020 19,000 $2.14 NOT ELIGIBLE FOR EXCHANGE – granted in 2020 193,540 66,366

Questions?