UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number 811-22759

The Private Shares Fund

(Exact name of registrant as specified in charter)

88 Pine Street, Suite 3101

New York, NY 10005

(Address of principal executive offices) (Zip code)

Cogency Global, Inc.

c/o The Private Shares Fund

850 New Burton Rd. Ste. 201

City of Dover, County of Kent, Delaware 19904

(Name and address of agent for service)

Copies to:

Dechert LLP

45 Fremont Street, 26th Floor

San Francisco, CA 94105

Registrant's telephone number, including area code: (646) 839-5548

Date of fiscal year end: December 31

Date of reporting period: June 30, 2025

Item 1. Reports to Stockholders.

(a) The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended.

|

THE PRIVATE SHARES FUND |

|

|

|

Table of Contents |

||

|

2 |

||

|

5 |

||

|

6 |

||

|

8 |

||

|

15 |

||

|

16 |

||

|

17 |

||

|

18 |

||

|

19 |

||

|

22 |

||

|

34 |

1

As of June 30, 2025, the Fund’s performance is as follows:

|

Total Return Information (Unaudited) |

||||||

|

The Private Shares Fund – Class A |

Ten |

Five |

Three |

One |

Annualized |

Cumulative |

|

Returns based on Purchase Without |

6.15% |

8.85% |

0.18% |

8.33% |

8.02% |

138.42% |

|

Returns based on Purchase With Maximum Sales Charge of 5.75% (POP) |

5.52% |

7.57% |

-1.78% |

2.10% |

7.45% |

124.71% |

|

Fund Benchmark |

||||||

|

Russell 2000® Index |

7.12% |

10.04% |

10.00% |

7.68% |

7.05% |

115.43% |

|

The Private Shares Fund – Class I |

Ten |

Five |

Three |

One |

Annualized |

Cumulative |

|

Returns based on Purchase Without Any Sales Charge (NAV) |

N/A |

9.08% |

0.36% |

8.41% |

8.33% |

83.92% |

|

Fund Benchmark |

||||||

|

Russell 2000® Index |

N/A |

10.04% |

10.00% |

7.68% |

6.51% |

61.61% |

|

The Private Shares Fund – Class L |

Ten |

Five |

Three |

One |

Annualized |

Cumulative |

|

Returns based on Purchase Without Any Sales Charge (NAV) |

N/A |

8.59% |

-0.06% |

8.11% |

7.28% |

65.11% |

|

Returns based on Purchase With Maximum Sales Charge of 4.25% (POP) |

N/A |

7.65% |

-1.49% |

3.52% |

6.63% |

58.09% |

|

Fund Benchmark |

||||||

|

Russell 2000® Index |

N/A |

10.04% |

10.00% |

7.68% |

5.77% |

49.25% |

Performance data quoted represents past performance and is no guarantee of future results. Public offering price (“POP”) performance assumes a maximum sales load of 5.75% (Class A) and 4.25% (Class L) on all sales. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. Current performance may be lower or higher than the performance data quoted. For performance as of the most recent month-end, please call 1-855-551-5510. Some of the Fund’s fees were waived or expenses reimbursed; otherwise, returns would have been lower. The Fund’s total annual expenses per the currently stated prospectus are 2.53% (Class A), 2.48% (Class I), and 2.76% (Class L). The Fund’s total net expenses are 2.72% (Class A), 2.47% (Class I), and 2.97% (Class L). Liberty Street Advisors, Inc. (the “Investment Adviser”) has contractually agreed to waive fees and/or reimburse (excluding taxes, interest expense, commitment fees, legal fees or other expenses related to any borrowing or leverage incurred by the Fund, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) expenses such that the total expenses do not exceed 2.65% (Class A), 2.40% (Class I), and 2.90% (Class L) through May 2, 2026. Net expenses are applicable to investors.

2

|

THE PRIVATE SHARES FUND |

|

Fund Performance (Continued) June 30, 2025 (Unaudited) |

DISCLOSURES

Investment in the Fund involves substantial risk. The Fund is not suitable for investors who cannot bear the risk of loss of all or part of their investment. The Fund is appropriate only for investors who can tolerate a high degree of risk and do not require a liquid investment. All investing involves risk including the possible loss of principal. Shares in the Fund are highly illiquid, and can be sold by shareholders only in the quarterly repurchase program of the Fund which allows for up to 5% of the Fund’s outstanding shares to be redeemed each quarter at NAV. Due to transfer restrictions and the illiquid nature of the Fund’s investments, you may not be able to sell your shares when, or in the amount that, you desire. The Fund primarily invests in late-stage operating businesses and does so primarily by directly investing in private, operating growth companies (“Portfolio Companies”). There are significant potential risks relating to investing in Portfolio Companies. Because most of the securities in which the Fund invests are not publicly traded, the Fund’s investments will be valued by Liberty Street Advisors, Inc. (the “Investment Adviser”) as Valuation Designee pursuant to fair valuation procedures and methodologies approved by the Board of Trustees, as set forth in the prospectus. As a consequence, the value of the securities, and therefore the Fund’s Net Asset Value (“NAV”), may vary. There are significant potential risks associated with investing in venture capital and private equity-backed companies with complex capital structures. The Fund focuses its investments in a limited number of securities, which could subject it to greater risk than that of a larger, more varied portfolio. There is a greater focus in technology securities that could adversely affect the Fund’s performance. The Fund’s quarterly repurchase policy may require the Fund to liquidate portfolio holdings earlier than the Investment Adviser would otherwise do so and may also result in an increase in the Fund’s expense ratio. Portfolio holdings of private companies that become publicly traded likely will be subject to more volatile market fluctuations than when private, and the Fund may not be able to sell shares at favorable prices. Such companies frequently impose lock-ups that would prohibit the Fund from selling shares for a period of time after an initial public offering (IPO). Market prices of public securities held by the Fund may decline substantially before the Investment Adviser is able to sell the securities. The Fund may invest in private securities utilizing special purpose vehicles (“SPVs”) and similar investment structures, venture capital funds and other funds that invest in private companies and rely on exclusions from the 1940 Act under section 3(c)(1) or 3(c)(7) (“Private Funds”), private investments in public equity (“PIPE”) transactions where the issuer is a special purpose acquisition company (“SPAC”), and may utilize profit sharing agreements. The Fund will bear its pro rata portion of expenses on investments in SPVs and Private Funds and will have no direct claim against underlying portfolio companies. The Fund’s investments in Private Funds subject it to the risks associated with direct ownership of the securities in which the underlying funds invest, as well as additional risks specific to the Private Funds, including operational risk, legal and indemnification risks, and lock-ups and other restrictions on withdrawal. PIPE transactions involve price risk, market risk, expense risk, and the risk that the Fund may not be able to sell the securities due to lock-ups or restrictions. Profit sharing agreements may expose the Fund to certain risks, including that the agreements could reduce the gain the Fund otherwise would have achieved on its investment, may be difficult to value and may result in contractual disputes. Certain conflicts of interest involving the Fund and its affiliates could impact the Fund’s investment returns and limit the flexibility of its investment policies. This is not a complete enumeration of the Fund’s risks. Please read the Fund prospectus for other risk factors related to the Fund.

The Fund may not be suitable for all investors. We encourage you to consult with appropriate financial professionals before considering an investment in the Fund.

The Russell 2000 is an index measuring the performance of approximately 2,000 smallest-cap American companies in the Russell 3000 Index, which is made up of 3,000 of the largest U.S. stocks. It is a market-cap weighted index. A SPAC is a company that has no commercial operations and is formed strictly to raise capital through an IPO for the purpose of acquiring or merging with an existing company.

The views expressed in this material reflect those of the Investment Adviser as of the date this is written and may not reflect its views on the date this material is first published or anytime thereafter. These views are intended to assist in understanding the Fund’s investment methodology and do not constitute investment advice. This material may contain discussions about investments that may or may not be held by the Fund. All current and future holdings are subject to risk and to change.

The Fund is distributed by Foreside Fund Services, LLC.

3

|

THE PRIVATE SHARES FUND |

|

Fund Performance (Continued) June 30, 2025 (Unaudited) |

IMPORTANT DISCLOSURES

The inclusion of various indices is for comparison purposes only. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

Holdings subject to change. Not a recommendation to buy, sell, or hold any specific security.

4

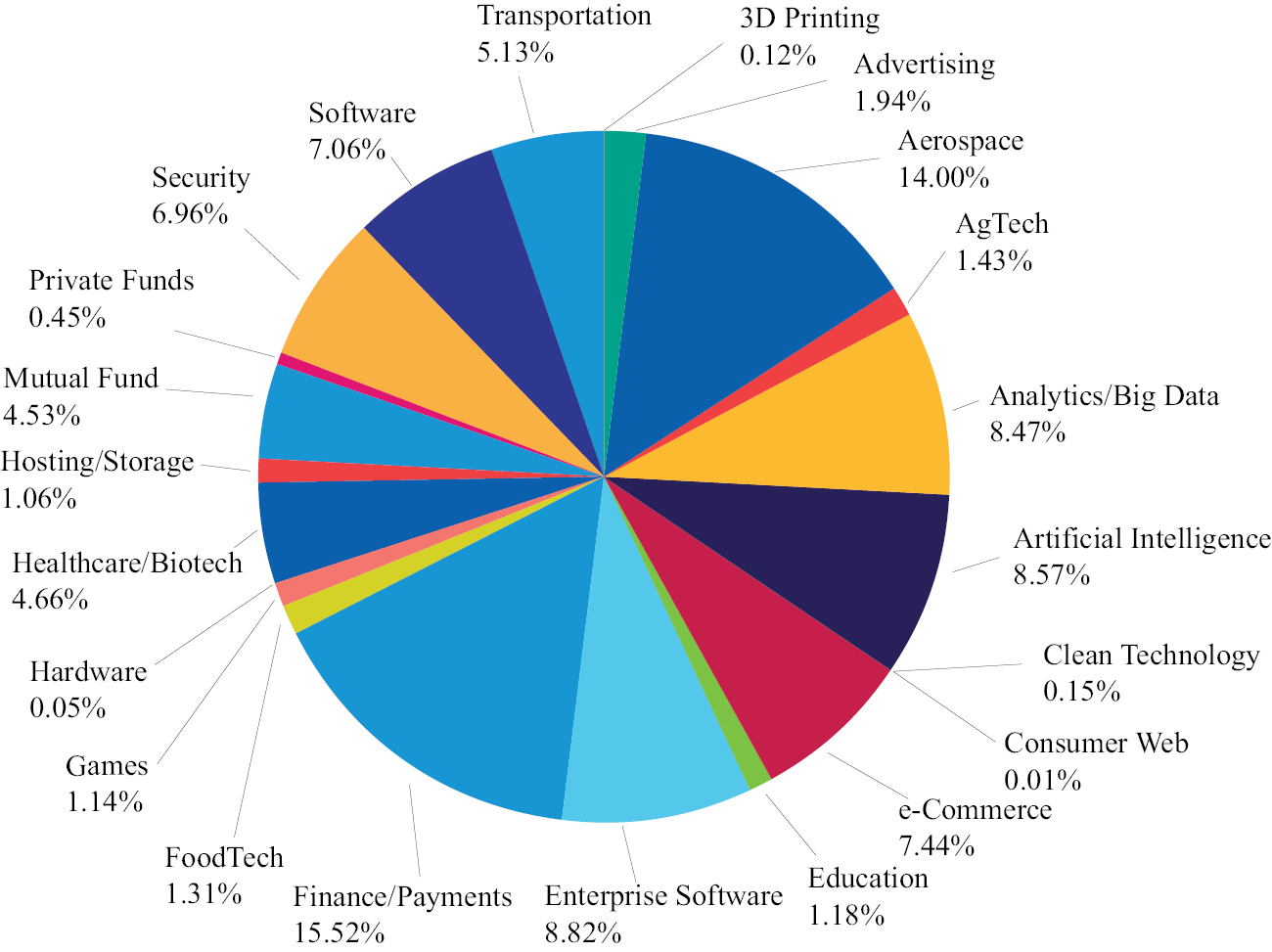

Fund Sector Diversification

The following chart provides a visual breakdown of the Fund, by the industry sectors that the underlying securities represent, as a percentage of the total investments.

5

Fund Holdings

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

6

|

THE PRIVATE SHARES FUND |

|

Portfolio Composition (Continued) June 30, 2025 (Unaudited) |

Fund Holdings (Continued)

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|||||

|

|

|

7

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Common Stock in Public Companies(a),(b) — 8.2% |

|

|

||||||||

|

Aerospace — 2.1% |

|

|

||||||||

|

Voyager Technologies, Inc. |

Mar 2022 |

544,823 |

$ |

14,999,950 |

$ |

21,384,303 |

||||

|

|

|

|||||||||

|

Finance/Payments — 5.3% |

|

|

||||||||

|

Circle Internet Group, Inc. |

Apr 2018 |

290,200 |

|

2,604,826 |

|

52,610,358 |

||||

|

|

|

|||||||||

|

Healthcare/Biotech — 0.8% |

|

|

||||||||

|

Omada Health, Inc. |

Dec 2021 |

444,800 |

|

7,999,995 |

|

8,139,840 |

||||

|

TOTAL COMMON STOCK IN PUBLIC COMPANIES |

|

25,604,771 |

|

82,134,501 |

||||||

|

|

|

|||||||||

|

Common Stock in Private Companies(a),(b) — 37.0% |

|

|

||||||||

|

3D Printing — 0.1% |

|

|

||||||||

|

Carbon, Inc. |

Jun 2019 |

158,853 |

|

2,125,214 |

|

1,172,335 |

||||

|

|

|

|||||||||

|

Advertising — 1.9% |

|

|

||||||||

|

GroundTruth, Inc. |

Oct 2016 |

1,659,427 |

|

446,424 |

|

481,234 |

||||

|

NextRoll, Inc. |

Mar 2017 |

2,367,054 |

|

16,079,048 |

|

16,072,297 |

||||

|

OpenX Software, Ltd. |

Jun 2015 |

2,899,297 |

|

2,615,386 |

|

2,609,367 |

||||

|

|

19,140,858 |

|

19,162,898 |

|||||||

|

Aerospace — 7.1% |

|

|

||||||||

|

Axiom Space, Inc. |

Mar 2021 |

29,543 |

|

5,099,983 |

|

3,666,287 |

||||

|

Relativity Space, Inc. |

Oct 2021 |

12,165 |

|

20,299,986 |

|

51,882 |

||||

|

Space Exploration Technologies Corp. |

May 2019 |

360,330 |

|

7,386,765 |

|

66,661,050 |

||||

|

|

32,786,734 |

|

70,379,219 |

|||||||

|

AgTech — 0.1% |

|

|

||||||||

|

Farmer’s Business Network, Inc. |

Sep 2021 |

119,676 |

|

5,042,625 |

|

935,866 |

||||

|

|

|

|||||||||

|

Analytics/Big Data — 5.7% |

|

|

||||||||

|

Content Square SAS |

Dec 2023 |

544,905 |

|

3,740,557 |

|

6,375,388 |

||||

|

Dataminr, Inc. |

Sep 2015 |

567,043 |

|

6,559,226 |

|

16,756,121 |

||||

|

Domino Data Lab, Inc. |

Apr 2021 |

330,000 |

|

4,118,400 |

|

5,412,000 |

||||

|

INRIX, Inc. |

May 2014 |

133,238 |

|

3,026,250 |

|

6,045,008 |

||||

|

SingleStore, Inc. |

May 2020 |

2,148,366 |

|

10,359,604 |

|

14,866,693 |

||||

|

Tealium, Inc. |

Sep 2020 |

200,000 |

|

1,300,000 |

|

2,990,000 |

||||

|

ThoughtSpot, Inc. |

Oct 2018 |

162,087 |

|

1,745,758 |

|

3,984,098 |

||||

|

|

30,849,795 |

|

56,429,308 |

|||||||

|

Artificial Intelligence — 4.1% |

|

|

||||||||

|

Brain Corp. |

Dec 2020 |

2,375,000 |

|

9,540,000 |

|

12,848,750 |

||||

|

Cerebras Systems, Inc. |

Feb 2022 |

309,813 |

|

6,946,627 |

|

11,351,548 |

||||

|

Nanotronics Imaging, Inc. |

Aug 2022 |

76,504 |

|

7,803,408 |

|

16,138,519 |

||||

|

|

24,290,035 |

|

40,338,817 |

|||||||

|

EDUCATION — 0.7% |

|

|

||||||||

|

Learneo, Inc. (f.k.a. Course Hero, Inc.) |

Jun 2020 |

270,000 |

|

3,429,200 |

|

6,501,600 |

||||

See accompanying Notes to the Financial Statements

8

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) June 30, 2025 (Unaudited) |

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Common Stock in Private Companies(a),(b) — 37.0% (Continued) |

|

|

||||||||

|

Enterprise Software — 3.6% |

|

|

||||||||

|

Automation Anywhere, Inc. |

Jul 2021 |

189,449 |

$ |

4,019,940 |

$ |

2,144,563 |

||||

|

Docker, Inc. |

May 2017 |

2,500 |

|

531,250 |

|

24,750 |

||||

|

EquipmentShare.com, Inc. |

Oct 2021 |

694,800 |

|

9,985,874 |

|

20,976,012 |

||||

|

Motive Technologies, Inc. (f.k.a. Keep Truckin, Inc.) |

May 2019 |

788,562 |

|

3,420,734 |

|

8,871,322 |

||||

|

Tebra Technologies, Inc. (f.k.a. Kareo, Inc.) |

Nov 2020 |

190,007 |

|

1,235,126 |

|

1,417,452 |

||||

|

Trax, Ltd. |

Mar 2020 |

149,970 |

|

5,100,000 |

|

2,080,084 |

||||

|

|

24,292,924 |

|

35,514,183 |

|||||||

|

Finance/Payments — 3.7% |

|

|

||||||||

|

Betterment Holdings, Inc. |

Mar 2021 |

1,457,800 |

|

14,999,995 |

|

24,388,994 |

||||

|

ConsenSys Software, Inc. |

May 2022 |

31,010 |

|

3,703,824 |

|

3,968,660 |

||||

|

Payward, Inc. (d.b.a. Kraken) |

Jun 2021 |

105,218 |

|

5,079,228 |

|

5,273,526 |

||||

|

Prosper Marketplace, Inc. |

Jan 2016 |

244,130 |

|

1,307,998 |

|

97,652 |

||||

|

Upgrade, Inc. |

Apr 2022 |

661,053 |

|

2,900,002 |

|

3,087,118 |

||||

|

|

27,991,047 |

|

36,815,950 |

|||||||

|

FoodTech — 0.4% |

|

|

||||||||

|

Impossible Foods, Inc. |

Oct 2022 |

373,248 |

|

3,569,496 |

|

4,452,849 |

||||

|

|

|

|||||||||

|

Games — 1.1% |

|

|

||||||||

|

Epic Games, Inc. |

Nov 2022 |

17,168 |

|

10,826,013 |

|

11,375,002 |

||||

|

|

|

|||||||||

|

Hardware — 0.0% |

|

|

||||||||

|

Hydrow, Inc. |

Feb 2022 |

14,172,560 |

|

4,999,989 |

|

473,364 |

||||

|

|

|

|||||||||

|

Healthcare/Biotech — 1.8% |

|

|

||||||||

|

Click Therapeutics, Inc. |

Nov 2020 |

1,000,000 |

|

3,500,000 |

|

4,967,100 |

||||

|

Color Health, Inc. |

Feb 2022 |

139,486 |

|

10,039,927 |

|

1,687,781 |

||||

|

Devoted Health, Inc. |

Aug 2022 |

177,776 |

|

9,999,953 |

|

11,055,889 |

||||

|

ZocDoc, Inc. |

Feb 2015 |

61,016 |

|

1,321,708 |

|

466,772 |

||||

|

|

24,861,588 |

|

18,177,542 |

|||||||

|

Security — 4.9% |

|

|

||||||||

|

Arctic Wolf Networks, Inc. |

Dec 2021 |

2,072,651 |

|

20,456,420 |

|

24,996,171 |

||||

|

Contrast Security, Inc. |

Sep 2022 |

31,250 |

|

255,000 |

|

288,125 |

||||

|

Cybereason, Inc. |

Apr 2025 |

2,115,128 |

|

7,631,457 |

|

1,336,338 |

||||

|

Lookout, Inc. |

Jul 2022 |

1,869,160 |

|

10,000,006 |

|

12,766,363 |

||||

|

Snyk, Ltd. |

Mar 2023 |

392,707 |

|

2,932,070 |

|

4,543,620 |

||||

|

Tanium, Inc. |

Apr 2019 |

640,000 |

|

4,787,200 |

|

5,203,200 |

||||

|

|

46,062,153 |

|

49,133,817 |

|||||||

|

Software — 1.5% |

|

|

||||||||

|

Discord, Inc. |

Dec 2021 |

36,603 |

|

15,833,016 |

|

14,153,648 |

||||

|

Roofstock, Inc. |

Jun 2024 |

127,231 |

|

6,130,637 |

|

1,080,191 |

||||

|

|

21,963,653 |

|

15,233,839 |

|||||||

See accompanying Notes to the Financial Statements

9

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) June 30, 2025 (Unaudited) |

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Common Stock in Private Companies(a),(b) — 37.0% (Continued) |

|

|

||||||||

|

Transportation — 0.3% |

|

|

||||||||

|

Flexport, Inc. |

Jul 2022 |

538,387 |

$ |

7,256,025 |

$ |

2,858,835 |

||||

|

TOTAL COMMON STOCK IN PRIVATE COMPANIES |

|

289,487,349 |

|

368,955,424 |

||||||

|

|

|

|||||||||

|

Preferred Stock in Private Companies(a),(b) — 38.5% |

|

|

||||||||

|

Advertising — 0.0% |

|

|

||||||||

|

GroundTruth, Inc., Preferred Series B-1 |

Jan 2017 |

600,000 |

|

149,200 |

|

174,000 |

||||

|

|

|

|||||||||

|

Aerospace — 4.8% |

|

|

||||||||

|

Axiom Space, Inc., Preferred Series B |

Dec 2020 |

32,221 |

|

2,019,958 |

|

3,998,627 |

||||

|

Axiom Space, Inc., Preferred Series C-1 |

Aug 2021 |

108,731 |

|

15,612,740 |

|

13,493,518 |

||||

|

Beta Technologies, Inc., Preferred Series A |

Apr 2021 |

40,944 |

|

2,999,967 |

|

4,686,860 |

||||

|

Beta Technologies, Inc., Preferred Series B |

Apr 2022 |

58,156 |

|

5,999,954 |

|

6,657,117 |

||||

|

Radian Aerospace, Inc., Preferred Series Seed 2 |

Sep 2021 |

607,336 |

|

1,999,997 |

|

2,332,170 |

||||

|

Relativity Space, Inc., Preferred Series 1A |

May 2025 |

1,172,360 |

|

4,999,998 |

|

4,999,998 |

||||

|

Relativity Space, Inc., Preferred Series Z |

May 2025 |

9,999 |

|

0 |

|

9,999,000 |

||||

|

Xplore, Inc., Preferred Series A1 |

Feb 2022 |

237,524 |

|

1,000,000 |

|

1,250,001 |

||||

|

|

34,632,614 |

|

47,417,291 |

|||||||

|

AgTech — 0.5% |

|

|

||||||||

|

Farmer’s Business Network, Inc., Preferred Series G |

Sep 2021 |

128,704 |

|

10,199,946 |

|

4,570,279 |

||||

|

|

|

|||||||||

|

Analytics/Big Data — 0.6% |

|

|

||||||||

|

Content Square SAS, Preferred Series F |

Dec 2023 |

160,410 |

|

1,693,701 |

|

2,441,440 |

||||

|

Dataminr, Inc., Preferred Series A |

Apr 2019 |

20,000 |

|

198,000 |

|

591,000 |

||||

|

Dataminr, Inc., Preferred Series B |

Apr 2019 |

87,496 |

|

866,211 |

|

2,585,507 |

||||

|

|

2,757,912 |

|

5,617,947 |

|||||||

|

Artificial Intelligence — 2.4% |

|

|

||||||||

|

Nanotronics Imaging, Inc., Preferred Series F-2 |

Apr 2022 |

90,888 |

|

15,300,066 |

|

19,172,823 |

||||

|

VerbIT, Inc., Preferred Series A |

Nov 2021 |

47,640 |

|

693,256 |

|

151,495 |

||||

|

VerbIT, Inc., Preferred Series B |

Nov 2021 |

288,180 |

|

4,194,173 |

|

916,412 |

||||

|

VerbIT, Inc., Preferred Series E-1 |

Nov 2021 |

423,720 |

|

6,166,668 |

|

3,915,173 |

||||

|

VerbIT, Inc., Preferred Series Seed 2 |

Nov 2021 |

65,000 |

|

945,904 |

|

206,700 |

||||

|

|

27,300,067 |

|

24,362,603 |

|||||||

|

Clean Technology — 0.1% |

|

|

||||||||

|

WiTricity Holdings, Inc., Preferred Series A |

Oct 2020 |

1,000,000 |

|

1,020,000 |

|

820,000 |

||||

|

WiTricity Holdings, Inc., Preferred Series B |

Jun 2022 |

333,253 |

|

999,999 |

|

559,865 |

||||

|

|

2,019,999 |

|

1,379,865 |

|||||||

|

Consumer Web — 0.0% |

|

|

||||||||

|

Trusper, Inc. (d.b.a. Musely), Preferred Series B |

Oct 2014 |

7,961 |

|

100,012 |

|

118,380 |

||||

|

|

|

|||||||||

|

e-Commerce — 7.2% |

|

|

||||||||

|

GrubMarket, Inc., Preferred Series D |

Oct 2020 |

440,742 |

|

1,999,999 |

|

11,865,590 |

||||

|

GrubMarket, Inc., Preferred Series E |

Jun 2021 |

1,520,838 |

|

14,999,995 |

|

40,943,773 |

||||

|

GrubMarket, Inc., Preferred Series F |

Feb 2022 |

697,526 |

|

9,999,982 |

|

18,778,690 |

||||

|

|

26,999,976 |

|

71,588,053 |

|||||||

See accompanying Notes to the Financial Statements

10

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) June 30, 2025 (Unaudited) |

|

Acquisition |

Shares |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Preferred Stock in Private Companies(a),(b) — 38.5% (Continued) |

|

|

||||||||

|

Education — 0.1% |

|

|

||||||||

|

Yanka Industries, Inc. (d.b.a. MasterClass), Preferred Series Seed 1 |

Jul 2021 |

193,100 |

$ |

6,146,189 |

$ |

1,204,944 |

||||

|

|

|

|||||||||

|

Enterprise Software — 5.0% |

|

|

||||||||

|

Checkr, Inc., Preferred Series A-1 |

Mar 2020 |

150,000 |

|

1,405,000 |

|

2,565,000 |

||||

|

Cohere Technologies, Inc., Preferred Series D-1 |

Feb 2022 |

279,571 |

|

1,999,995 |

|

1,973,771 |

||||

|

Cohere Technologies, Inc., Preferred Series D-2 |

Dec 2020 |

386,038 |

|

2,071,233 |

|

2,682,964 |

||||

|

EquipmentShare.com, Inc., Preferred Series E |

May 2022 |

323,064 |

|

4,999,997 |

|

9,753,302 |

||||

|

Motive Technologies, Inc. (f.k.a. Keep Truckin, Inc.), Preferred Series E |

May 2021 |

638,843 |

|

4,599,996 |

|

7,186,984 |

||||

|

Motive Technologies, Inc. (f.k.a. Keep Truckin, Inc.), Preferred Series F |

Jun 2022 |

1,923,076 |

|

14,999,993 |

|

21,634,605 |

||||

|

Tebra Technologies, Inc. (f.k.a. Kareo, Inc.), Preferred Series Seed 2 |

Nov 2020 |

123,819 |

|

804,870 |

|

923,690 |

||||

|

Trax, Ltd., Pre IPO |

Mar 2021 |

76,722 |

|

3,999,978 |

|

2,700,614 |

||||

|

|

34,881,062 |

|

49,420,930 |

|||||||

|

Finance/Payments — 6.0% |

|

|

||||||||

|

Betterment Holdings, Inc., Preferred Series F |

Sep 2021 |

318,380 |

|

3,999,999 |

|

5,326,497 |

||||

|

Fundbox, Ltd., Preferred Series C |

Jun 2019 |

439,552 |

|

4,999,992 |

|

5,551,542 |

||||

|

Fundbox, Ltd., Preferred Series D |

Sep 2021 |

531,914 |

|

7,499,988 |

|

7,127,648 |

||||

|

Payward, Inc. (d.b.a. Kraken), Preferred Series A |

Nov 2021 |

262,210 |

|

13,768,164 |

|

13,141,965 |

||||

|

Payward, Inc. (d.b.a. Kraken), Preferred Series Seed |

Apr 2022 |

67,000 |

|

3,505,340 |

|

3,358,040 |

||||

|

Prosper Marketplace, Inc., Preferred Series A |

Jan 2016 |

55,395 |

|

305,781 |

|

28,805 |

||||

|

Prosper Marketplace, Inc., Preferred Series A-1 |

Jan 2016 |

58,165 |

|

116 |

|

23,266 |

||||

|

Ripple Labs, Inc., Preferred Series A |

Dec 2018 |

40,697 |

|

488,364 |

|

10,174,250 |

||||

|

Upgrade, Inc., Preferred Series C-1 |

Mar 2022 |

3,290,000 |

|

14,159,000 |

|

15,364,300 |

||||

|

|

48,726,744 |

|

60,096,313 |

|||||||

|

FoodTech — 0.5% |

|

|

||||||||

|

Impossible Foods, Inc., Preferred Series E-1 |

Nov 2022 |

400,000 |

|

4,080,000 |

|

4,772,000 |

||||

|

|

|

|||||||||

|

Healthcare/Biotech — 2.0% |

|

|

||||||||

|

Click Therapeutics, Inc., Preferred Series A |

Nov 2020 |

60,087 |

|

210,304 |

|

298,458 |

||||

|

Collective Health, Inc., Preferred Series F |

May 2021 |

3,989,361 |

|

3,120,000 |

|

2,273,936 |

||||

|

Crossover Health Management Services, Inc., Preferred Series D |

Mar 2021 |

303,329 |

|

10,786,170 |

|

16,589,063 |

||||

|

Devoted Health, Inc., Preferred Series E |

Dec 2023 |

8,888 |

|

499,953 |

|

552,745 |

||||

|

ZocDoc, Inc., Preferred Series A |

Feb 2015 |

35,000 |

|

875,000 |

|

267,750 |

||||

|

|

15,491,427 |

|

19,981,952 |

|||||||

|

Security — 2.0% |

|

|

||||||||

|

Contrast Security, Inc., Preferred Series A |

Jul 2022 |

828,514 |

|

10,300,003 |

|

7,638,899 |

||||

|

Contrast Security, Inc., Preferred Series C |

Nov 2022 |

1,164,596 |

|

7,649,998 |

|

10,737,575 |

||||

|

Cybereason, Inc., Preferred Series H |

Apr 2025 |

175,604 |

|

110,947 |

|

110,947 |

||||

|

Lookout, Inc., Preferred Series A |

Feb 2015 |

204,000 |

|

1,927,800 |

|

1,393,320 |

||||

|

|

19,988,748 |

|

19,880,741 |

|||||||

See accompanying Notes to the Financial Statements

11

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) June 30, 2025 (Unaudited) |

|

Acquisition |

Shares/ |

Cost |

Fair Value |

||||||||

|

|

|

|

|||||||||

|

Preferred Stock in Private Companies(a),(b) — 38.5% (Continued) |

|

|

|||||||||

|

Software — 4.8% |

|

|

|

||||||||

|

Roofstock, Inc., Preferred Series E |

Mar 2022 |

|

339,154 |

$ |

9,999,990 |

$ |

6,688,117 |

||||

|

Tradeshift Holdings, Inc., Preferred Series 3 |

Jun 2021 |

|

28,797,969 |

|

12,551,436 |

|

41,469,075 |

||||

|

|

|

22,551,426 |

|

48,157,192 |

|||||||

|

Transportation — 2.5% |

|

|

|

||||||||

|

Clearmotion, Inc., Preferred Series A-3 |

Mar 2022 |

|

2,075,885 |

|

341,068 |

|

515,650 |

||||

|

Clearmotion, Inc., Preferred Series A-4 |

Mar 2022 |

|

12,954,589 |

|

908,932 |

|

3,217,920 |

||||

|

Clearmotion, Inc., Preferred Series B |

Mar 2023 |

|

2,484,760 |

|

500,000 |

|

617,214 |

||||

|

Flexport, Inc., Preferred Series A |

Jun 2022 |

|

580,165 |

|

8,489,030 |

|

3,080,676 |

||||

|

Flexport, Inc., Preferred Series B-1 |

Jul 2022 |

|

69,790 |

|

944,665 |

|

370,585 |

||||

|

Flexport, Inc., Preferred Series D-3 |

Jul 2022 |

|

82,613 |

|

1,117,776 |

|

474,199 |

||||

|

Loadsmart, Inc., Preferred Series D |

Jan 2022 |

|

500,000 |

|

10,000,000 |

|

8,280,000 |

||||

|

Neutron Holdings, Inc. (d.b.a. Lime), Preferred Series 1-D |

Mar 2019 |

|

20,618,556 |

|

5,000,000 |

|

1,870,103 |

||||

|

Turo, Inc., Preferred Series D-1 |

Jun 2018 |

|

314,017 |

|

2,932,295 |

|

5,988,304 |

||||

|

|

|

30,233,766 |

|

24,414,651 |

|||||||

|

TOTAL PREFERRED STOCK IN PRIVATE COMPANIES |

|

|

286,259,088 |

|

383,157,141 |

||||||

|

|

|

|

|||||||||

|

Convertible Notes of Private Companies(a),(b) — 4.2% |

|

|

|

||||||||

|

AgTech — 0.0% |

|

|

|

||||||||

|

Farmer’s Business Network, Inc., 15.00% 9/28/2025 |

Sep 2023 |

$ |

350,000 |

|

350,000 |

|

350,000 |

||||

|

|

|

|

|||||||||

|

Analytics/Big Data — 0.1% |

|

|

|

||||||||

|

Dataminr, Inc., 10.00% 2/28/2030 |

Jun 2025 |

$ |

1,000,000 |

|

1,000,000 |

|

1,000,000 |

||||

|

|

|

|

|||||||||

|

Artificial Intelligence — 0.3% |

|

|

|

||||||||

|

Nanotronics Imaging, Inc., 5.00% 4/25/2025 |

Apr 2023 |

$ |

3,000,000 |

|

3,000,000 |

|

3,418,031 |

||||

|

|

|

|

|||||||||

|

Hosting/Storage — 1.1% |

|

|

|

||||||||

|

TMGcore, Inc., 4.00% 9/30/2028 |

Dec 2021 |

$ |

10,476,362 |

|

10,476,362 |

|

10,494,731 |

||||

|

|

|

|

|||||||||

|

Software — 0.3% |

|

|

|

||||||||

|

Tradeshift Holdings, Inc., 0.00% 7/31/2026 |

Apr 2023 |

$ |

2,227,053 |

|

2,227,053 |

|

2,227,053 |

||||

|

Tradeshift Holdings, Inc., 0.00% 9/13/2027 |

Sep 2024 |

$ |

500,000 |

|

500,000 |

|

500,000 |

||||

|

|

|

2,727,053 |

|

2,727,053 |

|||||||

|

Transportation — 2.4% |

|

|

|

||||||||

|

Neutron Holdings, Inc. (d.b.a. Lime), 8.00% 10/29/2026(c) |

Oct 2021 |

$ |

18,054,330 |

|

18,054,330 |

|

22,526,544 |

||||

|

Neutron Holdings, Inc. (d.b.a. Lime), 4.00% 6/1/2027 |

Jun 2020 |

$ |

10,418,495 |

|

252,362 |

|

1,092,339 |

||||

|

|

|

18,306,692 |

|

23,618,883 |

|||||||

|

TOTAL CONVERTIBLE NOTES OF PRIVATE COMPANIES |

|

|

35,860,107 |

|

41,608,698 |

||||||

See accompanying Notes to the Financial Statements

12

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) June 30, 2025 (Unaudited) |

|

Acquisition |

Units |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

Units of Private Companies(a),(b) — 0.0% |

|

|

||||||||

|

Security — 0.0% |

|

|

||||||||

|

Excalibur CombineCo, L.P. Class A Units |

Jun 2023 |

194 |

$ |

193,877 |

$ |

193,857 |

||||

|

TOTAL UNITS OF PRIVATE COMPANIES |

|

193,877 |

|

193,857 |

||||||

|

|

|

|||||||||

|

Warrants of Private Companies(a),(b) — 0.1% |

|

|

||||||||

|

Software — 0.1% |

|

|

||||||||

|

Tradeshift Holdings, Inc., Exercise Price $0.001, Exercise Date 11/21/2031 |

Nov 2021 |

213,797 |

|

2,425,355 |

|

136,958 |

||||

|

Tradeshift Holdings, Inc., Exercise Price $0.001, Exercise Date 9/9/2031 |

Dec 2021 |

427,594 |

|

4,570,844 |

|

273,917 |

||||

|

Tradeshift Holdings, Inc., Exercise Price $0.001, Exercise Date 3/25/2032 |

Mar 2022 |

213,797 |

|

2,538,052 |

|

136,958 |

||||

|

|

9,534,251 |

|

547,833 |

|||||||

|

Transportation — 0.0% |

|

|

||||||||

|

Neutron Holdings, Inc. (d.b.a. Lime), Exercise Price $0.01, Exercise Date 6/2/2027 |

Jun 2020 |

1,016,483 |

|

807 |

|

82,742 |

||||

|

TOTAL WARRANTS OF PRIVATE COMPANIES |

|

9,535,058 |

|

630,575 |

||||||

|

|

|

|||||||||

|

SPECIAL PURPOSE VEHICLES(a),(b),(d) — 6.8% |

|

|

||||||||

|

AGTECH — 0.8% |

|

|

||||||||

|

Stage 1 Growth Fund, LLC, Series CiBO (invested in CIBO Technologies, Inc., Preferred Series C1) |

Aug 2021 |

1,298,566 |

|

3,210,057 |

|

3,116,558 |

||||

|

Stage 1 Growth Fund, LLC Series Invaio (invested in Invaio Sciences, Inc., Preferred Series C) |

Mar 2021 |

1,061,390 |

|

5,150,000 |

|

5,222,039 |

||||

|

|

8,360,057 |

|

8,338,597 |

|||||||

|

ANALYTICS/BIG DATA — 2.1% |

|

|

||||||||

|

KVC Select, LLC (invested in Dremio Corp., 26.2% Common Stock and 73.8% Preferred Series E) |

Dec 2021 |

636,258 |

|

5,213,383 |

|

4,270,465 |

||||

|

Tiger Global PIP 12-1, LLC (invested in Databricks, Inc., Preferred Series G) |

Jul 2022 |

182,664 |

|

10,815,024 |

|

16,896,420 |

||||

|

|

16,028,407 |

|

21,166,885 |

|||||||

|

ARTIFICIAL INTELLIGENCE — 1.7% |

|

|

||||||||

|

HOF Capital WH Strategic Opportunities Fund, LP (invested in X.AI, Corp., Preferred Series B) |

May 2024 |

267,335 |

|

3,296,000 |

|

9,773,768 |

||||

|

MVP Opportunity Fund VI LLC, Series 24G (invested in X.AI, Corp., Preferred Series C) |

Nov 2024 |

42,794 |

|

1,000,000 |

|

1,564,549 |

||||

|

SC JAL, LLC (invested in X.AI, Corp., Preferred Series B) |

May 2024 |

150,375 |

|

1,854,000 |

|

5,497,710 |

||||

|

|

6,150,000 |

|

16,836,026 |

|||||||

|

CLEAN TECHNOLOGY — 0.0% |

|

|

|

|

||||||

|

Stage 1 Growth Fund Series WiTricity Holdings (invested in WiTricity Holdings, Inc. Common Stock) |

Mar 2021 |

166,667 |

|

1,667 |

|

65,000 |

||||

|

|

|

|||||||||

|

E-COMMERCE — 0.2% |

|

|

||||||||

|

Irving Investors Privates OSC XXXVIII, LLC (invested in 1661, Inc. (d.b.a GOAT), 14.9% Common Stock, 13.1% Preferred Series A-1, 0.3% Preferred Series A-5, 17.1% Preferred Series A-7, 27.0% Preferred Series B, and 27.7% Preferred Series C) |

Sep 2021 |

859,200 |

|

5,100,463 |

|

2,388,576 |

||||

|

|

5,100,463 |

|

2,388,576 |

|||||||

|

EDUCATION — 0.4% |

|

|

||||||||

|

GSV ERS LP (invested in Eruditus Learning Solutions Pte., Ltd. Common Stock) |

Aug 2021 |

36,264 |

|

5,146,824 |

|

4,010,436 |

||||

See accompanying Notes to the Financial Statements

13

|

THE PRIVATE SHARES FUND |

|

Schedule of Investments (Continued) June 30, 2025 (Unaudited) |

|

Acquisition |

Units/ |

Cost |

Fair Value |

|||||||

|

|

|

|||||||||

|

SPECIAL PURPOSE VEHICLES(a),(b),(d) — 6.8% (Continued) |

|

|

||||||||

|

ENTERPRISE SOFTWARE — 0.3% |

|

|

||||||||

|

KVC Select, LLC (invested in Ocrolus, Inc., Preferred Series C) |

Aug 2021 |

438,327 |

$ |

3,137,450 |

$ |

2,770,227 |

||||

|

|

|

|||||||||

|

FINANCE/PAYMENTS — 0.5% |

|

|

||||||||

|

ParaFi Private Opportunities, LLC - Series J (invested in ConsenSys Software, Inc., Preferred Series D) |

Feb 2022 |

35,699 |

|

5,075,000 |

|

4,791,520 |

||||

|

|

|

|||||||||

|

FOODTECH — 0.4% |

|

|

||||||||

|

Khosla Ventures IFSPV II-B, LLC (invested in Impossible Foods, Inc., 74.2% Preferred Series H-1 and 25.8% Preferred Series H-2) |

Nov 2021 |

206,883 |

|

5,050,000 |

|

3,819,060 |

||||

|

|

|

|||||||||

|

SOFTWARE — 0.4% |

|

|

||||||||

|

Artist Edge Partners IV, LP (invested in Discord, Inc. Common Stock) |

Dec 2021 |

9,091 |

|

2,631,600 |

|

3,515,308 |

||||

|

TOTAL SPECIAL PURPOSE VEHICLES |

|

56,681,468 |

|

67,701,636 |

||||||

|

|

|

|||||||||

|

Simple Agreement for Future Equity of Private Companies(a),(b) — 0.0% |

|

|

||||||||

|

Artificial Intelligence — 0.0% |

|

|

||||||||

|

Cubefabs, Inc. |

Nov 2023 |

250,000 |

|

250,000 |

|

250,000 |

||||

|

TOTAL SIMPLE AGREEMENT FOR FUTURE EQUITY OF PRIVATE COMPANIES |

|

250,000 |

|

250,000 |

||||||

|

|

|

|||||||||

|

PRIVATE FUNDS(a),(b) — 0.5% |

|

|

||||||||

|

Private Funds — 0.5% |

|

|

||||||||

|

Northgate Growth Fund III |

Dec 2022 |

4,450,000 |

|

4,450,000 |

|

4,478,179 |

||||

|

TOTAL PRIVATE FUNDS |

|

4,450,000 |

|

4,478,179 |

||||||

|

|

|

|||||||||

|

Short-Term Investments — 4.6% |

|

|

||||||||

|

MUTuAL FUNDS — 4.6% |

|

|

||||||||

|

UMB Money Market II Special, 4.19%(e) |

|

45,306,372 |

|

45,306,372 |

||||||

|

|

|

|||||||||

|

TOTAL SHORT-TERM INVESTMENTS |

|

45,306,372 |

|

45,306,372 |

||||||

|

|

|

|||||||||

|

TOTAL INVESTMENTS — 99.9% |

|

753,628,090 |

|

994,416,383 |

||||||

|

Other assets less liabilities — 0.1% |

|

|

1,268,245 |

|||||||

|

|

|

|||||||||

|

NET ASSETS — 100.0% |

|

$ |

995,684,628 |

|||||||

(a) Debt positions (convertible notes of private companies) are income producing, all other positions are Equity positions and are non-income producing, except for short-term investments.

(b) Investments in private companies, and in some cases public companies, may be subject to restrictions on disposition imposed by the issuer. All positions held are non-controlled and non-affiliated investments, as defined by the Investment Company Act of 1940, as amended (“1940 Act”). As of June 30, 2025 restricted securities represented 95.32% of the net assets of the Fund.

(c) Denotes a variable rate security. The rate shown is the current interest rate as of June 30, 2025.

(d) The Fund has a direct investment in an SPV which has invested in an underlying portfolio company. If applicable, the number of units presented, are the units in the SPV owned by the Fund, which represents the equivalent number of securities of the underlying portfolio company for which the investment has economic exposure.

(e) Represents the 7-day effective yield as of June 30, 2025.

All issuers are based in the United States, except for OpenX Software, Ltd., and Snyk, Ltd., which are based in the UK, and Trax, Ltd., Eruditus Learning Solutions Pte., Ltd., Fundbox, Ltd., and Content Square SAS, which are based in the Cayman Islands, Singapore, Israel, and France, respectively.

See accompanying Notes to the Financial Statements

14

|

Assets: |

|

||

|

Investments, at fair value (cost $753,628,090) (Note 3) |

$ |

994,416,383 |

|

|

Receivable for fund shares sold |

|

532,732 |

|

|

Interest receivable |

|

3,209,735 |

|

|

Adviser contribution |

|

193,394 |

|

|

Prepaid expenses and other assets |

|

145,617 |

|

|

Prepaid borrowing costs |

|

38,441 |

|

|

Total assets |

|

998,536,302 |

|

|

|

|||

|

Liabilities: |

|

||

|

Advisory fees |

|

1,922,875 |

|

|

Payable for shareholder servicing fees - Class L |

|

1,165 |

|

|

Payable for shareholder servicing fees - Class A |

|

27,075 |

|

|

Payable for audit and tax fees |

|

297,534 |

|

|

Payable for transfer agent fees |

|

332,638 |

|

|

Payable for 12b-1 fees - Class L |

|

1,165 |

|

|

Payable for unused line of credit fees |

|

37,917 |

|

|

Other accrued liabilities |

|

231,305 |

|

|

Total liabilities |

|

2,851,674 |

|

|

Commitments and contingences (Note 9) |

|

||

|

Net assets |

$ |

995,684,628 |

|

|

|

|||

|

Net assets consist of: |

|

||

|

Capital stock (unlimited shares authorized, no par value) |

$ |

792,649,298 |

|

|

Total distributable earnings |

|

203,035,330 |

|

|

Net assets |

$ |

995,684,628 |

|

|

|

|||

|

Net assets: |

|

||

|

Class A |

$ |

127,025,805 |

|

|

Class I |

|

863,000,508 |

|

|

Class L |

|

5,658,315 |

|

|

Total net assets |

$ |

995,684,628 |

|

|

|

|||

|

Shares outstanding: |

|

||

|

Class A |

|

2,968,063 |

|

|

Class I |

|

19,802,383 |

|

|

Class L |

|

134,721 |

|

|

Total shares outstanding |

|

22,905,167 |

|

|

|

|||

|

Net asset value, public offering price, and redemption proceeds per share: |

|

||

|

Class A - Net asset value and redemption proceeds per share |

$ |

42.80 |

|

|

Class I - Net asset value and redemption proceeds per share |

$ |

43.58 |

|

|

Class L - Net asset value and redemption proceeds per share |

$ |

42.00 |

|

|

Class A - Public offering price per share(a) |

$ |

45.41 |

|

|

Class L - Public offering price per share(b) |

$ |

43.86 |

(a) Computation of public offering price per share 100/94.25 of net asset value. (See Note 10).

(b) Computation of public offering price per share 100/95.75 of net asset value. (See Note 10).

See accompanying Notes to the Financial Statements

15

|

Investment Income: |

|

|

||

|

Dividends1 |

$ |

2,019,029 |

|

|

|

Interest2 |

|

2,640,658 |

|

|

|

Total investment income |

|

4,659,687 |

|

|

|

|

|

|||

|

Expenses: |

|

|

||

|

Investment advisory fees (Note 5) |

|

9,324,925 |

|

|

|

Transfer agent fees |

|

965,928 |

|

|

|

Audit and tax fees |

|

432,424 |

|

|

|

Legal fees |

|

236,036 |

|

|

|

Fund accounting & administration fees |

|

203,487 |

|

|

|

Printing & postage |

|

179,121 |

|

|

|

Trustee fees |

|

172,301 |

|

|

|

Consulting expense |

|

123,411 |

|

|

|

Insurance fees |

|

98,003 |

|

|

|

Unused line of credit fees3 |

|

75,417 |

|

|

|

Borrowing fees3 |

|

57,184 |

|

|

|

Registration fees |

|

49,010 |

|

|

|

Chief compliance officer fees |

|

44,510 |

|

|

|

Miscellaneous expenses |

|

35,721 |

|

|

|

Shareholder servicing fees - Class A |

|

30,980 |

|

|

|

Custodian fees |

|

17,420 |

|

|

|

Distribution fees - Class L |

|

6,112 |

|

|

|

Shareholder servicing fees - Class L |

|

662 |

|

|

|

Total expenses |

|

12,052,652 |

|

|

|

Less: Net contractual waiver of fees and reimbursement of expenses (Note 4) |

|

(42,286 |

) |

|

|

Net expenses |

|

12,010,366 |

|

|

|

Net investment loss |

$ |

(7,350,679 |

) |

|

|

|

|

|||

|

Net realized loss on investments |

|

(11,458,305 |

) |

|

|

Net change in unrealized gain on investments |

|

33,851,859 |

|

|

|

Net realized and change in unrealized gain on investments |

|

22,393,554 |

|

|

|

Net change in net assets from operations |

$ |

15,042,875 |

|

1 Includes paid-in-kind dividends of $415,474.

2 Includes paid-in-kind interest of $724,193.

3 Line of credit borrowing costs incurred during the fiscal year that were excluded from the contractual waiver of fees.

See accompanying Notes to the Financial Statements

16

|

Six months ended |

Year ended |

|||||||

|

|

|

|

|

|||||

|

Operations: |

|

|

|

|

||||

|

Net investment loss |

$ |

(7,350,679 |

) |

$ |

(14,023,143 |

) |

||

|

Net realized loss on investments |

|

(11,458,305 |

) |

|

(3,734,037 |

) |

||

|

Net change in unrealized gain on investments |

|

33,851,859 |

|

|

122,482,195 |

|

||

|

Net change in net assets resulting from operations |

|

15,042,875 |

|

|

104,725,015 |

|

||

|

|

|

|

|

|||||

|

Fund share transactions: |

|

|

|

|

||||

|

Proceeds from shares issued - Class A |

|

8,877,781 |

|

|

14,608,294 |

|

||

|

Proceeds from shares issued - Class I |

|

104,902,684 |

|

|

177,329,680 |

|

||

|

Proceeds from shares issued - Class L |

|

1,414,137 |

|

|

743,511 |

|

||

|

Cost of shares repurchased - Class A |

|

(19,795,638 |

) |

|

(36,177,467 |

) |

||

|

Cost of shares repurchased - Class I |

|

(87,315,223 |

) |

|

(164,351,926 |

) |

||

|

Cost of shares repurchased - Class L |

|

(199,258 |

) |

|

(322,710 |

) |

||

|

Contribution from Investment Adviser |

|

139,427 |

|

|

— |

|

||

|

Net change in net assets from fund share transactions |

|

8,023,910 |

|

|

(8,170,618 |

) |

||

|

Net change in net assets |

$ |

23,066,785 |

|

$ |

96,554,397 |

|

||

|

|

|

|

|

|||||

|

Net assets: |

|

|

|

|

||||

|

Beginning of period |

$ |

972,617,843 |

|

$ |

876,063,446 |

|

||

|

End of period |

$ |

995,684,628 |

|

$ |

972,617,843 |

|

||

|

|

|

|

|

|||||

|

Transactions in shares: |

|

|

|

|

||||

|

Issuance of shares - Class A |

|

213,425 |

|

|

370,379 |

|

||

|

Issuance of shares - Class I |

|

2,468,493 |

|

|

4,429,079 |

|

||

|

Issuance of shares - Class L |

|

34,869 |

|

|

18,802 |

|

||

|

Repurchase of shares - Class A |

|

(469,720 |

) |

|

(903,982 |

) |

||

|

Repurchase of shares - Class I |

|

(2,012,055 |

) |

|

(4,035,918 |

) |

||

|

Repurchase of shares - Class L |

|

(4,693 |

) |

|

(8,174 |

) |

||

|

Net change in shares |

|

230,319 |

|

|

(129,814 |

) |

||

See accompanying Notes to the Financial Statements

17

|

Cash flows from operating activities: |

|

|

||

|

Net change in net assets from operations |

$ |

15,042,875 |

|

|

|

Adjustments to reconcile net change in net assets from operations to net cash used in operating activities: |

|

|

||

|

Purchases of investments |

|

(13,835,132 |

) |

|

|

Net sales of short-term investments |

|

8,041,220 |

|

|

|

Proceeds from sales of investments |

|

5,051,360 |

|

|

|

Net change in unrealized gain on investments |

|

(33,851,859 |

) |

|

|

Net realized loss on investments |

|

11,458,305 |

|

|

|

Paid-in-kind interest and dividends |

|

(1,139,667 |

) |

|

|

Change in operating assets and liabilities: |

|

|

||

|

Increase in interest receivable |

|

(255,045 |

) |

|

|

Decrease in prepaid expenses and other assets |

|

146,936 |

|

|

|

Increase in net payable to Investment Adviser |

|

204,379 |

|

|

|

Increase in other accrued liabilities |

|

56,891 |

|

|

|

Net cash used in operating activities |

|

(9,079,737 |

) |

|

|

|

|

|||

|

Cash flows from financing activities: |

|

|

||

|

Proceeds from shares issued, net of change in receivable for fund shares sold |

|

112,656,446 |

|

|

|

Cost of shares redeemed |

|

(104,109,688 |

) |

|

|

Contribution from Investment Adviser |

|

139,427 |

|

|

|

Net cash provided by financing activities |

|

8,686,185 |

|

|

|

|

|

|||

|

Net change in cash |

|

(393,552 |

) |

|

|

|

|

|||

|

Cash at beginning of period |

|

393,552 |

|

|

|

Cash at end of period |

$ |

— |

|

See accompanying Notes to the Financial Statements

18

|

Financial Highlights – Class A For a capital share outstanding throughout each period |

|

Six months |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Per share operating performance |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net asset value, beginning of period |

$ |

42.22 |

|

$ |

37.91 |

|

$ |

41.37 |

|

$ |

41.77 |

|

$ |

36.33 |

|

$ |

29.96 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Change in net assets from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net investment loss |

|

(0.33 |

) |

|

(0.67 |

) |

|

(0.64 |

) |

|

(0.80 |

) |

|

(0.88 |

) |

|

(0.90 |

) |

||||||

|

Net realized and unrealized gain/(loss) on investments |

|

0.87 |

|

|

4.98 |

|

|

(2.84 |

) |

|

0.98 |

|

|

9.54 |

|

|

7.98 |

|

||||||

|

Total change in net assets from operations |

|

0.54 |

|

|

4.31 |

|

|

(3.48 |

) |

|

0.18 |

|

|

8.66 |

|

|

7.08 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

From net return of capital |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.07 |

) |

||||||

|

From net realized gain on investments |

|

— |

|

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.64 |

) |

||||||

|

Total distributions |

|

— |

|

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.71 |

) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Impact of NAV Error |

|

0.04 |

|

|

— |

|

|

0.02 |

|

|

— |

|

|

— |

|

|

— |

|

||||||

|

Net increase (decrease) in net asset value |

|

0.58 |

|

|

4.31 |

|

|

(3.46 |

) |

|

(0.40 |

) |

|

5.44 |

|

|

6.37 |

|

||||||

|

Net asset value, end of period |

$ |

42.80 |

(b) |

$ |

42.22 |

|

$ |

37.91 |

|

$ |

41.37 |

(c) |

$ |

41.77 |

|

$ |

36.33 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total return(d) |

|

1.35 |

%(e)(f) |

|

11.40 |

% |

|

(8.36 |

)%(g) |

|

0.42 |

% |

|

23.85 |

% |

|

23.69 |

% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Ratios and supplemental data |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net assets, end of period (in thousands) |

$ |

127,026 |

|

$ |

136,148 |

|

$ |

142,451 |

|

$ |

178,577 |

|

$ |

158,433 |

|

$ |

103,984 |

|

||||||

|

Ratio of net expenses to average net assets |

|

2.57 |

%(i)(j) |

|

2.65 |

%(h)(i) |

|

2.60 |

%(h)(k)(l) |

|

2.51 |

%(h)(k) |

|

2.51 |

%(h)(k) |

|

2.50 |

%(h) |

||||||

|

Ratio of gross expenses before reimbursement to average net assets |

|

2.57 |

%(j) |

|

2.55 |

% |

|

2.48 |

% |

|

2.41 |

% |

|

2.64 |

% |

|

2.97 |

% |

||||||

|

Ratio of net investment loss to average net assets |

|

(1.62 |

)%(j) |

|

(1.70 |

)% |

|

(1.60 |

)% |

|

(1.89 |

)% |

|

(2.42 |

)% |

|

(2.48 |

)% |

||||||

|

Portfolio turnover |

|

0.55 |

%(e) |

|

0.84 |

% |

|

2.23 |

% |

|

3.17 |

% |

|

26.20 |

% |

|

6.97 |

% |

||||||

(a) Per share calculations are based on average shares outstanding throughout the period.

(b) The NAV per share has been adjusted from the published NAV of $42.73 for post-closing adjustments.

(c) The NAV per share has been adjusted from the published NAV of $41.75 for post-closing adjustments.

(d) The Fund’s total investment returns do not include a sales load.

(e) Not annualized for periods less than one year.

(f) The impact of the NAV error on Total Return at NAV was 0.17%.

(g) A revision on the valuation of certain securities resulted in understated NAV. The impact of the NAV error on Total Return at NAV was 0.05%.

(h) The ratio of net expenses includes recoupment of previously waived and/or reimbursed fees of $144,908, $199,187 and $184,461, or 0.10%, 0.12% and 0.10%, for the fiscal years ended December 31, 2024, December 31, 2023 and December 31, 2022, respectively, and contractual waivers and expense reimbursements of $171,876 and $492,357, or 0.12% and 0.47% for the fiscal years ended December 31, 2021 and 2020, respectively. Please see Note 4 in the Notes to the Financial Statements for additional information.

(i) Effective November 19, 2024 expenses associated with lines of credit are excluded from of the 2.65% expense cap. Borrowing costs incurred by the Fund and allocated to Class A during the six month period ended June 30, 2025 and November 19, 2024 to December 31, 2024 were $17,667 and $1,667 or 0.03% and 0.00%, respectively.

(j) Annualized for period less than one year.

(k) During the fiscal years ended December 31, 2023, 2022 and 2021 there were legal expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $943 or 0.00%, $17,472 or 0.01% and $17,854 or 0.01%, respectively.

(l) Effective May 1, 2023, the Investment Adviser contractually agreed to waive management fees and/or reimburse the Fund for expenses the Fund incurs, subject to certain exclusions, to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement to an annual rate of 2.65%, 2.40%, and 2.90% (each, an “Expense Limit”) of the average daily net assets of the Fund attributable to Class A, Class I and Class L Shares, respectively. Prior to May 1, 2023, the Expense Limit for Class A shares was 2.50%.

See accompanying Notes to the Financial Statements

19

|

THE PRIVATE SHARES FUND |

|

Financial Highlights – Class I For a capital share outstanding throughout each period |

|

Six months |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Per share operating performance |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net asset value, beginning of period |

$ |

43.01 |

|

$ |

38.52 |

|

$ |

41.94 |

|

$ |

42.22 |

|

$ |

36.61 |

|

$ |

30.12 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Change in net assets from operations: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net investment loss |

|

(0.31 |

) |

|

(0.58 |

) |

|

(0.55 |

) |

|

(0.65 |

) |

|

(0.62 |

) |

|

(0.47 |

) |

||||||

|

Net realized and unrealized gain/(loss) on investments |

|

0.88 |

|

|

5.07 |

|

|

(2.89 |

) |

|

0.95 |

|

|

9.45 |

|

|

7.67 |

|

||||||

|

Total change in net assets from operations |

|

0.57 |

|

|

4.49 |

|

|

(3.44 |

) |

|

0.30 |

|

|

8.83 |

|

|

7.20 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Distributions: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

From net return of capital |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(0.07 |

) |

||||||

|

From net realized gain on investments |

|

— |

|

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.64 |

) |

||||||

|

Total distributions |

|

— |

|

|

— |

|

|

— |

|

|

(0.58 |

) |

|

(3.22 |

) |

|

(0.71 |

) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Impact of NAV Error |

|

— |

|

|

— |

|

|

0.02 |

|

|

— |

|

|

— |

|

|

— |

|

||||||

|

Net increase (decrease) in net asset value |

|

0.57 |

|

|

4.49 |

|

|

(3.42 |

) |

|

(0.28 |

) |

|

5.61 |

|

|

6.49 |

|

||||||

|

Net asset value, end of period |

$ |

43.58 |

|

$ |

43.01 |

|

$ |

38.52 |

|

$ |

41.94 |

(b) |

$ |

42.22 |

|

$ |

36.61 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Total return |

|

1.33 |

%(c) |

|

11.66 |

% |

|

(8.15 |

)%(d) |

|

0.70 |

% |

|

24.13 |

% |

|

23.97 |

% |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Ratios and supplemental data |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net assets, end of period (in thousands) |

$ |

863,001 |

|

$ |

832,134 |

|

$ |

730,108 |

|

$ |

807,234 |

|

$ |

566,272 |

|

$ |

197,921 |

|

||||||

|

Ratio of net expenses to average net assets(e) |

|

2.43 |

%(f)(g) |

|

2.40 |

%(f) |

|

2.35 |

%(h)(i) |

|

2.26 |

%(h) |

|

2.26 |

%(h) |

|

2.25 |

% |

||||||

|

Ratio of gross expenses before reimbursement to average net assets |

|

2.44 |

%(g) |

|

2.49 |

% |

|

2.42 |

% |

|

2.34 |

% |

|

2.50 |

% |

|

2.75 |

% |

||||||

|

Ratio of net investment loss to average net assets |

|

(1.48 |

)%(g) |

|

(1.45 |

)% |

|

(1.36 |

)% |

|

(1.62 |

)% |

|

(2.15 |

)% |

|

(2.24 |

)% |

||||||

|

Portfolio turnover |

|

0.55 |

%(c) |

|

0.84 |

% |

|

2.23 |

% |

|

3.17 |

% |

|

26.20 |

% |

|

6.97 |

% |

||||||

(a) Per share calculations are based on average shares outstanding throughout the period.

(b) The NAV per share has been adjusted from the published NAV of $42.32 for post-closing adjustments.

(c) Not annualized for periods less than one year.

(d) A revision on the valuation of certain securities resulted in understated NAV. The impact of the NAV error on Total Return at NAV was 0.05%.

(e) The ratio of net expenses includes contractual waivers and expense reimbursements of $42,286, $719,354, $594,159, $631,951, $899,197, $567,388, and $546,174, or 0.01%, 0.09%, 0.07%, 0.08%, 0.23%, 0.50%, and 0.82%, for the six month period ended June 30, 2025 and the fiscal years ended December 31, 2024 December 31, 2023, 2022, 2021, and 2020, respectively. Please see Note 4 in the Notes to the Financial Statements for additional information.

(f) Effective November 19, 2024 expenses associated with lines of credit are excluded from of the 2.40% expense cap. Borrowing costs incurred by the Fund and allocated to Class I during the six month period ended June 30, 2025 and November 19, 2024 to December 31, 2024 were $114,273 and $10,000 or 0.03% and 0.00%, respectively.

(g) Annualized for period less than one year.

(h) During the fiscal years ended December 31, 2023, 2022 and 2021 there were legal expenses incurred by the Fund that were distinguishable in their characterization as being unusual in nature as well as not expected to be recurring in future periods. The exclusion of these extraordinary expenses from the Fund’s expense limitation agreement caused the expense ratio to exceed the contractual expense limit by $4,444 or 0.00%, $74,334 or 0.01% and $48,772 or 0.01%, respectively.

(i) Effective May 1, 2023, the Investment Adviser contractually agreed to waive management fees and/or reimburse the Fund for expenses the Fund incurs, subject to certain exclusions, to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement to an annual rate of 2.65%, 2.40%, and 2.90% (each, an “Expense Limit”) of the average daily net assets of the Fund attributable to Class A, Class I and Class L Shares, respectively. Prior to May 1, 2023, the Expense Limit for Class I shares was 2.25%.

See accompanying Notes to the Financial Statements

20

|

THE PRIVATE SHARES FUND |

|

Financial Highlights – Class L For a capital share outstanding throughout each period |

|

Six months |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

Per share operating performance |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Net asset value, beginning of period |

$ |

41.47 |

|

$ |

37.32 |

|

$ |

40.82 |

|