UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22759

The Private Shares Fund

(Exact name of registrant as specified in charter)

88 Pine Street, 31st Floor, Suite 3101

New York, NY 10005

(Address of principal executive offices) (Zip code)

Cogency Global, Inc.

c/o The Private Shares Fund

850 New Burton Rd. Ste. 201

City of Dover, County of Kent, Delaware 19904

(Name and address of agent for service)

Copies to:

Dechert LLP

45 Fremont Street, 26th Floor

San Francisco, CA 94105

Registrant's telephone number, including area code: (646) 839-5548

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

|

THE PRIVATE SHARES FUND |

|

|

|

Table of Contents |

||

|

2 |

||

|

4 |

||

|

7 |

||

|

8 |

||

|

10 |

||

|

17 |

||

|

18 |

||

|

19 |

||

|

20 |

||

|

21 |

||

|

24 |

||

|

36 |

||

|

37 |

||

|

39 |

1

PORTFOLIO MANAGER COMMENTARY

The Private Shares Fund (the “Fund” or “PSF”) can report that for the fourth quarter and full year 2024, the Fund generated a total return of 6.91% and 11.66%, respectively, as measured by the Fund’s Institutional Class (PIIVX). It is worth noting that the fourth quarter return of 6.91% represents the third best quarter since PIIVX’s inception.

The Portfolio Managers (“PMs”) continue to believe there is significant upside potential to current NAV across what we view as a best-in-class portfolio of late-stage, growth-oriented private innovation companies. In addition to new rounds of financing at higher valuations including SpaceX, Databricks and xAI, four of the Fund’s holdings have filed to go public. The PMs believe the Fund is well positioned to benefit from the prospect of improving macroeconomic conditions and less stringent regulations, which are likely to drive increased exit (e.g., Mergers & Acquisitions, IPO, etc.) and financing activity in 2025.

As of December 31, 2024, the average and median portfolio company revenue were $805 million and $158 million, respectively, with corresponding average and median revenue growth rates of 41% and 26%. Furthermore, 39% of the underlying portfolio companies were profitable. To be clear, these revenue and profitability metrics represent historic highs for the Fund.

Despite these record high operating metrics, 45% of the Fund’s holdings are priced below their last round using the Investment Adviser’s methodology, which represents approximately 30% of the Fund’s invested Assets Under Management (AUM). Of these investments, the average discount to last round is 36%. In our opinion, this represents significant embedded value.

As previously reported, we have been observing and discussing improving capital deployment and valuation trends for the past several quarters and continue to closely monitor this data across the venture capital and growth ecosystem. However, there continues to be a significant valuation disparity between late-stage private companies and public comparables, with the former trading at substantial relative discounts by most measures. While the Fed’s decision to continue to cut rates in December is a positive development, further rate cuts in the near-term are uncertain. In parallel, many investors remain liquidity constrained due to a lack of distributions, which further extends the already fertile ground for investors with dry powder to negotiate more favorable terms. Although we anticipate and encourage investors to remain highly selective and disciplined, we expect these trends to continue improving over the coming quarters, which should bode well for the Fund as recent headwinds potentially shift into tailwinds.

VC MARKET UPDATE

The National Venture Capital Association (NVCA) reported approximately 2,859 U.S. Venture Capital (VC)-backed deals closed in the fourth quarter of 2024 with an aggregate deal value of $74.6 billion. This pace of deal activity marks the highest levels in 10 quarters and far exceeds all pre-Covid levels. Full year 2024 VC deal activity came in at aggregate deal value of $209 billion, the third highest on record.

Although VC dry powder now sits at roughly $300 billion, there continues to be a significant supply/demand ratio imbalance as investors exhibit greater discipline. As a result, this creates greater negotiating leverage for active investors willing to commit capital in both secondary transactions and new financing rounds. That said, high-performing companies demonstrating strong operating metrics should continue to be rewarded with more attractive valuations.

Late-stage deal activity closed in the fourth quarter hit $33.4 billion, the highest level in 12 quarters. Full year 2024 late-stage deal activity hit $86.7 billion, the third highest on record. While it is believed that many late-stage companies continue sitting on substantial cash balances following the surge in capital raising over the prior couple years while in parallel implementing business efficiency measures, we believe deal activity is likely to pick up as the valuation and exit environment improve.

As previously reported, during the fourth quarter of 2022, the NVCA created a new category called venture-growth stage deals, which they define as any financing that is Series E or later or any VC financing of a company that is at least seven years old and has raised at least six VC rounds. The purpose is to better distinguish the mitigated risk/reward profile of these more mature companies compared to all VC deals. Venture-growth deal activity in the fourth quarter of $25.6 billion represents a new record, while full year 2024 activity of $52.9 billion represents the second highest on record.

Similar to the aforementioned trends, early-stage VC activity for full year 2024 of $54.7 billion is the second highest on record.

2

|

THE PRIVATE SHARES FUND |

|

Shareholder Letter (Continued) |

In terms of liquidity, VC exit activity for the fourth quarter of 2024 was higher in both exit count and deal value. Increases in corporate M&A activity and private equity-led buyouts are likely to continue in 2025 with improving macroeconomic conditions and expectations for a less stringent regulatory environment under the new Presidential administration. In parallel, we are looking at one of the largest and most compelling IPO backlogs in recent history, with many high-performing technology and innovation companies that are generating a healthy balance of strong growth rates and profitability. As recently reported, 18 of PSF’s holdings were cited by CB Insights as being amongst the highest profile IPO candidates for the next exit cycle. Based on our continued conversations with the Fund’s portfolio holdings, investment bankers and public market investors, we expect to see a pickup in public market offerings over the coming quarters.

As always, we are grateful for your continued support and welcome the opportunity to share further insights around our optimism for the Fund heading into 2025.

NEW PORTFOLIO ADDITIONS (2024)

xAi

xAi, founded by Elon Musk, is an artificial intelligence company focused on developing advanced AI systems to accelerate scientific discovery and enhance human understanding.

PORTFOLIO ADD-ONS (2024)

Northgate Growth Fund III

Northgate Growth Fund III is a special-purpose vehicle that holds an underlying private fund investment.

Voyager Technologies

Voyager Technologies is a defense and space company specializing in commercial space station development and national security solutions.

Tradeshift

Tradeshift develops financial platform software designed to drive supply chain innovation in the digital economy.

PORTFOLIO COMPANY LIQUIDITY ACTIVITY (2024)

Rubrik

On April 25, 2024, Rubrik (RBRK) began trading on the New York Stock Exchange at $32 per share, raising approximately $752 million.

Malwarebytes

In October 2024, the fund completed a secondary sale of a portion of its stake in Malwarebytes.

Code42

In July 2024, Mimecast announced that it had acquired Code42.

Udacity

In May 2024, Accenture announced that it had acquired Udacity.

Mynd

In May 2024, Mynd announced its merger with Roofstock to create a comprehensive, end-to-end solution for single-family rental investors.

3

As of December 31, 2024, the Fund’s performance is as follows:

|

Total Return Information (Unaudited) |

||||||

|

The Private Shares Fund – Class A |

Ten |

Five |

Three |

One |

Annualized |

Cumulative |

|

Returns based on Purchase Without |

6.72% |

9.45% |

0.83% |

11.40% |

8.27% |

135.24% |

|

Returns based on Purchase With Maximum Sales Charge of 5.75% (POP) |

6.09% |

8.16% |

-1.14% |

5.00% |

7.67% |

121.72% |

|

Fund Benchmark |

||||||

|

Russell 2000® Index |

7.82% |

7.40% |

1.24% |

11.54% |

7.57% |

119.35% |

|

The Private Shares Fund – Class I |

Ten |

Five |

Three |

One |

Annualized |

Cumulative |

|

Returns based on Purchase Without Any Sales Charge (NAV) |

N/A |

9.71% |

1.08% |

11.66% |

8.73% |

81.51% |

|

Fund Benchmark |

||||||

|

Russell 2000® Index |

N/A |

7.40% |

1.24% |

11.54% |

7.24% |

64.55% |

|

The Private Shares Fund – Class L |

Ten |

Five |

Three |

One |

Annualized |

Cumulative |

|

Returns based on Purchase Without Any Sales Charge (NAV) |

N/A |

9.17% |

0.58% |

11.12% |

7.64% |

63.03% |

|

Returns based on Purchase With Maximum Sales Charge of 4.25% (POP) |

N/A |

8.23% |

-0.86% |

6.39% |

6.94% |

56.10% |

|

Fund Benchmark |

||||||

|

Russell 2000® Index |

N/A |

7.40% |

1.24% |

11.54% |

6.50% |

51.96% |

Performance data quoted represents past performance and is no guarantee of future results. Public offering price (“POP”) performance assumes a maximum sales load of 5.75% (Class A) and 4.25% (Class L) on all sales. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than the performance data quoted. For performance as of the most recent month-end, please call 1-855-551-5510. Some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Fund’s total annual expenses per the currently stated prospectus are 2.54% (Class A), 2.49% (Class I), and 2.78% (Class L). The Fund’s total net expenses are 2.72% (Class A), 2.47% (Class I), and 2.97% (Class L). Liberty Street Advisors, Inc. (the “Investment Adviser”) has contractually agreed to waive fees and/or reimburse (excluding taxes, interest expense, commitment fees, legal fees or other expenses related to any borrowing or leverage incurred by the Fund, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) expenses such that the total expenses do not exceed 2.65% (Class A), 2.40% (Class I), and 2.90% (Class L) through May 2, 2026. Net expenses are applicable to investors.

4

|

THE PRIVATE SHARES FUND |

|

Fund Performance (Continued) December 31, 2024 (Unaudited) |

DISCLOSURES

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Fund’s outstanding shares to be redeemed each quarter at NAV. Due to transfer restrictions and the illiquid nature of the Fund’s investments, you may not be able to sell your shares when, or in the amount that, you desire. The Fund primarily invests in late-stage operating businesses and does so primarily by directly investing in private, operating growth companies (“Portfolio Companies”). There are significant potential risks relating to investing in Portfolio Companies. Because most of the securities in which the Fund invests are not publicly traded, the Fund’s investments will be valued by Liberty Street Advisors, Inc. (the “Investment Adviser”) as Valuation Designee pursuant to fair valuation procedures and methodologies approved by the Board of Trustees, as set forth in the prospectus. As a consequence, the value of the securities, and therefore the Fund’s Net Asset Value (“NAV”), may vary. There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund’s quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund’s expense ratio. Portfolio holdings of private companies that become publicly traded likely will be subject to more volatile market fluctuations than when private, and the Fund may not be able to sell shares at favorable prices. Such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). Market prices of public securities held by the Fund may decline substantially before the Investment Adviser is able to sell the securities. The Fund may invest in private securities utilizing special purpose vehicles (“SPVs”) and similar investment structures, venture capital funds and other funds that invest in private companies and rely on exclusions from the 1940 Act under section 3(c)(1) or 3(c)(7) (“Private Funds”), private investments in public equity (“PIPE”) transactions where the issuer is a special purpose acquisition company (“SPAC”), and may utilize profit sharing agreements. The Fund will bear its pro rata portion of expenses on investments in SPVs and Private Funds and will have no direct claim against underlying portfolio companies. The Fund’s investments in Private Funds subject it to the risks associated with direct ownership of the securities in which the underlying funds invest, as well as additional risks specific to the Private Funds, including operational risk, legal and indemnification risks, and lock-ups and other restrictions on withdrawal. PIPE transactions involve price risk, market risk, expense risk, and the risk that the Fund may not be able to sell the securities due to lock-ups or restrictions. Profit sharing agreements may expose the Fund to certain risks, including that the agreements could reduce the gain the Fund otherwise would have achieved on its investment, may be difficult to value and may result in contractual disputes. Certain conflicts of interest involving the Fund and its affiliates could impact the Fund’s investment returns and limit the flexibility of its investment policies. This is not a complete enumeration of the Fund’s risks. Please read the Fund prospectus for other risk factors related to the Fund.

The Fund may not be suitable for all investors. We encourage you to consult with appropriate financial professionals before considering an investment in the Fund.

The Russell 2000 is an index measuring the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks. It is a market-cap weighted index. A SPAC is a company that has no commercial operations and is formed strictly to raise capital through an IPO for the purpose of acquiring or merging with an existing company.

The views expressed in this material reflect those of the Investment Adviser as of the date this is written and may not reflect its views on the date this material is first published or anytime thereafter. These views are intended to assist in understanding the Fund’s investment methodology and do not constitute investment advice. This material may contain discussions about investments that may or may not be held by the Fund. All current and future holdings are subject to risk and to change.

The Fund is distributed by Foreside Fund Services, LLC.

5

|

THE PRIVATE SHARES FUND |

|

Fund Performance (Continued) December 31, 2024 (Unaudited) |

IMPORTANT DISCLOSURES

The inclusion of various indices is for comparison purposes only. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Holdings subject to change. Not a recommendation to buy, sell, or hold any specific security.

6

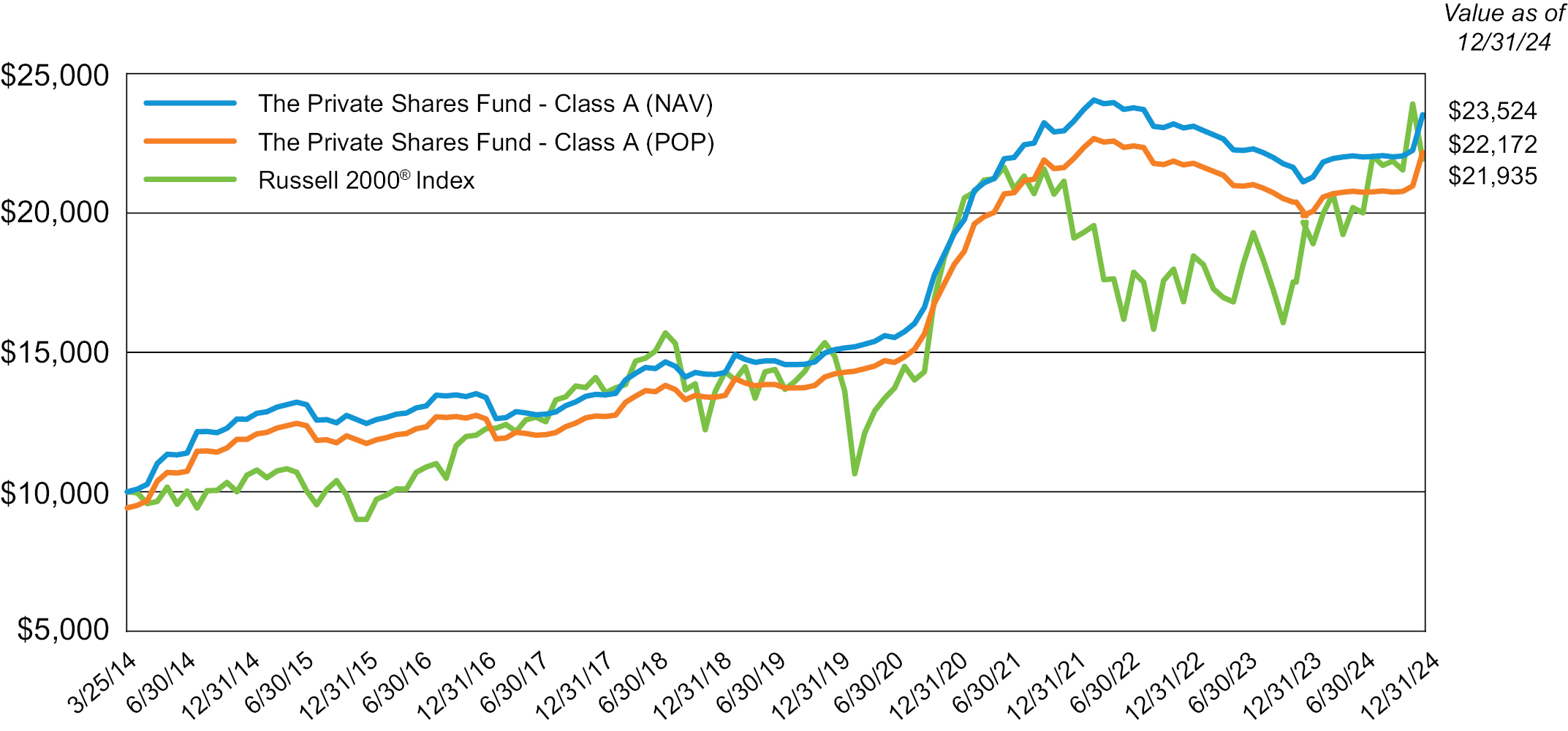

Growth of $10,000 Investment

This graph illustrates the hypothetical investment of $10,000 in the Class A from March 25, 2014 (Class inception) to December 31, 2024. The Total Return Information table and Growth of $10,000 Investment graph do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. The Public Offering Price (“POP”) assumes an initial investment of $9,425 ($10,000 less the maximum sales load of 5.75%). The Net Asset Value (“NAV”) assumes no sales load.

Performance data quoted represents past performance and is no guarantee of future results.

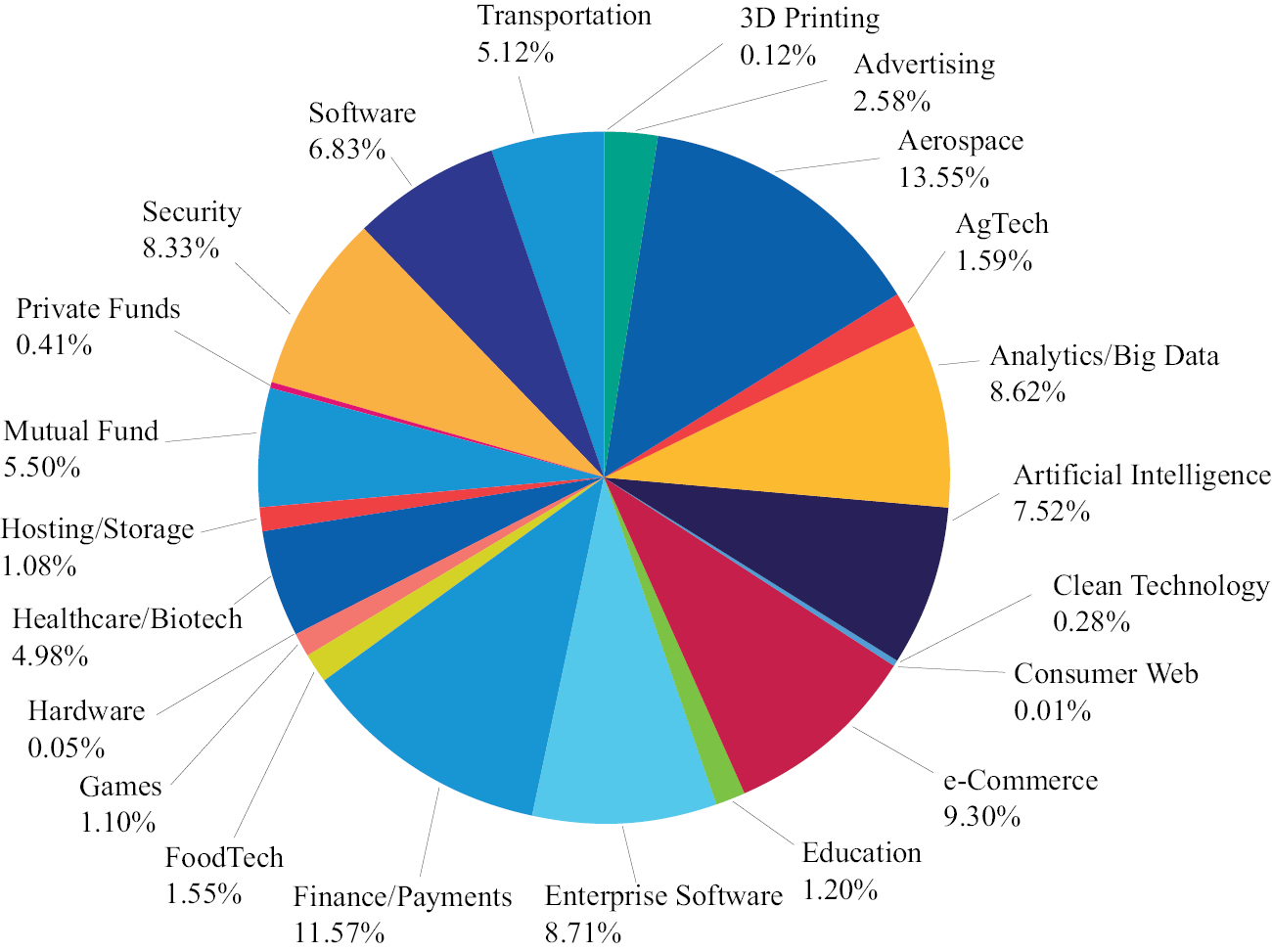

Fund Sector Diversification

The following chart provides a visual breakdown of the Fund, by the industry sectors that the underlying securities represent, as a percentage of the total investments.

7

Fund Holdings

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

8

|

THE PRIVATE SHARES FUND |

|

Portfolio Composition (Continued) December 31, 2024 (Unaudited) |

Fund Holdings (Continued)

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

9

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Common Stock in Private Companies(a),(b) — 43.2% |

|

|

||||||||

|

3D Printing — 0.1% |

|

|

||||||||

|

Carbon, Inc. |

Jun 2019 |

158,853 |

$ |

2,125,214 |

$ |

1,205,694 |

||||

|

|

|

|||||||||

|

Advertising — 2.6% |

|

|

||||||||

|

GroundTruth, Inc. |

Oct 2016 |

1,659,427 |

|

446,424 |

|

431,451 |

||||

|

NextRoll, Inc. |

Mar 2017 |

2,367,054 |

|

16,079,048 |

|

21,540,191 |

||||

|

OpenX Software, Ltd. |

Jun 2015 |

2,899,297 |

|

2,615,386 |

|

2,928,290 |

||||

|

|

19,140,858 |

|

24,899,932 |

|||||||

|

Aerospace — 8.3% |

|

|

||||||||

|

Axiom Space, Inc. |

Mar 2021 |

29,543 |

|

5,099,983 |

|

3,666,287 |

||||

|

Relativity Space, Inc. |

Oct 2021 |

437,922 |

|

9,999,993 |

|

9,926,378 |

||||

|

Space Exploration Technologies Corp. |

May 2019 |

360,330 |

|

7,386,765 |

|

66,661,050 |

||||

|

|

22,486,741 |

|

80,253,715 |

|||||||

|

AgTech — 0.2% |

|

|

||||||||

|

Farmer’s Business Network, Inc. |

Sep 2021 |

119,676 |

|

5,042,625 |

|

1,695,809 |

||||

|

|

|

|||||||||

|

Analytics/Big Data — 5.9% |

|

|

||||||||

|

Content Square SAS |

Dec 2023 |

544,905 |

|

3,740,557 |

|

6,048,446 |

||||

|

Dataminr, Inc. |

Sep 2015 |

567,043 |

|

6,559,226 |

|

16,863,859 |

||||

|

Domino Data Lab, Inc. |

Apr 2021 |

330,000 |

|

4,118,400 |

|

4,893,900 |

||||

|

Dremio Corp.(c) |

Dec 2021 |

166,664 |

|

1,035,883 |

|

966,651 |

||||

|

INRIX, Inc. |

May 2014 |

133,238 |

|

3,026,250 |

|

6,539,321 |

||||

|

SingleStore, Inc. |

May 2020 |

2,148,366 |

|

10,359,604 |

|

15,017,078 |

||||

|

Tealium, Inc. |

Sep 2020 |

200,000 |

|

1,300,000 |

|

2,896,000 |

||||

|

ThoughtSpot, Inc. |

Oct 2018 |

162,087 |

|

1,745,758 |

|

4,352,036 |

||||

|

|

31,885,678 |

|

57,577,291 |

|||||||

|

Artificial Intelligence — 3.7% |

|

|

||||||||

|

Brain Corp. |

Dec 2020 |

2,375,000 |

|

9,540,000 |

|

12,540,000 |

||||

|

Cerebras Systems, Inc. |

Feb 2022 |

309,813 |

|

6,946,627 |

|

9,015,558 |

||||

|

Nanotronics Imaging, Inc. |

Aug 2022 |

76,504 |

|

7,803,408 |

|

14,238,160 |

||||

|

|

24,290,035 |

|

35,793,718 |

|||||||

|

Clean Technology — 0.0% |

|

|

||||||||

|

WiTricity Holdings, Inc.(c) |

Mar 2021 |

166,667 |

|

1,667 |

|

273,334 |

||||

|

|

|

|||||||||

|

e-Commerce — 1.0% |

|

|

||||||||

|

1661, Inc. (d.b.a. GOAT)(c) |

Sep 2021 |

128,148 |

|

760,724 |

|

419,044 |

||||

|

CaaStle, Inc. |

Mar 2022 |

1,174,400 |

|

3,057,263 |

|

9,207,296 |

||||

|

|

3,817,987 |

|

9,626,340 |

|||||||

|

Education — 1.1% |

|

|

||||||||

|

Eruditus Learning Solutions Pte., Ltd.(c) |

Aug 2021 |

36,264 |

|

5,146,825 |

|

4,010,436 |

||||

|

Learneo, Inc. (f.k.a. Course Hero, Inc.) |

Jun 2020 |

270,000 |

|

3,429,200 |

|

6,787,800 |

||||

|

|

8,576,025 |

|

10,798,236 |

|||||||

See accompanying Notes to the Financial Statements

10

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) December 31, 2024 |

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Common Stock in Private Companies(a),(b) — 43.2% (Continued) |

|

|

||||||||

|

Enterprise Software — 3.4% |

|

|

||||||||

|

Automation Anywhere, Inc. |

Jul 2021 |

189,449 |

$ |

4,019,940 |

$ |

2,222,237 |

||||

|

Docker, Inc. |

May 2017 |

2,500 |

|

531,250 |

|

22,500 |

||||

|

EquipmentShare.com, Inc. |

Oct 2021 |

694,800 |

|

9,985,874 |

|

18,585,900 |

||||

|

Motive Technologies, Inc. (f.k.a. Keep Truckin, Inc.) |

May 2019 |

788,562 |

|

3,420,734 |

|

8,642,639 |

||||

|

Tebra Technologies, Inc. (f.k.a. Kareo, Inc.) |

Nov 2020 |

190,007 |

|

1,235,126 |

|

1,518,156 |

||||

|

Trax, Ltd. |

Mar 2020 |

149,970 |

|

5,100,000 |

|

2,198,560 |

||||

|

|

24,292,924 |

|

33,189,992 |

|||||||

|

Finance/Payments — 5.1% |

|

|

||||||||

|

Betterment Holdings, Inc. |

Mar 2021 |

1,457,800 |

|

14,999,995 |

|

24,724,288 |

||||

|

Circle Internet Financial, Ltd. |

Apr 2018 |

290,200 |

|

2,604,825 |

|

12,446,678 |

||||

|

ConsenSys Software, Inc. |

May 2022 |

31,010 |

|

3,703,824 |

|

4,343,261 |

||||

|

Payward, Inc. (d.b.a. Kraken) |

Jun 2021 |

105,218 |

|

5,079,228 |

|

5,151,473 |

||||

|

Prosper Marketplace, Inc. |

Jan 2016 |

244,130 |

|

1,307,998 |

|

107,417 |

||||

|

Upgrade, Inc. |

Apr 2022 |

661,053 |

|

2,900,002 |

|

3,027,623 |

||||

|

|

30,595,872 |

|

49,800,740 |

|||||||

|

FoodTech — 0.5% |

|

|

||||||||

|

Impossible Foods, Inc. |

Oct 2022 |

373,248 |

|

3,569,496 |

|

5,318,784 |

||||

|

|

|

|||||||||

|

Games — 1.1% |

|

|

||||||||

|

Epic Games, Inc. |

Nov 2022 |

17,168 |

|

10,826,013 |

|

10,660,813 |

||||

|

|

|

|||||||||

|

Hardware — 0.1% |

|

|

||||||||

|

Hydrow, Inc. |

Feb 2022 |

14,172,560 |

|

4,999,989 |

|

473,364 |

||||

|

|

|

|||||||||

|

Healthcare/Biotech — 2.3% |

|

|

||||||||

|

Click Therapeutics, Inc. |

Nov 2020 |

1,000,000 |

|

3,500,000 |

|

3,850,000 |

||||

|

Color Health, Inc. |

Feb 2022 |

139,486 |

|

10,039,927 |

|

6,095,538 |

||||

|

Devoted Health, Inc. |

Aug 2022 |

177,776 |

|

9,999,953 |

|

11,491,441 |

||||

|

ZocDoc, Inc. |

Feb 2015 |

61,016 |

|

1,321,708 |

|

544,873 |

||||

|

|

24,861,588 |

|

21,981,852 |

|||||||

|

Security — 5.5% |

|

|

||||||||

|

Arctic Wolf Networks, Inc. |

Dec 2021 |

2,072,651 |

|

20,456,420 |

|

24,208,564 |

||||

|

Contrast Security, Inc. |

Sep 2022 |

31,250 |

|

255,000 |

|

342,812 |

||||

|

Lookout, Inc. |

Jul 2022 |

1,869,160 |

|

10,000,006 |

|

18,878,516 |

||||

|

Snyk, Ltd. |

Mar 2023 |

392,707 |

|

2,932,070 |

|

4,948,108 |

||||

|

Tanium, Inc. |

Apr 2019 |

640,000 |

|

4,787,200 |

|

5,356,800 |

||||

|

|

38,430,696 |

|

53,734,800 |

|||||||

|

Software — 1.9% |

|

|

||||||||

|

Discord, Inc.(c) |

Dec 2021 |

45,694 |

|

18,405,998 |

|

17,675,810 |

||||

|

Roofstock, Inc. |

Jun 2024 |

127,231 |

|

6,130,637 |

|

1,160,400 |

||||

|

|

24,536,635 |

|

18,836,210 |

|||||||

See accompanying Notes to the Financial Statements

11

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) December 31, 2024 |

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Common Stock in Private Companies(a),(b) — 43.2% (Continued) |

|

|

||||||||

|

Transportation — 0.4% |

|

|

||||||||

|

Flexport, Inc. |

Jul 2022 |

538,387 |

$ |

7,256,025 |

$ |

3,547,970 |

||||

|

TOTAL COMMON STOCK IN PRIVATE COMPANIES |

|

286,736,068 |

|

419,668,594 |

||||||

|

|

|

|||||||||

|

Preferred Stock in Private Companies(a),(b) — 46.6% |

|

|

||||||||

|

Advertising — 0.0% |

|

|

||||||||

|

GroundTruth, Inc., Preferred Series B-1 |

Jan 2017 |

600,000 |

|

149,200 |

|

156,000 |

||||

|

|

|

|||||||||

|

Aerospace — 5.3% |

|

|

||||||||

|

Axiom Space, Inc., Preferred Series B |

Dec 2020 |

32,221 |

|

2,019,958 |

|

3,998,626 |

||||

|

Axiom Space, Inc., Preferred Series C-1 |

Aug 2021 |

108,731 |

|

15,612,740 |

|

13,493,518 |

||||

|

Beta Technologies, Inc., Preferred Series A |

Apr 2021 |

40,944 |

|

2,999,967 |

|

4,686,860 |

||||

|

Beta Technologies, Inc., Preferred Series B |

Apr 2022 |

58,156 |

|

5,999,954 |

|

6,657,117 |

||||

|

Radian Aerospace, Inc., Preferred Series Seed 2 |

Sep 2021 |

607,336 |

|

1,999,997 |

|

2,234,997 |

||||

|

Relativity Space, Inc., Preferred Series E |

Jul 2021 |

437,922 |

|

10,299,992 |

|

9,926,378 |

||||

|

Voyager Space Holdings, Inc., Preferred Series B |

Mar 2022 |

192,061 |

|

7,499,982 |

|

8,416,113 |

||||

|

Voyager Space Holdings, Inc., Preferred Series C |

Mar 2024 |

11,410 |

|

499,986 |

|

499,986 |

||||

|

Xplore, Inc., Preferred Series A1 |

Feb 2022 |

237,524 |

|

1,000,000 |

|

1,250,001 |

||||

|

|

47,932,576 |

|

51,163,596 |

|||||||

|

AgTech — 1.4% |

|

|

||||||||

|

CIBO Technologies, Inc., Preferred Series C(c) |

Aug 2021 |

600,000 |

|

3,090,000 |

|

2,946,000 |

||||

|

Farmer’s Business Network, Inc., Preferred Series G |

Sep 2021 |

128,704 |

|

10,199,946 |

|

4,960,252 |

||||

|

Invaio Sciences, Inc., Preferred Series C(c) |

Mar 2021 |

1,061,390 |

|

5,150,000 |

|

5,444,931 |

||||

|

|

18,439,946 |

|

13,351,183 |

|||||||

|

Analytics/Big Data — 2.7% |

|

|

||||||||

|

Content Square SAS, Preferred Series F |

Dec 2023 |

160,410 |

|

1,693,701 |

|

2,394,921 |

||||

|

Databricks, Inc., Preferred Series G(c) |

Jul 2022 |

182,664 |

|

10,807,205 |

|

16,896,420 |

||||

|

Dataminr, Inc., Preferred Series A |

Apr 2019 |

20,000 |

|

198,000 |

|

594,800 |

||||

|

Dataminr, Inc., Preferred Series B |

Apr 2019 |

87,496 |

|

866,211 |

|

2,602,131 |

||||

|

Dremio Corp., Preferred Series E(c) |

Dec 2021 |

469,594 |

|

4,140,000 |

|

3,385,773 |

||||

|

|

17,705,117 |

|

25,874,045 |

|||||||

|

Artificial Intelligence — 3.4% |

|

|

||||||||

|

Nanotronics Imaging, Inc., Preferred Series F-2 |

Apr 2022 |

90,888 |

|

15,300,066 |

|

16,915,166 |

||||

|

VerbIT, Inc., Preferred Series A |

Nov 2021 |

47,640 |

|

693,256 |

|

271,072 |

||||

|

VerbIT, Inc., Preferred Series B |

Nov 2021 |

288,180 |

|

4,194,173 |

|

1,639,744 |

||||

|

VerbIT, Inc., Preferred Series E-1 |

Nov 2021 |

423,720 |

|

6,166,668 |

|

4,393,976 |

||||

|

VerbIT, Inc., Preferred Series Seed 2 |

Nov 2021 |

65,000 |

|

945,904 |

|

369,850 |

||||

|

X.AI, Corp., Preferred Series B(c) |

May 2024 |

417,710 |

|

5,150,000 |

|

9,043,422 |

||||

|

X.AI, Corp., Preferred Series C(c) |

Nov 2024 |

42,794 |

|

1,000,000 |

|

926,490 |

||||

|

|

33,450,067 |

|

33,559,720 |

|||||||

See accompanying Notes to the Financial Statements

12

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) December 31, 2024 |

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Preferred Stock in Private Companies(a),(b) — 46.6% (Continued) |

|

|

||||||||

|

Clean Technology — 0.2% |

|

|

||||||||

|

WiTricity Holdings, Inc., Preferred Series A |

Oct 2020 |

1,000,000 |

$ |

1,020,000 |

$ |

1,640,000 |

||||

|

WiTricity Holdings, Inc., Preferred Series B |

Jun 2022 |

333,253 |

|

999,999 |

|

793,142 |

||||

|

|

2,019,999 |

|

2,433,142 |

|||||||

|

Consumer Web — 0.0% |

|

|

||||||||

|

Trusper, Inc. (d.b.a. Musely), Preferred Series B |

Oct 2014 |

7,961 |

|

100,012 |

|

106,120 |

||||

|

|

|

|||||||||

|

e-Commerce — 8.3% |

|

|

||||||||

|

1661, Inc. (d.b.a. GOAT), Preferred Series A-1(c) |

Sep 2021 |

112,563 |

|

668,206 |

|

368,081 |

||||

|

1661, Inc. (d.b.a. GOAT), Preferred Series A-5(c) |

Sep 2021 |

2,394 |

|

14,211 |

|

7,828 |

||||

|

1661, Inc. (d.b.a. GOAT), Preferred Series A-7(c) |

Sep 2021 |

146,495 |

|

869,637 |

|

479,039 |

||||

|

1661, Inc. (d.b.a. GOAT), Preferred Series B(c) |

Sep 2021 |

231,687 |

|

1,375,362 |

|

757,616 |

||||

|

1661, Inc. (d.b.a. GOAT), Preferred Series C(c) |

Sep 2021 |

237,913 |

|

1,412,322 |

|

777,976 |

||||

|

CaaStle, Inc., Preferred Series A-12 |

Dec 2021 |

1,801,270 |

|

8,110,608 |

|

14,121,957 |

||||

|

GrubMarket, Inc., Preferred Series D |

Oct 2020 |

440,742 |

|

1,999,999 |

|

10,044,065 |

||||

|

GrubMarket, Inc., Preferred Series E |

Jun 2021 |

1,520,838 |

|

14,999,995 |

|

34,658,362 |

||||

|

GrubMarket, Inc., Preferred Series F |

Feb 2022 |

697,526 |

|

9,999,982 |

|

15,895,913 |

||||

|

Lyst, Ltd., Preferred Series E |

Jul 2021 |

401,929 |

|

5,172,500 |

|

3,476,686 |

||||

|

|

44,622,822 |

|

80,587,523 |

|||||||

|

Education — 0.1% |

|

|

||||||||

|

Yanka Industries, Inc. (d.b.a. MasterClass), Preferred Series Seed 1 |

Jul 2021 |

193,100 |

|

6,146,189 |

|

890,191 |

||||

|

|

|

|||||||||

|

Enterprise Software — 5.3% |

|

|

||||||||

|

Checkr, Inc., Preferred Series A-1 |

Mar 2020 |

150,000 |

|

1,405,000 |

|

2,805,000 |

||||

|

Cohere Technologies, Inc., Preferred Series D-1 |

Feb 2022 |

279,571 |

|

1,999,995 |

|

2,130,331 |

||||

|

Cohere Technologies, Inc., Preferred Series D-2 |

Dec 2020 |

386,038 |

|

2,071,233 |

|

2,941,610 |

||||

|

EquipmentShare.com, Inc., Preferred Series E |

May 2022 |

323,064 |

|

4,999,997 |

|

8,641,962 |

||||

|

Motive Technologies, Inc. (f.k.a. Keep Truckin, Inc.), Preferred Series E |

May 2021 |

638,843 |

|

4,599,996 |

|

7,001,719 |

||||

|

Motive Technologies, Inc. (f.k.a. Keep Truckin, Inc.), Preferred Series F |

Jun 2022 |

1,923,076 |

|

14,999,993 |

|

21,076,913 |

||||

|

Ocrolus, Inc., Preferred Series C(c) |

Aug 2021 |

438,327 |

|

3,114,950 |

|

3,024,456 |

||||

|

Tebra Technologies, Inc. (f.k.a. Kareo, Inc.), Preferred Series Seed 2 |

Nov 2020 |

123,819 |

|

804,870 |

|

989,314 |

||||

|

Trax, Ltd., Pre IPO |

Mar 2021 |

76,722 |

|

3,999,978 |

|

2,724,398 |

||||

|

|

37,996,012 |

|

51,335,703 |

|||||||

|

Finance/Payments — 6.4% |

|

|

||||||||

|

Betterment Holdings, Inc., Preferred Series F |

Sep 2021 |

318,380 |

|

3,999,999 |

|

5,399,725 |

||||

|

ConsenSys Software, Inc., Preferred Series D(c) |

Feb 2022 |

35,699 |

|

5,075,000 |

|

5,000,002 |

||||

|

Fundbox, Ltd., Preferred Series C |

Jun 2019 |

439,552 |

|

4,999,992 |

|

7,041,623 |

||||

|

Fundbox, Ltd., Preferred Series D |

Sep 2021 |

531,914 |

|

7,499,988 |

|

8,521,262 |

||||

|

Payward, Inc. (d.b.a. Kraken), Preferred Series A |

Nov 2021 |

262,210 |

|

13,768,164 |

|

12,837,801 |

||||

|

Payward, Inc. (d.b.a. Kraken), Preferred Series Seed |

Apr 2022 |

67,000 |

|

3,505,340 |

|

3,280,320 |

||||

|

Prosper Marketplace, Inc., Preferred Series A |

Jan 2016 |

55,395 |

|

305,781 |

|

32,129 |

||||

|

Prosper Marketplace, Inc., Preferred Series A-1 |

Jan 2016 |

58,165 |

|

116 |

|

25,593 |

||||

|

Ripple Labs, Inc., Preferred Series A |

Dec 2018 |

42,000 |

|

504,000 |

|

5,250,000 |

||||

|

Upgrade, Inc., Preferred Series C-1 |

Mar 2022 |

3,290,000 |

|

14,159,000 |

|

15,068,200 |

||||

|

|

53,817,380 |

|

62,456,655 |

|||||||

See accompanying Notes to the Financial Statements

13

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) December 31, 2024 |

|

Acquisition |

Shares/ |

Cost |

Fair Value |

||||||||

|

|

|

|

|||||||||

|

Preferred Stock in Private Companies(a),(b) — 46.6% (Continued) |

|

|

|

||||||||

|

FoodTech — 1.0% |

|

|

|

||||||||

|

Impossible Foods, Inc., Preferred Series E-1 |

Nov 2022 |

|

400,000 |

$ |

4,080,000 |

$ |

5,700,000 |

||||

|

Impossible Foods, Inc., Preferred Series H-1(c) |

Nov 2021 |

|

153,494 |

|

3,746,778 |

|

2,988,528 |

||||

|

Impossible Foods, Inc., Preferred Series H-2(c) |

Nov 2021 |

|

53,389 |

|

1,303,222 |

|

1,039,484 |

||||

|

|

|

9,130,000 |

|

9,728,012 |

|||||||

|

Healthcare/Biotech — 2.7% |

|

|

|

||||||||

|

Click Therapeutics, Inc., Preferred Series A |

Nov 2020 |

|

60,087 |

|

210,304 |

|

231,335 |

||||

|

Collective Health, Inc., Preferred Series F |

May 2021 |

|

3,989,361 |

|

3,120,000 |

|

2,433,510 |

||||

|

Crossover Health Management Services, Inc., Preferred Series D |

Mar 2021 |

|

291,645 |

|

10,370,696 |

|

16,273,791 |

||||

|

Devoted Health, Inc., Preferred Series E |

Dec 2023 |

|

8,888 |

|

499,953 |

|

574,520 |

||||

|

Omada Health, Inc., Preferred Series E |

Dec 2021 |

|

1,334,400 |

|

7,999,995 |

|

6,538,560 |

||||

|

ZocDoc, Inc., Preferred Series A |

Feb 2015 |

|

35,000 |

|

875,000 |

|

312,550 |

||||

|

|

|

23,075,948 |

|

26,364,266 |

|||||||

|

Security — 2.8% |

|

|

|

||||||||

|

Contrast Security, Inc., Preferred Series A |

Jul 2022 |

|

828,514 |

|

10,300,003 |

|

9,088,799 |

||||

|

Contrast Security, Inc., Preferred Series C |

Nov 2022 |

|

1,164,596 |

|

7,649,998 |

|

12,775,618 |

||||

|

Cybereason, Inc., Preferred Series F |

Jul 2021 |

|

1,510,600 |

|

7,631,457 |

|

2,945,670 |

||||

|

Lookout, Inc., Preferred Series A |

Feb 2015 |

|

204,000 |

|

1,927,800 |

|

2,060,400 |

||||

|

|

|

27,509,258 |

|

26,870,487 |

|||||||

|

Software — 4.5% |

|

|

|

||||||||

|

Roofstock, Inc., Preferred Series E |

Mar 2022 |

|

339,154 |

|

9,999,990 |

|

6,613,503 |

||||

|

Tradeshift Holdings, Inc., Preferred Series 3 |

Jun 2021 |

|

28,797,969 |

|

12,551,436 |

|

36,939,155 |

||||

|

|

|

22,551,426 |

|

43,552,658 |

|||||||

|

Transportation — 2.5% |

|

|

|

||||||||

|

Clearmotion, Inc., Preferred Series A-3 |

Mar 2022 |

|

2,075,885 |

|

341,068 |

|

515,650 |

||||

|

Clearmotion, Inc., Preferred Series A-4 |

Mar 2022 |

|

12,954,589 |

|

908,932 |

|

3,217,920 |

||||

|

Clearmotion, Inc., Preferred Series B |

Mar 2023 |

|

2,484,760 |

|

500,000 |

|

617,214 |

||||

|

Flexport, Inc., Preferred Series A |

Jun 2022 |

|

580,165 |

|

8,489,030 |

|

3,823,287 |

||||

|

Flexport, Inc., Preferred Series B-1 |

Jul 2022 |

|

69,790 |

|

944,665 |

|

459,916 |

||||

|

Flexport, Inc., Preferred Series D-3 |

Jul 2022 |

|

82,613 |

|

1,117,776 |

|

544,420 |

||||

|

Loadsmart, Inc., Preferred Series D |

Jan 2022 |

|

500,000 |

|

10,000,000 |

|

8,170,000 |

||||

|

Neutron Holdings, Inc. (d.b.a. Lime), Preferred Series 1-D |

Mar 2019 |

|

20,618,556 |

|

5,000,000 |

|

1,470,103 |

||||

|

Turo, Inc., Preferred Series D-1 |

Jun 2018 |

|

314,017 |

|

2,932,295 |

|

5,988,304 |

||||

|

|

|

30,233,766 |

|

24,806,814 |

|||||||

|

TOTAL PREFERRED STOCK IN PRIVATE COMPANIES |

|

|

374,879,718 |

|

453,236,115 |

||||||

|

|

|

|

|||||||||

|

Convertible Notes of Private Companies(a),(b) — 3.9% |

|

|

|

||||||||

|

AgTech — 0.0% |

|

|

|

||||||||

|

Farmer’s Business Network, Inc., 15.00% 9/28/2025 |

Sep 2023 |

$ |

350,000 |

|

350,000 |

|

350,000 |

||||

|

|

|

|

|||||||||

|

Artificial Intelligence — 0.3% |

|

|

|

||||||||

|

Nanotronics Imaging, Inc., 5.00% 4/25/2025 |

Apr 2023 |

$ |

3,000,000 |

|

3,000,000 |

|

3,318,614 |

||||

See accompanying Notes to the Financial Statements

14

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) December 31, 2024 |

|

Acquisition |

Principal/ |

Cost |

Fair Value |

||||||||

|

|

|

|

|||||||||

|

Convertible Notes of Private Companies(a),(b) — 3.9% (Continued) |

|

|

|||||||||

|

Hosting/Storage — 1.1% |

|

|

|

||||||||

|

TMGcore, Inc., 4.00% 9/30/2028 |

Dec 2021 |

$ |

10,476,362 |

$ |

10,476,362 |

$ |

10,488,991 |

||||

|

|

|

|

|||||||||

|

Software — 0.3% |

|

|

|

||||||||

|

Tradeshift Holdings, Inc., 0.00% 4/3/2025 |

Apr 2023 |

$ |

2,227,053 |

|

2,227,053 |

|

2,227,053 |

||||

|

Tradeshift Holdings, Inc., 0.00% 9/5/2026 |

Sep 2024 |

$ |

500,000 |

|

500,000 |

|

500,000 |

||||

|

|

|

2,727,053 |

|

2,727,053 |

|||||||

|

Transportation — 2.2% |

|

|

|

||||||||

|

Neutron Holdings, Inc. (d.b.a. Lime), 4.00% 6/1/2027 |

Jun 2020 |

$ |

10,418,495 |

|

252,362 |

|

762,795 |

||||

|

Neutron Holdings, Inc. (d.b.a. Lime), 7.50% 10/29/2025(d) |

Oct 2021 |

$ |

17,330,137 |

|

17,330,137 |

|

20,472,597 |

||||

|

|

|

17,582,499 |

|

21,235,392 |

|||||||

|

TOTAL CONVERTIBLE NOTES OF PRIVATE COMPANIES |

|

|

34,135,914 |

|

38,120,050 |

||||||

|

|

|

|

|||||||||

|

UNITS OF PRIVATE COMPANIES(a),(b) — 0.0% |

|

|

|

||||||||

|

Security — 0.0% |

|

|

|

||||||||

|

Excalibur CombineCo, L.P. Class A Units |

Jun 2023 |

|

194 |

|

193,877 |

|

193,857 |

||||

|

TOTAL UNITS OF PRIVATE COMPANIES |

|

|

193,877 |

|

193,857 |

||||||

|

|

|

|

|||||||||

|

Warrants of Private Companies(a),(b) — 0.1% |

|

|

|

||||||||

|

Analytics/Big Data — 0.0% |

|

|

|

||||||||

|

Content Square SAS, Exercise Price $0.0001, Exercise Date 6/11/2025 |

Dec 2023 |

|

14,553 |

|

153,658 |

|

217,275 |

||||

|

|

|

|

|||||||||

|

Software — 0.1% |

|

|

|

||||||||

|

Tradeshift Holdings, Inc., Exercise Price $0.001, Exercise Date 11/21/2031 |

Nov 2021 |

|

213,797 |

|

2,425,355 |

|

274,238 |

||||

|

Tradeshift Holdings, Inc., Exercise Price $0.001, Exercise Date 9/9/2031 |

Dec 2021 |

|

427,594 |

|

4,570,844 |

|

548,475 |

||||

|

Tradeshift Holdings, Inc., Exercise Price $0.001, Exercise Date 3/25/2032 |

Mar 2022 |

|

213,797 |

|

2,538,052 |

|

274,237 |

||||

|

|

|

9,534,251 |

|

1,096,950 |

|||||||

|

Transportation — 0.0% |

|

|

|

||||||||

|

Neutron Holdings, Inc. (d.b.a. Lime), Exercise Price $0.01, Exercise Date 6/2/2027 |

Jun 2020 |

|

1,016,483 |

|

807 |

|

52,145 |

||||

|

TOTAL WARRANTS OF PRIVATE COMPANIES |

|

|

9,688,716 |

|

1,366,370 |

||||||

|

|

|

|

|||||||||

|

Simple Agreement for Future Equity of Private Companies(a),(b) — 0.0% |

|

|

|||||||||

|

Artificial Intelligence — 0.0% |

|

|

|

||||||||

|

Cubefabs, Inc. |

Nov 2023 |

|

250,000 |

|

250,000 |

|

250,000 |

||||

|

TOTAL SIMPLE AGREEMENT FOR FUTURE EQUITY OF PRIVATE COMPANIES |

|

250,000 |

|

250,000 |

|||||||

|

|

|

|

|||||||||

|

Special Purpose Vehicles/PRIVATE FUNDS(a),(b) — 0.4% |

|

|

|

||||||||

|

Private Funds — 0.4% |

|

|

|

||||||||

|

Northgate Growth Fund III |

Dec 2022 |

|

|

3,950,000 |

|

3,958,030 |

|||||

|

TOTAL SPECIAL PURPOSE VEHICLES/PRIVATE FUNDS |

|

|

3,950,000 |

|

3,958,030 |

||||||

See accompanying Notes to the Financial Statements

15

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) December 31, 2024 |

|

Cost |

Fair Value |

|||||||||

|

|

|

|||||||||

|

Short-Term Investments — 5.5% |

|

|

||||||||

|

MUTUAL FUNDS — 5.5% |

|

|

||||||||

|

Goldman Sachs Government Fund, 4.31%(e) |

$ |

1,758,237 |

$ |

1,758,237 |

||||||

|

UMB Money Market II Special, 4.19%(e) |

|

51,589,355 |

|

51,589,355 |

||||||

|

|

|

|||||||||

|

TOTAL SHORT-TERM INVESTMENTS |

|

53,347,592 |

|

53,347,592 |

||||||

|

|

|

|||||||||

|

TOTAL INVESTMENTS — 99.7% |

|

763,181,885 |

|

970,140,608 |

||||||

|

Other assets less liabilities — 0.3% |

|

|

2,477,235 |

|||||||

|

|

|

|||||||||

|

NET ASSETS — 100.0% |

|

$ |

972,617,843 |

|||||||

(a) Investments in private companies, and in some cases public companies, may be subject to restrictions on disposition imposed by the issuer. All positions held are non-controlled and non-affiliated investments, as defined by the Investment Company Act of 1940, as amended (“1940 Act”). As of December 31, 2024 restricted securities represented 94.26% of the net assets of the Fund.

(b) Debt positions (convertible notes of private companies) are income producing, all other positions are Equity positions and are non-income producing, except for short-term investments.

(c) These securities have been purchased through Special Purpose Vehicles/Private Funds in which the Fund has a direct investment of ownership units of the Vehicles. The shares, cost basis and fair value stated are disclosed based on the underlying securities purchased by the Vehicle and the Fund’s ownership percentage.

(d) Denotes a variable rate security. The rate shown is the current interest rate as of December 31, 2024.

(e) Represents the 7-day effective yield as of December 31, 2024.

All issuers are based in the United States, except for Lyst, Ltd., OpenX Software, Ltd., and Snyk, Ltd., which are based in the UK, and Trax, Ltd., Eruditus Learning Solutions Pte., Ltd., Fundbox, Ltd., and Content Square SAS, which are based in the Cayman Islands, Singapore, Israel, and France, respectively.

See accompanying Notes to the Financial Statements

16

|

Assets: |

|

||

|

Investments, at fair value (cost $763,181,885) (Note 3) |

$ |

970,140,608 |

|

|

Cash |

|

393,552 |

|

|

Receivable for fund shares sold |

|

1,195,009 |

|

|

Interest receivable |

|

2,954,690 |

|

|

Prepaid expenses and other assets |

|

330,994 |

|

|

Total assets |

|

975,014,853 |

|

|

|

|||

|

Liabilities: |

|

||

|

Advisory fees |

|

1,525,102 |

|

|

Payable for shareholder servicing fees - Class L |

|

869 |

|

|

Payable for shareholder servicing fees - Class A |

|

29,390 |

|

|

Payable for audit and tax fees |

|

168,100 |

|

|

Payable for transfer agent fees |

|

346,890 |

|

|

Payable for 12b-1 fees - Class L |

|

869 |

|

|

Other accrued liabilities |

|

325,790 |

|

|

Total liabilities |

|

2,397,010 |

|

|

Commitments and contingences (Note 9) |

|

||

|

Net assets |

$ |

972,617,843 |

|

|

|

|||

|

Net assets consist of: |

|

||

|

Capital stock (unlimited shares authorized, no par value) |

$ |

784,625,388 |

|

|

Total distributable earnings |

|

187,992,455 |

|

|

Net assets |

$ |

972,617,843 |

|

|

|

|||

|

Net assets: |

|

||

|

Class A |

$ |

136,148,130 |

|

|

Class I |

|

832,134,463 |

|

|

Class L |

|

4,335,250 |

|

|

Total net assets |

$ |

972,617,843 |

|

|

|

|||

|

Shares outstanding: |

|

||

|

Class A |

|

3,224,358 |

|

|

Class I |

|

19,345,945 |

|

|

Class L |

|

104,545 |

|

|

Total shares outstanding |

|

22,674,848 |

|

|

|

|||

|

Net asset value, public offering price, and redemption proceeds per share: |

|

||

|

Class A - Net asset value and redemption proceeds per share |

$ |

42.22 |

|

|

Class I - Net asset value and redemption proceeds per share |

$ |

43.01 |

|

|

Class L - Net asset value and redemption proceeds per share |

$ |

41.47 |

|

|

Class A - Public offering price per share(a) |

$ |

44.80 |

|

|

Class L - Public offering price per share(b) |

$ |

43.31 |

(a) Computation of public offering price per share 100/94.25 of net asset value. (See Note 10).

(b) Computation of public offering price per share 100/95.75 of net asset value. (See Note 10).

See accompanying Notes to the Financial Statements

17

|

Investment Income: |

|

|

||

|

Dividends1 |

$ |

2,660,102 |

|

|

|

Interest2 |

|

6,258,279 |

|

|

|

Total investment income |

|

8,918,381 |

|

|

|

|

|

|||

|

Expenses: |

|

|

||

|

Investment advisory fees (Note 5) |

|

17,858,079 |

|

|

|

Transfer agent fees |

|

1,970,576 |

|

|

|

Audit and tax fees |

|

1,167,800 |

|

|

|

Legal fees |

|

508,098 |

|

|

|

Printing & postage |

|

429,028 |

|

|

|

Fund accounting & administration fees |

|

392,972 |

|

|

|

Trustee fees |

|

331,975 |

|

|

|

Insurance fees |

|

191,139 |

|

|

|

Consulting expense |

|

182,000 |

|

|

|

Miscellaneous expenses3 |

|

163,500 |

|

|

|

Registration fees |

|

92,295 |

|

|

|

Chief compliance officer fees |

|

90,000 |

|

|

|

Shareholder servicing fees - Class A |

|

80,771 |

|

|

|

Custodian fees |

|

42,621 |

|

|

|

Distribution fees - Class L |

|

9,229 |

|

|

|

Shareholder servicing fees - Class L |

|

3,529 |

|

|

|

Total expenses |

|

23,513,612 |

|

|

|

Less: Net contractual waiver of fees and reimbursement of expenses (Note 4) |

|

(572,088 |

) |

|

|

Net expenses |

|

22,941,524 |

|

|

|

Net investment loss |

$ |

(14,023,143 |

) |

|

|

|

|

|||

|

Net realized loss on investments |

|

(3,734,037 |

) |

|

|

Net change in unrealized gain on investments |

|

122,482,195 |

|

|

|

Net realized and change in unrealized gain on investments |

|

118,748,158 |

|

|

|

Net change in net assets from operations |

$ |

104,725,015 |

|

1 Includes paid-in-kind dividends of $791,797.

2 Includes paid-in-kind interest of $759,949.

3 Includes borrowing costs incurred during the fiscal year in the amount of $11,721 were excluded from the contractual waiver of fees.

See accompanying Notes to the Financial Statements

18

|

Year ended |

Year ended |

|||||||

|

|

|

|

|

|||||

|

Operations: |

|

|

|

|

||||

|

Net investment loss |

$ |

(14,023,143 |

) |

$ |

(13,673,227 |

) |

||

|

Net realized loss on investments |

|

(3,734,037 |

) |

|

(7,220,192 |

) |

||

|

Net change in unrealized gain/(loss) on investments |

|

122,482,195 |

|

|

(62,099,665 |

) |

||

|

Net change in net assets resulting from operations |

|

104,725,015 |

|

|

(82,993,084 |

) |

||

|

|

|

|

|

|||||

|

Fund share transactions: |

|

|

|

|

||||

|

Proceeds from shares issued - Class A |

|

14,608,294 |

|

|

17,392,389 |

|

||

|

Proceeds from shares issued - Class I |

|

177,329,680 |

|

|

151,699,613 |

|

||

|

Proceeds from shares issued - Class L |

|

743,511 |

|

|

766,702 |

|

||

|

Cost of shares repurchased - Class A |

|

(36,177,467 |

) |

|

(39,289,111 |

) |

||

|

Cost of shares repurchased - Class I |

|

(164,351,926 |

) |

|

(160,988,941 |

) |

||

|

Cost of shares repurchased - Class L |

|

(322,710 |

) |

|

(403,663 |

) |

||

|

Contribution from Investment Advisor1 |

|

— |

|

|

592,258 |

|

||

|

Net change in net assets from fund share transactions |

|

(8,170,618 |

) |

|

(30,230,753 |

) |

||

|

Net change in net assets |

$ |

96,554,397 |

|

$ |

(113,223,837 |

) |

||

|

|

|

|

|

|||||

|

Net assets: |

|

|

|

|

||||

|

Beginning of year |

$ |

876,063,446 |

|

$ |

989,287,283 |

|

||

|

End of year |

$ |

972,617,843 |

|

$ |

876,063,446 |

|

||

|

|

|

|

|

|||||

|

Transactions in shares: |

|

|

|

|

||||

|

Issuance of shares - Class A |

|

370,379 |

|

|

431,499 |

|

||

|

Issuance of shares - Class I |

|

4,429,079 |

|

|

3,707,863 |

|

||

|

Issuance of shares - Class L |

|

18,802 |

|

|

19,130 |

|

||

|

Repurchase of shares - Class A |

|

(903,982 |

) |

|

(989,755 |

) |

||

|

Repurchase of shares - Class I |

|

(4,035,918 |

) |

|

(4,000,220 |

) |

||

|

Repurchase of shares - Class L |

|

(8,174 |

) |

|

(10,362 |

) |

||

|

Net change in shares |

|

(129,814 |

) |

|

(841,845 |

) |

||

1 See Note 2 in the Notes to the Financial Statements.

See accompanying Notes to the Financial Statements

19

|

Cash flows from operating activities: |

|

|

||

|

Net change in net assets from operations |

$ |

104,725,015 |

|

|

|

Adjustments to reconcile net change in net assets from operations to net cash provided by operating activities: |

|

|

||

|

Purchases of investments |

|

(10,195,808 |

) |

|

|

Net sales of short-term investments |

|

30,500,001 |

|

|

|

Proceeds from sales of investments |

|

7,079,081 |

|

|

|

Net change in unrealized gain on investments |

|

(122,482,195 |

) |

|

|

Net realized loss on investments |

|

3,734,037 |

|

|

|

Paid-in-kind interest and dividends |

|

(1,551,746 |

) |

|

|

Change in operating assets and liabilities: |

|

|

||

|

Increase in interest receivable |

|

(1,744,835 |

) |

|

|

Increase in prepaid expenses and other assets |

|

(88,135 |

) |

|

|

Increase in net payable to Investment Adviser |

|

111,778 |

|

|

|

Decrease in other accrued liabilities |

|

(263,772 |

) |

|

|

Net cash provided by operating activities |

|

9,823,421 |

|

|

|

|

|

|||

|

Cash flows from financing activities: |

|

|

||

|

Proceeds from shares issued, net of change in receivable for fund shares sold |

|

189,084,133 |

|

|

|

Cost of shares redeemed, net of change in payable |

|

(198,514,002 |

) |

|

|

Net cash used in financing activities |

|

(9,429,869 |

) |

|

|

|

|

|||

|

Net change in cash |

|

393,552 |

|

|

|

|

|

|||

|

Cash at beginning of year |

|

— |

|

|

|

Cash at end of year |

$ |

393,552 |

|

|

|

|

|

|||

|

Supplemental disclosure of noncash financing activities |

|

|

||

|

Transfer in and out between share classes |

$ |

2,892,505 |

|

See accompanying Notes to the Financial Statements

20

|

Financial Highlights – Class A For a capital share outstanding throughout each period |

|

Year ended |

Year ended |

Year ended |

Year ended |

Year ended |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Per share operating performance |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net asset value, beginning of year |

$ |

37.91 |

|

$ |

41.37 |

|

$ |

41.77 |

|

$ |

36.33 |

|

$ |

29.96 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Change in net assets from operations: |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net investment loss |

|

(0.67 |

) |

|

(0.64 |

) |

|

(0.80 |

) |

|

(0.88 |

) |

|

(0.90 |

) |

|||||

|

Net realized and unrealized gain/(loss) on investments |

|

4.98 |

|

|

(2.84 |

) |

|

0.98 |

|

|

9.54 |

|

|

7.98 |

|

|||||

|

Total change in net assets from operations |

|

4.31 |

|

|

(3.48 |

) |

|

0.18 |

|

|

8.66 |

|

|

7.08 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Distributions: |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

From net return of capital |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.07 |

) |

|||||

|

From net realized gain on investments |

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.64 |

) |

|||||

|

Total distributions |

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.71 |

) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Impact of NAV Error |

|

— |

|

|

0.02 |

|

|

— |

|

|

— |

|

|

— |

|

|||||

|

Net increase (decrease) in net asset value |

|

4.31 |

|

|

(3.46 |

) |

|

(0.40 |

) |

|

5.44 |

|

|

6.37 |

|

|||||

|

Net asset value, end of year |

$ |

42.22 |

|

$ |

37.91 |

|

$ |

41.37 |

(b) |

$ |

41.77 |

|

$ |

36.33 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Total return(c) |

|

11.40 |

% |

|

(8.36 |

)%(d) |

|

0.42 |

% |

|

23.85 |

% |

|

23.69 |

% |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Ratios and supplemental data |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net assets, end of year (in thousands) |

$ |

136,148 |

|

$ |

142,451 |

|

$ |

178,577 |

|

$ |

158,433 |

|

$ |

103,984 |

|

|||||

|

Ratio of net expenses to average net assets(e) |

|

2.65 |

%(f) |

|

2.60 |

%(g)(h) |

|

2.51 |

%(g) |

|

2.51 |

%(g) |

|

2.50 |

% |

|||||

|

Ratio of gross expenses before reimbursement to average net assets |

|

2.55 |

% |

|

2.48 |

% |

|

2.41 |

% |

|

2.64 |

% |

|

2.97 |

% |

|||||

|

Ratio of net investment loss to average net assets |

|

(1.70 |

)% |

|

(1.60 |

)% |

|

(1.89 |

)% |

|

(2.42 |

)% |

|

(2.48 |

)% |

|||||

|

Portfolio turnover |

|

0.84 |

% |

|

2.23 |

% |

|

3.17 |

% |

|

26.20 |

% |

|

6.97 |

% |

|||||

(a) Per share calculations are based on average shares outstanding throughout the period.

(b) The NAV per share has been adjusted from the published NAV of $41.75 for post-closing adjustments.

(c) The Fund’s total investment returns do not include a sales load.

(d) A revision on the valuation of certain securities resulted in understated NAV. The impact of the NAV error on Total Return at NAV was 0.05%.

(e) The ratio of net expenses includes recoupment of previously waived and/or reimbursed fees of $144,908, $199,187 and $184,461, or 0.10%, 0.12% and 0.10%, for the fiscal year ended December 31, 2024, 2023 and 2022, respectively, and contractual waivers and expense reimbursements of $171,876 and $492,357, or 0.12% and 0.47% for the fiscal years ended December 31, 2021 and 2020, respectively. Please see Note 4 in the Notes to the Financial Statements for additional information.

(f) Effective November 19, 2024 expenses associated with lines of credit are excluded from of the 2.65% expense cap. Borrowing costs incurred by the Fund and allocated to Class A during November 19, 2024 to December 31, 2024 were $1,667 or 0.00%.

(g) During the fiscal years ended December 31, 2023, 2022 and 2021 there were legal expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $943 or 0.00%, $17,472 or 0.01% and $17,854 or 0.01%, respectively.

(h) Effective May 1, 2023, the Investment Adviser contractually agreed to waive management fees and/or reimburse the Fund for expenses the Fund incurs, subject to certain exclusions, to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement to an annual rate of 2.65%, 2.40%, and 2.90% (each, an “Expense Limit”) of the average daily net assets of the Fund attributable to Class A, Class I and Class L Shares, respectively. Prior to May 1, 2023, the Expense Limit for Class A shares was 2.50%.

See accompanying Notes to the Financial Statements

21

|

THE PRIVATE SHARES FUND |

|

Financial Highlights – Class I For a capital share outstanding throughout each period |

|

Year ended |

Year ended |

Year ended |

Year ended |

Year ended |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Per share operating performance |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net asset value, beginning of year |

$ |

38.52 |

|

$ |

41.94 |

|

$ |

42.22 |

|

$ |

36.61 |

|

$ |

30.12 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Change in net assets from operations: |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Net investment loss |

|

(0.58 |

) |

|

(0.55 |

) |

|

(0.65 |

) |

|

(0.62 |

) |

|

(0.47 |

) |

|||||

|

Net realized and unrealized gain/(loss) on investments |

|

5.07 |

|

|

(2.89 |

) |

|

0.95 |

|

|

9.45 |

|

|

7.67 |

|

|||||

|

Total change in net assets from operations |

|

4.49 |

|

|

(3.44 |

) |

|

0.30 |

|

|

8.83 |

|

|

7.20 |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Distributions: |

|

|

|

|

|

|

|

|

|

|

||||||||||

|

From net return of capital |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.07 |

) |

|||||

|

From net realized gain on investments |

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.64 |

) |

|||||

|

Total distributions |

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.71 |

) |

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Impact of NAV Error |

|

— |