Tecogen Q3 2025 NYSE American: TGEN November 13th 2025

SAFE HARBOR STATEMENT This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non-historical matters, or projected revenues, Income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 2

Table of Contents Data Center Update Factory Capacity and Use of Capital Q3 Results On-Site CogenerationService Company Financials

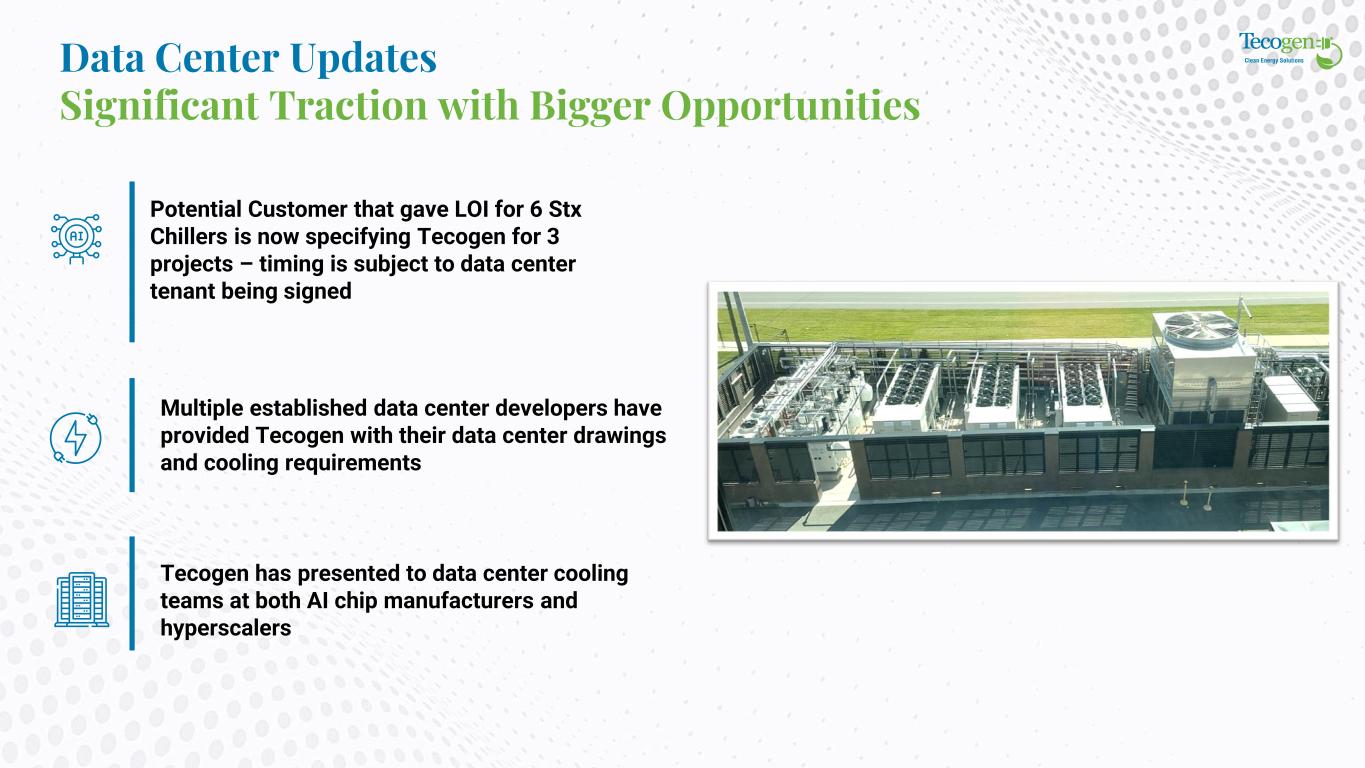

Data Center Updates Significant Traction with Bigger Opportunities Potential Customer that gave LOI for 6 Stx Chillers is now specifying Tecogen for 3 projects – timing is subject to data center tenant being signed Tecogen has presented to data center cooling teams at both AI chip manufacturers and hyperscalers Multiple established data center developers have provided Tecogen with their data center drawings and cooling requirements

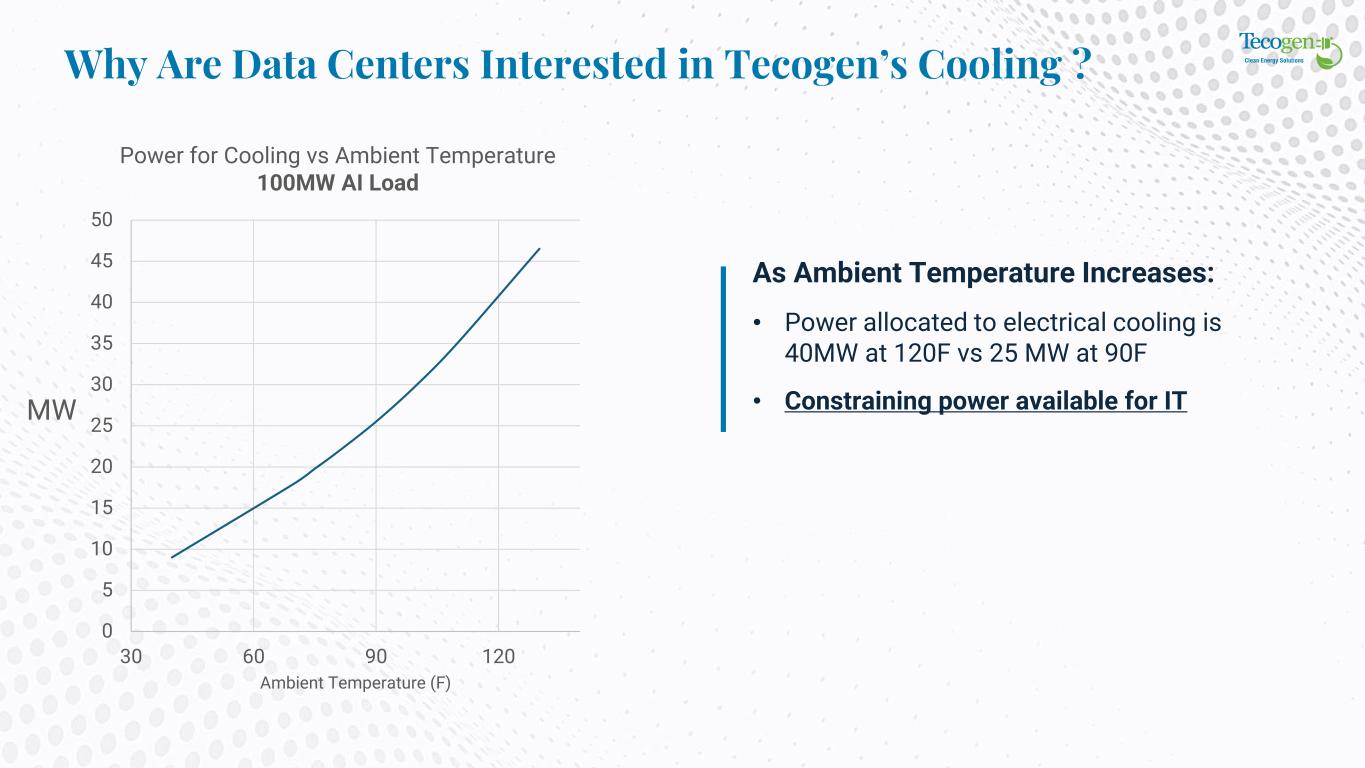

Why Are Data Centers Interested in Tecogen’s Cooling ? 0 5 10 15 20 25 30 35 40 45 50 30 60 90 120 MW Ambient Temperature (F) Power for Cooling vs Ambient Temperature 100MW AI Load As Ambient Temperature Increases: • Power allocated to electrical cooling is 40MW at 120F vs 25 MW at 90F • Constraining power available for IT

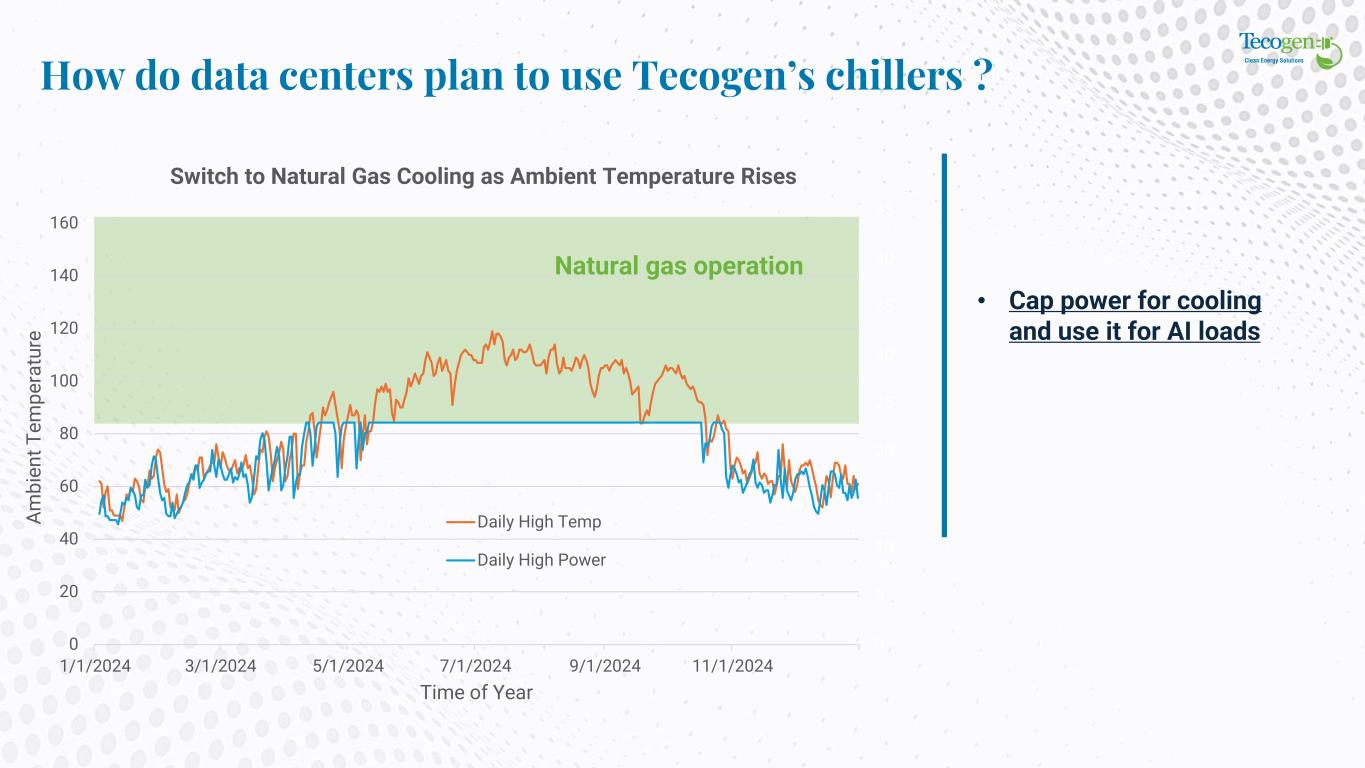

0 5 10 15 20 25 30 35 40 45 0 20 40 60 80 100 120 140 160 1/1/2024 3/1/2024 5/1/2024 7/1/2024 9/1/2024 11/1/2024 A m b ie n t T e m p e ra tu re Time of Year Switch to Natural Gas Cooling as Ambient Temperature Rises Daily High Temp Daily High Power How do data centers plan to use Tecogen’s chillers ? • Cap power for cooling and use it for AI loads Natural gas operation

Updates Market Need + Manufacturing Capacity = Growth 7 Contract Manufacturing + Factory Layout Changes • Currently modifying factory layout to increase throughput, expect to be completed by year end • Working with contract manufacturers – expect first articles before year end Other Strategic Options • Working with Vertiv on supply chain and ways to increase chiller production

Backlog & Cash 8 Cash • $14m Backlog • $4m (Including Las Vegas prepaid 10 year service and not including LOI for data center customers) • $2.5m to $3.5m of cannabis projects continue to delay (Expected late Q4) Related Party Loan • Repaid from offering proceeds

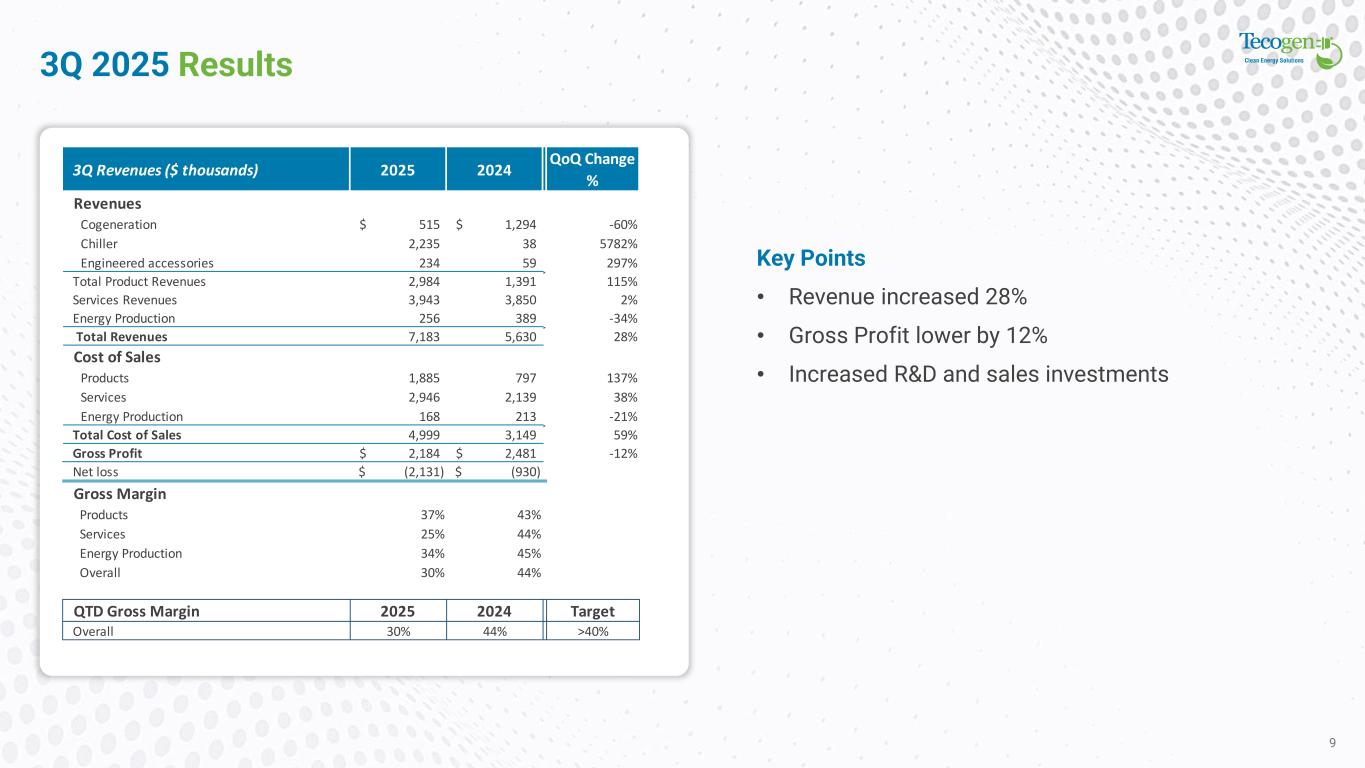

3Q 2025 Results 9 Key Points • Revenue increased 28% • Gross Profit lower by 12% • Increased R&D and sales investments 3Q Revenues ($ thousands) 2025 2024 QoQ Change % Revenues Cogeneration 515$ 1,294$ -60% Chiller 2,235 38 5782% Engineered accessories 234 59 297% Total Product Revenues 2,984 1,391 115% Services Revenues 3,943 3,850 2% Energy Production 256 389 -34% Total Revenues 7,183 5,630 28% Cost of Sales Products 1,885 797 137% Services 2,946 2,139 38% Energy Production 168 213 -21% Total Cost of Sales 4,999 3,149 59% Gross Profit 2,184$ 2,481$ -12% Net loss (2,131)$ (930)$ Gross Margin Products 37% 43% Services 25% 44% Energy Production 34% 45% Overall 30% 44% QTD Gross Margin 2025 2024 Target Overall 30% 44% >40%

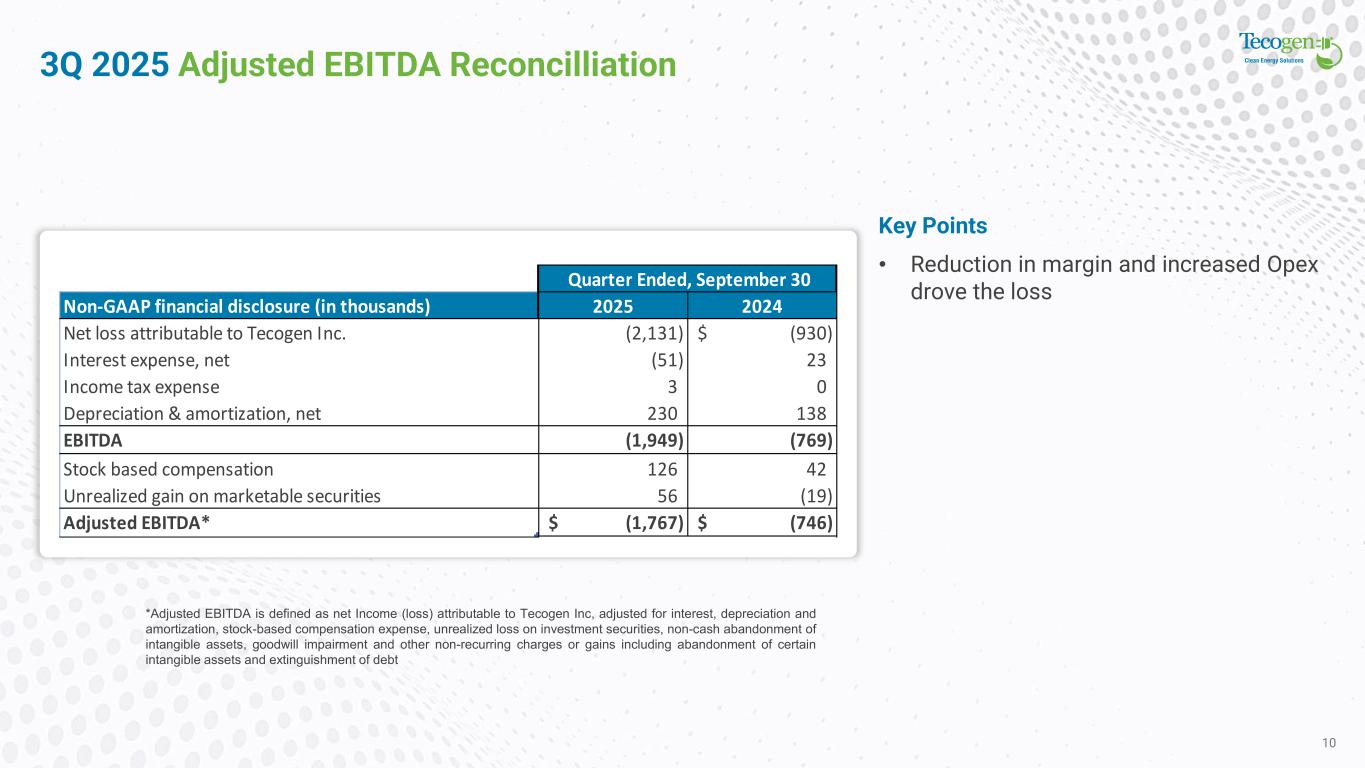

3Q 2025 Adjusted EBITDA Reconcilliation 10 Key Points • Reduction in margin and increased Opex drove the loss *Adjusted EBITDA is defined as net Income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, unrealized loss on investment securities, non-cash abandonment of intangible assets, goodwill impairment and other non-recurring charges or gains including abandonment of certain intangible assets and extinguishment of debt Non-GAAP financial disclosure (in thousands) 2025 2024 Net loss attributable to Tecogen Inc. (2,131) (930)$ Interest expense, net (51) 23 Income tax expense 3 0 Depreciation & amortization, net 230 138 EBITDA (1,949) (769) Stock based compensation 126 42 Unrealized gain on marketable securities 56 (19) Adjusted EBITDA* (1,767)$ (746)$ Quarter Ended, September 30

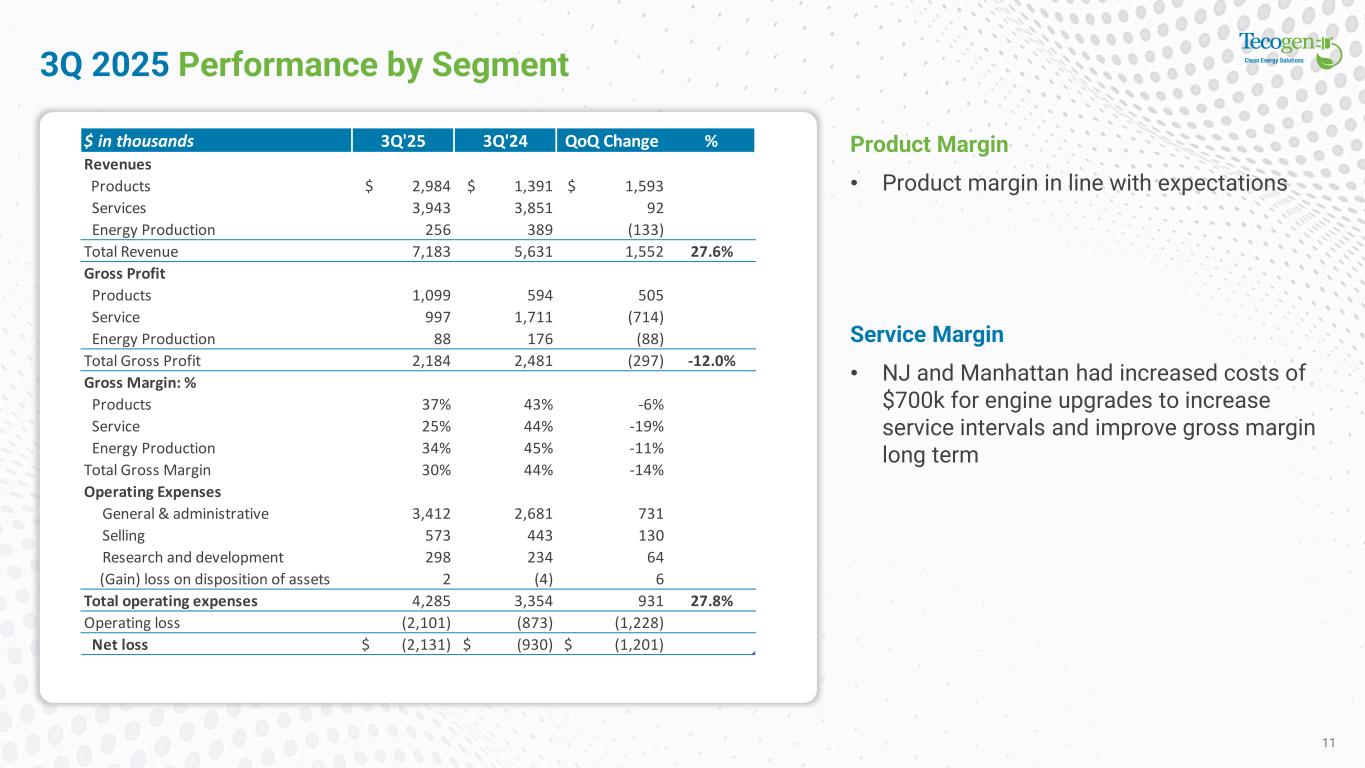

3Q 2025 Performance by Segment 11 Service Margin • NJ and Manhattan had increased costs of $700k for engine upgrades to increase service intervals and improve gross margin long term Product Margin • Product margin in line with expectations $ in thousands 3Q'25 3Q'24 QoQ Change % Revenues Products $ 2,984 $ 1,391 $ 1,593 Services 3,943 3,851 92 Energy Production 256 389 (133) Total Revenue 7,183 5,631 1,552 27.6% Gross Profit Products 1,099 594 505 Service 997 1,711 (714) Energy Production 88 176 (88) Total Gross Profit 2,184 2,481 (297) -12.0% Gross Margin: % Products 37% 43% -6% Service 25% 44% -19% Energy Production 34% 45% -11% Total Gross Margin 30% 44% -14% Operating Expenses General & administrative 3,412 2,681 731 Selling 573 443 130 Research and development 298 234 64 (Gain) loss on disposition of assets 2 (4) 6 Total operating expenses 4,285 3,354 931 27.8% Operating loss (2,101) (873) (1,228) 140.7% Net loss $ (2,131) $ (930) $ (1,201) 129.1%

Summary Capital raised to strengthen balance sheet And increase manufacturing capacity LOIs for pilot projects New leads for sizeable projects Complete data center chiller line including unique dual power source chiller