Investor Deck July 2025 WELCOME TO TRIUMPH NASDAQ: TFIN

2 Safe Harbor Statement Forward-Looking Statements This presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; changes in management personnel; interest rate risk; concentration of our products and services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; risks related to the integration of acquired businesses and any future acquisitions; our ability to successfully identify and address the risks associated with our possible future acquisitions, and the risks that our prior and possible future acquisitions make it more difficult for investors to evaluate our business, financial condition and results of operations, and impairs our ability to accurately forecast our future performance; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets or deferred tax assets; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and non-bank financial services industries, nationally, regionally or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities and tax laws and regulations, such as the Dodd- Frank Act and their application by our regulators; governmental monetary and fiscal policies; changes in the scope and cost of FDIC, insurance and other coverages; failure to receive regulatory approval for future acquisitions and increases in our capital requirements. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see "Risk Factors" and the forward-looking statement disclosure contained in Triumph Financial’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 11, 2025. Non-GAAP Financial Measures This presentation may include certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non -GAAP financial measures to GAAP financial measures, if included, are provided at the end of this presentation. Unless otherwise noted, all data presented in this document is as of the quarter ending June 30, 2025. © TBK Bank, SSB, DBA Triumph

Overview

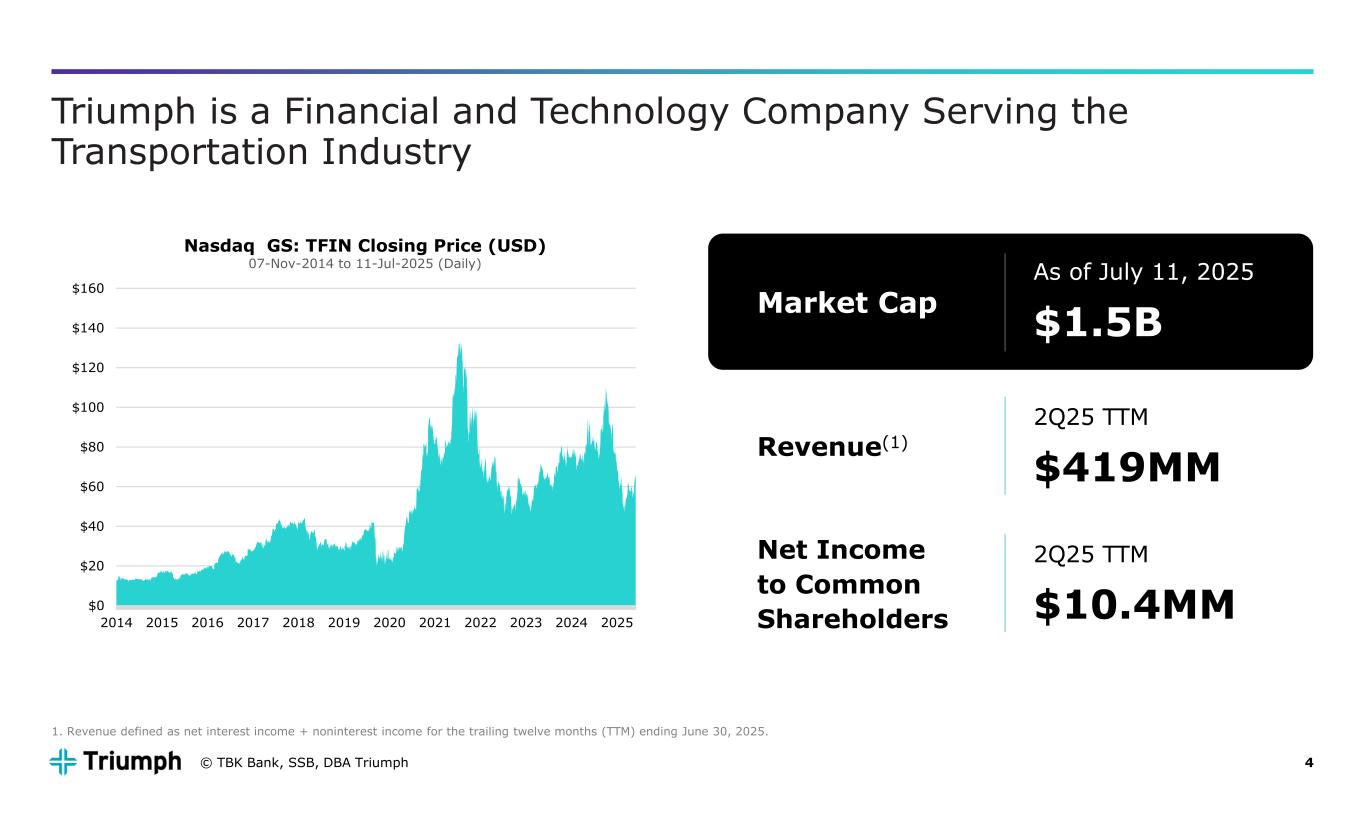

4 Triumph is a Financial and Technology Company Serving the Transportation Industry © TBK Bank, SSB, DBA Triumph Market Cap As of July 11, 2025 $1.5B Revenue(1) Net Income to Common Shareholders 2Q25 TTM $419MM 2Q25 TTM $10.4MM 1. Revenue defined as net interest income + noninterest income for the trailing twelve months (TTM) ending June 30, 2025. $0 $20 $40 $60 $80 $100 $120 $140 $160 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Nasdaq GS: TFIN Closing Price (USD) 07-Nov-2014 to 11-Jul-2025 (Daily)

Positioned to Win

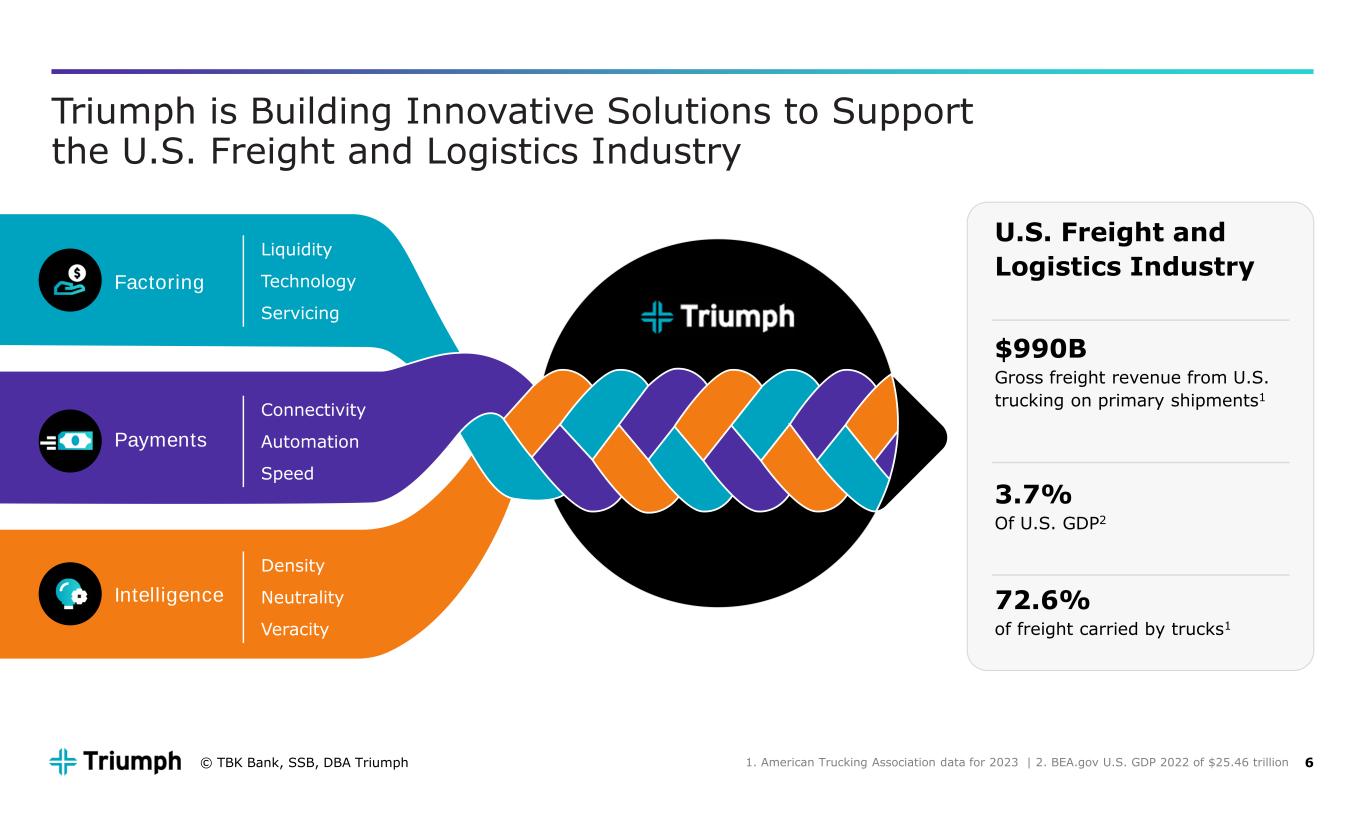

6 Triumph is Building Innovative Solutions to Support the U.S. Freight and Logistics Industry 1. American Trucking Association data for 2023 | 2. BEA.gov U.S. GDP 2022 of $25.46 trillion Factoring Payments Intelligence Liquidity Technology Servicing Connectivity Automation Speed Density Neutrality Veracity U.S. Freight and Logistics Industry $990B Gross freight revenue from U.S. trucking on primary shipments1 3.7% Of U.S. GDP2 72.6% of freight carried by trucks1 © TBK Bank, SSB, DBA Triumph

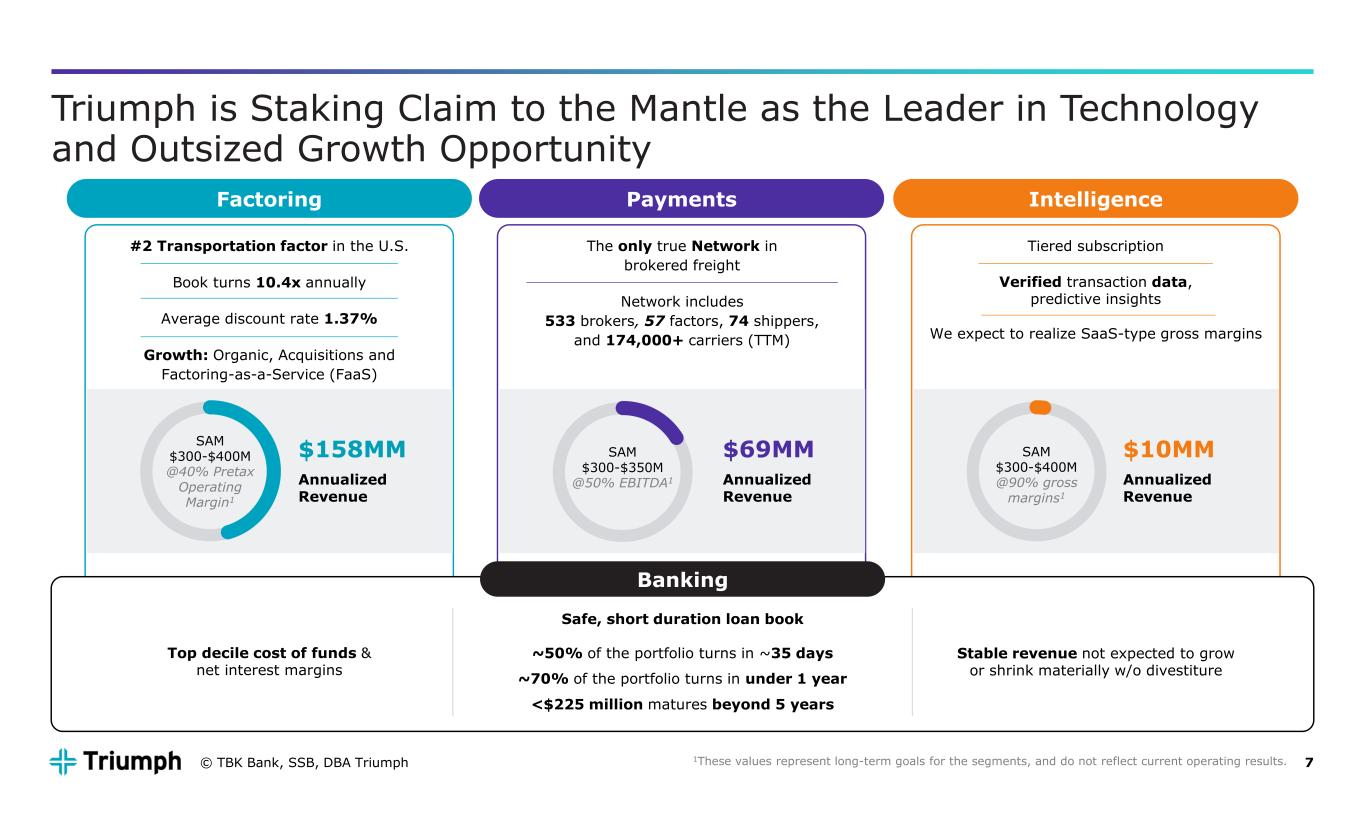

7 SAM $300-$400M @90% gross margins1 Triumph is Staking Claim to the Mantle as the Leader in Technology and Outsized Growth Opportunity The only true Network in brokered freight Network includes 533 brokers, 57 factors, 74 shippers, and 174,000+ carriers (TTM) $69MM Annualized Revenue SAM $300-$350M @50% EBITDA1 Payments IntelligenceFactoring #2 Transportation factor in the U.S. Book turns 10.4x annually Average discount rate 1.37% Growth: Organic, Acquisitions and Factoring-as-a-Service (FaaS) Tiered subscription Verified transaction data, predictive insights We expect to realize SaaS-type gross margins Banking Top decile cost of funds & net interest margins Safe, short duration loan book ~50% of the portfolio turns in ~35 days ~70% of the portfolio turns in under 1 year <$225 million matures beyond 5 years Stable revenue not expected to grow or shrink materially w/o divestiture $158MM Annualized Revenue $10MM Annualized Revenue SAM $300-$400M @40% Pretax Operating Margin1 1These values represent long-term goals for the segments, and do not reflect current operating results.© TBK Bank, SSB, DBA Triumph

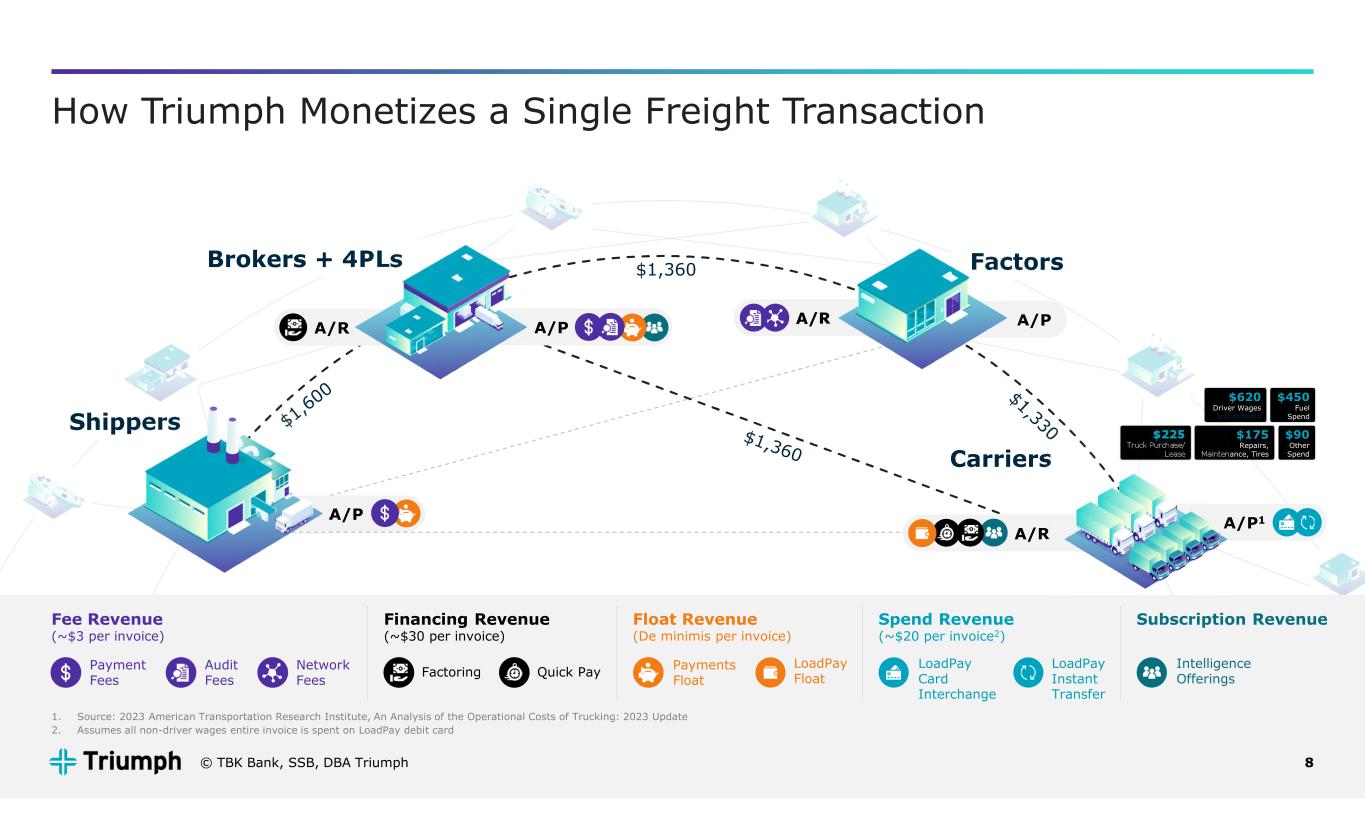

8 A/P1 How Triumph Monetizes a Single Freight Transaction $1,360 A/PA/R A/R A/P FactorsBrokers + 4PLs A/R Carriers Shippers $620 Driver Wages and Benefits $450 Fuel Spend $225 Truck Purchase/ Lease $175 Repairs, Maintenance, Tires $90 Other Spend Fee Revenue (~$3 per invoice) Financing Revenue (~$30 per invoice) Float Revenue (De minimis per invoice) Spend Revenue (~$20 per invoice2) Quick Pay Audit Fees Network Fees Payment Fees Factoring Payments Float LoadPay Card Interchange LoadPay Instant Transfer LoadPay Float Subscription Revenue Intelligence Offerings A/P 1. Source: 2023 American Transportation Research Institute, An Analysis of the Operational Costs of Trucking: 2023 Update 2. Assumes all non-driver wages entire invoice is spent on LoadPay debit card © TBK Bank, SSB, DBA Triumph

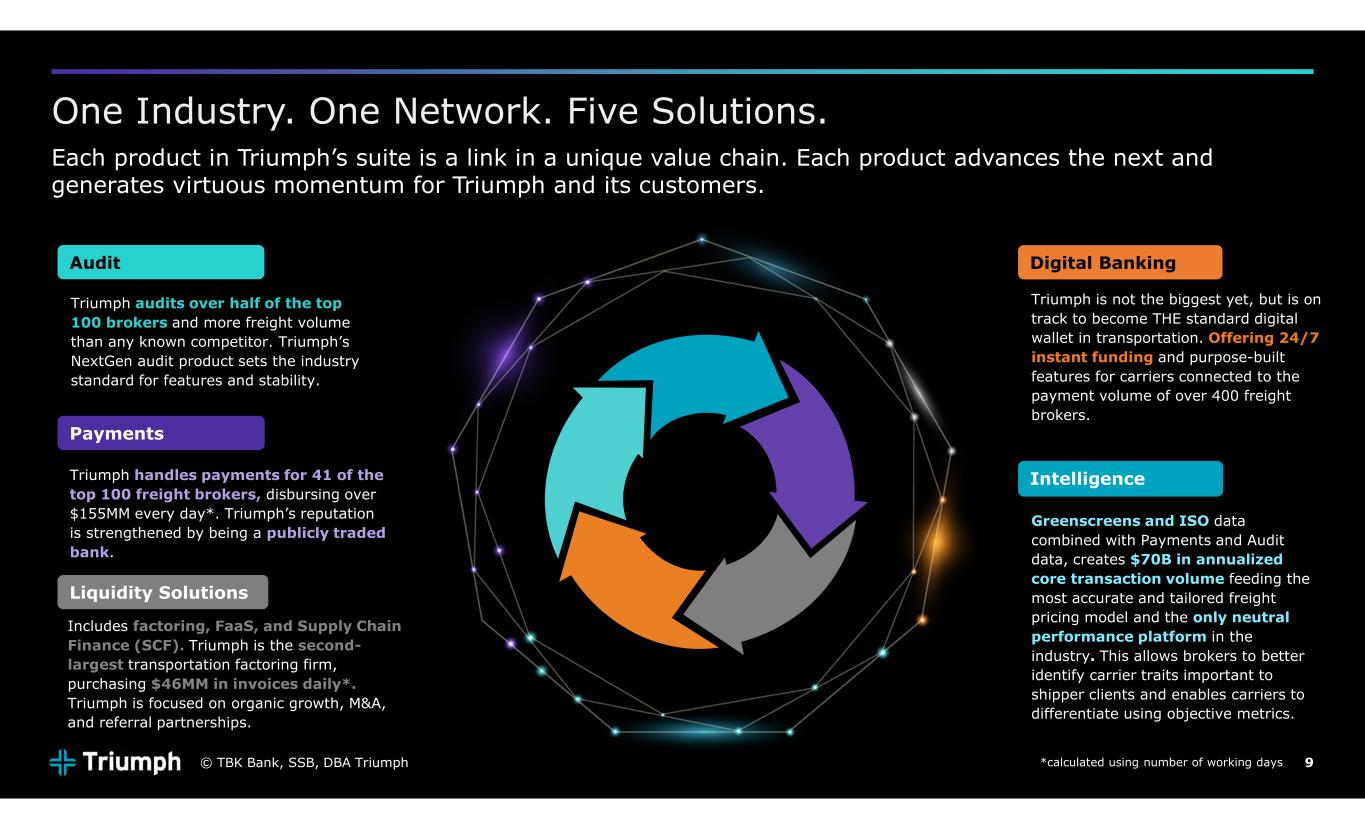

9 One Industry. One Network. Five Solutions. Each product in Triumph’s suite is a link in a unique value chain. Each product advances the next and generates virtuous momentum for Triumph and its customers. Payments Triumph handles payments for 41 of the top 100 freight brokers, disbursing over $155MM every day*. Triumph’s reputation is strengthened by being a publicly traded bank. Audit Triumph audits over half of the top 100 brokers and more freight volume than any known competitor. Triumph’s NextGen audit product sets the industry standard for features and stability. Liquidity Solutions Includes factoring, FaaS, and Supply Chain Finance (SCF). Triumph is the second- largest transportation factoring firm, purchasing $46MM in invoices daily*. Triumph is focused on organic growth, M&A, and referral partnerships. Digital Banking Triumph is not the biggest yet, but is on track to become THE standard digital wallet in transportation. Offering 24/7 instant funding and purpose-built features for carriers connected to the payment volume of over 400 freight brokers. Intelligence Greenscreens and ISO data combined with Payments and Audit data, creates $70B in annualized core transaction volume feeding the most accurate and tailored freight pricing model and the only neutral performance platform in the industry. This allows brokers to better identify carrier traits important to shipper clients and enables carriers to differentiate using objective metrics. *calculated using number of working days© TBK Bank, SSB, DBA Triumph

Factoring Payments Intelligence

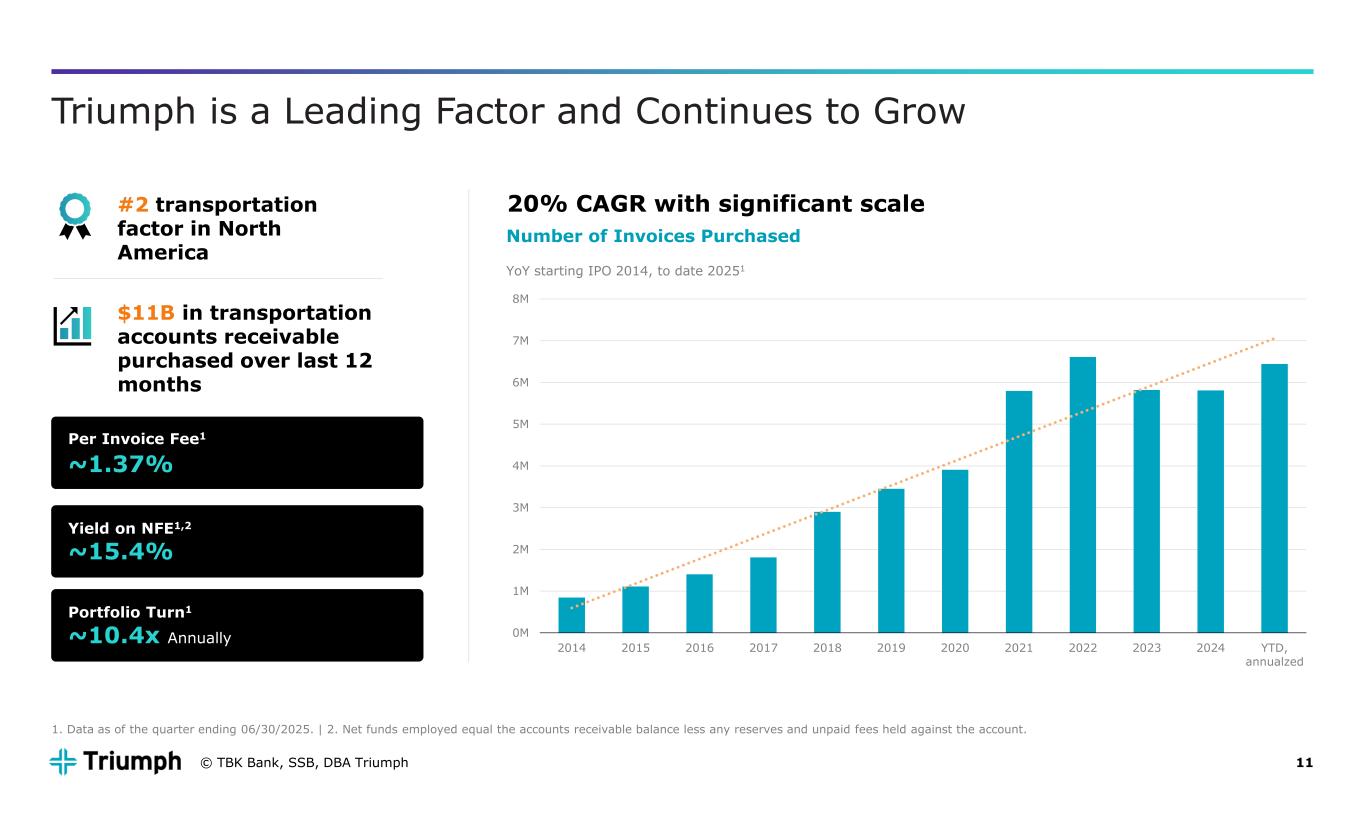

11 0M 1M 2M 3M 4M 5M 6M 7M 8M 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 YTD, annualzed 20% CAGR with significant scale Triumph is a Leading Factor and Continues to Grow 1. Data as of the quarter ending 06/30/2025. | 2. Net funds employed equal the accounts receivable balance less any reserves and unpaid fees held against the account. #2 transportation factor in North America $11B in transportation accounts receivable purchased over last 12 months Per Invoice Fee1 ~1.37% Average Discount Rate Yield on NFE1,2 ~15.4% Portfolio Turn1 ~10.4x Annually Number of Invoices Purchased YoY starting IPO 2014, to date 20251 © TBK Bank, SSB, DBA Triumph

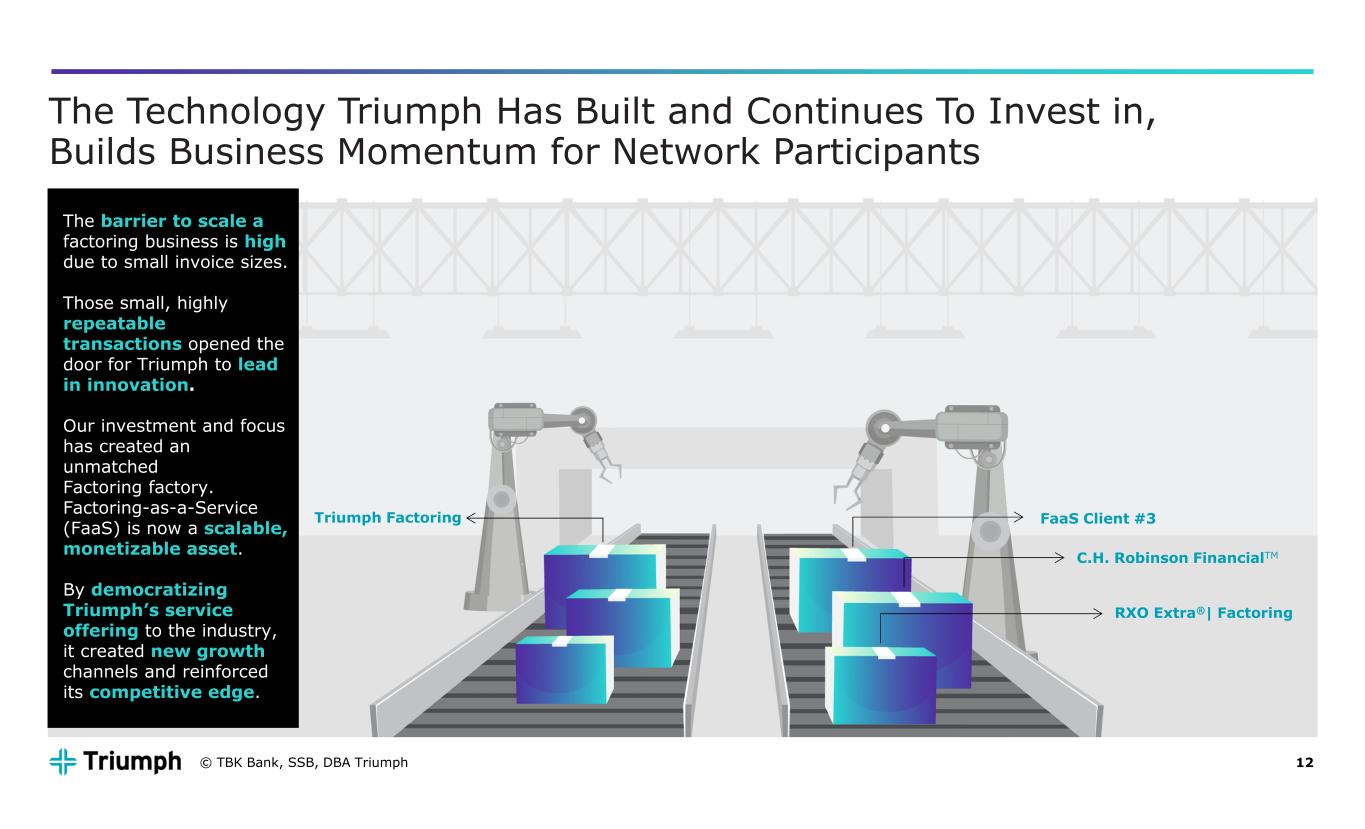

12 The Technology Triumph Has Built and Continues To Invest in, Builds Business Momentum for Network Participants The barrier to scale a factoring business is high due to small invoice sizes. Those small, highly repeatable transactions opened the door for Triumph to lead in innovation.. Our investment and focus has created an unmatched Factoring factory. Factoring-as-a-Service (FaaS) is now a scalable, monetizable asset. By democratizing Triumph’s service offering to the industry, it created new growth channels and reinforced its competitive edge. FaaS Client #3 C.H. Robinson FinancialTM RXO Extra®| Factoring Triumph Factoring © TBK Bank, SSB, DBA Triumph

Factoring Payments Intelligence

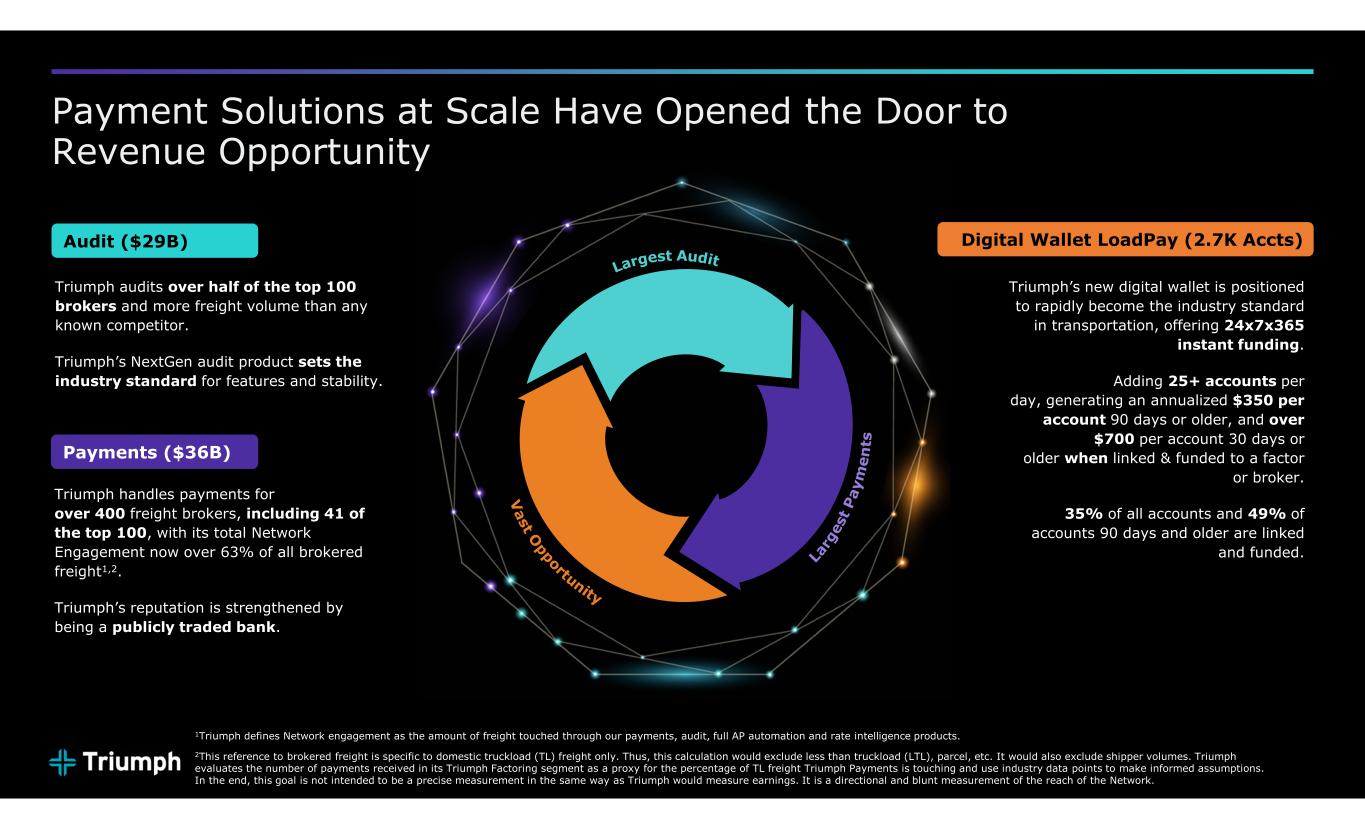

14 Payment Solutions at Scale Have Opened the Door to Revenue Opportunity 1Triumph defines Network engagement as the amount of freight touched through our payments, audit, full AP automation and rate intelligence products. 2This reference to brokered freight is specific to domestic truckload (TL) freight only. Thus, this calculation would exclude less than truckload (LTL), parcel, etc. It would also exclude shipper volumes. Triumph evaluates the number of payments received in its Triumph Factoring segment as a proxy for the percentage of TL freight Triumph Payments is touching and use industry data points to make informed assumptions. In the end, this goal is not intended to be a precise measurement in the same way as Triumph would measure earnings. It is a directional and blunt measurement of the reach of the Network. Triumph audits over half of the top 100 brokers and more freight volume than any known competitor. Triumph’s NextGen audit product sets the industry standard for features and stability. Triumph handles payments for over 400 freight brokers, including 41 of the top 100, with its total Network Engagement now over 63% of all brokered freight1,2. Triumph’s reputation is strengthened by being a publicly traded bank. Triumph’s new digital wallet is positioned to rapidly become the industry standard in transportation, offering 24x7x365 instant funding. Adding 25+ accounts per day, generating an annualized $350 per account 90 days or older, and over $700 per account 30 days or older when linked & funded to a factor or broker. 35% of all accounts and 49% of accounts 90 days and older are linked and funded. Audit ($29B) Payments ($36B) Digital Wallet LoadPay (2.7K Accts)

Factoring Payments Intelligence

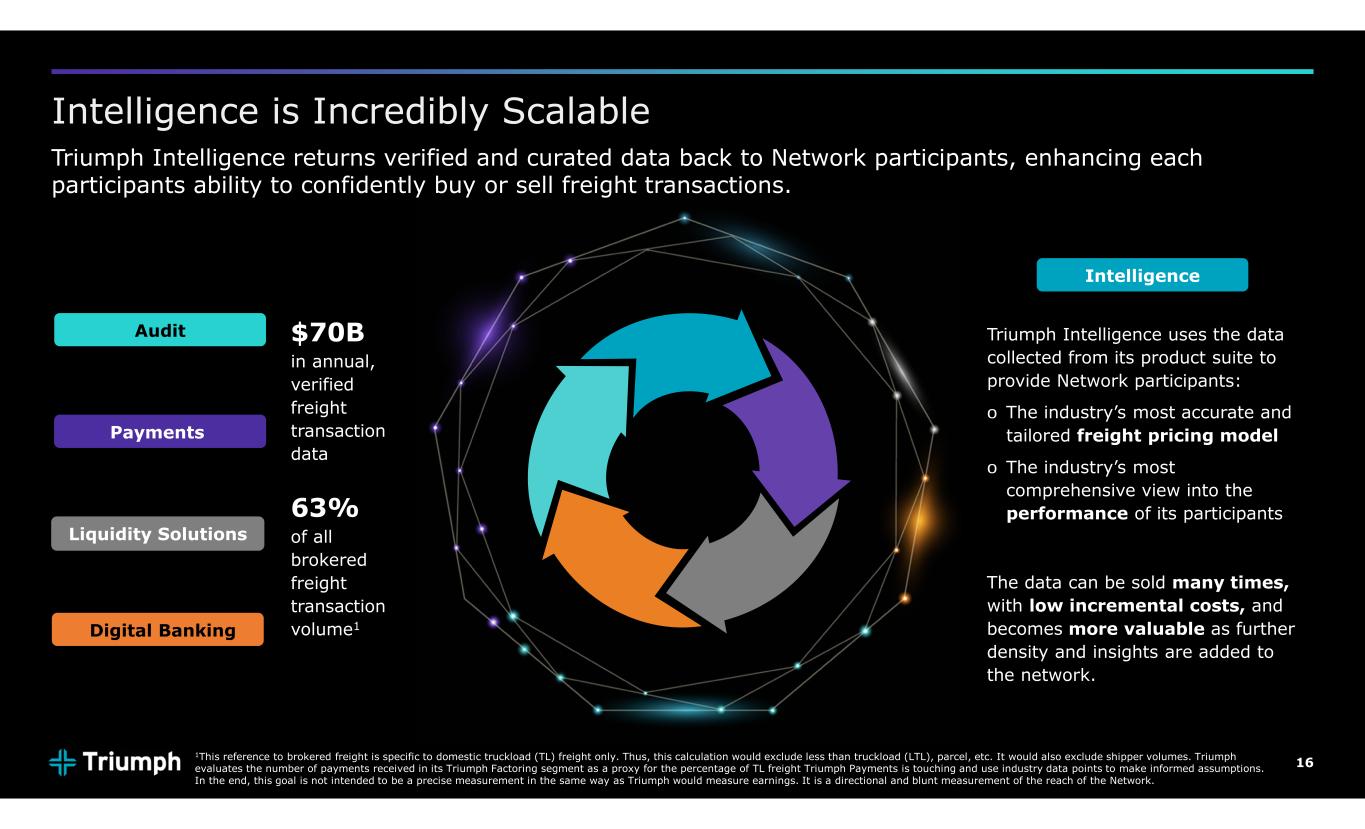

16 Intelligence is Incredibly Scalable Triumph Intelligence returns verified and curated data back to Network participants, enhancing each participants ability to confidently buy or sell freight transactions. Payments Audit Liquidity Solutions Digital Banking Intelligence $70B in annual, verified freight transaction data 63% of all brokered freight transaction volume1 Triumph Intelligence uses the data collected from its product suite to provide Network participants: o The industry’s most accurate and tailored freight pricing model o The industry’s most comprehensive view into the performance of its participants The data can be sold many times, with low incremental costs, and becomes more valuable as further density and insights are added to the network. 1This reference to brokered freight is specific to domestic truckload (TL) freight only. Thus, this calculation would exclude less than truckload (LTL), parcel, etc. It would also exclude shipper volumes. Triumph evaluates the number of payments received in its Triumph Factoring segment as a proxy for the percentage of TL freight Triumph Payments is touching and use industry data points to make informed assumptions. In the end, this goal is not intended to be a precise measurement in the same way as Triumph would measure earnings. It is a directional and blunt measurement of the reach of the Network.

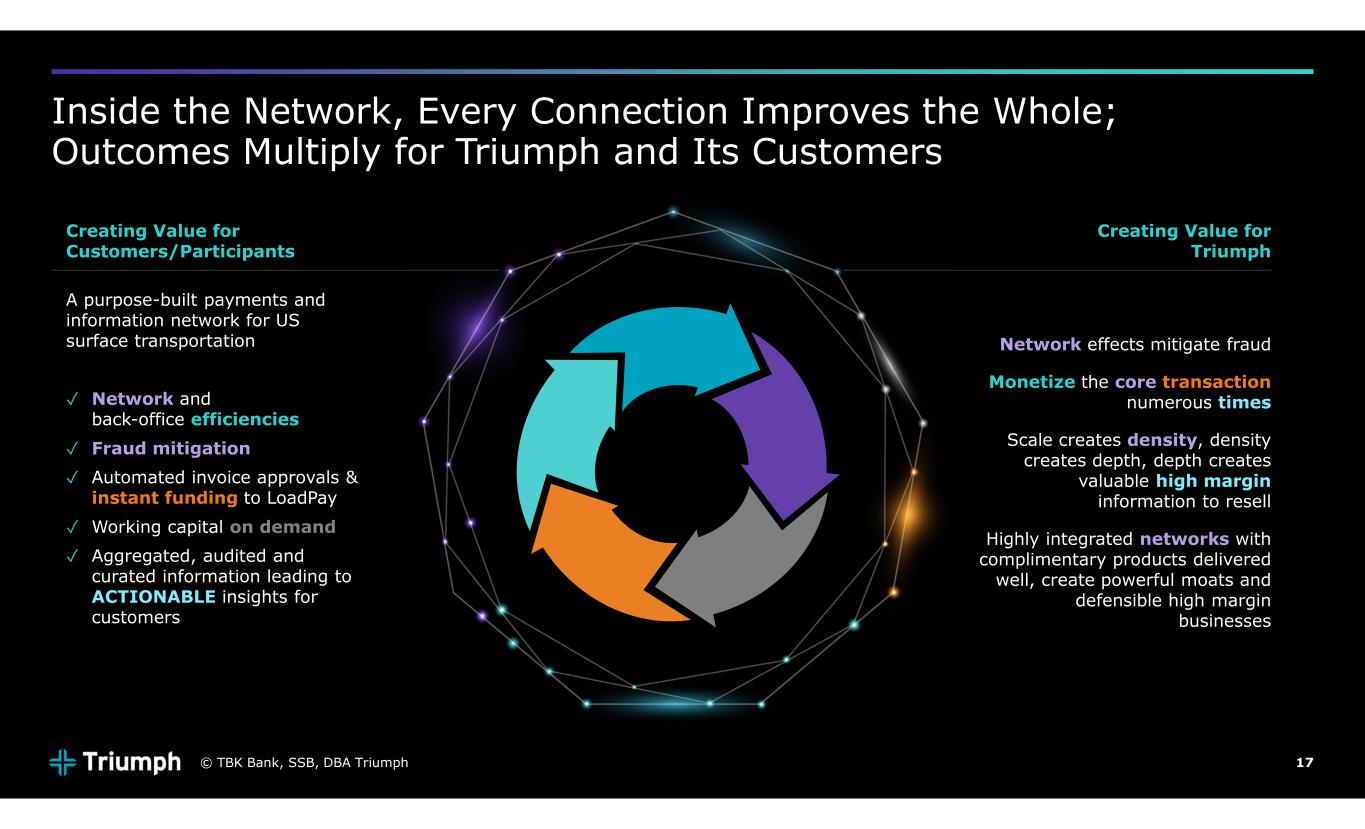

17 Inside the Network, Every Connection Improves the Whole; Outcomes Multiply for Triumph and Its Customers Creating Value for Customers/Participants A purpose-built payments and information network for US surface transportation ✓ Network and back-office efficiencies ✓ Fraud mitigation ✓ Automated invoice approvals & instant funding to LoadPay ✓ Working capital on demand ✓ Aggregated, audited and curated information leading to ACTIONABLE insights for customers Creating Value for Triumph Network effects mitigate fraud Monetize the core transaction numerous times Scale creates density, density creates depth, depth creates valuable high margin information to resell Highly integrated networks with complimentary products delivered well, create powerful moats and defensible high margin businesses © TBK Bank, SSB, DBA Triumph

Sustainable Business Practices

19 Our Values Transparency Communicate the truth consistently, directly and professionally. Open communication is the foundation of strong relationships. Respect Treat others as you want to be treated. Put the needs of others and the needs of the team before promoting your own agenda. Invest for the future Do not allow the immediate to crowd out the important. Success that endures is built upon a long-term perspective. Unique is good Be wary of following the crowd. Being unique can be difficult, but if it were easy, everyone would do it. Mission is more than money Make everything you're involved in better. This includes doing good in the areas of greatest need – in your community and around the world. People make the difference In any situation, the most important criteria for success are the quality of people and the quality of their thinking. Humility Model humility in all that you do. Humility is not passivity, as it requires the courage to prefer others' needs over your own. T MI R P H U © TBK Bank, SSB, DBA Triumph

20 Our Environmental Practices What We Believe What We Monitor We recognize that our activities may have an impact on our planet We are committed to sustainable finance, balancing environmental stewardship with responsible business operations and complying with all applicable laws We focus our efforts on responsible resource use while creating comfortable, safe and healthy workplaces for our team members and stakeholders Limits set on concentrations of certain types of lending or industries The company requires Board oversight and approval of relationships exceeding certain thresholds The company employs external loan review and between 70% and 75% of the portfolio is reviewed annually The company stress tests the portfolio regularly and evaluates whether climate change loss factors should be included in credit loss forecasting Our Environmental Policy What We Practice ✓ Preference for environmentally friendly products ✓ Leverage document and image technology to reduce paper consumption, our largest waste product ✓ Newest branch operates solar panels and geothermal heat pumps ✓ New offices use LED lighting and occupancy sensors. Existing branches are being upgraded Our Corporate Sustainability Report © TBK Bank, SSB, DBA Triumph

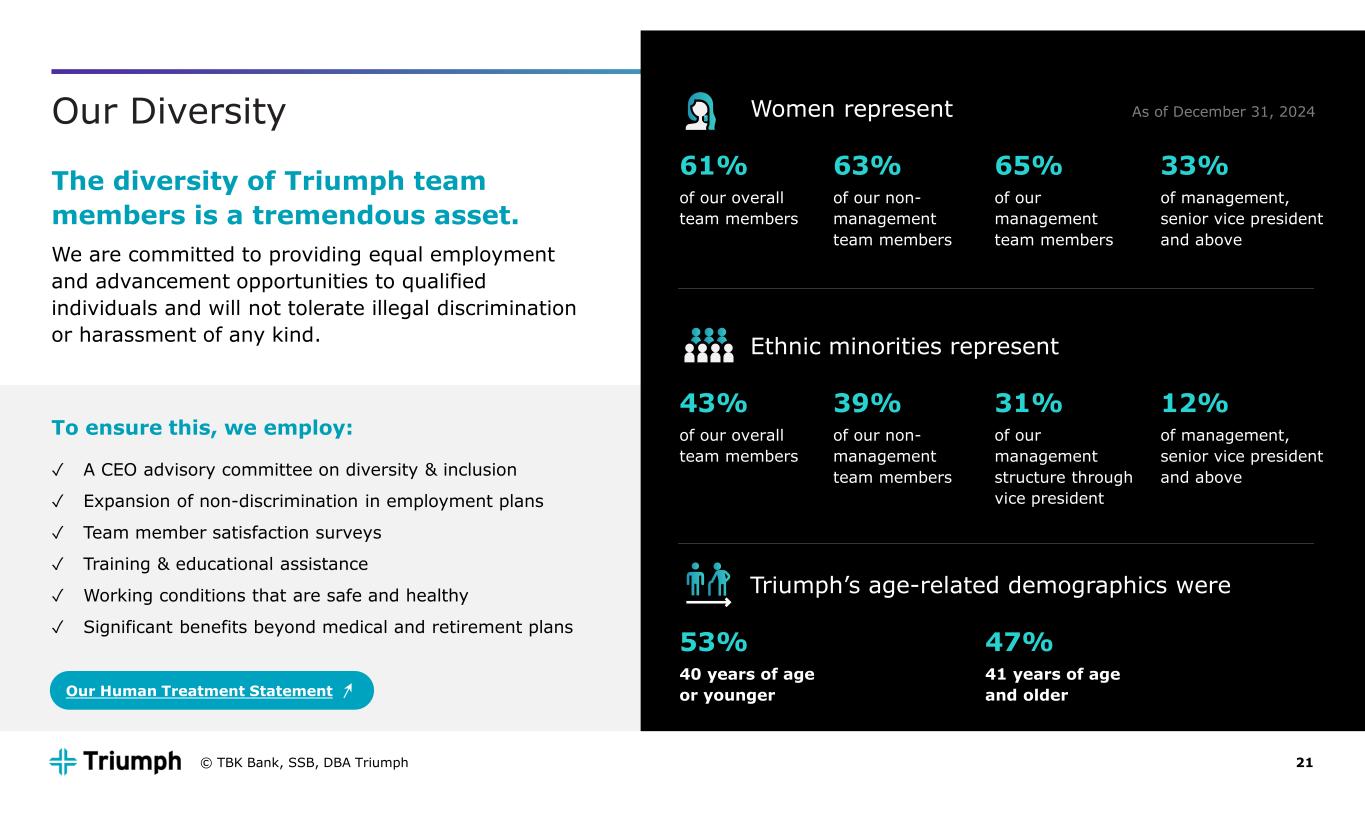

21 Our Diversity The diversity of Triumph team members is a tremendous asset. We are committed to providing equal employment and advancement opportunities to qualified individuals and will not tolerate illegal discrimination or harassment of any kind. Women represent 61% of our overall team members 63% of our non- management team members 65% of our management team members 33% of management, senior vice president and above Our Human Treatment Statement To ensure this, we employ: ✓ A CEO advisory committee on diversity & inclusion ✓ Expansion of non-discrimination in employment plans ✓ Team member satisfaction surveys ✓ Training & educational assistance ✓ Working conditions that are safe and healthy ✓ Significant benefits beyond medical and retirement plans Ethnic minorities represent 43% of our overall team members 39% of our non- management team members 31% of our management structure through vice president 12% of management, senior vice president and above Triumph’s age-related demographics were 53% 40 years of age or younger 47% 41 years of age and older As of December 31, 2024 © TBK Bank, SSB, DBA Triumph

22 Our Philanthropy In 2024, Triumph's Matching Gifts Program Aside from volunteering, Triumph's Matching Gifts Program, supports organizations important to team members by matching their charitable contributions to qualified organizations, dollar- for-dollar, up to $1,000 for each team member, each calendar year. 424 Team members volunteered 8,366 Volunteer hours were reported 398 Organizations were supported $54,190 Donated through the Matching Gifts Program in 2024 Major Charitable Initiatives The Mission is More Than Money We focus on doing the most good in the areas of greatest need through our philanthropic endeavors. Below are four areas of focus used to guide Triumph’s decision making around nonprofit partnerships, charitable giving opportunities, and team member volunteer events. • Advocating for Safety & Justice • Supporting Families • Providing Access to Basic Needs • Transforming Communities Triumph Workshop Triumph Workshop provides the tools, knowledge, and connections to foster a community of creation, innovation and success. Triumph and TBK Bank established Triumph Workshop as a makerspace to serve the community through programs focusing on workforce development, education initiatives and entrepreneur support. TBK Scholars Program In 2024, we completed our 6th annual scholarship program, awarding fifteen $1,000 scholarships to high school seniors from low-to-moderate income ("LMI") families in the communities the bank serves. Crosshairs Charitable Foundation This organization provides an opportunity for others to participate in community development and charitable activities that Triumph supports. © TBK Bank, SSB, DBA Triumph

Appendix

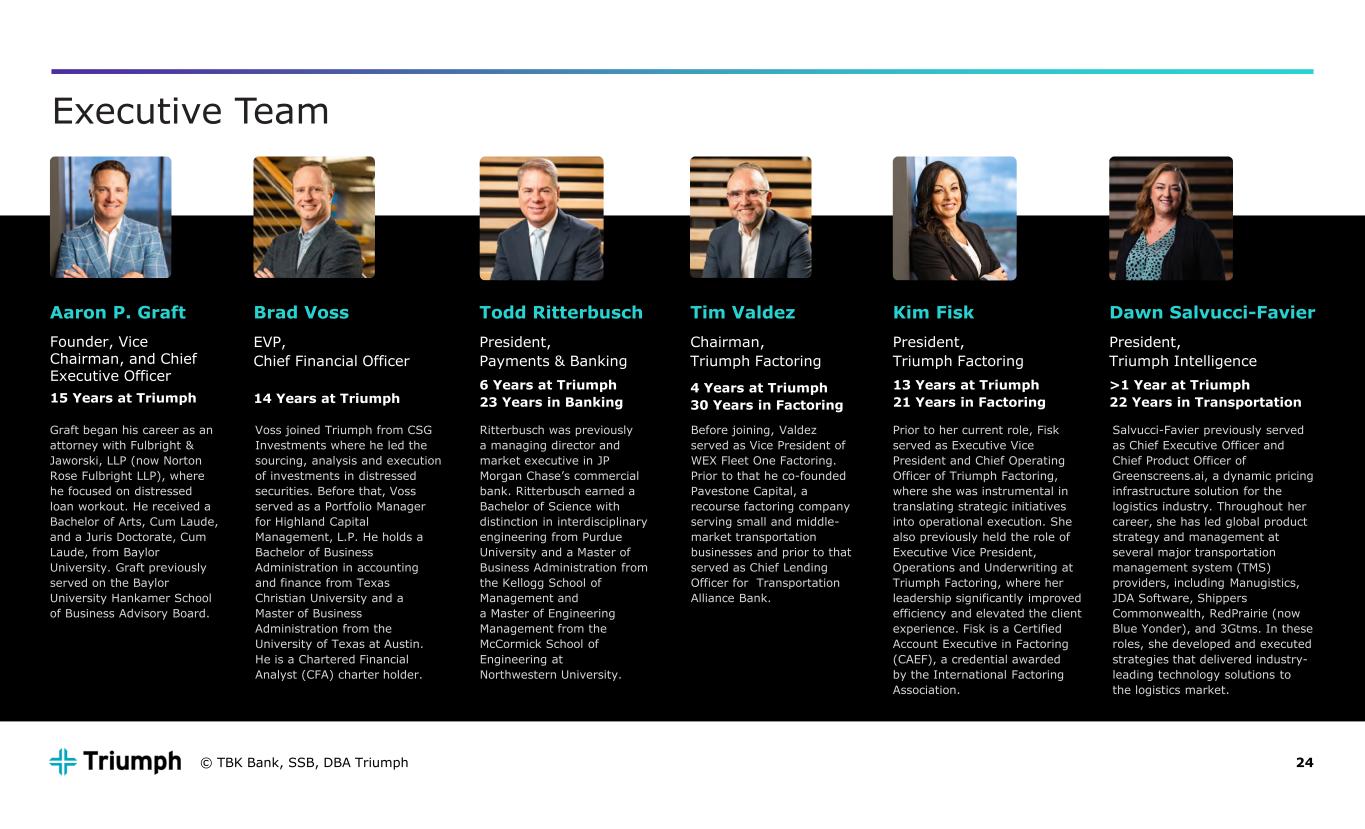

24 Executive Team Aaron P. Graft Founder, Vice Chairman, and Chief Executive Officer 15 Years at Triumph Brad Voss EVP, Chief Financial Officer 14 Years at Triumph Todd Ritterbusch President, Payments & Banking 6 Years at Triumph 23 Years in Banking Kim Fisk President, Triumph Factoring 13 Years at Triumph 21 Years in Factoring Dawn Salvucci-Favier President, Triumph Intelligence >1 Year at Triumph 22 Years in Transportation Graft began his career as an attorney with Fulbright & Jaworski, LLP (now Norton Rose Fulbright LLP), where he focused on distressed loan workout. He received a Bachelor of Arts, Cum Laude, and a Juris Doctorate, Cum Laude, from Baylor University. Graft previously served on the Baylor University Hankamer School of Business Advisory Board. Voss joined Triumph from CSG Investments where he led the sourcing, analysis and execution of investments in distressed securities. Before that, Voss served as a Portfolio Manager for Highland Capital Management, L.P. He holds a Bachelor of Business Administration in accounting and finance from Texas Christian University and a Master of Business Administration from the University of Texas at Austin. He is a Chartered Financial Analyst (CFA) charter holder. Ritterbusch was previously a managing director and market executive in JP Morgan Chase’s commercial bank. Ritterbusch earned a Bachelor of Science with distinction in interdisciplinary engineering from Purdue University and a Master of Business Administration from the Kellogg School of Management and a Master of Engineering Management from the McCormick School of Engineering at Northwestern University. Prior to her current role, Fisk served as Executive Vice President and Chief Operating Officer of Triumph Factoring, where she was instrumental in translating strategic initiatives into operational execution. She also previously held the role of Executive Vice President, Operations and Underwriting at Triumph Factoring, where her leadership significantly improved efficiency and elevated the client experience. Fisk is a Certified Account Executive in Factoring (CAEF), a credential awarded by the International Factoring Association. Salvucci-Favier previously served as Chief Executive Officer and Chief Product Officer of Greenscreens.ai, a dynamic pricing infrastructure solution for the logistics industry. Throughout her career, she has led global product strategy and management at several major transportation management system (TMS) providers, including Manugistics, JDA Software, Shippers Commonwealth, RedPrairie (now Blue Yonder), and 3Gtms. In these roles, she developed and executed strategies that delivered industry- leading technology solutions to the logistics market. Tim Valdez Chairman, Triumph Factoring 4 Years at Triumph 30 Years in Factoring Before joining, Valdez served as Vice President of WEX Fleet One Factoring. Prior to that he co-founded Pavestone Capital, a recourse factoring company serving small and middle- market transportation businesses and prior to that served as Chief Lending Officer for Transportation Alliance Bank. © TBK Bank, SSB, DBA Triumph

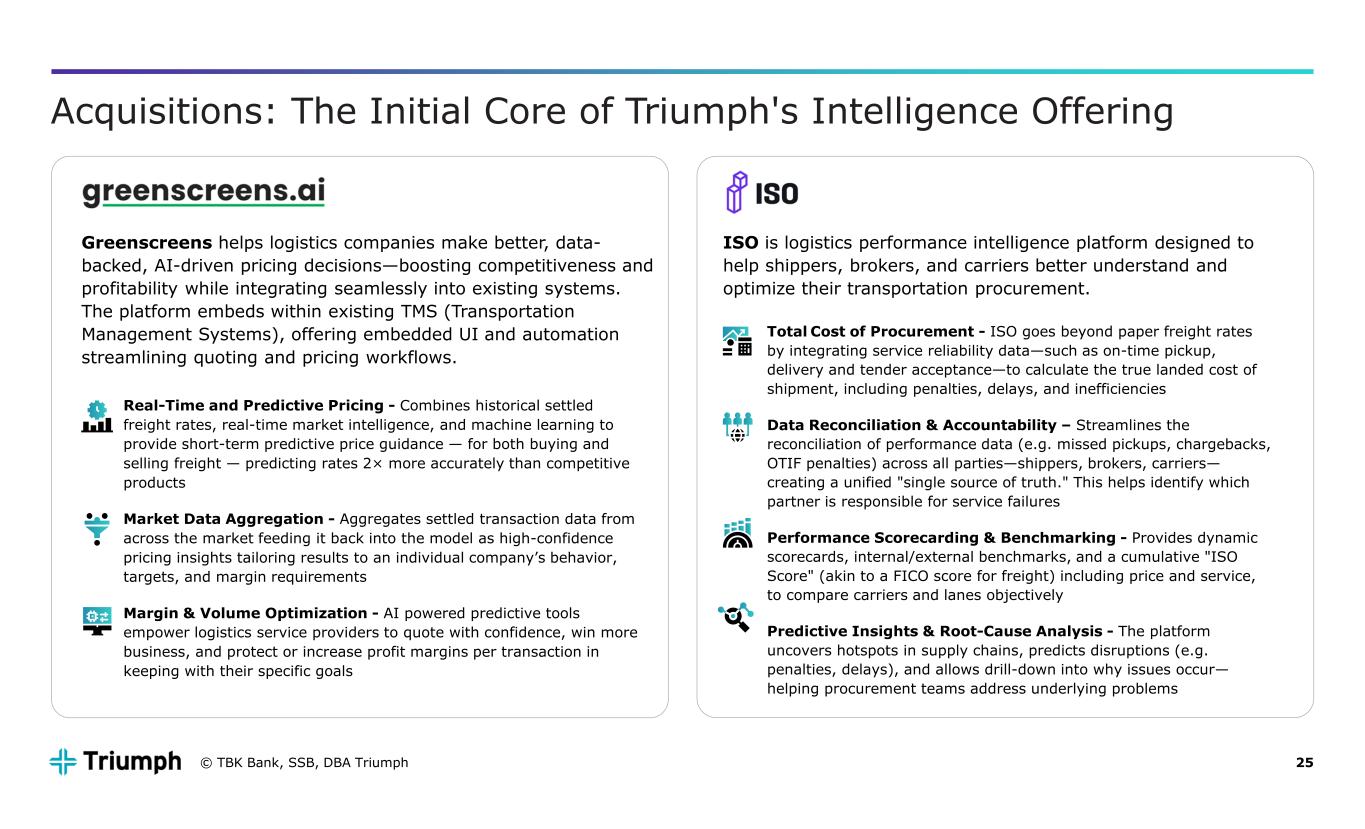

25 Acquisitions: The Initial Core of Triumph's Intelligence Offering Greenscreens helps logistics companies make better, data- backed, AI-driven pricing decisions—boosting competitiveness and profitability while integrating seamlessly into existing systems. The platform embeds within existing TMS (Transportation Management Systems), offering embedded UI and automation streamlining quoting and pricing workflows. ISO is logistics performance intelligence platform designed to help shippers, brokers, and carriers better understand and optimize their transportation procurement. Real-Time and Predictive Pricing - Combines historical settled freight rates, real-time market intelligence, and machine learning to provide short-term predictive price guidance — for both buying and selling freight — predicting rates 2× more accurately than competitive products Market Data Aggregation - Aggregates settled transaction data from across the market feeding it back into the model as high-confidence pricing insights tailoring results to an individual company’s behavior, targets, and margin requirements Margin & Volume Optimization - AI powered predictive tools empower logistics service providers to quote with confidence, win more business, and protect or increase profit margins per transaction in keeping with their specific goals Total Cost of Procurement - ISO goes beyond paper freight rates by integrating service reliability data—such as on-time pickup, delivery and tender acceptance—to calculate the true landed cost of shipment, including penalties, delays, and inefficiencies Data Reconciliation & Accountability – Streamlines the reconciliation of performance data (e.g. missed pickups, chargebacks, OTIF penalties) across all parties—shippers, brokers, carriers— creating a unified "single source of truth." This helps identify which partner is responsible for service failures Performance Scorecarding & Benchmarking - Provides dynamic scorecards, internal/external benchmarks, and a cumulative "ISO Score" (akin to a FICO score for freight) including price and service, to compare carriers and lanes objectively Predictive Insights & Root-Cause Analysis - The platform uncovers hotspots in supply chains, predicts disruptions (e.g. penalties, delays), and allows drill-down into why issues occur— helping procurement teams address underlying problems © TBK Bank, SSB, DBA Triumph

Thank you!