1 Carlyle Secured Lending, Inc. Quarterly Earnings Presentation September 30, 2025

Disclaimer and Forward-Looking Statement This presentation (the “Presentation”) has been prepared by Carlyle Secured Lending, Inc. (together with its consolidated subsidiaries, “we,” “us,” “our,” “CGBD” or the “Company”) (NASDAQ: CGBD) and may only be used for informational purposes only. This Presentation should be viewed in conjunction with the earnings conference call of the Company held on November 5, 2025 and the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2025. The information contained herein may not be used, reproduced, referenced, quoted, linked by website, or distributed to others, in whole or in part, except as agreed in writing by the Company. This Presentation does not constitute a prospectus and should under no circumstances be understood as an offer to sell or the solicitation of an offer to buy our common stock or any other securities nor will there be any sale of the common stock or any other securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such state or jurisdiction. This Presentation provides limited information regarding the Company and is not intended to be taken by, and should not be taken by, any individual recipient as investment advice, a recommendation to buy, hold or sell, or an offer to sell or a solicitation of offers to purchase, our common stock or any other securities that may be issued by the Company, or as legal, accounting or tax advice. An investment in securities of the type described herein presents certain risks. This Presentation may contain forward-looking statements that involve substantial risks and uncertainties. You can identify these statements by the use of forward- looking terminology such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may,” “plans,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “targets,” “projects,” “outlook,” “potential,” “predicts” and variations of these words and similar expressions to identify forward-looking statements, although not all forward-looking statements include these words. You should read statements that contain these words carefully because they discuss our plans, strategies, prospects and expectations concerning our business, operating results, financial condition and other similar matters. We believe that it is important to communicate our future expectations to our investors. There may be events in the future, however, that we are not able to predict accurately or control. You should not place undue reliance on these forward-looking statements, which speak only as of the date on which we make them. Factors or events that could cause our actual results to differ, possibly materially from our expectations, include, but are not limited to, the risks, uncertainties and other factors we identify in the sections entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements” in filings we make with the Securities and Exchange Commission (the “SEC”), and it is not possible for us to predict or identify all of them. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Information throughout the Presentation provided by sources other than the Company (including information relating to portfolio companies) has not been independently verified and, accordingly, the Company makes no representation or warranty in respect of this information. The following slides contain summaries of certain financial and statistical information about the Company. The information contained in this Presentation is summary information that is intended to be considered in the context of our SEC filings and other public announcements that we may make, by press release or otherwise, from time to time. We undertake no duty or obligation to publicly update or revise the information contained in this Presentation. CGBD is managed by Carlyle Global Credit Investment Management L.L.C. (the “Investment Adviser”), an SEC-registered investment adviser and a wholly owned subsidiary of The Carlyle Group Inc. (together with its affiliates, “Carlyle”). This Presentation contains information about the Company and certain of its affiliates and includes the Company’s historical performance. You should not view information related to the past performance of the Company as indicative of the Company’s future results, the achievement of which is dependent on many factors, many of which are beyond the control of the Company and the Investment Adviser and cannot be assured. There can be no assurances that future dividends will match or exceed historical rates or will be paid at all. Further, an investment in the Company is discrete from, and does not represent an interest in, any other Carlyle entity. Nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance of the Company or any other Carlyle entity. 2

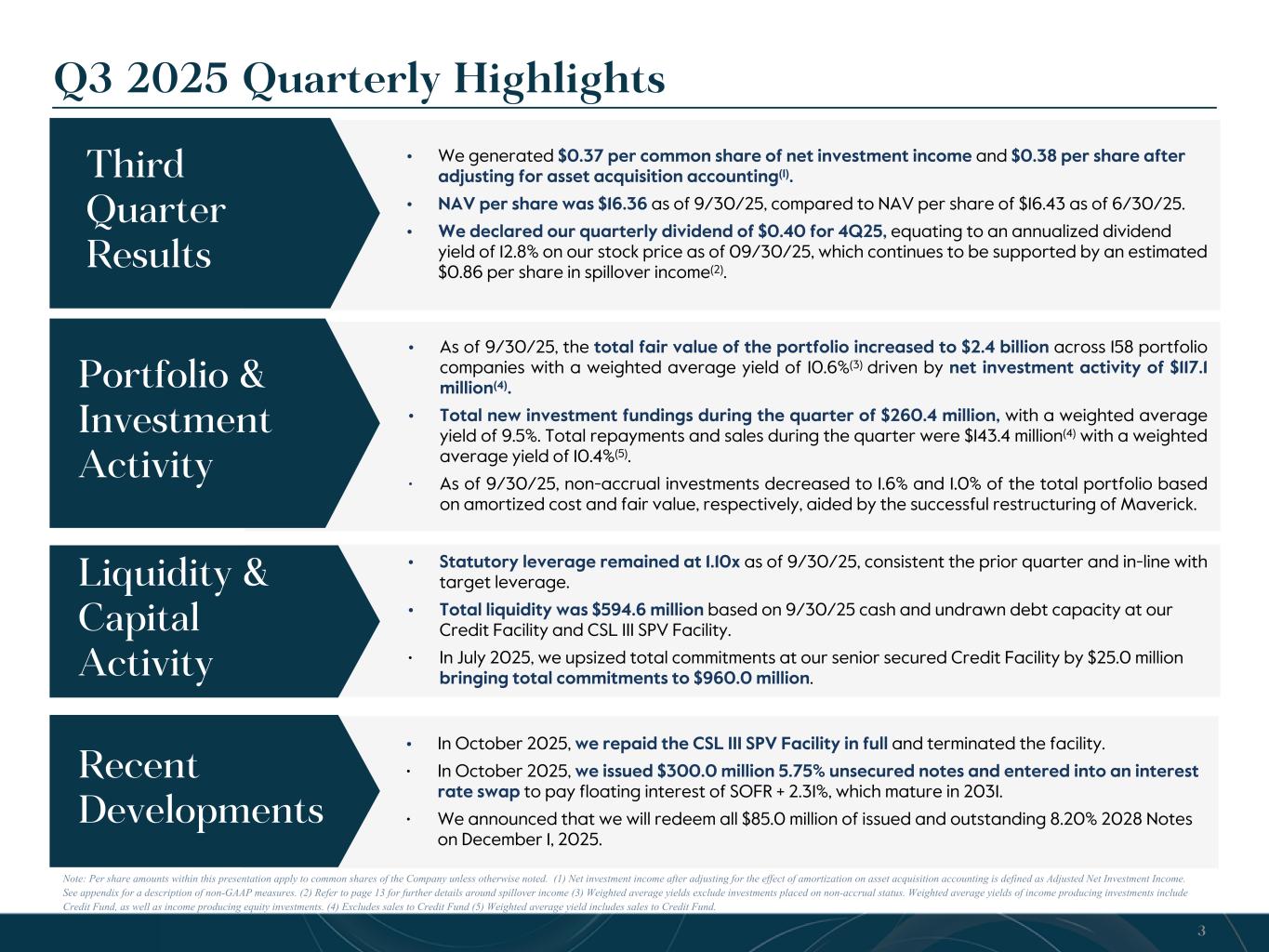

• As of 9/30/25, the total fair value of the portfolio increased to $2.4 billion across 158 portfolio companies with a weighted average yield of 10.6%(3) driven by net investment activity of $117.1 million(4). • Total new investment fundings during the quarter of $260.4 million, with a weighted average yield of 9.5%. Total repayments and sales during the quarter were $143.4 million(4) with a weighted average yield of 10.4%(5). • As of 9/30/25, non-accrual investments decreased to 1.6% and 1.0% of the total portfolio based on amortized cost and fair value, respectively, aided by the successful restructuring of Maverick. • Statutory leverage remained at 1.10x as of 9/30/25, consistent the prior quarter and in-line with target leverage. • Total liquidity was $594.6 million based on 9/30/25 cash and undrawn debt capacity at our Credit Facility and CSL III SPV Facility. • In July 2025, we upsized total commitments at our senior secured Credit Facility by $25.0 million bringing total commitments to $960.0 million. Q3 2025 Quarterly Highlights 3 Note: Per share amounts within this presentation apply to common shares of the Company unless otherwise noted. (1) Net investment income after adjusting for the effect of amortization on asset acquisition accounting is defined as Adjusted Net Investment Income. See appendix for a description of non-GAAP measures. (2) Refer to page 13 for further details around spillover income (3) Weighted average yields exclude investments placed on non-accrual status. Weighted average yields of income producing investments include Credit Fund, as well as income producing equity investments. (4) Excludes sales to Credit Fund (5) Weighted average yield includes sales to Credit Fund. • We generated $0.37 per common share of net investment income and $0.38 per share after adjusting for asset acquisition accounting(1). • NAV per share was $16.36 as of 9/30/25, compared to NAV per share of $16.43 as of 6/30/25. • We declared our quarterly dividend of $0.40 for 4Q25, equating to an annualized dividend yield of 12.8% on our stock price as of 09/30/25, which continues to be supported by an estimated $0.86 per share in spillover income(2). • In October 2025, we repaid the CSL III SPV Facility in full and terminated the facility. • In October 2025, we issued $300.0 million 5.75% unsecured notes and entered into an interest rate swap to pay floating interest of SOFR + 2.31%, which mature in 2031. • We announced that we will redeem all $85.0 million of issued and outstanding 8.20% 2028 Notes on December 1, 2025. Third Quarter Results Portfolio & Investment Activity Liquidity & Capital Activity Recent Developments

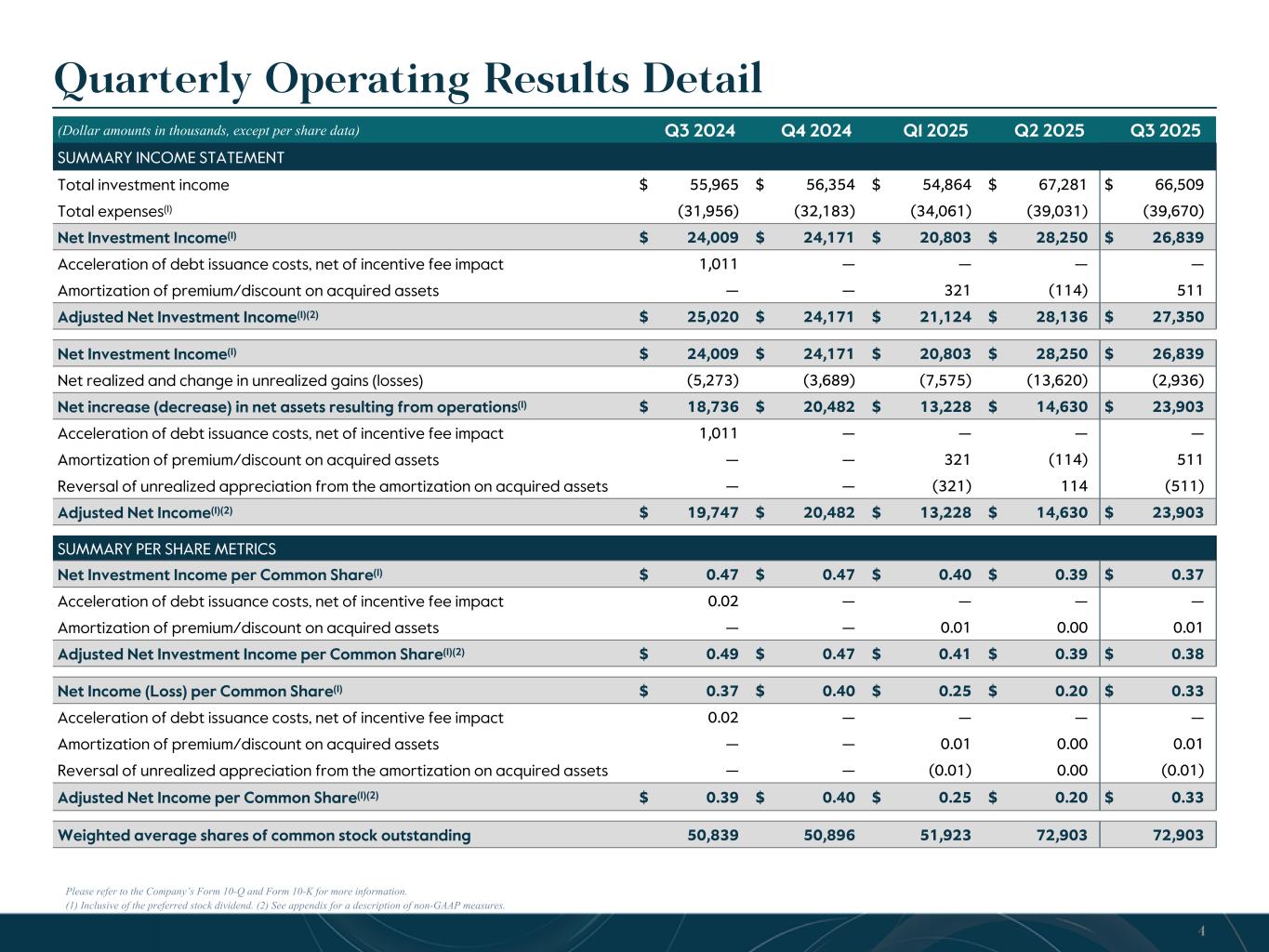

Quarterly Operating Results Detail Please refer to the Company’s Form 10-Q and Form 10-K for more information. (1) Inclusive of the preferred stock dividend. (2) See appendix for a description of non-GAAP measures. (Dollar amounts in thousands, except per share data) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 SUMMARY INCOME STATEMENT Total investment income $ 55,965 $ 56,354 $ 54,864 $ 67,281 $ 66,509 Total expenses(1) (31,956) (32,183) (34,061) (39,031) (39,670) Net Investment Income(1) $ 24,009 $ 24,171 $ 20,803 $ 28,250 $ 26,839 Acceleration of debt issuance costs, net of incentive fee impact 1,011 — — — — Amortization of premium/discount on acquired assets — — 321 (114) 511 Adjusted Net Investment Income(1)(2) $ 25,020 $ 24,171 $ 21,124 $ 28,136 $ 27,350 Net Investment Income(1) $ 24,009 $ 24,171 $ 20,803 $ 28,250 $ 26,839 Net realized and change in unrealized gains (losses) (5,273) (3,689) (7,575) (13,620) (2,936) Net increase (decrease) in net assets resulting from operations(1) $ 18,736 $ 20,482 $ 13,228 $ 14,630 $ 23,903 Acceleration of debt issuance costs, net of incentive fee impact 1,011 — — — — Amortization of premium/discount on acquired assets — — 321 (114) 511 Reversal of unrealized appreciation from the amortization on acquired assets — — (321) 114 (511) Adjusted Net Income(1)(2) $ 19,747 $ 20,482 $ 13,228 $ 14,630 $ 23,903 SUMMARY PER SHARE METRICS Net Investment Income per Common Share(1) $ 0.47 $ 0.47 $ 0.40 $ 0.39 $ 0.37 Acceleration of debt issuance costs, net of incentive fee impact 0.02 — — — — Amortization of premium/discount on acquired assets — — 0.01 0.00 0.01 Adjusted Net Investment Income per Common Share(1)(2) $ 0.49 $ 0.47 $ 0.41 $ 0.39 $ 0.38 Net Income (Loss) per Common Share(1) $ 0.37 $ 0.40 $ 0.25 $ 0.20 $ 0.33 Acceleration of debt issuance costs, net of incentive fee impact 0.02 — — — — Amortization of premium/discount on acquired assets — — 0.01 0.00 0.01 Reversal of unrealized appreciation from the amortization on acquired assets — — (0.01) 0.00 (0.01) Adjusted Net Income per Common Share(1)(2) $ 0.39 $ 0.40 $ 0.25 $ 0.20 $ 0.33 Weighted average shares of common stock outstanding 50,839 50,896 51,923 72,903 72,903 4

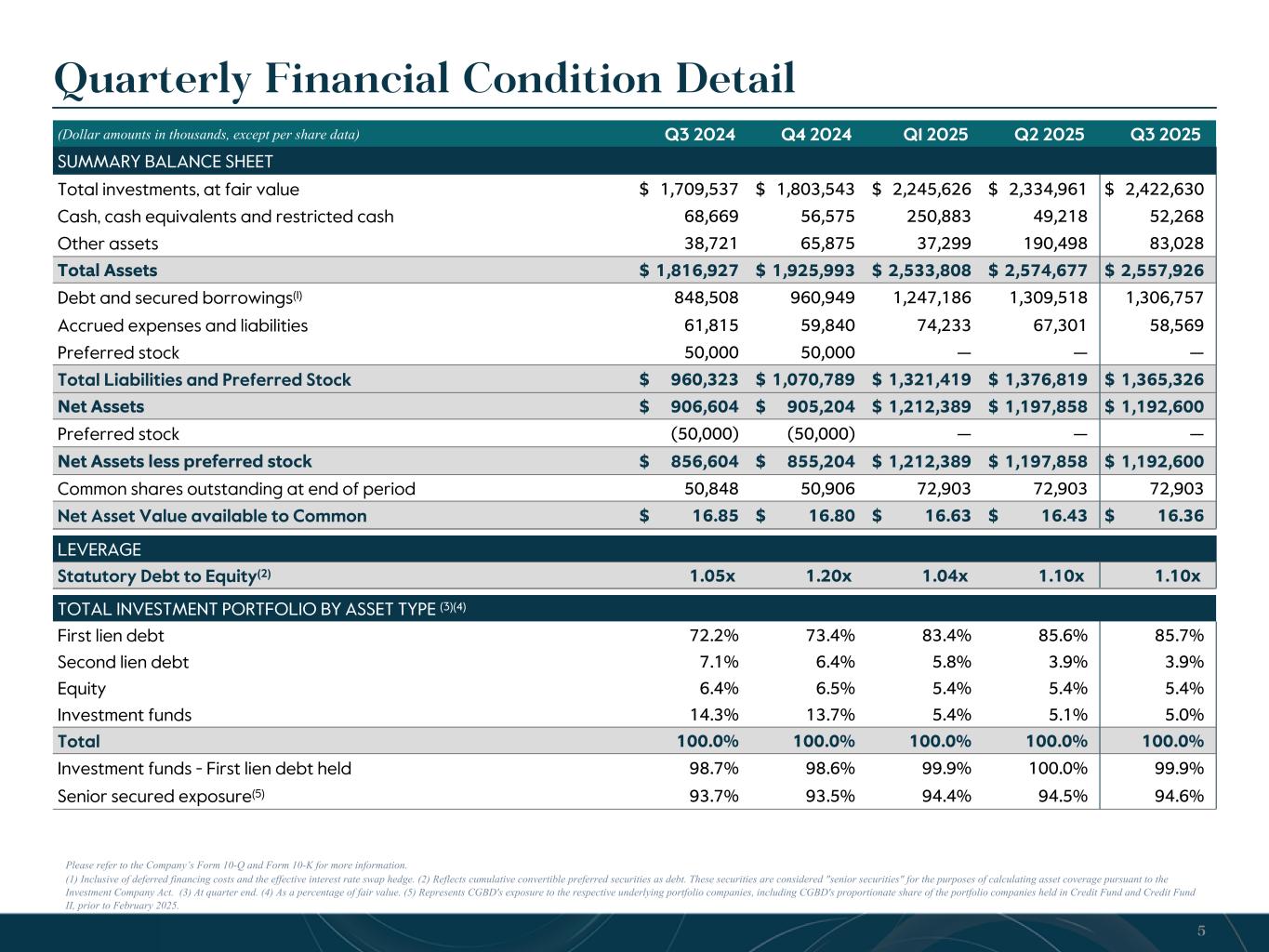

Please refer to the Company’s Form 10-Q and Form 10-K for more information. (1) Inclusive of deferred financing costs and the effective interest rate swap hedge. (2) Reflects cumulative convertible preferred securities as debt. These securities are considered "senior securities" for the purposes of calculating asset coverage pursuant to the Investment Company Act. (3) At quarter end. (4) As a percentage of fair value. (5) Represents CGBD's exposure to the respective underlying portfolio companies, including CGBD's proportionate share of the portfolio companies held in Credit Fund and Credit Fund II, prior to February 2025. Quarterly Financial Condition Detail (Dollar amounts in thousands, except per share data) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 SUMMARY BALANCE SHEET Total investments, at fair value $ 1,709,537 $ 1,803,543 $ 2,245,626 $ 2,334,961 $ 2,422,630 Cash, cash equivalents and restricted cash 68,669 56,575 250,883 49,218 52,268 Other assets 38,721 65,875 37,299 190,498 83,028 Total Assets $ 1,816,927 $ 1,925,993 $ 2,533,808 $ 2,574,677 $ 2,557,926 Debt and secured borrowings(1) 848,508 960,949 1,247,186 1,309,518 1,306,757 Accrued expenses and liabilities 61,815 59,840 74,233 67,301 58,569 Preferred stock 50,000 50,000 — — — Total Liabilities and Preferred Stock $ 960,323 $ 1,070,789 $ 1,321,419 $ 1,376,819 $ 1,365,326 Net Assets $ 906,604 $ 905,204 $ 1,212,389 $ 1,197,858 $ 1,192,600 Preferred stock (50,000) (50,000) — — — Net Assets less preferred stock $ 856,604 $ 855,204 $ 1,212,389 $ 1,197,858 $ 1,192,600 Common shares outstanding at end of period 50,848 50,906 72,903 72,903 72,903 Net Asset Value available to Common $ 16.85 $ 16.80 $ 16.63 $ 16.43 $ 16.36 LEVERAGE Statutory Debt to Equity(2) 1.05x 1.20x 1.04x 1.10x 1.10x TOTAL INVESTMENT PORTFOLIO BY ASSET TYPE (3)(4) First lien debt 72.2 % 73.4 % 83.4 % 85.6 % 85.7 % Second lien debt 7.1 % 6.4 % 5.8 % 3.9 % 3.9 % Equity 6.4 % 6.5 % 5.4 % 5.4 % 5.4 % Investment funds 14.3 % 13.7 % 5.4 % 5.1 % 5.0 % Total 100.0 % 100.0 % 100.0 % 100.0 % 100.0 % Investment funds - First lien debt held 98.7 % 98.6 % 99.9 % 100.0 % 99.9 % Senior secured exposure(5) 93.7 % 93.5 % 94.4 % 94.5 % 94.6 % 5

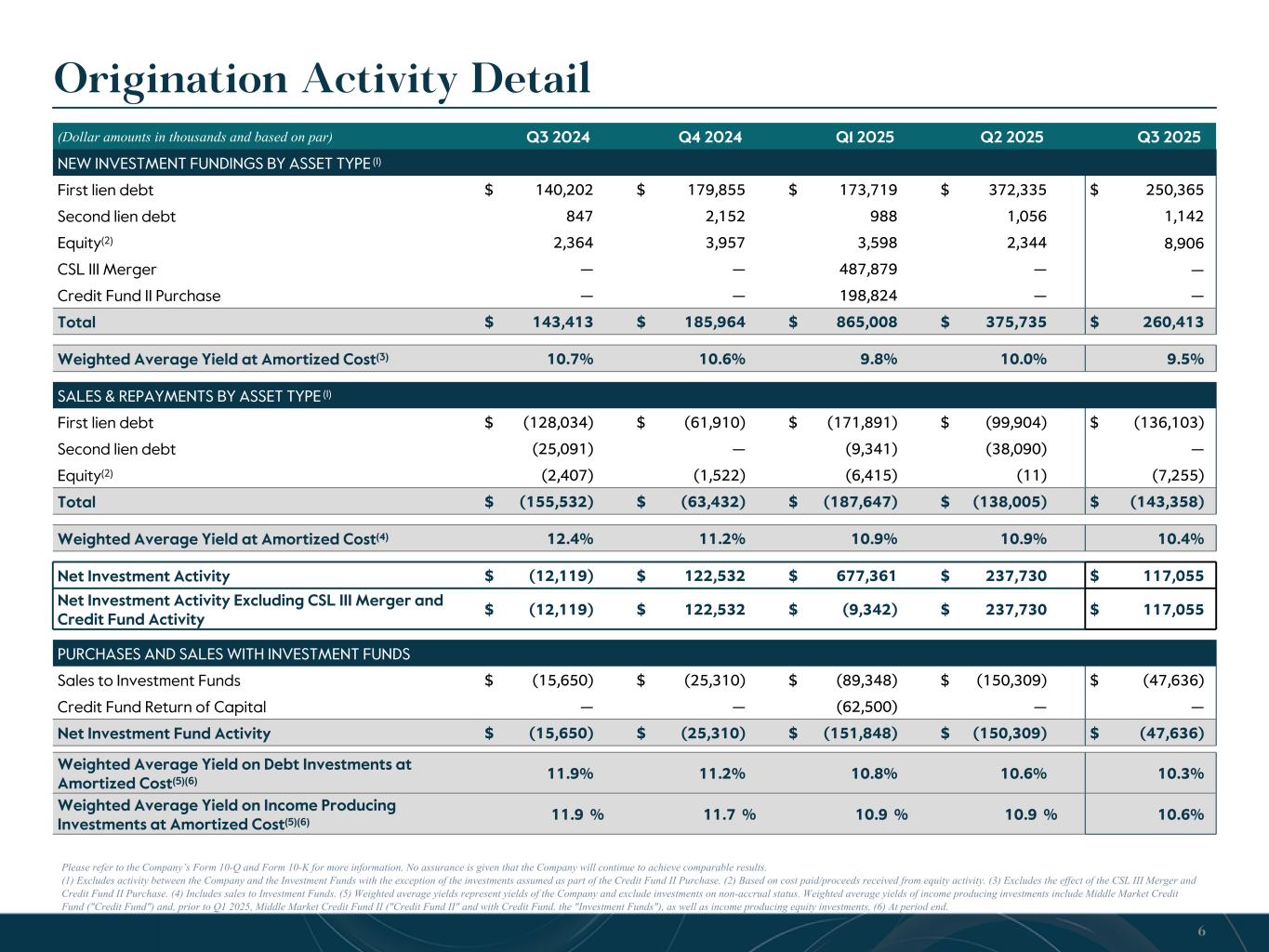

Origination Activity Detail Please refer to the Company’s Form 10-Q and Form 10-K for more information. No assurance is given that the Company will continue to achieve comparable results. (1) Excludes activity between the Company and the Investment Funds with the exception of the investments assumed as part of the Credit Fund II Purchase. (2) Based on cost paid/proceeds received from equity activity. (3) Excludes the effect of the CSL III Merger and Credit Fund II Purchase. (4) Includes sales to Investment Funds. (5) Weighted average yields represent yields of the Company and exclude investments on non-accrual status. Weighted average yields of income producing investments include Middle Market Credit Fund ("Credit Fund") and, prior to Q1 2025, Middle Market Credit Fund II ("Credit Fund II" and with Credit Fund. the "Investment Funds"), as well as income producing equity investments. (6) At period end. (Dollar amounts in thousands and based on par) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 NEW INVESTMENT FUNDINGS BY ASSET TYPE (1) First lien debt $ 140,202 $ 179,855 $ 173,719 $ 372,335 $ 250,365 Second lien debt 847 2,152 988 1,056 1,142 Equity(2) 2,364 3,957 3,598 2,344 8,906 CSL III Merger — — 487,879 — — Credit Fund II Purchase — — 198,824 — — Total $ 143,413 $ 185,964 $ 865,008 $ 375,735 $ 260,413 Weighted Average Yield at Amortized Cost(3) 10.7 % 10.6 % 9.8 % 10.0 % 9.5 % SALES & REPAYMENTS BY ASSET TYPE (1) First lien debt $ (128,034) $ (61,910) $ (171,891) $ (99,904) $ (136,103) Second lien debt (25,091) — (9,341) (38,090) — Equity(2) (2,407) (1,522) (6,415) (11) (7,255) Total $ (155,532) $ (63,432) $ (187,647) $ (138,005) $ (143,358) Weighted Average Yield at Amortized Cost(4) 12.4 % 11.2 % 10.9 % 10.9 % 10.4 % Net Investment Activity $ (12,119) $ 122,532 $ 677,361 $ 237,730 $ 117,055 Net Investment Activity Excluding CSL III Merger and Credit Fund Activity $ (12,119) $ 122,532 $ (9,342) $ 237,730 $ 117,055 PURCHASES AND SALES WITH INVESTMENT FUNDS Sales to Investment Funds $ (15,650) $ (25,310) $ (89,348) $ (150,309) $ (47,636) Credit Fund Return of Capital — — (62,500) — — Net Investment Fund Activity $ (15,650) $ (25,310) $ (151,848) $ (150,309) $ (47,636) Weighted Average Yield on Debt Investments at Amortized Cost(5)(6) 11.9 % 11.2 % 10.8 % 10.6 % 10.3 % Weighted Average Yield on Income Producing Investments at Amortized Cost(5)(6) 11.9 % 11.7 % 10.9 % 10.9 % 10.6 % 6

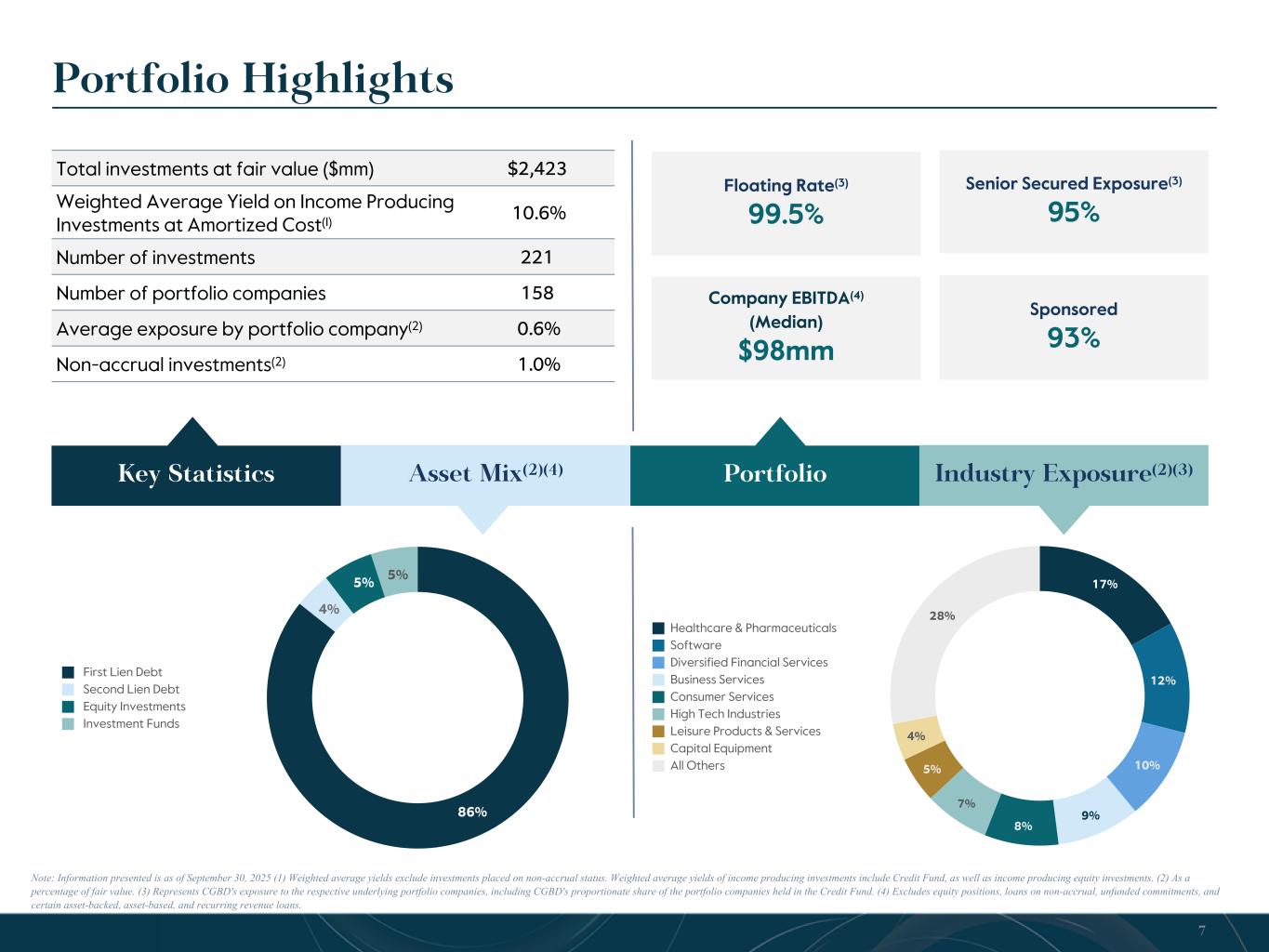

Senior Secured Exposure(3) 95% 86% 4% 5% 5% First Lien Debt Second Lien Debt Equity Investments Investment Funds 17% 12% 10% 9% 8% 7% 5% 4% 28% Healthcare & Pharmaceuticals Software Diversified Financial Services Business Services Consumer Services High Tech Industries Leisure Products & Services Capital Equipment All Others Portfolio Highlights Note: Information presented is as of September 30, 2025 (1) Weighted average yields exclude investments placed on non-accrual status. Weighted average yields of income producing investments include Credit Fund, as well as income producing equity investments. (2) As a percentage of fair value. (3) Represents CGBD's exposure to the respective underlying portfolio companies, including CGBD's proportionate share of the portfolio companies held in the Credit Fund. (4) Excludes equity positions, loans on non-accrual, unfunded commitments, and certain asset-backed, asset-based, and recurring revenue loans. Total investments at fair value ($mm) $2,423 Weighted Average Yield on Income Producing Investments at Amortized Cost(1) 10.6% Number of investments 221 Number of portfolio companies 158 Average exposure by portfolio company(2) 0.6% Non-accrual investments(2) 1.0% 7 Key Statistics Asset Mix(2)(4) Portfolio Industry Exposure(2)(3) Floating Rate(3) 99.5% Company EBITDA(4) (Median) $98mm Sponsored 93%

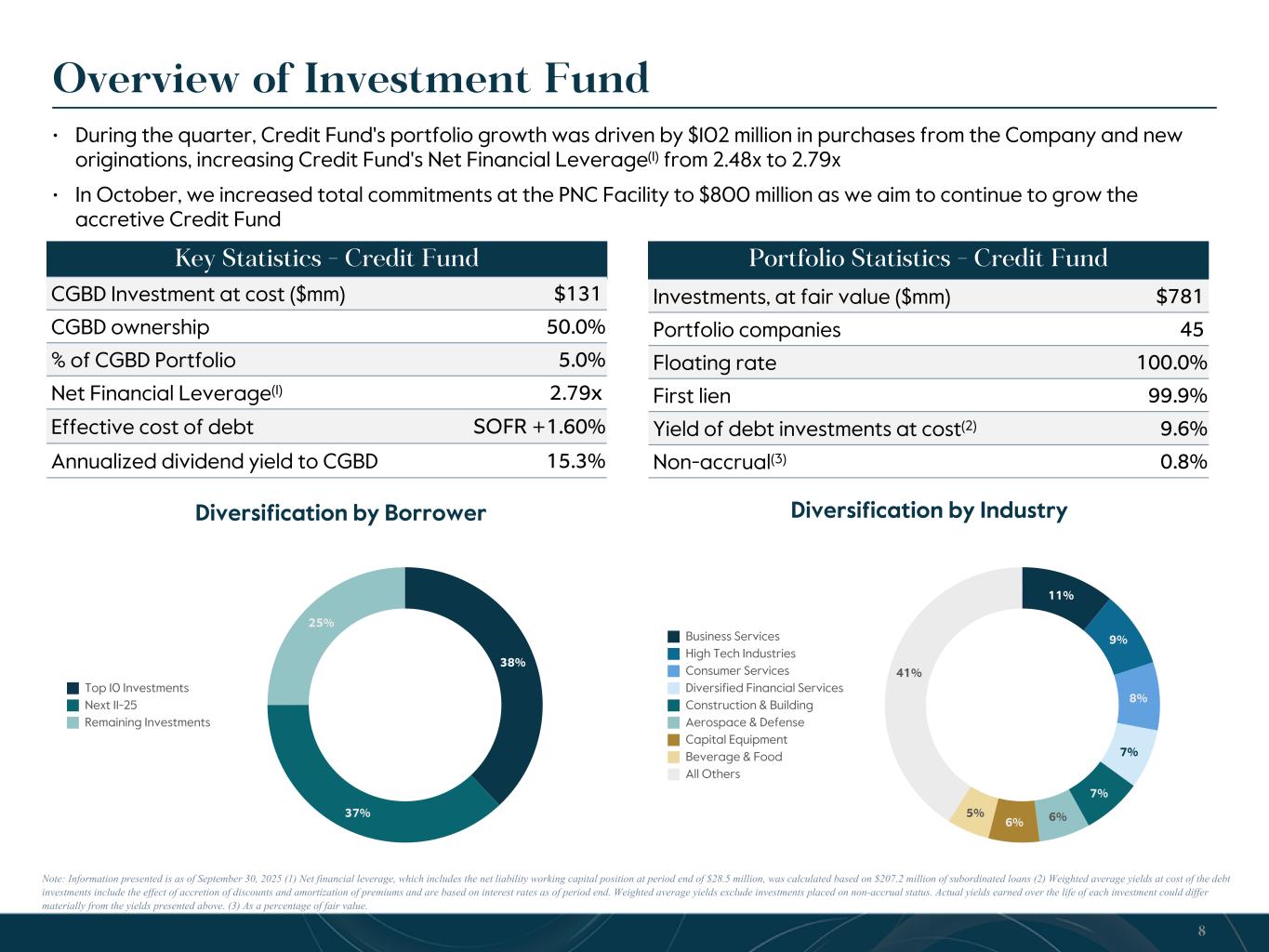

• During the quarter, Credit Fund's portfolio growth was driven by $102 million in purchases from the Company and new originations, increasing Credit Fund's Net Financial Leverage(1) from 2.48x to 2.79x • In October, we increased total commitments at the PNC Facility to $800 million as we aim to continue to grow the accretive Credit Fund 38% 37% 25% Top 10 Investments Next 11-25 Remaining Investments 11% 9% 8% 7% 7% 6%6% 5% 41% Business Services High Tech Industries Consumer Services Diversified Financial Services Construction & Building Aerospace & Defense Capital Equipment Beverage & Food All Others Overview of Investment Fund Note: Information presented is as of September 30, 2025 (1) Net financial leverage, which includes the net liability working capital position at period end of $28.5 million, was calculated based on $207.2 million of subordinated loans (2) Weighted average yields at cost of the debt investments include the effect of accretion of discounts and amortization of premiums and are based on interest rates as of period end. Weighted average yields exclude investments placed on non-accrual status. Actual yields earned over the life of each investment could differ materially from the yields presented above. (3) As a percentage of fair value. 8 Diversification by Borrower Diversification by Industry Key Statistics - Credit Fund CGBD Investment at cost ($mm) $131 CGBD ownership 50.0 % % of CGBD Portfolio 5.0 % Net Financial Leverage(1) 2.79x Effective cost of debt SOFR +1.60% Annualized dividend yield to CGBD 15.3 % Portfolio Statistics - Credit Fund Investments, at fair value ($mm) $781 Portfolio companies 45 Floating rate 100.0 % First lien 99.9 % Yield of debt investments at cost(2) 9.6 % Non-accrual(3) 0.8 %

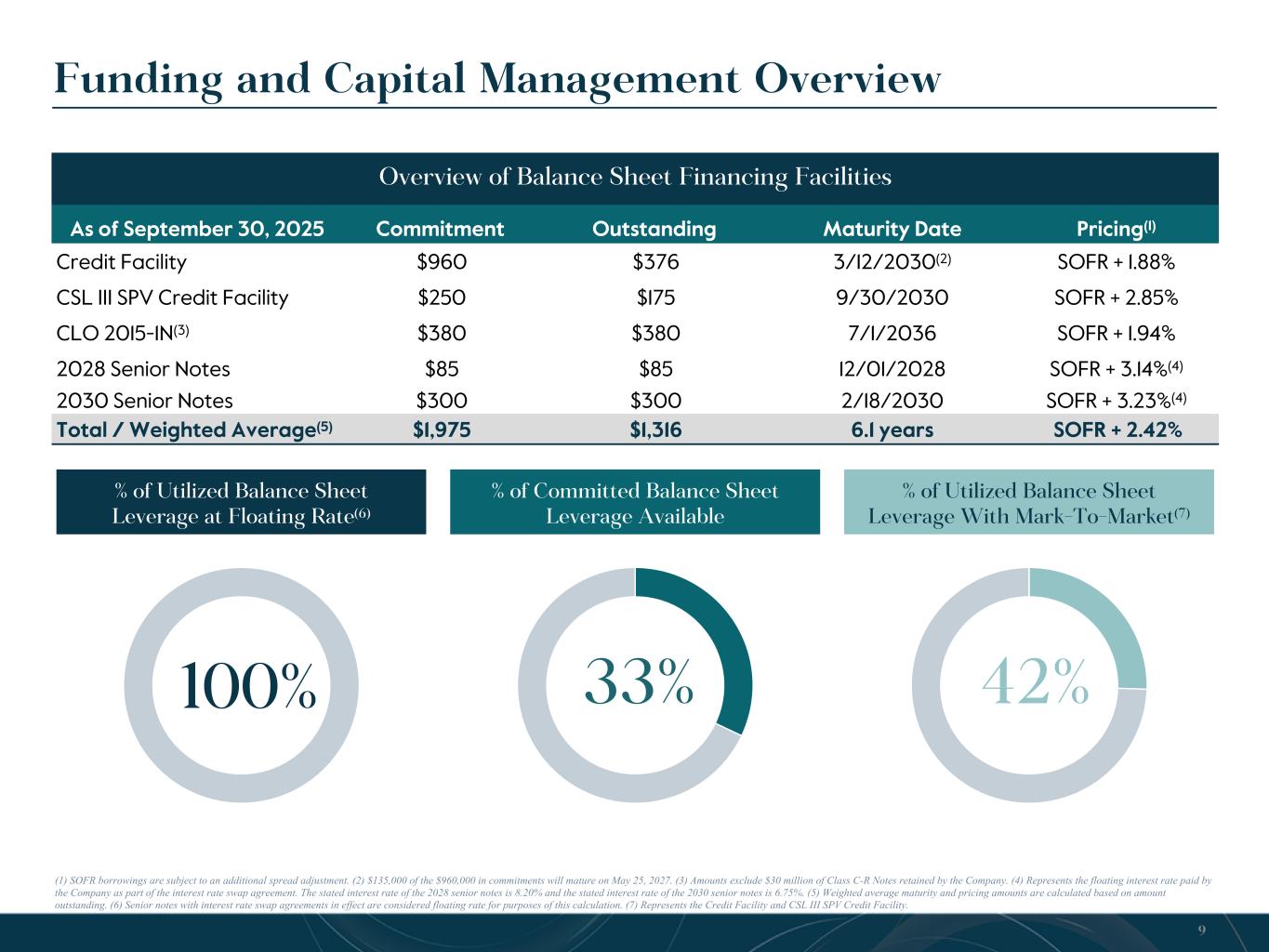

Funding and Capital Management Overview Overview of Balance Sheet Financing Facilities 9 As of September 30, 2025 Commitment Outstanding Maturity Date Pricing(1) Credit Facility $960 $376 3/12/2030(2) SOFR + 1.88% CSL III SPV Credit Facility $250 $175 9/30/2030 SOFR + 2.85% CLO 2015-1N(3) $380 $380 7/1/2036 SOFR + 1.94% 2028 Senior Notes $85 $85 12/01/2028 SOFR + 3.14%(4) 2030 Senior Notes $300 $300 2/18/2030 SOFR + 3.23%(4) Total / Weighted Average(5) $1,975 $1,316 6.1 years SOFR + 2.42% 33% % of Committed Balance Sheet Leverage Available % of Utilized Balance Sheet Leverage With Mark-To-Market(7) % of Utilized Balance Sheet Leverage at Floating Rate(6) 100% (1) SOFR borrowings are subject to an additional spread adjustment. (2) $135,000 of the $960,000 in commitments will mature on May 25, 2027. (3) Amounts exclude $30 million of Class C-R Notes retained by the Company. (4) Represents the floating interest rate paid by the Company as part of the interest rate swap agreement. The stated interest rate of the 2028 senior notes is 8.20% and the stated interest rate of the 2030 senior notes is 6.75%. (5) Weighted average maturity and pricing amounts are calculated based on amount outstanding. (6) Senior notes with interest rate swap agreements in effect are considered floating rate for purposes of this calculation. (7) Represents the Credit Facility and CSL III SPV Credit Facility. 42%

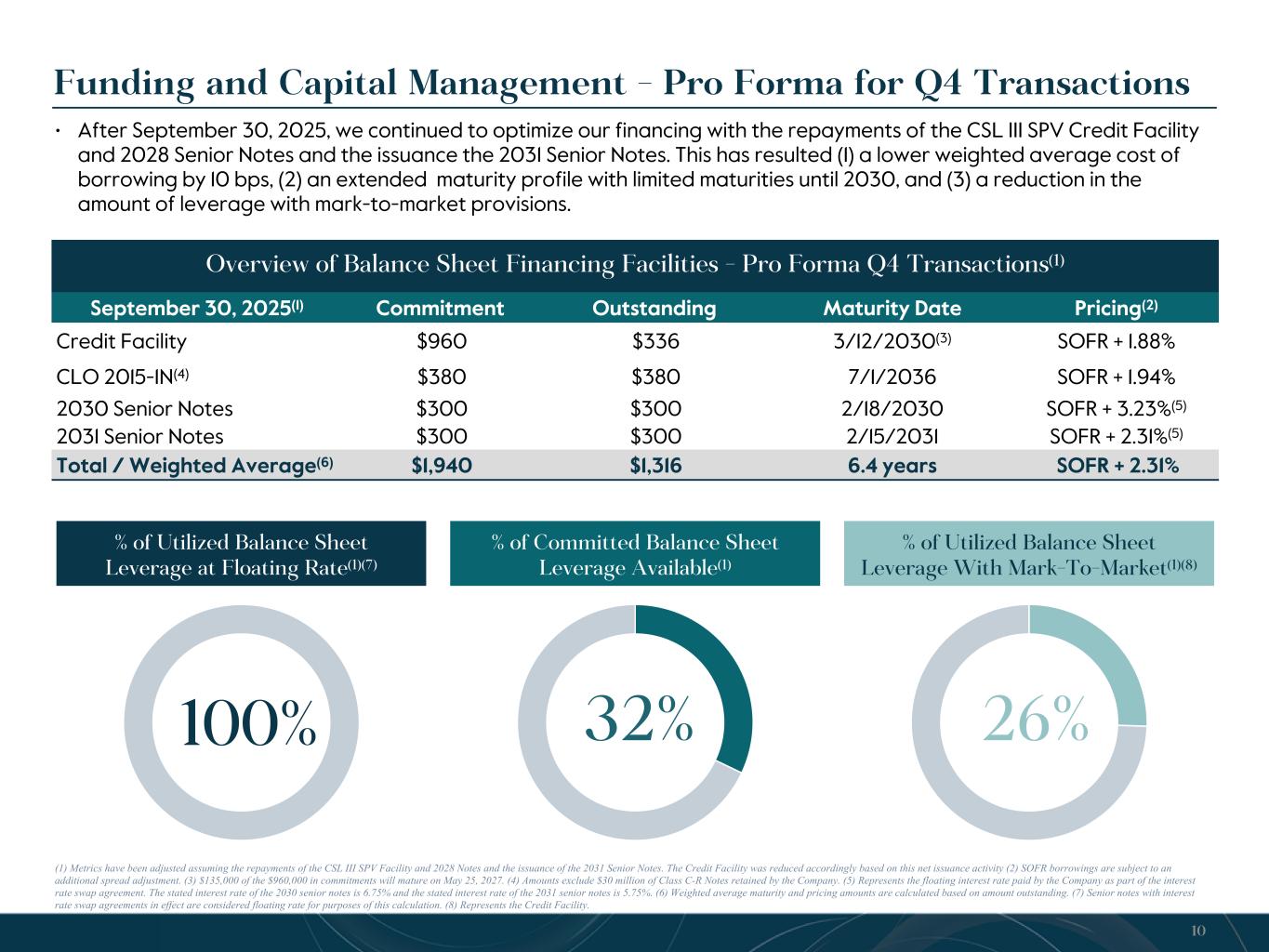

Funding and Capital Management - Pro Forma for Q4 Transactions Overview of Balance Sheet Financing Facilities - Pro Forma Q4 Transactions(1) 10 September 30, 2025(1) Commitment Outstanding Maturity Date Pricing(2) Credit Facility $960 $336 3/12/2030(3) SOFR + 1.88% CLO 2015-1N(4) $380 $380 7/1/2036 SOFR + 1.94% 2030 Senior Notes $300 $300 2/18/2030 SOFR + 3.23%(5) 2031 Senior Notes $300 $300 2/15/2031 SOFR + 2.31%(5) Total / Weighted Average(6) $1,940 $1,316 6.4 years SOFR + 2.31% 32% % of Committed Balance Sheet Leverage Available(1) % of Utilized Balance Sheet Leverage With Mark-To-Market(1)(8) % of Utilized Balance Sheet Leverage at Floating Rate(1)(7) 100% (1) Metrics have been adjusted assuming the repayments of the CSL III SPV Facility and 2028 Notes and the issuance of the 2031 Senior Notes. The Credit Facility was reduced accordingly based on this net issuance activity (2) SOFR borrowings are subject to an additional spread adjustment. (3) $135,000 of the $960,000 in commitments will mature on May 25, 2027. (4) Amounts exclude $30 million of Class C-R Notes retained by the Company. (5) Represents the floating interest rate paid by the Company as part of the interest rate swap agreement. The stated interest rate of the 2030 senior notes is 6.75% and the stated interest rate of the 2031 senior notes is 5.75%. (6) Weighted average maturity and pricing amounts are calculated based on amount outstanding. (7) Senior notes with interest rate swap agreements in effect are considered floating rate for purposes of this calculation. (8) Represents the Credit Facility. 26% • After September 30, 2025, we continued to optimize our financing with the repayments of the CSL III SPV Credit Facility and 2028 Senior Notes and the issuance the 2031 Senior Notes. This has resulted (1) a lower weighted average cost of borrowing by 10 bps, (2) an extended maturity profile with limited maturities until 2030, and (3) a reduction in the amount of leverage with mark-to-market provisions.

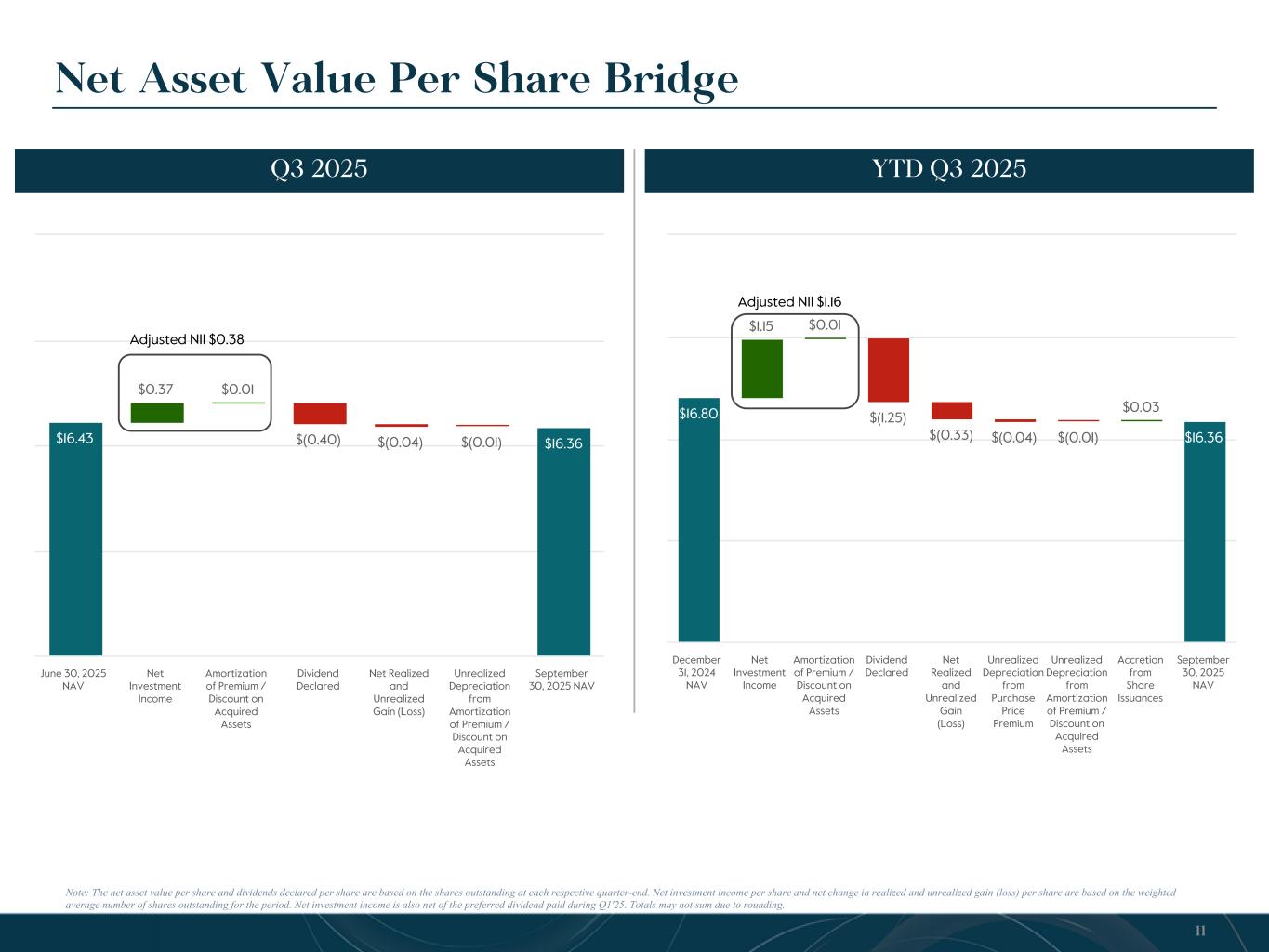

$16.43 $0.37 $0.01 $(0.40) $(0.04) $(0.01) $16.36 June 30, 2025 NAV Net Investment Income Amortization of Premium / Discount on Acquired Assets Dividend Declared Net Realized and Unrealized Gain (Loss) Unrealized Depreciation from Amortization of Premium / Discount on Acquired Assets September 30, 2025 NAV Note: The net asset value per share and dividends declared per share are based on the shares outstanding at each respective quarter-end. Net investment income per share and net change in realized and unrealized gain (loss) per share are based on the weighted average number of shares outstanding for the period. Net investment income is also net of the preferred dividend paid during Q1'25. Totals may not sum due to rounding. Net Asset Value Per Share Bridge YTD Q3 2025Q3 2025 11 $16.80 $1.15 $0.01 $(1.25) $(0.33) $(0.04) $(0.01) $0.03 $16.36 December 31, 2024 NAV Net Investment Income Amortization of Premium / Discount on Acquired Assets Dividend Declared Net Realized and Unrealized Gain (Loss) Unrealized Depreciation from Purchase Price Premium Unrealized Depreciation from Amortization of Premium / Discount on Acquired Assets Accretion from Share Issuances September 30, 2025 NAV Adjusted NII $0.38 Adjusted NII $1.16

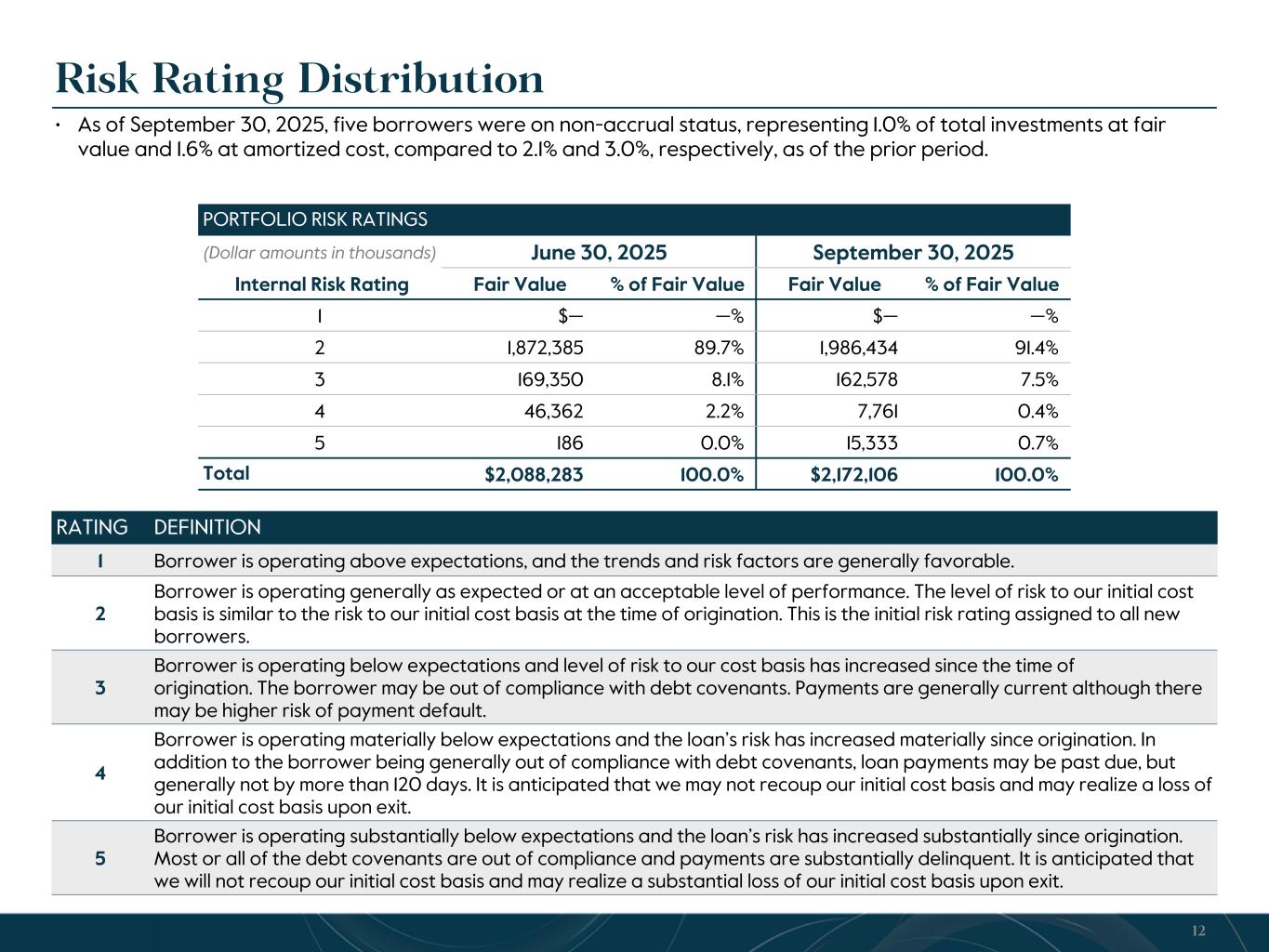

• As of September 30, 2025, five borrowers were on non-accrual status, representing 1.0% of total investments at fair value and 1.6% at amortized cost, compared to 2.1% and 3.0%, respectively, as of the prior period. Risk Rating Distribution RATING DEFINITION 1 Borrower is operating above expectations, and the trends and risk factors are generally favorable. 2 Borrower is operating generally as expected or at an acceptable level of performance. The level of risk to our initial cost basis is similar to the risk to our initial cost basis at the time of origination. This is the initial risk rating assigned to all new borrowers. 3 Borrower is operating below expectations and level of risk to our cost basis has increased since the time of origination. The borrower may be out of compliance with debt covenants. Payments are generally current although there may be higher risk of payment default. 4 Borrower is operating materially below expectations and the loan’s risk has increased materially since origination. In addition to the borrower being generally out of compliance with debt covenants, loan payments may be past due, but generally not by more than 120 days. It is anticipated that we may not recoup our initial cost basis and may realize a loss of our initial cost basis upon exit. 5 Borrower is operating substantially below expectations and the loan’s risk has increased substantially since origination. Most or all of the debt covenants are out of compliance and payments are substantially delinquent. It is anticipated that we will not recoup our initial cost basis and may realize a substantial loss of our initial cost basis upon exit. PORTFOLIO RISK RATINGS (Dollar amounts in thousands) June 30, 2025 September 30, 2025 Internal Risk Rating Fair Value % of Fair Value Fair Value % of Fair Value 1 $— — % $— — % 2 1,872,385 89.7 % 1,986,434 91.4 % 3 169,350 8.1 % 162,578 7.5 % 4 46,362 2.2 % 7,761 0.4 % 5 186 0.0 % 15,333 0.7 % Total $2,088,283 100.0 % $2,172,106 100.0 % 12

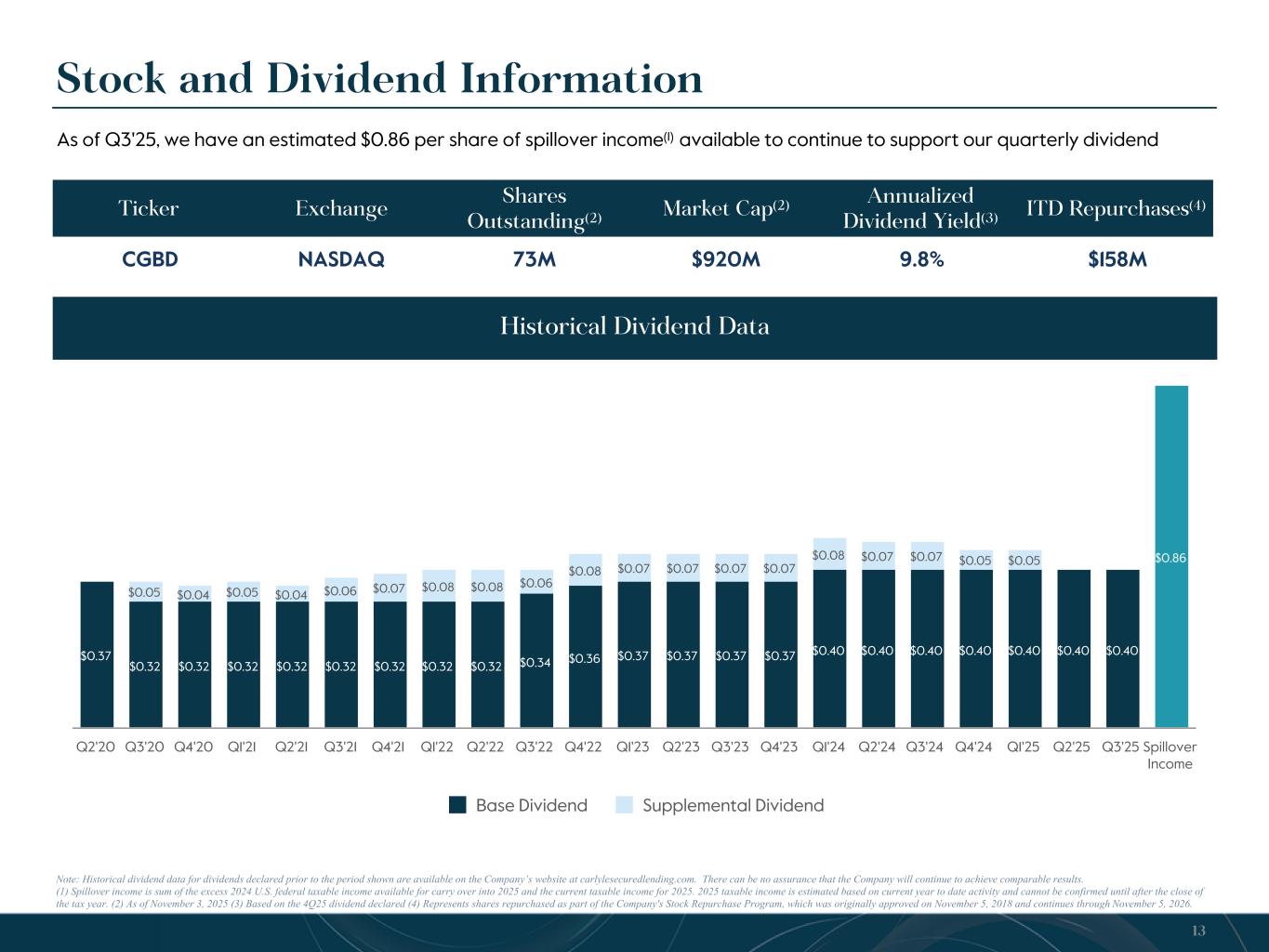

$0.37 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.32 $0.34 $0.36 $0.37 $0.37 $0.37 $0.37 $0.40 $0.40 $0.40 $0.40 $0.40 $0.40 $0.40 $0.86 $0.05 $0.04 $0.05 $0.04 $0.06 $0.07 $0.08 $0.08 $0.06 $0.08 $0.07 $0.07 $0.07 $0.07 $0.08 $0.07 $0.07 $0.05 $0.05 Base Dividend Supplemental Dividend Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q4'24 Q1'25 Q2'25 Q3'25 Spillover Income Note: Historical dividend data for dividends declared prior to the period shown are available on the Company’s website at carlylesecuredlending.com. There can be no assurance that the Company will continue to achieve comparable results. (1) Spillover income is sum of the excess 2024 U.S. federal taxable income available for carry over into 2025 and the current taxable income for 2025. 2025 taxable income is estimated based on current year to date activity and cannot be confirmed until after the close of the tax year. (2) As of November 3, 2025 (3) Based on the 4Q25 dividend declared (4) Represents shares repurchased as part of the Company's Stock Repurchase Program, which was originally approved on November 5, 2018 and continues through November 5, 2026. Stock and Dividend Information 13 Ticker Exchange Shares Outstanding(2) Market Cap(2) Annualized Dividend Yield(3) ITD Repurchases(4) CGBD NASDAQ 73M $920M 9.8% $158M Historical Dividend Data As of Q3'25, we have an estimated $0.86 per share of spillover income(1) available to continue to support our quarterly dividend

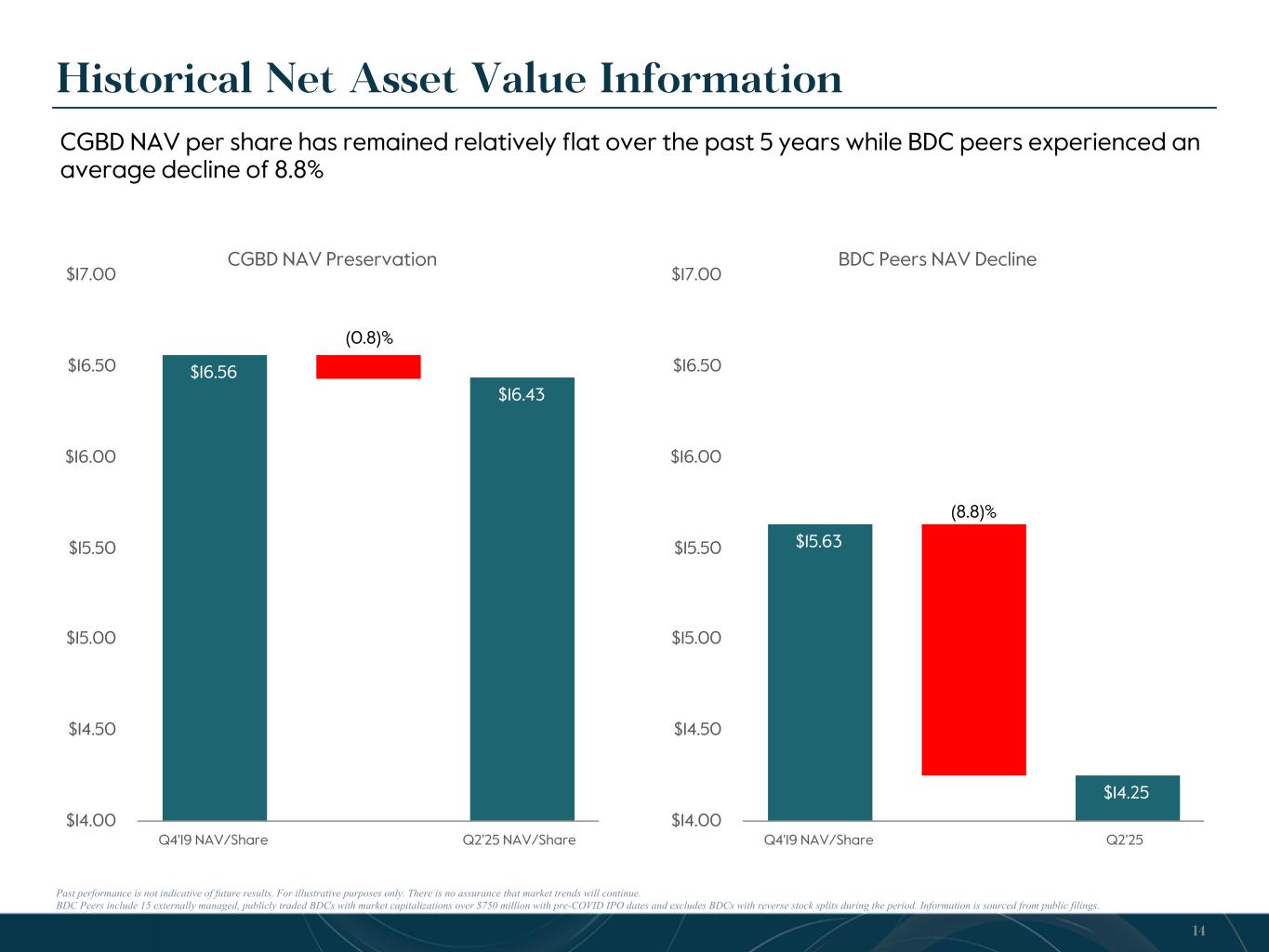

CGBD NAV Preservation $16.56 $16.43 Q4'19 NAV/Share Q2'25 NAV/Share $14.00 $14.50 $15.00 $15.50 $16.00 $16.50 $17.00 Past performance is not indicative of future results. For illustrative purposes only. There is no assurance that market trends will continue. BDC Peers include 15 externally managed, publicly traded BDCs with market capitalizations over $750 million with pre-COVID IPO dates and excludes BDCs with reverse stock splits during the period. Information is sourced from public filings. Historical Net Asset Value Information 14 BDC Peers NAV Decline $15.63 $14.25 Q4'19 NAV/Share Q2'25 $14.00 $14.50 $15.00 $15.50 $16.00 $16.50 $17.00 (8.8)% (0.8)% CGBD NAV per share has remained relatively flat over the past 5 years while BDC peers experienced an average decline of 8.8%

15 Appendix

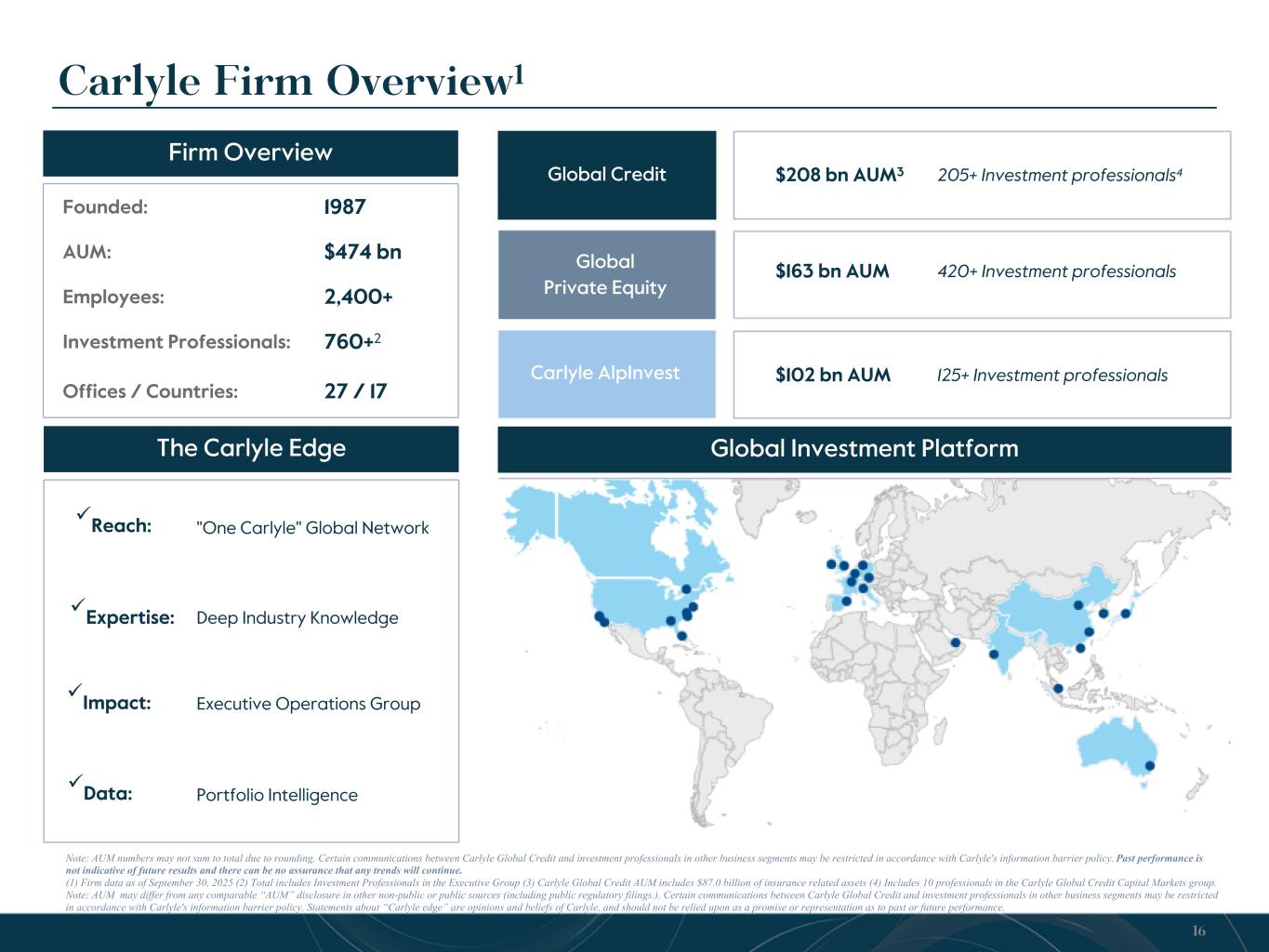

Carlyle Firm Overview1 Note: AUM numbers may not sum to total due to rounding. Certain communications between Carlyle Global Credit and investment professionals in other business segments may be restricted in accordance with Carlyle's information barrier policy. Past performance is not indicative of future results and there can be no assurance that any trends will continue. (1) Firm data as of September 30, 2025 (2) Total includes Investment Professionals in the Executive Group (3) Carlyle Global Credit AUM includes $87.0 billion of insurance related assets (4) Includes 10 professionals in the Carlyle Global Credit Capital Markets group. Note: AUM may differ from any comparable “AUM” disclosure in other non-public or public sources (including public regulatory filings.). Certain communications between Carlyle Global Credit and investment professionals in other business segments may be restricted in accordance with Carlyle's information barrier policy. Statements about “Carlyle edge” are opinions and beliefs of Carlyle, and should not be relied upon as a promise or representation as to past or future performance. Firm Overview Global Credit Global Private Equity Carlyle AlpInvest Founded: 1987 AUM: $474 bn Employees: 2,400+ Investment Professionals: 760+2 Offices / Countries: 27 / 17 "One Carlyle" Global Network Deep Industry Knowledge Executive Operations Group Portfolio Intelligence $208 bn AUM3 205+ Investment professionals4 üReach: üExpertise: üImpact: üData: $163 bn AUM 420+ Investment professionals $102 bn AUM 125+ Investment professionals The Carlyle Edge Global Investment Platform 16

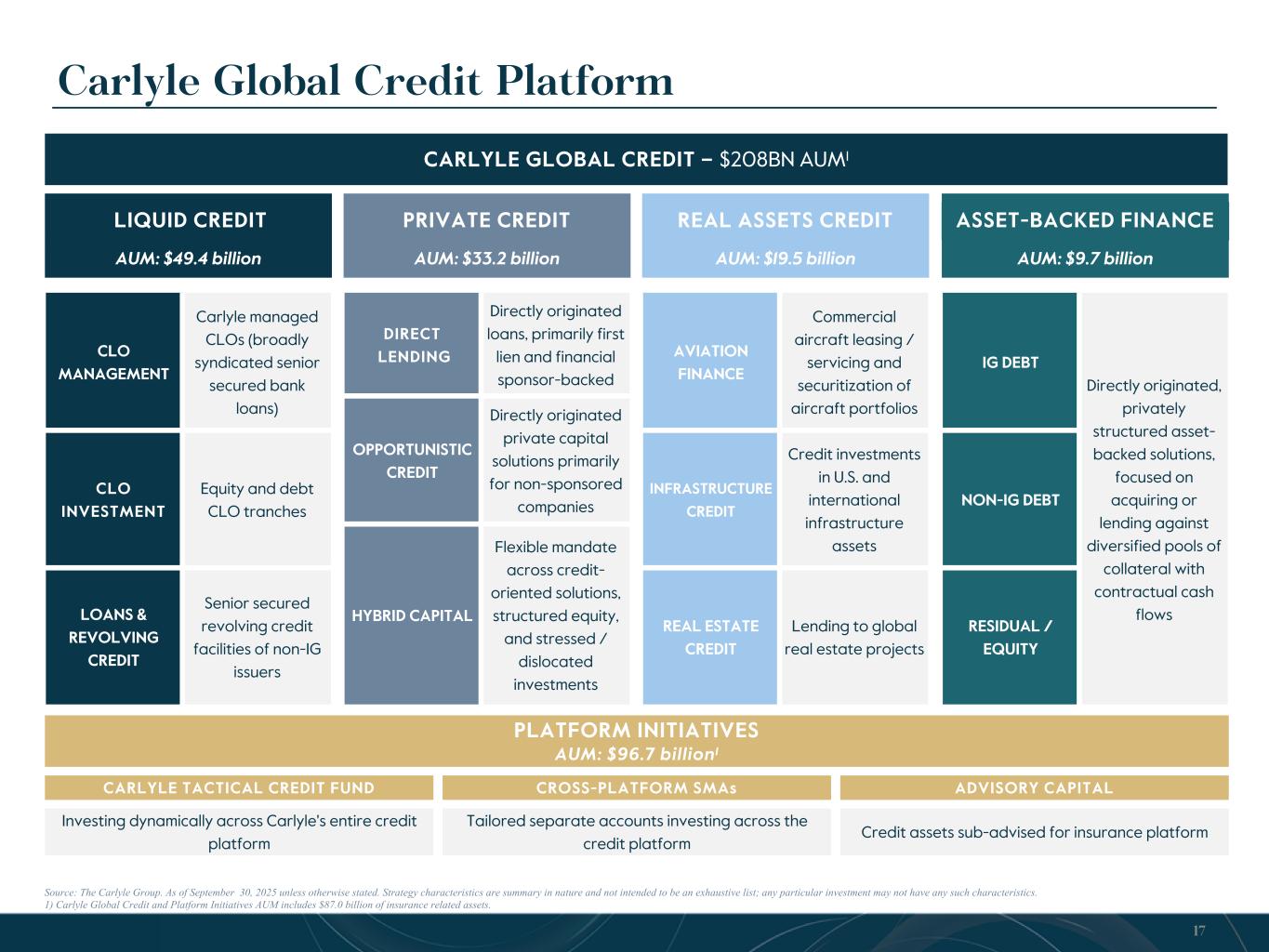

AUM: $9.7 billion ASSET-BACKED FINANCE Carlyle Global Credit Platform Source: The Carlyle Group. As of September 30, 2025 unless otherwise stated. Strategy characteristics are summary in nature and not intended to be an exhaustive list; any particular investment may not have any such characteristics. 1) Carlyle Global Credit and Platform Initiatives AUM includes $87.0 billion of insurance related assets. CARLYLE GLOBAL CREDIT – $208BN AUM1 AUM: $49.4 billion LIQUID CREDIT AUM: $33.2 billion PRIVATE CREDIT AUM: $19.5 billion REAL ASSETS CREDIT CLO MANAGEMENT Carlyle managed CLOs (broadly syndicated senior secured bank loans) CLO INVESTMENT Equity and debt CLO tranches LOANS & REVOLVING CREDIT Senior secured revolving credit facilities of non-IG issuers DIRECT LENDING Directly originated loans, primarily first lien and financial sponsor-backed OPPORTUNISTIC CREDIT Directly originated private capital solutions primarily for non-sponsored companies HYBRID CAPITAL Flexible mandate across credit- oriented solutions, structured equity, and stressed / dislocated investments AVIATION FINANCE Commercial aircraft leasing / servicing and securitization of aircraft portfolios INFRASTRUCTURE CREDIT Credit investments in U.S. and international infrastructure assets REAL ESTATE CREDIT Lending to global real estate projects PLATFORM INITIATIVES AUM: $96.7 billion1 CARLYLE TACTICAL CREDIT FUND CROSS-PLATFORM SMAs ADVISORY CAPITAL Investing dynamically across Carlyle's entire credit platform Tailored separate accounts investing across the credit platform Credit assets sub-advised for insurance platform IG DEBT Directly originated, privately structured asset- backed solutions, focused on acquiring or lending against diversified pools of collateral with contractual cash flows NON-IG DEBT RESIDUAL / EQUITY 17

18 Carlyle Direct Lending Investment Philosophy & Overview Note: Comments made here are based on Carlyle's subjective views. Past performance is not indicative of future results. There can be no assurance that a fund will be able to achieve comparable results, implement its investment strategy or achieve its investment objective. No assurance is given that any trends will continue, that forecasts will ultimately materialize, or that investment opportunities will be available. Carlyle Direct Lending seeks to operate in the middle market, utilizing an integrated platform sourcing approach

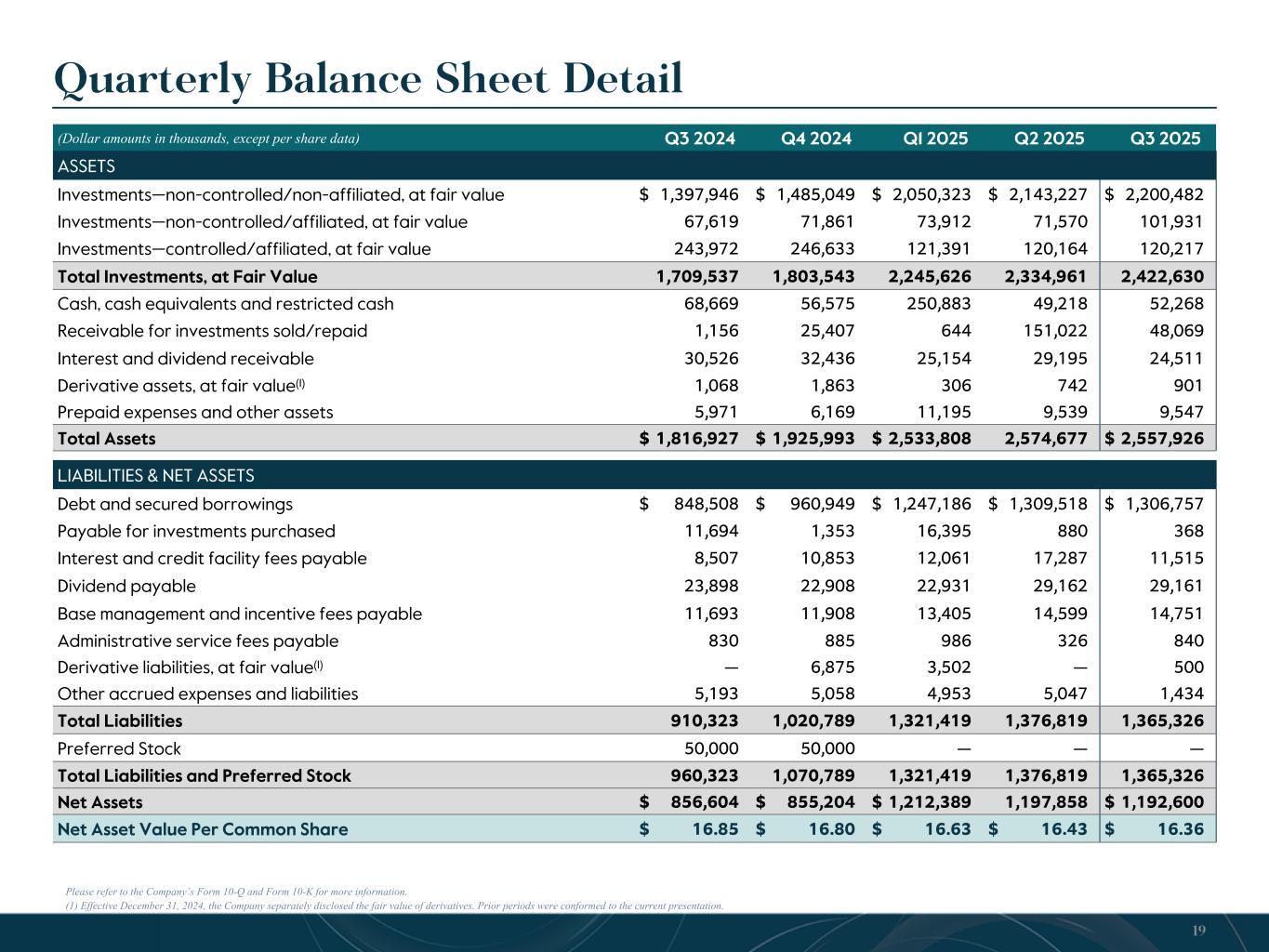

Quarterly Balance Sheet Detail (Dollar amounts in thousands, except per share data) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 ASSETS Investments—non-controlled/non-affiliated, at fair value $ 1,397,946 $ 1,485,049 $ 2,050,323 $ 2,143,227 $ 2,200,482 Investments—non-controlled/affiliated, at fair value 67,619 71,861 73,912 71,570 101,931 Investments—controlled/affiliated, at fair value 243,972 246,633 121,391 120,164 120,217 Total Investments, at Fair Value 1,709,537 1,803,543 2,245,626 2,334,961 2,422,630 Cash, cash equivalents and restricted cash 68,669 56,575 250,883 49,218 52,268 Receivable for investments sold/repaid 1,156 25,407 644 151,022 48,069 Interest and dividend receivable 30,526 32,436 25,154 29,195 24,511 Derivative assets, at fair value(1) 1,068 1,863 306 742 901 Prepaid expenses and other assets 5,971 6,169 11,195 9,539 9,547 Total Assets $ 1,816,927 $ 1,925,993 $ 2,533,808 2,574,677 $ 2,557,926 LIABILITIES & NET ASSETS Debt and secured borrowings $ 848,508 $ 960,949 $ 1,247,186 $ 1,309,518 $ 1,306,757 Payable for investments purchased 11,694 1,353 16,395 880 368 Interest and credit facility fees payable 8,507 10,853 12,061 17,287 11,515 Dividend payable 23,898 22,908 22,931 29,162 29,161 Base management and incentive fees payable 11,693 11,908 13,405 14,599 14,751 Administrative service fees payable 830 885 986 326 840 Derivative liabilities, at fair value(1) — 6,875 3,502 — 500 Other accrued expenses and liabilities 5,193 5,058 4,953 5,047 1,434 Total Liabilities 910,323 1,020,789 1,321,419 1,376,819 1,365,326 Preferred Stock 50,000 50,000 — — — Total Liabilities and Preferred Stock 960,323 1,070,789 1,321,419 1,376,819 1,365,326 Net Assets $ 856,604 $ 855,204 $ 1,212,389 1,197,858 $ 1,192,600 Net Asset Value Per Common Share $ 16.85 $ 16.80 $ 16.63 $ 16.43 $ 16.36 19 Please refer to the Company’s Form 10-Q and Form 10-K for more information. (1) Effective December 31, 2024, the Company separately disclosed the fair value of derivatives. Prior periods were conformed to the current presentation.

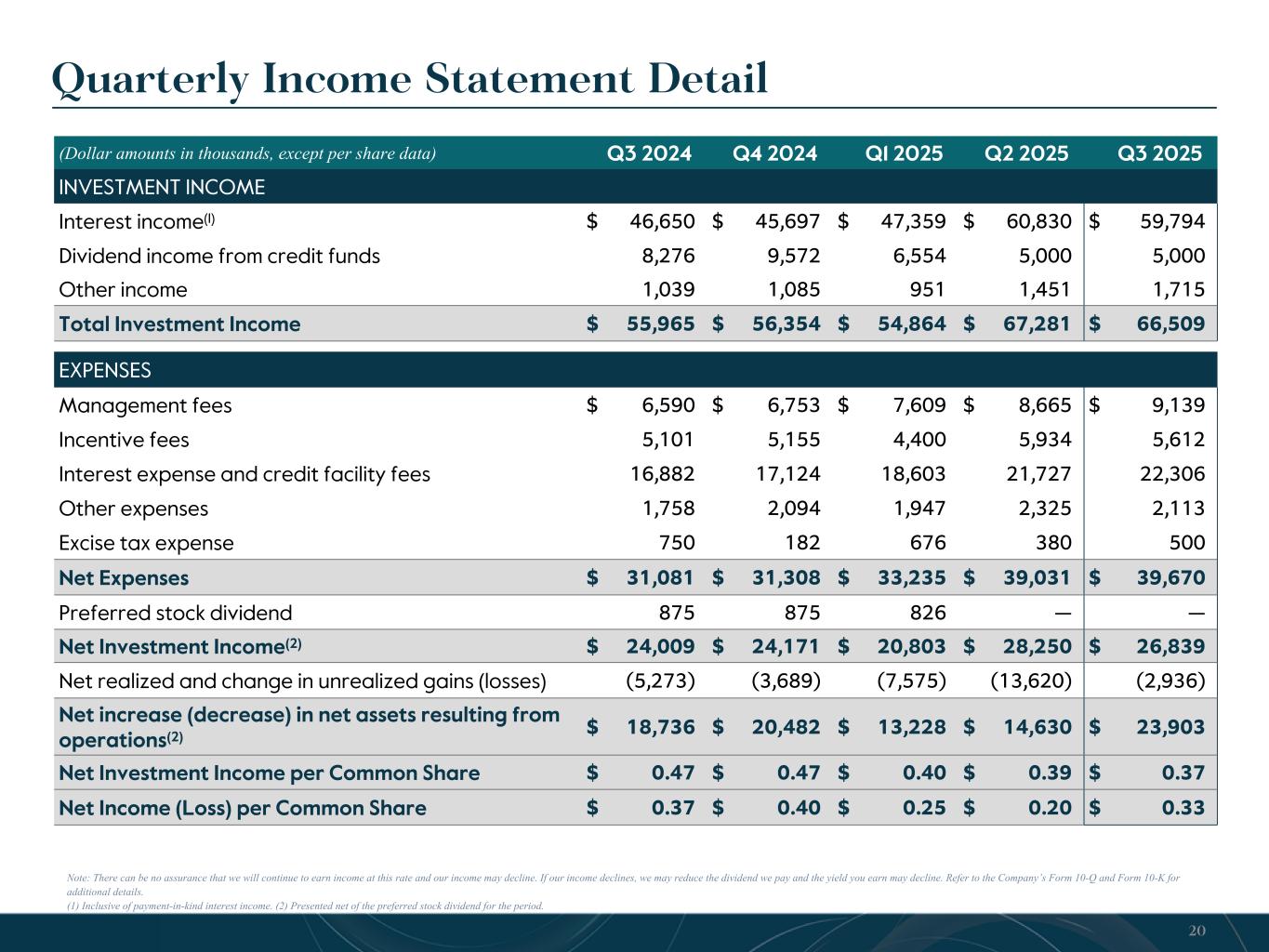

Quarterly Income Statement Detail Note: There can be no assurance that we will continue to earn income at this rate and our income may decline. If our income declines, we may reduce the dividend we pay and the yield you earn may decline. Refer to the Company’s Form 10-Q and Form 10-K for additional details. (1) Inclusive of payment-in-kind interest income. (2) Presented net of the preferred stock dividend for the period. (Dollar amounts in thousands, except per share data) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 INVESTMENT INCOME Interest income(1) $ 46,650 $ 45,697 $ 47,359 $ 60,830 $ 59,794 Dividend income from credit funds 8,276 9,572 6,554 5,000 5,000 Other income 1,039 1,085 951 1,451 1,715 Total Investment Income $ 55,965 $ 56,354 $ 54,864 $ 67,281 $ 66,509 EXPENSES Management fees $ 6,590 $ 6,753 $ 7,609 $ 8,665 $ 9,139 Incentive fees 5,101 5,155 4,400 5,934 5,612 Interest expense and credit facility fees 16,882 17,124 18,603 21,727 22,306 Other expenses 1,758 2,094 1,947 2,325 2,113 Excise tax expense 750 182 676 380 500 Net Expenses $ 31,081 $ 31,308 $ 33,235 $ 39,031 $ 39,670 Preferred stock dividend 875 875 826 — — Net Investment Income(2) $ 24,009 $ 24,171 $ 20,803 $ 28,250 $ 26,839 Net realized and change in unrealized gains (losses) (5,273) (3,689) (7,575) (13,620) (2,936) Net increase (decrease) in net assets resulting from operations(2) $ 18,736 $ 20,482 $ 13,228 $ 14,630 $ 23,903 Net Investment Income per Common Share $ 0.47 $ 0.47 $ 0.40 $ 0.39 $ 0.37 Net Income (Loss) per Common Share $ 0.37 $ 0.40 $ 0.25 $ 0.20 $ 0.33 20

On a supplemental basis, we are disclosing Adjusted Net Investment Income, Adjusted Net Investment Income Per Common Share, Adjusted Net Income and Adjusted Net Income Per Common Share each of which is calculated and presented on a basis other than in accordance with GAAP (“non-GAAP”). We use these non-GAAP financial measures internally to analyze and evaluate financial results and performance, and we believe these non-GAAP financial measures are useful to investors as an additional tool to evaluate our ongoing results and trends and to review our performance without giving effect to (i) the amortization/accretion resulting from the new cost basis of the investments acquired and accounted for under the acquisition method of accounting in accordance with ASC 805 and (ii) the purchase one-time or non-recurring investment income and expense events, including the effects on incentive fees. In addition, Company’s management uses the non-GAAP financial measure described above internally to analyze and evaluate financial results and performance and to compare its financial results with those of other business development companies that have not had similar one-time or non-recurring events. The presentation of these non-GAAP measures is not intended to be a substitute for financial results prepared in accordance with GAAP and should not be considered in isolation. Starting in the first quarter of 2025, the adjustment to Adjusted Net Investment Income Per Common Share Represents the difference between GAAP amortization under the asset acquisition method of accounting in accordance with ASC 850 and management’s non-GAAP measure of amortization related to assets acquired in connection with the CSL III Merger on March 27, 2025, and the Credit Fund II Purchase on February 11, 2025. This adjustment reflects management’s view of the economic yield on the acquired assets and is consistent with the internal evaluation of performance. The following details the additional one-time or non-recurring events considered as part of the non-GAAP measures: • On July 2, 2024, Carlyle Direct Lending CLO 2015-1R LLC, a wholly-owned and consolidated subsidiary of the Company, completed the refinancing of its outstanding notes by redeeming the notes in full and issuance of new notes and loans (the “2015-1R CLO Reset”). Refer to Note 8, Borrowings, in the Company’s Form 10-K for the Annual Period ended December 31, 2024 for more information on the refinancing. In connection with the refinancing, the debt issuance costs were accelerated in accordance with GAAP. Non-GAAP Measures 21