Please wait

| | | | | | | | |

| 228 Santa Monica Boulevard | 310.434.5400 |

| Suite 300 | Fenwick.com |

| Santa Monica, CA 90401 | |

| | |

| Ran D. Ben-Tzur | |

| rbentzur@fenwick.com | 650.335.7613 | |

| | |

| CERTAIN PORTIONS OF THIS LETTER AS FILED VIA EDGAR HAVE BEEN OMITTED AND SUBMITTED SEPARATELY TO THE SECURITIES AND EXCHANGE COMMISSION. CONFIDENTIAL TREATMENT HAS BEEN REQUESTED FOR THE OMITTED PORTIONS, WHICH HAVE BEEN REPLACED WITH THE FOLLOWING PLACEHOLDER: “[*].” |

October 21, 2021

VIA EDGAR AND OVERNIGHT DELIVERY

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

| | | | | |

| Attention: | Amanda Kim, Staff Accountant |

| Stephen Krikorian, Accounting Branch Chief |

| Edwin Kim, Staff Attorney |

| Larry Spirgel, Office Chief |

| | | | | |

| Re: | UserTesting, Inc. |

| Registration Statement on Form S-1 |

| File No. 333-260224 |

Ladies and Gentlemen:

On behalf of UserTesting, Inc. (the “Company”), and in connection with the above-referenced Registration Statement on Form S-1 originally confidentially submitted by the Company with the Securities and Exchange Commission (the “Commission”) on June 14, 2021 (in the form subsequently publicly filed by the Company with the Commission on October 13, 2021, the “Registration Statement”), we submit this letter to the staff of the Commission (the “Staff”) in response to the Staff’s comment 6 in its letter dated July 14, 2021, requesting an explanation of the differences between the fair values of the Company’s common stock (“Common Stock”) on each grant date, including the difference between the most recent grant date fair value and the midpoint of the Preliminary Price Range (as defined below), for equity awards granted by the Company since January 1, 2021.

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 1

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 2

Confidential Treatment Request

Because of the commercially sensitive nature of information contained herein, this submission is accompanied by the Company’s request for confidential treatment of selected portions of this letter pursuant to Rule 83 of the Commission’s Rules on Information and Requests, 17 C.F.R. § 200.83 and the Freedom of Information Act.

Preliminary IPO Price Range

We advise the Staff that the Company currently anticipates that it will include a price range in its preliminary prospectus for the proposed offering that will be between $[*] and $[*] per share (the “Preliminary Price Range”), with an estimated midpoint of $[*] per share (the “Midpoint”).

The Preliminary Price Range has been determined based, in part, upon current market conditions and input received from the lead underwriters on the proposed initial public offering (the “Offering”) on October 11, 2021 among the Company’s Board of Directors (the “Board”), senior management of the Company and representatives of Morgan Stanley & Co. LLC and J.P. Morgan Securities LLC, the lead underwriters of the Offering. Prior to October 11, 2021, the Board and senior management of the Company had not together held formal discussions with the underwriters regarding a price range for the Offering. The Preliminary Price Range does not take into account the current lack of liquidity for the Common Stock and assumes a successful Offering in [*], with no weighting attributed to any other outcome for the Company’s business, such as remaining a privately held company or being sold to a third party.

The Company also notes that it will set forth a bona fide offering price range in a pre-effective amendment to the Registration Statement (the “Bona Fide Price Range”) prior to the distribution of any preliminary prospectus, but the parameters of the Bona Fide Price Range will be subject to then-current market conditions, continuing discussions with the underwriters, as well as further business and market developments affecting the Company. The spread within the Bona Fide Price Range will be no more than 20%. The Company expects to include the Bona Fide Price Range in a pre-effective amendment to the Registration Statement that would shortly precede the commencement of the Company’s public marketing process, which it anticipates could commence as soon as [*].

Fair Value Determinations

Given the absence of an active market for the Common Stock, the Board was required to estimate the fair value of the Common Stock at the time of each stock option, restricted stock unit (“RSU”) and restricted stock award (“RSA”) grant based upon several factors, including the Board’s consideration of input from management including independent third-party valuations.

The Company supplementally advises the Staff that, as described on pages 88 through 90 of the Registration Statement, the Board has considered a variety of factors in determining the fair value of the Common Stock for purposes of granting stock options and RSUs to date.

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 2

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 3

In valuing the Common Stock, the Board determined the equity value of the Company’s business, or enterprise value, using either the income approach or a combination of the market and income approaches with input from management. The income approach estimates the fair value of a company based on the present value of the company’s future estimated cash flows and the residual value of the company beyond the forecast period. These future cash flows, including the cash flows beyond the forecast period for the residual value, are discounted to their present values using an appropriate discount rate, to reflect the risks inherent in the company achieving these estimated cash flows. The market approach estimates value based on a comparison of the subject company to comparable public companies in a similar line of business. From the comparable companies, a representative market value multiple is determined and then applied to the subject company’s financial results to estimate the value of the subject company.

Prior to September 30, 2020, the resulting equity value was then allocated to each class of stock using the option pricing method (“OPM”). The OPM treats common stock and convertible preferred stock as call options on an equity value, with exercise prices based on the liquidation preference of the convertible preferred stock. The Common Stock is modeled as a call option with a claim on the equity value at an exercise price equal to the remaining value immediately after the convertible preferred stock is liquidated. The Company believed that use of the OPM for valuations prior to September 30, 2020 was appropriate because the range of possible future outcomes was difficult to predict and highly speculative. In September 2020, the Company commenced early preparations for the Offering, which the Company intended to effectuate by December 31, 2021, and selected lead underwriters and held an organizational meeting for the Offering in early April 2021. Accordingly, for valuations as of and subsequent to September 30, 2020, the Company used a hybrid method utilizing a combination of the OPM and the probability-weighted expected return method (“PWERM”), which includes a probability-weighted analysis of varying values for the Common Stock assuming possible future events for the Company, including scenarios of completing the Offering, completing an acquisition, and remaining a private company.

Under both the OPM and the PWERM, after the equity value was determined and allocated to the various classes of shares, a discount for lack of marketability (“DLOM”) was applied to arrive at the fair value of the Common Stock on a non-marketable basis. A DLOM is applied based on the theory that as an owner of a private company stock, the stockholder has limited information and opportunities to sell this stock. A market participant that would purchase this stock would recognize this risk and thereby require a higher rate of return, which would reduce the overall fair market value.

The Company’s assessments of the fair value of the Common Stock for grant dates were based in part on the current available financial and operational information and the Common Stock value provided in the most recent valuation as compared to the timing of each grant. For financial reporting purposes, the Company considered the amount of time between the valuation date and the grant date to determine whether to use the latest Common Stock valuation or a straight-line interpolation between the two valuation dates. This determination included an evaluation of whether the subsequent valuation indicated that any significant change in valuation had occurred between the previous valuation and the grant date.

Subsequent to June 30, 2021, the Company determined the fair value of the Common Stock in relation to stock-based compensation awards by a linear interpolation between the June 2021 Valuation (as

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 3

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 4

defined below) and the Midpoint. The Company believes that the linear interpolation methodology provides a reasonable basis for the valuation of its Common Stock for financial reporting purposes as the Company did not identify any single event that occurred subsequent to the June 2021 Valuation Report that would have caused a material change in the fair value of the Common Stock.

Equity Grants

A summary of the Company’s stock option grants and the associated valuations from January 1, 2021 through the date of this letter are below:

| | | | | | | | | | | | | | | | | |

Grant Date | Number of Shares Subject to Stock Options Granted | Exercise Price per Share | Fair Market Value Reflected in Third-Party Valuation Report | Common Stock Fair Value Per Share Used for Financial Reporting Purposes* | Valuation Report Date |

March 10, 2021 | 583,200 | $3.39 | $3.39 | $3.88 | December 31, 2020 |

May 11, 2021 | 2,575,032 | $4.03 | $4.03 | $4.36 | March 31, 2021 |

August 11, 2021 | 636,100 | $4.76 | $4.76 | $[*] | June 30, 2021 |

September 21, 2021 | 333,700 | $4.76 | $4.76 | $[*] | June 30, 2021 |

Total | 4,128,032 | | | | |

*For additional detail on the Company’s interpolated share price for purposes of determining its stock-based compensation expenses, see “Summary of Valuations” below.

A summary of the Company’s RSU grants and the associated valuations from January 1, 2021 through the date of this letter are below:

| | | | | | | | | | | | | | |

Grant Date | Number of Shares Subject to RSUs Granted | Fair Market Value Reflected in Third-Party Valuation Report | Common Stock Fair Value Per Share Used for Financial Reporting Purposes* |

Valuation Report Date |

September 22, 2021 | 2,146,000 | $4.76 | $[*] | June 30, 2021 |

September 27, 2021 | 10,000 | $4.76 | $[*] | June 30, 2021 |

Total | 2,156,000 | | | |

*For additional detail on the Company’s interpolated share price for purposes of determining its stock-based compensation expenses, see “Summary of Valuations” below.

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 4

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 5

A summary of the Company’s RSA grants and the associated valuations from January 1, 2021 through the date of this letter are below:

| | | | | | | | | | | | | | |

Grant Date | Number of Shares Subject to RSAs Granted | Fair Market Value Reflected in Third-Party Valuation Report | Common Stock Fair Value Per Share Used for Financial Reporting Purposes* |

Valuation Report Date |

May 11, 2021 | 9,434 | $4.03 | $4.36 | March 31, 2021 |

*For additional detail on the Company’s interpolated share price for purposes of determining its stock-based compensation expenses, see “Summary of Valuations” below.

No single event caused the valuation of the Common Stock to fluctuate. Instead, a combination of Company-specific factors and external market factors described below led to the changes in the fair value. For example, total revenue grew from $46.5 million for the six months ended June 30, 2020 to $66.3 million for the six months ended June 30, 2021, representing period-over-period growth of 43%, and the Company expects to continue to grow its business in future periods. In addition, the Dow Jones index, S&P 500, and Nasdaq composite index increased by approximately 33%, 32%, and 44%, respectively, between June 30, 2020 and September 30, 2021, which had a positive impact on the Company’s fair value determinations during that period.

Summary of Valuations

December 2020 Valuation

The fair value determination for the stock options granted on March 10, 2021 was based in part upon a valuation provided by an independent third-party valuation firm as of December 31, 2020 (the “December 2020 Valuation”). The Company utilized this valuation as the starting point from which the share price of its Common Stock was interpolated through March 31, 2021.

The Company relied upon the PWERM methodology in determining the value of the Common Stock. This approach involves the estimation of future potential outcomes for the Company, as well as values and probabilities associated with each respective potential outcome. The Common Stock per share value determined using this approach is ultimately based upon probability-weighted per share values resulting from the various future scenarios, which can include an initial public offering, merger or sale, dissolution, or continued operation as a private company.

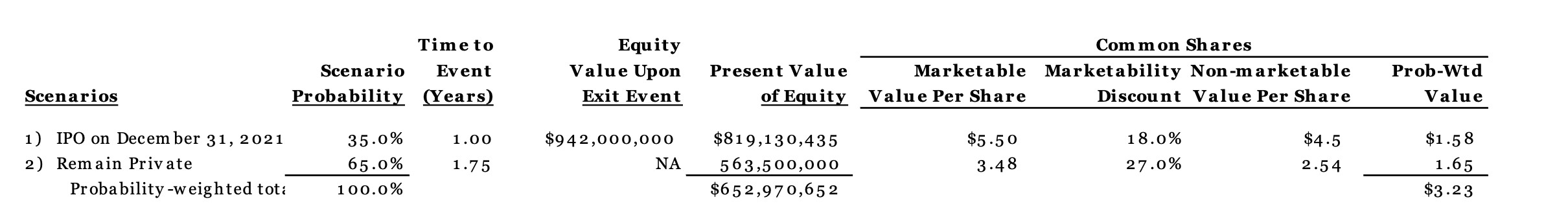

For the analysis the following scenarios to value the Common Stock were utilized:

•Scenario #1 – IPO on December 31, 2021: Company management estimated a 35.0% probability associated with the Offering on December 31, 2021. The estimated exit value was determined to be $942.0 million based on guideline company revenue multiple indications. As of the date of the December 2020 Valuation, the Company had not selected underwriters, had only begun its process

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 5

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 6

towards completing its first PCAOB audit, and had not effectuated a reincorporation from California to Delaware. Accordingly, there was significant uncertainty regarding the initial public offering scenario.

•Scenario #2 – Remain Private: Under the remain private scenario, there was a very wide range of possible future exit events given the expectations to stay private for a longer period of time, and forecasting potential values associated with any future events would be highly speculative. Based on the wide range of possible exit scenarios under the remain private scenario, the application of the OPM was determined to be an appropriate methodology under the remain private scenario. The equity value for the Company under this scenario was estimated as follows:

•Income Approach. The Company is an operating entity expected to generate future cash flows for its capital owners. Any future sale or transaction is expected to be based on the Company’s future cash flow expectations. As such, the Income Approach was deemed applicable and was assigned a 50% weighting in arriving at a value for the Company’s total equity.

•Public Company Market Multiple Method Approach. This methodology was considered to be applicable in the Company’s analysis and was assigned a 50% weighting in arriving at a value for the Company’s total equity. In utilizing this approach, multiples of the selected publicly traded guideline companies were adjusted to reflect relative differences in terms of growth, profitability, and size.

The current equity value used in the remain private scenario was determined to be $563.5 million.

Since the Company was a closely held entity, it also considered appropriate adjustments to recognize the lack of marketability inherently present in interests of this type.

Below is a summary of the valuation approaches utilized in the December 2020 valuation:

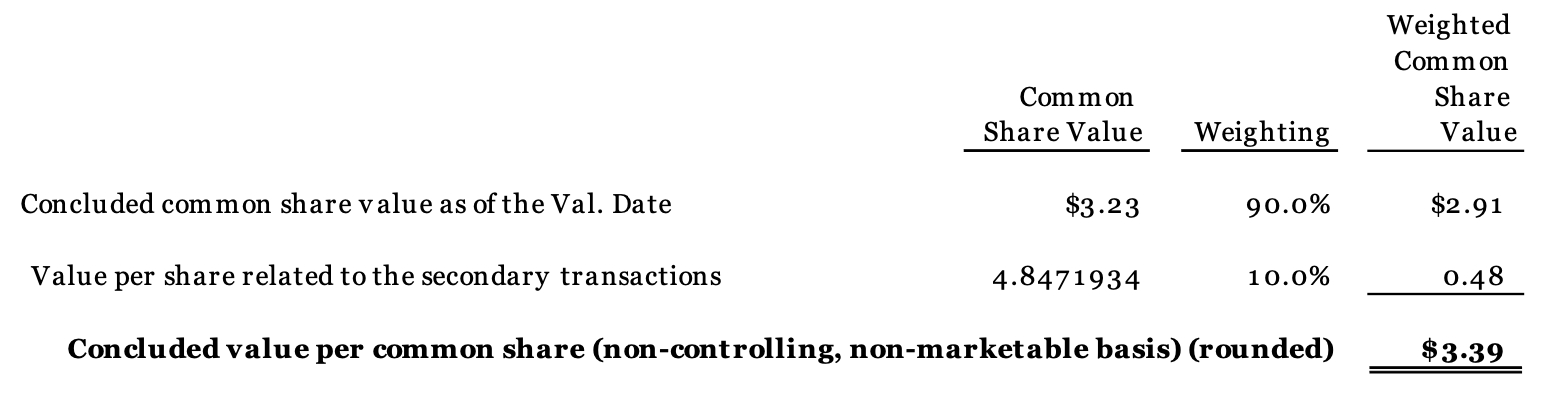

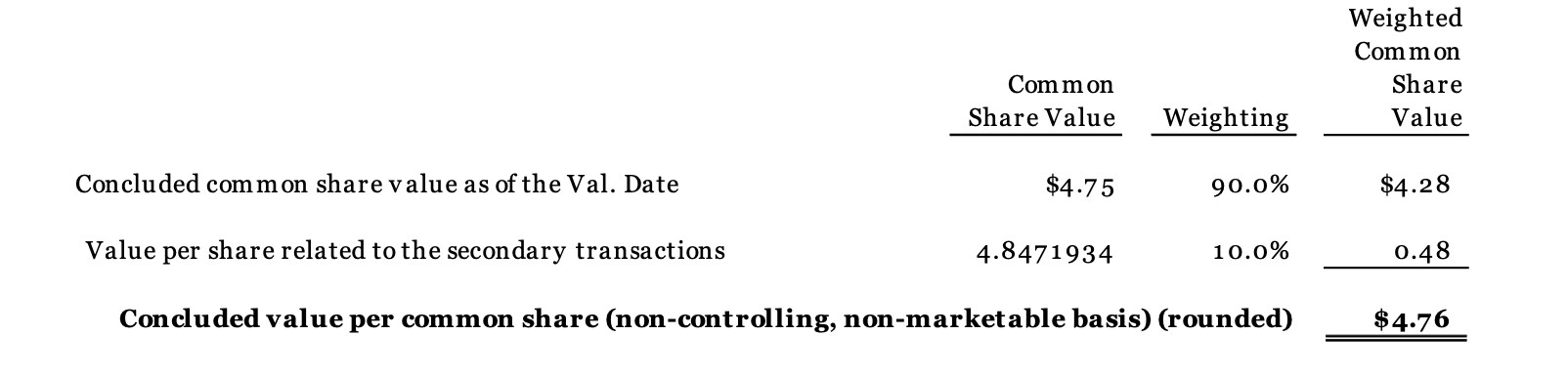

In December 2020, one of the Company’s existing investors, Clearstone Venture Partners, sold 10,628,435 shares of Series A, Series A-1 and Series B convertible preferred stock at $4.8471934 per share to another one of the Company’s existing investors, Greenspring Associates (the “December 2020 Secondary”). Taking into account the volume of shares exchanged, the number of parties involved, and the proximity of these transactions to the date of the December 2020 Valuation, the Company assigned a 10.0% weighting to these secondary transactions in determining the value of the Common Stock.

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 6

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 7

After applying a 90.0% weighting to the value from the Company’s PWERM analysis and a 10.0% weighting to the secondary transaction price, the concluded value per share of Common Stock was determined to be $3.39 on a non-controlling, non-marketable basis. Please see the following table for further details:

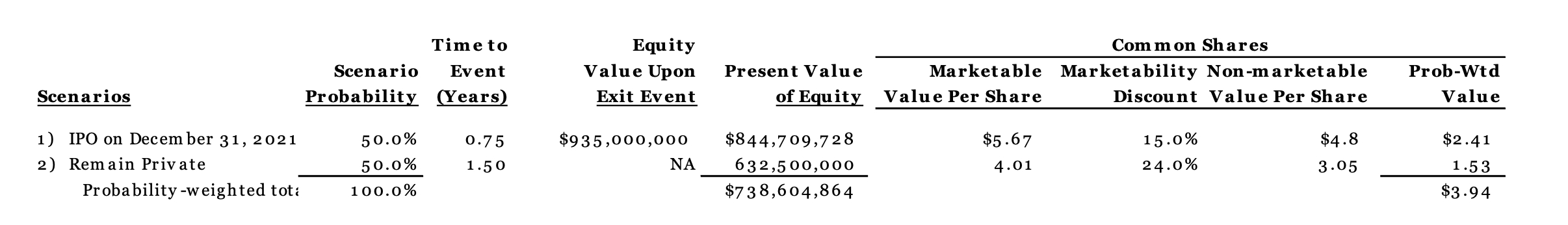

March 2021 Valuation

The fair value determination for the stock options granted on May 11, 2021 was based in part upon a valuation provided by an independent third-party valuation firm as of March 31, 2021 (the “March 2021 Valuation”). The Company utilized this valuation as the starting point from which the share price of its Common Stock was interpolated through June 30, 2021.

For the March 2021 Valuation, the same methodology as the December 2020 Valuation was applied. Below is a summary of the scenarios utilized in the valuation:

•Scenario #1 – IPO on December 31, 2021: Company management estimated a 50.0% probability associated with the Offering on December 31, 2021. The estimated exit value was determined to be $935.0 million based on guideline company revenue multiple indications. The valuation reflected that the Company had engaged underwriters, held an organizational meeting in April 2021, and planned to submit its Registration Statement in the summer of 2021. As of the date of the March 2021 Valuation, there remained significant uncertainty regarding the initial public offering scenario, including that the Company had not yet completed its first PCAOB audit, had not submitted its Registration Statement with the SEC, and had not yet effectuated a planned reincorporation from California to Delaware.

•Scenario #2 – Remain Private: As of the date of the March 2021 Valuation, Company management believed that there was a 50.0% probability that the Company would not experience a liquidity event for approximately two years. Based on the wide range of possible exit scenarios under the remain private scenario, the application of the OPM was determined to be an appropriate methodology. The equity value used in the remain private scenario was determined to be approximately $632.5 million.

By applying the applicable adjustments for lack of marketability and taking into consideration the probability-weighted values of each scenario, the Company arrived at a value per share on a minority, non-

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 7

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 8

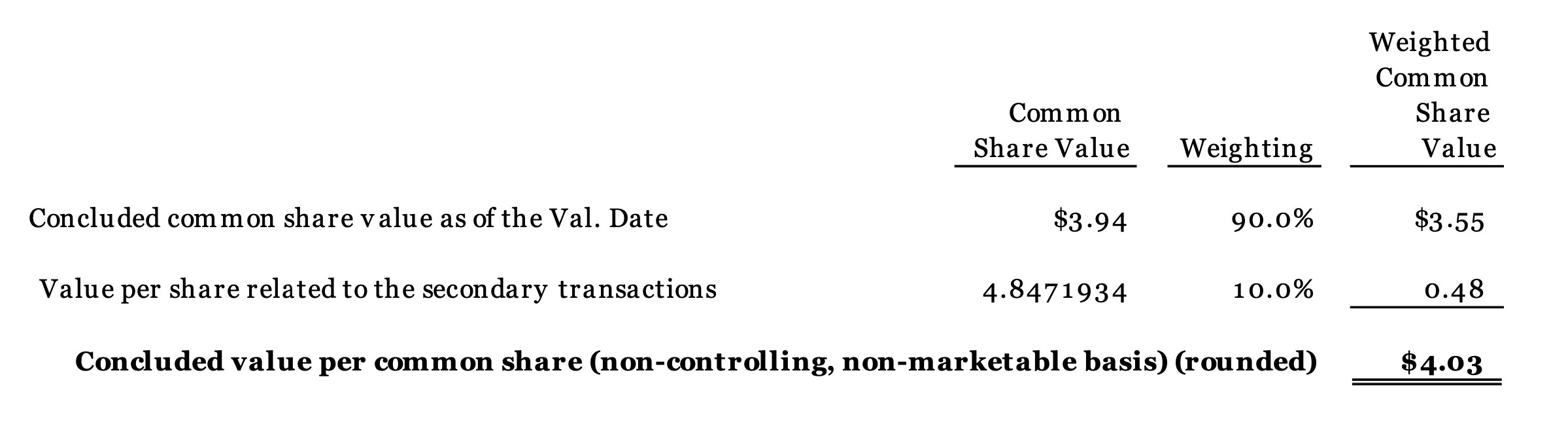

marketable basis of $3.94 for the Common Stock based on the PWERM (before consideration of the secondary transactions).

After applying a 90.0% weighting to the value from the PWERM analysis and a 10.0% weighting to the December 2020 Secondary transaction price, the concluded value per share of the Common Stock was determined to be $4.03 on a non-controlling, non-marketable basis. Please see the following table for further details:

June 2021 Valuation

The fair value determination for the stock options and RSUs granted in August 2021 and September 2021 was based in part upon a valuation provided by an independent third-party valuation firm as of June 30, 2021 (the “June 2021 Valuation”). The Company utilized this valuation as the starting point from which the share price of its Common Stock was interpolated through October 11, 2021, the date that the Preliminary Price Range was formally communicated to Company management and the Board.

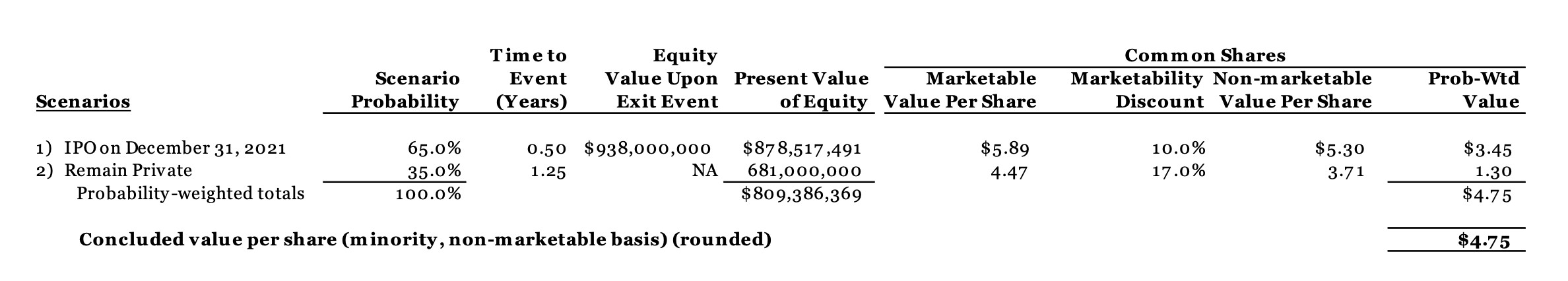

For the June 2021 Valuation, the same methodology as in the valuations described above was applied. Below is a summary of the scenarios utilized in the valuation:

•Scenario #1 – IPO on December 31, 2021: Company management estimated a 65.0% probability associated with the Offering on December 31, 2021. The estimated exit value was determined to be $938.0 million based on guideline company revenue multiple indications. As of the date of the June 2021 Valuation, there still remained significant uncertainty regarding the initial public offering scenario, including that the Company had just submitted its Registration Statement with the SEC and had not yet received comments and the Company had not yet effectuated a planned reincorporation from California to Delaware.

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 8

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 9

•Scenario #2 – Remain Private: As of the date of the June 2021 Valuation, Company management believed that there was a 35.0% probability that the Company would not experience a liquidity event for approximately 1.25 years. Based on the wide range of possible exit scenarios under the remain private scenario, the application of the OPM was determined to be an appropriate methodology. The equity value used in the remain private OPM analysis was determined to be approximately $681.0 million.

By applying the applicable adjustments for lack of marketability and taking into consideration the probability-weighted values of each scenario, the Company arrived at a value per share on a minority, non- marketable basis of $4.75 for the Common Stock based on the PWERM (before consideration of the secondary transactions).

After applying a 90.0% weighting to the value from the PWERM analysis and a 10.0% weighting to the December 2020 Secondary transaction price, the concluded value per share of the Common Stock was determined to be $4.76 on a non-controlling, non-marketable basis. Please see the following table for further details.

As the Company determined that there had been no other significant changes to the business or other relevant factors to determine the fair value of its Common Stock, it used a straight-line interpolation between the fair value per share of the Common Stock per the June 2021 Valuation and the Midpoint to determine the fair value of underlying Common Stock for the grants made in August 2021 and September 2021.

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 9

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 10

Additional Considerations

In addition to the analysis described above, the Company also submits that the Common Stock fair valuation determinations described above are reasonable due to the following considerations:

(i)the significant growth in the equity capital markets of technology stocks, in particular the valuations of recent software company initial public offerings have increased dramatically throughout 2021, due to favorable market conditions, growth, the interest rate environment, and flexible “work from home,” “hybrid,” and “remote” business models;

(ii)the Preliminary Price Range assumes that the Offering has occurred and a public market for the Common Stock has been created, and therefore excludes any marketability or illiquidity discount for the Common Stock, which was appropriately taken into account in the Board’s historical fair value determinations;

(iii)the differences in the valuation methodologies, assumptions, and inputs used by the underwriters in their valuation analysis discussed with the Company’s management, which assume a successful Offering with no weighting attributed to any other outcome, compared to the valuation methodologies, assumptions, and inputs used in the historical valuations considered by the Board;

(iv)the differences in comparable companies in the software technology markets discussed between the Company and the underwriters with respect to the underwriters’ view of the initial public offering market and the positioning of the Company for a successful Offering, as compared to the set of comparable companies used by the Board in determining the historical valuations. The comparable companies used by the Board included certain of the companies analyzed by the underwriters, but additionally included certain legacy providers of user experience platforms, with different trading and valuation profiles. The comparable companies used by the underwriters for purposes of determining the Preliminary Price Range included various customer experience and enterprise companies, with the median valuation multiple based on 2022 revenue for the customer experience companies of 22 times and for the enterprise software companies of 17.5 times whereas the median valuation multiple for the June 2020 Valuation guideline companies was 6.5 times;

(v)the expected proceeds of a successful Offering would likely substantially increase the Company’s cash balances;

(vi)the time value of money taking into account the expected timing of the Offering and potential delays in that timing;

(vii)the holders of the Company’s convertible preferred stock currently enjoy substantial economic rights and preferences over the holders of its Common Stock. The Preliminary Price Range assumes the conversion of all of the Company’s convertible preferred stock

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 10

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 11

upon the completion of its Offering and the corresponding elimination of the preferences and rights enjoyed by the holders of such preferred stock results in a higher valuation of the Common Stock, which is reflected in the Preliminary Price Range;

(viii)the possibility that the actual offering price could be lower than the Preliminary Price Range; and

(ix)the lock-up period to which certain of the shares underlying stock options and RSUs will be subject after the Offering.

Conclusion

As such, taking into account all of the above, the Company believes it has fully complied with all applicable rules and regulations for the determination of fair value, including the best practices outlined in the American Institute of Certified Public Accountants Practice Aid, Valuation of Privately-Held-Company Equity Securities Issued as Compensation. The Company also believes that the fair values determined by the Board for the Common Stock underlying each stock option and RSU grant are appropriate and demonstrate the Board’s consideration of all relevant factors in determining fair value at each valuation date. Accordingly, the Company submits that it believes that its determination of the fair value of the Common Stock for financial reporting purposes is appropriate and it has properly reflected the stock-based compensation expense for its historical grants, including those grants made since January 1, 2021.

The Company advises the Staff that, following this date, the Company intends to use either the Midpoint or, following the date in which it is communicated by the underwriters, the midpoint of the Bona Fide Price Range, to value, for accounting purposes, any additional stock options and RSUs granted until the time that there is a public market for its Common Stock.

* * *

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 11

Securities and Exchange Commission

Division of Corporation Finance

October 21, 2021

Page 12

Should the Staff have additional questions or comments regarding the foregoing, please do not hesitate to contact the undersigned at (650) 335-7613, or, in his absence, Michael Shaw, at (650) 335-7842.

| | |

| Sincerely yours, |

|

| /s/ Ran Ben-Tzur |

|

| Ran Ben-Tzur |

| | | | | |

| cc: | Jon Pexton, Chief Financial Officer |

| Mona Sabet, Chief Corporate Strategy Officer |

| Ambyr O’Donnell, General Counsel |

| UserTesting, Inc. |

| |

| Einat Meisel |

| Michael Shaw |

| Fenwick & West LLP |

| |

| Richard Kline |

| Adam Gelardi |

| Latham & Watkins LLP |

CONFIDENTIAL TREATMENT REQUESTED BY USERTESTING, INC.

USERTESTING - 12