Fourth Quarter 2025 Earnings February 12, 2026 Chris Cartwright, President and CEO Todd Cello, CFO .2

2© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Non-GAAP Financial InformationForward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on the current beliefs and expectations of TransUnion’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those described in the forward-looking statements. Factors that could cause TransUnion’s actual results to differ materially from those described in the forward-looking statements include: macroeconomic effects and changes in market conditions, including the impact of tariffs, inflation, risk of recession and industry trends and adverse developments in the debt, consumer credit and financial services markets, including the impact on the carrying value of our assets in all of the markets where we operate; our ability to provide competitive services and prices; our ability to retain or renew existing agreements with large or long-term customers; our ability to maintain the security and integrity of our data; our ability to deliver services timely without interruption; uncertainty related to FICO’s new Mortgage Direct License Program; our ability to maintain our access to data sources; government regulation and changes in the regulatory environment; litigation or regulatory proceedings; our approach to the use of artificial intelligence; our ability to effectively manage our costs; our ability to maintain effective internal control over financial reporting or disclosure controls and procedures; economic and political stability in the United States and risks associated with the international markets where we operate; our ability to effectively develop and maintain strategic alliances and joint ventures; our ability to timely develop new services and the market’s willingness to adopt our new services; our ability to manage and expand our operations and keep up with rapidly changing technologies; our ability to acquire businesses, successfully secure financing for our acquisitions, timely consummate our acquisitions, successfully integrate the operations of our acquisitions, control the costs of integrating our acquisitions and realize the intended benefits of such acquisitions; our ability to protect and enforce our intellectual property, trade secrets and other forms of unpatented intellectual property; our ability to defend our intellectual property from infringement claims by third parties; the ability of our outside service providers and key vendors to fulfill their obligations to us; further consolidation in our end-customer markets; the increased availability of free or inexpensive consumer information; losses against which we do not insure; risks related to our indebtedness, including our ability to make timely payments of principal and interest and our ability to satisfy covenants in the agreements governing our indebtedness; our ability to maintain our liquidity; stock price volatility; share repurchase plans; dividend rate; our reliance on key management personnel; changes in tax laws or adverse outcomes resulting from examination of our tax returns; and other one-time events and other factors that can be found in our Annual Report on Form 10-K for the year ended December 31, 2025, to be filed with the Securities and Exchange Commission (“SEC”) in February 2026, and our Annual Report on Form 10-K for the year ended December 31, 2024, and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are filed with the SEC and are available on TransUnion’s website (www.transunion.com/tru) and on the SEC’s website (www.sec.gov). TransUnion undertakes no obligation to publicly release the result of any revisions to these forward- looking statements to reflect the impact of events or circumstances that may arise after the date of this presentation. This investor presentation includes certain non-GAAP measures that are more fully described in the appendices to the presentation. , “Press release of TransUnion dated February 12, 2026, announcing results for the quarter and year ended December 31, 2025,” under the heading ‘Non-GAAP Financial Measures,’” furnished to the Securities and Exchange Commission on February 12, 2026. These financial measures should be reviewed in conjunction with the relevant GAAP financial measures and are not presented as alternative measures of GAAP. Other companies in our industry may define or calculate these measures differently than we do, limiting their usefulness as comparative measures. Because of these limitations, these non-GAAP financial measures should not be considered in isolation or as substitutes for performance measures calculated in accordance with GAAP. Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measures for each of the periods included in this presentation are included in the Appendices at the back of this investor presentation.

3© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Fourth quarter highlights and 2025 accomplishments1 2026 strategic priorities2 3@ Copyright 2026 Tran Union, its ubsidiaries and/or affiliates. All Rights Reserved. Fourth quarter 2025 financial results3 First quarter and full-year 2026 guidance4

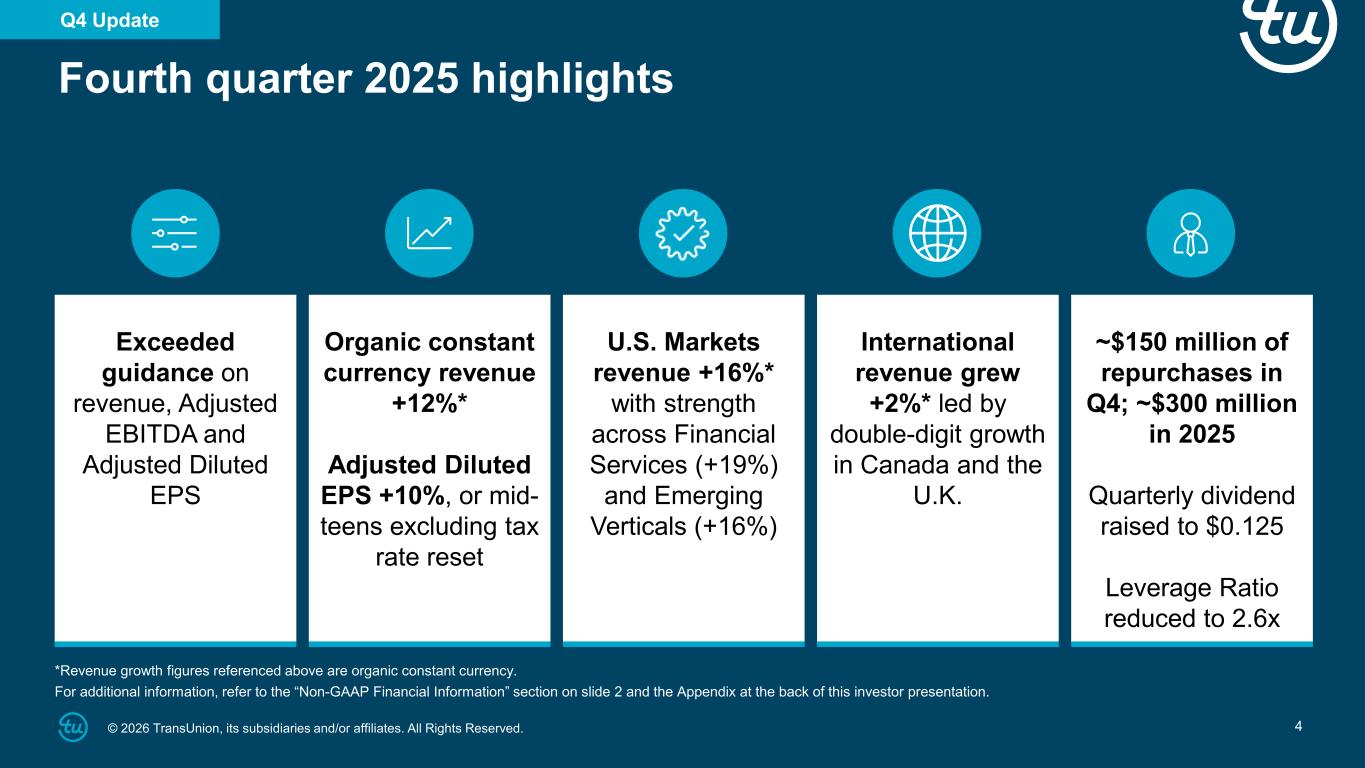

4© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. *Revenue growth figures referenced above are organic constant currency. International revenue grew +2%* led by double-digit growth in Canada and the U.K. U.S. Markets revenue +16%* with strength across Financial Services (+19%) and Emerging Verticals (+16%) Organic constant currency revenue +12%* Adjusted Diluted EPS +10%, or mid- teens excluding tax rate reset Exceeded guidance on revenue, Adjusted EBITDA and Adjusted Diluted EPS ~$150 million of repurchases in Q4; ~$300 million in 2025 Quarterly dividend raised to $0.125 Leverage Ratio reduced to 2.6x For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Fourth quarter 2025 highlights Q4 Update

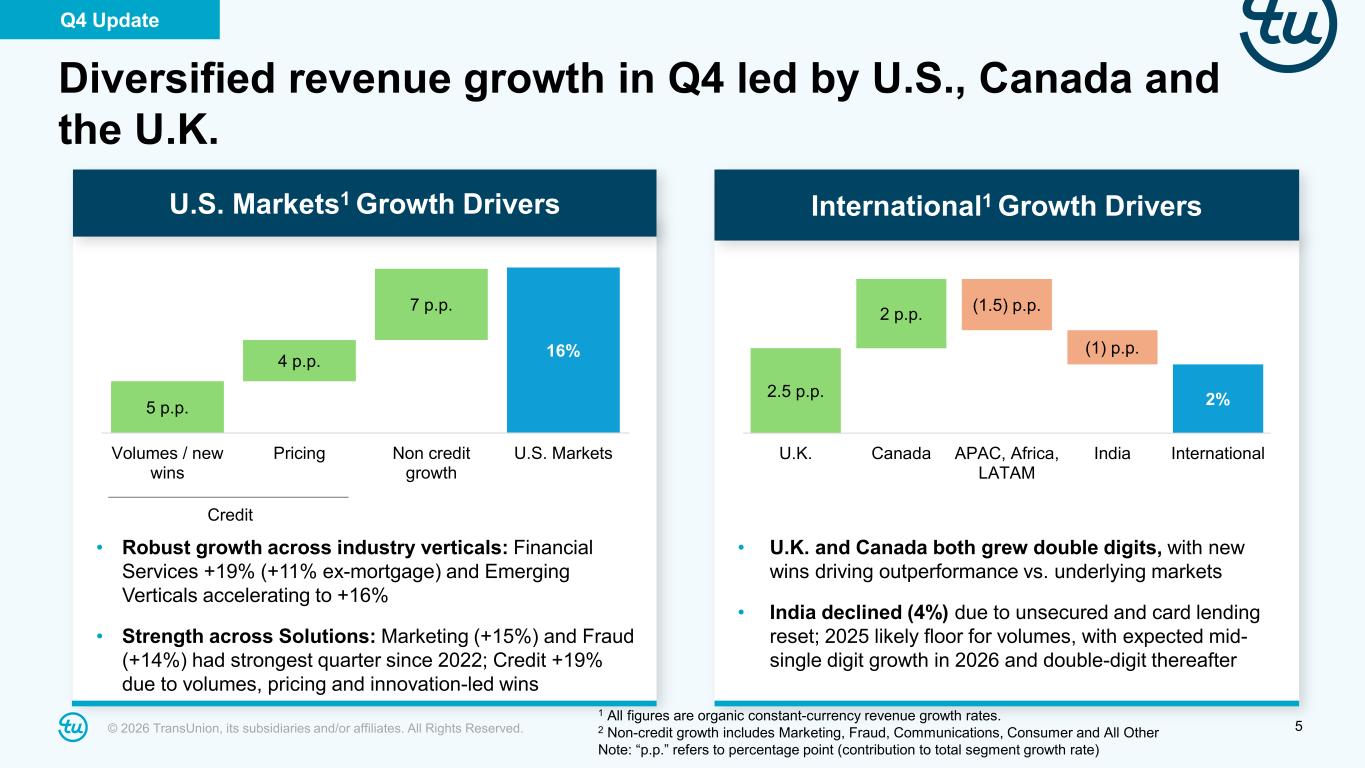

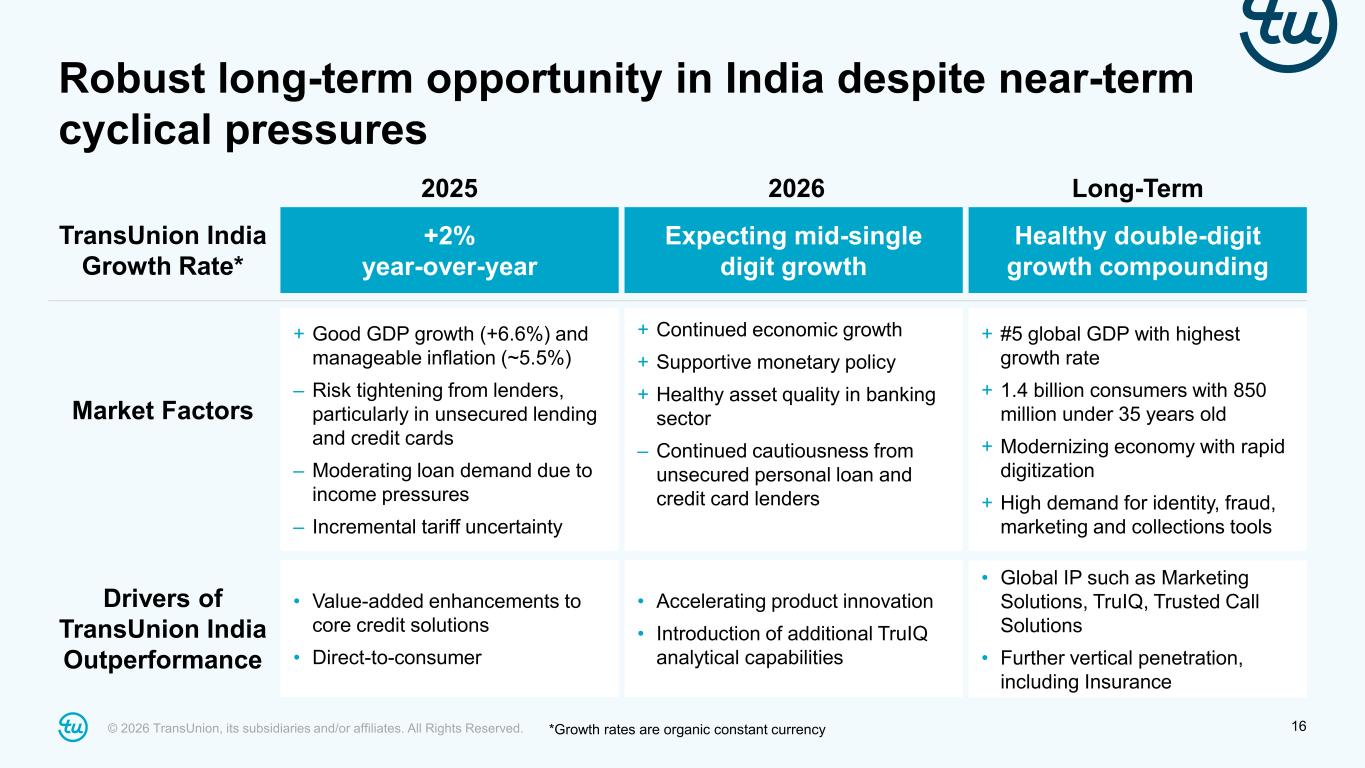

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 5 Diversified revenue growth in Q4 led by U.S., Canada and the U.K. 1 All figures are organic constant-currency revenue growth rates. 2 Non-credit growth includes Marketing, Fraud, Communications, Consumer and All Other Note: “p.p.” refers to percentage point (contribution to total segment growth rate) Credit • Robust growth across industry verticals: Financial Services +19% (+11% ex-mortgage) and Emerging Verticals accelerating to +16% • Strength across Solutions: Marketing (+15%) and Fraud (+14%) had strongest quarter since 2022; Credit +19% due to volumes, pricing and innovation-led wins • U.K. and Canada both grew double digits, with new wins driving outperformance vs. underlying markets • India declined (4%) due to unsecured and card lending reset; 2025 likely floor for volumes, with expected mid- single digit growth in 2026 and double-digit thereafter International1 Growth DriversU.S. Markets1 Growth Drivers 2.5 p.p. 2% 2 p.p. (1.5) p.p. (1) p.p. U.K. Canada APAC, Africa, LATAM India International 5 p.p. 16% 4 p.p. 7 p.p. Volumes / new wins Pricing Non credit growth U.S. Markets Q4 Update

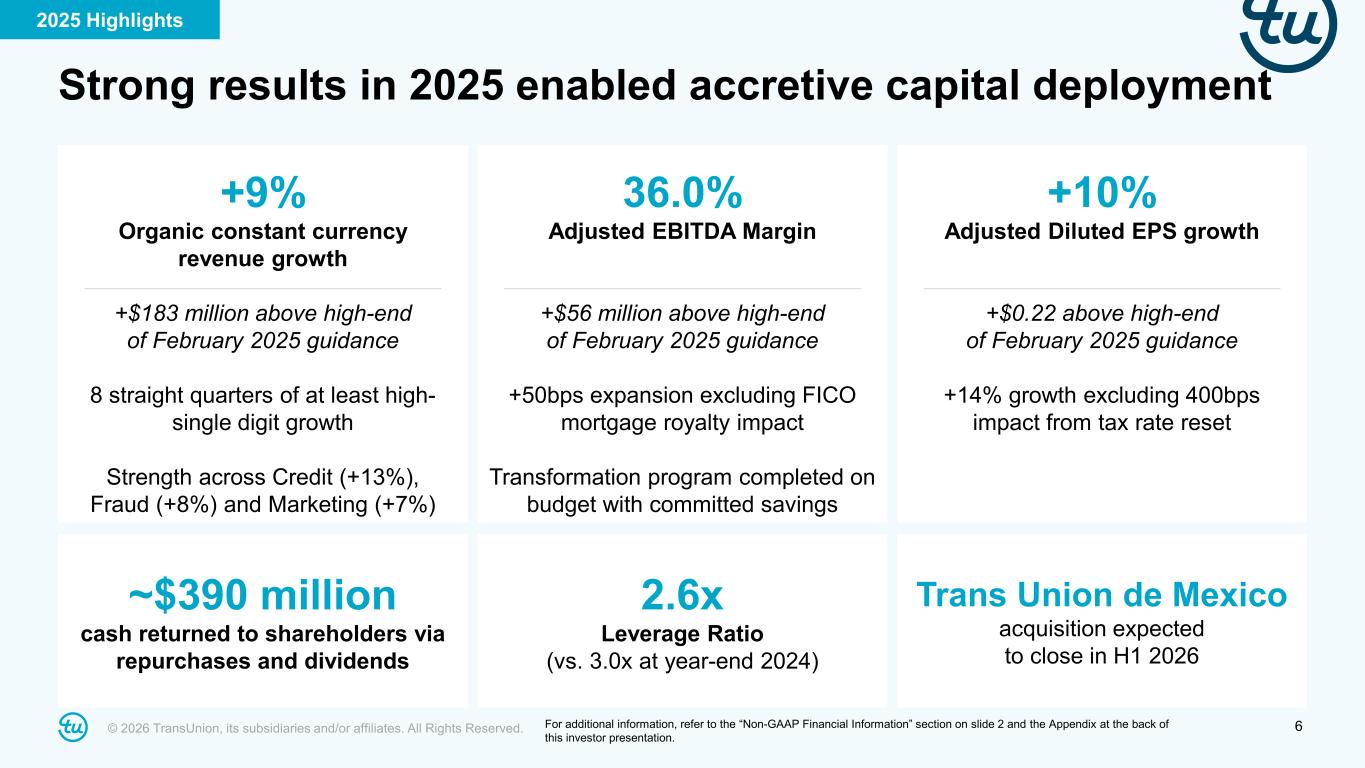

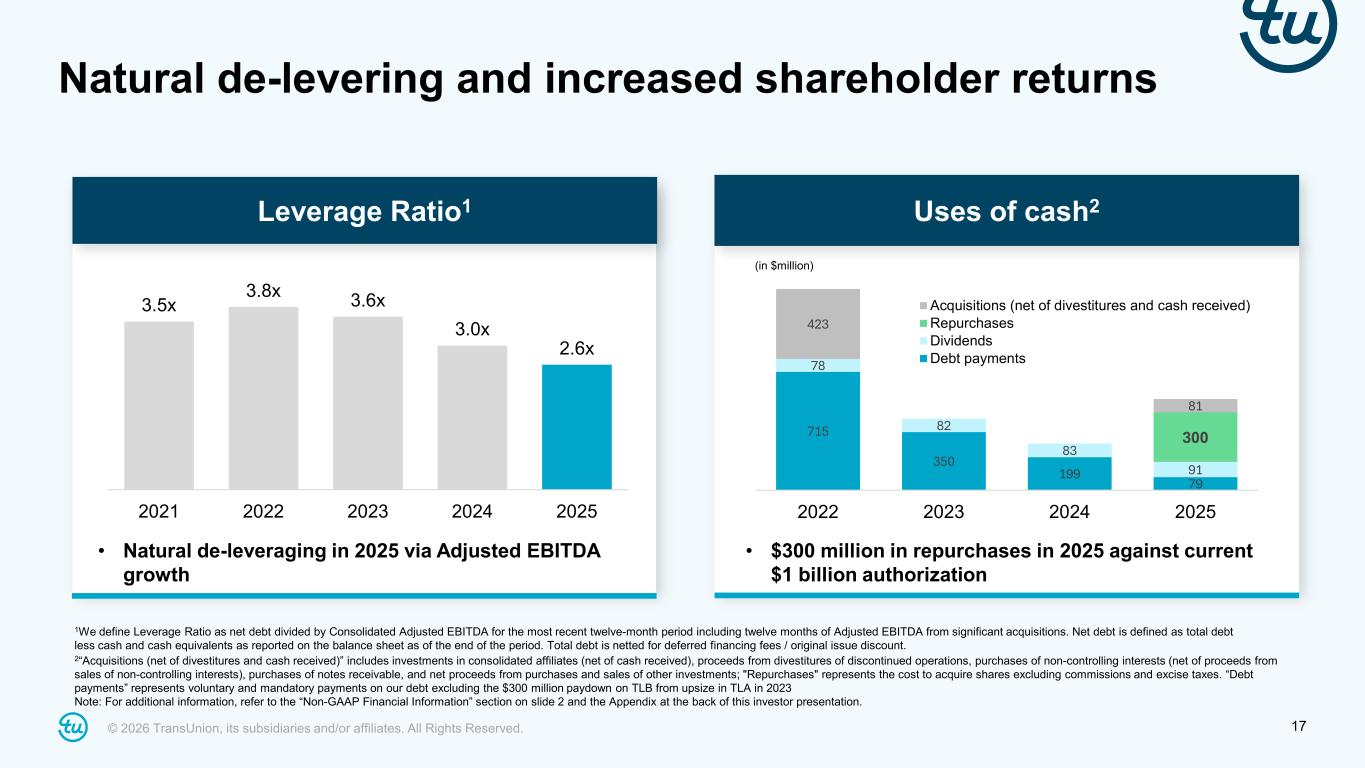

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 6 Strong results in 2025 enabled accretive capital deployment +9% Organic constant currency revenue growth +$183 million above high-end of February 2025 guidance 8 straight quarters of at least high- single digit growth Strength across Credit (+13%), Fraud (+8%) and Marketing (+7%) 36.0% Adjusted EBITDA Margin +$56 million above high-end of February 2025 guidance +50bps expansion excluding FICO mortgage royalty impact Transformation program completed on budget with committed savings +10% Adjusted Diluted EPS growth +$0.22 above high-end of February 2025 guidance +14% growth excluding 400bps impact from tax rate reset ~$390 million cash returned to shareholders via repurchases and dividends 2.6x Leverage Ratio (vs. 3.0x at year-end 2024) Trans Union de Mexico acquisition expected to close in H1 2026 2025 Highlights For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation.

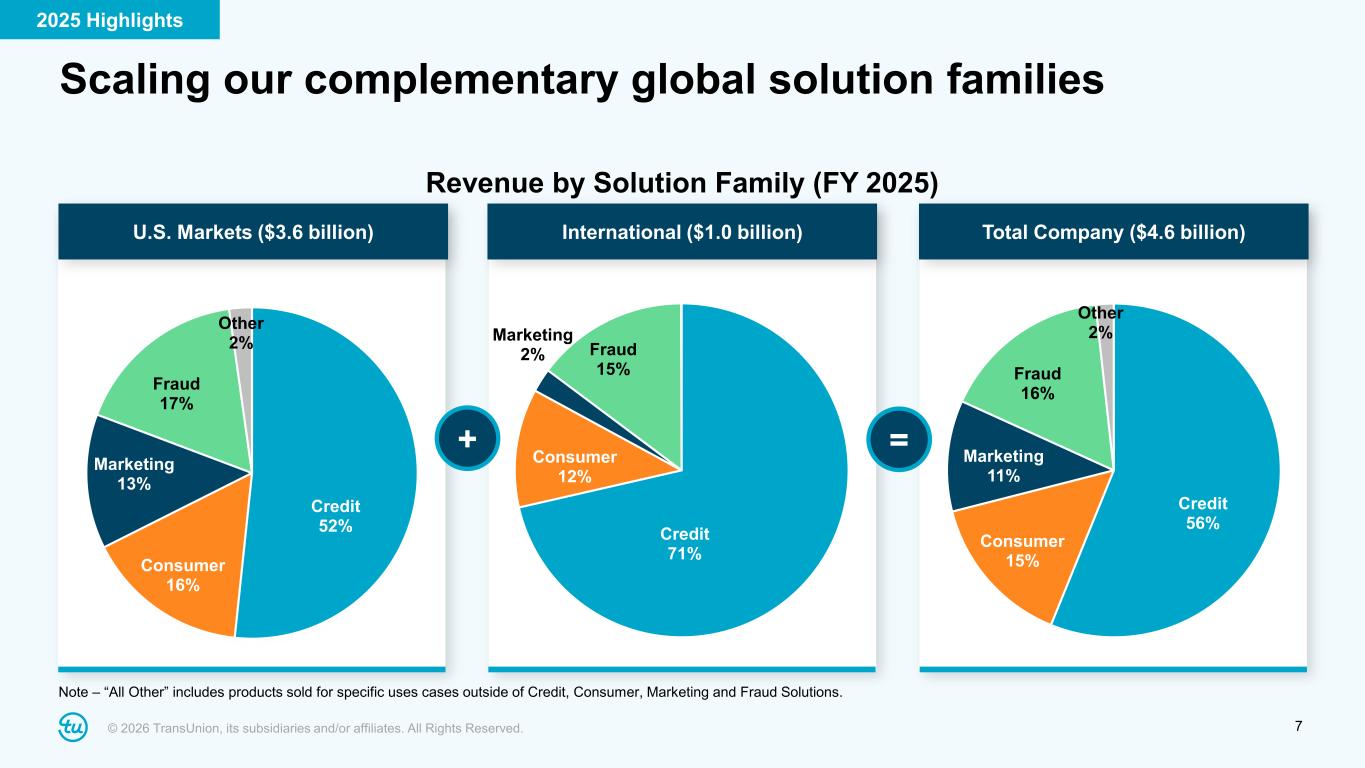

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 7 Credit 56% Consumer 15% Marketing 11% Fraud 16% Other 2% Credit 52% Consumer 16% Marketing 13% Fraud 17% Other 2% Credit 71% Consumer 12% Marketing 2% Fraud 15% + = Scaling our complementary global solution families U.S. Markets ($3.6 billion) International ($1.0 billion) Total Company ($4.6 billion) Note – “All Other” includes products sold for specific uses cases outside of Credit, Consumer, Marketing and Fraud Solutions. Revenue by Solution Family (FY 2025) 2025 Highlights

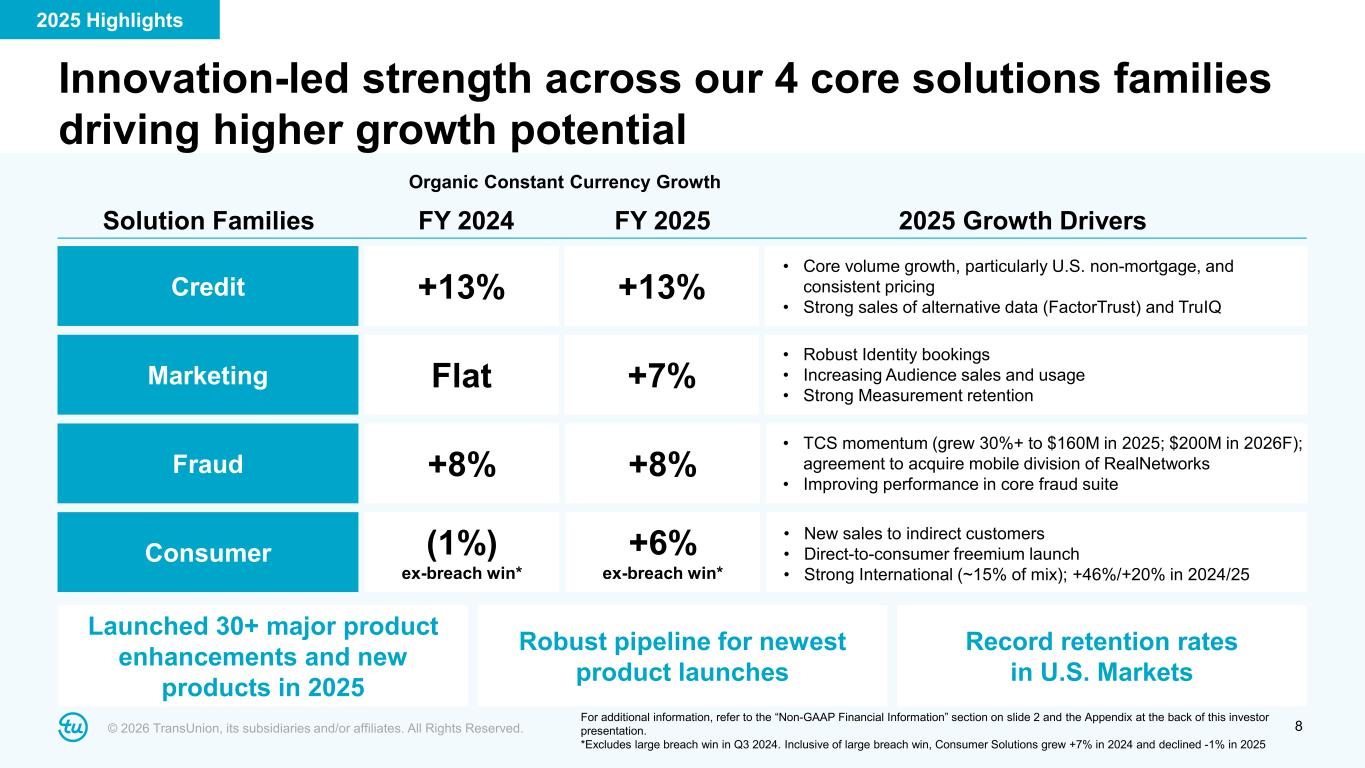

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 8 Solution Families Organic Constant Currency Growth 2025 Growth Drivers Innovation-led strength across our 4 core solutions families driving higher growth potential For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. *Excludes large breach win in Q3 2024. Inclusive of large breach win, Consumer Solutions grew +7% in 2024 and declined -1% in 2025 (1%) ex-breach win* Consumer • New sales to indirect customers • Direct-to-consumer freemium launch • Strong International (~15% of mix); +46%/+20% in 2024/25 +6% ex-breach win* +8%Fraud • TCS momentum (grew 30%+ to $160M in 2025; $200M in 2026F); agreement to acquire mobile division of RealNetworks • Improving performance in core fraud suite +8% FlatMarketing • Robust Identity bookings • Increasing Audience sales and usage • Strong Measurement retention +7% +13%Credit • Core volume growth, particularly U.S. non-mortgage, and consistent pricing • Strong sales of alternative data (FactorTrust) and TruIQ +13% FY 2024 FY 2025 Launched 30+ major product enhancements and new products in 2025 Robust pipeline for newest product launches Record retention rates in U.S. Markets 2025 Highlights

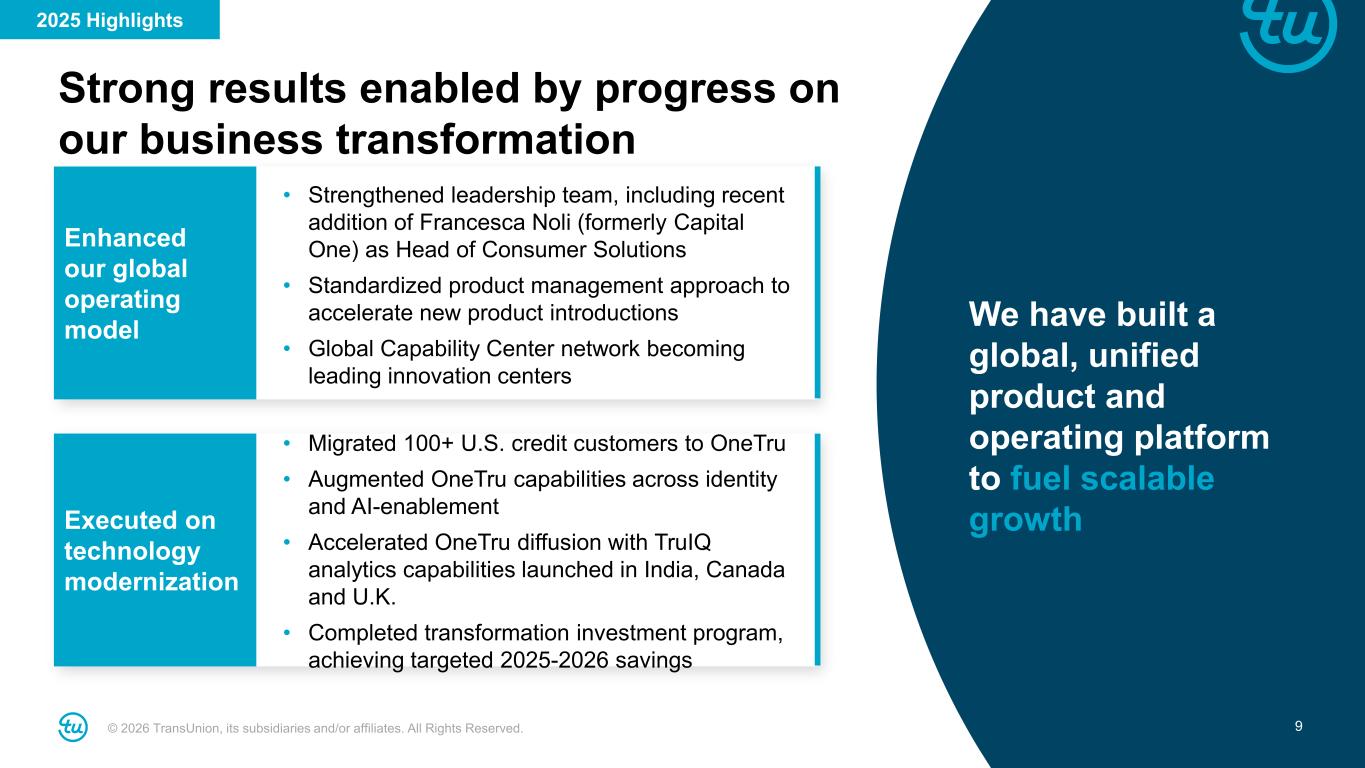

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 9 Strong results enabled by progress on our business transformation We have built a global, unified product and operating platform to fuel scalable growth • Strengthened leadership team, including recent addition of Francesca Noli (formerly Capital One) as Head of Consumer Solutions • Standardized product management approach to accelerate new product introductions • Global Capability Center network becoming leading innovation centers • Migrated 100+ U.S. credit customers to OneTru • Augmented OneTru capabilities across identity and AI-enablement • Accelerated OneTru diffusion with TruIQ analytics capabilities launched in India, Canada and U.K. • Completed transformation investment program, achieving targeted 2025-2026 savings Enhanced our global operating model Executed on technology modernization 2025 Highlights

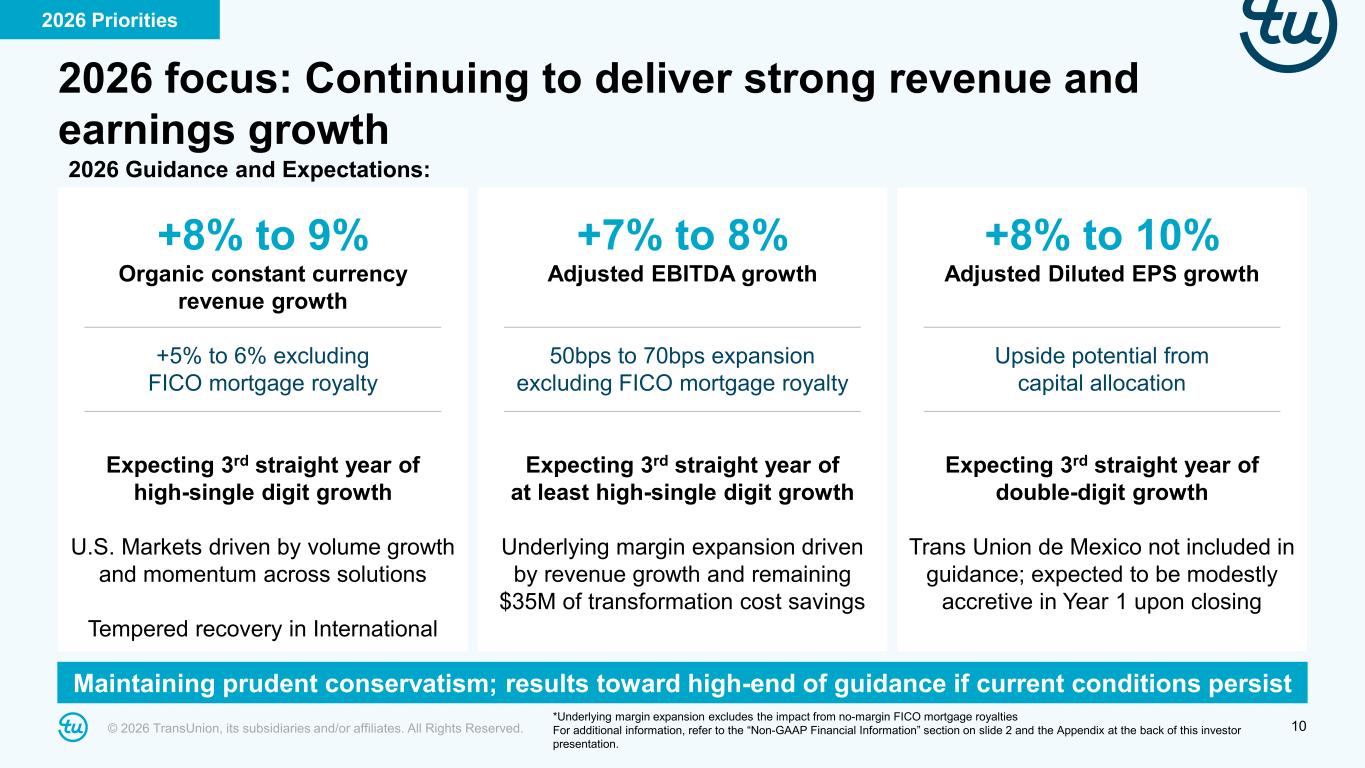

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 10 2026 focus: Continuing to deliver strong revenue and earnings growth +8% to 9% Organic constant currency revenue growth +5% to 6% excluding FICO mortgage royalty Expecting 3rd straight year of high-single digit growth U.S. Markets driven by volume growth and momentum across solutions Tempered recovery in International +7% to 8% Adjusted EBITDA growth 50bps to 70bps expansion excluding FICO mortgage royalty Expecting 3rd straight year of at least high-single digit growth Underlying margin expansion driven by revenue growth and remaining $35M of transformation cost savings +8% to 10% Adjusted Diluted EPS growth Upside potential from capital allocation Expecting 3rd straight year of double-digit growth Trans Union de Mexico not included in guidance; expected to be modestly accretive in Year 1 upon closing Maintaining prudent conservatism; results toward high-end of guidance if current conditions persist 2026 Priorities *Underlying margin expansion excludes the impact from no-margin FICO mortgage royalties For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. 2026 Guidance and Expectations:

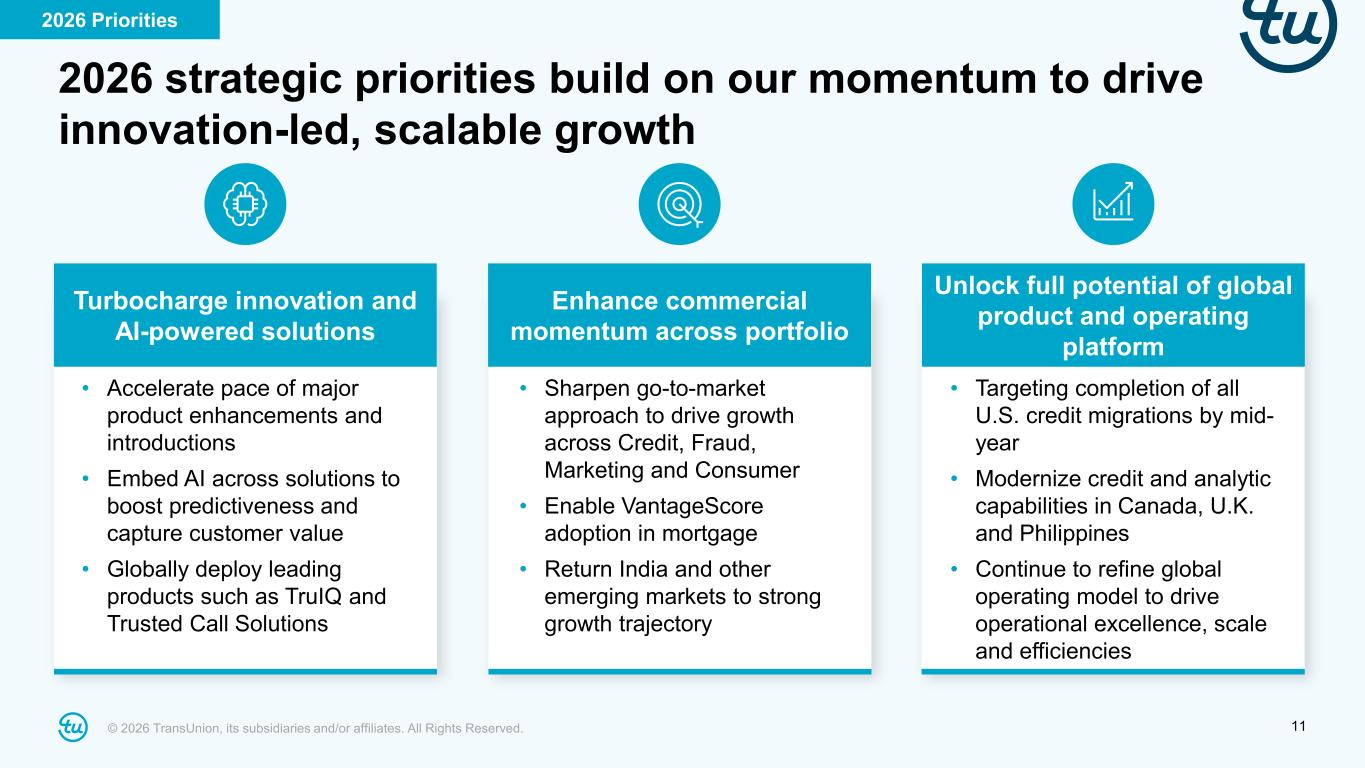

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 11 • Accelerate pace of major product enhancements and introductions • Embed AI across solutions to boost predictiveness and capture customer value • Globally deploy leading products such as TruIQ and Trusted Call Solutions Turbocharge innovation and AI-powered solutions 2026 strategic priorities build on our momentum to drive innovation-led, scalable growth Enhance commercial momentum across portfolio Unlock full potential of global product and operating platform • Sharpen go-to-market approach to drive growth across Credit, Fraud, Marketing and Consumer • Enable VantageScore adoption in mortgage • Return India and other emerging markets to strong growth trajectory • Targeting completion of all U.S. credit migrations by mid- year • Modernize credit and analytic capabilities in Canada, U.K. and Philippines • Continue to refine global operating model to drive operational excellence, scale and efficiencies 2026 Priorities

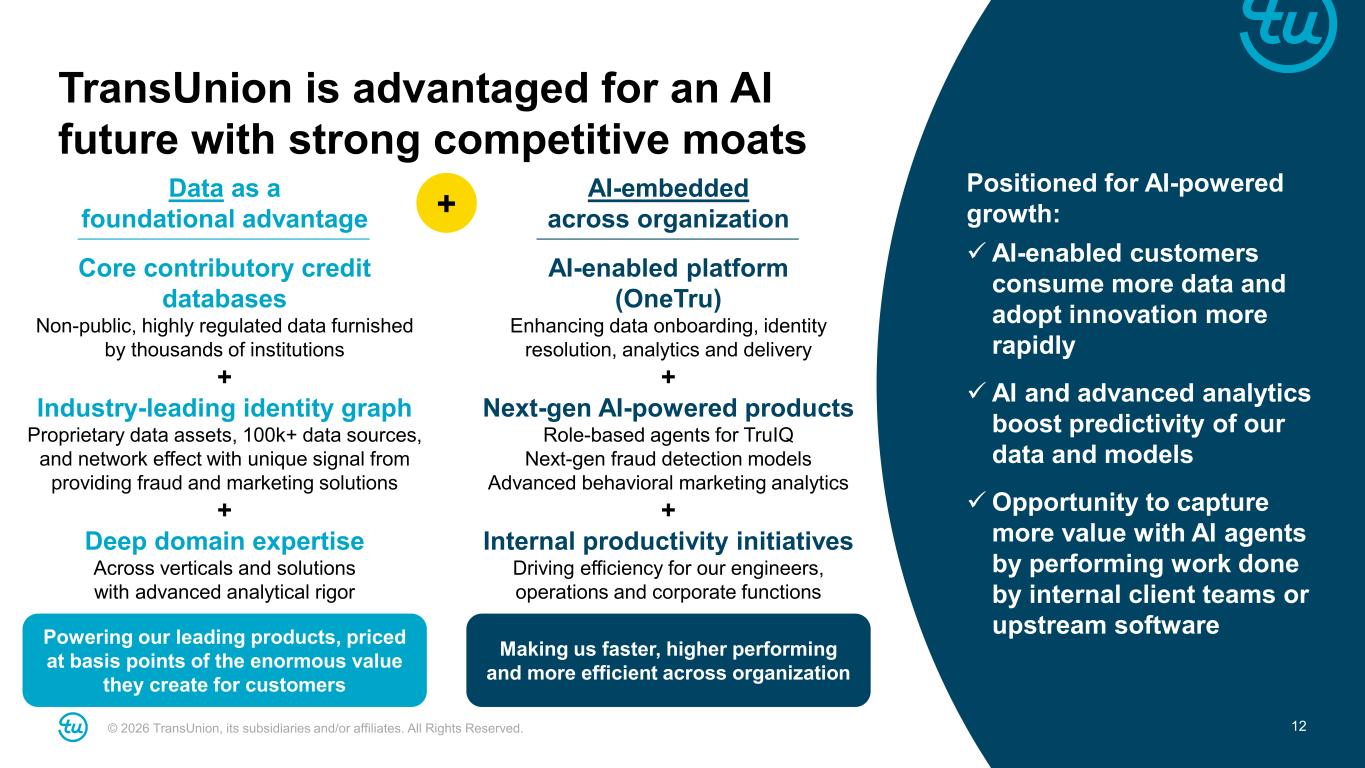

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 12 TransUnion is advantaged for an AI future with strong competitive moats Positioned for AI-powered growth: AI-enabled customers consume more data and adopt innovation more rapidly AI and advanced analytics boost predictivity of our data and models Opportunity to capture more value with AI agents by performing work done by internal client teams or upstream software Core contributory credit databases Non-public, highly regulated data furnished by thousands of institutions + Industry-leading identity graph Proprietary data assets, 100k+ data sources, and network effect with unique signal from providing fraud and marketing solutions + Deep domain expertise Across verticals and solutions with advanced analytical rigor Data as a foundational advantage AI-embedded across organization AI-enabled platform (OneTru) Enhancing data onboarding, identity resolution, analytics and delivery + Next-gen AI-powered products Role-based agents for TruIQ Next-gen fraud detection models Advanced behavioral marketing analytics + Internal productivity initiatives Driving efficiency for our engineers, operations and corporate functions + Powering our leading products, priced at basis points of the enormous value they create for customers Making us faster, higher performing and more efficient across organization

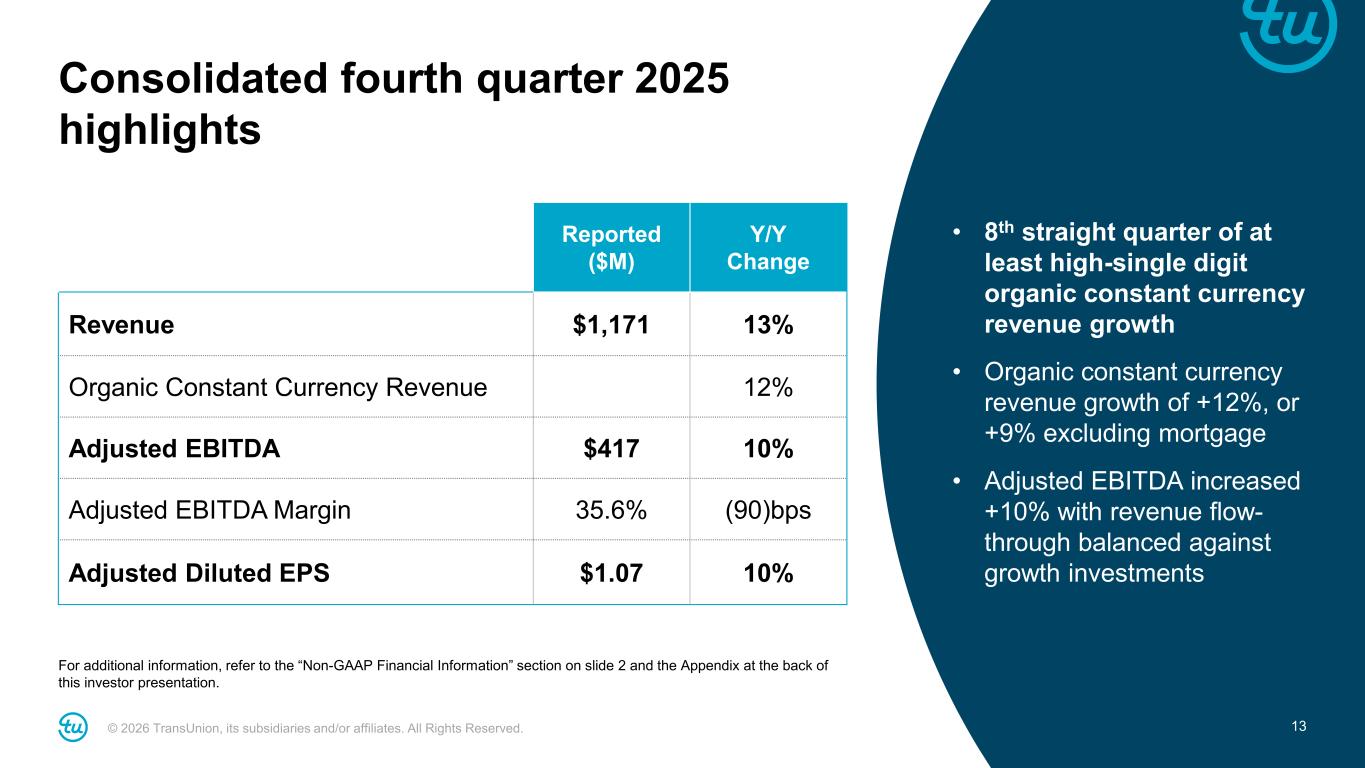

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 13 Consolidated fourth quarter 2025 highlights For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Reported ($M) Y/Y Change Revenue $1,171 13% Organic Constant Currency Revenue 12% Adjusted EBITDA $417 10% Adjusted EBITDA Margin 35.6% (90)bps Adjusted Diluted EPS $1.07 10% • 8th straight quarter of at least high-single digit organic constant currency revenue growth • Organic constant currency revenue growth of +12%, or +9% excluding mortgage • Adjusted EBITDA increased +10% with revenue flow- through balanced against growth investments

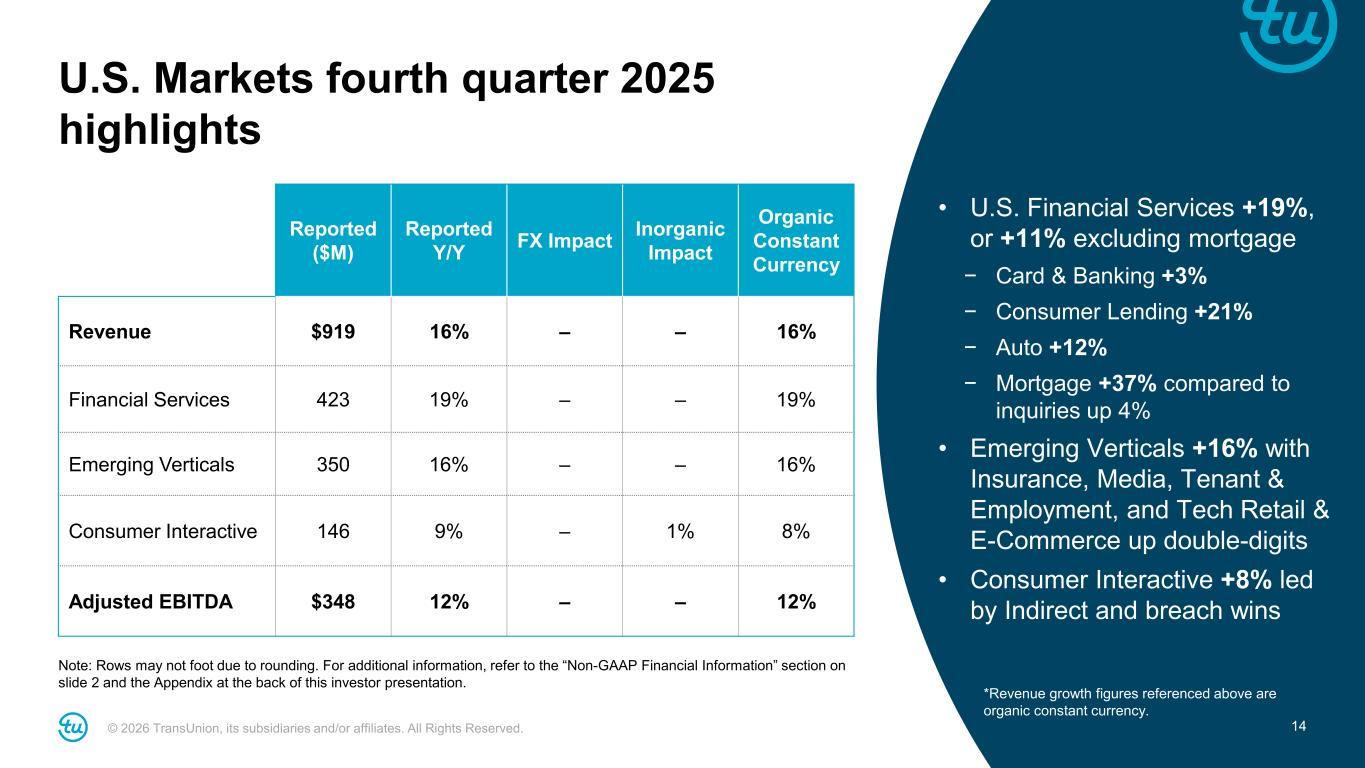

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 14 U.S. Markets fourth quarter 2025 highlights Note: Rows may not foot due to rounding. For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. • U.S. Financial Services +19%, or +11% excluding mortgage − Card & Banking +3% − Consumer Lending +21% − Auto +12% − Mortgage +37% compared to inquiries up 4% • Emerging Verticals +16% with Insurance, Media, Tenant & Employment, and Tech Retail & E-Commerce up double-digits • Consumer Interactive +8% led by Indirect and breach wins Reported ($M) Reported Y/Y FX Impact Inorganic Impact Organic Constant Currency Revenue $919 16% – – 16% Financial Services 423 19% – – 19% Emerging Verticals 350 16% – – 16% Consumer Interactive 146 9% – 1% 8% Adjusted EBITDA $348 12% – – 12% *Revenue growth figures referenced above are organic constant currency.

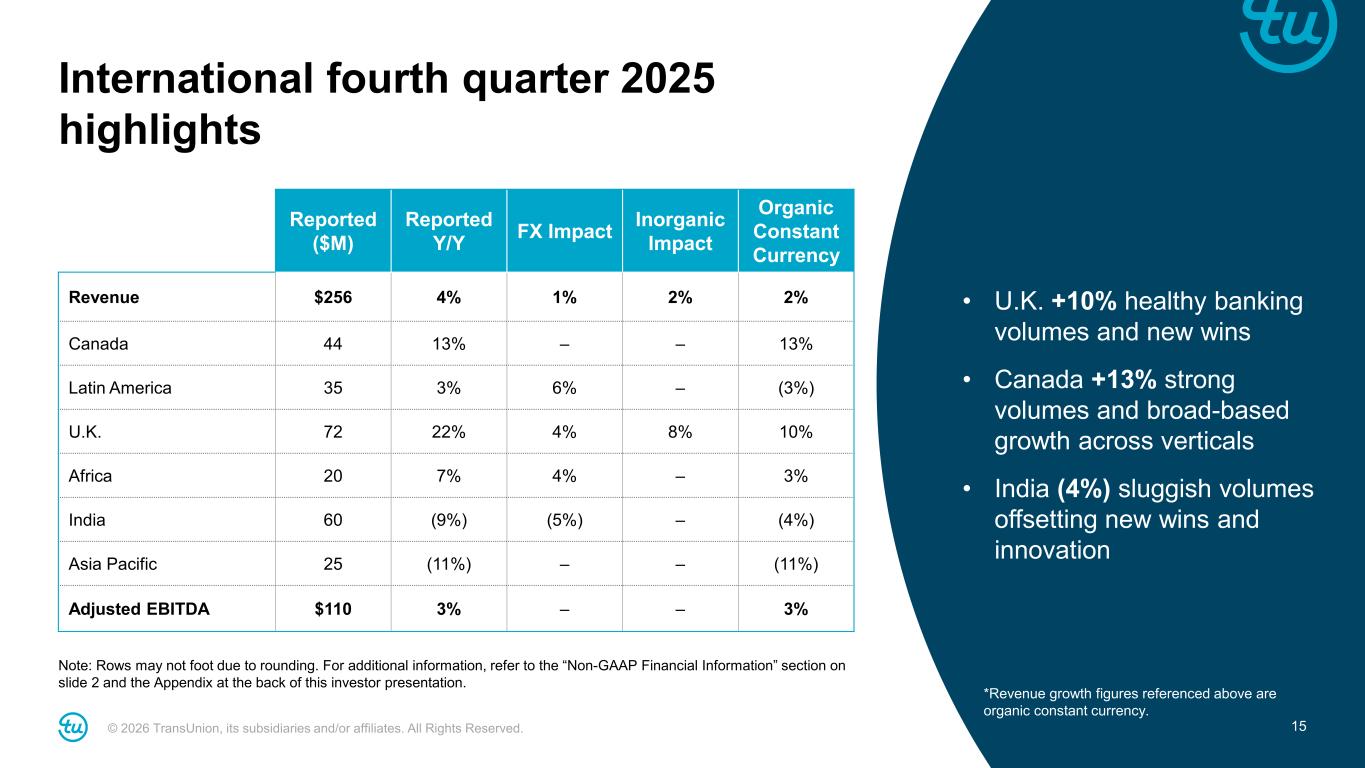

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 15 International fourth quarter 2025 highlights Note: Rows may not foot due to rounding. For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Reported ($M) Reported Y/Y FX Impact Inorganic Impact Organic Constant Currency Revenue $256 4% 1% 2% 2% Canada 44 13% – – 13% Latin America 35 3% 6% – (3%) U.K. 72 22% 4% 8% 10% Africa 20 7% 4% – 3% India 60 (9%) (5%) – (4%) Asia Pacific 25 (11%) – – (11%) Adjusted EBITDA $110 3% – – 3% *Revenue growth figures referenced above are organic constant currency. • U.K. +10% healthy banking volumes and new wins • Canada +13% strong volumes and broad-based growth across verticals • India (4%) sluggish volumes offsetting new wins and innovation

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 16 Long-Term2025 +2% year-over-year Expecting mid-single digit growth Healthy double-digit growth compounding 2026 TransUnion India Growth Rate* + Good GDP growth (+6.6%) and manageable inflation (~5.5%) – Risk tightening from lenders, particularly in unsecured lending and credit cards – Moderating loan demand due to income pressures – Incremental tariff uncertainty Market Factors Drivers of TransUnion India Outperformance + Continued economic growth + Supportive monetary policy + Healthy asset quality in banking sector – Continued cautiousness from unsecured personal loan and credit card lenders + #5 global GDP with highest growth rate + 1.4 billion consumers with 850 million under 35 years old + Modernizing economy with rapid digitization + High demand for identity, fraud, marketing and collections tools • Value-added enhancements to core credit solutions • Direct-to-consumer • Accelerating product innovation • Introduction of additional TruIQ analytical capabilities • Global IP such as Marketing Solutions, TruIQ, Trusted Call Solutions • Further vertical penetration, including Insurance *Growth rates are organic constant currency Robust long-term opportunity in India despite near-term cyclical pressures

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 17 Natural de-levering and increased shareholder returns Uses of cash2 Leverage Ratio1 1We define Leverage Ratio as net debt divided by Consolidated Adjusted EBITDA for the most recent twelve-month period including twelve months of Adjusted EBITDA from significant acquisitions. Net debt is defined as total debt less cash and cash equivalents as reported on the balance sheet as of the end of the period. Total debt is netted for deferred financing fees / original issue discount. 2“Acquisitions (net of divestitures and cash received)” includes investments in consolidated affiliates (net of cash received), proceeds from divestitures of discontinued operations, purchases of non-controlling interests (net of proceeds from sales of non-controlling interests), purchases of notes receivable, and net proceeds from purchases and sales of other investments; "Repurchases" represents the cost to acquire shares excluding commissions and excise taxes. “Debt payments” represents voluntary and mandatory payments on our debt excluding the $300 million paydown on TLB from upsize in TLA in 2023 Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. 3.5x 3.8x 3.6x 3.0x 2.6x 2021 2022 2023 2024 2025 715 350 199 79 78 82 83 91 300 423 81 2022 2023 2024 2025 Acquisitions (net of divestitures and cash received) Repurchases Dividends Debt payments (in $million) • $300 million in repurchases in 2025 against current $1 billion authorization • Natural de-leveraging in 2025 via Adjusted EBITDA growth

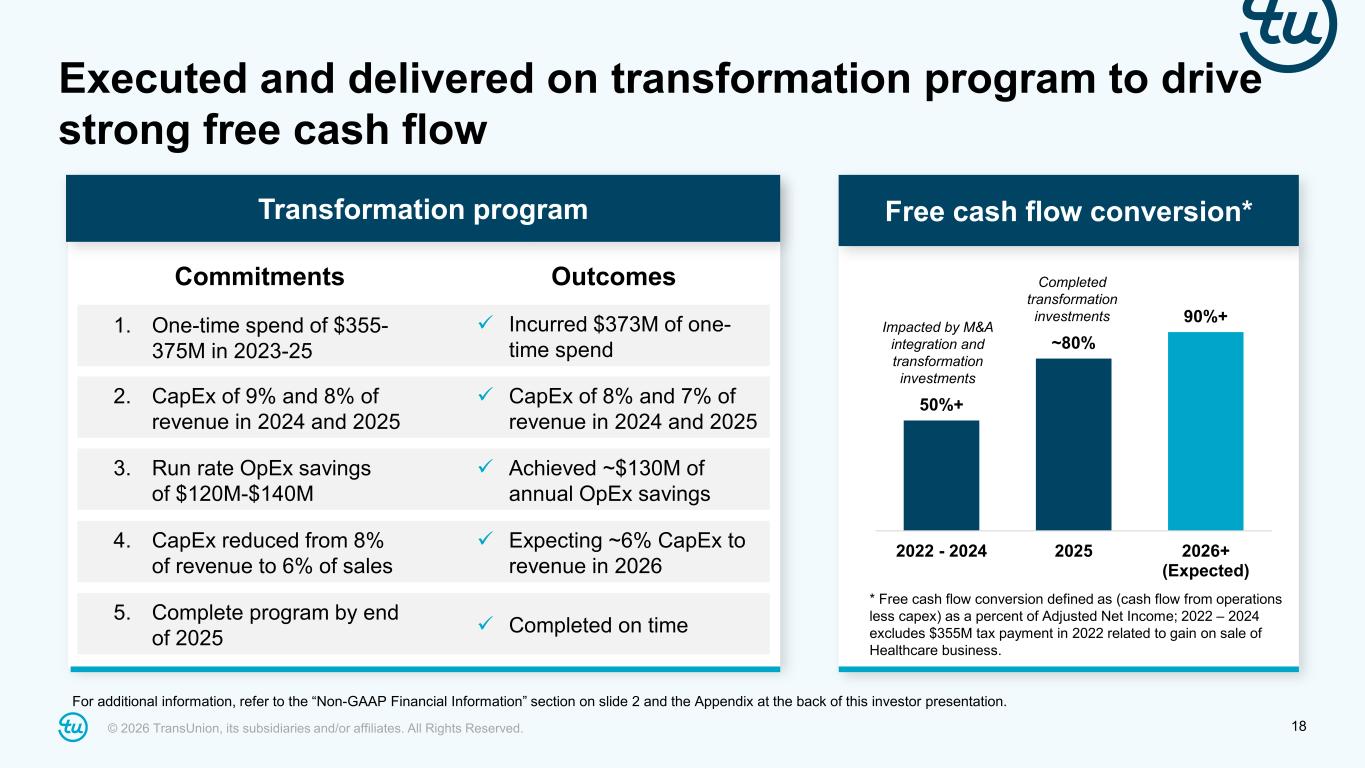

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 18 50%+ ~80% 90%+ 2022 - 2024 2025 2026+ (Expected) Executed and delivered on transformation program to drive strong free cash flow For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Free cash flow conversion* * Free cash flow conversion defined as (cash flow from operations less capex) as a percent of Adjusted Net Income; 2022 – 2024 excludes $355M tax payment in 2022 related to gain on sale of Healthcare business. Transformation program Impacted by M&A integration and transformation investments Completed transformation investments OutcomesCommitments 1. One-time spend of $355- 375M in 2023-25 5. Complete program by end of 2025 3. Run rate OpEx savings of $120M-$140M 4. CapEx reduced from 8% of revenue to 6% of sales Incurred $373M of one- time spend Completed on time Achieved ~$130M of annual OpEx savings Expecting ~6% CapEx to revenue in 2026 2. CapEx of 9% and 8% of revenue in 2024 and 2025 CapEx of 8% and 7% of revenue in 2024 and 2025

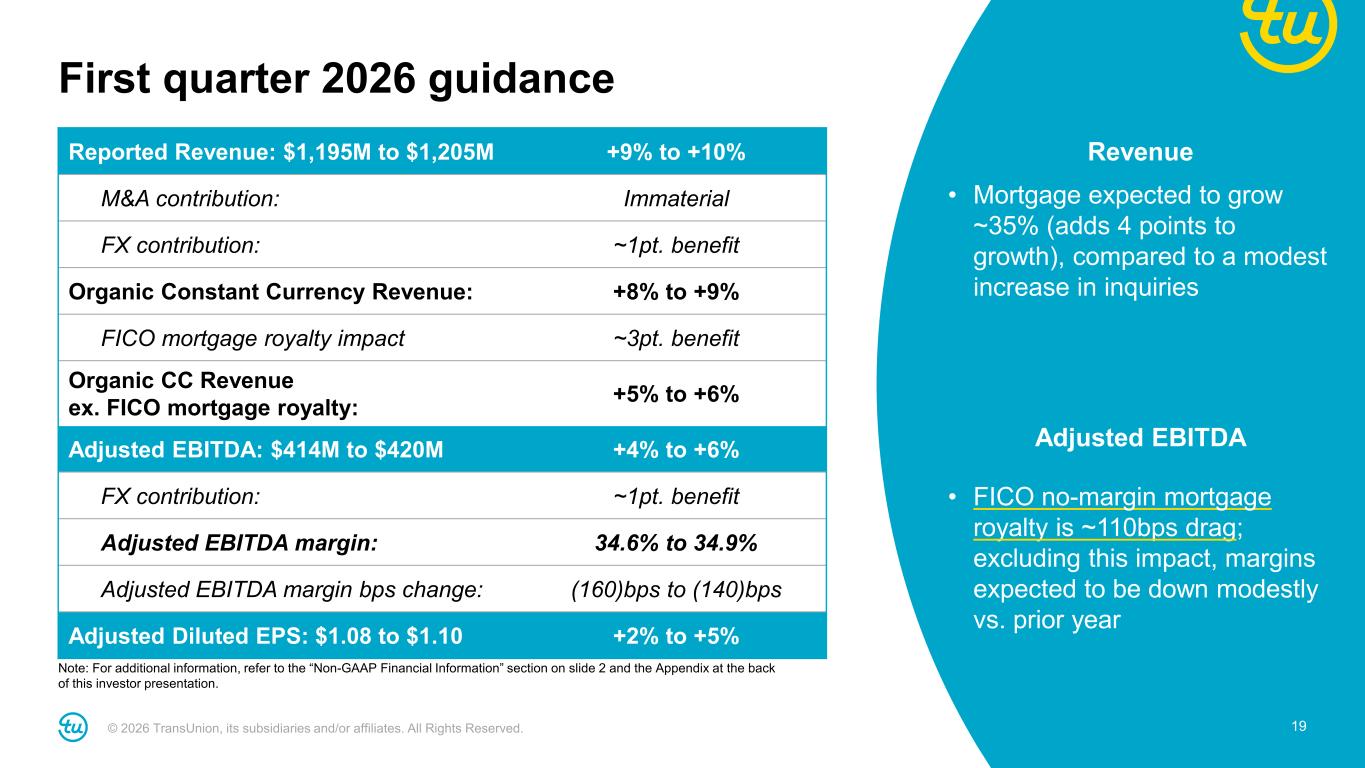

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 19 Reported Revenue: $1,195M to $1,205M +9% to +10% M&A contribution: Immaterial FX contribution: ~1pt. benefit Organic Constant Currency Revenue: +8% to +9% FICO mortgage royalty impact ~3pt. benefit Organic CC Revenue ex. FICO mortgage royalty: +5% to +6% Adjusted EBITDA: $414M to $420M +4% to +6% FX contribution: ~1pt. benefit Adjusted EBITDA margin: 34.6% to 34.9% Adjusted EBITDA margin bps change: (160)bps to (140)bps Adjusted Diluted EPS: $1.08 to $1.10 +2% to +5% First quarter 2026 guidance Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Revenue • Mortgage expected to grow ~35% (adds 4 points to growth), compared to a modest increase in inquiries Adjusted EBITDA • FICO no-margin mortgage royalty is ~110bps drag; excluding this impact, margins expected to be down modestly vs. prior year

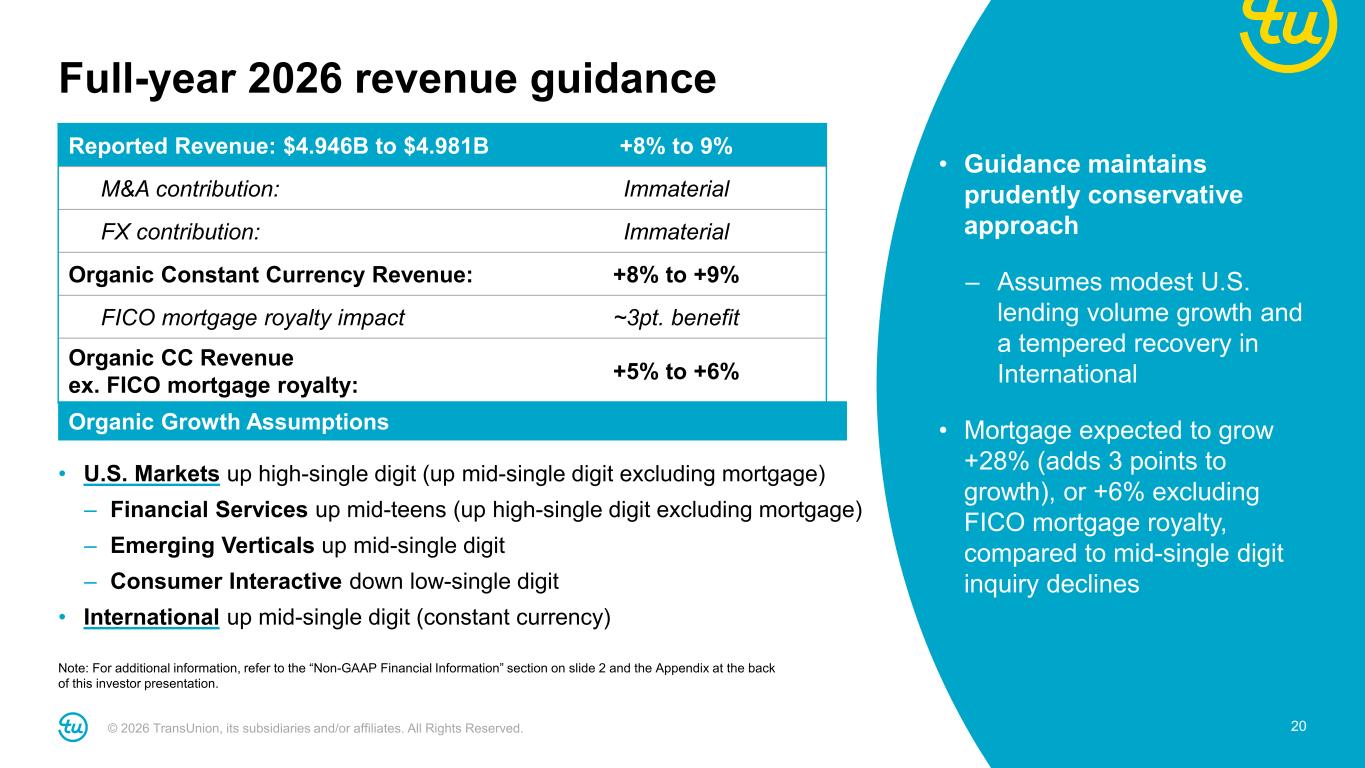

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 20 • Guidance maintains prudently conservative approach – Assumes modest U.S. lending volume growth and a tempered recovery in International • Mortgage expected to grow +28% (adds 3 points to growth), or +6% excluding FICO mortgage royalty, compared to mid-single digit inquiry declines Full-year 2026 revenue guidance Reported Revenue: $4.946B to $4.981B +8% to 9% M&A contribution: Immaterial FX contribution: Immaterial Organic Constant Currency Revenue: +8% to +9% FICO mortgage royalty impact ~3pt. benefit Organic CC Revenue ex. FICO mortgage royalty: +5% to +6% Organic Growth Assumptions • U.S. Markets up high-single digit (up mid-single digit excluding mortgage) – Financial Services up mid-teens (up high-single digit excluding mortgage) – Emerging Verticals up mid-single digit – Consumer Interactive down low-single digit • International up mid-single digit (constant currency) Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation.

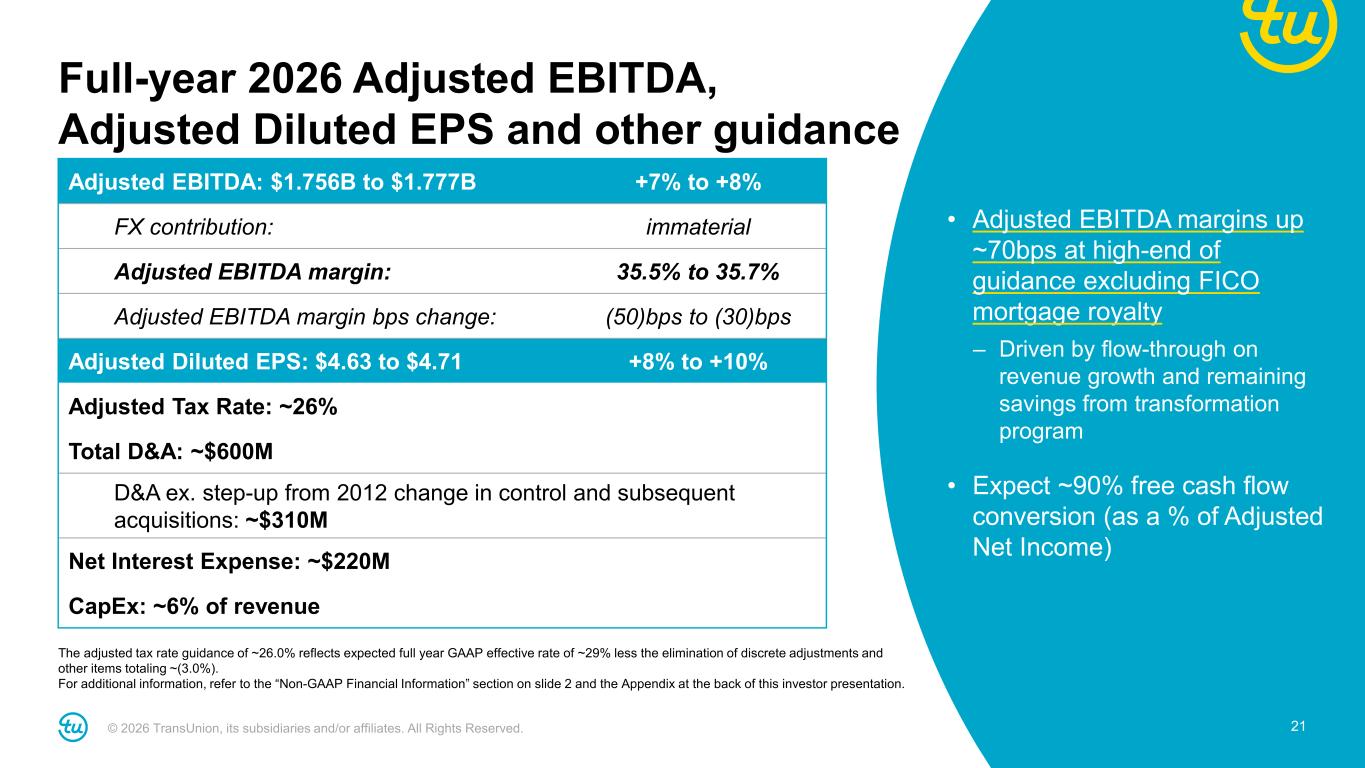

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 21 The adjusted tax rate guidance of ~26.0% reflects expected full year GAAP effective rate of ~29% less the elimination of discrete adjustments and other items totaling ~(3.0%). For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Full-year 2026 Adjusted EBITDA, Adjusted Diluted EPS and other guidance Adjusted EBITDA: $1.756B to $1.777B +7% to +8% FX contribution: immaterial Adjusted EBITDA margin: 35.5% to 35.7% Adjusted EBITDA margin bps change: (50)bps to (30)bps Adjusted Diluted EPS: $4.63 to $4.71 +8% to +10% Adjusted Tax Rate: ~26% Total D&A: ~$600M D&A ex. step-up from 2012 change in control and subsequent acquisitions: ~$310M Net Interest Expense: ~$220M CapEx: ~6% of revenue • Adjusted EBITDA margins up ~70bps at high-end of guidance excluding FICO mortgage royalty – Driven by flow-through on revenue growth and remaining savings from transformation program • Expect ~90% free cash flow conversion (as a % of Adjusted Net Income)

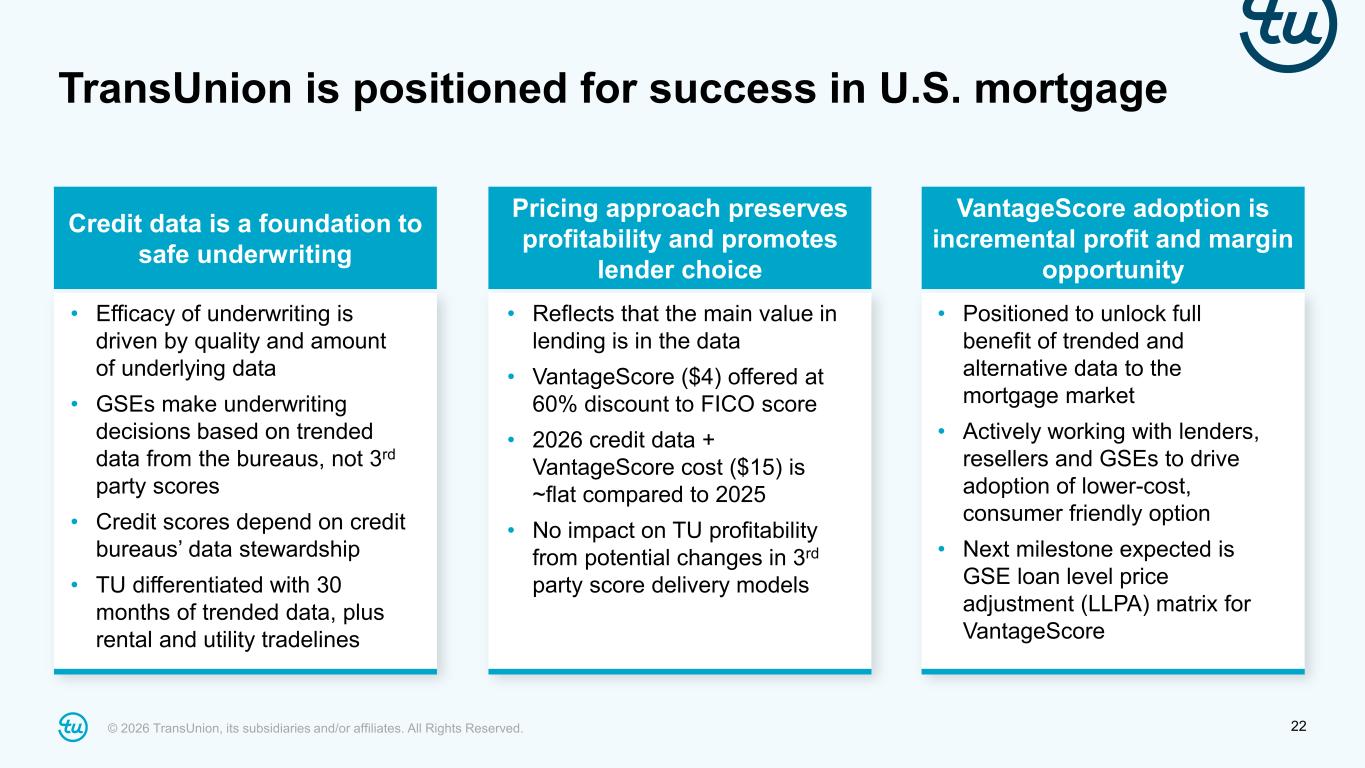

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 22 Credit data is a foundation to safe underwriting Pricing approach preserves profitability and promotes lender choice VantageScore adoption is incremental profit and margin opportunity • Efficacy of underwriting is driven by quality and amount of underlying data • GSEs make underwriting decisions based on trended data from the bureaus, not 3rd party scores • Credit scores depend on credit bureaus’ data stewardship • TU differentiated with 30 months of trended data, plus rental and utility tradelines • Reflects that the main value in lending is in the data • VantageScore ($4) offered at 60% discount to FICO score • 2026 credit data + VantageScore cost ($15) is ~flat compared to 2025 • No impact on TU profitability from potential changes in 3rd party score delivery models • Positioned to unlock full benefit of trended and alternative data to the mortgage market • Actively working with lenders, resellers and GSEs to drive adoption of lower-cost, consumer friendly option • Next milestone expected is GSE loan level price adjustment (LLPA) matrix for VantageScore TransUnion is positioned for success in U.S. mortgage

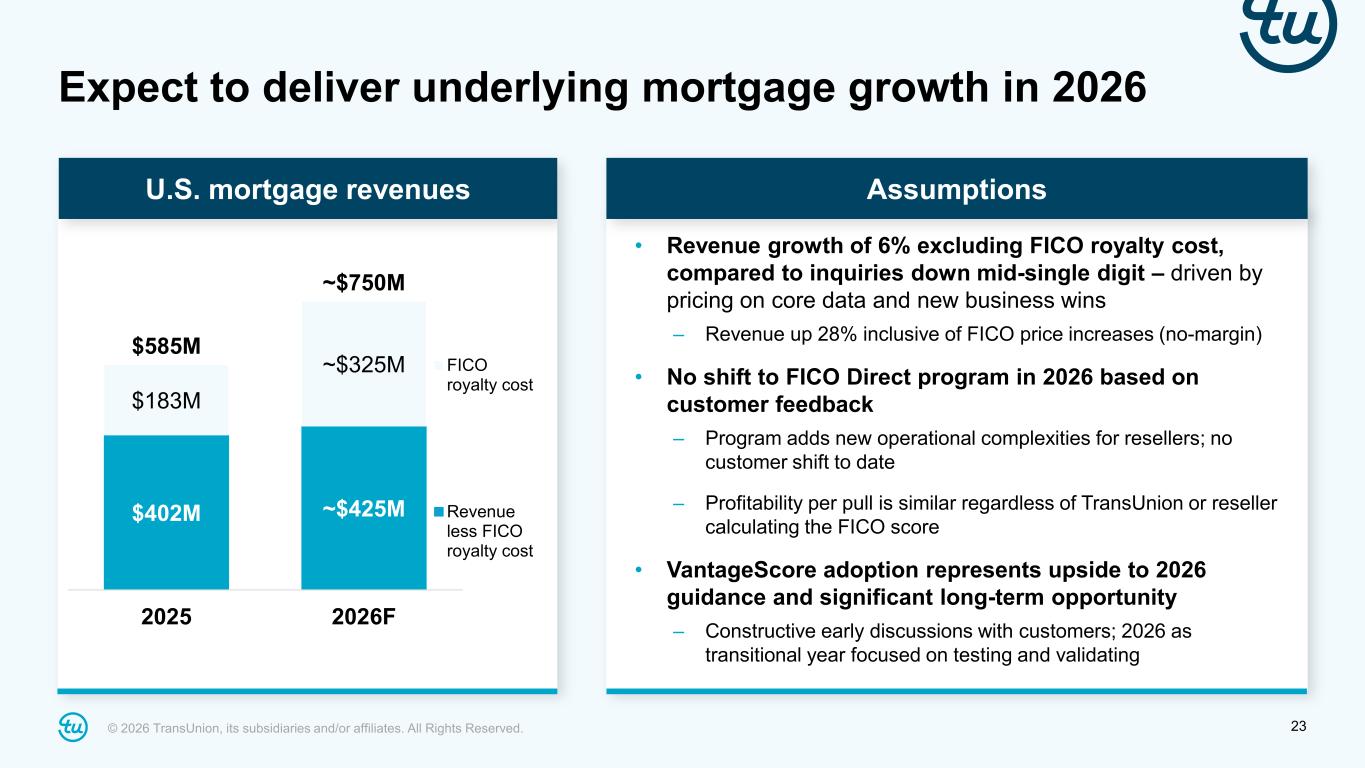

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 23 U.S. mortgage revenues Assumptions Expect to deliver underlying mortgage growth in 2026 • Revenue growth of 6% excluding FICO royalty cost, compared to inquiries down mid-single digit – driven by pricing on core data and new business wins – Revenue up 28% inclusive of FICO price increases (no-margin) • No shift to FICO Direct program in 2026 based on customer feedback – Program adds new operational complexities for resellers; no customer shift to date – Profitability per pull is similar regardless of TransUnion or reseller calculating the FICO score • VantageScore adoption represents upside to 2026 guidance and significant long-term opportunity – Constructive early discussions with customers; 2026 as transitional year focused on testing and validating $402M ~$425M $183M ~$325M $585M ~$750M 2025 2026F FICO royalty cost Revenue less FICO royalty cost

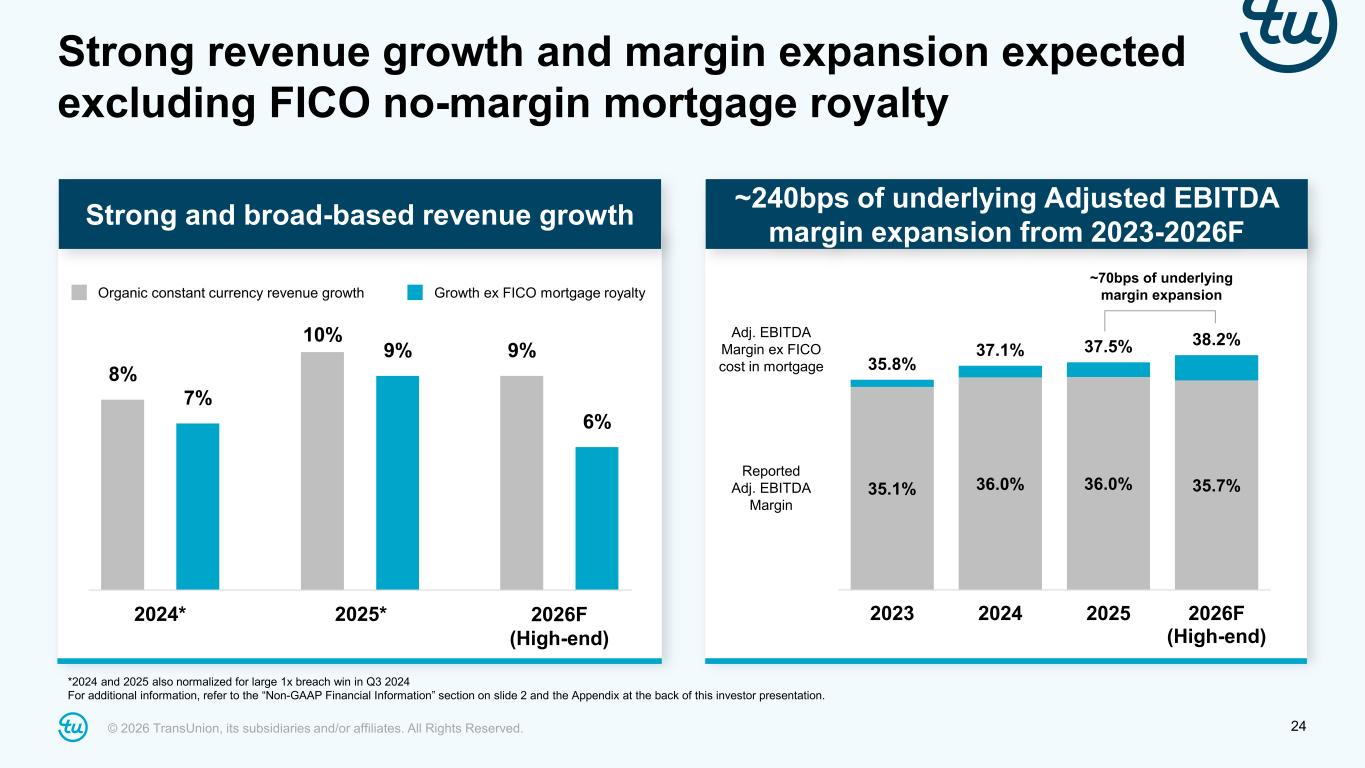

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 24 Strong and broad-based revenue growth ~240bps of underlying Adjusted EBITDA margin expansion from 2023-2026F Strong revenue growth and margin expansion expected excluding FICO no-margin mortgage royalty 2025* 2026F (High-end) 10% 9% 9% 6% 35.1% 36.0% 36.0% 35.7% 35.8% 37.1% 37.5% 38.2% 2023 2024 2025 2026F (High-end) Reported Adj. EBITDA Margin Adj. EBITDA Margin ex FICO cost in mortgage8% 7% 2024* Organic constant currency revenue growth Growth ex FICO mortgage royalty ~70bps of underlying margin expansion *2024 and 2025 also normalized for large 1x breach win in Q3 2024 For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation.

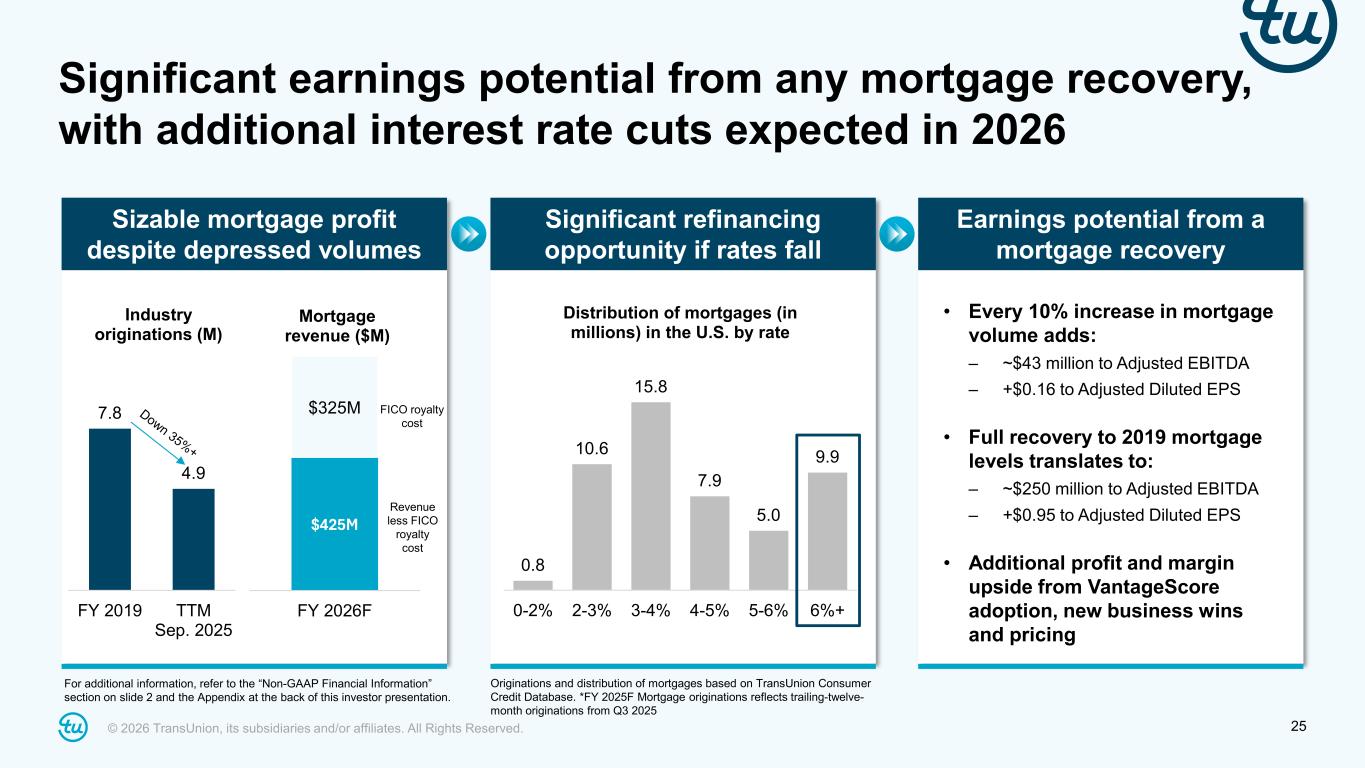

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 25 Significant earnings potential from any mortgage recovery, with additional interest rate cuts expected in 2026 Sizable mortgage profit despite depressed volumes Originations and distribution of mortgages based on TransUnion Consumer Credit Database. *FY 2025F Mortgage originations reflects trailing-twelve- month originations from Q3 2025 7.8 4.9 FY 2019 TTM Sep. 2025 Industry originations (M) $425M $325M FY 2026F Mortgage revenue ($M) Significant refinancing opportunity if rates fall 0.8 10.6 15.8 7.9 5.0 9.9 0-2% 2-3% 3-4% 4-5% 5-6% 6%+ Distribution of mortgages (in millions) in the U.S. by rate Earnings potential from a mortgage recovery • Every 10% increase in mortgage volume adds: – ~$43 million to Adjusted EBITDA – +$0.16 to Adjusted Diluted EPS • Full recovery to 2019 mortgage levels translates to: – ~$250 million to Adjusted EBITDA – +$0.95 to Adjusted Diluted EPS • Additional profit and margin upside from VantageScore adoption, new business wins and pricing FICO royalty cost Revenue less FICO royalty cost For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation.

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 26 Expecting a strong 2026 with +8% to +9% revenue growth and +8% to +10% Adjusted Diluted EPS growth Delivered robust Q4 with +12% organic constant currency revenue growth and +10% Adjusted Diluted EPS growth 2026 strategic priorities emphasize driving innovation- led, scalable growth Note: For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation.

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 27

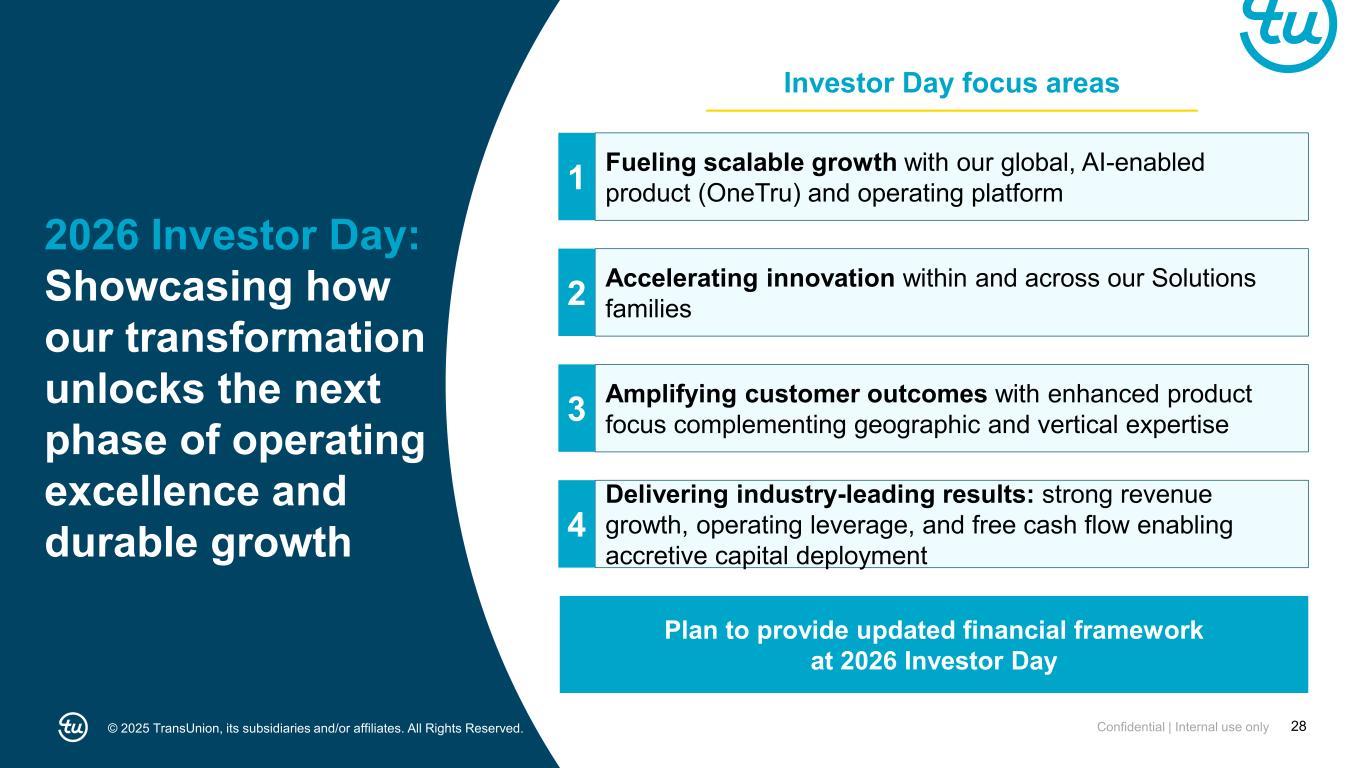

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 28Confidential | Internal use only5 2026 Investor Day: Showcasing how our transformation unlocks the next phase of operating excellence and durable growth Fueling scalable growth with our global, AI-enabled product (OneTru) and operating platform1 Accelerating innovation within and across our Solutions families2 Amplifying customer outcomes with enhanced product focus complementing geographic and vertical expertise3 Delivering industry-leading results: strong revenue growth, operating leverage, and free cash flow enabling accretive capital deployment 4 Plan to provide updated financial framework at 2026 Investor Day Investor Day focus areas

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 29 Q&A

Appendices and Non-GAAP Reconciliations

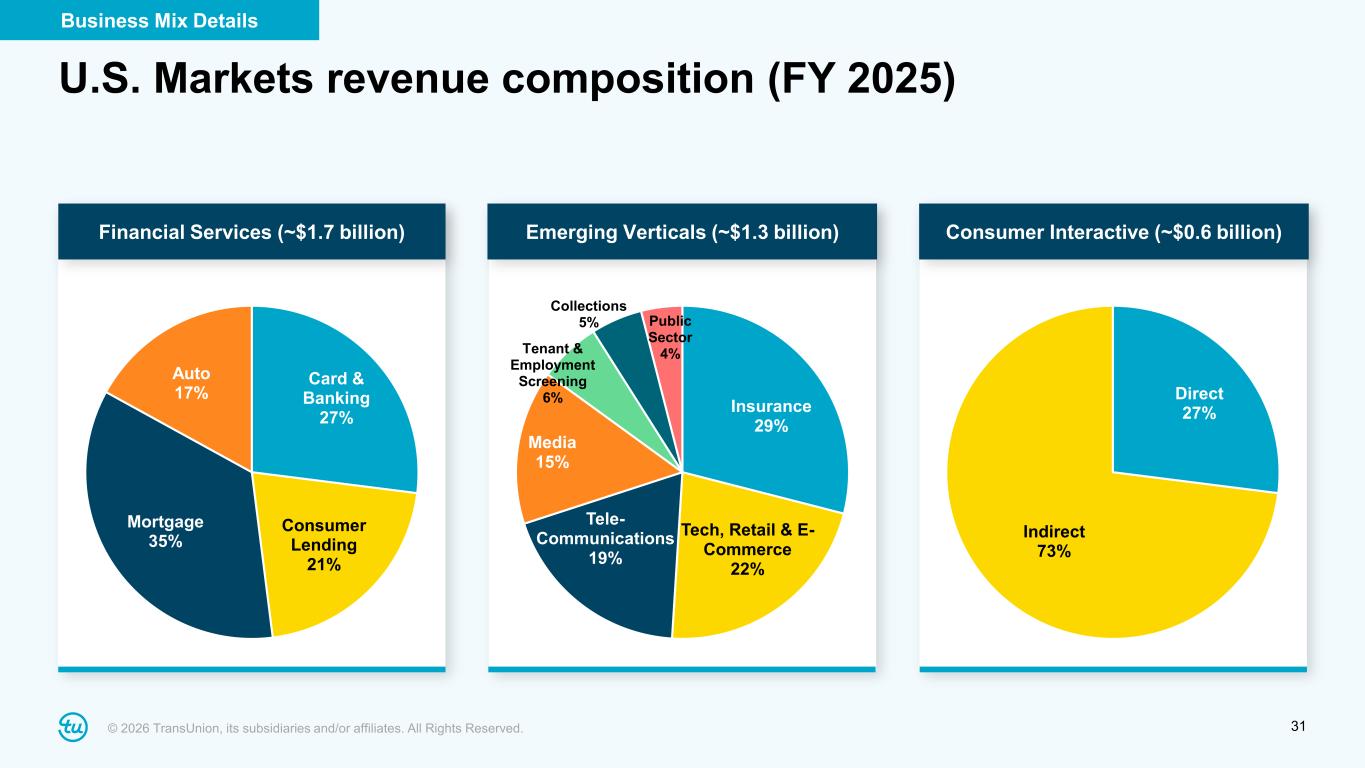

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 31 U.S. Markets revenue composition (FY 2025) Card & Banking 27% Consumer Lending 21% Mortgage 35% Auto 17% Insurance 29% Tech, Retail & E- Commerce 22% Tele- Communications 19% Media 15% Tenant & Employment Screening 6% Collections 5% Public Sector 4% Direct 27% Indirect 73% Financial Services (~$1.7 billion) Emerging Verticals (~$1.3 billion) Consumer Interactive (~$0.6 billion) Business Mix Details

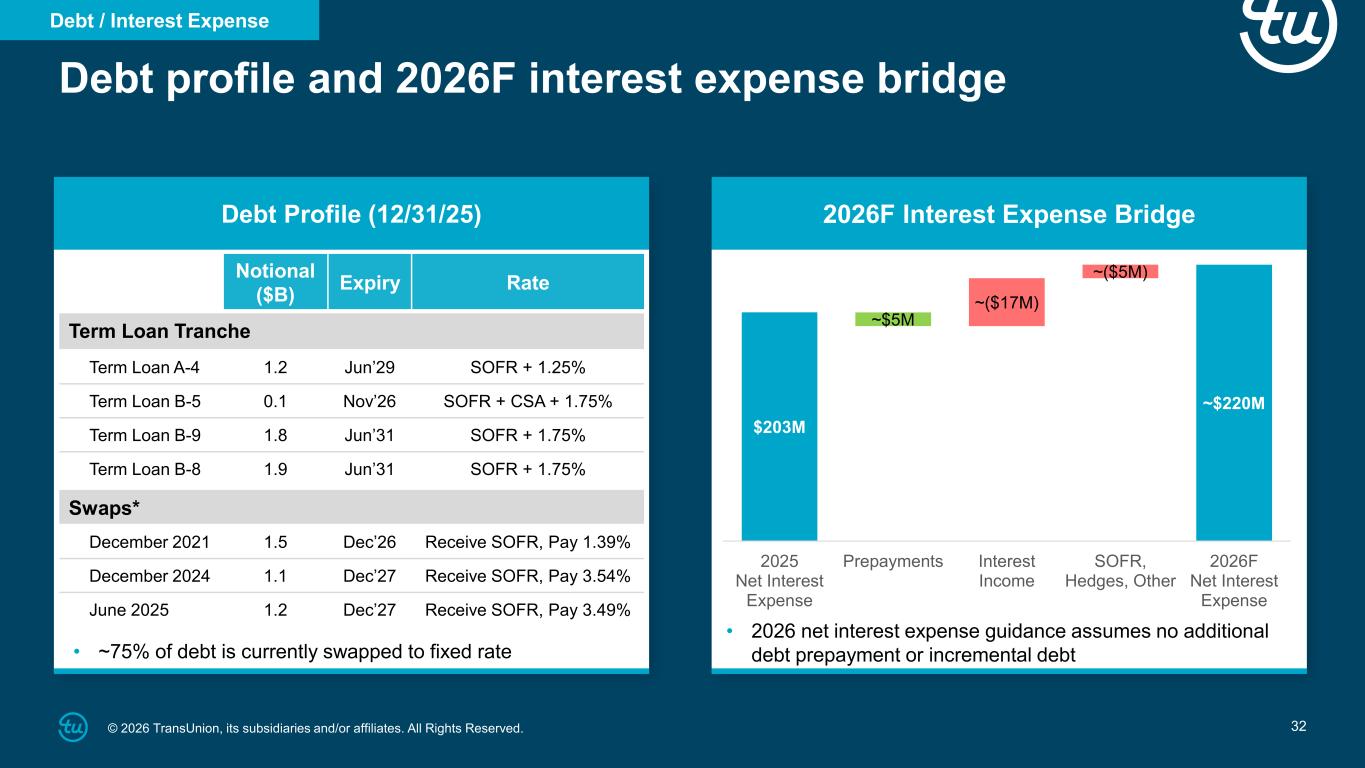

32© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. Debt profile and 2026F interest expense bridge Debt Profile (12/31/25) 2026F Interest Expense Bridge Notional ($B) Expiry Rate Term Loan Tranche Term Loan A-4 1.2 Jun’29 SOFR + 1.25% Term Loan B-5 0.1 Nov’26 SOFR + CSA + 1.75% Term Loan B-9 1.8 Jun’31 SOFR + 1.75% Term Loan B-8 1.9 Jun’31 SOFR + 1.75% Swaps* December 2021 1.5 Dec’26 Receive SOFR, Pay 1.39% December 2024 1.1 Dec’27 Receive SOFR, Pay 3.54% June 2025 1.2 Dec’27 Receive SOFR, Pay 3.49% • ~75% of debt is currently swapped to fixed rate • 2026 net interest expense guidance assumes no additional debt prepayment or incremental debt Debt / Interest Expense $203M ~$220M ~$5M ~($17M) ~($5M) 2025 Net Interest Expense Prepayments Interest Income SOFR, Hedges, Other 2026F Net Interest Expense

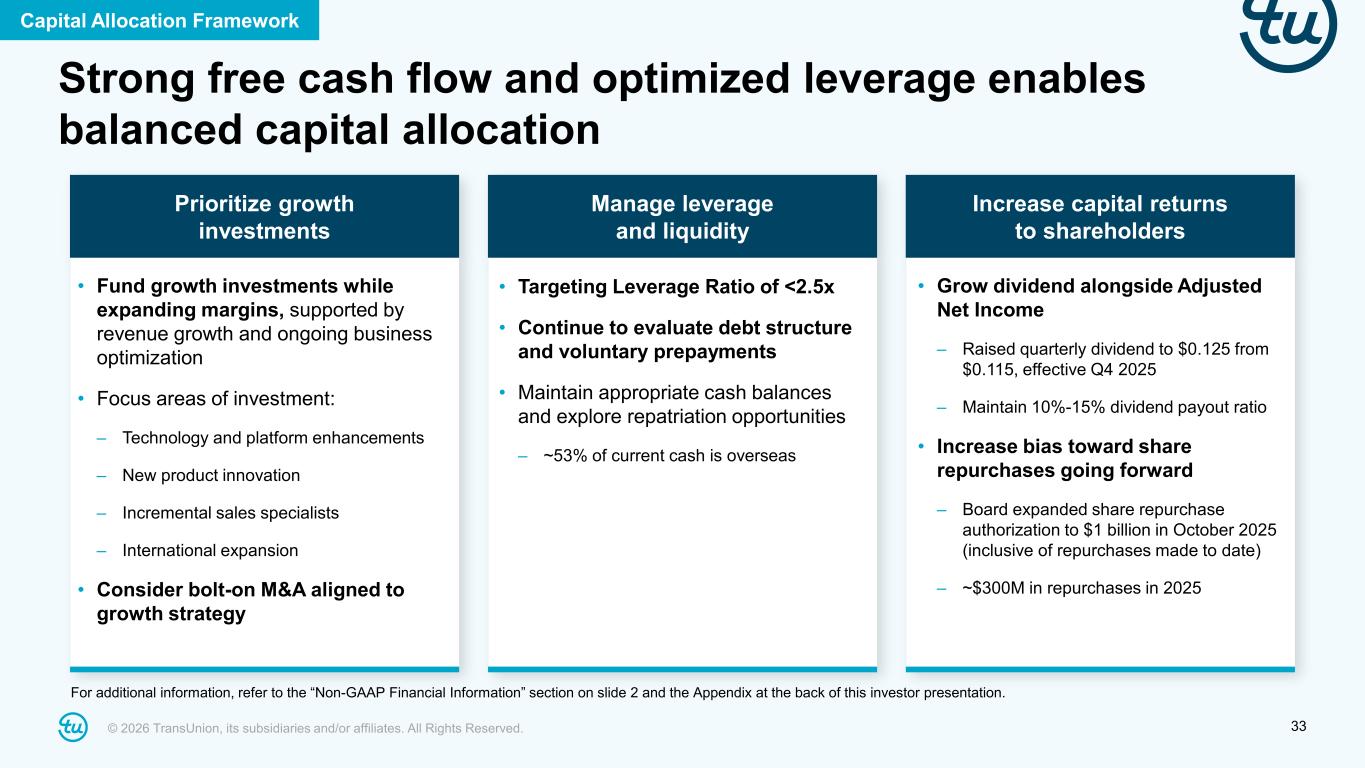

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 33 Strong free cash flow and optimized leverage enables balanced capital allocation Capital Allocation Framework For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Prioritize growth investments • Fund growth investments while expanding margins, supported by revenue growth and ongoing business optimization • Focus areas of investment: – Technology and platform enhancements – New product innovation – Incremental sales specialists – International expansion • Consider bolt-on M&A aligned to growth strategy Manage leverage and liquidity • Targeting Leverage Ratio of <2.5x • Continue to evaluate debt structure and voluntary prepayments • Maintain appropriate cash balances and explore repatriation opportunities – ~53% of current cash is overseas Increase capital returns to shareholders • Grow dividend alongside Adjusted Net Income – Raised quarterly dividend to $0.125 from $0.115, effective Q4 2025 – Maintain 10%-15% dividend payout ratio • Increase bias toward share repurchases going forward – Board expanded share repurchase authorization to $1 billion in October 2025 (inclusive of repurchases made to date) – ~$300M in repurchases in 2025

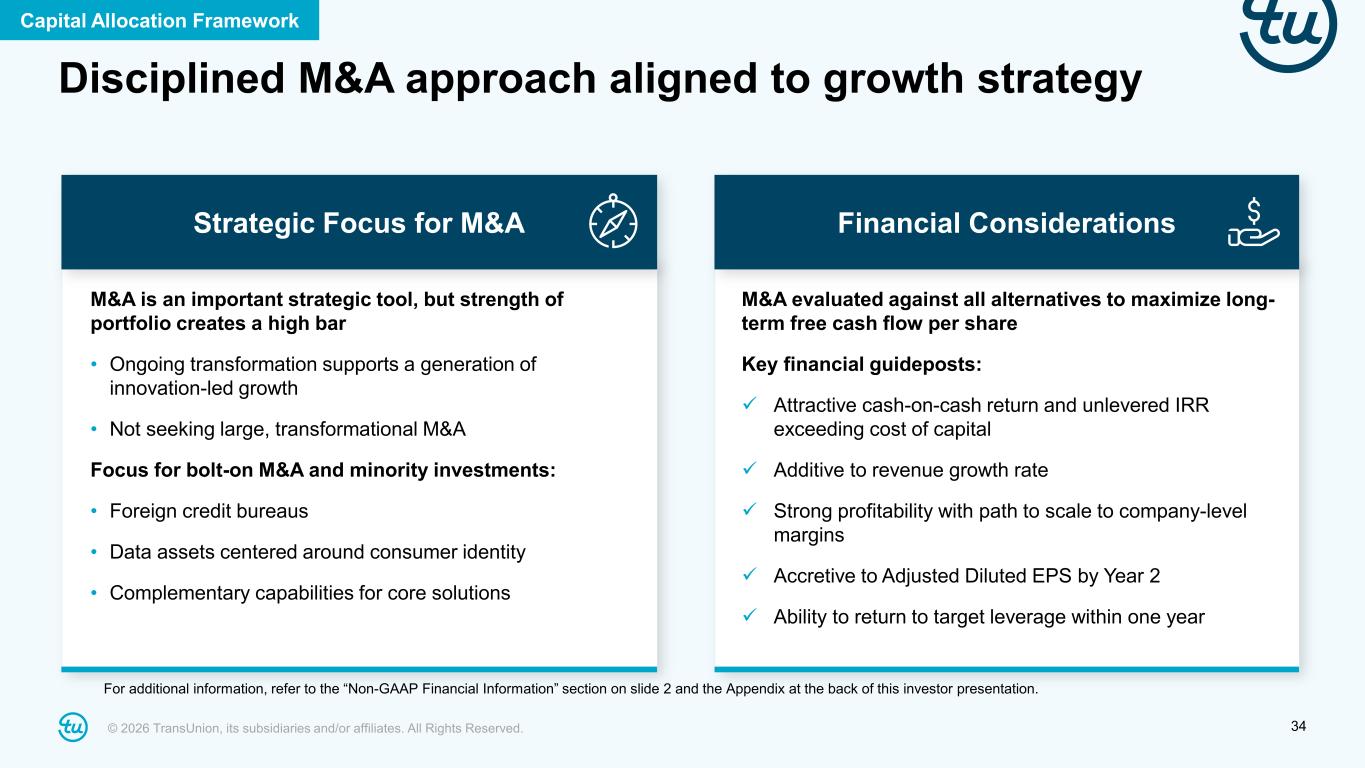

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 34 Disciplined M&A approach aligned to growth strategy Strategic Focus for M&A M&A is an important strategic tool, but strength of portfolio creates a high bar • Ongoing transformation supports a generation of innovation-led growth • Not seeking large, transformational M&A Focus for bolt-on M&A and minority investments: • Foreign credit bureaus • Data assets centered around consumer identity • Complementary capabilities for core solutions Capital Allocation Framework For additional information, refer to the “Non-GAAP Financial Information” section on slide 2 and the Appendix at the back of this investor presentation. Financial Considerations M&A evaluated against all alternatives to maximize long- term free cash flow per share Key financial guideposts: Attractive cash-on-cash return and unlevered IRR exceeding cost of capital Additive to revenue growth rate Strong profitability with path to scale to company-level margins Accretive to Adjusted Diluted EPS by Year 2 Ability to return to target leverage within one year

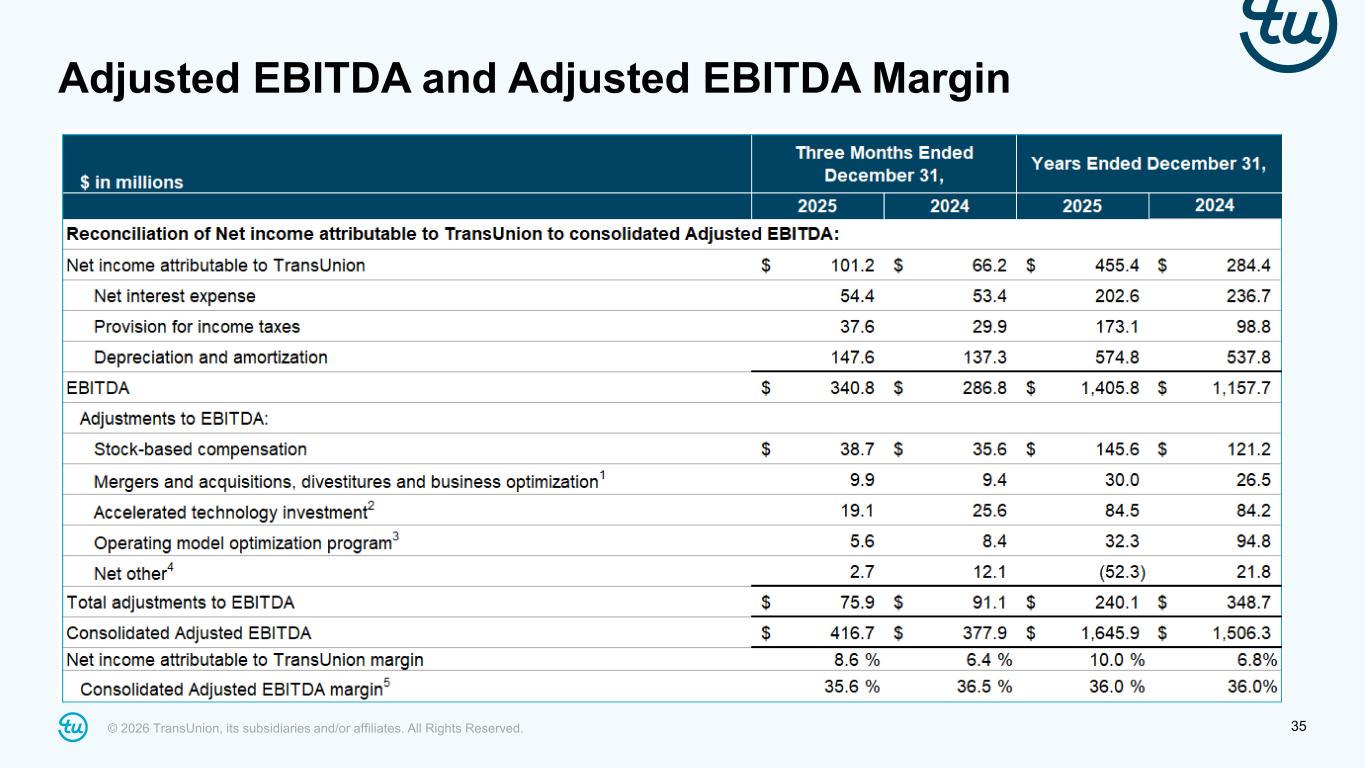

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 35 Adjusted EBITDA and Adjusted EBITDA Margin

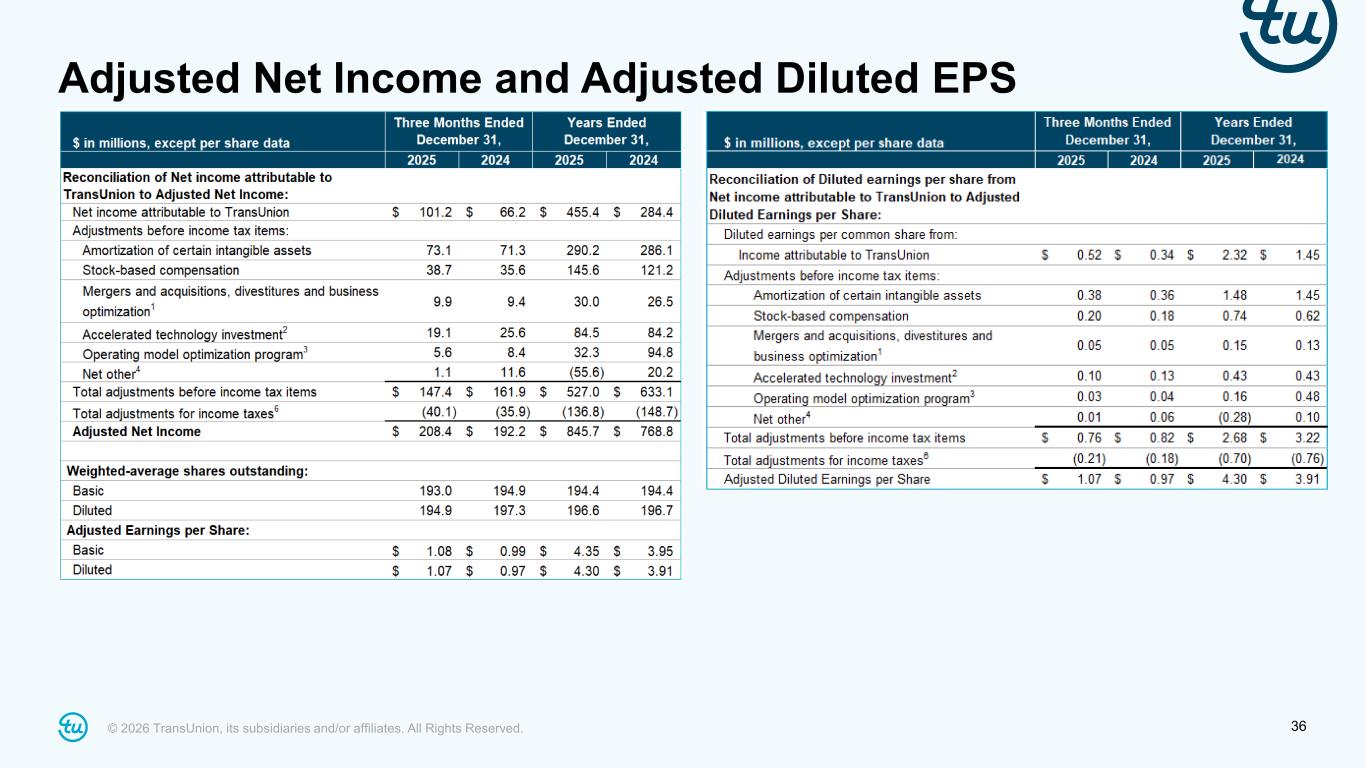

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 36 Adjusted Net Income and Adjusted Diluted EPS

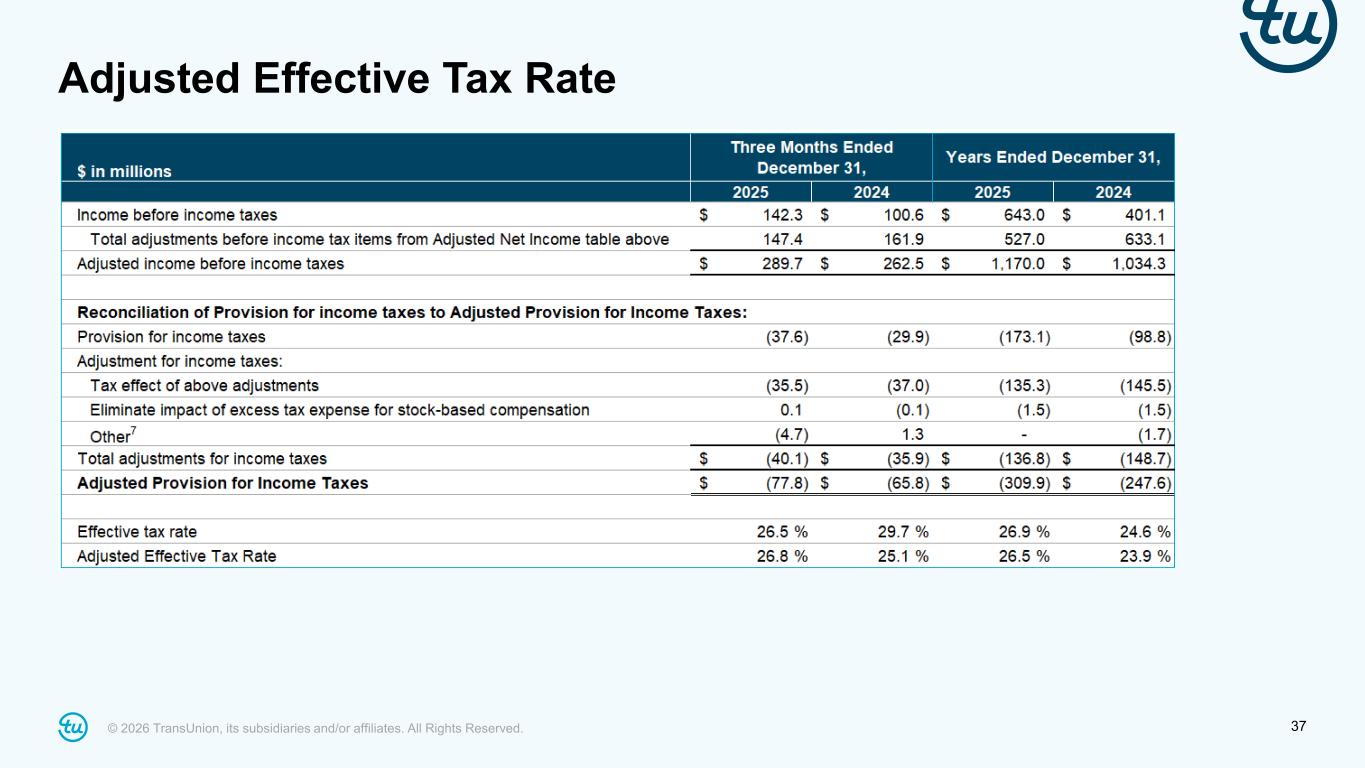

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 37 Adjusted Effective Tax Rate

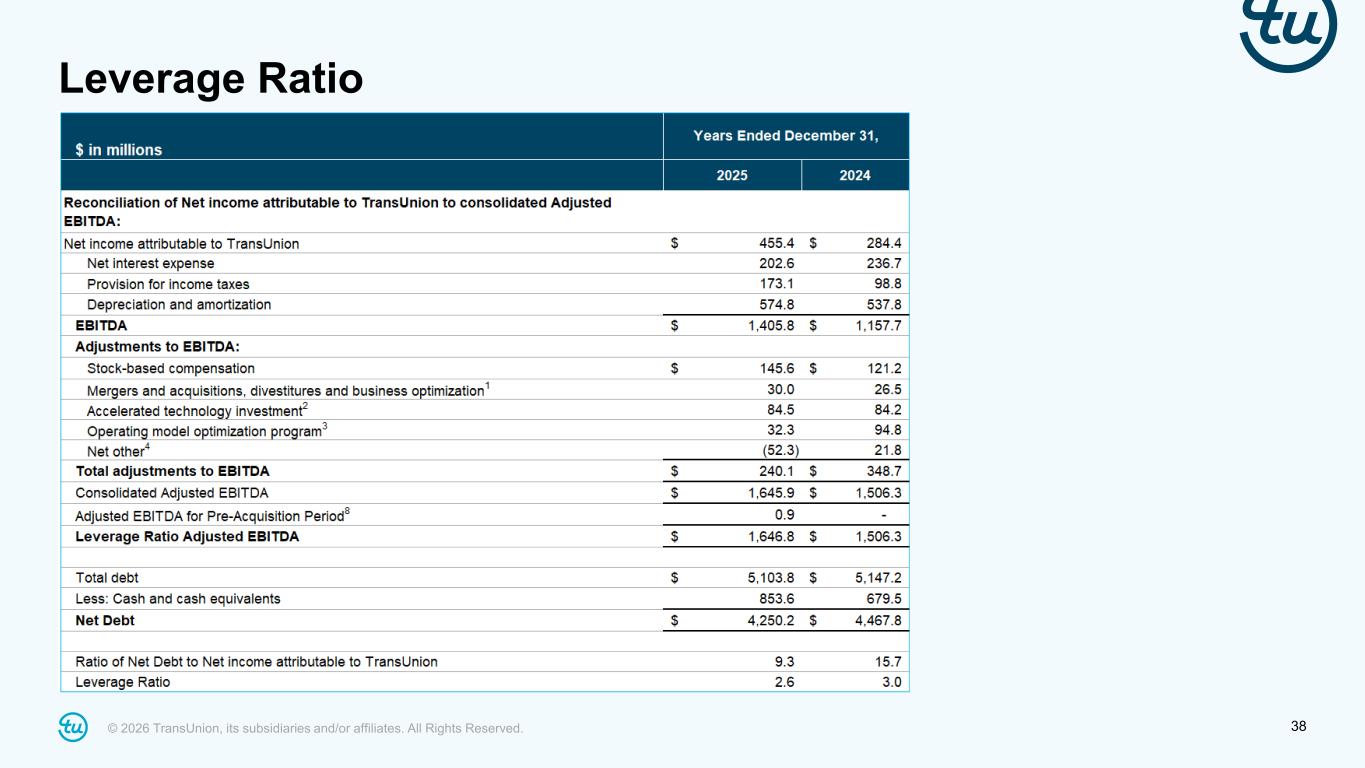

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 38 Leverage Ratio

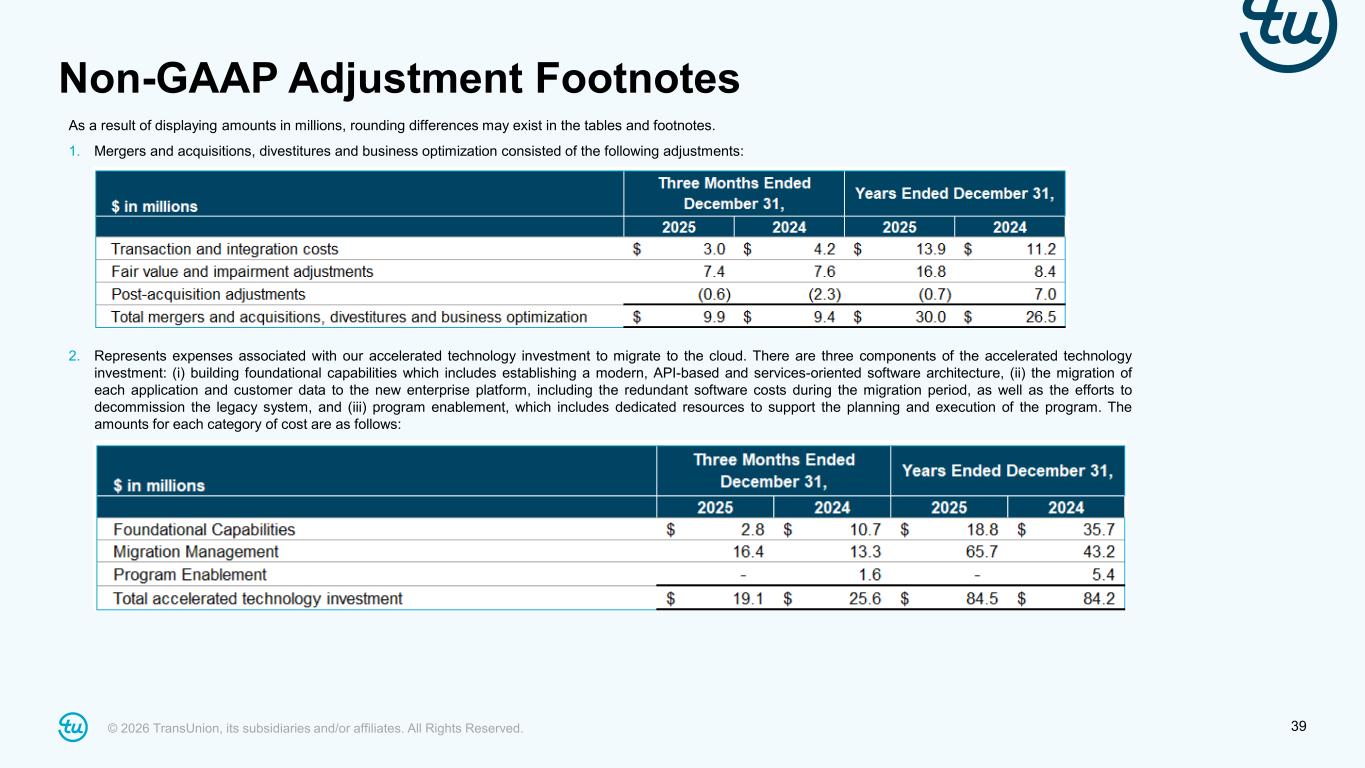

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 39 Non-GAAP Adjustment Footnotes As a result of displaying amounts in millions, rounding differences may exist in the tables and footnotes. 1. Mergers and acquisitions, divestitures and business optimization consisted of the following adjustments: 2. Represents expenses associated with our accelerated technology investment to migrate to the cloud. There are three components of the accelerated technology investment: (i) building foundational capabilities which includes establishing a modern, API-based and services-oriented software architecture, (ii) the migration of each application and customer data to the new enterprise platform, including the redundant software costs during the migration period, as well as the efforts to decommission the legacy system, and (iii) program enablement, which includes dedicated resources to support the planning and execution of the program. The amounts for each category of cost are as follows:

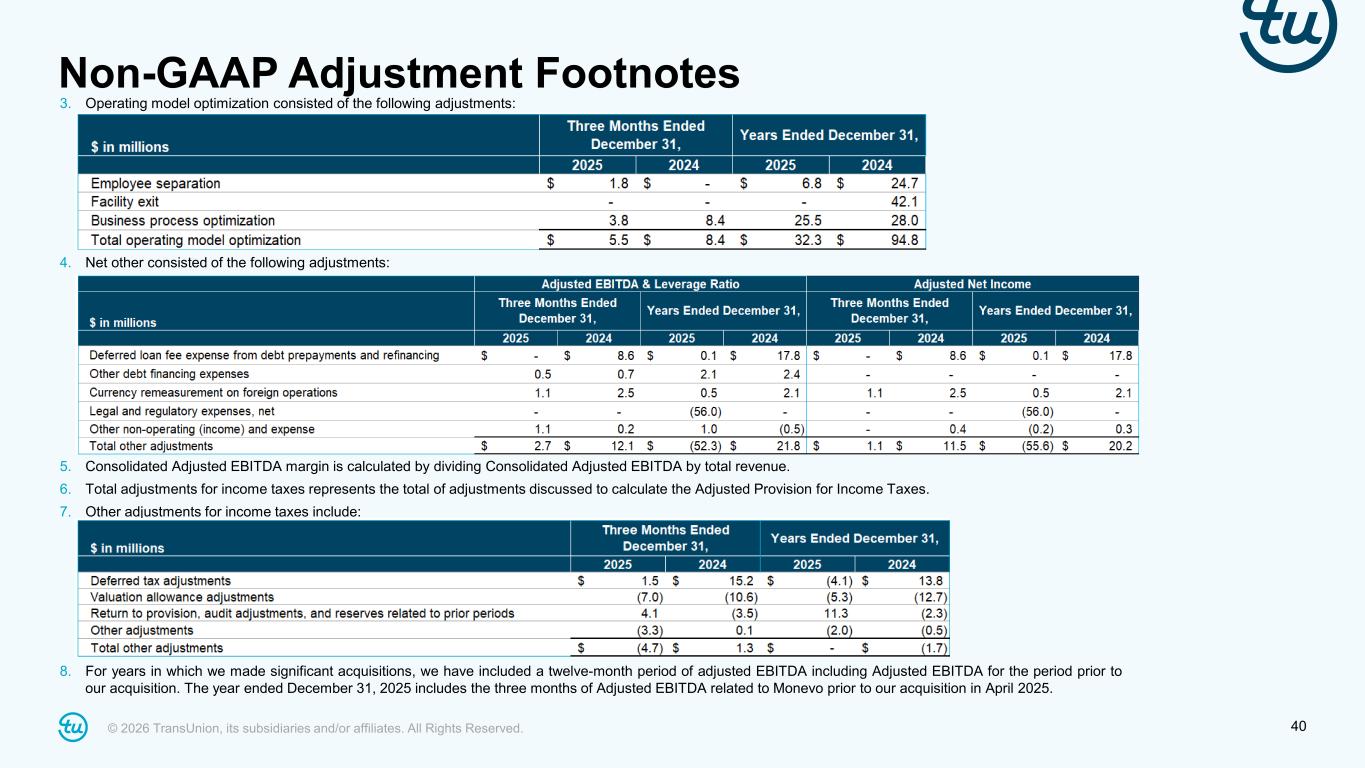

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 40 Non-GAAP Adjustment Footnotes 3. Operating model optimization consisted of the following adjustments: 4. Net other consisted of the following adjustments: 5. Consolidated Adjusted EBITDA margin is calculated by dividing Consolidated Adjusted EBITDA by total revenue. 6. Total adjustments for income taxes represents the total of adjustments discussed to calculate the Adjusted Provision for Income Taxes. 7. Other adjustments for income taxes include: 8. For years in which we made significant acquisitions, we have included a twelve-month period of adjusted EBITDA including Adjusted EBITDA for the period prior to our acquisition. The year ended December 31, 2025 includes the three months of Adjusted EBITDA related to Monevo prior to our acquisition in April 2025.

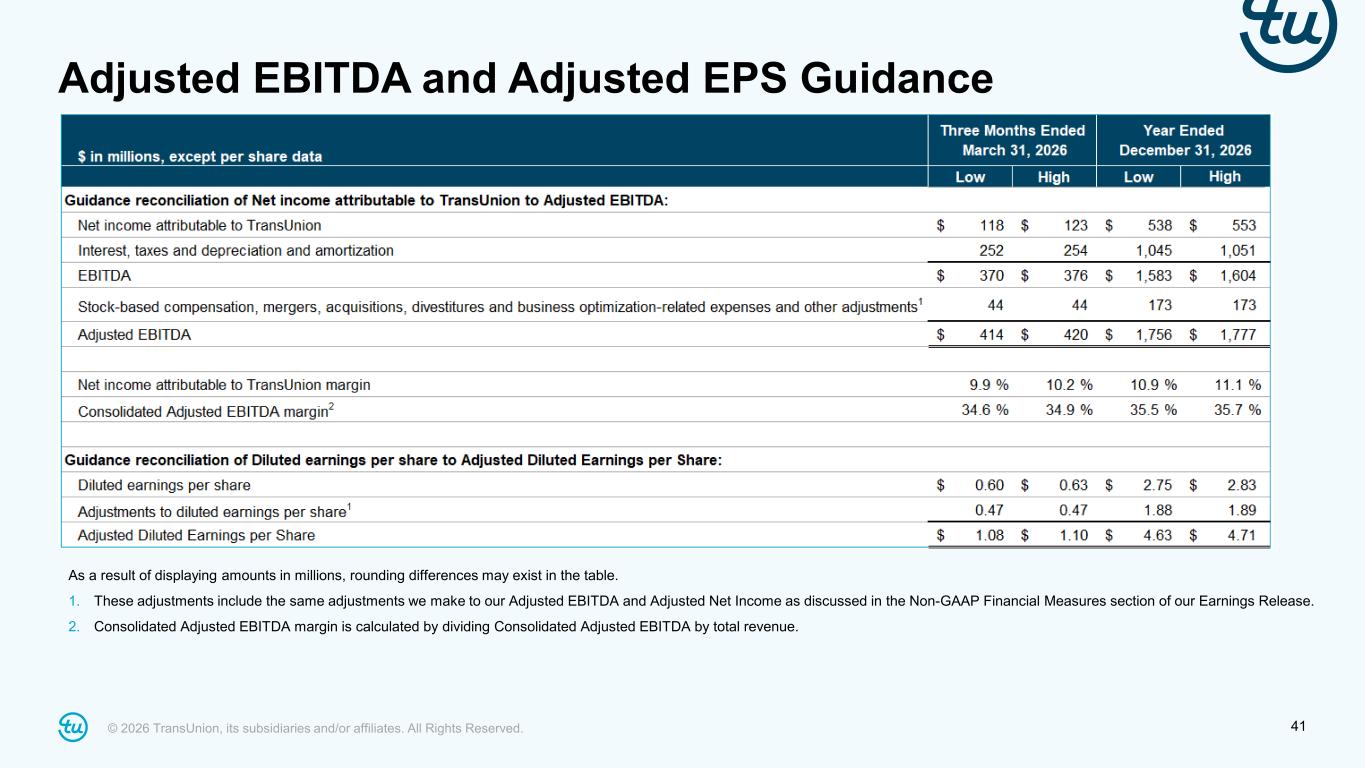

© 2026 TransUnion, its subsidiaries and/or affiliates. All Rights Reserved. 41 Adjusted EBITDA and Adjusted EPS Guidance As a result of displaying amounts in millions, rounding differences may exist in the table. 1. These adjustments include the same adjustments we make to our Adjusted EBITDA and Adjusted Net Income as discussed in the Non-GAAP Financial Measures section of our Earnings Release. 2. Consolidated Adjusted EBITDA margin is calculated by dividing Consolidated Adjusted EBITDA by total revenue.