Please wait

October 15, 2025

Fellow Shareholders,

For the third quarter, we recorded net income to common stockholders of $0.9 million, or $0.04 per diluted share. Our results include certain non-core expenses totaling $4.4 million which were largely due to previously announced restructuring efforts. There is further detail on non-core items at the end of this letter.[1]

During the quarter, we continued to execute the strategy we have articulated for several prior quarters — investing through the cycle and proving the power of our integrated network and platform. We are beginning to realize the benefits of our investments and efficiency initiatives, which is showing up in our financial results.

CEO Summary of Key Points

•Transportation Revenue Growth & Outlook. Our Payments revenue grew 7.4% q/o/q; EBITDA margin improved to 16.8%, and we generated positive pretax operating income in the segment for the first time. Factoring revenue was up slightly and core operating margin improved. Intelligence revenue was flat. In a difficult market, we grew total transportation revenue 3.7% q/o/q in 3Q[2]. I stand by my statement in the last earnings call that we expect our transportation revenue to grow 20% annually.

•Expense Reduction & Margin Improvement. We reduced total expenses by ~5% through our efficiency efforts in 3Q, and 90% of those savings are in our run rate as we begin 4Q. We expect the remaining savings to be in place by year-end. These restructuring efforts were not a one-and-done event; they are representative of the evolution of our business I've been alluding to for the last few quarters. We are now at the point of properly monetizing our platform and Network and improving efficiency. Our work to become leaner and more efficient is far from done, and we expect to progress on this front in 2026. The investments we have made in AI tools are bearing the expected fruit, and we continue to find new ways to incorporate these tools into our operations, as I discuss later. We project 4Q expenses to be $96.5 million, which is 4.5% below adjusted 2Q 2025 numbers. The following table shows the expense reductions segment and adjusts for the impact of non-recurring items.

| | | | | | | | | | | | | | | | | | | | | |

| Noninterest Expense | |

|

| in millions | Reported 2Q25 | Reported 3Q25 | Adjusted 2Q25 | Adjusted 3Q25 | Adjusted QoQ $ | Adjusted QoQ % | |

|

| Factoring | $ | 14.1 | | $ | 19.1 | | $ | 19.5 | | $ | 18.0 | | $ | (1.5) | | (7.7) | % | |

| Payments | $ | 16.8 | | $ | 17.1 | | $ | 16.8 | | $ | 16.6 | | $ | (0.2) | | (1.2) | % | |

| Intelligence (partial qtr 2Q) | $ | 7.7 | | $ | 5.9 | | $ | 4.7 | | $ | 5.7 | | $ | 1.0 | | 21.3 | % | |

| Banking | $ | 32.0 | | $ | 31.7 | | $ | 32.0 | | $ | 31.2 | | $ | (0.8) | | (2.5) | % | |

| Corporate | $ | 30.2 | | $ | 29.9 | | $ | 28.1 | | $ | 27.8 | | $ | (0.3) | | (1.1) | % | |

| Total | $ | 100.8 | | $ | 103.7 | | $ | 101.1 | | $ | 99.3 | | $ | (1.8) | | (1.8) | % | |

Note - adjusted to exclude, as appropriate, the expense impacts of USPS and other nonrecurring items highlighted in 2Q reporting,

and restructuring expense related non-recurring items in 3Q (see footnotes [1,3]).

•Credit. The market noise around Tricolor was unexpected and unfortunate. We have more to learn about the outcome of this credit, but at present we believe we remain adequately secured. Our collateral is of a different nature than lenders who may take the largest losses, and we have been diligent in monitoring it. In a war no one wants to be involved in, we like our battlefield position better than most others. Nevertheless, this type of lending is not core to our strategy, and investors should expect us to continue to shrink our non-transportation footprint.

•Share Repurchase Announcement. We believe our current share price does not reflect the intrinsic value of Triumph. As of today, our board authorized a $30 million share repurchase program. We have consistently told investors that we have three potential outlets for excess capital: (i) as a buffer against the unknown, (ii) to pursue

acquisitions that enhance the value we deliver to the transportation industry, and (iii) to reduce our share count. We will always maintain a capital cushion above regulatory requirements. For as long as our stock trades near current levels, we expect to use a portion of our earnings to buy back shares.

Our Strategy and The Harmony of a Customer-Centric Organization

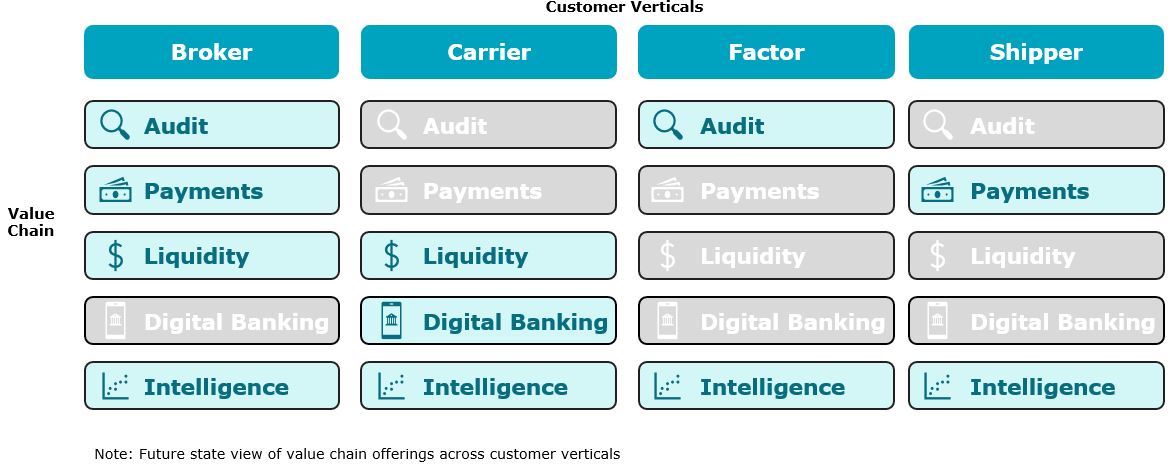

Triumph is a technology and payments provider to the trucking industry. We connect brokers, carriers, shippers, and factors to improve their data strategy, payments, and working capital. Our goal is to serve our customers through the integrated value chain we are building, which is transforming the financial infrastructure of trucking, leading to improved margins, greater profitability, and reduced fraud and waste for all our stakeholders. Our competitive advantage in furtherance of this goal comes from the system of reinforcing activities across audit, payments, liquidity solutions, digital banking, and intelligence. No single competitor offers this full suite of services, nor can they easily replicate it. It took five years to lay the foundation, but we believe the integrated, reinforcing power of this value chain will drive sustainable revenue growth and margin expansion for our shareholders.

1.Audit – reducing the time and effort required to process invoices through automation and efficiency at scale

2.Payments – improving transactional confidence by efficiently making remittances to the right party at the right time while mitigating fraud

3.Liquidity Solutions – factoring, supply chain finance ("SCF"), Factoring-as-a-Service ("FaaS"), quickpay and cash advances that turn freight receivables into cash as well as equipment financing

4.Digital Banking+ – a business bank account integrated with our Network to allow for the seamless movement of money, plus an integrated set of tools to serve as the hub of a carrier’s back office

5.Intelligence – fraud protection, pricing, capacity and performance insights powered by our data

Each of these activities reinforces others, creating a competitive advantage rivals cannot copy piecemeal. As examples, our audit and payments processes feed transactional data to our Intelligence platform, and our payments Network and liquidity solutions connect directly to LoadPay, our digital banking product. It is difficult for any company to achieve competence in multiple products, but when all these products are fully integrated and working in harmony, it will create greater customer and shareholder value.

Reorganizing around a customer-centric view better serves our clients and creates efficiencies for the enterprise. Using a product-centric approach as we built density was appropriate, but to achieve the long-term revenue growth and margin improvement goals we have set, this is now the best path forward.

In hindsight, none of us comprehended how bad the freight market of 2021-2022 was going to be for trucking. In fact, I think that the issues created by that market distortion have been a net negative for Triumph and the industry, despite the short-term boost to our stock price. The unprecedented growth created an all-hands-on-deck situation that became a desperate attempt to hold the sail while market tailwinds pushed us along. That same tailwind also brought with it a flood of capacity that the government has struggled to properly regulate, license and track. Organized crime also took advantage of this chaos. These elements have always been part of the trucking industry, but they are more present in the supply chain now than ever before. I am encouraged that our government is beginning to focus on this issue. Truckers should not have to bend or break the rules just to compete against a shadow market.

Our focus is now squarely on two things: (i) serving our customers with excellence as an indispensable partner, and (ii) growing revenue and improving margins to create long-term shareholder value. Through a major effort and despite the voices of many skeptics and naysayers, we have willed into existence the only financial Network in brokered freight. We have largely done it through the most difficult freight cycle since deregulation in the 1980s. We will continue to expand the value of the Network as we now focus on building returns and delivering a leaner enterprise.

Payments

1.Analysis of Financial and Operational Performance for the Quarter

2.Pricing Changes; Revenue Drivers and Growth Forecasts

3.LoadPay Update

4.Additional Segment Financial Analysis

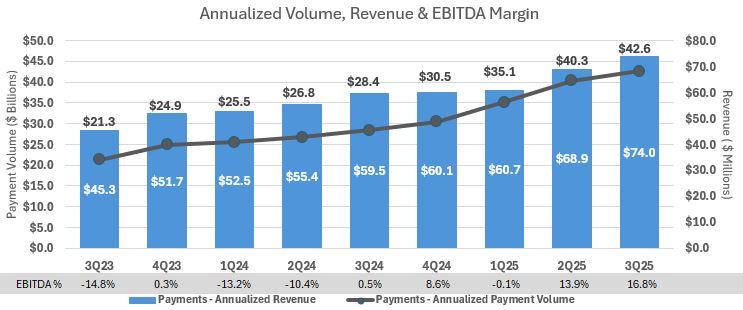

Analysis of Financial and Operational Performance for the Quarter. Revenue grew 7.4% q/o/q, and EBITDA margin for the quarter improved to 16.8%. Pretax operating income was positive for the first time in 3Q.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 | | Current Quarter Q/Q | | Current Year Y/Y |

| For the Qtr Ending | | | | | | Change | | % Change | | Change | | % Change |

| Payments: | | | | | | | | | | | | | | | | | |

| Invoice Volume | 8,826,848 | | | 8,500,565 | | | 7,182,044 | | | 6,788,408 | | | 6,278,246 | | | 326,283 | | | 3.8 | % | | 2,548,602 | | | 40.6 | % |

| Payment Volume | $ | 10,662,418,000 | | | $ | 10,081,206,000 | | | $ | 8,777,825,000 | | | $ | 7,625,735,000 | | | $ | 7,091,493,000 | | | $ | 581,212,000 | | | 5.8 | % | | $ | 3,570,925,000 | | | 50.4 | % |

| Network Invoice Volume | 1,057,606 | | | 1,004,603 | | | 719,531 | | | 567,258 | | | 661,628 | | | 53,003 | | | 5.3 | % | | 395,978 | | | 59.8 | % |

| Network Payment Volume | $ | 1,696,817,000 | | | $ | 1,579,662,000 | | | $ | 1,167,464,000 | | | $ | 922,927,000 | | | $ | 1,063,228,000 | | | $ | 117,155,000 | | | 7.4 | % | | $ | 633,589,000 | | | 59.6 | % |

| Average Invoice Price | 1,208 | | 1,186 | | 1,222 | | 1,123 | | 1,130 | | 22 | | | 1.9 | % | | 78 | | | 6.9 | % |

| Network Engagement | 63.4 | % | | 63.3 | % | | 50.4 | % | | 48.7 | % | | 47.8 | % | | 0.1 | % | | 0.2 | % | | 15.6 | % | | 32.6 | % |

| Average Float | $ | 484,582,000 | | | $ | 469,211,000 | | | $ | 442,901,000 | | | $ | 410,044,000 | | | $ | 363,255,000 | | | $ | 15,371,000 | | | 3.3 | % | | $ | 121,327,000 | | | 33.4 | % |

| Fee Revenue | $ | 8,791,000 | | | $ | 8,105,000 | | | $ | 6,903,000 | | | $ | 6,704,000 | | | $ | 6,611,000 | | | $ | 686,000 | | | 8.5 | % | | $ | 2,180,000 | | | 33.0 | % |

| Total Revenue | $ | 18,503,000 | | | $ | 17,231,000 | | | $ | 15,184,000 | | | $ | 15,031,000 | | | $ | 14,873,000 | | | $ | 1,272,000 | | | 7.4 | % | | $ | 3,630,000 | | | 24.4 | % |

| # of LoadPay Accounts | 4,421 | | 2,367 | | 778 | | 192 | | 65 | | 2,054 | | | 86.8 | % | | 4,356 | | | 6701.5 | % |

| LoadPay Funding | $ | 53,042,000 | | | $ | 22,212,000 | | | $ | 4,986,000 | | | $ | 777,000 | | | $ | 178 | | | $ | 30,830,000 | | | 138.8 | % | | $ | 52,864,000 | | | 29698.9 | % |

| Average Interchange Fees | 1.64 | % | | 1.61 | % | | 1.76 | % | | 1.67 | % | | — | % | | 0.03 | % | | 1.86 | % | | 1.64 | % | | — | % |

| EBITDA margin | 16.8 | % | | 13.9 | % | | (0.1) | % | | 8.6 | % | | 0.5 | % | | 2.9 | % | | 20.9 | % | | 16.3 | % | | 3260.0 | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

For 3Q, annualized Network engagement[4] (breadth) was steady at $70 billion, while depth was $114 billion[5]. As a reminder, the breadth of the network represents the percentage of unique brokered freight[6] transactions Triumph has touched at least once regardless of product or segment. The depth of the network is the dollar volume of all transactions in each product or segment. The depth is larger because we touch certain transactions in multiple products and segments. Payment volume increased by 5.8% to $42.6 billion, annualized. Our broker customers represent $38.1 billion of that.

Pricing Changes; Revenue Drivers and Growth Forecasts. Payments revenue grew 7.4% in 3Q to an annualized rate of $74.0 million. While growth over the last two quarters has been driven by new customer additions, we expect our repricing efforts to drive more revenue growth in 4Q 2025 and accelerate in 1Q 2026.

Anyone can use inflation or a hot market as air cover for price increases. While we see inflationary pressures, we do not have anything resembling a hot market in freight (right now or for the last three years). Investors have asked about the revenue growth trajectory of our existing customer base – specifically, when would we bring legacy customers to our standard pricing. Our position has been that the value we provide our customers would precede monetization. This is how we create long-term value for both customers and shareholders. We have reached that point in the development of the Network. Our experience with recent repricing efforts confirms the logic of our approach. We have proven the increasing value proposition of our payments services to customers, which has allowed us to increase prices towards our standard rates with no customer attrition thus far.

Importantly, fee revenue represented ~54% of the growth this quarter and should continue to lead our growth. In 3Q, the percentage of payments for which we charged a fee increased from 28.5% to 30.8%. During the quarter, fee revenue for payments increased by $0.7 million, or an annualized $2.7 million.

Closely related to the repricing question, I am often asked about the revenue opportunity of our existing Payments business. Investors and analysts want to be able to forecast the future. I want to do the same. My experience, however, has been that forecasting the Network is hard to do. Perhaps the best way to look at this is on a per invoice basis.

We have sized the brokered freight industry at about $110 billion for several years. When we use that number, we are referring to what brokers pay carriers (not what brokers charge shippers, which would be larger to account for broker margins). That number is directionally correct today given lower invoice sizes, although it is fair to say that brokered freight continues to grow. We can use $1,500 as an average for all truckload invoices. Doing that math, we can estimate about 73 million invoices annually for full truckload freight. If you use our standard rate card for doing both audit and payment, the potential fee revenue for the truckload brokered market is ~$150 million. This is a market dimension of fee revenue, not a target. This does not include revenue potential from our existing embedded liquidity solutions, the value of float, less-than-truckload (“LTL”) audit which we just launched with RXO, and other areas of our future expansion. We will account for the revenue from these offerings in Payments, and cumulatively, these have a larger total revenue opportunity than per invoice audit and payment fees.

In 3Q, we earned $7.1 million in broker noninterest income on 8.8 million invoices. Triumph’s annualized run rate of invoices paid is approximately 35 million invoices, or 47% of all invoices. As a reminder, broker noninterest income includes audit and payment revenues, and we audit some invoices that we do not pay. For purposes of this sizing exercise, we are using invoices that we pay and excluding those where we only perform audit. We earned $0.80 per invoice on average for those payment invoices. Using basic assumptions, we believe there is an opportunity to generate $42 million more revenue per year if existing customers for whom we currently make payments utilized our audit feature and paid standard pricing for audit and payments. It is highly improbable that we will get to 100% of this revenue opportunity in the near term, but the opportunity to grow fee income within our existing client base alone is still a material one. Further, we have growth opportunities to add new clients and monetize the network in other ways, as described below. This repricing exercise to our standard rates isn’t accomplished by just announcing fee increases; we are doing it by individually demonstrating the increasing value of the Network to the broker for their own operation. It is a collaborative approach. If I were on the other side of the negotiation, it’s how I would want to be treated. That’s how we endeavor to do things at Triumph. It may take longer and more work, but it builds loyalty and trust in your brand.

Once again, we recognize that 100% realization on penetration or pricing is not realistic, but we are making demonstrable progress in moving pricing towards standard rates and improving margins while we do it. The ability to cross-sell brokers our other products (e.g., Intelligence) and other modes (e.g., LTL) to deliver more value to their bottom line is also an exciting opportunity. Finally, we will continue to add new customers nearly every quarter.

LoadPay Update. If the broker fee revenue of our original payments business is still less than 50% of its total opportunity, then LoadPay is just getting started. LoadPay is positioned to win for several reasons, but its primary competitive edge is its deep integration and connection into our payments Network. We have previously sized the LoadPay addressable market to be about $100 million, and we stand by that projection.

We added 2,054 LoadPay accounts during the quarter, nearly doubling our total number of accounts to 4,421. With a quarter to go, we can reaffirm our expectation that we will open between 5,000 and 10,000 accounts in 2025. LoadPay functionality is expanding beyond being the leading bank for over-the-road carriers. In 3Q, we started connecting limited

factoring capabilities for carriers who use both our factoring services and LoadPay banking accounts. This is a first step in expanding LoadPay beyond its banking roots into a full-service financial companion for carriers. In the coming months, we will introduce features which empower carriers to make more informed business decisions and build financial resilience. Features include the ability for carriers to access lane rate insights and savings toward specific goals or recurring costs. We will also begin offering cash advances and insights driven by both the carriers' own behavior/data and industry insights.

Additional Segment Financial Analysis. In the chart below we graphically highlight the continued revenue growth and its trend over the last eight quarters against the backdrop of our payment volumes (note this is payment volume only, not Network engagement). We have generated a roughly 27.8% CAGR in revenue over the last two years and 102% over the last six years despite more than half of that period being part of the longest recession in the history of trucking..

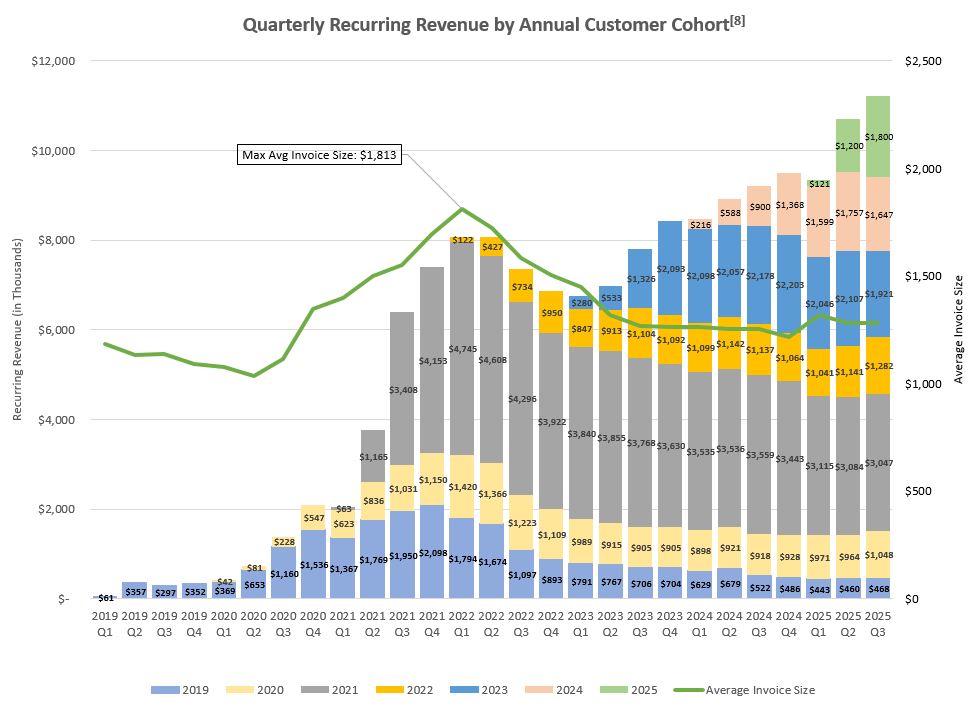

The chart on the next page provides a visual demonstration of how we have increased revenue in our Payments segment to date. The line represents invoice sizes[7], while the bars represent revenue. The revenue bars highlight fee income which can be attributed to a specific customer in a specific year and excludes supply chain finance income and float.

Factoring

1.Analysis of Financial and Operational Performance for the Quarter

2.Automation & AI Update

3.FaaS Update

Analysis of Financial and Operational Performance for the Quarter. Factoring segment pretax operating income was $8.2 million, revenue declined (2.7)% q/o/q, and pretax operating margin was 20.7%. Adjusting for USPS and our restructuring efforts[1,2,3], pretax operating income was $9.3 million, revenue was up 0.3% q/o/q, and pretax operating margin was 23.5%. During 3Q, our average transportation invoice price was $1,690. This is $27 higher than 2Q 2025, but $34 lower than the same period in 2024. Given the two distinct customer profiles we serve — fleets and small owner-operators (“O/O”) — it is helpful to look at the average invoice size separately. This is also interesting as it leverages our data to help explain a common question in trucking: “why are O/O not leaving the system faster?” The average invoice size for our fleet customers was $1,817; for O/O it was $1,317. Said differently, on average, fleet invoices are 38% larger. Compared to 2Q, these numbers represent modest declines of $36 and $16, respectively. Compared to 3Q 2024, fleet average invoice sizes were down $92, while the O/O segment showed a $16 increase. I would offer a few takeaways from this data, although I am not suggesting that these anecdotes fully explain all the countervailing market forces in trucking and in our own client base...doing that would require a much longer letter.

•First, it is important to recognize that the O/O has a lower fixed operating cost and more flexibility. They can park their truck, drive for Uber and skip maintenance cycles. I am not saying it is always in their best interest long term to do this, but it allows them to stay in the game longer than many thought possible. Because of a fleet’s large, fixed cost base, they don’t have the same option to sit on the sidelines. This partially explains why O/O invoice sizes have gone up while fleets have not – the O/O market has partially self-regulated.

•Second, O/Os have access to different load offerings and aggregated discounts that were not as prevalent in the last major slowdown in 2009. Taking an Amazon power-only load with shorter hauls between distribution centers can keep O/Os alive, while a fleet would not likely take that load. The fuel discount aggregators have also reduced a major gap between what fleets and O/Os pay for fuel.

The punchline is this; small carriers are suffering for a variety of reasons, but have hung in longer than anyone anticipated. Until there is focused enforcement to ensure the capacity in the system is properly licensed and tracked, low rates are likely here to stay. It is possible we are at an inflection point, but this all happens against the backdrop of trade policy and macroeconomic forces.

Total purchased volume reached $3.0 billion for the quarter, a 4.3% increase over 2Q, and 14.9% over the same quarter in 2024. Invoice volume increased 2.2% this quarter.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 | | Current Quarter Q/Q | | Current Year Y/Y |

| For the Qtr Ending | | | | | | Change | | % Change | | Change | | % Change |

| Factoring: | | | | | | | | | | | | | | | | | |

| Invoice Volume | 1,735,860 | | | 1,697,851 | | | 1,497,644 | | | 1,524,904 | | | 1,480,824 | | | 38,009 | | | 2.2 | % | | 255,036 | | | 17.2 | % |

| Purchased Volume | $ | 2,997,895,000 | | | $ | 2,873,659,000 | | | $ | 2,707,805,000 | | | $ | 2,747,351,000 | | | $ | 2,610,177,000 | | | $ | 124,236,000 | | | 4.3 | % | | $ | 387,718,000 | | | 14.9 | % |

| Average Transportation Invoice Size | $ | 1,690 | | | $ | 1,663 | | | $ | 1,769 | | | $ | 1,767 | | | $ | 1,724 | | | $ | 27 | | | 1.6 | % | | $ | (34) | | | (2.0) | % |

| Invoices / Client | 236 | | | 232 | | | 204 | | | 205 | | | 192 | | | 4 | | | 1.7 | % | | 44 | | | 22.9 | % |

| Discount Rate | 1.29 | % | | 1.37 | % | | 1.31 | % | | 1.34 | % | | 1.40 | % | | (0.08) | % | | (5.8) | % | | (0.11) | % | | (7.9) | % |

| Avg Daily Purchases* | $ | 46,842,000 | | | $ | 45,614,000 | | | $ | 44,390,000 | | | $ | 43,609,000 | | | $ | 40,784,000 | | | 1,228,000 | | | 2.7 | % | | 6,058,000 | | | 14.9 | % |

| Operating margin | 20.71 | % | | 48.46 | % | | 19.24 | % | | 23.67 | % | | 20.99 | % | | (27.75) | % | | (57.3) | % | | (0.28) | % | | (1.3) | % |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

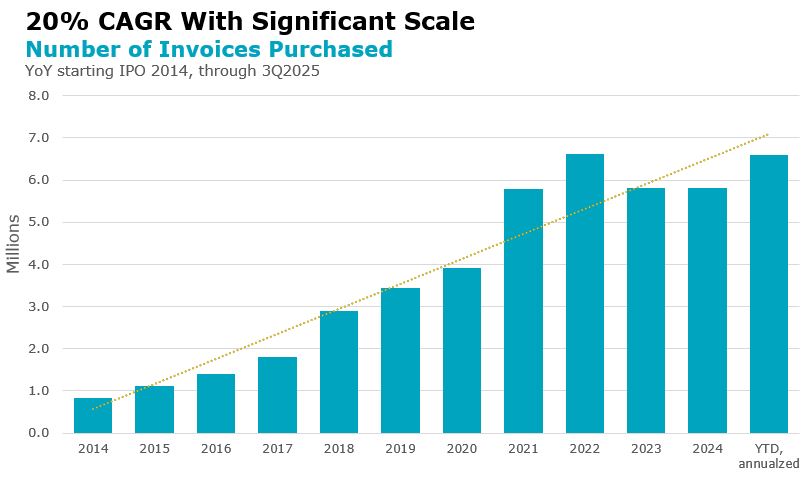

*calculated using number of working days

It is not easy to grow a business of material size and scale at a 20% CAGR consistently for over a decade. We have done so. As we reached nearly $3 billion in purchases last quarter with subdued invoice prices, it reminds me that we have a lot to celebrate in our factoring business.

Automation & AI Update. We remain focused on initiatives that will drive revenue growth and improve operating margin. In 3Q, we launched automated cash posting, delivering a ~20% efficiency lift within our treasury department. We expect that additional enhancements that are underway in this area will further streamline back-office operations and reduce manual effort.

We also introduced our automated bill reminder system, which proactively reaches out to account debtors regarding aged invoices. While currently in beta testing, the early results are promising, showing the capability to touch 10x more invoices than could previously be managed. This allows our staff to focus their time and expertise on exception handling and complex cases rather than routine outreach.

Our instant decision model continues to drive efficiency, with a pass and approval rate of 58% in our O/O segment, enabling these clients to get instant funding when they use LoadPay or our fuel card. Today, the product team is working on improving the model to better support our large fleet operations team, which is currently experiencing a ~15% approval rate. This is custom built AI that is, in my opinion, unrivaled in the industry. We will continue to update our AI models to improve performance, reduce friction, and increase margins.

We also have some exciting initiatives on the horizon, including the automation of our origination process to enhance the client experience and accelerate approvals during the application journey. These efforts will streamline workflow and ensure that applications move through the funnel more efficiently, delivering faster decisions, greater satisfaction for our clients, and the ability to manage more volume without adding expenses.

FaaS Update. FaaS is slowly grinding upwards, but we are beginning to see some inflection in adoption. This is to be expected with an intricate partnership – it takes time to get things in place and work out the kinks. Our partners are deeply committed to the opportunity and recognize the value it brings to their organizations. For example, CHRW has publicly discussed it as an area of growth. While our partners focus on deployment and capitalizing on their unique delivery channels, we continue to advance the technology behind FaaS to deliver a more seamless, efficient, and intuitive experience for our shared clients, positioning us for meaningful growth as adoption accelerates.

Intelligence

1.Analysis of Financial and Operational Performance for the Quarter

2.Product Roadmap

3.Partnership with Highway on the Trusted Freight Exchange

Analysis of Financial and Operational Performance for the Quarter. Total revenue was $2.3 million, our average contract value (ACV) was $43 thousand, and gross margin was 89%.

Product Roadmap. It has been 160 days since we completed the acquisition of Greenscreens.ai. We did not intend to just offer the existing Greenscreens product with a rebranded interface. Our goal was to combine that product with the ISO platform we acquired in December 2024, and to inject existing Triumph data into the combined offering. This has taken a bit of time and explains why revenue remained flat during our first full quarter post-acquisition.

In late September, we launched our integrated Pricing and Performance Intelligence solution. This product unifies pricing, performance, and capacity sourcing into a single data solution for freight brokers. With this tool, brokers can see rate, performance, and embedded capacity information with AI-driven predictive analytics and capacity sourcing suggestions. This solution builds on the AI models we acquired with Greenscreens. By combining real-world performance metrics with predictive analytics, brokers can sharpen their pencil on pricing, making smarter, more efficient decisions, balancing cost and reliability to improve load coverage and overall freight outcomes. Using AI and our proprietary data to do this makes our offering differentiated and highly scalable. I would also mention that we have ~400 Payments Network customers who do not currently use our Intelligence solution or its Greenscreens predecessor, and I would repeat here what I said earlier about treating customers the way we want to be treated to build loyalty and brand trust. If customers can trust you to do one thing well, they are likely to trust you with another. I would expect many of our existing Payments customers to become Intelligence customers in 2026.

We are also working on our Intelligence solutions for shippers to enable strategic rate and performance benchmarking and transportation procurement. The first phase of this initiative will see us establish a pilot program to achieve critical mass of shipper intelligence data with an expected commercial offering by the second half of 2026. This product would focus on the aggregation of information derived from participating Shippers, as opposed to Brokers, in an effort to provide a targeted solution for this market.

Partnership with Highway on the Trusted Freight Exchange. Our work continues in our partnership with Highway to power portions of their Trusted Freight Exchange (TFX). TFX is a secure alternative to public loadboards. As Highway continues to build density within their two-sided freight exchange, we are actively integrating various Intelligence and liquidity solutions capabilities to enhance the experience for carriers and brokers.

In TFX, carriers can access market rate ranges in the context of each load they evaluate using our Intelligence rate data. Carriers are also able to understand the specific payment terms available to them on a given load by incorporating the capabilities of our Payments platform. There are additional liquidity solutions in development for carriers on loads posted from brokers who are Payments customers. We will provide more details on this in future quarters.

Banking

1.Analysis of Financial and Operational Performance for the Quarter

2.Update on Credit Metrics

Analysis of Financial and Operational Performance for the Quarter. Banking segment operating income increased $0.7 million to $27.1 million, or 2.7%, from the prior quarter, on lower noninterest and credit loss expense, while revenue was marginally higher.

Update on Credit Metrics. The credit risk in our business is generally low, but we must be diligent against fraud. When introducing investors to Triumph, we stress the quick turn of our portfolio where the receivables portion turns about every 37 days, our mortgage warehouse portfolio turns about every three weeks, and 70% of the entire portfolio will turn in under one year. Our allowance for credit losses reflects these fast-turning portfolios and, when those specifics are accounted for, the rest of the portfolio reserves are in-line with most community banks. Our credit outlook and expectations remain in line with our comments on last quarter’s earnings call.

Fraud is something against which we maintain constant vigilance. Despite that, in mid-September, we issued an 8-K related to Tricolor’s bankruptcy announcement. Although we do not yet know the details, there have been public statements that Tricolor had engaged in fraud. We have $22.5 million of a $60 million facility. Our exposure is through a floorplan lending facility secured by vehicle inventory with a perfected first lien position. This perfected status should give us priority in repayment. As of now, we can identify thousands of vehicles we believe are collateral that adequately secure our loan and as such it would not be appropriate to record a specific loss reserve at this time. Should the bankruptcy process lead us to a place where our beliefs around the nature of that collateral is no longer correct, we will evaluate accordingly. Going forward, we will continue to review our portfolio in light of our strategic focus on transportation.

Credit metrics for the quarter generally moved modestly negatively, largely influenced by Tricolor.

•Total non-performing loans to total loans increased by 0.16% to 1.36%.

•Total classified assets increased by $8.2 million.

•Past due to total loans improved by 0.30% to 1.91%.

Freight Market Update

State of the US Trucking Market. The U.S. trucking industry remains in a prolonged correction phase caused by excess capacity built during the post-Covid boom. Supply continues to exceed demand, leading to stagnant rates and margin pressures for carriers. Gradual capacity rationalization and modest economic growth signals potential stabilization, though key metrics continue to send mixed signals.

Trucking capacity remains oversupplied, keeping rates near or below breakeven for carriers due to structural challenges from private fleet insourcing and slow exits among O/O. Key drivers of these challenges include uncertainty around tariffs (particularly tariffs on heavy duty imports, raw materials, and manufacturing components) as well as the FMCSA’s Interim Final Ruling “Restoring Integrity to the Issuance of Non-Domiciled Commercial Drivers Licenses”. The FMCSA IFR states: “There are roughly 200,000 non-domiciled CDL holders, which is approximately five percent of the 3.8 million active interstate CDL holders in 2024. A focus on enforcement of non-domiciled capacity issues could create material benefits for legitimate American small businesses, restoring some pricing power to small U.S. carriers. FMCSA anticipates that these non-domiciled drivers will exit the market within approximately two years as their credential comes up for renewal, and that the market will respond to this change in capacity as it has in the past, with rates adjusting and drivers and carriers entering the market where needed.” We would add to this statement that while the 3.8 million number is accurate as a total, it is more precise to say that 1.0 - 1.3 million drivers work in for-hire freight (as opposed to company owned fleets). We believe that a significant proportion of non-domiciled CDL holders work in the for-hire market, which is the market we primarily serve. If the enforcement actions proceed, it will likely have a bigger impact on the for-hire market than the overall market.

Expense Forecast & Closing Thoughts

As I noted at the beginning of the letter, there was noise this quarter related to our restructuring efforts, but those benefits are evidenced in our improving core expense run rate. We will not see the full benefit of those savings until 4Q, and project 4Q noninterest expense to be approximately $96.5 million. We are not done in our pursuit of greater efficiencies for our enterprise, and we expect to make additional progress in 2026.

While we are pursuing expense discipline, we remain committed to strategic investments, helping our broker customers ensure they are dealing with legitimate capacity and helping our carriers ensure they are working with legitimate and solvent payors.

I am excited about our Network and platform and the work we are doing in that ecosystem today to deliver unique value to our customers, helping them capture efficiency, improve margins, and generate new sources of revenue. While they do that, we will continue to innovate to help them capitalize on the opportunities tomorrow’s challenges will bring.

With warm regards,

Aaron P. Graft

Founder, Vice Chairman and CEO

[1]Summary of nonrecurring items highlighted in 2Q25 and 3Q25.

| | | | | | | | | | | |

| (in millions) | | 2Q25 | 3Q25 |

| Factoring | | | |

| Noninterest expense | | $ | 14.1 | | $ | 19.1 | |

| Salaries and benefits | Restructuring costs | — | | (1.1) | |

| Professional Fees | USPS - Recovery of legal expense | 7.4 | | — | |

| Other | Other Legal Settlements | (2.0) | | — | |

| Adjusted noninterest expense | | $ | 19.5 | | $ | 18.0 | |

| | | |

| Payments | | | |

| Noninterest expense | | $ | 16.8 | | $ | 17.1 | |

| Salaries and benefits | Restructuring costs | — | | (0.5) | |

| Adjusted noninterest expense | | $ | 16.8 | | $ | 16.6 | |

| | | |

| Intelligence (partial qtr 2Q) | | | |

| Noninterest expense | | $ | 7.7 | | $ | 5.9 | |

| Salaries and benefits | Restructuring costs | — | | (0.2) | |

| Professional fees | Greenscreens transaction costs | (3.0) | | — | |

| Adjusted noninterest expense | | $ | 4.7 | | $ | 5.7 | |

| | | |

| Banking | | | |

| Noninterest expense | | $ | 32.0 | | $ | 31.7 | |

| Salaries and benefits | Restructuring costs | — | | (0.5) | |

| Adjusted noninterest expense | | $ | 32.0 | | $ | 31.2 | |

| | | |

| Corporate | | | |

| Noninterest expense | | $ | 30.2 | | $ | 29.9 | |

| Salaries and benefits and Professional fees | Restructuring costs | — | | (2.1) | |

| Other and Amortization of intangibles | New HQ termination fees and accelerated amortization | (2.1) | | — | |

| Adjusted noninterest expense | | $ | 28.1 | | $ | 27.8 | |

| | | |

| Total | | | |

| Noninterest expense | | $ | 100.8 | | $ | 103.7 | |

| Salaries and benefits and Professional fees | Restructuring costs | — | | (4.4) | |

| Professional Fees | USPS - Recovery of legal expense | 7.4 | | — | |

| Professional fees | Greenscreens transaction costs | (3.0) | | — | |

| Other | Other Legal Settlements | (2.0) | | — | |

| Other and Amortization of intangibles | New HQ termination fees and accelerated amortization | (2.1) | | — | |

| Adjusted noninterest expense | | $ | 101.1 | | $ | 99.3 | |

[2]Summary of nonrecurring items and highlighted in 2Q25 and 3Q25.

| | | | | | | | | | | |

| (in millions) | | 2Q25 | 3Q25 |

| Factoring | | | |

| Total Revenue | | $ | 40.8 | | $ | 39.7 | |

| Noninterest Income | Intersegment Noninterest Income | (0.9) | (0.9) |

| Interest Income and Fees | USPS - Collection of fees | (1.2) | | — | |

| Adjusted Total Revenue | | $ | 38.7 | | $ | 38.8 | |

| | | |

| Payments | | | |

| Total Revenue | | $ | 17.2 | | $ | 18.5 | |

| Noninterest Income | Intersegment Noninterest Income | (0.4) | (0.3) |

| No Adjustments | No Adjustments | — | | — | |

| Adjusted Total Revenue | | $ | 16.8 | | $ | 18.2 | |

| | | |

| Intelligence (partial qtr 2Q) | | | |

| Total Revenue | | $ | 1.7 | | $ | 2.3 | |

| No Adjustments | No Adjustments | — | | — | |

| Adjusted Total Revenue | | $ | 1.7 | | $ | 2.3 | |

| | | |

| Total Transportation Revenue* | | | |

| Total revenue | | $ | 59.7 | | $ | 60.5 | |

| Noninterest Income | Intersegment Noninterest Income | (1.3) | | (1.2) | |

| Interest Income and Fees | USPS - Collection of fees | (1.2) | | — | |

| Adjusted Total Transportation Revenue | | $ | 57.2 | | $ | 59.3 | |

| Annualized Adjusted Total Transportation Revenue | | $ | 228.8 | | $ | 237.2 | |

*Presented this quarter and going forward excluding intracompany noninterest revenue.

[3]Summary of 2Q nonrecurring items included in 2Q reporting.

| | | | | | | | | | | | | | | |

| Broad Category | Income Statement

Line Item | Segment | Description | $ Impact | |

|

| Interest income | Interest income and fees | Factoring | USPS - Collection of fees | $1,213,000 | |

| Noninterest expense | Professional Fees | Factoring | USPS - Recovery of legal expense | $7,376,000 | |

| Credit loss expense | Credit loss expense | Factoring | USPS - ACL Recovery | $3,773,000 | |

| | | Net impact of USPS settlement | $12,362,000 | |

| | | | | |

| Noninterest expense | Professional Fees | Intelligence | Greenscreens transaction costs | $(3,024,000) | |

| Noninterest expense | Other Noninterest Expense | Factoring | Other Legal Settlements | $(2,000,000) | |

| Noninterest expense | Other & Amortization of intangibles | Corporate | New HQ termination fees and accelerated amortization. | $(2,067,000) | |

| | | Net impact of other non-recurring items | $(7,091,000) | |

| | | Pre-tax operating income impact | $5,271,000 | |

| | | | | |

| Income Tax Expense | Income Tax Expense | All Segments | Equity award vesting and non-deductible transaction expenses | $ | (1,100,000) | | |

[4] We define Network engagement as the amount of freight touched through our payments, audit, full AP automation and rate intelligence products. It is an indicator of our broker volume density in the market, the source for growing available Network transactions and data assets, and a key value driver of the Network.

[5] The step up this quarter in depth is mostly related to the inclusion of all of Triumph Factoring's broker related volumes as well as continued improvement in our data validation processes. Triumph Factoring's data in 2Q only included the associated TriumphPay Audit volumes in keeping with our historical reporting practices.

[6] This reference to brokered freight is specific to domestic truckload (TL) freight only. Thus, this calculation would exclude less than truckload (LTL), parcel, etc. It would also exclude shipper volumes. Admittedly, this is a difficult percentage to calculate with precision, and it will move from year to year. That being said, we can evaluate the number of payments received in our factoring segment as a proxy for the percentage of TL freight Triumph

Payments is touching and also use industry data points to make informed assumptions. In the end, this goal is not intended to be a precise measurement in the same way as we would measure earnings. It is a directional and blunt measurement of the reach of the Network.

[7] Average invoice sizes in our payments segment are generally smaller than average invoice sizes in our factoring segment as a transportation factor generally will only factor long-haul trucking invoices. Less than truckload (LTL) and parcel typically are not regularly serviced by the transportation factoring industry due to their small ticket size. Our payments business pays all transportation invoices of a freight broker and, as such, includes some LTL, parcel and shorter hauls that a transportation factor normally will not service.

[8] Recurring cohort revenue is defined as quickpay revenue and fee revenue attributable to customers onboarded in the annual cohorts shown. It does not include non-recurring fees or gains, float revenue, or other supply chain finance income aside from quickpays. Average Invoice size presented excludes shipper and freight broker factoring invoices.

Conference Call Information

Aaron P. Graft, Vice Chairman and CEO, and Brad Voss, CFO, will review the financial results in a conference call with investors and analysts beginning at 9:30 a.m. central time on Thursday, October 16, 2025.

The live video conference option may be accessed directly through this link, https://triumph-financial-q3-2025-earnings.open-exchange.net/ or via the Company's IR website at ir.triumph.io through the News & Events, Events & Presentations links. An archive of this conference call will subsequently be available at this same location, referenced above, on the Company’s website.

About Triumph Financial

Triumph Financial, Inc. (NYSE: TFIN) is a financial and technology company focused on payments, factoring, intelligence and banking to modernize and simplify freight transactions. Headquartered in Dallas, Texas, its portfolio of brands includes Triumph, TBK Bank and LoadPay. ir.triumph.io

Forward-Looking Statements

This letter to shareholders contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; changes in management personnel; interest rate risk; concentration of our products and services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve non-performing assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; risks related to the integration of acquired businesses and any future acquisitions; our ability to successfully identify and address the risks associated with our possible future acquisitions, and the risks that our prior and possible future acquisitions make it more difficult for investors to evaluate our business, financial condition and results of operations, and impairs our ability to accurately forecast our future performance; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations, such as the Dodd-Frank Act and their application by our regulators as well as privacy, cybersecurity, and artificial intelligence regulation and oversight; governmental monetary and fiscal policies; changes in the scope and cost of FDIC, insurance and other coverages; failure to receive regulatory approval for future acquisitions and increases in our capital requirements.

While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see "Risk Factors" and the forward-looking statement disclosure contained in Triumph Financial’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 11, 2025.

Non-GAAP Financial Measures

This letter to shareholders includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non‐GAAP financial measures to GAAP financial measures are provided at the end of this letter to shareholders.

The following table sets forth key metrics used by Triumph Financial to monitor our operations. Footnotes in this table can be found in our definitions of non-GAAP financial measures at the end of this document.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the Three Months Ended | | As of and for the Nine Months Ended |

| (Dollars in thousands) | September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 | | September 30,

2025 | | September 30,

2024 |

| Financial Highlights: | | | | | | | | | | | | | |

| Total assets | $ | 6,357,149 | | | $ | 6,494,748 | | | $ | 6,268,394 | | | $ | 5,948,975 | | | $ | 5,866,046 | | | $ | 6,357,149 | | | $ | 5,866,046 | |

| Loans held for investment | $ | 4,986,922 | | | $ | 4,953,170 | | | $ | 4,666,223 | | | $ | 4,546,960 | | | $ | 4,332,967 | | | $ | 4,986,922 | | | $ | 4,332,967 | |

| Deposits | $ | 4,955,246 | | | $ | 5,186,098 | | | $ | 4,976,750 | | | $ | 4,820,820 | | | $ | 4,706,694 | | | $ | 4,955,246 | | | $ | 4,706,694 | |

| Net income available to common stockholders | $ | 907 | | | $ | 3,618 | | | $ | (784) | | | $ | 3,036 | | | $ | 4,546 | | | $ | 3,741 | | | $ | 9,848 | |

| | | | | | | | | | | | | |

| Performance Ratios - Annualized: | | | | | | | | | | | | | |

| Return on average assets | 0.11 | % | | 0.28 | % | | — | % | | 0.26 | % | | 0.36 | % | | 0.13 | % | | 0.29 | % |

| Return on average total equity | 0.73 | % | | 1.95 | % | | 0.01 | % | | 1.70 | % | | 2.39 | % | | 0.90 | % | | 1.85 | % |

| Return on average common equity | 0.41 | % | | 1.68 | % | | (0.37 | %) | | 1.41 | % | | 2.14 | % | | 0.58 | % | | 1.57 | % |

Return on average tangible common equity (1) | 0.76 | % | | 2.81 | % | | (0.53 | %) | | 2.01 | % | | 3.07 | % | | 0.94 | % | | 2.26 | % |

| Yield on loans | 8.17 | % | | 8.41 | % | | 8.37 | % | | 8.48 | % | | 8.85 | % | | 8.31 | % | | 9.01 | % |

| Cost of interest bearing deposits | 2.36 | % | | 2.22 | % | | 2.14 | % | | 2.17 | % | | 2.20 | % | | 2.24 | % | | 2.18 | % |

| Cost of total deposits | 1.35 | % | | 1.25 | % | | 1.23 | % | | 1.22 | % | | 1.23 | % | | 1.28 | % | | 1.26 | % |

| Cost of total funds | 1.55 | % | | 1.53 | % | | 1.45 | % | | 1.41 | % | | 1.57 | % | | 1.51 | % | | 1.55 | % |

| Net interest margin | 6.29 | % | | 6.43 | % | | 6.49 | % | | 6.65 | % | | 6.81 | % | | 6.40 | % | | 7.05 | % |

| Net noninterest expense to average assets | 5.08 | % | | 5.13 | % | | 5.61 | % | | 5.17 | % | | 5.29 | % | | 5.27 | % | | 5.52 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Asset Quality:(2) | | | | | | | | | | | | | |

| Past due to total loans | 1.91 | % | | 2.21 | % | | 3.24 | % | | 3.27 | % | | 2.62 | % | | 1.91 | % | | 2.62 | % |

| Non-performing loans to total loans | 1.36 | % | | 1.20 | % | | 2.07 | % | | 2.49 | % | | 2.62 | % | | 1.36 | % | | 2.62 | % |

| Non-performing assets to total assets | 1.10 | % | | 1.04 | % | | 1.64 | % | | 2.02 | % | | 2.07 | % | | 1.10 | % | | 2.07 | % |

| ACL to non-performing loans | 49.53 | % | | 65.02 | % | | 37.47 | % | | 35.93 | % | | 36.28 | % | | 49.53 | % | | 36.28 | % |

| ACL to total loans | 0.67 | % | | 0.78 | % | | 0.78 | % | | 0.90 | % | | 0.95 | % | | 0.67 | % | | 0.95 | % |

| Net charge-offs to average loans | 0.19 | % | | 0.17 | % | | 0.13 | % | | 0.11 | % | | 0.08 | % | | 0.49 | % | | 0.20 | % |

| | | | | | | | | | | | | |

| Capital: | | | | | | | | | | | | | |

Tier 1 capital to average assets(3) | 9.55 | % | | 9.46 | % | | 12.04 | % | | 12.03 | % | | 12.21 | % | | 9.55 | % | | 12.21 | % |

Tier 1 capital to risk-weighted assets(3) | 10.20 | % | | 9.98 | % | | 12.90 | % | | 13.06 | % | | 13.57 | % | | 10.20 | % | | 13.57 | % |

Common equity tier 1 capital to risk-weighted assets(3) | 8.65 | % | | 8.43 | % | | 11.27 | % | | 11.40 | % | | 11.85 | % | | 8.65 | % | | 11.85 | % |

| Total capital to risk-weighted assets | 12.09 | % | | 11.95 | % | | 14.93 | % | | 15.23 | % | | 16.62 | % | | 12.09 | % | | 16.62 | % |

| Total equity to total assets | 14.46 | % | | 14.05 | % | | 14.26 | % | | 14.98 | % | | 15.10 | % | | 14.46 | % | | 15.10 | % |

Tangible common stockholders' equity to tangible assets(1) | 7.87 | % | | 7.53 | % | | 9.86 | % | | 10.33 | % | | 10.50 | % | | 7.87 | % | | 10.50 | % |

| | | | | | | | | | | | | |

| Per Share Amounts: | | | | | | | | | | | | | |

| Book value per share | $ | 36.79 | | | $ | 36.56 | | | $ | 36.25 | | | $ | 36.16 | | | $ | 35.95 | | | $ | 36.79 | | | $ | 35.95 | |

Tangible book value per share (1) | $ | 19.70 | | | $ | 19.31 | | | $ | 25.32 | | | $ | 25.13 | | | $ | 25.22 | | | $ | 19.70 | | | $ | 25.22 | |

| Basic earnings per common share | $ | 0.04 | | | $ | 0.15 | | | $ | (0.03) | | | $ | 0.13 | | | $ | 0.19 | | | $ | 0.16 | | | $ | 0.42 | |

| Diluted earnings per common share | $ | 0.04 | | | $ | 0.15 | | | $ | (0.03) | | | $ | 0.13 | | | $ | 0.19 | | | $ | 0.16 | | | $ | 0.42 | |

| | | | | | | | | | | | | |

| Shares outstanding end of period | 23,763,401 | | | 23,727,046 | | | 23,419,740 | | | 23,391,411 | | | 23,387,522 | | | 23,763,401 | | | 23,387,522 | |

Unaudited consolidated balance sheet as of:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 |

| ASSETS | | | | | | | | | |

| Total cash and cash equivalents | $ | 147,222 | | | $ | 282,346 | | | $ | 502,944 | | | $ | 330,117 | | | $ | 489,280 | |

| Securities - available for sale | 378,088 | | | 392,275 | | | 411,925 | | | 381,561 | | | 403,186 | |

| Securities - held to maturity, net | 1,766 | | | 1,782 | | | 1,731 | | | 1,876 | | | 2,121 | |

| Equity securities with readily determinable fair value | 4,569 | | | 4,526 | | | 4,512 | | | 4,445 | | | 4,583 | |

| Loans held for sale | 9,741 | | | 6,066 | | | 2,950 | | | 1,172 | | | 26 | |

| Loans held for investment | 4,986,922 | | | 4,953,170 | | | 4,666,223 | | | 4,546,960 | | | 4,332,967 | |

| Allowance for credit losses | (33,549) | | | (38,691) | | | (36,229) | | | (40,714) | | | (41,243) | |

| Loans, net | 4,953,373 | | | 4,914,479 | | | 4,629,994 | | | 4,506,246 | | | 4,291,724 | |

| FHLB and other restricted stock | 14,092 | | | 13,339 | | | 12,987 | | | 14,054 | | | 7,112 | |

| Premises and equipment, net | 141,141 | | | 149,120 | | | 150,247 | | | 160,737 | | | 156,462 | |

| Capitalized software, net | 44,934 | | | 43,011 | | | 40,869 | | | 37,971 | | | 34,481 | |

| Goodwill | 353,898 | | | 353,900 | | | 241,949 | | | 241,949 | | | 233,709 | |

| Intangible assets, net | 52,291 | | | 55,265 | | | 13,963 | | | 16,259 | | | 17,316 | |

| Bank-owned life insurance | 64,338 | | | 63,787 | | | 63,200 | | | 62,690 | | | 42,381 | |

| Deferred tax asset, net | — | | | 3,023 | | | 11,868 | | | 13,581 | | | 10,667 | |

| Other assets | 191,696 | | | 211,829 | | | 179,255 | | | 176,317 | | | 172,998 | |

| Total assets | $ | 6,357,149 | | | $ | 6,494,748 | | | $ | 6,268,394 | | | $ | 5,948,975 | | | $ | 5,866,046 | |

| LIABILITIES | | | | | | | | | |

| Noninterest bearing deposits | $ | 2,095,017 | | | $ | 2,285,327 | | | $ | 2,260,048 | | | $ | 1,964,457 | | | $ | 2,103,092 | |

| Interest bearing deposits | 2,860,229 | | | 2,900,771 | | | 2,716,702 | | | 2,856,363 | | | 2,603,602 | |

| Total deposits | 4,955,246 | | | 5,186,098 | | | 4,976,750 | | | 4,820,820 | | | 4,706,694 | |

| Federal Home Loan Bank advances | 280,000 | | | 180,000 | | | 205,000 | | | 30,000 | | | 30,000 | |

| Subordinated notes | 69,829 | | | 69,780 | | | 69,732 | | | 69,662 | | | 109,072 | |

| Junior subordinated debentures | 42,829 | | | 42,666 | | | 42,507 | | | 42,352 | | | 42,196 | |

| Deferred tax liabilities, net | 687 | | | — | | | — | | | — | | | — | |

| Other liabilities | 89,225 | | | 103,822 | | | 80,478 | | | 95,222 | | | 92,320 | |

| Total liabilities | 5,437,816 | | | 5,582,366 | | | 5,374,467 | | | 5,058,056 | | | 4,980,282 | |

| EQUITY | | | | | | | | | |

| Preferred Stock | 45,000 | | | 45,000 | | | 45,000 | | | 45,000 | | | 45,000 | |

| Common stock | 295 | | | 295 | | | 292 | | | 291 | | | 291 | |

| Additional paid-in-capital | 593,624 | | | 588,302 | | | 572,143 | | | 567,884 | | | 564,464 | |

| Treasury stock, at cost | (270,619) | | | (270,619) | | | (268,520) | | | (268,356) | | | (268,352) | |

| Retained earnings | 552,956 | | | 552,049 | | | 548,431 | | | 549,215 | | | 546,179 | |

| Accumulated other comprehensive income (loss) | (1,923) | | | (2,645) | | | (3,419) | | | (3,115) | | | (1,818) | |

| Total stockholders' equity | 919,333 | | | 912,382 | | | 893,927 | | | 890,919 | | | 885,764 | |

| Total liabilities and equity | $ | 6,357,149 | | | $ | 6,494,748 | | | $ | 6,268,394 | | | $ | 5,948,975 | | | $ | 5,866,046 | |

Unaudited consolidated statement of income:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Nine Months Ended |

| (Dollars in thousands) | September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 | | September 30,

2025 | | September 30,

2024 |

| Interest income: | | | | | | | | | | | | | |

| Loans, including fees | $ | 56,400 | | | $ | 54,836 | | | $ | 53,576 | | | $ | 52,493 | | | $ | 52,886 | | | $ | 164,812 | | | $ | 161,338 | |

| Factored receivables, including fees | 43,841 | | | 44,217 | | | 38,694 | | | 41,351 | | | 40,598 | | | 126,752 | | | 118,535 | |

| Securities | 5,489 | | | 5,721 | | | 5,308 | | | 6,182 | | | 6,500 | | | 16,518 | | | 17,374 | |

| FHLB and other restricted stock | 223 | | | 246 | | | 249 | | | 153 | | | 379 | | | 718 | | | 845 | |

| Cash deposits | 2,987 | | | 4,181 | | | 4,443 | | | 5,299 | | | 7,712 | | | 11,611 | | | 18,945 | |

| Total interest income | 108,940 | | | 109,201 | | | 102,270 | | | 105,478 | | | 108,075 | | | 320,411 | | | 317,037 | |

| Interest expense: | | | | | | | | | | | | | |

| Deposits | 17,532 | | | 15,505 | | | 14,397 | | | 14,522 | | | 14,041 | | | 47,434 | | | 41,713 | |

| Subordinated notes | 661 | | | 661 | | | 682 | | | 1,024 | | | 1,227 | | | 2,004 | | | 3,676 | |

| Junior subordinated debentures | 1,049 | | | 1,035 | | | 994 | | | 1,129 | | | 1,172 | | | 3,078 | | | 3,518 | |

| Other borrowings | 1,865 | | | 3,322 | | | 1,814 | | | 996 | | | 2,936 | | | 7,001 | | | 5,481 | |

| Total interest expense | 21,107 | | | 20,523 | | | 17,887 | | | 17,671 | | | 19,376 | | | 59,517 | | | 54,388 | |

| Net interest income | 87,833 | | | 88,678 | | | 84,383 | | | 87,807 | | | 88,699 | | | 260,894 | | | 262,649 | |

| Credit loss expense (benefit) | 4,284 | | | (702) | | | 1,330 | | | 4,453 | | | 4,263 | | | 4,912 | | | 14,314 | |

| Net interest income after credit loss expense (benefit) | 83,549 | | | 89,380 | | | 83,053 | | | 83,354 | | | 84,436 | | | 255,982 | | | 248,335 | |

| Noninterest income: | | | | | | | | | | | | | |

| Service charges on deposits | 1,847 | | | 1,742 | | | 1,596 | | | 1,682 | | | 1,865 | | | 5,185 | | | 5,402 | |

| Card income | 1,968 | | | 1,922 | | | 1,797 | | | 1,948 | | | 2,135 | | | 5,687 | | | 6,088 | |

| Net gains (losses) on sale of securities | — | | | — | | | — | | | (1) | | | — | | | — | | | — | |

| Net gains (losses) on sale of loans | 119 | | | 190 | | | 134 | | | (6) | | | 253 | | | 443 | | | 184 | |

| Fee income | 14,305 | | | 12,755 | | | 9,114 | | | 9,048 | | | 9,129 | | | 36,174 | | | 26,329 | |

| Insurance commissions | 1,481 | | | 1,282 | | | 1,250 | | | 1,338 | | | 1,472 | | | 4,013 | | | 4,545 | |

| Other | 1,728 | | | 1,493 | | | 3,299 | | | 1,742 | | | 2,643 | | | 6,520 | | | 7,115 | |

| Total noninterest income | 21,448 | | | 19,384 | | | 17,190 | | | 15,751 | | | 17,497 | | | 58,022 | | | 49,663 | |

| Noninterest expense: | | | | | | | | | | | | | |

| Salaries and employee benefits | 60,192 | | | 59,882 | | | 58,718 | | | 53,943 | | | 55,447 | | | 178,792 | | | 165,637 | |

| Occupancy, furniture and equipment | 7,862 | | | 8,139 | | | 8,442 | | | 8,112 | | | 8,701 | | | 24,443 | | | 24,902 | |

| FDIC insurance and other regulatory assessments | 1,468 | | | 894 | | | 727 | | | 744 | | | 679 | | | 3,089 | | | 1,973 | |

| Professional fees | 5,228 | | | (320) | | | 6,064 | | | 5,006 | | | 4,734 | | | 10,972 | | | 12,833 | |

| Amortization of intangible assets | 2,956 | | | 3,400 | | | 2,400 | | | 2,799 | | | 3,600 | | | 8,756 | | | 9,193 | |

| Advertising and promotion | 2,209 | | | 1,838 | | | 1,464 | | | 1,545 | | | 1,416 | | | 5,511 | | | 4,638 | |

| Communications and technology | 12,295 | | | 12,315 | | | 12,244 | | | 12,299 | | | 12,422 | | | 36,854 | | | 38,623 | |

| Software amortization | 2,868 | | | 2,865 | | | 1,992 | | | 1,831 | | | 1,484 | | | 7,725 | | | 4,015 | |

| Travel and entertainment | 1,043 | | | 1,619 | | | 1,492 | | | 975 | | | 1,431 | | | 4,154 | | | 4,453 | |

| Other | 7,593 | | | 10,208 | | | 6,630 | | | 6,021 | | | 5,732 | | | 24,431 | | | 17,093 | |

| Total noninterest expense | 103,714 | | | 100,840 | | | 100,173 | | | 93,275 | | | 95,646 | | | 304,727 | | | 283,360 | |

| Net income before income tax | 1,283 | | | 7,924 | | | 70 | | | 5,830 | | | 6,287 | | | 9,277 | | | 14,638 | |

| Income tax expense | (425) | | | 3,504 | | | 53 | | | 1,992 | | | 940 | | | 3,132 | | | 2,386 | |

| Net income | $ | 1,708 | | | $ | 4,420 | | | $ | 17 | | | $ | 3,838 | | | $ | 5,347 | | | $ | 6,145 | | | $ | 12,252 | |

| Dividends on preferred stock | (801) | | | (802) | | | (801) | | | (802) | | | (801) | | | (2,404) | | | (2,404) | |

| Net income available to common stockholders | $ | 907 | | | $ | 3,618 | | | $ | (784) | | | $ | 3,036 | | | $ | 4,546 | | | $ | 3,741 | | | $ | 9,848 | |

Earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Nine Months Ended |

| (Dollars in thousands) | September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 | | September 30,

2025 | | September 30,

2024 |

| Basic | | | | | | | | | | | | | |

| Net income (loss) to common stockholders | $ | 907 | | | $ | 3,618 | | | $ | (784) | | | $ | 3,036 | | | $ | 4,546 | | | $ | 3,741 | | | $ | 9,848 | |

| Weighted average common shares outstanding | 23,752,331 | | | 23,590,119 | | | 23,362,400 | | | 23,339,651 | | | 23,330,635 | | | 23,569,712 | | | 23,268,887 | |

| Basic earnings (loss) per common share | $ | 0.04 | | | $ | 0.15 | | | $ | (0.03) | | | $ | 0.13 | | | $ | 0.19 | | | $ | 0.16 | | | $ | 0.42 | |

| | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | | |

| Net income (loss) to common stockholders - diluted | $ | 907 | | | $ | 3,618 | | | $ | (784) | | | $ | 3,036 | | | $ | 4,546 | | | $ | 3,741 | | | $ | 9,848 | |

| Weighted average common shares outstanding | 23,752,331 | | | 23,590,119 | | | 23,362,400 | | | 23,339,651 | | | 23,330,635 | | | 23,569,712 | | | 23,268,887 | |

| Dilutive effects of: | | | | | | | | | | | | | |

| Assumed exercises of stock options | 59,389 | | | 54,952 | | | — | | | 106,713 | | | 95,472 | | | 65,104 | | | 89,349 | |

| Restricted stock awards | — | | | 16,097 | | | — | | | 43,875 | | | 40,259 | | | 20,410 | | | 67,805 | |

| Restricted stock units | 90,675 | | | 89,156 | | | — | | | 153,326 | | | 130,331 | | | 115,441 | | | 129,047 | |

| Performance stock units - market based | 18,812 | | | 17,704 | | | — | | | 223,173 | | | 128,157 | | | 20,699 | | | 117,101 | |

| Employee stock purchase plan | 3,651 | | | 4,627 | | | — | | | 2,711 | | | 470 | | | 4,083 | | | 1,774 | |

| Weighted average shares outstanding - diluted | 23,924,858 | | | 23,772,655 | | | 23,362,400 | | | 23,869,449 | | | 23,725,324 | | | 23,795,449 | | | 23,673,963 | |

| Diluted earnings (loss) per common share | $ | 0.04 | | | $ | 0.15 | | | $ | (0.03) | | | $ | 0.13 | | | $ | 0.19 | | | $ | 0.16 | | | $ | 0.42 | |

Shares that were not considered in computing diluted earnings per common share because they were antidilutive or have not met the thresholds to be considered in the dilutive calculation are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Nine Months Ended |

| September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 | | September 30,

2025 | | September 30,

2024 |

| Stock options | 181,647 | | | 199,859 | | | 253,629 | | | 43,582 | | | 64,315 | | | 141,531 | | | 43,389 | |

| Restricted stock awards | — | | | — | | | 48,076 | | | — | | | — | | | — | | | — | |

| Restricted stock units | — | | | 5,171 | | | 203,812 | | | — | | | 7,500 | | | 3,750 | | | 7,818 | |

| Performance stock units - market based | 77,074 | | | 56,311 | | | 82,020 | | | 23,476 | | | — | | | 42,846 | | | 24,798 | |

| Employee stock purchase plan | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | | | |

Loans held for investment summarized as of:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 |

| Commercial real estate | $ | 769,314 | | | $ | 754,509 | | | $ | 811,244 | | | $ | 777,689 | | | $ | 762,343 | |

| Construction, land development, land | 204,247 | | | 221,419 | | | 204,021 | | | 203,804 | | | 217,148 | |

| 1-4 family residential properties | 180,970 | | | 172,312 | | | 159,105 | | | 154,020 | | | 126,103 | |

| Farmland | 43,208 | | | 44,069 | | | 47,311 | | | 56,366 | | | 57,621 | |

| Commercial | 1,144,872 | | | 1,132,269 | | | 1,121,740 | | | 1,119,245 | | | 1,093,477 | |

| Factored receivables | 1,424,631 | | | 1,401,377 | | | 1,350,656 | | | 1,204,510 | | | 1,201,495 | |

| Consumer | 17,235 | | | 17,520 | | | 7,088 | | | 8,000 | | | 6,990 | |

| Mortgage warehouse | 1,202,445 | | | 1,209,695 | | | 965,058 | | | 1,023,326 | | | 867,790 | |

| Total loans | $ | 4,986,922 | | | $ | 4,953,170 | | | $ | 4,666,223 | | | $ | 4,546,960 | | | $ | 4,332,967 | |

Our banking loan portfolio consists of traditional community bank loans as well as commercial finance product lines focused on businesses that require specialized financial solutions and national lending product lines that further diversify our lending operations.

Banking loans held for investment are further summarized below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 |

| Commercial real estate | $ | 769,314 | | | $ | 754,509 | | | $ | 811,244 | | | $ | 777,689 | | | $ | 762,343 | |

| Construction, land development, land | 204,247 | | | 221,419 | | | 204,021 | | | 203,804 | | | 217,148 | |

| 1-4 family residential | 180,970 | | | 172,312 | | | 159,105 | | | 154,020 | | | 126,103 | |

| Farmland | 43,208 | | | 44,069 | | | 47,311 | | | 56,366 | | | 57,621 | |

| Commercial - General | 285,571 | | | 298,653 | | | 274,697 | | | 285,469 | | | 284,989 | |

| Commercial - Agriculture | 49,742 | | | 48,107 | | | 49,529 | | | 49,365 | | | 52,997 | |

| Commercial - Equipment | 564,984 | | | 543,062 | | | 529,359 | | | 511,855 | | | 488,326 | |

| Commercial - Asset-based lending | 198,809 | | | 192,793 | | | 214,000 | | | 205,353 | | | 205,476 | |

| Commercial - Liquid Credit | 42,593 | | | 47,061 | | | 53,075 | | | 65,053 | | | 59,539 | |

| Consumer | 17,235 | | | 17,520 | | | 7,088 | | | 8,000 | | | 6,990 | |

| Mortgage Warehouse | 1,202,445 | | | 1,209,695 | | | 965,058 | | | 1,023,326 | | | 867,790 | |

| Total banking loans held for investment | $ | 3,559,118 | | | $ | 3,549,200 | | | $ | 3,314,487 | | | $ | 3,340,300 | | | $ | 3,129,322 | |

The following table presents the Company’s operating segments:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | | Total | | Corporate | | |

| Three Months Ended September 30, 2025 | | Banking | | Factoring | | Payments | | Intelligence | | Segments | | and Other(1) | | Consolidated |

| Total interest income | | $ | 64,931 | | | $ | 37,157 | | | $ | 6,769 | | | $ | — | | | $ | 108,857 | | | $ | 83 | | | $ | 108,940 | |

| Intersegment interest allocations | | 6,657 | | | (9,600) | | | 2,943 | | | — | | | — | | | — | | | — | |

| Total interest expense | | 19,391 | | | 6 | | | — | | | — | | | 19,397 | | | 1,710 | | | 21,107 | |

| Net interest income (expense) | | 52,197 | | | 27,551 | | | 9,712 | | | — | | | 89,460 | | | (1,627) | | | 87,833 | |

| Credit loss expense (benefit) | | 1,973 | | | 2,302 | | | 9 | | | — | | | 4,284 | | | — | | | 4,284 | |

| Net interest income after credit loss expense | | 50,224 | | | 25,249 | | | 9,703 | | | — | | | 85,176 | | | (1,627) | | | 83,549 | |

| Noninterest income | | 8,364 | | | 1,585 | | | 8,462 | | | 2,338 | | | 20,749 | | | 699 | | | 21,448 | |

| Noninterest expense: | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 15,349 | | | 13,674 | | | 8,769 | | | 3,767 | | | 41,559 | | | 18,633 | | | 60,192 | |

| Depreciation | | 1,603 | | | 449 | | | 203 | | | 15 | | | 2,270 | | | 1,431 | | | 3,701 | |

| Other occupancy, furniture and equipment | | 2,134 | | | 525 | | | 152 | | | 17 | | | 2,828 | | | 1,333 | | | 4,161 | |

| FDIC insurance and other regulatory assessments | | 1,468 | | | — | | | — | | | — | | | 1,468 | | | — | | | 1,468 | |

| Professional fees | | 1,194 | | | 45 | | | 248 | | | 131 | | | 1,618 | | | 3,610 | | | 5,228 | |

| Amortization of intangible assets | | 385 | | | 193 | | | 904 | | | 1,360 | | | 2,842 | | | 114 | | | 2,956 | |

| Advertising and promotion | | 416 | | | 186 | | | 1,221 | | | 56 | | | 1,879 | | | 330 | | | 2,209 | |

| Communications and technology | | 4,541 | | | 2,251 | | | 2,713 | | | 381 | | | 9,886 | | | 2,409 | | | 12,295 | |

| Software amortization | | — | | | 952 | | | 1,550 | | | 12 | | | 2,514 | | | 354 | | | 2,868 | |

| Travel and entertainment | | 188 | | | 108 | | | 179 | | | 127 | | | 602 | | | 441 | | | 1,043 | |

| Other | | 4,393 | | | 702 | | | 1,155 | | | 70 | | | 6,320 | | | 1,273 | | | 7,593 | |

| Total noninterest expense | | 31,671 | | | 19,085 | | | 17,094 | | | 5,936 | | | 73,786 | | | 29,928 | | | 103,714 | |

Net intersegment noninterest income (expense)(2) | | 158 | | | 463 | | | (621) | | | — | | | — | | | — | | | — | |

| Operating income (loss) | | $ | 27,075 | | | $ | 8,212 | | | $ | 450 | | | $ | (3,598) | | | $ | 32,139 | | | $ | (30,856) | | | $ | 1,283 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | | | | | | | | | Total | | Corporate | | |

| Three Months Ended June 30, 2025 | | Banking | | Factoring | | Payments | | Intelligence | | Segments | | and Other(1) | | Consolidated |

| Total interest income | | $ | 64,851 | | | $ | 38,040 | | | $ | 6,230 | | | $ | — | | | $ | 109,121 | | | $ | 80 | | | $ | 109,201 | |

| Intersegment interest allocations | | 6,386 | | | (9,282) | | | 2,896 | | | — | | | — | | | — | | | — | |

| Total interest expense | | 18,825 | | | 2 | | | — | | | — | | | 18,827 | | | 1,696 | | | 20,523 | |

| Net interest income (expense) | | 52,412 | | | 28,756 | | | 9,126 | | | — | | | 90,294 | | | (1,616) | | | 88,678 | |

| Credit loss expense (benefit) | | 2,219 | | | (2,916) | | | 92 | | | — | | | (605) | | | (97) | | | (702) | |

| Net interest income after credit loss expense | | 50,193 | | | 31,672 | | | 9,034 | | | — | | | 90,899 | | | (1,519) | | | 89,380 | |

| Noninterest income | | 7,989 | | | 1,811 | | | 7,724 | | | 1,724 | | | 19,248 | | | 136 | | | 19,384 | |

| Noninterest expense: | | | | | | | | | | | | | | |

| Salaries and employee benefits | | 16,001 | | | 13,444 | | | 8,711 | | | 3,234 | | | 41,390 | | | 18,492 | | | 59,882 | |

| Depreciation | | 1,656 | | | 468 | | | 222 | | | 7 | | | 2,353 | | | 1,602 | | | 3,955 | |

| Other occupancy, furniture and equipment | | 1,896 | | | 508 | | | 163 | | | 14 | | | 2,581 | | | 1,603 | | | 4,184 | |

| FDIC insurance and other regulatory assessments | | 894 | | | — | | | — | | | — | | | 894 | | | — | | | 894 | |

| Professional fees | | 1,801 | | | (7,272) | | | 240 | | | 2,995 | | | (2,236) | | | 1,916 | | | (320) | |

| Amortization of intangible assets | | 385 | | | 193 | | | 1,418 | | | 946 | | | 2,942 | | | 458 | | | 3,400 | |

| Advertising and promotion | | 557 | | | 223 | | | 669 | | | 22 | | | 1,471 | | | 367 | | | 1,838 | |

| Communications and technology | | 5,257 | | | 2,438 | | | 2,455 | | | 278 | | | 10,428 | | | 1,887 | | | 12,315 | |

| Software amortization | | — | | | 1,125 | | | 1,413 | | | — | | | 2,538 | | | 327 | | | 2,865 | |

| Travel and entertainment | | 306 | | | 245 | | | 456 | | | 130 | | | 1,137 | | | 482 | | | 1,619 | |

| Other | | 3,210 | | | 2,770 | | | 1,097 | | | 84 | | | 7,161 | | | 3,047 | | | 10,208 | |

| Total noninterest expense | | 31,963 | | | 14,142 | | | 16,844 | | | 7,710 | | | 70,659 | | | 30,181 | | | 100,840 | |

Intersegment noninterest income (expense)(2) | | 155 | | | 413 | | | (568) | | | — | | | — | | | — | | | — | |

| Operating income (loss) | | $ | 26,374 | | | $ | 19,754 | | | $ | (654) | | | $ | (5,986) | | | $ | 39,488 | | | $ | (31,564) | | | $ | 7,924 | |

(1) Includes revenue and expense from the Company’s holding company, which does not meet the definition of an operating segment. Also includes corporate shared service costs such as the majority of salaries and benefits expense for our executive leadership team, as well as other selling, general, and administrative shared services costs including human resources, accounting, finance, risk management and a significant amount of information technology expense.

(2) Intersegment noninterest income (expense) includes:

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | Banking | | Factoring | | Payments |

| Three Months Ended September 30, 2025 | | | | | | |

| Factoring revenue received from Payments | | $ | — | | | $ | 911 | | | $ | (911) | |

| Payments revenue received from Factoring | | — | | | (329) | | | 329 | |

| Banking revenue received from Payments and Factoring | | 158 | | | (119) | | | (39) | |

| Intersegment noninterest income (expense) | | $ | 158 | | | $ | 463 | | | $ | (621) | |

| | | | | | |

| Three Months Ended June 30, 2025 | | | | | | |

| Factoring revenue received from Payments | | $ | — | | | $ | 910 | | | $ | (910) | |

| Payments revenue received from Factoring | | — | | | (381) | | | 381 | |

| Banking revenue received from Payments and Factoring | | 155 | | | (116) | | | (39) | |

| Intersegment noninterest income (expense) | | $ | 155 | | | $ | 413 | | | $ | (568) | |

Information pertaining to our Factoring segment, summarized as of and for the quarters ended:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Factoring | | September 30,

2025 | | June 30,

2025 | | March 31,

2025 | | December 31,

2024 | | September 30,

2024 |

| Factored receivable period end balance | | $ | 1,193,849,000 | | | $ | 1,174,830,000 | | | $ | 1,146,429,000 | | | $ | 1,032,842,000 | | | $ | 1,031,633,000 | |

| Commercial loans period end balance | | $ | 3,173,000 | | | $ | 2,593,000 | | | $ | 1,080,000 | | | $ | 2,150,000 | | | $ | 2,150,000 | |

Yield on average receivable balance(1) | | 12.63 | % | | 13.40 | % | | 12.75 | % | | 13.36 | % | | 13.57 | % |

Current quarter charge-off rate(2) | | 0.33 | % | | (0.19 | %) | | 0.11 | % | | 0.26 | % | | 0.07 | % |

| Factored receivables - transportation concentration | | 96 | % | | 96 | % | | 97 | % | | 97 | % | | 97 | % |

| | | | | | | | | | |

| Interest income, including fees | | $ | 37,157,000 | | | $ | 38,040,000 | | | $ | 33,331,000 | | | $ | 35,754,000 | | | $ | 34,905,000 | |

| Noninterest income | | 1,585,000 | | | 1,811,000 | | | 1,719,000 | | | 1,594,000 | | | 2,170,000 | |

| Intersegment noninterest income | | 911,000 | | | 910,000 | | | 911,000 | | | 864,000 | | | 864,000 | |

| Factoring total revenue | | 39,653,000 | | | 40,761,000 | | | 35,961,000 | | | 38,212,000 | | | 37,939,000 | |

| Average net funds employed | | 1,097,229,000 | | | 1,065,073,000 | | | 948,729,000 | | | 950,776,000 | | | 915,257,000 | |