Please wait

.5

NRMLT 2026-NQM1

Rithm Capital Corp.

Opus Capital Markets Consultants,

LLC

| 300 Tri-State International – Suite 320 | Lincolnshire, IL 60069 | www.opuscmc.com

| 224.632.1300 |

Executive Narrative

January 9, 2026

Performed by

Opus Capital Markets Consultants, LLC

For

Rithm Capital Corp.

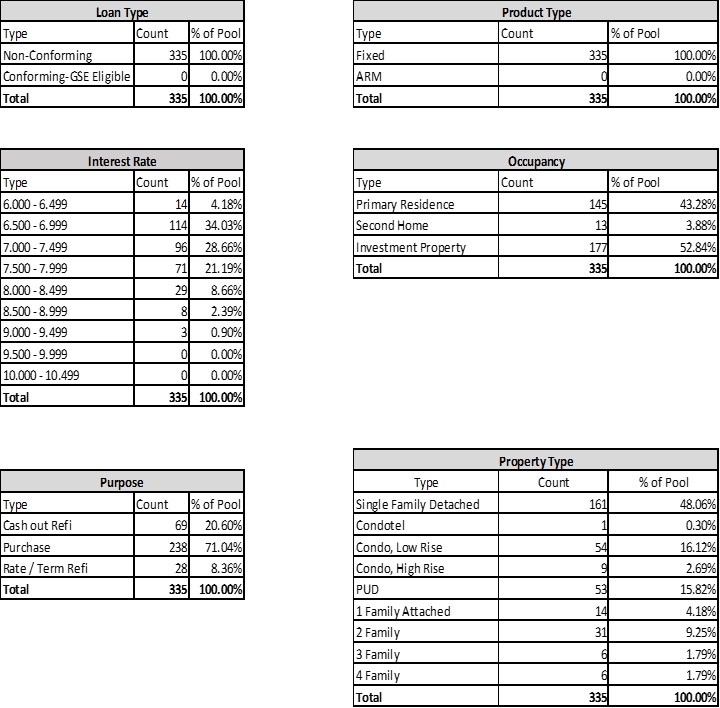

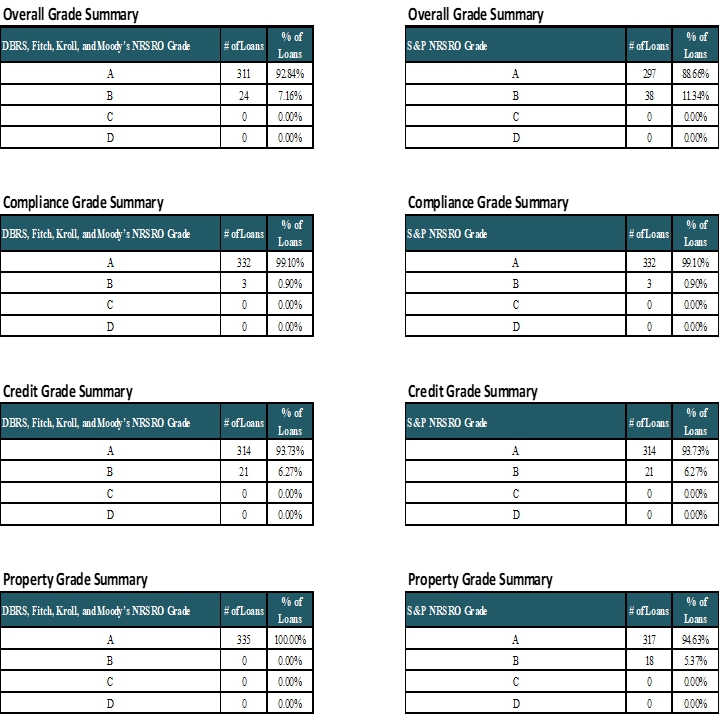

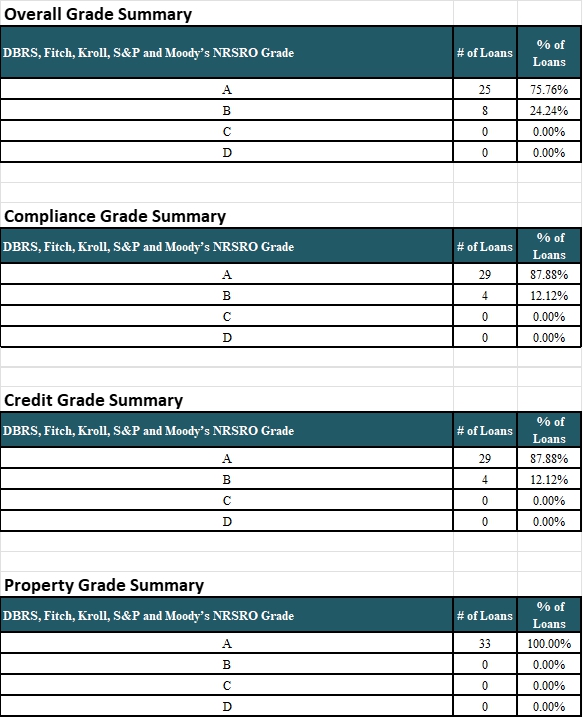

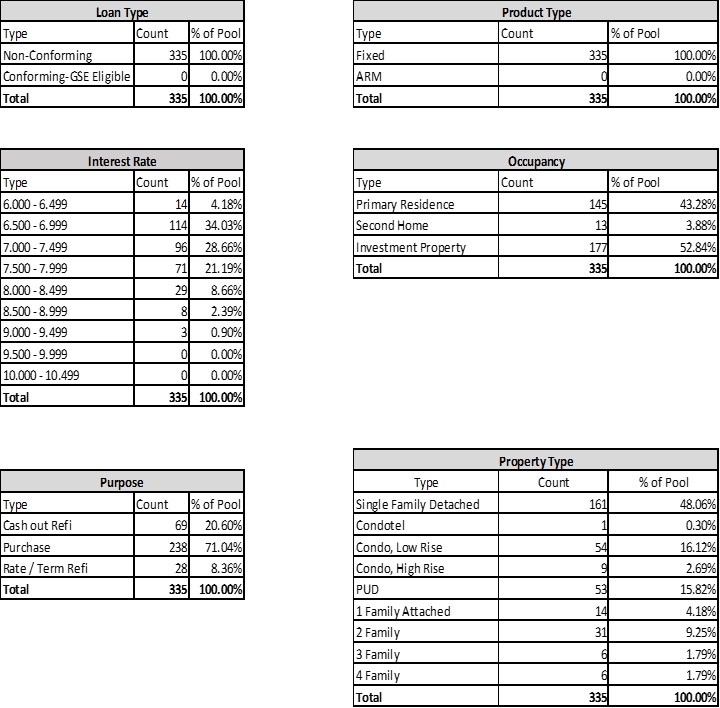

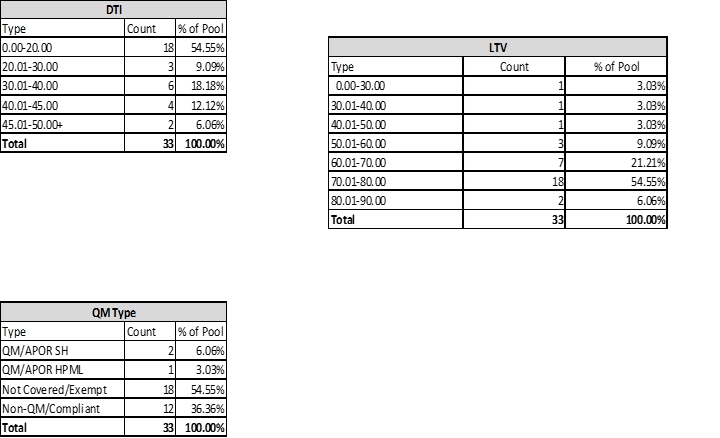

The reports summarize the results of a due diligence QC review performed

on a pool of 335 loans, which were provided by Rithm Capital Corp. (“Client”) who provided Opus Capital Markets Consultants,

LLC (“Consultant”) with a data tape, from which 100% of the loan population was chosen.

The scope of review completed by Opus is identified as the scope of services

under the terms of Exhibit A below.

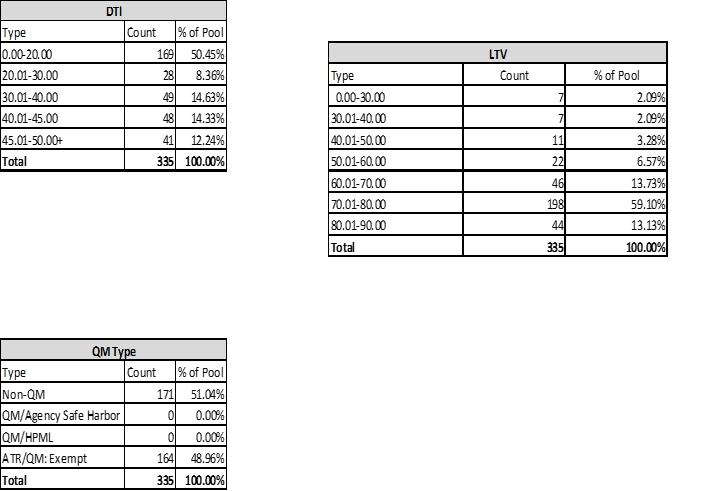

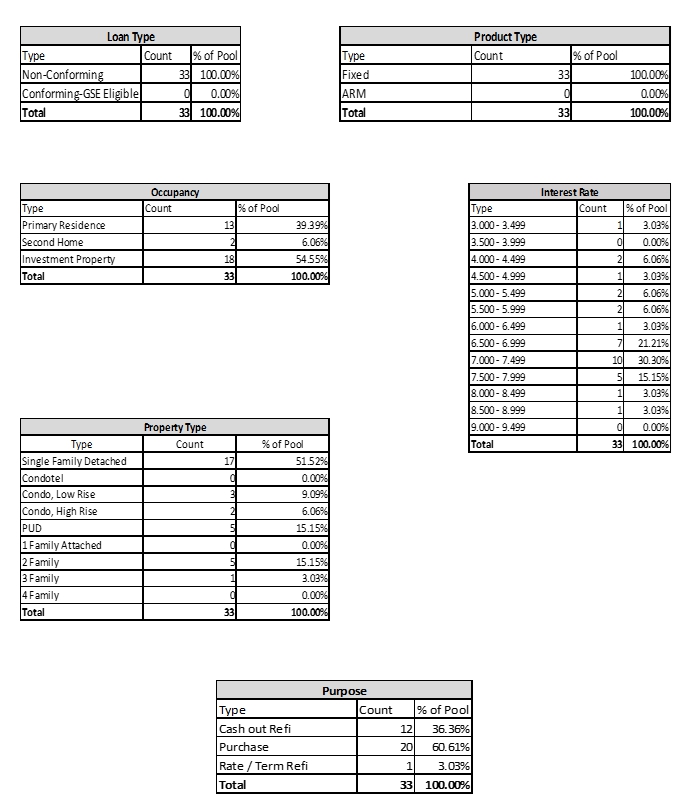

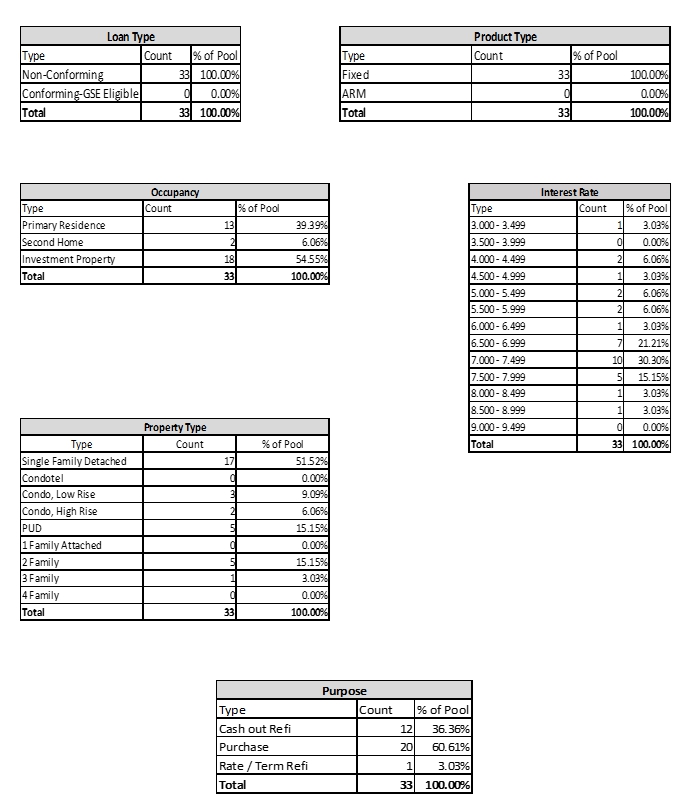

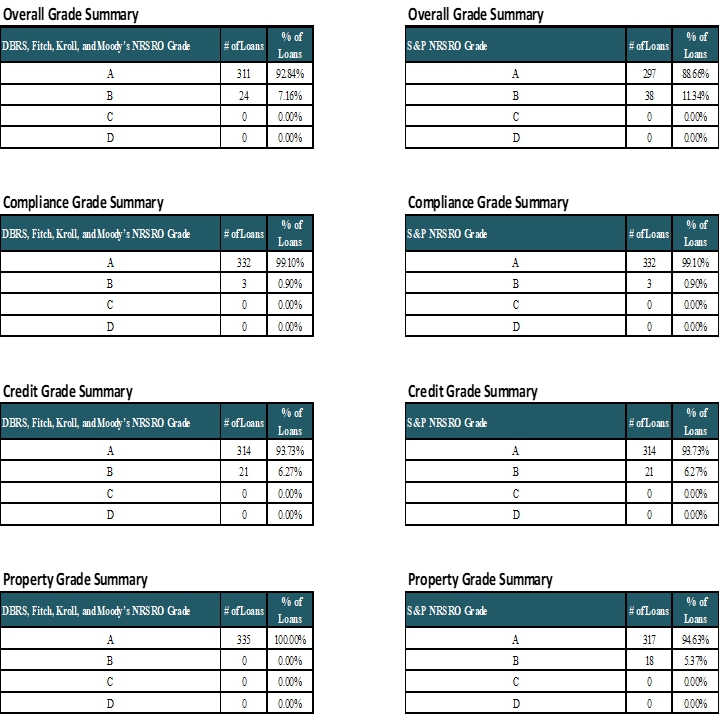

In addition, Consultant performed the QC review of one prior securitization

review completed by the Recovco Mortgage Management LLC (“Recovco) on behalf of Rithm Capital Corp. (“Client”). This

population comprised 33 seasoned loans in which a credit and compliance review was conducted.

The scope of review completed by Opus is identified as the scope of services

under the terms of Exhibit B below.

The scope of review previously completed by Recovco is identified as the

scope of services under the terms of Exhibit C below.

EXHIBIT

A - Opus

Credit Review

Credit Qualification

A re-underwriting review will be conducted in order to verify that the

requisite underwriting guidelines as specified by Client are met. Confirmation of the loan terms will be performed through recalculation

and review of documentation contained in the loan file provided to the Consultant. The Credit Qualification review will consist of the

following:

| a) | Guidelines: Determine whether each mortgage loan meets the requisite guideline requirements as specified by the Client. In

lieu of specific requirements, Consultant should consider Regulation Z including Appendix Q if applicable. If the loan pre-dates the requirements

of Regulation Z and Appendix Q, Consultant will consider Fannie Mae’s Single-Family guidelines. |

| b) | Employment: Review the file documentation for minimum required level of employment, income and asset verifications pursuant

to Client provided underwriting guidelines. |

| c) | Income: Recalculate borrower(s) monthly gross income and verify calculations of income as used by the original loan underwriter

at origination to determine compliance with the Client provided underwriting guidelines. |

| d) | Assets: Confirm the presence of adequate asset documentation to comply with the Client provided underwriting guideline requirements

for closing funds, reserves and borrower liquidity. |

| e) | Debt Ratio: Recalculate the debt-to-income ratio and verify the ratio accuracy used by the loan underwriter at origination

to determine compliance with Client provided underwriting guidelines and regulatory requirements. |

| f) | Property Valuation: Analyze all appraisals and alternative value tools used to qualify the loan for integrity of comparable

sales, completeness of data, eligibility of the appraiser and reasonableness of estimated value. Review the appraisal to determine the

appraisal(s) meet the requirements of Client provided underwriting guidelines. |

| g) | Loan-to-Value Ratio: Recalculate and verify the loan-to-value ratio and combined loan-to-value ratio were accurate at origination

and meet Client provided underwriting guideline and regulatory requirements. |

| h) | Credit History: Review the credit report to verify that the borrower(s) demonstrate adequate credit depth to comply with the

Client provided underwriting guideline requirements. |

| i) | Credit Scores: Verify that borrower(s) meet minimum credit score requirements of the Client provided underwriting guidelines. |

| j) | Compensating Factors: Verify exceptions to the Client provided underwriting guidelines are documented and reasonable. |

Document Review

Document Review

A review of each loan file will

be performed to confirm the presence of material documentation as applicable to the specifics of the loan transaction. The Document Review

will consist of the following:

a) Collateral Docs

| · | Title Commitment / Policy: Verify the presence of the title commitment or

final title policy. Confirm vested parties and the description of the property, liens and tax assessments. |

| · | Mortgage Note / Security Instrument: Verify the presence of the mortgage

note or security instrument. Confirm that the document has been executed by all borrowers and that all riders, addendums and endorsement

are present and duly executed. |

| · | Mortgage / Deed of Trust: Verify the presence of a copy Mortgage or Deed

of Trust. Confirm that the documents have been executed by all required parties and that all riders, addendums and exhibits are present

and duly executed. If the loan closed within 12 months of the review, Consultant will confirm the presence of a letter from the title

company specifying the date the Mortgage / Deed Trust was sent for recording. If the closing did not occur within 12 months of the review

and a copy of the recorded Mortgage /Deed of Trust is not contained in the loan file, the Client will submit a report from an independent

document custodian verifying the presence of a recoded mortgage or a stamped / signed copy of the document stating the date the document

was sent for recording. |

| · | Conveyance

Deed: Verify as applicable that a proper conveyance deed is present in the loan file. Confirm the proper transfer of ownership interest

of the subject parties is detailed on the deed.

|

b) Closing Docs

| · | Final Hud-1 Settlement Statement: If required, verify the presence of a

final HUD-1. Verify the completeness of required data and signatures or certification depending upon state compliance requirements. |

| · | Final Truth-in-Lending Disclosure: If required, verify the presence of a

final Truth-in-Lending Disclosure. Verify the completeness of required data and that all required signatures are present. |

| · | Notice of Right to Cancel: If required based on the specifics of the loan

transaction, confirm the presence and required execution of the Notice of Right to Cancel. |

| · | Loan Estimate: If required verify the presence of the current Loan Estimate

(LE) at the time of origination |

| · | Closing

Disclosure: If required verify the presence of the current Closing Disclosure (CD) at the time of origination.

|

c) Credit Docs

| · | Loan Application: Verify the presence and completeness of both the initial

and final loan applications. |

| · | Underwriting Worksheet: Verify the presence of the relative underwriting

worksheet i.e. form 1008, FHA MCAW and VA’s Loan Analysis. |

| · | Credit Report: Verify the presence of a credit report for each borrower.

Confirm that the credit report was pulled within the timing requirements allowable per the Client provided underwriting guidelines. |

| · | Housing Payment History: In the absence of housing payment histories on

the borrower(s) credit report(s), verify that that the file contains a verification of rent or a verification of mortgage form. |

| · | Letters of Explanation: When Letters of Explanation are required by the

Client provided underwriting guidelines, verify the presence of any such letters exist in the loan file. |

| · | Gift Letters: When Gift Letters are required by the Client provided underwriting

guidelines, verify the presence of any such letters exist in the loan file. |

| · | Income Documentation: Verify the presence of income and employment related

documentation required by the Client provided underwriting guidelines for all borrowing parties contributing income to the debt ratio

calculation. |

| · | Asset Documentation: Verify the presence of asset documentation required

by the Client provided underwriting guidelines in the loan file. |

| · | Property Valuation Tools: Verify that each loan file contains adequate appraisal

and other third party valuation tools to satisfy the minimum required documentation under the relative Client provided underwriting guidelines. |

| · | Proof of Insurance: Verify the presence of insurance certificates for mortgage,

hazard and flood insurance on an as needed basis depending upon the specifics of the loan. Confirm that adequate coverage is present to

meet the requirements of the Client provided underwriting guidelines. |

Regulatory Compliance

For each Mortgage Loan, Consultant shall determine, to the extent possible

and subject to caveats below, whether such Mortgage Loan at the time of origination complied with:

| 1. | The

“material”1 disclosure

requirements of the federal Truth-in-Lending Act (“TILA”), as amended by the

Home Ownership and Equity Protection Act (“HOEPA”) and Dodd-Frank, 15 U.S.C.

§ 1601 et seq. and implemented by Regulation Z, 12 C.F.R. Part 1026, including

the material provisions relating to Higher-Priced Mortgage Loans in Regulation Z, 12 C.F.R.

§§ 1026.35, and the early TIL disclosure provisions of the Mortgage Disclosure

Improvement Act (“MDIA”), as implemented by Regulation Z, 12 C.F.R. §§

1026.17 et seq; and as amended by the TILA-RESPA Integrated Disclosure (“TRID”)

Rule, TRID will be reviewed in accordance with the SFA TRID Grid 4.0, as amended from time

to time, as set forth below: |

| a. | For Right of Rescission |

| i. | A review of the Notice of Right to Cancel, including a verification of the

transaction date and expiration date, ensuring proper execution of the Notice of Right to Cancel by all required parties, verifying the

disbursement date and determining if a full three (3) day rescission period was adequately provided to the borrower(s). |

| A. | This review is also to be performed on transactions that are exempt from

the rescission requirement but on which a Notice of Right to Cancel was provided. |

| B. | A condition must be placed if the transaction is a refinance by the original

creditor and the borrower was provided the Form H-8 rescission notice. Consultant will note in the condition whether there was a new advance

that is subject to rescission per TILA/Regulation Z. |

| b. | For TILs (Application Dates prior to 10/3/2015) |

| i. | Confirm the initial TIL disclosure and final TIL disclosures were provided.

|

| ii. | Review and compare the initial and final TIL, and any re-disclosed TIL(s),

with a report outlining any TILA violations, including a recalculation of disclosed finance charge, proper execution by all required parties,

principal and interest calculations, proper completion of the interest rate and payment summary, recalculation of disclosed APR, and a

review to determine disclosure differences were within the allowed tolerances and disclosures were provided within the required timeframes;

|

1

These “material” disclosures include the required disclosures of the APR, the finance charge, the amount financed, the total

number of payments, the payment schedule, and if the loan is subject to the Homeownership and Equity Protection Act (“HOEPA”),

the disclosure requirements and prohibitions of that statute which are set forth in 12 C.F.R. §§ 1026.32(c) and (d).

| c. | For TRID Disclosures (Application Dates on or after 10/3/2015) |

| i. | Confirm the initial Loan Estimate (LE) was delivered within three (3) business

days of application and seven (7) business days prior to consummation in accordance with Client’s Underwriting Guidelines; |

| ii. | Review the required sections of each LE to ensure they were

populated in accordance with the TRID Rules. (If the file reflects more than one LE was provided, each revised LE must have corresponding

Change of Circumstance documentation. The 0% and 10% fee tolerance evaluations will be based on the fee amounts disclosed on the

initial LE and any valid changes documented and disclosed after the initial LE; |

| iii. | Confirm the Closing Disclosure (CD) confirm the borrower received

the initial CD at least three (3) business days prior to consummation; |

| iv. | Review the required sections of each CD to ensure they were populated in

accordance with the TRID Rules. (Any fee tolerance issues to be cured at closing or within 60 days of loan consummation.) |

| 2. | Section 4 of the Real Estate Settlement Procedures Act

(“RESPA”), 12 U.S.C. §2603 and 2604, as implemented by Regulation X, 12 C.F.R. Part 1024, and as amended by the TRID

Rule; TRID will be reviewed in accordance with the SFA TRID Grid 4.0, as amended from time to time. |

| 3. | The disclosure requirements and prohibitions of Section

50(a)(6), Article XVI of the Texas Constitution; |

| 4. | Confirmation that one of the following are in the loan

file, per the Fair Credit Reporting Act: Consumer Credit Score Disclosure, Your Credit Score and the Price You Pay for Credit, or Notice

to Home Loan Applicant; |

| 5. | Sections 1411 and 1412 of the Dodd-Frank Wall Street Reform

and Consumer Protection Act (“Dodd-Frank”) amending TILA, as implemented by Regulation Z, 12 C.F.R. 1026.43: the general Ability

to Repay underwriting standards (12 C.F.R. 1026.43(c)); refinancing of non-standard mortgages (12 C.F.R. 1026.43(d)); Qualified Mortgages

(12 C.F.R. 1026.43(e) (including qualified mortgages as defined by the Department of Housing and Urban Development (24 C.F.R. 201 and

203 et seq.) and the Department of Veterans Affairs (38 C.F.R. Part 36 et seq.; and Balloon-payment qualified mortgages made by certain

creditors (12 C.F.R. 1026.43(f)) In accordance with “Ability to Repay and Qualified Mortgage Review” description below; |

| 6. | The Loan Originator Compensation and Prohibitions on Steering

provisions of TILA, as implemented by Regulation Z, 12 C.F.R 1026.36; |

| 7. | The requirements for Higher-Price Mortgage Loans, as implemented

by Regulation Z, 12 C.F.R. 1026.35; |

| 8. | The appraisal and valuation requirements of TILA and the

Equal Credit Opportunity Act, as implemented by Regulation Z, 12 C.F.R. 1026.35 and Regulation B, 12 C.F.R. 1002.14, respectively; |

| 9. | The counseling requirements of TILA, as implemented by

Regulation Z, 12 C.F.R. 1026.36(k) and RESPA, as implemented by Regulation X, 12 C.F.R. 1024.20; |

| 10. | The escrow requirements of TILA and RESPA, as implemented

by Regulation Z, 12 C.F.R 1026.35, and Regulation X, 12 C.F.R 1024.17, respectively; |

| 11. | The disclosure requirements and prohibitions of any applicable

state, county and municipal laws and ordinances, as amended, that have been enacted to regulate so-called “predatory lending”: |

| 12. | Consultant shall confirm that any mortgage property located

in an area identified on a flood hazard map or flood insurance rate map issued by the Federal Emergency Management Agency as having special

flood hazards is subject to a qualified flood insurance policy that appears to be is in effect. |

| 13. | For any loans designated as TILA exemption, Consultant

shall review the loan file for evidence that the primary purpose of the loan was for commercial or business purposes, including, but not

limited to a business purpose certification. |

| 14. | Documentation. Review of the following documents for regulatory

compliance: |

| a. | Final HUD-1 Settlement Statement (“HUD-1”),

if applicable |

| i. | If the loan is in an escrow state, the HUD-1 will be considered

final as follows: |

| i. | If HUD-1 is not marked Final, it must be stamped certified

by the closing agent. |

| ii. | There should be no markings indicating that the HUD-1 is

estimated. |

| B. | HUD-1 is signed by all parties (including closing agent)

or stamped certified by the closing agent; and |

| C. | If HUD-1 is stamped, the HUD-1 / stamp should be signed

or initialed by the closing agent; if the stamp does not contain the signature or initials, it must identify the name of the closing agent. |

| b. | Final Truth in Lending Disclosure (“TIL”),

if applicable |

| c. | Loan Estimate, if applicable |

| i. | The Loan Estimate in will be considered delivered based

on the date issued, subject to the three-day mailing rule unless the file contains documentation indicating earlier receipt. The loan

file may contain one or more Loan Estimates with the latest one provided up until three business days prior to the issuance of an initial

Closing Disclosure. |

| d. | Closing Disclosure, if applicable |

| i. | The Closing Disclosure in the loan file will be considered

delivered based on the date issued, subject to the three-day mailing rule unless the file contains documentation indicating earlier receipt.

The loan file may contain one or more Closing Disclosures with the latest one provided up until the consummation date being considered

the Final with any delivered post consummation considered as a corrected Closing Disclosure. |

| e. | Notice of Right to Cancel (if applicable) |

| f. | Initial TIL, if applicable |

| g. | Good Faith Estimate (“GFE”), if applicable

|

| i. | Third party fees on the HUD-1 or Closing Disclosure if

applicable referred to as HUD-1/Closing Disclosure, must be shown as paid to the third-party provider. A condition must be set if a third-party

fee is paid to the lender, investor, etc. or the payee is blank. |

| ii. | CONSULTANT will condition for evidence in the file indicating

that a charge on the HUD-1/Closing Disclosure exceeds the actual cost to the borrower (i.e. cost printed / stamped on the face of the

document showing an amount less than the charge on the HUD-1/Closing Disclosure). Variations of less than $1 are deemed to be within reasonable

limits and are not to be reported. |

| iii. | Any refunds that are provided to the borrower must be accompanied

by a revised HUD-1/Closing Disclosure to show the final, accurate charges to the borrower. |

Each loan reviewed will be assigned a Compliance condition grade in accordance

with the Rating Agency Criteria as more fully described in Section 2(f).

Consultant will not make a determination as to whether the loans comply

with federal, state or local laws, constitutional provisions, regulations or ordinances that are not expressly enumerated above. Furthermore,

the findings reached by Consultant are dependent upon its receipt of complete and accurate data regarding the loans from loan originators

and other third parties upon which Consultant is relying in reaching such findings.

Ability to Repay and Qualified Mortgage Review

| 1. | For Agency Eligible Loans Only: Consultant

reviews applicable loans for compliance with the Qualified Mortgage (QM) rule requirements set forth in Regulation Z (12 C.F.R. 1026.43

et seq.) based upon the loan’s designation (Safe Harbor QM, Rebuttable Presumption QM, Exempt). Consultant determines the loan’s

status under the QM rule requirements and assigns a due diligence loan designation. Consultant notes as a material exception if the due

diligence findings do not confirm the same loan designation. Additionally, Consultant notes if a loan designation was not provided. Consultant

will verify if each loan meets the requirements for a QM under § 1026.43(e)(2)—whether the loan is a safe harbor QM under §

1026.43(e)(1)(i) or a rebuttable presumption QM under § 1026.43(e)(1)(ii). Consultant will verify the presence of documentation for

lender determination of QM and indicating factors in its ability-to-repay determination, including how the originator applied its policies

and procedures in verification. For loans applications taken on or after June 1, 2021, Consultant will verify whether the loan meets the

requirements of the revised general QM definition effective March 1, 2021. |

| 2. | For loans for which applications were received prior to

July 1, 2021, if a loan was designated as QM and identified as eligible for guarantee, purchase, or insurance by an applicable agency

as permitted under the QM final rule, Consultant reviews the loan to determine whether, based on available information in the loan file

the loan satisfied (i), (ii) and (iii) in the paragraph (3)(a)(i) below and reviews the Automated Underwriting System output within the

file to confirm agency eligibility. |

| 3. | For Non-Agency Eligible Loans: Consultant reviews applicable loans for compliance with the Ability to Repay (ATR) but

not Qualified Mortgage (QM) rule requirements set forth in Regulation Z (12 C.F.R. 1026.43 et seq.). |

a. Qualified Mortgage:

| i. | For QM (Safe Harbor or HPCT) designated loans, Consultant reviews the loan

to determine whether, based on available information in the loan file: (i) the loan contains risky loan features and terms (e.g. an interest

only feature or negative amortization), (ii) the “points and fees” exceed the applicable QM threshold, (iii) the monthly payment

was calculated appropriately. Consultant reviews to the applicable consider and verify requirements under the QM rule depending on whether

the QM was originated under the original general QM definition or the revised general QM definition effective March 1, 2021. |

| ii. | For each QM designated loan that satisfied the applicable requirements enumerated above, Consultant then determines whether the loan

is a Safe Harbor QM or Higher Priced QM by comparing the loan’s actual annual percentage rate, as recalculated, to the applicable

average prime offer rate plus a certain percentage. For QM designated loans originated under the revised general QM definition effective

March 1, 2021, Consultant also determines whether the loan exceeds the pricing thresholds for QM loans. |

b. Ability to Repay:

| i. | The ability to repay portion of the review for non-agency eligible loans

only will focus on the eight factors detailed in the ATR Rule as detailed below for non-agency eligible loans. The Consultant will review

the loan file to determine if the creditor verified and considered each of the eight factors utilizing reasonably reliable third-party

documentation at or before consummation. |

| 1. | Current or reasonably expected income or assets that the

consumer will rely on to repay the loan. |

| 2. | Current employment status |

| 3. | Monthly mortgage payment for subject loan using the introductory

or fully indexed rate, whichever is higher, and monthly, fully amortizing payments that are substantially equal. |

| 4. | Monthly payment on any simultaneous loans secured by the

subject property. |

| 5. | Monthly payments for property taxes and hazard/flood insurance

and certain other costs related to the property such as homeowner’s association fees or ground rent. |

| 6. | Debts, alimony, and child support obligations |

| 7. | Monthly debt-to-income ratio or residual income |

| ii. | For loans designated as agency eligible, Consultant will not review for compliance with the requirements of Appendix Q or General

Ability to Repay. |

| iii. | Consultant reviews loans to determine their conformity with the ATR/QM factors above and is not rendering an independent assessment

or analysis. Consultant’s review is based on information contained in the loan file at the time it is provided to Consultant, and

only reflects information as of that point in time and does not mean any regulator, judicial or agency will agree with the Consultant’s

conclusion. |

| a) | Regulatory

Compliance Disclaimer |

Please be advised that Consultant will not make a determination as to

whether loans complied with federal, state or local laws, constitutional provisions, regulations or ordinances that are not expressly

enumerated herein. There can be no assurance that the review uncovered all issues relating to the origination of the mortgage loans, their

compliance with applicable law and regulation and the original appraisals relating of the mortgaged properties or uncovered all relevant

factors that could affect the future performance of the mortgage loans. Furthermore, the findings reached by Consultant are dependent

upon its receiving complete and accurate data regarding the mortgage loans from loans originators and other third parties upon which Consultant

is relying in reaching such findings.

Please be further advised that Consultant does not employ personnel who

are licensed to practice law in various jurisdictions, and the findings set forth in the reports prepared by Consultant do not constitute

legal advice or opinions. They are recommendations or conclusions based on information provided to Consultant. All final decisions as

to whether to purchase or enter into a transaction related to any individual mortgage loan or the mortgage loans in the aggregate, any

investment strategy and any legal conclusions, including potential liability related to the purchase or other transaction involving any

such loans, shall be made solely by the Client, or other agreed upon party, that has engaged Consultant to prepare its reports pursuant

to its instructions and guidelines. Client, or other agreed upon party, acknowledges and agrees that the scoring models applied by Consultant

are designed to identify potential risk and the Client, or other agreed upon party, assumes sole responsibility for determining the suitability

of the information for its particular use.

| b) | Seasoning

And Certain Compliance Exceptions |

Pursuant to the applicable NRSRO criteria, Consultant graded certain compliance

exceptions as non-material based on seasoning of the mortgage loan. Certain mortgage loans were seasoned beyond the applicable period

under TILA in which affirmative claims could be brought by a consumer. The time period is not limited for claims, other than recession,

which are raised as a defense to foreclosure. Information contained in any Consultant reports related to the applicable statute of limitations

for certain claims may not be accurate or reflect the most recent controlling case law. Further, a particular court in a particular jurisdiction

may extend, not enforce or otherwise allow claims beyond the statute of limitations identified in the report based on certain factors,

including the facts and circumstances of an individual loan.

Additional Disclosures and Requirements:

Consultant will confirm compliance with current documentation and timing

requirements in effect at origination of the Mortgage Loan including:

| · | Servicing Transfer Disclosure (for applications prior to 10/03/2015): |

| o | Confirm the presence of the Servicing Transfer Disclosure form in file |

| o | Verify the Servicing Transfer Disclosure was provided to the borrower(s)

within three general business days of “Application” |

| · | Special Information Booklet (for applications prior to 10/03/2015)/ Home

Loan Tool Kit (for applications on or after 10/03/2015): |

| o | Confirm the presence of the Home Loan Tool Kit is in file for covered loans. |

| o | Confirm the Home Loan Tool Kit is provided within three general business

days of application |

| · | Affiliated Business Disclosure |

| o | Confirm the presence of the Affiliated Business Disclosure in file in the

event the lender has affiliated business arrangements |

| o | Confirm the Affiliated Business Disclosure provided within three general

business days of “Application” (Consultant reviews for this disclosure to be provided within three general business days,

as the lender will typically know at the time of application if borrower(s) will be referred to affiliates for provision of third-party

services) |

| o | Confirm the Affiliated Business Disclosure is executed. |

| · | Initial Escrow Disclosure Statement |

| o | Confirm the presence of the Initial Escrow Disclosure Statement in file |

| o | Confirm the Initial Escrow Disclosure Statement was provided at closing

or within 45 days after settlement |

Equal Credit Opportunity Act (Regulation B)

| · | Confirm the lender has provided the borrower a disclosure of the right to

receive a copy of appraisals within three (3) business days of application. This disclosure requirement may be met by disclosure on the

Loan Estimate pursuant to 12 CFR § 1026.27(m)(1). |

| · | Confirm that the lender has provided (delivered) copies of appraisals and

all other written valuations (as disclosed to the borrower on the HUD-1 and/or contained in the Mortgage Loan File) to the borrower at

least three (3) business days prior to consummation Opus uses the following test: Was appraisal/valuation documentation processed at least

6 days prior to account opening/ consummation date (3 day rule plus 3 days mailing time)? |

| · | For a borrower that has waived the 3-business day disclosure requirement,

confirm that the borrower has either (1) signed the waiver at least three (3) business days prior to consummation or (2) has signed an

acknowledgment that the waiver occurred at least three (3) business days prior to consummation. Additionally, confirm that the lender

has provided copies of appraisals and other written valuations at or prior to consummation. |

Fair Credit Report Act (Regulation V)

| · | Confirm that the lender has provided the borrower the risk-based pricing

notice (as required by 12 CFR § 1022.73) or credit score disclosure (as required by 12 CFR § 1022.74(d)), as applicable; (a)

If the lender has provided the risk-based pricing notice, confirm the disclosure was provided before consummation, but not earlier than

the approval decision was communicated to the consumer; and (b) If the lender has provided the credit score disclosure, confirm the disclosure

was provided before consummation. |

| · | Confirm that the lender has provided a copy of the disclosure of credit

score and the Notice to Home Loan Applicant (as required by 15 U.S.C. § 1681g) before consummation. |

High-Cost,

State & Local Anti-Predatory Regulations

In addition to federal thresholds, Consultant will review the anti-predatory

lending statutes in the following states and local municipalities, as applicable, as well as any additional applicable regulations implemented

during the Term of this SOW.

| · | Arkansas Home Loan Protection Act, Ark. Stat. Ann. § 23-53-101 et seq. |

| · | California Anti-Predatory Lending Statute, Cal. Fin. Code § 4970 et

seq. |

| · | California Higher-Priced Mortgage Loan Statute, Cal. Fin. Code §4995

et seq. |

| · | Colorado Consumer Equity Protection Act, Colo, Rev. Stat.

§ 5-3.5-101 et seq.. |

| · | Connecticut Abusive Home Loan Lending Practices Act, Conn. Stat. Ann. §36a-

746 et seq., as amended from time to time. |

| · | Connecticut Nonprime Home Loans Statute, Conn. Gen. Stat. §§ 36a-760

et seq. (as originally enacted and as amended by Senate Bill 949). |

| · | District of Columbia Home Loan Protection Act, D.C. Official Code §

26-1151.01 et seq., as implemented by 20 D.C. Municipal Reg § 2000.1 et seq. |

| · | Florida Fair Lending Act, Fla. Stat. Ann. § 494.0078 et seq. (for loans

closed before July 1, 2014). |

| · | Georgia Fair Lending Act, Ga. Stat. Ann.

§ 7-6A-1 et seq. (as originally enacted by House Bill 02-1361 and as modified by Senate Bill 03-53). |

| · | Idaho Residential Mortgage Practices Act, Idaho Code § 26-3101 et seq.

|

| · | Illinois High Risk Home Loan Regulations, 38 Ill. Admin. Code §345.10

et seq. |

| · | Illinois High Risk Home Loan Act, Public Act. 93-0561 (2003) codified at

815, ILCS §§ 137/5 et seq., and as amended by SB 1692 (2012), effective January 10, 2014. |

| · | Illinois Predatory Lending Database Program, Public Act 95-0691 (SB 1167).

|

| · | City of Chicago, Illinois, Anti-Predatory Lending Ordinance, Chicago Municipal

Code, §§ 2-32-440; 2-32-455; 2-92-325; 4-4-155; 8-4-325. |

| · | Cook County, Illinois, Anti-Predatory Lending Ordinance, Cook County Code

of Ordinances § 34-341. |

| · | Cook County, Illinois, Anti-Predatory Lending Pilot Program, Illinois House

Bill 4050 (2005). |

| · | Indiana Home Loan Practices Act, as amended by HB 1179 (2005), Ind. Code

§24-9-1 et seq. |

| · | Section 16a-3-308a of the Kansas Consumer Credit Code, Kan. Stat. Ann. §16a.101

et seq. |

| · | Kansas Consumer Credit Code |

| · | Kentucky Anti-Predatory Lending Statute, Ky. Rev. Stat. § 360.100 et

seq. |

| · | Maine, An Act to Enhance Consumer Protections in Relation to Certain Mortgages

(for loans closed prior to September 27, 2011), Me. Rev. Stat. Ann. Tit. 9-A, §§ 8-103(1); 8-206(8);8-206A, as amended by Legislative

Documents 1869 (2007), 2125 (2008) and 1439 (2009). |

| · | Maine Consumer Credit Code - Truth-in-Lending, (for loans closed on or after

September 27, 2011), Me. Rev. Stat. Ann. tit. 9-A, §§ 8-501 et seq., as amended from time to time. |

| · | Maryland Commercial Law, Md. Code Ann., Com. Law §§ 12-124.1;

12-127; 12- 409.1; 12-1029. |

| · | Maryland

Regulations for Higher Priced Mortgage Loans, as promulgated under the Maryland Mortgage Lender Law, Md. Code Ann., Fin. Instit. Code

§§ 11-501 et seq.; Md. Code Regs. §§ 09.03.06.01 et seq. |

| · | Massachusetts High-Cost Mortgage Regulations, 209 CMR Parts 32 and 40, as

amended from time to time. |

| · | Massachusetts Predatory Home Loan Practices Act, M.G.L. Chapter 183C, §§

1 et seq. |

| · | Massachusetts “Borrower’s Interest” Standard, M.G.L. Chapter

183, §28C. |

| · | Massachusetts Mortgage Lender and Broker Regulations, 940 CMR §800

(15-17). |

| · | Massachusetts Regulations for Higher Priced Mortgage Loans, 209 CMR §§

32.00 et.seq., as amended from time to time. |

| · | Massachusetts Subprime ARMs to First Time Homebuyers, M.G.L. Chapter 184,

§17B.5. |

| · | Michigan Consumer Mortgage Protection Act, Mich. Stat. Ann.

§ 445-1631 et seq. |

| · | Minnesota Mortgage Originator and Service Licensing Act, § 58.137 et

seq. (S.F. 2988 (2002)), as amended by House File 1004 (2007) and Senate File 988 (2007). |

| · | Nebraska Mortgage Bankers Registration and Licensing Act, Neb. Stat §

45-702 et seq. |

| · | Nevada Anti-Predatory Lending Law, Assembly Bill No. 284 (2003) and Amended

by Assembly Bill No. 440 (2007), codified as NRS § 598D.010 et seq. |

| · | New

Jersey Home Ownership Security Act of 2002, NJ Stat. Ann. § C:46:10B-22 et seq., as amended from time to time. |

| · | New Mexico Home Loan Protection Act, Senate Bill 449 (Regular Session 2003),

codified at NM Rev. Stat. § 58-21A-1 et seq. and as amended from time to time. |

| · | New York High-Cost Home Loan Regulations, 3 NYCCR Part 41 (2001). |

| · | New York High-Cost Home Loan Act, N.Y. Bank.

L. Ch. 626., as codified in NY Bank. Law § 6-l, and as implemented by 3 NYCCR Part 41 as amended from time to time. |

| · | New York Subprime Home Loans Statute, NY Bank. Law § 6-m. |

| · | North Carolina Anti-Predatory Lending Law, N.C. Gen. Stat. §§

24-1.1A to 24- 10.2 and North Carolina Amendments to Anti-Predatory Lending Law, N.C. Gen. Stat. §§ 24-9; 24-1.1(E)(a); 24-10.2(a),

as amended from time to time. |

| · | Ohio Anti-Predatory Lending Statute, HB 386 as amended by Senate Bill 185

(2006), and as codified in various sections of the Ohio Code. |

| · | Ohio Consumer Sales Practices Act, Ohio Rev. Code Ann.

§ 1345.01, as implemented

by Ohio Admin. Rules § 109 4-3-01 et seq. |

| · | City of Cleveland Heights, Ohio, Anti-Predatory Lending

Ordinance, Ordinance No.

72-2003 (PSH), Mun. Code §§ 757.01 et seq. |

| · | Summit County, Ohio, Anti-Predatory Lending Ordinance, Ordinance No. 2004-618,

Muni. Code §§ 201.01 et seq. |

| · | Oklahoma Anti-Predatory Lending Law, House Bill No. 1574 (2003), as codified

in various sections of Title 14A of the Oklahoma Consumer Credit Code. |

| · | Oklahoma

Higher-Priced Mortgage Loans Law, Okla. Admin. Code §§ 160:45-9-1 et seq. |

| · | Pennsylvania Consumer Equity Protection Act, 63 Pa. Cons. Stat. Ann. §

456.501 et seq. |

| · | Rhode Island Home

Loan Protection Act, R.I. Gen. L. 34-25.1-2 et seq, as implemented by Emergency Banking Regulation 3 (2006) and Final Banking

Regulation 3 (2007) and amended by Senate Bill 371 (2007). |

| · | City of Providence, Rhode Island, Anti-Predatory Lending Ordinance, Chapter

2006-33, Ordinance No. 245. |

| · | South Carolina High-Cost and Consumer Home Loans Act, S.C. Code § 37-23-10

et seq. |

| · | Tennessee Home Loan Protection Act, Tenn. H.R. 3597 (2006), as codified

at Tenn. Code Ann. §§ 45-20-101 et seq. |

| · | Texas High-Cost Home Loan Statute, Tx. Fin. Code Ann. § 343.201 et

seq. |

| · | Section 50(a)(6), Article XVI of the Texas Constitution |

| · | Section 50(f)(2), Article XVI of the Texas Constitution |

| · | Utah Residential Mortgage Practices Amendments, Utah Code Ann. § 61-2c-102

et seq. |

| · | Utah High-Cost Home Loan Act, Utah Code § 61-2d-101 et seq. |

| · | Vermont Interest Act, 9 V.S.A. § 104, implemented by Regulation B-98-2. |

| · | Virginia Mortgage Lender and Broker Act (for loans originated prior to July

1, 2003), Va. Code Ann. §§ 6.1-413; 6.1-422; 6.1-428. |

| · | Virginia Mortgage Lender and Broker Act (for loans originated on or after

July 1, 2003 to September 30, 2010, as amended), Va. Code Ann. §§ 6.1-411, 6.1-422.1, 6.1-425.1 and 6.1-425.2. |

| · | Virginia Mortgage Lender and Broker Act (for loans originated on or after

October 1, 2010), Va. Code Ann. §§ 6.2-1600 et seq., as amended from time to time. |

| · | Virginia Senate Bill 797 (2008), effective July 1, 2008 (uncodified). |

| · | Washington House Bill 2770, Mortgage Lending Ownership |

| · | West Virginia Residential Mortgage Lender, Broker and Servicer

Act, W.Va. Code § 31-17 et seq. |

| · | Wisconsin Responsible High-Cost Mortgage Lending Act, Wis. Stat. §

428.202, as implemented by Wis. Admin. Code DFI-Bkg 46.01 et seq. |

Flood Insurance Testing

National Flood Insurance Program (NFIP)

Each mortgage loan will be reviewed to ensure adherence to flood insurance

coverage requirements as outlined under the NFIP, including identification of flood zones and subsequent policy documentation for evidence

of adequate coverage amounts.

Homeowner’s Flood Affordability Act (HFIAA)

Each mortgage loan made by an FDIC-supervised institution or servicer

acting on its behalf shall require the escrow of all premiums and fess for flood insurance for any designated loan secured by residential

improved real estate or a mobile home, made, increased, extended or renewed on or after January 1, 2016.

Frequency – Payable with same frequency as payments designated for

the loans

Exceptions

| · | Loan is an extension of credit primarily for business, commercial or agricultural

purposes |

| · | Loan is in a subordinate position to a senior lien secured by the same residential

improved real estate or mobile for which the borrower has obtained flood insurance |

| · | Flood Insurance coverage for the residential real estate is provided by

a policy that |

| b. | Provided by a condominium association, cooperative or other applicable group and |

| c. | The premium for which is paid by the condominium associate, cooperative, homeowners association, or other group as a common expense. |

Misrepresentation

and Third-Party Review

Validate that fraud reports and independent third-party property valuations

reports are in the file. The review will consist of the following:

1) Misrepresentation Review and Valuation Review

Review on each loan to identify potential misrepresentations of income,

employment, identity, occupancy, transaction and appraisal misrepresentation or other areas of potential misrepresentation. The Misrepresentation

may include the following:

| · | Signatures: Validate signature consistency across documents. To the extent

imaged or hard copy files are provided, Consultant will utilize reasonable efforts to validate the consistency of signatures across documents. |

| · | Alerts: Assess credit report alerts for accuracy and potential issues. |

| · | Social Security Numbers: Compare SSN(s) across all file documents. |

| · | Document Integrity: Review for apparent alterations to loan documents. To

the extent imaged or hard copy files are provided, Consultant will utilize reasonable review of alterations to the loan documents. |

| · | Data Consistency: Review the documents contained in the loan file for consistency

of data. |

| · | Third Party Fraud Tools: To the extent a third party fraud tool is contained

in the loan file, the Consultant will ensure high level or critical warnings are reviewed and addressed.

|

Independent Third-Party Values

Review each loan to determine whether a third party valuation product

was required and if required, that the third party product value was compared to the original appraised value to identify a value variance

and apply the appropriate rating agency grade after reviewing the required valuation products. i) Consultant will perform the following

steps.

| · | Value is based on as-is condition or provides satisfactory completion of

all material conditions including inspections, licenses, and certifications (including certificates of occupancy) to be made or issued

with respect to all occupied portions of the mortgaged property and with respect to the use and occupancy of the same, have been made

or obtained from the appropriate authorities. |

| · | Property is described in average or better condition |

| · | No apparent appraiser independence violation statements |

| · | Appraisal addresses any adverse comments |

| · | Appraisal is completed on appropriate GSE Forms |

| · | Appraisal contains required attachments. |

| · | Appraiser was appropriately licensed at the time the appraisal was signed |

If the valuation vendor des not supply the updated valuation product directly

to the Consultant, the Client will authorize the valuation vendor to issue an attestation with sufficient information for the Consultant

to determine the correct valuation product was utilized to verify the accuracy of the origination appraisal.

Value Review Disclaimer

| · | The individuals performing the above procedures are not person providing

valuations for the purpose of the Uniform Standards of Professional Appraisal Practice (“USPAP”) or necessarily licensed as

appraiser under Federal or State law, and the services being performed do not constitute appraisal reviews for the purposes of USPAP or

Federal or State law. |

| · | Opus makes no representation or warranty as to the value of the mortgaged

property, notwithstanding that Opus may have reviewed the valuation information for reasonableness. |

| · | Opus is not an Appraisal Management Company (“AMC”) and therefore

does not opine on the actual value of the underlying property. |

| · | Opus is not a creditor within the meaning of the Equal Credit Opportunity

Act (“ECOA”) or other lending laws and regulations, and therefore Opus will not have and communications with or responsibility

to any individual concerning property valuations. |

Properties in FEMA declared disaster zones.

If a FEMA declared disaster occurs after the inspection date on the appraisal,

Consultant will review the file to determine if an exterior inspection to ensure:

| · | No apparent damage to the property |

| · | Property appears to be occupied |

Data

Compare

Client will provide a data tape with the following data fields and Consultant

will compare the field to the applicable source document and report any variance

| · | Second Mortgage Lien Amount |

Rating

Agency Grading Criteria

Fitch Ratings Grading Criteria

Grading shall be provided for each exception, each exception category

and holistically for each loan. The methodology for the application of the RMBS grading as defined by Fitch in their current industry

publications as updated from time to time.

Moody’s Investor Services Grading Criteria

Grading shall be provided for each exception, each exception category

and holistically for each loan. The methodology for the application of the RMBS grading as defined by Moody’s in their current industry

publications as updated from time to time.

Kroll Bond Rating Agency LLC Grading Criteria

Grading shall be provided for each exception, each exception category

and holistically for each loan. The methodology for the application of the RMBS grading as defined by Kroll in their current industry

publications as updated from time to time.

S&P Global Ratings Grading Criteria

Grading shall be provided for each exception, each exception category

and holistically for each loan. The methodology for the application of the RMBS grading as defined by Standard & Poor’s in their

current industry publications and updated from time to time.

DBRS Morningstar Grading Criteria

Grading shall be provided for each exception, each exception category

and holistically for each loan. The methodology for the application of the RMBS grading as defined by DBRS in their current industry publications

and updated from time to time.

Opus

Grading Criteria

1) Opus Grading Criteria

Grading shall be provided for each exception, each exception category

and holistically for each loan. The following grading is not intended for securitization reviews and Opus will not issue a Rating Agency

Narrative, Reliance or Form ABS Due Diligence 15E if Client elects to utilize the following grading criteria. The methodology for the

application of grading is defined by Opus and updated from time to time shall be determined as follows:

Opus Credit Grades

| · | Level 1 Credit Grade Definition: Loan was originated in accordance with

the mortgage loan originator underwriting guidelines without exception. |

| · | Level 2 Credit Grade Definition: Loan was originated in substantial compliance

with the originator's underwriting guidelines and there are sufficient compensating factors for any exceptions. |

| · | Level 3 Credit Grade Definition: Loan was not originated in substantial

compliance with the originator's underwriting guidelines and there are insufficient compensating factors for the exceptions or is missing

material documentation.

|

Opus Property Grades

| · | Level 1 Property Grade Definition: Property value appears to be within 10%

of original appraised amount and there are no material deficiencies in the appraisal process. |

| · | Level 2 Property Grade Definition: Property value appears to be within 10%

of original appraised amount, but minor issues in the appraisal process were identified. |

| · | Level 3 Property Grade Definition: Property value does not appear to fall

within 10% of the original appraised value and/or material deficiencies exist with respect to the appraisal process or the file is missing

material documentation.

|

Opus Compliance Grades

| · | Level 1 Compliance Grade Definition: Loan complies with all applicable laws

and regulations reviewed under the applicable scope of work. |

| · | Level 2 Compliance Grade Definition: There are minor issues regarding legal

and/or regulatory compliance but such issues do not represent risks to the enforceability of the borrower's obligation under the loan

documents and will not result in assignee liability to the investor. |

| · | Level 3 Compliance Grade Definition: Loan is not in compliance with laws

and regulations reviewed under the applicable scope of work or the loan is missing material documentation. |

REDACTED

INFORMATION

| · | Property Address, City, County, MSA, Zip |

| · | Account Number, including Originator and Servicer Loan Number |

| · | Names of Borrowers or any other Individuals |

| · | Company and Entity Names |

| · | Financial Institution Names |

| · | Any Location Information (other than state), including City, County, MSA

and Zip |

| · | Account Numbers of any type |

| · | Insurance Policy Numbers |

| · | Foreclosure Action dates and Case Numbers |

| · | Bankruptcy Action dates and Case Numbers |

| · | Any reference that would allow the identification of the location of a property

(e.g. neighborhood, body of water, schools, major highways) |

DSCR Loan Review

A re-underwriting review will be conducted in order to

verify that the requisite underwriting guidelines as specified by Client (the “Underwriting Guidelines”) are met.

Confirmation of the loan terms will be performed through recalculation and review of documentation contained in the loan file provided

to the Consultant. The Credit Qualification review guidelines will consist of the following:

Borrower Underwriting:

| · | Borrower Liquidity: Review and confirm borrower’s liquidity position adheres to Underwriting

Guidelines. |

| · | Credit / Background Check: Review and confirm each guarantor and/or owner of the borrowing entity

requirements meet Underwriting Guidelines, including OFAC. |

| · | Property management questionnaire: Review the questionnaire to confirm management experience

meets Underwriting Guidelines. |

| · | Borrowing Entity: Confirm the entity is in good standing and duly formed (if applicable documents

are in the file). Verify the individual signing on behalf of the organization has the authority to bind the entity (if applicable documents

are in the file). |

| · | Loan-to-Value (LTV)/Loan-to-Cost (LTC) Limits: Confirm the LTV/LTC meets Underwriting Guidelines

per Underwriting Guidelines. |

| · | Permitted Loan Terms: Confirm the loan terms are eligible per the Underwriting Guidelines. |

| · | Property Requirements and Market Requirements: Confirm the loan Property and Market Requirements

are eligible per the Underwriting Guidelines. |

| · | DSCR—ensure components of Debt Service Coverage Ratio are identified correctly: Recalculation

of DSCR |

Title Insurance Requirements are met per Guidelines only

as follows

Confirm Loss payee language must be present and required

insurance policies and coverage amounts meet the Underwriting Guidelines.

| · | Condominium Eligibility: Confirm Condo Master Policy is present and meets the Underwriting Guidelines

|

| · | Property Insurance: Confirm each mortgaged property has a policy in place and proper coverage

amount in adherence to the Underwriting Guidelines. |

| · | Preliminary/Commitment Title: Review and confirm first lien holder position, validate no loan

file discrepancies, delinquent taxes, and/or additional liens at time of consummation. |

Credit

Document Check

| · | Loan Application: Verify the presence and completeness of both the initial and final loan applications.

|

| · | Credit Report: Verify the presence of a credit report for each borrower. Confirm that the credit report

was pulled within the timing requirements allowable per the Client provided underwriting guidelines. |

| · | Housing Payment History: In the absence of housing payment histories on

the borrower(s) credit report(s), verify that that the file contains a verification of rent or a verification of mortgage form. |

| · | Letters of Explanation: When Letters of Explanation are required by the Client provided underwriting

guidelines, verify the presence of any such letters exist in the loan file. |

| · | Gift Letters: When Gift Letters are required by the Client provided underwriting guidelines, verify

the presence of any such letters exist in the loan file. |

| · | Asset Documentation: Verify the presence of asset documentation required by the Client provided underwriting

guidelines in the loan file. |

| · | Property Valuation Tools: Verify that each loan file contains adequate appraisal and other third party

valuation tools to satisfy the minimum required documentation under the relative Client provided underwriting guidelines. |

| · | Proof of Insurance: Verify the presence of insurance certificates for mortgage, hazard and flood insurance

on an as needed basis depending upon the specifics of the loan. Confirm that adequate coverage is present to meet the requirements of

the Client provided underwriting guidelines. |

Compliance

| · | No compliance testing for the DSCR review. |

EXHIBIT B - Opus

The Consultant shall obtain all necessary loan files, reports, guidelines,

data tapes, and narratives that were reviewed or produced by the original due diligence vendor. Prior to commencing the Quality Control

(QC) review, the Consultant shall perform a comprehensive review of the applicable underwriting guidelines and the original scope of work.

A QC Review shall be conducted to verify the accuracy of the final report

and narrative documents produced by the original due diligence vendor. The QC Review shall encompass the following components:

| k) | Scope Review: The Consultant shall review the original scope of review details to confirm that all applicable requirements

were contemplated and performed in the original review. |

| l) | Guidelines: The Consultant shall review applicable guidelines and perform a data analysis of the final reports to confirm the

completeness and validity of the report content. |

| m) | Findings Review: The Consultant shall conduct a comprehensive review of all loans identified with exceptions in the final

report. This review shall include verification that all required trailing documents are present within the respective loan files. Additionally,

the Consultant shall confirm that all documentation used to resolve previously identified conditions is valid and sufficient to address

the original exception. In instances where trailing documents are unavailable, the Consultant shall analyze the report commentary to ensure

that adequate explanatory notes are included, detailing how the exception was otherwise resolved. |

| n) | Compliance QC Review: The Consultant shall review all calculated Annual Percentage Rates (APRs) and conduct comprehensive compliance

testing on any loan for which the APR exceeds the applicable state usury limit. Additionally, the Consultant shall compare five percent

(5%) of the original loan amount to the amount reported as “Points and Fees (Regulation Z).” For any loan in which the reported

“Points and Fees” exceed this 5% threshold, the Consultant shall perform a full compliance review to ensure adherence to applicable

regulatory requirements. |

| o) | Tax and Title Review: The Consultant will perform a title review and perform the following procedures: |

| a. | Review updated title report (One Owner O&E report) to identify judgments / liens / encumbrances (pre and post origination) which

would impact the lien position of the subject mortgage. |

| b. | Confirm subject mortgage is recorded. |

| c. | Review Schedule B: Ensure any liens recorded prior to the mortgage recordation date are listed to exceptions on the final title policy. |

| d. | Super lien Homeowners’ Association (HOA) liens. |

| e. | For the purpose of the review the following states are subject to HOA super liens |

| f. | AL, AK, CO, CT, DC, DE, FL, HI, IL, MA, MD, MN, MO, NV, NH, NJ, OR, PA, RI, TN, VA, VT, WA and WV. |

| p) | Value Review: The Consultant shall review the final value report to verify that all required secondary values are included

and that each meets the minimum threshold of ten percent (10%). The Consultant shall also confirm that the valuation process adheres to

the prescribed value hierarchy (value waterfall) as set forth in applicable guidelines and meet securitization standards. |

| q) | Securitization Preparation: The Consultant shall create and provide all required securitization

documents, including securitization reporting, reliance letters, narrative summaries, attestations, and a 15-E disclosure, as applicable. |

Document Review

A review of each loan file will be performed to confirm the presence of

material documentation as applicable to the specifics of the loan transaction. The Document Review will consist of the following:

a) Collateral Docs

| · | Title Commitment / Policy: Verify the presence of the title commitment or

final title policy. Confirm vested parties and the description of the property, liens and tax assessments. |

| · | Mortgage Note / Security Instrument: Verify the presence of the mortgage

note, security instrument, or equivalent per Costa Rica recording requirements. Confirm that the document has been executed by all borrowers

and that all riders, addendums and endorsement are present and duly executed. |

| · | Mortgage / Deed of Trust: Verify the presence of a copy Mortgage, Deed of

Trust, or Transfer Deed. Confirm that the documents have been executed by all required parties and that all riders, addendums and exhibits

are present and duly executed. |

| · | e Deed: Verify as applicable that a proper conveyance deed is present in

the loan file. Confirm the proper transfer of ownership interest of the subject parties is detailed on the deed. |

b) Closing Docs

| · | Final Hud-1 Settlement Statement or Closing Disclosure: If required, verify

the presence of a final HUD-1 / Closing Disclosure. Verify the completeness of required data and signatures or certification depending

upon state compliance requirements. |

| · | Final Truth-in-Lending Disclosure: Not Applicable |

| · | Notice of Right to Cancel: Not Applicable |

| · | Loan Estimate: If required verify the presence of the current Loan Estimate

(LE) at the time of origination |

| · | Closing

Disclosure: If required verify the presence of the current Closing Disclosure (CD) at the time of origination. |

c) Credit Docs

| · | Loan Application: Verify the presence and completeness of both the initial

and final loan applications. |

| · | Underwriting Worksheet: Verify the presence of the relative underwriting

worksheet i.e. form 1008, FHA MCAW and VA’s Loan Analysis. |

| · | Credit Report: Verify the presence of a credit report for each borrower.

Confirm that the credit report was pulled within the timing requirements allowable per the Client provided underwriting guidelines. |

| · | Housing Payment History: In the absence of housing payment histories on

the borrower(s) credit report(s), verify that that the file contains a verification of rent or a verification of mortgage form. |

| · | Letters of Explanation: When Letters of Explanation are required by the

Client provided underwriting guidelines, verify the presence of any such letters exist in the loan file. |

| · | Gift Letters: When Gift Letters are required by the Client provided underwriting

guidelines, verify the presence of any such letters exist in the loan file. |

| · | Income Documentation: Verify the presence of income and employment related

documentation required by the Client provided underwriting guidelines for all borrowing parties contributing income to the debt ratio

calculation. |

| · | Asset Documentation: Verify the presence of asset documentation required

by the Client provided underwriting guidelines in the loan file. |

| · | Property Valuation Tools: Verify that each loan file contains adequate appraisal

and other third-party valuation tools to satisfy the minimum required documentation under the relative Client provided underwriting guidelines. |

| · | Proof of Insurance: Verify the presence of insurance certificates for mortgage,

hazard and flood insurance on an as needed basis depending upon the specifics of the loan. Confirm that adequate coverage is present to

meet the requirements of the Client provided underwriting guidelines. |

Not applicable as loans do not meet US regulatory compliance requirements

as originated outside of the United States.

| 1. | The

“material”2 disclosure requirements of the federal Truth-in-Lending

Act (“TILA”), as amended by the Home Ownership and Equity Protection Act (“HOEPA”)

and Dodd-Frank, 15 U.S.C. § 1601 et seq. and implemented by Regulation Z, 12

C.F.R. Part 1026, including the material provisions relating to Higher-Priced Mortgage Loans

in Regulation Z, 12 C.F.R. §§ 1026.35, and the early TIL disclosure provisions

of the Mortgage Disclosure Improvement Act (“MDIA”), as implemented by Regulation

Z, 12 C.F.R. §§ 1026.17 et seq; and as amended by the TILA-RESPA Integrated Disclosure

(“TRID”) Rule, as set forth below: |

| a. | For Right of Rescission |

| i. | A review of the Notice of Right to Cancel, including a verification of the

transaction date and expiration date, ensuring proper execution of the Notice of Right to Cancel by all required parties, verifying the

disbursement date and determining if a full three (3) day rescission period was adequately provided to the borrower(s). |

| A. | This review is also to be performed on transactions that are exempt from

the rescission requirement but on which a Notice of Right to Cancel was provided. |

| B. | A condition must be placed if the transaction is a refinance by the original

creditor and the borrower was provided the Form H-8 rescission notice. Consultant will note in the condition whether there was a new advance

that is subject to rescission per TILA/Regulation Z. |

| b. | For TILs (Application Dates prior to 10/3/2015) |

| i. | Confirm the initial TIL disclosure and final TIL disclosures were provided.

|

| ii. | Review

and compare the initial and final TIL, and any re-disclosed TIL(s), with a report outlining any TILA violations, including a recalculation

of disclosed finance charge, proper execution by all required parties, principal and interest calculations, proper completion of the

interest rate and payment summary, recalculation of disclosed APR, and a review to determine disclosure differences were within the allowed

tolerances and disclosures were provided within the required timeframes; |

| c. | For TRID Disclosures (Application Dates on or after 10/3/2015) |

| i. | Confirm

the initial Loan Estimate (LE) was delivered within three (3) business days of application and seven (7) business days prior to consummation

in accordance with Client’s Underwriting Guidelines; |

| ii. | Review

the required sections of each LE to ensure they were populated in accordance with the TRID

Rules. (If the file reflects more than one LE was provided, each revised LE must have corresponding

Change of Circumstance documentation. The 0% and 10% fee tolerance evaluations will be based

on the fee amounts disclosed on the initial LE and any valid changes documented and disclosed

after the initial LE; |

| iii. | Confirm the Closing Disclosure (CD) confirm the borrower received

the initial CD at least three (3) business days prior to consummation; |

| iv. | Review the required sections of each CD to ensure they were populated in

accordance with the TRID Rules. (Any fee tolerance issues to be cured at closing or within 60 days of loan consummation.) |

2 These “material” disclosures include the required

disclosures of the APR, the finance charge, the amount financed, the total number of payments, the payment schedule, and if the

loan is subject to the Homeownership and Equity Protection Act (“HOEPA”), the disclosure requirements and prohibitions of

that statute which are set forth in 12 C.F.R. §§ 1026.32(c) and (d).

| 2. | Section 4 of the Real Estate Settlement Procedures Act

(“RESPA”), 12 U.S.C. §2603 and 2604, as implemented by Regulation X, 12 C.F.R. Part 1024, and as amended by the TRID

Rule. |

| 3. | The disclosure requirements and prohibitions of Section

50(a)(6), Article XVI of the Texas Constitution. |

| 4. | Confirmation that one of the following is in the loan file,

per the Fair Credit Reporting Act: Consumer Credit Score Disclosure, Your Credit Score and the Price You Pay for Credit or Notice to Home

Loan Applicant. |

| 5. | Sections 1411 and 1412 of the Dodd-Frank Wall Street Reform

and Consumer Protection Act (“Dodd-Frank”) amending TILA, as implemented by Regulation Z, 12 C.F.R. 1026.43: the general Ability

to Repay underwriting standards (12 C.F.R. 1026.43(c)); refinancing of non-standard mortgages (12 C.F.R. 1026.43(d)); Qualified Mortgages

(12 C.F.R. 1026.43(e) (including qualified mortgages as defined by the Department of Housing and Urban Development (24 C.F.R. 201 and

203 et seq.) and the Department of Veterans Affairs (38 C.F.R. Part 36 et seq.; and Balloon-payment qualified mortgages made by certain

creditors (12 C.F.R. 1026.43(f)) In accordance with “Ability to Repay and Qualified Mortgage Review” description below; |

| 6. | The Loan Originator Compensation and Prohibitions on Steering

provisions of TILA, as implemented by Regulation Z, 12 C.F.R 1026.36; |

| 7. | The requirements for Higher-Price Mortgage Loans, as implemented

by Regulation Z, 12 C.F.R. 1026.35;

|

| 8. | The appraisal and valuation requirements of TILA and the

Equal Credit Opportunity Act, as implemented by Regulation Z, 12 C.F.R. 1026.35 and Regulation B, 12 C.F.R. 1002.14, respectively; |

| 9. | The counseling requirements of TILA, as implemented by

Regulation Z, 12 C.F.R. 1026.36(k) and RESPA, as implemented by Regulation X, 12 C.F.R. 1024.20; |

| 10. | The escrow requirements of TILA and RESPA, as implemented

by Regulation Z, 12 C.F.R 1026.35, and Regulation X, 12 C.F.R 1024.17, respectively; |

| 11. | The disclosure requirements and prohibitions of any applicable

state, county and municipal laws and ordinances, as amended, that have been enacted to regulate so-called “predatory lending”: |

| 12. | Consultant shall confirm that any mortgage property located

in an area identified on a flood hazard map or flood insurance rate map issued by the Federal Emergency Management Agency as having special

flood hazards is subject to a qualified flood insurance policy that appears to be is in effect. |

| 13. | For any loans designated as TILA exemption, Consultant

shall review the loan file for evidence that the primary purpose of the loan was for commercial or business purposes, including, but not

limited to a business purpose certification. |

| 14. | Documentation. Review of the following documents for regulatory

compliance: |

| a. | Final HUD-1 Settlement Statement (“HUD-1”),

if applicable |

| i. | If the loan is in an escrow state, the HUD-1 will be considered

final as follows: |

| i. | If HUD-1 is not marked Final, it must be stamped certified

by the closing agent. |

| ii. | There should be no markings indicating that the HUD-1 is

estimated. |

| B. | HUD-1 is signed by all parties (including closing agent)

or stamped certified by the closing agent; and |

| C. | If HUD-1 is stamped, the HUD-1 / stamp should be signed

or initialed by the closing agent; if the stamp does not contain the signature or initials, it must identify the name of the closing agent. |

| b. | Final Truth in Lending Disclosure (“TIL”),

if applicable |

| c. | Loan Estimate, if applicable |

| i. | The Loan Estimate in will be considered delivered based

on the date issued, subject to the three-day mailing rule unless the file contains documentation indicating earlier receipt. The loan

file may contain one or more Loan Estimates with the latest one provided up until three business days prior to the issuance of an initial

Closing Disclosure. |

| d. | Closing Disclosure, if applicable |

| i. | The Closing Disclosure in the loan file will be considered

delivered based on the date issued, subject to the three-day mailing rule unless the file contains documentation indicating earlier receipt.

The loan file may contain one or more Closing Disclosures with the latest one provided up until the consummation date being considered

the Final with any delivered post consummation considered as a corrected Closing Disclosure. |

| e. | Notice of Right to Cancel (if applicable) |

| f. | Initial TIL, if applicable |

| g. | Good Faith Estimate (“GFE”), if applicable

|

| i. | Third party fees on the HUD-1 or Closing Disclosure, if

applicable referred to as HUD-1/Closing Disclosure, must be shown as paid to the third-party provider. A condition must be set if a third-party

fee is paid to the lender, investor, etc. or the payee is blank. |

| ii. | CONSULTANT will condition for evidence in the file indicating

that a charge on the HUD-1/Closing Disclosure exceeds the actual cost to the borrower (i.e. cost printed / stamped on the face of the

document showing an amount less than the charge on the HUD-1/Closing Disclosure). Variations of less than $1 are deemed to be within reasonable

limits and are not to be reported. |

| iii. | Any refunds that are provided to the borrower must be accompanied

by a revised HUD-1/Closing Disclosure to show the final, accurate charges to the borrower. |

Each loan reviewed will be assigned a Compliance condition grade in accordance

with the Rating Agency Criteria as more fully described in Section 2(f).

Consultant will not make a determination as to whether the loans comply

with federal, state or local laws, constitutional provisions, regulations or ordinances that are not expressly enumerated above. Furthermore,

the findings reached by Consultant are dependent upon its receipt of complete and accurate data regarding the loans from loan originators

and other third parties upon which Consultant is relying in reaching such findings.

Ability to Repay and Qualified Mortgage Review

| 1. | For Agency Eligible Loans Only: Consultant

reviews applicable loans for compliance with the Qualified Mortgage (QM) rule requirements set forth in Regulation Z (12 C.F.R. 1026.43

et seq.) based upon the loan’s designation (Safe Harbor QM, Rebuttable Presumption QM, Exempt). Consultant determines the loan’s

status under the QM rule requirements and assigns a due diligence loan designation. Consultant notes as a material exception if the due

diligence findings do not confirm the same loan designation. Additionally, Consultant notes if a loan designation was not provided. Consultant

will verify if each loan meets the requirements for a QM under § 1026.43(e)(2)—whether the loan is a safe harbor QM under §

1026.43(e)(1)(i) or a rebuttable presumption QM under § 1026.43(e)(1)(ii). Consultant will verify the presence of documentation for

lender determination of QM and indicating factors in its ability-to-repay determination, including how the originator applied its policies

and procedures in verification. For loans applications taken on or after June 1, 2021, Consultant will verify whether the loan meets the

requirements of the revised general QM definition effective March 1, 2021. |

| 2. | For loans for which applications were received prior to

July 1, 2021, if a loan was designated as QM and identified as eligible for guarantee, purchase, or insurance by an applicable agency

as permitted under the QM final rule, Consultant reviews the loan to determine whether, based on available information in the loan file

the loan satisfied (i), (ii) and (iii) in the paragraph (3)(a)(i) below and reviews the Automated Underwriting System output within the

file to confirm agency eligibility. |

| 3. | For Non-Agency Eligible Loans: Consultant reviews applicable loans for compliance with the Ability to Repay (ATR) but

not Qualified Mortgage (QM) rule requirements set forth in Regulation Z (12 C.F.R. 1026.43 et seq.). |

a. Qualified Mortgage:

| i. | For QM (Safe Harbor or HPCT) designated loans, Consultant reviews the loan

to determine whether, based on available information in the loan file: (i) the loan contains risky loan features and terms (e.g. an interest

only feature or negative amortization), (ii) the “points and fees” exceed the applicable QM threshold, (iii) the monthly payment

was calculated appropriately. Consultant reviews to the applicable consider and verify requirements under the QM rule depending on whether

the QM was originated under the original general QM definition or the revised general QM definition effective March 1, 2021. |

| ii. | For each QM designated loan that satisfied the applicable requirements enumerated above, Consultant then determines whether the loan

is a Safe Harbor QM or Higher Priced QM by comparing the loan’s actual annual percentage rate, as recalculated, to the applicable

average prime offer rate plus a certain percentage. For QM designated loans originated under the revised general QM definition effective

March 1, 2021, Consultant also determines whether the loan exceeds the pricing thresholds for QM loans. |

b. Ability to Repay:

| i. | The ability to repay portion of the review for non-agency eligible loans

only will focus on the eight factors detailed in the ATR Rule as detailed below for non-agency eligible loans. The Consultant will review

the loan file to determine if the creditor verified and considered each of the eight factors utilizing reasonably reliable third-party

documentation at or before consummation. |

| 1. | Current or reasonably expected income or assets that the

consumer will rely on to repay the loan. |

| 2. | Current employment status |

| 3. | Monthly mortgage payment for subject loan using the introductory

or fully indexed rate, whichever is higher, and monthly, fully amortizing payments that are substantially equal. |

| 4. | Monthly payment on any simultaneous loans secured by the

subject property. |

| 5. | Monthly payments for property taxes and hazard/flood insurance

and certain other costs related to the property such as homeowner’s association fees or ground rent. |

| 6. | Debts, alimony, and child support obligations |

| 7. | Monthly debt-to-income ratio or residual income |

| ii. | For loans designated as agency eligible, Consultant will not review for compliance with the requirements of Appendix Q or General

Ability to Repay. |

| iii. | Consultant reviews loans to determine their conformity with the ATR/QM factors above and is not rendering an independent assessment

or analysis. Consultant’s review is based on information contained in the loan file at the time it is provided to Consultant and

only reflects information as of that point in time and does not mean any regulator, judicial or agency will agree with the Consultant’s

conclusion. |

| a) | Regulatory Compliance Disclaimer

|

Please be advised that Consultant will not make a determination as to

whether loans complied with federal, state or local laws, constitutional provisions, regulations or ordinances that are not expressly

enumerated herein. There can be no assurance that the review uncovered all issues relating to the origination of the mortgage loans, their

compliance with applicable law and regulation and the original appraisals relating of the mortgaged properties or uncovered all relevant

factors that could affect the future performance of the mortgage loans. Furthermore, the findings reached by Consultant are dependent

upon its receiving complete and accurate data regarding the mortgage loans from loans originators and other third parties upon which Consultant

is relying in reaching such findings.

Please be further advised that Consultant does not employ personnel who

are licensed to practice law in various jurisdictions, and the findings set forth in the reports prepared by Consultant do not constitute

legal advice or opinions. They are recommendations or conclusions based on information provided to Consultant. All final decisions as

to whether to purchase or enter into a transaction related to any individual mortgage loan or the mortgage loans in the aggregate, any