P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON1 3rd Quarter 2025 Earnings Supplement November 2025

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON2 Safe Harbor Statement This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding our financial outlook for the fourth quarter and full year 2025, including the impact of our sales season and client launches; our anticipated number of clients and covered lives for 2026; our expected utilization rates and mix; the demand for our solutions; our positioning to successfully manage economic uncertainty on our business; the timing of client decisions; our ability to retain existing clients and acquire new clients; and our business strategy, plans, goals and expectations concerning our market position, future operations, and other financial and operating information. The words “anticipates,” “assumes,” “believe,” “contemplate,” “continues, ” “could,” “estimates,” “expects,” “future,” “intends,” “may,” “plans,” “predict,” “potential,” “project,” “seeks,” “should,” “target,” “will,” and the negative of these or similar expressions and phrases are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. Forward-looking statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These risks include, without limitation, failure to meet our publicly announced guidance or other expectations about our business; competition in the market in which we operate; our history of operating losses and ability to sustain profitability; unfavorable conditions in our industry or the United States economy; our limited operating history and the difficulty in predicting our future results of operations; our ability to attract and retain clients and increase the adoption of services within our client base; the loss of any of our largest client accounts; changes in the technology industry; changes or developments in the health insurance market; negative publicity in the health benefits industry; lags, failures or security breaches in our computer systems or those of our vendors; a significant change in the utilization of our solutions; our ability to offer high-quality support; positive references from our existing clients; our ability to develop and expand our marketing and sales capabilities; the rate of growth of our future revenue; the accuracy of the estimates and assumptions we use to determine the size of target markets; our ability to successfully manage our growth; reductions in employee benefits spending; seasonal fluctuations in our sales; the adoption of new solutions and services by our clients or members; our ability to innovate and develop new offerings; our ability to adapt and respond to the changing medical landscape, regulations, and client needs, requirements or preferences; our ability to maintain and enhance our brand; our ability to attract and retain members of our management team, key employees, or other qualified personnel; risks related to any litigation against us; our ability to maintain our Center of Excellence network of healthcare providers; our strategic relationships with and monitoring of third parties; our ability to maintain our pharmacy distribution network if there is a disruption to our network or its associated supply chains; our relationship with key pharmacy program partners or any decline in rebates provided by them; our ability to maintain our relationships with benefits consultants; exposure to credit risk from our members; risks related to government regulation; risks related to our business with government entities; our ability to protect our intellectual property rights; risks related to acquisitions, strategic investments, or partnerships; federal tax reform and changes to our effective tax rate; the imposition of state and local state taxes; our ability to utilize a portion of our net operating loss or research tax credit carryforwards; our ability to develop or maintain effective internal control over financial reporting; and our ability to adapt and respond to the changing SEC or stakeholder expectations regarding environmental, social and governance practices. For a detailed discussion of these and other risk factors, please refer to our filings with the Securities and Exchange Commission (the “SEC”), including in the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and subsequent reports that we file with the SEC, which are available at http://investors.progyny.com and on the SEC’s website at https://www.sec.gov. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this press release. Our actual future results could differ materially from what we expect. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons. Non-GAAP Financial Measures: In addition to disclosing financial measures prepared in accordance with U.S. generally accepted accounting principles (“GAAP”), this presentation includes the non-GAAP financial measures Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA margin on incremental revenue and Adjusted earnings per diluted share. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA margin on incremental revenue and Adjusted earnings per diluted share are supplemental financial measures that are not required by, or presented in accordance with, GAAP. We believe that these non-GAAP measures, when taken together with our GAAP financial results, provide meaningful supplemental information regarding our operating performance and facilitates internal comparisons of our historical operating performance on a more consistent basis by excluding certain items that may not be indicative of our business, results of operations or outlook. In particular, we believe that the use of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA margin on incremental revenue and Adjusted earnings per diluted share are helpful to our investors as they are measures used by management in assessing the health of our business, determining incentive compensation, evaluating our operating performance, and for internal planning and forecasting purposes. Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA margin on incremental revenue and Adjusted earnings per diluted share are presented for supplemental informational purposes only, have limitations as analytical tools and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Some of the limitations of Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA margin on incremental revenue and Adjusted earnings per diluted share include: (1) it does not properly reflect capital commitments to be paid in the future; (2) although depreciation and amortization are non-cash charges, the underlying assets may need to be replaced and Adjusted EBITDA does not reflect these capital expenditures; (3) it does not consider the impact of stock-based compensation expense; (4) it does not reflect other non-operating income and expenses, including interest and other income, net; and (5) it does not reflect tax payments that may represent a reduction in cash available to us. In addition, our non-GAAP measures may not be comparable to similarly titled measures of other companies because they may not calculate such measures in the same manner as we calculate these measures, limiting their usefulness as comparative measures. Because of these limitations, when evaluating our performance, you should consider Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBITDA margin on incremental revenue and Adjusted earnings per diluted share alongside other financial performance measures, including our net income, gross margin, and our other GAAP results. We calculate Adjusted EBITDA as net income, adjusted to exclude depreciation and amortization; stock-based compensation expense; interest and other income, net; and provision for income taxes. We calculate Adjusted EBITDA margin as Adjusted EBITDA divided by revenue. We calculate Adjusted EBITDA margin on incremental revenue as incremental Adjusted EBITDA in 2025 divided by incremental revenue in 2025. We calculate Adjusted earnings per diluted share as net income per diluted share excluding the impact of stock-based compensation, adjusted for the associated impact of taxes. Please see the Appendix “Reconciliation of GAAP to Non-GAAP Financial Measures” in this presentation.

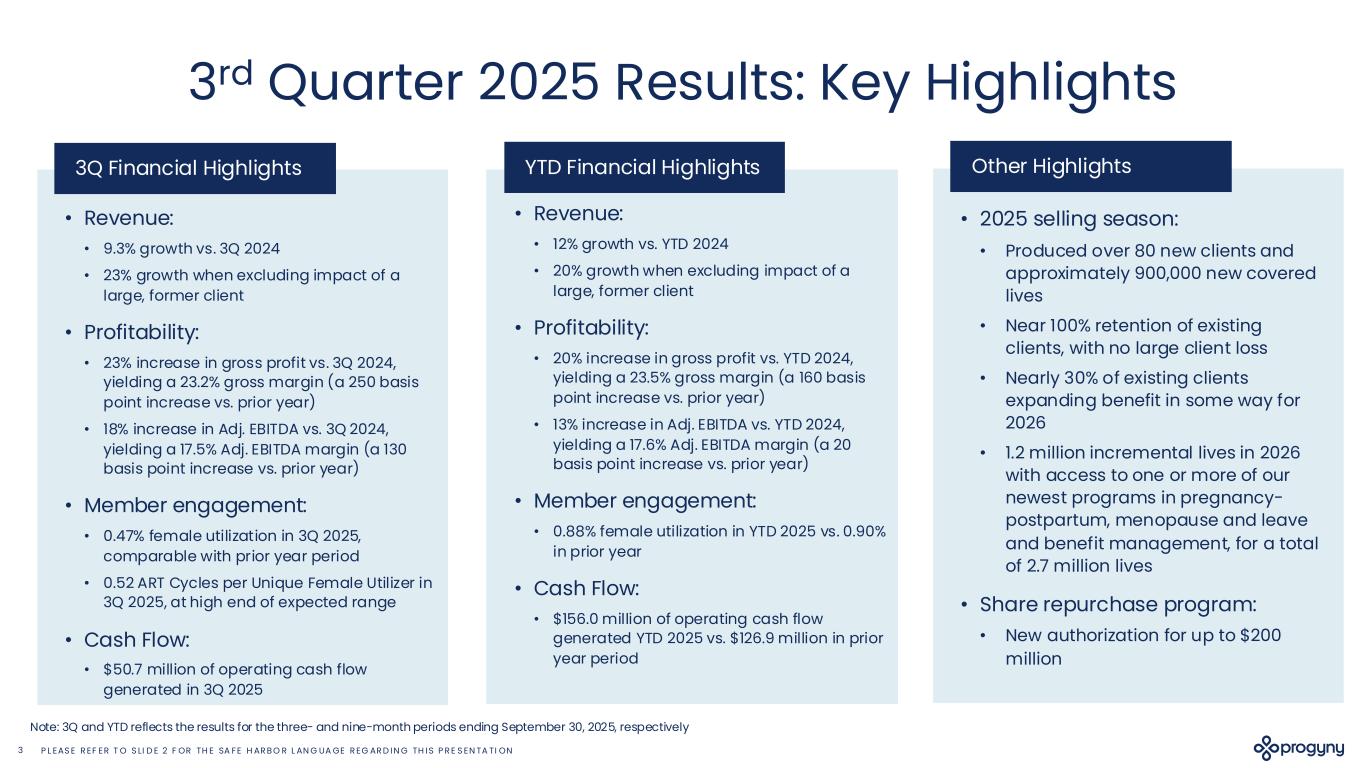

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON3 3rd Quarter 2025 Results: Key Highlights 3Q Financial Highlights • Revenue: • 9.3% growth vs. 3Q 2024 • 23% growth when excluding impact of a large, former client • Profitability: • 23% increase in gross profit vs. 3Q 2024, yielding a 23.2% gross margin (a 250 basis point increase vs. prior year) • 18% increase in Adj. EBITDA vs. 3Q 2024, yielding a 17.5% Adj. EBITDA margin (a 130 basis point increase vs. prior year) • Member engagement: • 0.47% female utilization in 3Q 2025, comparable with prior year period • 0.52 ART Cycles per Unique Female Utilizer in 3Q 2025, at high end of expected range • Cash Flow: • $50.7 million of operating cash flow generated in 3Q 2025 Other Highlights • 2025 selling season: • Produced over 80 new clients and approximately 900,000 new covered lives • Near 100% retention of existing clients, with no large client loss • Nearly 30% of existing clients expanding benefit in some way for 2026 • 1.2 million incremental lives in 2026 with access to one or more of our newest programs in pregnancy- postpartum, menopause and leave and benefit management, for a total of 2.7 million lives • Share repurchase program: • New authorization for up to $200 million YTD Financial Highlights • Revenue: • 12% growth vs. YTD 2024 • 20% growth when excluding impact of a large, former client • Profitability: • 20% increase in gross profit vs. YTD 2024, yielding a 23.5% gross margin (a 160 basis point increase vs. prior year) • 13% increase in Adj. EBITDA vs. YTD 2024, yielding a 17.6% Adj. EBITDA margin (a 20 basis point increase vs. prior year) • Member engagement: • 0.88% female utilization in YTD 2025 vs. 0.90% in prior year • Cash Flow: • $156.0 million of operating cash flow generated YTD 2025 vs. $126.9 million in prior year period Note: 3Q and YTD reflects the results for the three- and nine-month periods ending September 30, 2025, respectively

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON4 3rd Quarter 2025 Results Highlights for 3-Month Period Ending September 30, 2025 Revenue Op. Cash Flow $313.3 3Q 2024 3Q 2025 • 9.3% growth vs. 3Q24; 23% when excluding the impact of large, former client • Increase driven by growth in clients and covered lives Contribution from Large, Former Client* $M Adj. EBITDA • 18% increase in Adj. EBITDA vs. 3Q24, as the higher gross profit more than offset our increased investments to expand the platform and integrate previously announced acquisitions $46.5 $55.0 3Q 2024 3Q 2025 $M 16.2% margin 17.5% margin $253.8 $44.5 $50.7 3Q 2024 3Q 2025 $M • Increase in OCF reflects higher profitability and timing of certain working capital items in both periods • Successfully maintaining targeted 75+% conversion of Adj. EBITDA to OCF Gross Profit • 23% increase in gross profit vs. 3Q24 • Gross margin expanded by 250 basis points • Reflects ongoing efficiencies realized in the delivery of our care management services $59.2 $72.8 3Q 2024 3Q 2025 $M 20.7% gross margin 23.2% gross margin $286.6 as reported +23% *Reflects contribution of $32.8 and $0 in 3Q24 and 3Q25, respectively +18% +9.3% +23% +14%

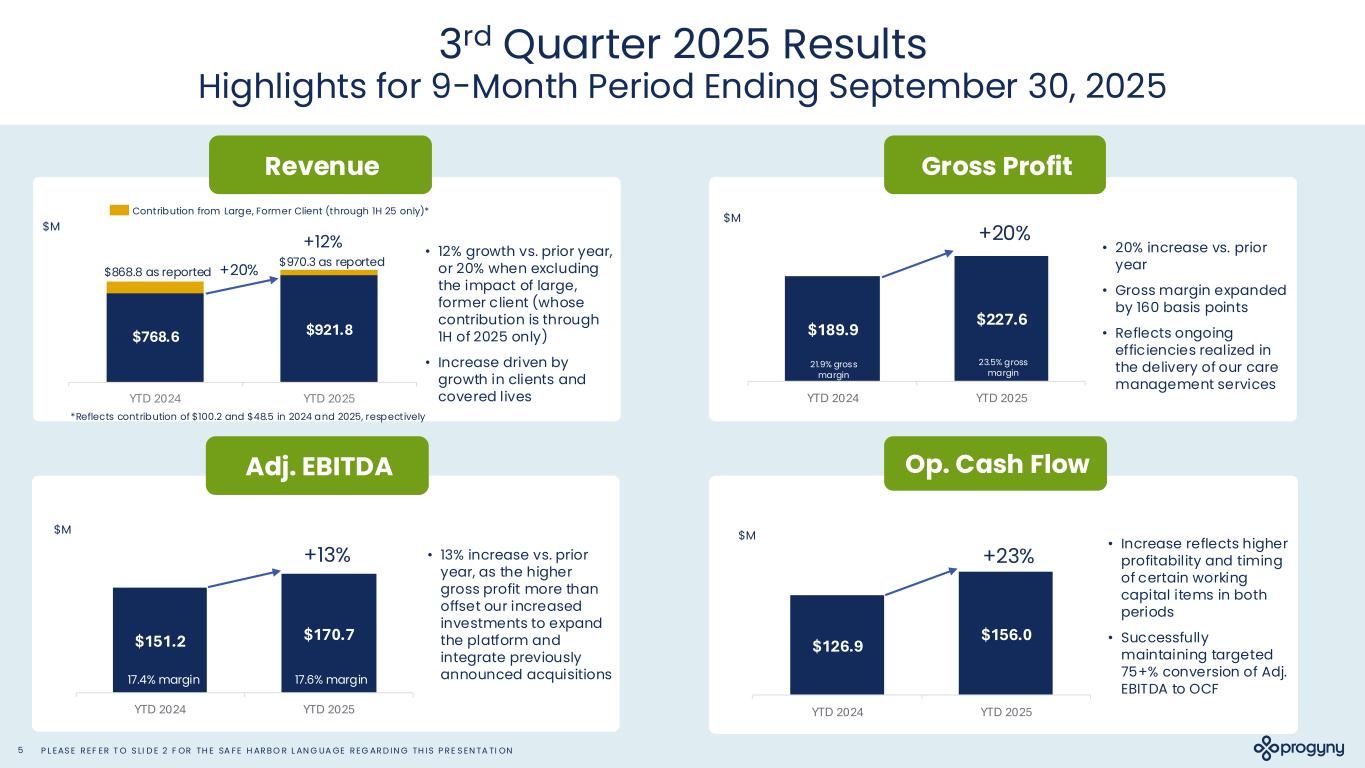

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON5 3rd Quarter 2025 Results Highlights for 9-Month Period Ending September 30, 2025 Revenue Op. Cash Flow $921.8 YTD 2024 YTD 2025 • 12% growth vs. prior year, or 20% when excluding the impact of large, former client (whose contribution is through 1H of 2025 only) • Increase driven by growth in clients and covered lives Contribution from Large, Former Client (through 1H 25 only)* $M Adj. EBITDA • 13% increase vs. prior year, as the higher gross profit more than offset our increased investments to expand the platform and integrate previously announced acquisitions $151.2 $170.7 YTD 2024 YTD 2025 $M 17.4% margin 17.6% margin $768.6 $126.9 $156.0 YTD 2024 YTD 2025 $M • Increase reflects higher profitability and timing of certain working capital items in both periods • Successfully maintaining targeted 75+% conversion of Adj. EBITDA to OCF Gross Profit • 20% increase vs. prior year • Gross margin expanded by 160 basis points • Reflects ongoing efficiencies realized in the delivery of our care management services $189.9 $227.6 YTD 2024 YTD 2025 $M 21.9% gross margin 23.5% gross margin $868.8 as reported $970.3 as reported *Reflects contribution of $100.2 and $48.5 in 2024 and 2025, respectively +20% +20% +23%+13% +12%

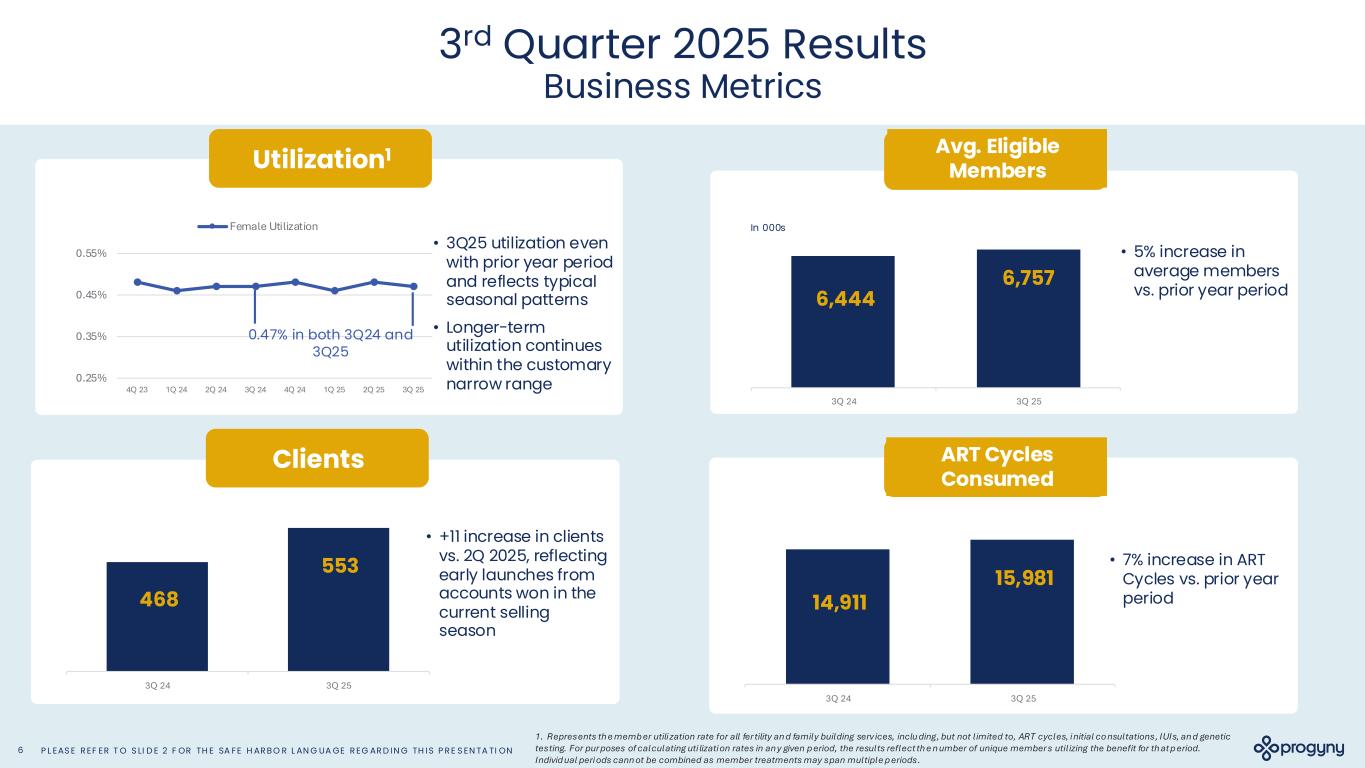

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON6 3rd Quarter 2025 Results Business Metrics ART Cycles Consumed Clients 3Q 24 3Q 25 3Q 24 3Q 25 Utilization1 • 3Q25 utilization even with prior year period and reflects typical seasonal patterns • Longer-term utilization continues within the customary narrow range0.25% 0.35% 0.45% 0.55% 4Q 23 1Q 24 2Q 24 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 Female Utilization 0.47% in both 3Q24 and 3Q25 15,981553 468 14,911 • +11 increase in clients vs. 2Q 2025, reflecting early launches from accounts won in the current selling season • 7% increase in ART Cycles vs. prior year period Avg. Eligible Members In 000s 3Q 24 3Q 25 6,757 6,444 • 5% increase in average members vs. prior year period 1. Represents th e memb er utilization rate for all fer tility an d family building serv ices, inclu ding, but not limited to, ART cycles, initial co nsultations, IUIs, an d genetic testing. For pur poses of calculating uti lization rates in an y given p eriod, the results reflect th e n umber of unique member s utilizing the benefit for th at p eriod. Individ ual peri ods cann ot be combined as member treatments may span multiple p eriods.

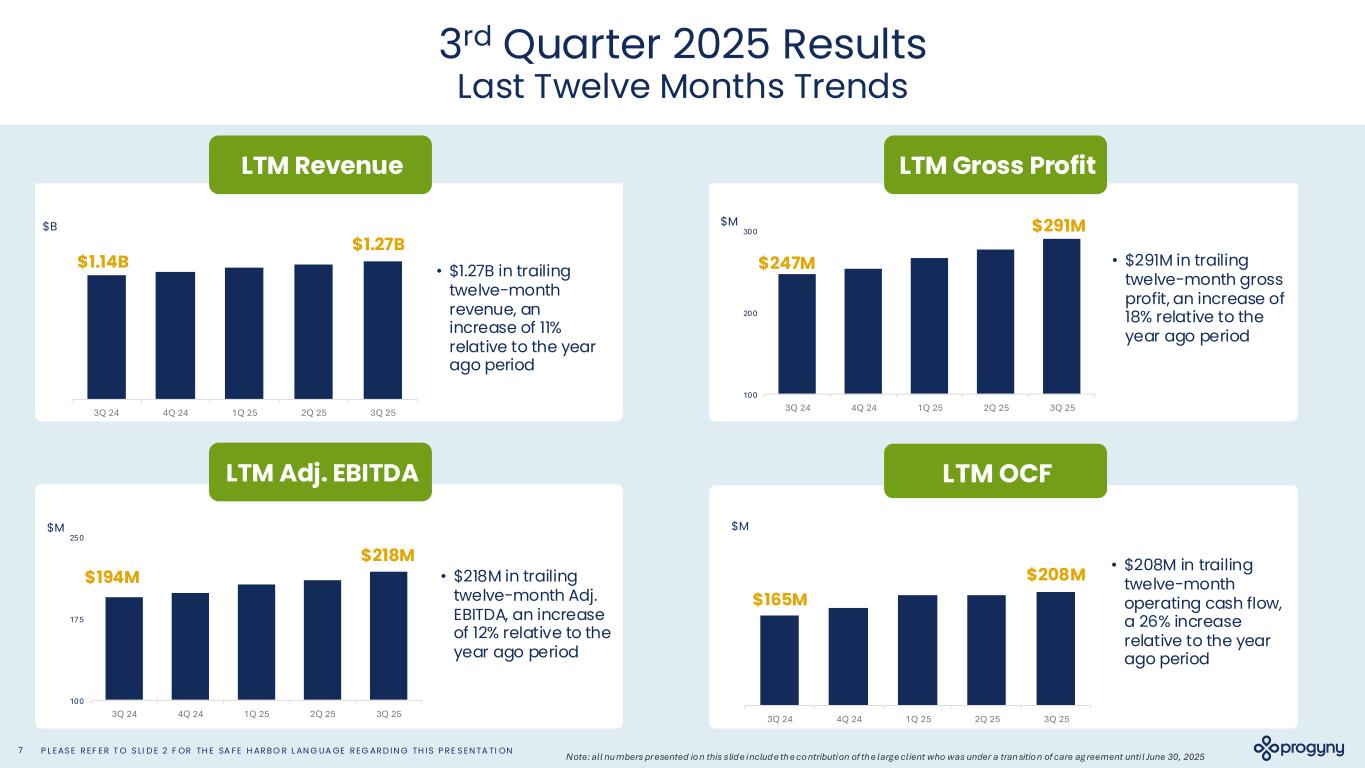

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON7 3rd Quarter 2025 Results Last Twelve Months Trends LTM Gross Profit LTM Adj. EBITDA LTM OCF • $1.27B in trailing twelve-month revenue, an increase of 11% relative to the year ago period LTM Revenue 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 $B 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 • $208M in trailing twelve-month operating cash flow, a 26% increase relative to the year ago period $M • $291M in trailing twelve-month gross profit, an increase of 18% relative to the year ago period 100 200 300 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 $M • $218M in trailing twelve-month Adj. EBITDA, an increase of 12% relative to the year ago period 100 175 250 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 $M $1.27B $218M $291M $208M $1.14B $194M $247M $165M Note: all nu mbers pr esented io n this slid e includ e th e co ntribution of th e large client who was under a tran sitio n of care ag reement unti l June 30, 2025

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON8 Balance Sheet and Cash Position • Maintaining balance sheet strength and operational flexibility: • $345 million in cash, cash equivalents and marketable securities • No debt, and the $200 million revolving credit facility remains undrawn • Ongoing focus on revenue cycle management driving continued improvement in days sales outstanding (DSO) • 72.5 days outstanding as of September 2025, an improvement of more than 15 days from the year ago period • $412 million in net working capital • $200 million share repurchase program announced today will use cash on hand and is expected to have no impact on the Company’s ability to invest in its business and continue to execute against its strategies

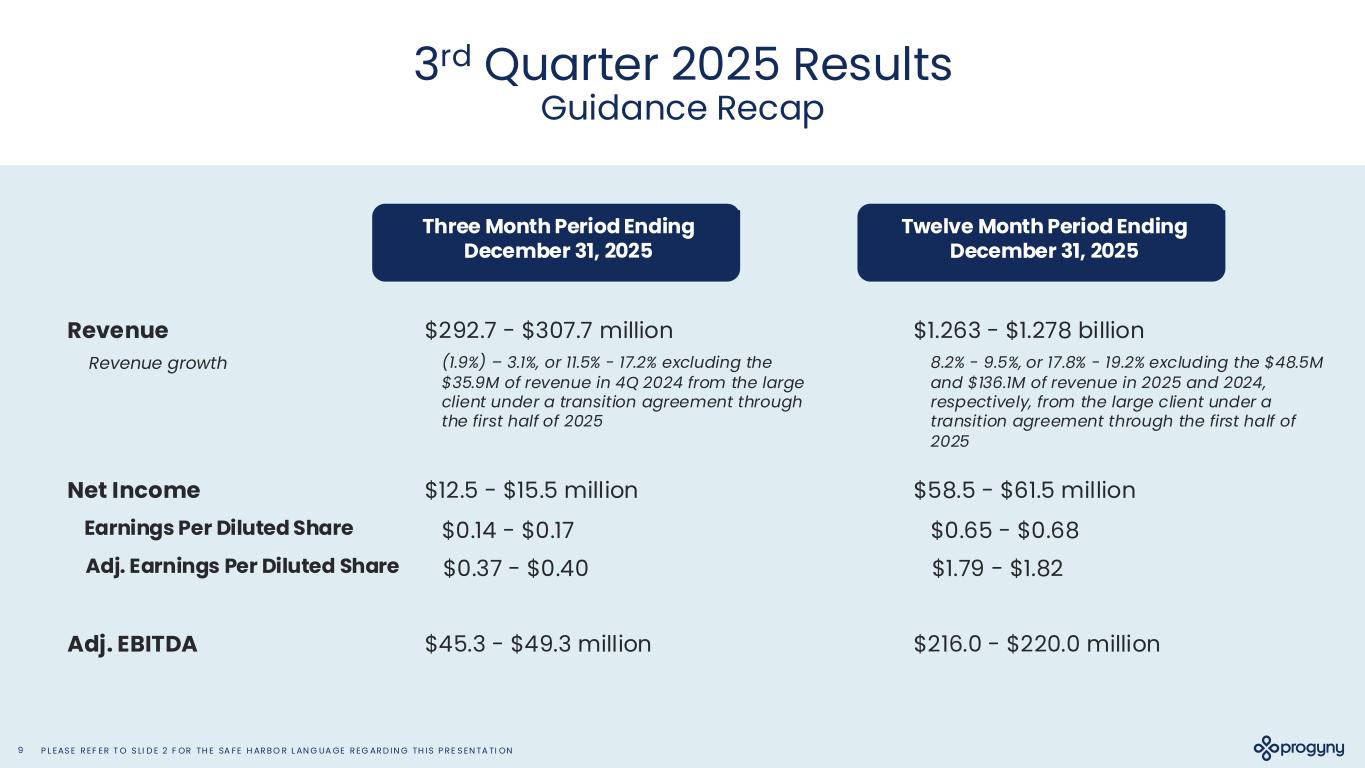

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON9 3rd Quarter 2025 Results Guidance Recap Three Month Period Ending December 31, 2025 Twelve Month Period Ending December 31, 2025 Revenue Net Income Adj. EBITDA $292.7 - $307.7 million $12.5 - $15.5 million $45.3 - $49.3 million $1.263 - $1.278 billion $58.5 - $61.5 million $216.0 - $220.0 million Revenue growth (1.9%) – 3.1%, or 11.5% - 17.2% excluding the $35.9M of revenue in 4Q 2024 from the large client under a transition agreement through the first half of 2025 8.2% - 9.5%, or 17.8% - 19.2% excluding the $48.5M and $136.1M of revenue in 2025 and 2024, respectively, from the large client under a transition agreement through the first half of 2025 Earnings Per Diluted Share $0.14 - $0.17 $0.65 - $0.68 Adj. Earnings Per Diluted Share $0.37 - $0.40 $1.79 - $1.82

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON10 Appendix

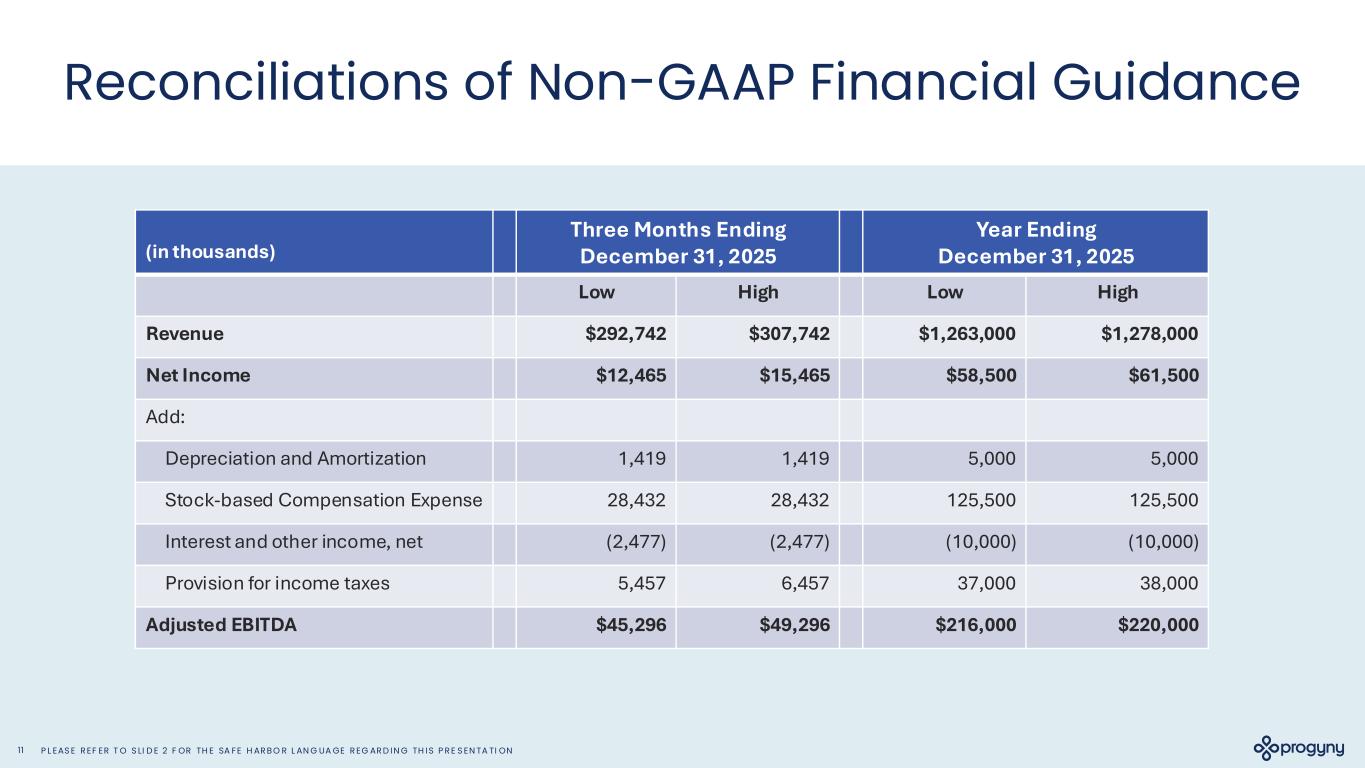

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON11 Reconciliations of Non-GAAP Financial Guidance (in thousands) Three Months Ending December 31, 2025 Year Ending December 31, 2025 Low High Low High Revenue $292,742 $307,742 $1,263,000 $1,278,000 Net Income $12,465 $15,465 $58,500 $61,500 Add: Depreciation and Amortization 1,419 1,419 5,000 5,000 Stock-based Compensation Expense 28,432 28,432 125,500 125,500 Interest and other income, net (2,477) (2,477) (10,000) (10,000) Provision for income taxes 5,457 6,457 37,000 38,000 Adjusted EBITDA $45,296 $49,296 $216,000 $220,000

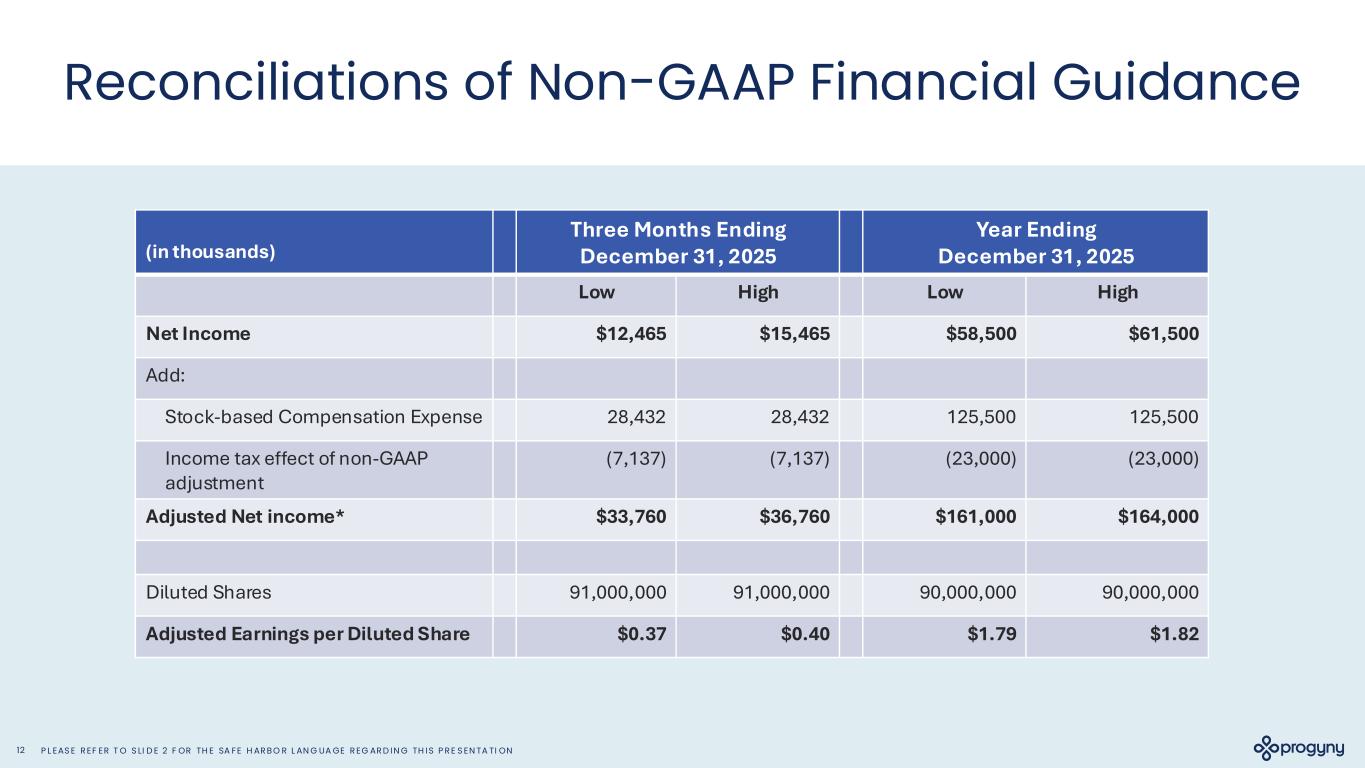

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON12 Reconciliations of Non-GAAP Financial Guidance (in thousands) Three Months Ending December 31, 2025 Year Ending December 31, 2025 Low High Low High Net Income $12,465 $15,465 $58,500 $61,500 Add: Stock-based Compensation Expense 28,432 28,432 125,500 125,500 Income tax effect of non-GAAP adjustment (7,137) (7,137) (23,000) (23,000) Adjusted Net income* $33,760 $36,760 $161,000 $164,000 Diluted Shares 91,000,000 91,000,000 90,000,000 90,000,000 Adjusted Earnings per Diluted Share $0.37 $0.40 $1.79 $1.82

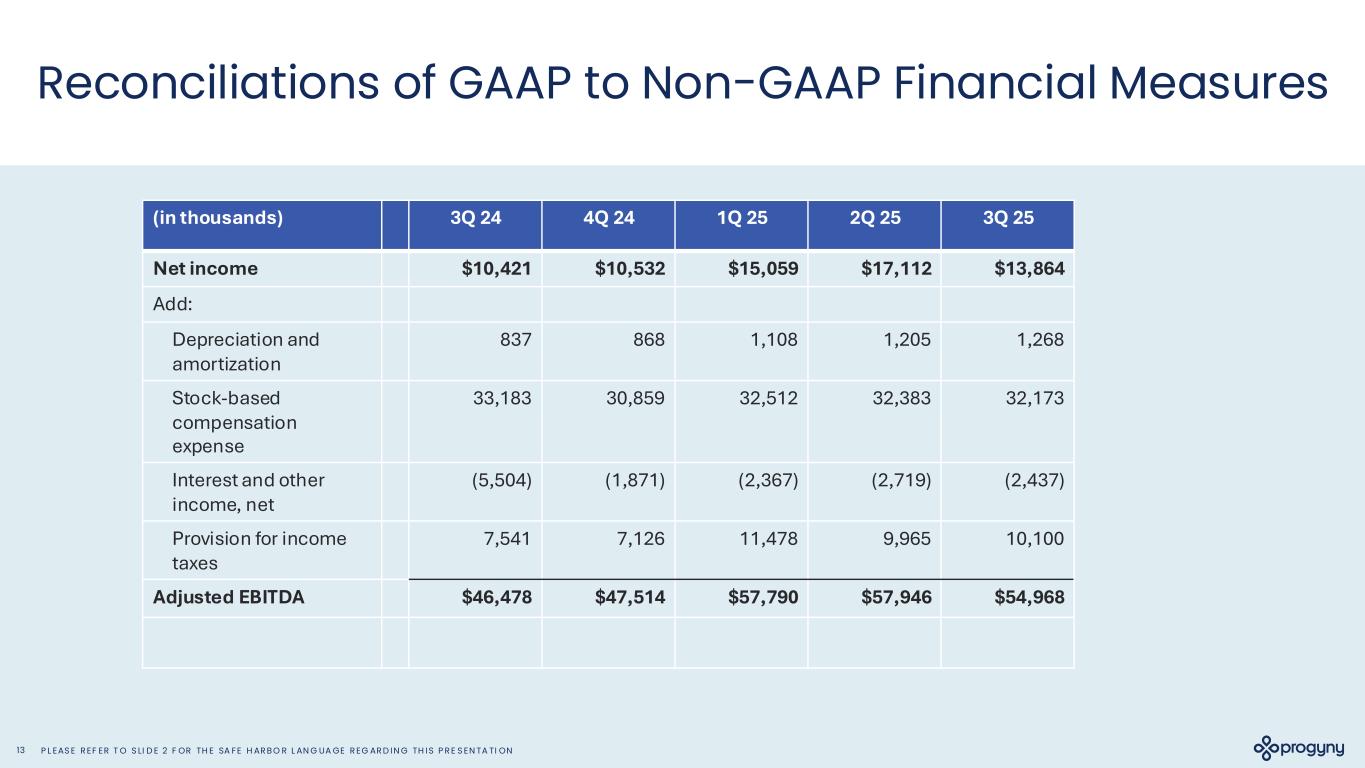

P L EAS E R EF ER T O S LI D E 2 F OR TH E SA FE H AR B O R L AN G UA GE R EG AR D IN G TH IS P R E S EN TA TI ON13 Reconciliations of GAAP to Non-GAAP Financial Measures (in thousands) 3Q 24 4Q 24 1Q 25 2Q 25 3Q 25 Net income $10,421 $10,532 $15,059 $17,112 $13,864 Add: Depreciation and amortization 837 868 1,108 1,205 1,268 Stock-based compensation expense 33,183 30,859 32,512 32,383 32,173 Interest and other income, net (5,504) (1,871) (2,367) (2,719) (2,437) Provision for income taxes 7,541 7,126 11,478 9,965 10,100 Adjusted EBITDA $46,478 $47,514 $57,790 $57,946 $54,968