Protein Degraders to Outmatch Cancer and Autoimmune Disease Investor Presentation September 2025

Important Notice and Disclaimers This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. When or if used in this presentation, the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “predict,” “should,” “will,” and similar expressions and their variants, as they relate to Nurix Therapeutics, Inc. (“Nurix”, the “Company,” “we,” “us” or “our”), may identify forward-looking statements. All statements that reflect Nurix’s expectations, assumptions or projections about the future, other than statements of historical fact, are forward- looking statements, including, without limitation, statements regarding our future financial or business plans; our future performance, prospects and strategies; future conditions, trends, and other financial and business matters; our current and prospective drug candidates; the planned timing and conduct of the clinical trial programs for our drug candidates; the planned timing for the provision of updates and initial findings from our clinical studies; the potential benefits of our collaborations, including potential milestone and sales-related payments; the potential advantages of DEL-AI and our drug candidates; the extent to which our scientific approach, our drug discovery engine, targeted protein degradation, and degrader antibody conjugates may potentially address a broad range of diseases; the extent animal model data predicts human efficacy; the timing and success of the development and commercialization of our current and anticipated drug candidates; and our ability to fund our operations into the first half of 2027. Forward-looking statements reflect Nurix’s current beliefs, expectations, and assumptions. Although Nurix believes the expectations and assumptions reflected in such forward-looking statements are reasonable, Nurix can give no assurance that they will prove to be correct. Forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, which could cause Nurix’s actual activities and results to differ materially from those expressed in any forward-looking statement. Such risks and uncertainties include, but are not limited to: (i) risks and uncertainties related to Nurix’s ability to advance its drug candidates, obtain regulatory approval of and ultimately commercialize its drug candidates; (ii) the timing and results of clinical trials; (iii) Nurix’s ability to fund development activities and achieve development goals; (iv) risks and uncertainties relating to the timing and receipt of payments from Nurix's collaboration partners, including milestone payments and royalties on future potential product sales; (v) the impact of macroeconomic events and conditions, including increasing financial market volatility and uncertainty, inflation, interest rate fluctuations, instability in the global banking system, uncertainty with respect to the federal budget and debt ceiling, the impact of war, military or regional conflicts, and global health pandemics, on Nurix’s clinical trials and operations; (vi) Nurix’s ability to protect intellectual property and (vii) other risks and uncertainties described under the heading “Risk Factors” in Nurix’s Quarterly Report on Form 10-Q for the fiscal quarter ended May 31, 2025, and other SEC filings. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements. The statements in this presentation speak only as of the date of this presentation, even if subsequently made available by Nurix on its website or otherwise. Nurix disclaims any intention or obligation to update publicly any forward-looking statements, whether in response to new information, future events, or otherwise, except as required by applicable law. Certain information contained in this presentation relates to or is based on studies, publications, surveys and other data obtained from third-party sources and the Company’s own internal estimates and research. While the Company believes these third-party sources to be reliable as of the date of this presentation, it has not independently verified, and makes no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from third-party sources. In addition, all of the market data included in this presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Furthermore, while we believe our own internal estimates and research are reliable, such estimates and research have not been verified by any independent source. 2

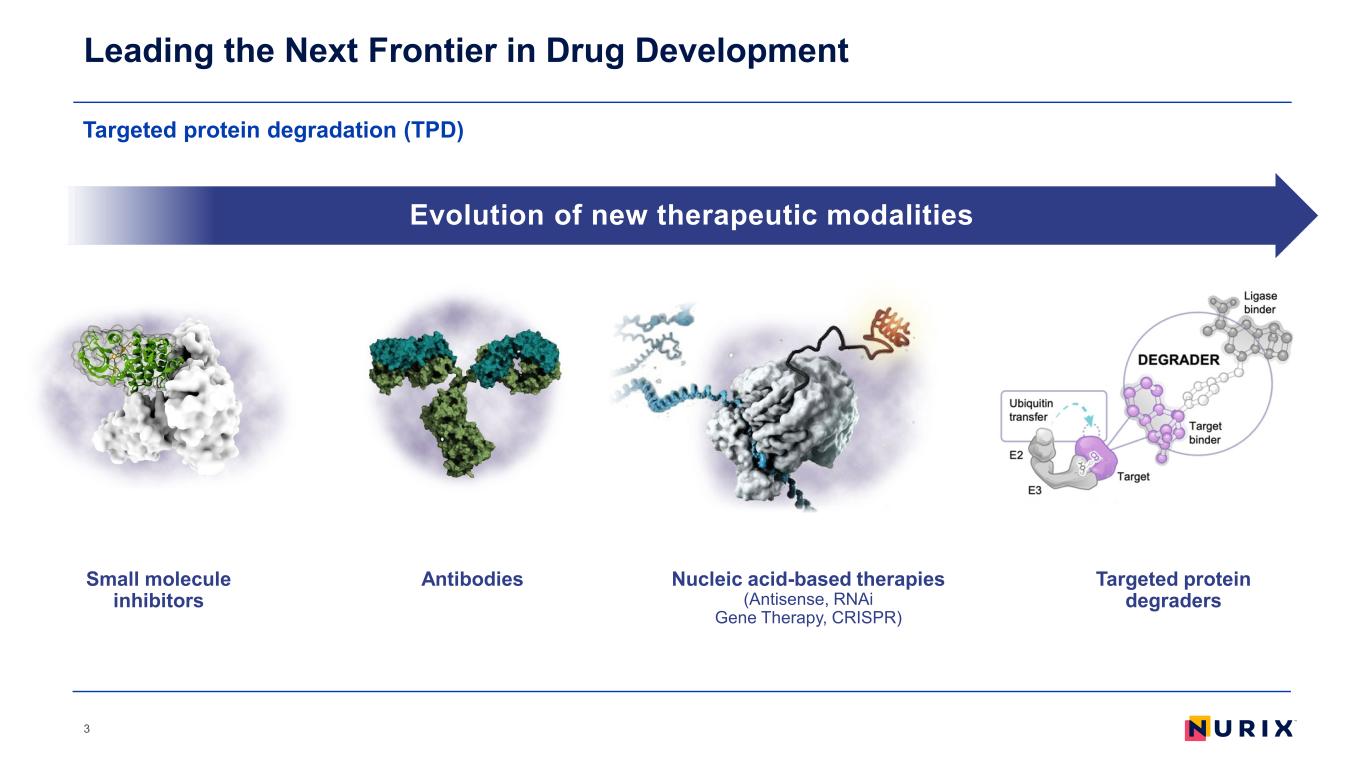

Targeted protein degradation (TPD) Leading the Next Frontier in Drug Development 3 Evolution of new therapeutic modalities AntibodiesSmall molecule inhibitors Nucleic acid-based therapies (Antisense, RNAi Gene Therapy, CRISPR) Targeted protein degraders

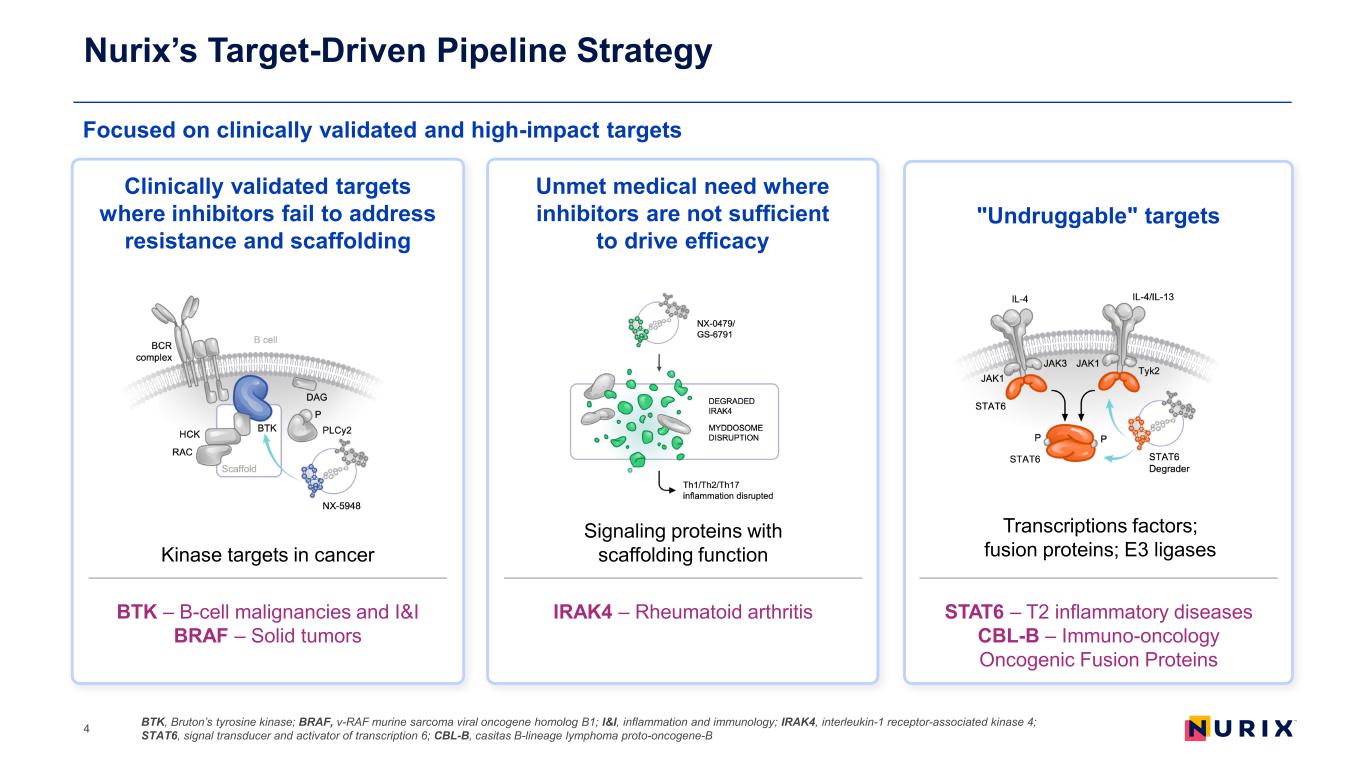

Focused on clinically validated and high-impact targets Nurix’s Target-Driven Pipeline Strategy BTK, Bruton’s tyrosine kinase; BRAF, v-RAF murine sarcoma viral oncogene homolog B1; I&I, inflammation and immunology; IRAK4, interleukin-1 receptor-associated kinase 4; STAT6, signal transducer and activator of transcription 6; CBL-B, casitas B-lineage lymphoma proto-oncogene-B4 Clinically validated targets where inhibitors fail to address resistance and scaffolding Unmet medical need where inhibitors are not sufficient to drive efficacy "Undruggable" targets Kinase targets in cancer BTK – B-cell malignancies and I&I BRAF – Solid tumors Signaling proteins with scaffolding function IRAK4 – Rheumatoid arthritis STAT6 – T2 inflammatory diseases CBL-B – Immuno-oncology Oncogenic Fusion Proteins Transcriptions factors; fusion proteins; E3 ligases

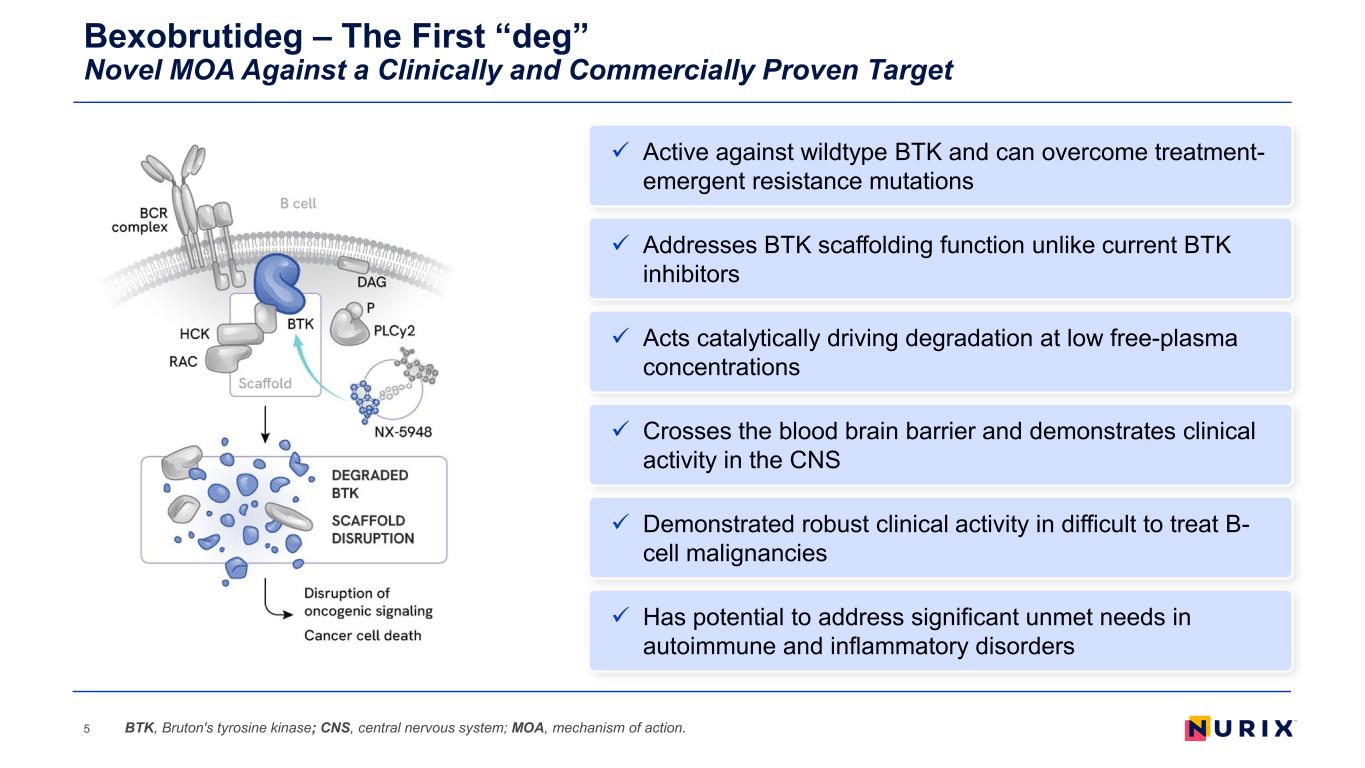

Bexobrutideg – The First “deg” Novel MOA Against a Clinically and Commercially Proven Target 5 Addresses BTK scaffolding function unlike current BTK inhibitors Acts catalytically driving degradation at low free-plasma concentrations Demonstrated robust clinical activity in difficult to treat B- cell malignancies Active against wildtype BTK and can overcome treatment- emergent resistance mutations Crosses the blood brain barrier and demonstrates clinical activity in the CNS Has potential to address significant unmet needs in autoimmune and inflammatory disorders BTK, Bruton's tyrosine kinase; CNS, central nervous system; MOA, mechanism of action.

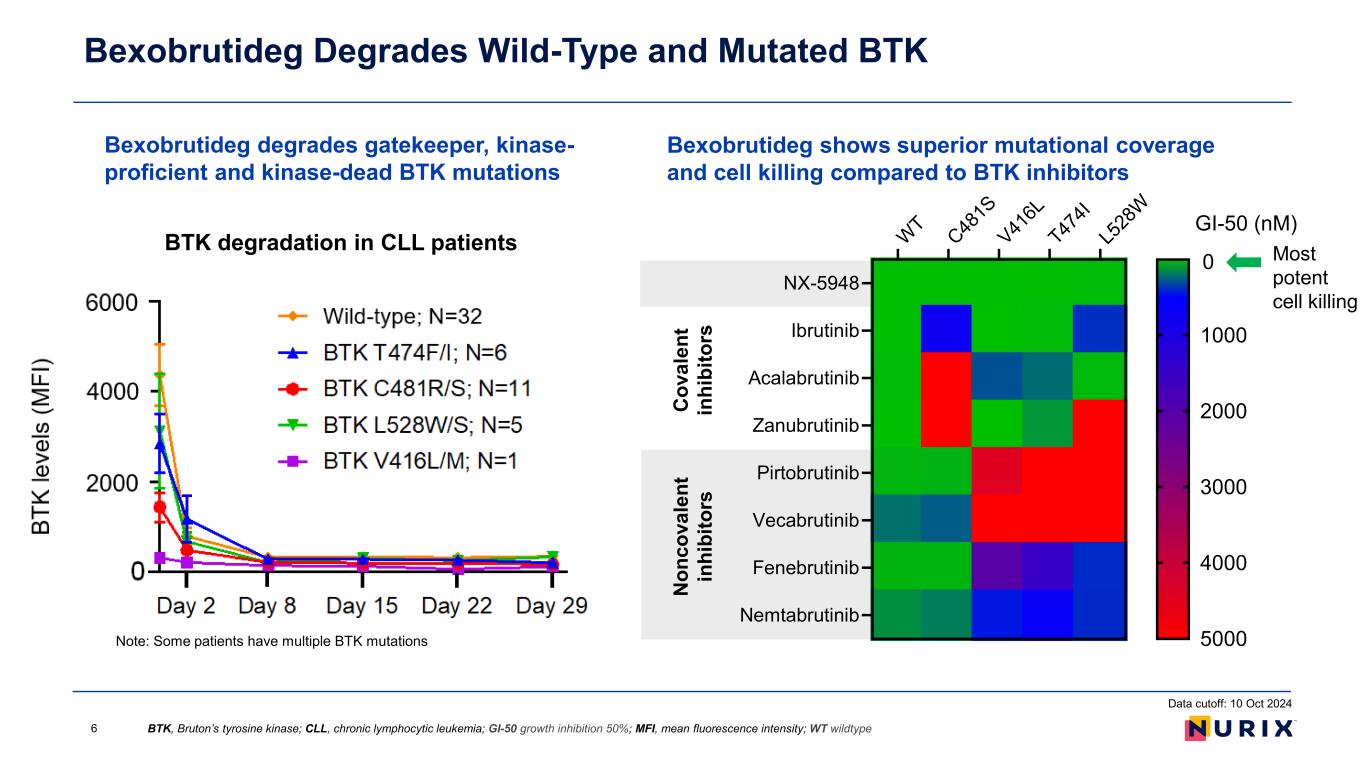

Bexobrutideg degrades gatekeeper, kinase- proficient and kinase-dead BTK mutations Bexobrutideg Degrades Wild-Type and Mutated BTK Note: Some patients have multiple BTK mutations BTK degradation in CLL patients BTK, Bruton’s tyrosine kinase; CLL, chronic lymphocytic leukemia; GI-50 growth inhibition 50%; MFI, mean fluorescence intensity; WT wildtype Data cutoff: 10 Oct 2024 6 Bexobrutideg shows superior mutational coverage and cell killing compared to BTK inhibitors WT C48 1S V41 6L T47 4I L5 28 W NX-5948 Ibrutinib Acalabrutinib Zanubrutinib Pirtobrutinib Vecabrutinib Fenebrutinib Nemtabrutinib GI-50 (nM) 0 1000 2000 3000 4000 5000 Most potent cell killing N on co va le nt in hi bi to rs C ov al en t in hi bi to rs

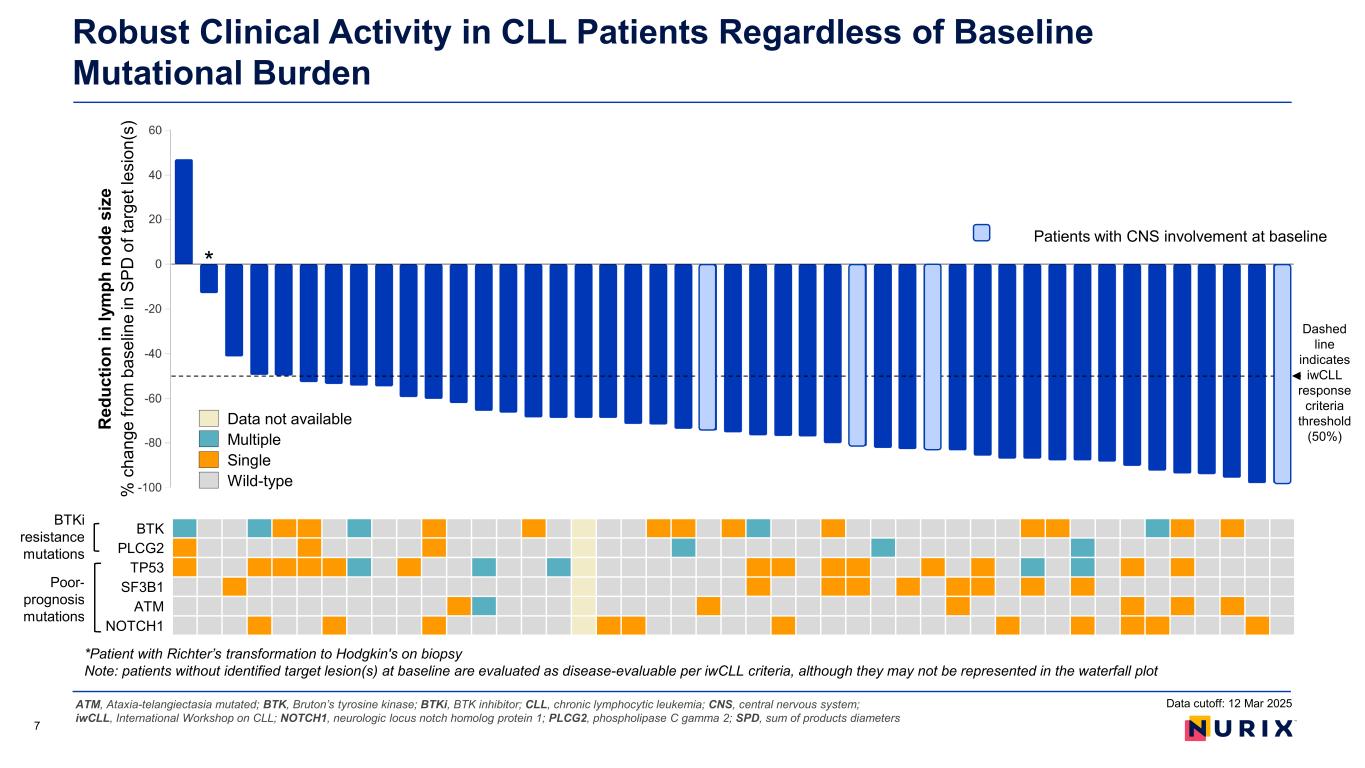

Robust Clinical Activity in CLL Patients Regardless of Baseline Mutational Burden ATM, Ataxia-telangiectasia mutated; BTK, Bruton’s tyrosine kinase; BTKi, BTK inhibitor; CLL, chronic lymphocytic leukemia; CNS, central nervous system; iwCLL, International Workshop on CLL; NOTCH1, neurologic locus notch homolog protein 1; PLCG2, phospholipase C gamma 2; SPD, sum of products diameters 7 BTKi resistance mutations Poor- prognosis mutations BTK PLCG2 TP53 SF3B1 ATM NOTCH1 Dashed line indicates iwCLL response criteria threshold (50%) Patients with CNS involvement at baseline Data not available Multiple Single Wild-type Data cutoff: 12 Mar 2025 * *Patient with Richter’s transformation to Hodgkin's on biopsy Note: patients without identified target lesion(s) at baseline are evaluated as disease-evaluable per iwCLL criteria, although they may not be represented in the waterfall plot R ed uc tio n in ly m ph n od e si ze % c ha ng e fro m b as el in e in S PD o f t ar ge t l es io n( s)

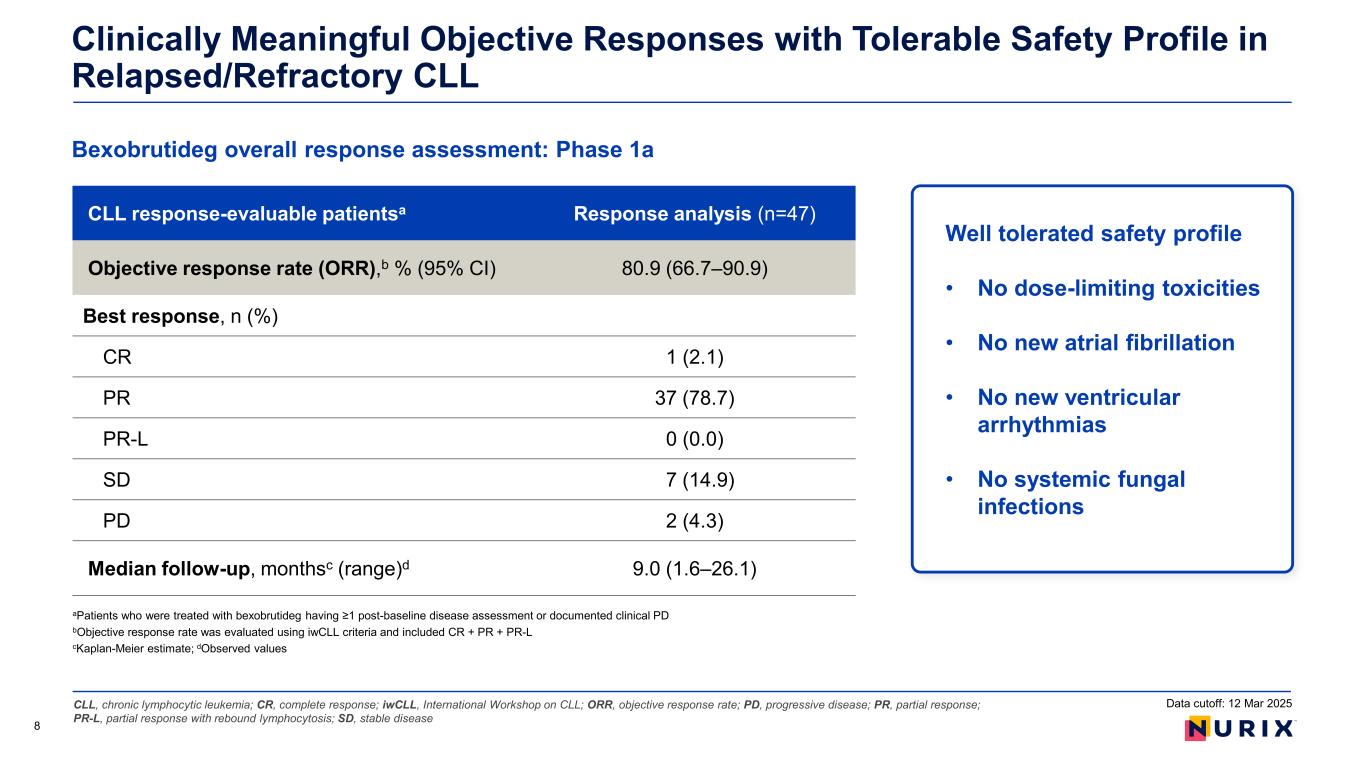

CLL, chronic lymphocytic leukemia; CR, complete response; iwCLL, International Workshop on CLL; ORR, objective response rate; PD, progressive disease; PR, partial response; PR-L, partial response with rebound lymphocytosis; SD, stable disease Bexobrutideg overall response assessment: Phase 1a Clinically Meaningful Objective Responses with Tolerable Safety Profile in Relapsed/Refractory CLL aPatients who were treated with bexobrutideg having ≥1 post-baseline disease assessment or documented clinical PD bObjective response rate was evaluated using iwCLL criteria and included CR + PR + PR-L cKaplan-Meier estimate; dObserved values 8 CLL response-evaluable patientsa Response analysis (n=47) Objective response rate (ORR),b % (95% CI) 80.9 (66.7–90.9) Best response, n (%) CR 1 (2.1) PR 37 (78.7) PR-L 0 (0.0) SD 7 (14.9) PD 2 (4.3) Median follow-up, monthsc (range)d 9.0 (1.6–26.1) Data cutoff: 12 Mar 2025 Well tolerated safety profile • No dose-limiting toxicities • No new atrial fibrillation • No new ventricular arrhythmias • No systemic fungal infections

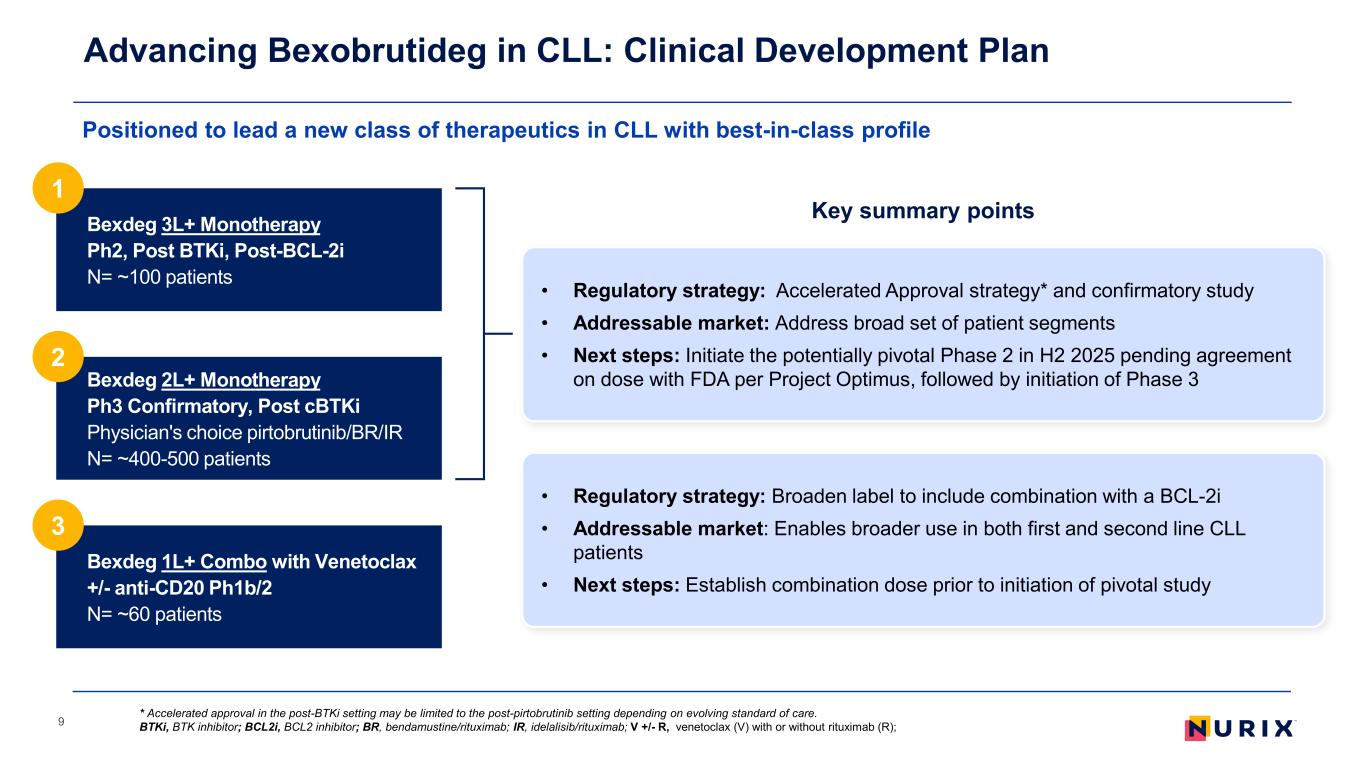

Advancing Bexobrutideg in CLL: Clinical Development Plan 9 Key summary points Positioned to lead a new class of therapeutics in CLL with best-in-class profile * Accelerated approval in the post-BTKi setting may be limited to the post-pirtobrutinib setting depending on evolving standard of care. BTKi, BTK inhibitor; BCL2i, BCL2 inhibitor; BR, bendamustine/rituximab; IR, idelalisib/rituximab; V +/- R, venetoclax (V) with or without rituximab (R); • Regulatory strategy: Accelerated Approval strategy* and confirmatory study • Addressable market: Address broad set of patient segments • Next steps: Initiate the potentially pivotal Phase 2 in H2 2025 pending agreement on dose with FDA per Project Optimus, followed by initiation of Phase 3 • Regulatory strategy: Broaden label to include combination with a BCL-2i • Addressable market: Enables broader use in both first and second line CLL patients • Next steps: Establish combination dose prior to initiation of pivotal study Bexdeg 3L+ Monotherapy Ph2, Post BTKi, Post-BCL-2i N= ~100 patients 1 Bexdeg 2L+ Monotherapy Ph3 Confirmatory, Post cBTKi Physician's choice pirtobrutinib/BR/IR N= ~400-500 patients 2 Bexdeg 1L+ Combo with Venetoclax +/- anti-CD20 Ph1b/2 N= ~60 patients 3

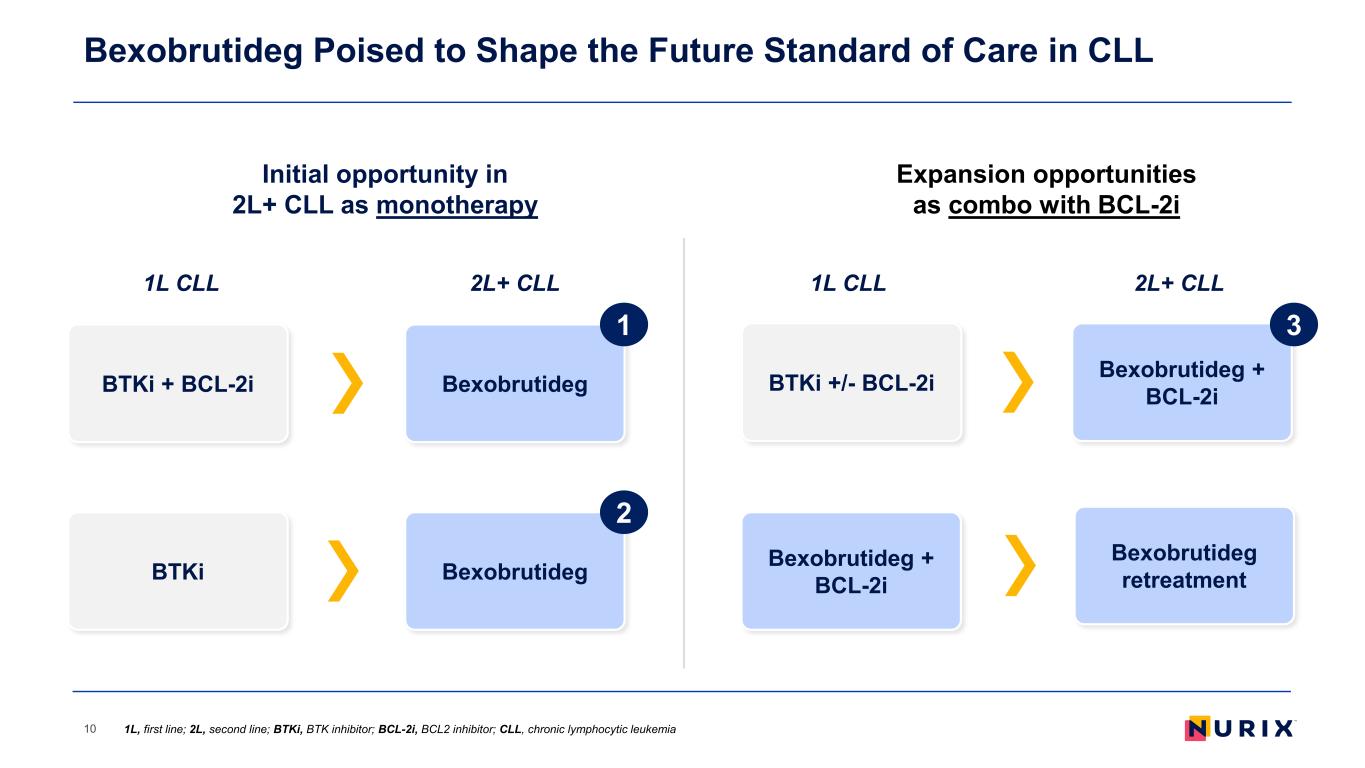

BexobrutidegBTKi + BCL-2i 1 Initial opportunity in 2L+ CLL as monotherapy Bexobrutideg Poised to Shape the Future Standard of Care in CLL 10 BTKi Bexobrutideg 1L CLL 2L+ CLL Expansion opportunities as combo with BCL-2i 1L CLL 2L+ CLL BTKi +/- BCL-2i Bexobrutideg + BCL-2i Bexobrutideg + BCL-2i 1L, first line; 2L, second line; BTKi, BTK inhibitor; BCL-2i, BCL2 inhibitor; CLL, chronic lymphocytic leukemia Bexobrutideg retreatment 2 3

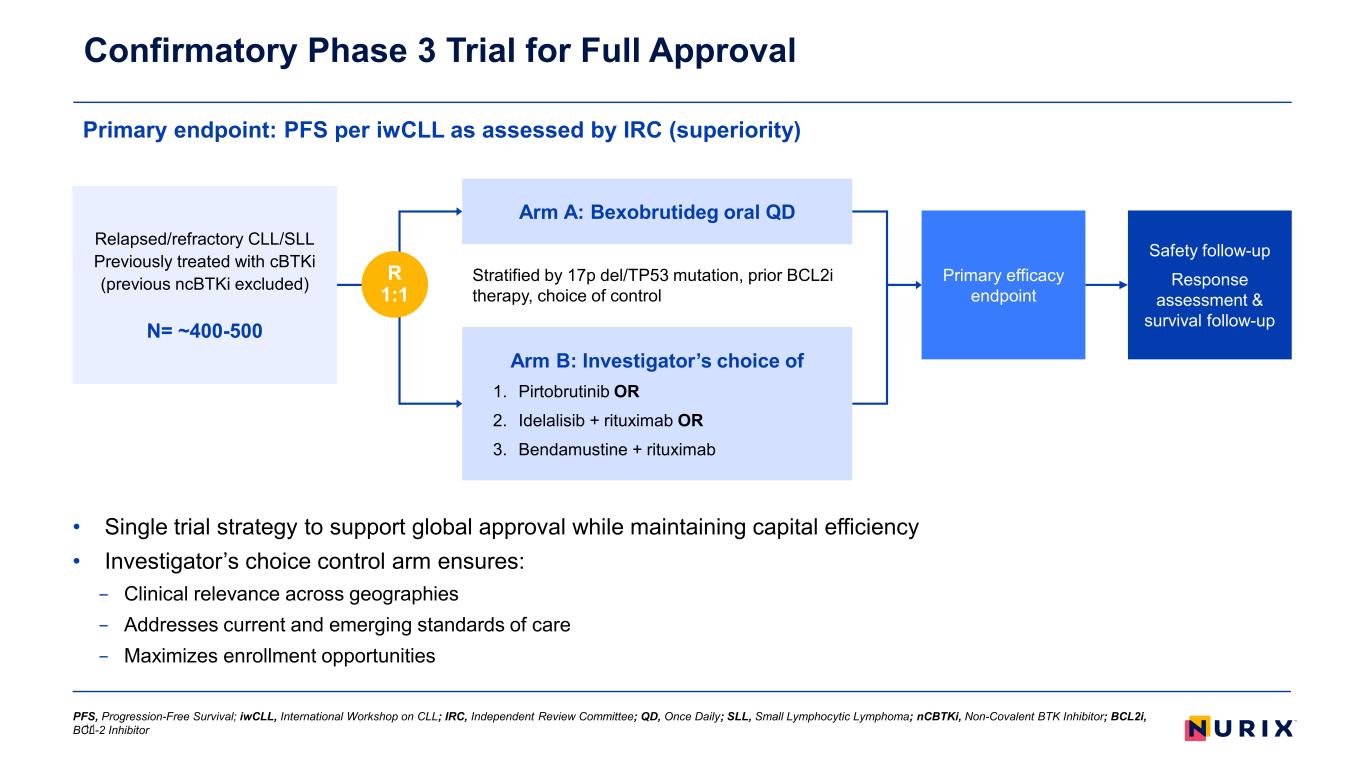

• Single trial strategy to support global approval while maintaining capital efficiency • Investigator’s choice control arm ensures: − Clinical relevance across geographies − Addresses current and emerging standards of care − Maximizes enrollment opportunities Primary endpoint: PFS per iwCLL as assessed by IRC (superiority) Confirmatory Phase 3 Trial for Full Approval 11 Stratified by 17p del/TP53 mutation, prior BCL2i therapy, choice of control Primary efficacy endpoint Relapsed/refractory CLL/SLL Previously treated with cBTKi (previous ncBTKi excluded) N= ~400-500 R 1:1 Arm A: Bexobrutideg oral QD Arm B: Investigator’s choice of 1. Pirtobrutinib OR 2. Idelalisib + rituximab OR 3. Bendamustine + rituximab Safety follow-up Response assessment & survival follow-up PFS, Progression-Free Survival; iwCLL, International Workshop on CLL; IRC, Independent Review Committee; QD, Once Daily; SLL, Small Lymphocytic Lymphoma; nCBTKi, Non-Covalent BTK Inhibitor; BCL2i, BCL-2 Inhibitor

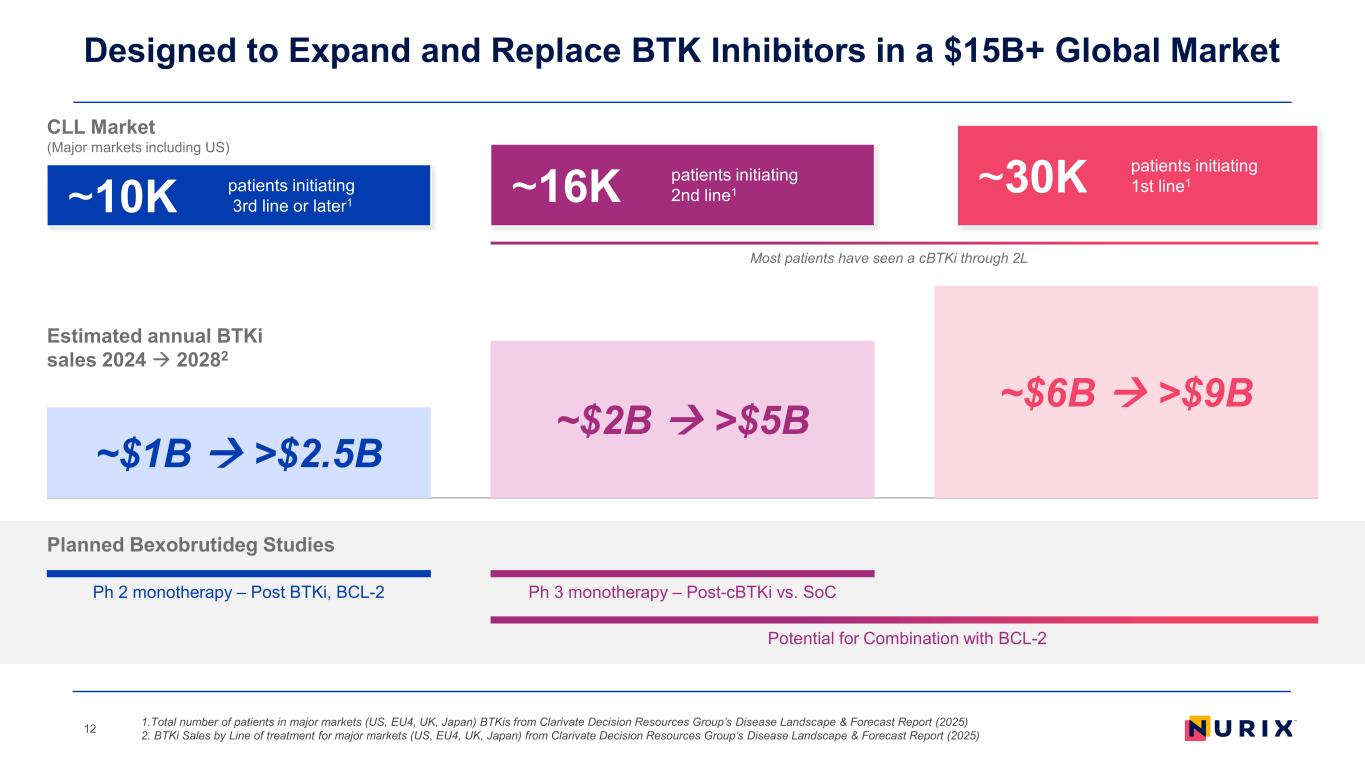

Designed to Expand and Replace BTK Inhibitors in a $15B+ Global Market 1.Total number of patients in major markets (US, EU4, UK, Japan) BTKis from Clarivate Decision Resources Group’s Disease Landscape & Forecast Report (2025) 2. BTKi Sales by Line of treatment for major markets (US, EU4, UK, Japan) from Clarivate Decision Resources Group’s Disease Landscape & Forecast Report (2025) 12 ~30K patients initiating 1st line1 CLL Market (Major markets including US) Most patients have seen a cBTKi through 2L ~16K patients initiating 2nd line1~10K patients initiating 3rd line or later1 Ph 2 monotherapy – Post BTKi, BCL-2 Planned Bexobrutideg Studies Ph 3 monotherapy – Post-cBTKi vs. SoC Potential for Combination with BCL-2 ~$6B >$9B ~$1B >$2.5B ~$2B >$5B Estimated annual BTKi sales 2024 20282