| 1. |

Description of the Transaction

|

| 2. |

Transaction Steps, Exchange Ratio, Redemption Ratio and Justification

|

| (i) |

Merger of all shares issued by Sinqia, except for the shares already held by Evertec BR, pursuant to article 252 of the Brazilian Corporations Law, at market value, by Evertec BR, assigning to Sinqia

Shareholders the Evertec BR New PN Shares (“Merger of Shares”). The Merger of Shares will observe the following exchange ratio: for each common share issued by Sinqia, there will be delivered (a) one (1) Evertec BR PNA Share; and

(b) one (1) Evertec BR PNB Share (“Exchange Ratio”). Since they are already part of the equity of Evertec BR, the shares issued by Sinqia held by Evertec BR will be disregarded for the purposes of the Merger of Shares.

|

| (ii) |

On the same date of the implementation of the Merger of Shares, and as a subsequent and interdependent act, the automatic redemption of the Evertec BR New PN Shares (“Redemption”) will be implemented,

through the delivery of the following assets to their holders (“Redemption Ratio”):

|

| (a) |

for each 1 (one) Evertec BR PNA Share held by its holder, it shall be paid, as consideration for the redemption, R$ 24.47 (twenty-four reais and forty-seven cents), adjusted pursuant to Section 2.3 and 2.4

below (“Cash Portion”); and

|

| (b) |

for each one (1) Evertec BR PNB Share held by its holder, it shall be delivered, as consideration for the Redemption, 0.014354 Level I Brazilian Depositary Receipts (BDR) backed by common shares issued by

Evertec Inc, with a par value of US$ 0.01 (one cent) per share and traded on the New York Stock Exchange, which will be admitted to trading on B3 – Brasil, Bolsa, Balcão (“B3”) as set forth in Section 6.6 (“Evertec Inc

BDR”).

|

| (i) |

except with respect to the interest on equity already declared by Sinqia’s GSM held on April 27, 2023, in the amount of R$ 4,690,007.39 (four million, six hundred and ninety thousand and seven reais and

thirty-nine cents) that will be paid until July 31, 2023 (“JCP Sinqia 2023”), there will be no declaration, payment of dividends or interest on equity by Sinqia between the date of signature of the Merger Agreement and the Closing

Date;

|

| (ii) |

Sinqia’s corporate capital is represented by 87,941,972 (eighty-seven million, nine hundred and forty-one thousand, nine hundred and seventy-two) common, registered, book-entry shares, without par value, on a

fully diluted basis, including treasury shares;

|

| (iii) |

Sinqia has 3,254,876 (three million, two hundred and fifty-four thousand, eight hundred and seventy-six) shares of its own issue held in treasury;

|

| (iv) |

there are 1,370,540 (one million, three hundred and seventy thousand, five hundred and forty) stock options issued by Sinqia under stock option plans and restricted shares issued by Sinqia under share granting

plans that will have their respective vesting periods and share transfer restriction periods accelerated upon the approval of the Transaction at Sinqia’s GSM (“Sinqia’s Stock Plans”). Prior to the Closing Date, Sinqia will deliver,

from its treasury, up to 1,370,540 (one million, three hundred and seventy thousand, five hundred and forty) shares in the context of Sinqia’s Stock Plans, and thereafter, all Sinqia Stock Plans will be terminated, with no remaining stock

option or restricted share issued by Sinqia ; and

|

| (v) |

except as set forth in this Section, after the Closing Date, there shall be no further issue of shares or remaining obligation relating to Sinqia’s Stock Plans.

|

|

3.

|

Conditions Precedent to the Closing of the Transaction

|

| (i) |

Evertec BR’s Representations and Warranties. The representations and warranties made by Evertec BR in Section 8.1 of this Protocol shall be true and correct in all material respects between the

date of execution of the Merger Agreement and the Closing Date (except where the representations and warranties themselves contain reference to an earlier date, when they shall be true and correct in all material respects as of such

date);

|

| (ii) |

Evertec Inc’s Representations and Warranties. The representations and warranties made by Evertec Inc in the Merger Agreement shall be true and correct in all material respects between the date of

execution of the Merger Agreement and the Closing Date (except where the representations and warranties themselves contain reference to an earlier date, when they shall be true and correct in all material respects as of such date);

|

| (iii) |

Compliance with Obligations. Evertec BR and Evertec Inc shall have complied with all material obligations and relevant commitments entered into in this Protocol and in the Merger Agreement;

|

| (iv) |

BDR Registration and Trading Admission. The registration of the BDR Level I program sponsored by Evertec Inc concerning the Evertec Inc BDRs (“BDR Program”) with CVM shall have been obtained and

the Evertec Inc BDRs shall have been admitted for trade at the B3;

|

| (v) |

Evertec Notification. Upon completion of Evertec’s Financing efforts under the Merger Agreement, Evertec BR shall notify Sinqia that it has completed its Financing efforts for the Closing of the

Transaction;

|

| (vi) |

Execution of the Protocol. This Protocol shall be approved and signed by Evertec BR’s management; and

|

| (vii) |

Corporate Approvals. Evertec BR shall have approved the Transaction, pursuant to the Applicable Laws and their articles of incorporation, as provided in Section 6.1(ii) and 6.1(iii) below.

|

| (i) |

Sinqia’s Representations and Warranties. The representations and warranties made by Sinqia in Section 8.2 of this Protocol shall be true and correct in all material respects between the date of

signature of the Merger Agreement and the Closing Date (except in the event that the representations and warranties themselves contain reference to an earlier date, when they shall be true and correct in all material respects as of such

date;

|

| (ii) |

Key Shareholders’ Representations and Warranties. The representations and warranties made by the Key Shareholders in the Merger Agreement shall be true and correct in all material respects between the

date of signature of the Merger Agreement and the Closing Date (except where the representations and warranties themselves contain reference to an earlier date, when they shall be true and correct in all material respects on such date);

|

| (iii) |

Compliance with Obligations Sinqia. Sinqia shall have complied with all material obligations and material commitments undertaken in this Protocol and in the Merger Agreement;

|

| (iv) |

Compliance with obligations by Key Shareholders. The Key Shareholders shall have complied with all material obligations and relevant commitments that, under the terms of the Merger Agreement and other

documents of the Transaction, must be complied with prior to the Closing Date;

|

| (v) |

Third Party Consents. Sinqia shall have obtained the consent or waiver relating to the early redemption or early maturity of the obligations arising from the following two issues of debentures of Sinqia,

as a result of the Transaction, or performed their prepayment: (a) 2nd issue of simple debentures, non-convertible into shares, of unsecured type, with real and additional fiduciary guarantees, in a single series; and (b) 3rd issue of

simple debentures, non-convertible into shares, of the unsecured type, with additional real and additional fiduciary guarantees, in a single series;

|

| (vi) |

Sinqia’s Stock Plans. The one million, three hundred and seventy thousand and five hundred and forty (1,370,540) outstanding stock options and restricted shares issued by Sinqia related to Sinqia’s Stock

Plans shall have their respective grace periods and transfer restriction periods accelerated or shall have been canceled by the Closing Date and all Sinqia’s Stock Plans shall be canceled until Closing;

|

| (vii) |

Execution of the Protocol. This Protocol shall be approved by Sinqia’s Board of Directors and signed by Sinqia, and immediately afterwards Sinqia shall call the Sinqia’s GSM;

|

| (viii) |

Corporate Approvals. Sinqia’s GSM (as defined in Section 6.1(i)) shall have approved the matters related to the Transaction, pursuant to the Brazilian Corporations Law, as set out in Section

6.1(i) below; and

|

| (ix) |

No Material Adverse Change. From the date of execution of the Merger Agreement until the Closing Date, there will be no material adverse change on Sinqia, which is understood to mean (1) any

event, circumstance, effect, occurrence or factual situation, or any combination thereof, which, individually or as a whole, adversely affects or may be reasonably expected to adversely affect the business, operations, assets, properties,

commercial or financial condition of Sinqia or any of its Subsidiaries, taken as a whole, in an amount equal to or greater than (a) fifteen (15%) of the consolidated net worth of Sinqia according to its annual financial statements of the

fiscal year ended in 2022; or (b) fifteen (15%) of the consolidated gross revenues of Sinqia according to its annual financial statements of the fiscal year ended in 2022, whichever is lower, except to the extent that such change or

adverse effect results from adverse economic or exchange effects on the whole industry in which Sinqia operates in Brazil, so long as such changes or conditions do not have an adverse impact in Sinqia or any of its Subsidiaries, as the

case may be, taken as a whole, in a materially disproportionate manner relative to other similarly situated participants in the industries or markets in which they operate or (2) bankruptcy of Sinqia or any of its Subsidiaries or filing

for recuperação judicial or extrajudicial of Sinqia or any of its Subsidiaries.

|

|

4.

|

Appraisal of sinqia’s shares for the Merger of Shares

|

|

5.

|

Evertec BR’s Capital Increase

|

|

6.

|

Corporate approvals, Right of Withdraw and Closing of the Transaction

|

| (i) |

Sinqia’s extraordinary general shareholders’ meeting to approve (a) this Protocol; (b) the Merger of Shares; (c) the authorization for Sinqia’s management to subscribe the Evertec BR New

PN Shares on the Closing Date; (d) the waiver of Evertec BR’s admission to B3’s Novo Mercado special listing segment, pursuant to article 46, sole paragraph, of the Novo Mercado regulation; and (e) the authorization for the management to

perform all acts necessary for the implementation of the resolutions taken (“Sinqia’s GSM”).

|

| (ii) |

Evertec BR’s extraordinary general shareholders’ meeting to approve (a) this Protocol; (b) the ratification of the engagement of the Appraisal Company; (c) the Appraisal Report; (d) the

Merger of Shares; (e) the increase in the corporate capital of Evertec BR due to the Merger of Shares with the consequent issuance of the Evertec BR New PN Shares and amendment of its bylaws; (f) the Redemption of the Evertec BR New PN

Shares and the cancellation of the Evertec BR New PN Shares upon payment of the Redemption Ratio, with the consequent amendment of its bylaws; (g) the authorization for the management of Evertec BR to adopt all measures necessary to

implement the resolutions taken (“Evertec BR’s GSM”);

|

|

7.

|

Ordinary Course of Business

|

|

8.

|

Representations and Warranties

|

| (i) |

Incorporation, Capacity and Authority. Evertec BR is a corporation duly organized and validly existing under the Laws of the Federative Republic of Brazil. The execution of the Merger and the Protocol were - and the consummation

of the transactions contemplated by the Merger Agreement and the Protocol will have been on their respective dates - duly and regularly authorized and approved in accordance with the Applicable Law and the respective charter documents of

Evertec BR. The Merger Agreement and the Protocol are valid and binding obligations on Evertec BR and Evertec Inc and are enforceable against it in accordance with their terms. All of Evertec Inc’s corporate approvals necessary for the

execution of this Protocol and to comply with the obligations assumed herein have been obtained and there is no additional corporate approval required for Evertec Inc to consummate the Transaction that is not expressly mentioned in this

Protocol.

|

| (ii) |

No Conflicts. The performance of the acts set forth in this Protocol and in the other documents entered into in the context of the Transaction by Evertec BR and Evertec Inc does not (a) materially violate any Applicable Law or

Governmental Order with jurisdiction over Evertec BR, Evertec Inc or its Subsidiaries; and (b) violate any provision of Evertec BR’s bylaws or Evertec Inc’s charter documents. There is no legal action, suit or investigation known to

Evertec BR or Evertec Inc, or proceeding pending or imminent against Evertec BR or Evertec Inc that, if adjudicated unfavorably, would impair Evertec BR or Evertec Inc’s ability to perform its obligations under the Merger Agreement and

the Protocol and to consummate the Transaction.

|

| (iii) |

Governmental Authorization. The execution of the Merger Agreement and the Protocol and the performance by Evertec BR or Evertec Inc of the acts contemplated by the Merger Agreement and the Protocol are not dependent on any

action, approval, consent or declaration of any Governmental Authority having jurisdiction over Evertec BR, assuming that the statements made by Sinqia in Sections 8.2(iv), 8.2(v), 8.2(xiv) below and by the Key

Shareholders in Section 6.2(iv) of the Merger Agreement are correct.

|

| (iv) |

Exemption of SEC Registration. Assuming that the statement made by Sinqia in Section 8.2(xiv) is correct in all respects, no registration of the shares of Evertec Inc., including in the form of a BDR, under the U.S.

Securities Act of 1933, as amended (“U.S. Securities Act”) is required for the offer, issuance and delivery of the BDRs of Evertec Inc. to Sinqia’s shareholders in connection with the transactions contemplated by this Protocol.

|

| (v) |

Absence of Revenues for Mandatory Notification with CADE. Evertec BR’s economic group, as defined in Brazilian Administrative Council for Economic Defense (CADE) Resolution No. 33, dated April 14, 2022, did not accrue annual

revenues equal to or greater than seven hundred and fifty million Reais (R$ 750,000,000.00) in Brazil in the fiscal year ended on December 31, 2022.

|

| (vi) |

Bribery and Anti-Corruption. Evertec BR or Evertec Inc and its Subsidiaries have not carried out, offered, promised, nor given, directly or indirectly, nor allowed, within the terms of their duties, responsibilities and

activities, that any director, employee, representative, consultant or other individual or legal entity, as well as any investment fund, entity or organization, national or foreign acting on their behalf to effect, offer, promise or give

any gift, entertainment, payment, loan or other illegal contribution to any Governmental Authority or any officials, agents or employees of a Governmental Authority, in order to benefit Evertec BR, Evertec Inc or its Subsidiaries, and/or

any of their Related Parties, or any Persons in any way, with the intention of: (a) having influence over the applicable Governmental Authority, servant, agent or employee to perform or perform any act or take any decision regarding his

position and/or function; or (b) induce any Governmental Authority or employee, servant or agent thereof to perform or cease to perform any act in violation of the conduct recommended or required by applicable law with respect to the

Governmental Authority, servant, agent or employee thereof; or (c) induce a Governmental Authority, servant, agent or employee thereof to use its influence to obtain any advantage or favorable treatment for the purpose of assisting

Evertec BR, Evertec Inc or its Subsidiaries, or any of its Related Parties; or (d) perform any act in violation of Anti-Corruption Laws.

|

| (vii) |

Financial Capacity. Evertec BR will have, until the Closing Date, sufficient resources for the consummation of the Transaction and the fulfillment of all obligations assumed by it in the Merger Agreement, in this Protocol and in

the other documents of the Transaction, including, but not limited to, the payment of the Redemption.

|

| (i) |

Incorporation, Capacity and Authority. Sinqia is a Brazilian corporation, duly organized and validly existing under the Laws of the Federative Republic of Brazil. The execution of the Merger Agreement and the Protocol were -

and, as applicable, the consummation of the events provided for in the Merger Agreement and in the Protocol shall have taken place on the respective applicable dates - duly and regularly authorized and approved under Applicable Law and

the respective organizational documents of Sinqia. The Merger Agreement and this Protocol constitute a valid and binding obligation on Sinqia and are enforceable against Sinqia in accordance with their terms.

|

| (ii) |

No Conflicts. The performance of the acts provided for in the Merger Agreement, the Protocol and the other documents entered into in the context of the Transaction by Sinqia will not, (a) except for the contracts referred to in

Exhibit 6.1(ii) of the Merger Agreement, result in conflicts or a breach and will not constitute a material default of any contract that has generated gross invoiced revenue equal to or greater than R$ 10,000,000.00 (ten million

reais) considered individually, in the last twelve (12) months, counted from July 2022 to June 2023, or create a right, or give cause for allegation of termination or amendment, or require modification of financial obligations, involving

an annual amount equal to or greater than R$ 10,000,000.00 (ten million reais) considered individually, in the last 12 (twelve) months counted from July 2022 to June 2023, or will give rise to early maturity of financial obligations, or

cancellation or loss of benefit or the constitution of any liens (or obligation to constitute liens) on property, assets or rights of Sinqia or its Subsidiaries; (b) conflict with or result in the breach of any obligation under a

Governmental Order or authorization, license, permit or consent of a Governmental Authority to which Sinqia or any of its Subsidiaries is subject or a party; nor (c) violate any provisions of Sinqia’s by-laws or charter documents. As of

the date of execution of the Merger Agreement, there is no pending action, legal proceeding or investigation against Sinqia or its respective Subsidiaries that could legally hinder the performance of any of the transactions under this

Protocol.

|

| (iii) |

Capital Stock. On the of execution of the Merger Agreement, the share capital of Sinqia was represented exclusively by eighty-seven million nine hundred and forty-one thousand nine hundred and seventy-two (87,941,972) book-entry

common shares, registered and with no par value, including three million two hundred and fifty-four thousand eight hundred and seventy-six (3,254,876) shares held in treasury, all of which are validly issued and fully subscribed and paid

in. Except for the obligations arising from Sinqia’s Stock Plans, (a) there are not, on the date hereof, and there will not be on the Closing Date, any put or call options, rights of first refusal, rights of conversion, repurchase or

redemption rights or agreements of any nature to the benefit of any Person, to acquire, sell, subscribe, convert, exchange for, repurchase, redeem or otherwise transfer shares issued by Sinqia, that has been granted or issued by Sinqia;

and (b) there are no contractual obligations to approve repurchase, redemption or any other form of acquisition of any shares issued by Sinqia or its Subsidiaries.

|

| (iv) |

Governmental Authorization. The execution of the Merger Agreement and the Protocol and the performance of the acts contemplated in these documents by Sinqia are not dependent on any action, approval, consent or declaration of

any Governmental Authority, assuming that the statements made by Evertec BR and Evertec Inc in Section 8.1(v) are true.

|

| (v) |

Absence of Revenues for Mandatory Notification with CADE. Sinqia’s economic group, as defined in Brazilian Administrative Council for Economic Defense (CADE) Resolution No. 33, dated April 14, 2022, did not accrue annual

revenues equal to or greater than seven hundred and fifty million Reais (R$ 750,000,000.00) in Brazil in the fiscal year ended on December 31, 2022.

|

| (vi) |

Sinqia’s Financial Statements. Sinqia’s audited financial statements as of December 31, 2022, disclosed on CVM’s website, as well as any Quarterly Information - ITR or financial statement referring to the period subsequent to

December 31, 2022, (jointly, “Sinqia’s Financial Statements”) are or shall be complete and true in all their material aspects, were or shall be prepared in accordance with the Brazilian GAAP, on a consistent basis, throughout all

the relevant periods, adequately reflecting, in accordance with the Brazilian GAAP, Sinqia’s individual and consolidated financial position, results of operations and cash flows. Sinqia did not have, in the periods covered by Sinqia’s

Financial Statements, any liabilities or obligations of any nature, involving material amounts, in addition to the liabilities or obligations that were disclosed, reflected or referred to in Sinqia’s Financial Statements in accordance

with the Brazilian GAAP or in its reference form, disclosed on CVM’s website (“Reference Form”). Since December 31, 2022, Sinqia has been conducting its activities in the normal course of business and in a manner consistent with

previously adopted practices.

|

| (vii) |

Reference Form. Sinqia’s Reference Form, as filed with CVM, is complete in all material aspects and does not contain any untrue information or statement about a relevant event or omission of information or relevant event that

may cause the information and statements contained in Sinqia’s Reference Form not to be true, complete, consistent and/or misleading. On the date of execution of the Merger Agreement, except for the disclosure of the material fact notices

related to the Transaction, there were no material fact pending disclosure to the market by Sinqia.

|

| (viii) |

Operational Activities. As of the date of execution of the Merger Agreement, there was no event or circumstance that could cause a Material Adverse Change on the operations of Sinqia or its Subsidiaries (including due to the

execution of the Merger Agreement). Except as set forth in Sinqia’s Reference Form, Sinqia and its Subsidiaries have, as at the date of execution of the Merger Agreement and up to the Closing Date, all licenses, permits, permissions and

authorizations for opening and operation that are materially necessary to conduct their businesses. There are no material challenges or disputes of any kind regarding the license, permit, permission or authorization for the operation of

their establishments.

|

| (ix) |

Intellectual Property. Sinqia’s and its Subsidiaries’ material Intellectual Property are duly registered and/or protected under Applicable Law and represent all Intellectual Property assets necessary to enable Sinqia and its

Subsidiaries to conduct their businesses. Except as referred to in Exhibit 6.1(ix) of the Merger Agreement, Sinqia and its Subsidiaries have not received any notice of violation or conflict with third-party rights in connection

with any Intellectual Property. The conduct of business by Sinqia and its Subsidiaries does not infringe, misappropriate, unduly use or violate any third-party Intellectual Property rights. All Sinqia’s and its Subsidiaries’ Software are

solely owned by Sinqia or its Subsidiaries, as the case may be. Any employee or service provider participating in the development of Software has assigned its copyrights and all software development rights to Sinqia or its Subsidiaries,

as the case may be, by operation of Applicable Law or by specific and licit agreements. No developer or any other third parties have any reason to claim ownership of Sinqia’s or its Subsidiaries’ Software or any rights related thereto.

|

| (x) |

Contingencies, Litigation and Liabilities. There are no obligations, liabilities, contingencies, direct damages, losses, pecuniary or convertible to pecuniary liability (including monetary adjustment, reasonable attorneys’ fees

and court costs), claims, actions, investigations (that are known by Sinqia), lawsuits, final and non-appealable judgments (including judicial, administrative or arbitration judgements), fines, interest, penalties, costs, expenses and

imposition of Liens (including the attachment of assets, property, rights or credits, and/or partial or total, temporary or permanent limitation, to the free use or disposition of any amounts deposited in bank accounts), of any nature,

including but not limited to civil, labor, social security, tax, judicial, arbitration or administrative (before or by any person, public entity or arbitrator), involving Sinqia and its Subsidiaries that, according to Sinqia’s management

best knowledge, is likely to result in a loss, individually or in the aggregate, higher than five million Reais (R$ 5,000,000.00) and which have not been disclosed in Sinqia’s Reference Form and/or in Sinqia’s Financial Statements.

|

| (xi) |

Agreements with Related Parties. All transactions carried out by Sinqia and its Subsidiaries with Related Parties complied with the Applicable Law, were carried out under market conditions and were duly accounted for. Any and

all Taxes levied on operations carried out by Sinqia and/or its Subsidiaries with Related Parties were duly accounted for and paid. There are no transactions carried out by Sinqia and/or its Subsidiaries with Related Parties that have not

been disclosed in Sinqia’s Reference Form as required in Applicable Law.

|

| (xii) |

Bribery and Anti-Corruption. Sinqia and its Subsidiaries have not carried out, offered, promised, nor given, directly or indirectly, nor allowed, within the terms of their duties, responsibilities and activities, that any

director, employee, representative, consultant or other individual or legal entity, as well as any investment fund, entity or organization, national or foreign acting on their behalf to effect, offer, promise or give any gift,

entertainment, payment, loan or other illegal contribution to any Governmental Authority or any officials, agents or employees of a Governmental Authority, in order to benefit Sinqia or its Subsidiaries, and/or any of their Related

Parties, or any Persons in any way, with the intention of: (a) having influence over the applicable Governmental Authority, servant, agent or employee to perform or abstain to perform any act or take any decision regarding his position

and/or function; or (b) induce any Governmental Authority or employee, servant or agent thereof to perform or cease to perform any act in violation of the conduct recommended or required by applicable law with respect to the Governmental

Authority, servant, agent or employee thereof; or (c) induce a Governmental Authority, servant, agent or employee thereof to use its influence to obtain any advantage or favorable treatment for the purpose of assisting Sinqia or its

Subsidiaries, or any of its Related Parties; or (d) perform any act in violation of Anti-Corruption Laws.

|

| (xiii) |

Sanctions. Sinqia and its Subsidiaries are not (a) listed on any economic or financial sanctions-related restricted or prohibited list maintained by the Office of Foreign Assets Control of the U.S. Department of the Treasury,

the U.S. Department of State, or by the United Nations Security Council, Brazil, the European Union or any European Union member state or Her Majesty’s Treasury of the United Kingdom (“Blocked Person”); (b) operating, organized or

resident in a country, region or territory which is itself the subject of comprehensive economic or financial sanctions; (c) an entity in which one or more Blocked Persons have in the aggregate, directly or indirectly, a fifty percent

(50%) or greater equity interest; (d) an entity Controlled by a Blocked Person; or (e) been notified by any Governmental Authority that it may become a Blocked Person in the future.

|

| (xiv) |

US Shareholding Base Test Confirmation. As of July 19, 2023, U.S. holders (as defined in Rule 800(h) under the U.S. Securities Act of 1933, as amended (the “Securities Act”)) hold no more than ten percent (10%) of common

shares issued by Sinqia that are the subject of the Transaction, in each case as calculated and determined in accordance with Rules 800 and 802 under the Securities Act.

|

|

9.

|

Applicable Law and Dispute Resolution

|

|

10.

|

Miscellaneous

|

|

|

||

|

SINQIA S.A.

|

||

|

By: Bernardo Francisco Pereira Gomes e

|

||

|

Thiago Almeida Ribeiro da Rocha

|

||

|

|

||

|

EVERTEC BRASIL INFORMÁTICA S.A.

|

||

|

By: Pilar Maria Bazterrica

|

||

|

EVERTEC, INC.

|

||

|

By: Alberto López Gaffney

|

||

|

Name: Roberta Sabino

|

Name: Jorge de Jesus Medina

|

|

1

|

The comparable companies are presented on page 20 of the Report.

|

|

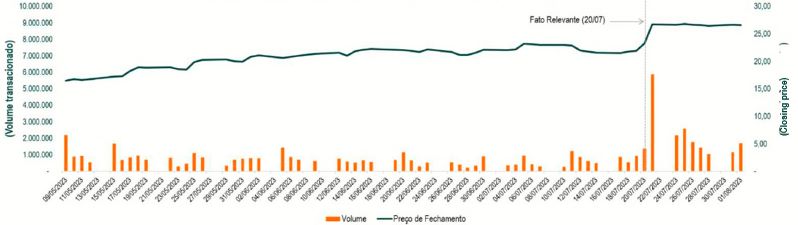

2

|

Volume weighted average price.

|

|

METHODOLOGY

|

PERIOD

|

BRL/SHARE

|

|

VWAP1 in the 9 business days prior to the deal announcement

|

7/20/2023 to 08/01/2023

|

26.45

|

|

Market Multiple Value (EV/EBITDA)

|

03/31/2023

|

27.89

|

|

Market Multiple Value (EV/ROL)

|

03/31/2023

|

24.96

|

|

Transaction Multiple Value (EV/EBITDA)

|

Last five years from the Base Date

|

26.72

|

|

SINQIA’S ENTERPRISE VALUE PER SHARE

|

26.50

|

|

|

NUMBER OF SHARES2

|

85,309,792

|

|

|

SINQIA’S ENTERPRISE VALUE (BRL thousands)

|

2,261,095

|

|

|

1

|

Volume weighted average price.

|

|

2

|

On the report’s base date SINQIA had 85,309,792 in circulation excluding treasury shares and including open share call options.

|

|

VALUE PARAMETER

|

MARKET VALUE (BRL thousands)

|

TOTAL NUMBER OF SHARES1

|

BRL/SHARE

|

|

9 day VWAP

|

2,256,449.55

|

85,309,792

|

26.45

|

|

1 On the report’s base date SINQIA had 85,309,792 in circulation excluding treasury shares and including open share call options.

|

|||

|

SINQIA EBITDA (BRL

thousands)

|

MARKET MULTIPLES

|

OPERATIONAL VALUE

|

NET DEBT3

|

VALOR ECONÔMICO

|

BRL/SHARE4

|

|

165,132

|

15.94 x

|

2,632,496

|

252,890

|

2,379,606

|

27.89

|

|

SINQIA’S EBITDA values are for the 12 months ending in the first quarter of 2023 and were taken from the Investor Relations website.

2 Refers to the company debt in march 2023 according to the quarterly report also taken from the Investor Relations website

3 On the report’s base date the company had 85,309,792 in circulation excluding treasury shares and including open share call options.

|

|||||

|

SINQIA ROL (BRL thousands)

|

MARKET MULTIPLES

|

OPERATIONAL VALUE

|

NET DEBT2

|

VALOR ECONÔMICO

|

BRL/SHARE3

|

|

641,857

|

3.71 x

|

2,381,955

|

252,890

|

2,129,065

|

24.96

|

|

3

|

Refers to the company debt in march 2023 according to the quarterly report also taken from the Investor Relations website

|

|

4

|

On the report’s base date the company had 85,309,792 in circulation excluding treasury shares and including open share call options.

|

|

SINQIA ROL (BRL thousands)

|

TRANSACTION

MULTIPLES

|

OPERATIONAL VALUE

|

NET DEBT*

|

VALOR ECONÔMICO

|

BRL/SHARE3

|

|

641,857

|

3.95 x

|

2,532,151

|

252,890

|

2,279,261

|

26.72

|

|

1

|

SINQIA’S Net Operating Revenue (ROL) values are for the 12 months ending in the first quarter of 2023 and were taken from the Investor Relations website.

|

|

2

|

Refers to the company debt in march 2023 according to the quarterly report also taken from the Investor Relations website

|

|

3

|

On the report’s base date the company had 85,309,792 in circulation excluding treasury shares and including open share call options.

|

|

METHODOLOGY

|

PERIOD

|

BRL/SHARE

|

|

VWAP1 in the 9 business days prior to the deal announcement

|

7/20/2023 to 08/01/2023

|

26.45

|

|

Market Multiple Value (EV/EBITDA)

|

03/31/2023

|

27.89

|

|

Market Multiple Value (EV/ROL)

|

03/31/2023

|

24.96

|

|

Transaction Multiple Value (EV/EBITDA)

|

Last five years from the Base Date

|

26.72

|

|

SINQIA’S ENTERPRISE VALUE PER SHARE

|

26.50

|

|

|

NUMBER OF SHARES2

|

85,309,792

|

|

|

SINQIA’S ENTERPRISE VALUE (BRL thousands)

|

2,261,095

|

|

|

1

|

Volume weighted average price.

|

|

PURPOSE:

|

1

|

|

EXECUTIVE SUMMARY

|

2

|

|

FINAL PRICE

|

2

|

|

PRICE USING THE EV/ROL MARKET MULTIPLES METHODOLOGY

|

4

|

|

CONCLUSION

|

5

|

|

SUMMARY

|

6

|

|

1. INTRODUCTION

|

8 |

|

This report was produced by:

|

8

|

|

2. PRINCIPLES AND DISCLAIMERS

|

9 |

|

3. DISCLAIMER

|

9 |

|

5. SECTOR ANALYSIS

|

14 |

|

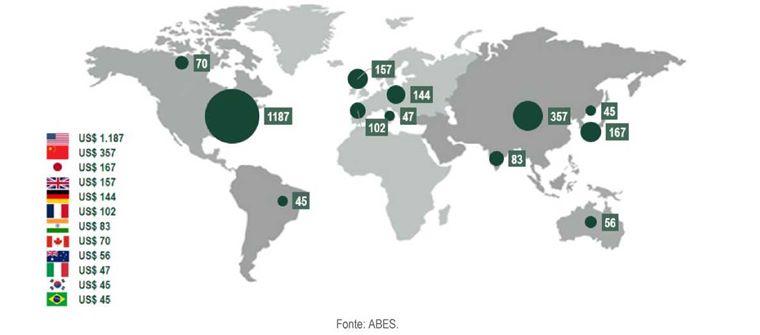

Global IT Market in 2022

|

15

|

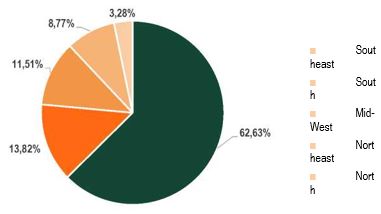

|

Information Technology Investment by Region in 2022

|

16

|

|

6. APPRAISAL METHODOLOGY

|

17 |

|

MARKET APPROACH – STOCK EXCHANGE PRICES

|

17

|

|

SINQIA STOCK PRICES

|

17

|

|

MARKET APPROACH – MULTIPLES OF COMPARABLE COMPANIES

|

19

|

|

The market multiples methodology defines an average parameter that can be used to value companies in the same industry. This is based on the assumption companies in the same business are subject to

the same risks and influences and have similar expected returns. This is how assets with similar characteristics can be priced.

|

19

|

|

MARKET APPROACH – TRANSACTION MULTIPLES

|

20

|

|

7. ESTIMATED MARKET VALUE

|

22

|

|

8. CONCLUSION

|

23

|

|

9. LIST OF ATTACHMENTS

|

24

|

| ■ |

The report on the daily closing prices and trading volumes for SINQIA stock obtained from the S&P Capital IQ platform:

|

| ■ |

SINQIA’S Financial Statements, available from the company’s Investor Relations website.

|

| ■ |

ALLAN LOUZADA PARENTE - Projects

|

| ■ |

LEONARDO REBELLO DE MENDOZA – Projects

|

| ■ |

MIGUEL CÔRTES CARNEIRO MONTEIRO – Director / Economist and Accountant (CORECON/RJ 26898 and CRC/SP-344323/O-6)

|

| ■ |

THIAGO RICHTER FONSECA - Projects

|

| ■ |

The consultants have no direct or indirect interest in the companies involved or the transaction and there are no other material circumstances that might represent a conflict of interest.

|

| ■ |

APSIS’ fees are in no way conditional on the Report’s conclusions.

|

| ■ |

To the best of the consultants’ knowledge, the Report’s analyses, opinions and conclusions are based on accurate and correct data, verifications, surveys and research.

|

| ■ |

Information received from third parties is presumed to be accurate and all sources are included and cited in the Report.

|

| ■ |

Forecasting is based on the assumption there are no judicial or extrajudicial burdens or onus on the companies in question and that have not been listed in this Report.

|

| ■ |

The Report provides all the limitations imposed by the methodologies that were adopted, if any, and which may affect our analyses, opinions and conclusions.

|

| ■ |

The Report was produced by APSIS and the analyses and corresponding conclusions were prepared by the consultants themselves.

|

| ■ |

APSIS takes full liability, including any implicit liability, for the Appraisal and for their work, which is subject to rules set out in various laws, codes and regulations.

|

| ■ |

The Report compliance with the criteria and recommendations issued by the Brazilian Association of Technical Standards (ABNT), the Uniform

Standards of Professional Appraisal Practice (USPAP) and the International Valuation Standards

(IVS).

|

| ■ |

Neither the controlling shareholders no management of the companies involved have directed, limited, hampered or otherwise taken steps that have previously or could in the future compromise the

availability of any information, assets, documents or methodologies that is relevant in reaching the Report’s conclusions.

|

| ■ |

The internal process involved in producing and improving this document followed the steps described below: (I) analysis of documentation provided by management; (II) analysis of the market in which the

company and comparable firms operate; (III) submission of the report for an independent in-house review; (IV) adoption of any suggested changes or improvements; (V) production of the final report.

|

| ■ |

APSIS used audited and unaudited historical data and information submitted in writing by the company’s management and other data and information obtained from the aforementioned sources to produce this

Report. APSIS has therefore assumed the information obtained for this Report is accurate and correct and takes no liability for its veracity.

|

| ■ |

The scope of work did not include auditing the financial statements or reviewing any of the work carried out by the auditors. Consequently, APSIS is not expressing an opinion on the Applicant’s financial

statements.

|

| ■ |

We take no liability for any losses the Applicant or its subsidiaries, shareholders, officers, creditors or other parties may suffer from using the0 data and information the company provided and which has

been included in this Report.

|

| ■ |

This Report was produced solely for the Applicant and its shareholders for internal use and should not be used for any other purpose (involving tax, corporate or other issues). This Report should not be

published, circulated, reproduced, disclosed or updated for any purpose other than as a source of internal information without express, written approval from APSIS’ legal representative.

|

| ■ |

The analyses and conclusions contained herein are based on a number of assumptions themselves based on information provided prior to the date of this Report. This means the company’s future operating

results may differ from any of the estimates or forecasts included in this Report, particularly if information not available at the time the Report was produced subsequently comes to light.

|

| ■ |

The appraisal does not reflect any events occurring after the date of this Report, or any related impacts.

|

| ■ |

APSIS takes no liability for any indirect or direct losses or business interruption that could result from misuse of this Report.

|

| ■ |

We draw your attention to the fact that the Report and its attachments should be read in full in order to properly understand its conclusions; consequently, no conclusions should be drawn from a partial

reading of the Report, as they may be incorrect or misleading.

|

|

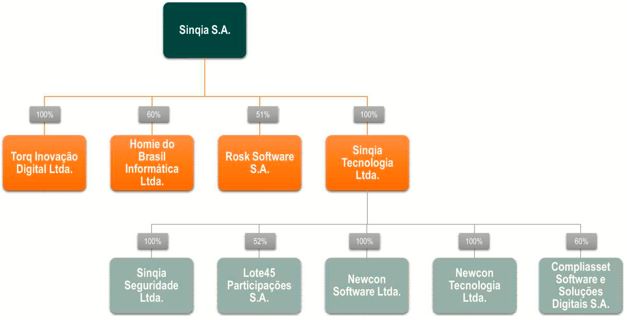

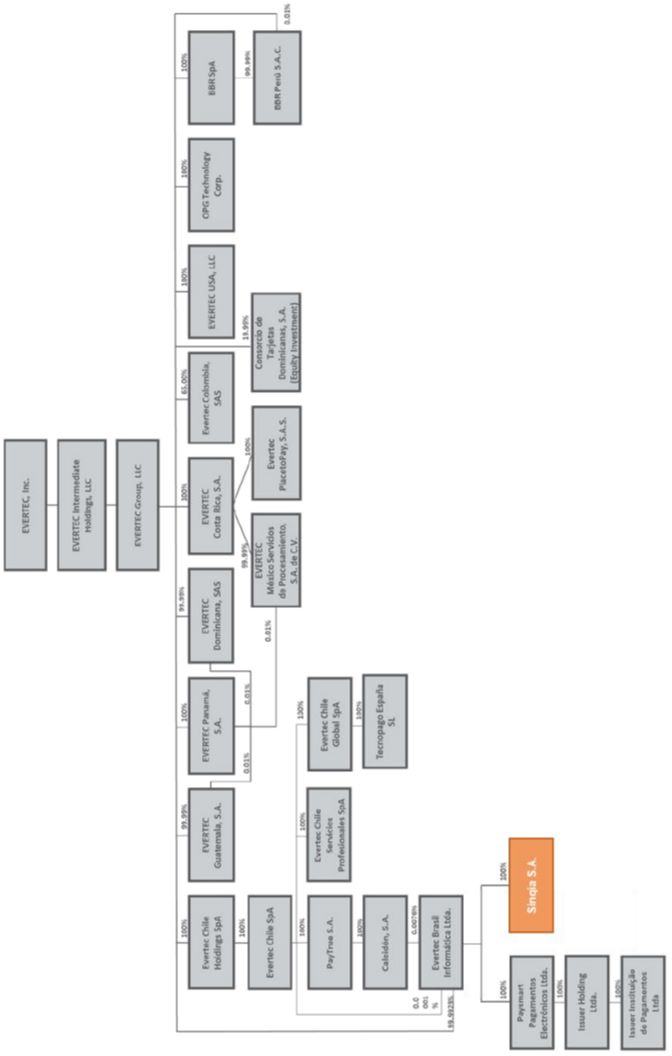

4. DESCRIPTION OF SINQIA

|

SINQIA is a company that provides financial technology and software solutions to financial institutions in Brazil. Founded in 1996, it is based in São Paulo and, over the years, it has

achieved market prominence and built a reputation as a go-to supplier of specialized systems to banks, credit cooperatives, brokers, fund managers, insurers and other financial market agents.

|

|

|

The company offers innovative and intelligent solutions that help customers drive growth and efficiency. Its mission is to provide reliable, secure and high performance systems that

allow its customers to offer more flexible and efficient financial services that can adapt to market demands.

|

| 1. |

Banks − The Full Banking platform provides end to end solutions for major bank and fintech processing requirements. It includes applications that range from front-end customer services channels to backend operational, calculation, accounting and accounting, tax and regulatory control operations, as well as settlement

(Pix, SPB etc.).

|

| 2. |

Funds − The company provides a cloud-based web interface provided as a software as a service (SaaS) or on premise solution. It serves various

types of assets and portfolios (portfolios, clubs and funds). It is flexible and can be adapted to fund manager, distributor, controlling shareholder, custodian and management business requirements.

|

| 3. |

Pensions − Focusing on the user experience, the platform can be used to manage and control investment portfolios and automate operational

processes and customer service for pension, welfare, financial and controller areas and also provides a fully fledged health autosuggestion solution.

|

| 4. |

Consortia − The suites for consortia include solutions for managing groups, from disposals to winding down procedures. They include accounting

control and accounts payable, regulatory and digital library modules that can be used to create a database with version controls, document recovery and search features.

|

| 5. |

Services − This unit installs, deploys, integrates and personalizes Sinqia’s systems. Date office services that allow customers to outsource

management of systems and critical processes and provides consultancy on setting up, reorganizing, planning and process reviews for financial institutions.

|

| 6. |

Digital − Created in 2021, this unit offers software as a service to manage and authorize transactions based on electronic signatures that have

legal validity, thereby simplifying registration and analysis of antifraud documents, debt negotiations and regulatory compliance management.

|

|

SHAREHOLDERS

|

NUMBER OF SHARES*

|

PERCENTAGE

INTEREST %

|

|

HIX Investimentos Ltda.

|

9,588,025

|

10.90%

|

|

Antônio Luciano de Camargo

|

6,483,752

|

7.37%

|

|

Bernardo Francisco Pereira

|

5,689,450

|

6.47%

|

|

SFA Investimentos Ltda.

|

5,404,400

|

6.15%

|

|

SK Tarpon

|

4,405,877

|

5.01%

|

|

Treasury Shares

|

3,360,684

|

3.82%

|

|

Other shareholders

|

53,009,784

|

60.28%

|

|

TOTAL(=)

|

87,941,972

|

100%

|

|

* Source: Sinqia S.A. and Subsidiaries - Quarterly Information - ITR dated March 31, 2023.

|

||

|

EV/ROL MARKET MULTIPLES

|

EV/EBITDA MARKET MULTIPLES

|

||||

|

COMPANY

|

COUNTRY

|

EV/ROL*

|

COMPANY

|

COUNTRY

|

EV/EBITDA*

|

|

EVERTEC, Inc.

|

USA

|

4.49 x

|

EVERTEC, Inc.

|

USA

|

12.69x

|

|

Jack Henry & Associates, Inc.

|

USA

|

6.41 x

|

Jack Henry & Associates, Inc.

|

USA

|

23.42 x

|

|

Repay Holdings Corporation

|

USA

|

3.92 x

|

Repay Holdings Corporation

|

USA

|

16.82 x

|

|

i3 Verticals, Inc.

|

USA

|

3.06 x

|

i3 Verticals, Inc.

|

USA

|

18.45 x

|

|

WEX Inc.

|

USA

|

3.23 x

|

WEX Inc.

|

USA

|

9.35 x

|

|

Endava plc

|

United Kingdom

|

3.35 x

|

Endava plc

|

United Kingdom

|

17.71 x

|

|

Shift4 Payments, Inc.

|

USA

|

2.45 x

|

Shift4 Payments, Inc.

|

USA

|

20.16 x

|

|

Euronet Worldwide, Inc.

|

USA

|

1.74 x

|

Euronet Worldwide, Inc.

|

USA

|

8.20 x

|

|

SS&C Technologies Holdings, Inc.

|

USA

|

4.19 x

|

SS&C Technologies Holdings, Inc.

|

USA

|

12.23 x

|

|

TOTVS S.A.

|

Brazil

|

4.27 x

|

TOTVS S.A.

|

Brazil

|

20.40 x

|

|

AVERAGE

|

3.71 x

|

AVERAGE

|

15.94x

|

||

|

STANDARD DEVIATION

|

1.28 x

|

STANDARD DEVIATION

|

5.07 x

|

||

|

*Multiples calculated in a period covering the 12 months prior to March 2023

|

*Multiples calculated in a period covering the 12 months prior to March 2023

|

||||

|

EV/ROL TRANSACTION MULTIPLES

|

|||

|

COMPANY (TARGET)

|

COUNTRY

|

% ACQUISITION

|

EV/ROL

|

|

Electra Information Systems, Inc.

|

USA

|

100%

|

2.69 x

|

|

Eze Software Group LLC

|

USA

|

100%

|

5.18 x

|

|

FICANEX Technology Inc.

|

Canada

|

100%

|

6.38 x

|

|

Fidessa Group Holdings Limited

|

United Kingdom

|

100%

|

4.10 x

|

|

Harvest S.A.

|

France

|

61%

|

3.72 x

|

|

Trustquay Financial Systems Limited

|

United Kingdom

|

100%

|

2.86 x

|

|

PATRONAS Financial Systems GmbH

|

Germany

|

100%

|

2.70 x

|

|

AVERAGE

|

3.95 x

|

||

|

STANDARD DEVIATION

|

1.40 x

|

||

|

METHODOLOGY

|

PERIOD

|

BRL/SHARE

|

|

VWAP1 in the 9 business days prior to the deal announcement

|

7/20/2023 to 08/01/2023

|

26.45

|

|

Market Multiple Value (EV/EBITDA)

|

03/31/2023

|

27.89

|

|

Market Multiple Value (EV/ROL)

|

03/31/2023

|

24.96

|

|

Transaction Multiple Value (EV/EBITDA)

|

Last five years from the Base Date

|

26.72

|

|

SINQIA’S ENTERPRISE VALUE PER SHARE

|

26.50

|

|

|

NUMBER OF SHARES2

|

85,309,792

|

|

|

SINQIA’S ENTERPRISE VALUE (BRL thousands)

|

2,261,095

|

|

|

1

|

Volume weighted average price.

|

|

2

|

On the report’s base date SINQIA had 85,309,792 in circulation excluding treasury shares and including open share call options.

|

|

Officer

|

Projects

|

|

1.

|

Daily Closing Prices and Trading Volumes – B3:SQIA3

|

|

2.

|

Description of Comparable Companies

|

|

3.

|

Glossary

|

|

Company

|

Evertec BR (PNA and PNB shares)

|

|

|

Right to

Dividends

|

Pursuant to the Company’s bylaws, at least 25% of the balance of the net income remaining after the allocations to the legal reserve and to the contingency reserve, will be

allocated to the payment of the minimum mandatory dividend, which may be paid through interest on equity.

The remaining net income, after the allocations described above, may be allocated to the formation of the reserves provided for in the Company’s bylaws, subject to certain limits

set forth in the bylaws.

|

At least 25% of the balance of the net profit remaining after the allocations to the legal reserve, under the terms of the Brazilian Corporations Law, will be allocated to the

payment of the minimum mandatory dividend.

The remaining balance will be allocated as determined by the General Shareholders’ Meeting of Evertec BR.

|

|

Voting

Rights

|

Full

|

No

|

|

Conversibility

|

No

|

No

|

|

Company

|

Evertec BR (PNA and PNB shares)

|

|

|

Rights in

Equity

Repayment

|

Under the terms of the Brazilian Corporations Law.

|

Priority in the repayment of equity in the event of winding-up, without premium.

|

|

Restrictions

to

Circulation

|

No

|

No

|

|

Conditions

for

modifying

the rights

granted

by such

securities

|

The rights granted to the shares that are not established by the applicable legislation may be modified by amending the bylaws, approved at a general shareholders’ meeting, to be

held in accordance with the installation and resolution quorums and conditions established in the Brazilian Corporations Law.

In accordance with the Brazilian Corporations Law, the company’s bylaws and the resolutions adopted by its shareholders at general meetings may not deprive its shareholders of

the following rights: (i) the right to participate in the distribution of profits; (ii) the right to participate, in proportion to their interest in the share capital, in the distribution of any assets remaining in the event

of winding-up; (iii) preemptive rights in the subscription of shares, debentures convertible into shares or subscription warrants, except in certain circumstances provided for in the Brazilian Corporations Law; (iv) the right

to supervise, in the manner provided for in the Brazilian Corporations Law, the management of corporate business; and (v) the right to withdraw in the cases provided for in the Brazilian Corporations Law.

|

The rights granted to the shares that are not established by the applicable legislation may be modified by amending the bylaws, approved at a general shareholders’ meeting, to be

held in accordance with the installation and resolution quorums and conditions established in the Brazilian Corporations Law.

In accordance with the Brazilian Corporations Law, the company’s bylaws and the resolutions adopted by its shareholders at general meetings may not deprive its shareholders of

the following rights: (i) the right to participate in the distribution of profits; (ii) the right to participate, in proportion to their interest in the share capital, in the distribution of any assets remaining in the event

of winding-up; (iii) preemptive rights in the subscription of shares, debentures convertible into shares or subscription warrants, except in certain circumstances provided for in the Brazilian Corporations Law; (iv) the right

to supervise, in the manner provided for in the Brazilian Corporations Law, the management of corporate business; and (v) the right to withdraw in the cases provided for in the Brazilian Corporations Law.

|

|

Possibility

of

Redemption

|

No

|

Mandatorily redeemable shares, whose redemption will occur on the Transaction consummation date, under the terms described in this exhibit.

|

|

Other

relevant characteristics

|

Listed at B3’s Novo Mercado special segment.

|

Not applicable.

|

| • |

The Company may not be able to compete effectively in the highly competitive software industry.

|

| • |

If we cannot keep pace with rapid developments and change in our industry and continue to acquire new clients, the use of our services could decline, reducing our

revenues.

|

| • |

Acquisitions present risks, and the Company may not reach the strategic goals foreseen at the time of any transaction.

|

| • |

Our systems and our third party providers’ systems may fail due to factors beyond our control, which could interrupt our service, cause us to lose business and

increase our costs.

|

| • |

The Company is subject to risks associated with non-compliance with data protection laws (both domestic and international) and may be adversely affected by the imposition of

fines and other types of sanctions.

|

|

Shareholder

|

CPF/CNPJ

|

% of Common Shares

|

% of Preferred Shares

|

% Total Shares

|

Controlling Shareholder

|

Party to a shareholders’ agreement?

|

|

EVERTEC BRASIL INFORMÁTICA S.A.

|

06.187.556/0001-15

|

100%

|

0%

|

100%

|

Yes

|

No

|

|

Date of last general shareholders’ meeting / Date of last change

|

11/05/2023

|

|

Number of natural person shareholders

|

0

|

|

Number of legal entities shareholders

|

1

|

|

Number of institutional investor shareholders

|

0

|

|

Common shares free float

|

0

|

0%

|

|

Preferred shares free float

|

0

|

0%

|

|

Total

|

0

|

0%

|

|

Name

|

CNPJ

|

Issuer’s Stake (%)

|

|

Compliasset Software e Soluções Digitais S.A.

|

25.025.534/0001-01

|

60%

|

|

Homie do Brasil Informática S.A.

|

07.914.074/0001-82

|

60%

|

|

LOTE45 Participações S.A.

|

07.923.056/0001-67

|

52%

|

|

Rosk Software S.A.

|

06.145.272/0001-66

|

51%

|

|

Sinqia Tecnologia Ltda.

|

03.017.804/0001-91

|

100%

|

|

Torq Inovação Digital Ltda.

|

30.256.443/0001-09

|

100%

|

| • |

Average price:

|

| • |

Number of stocks involved:

|

| • |

Securities involved:

|

| • |

Percentage in relation to class and kind of security:

|

| • |

Other relevant conditions:

|

|

Private sale transactions performed by the Company

|

|

|

1) Average price:

|

R$ 13.52

|

|

2) Number of stocks involved:

|

163,678

|

|

3) Securities involved:

|

SQIA3

|

|

4) Percentage in relation to class and kind of security:

|

0.1861%

|

|

5) Other relevant conditions

|

Sales related to the exercise of stock options by certain executives of the Company.

|

| • |

Average price:

|

| • |

Number of stocks involved:

|

| • |

Securities involved:

|

| • |

Percentage in relation to class and kind of security:

|

| • |

Other relevant conditions:

|

| • |

Average price:

|

| • |

Number of stocks involved:

|

| • |

Securities involved:

|

| • |

Percentage in relation to class and kind of security:

|

| • |

Other relevant conditions:

|

|

Private purchase transactions performed by related parties of the Company

|

|

|

1) Average price:

|

R$ 16.05

|

|

2) Number of stocks involved:

|

114,589

|

|

3) Securities involved:

|

SQIA3

|

|

4) Percentage in relation to class and kind of security:

|

0.1303%

|

|

5) Other relevant conditions

|

Purchases related to the exercise of stock options by certain executives of the Company.

|

| • |

Average price:

|

| • |

Number of stocks involved:

|

| • |

Securities involved:

|

| • |

Percentage in relation to class and kind of security:

|

| • |

Other relevant conditions:

|

| • |

Average price:

|

| • |

Number of stocks involved:

|

| • |

Securities involved:

|

| • |

Percentage in relation to class and kind of security:

|

| • |

Other relevant conditions:

|

|

Sale transactions in regulated markets performed by related parties of the Company

|

|

|

1) Average price:

|

R$ 19.56

|

|

2) Number of stocks involved:

|

45,022

|

|

3) Securities involved:

|

SQIA3

|

|

4) Percentage in relation to class and kind of security:

|

0.0512%

|

|

5) Other relevant conditions

|

Sales of shares in the Stock Exchange performed by executives of the Company.

|

| 1. |

Describe the event from which the withdrawal right arose/will arise and its legal base

|

| 2. |

Inform the shares and classes to which the withdrawal right applies

|

| 3. |

Provide the date of the first publication of the call notice of the Shareholders Meeting, as well as the date in which the material fact related to the resolution from which the withdrawal right arose was

disclosed

|

| 4. |

Provide the term for the exercise of the withdrawal right and the date that will be considered for the purposes of establishing the holders of the shares who will be entitled to exercise the withdrawal

right

|

| 5. |

Provide the reimbursement value per share or, if not previously determined, the management’s estimate of this value

|

| 6. |

Inform how the reimbursement value was calculated

|

| 7. |

Inform if the shareholders will be entitled to request the preparation of a special balance sheet

|

| 8. |

If the reimbursement amount is determined by means of appraisal, list the specialists or specialized firms recommended by management

|

| 9. |

In the event of merger, merger of shares or consolidation (fusão) involving controlling, controlled or under common control companies: a) Calculate the replacement ratio of the shares based on the net

equity amount at market price or other criteria accepted by the Brazilian Securities Commission (“CVM”); b) Inform if the replacement ratios of the shares provided in the transaction protocol are less beneficial than the ones calculated

in accordance with item 9(a) above; c) Inform the reimbursement amount calculated based on the net equity amount at market price or other criteria accepted by CVM

|

| 10. |

Provide the equity value of each share according to the latest balance sheet approved

|

|

1Q23 |

|

Annualized Net Revenues R$642 million R$164.2 million in the quarter, 18.3% higher than 1Q22 |

|

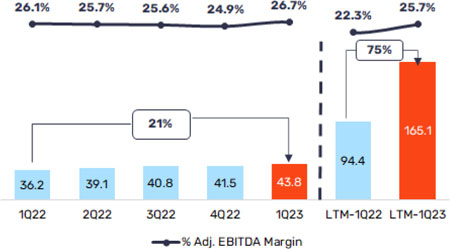

Annualized EBITDA R$165 million R$43.8 million in 1Q23, 20.9% higher than 1Q22, with EBITDA margin of 26.7% |

|

|

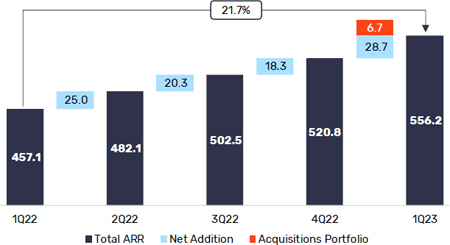

Software ARR R$556 million 21.7% higher than 1Q22 |

|

São Paulo, May 8th, 2023. Sinqia S.A. (B3: SQIA3) (“Company”), a leading provider of technology for the financial system, announces the consolidated results for the first quarter of 2023 (“1Q23”).

| (R$ '000) | 1Q23 | 1Q22 | Var. 1Q23/1Q22 |

4Q22 | Var. 1Q23/4Q22 |

LTM-1Q23 | LTM-1Q22 | Var. LTM- 1Q23/LTM-1Q22 |

| ARR | 556,217 | 457,106 | 21.7% | 520,754 | 6.8% | 556,217 | 457,106 | 21.7% |

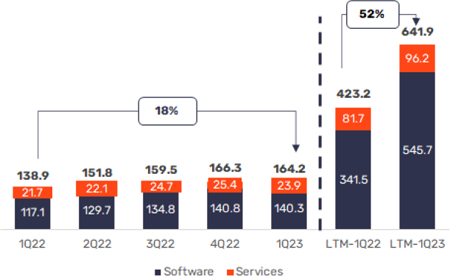

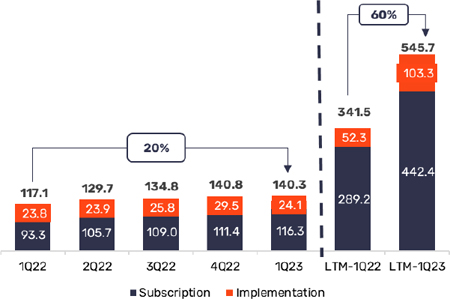

| Net Revenue | 164,241 | 138,856 | 18.3% | 166,272 | -1.2% | 641,857 | 423,214 | 51.7% |

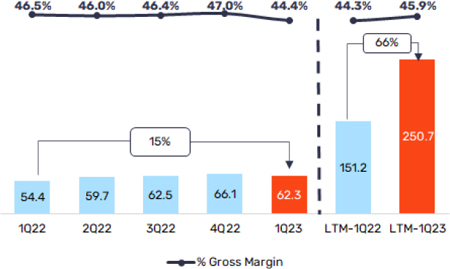

| Software | 140,336 | 117,120 | 19.8% | 140,840 | -0.4% | 545,696 | 341,510 | 59.8% |

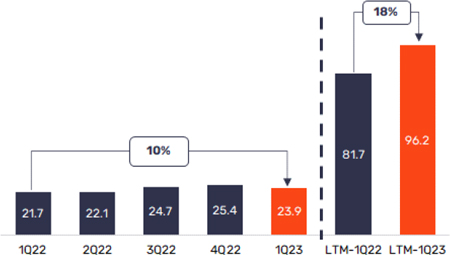

| Service | 23,905 | 21,736 | 10.0% | 25,432 | -6.0% | 96,161 | 81,702 | 17.7% |

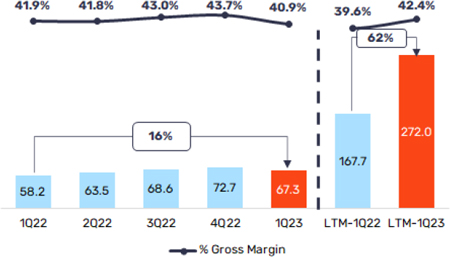

| Gross Profit | 67,252 | 58,224 | 15.5% | 72,663 | -7.4% | 271,976 | 167,739 | 62.1% |

| Gross Margin | 40.9% | 41.9% | -1.0 p.p. | 43.7% | -2.8 p.p. | 42.4% | 39.6% | 2.7 p.p. |

| Adjusted EBITDA | 43,795 | 36,235 | 20.9% | 41,473 | 5.6% | 165,133 | 94,358 | 75.0% |

| Adjusted EBITDA Margin | 26.7% | 26.1% | 0.6 p.p. | 24.9% | 1.7 p.p. | 25.7% | 22.3% | 3.4 p.p. |

|

SQIA3: R$ 15.62 per share Total shares: 87,941,972 Market cap: R$ 1.37 billion |

|

EARNINGS CALL May 09th , 2023 (Tuesday) 11 a.m. (Brasília) / 10 a.m. (NYC) / 3 p.m. (London) Access the videoconference via QR code or this link |

|

| 1Q23 Results | 2 |

| MESSAGE FROM MANAGEMENT

The results of this first quarter confirm our successful growth trajectory. Since our IPO in 2013, driven by successful acquisitions and integrations, we have multiplied by 13 our revenues. This significant progress has secured our market leadership. With a comprehensive product portfolio and a broad customer base, we have established a solid path for growth and profitability.

In this quarter, we reached a record in net sales of Software ARR, totaling R$14.7 million, already reaping the benefits of the recent commercial reorganization, leveraging cross-selling opportunities, and increased investment in R&D. In addition, contractual adjustments for inflation and volume amounted to R$14.1 million, a strong pace despite inflationary slowdown, driven by a significant increase in consumption. Thus, the Software ARR reached a record of R$556.2 million, a growth of 21.7% compared to the same period last year.

Net revenue in the quarter reached R$164.2 million (+18.3% vs. 1Q22), with Software growing 19.8% and Services 10.0%. As for profitability, Gross Profit was R$ 67.3 million (+15.5% vs. 1Q22) and Adjusted EBITDA was R$43.8 million (+20.9% vs. 1Q22), with a record Adjusted EBITDA margin of 26.7%.

Efficiency is our watchword for 2023 and we are conducting several initiatives related to pricing, streamlining our cost structure, and optimizing expenses that will generate significant results as early as the second half of 2023.

Also in the first quarter, we began the integration of Compliasset, our most recent acquisition and a reference in technological solutions for managing regulatory compliance programs. With this consolidation, our customer base reached a record (964 clients), an important progress to further increase cross-selling.

Thinking in the long term, we continue to advance in the unification of our product portfolio, implementation agility, and ensuring customer satisfaction. In terms of M&A, given the current economic scenario, we continue to analyze opportunities available in the market, but in a more selective and careful manner, seeking to maintain a healthy balance between leverage and growth. In the first quarter, we amortized R$ 94.4 million in debt, maintaining the trend of reducing our financial leverage.

Aware of how seasonality impacts our numbers more noticeably in a scenario where there were no new relevant acquisitions, we are satisfied with the first quarter, aware of the challenge imposed by the more adverse economic scenario, but confident in the results for the year. Our business is stable, predictable, and resilient.

| 1Q23 Results | 3 |

| RECENT EVENTS

Election of the Board of Directors. At the Annual Shareholders’ Meeting held on April 27, our shareholders elected the Board of Directors (“BD”) for the next term of office. The BD continues to include 7 members, 6 of which were re-elected and 1 new member joined the body. Mr. Carlos Furlan (Independent Member) no longer belongs to the Board of Directors, having made valuable contributions to discussions on the Company's innovation program. Mr. Caio Lewkowicz (Independent Member) has joined the staff.

Election of the Fiscal Council. At the Annual Shareholders’ Meeting held on April 27, we installed, for the 2nd consecutive year, the Fiscal Council (“FC”), whose purpose is to supervise the actions of managers and verify their compliance with legal and statutory duties and give an opinion on the financial statements and reports of the management, among other attributions described in Art. 163 of the Brazilian Corporation Law. To compose the FC, the Shareholders’ Meeting elected Messrs. Augusto Frederico Caetano Schaffer (Permanent Member) and Eduardo Sanchez Palma (Alternate); Wesley Montechiari Figueira (Permanent Member) and Cristiana Pereira (Alternate); and Hugo Paulo Ehrentreich (Permanent Member) and Bruno Cals de Oliveira (Alternate).

Payment of Interest on Shareholders' Equity (“JSCP”). At the Annual Shareholders’ Meeting held on April 27, we approved the payment of interest on shareholders’ equity for the year 2022, in the total amount of R$4,690,007.39, equivalent to R$0.055404594 per share. Shareholders on the base date of May 5, 2023 will be entitled to JSCP, and the shares will be traded "ex-JSCP" as from May 8, 2023. JSCP payment will be made in reais, in one single installment, as from August 31, 2023, without monetary adjustment.

| 1Q23 Results | 4 |

| OPERATING PERFORMANCE

Software ARR1

Software ARR reached a record R$556.2 million in 1Q23, 21.7% higher than that reported in 1Q22, representing a total addition of R$99.1 million. Excluding Compliasset's portfolio of contracts, consolidated in the quarter, in the amount of R$6.7 million, the ARR for the quarter increased by 20.2% in the annual comparison, representing a net addition² of R$92.4 million.

The net addition highlighted above reflected the combination of accumulated balances of: (i) net sales³ in the amount of R$39.1 million, given our satisfactory sales performance in the last 12 months, with an important contribution from cross-selling; and (ii) inflation and volume adjustments in the amount of R$53.2 million, 36.4% of which corresponded to inflationary transfers and 63.6% to increased volumes.

From the business point of view, the accumulated net addition amounted to R$37.7 million in Funds, R$22.2 million in Digital, R$15.2 million in Pension, R$11.4 million in Banks and R$5.9 million in Consortium. Therefore, all business units had positive net additions. In the case of the first two units, that is, Funds and Digital, the last 12 months were marked by important sales and expressive adjustments.

It is worth noting that the net addition in 1Q23 was a record, totaling R$28.7 million. Net sales of R$14.7 million were punctually high in the quarter, as a result of the closing of some sales opportunities that were expected for 2022, combined with above-average churn, mainly driven by Pension customers especially those whose cancellation was foreseen at the time of the acquisition of Mercer Seguridade. Inflation and volume adjustments of R$14.1 million remain strong despite the inflationary slowdown.

Software ARR (R$ million)

1 Annualized signed contracts, implemented or not, which started to generate recurring revenues after completion of the implementation.

2 Result of the sum of sales, contract cancellations and contractual adjustments.

3 Result of the sum of sales and contract cancellations.

| 1Q23 Results | 5 |

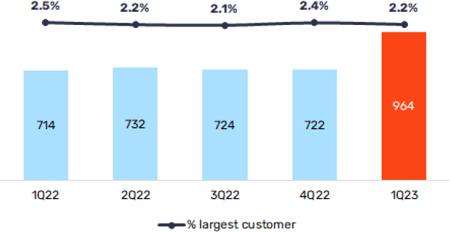

Number of Customers

The Company ended the first quarter of 2023 with 964 customers in its portfolio, or an increase of 250 customers compared to the same period in 2022, as a result of the consolidation of Compliasset’s base and new sales. In 1Q23, the largest customer accounted for 2.2% of net revenues, down 0.3 p.p. against the same period of the previous year, reflecting the dilution of the portfolio on the entry of new customers.

Number of Customers

| FINANCIAL PERFORMANCE

Net Revenues

Net revenues for the quarter reached R$164.2 million, up 18.3% over the same period of the previous year. This result was due to the 19.8% increase in the Software unit, which totaled R$140.3 million, combined with the 10.0% growth in Services, which reached R$23.9 million. The highlight is the Funds unit, which outperformed the other units, having grown 50.2% compared to 1Q22.

Net Revenues (R$ million)

| 1Q23 Results | 6 |

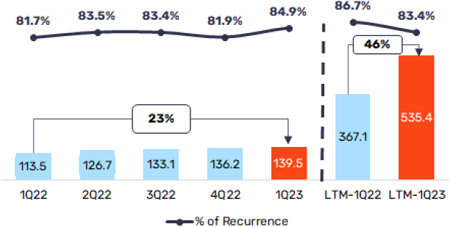

Recurring Revenues

In 1Q23, recurring revenues reached a record of R$139.5 million, up by 22.9% compared to 1Q22. The level of recurring revenues over total net revenues in the quarter was 84.9%, up by 3.2 p.p. compared to the same period of the previous year. This performance is explained by both, the implementation of the backlog originated by new sales and the contractual readjustments that occurred in the quarter.

It is also worth mentioning that the drop in variable revenues in the annual comparison was mainly due to one-off projects carried out in some Services customers in 1Q22 that were not repeated in 1Q23. In the quarterly comparison, this reduction is explained by the seasonal effect of these revenues, given that Software customers tend to accelerate specific customization projects in the last quarter, which is not observed in other quarters.

Recurring Revenues (R$ million)

Costs

Costs for the quarter totaled R$97.0 million, 20.3% higher than in 1Q22. This increase was mainly due to the growth in the number of employees and salary adjustments arising from the collective bargaining agreement that was paid at the beginning of the year to workers located in São Paulo, which represented 67,0% of Company’s staff.

Gross Profit and Gross Margin

Gross profit for the quarter was R$67.3 million, or 15.5% higher than in the same quarter of the previous year, while the gross margin ended 1Q23 at 40.9%, or 1.0 p.p. below that observed in 1Q22. This performance was impacted by the reduction in variable income, and higher costs due to the increase in the number of employees and collective salary adjustments.

| 1Q23 Results | 7 |

Total Gross Profit (R$ million)

| Software Unit

Software Net Revenues

In 1Q23, net revenues from Software reached R$140.3 million, up 19.8% over the same period of the previous year, mainly driven by the good performance observed in all business units. We highlight that this growth already reflects the current dynamics of our business, in which we see an intensification of cross-selling with sales both between units, especially between (i) Funds and Pension and (ii) Digital and Consortia, and within the same unit.

Net subscription revenue was R$116.3 million, 24.6% higher than the same period last year, as a result of the good performance of all business units, with emphasis on Funds, which performed 49.4% above 1Q22, followed by Digital, which grew by 39.6% over the same period observed. Implementation and customization revenues, in turn, reached R$24.1 million, up by 1.2% over the same period of the previous year.

Software Net Revenues (R$ thousand)

| 1Q23 Results | 8 |

Software Costs

Software costs in the quarter totaled R$78.0 million, 24.4% higher than those reported in 1Q22, mainly reflecting the increase in teams in the period and the salary adjustment in January for employees in São Paulo.

Depreciation and Amortization costs totaled R$2.1 million in the quarter.

Software Gross Profit and Gross Margin

Gross profit in the quarter reached R$62.3 million, up by 14.5% compared to 1Q22. The gross margin was 44.4% in the period, 2.0 p.p. below that reported in the previous year, due to the increase in costs against revenues, as explained above.

Software Gross Profit (R$ million)

| Services Unit

Net Revenues from Services

Net Revenues from Services reached R$23.9 million in the quarter, up by 10.0% over the same period of the previous year. Outsourcing revenues was R$23.3 million, up by 15.3% over 1Q22, driven by the increase in operations within the customer’s base. The Projects line, in turn, totaled R$0.7 million, down by 56.0% compared to the amounts reported in 1Q22, mainly impacted by one-off projects observed in 1Q22 that were not repeated in the current quarter.

| 1Q23 Results | 9 |

Net Revenues from Services (R$ million)

Services Costs

The costs of services totaled R$19.0 million in the quarter, 5.9% above the amount reported in 1Q22, mainly as a result of the increase in expenses related to the expansion of operations in some customers of the base.

Depreciation and Amortization costs in 1Q23 amounted to R$0.9 million.

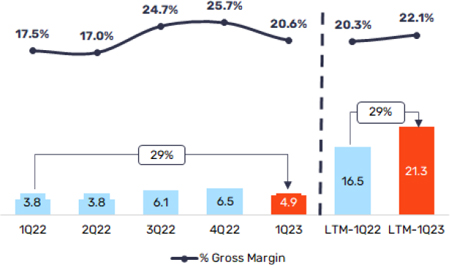

Gross Profit and Gross Margin from Services

Gross profit from Services in 1Q23 reached R$4.9 million, up by 29.3% over the same period of the previous year, while the gross margin ended the quarter at 20.6%, 3.1 p.p. higher than in 1Q22. This result is explained by the good performance of Outsourcing and the stabilization of turnover against the same period of the previous year. The margin expansion demonstrates that the offer of more specialized services and the expansion of the customer base has proven to be an efficient strategy to circumvent the challenging scenario, where we see customers being more cautious due to the macroeconomic situation.

Gross Profit from Services (R$ million)

| 1Q23 Results | 10 |

Operational Expenses

Selling, General & Administrative Expenses

Selling, general and administrative expenses totaled R$28.4 million, 17.2% higher than in 1Q22. In the quarter, expenses represented 17.3% as a proportion of net revenues, remaining stable against the same period of the previous year, even considering higher expenses with senior management and the sales and corporate teams, as well as the impacts of the annual collective bargaining agreement applied to the salary base in São Paulo as from Jan/23.

The main variations observed in the annual comparison occurred in the Sales and Administrative lines, which, together, recorded a 34.8% growth against 1Q22, reflecting, as mentioned above, the increase in expenses due to the restructuring of the sales area, the reinforcement of the staff and senior management in 2022, and the impact of the annual collective bargaining agreement in São Paulo. Additionally, IT and Facilities expenses grew by 67.1% compared to the same period of the previous year, due to the increase in the number of employees and salary adjustments, in addition to the increase in expenses with Information Security systems.

These increases were offset by the reduction in expenses with: (i) M&A, due to the lower volume of ongoing transactions; (ii) R&DI, given the activation of expenses relating to project development, which amounted R$2.0 million; and (iii) Other expenses, which were positively impacted by the reversal of the provision for labor and civil contingencies in the amount of R$2.3 million, with no cash impact.

General and Administrative Expenses (R$ thousand)

| (R$ ‘000) | 1Q23 | 1Q22 | 1Q23x1Q22 | 4Q22 | 1Q23x4Q22 | LTM-1Q23 | LTM-1Q22 | LTM-1Q23 x LTM-1Q22 |